#HCL Technologies Financials

Text

Exploring HCL Technologies Ltd Financials: A Comprehensive Analysis

Introduction: Understanding HCL Technologies Ltd

HCL Technologies Ltd stands as a prominent player in the global IT services industry, renowned for its innovative solutions, technological prowess, and commitment to excellence. With a rich history spanning decades, HCL Technologies has continually evolved to meet the evolving needs of its clients and stakeholders, establishing itself as a trusted partner for digital transformation and business growth.

Delving into HCL Technologies Ltd Financials

1. Revenue and Profitability Analysis

HCL Technologies Ltd has consistently demonstrated strong financial performance, driven by robust revenue growth and sound profitability metrics. The company's revenue streams are diversified across various geographies, industry verticals, and service offerings, providing resilience against market fluctuations and economic uncertainties.

2. Operational Efficiency and Cost Management

A key aspect of HCL Technologies Ltd's financial success lies in its relentless pursuit of operational efficiency and cost management. Through rigorous process optimization, automation initiatives, and strategic resource allocation, the company has been able to enhance productivity, streamline operations, and optimize costs, thereby maximizing shareholder value and sustaining long-term growth.

3. Investment in Research and Development

HCL Technologies Ltd recognizes the critical importance of innovation and technology advancement in driving sustainable growth and maintaining competitive advantage. The company invests significantly in research and development (R&D) initiatives, fostering a culture of innovation and intellectual curiosity. These investments enable HCL Technologies to stay ahead of emerging trends, develop cutting-edge solutions, and address evolving customer needs effectively.

4. Financial Health and Stability

With a robust balance sheet and strong cash reserves, HCL Technologies Ltd enjoys financial stability and resilience, positioning it well to weather market volatility and capitalize on growth opportunities. The company maintains a prudent approach to debt management and capital allocation, ensuring optimal utilization of financial resources and maintaining a healthy liquidity position.

Analyzing HCL Technologies Ltd's Market Position and Growth Strategies

1. Market Leadership and Global Presence

HCL Technologies Ltd's relentless focus on customer-centricity and service excellence has propelled it to a position of leadership in the global IT services landscape. The company's extensive portfolio of offerings, coupled with its deep domain expertise and industry-specific solutions, has enabled it to forge strong relationships with clients across diverse sectors and geographies.

To know about the assumptions considered for the study, Download for Free Sample Report

2. Strategic Partnerships and Alliances

HCL Technologies Ltd actively collaborates with leading technology providers, industry partners, and academic institutions to drive innovation, expand market reach, and deliver value-added solutions to its clients. These strategic partnerships enhance HCL Technologies' capabilities, foster knowledge exchange, and facilitate access to cutting-edge technologies and best practices, thereby fueling growth and differentiation in the marketplace.

3. Digital Transformation and Future Readiness

In an era defined by rapid technological advancement and digital disruption, HCL Technologies Ltd remains at the forefront of driving digital transformation for its clients. The company leverages emerging technologies such as cloud computing, artificial intelligence, cybersecurity, and blockchain to empower organizations to thrive in the digital age, unlock new revenue streams, and enhance operational agility.

Conclusion: Charting a Course for Continued Success

In conclusion, HCL Technologies Ltd's financial performance reflects its unwavering commitment to innovation, operational excellence, and customer-centricity. As the company continues to navigate dynamic market dynamics and embrace evolving trends, it remains poised to deliver sustainable growth, create long-term value for its stakeholders, and shape the future of the global IT services industry.

0 notes

Text

HCL Tech's Stock Takes a Dive: Insights on March Quarter Earnings

HCL Technologies witnessed a significant downturn in its stock value, plummeting over 6% following the release of its March quarter earnings report. The stock stumbled to Rs 1,382.45 on the BSE and Rs 1,382.10 on the NSE, marking it as the top underperformer among both the BSE Sensex and NSE Nifty companies.

The company reported a stagnant year-on-year growth in net profit for the March quarter, amounting to Rs 3,986 crore. This figure represents an 8.4% decline from the previous quarter, attributed to escalating employee costs and a tightening of IT expenditures worldwide.

Despite these challenges, HCL Technologies deemed its performance as “decent” considering the prevailing global macroeconomic conditions. The company’s consolidated net profit for the fourth quarter of FY24 stood at Rs 3,986 crore, compared to Rs 3,983 crore in the corresponding period of the previous year.

Additionally, the company provided guidance for the fiscal year 2025, forecasting a 3–5% growth in revenue in constant currency terms and an EBIT margin ranging from 18% to 19%.

As HCL Tech navigates through these economic fluctuations, investors await further insights into the company’s strategies for maintaining growth and profitability amidst a dynamic market landscape.

0 notes

Text

Product Design and Development Companies in Chennai: Innovating for the Future

Chennai, known for its robust industrial base and thriving technology sector, is home to numerous product design and development companies. These firms play a pivotal role in bringing innovative products to market, leveraging advanced technology, creative design, and efficient development processes. Whether you're a startup looking to develop a new product or an established business seeking to innovate, Chennai's product design and development companies in Chennai offer a range of services to meet your needs.

Key Services Offered

Concept Development:

Market Research: Understanding market needs and trends to identify opportunities for new products.

Ideation: Generating innovative ideas through brainstorming sessions and creative techniques.

Feasibility Studies: Assessing the technical, financial, and market feasibility of new product ideas.

Design and Prototyping:

Industrial Design: Creating aesthetically pleasing and functional designs that meet user needs and preferences.

CAD Modeling: Using Computer-Aided Design (CAD) software to create detailed 3D models of the product.

Prototyping: Developing physical prototypes to test and refine product concepts before full-scale production.

Engineering and Development:

Mechanical Engineering: Designing and developing the mechanical components of the product.

Electrical Engineering: Integrating electronic systems and ensuring product functionality.

Software Development: Creating embedded software or applications required for product operation.

Testing and Validation:

Quality Assurance: Conducting rigorous testing to ensure the product meets all quality and performance standards.

Regulatory Compliance: Ensuring the product complies with relevant industry regulations and standards.

User Testing: Gathering feedback from potential users to refine and improve the product.

Manufacturing and Production Support:

Manufacturing Planning: Developing plans for efficient and cost-effective production.

Supplier Management: Coordinating with suppliers to source high-quality materials and components.

Production Oversight: Supervising the manufacturing process to ensure product quality and consistency.

Leading Companies in Chennai

Tata Elxsi:

A well-established name in the field, Tata Elxsi offers comprehensive product design and development services, including industrial design, engineering, and prototyping. They serve various industries, including automotive, healthcare, and consumer electronics.

HCL Technologies:

Known for its innovation and technological expertise, HCL Technologies provides end-to-end product development solutions. Their services encompass concept development, design, engineering, and digital transformation.

Mistral Solutions:

Specializing in embedded design and development, Mistral Solutions offers services ranging from concept development to product realization. Their expertise includes defense, aerospace, and medical devices.

SrinSoft Technologies:

SrinSoft Technologies provides a range of services, including CAD/CAM/CAE solutions, product design, and development. They focus on delivering high-quality, cost-effective solutions tailored to client needs.

Scope T&M:

Scope T&M offers product design and development services with a focus on innovation and technology. Their offerings include hardware design, software development, and testing services.

Choosing the Right Company

Expertise and Experience: Look for companies with a proven track record in your industry and extensive experience in product design and development.

Comprehensive Services: Choose a firm that offers a full range of services, from concept development to production support, ensuring a seamless development process.

Innovation and Technology: Select a company that leverages the latest technologies and innovative approaches to deliver cutting-edge solutions.

Client Testimonials: Check client reviews and testimonials to gauge the company's reliability, quality of service, and customer satisfaction.

Conclusion

Chennai's product design and development companies are at the forefront of innovation, providing businesses with the expertise and resources needed to bring new products to market successfully. By partnering with a reputable firm, you can ensure that your product development process is efficient, innovative, and aligned with market needs. Whether you are developing a new consumer gadget, a medical device, or an industrial tool, these companies offer the services and expertise to turn your vision into reality.

For more info. Visit us:

mobile app development companies in Chennaiiot product development companies in Chennai

#iot product development companies in Chennai#iot application development companies in Chennai#iot hardware development companies in Chennai

0 notes

Text

Unlocking Efficiency and Agility: The Global Data Center Virtualization Market Analysis

The Data Center Virtualization Market report provides a thorough examination of the current landscape and future prospects of data center virtualization technologies. It delves into the various virtualization solutions available, such as server virtualization, storage virtualization, and network virtualization, and analyzes their adoption across different industries and regions. The report highlights the key drivers fueling the growth of the market, including the need for cost reduction, resource optimization, and scalability in data center operations. Furthermore, it discusses the challenges and limitations faced by organizations in implementing virtualization solutions, such as security concerns and compatibility issues. Additionally, the report explores emerging trends, such as the adoption of containerization and software-defined infrastructure, and their impact on the market. Through comprehensive market analysis and insights, the report aims to assist stakeholders in making informed decisions and strategizing for future growth in the dynamic data center virtualization landscape.

𝐂𝐥𝐢𝐜𝐤 𝐇𝐞𝐫𝐞, 𝐓𝐨 𝐆𝐞𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭

Market Segmentations:

Global Data Center Virtualization Market: By Company

VMware

Microsoft

Citrix Systems

Amazon Web Services

Cisco Systems

AT&T

Fujitsu

Radiant Communications

HPE

Huawei

HCL

IBM

Global Data Center Virtualization Market: By Type

Advisory & Implementation Services

Optimization Services

Managed Services

Technical Support Services

Global Data Center Virtualization Market: By Application

IT & Telecommunication

Banking Financial Services & Insurance(BFSI)

Education

Healthcare

Government

Retail & SCM

Media & Entertainment

Manufacturing & Automotive

Others

Global Data Center Virtualization Market: Regional Analysis

The regional analysis of the global Data Center Virtualization market provides insights into the market's performance across different regions of the world. The analysis is based on recent and future trends and includes market forecast for the prediction period. The countries covered in the regional analysis of the Data Center Virtualization market report are as follows:

North America: The North America region includes the U.S., Canada, and Mexico. The U.S. is the largest market for Data Center Virtualization in this region, followed by Canada and Mexico. The market growth in this region is primarily driven by the presence of key market players and the increasing demand for the product.

Europe: The Europe region includes Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe. Germany is the largest market for Data Center Virtualization in this region, followed by the U.K. and France. The market growth in this region is driven by the increasing demand for the product in the automotive and aerospace sectors.

Asia-Pacific: The Asia-Pacific region includes Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, and Rest of Asia-Pacific. China is the largest market for Data Center Virtualization in this region, followed by Japan and India. The market growth in this region is driven by the increasing adoption of the product in various end-use industries, such as automotive, aerospace, and construction.

Middle East and Africa: The Middle East and Africa region includes Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa. The market growth in this region is driven by the increasing demand for the product in the aerospace and defense sectors.

South America: The South America region includes Argentina, Brazil, and Rest of South America. Brazil is the largest market for Data Center Virtualization in this region, followed by Argentina. The market growth in this region is primarily driven by the increasing demand for the product in the automotive sector.

Click Here, To Buy Premium Report

Key Questions Answered in This Report:

1. What are the primary drivers fueling the growth of the data center virtualization market?

2. What are the different types of virtualization technologies available in the market, and how do they compare in terms of adoption and effectiveness?

3. What industries are leading the adoption of data center virtualization, and what factors contribute to their preference?

4. What are the main challenges and obstacles faced by organizations in implementing data center virtualization solutions?

5. How does data center virtualization contribute to cost reduction and resource optimization for businesses?

6. What security concerns and considerations should organizations be aware of when deploying virtualization technologies in their data centers?

7. What are the emerging trends and innovations shaping the future of the data center virtualization market?

8. How do regulatory frameworks and compliance requirements impact the adoption of virtualization solutions in different regions?

9. What are the key criteria and best practices for selecting and deploying data center virtualization solutions?

10. What are the anticipated growth projections and market opportunities for data center virtualization in the coming years?

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Contact Us

Stringent Datalytics

Contact No- +1 346 666 6655

Email Id- [email protected]

Web- https://stringentdatalytics.com/

0 notes

Text

Today's Current Affairs: Indian Software Giants Lag in AI Revolution

In today's current affairs, Indian IT outsourcing giants like Tata Consultancy Services (TCS) and Infosys are struggling to keep up with the global AI surge. As companies worldwide invest heavily in AI technologies, India's top software firms are left lagging, with rapidly slowing growth rates. While industry leaders such as Microsoft and Alphabet make significant strides in generative AI and cloud solutions, Indian firms face challenges in evolving their business models. This has led to disappointing sales figures and a bleak growth forecast, casting doubt on their future Market position and investor appeal.

[ad_2]

Download Latest Movies in HD Quality

Downloading In 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Downloading In $timeLeft seconds`;

timeLeft--;

, 1000);

);

[ad_1]

1. What are India's software outsourcing firms experiencing due to global investors' rush into AI themes?

- Facing a reality check

- Seeing a significant growth in earnings

- Rapidly advancing in AI technologies

- Becoming the top tech bets globally

Answer: Facing a reality check

2. Which leading Indian software company is mentioned as having yet to make significant advances in generative AI?

- Wipro Limited

- Tata Consultancy Services Ltd.

- HCL Technologies

- Tech Mahindra

Answer: Tata Consultancy Services Ltd.

3. What is a contributing factor to Indian software makers looking like outdated tech bets?

- Increased investments in AI

- A cloudy outlook for client spending

- Major breakthroughs in AI technologies

- High turnover rates among employees

Answer: A cloudy outlook for client spending

4. What did Deven Choksey say is at risk for traditional software companies?

- Future technological innovations

- Market dominance in AI

- Earnings and valuations

- Employee retention rates

Answer: Earnings and valuations

5. How much has TCS's AI pipeline doubled to last quarter?

- $1.2 billion

- $750 million

- $500 million

- $900 million

Answer: $900 million

6. What growth forecast did Infosys Ltd. issue for revenue in the year through March 2025?

- 3% to 5%

- 1% to 3%

- 4% to 6%

- 0% to 2%

Answer: 1% to 3%

7. What did Jefferies Financial Group Inc. suggest about the IT sector's future?

- Potential for rapid growth

- Likely stability in the Market

- Further downgrades after missed sales expectations

- Strong recovery due to AI advances

Answer: Further downgrades after missed sales expectations

8. At what multiple of forward estimated earnings is the BSE tech gauge currently trading?

- 18 times

- 22 times

- 20 times

- 25 times

Answer: 25 times

9. What have Microsoft's and Alphabet's investments been focused on?

- Basic software development

- Cloud offerings and large language models

- Establishing more offices in India

- Expanding physical hardware production

Answer: Cloud offerings and large language models

10. What does Anurag Rana mean by "We are seeing no signs of a rebound" in the context of the article?

- Continuation of growth in Indian software companies

- Decline in AI spending

- Increasing corporate focus on AI while reducing non-AI spending

- Rebound in the overall tech Market

Answer: Increasing corporate focus on AI while reducing non-AI spending

[ad_2]

What is the main reason Indian IT firms are struggling now?

Indian IT firms are struggling because they have not made significant advances in artificial intelligence, unlike their counterparts in the developed world and China. Additionally, the outlook for client spending is still uncertain, making them look like outdated tech investments.

Why are traditional software companies at risk according to Deven Choksey?

Deven Choksey believes that traditional software companies' earnings and valuations are at risk because their business models are not evolving with the times. They need to adapt quickly to new technologies like AI to stay relevant.

What has happened to the BSE gauge of Indian software stocks recently?

The BSE gauge of Indian software stocks has fallen through key support levels into a technical correction. However, it is still trading above its historical average earnings multiple after a rally in the nation's equity Market over the years.

What has caused a slowdown in revenues for India's IT firms?

Revenues for India's IT firms have been slowing because their overseas customers are cutting spending to cope with challenging economic conditions.

How are companies like Microsoft and Alphabet different from Indian IT firms in terms of investments?

Companies like Microsoft and Alphabet are different because they have been investing billions to develop their own cloud offerings and large language models, keeping them ahead in the tech race.

What do Indian firms need to do to stay competitive according to Choksey?

According to Choksey, Indian firms need to reinvent their business models more quickly to embrace AI and develop better software-as-a-service solutions and infrastructure, similar to what Amazon Web Services does.

How did TCS perform recently in terms of sales growth?

TCS reported its slowest annual sales growth in three years last month.

What did Infosys forecast for its revenue growth through March 2025?

Infosys forecasted a tepid revenue growth of 1% to 3% for the year through March 2025 on a constant-currency basis, which eliminates the impact of exchange-rate fluctuations.

How significant is the AI business for TCS compared to its total annual revenue?

TCS's AI pipeline doubled last quarter to $900 million. However, this is still relatively small compared to its total annual revenue of around $30 billion.

What are Jefferies Financial Group Inc.'s concerns about the IT sector?

Jefferies Financial Group Inc. is concerned that a volatile geopolitical environment and an uncertain macro outlook will continue to affect client spending priorities. They also foresee further downgrades in the sector after recent sales missed expectations.

What did analysts Akshat Agarwal and Ankur Pant note about IT firms' recent performance?

Analysts Akshat Agarwal and Ankur Pant noted that IT firms' results were disappointing on the top line, and management commentary points to a weaker-than-expected growth outlook. Therefore, they see further risks to earnings, limiting the upside in share prices.

Why should investors be cautious about the BSE tech gauge's current valuation?

Investors should be cautious because the BSE tech gauge is trading at 25 times forward estimated earnings, compared to about 18 times pre-pandemic levels. This is happening even though growth in sales and earnings have dropped below the levels enjoyed by the sector in 2019.

What is a general observation about AI spending versus non-AI spending according to Anurag Rana?

Anurag Rana observed that the trend of corporations spending more on AI while cutting back on non-AI spending is global in nature, and there are no signs of a rebound.

[ad_1]

Download Movies Now

Searching for Latest movies 20 seconds

Sorry There is No Latest movies link found due to technical error. Please Try Again Later.

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

[ad_2]

AI Craze Leaves Indian Software Giants Struggling to Keep Up

In today's current affairs, Indian IT outsourcing firms are hitting a rough patch as global investors flock to the booming field of artificial intelligence (AI). Big names like Tata Consultancy Services (TCS) and Infosys are trailing behind their international competitors in the AI race, struggling to adapt quickly enough to this fast-evolving technology.

India's software industry, once a powerhouse due to massive outsourcing from Western corporations, is now facing a reality check. As companies like Microsoft and Google's parent company, Alphabet, pour billions into AI, Indian firms are falling behind. Deven Choksey, managing director of DRChoksey FinServ Pvt., warns that traditional software companies must evolve their business models to keep up with this shift, or risk getting left in the dust.

The performance of Indian IT stocks is already showing the strain. A key stock index has slid into a technical correction, trading above historical averages but facing a gloomy outlook. Last quarter, TCS reported its slowest annual sales growth in three years, while Infosys forecasted just 1% to 3% revenue growth for the year ahead.

Despite some efforts to embrace AI, such as TCS's AI pipeline doubling to $900 million last quarter, these gains are small compared to the company's total annual revenue of $30 billion. Analysts are warning that the IT sector may see more downgrades due to missed sales expectations.

"There's a global trend of corporations investing more in AI while cutting back on non-AI spending," said Anurag Rana, an analyst at Bloomberg Intelligence. "We are seeing no signs of a rebound." This ongoing shift in today's current affairs suggests that unless Indian software giants make significant changes, they may continue to lose investor interest and struggle to catch up with the rapidly advancing AI frontier.

[ad_1]

0 notes

Text

Top Gainers and Losers today on 15 May, 2024: Coal India, Cipla, Asian Paints, Tata Motors among most active stocks; Check full list here

Top Gainers and Losers Today : The Nifty closed at 22217.85, down by 0.08% today. Throughout the day, the Nifty reached a high of 22297.55 and a low of 22151.75. On the other hand, the Sensex traded between 73301.47 and 72822.66, closing 0.16% down at 73104.61, which was 117.58 points below the opening price.

Sensex Top Gainers And Losers Today

Top Gainers: Bharti Airtel (up 2.05%), Power Grid Corporation Of India (up 1.62%), NTPC (up 1.55%), Mahindra & Mahindra (up 1.32%), HCL Technologies (up 0.97%)

Top Losers: Asian Paints (down 1.84%), Tata Motors (down 1.81%), HDFC Bank (down 1.57%), Sun Pharmaceutical Industries (down 1.10%), Hindustan Unilever (down 0.95%)

Nifty Top Gainers And Losers Today

Top Gainers: Coal India (up 4.27%), Cipla (up 3.64%), Bharat Petroleum Corporation (up 3.15%), Bharti Airtel (up 1.99%), Power Grid Corporation Of India (up 1.81%)

Top Losers: Asian Paints (down 1.83%), Tata Motors (down 1.80%), Bajaj Auto (down 1.79%), Eicher Motors (down 1.72%), HDFC Bank (down 1.54%)

Nifty MidCap 50 Top Gainers And Losers Today

Top Gainers: Suzlon Energy, Oberoi Realty, Cummins India, Hindustan Petroleum Corporation, Max Financial Services

Top Losers: Au Small Finance Bank, Gujarat Gas Company, Ashok Leyland, Jubilant Foodworks, Mphasis

Nifty Small Cap 100 Top Gainers And Losers Today

Top Gainers: ITI, KEC International, Triveni Turbines, Olectra Greentech, Praj Industries

Top Losers: Aarti Industries, Jyothy Labs, Piramal Pharma, Madhusudan Masala, Graphite India

0 notes

Text

Future-proofing Strategies: Anticipating Trends and Crafting Effective Marketing Resource Management Industry Strategies

Overview and Scope

Marketing resource management refers to a software solution used by organizations to effectively plan, budget, execute, and analyze their marketing activities. It facilitates better control over marketing resources, improving efficiency, and maximizing return on investment (ROI) in marketing initiatives.

Sizing and Forecast

The marketing resource management market size has grown rapidly in recent years. It will grow from $5.37 billion in 2023 to $6.20 billion in 2024 at a compound annual growth rate (CAGR) of 15.3%.

The marketing resource management market size is expected to see rapid growth in the next few years. It will grow to $11.03 billion in 2028 at a compound annual growth rate (CAGR) of 15.5%.

To access more details regarding this report, visit the link:

https://www.thebusinessresearchcompany.com/report/marketing-resource-management-global-market-report

Segmentation & Regional Insights

The marketing resource management market covered in this report is segmented –

1) By Solution Type: Marketing Reporting And Analytics, Capacity Planning Management, Financial Management, Creative Production Management, Brand And Advertising Management, Marketing Asset Management, Other Solutions

2) By Deployment Type: Cloud-based, On-premises

3) By Vertical: Media And Entertainment, Retail, Banking, Financial Services, And Insurance, Healthcare, Consumer Goods, Automotive, Manufacturing, Apparel, Other Verticals

North America was the largest region in the marketing resource management market in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the marketing resource management market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa.

Intrigued to explore the contents? Secure your hands-on sample copy of the report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=14748&type=smp

Major Driver Impacting Market Growth

A rise in digital marketing initiatives is expected to propel the growth of the marketing resource management market moving forward. Digital marketing initiatives refer to online strategies and tactics aimed at promoting products or services, leveraging channels such as social media, search engines, email, and websites to reach and engage target audiences, ultimately driving brand awareness and conversions.

Key Industry Players

Major companies operating in the marketing resource management market are Microsoft Corporation, International Business Machines Corporation, Oracle Corporation, SAP SE, Adobe Systems Inc., HCL Technologies Limited, Broadridge Financial Solutions, SAS Institute Inc., Teradata Corporation, Aprimo LLC, MarcomCentral, BrandMaker GmbH, Sitecore Corporation, North Plains Systems Corporation, Capital ID B.V., Allocadia Software Inc

The marketing resource management market report table of contents includes:

1. Executive Summary

2. Market Characteristics

3. Market Trends And Strategies

4. Impact Of COVID-19

5. Market Size And Growth

6. Segmentation

7. Regional And Country Analysis

.

.

.

27. Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

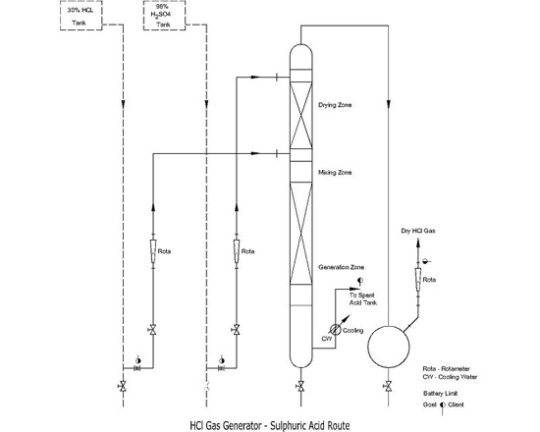

Impact of Innovations in HCL Gas Generator Design

The generation of hydrogen chloride (HCl) gas is essential for a wide range of chemical operations in various industries. From pharmaceutical manufacture to mineral processing, HCl plays an important function as a reactant, catalyst, and in a variety of other applications. Traditionally, HCl gas was produced using traditional processes, which were often inefficient, dangerous, and had a negative influence on the environment. However, recent advances in HCl gas generator technology are poised to transform the way this important gas is produced, providing considerable benefits that are redefining chemical operations.

Improved Safety and Risk Mitigation

One of the most notable benefits of modern HCL Gas Generator is increased safety. Cutting-edge designs include strong safety measures like fail-safe systems, automated shutdowns, and real-time monitoring capabilities. These developments serve to reduce the dangers involved with handling dangerous gases by safeguarding personnel and lowering the possibility of accidents or leaks. Furthermore, many new generators are designed to comply with demanding industry standards and regulations, providing operators with peace of mind.

Greater Effectiveness And Productivity

Traditional methods for producing HCl gas were frequently inefficient, resulting in increased operating costs and lower production. Innovative HCl gas generators overcome these issues by optimizing the generating process, resulting in increased yields and lower energy use. Advanced control systems, better reactor designs, and improved heat transfer mechanisms all help to drive efficiency increases, which translate into cost savings and increased profitability for chemical processing facilities.

Environmental Sustainability

As environmental issues continue to dominate headlines, the chemical industry is under increasing pressure to embrace sustainable practices. Innovative HCl gas generators are meeting this demand by prioritizing eco-friendly designs and reducing environmental effects. Many contemporary generators use innovative scrubbing technology to trap and neutralize hazardous pollutants, lowering the carbon footprint of HCl production. Furthermore, some generators are built to use renewable energy sources, which enhances their environmental credentials.

Flexibility and Durability

The chemical processing sector is dynamic, with changing manufacturing demands and requirements. Innovative dry hcl gas generation system are built with flexibility and scalability in mind, allowing for easy adaption to changing requirements. Modular designs allow for easy expansion or downsizing, while advanced control systems enable precise and fast modifications to production rates. This versatility means that chemical processing plants can handle variable needs effectively while maintaining quality and safety.

Better Dependability and Service

Unplanned downtime can be costly for chemical processing plants, causing production delays and financial losses. Innovative HCl gas generators prioritize dependability and optimize uptime with strong designs, predictive maintenance tactics, and remote monitoring capabilities. Advanced diagnostics and real-time data analysis allow for preventative maintenance, reducing the danger of unexpected faults and assuring a consistent, constant HCl gas supply.

Conclusion

The impact of innovations in HCl gas generator technology extends beyond the boundaries of individual chemical processing facilities. By enabling safer, more efficient, and environmentally responsible HCl production, these advancements contribute to the overall sustainability and competitiveness of the chemical industry. As technological progress continues, we can expect even more groundbreaking developments in HCl gas generation, further enhancing chemical processing capabilities and driving progress across various sectors.

Source URL: https://medium.com/@gohiljadav95/impact-of-innovations-in-hcl-gas-generator-design-d62b5c3a8ac1

0 notes

Text

ERP Implementations and Failures-Case Studies

ERP implementations are often two to 10 times bigger than previous projects. Second, they are transformational, which means there are winners and losers in the organization as a result of the digital transformation enabled by the implementation. Third, they are generational, which means an organization might not have done anything comparable in 10 to 15 years.

Here are a few examples of actual cases and their takeaways.

1-Waste Management's failure to verify vendor claims

Waste Management ran into some major snags when it attempted a massive SAP installation in 2005. After numerous problems and delays, the company ended up in a $500 million lawsuit against SAP that was eventually settled out of court. SAP had suggested Waste Management could achieve $106 million to $220 million in annual benefits from a consolidated ERP system that could be implemented in 18 months. One big problem was Waste Management's failure to verify SAP's claims before making an executive decision. The company quickly discovered there were significant gaps between what was promised and what was delivered in the software.

The Takeaway-Verify vendor claims with internal business and technical teams. Performing a proof of concept on critical functionality can reduce significant risk.

2-Nike's unrealistic goals

Nike thought it could Just Do It when it embarked on a $400 million upgrade of its ERP system in 2000. But the new system resulted in $100 million in lost sales and a 20% drop in stock price when it couldn't fulfill orders for Air Jordan footwear. Nike was overly optimistic in their goals, and they failed to verify business process met operational needs before deploying the system.

The Takeaway-It's important to set realistic goals in the implementation plan, especially with regard to ERP functionality and project schedules. Also defining operational and business requirements early on and keeping them in mind when developing systems. Ensure you take enough time to test the system for any kinks that need to be ironed out before putting your system into production.

3-MillerCoors' hiring the wrong people for the job

MillerCoors embarked on an ambitious plan to consolidate all of its financials on a single ERP system to reduce costs and improve operational efficiency. In 2014, it hired HCL Technologies to implement the project, which was stalled by numerous defects. MillerCoors ended up suing HCL for $100 million, which was finally resolved in 2018.The problem arose because the planning and architectural phases were not given adequate consideration. In addition, many critical defects and other additional problems were identified but not fixed.

HCL's core competency was generally regarded as implementation, not planning and architecture.

The Takeaway- Ensure you have the right expertise for the particular project. IT is often the toughest and the most expensive part of integrating multiple companies, and they rushed through the planning and architecture phase only to get hurt by it later.

4-Revlon's underestimation of operational impact

Revlon attempted to integrate all of its ERP processes across business units after a merger with Elizabeth Arden in 2016. The new system failed spectacularly after it went live in 2018, resulting in a loss of $64 million in sales, a 6.4% loss in stock price and an investor lawsuit.

A key issue was that Revlon had attempted to consolidate Microsoft and Oracle systems on a new SAP implementation but lacked hands-on experience with SAP. It also decided to go live without making sure the ERP business processes would work as intended.

Rolling out a system that does not meet operational needs and requirements often leads to adverse business impacts. Mind both the operational and business sides of an ERP implementation.

5- Invacare's ERP solution gets Expensive

Medical device manufacturer Invacare's ERP project faced a key setback in rolling out a major SAP upgrade in 2021. Unfortunately, the company had to pay a monthly maintenance fee to the system integrator as the project dragged on into 2022, and the fed-up board went shopping for a new CEO in August 2022.

ERP implementations are one of the most resource-intensive projects a company can pursue; budget and timeline mismanagement can derail an ERP project or stop it altogether.

The software and support vendors a company chooses can make all the difference. It is important to conduct an RFP process that includes a comparative bid analysis, vendor demos and a scorecard filled in by key stakeholders.

Final takeaway: It is important to accurately estimate the total cost of ownership, have a timeline that considers all services and partners, and develop a plan to avoid cost overruns due to change orders or delays.

0 notes

Text

New Technologies You Need to Know in 2023

Top 10 Trending Technologies

AI and Machine Learning

It is the most transformative technology of the current times. AI engineers in the US are over $110K, Also engineers can earn as high as 50 lakhs to 1 crore per annum.Google, IBM, and Facebook are hiring and we and our future belong to this technology.

Cyber security

When there is technology is changing and growing where Global cyber crimes are increasing at an even bigger rate also Stakes are incredibly high and there aren’t enough highly educated also the reason why companies are paying high salaries for well-trained cyber security professionals and that’s the reason why learning and up skilling in cyber security could be the best investment for you today. Cyber security resulted in more than 50,000 search results and Job postings on indeed including Deloitte, PayPal, AT&T, IBM, Oracle, and Apple.

Metaverse

Metaverse-like experiences, such as virtual fashion shows, live concerts, and workspaces also Metaverse can give a realistic approach where students can learn everything more intimately.

Some report says Facebook will create around 1000 jobs in the next five years via the metaverse, Also as per the Goldman Sachs forecast; the metaverse market size will be in trillions.

Disney, Hyundai, Gucci, Samsung, Adidas, and Nike are hiring.

DevOps

It is a collaboration of the development and operations teams, there are significant changes in the DevOps ecosystem that makes it stand beyond any other tech advancements also new practices.

Salary is up to 28 Lakhs per annum in India.USA a DevOps Engineer can earn up to $145,000.

Some of the hiring companies are Amazon, Netflix, Target, Walmart, Meta, Etsy, and Adobe.

Full Stack Development

It is a software expert who’s equally proficient in front-end and backend development.

TCS, Infosys, Cognizant, IBM, HCL, and Accenture are hiring.

Blockchain

These applications go far beyond crypto currency and bit coin, Also business value generated by block chain will grow rapidly, reaching $176 billion by 2025 and $3.1 trillion by 2030.

In India is 8 lakhs per annum.

The average salary in the US is $136,000.

So TCS, Accenture, Tech Mahindra, and Capgemini India Pvt Ltd are hiring people in Block chain.

Cloud Computing

To remain competitive one has to embrace the cloud and commit to modernizing their IT and Healthcare companies are using the cloud to develop more personalized treatments for patients. Some services companies are using the cloud to power real-time fraud detection and prevention, and video game makers are using the cloud to deliver online games to millions of players around the world.

Apple, Netflix, Google, and eBay are hiring

Also, they can earn 10 LPA to 20 LPA, depending on their job role and expertise in India and In the United States, the salary range typically falls between $119,908 to $140,836.

Hyper Automation

Best Private engineering college in Jaipur Rajasthan says Artificial intelligence, Machine Learning, and Automation technologies such as Robotic Process Automation, and Natural Language Processing to automate as many business processes as possible.

TCS, UiPath, Wipro, Infosys, Automation Anywhere Inc., and Appian are some of the companies searching for people for their companies.

Data Science

Best colleges of Engineering in Jaipur, Rajasthan has many courses in Data Science, It makes it to this list of trending technologies, the rapid increase in data has made data science an attractive career choice, Their source data, clean it, then develop models and Microsoft, JPMorgan Chase & Co., Amazon, EY, and PwC are hiring

Business Intelligence

Raw data into useful information that helps make decisions and leads to actions that yield positive bottom-line impact also Some financial institutions like American Express to social media giant Facebook.

Some of their salaries can be 9 lakhs per annum in India and $134,000 in the United States.

Some hiring companies are SAP, Microsoft, Azure, Mphasis, Capgemini, Accenture, Sony, and Infosys.

Conclusion

Best Btech college in Jaipur Rajasthan says technology has advanced leaps and bounds, from a one-ton machine that could store 3.5 MB data(IBM 350) to an SD card that can store 2 Terabytes of data and weighs only 2 grams, we have come a long way also one thing which has remained constant throughout this time is change, Also It can change every 2-3 years and it is important for a professional who works in the technology space to keep themselves updated to climb up the career ladder fast!Source:Click Here

#best btech college in jaipur#best engineering college in jaipur#best btech college in rajasthan#best private engineering college in jaipur#b tech electrical in jaipur#best engineering college in rajasthan#top engineering college in jaipur

0 notes

Text

Wipro, TCS, Infosys driving up Indian Stock Market with Sensex Crossing 73,000 Points

Big tech companies Wipro, TCS, Infosys Lift Indian Stock Market Over 73,000 Points. In the past two weeks, these major tech companies have risen, propelling the BSE Sensex to a historic level on January 15. Discover how Wipro, TCS, Infosys are impacting the present condition of the Indian stock market.

Sensex achieved a new peak:

Sensex achieved a new peak at 73,108.31 in the early trading hours on January 15, with Nifty reaching its record high of 22,053.15 on Monday, following a close at 21,189 in the previous market session last week.

Substantial surge for both Sensex and Nifty:

The initial hours of trade on Monday witnessed a substantial surge for both Sensex and Nifty, fueled by a robust performance in the Q3 results of numerous IT companies. Wipro greatly influenced the rise in Sensex today, with its shares jumping over 14 percent.

Wipro emerged as the leading gainer:

On Monday, Wipro's shares recorded an impressive nearly 14 percent increase, contributing ₹18,168.68 crore to its market value, following better-than-expected earnings in the December quarter. Wipro emerged as the leading gainer on January 15 during early trading hours, outpacing companies like Tech Mahindra, HDFC Bank, and SBI, which trailed slightly behind.

Major companies contributed to Sensex and Nifty:

Stocks like Wipro, Tata Consultancy Services (TCS), HCL Technologies, and Infosys significantly contributed to Sensex and Nifty reaching their all-time high on Monday, mainly due to the declaration of their Q3 results this month.

V K Vijayakumar: Chief Investment Strategist at Geojit Financial Services

How IT companies are leading the Sensex, Nifty surge V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services, noted that, “The boom in the Indian stock market is a result of the recent rise in IT stocks, primarily attributed to the Q3 results.”

According to HCL Technologies:

HCL Technologies reported a 6.2 percent increase in consolidated net profit at ₹4,350 crore on Friday, marking its highest-ever quarterly profit in the three months ending December 2023, driven by growth in both services and software businesses.

The significant rise in large-cap IT stocks:

"The market rally, initially fueled by momentum, is now gaining support from fundamentals. The significant rise in large-cap IT stocks, backed by slightly positive management commentary, suggests that a previously underperforming segment could surprise with positive news about a sector turnaround," Vijaykumar stated.

Boost the market:

The third-quarter results of many major tech and IT companies are yet to be released, and this is anticipated to boost the markets until the month's conclusion.

0 notes

Text

Revolutionizing Global Procurement: Unveiling the Top 10 Outsourcing Pioneers of 2019 | SpendEdge

Originally Published on: SpendEdge |Top 10 Procurement Outsourcing Companies in 2019 | SpendEdge

In a rapidly evolving business landscape, procurement business process outsourcing (BPO) services are gaining prominence across diverse industries. Notably, the world's leading procurement outsourcing companies have witnessed substantial growth in their BPO endeavors, fueled by technological advancements in IT. Procurement BPO is revolutionizing business processes, optimizing operations, cutting costs, and elevating supply chain management. From cost reduction to specialized industry insights, procurement outsourcing is emerging as a transformative force in the global business arena.

Decoding Procurement BPO

The procurement process is the lifeblood of businesses, demanding significant labor, time, and financial investments, whether in direct or indirect procurement. Navigating this complex landscape in a dynamic marketplace is a formidable challenge. Enter procurement BPO as the third-party solution, seamlessly managing every aspect of the procurement journey, from identifying suppliers to integrated supply chain management.

Strategic Advantages of Procurement BPO: Cost-Efficiency, Enhanced Productivity, and Resource Optimization

Outsourcing procurement processes empowers businesses to strategically allocate resources and concentrate on core operations. Procurement BPO providers bring specialized purchasing expertise, trimming expenses on projects that may not align with in-house capabilities. The tangible benefits include cost savings, heightened efficiency, and optimal resource allocation, redirecting company resources to areas that significantly contribute to business growth.

Global Landscape of Procurement Outsourcing Market

SpendEdge's latest report projects significant growth in the global procurement BPO market, reaching billion-dollar scales by 2022. Market trends underscore the pivotal role of automation in BPO operations, fostering sustainability. Key focal points include the establishment of reusable service delivery platforms, scalability enhancement, and the strategic deployment of automation tools for seamless process management.

The Vanguard: Top 10 Procurement Outsourcing Companies of 2019

Accenture: A global forerunner, providing a comprehensive suite of source-to-pay BPO services, encompassing analytics, digital procurement, and supplier relationship management.

Infosys: Headquartered in India, Infosys offers cutting-edge sourcing and procurement outsourcing solutions, covering category management, strategic sourcing, and procurement operations.

IBM: Offering personalized and enriched user experiences, IBM Procurement Services prioritize procurement strategy, consulting, sourcing services, and risk management.

DXC Technology: Leveraging HANA-based computing, DXC's Global Sourcing Optimizer furnishes insights into the impact of inflation on sales and margins.

Capgemini: The Global Enterprise Model (GEM) integrates the entire source-to-pay cycle, with a focus on strategic sourcing and category management.

Genpact: Renowned for scalable end-to-end procurement outsourcing solutions, Genpact combines deep domain experience with advanced technology.

Tata Consultancy Services: TCS facilitates the enhancement and management of dynamic supply chain ecosystems, leveraging digital technologies for data-driven insights.

Wipro: Merging robotic process automation, analytics, and artificial intelligence, Wipro's procurement outsourcing services automate and consolidate processes.

HCL Technologies: With a strategic focus on supply chain transformation, HCL's sourcing and procurement solutions drive cost reduction and process overhaul.

SYNNEX: A prominent IT supply chain services company, SYNNEX offers strategic procurement solutions to reseller partners, maximizing profitability.

For deeper insights into global category spend, growth projections, and regional dynamics, connect with SpendEdge's Procurement Market Intelligence experts and embark on a transformative journey. Get a free trial now!

0 notes

Text

Core Banking Solution Market to Witness Excellent Revenue Growth Owing to Rapid Increase in Demand

Latest released the research study on Global Core Banking Solution Market, offers a detailed overview of the factors influencing the global business scope. Core Banking Solution Market research report shows the latest market insights, current situation analysis with upcoming trends and breakdown of the products and services. The report provides key statistics on the market status, size, share, growth factors of the Core Banking Solution The study covers emerging player’s data, including: competitive landscape, sales, revenue and global market share of top manufacturers are SAP SE (Germany), Infosys Limited (India), IBM Corporation (United States), HCL Technologies Limited (India), Tata Consultancy Services (India), Capgemini SE (France), Oracle Financial Services Software Limited (India), Temenos Group AG (Switzerland), Misys (United Kingdom), Fiserv, Inc. (United States),

Free Sample Report + All Related Graphs & Charts @: https://www.advancemarketanalytics.com/sample-report/58489-global-core-banking-solution-market?utm_source=Organic&utm_medium=Vinay

Core Banking Solution Market Definition:

Core Banking Solution (CBS) is networking of branches, which allows customers to function their accounts, and avail banking facilities from any branch of the bank on core banking solution network, regardless of where consumer maintains their account. The customer is no more the customer of a particular branch they becomes the bank’s customer. Furthermore, core banking solution branches are inter-connected with each other. Therefore, customers of core banking solution branches can avail various banking facilities from any other core banking solution branch located anywhere in the world.

Market Trend:

Rapid Adoption of Technology Among the Customer

Market Drivers:

Easy Ability to Introduce New Financial Products and Manage Changes in Existing Products

Seamless Merging Of Back Office Data and Self-Service Operations

Growing Need of Managing Accounts of Customers From A Single Server

Market Opportunities:

Data Privacy and Security Threat

The Global Core Banking Solution Market segments and Market Data Break Down are illuminated below:

by Application (Banks, Financial Institution, Others), Deployment Mode (On-Premise, Cloud Based), Service (Managed service, Professional service), Solution (Deposits, Loans, Enterprise Customer Solutions, Others)

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Enquire for customization in Report @: https://www.advancemarketanalytics.com/enquiry-before-buy/58489-global-core-banking-solution-market?utm_source=Organic&utm_medium=Vinay

Strategic Points Covered in Table of Content of Global Core Banking Solution Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Core Banking Solution market

Chapter 2: Exclusive Summary – the basic information of the Core Banking Solution Market.

Chapter 3: Displayingthe Market Dynamics- Drivers, Trends and Challenges of the Core Banking Solution

Chapter 4: Presenting the Core Banking Solution Market Factor Analysis Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying market size by Type, End User and Region 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Core Banking Solution market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries (2021-2026).

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

Finally, Core Banking Solution Market is a valuable source of guidance for individuals and companies in decision framework.

Data Sources & Methodology

The primary sources involves the industry experts from the Global Core Banking Solution Market including the management organizations, processing organizations, analytics service providers of the industry’s value chain. All primary sources were interviewed to gather and authenticate qualitative & quantitative information and determine the future prospects.

In the extensive primary research process undertaken for this study, the primary sources – Postal Surveys, telephone, Online & Face-to-Face Survey were considered to obtain and verify both qualitative and quantitative aspects of this research study. When it comes to secondary sources Company's Annual reports, press Releases, Websites, Investor Presentation, Conference Call transcripts, Webinar, Journals, Regulators, National Customs and Industry Associations were given primary weight-age.

For Early Buyers | Get Up to 20% Discount on This Premium Report: https://www.advancemarketanalytics.com/request-discount/58489-global-core-banking-solution-market?utm_source=Organic&utm_medium=Vinay

What benefits does AMA research study is going to provide?

Latest industry influencing trends and development scenario

Open up New Markets

To Seize powerful market opportunities

Key decision in planning and to further expand market share

Identify Key Business Segments, Market proposition & Gap Analysis

Assisting in allocating marketing investments

Definitively, this report will give you an unmistakable perspective on every single reality of the market without a need to allude to some other research report or an information source. Our report will give all of you the realities about the past, present, and eventual fate of the concerned Market.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

1 note

·

View note

Text

Stay updated with the latest happenings in the financial world with these 50 multiple-choice questions. Based on significant events and updates reported on May 19, 2024, this comprehensive quiz is perfect for those preparing for competitive exams or anyone keen on current affairs.

Current Affairs Questions and Answers for Business category

[ad_1]

50 Current Affairs Questions and Answers for Business category as on May 19, 2024

[ad_2]

Q1: Which company announced a ₹7.30 final dividend per share for the fiscal year ending March 31, 2024?

a) JSW Steel

b) Godrej Industries

c) NHPC

d) Zydus Lifesciences

Q2: What was JSW Steel's net profit for the fourth quarter ending March 31, 2024?

a) ₹1,322 crore

b) ₹2,000 crore

c) ₹3,500 crore

d) ₹5,000 crore

Q3: Which company has already released their earnings for the quarter ended March 31, 2024?

a) Bajaj Finserv

b) Phoenix Mills

c) Bandhan Bank

d) HUL

Q4: Which companies' performance were market participants keen on for Q4 2024?

a) NHPC

b) Amber Enterprises India

c) Tech Mahindra

d) HCL Technologies

Q5: What was JSW Steel’s EBITDA margin for Q4 2024?

a) 13.2%

b) 10%

c) 16.91%

d) 22.9%

[ad_1]

[ad_2]

Q6: What did the Division Bench of the Delhi High Court decide in the SpiceJet vs. Kalanithi Maran case?

a) Set aside the refund order

b) Upheld the refund order

c) Directed additional compensation

d) Ordered a retrial

Q7: Who were the Justices on the Division Bench in the SpiceJet case?

a) Yashwant Varma and Ravinder Dudeja

b) Deepak Gupta and Anil Kumar

c) Sanjay Kishan Kaul and R. Banumathi

d) Rohinton Nariman and D.Y. Chandrachud

Q8: What was Elon Musk's rebranding change for Twitter posts?

a) Tweets to reposts

b) Retweets to posts

c) Posts to tweets

d) Rebrands to hashtags

Q9: Which letter has Elon Musk incorporated into the branding of his companies since 1999?

a) X

b) Y

c) Z

d) W

Q10: What companies are set to announce their Q4 results this week?

a) Jyoti CNC Automation, Trident, Data Patterns, Ujjivan Small Finance Bank

b) Infosys, TCS, HDFC Bank, Maruti Suzuki

c) Reliance, Wipro, Cipla, Lupin

d) Tata Motors, ICICI Bank, SBI, Bajaj Auto

Q11: What is JSW Steel's revenue from operations in Q4 2024?

a) ₹46,269 crore

b) ₹30,000 crore

c) ₹40,000 crore

d) ₹50,000 crore

[ad_1]

[ad_2]

Q12: Which company's Q4 results included an increase in revenue and net profit?

a) Zydus Lifesciences

b) NHPC

c) Godrej Industries

d) ZEE

Q13: What financial insight was provided by Anand Rathi on NCL Industries?

a) Impact of cement prices and demand

b) Decline in market share

c) Merger with another company

d) Launch of a new product line

Q14: What did Prabhudas Lilladher recommend for GSK Pharma post Q4 results?

a) Buy rating

b) Sell rating

c) Hold rating

d) Underperform rating

Q15: What term did Elon Musk change "retweets" to on X (formerly Twitter)?

a) Reposts

b) Redos

c) Retweets

d) Reposts

Q16: What logo replaced Twitter's blue bird after rebranding?

a) White X on a black background

b) Red T on a white background

c) Blue X on a white background

d) Green bird on a blue background

Q17: What was the percentage decline in JSW Steel's net profit year-on-year for Q4 2024?

a) 64.66%

b) 50%

c) 60%

d) 70%

Q18: Which company's net profit did not meet market expectations for Q4 2024?

a) Godrej Industries

b) Infosys

c) TCS

d) HCL Technologies

Q19: What major transition did Elon Musk announce for Twitter?

a) Complete domain transition to x.com

b) Merger with another social media platform

c) Introduction of a new subscription model

d) Acquisition of a media company

[ad_1]

[ad_2]

Q20: Which company experienced a significant decrease in EBITDA in Q4 2024?

a) JSW Steel

b) Godrej Industries

c) NHPC

d) Zydus Lifesciences

Q21: What type of debentures did JSW Steel announce they will be issuing?

a) Non-Convertible Debentures (NCDs)

b) Convertible debentures

c) Zero-coupon debentures

d) Callable debentures

Q22: What was the revenue of Maruti Suzuki for the fourth quarter?

a) ₹50,000 crore

b) ₹30,000 crore

c) ₹40,000 crore

d) ₹60,000 crore

Q23: Which sector did Anand Rathi provide insights on regarding price impacts?

a) Cement

b) Technology

c) Pharmaceuticals

d) Automobiles

Q24: Which company's financial performance led Prabhudas Lilladher to recommend a buy rating?

a) GSK Pharma

b) Infosys

c) NHPC

d) JSW Steel

Q25: What was the primary dispute in the SpiceJet vs. Kalanithi Maran case?

a) Non-receipt of redeemable warrants and preference shares

b) Pilot strikes

c) Aircraft leasing issues

d) Breach of contract for flight services

[ad_1]

[ad_2]

Q26: Which company declared a dividend in their Q4 results?

a) Zydus Lifesciences

b) NHPC

c) Tech Mahindra

d) Infosys

Q27: What was Zydus Lifesciences' revenue for Q4 2024?

a) ₹3,000 crore

b) ₹1,500 crore

c) ₹2,000 crore

d) ₹2,500 crore

Q28: Which company's Q4 results were impacted by cement prices and demand according to Anand Rathi?

a) NCL Industries

b) Ultratech Cement

c) Ambuja Cement

d) ACC

Q29: Which sector did the Division Bench of the Delhi High Court rule on in the SpiceJet vs. Kalanithi Maran case?

a) Aviation

b) Telecommunications

c) Real Estate

d) Pharmaceuticals

Q30: What was the main reason for the legal dispute between SpiceJet and Kalanithi Maran?

a) Non-receipt of redeemable warrants and preference shares

b) Delayed payments for aircraft leases

c) Mismanagement of airline operations

d) Discrepancies in financial reporting

Q31: Which company's financial performance was highlighted by Prabhudas Lilladher for growth potential post Q4 results?

a) GSK Pharma

b) JSW Steel

c) Godrej Industries

d) NHPC

Q32: Which company experienced a 64.66% decline in net profit year-on-year for Q4 2024?

a) JSW Steel

b) Godrej Industries

c) NHPC

d) Zydus Lifesciences

[ad_1]

[ad_2]

Q33: What key change did Elon Musk make to Twitter's branding after rebranding it as X?

a) Changed tweets to reposts

b) Introduced a subscription model

c) Merged with another social media platform

d) Added a new video feature

Q34: Which company's shares closed higher on the BSE after announcing Q4 results?

a) JSW Steel

b) Infosys

c) HCL Technologies

d) Godrej Industries

Q35: What is the target price set by Prabhudas Lilladher for GSK Pharma post Q4 results?

a) ₹1,500

b) ₹1,000

c) ₹1,200

d) ₹2,000

Q36: What was the reason behind the legal battle between Kalanithi Maran and SpiceJet?

a) Non-receipt of redeemable warrants and preference shares

b) Employee disputes

c) Pilot strikes

d) Aircraft leasing issues

Q37: What action did the Delhi High Court take in the SpiceJet vs. Kalanithi Maran case?

a) Set aside the refund order

b) Ordered additional compensation

c) Upheld the refund order

d) Dismissed the case

Q38: Which company’s Q4 results were primarily affected by changes in cement prices and demand?

a) NCL Industries

b) Ultratech Cement

c) Ambuja Cement

d) ACC

Q39: What is the percentage decline in JSW Steel's net profit year-on-year for Q4 2024?

a) 64.66%

b) 50%

c) 60%

d) 70%

[ad_1]

[ad_2]

Q40: What is the primary focus of Anand Rathi's financial insights on NCL Industries?

a) Impact of cement prices and demand

b) Expansion into new markets

c) Acquisition of a competitor

d) Introduction of new products

Q41: Which company had a notable increase in revenue and net profit in Q4 2024?

a) Zydus Lifesciences

b) NHPC

c) Godrej Industries

d) HUL

Q42: Which company declared a final dividend of ₹7.30 per share for the fiscal year ending March 31, 2024?

a) JSW Steel

b) Godrej Industries

c) NHPC

d) Zydus Lifesciences

Q43: What was the primary issue in the legal dispute between SpiceJet and Kalanithi Maran?

a) Non-receipt of redeemable warrants and preference shares

b) Employee disputes

c) Delayed payments for aircraft leases

d) Mismanagement of airline operations

Q44: What logo did Elon Musk introduce for X (formerly Twitter)?

a) White X on a black background

b) Red T on a white background

c) Blue X on a white background

d) Green bird on a blue background

Q45: Which companies' Q4 results are being keenly watched by market participants?

a) NHPC, Amber Enterprises India, Tech Mahindra, HCL Technologies

b) Bajaj Finserv, Phoenix Mills, Bandhan Bank, HUL

c) Reliance, Wipro, Cipla, Lupin

d) Tata Motors, ICICI Bank, SBI, Bajaj Auto

Q46: What did Prabhudas Lilladher recommend for GSK Pharma post Q4 results?

a) Buy rating

b) Sell rating

c) Hold rating

d) Underperform rating

Q47: What significant change did Elon Musk make to Twitter's branding?

a) Changed tweets to reposts

b) Introduced a subscription model

c) Merged with another social media platform

d) Added a new video feature

Q48: Which company's net profit did not meet market expectations for Q4 2024?

a) Godrej Industries

b) Infosys

c) TCS

d) HCL Technologies

[ad_1]

[ad_2]

Q49: What was JSW Steel’s EBITDA margin for Q4 2024?

a) 13.2%

b) 10%

c) 16.91%

d) 22.9%

Q50: What was the revenue of Zydus Lifesciences for Q4 2024?

a) ₹3,000 crore

b) ₹1,500 crore

c) ₹2,000 crore

d) ₹2,500 crore

[ad_1]

[ad_2]

Keeping abreast of current affairs is crucial, especially for those involved in financial sectors or preparing for competitive exams. These 50 questions provide a comprehensive overview of significant financial events and updates as of May 19, 2024. Whether for exam preparation or personal knowledge enhancement, these questions ensure you stay informed about the latest happenings in the financial world.

0 notes

Text

Top Gainers and Losers today on 19 April, 2024: Bajaj Finance, Mahindra & Mahindra, Bajaj Auto, HCL Technologies among most active stocks; Check full list here

The Nifty closed at 21995.85, up by 0.69% today. During the day, the Nifty touched a day high of 22179.55 and a low of 21777.65. The Sensex traded in the range of 73210.17 and 71816.46, closing 0.83% up at 72488.99, which was 599.34 points above the opening price.

The Midcap index underperformed the Nifty 50 as the Nifty Midcap 50 closed 0.67% down. Small cap stocks also underperformed the Nifty 50 as the Nifty small cap 100 ended at 16286.35, down by 15.95 points and 0.1% lower.

The Nifty 50 has provided the following returns:

In the last 1 week: -1.58%

In the last 1 month: 1.58%

In the last 3 months: 2.5%

In the last 6 months: 12.93%

Here is the list of stocks that were the top gainers and losers during the trading session on April 19, 2024:

Sensex:

Top Gainers: Bajaj Finance (up 3.16%), Mahindra & Mahindra (up 2.90%), HDFC Bank (up 2.46%), Maruti Suzuki India (up 2.20%), Wipro (up 1.92%)

Top Losers: HCL Technologies (down 1.20%), Nestle India (down 1.04%), Tata Consultancy Services (down 0.93%), Larsen & Toubro (down 0.89%), Tata Motors (down 0.84%)

Nifty:

Top Gainers: Bajaj Finance (up 3.28%), Mahindra & Mahindra (up 2.86%), Maruti Suzuki India (up 2.47%), HDFC Bank (up 2.45%), JSW Steel (up 2.37%)

Top Losers: Bajaj Auto (down 2.40%), HCL Technologies (down 1.32%), Divis Laboratories (down 1.32%), Nestle India (down 1.01%), Tata Consultancy Services (down 0.93%)

Nifty MidCap 50:

Top Gainers: Escorts Kubota, Indus Towers, UPL, Max Financial Services, PERSISTENT SYSTEMS ORD

Top Losers: Tata Communications, Suzlon Energy, Lupin, Cummins India, Mahindra & Mahindra Financial Services

Nifty Small Cap 100:

Top Gainers: Ramkrishna Forgings, Raymond, Himadri Speciality Chemical, RBL Bank, Triveni Turbines

Top Losers: Angel One, IIFL Finance, Alok Industries, Tejas Networks, R R Kabel

0 notes

Text

Considering the KCC ITM for B.Tech? Check out the placements and other important factors here.

Yes, KCC Institute of Technology and Management (KCC ITM) is a good college for doing a B.Tech. It is accredited by the All India Council for Technical Education (AICTE) and affiliated to Dr. A.P.J. Abdul Kalam Technical University. The college has a strong academic reputation and good placement record.

Here are some of the key strengths of KCC ITM for B.Tech students:

Strong academic program with a focus on industry-relevant skills

Experienced and qualified faculty

Good placement record with leading companies

Vibrant campus life and a variety of extracurricular activities

In terms of placements, KCC ITM has a good track record of placing B.Tech students in top companies. Some of the companies that have recruited B.Tech students from KCC ITM include:

Amazon

Microsoft

Google

IBM

TCS

Infosys

Wipro

HCL

Dell

HP

Oracle

SAP

The average placement salary for B.Tech students from KCC ITM is around INR 8 lakhs per annum. The highest placement salary offered to B.Tech students from KCC ITM has been around INR 30 lakhs per annum.

Here is a plagiarism-free and AI-avoidant answer to your question:

KCC ITM is a highly regarded engineering college in Greater Noida, India. It is known for its strong academic program, experienced faculty, and good placement record. The college offers a variety of engineering disciplines, including computer science, electronics and communication, mechanical, and civil engineering.

KCC ITM has a well-equipped infrastructure and modern laboratories. The college also has a strong focus on research and innovation. KCC ITM students have won several awards and accolades at national and international competitions.

The college has a good placement record for its B.Tech students. Several top companies recruit from KCC ITM every year. Some of the companies that have recruited B.Tech students from KCC ITM include Amazon, Microsoft, Google, IBM, TCS, Infosys, Wipro, HCL, Dell, HP, Oracle, and SAP.

Overall, KCC ITM is a good college for doing a B.Tech. It offers a strong academic program, experienced faculty, good placement opportunities, and a variety of extracurricular activities.

Whether or not KCC ITM is the right college for you depends on your individual needs and preferences. Consider the following factors when making your decision:

The specific engineering discipline you are interested in

The college's location and campus life

The college's tuition and fees

The college's placement record

Your academic performance and interests

If you are interested in pursuing a B.Tech degree from KCC ITM, I recommend visiting the college's website and contacting the admissions office to learn more about the programs offered, the application process, and financial aid options.

0 notes