#GST Amount Online

Text

Are you tired of manually crunching numbers to calculate your GST amount? Say goodbye to the headache and hello to convenience with our user-friendly GST Calculator! In this blog post, we will break down what GST is, how it's calculated, provide you with a handy formula, show you how to use our calculation tool effortlessly, and answer some FAQs. Let's dive in and make calculating GST a breeze!

2 notes

·

View notes

Text

GST News: Proposal to increase rate on online gaming postponed, industry of 30 thousand crores expressed this apprehension

GST News: Proposal to increase rate on online gaming postponed, industry of 30 thousand crores expressed this apprehension

GST News: The GST Council has today postponed the proposal to increase the GST rate on online gaming.

GST News: The GST (Goods and Services Tax) Council has today (June 29) postponed the proposal to increase the GST rate on online gaming. On this, there was a proposal to increase the rate of GST from 18 percent to 28 percent. This information has been given by Karnataka Chief Minister BS Bommai.…

View On WordPress

#casino#contest entry amount#GST#gst council#gst rate hike on online gaming#Latest news of GST#latest news on GST

0 notes

Text

Zerodha Discount Broker Review 2020: Compare Broker Online

Zerodha with a one of a kind name and significance, Zero + rodha (Barrier in English) is developing as the single largest discount broker in India you will see in this zerodha discount broker review 2020. The reason Zerodha turning into the best trading platform in India is expected to giving “the best internet exchanging stage India”, “low brokerage and high presentation”, “free direct shared reserve venture stage” and “effective client assistance.”

In only a limited capacity to focus time (9+ years) Zerodha top the list to become the best stock broker in India as far as dynamic customers. Zerodha contributions & backing is developing step by step.

The principle contributing exercises offered by Zerodha are exchanging value, value F&O, ware, cash on NSE, BSE, MCX and MCX-SX and interest in Direct Mutual Funds through SIP and single amount, ETFs, Government protections, and securities.

Zerodha offers free exchanging value delivery and charges a low brokerage of Rs 20 or .03% whichever is lower for exchanging value Intraday, F&O, cash, and ware.

The Demat administrations provided are of being a DP of CDSL. Furthermore, there is NRI trading facility at Rs 200 or .1% per request whichever is lower for value conveyance and Rs 100 for each request for value F&O.

Zerodha Mutual Fund Investment

This is the first broker in quite a while to offer a Direct Mutual Fund investment facility to its clients for nothing.

In this, you can put resources into direct shared store plots that give you better returns contrasted with customary common reserve plans.

Fundamentally, there is no commission setting off to the brokerage house from your common store speculation.

Zerodha Account Opening Process and 3-in-1 Account

You would instant be able to open records with them. The advantages of 3-in-1 record are offered in tie-up with IDFC First bank in the structure of Zerodha-IDFC FIRST Bank 3-in-1 record.

The business as usual of the record – a solitary record comprehensive of exchanging, DEMAT and financial balance for consistent and bother free web based banking and contributing experience. It has now become the exchanging and self-clearing part to give customers the advantage of no clearing charges. In addition, Zerodha provides cover request and section request (CO/BO) with trailing stop misfortune include for value and F&O best among the top 10 discount brokers in India.

Zerodha Charge/Fee Structure:

Protections Transaction Tax (STT): This is charged distinctly on the sell side for intraday and F&O exchanges. It’s charged on two sides for Delivery exchanges Equity.

Stamp Duty: Charged according to the condition of the customer’s correspondence address.

Merchandise and Enterprises Tax (GST): This is charged at 18% of the complete expense of brokerage in addition to exchange charges.

Different Charges (Zerodha Hidden Fees):

Call and Trade highlight is accessible at an additional expense of ₹50 per call.

Source - https://medium.com/@deepakcomparebroker/zerodha-discount-broker-review-2020-compare-broker-online-2e0b057bef50

Related - https://comparebrokeronline.com/

#best trading platform in india#top stock broker#best stock broker in india#lowest brokerage charges#top share broker#zerodha review

2 notes

·

View notes

Text

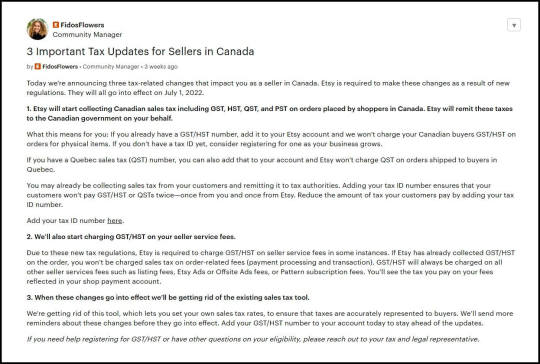

Seller Information on Etsy’s Canadian Tax Plans

As some of you now know, Etsy will be forcing Canadian sellers registered to collect GST and HST to roll that tax into their prices as of July 1 2022, instead of calculating it accurately and automatically at checkout. My main post on that is on my website blog: https://www.cindylouwho2.com/blog/2022/6/23/etsy-botches-implementation-of-new-canadian-tax-laws

This post is designed to help sellers strategize their approach to this ridiculous change.

UPDATE: (August 30, 2022) Etsy has begun charging some sellers GST and HST on the their seller fees, and is doing it retroactive to July 1. I will update this post when I know more; I haven’t even been charged yet. (September 11, 2022): here is my post on GST on fees; not everything is clear yet.

UPDATE (July 17 2022): For Non-Canadian Sellers and Canadian Buyers

If a customer in Saskatchewan or Manitoba orders a physical item from a non-Canadian seller, Etsy is supposed to charge them provincial sales taxes on their order.

However, Etsy is also charging provincial taxes on sales to British Columbia from outside of Canada, and the BC government confirms that is not allowed. Buyers are supposed to request a refund from Etsy, but as you can see from that link, Etsy isn't moving quickly on this. [UPDATE (August 7): It appears Etsy has fixed this on at least some BC orders from outside the country, but there are still lots of bugs, so keep an eye open for it.]

For those of you who have been overcharged and have applied to Etsy for a refund, please let me know how long it takes.

Things GST-Registered Sellers Should Know

It’s legal to include GST and HST in the item price; see here: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-collect-receipts-invoices.html “...you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST.“ As you know, that isn’t very common with products that are purchased online, though; it’s usually seen when buying a drink in the stands at a hockey game. One location makes it easy; different tax rates make it impossible to do accurately.

CRA reps have told people they can’t remove their tax registration numbers on Etsy: https://community.etsy.com/t5/All-Things-Finance/Changes-to-Canadian-GST-collection-remittance/m-p/138775766/highlight/true#M274389 so I strongly recommend talking to an agent or your accountant if you are considering this action. Here’s info on contacting the CRA on this topic: https://community.etsy.com/t5/All-Things-Finance/Changes-to-Canadian-GST-collection-remittance/m-p/138696588/highlight/true#M273726

You don’t have to register for GST/HST unless you are legally required to, or think it might be beneficial to you. Etsy is pushing sellers to register because it saves Etsy some work and makes them more in fees, but no one is required to register until they meet the requirements laid out here: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/when-register-charge.html Please consult with an accountant, the Canada Revenue Agency, or another expert in this area if you aren’t sure what you should do, but don’t take advice from Etsy on this question.

It is against Etsy rules to tell anyone who contacts you on Etsy to buy the items elsewhere; that includes cancelling the order and sending them an email to your website etc. https://www.etsy.com/legal/fees/#avoidance

Options for GST-Registered Sellers

There aren’t a lot of great ones, since we can’t opt not to ship to Canada. We can:

Comply with Etsy’s suggestions to add the tax to our prices. You can edit each listing individually to change the price in Canada only: https://help.etsy.com/hc/en-us/articles/4403156582039-How-to-Add-Domestic-Global-Pricing-to-Your-Listings?segment=selling or use other tools to raise your prices everywhere.

Note that digital items can’t use the domestic pricing tool, as it was originally designed to accommodate free shipping. [UPDATE (July 10): The tool is also not available for listing with more than 400 variations.] Remember that GST & HST apply to the shipping cost as well. If you are going to increase your listing prices by the largest amount (15%) and then refund buyers in GST-only provinces, remember that Etsy is collecting fees on the total item price, so you would have to raise all of your prices around 16.5% to come out even.

If you opt to add tax into your prices, here is how to calculate what you must remit to the government: https://legalbeagle.com/7648943-reverse-calculate-gst.html You will also be required to provide a receipt with the tax broken down if your customers request one. https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-collect-receipts-invoices.html

Close our Etsy shops.

Raise our Canadian shipping fees so high that no Canadian will buy from us. This is what I am planning on doing for the moment. I will mention in my policies that I am unable to fulfill orders to Canada on Etsy at this time. I will then email my Canadian newsletter subscribers and let them know that my website is their only option right now, and that prices are cheaper than my Etsy shop anyway. [UPDATE (July 10): While Etsy’s legal policies state sellers must “Charge an appropriate amount for shipping”, Etsy is itself breaking the law in multiple ways while applying the new tax changes (see below). I argue it is completely appropriate to want to make sure our customers are not overcharged tax and otherwise inconvenienced by Etsy’s illegal activities, and since Etsy doesn’t provide us any other way to stop selling to Canada, we are forced to raise shipping prices to honour Canadian law.]

If you buy business supplies from Canadian Etsy sellers, try to find their other sites (which will likely give you a proper tax receipt).

[UPDATE: (July 17) One enterprising seller has submitted an Agent and Principal form to Etsy: https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/gst506.html which if completed, allows Etsy to charge and remit GST/HST on the seller’s behalf. This is the same method eBay and Poshmark are using to comply with the new laws. While Etsy will probably reject the request, it is worth trying. Let me know if this works for you! (August 7): It didn’t work out for me]

And of course, complain to Etsy about this, and spread the word everywhere!

UPDATE: (June 29, 2022) Tracey from MyCorabella has written a great letter to her MP, and has agreed to share it for copying/editing, if you are planning on sending your own and need a good template. Here it is:

Dear [name of MP]

For years, Canadian GST registered small businesses selling via the Etsy platform have been using a tax calculation tool provided on Etsy to charge the appropriate GST/HST by province/territory, and directly remitting taxes to CRA. In response to Canada’s changes to GST/HST legislation regarding collection from online transactions, as of July 1 Etsy is removing the tax tool and forcing Canadian GST registered sellers to instead include taxes in their pricing. This disadvantages Canadian small businesses, it creates confusion for customers as to what taxes they are paying, and Etsy will financially benefit by being able to charge Canadian small businesses additional fees.

The biggest issues are well outlined in the following blog post: https://www.cindylouwho2.com/blog/2022/6/23/etsy-botches-implementation-of-new-canadian-tax-laws

…and in this active discussion among Canadian sellers in the following Etsy forum:

https://community.etsy.com/t5/All-Things-Finance/Canadian-Sellers-who-are-Registered-to-Collect-GST-HST-will-be/td-p/138747667

The massive confusion Etsy is creating will no doubt lead to many Canadian small business owners inadvertently making errors in sales tax collection/remittance. It will also cost us time & resources in added paperwork and fees as we shoulder the burden of Etsy’s laziness in their poorly executed implementation of this new tax law. However, Etsy will clearly benefit financially by shoving workload down the food chain and collecting extra fees.

This is a far cry from the intention stated in the budget “Applying the tax to the consumption of most goods and services helps ensure that the GST/HST system is fair, efficient and simple”, and does not align with the intention ”To improve the collection of the GST/HST and level the playing field between resident and non-resident vendors.”

The demographic of Canadian sellers on Etsy includes a significant cohort of disadvantaged and lower income people, most of which make less than the poverty line. They should not have to shoulder this added burden while paying more fees to Etsy for less services.

Other e-commerce platforms (eBay, Amazon, Airbnb, Poshmark) have each figured out viable solutions. Etsy is treating the implementation of the new tax law as an opportunity to increase their sales (since they are asking us to include taxes in our prices), charge more fees, and push the true cost of implementation squarely on Canadian small businesses.

Ultimately, this issue will cost all Canadians as CRA and small businesses become buried in the minutia of tiny amounts of potentially overcharged or undercharged sales tax. The solution is clearly to force the large companies operating these platforms to follow the intention of the law which was to simplify and create equity for Canadians for businesses. However, by removing an existing simple tax tool that has existed for years yet failing to create an alternative, and by forcing Canadian small businesses to absorb sales tax into their prices at the cost of added workload, Etsy has done the opposite.

I thank you for your time and attention to this matter.

Sincerely,

...

UPDATE: (July 2 & 10, 2022) There have been numerous issues since this rolled out on June 30th (yes, Etsy stopped charging taxes with the tool as early as the afternoon before they said they would). I have posted examples on Twitter and in my updated blog post.

Check your Canadian orders for the following:

Tax not charged on June 30th.

PST charged on top of the GST included in item prices; this is ongoing and the BC government has confirmed it is illegal. BC says buyers should apply to Etsy for refunds on the overcharges, but Etsy Support has not been very competent in figuring this out so far.

GST and PST charged to the customer despite the seller being GST-registered - then Etsy adds the collected tax to the shop’s payment account! Most examples seem to be sales to BC, and happened July 1.

PST charged at too low a rate (5% instead of the higher provincial percentages).

HST charged on registered seller orders, but not charged on unregistered seller orders.

BC PST charged on orders shipped from outside of Canada - this should only be happening with Manitoba and Saskatchewan buyers.

Also, Etsy said they would be charging Canadian tax on our seller fees, but hasn’t so far. There reason will likely surprise no one - they just haven’t gotten around to programming that yet. See my tweet on the topic with a screenshot: https://twitter.com/CindyLouWho_2/status/1548808767130816514?s=20&t=lv8nS63SBAtHa8UeXlnZYQ

Did I miss anything? Please email me, or leave a comment here.

UPDATED September 11, 2022.

2 notes

·

View notes

Text

Unlocking the Potential: Understanding the Private Limited Company

In the vast landscape of business entities, the private limited company registration in Telangana stands as a popular choice, offering a blend of flexibility, credibility, and limited liability. This article aims to shed light on the essence of a private limited company registration online in Telangana, exploring its structure, advantages, and key considerations for entrepreneurs.

Understanding the Private Limited Company:

A Private Limited Company, often abbreviated as pvt ltd company registration in Telangana, is a privately held business entity characterized by limited liability. This means private limited company registration provider in Telangana that the liability of its shareholders is restricted to the amount of their shareholding in the company. In simpler terms, the personal assets of shareholders are protected in case the company faces financial distress, thus offering a shield against personal bankruptcy.

Structure:

The structure of a Private Limited Company typically comprises new ltd company registration in Telangana shareholders, directors, and the company itself as a separate legal entity. Shareholders are the owners of the company and hold shares representing their ownership. Directors are appointed by shareholders to manage the affairs of the company. One of the notable aspects of a Private Limited Company is its autonomy to pvt limited gst registration services in Telangana operate independently of its shareholders and directors.

Advantages:

Limited Liability: Shareholders enjoy limited liability, protecting their personal assets from the debts and liabilities of the company.

Separate Legal Entity: A Private Limited Company is a distinct legal entity from its shareholders and directors, offering credibility and enhancing the company's ability to enter into contracts, acquire assets, and incur debts.

Flexibility in Ownership: Private Limited Companies can have a minimum of two and a maximum of two hundred shareholders, offering flexibility in ownership structure.

Ease of Fundraising: Compared to sole proprietorships and partnerships, Private Limited Companies find it relatively easier to raise funds through equity issuance and bank loans.

Perpetual Succession: The existence of a Private Limited Company is unaffected by changes in its ownership or management, ensuring continuity and stability.

Tax Benefits: Private Limited Companies often benefit from various tax deductions and exemptions, enhancing their profitability.

Key Considerations:

While the Private Limited Company structure offers numerous advantages, entrepreneurs should carefully consider certain aspects before incorporating:

Compliance Requirements: Private Limited Companies are subject to various statutory compliances, including annual filings, board meetings, and maintenance of statutory registers.

Costs: Setting up and maintaining a Private Limited Company involves costs such as registration fees, legal fees, and compliance costs.

Complexity: The regulatory framework governing Private Limited Companies can be complex, requiring professional expertise for compliance and governance.

Shareholder Agreements: Clear shareholder agreements are essential to manage relationships, rights, and obligations among shareholders effectively.

Conclusion:

The Private Limited Company structure offers a compelling blend of limited liability, credibility, and flexibility, making it a preferred choice for entrepreneurs worldwide. By understanding its structure, advantages, and key considerations, entrepreneurs can harness the full potential of a Private Limited Company to realize their business aspirations. In the dynamic landscape of commerce, the Private Limited Company stands as a beacon of stability and growth, empowering entrepreneurs to embark on their journey of success.

0 notes

Text

Tax Savers provides the ultimate accounting services

Many entities in developed nations have now started outsourcing their work of tax preparation to countries like Melbourne. The reason for the same is that Melbourne has an abundance of Individual tax return accountant who hold expertise in tax preparation for foreign countries. Besides, the services can be availed at comparatively lower prices in comparison to the home country.

Individual tax return accountant in developed nations charge an exorbitant amount for tax preparation services. On the other hand, in Melbourne, the same work, without making any compromise on the quality, can be done at almost half the price.

Melbourne also has the required infrastructure and technology to be able to provide the tax preparation services efficiently to the foreign clientele.

Reasons why Tax Savers are best in accounting services?

Tax Savers excels in delivering exceptional accounting services through a variety of comprehensive approaches:

Business Tax Services

Thorough Online business registration and review of company tax returns and associated work papers for corporate, trust, and partnership clients.

Data Analysis and Tax Technology Services

Efficient handling of data input, organization, analysis, application development and maintenance, testing, quality assurance, and business analysis using cutting-edge tax technology.

Indirect Tax Compliance

Skillful management of sales/use tax returns, GST/PST, small business bookkeeping services, business licences, tax exemption certificate management, resolution of tax notices, sales/use tax registrations, refunds, property tax compliance, and more.

Transfer Pricing

Conducting benchmarking studies for transfer pricing, preparing comprehensive company overviews, performing industry analyses, and providing valuable support for transfer pricing documentation.

Mergers and Acquisitions

Conducting thorough tax due diligence and offering specialized M&A services, including change of control studies, earnings and profits (E&P) studies, stock basis studies, and transaction cost analyses (TCA).

Personal Tax Services

Efficient preparation and review of online tax returns Melbourne and related work papers tailored specifically for High Net Worth Individuals.

Engagement Administrative Support Services

Providing invaluable assistance in engagement financial management, engagement setup, and tax processing support services for Tax engagements.

In summary, Tax Savers leverage their expertise, advanced technology, personalized approach, adherence to compliance standards, and effective communication to deliver top-notch accounting services that cater to the diverse needs of their clients.

Benefits of Tax Payers Services

There are numerous advantages to utilizing the services of Tax Savers for your accounting and tax requirements. Here are some key benefits:

Time Efficiency

By entrusting your accounting and tax needs to Tax Savers, you can save valuable time and concentrate on core business activities, Sole trader tax return, enhancing overall productivity and efficiency while leaving accounting and tax work in the hands of skilled professionals.

User-Friendly Convenience

Utilizing an online tax service offers convenience, allowing you to file your taxes from the comfort of your own home. You no longer need to transport all your tax documents to a local tax preparer. Completing your entire tax return may take as little as an hour of your time.

Online tax preparation services provide comprehensive guidance, walking you through each step of the filing process. You do not require in-depth tax knowledge or tax preparation skills.

Swift Processing and Turnaround

Filing your taxes online ensures timelier processing compared to traditional mail filing. Online filing enables faster acceptance and processing by the IRS, resulting in expedited refunds, if applicable.

Moreover, online tax filing is quicker than engaging a paid tax preparer. When utilizing a paid tax professional, your return enters a queue alongside other taxpayers awaiting filing.

Effective Record Keeping

Most online tax preparation software retains your prior years' information, saving time when filing in subsequent years, provided your living circumstances have not significantly changed.

Furthermore, having access to prior years' returns is crucial in the event of an IRS audit. For purposes such as applying for a home mortgage or other loans, access to previous years' returns is often required as supporting documentation during the application process.Final Words

In summary, Tax Savers prides itself on providing exceptional tax and accounting services to individuals and enterprises located in Melbourne, Australia. We encourage you to reach out to us at your convenience to explore how we can effectively address your tax and accounting needs. Be assured that our online tax return services are reinforced by a team of proficient accountants and tax agents who are committed to delivering reliable and accurate tax guidance.

Source URL : https://penzu.com/public/2f3eb7be

0 notes

Text

Streamline your GST Return with Online GST Billing Software

With the arrival of Goods and Services Tax (GST) on July 1, 2017, the whole Indian business witnessed the beginning of comprehensive tax filing protocols. While many small businesses and MSMEs (medium small and micro enterprises) found the process overwhelming at the beginning, the best GST billing software in India helped fill the gap and helped businesses to adopt GST completely. There are multiple online GST billing software options available for each business type, and you can choose the best GST billing software based on your business needs. Most online GST billing software offers a wide range of advantages.

What is online GST billing software?

Online GST billing software is a comprehensive tool that allows companies, proprietors, and MSMEs to file, track, and manage their GST returns. The free GST billing software enables you to comply with the latest GST rules and regulations, calculate the correct amount of tax to be paid to the government, file your returns, and pay your taxes on time to avoid late charges. The free GST billing software is a boon for traders, distributors, manufacturers, producers, and retailers.

There are many small businesses that have struggled with GST filings due to a lack of tech knowledge, while some businesses have found the best GST billing software. But this problem can be easily overcome by getting the best GST billing software in India.

Online GST billing software like Eazybills is making the GST filing process smooth and effortless. Eazybills is the best GST billing software because it makes GST compliance smooth. With Eazybills, you can save both time and money.

List of Benefits of the Best GST Billing Software

The best GST billing software can help take away the difficulties of manually calculating taxes and reconciling mismatched reports, amongst other things. Here is a brief list of some of the benefits of online GST billing software:

Simple Data Filling: Exporting the business data manually can be a lengthy and time-consuming process. To save both money and time, a GST billing software offers easy GST registration, quick transfer of accounting data, and reconciliation for timely and error-free GST filing.

Time-saving: It doesn’t matter what the nature of your business is; there are a number of documents and information that are required every month for GST return filing. Collecting and managing all the data can be overwhelming, so GST billing software will help you save time with the proper management of documents and sending reminders to vendors.

Secure Data Storage: Since all the financial and accounting data, bills, and other important information are stored electronically, it is important to ensure that it is stored safely. GST software makes sure that your data is secured by putting in passwords and authentication steps to access it.

Parting Words

GST billing software is a helping hand for business owners. While GST software facilitates faster and simpler filing of GST returns, it also helps prevent financial losses. Finding the best GST billing software in India can be a struggle for many business owners who want all-in-one software. Fortunately, Eazybills offers an overall solution to this problem and helps business entities file GST returns using the GST software in an easy, hassle-free, and super-quick manner. Hurry Up! Connect with us for a demo today!

#billing software#free billing software#free gst billing software#free online gst billing software#online billing software#best billing software#easy billing software#invoice software#best invoice software#free invoice software#invoicing software#free invoicing software#best billing software in india#best invoice software in india#online invoicing software

0 notes

Text

Unveiling the Shocking Reality: Over Rs 2 Lakh Crore GST Evasion in FY24

In a surprising turn of events, authorities have uncovered GST evasion amounting to over Rs 2 lakh crore during the fiscal year 2023-24, nearly equivalent to 10% of the total GST collections. Despite a commendable 11.6% increase in gross GST collections from the previous financial year, this staggering revelation underscores the persistent challenges faced in combating tax evasion.

The Directorate General of GST Intelligence (DGGI), the enforcement arm under the Ministry of Finance’s Department of Revenue, has identified various sectors where the majority of alleged tax evasion occurred. Among these, sectors such as online gaming and casinos, co-insurance/re-insurance, and secondment have been particularly implicated, with significant sums involved.

The FY24 data reveals a substantial surge in detected cases of duty evasion, totaling around Rs 2,01,931 crore across 6,074 cases—a staggering 99% increase from the previous financial year. Moreover, voluntary payments towards the evasion have also risen, amounting to Rs 26,598 crore, representing approximately 1.3% of total GST collections in FY24.

Wrongful availment of input tax credit (ITC) or fake ITC claims has emerged as a major concern for GST authorities. Special drives have been conducted to counter this menace, resulting in the detection of numerous cases involving fraudulent ITC claims. Notably, the focus has been on dismantling fake input tax credit syndicates and apprehending masterminds behind these schemes, leading to a significant number of arrests.

In addition to domestic tax evasion, investigations have been initiated against offshore online gaming entities that fail to comply with GST laws. The crackdown on tax evasion has been relentless, with authorities issuing a slew of notices to entities across various sectors, including banking, insurance, online gaming, and more.

To strengthen enforcement efforts, GST authorities are leveraging advanced technologies such as Big Data Analytics and Artificial Intelligence to detect evasion. The DGGI has bolstered its cyber forensics infrastructure and established digital forensic laboratories across strategic locations in India.

In a bid to streamline investigations and ensure effective enforcement, the Central Board of Indirect Taxes and Customs (CBIC) has issued guidelines outlining standard operating procedures for GST officers. These guidelines aim to expedite investigations, particularly in cases involving major industrial houses or multinational corporations, while maintaining a strict deadline for concluding inquiries.

The revelation of such significant GST evasion underscores the critical importance of robust enforcement measures and technological advancements in combating tax fraud. As authorities continue to intensify their efforts, it remains imperative for businesses to adhere to GST regulations and uphold integrity in tax compliance.

0 notes

Text

Get Rental Agreement Online – A Step-by-Step Guide with ZeroChaos

Imagine having the ease of getting paperwork done from the comfort of your home. A complete no-broker rental agreement? In today’s world of hustle culture, convenience plays a key role.

As the world shifts to the digital era, gaining popularity are platforms that help you break free from conventional practices. From banking to business, everything now has a digital platform.

Looking for an efficient platform to simplify paperwork related to your home? ZeroChaos is your ultimate solution. We are thoughtfully designed to eliminate lengthy paperwork, reducing the carbon footprint as well.

ZeroChaos is the most comprehensive solution to all your rental agreement needs. Everything is digitally managed, keeping in mind your ease.

Our primary aim? To empower you by simplifying the entire process of creating home ownership in Bangalore and many other states via legally vetted processes and utmost transparency. One of our most popular features is our online rental agreement and we want to help both parties i.e. landlords and tenants to have a comfortable experience facilitating this.

Following is a quick guide with crisp steps, which will help you seal that deal. Read on to know more!

6 Easy Steps To Getting Hassle-free House Rental Agreement

Step 1: Sign Up or Log In

A very simple step to being – all you need to do is visit this link, enter your name and email, and hit ‘Continue’.

Step 2: Generate the rental agreement

Fill in the details of the property, the owner, and the tenant. You will need to enter the amount of stamp paper and the type of digital signature to proceed. Make sure you review all the information before proceeding. Once stamp paper is purchased, the type of signature cannot be changed.

From rules to additional terms to clauses, ZeroChaos allows you to make an agreement that is transparent, informative, and error-free. You can also check out the Rental Act to know what you are entitled to as a landlord/tenant.

Step 3: Make the payment

A platform fee of Rs.499 + GST has to be made before you proceed. Also, the stamp duty needs to be paid.

Step 4: Review and Edit

Take a moment to review the entire agreement, if any edits are necessary, make them before proceeding. Some of the very common disputes can be avoided at this step.

Step 5: E-signatures for the win

One of the finest features of ZeroChaos is that you can digitally sign on the papers. Easily skip the traditional way of adding signs to documents. You can just e-sign the documents and then proceed to save them. The e-sign is done digitally or by Aadhaar Card, all done under lawful guidelines.

Step 6: Save, Download and Share

Once the agreement is finalised, download a copy for your records. ZeroChaos typically provides the option to save the agreement as a PDF, making it easily accessible whenever needed. The agreement is automatically sent in email and to other parties after each has signed. And THAT completes your entire rental agreement process – in a jiffy!

Summing It Up!

This quick and efficient guide to getting your rental agreement online with ZeroChaos helps you with the convenience of technology, saving your time, and ensuring a smooth rental process for both landlords and tenants. It’s simple, it’s crisp, it’s transparent!

If you need further assistance, please feel free to reach out to us at +91 70900 11220 or shoot us an email at [email protected].

For further information and guides, explore more here!

0 notes

Text

What are the different types of compulsory registration under GST?

The different types of compulsory registration under GST

Under Section 24 of the Central Goods and Services Tax Act 2017, certain categories are required to obtain compulsory registration as outlined below:

Casual Taxable Person: This refers to entities or individuals engaged in taxable activities sporadically or infrequently. Any business entity occasionally involved in taxable supply of goods and services must obtain GST registration.

Non-resident Taxable Person: Non-residents selling goods and services, whether as agents or principals, and lacking a fixed place of business in India are obligated to register for GST if they engage in taxable supply within the taxable territory, irrespective of transaction amount or frequency.

E-Commerce Operator: Individuals or entities managing digital platforms for buying and selling goods and services online must obtain compulsory GST registration, regardless of turnover.

Aggregate Turnover: Businesses exceeding an annual turnover of 40 lakhs in goods supply or 20 lakhs in service supply are mandated to register for GST. However, this threshold is reduced to 10 lakhs in certain states such as those in the northeastern and hill regions.

Inter-State Supply: Registration under GST is mandatory for entities engaged in inter-state supply, where the supplier's location and place of supply differ. Obtaining a GST number is essential before commencing inter-state supplies.

Taxpayers under Reverse Charge Mechanism: Individuals liable under the reverse charge mechanism must register for GST unless their aggregate turnover falls below the exemption limit. Under this mechanism, the recipient of goods and services is responsible for paying all applicable provisions and taxes.

OIDAR (Online Information Database Access and Retrieval) Services: Compulsory GST registration is required for services provided over the internet where there is no physical interface between the seller and buyer.

0 notes

Text

Online Indian GST Calculator

GST calculator involves determining the taxable value of goods or services and applying the appropriate GST rate to it. The process begins by identifying whether an item is subject to GST or exempt from it. Next, the GST amount is calculated by multiplying the taxable value with the applicable GST rate. Visit: https://shorturl.at/ciuKV

0 notes

Text

Udyam Registration Procedure

India has the world’s largest MSMEs after China (Micro, Small, and Medium Enterprises). MSMEs contribute significantly to the economic and social development of the country by stimulating innovation, entrepreneurship, job creation, exports, and inclusive growth.

The MSME sector generated 30.3 percent of the country’s overall GDP in 2018-19, according to the National Statistical Office. The Government of India has always placed a great emphasis on the sector’s growth and development, and a recent step was the implementation of Udyam Registration for MSME’s, which will go into effect on July 1, 2020, and will streamline the process of MSME registration from UAM and EM-II (old process).

With effect from July 1, 2020, all businesses will be classified as MSME

The Micro, Small, and Medium Enterprises Development (MSMED) Act, which was notified in 2006, establishes the legal framework for an enterprise to be classed as an MSME. This act attempts to foster the development of these enterprises as well as boost their competitiveness through a variety of schemes, privileges, and other incentives provided by the Government of India.

While delivering the economic package as part of the Aatmanirbhar Bharat Abhiyaan, Finance Minister Nirmala Sitaraman announced revisions to the idea of Micro, Small, and Medium Enterprises (MSME). These modifications were initially announced in June 2020 and will take effect on July 1, 2020. MSMEs were previously characterized primarily by the amount of money invested; however, the new criteria now include the company’s turnover as well. Furthermore, under the new definition, both manufacturing and service enterprises would be included in the same statistic.

An Enterprise (Udyam) must register by completing the following steps:

Anyone who wants to start a micro, small, or medium business can apply for Udyam Registration online through the Udyam Registration portal, which is self-declaration-based and does not require the upload of any paperwork, papers, certifications, or proof.

In contrast to the UAM / EM-II, which required annual renewals, the new Udyam Registration is a one-time registration for an MSME.

A simplified registration form is available on the Udyam Registration webpage. When a company receives a GSTIN, the GST site obtains the company’s name, address, and bank information.

Udyam Registration will necessitate the use of an Aadhaar number. In the case of a proprietorship firm, the proprietor’s Aadhaar number, in the case of a partnership firm, and a Karta’s Aadhaar number in the case of a Hindu Undivided Family’s Aadhaar number in the case of a Hindu Undivided Family’s Aadhaar number in the case of a Hindu Undivided Family’s Aadhaar number in the case of a Hindu Undivided (HUF). The GSTIN and PAN, as well as the Aad, must be filed by the organization or its authorized signatory if it is a corporation, a limited liability partnership, a cooperative society, a society, or a trust.

If an entity has been correctly registered as an Udyam and has a PAN, any information gaps from previous years when it did not have a PAN must be filled out on a self-declaration basis. There may be no more than one Udyam Registration per business, but any number of operations, including production, service, or both, maybe included or added to a single Udyam Registration. Control Rooms located at various institutions and offices of the Ministry of Micro, Small, and Medium Enterprises, such as Development Institutes (MSME-DIs) and District Industries Centres (DICs), would act as Single Window Systems to facilitate the registration process.

By July 1, 2020, all current EM–Part-II or UAM-registered firms must re-register on the Udyam Registration portal. All businesses registered before June 30, 2020, would be reclassified, according to a notification issued on June 26, 2020. Existing enterprises established before to June 30, 2020, will be valid only until March 31, 2021. Companies that are already registered with another Ministry of Micro, Small, and Medium Enterprises agency must also register with Udyam Registration.

After acquiring the Udyam Registration Number, the business must self-declare its information online in the Udyam Registration site, including the contents of the previous fiscal year’s ITR and GST Return, as well as any other information that may be required. The enterprise’s status will be stopped if the critical information is not updated within the term specified on the Udyam Registration portal. The business classification will be changed based on data submitted or received from government sources such as ITRs or GST returns.

#print udyam certificate#udyam registration#udyog aadhar#udyog aadhar registration#udyam registration online

0 notes

Text

Navigating GST Filing: Understanding Fees Charged by Chartered Accountants

Goods and Services Tax (GST) filing is a crucial aspect of compliance for businesses operating in India. While the process itself can be complex and time-consuming, many businesses choose to enlist the expertise of Chartered Accountants (CAs) to ensure accuracy and adherence to regulatory requirements. In this article, we explore the role of Expert Advice on Gst Filings and shed light on the fees typically charged for their services.

The Role of Chartered Accountants in GST Filing

Chartered Accountants play a vital role in assisting businesses with GST compliance, offering expert guidance and support throughout the filing process. From registration and return filing to compliance audits and advisory services, CAs provide comprehensive assistance to ensure that businesses meet their GST obligations effectively.

CAs are well-versed in the intricacies of GST law and regulations, allowing them to navigate complex issues such as input tax credit (ITC) reconciliation, tax liability calculation, and compliance with filing deadlines. Their expertise and experience help businesses minimize errors, mitigate risks, and optimize their tax liabilities under the GST regime.

Understanding GST Filing Fees

The fees charged by Chartered Accountants for Gst Filing Services in India can vary depending on various factors, including the complexity of the business operations, the volume of transactions, and the level of service required. While some CAs may offer fixed-fee packages for standard filing services, others may charge hourly rates or fees based on the scope of work involved.

Typically, the fees charged by CAs for GST filing services cover a range of activities, including:

GST Registration: Assistance with GST registration for businesses that are required to register under the GST regime.

Return Filing: Preparation and filing of GST returns, including GSTR-1 (outward supplies), GSTR-3B (summary return), and GSTR-9 (annual return).

Compliance Reviews: Regular reviews and audits to ensure compliance with GST laws and regulations, including reconciliation of input tax credits and verification of tax liability calculations.

Advisory Services: Expert advice and guidance on GST matters, including interpretation of GST laws, clarification of regulatory requirements, and assistance with compliance issues.

Factors Influencing Fees

Several factors can influence the fees charged by CAs for GST filing services:

Business Size and Complexity: The size and complexity of the business operations, including the volume and nature of transactions, can impact the amount of time and effort required to complete Online GST Filing Services activities.

Scope of Services: The scope of services required by the business, such as registration, return filing, compliance reviews, and advisory services, can affect the overall fees charged by CAs.

Frequency of Filing: Businesses that are required to file GST returns more frequently, such as monthly or quarterly filers, may incur higher fees due to the increased frequency of filings.

Value-Added Services: Additional value-added services provided by CAs, such as tax planning, audit representation, and dispute resolution, may incur additional fees beyond standard filing services.

Conclusion

Navigating gst filing fees by ca requirements can be a daunting task for businesses, but with the assistance of Chartered Accountants, businesses can ensure compliance with GST laws and regulations while optimizing their tax liabilities. While the fees charged by CAs for GST filing services can vary based on factors such as business size, complexity, and scope of services, the expertise and support they provide are invaluable in helping businesses meet their GST obligations effectively and efficiently.

Source Url:- https://sites.google.com/view/rapidtaxcom12212/home

0 notes

Text

How much investment is required for pharma franchise?

How much investment is required to start a Pharma Franchise Company? Every business needs capital, and no firm can survive without it. Whether it is a small or large investment, a franchise, or an independent company, there is a certain amount of capital and resources required to start a business. To meet the market demand, several expenses need to be incurred. These expenses include product purchases, promotion and marketing activities, personnel compensation, etc. Eyeris Vision Care is the leading eye drops PCD pharma franchise company in India.

Let’s discuss how much investment is needed to start a Pharma franchise company in India. The pharmaceutical industry is one of the most profitable businesses in the world. The demand for quality pharmaceuticals increases every two weeks. The pharmaceutical industry has been declared the best industry to start a business in. It has many advantages such as marketing tools, monopoly rights, legal investment strategy, and high-profit returns.

Why invest in the Pharma Franchise business?

No special skills or experience are required.

Can be started without leaving your current job or profession.

Limited product portfolio to manage.

It’s a monopoly rights-based business option.

You become the only owner in your local area, with limited area for sale, and no interference from the franchising company.

No target was provided by the company.

No marketing and promotion as a franchise partner.

Early and higher returns, no risk of capital crunch.

It’s easy to get started with minimal capital.

Investment Required for PCD Pharma Franchise in India

Pharma franchise cost in India

The Pharma Franchise Cost is the first fee paid by the franchisor to the franchisee for operating under their brand. This fee can be anywhere from tens of thousands of IND to hundreds of thousands of INRs depending on the brand’s popularity, brand reputation, and the territory’s exclusivity. The Pcd Pharma Franchise can Start at the price of Rs. 50,000 INR. depending on your Pharmaceuticals.

Setup and Infrastructure Costs

Expenses associated with the establishment of an office or retail premises. These may include rental costs, refurbishment costs, interior design costs, fixtures, and equipment costs. The costs will vary depending on the size and location of the premises.

Legal complications and licensing

Pharmaceutical businesses need to have a variety of licenses and permits to operate legally. This includes drug licenses, goods, and services tax (GST) registration, FDA compliance, and more. The cost of these licenses will vary depending on the country or region in which your business operates.

Inventory

The cost of stock will vary depending on the amount and type of pharmaceuticals you plan to stock. It’s important to stock a wide variety of medications to meet the needs of different customers. The cost of stock can vary greatly.

Staff and Traning Programs You'll also need to think about how much it will cost to hire and train employees. This includes salary, benefits, and training programs, as well as whether or not you need to hire a pharmacist (or other qualified personnel) to manage your operations.

Promotions and Marketing

How much money do you need to spend on marketing and promotion to get your brand out there and attract customers? Your marketing budget can vary depending on your target market and how competitive your local market is. You can use online ads, traditional marketing methods, marketing materials, and even attend local healthcare events to get your name out there.

0 notes

Text

Can a business owner in Jaipur amend their GST registration details, and if so, how?

Understanding GST Registration: Types, Process, and Benefits

The Goods and Service Tax Act (GST Act) was introduced by the Indian Government on July 1, 2017, with the aim of simplifying tax collection and increasing efficiency. If you're a business with an annual turnover of Rs. 40 Lakh or more (or Rs. 10 Lakh in the North East and Hill states), getting a GST registration is now a must.

Let's break down the different types of GST and the registration process.

Types of GST:

GST is categorized into four types based on the transaction type:

Who Should Register for GST? Businesses meeting specific criteria must register for GST under the Goods and Services Act. This ensures a hassle-free registration process.

Types of GST Registration:

Registration under GST comes in various forms. Understanding these types is crucial for a smooth registration process. Here's a quick overview:

Casual Taxable Person: For those involved in occasional businesses, a deposit equal to the GST liability is required.

Non-Resident Taxable Person: Individuals or businesses not residing in India but involved in taxable activities.

Normal Taxpayer: The standard registration for businesses with a yearly turnover exceeding Rs. 1 Crore.

Documents Necessary for New GST Registration Online:

Successful GST registration requires specific documents, varying for businesses and individuals. Here's a summary:

Businesses:

PAN card of the business

Proof of business registration

Address proof of the place of business

Individuals:

PAN card

Aadhar card

Photograph

Upon submission of these documents, a unique 15-digit GSTIN is generated without any registration charges.

Fines for Not Registering Under GST:

Failure to pay taxes may result in penalty charges. For unintentional errors, the penalty is 10% of the total tax if it exceeds Rs. 1 Lakh. Intentional errors require the full payment of the due amount as a penalty.

Advantages of GST Registration:

Businesses enjoy several benefits under GST, including simplified tax filing and an efficient indirect tax collection regime.

GST Deregistration:

There are scenarios where businesses might need to cancel their GST registration:

Turnover below Minimum Limit: If a business's turnover falls below the minimum threshold in its state, it can apply for deregistration.

Discontinuation of Business: If a business ceases operations, it should apply for cancellation.

Change in Business Status or Constitution: Changes in ownership status or business constitution may require cancellation and re-registration.

How to Apply for Cancellation of GST Registration:

Use Form GST REG-29 and provide necessary details. An officer will issue a formal order within a month, specifying the effective cancellation date.

Both GST registration and deregistration are detailed processes requiring diligence and understanding of GST regulations. Staying updated and compliant is essential to avoid legal consequences.

In addition to streamlining tax collection, businesses often benefit from lower tax liabilities due to changes in the indirect taxation structure under the GST Act. Therefore, registering for GST can prove advantageous in multiple aspects.

0 notes