#EmpowerYourWallet

Text

Supercharge your digital currency experience—Empower your crypto wallet with OTX!

#OTXPower#CryptoEvolution#EmpowerYourWallet#OTXToken#DigitalCurrencyDoneRight#CryptoWalletRevolution

0 notes

Text

Get Personal Loan in Singapore - Best Licensed Moneylender

Embark on your financial journey with confidence! At Best Licensed Moneylender, we're here to make dreams happen. Secure your path to prosperity with our personalized financial solutions. Whether it's for education, travel, or unexpected expenses, our Personal Loan Singapore services ensure your aspirations are within reach. Experience the ease of borrowing with a trusted partner who prioritizes your financial well-being. Let's turn your dreams into reality – because everyone deserves a chance to thrive.

#financialfreedom#personalloanjourney#moneymatters#loansolutions#borrowsmart#cashflowboost#financeoptions#loanlife#moneygoals#empoweryourwallet

0 notes

Text

How to Budget your Money💰 (During a Recession) in 2024!

youtube

Navigating a recession and wondering how to budget your money effectively in 2024? Join us as we break down practical tips and strategies to help you weather the financial storm. Learn how to prioritize spending, cut unnecessary expenses, and build a resilient budget that ensures financial stability during uncertain times. Don't let a recession dictate your financial well-being—empower yourself with actionable insights in this must-watch video!

#BudgetingTips#FinancialResilience#RecessionSurvival#MoneyManagement#SmartSpending#EmergencyFund#FinancialWellBeing#ThrivingInRecession#PersonalFinance#EmpowerYourWallet#Youtube

0 notes

Text

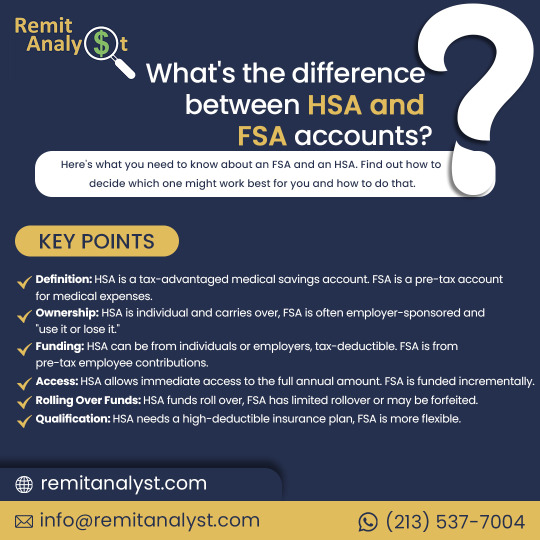

What's the difference between HSA and FSA accounts?

HSA (Health Savings Account) and FSA (Flexible Spending Account). Let's break down the differences between these options and help you make informed choices!

Health Savings Account (HSA)

🔹 Imagine it like a healthcare piggy bank - money goes in tax-free!

🔹 You control it, and it stays with you, even if you change jobs or health plans.

🔹 Contributions are tax-deductible, which is like giving yourself a little financial boost.

🔹 The funds in your HSA can grow over time, providing a nest egg for future medical expenses.

🔹 You need a high-deductible health plan (HDHP) to be eligible for an HSA.

Flexible Spending Account (FSA)

🔸 Think of it as a yearly budget for medical expenses - you plan ahead.

🔸 Funded by pre-tax dollars from your paycheck, reducing your taxable income.

🔸 Use it or lose it - generally, you need to spend the funds within the plan year or a grace period.

🔸 Great for predictable, planned medical expenses like copayments, deductibles, or prescriptions.

🔸 Typically, your employer offers FSA options as part of your benefits package.

difference between HSA and FSA accounts depends on your health needs and financial situation. If you anticipate high medical expenses, an HSA could be a great long-term savings tool. If you have predictable costs and want to save on taxes, an FSA might be your best bet!

Remember, it's your healthcare and your money - understanding these options can put you in the driver's seat. Choose wisely and stay financially healthy! 💪🏥

Discover the Best Rates! Send money to India hassle-free from the USA with RemitAnalyst. Get the top exchange rates and seamless online money transfers.

Convert USD to INR effortlessly. Start saving on every transfer now!

#HealthcareSavings#FinancialWellness#HSAExplained#FSAInsights#MoneyMatters#MedicalExpenses#BudgetingTips#HealthcareEducation#SaveSmart#EmpowerYourWallet#HSA#FSA#HealthcareFinance101

0 notes