#Debt Consolidation Loan

Text

Debt Consolidation Loans - Simplify Your Finances | Heritage Financial Credit Union

Discover Heritage Financial Credit Union's Debt Consolidation Loans, designed to help you manage and reduce your debt effectively. Learn about our competitive rates, flexible terms, and how consolidating your debts into one manageable loan can lead to lower monthly payments, reduced interest rates, and a streamlined path to financial freedom. Start your journey towards a debt-free life today with Heritage FCU.

0 notes

Text

Should You Seek Guidance From A Financial Advisor?

Although it is a good sign that you emphasise research, it might take time, thereby causing you to miss a significant opportunity. Petty financial issues like whether or not you must get a debt consolidation loan in between some crises just need your insight on your current situation. There is no need for you to seek any guidance from some specialist.

0 notes

Text

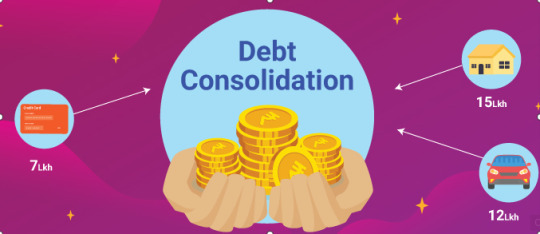

The first step towards debt consolidation is to take stock of the existing debts, recognise a problem and actively take steps to resolve it.Once the CIBIL Score is affected, it can affect the client’s prospects of acquiring further credit quickly: mishandling unsecured credit like a Personal Loan or a credit card is more of an issue.

#Debt Consolidation#Debt Consolidation Loan#consolidation loans#consolidate credit card debt#personal loan for debt consolidation

0 notes

Text

Simplifying Your Finances: Debt Consolidation Loan Guide

The concept of a debt consolidation loan emerges as a beacon, offering a streamlined approach to managing financial obligations. This guide aims to unravel the intricacies of this financial instrument, providing a compass for those seeking to simplify their finances and untangle the web of multiple debts.

0 notes

Text

Thrive Broking

Address: Somerset Drive, Thornton, NSW, 2322

Country:- Australia

Main Phone:- 61 421 195 741 & 0421 195 741

Additional Phone:- (02) 4049 4441

Business Email :- [email protected] (mailto:[email protected])

Website:- thrivebroking.com.au (http://thrivebroking.com.au/)

We are specialists for business, equipment & personal finance solutions across Australia. Our mission is to help you obtain the funding you need to thrive, We'll Put in the Hard Work

In pursuit of excellence, Thrive Broking embraces the virtue of hard work to find the best solutions for your financial growth and prosperity, Lender Negotiation On Your Behalf

Our expert team at Thrive Broking excels in lender negotiation, securing optimal terms and rates for your financing needs, ensuring your borrowing experience is seamless and advantageous, 24/7 Communication

We at Thrive Broking offer waking hours support, available when you need us and keeping you informed every step of the way and afterwards.

Services:-

National Service Provider, Equipment & Vehicle Finance, Marine Finance & Insurance (Boat & Jetski), Caravan, Camper & Motor Home Finance & Insurance ,Motorbike Finance , Insurance , Commercial Business, Business Cash flow, Working Capital, Invoice Finance, Business Acquisition, Chattel Mortgage Machinery & Equipment ALL INDUSTRY for MOST worthwhile purposes , Purchase New or Used, Dealership, Private sale, or Auction Insurance & Car Search Services available.

#Loan#Car loans#Business loans#Caravan loan#Motorbike loan#Working capital loan#Cashflow loans#Personal loans#Business lending#Business car loan#Truck loan#Low doc loan#Debt consolidation loan#Boat loan#Loan broker#Equipment finance#Machinery finance#Farm machinery finance#Asset finance#Business finance#Personal finance#Car financing#Commercial finance#Trade finance#Vehicle finance#Truck finance#Excavator finance#Marine finance#Jet ski finance#Farm finance

1 note

·

View note

Text

Akal Mortgage - Your Trusted Source for Second Mortgages in Mississauga When financial challenges arise and you need access to additional funds, Akal Mortgage is here to help you secure a second mortgage in Mississauga. As a reputable mortgage company, we understand that life can present unexpected situations, and our team is dedicated to providing practical and flexible solutions to meet your unique needs.

With years of experience in the mortgage industry, Akal Mortgage has developed strong relationships with lenders in Mississauga, enabling us to offer competitive rates and terms on second mortgages. Whether you're looking to consolidate debts, invest in home improvements, or finance a major life event, our knowledgeable mortgage specialists will guide you through the process with transparency and expertise.

At Akal Mortgage, we prioritize our clients' financial well-being. We take the time to understand your goals and financial situation, allowing us to tailor a second mortgage solution that aligns with your objectives. Our commitment to exceptional customer service means that you can count on us to be there every step of the way, making the process of obtaining a second mortgage in Mississauga as smooth and stress-free as possible.

Unlock the equity in your home and explore the possibilities with a second mortgage from Akal Mortgage. Let our team of experts assist you in achieving your financial goals and securing a brighter future for you and your family.

#debt consolidation#second mortgage#bad credit debt consolidation mortgage#best debt consolidation mortgage#consolidate debt with mortgage#first-time homebuyer#debt consolidation mortgage rates#debt relief mortgage#debt consolidation calculator#debt consolidation loan

0 notes

Text

Debt Assistance in SA

Debt Consolidation for Bill Payment Assistance – If you're finding it difficult to manage your finances, we're here to help. We can provide the funds necessary to cover your bills, resolve debts, and ensure your home remains functional.

Do you need to resolve debt and mortgage arrears in South Africa?

Are You looking for the Best debt consolidation Firm in South Africa?

Cape Town Loan Consolidation

Our specialists will guide you in assessing all your options, such as selling the property or considering a reverse mortgage. We'll collaborate with you to determine the most appropriate solution for your circumstances.

1 note

·

View note

Text

Credit Card Refinancing vs Debt Consolidation Loan

When it comes to managing credit card debt, two options to consider are credit card refinancing and debt consolidation loans. Credit card refinancing involves transferring your credit card balances to a new credit card with a lower interest rate. This can potentially save you money on interest charges, but you'll still have to pay off the entire balance on the new card. Debt consolidation loans, on the other hand, involve taking out a new loan to pay off multiple debts, including credit card balances. This can simplify your monthly payments, potentially reduce your interest rates, and help you pay off your debt faster.

0 notes

Text

Achieving Small Business Success: Strategies to Help You Succeed

We all know it’s hard to earn money through a business!There are many things to consider, like marketing, ensuring clients get terrific service, keeping an eye on cash, and running business. We've noted effective methods to run a small business to assist you reach your objectives below.

Success Strategies for Small Businesses

1. Setting Goals and Developing a Business Plan

The initial step to making a small business effective is to make a list of objectives and a tactical business strategy. Having a strategy will assist you remain on track and offer you a plan to follow. You need to make certain you can reach your objectives prior to you set them.

Making strategies for both long-lasting and short-term objectives is vital. Having a business strategy will not just assist you remain arranged, but it will likewise ensure you are entering the right instructions to reach your objectives.

2. Customer support

Small businesses that wish to succeed need to have terrific client service. Consumers are a business's main income. It is crucial to make sure that all of their requirements are fulfilled, and their expectations are constantly exceeded.

This can imply various things, like ensuring orders are done on time or providing valuable recommendations. Customer support that exceeds and beyond can likewise result in more consumer commitment and word-of-mouth advertising.

3. Financial Management

Tracking the cash in a small business is a crucial part of running it. When businesses do not manage their money well, it does not take wish for them to face difficulty. It's vital to keep precise records of all costs and capital, so you understand just how much money is can be found in and heading out.

Looking after your financial resources offers you the info you need to make great choices. Ensures your business is entering the right instructions.

4. Remaining Organised

Without excellent organisation, a small business can't succeed. Keeping all your records and files in order is necessary to track jobs and conference due dates. Guarantee they're constantly approximately date and simple to discover.

Having a clear, user friendly filing system that makes good sense and is simple to discover things in. Arranging your records and documents can assist you be more efficient and increase your opportunities of long-lasting success.

5. Networking

You need to make good friends with other business owners, specialists, and market professionals if you desire to understand what's going on in your pitch and the most current patterns.

You can likewise get your name out there and fulfill individuals who might be able to assist you by going to regional occasions and signing up with groups in your field. Invest the time and effort required to research study and participate in networking occasions pertinent to your business and field.

6. Staying up to date with Industry Trends

They need to understand what's occurring in their markets if small business owners desire their businesses to keep doing well. Stay up to date with the most recent modifications in your field so you can remain ahead of the competitors and benefit from any brand-new chances.

It's vital to understand about any brand-new laws or guidelines that might impact the business. Follow trade publications for your market, participate in conferences, and sign up with online forums and conversation boards. Networking with individuals in the exact same business is a fantastic method to keep up with market patterns.

7. Concentrate on the Right Borrowing Options

Getting a loan for a small business is not constantly simple, but it can be made with the correct actions. The primary step is guaranteeing you have an excellent credit rating and a strong business strategy. It is likewise necessary to comprehend just how much money you need, how you prepare to utilize it, and the length of time it will require to repay.

Furthermore, having a clear concept of the marketplace and the capacity of your business will be useful. You need to likewise show that you have the essential capital or resources to make your business effective.

You might begin looking for loan providers when you have all the documents. While conventional banks might not be the very best alternative for bank loan, there are lots of other choices. You can likewise think about alternative loan providers who can supply more versatile alternatives. Research study and comprehend any loan arrangement you sign.

Another essential element for protecting a small business loan is settling any existing financial obligations you might have. A debt consolidation loan from a direct lender might be the very best choice for some. Settling your financial obligations can assist you get the finest business financing offer. It is necessary to bear in mind that debt consolidation loans normally include greater interest rates, so ensure you comprehend the expense prior to starting.

Conclusion

The success of a small business is a not difficult but tough objective. Concentrating on the crucial steps in this blog site, like setting achievable objectives, developing a strong network, remaining arranged, and purchasing the right resources, will assist you develop a strong structure for your future successes.

You can construct a small business that succeeds and grows with effort and a strong dedication.

0 notes

Text

Balancing multiple debts can be difficult. Talk to a Loan Specialist to see if consolidation is the best option for you.Debt Consolidation allows you to pack your current loans into just one monthly payment

#personal loan usa#debt consolidation loan#online loan apply#online loan usa#sandstone financial#san antanio#usa

0 notes

Text

Here Are 7 Questions To Ask Before You Apply For A Debt Consolidation Loan

A personal loan happens to be one of the most affordable alternatives to any credit card. It can help you provide the needed finance whenever you are trying to make a big purchase.

The 7 important questions to ask before taking up a loan

What is the amount of loan that you require?

It would depend upon your need for taking the loan. Make sure that you take the loan only if you are in financial…

View On WordPress

1 note

·

View note

Text

Debt consolidation mortgage Ottawa | Mortgage Loan Ontario

Get lower Interest rate and Improve your Credit score with Best Debt Consolidation Mortgage Broker in Ottawa, Hassle-Free Application & No Credit Checks. Apply now!

0 notes

Text

Everything You Need to Know about Private Mortgage

Are you exhausted from renting and longing to become a homeowner? Well, the solution you’ve been seeking might just be a private mortgage! Private mortgages provide flexibility, accessibility, and a variety of options that traditional lenders cannot match. But what exactly is a private mortgage, how does it function, and why should you consider it over a conventional loan? In this article, we’ll provide a comprehensive overview of private mortgages, guiding you towards making the best decision for your journey towards homeownership. So fasten your seatbelt and let’s dive right in!

Understanding Private Mortgages

Requirements for Private Mortgages

To obtain a private mortgage, there are several prerequisites you must meet. Firstly, you’ll need to have a good credit score. If your credit score is lower, you may still be eligible for a private mortgage but anticipate a higher interest rate. Additionally, you’ll be required to demonstrate your financial capability to make monthly mortgage payments. Lenders will evaluate your income and debts to ensure that you can afford the loan repayments.

Ideal Situations for Private Mortgages

Certain circumstances make private mortgages a viable option. Here are a few scenarios in which a private mortgage may be advantageous:

Self-employment or alternative income: If you’re self-employed or receive income from unconventional sources, a private mortgage can showcase your ability to repay a loan.

Limited credit score for refinancing: If you possess home equity but your credit score isn’t high enough to qualify for traditional refinancing, a private mortgage could be a suitable alternative.

Short-term loan for home improvements: If you require a short-term loan (typically one year or less) to fund repairs or enhancements for your home, a private mortgage might be the best choice. Traditional mortgages typically have terms spanning 15 to 30 years.

When contemplating a private mortgage Mississauga, it’s crucial to shop around and compare offers from multiple lenders. Ensure that you carefully review the fine print and fully comprehend all the terms and conditions before entering into any agreement.

#debt consolidation#bad credit debt consolidation mortgage#second mortgage#best debt consolidation mortgage#debt consolidation calculator#first-time homebuyer#debt consolidation mortgage rates#consolidate debt with mortgage#debt consolidation loan#debt relief mortgage#private mortgage#mortgage broker mississauga

0 notes

Text

Who Can You Trust For Debt Advice?

Who Can You Trust For Debt Advice?

With inflation in the UK at a 40-year high, and the cost of living crisis keeping a tight grip on the nation’s wallets, it’s little surprise that the amount of UK adults with debt issues is rising.

(more…)

View On WordPress

0 notes

Text

Samle Lån: Collecting Loans for Debt Consolidation

Samle Lån: Collecting Loans for Debt Consolidation

Going into debt is something people try to avoid. While some really skilled businessmen use credits favorably, ordinary people rather go through life not having to worry about meeting a payment deadline. But as much as we try to avoid debt at all costs, sometimes it is inevitable. A myriad of events could send one running after loan providers regardless of terms and interest rates.

In the world…

View On WordPress

0 notes