#Data Center Renovation Market Growth

Text

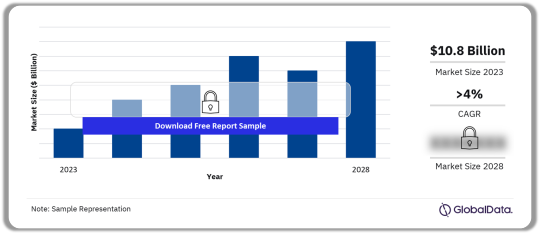

Data Center Renovation Market Predicted to Witness Steady Growth by 2028

The Data Center Renovation Market is poised to record lucrative growth through 2028 due to increased emphasis on renovating older modules of solutions like cooling & power systems and networking equipment.

Data center upgrades help improve the existing infrastructure and adapt to new standards to introduce advanced technologies with more efficiency and better performance. Moreover, the requirement for data centers has risen in recent years because of high adoption of cloud services. Companies planning to adopt cloud computing systems are relying on data centers that are equipped with the underlying infrastructure and foundation for a cloud service model, which has played a vital role in business growth.

Get sample copy of this research report @ https://www.gminsights.com/request-sample/detail/5239

The data center renovation market has been classified in terms of product, application, and region. Based on product, the data center renovation industry has been segregated into networking equipment, power, IT racks & enclosures, cooling, and DCIM.

The power segment is anticipated to observe strong growth over the assessment timespan. The growth of this segment is attributed to government initiatives aiming to regulate and reduce energy consumption in data centers, which would drive the need for efficient power systems in existing facilities.

The networking equipment segment is slated to exhibit substantial growth owing to increasing R&D investment for technology development. This is prompting companies to focus on launching new solutions to gain a competitive edge in the industry, which is set to propel segmental growth.

From the application perspective, the data center renovation market has been divided into BFSI, colocation, energy, government, healthcare, manufacturing, IT & telecom, and others. The energy segment is speculated to accrue considerable growth over the study timeframe due to rising need for efficient cooling and power system.

The government segment is foreseen to amass substantial gains through 2028. Rising focus of government authorities on transitioning into a digital economy would surge the need of data center renovation solutions and services to increase the capacity of the current facility, which is estimated to boost product uptake in the government sector.

The healthcare segment is expected to grow at a notable pace over the review timeline supported by widespread inclusion of advanced technologies like cloud computing, AI, and IoT in the healthcare sector for efficiently monitoring and maintaining patients' data The manufacturing segment is stipulated to witness considerable growth by 2028 owing to rising adoption of industry 4.0 practices along the manufacturing sector.

The others segment is foreseen to reach a sizable revenue by the end of 2028. Growing focus of retail industry on improving customer shopping experience, which would encourage industry players to upgrade their facilities to handle upcoming changes, which is set to foster segmental outlook.

Request for customization @ https://www.gminsights.com/roc/5239

From the regional standpoint, the South America data center renovation market is poised to record significant growth over the forecast period due to mounting availability and accessibility of affordable data center renovation solutions and services in the region, which would push more customers to modernize their facility.

Meanwhile, the Middle East & Africa data center renovation industry is primed to garner a notable share in the global market by the end of 2028. The expanding IT & telecom industry in the MEA region would provide affordable internet access to citizens, which is estimated to support market growth.

Table of Contents (ToC) of the report:

Chapter 1 Methodology & Scope

1.1 Scope & definitions

1.2 Methodology & forecast parameters

1.3 Regional trends

1.3.1 North America

1.3.2 Europe

1.3.3 Asia Pacific

1.3.4 South America

1.3.5 MEA

1.4 COVID-19 impact

1.4.1 North America

1.4.2 Europe

1.4.3 Asia Pacific

1.4.4 Latin America

1.4.5 MEA

1.5 Data sources

1.5.1 Secondary

1.5.2 Primary

1.6 Glossary

Chapter 2 Executive Summary

2.1 Data center renovation market 360º synopsis, 2018 - 2028

2.1.1 Business trends

2.1.2 Regional trends

2.1.3 Product trends

2.1.4 Application trends

Browse complete Table of Contents (ToC) of this research report @ https://www.gminsights.com/toc/detail/data-center-renovation-market

Electronics and Semiconductors Research Reports

Earphones & Headphones Market

Wireless Fire Detection Systems Market

Aerial Imaging Market

About Global Market Insights:

Global Market Insights, Inc., headquartered in Delaware, U.S., is a global market research and consulting service provider; offering syndicated and custom research reports along with growth consulting services. Our business intelligence and industry research reports offer clients with penetrative insights and actionable market data specially designed and presented to aid strategic decision making. These exhaustive reports are designed via a proprietary research methodology and are available for key industries such as chemicals, advanced materials, technology, renewable energy and biotechnology.

Contact Us:

Aashit Tiwari

Corporate Sales, USA

Global Market Insights Inc.

Toll Free: 1-888-689-0688

USA: +1-302-846-7766

Europe: +44-742-759-8484

APAC: +65-3129-7718

Email: [email protected]

#Data Center Renovation Market Analysis#Data Center Renovation Market by Type#Data Center Renovation Market ShareData Center Renovation Market Development#Data Center Renovation Market Growth

0 notes

Text

#Data Center Renovation (Transformation) Market#Data Center Renovation (Transformation) Market Trends#Data Center Renovation (Transformation) Market Growth#Data Center Renovation (Transformation) Market Industry#Data Center Renovation (Transformation) Market Research#Data Center Renovation (Transformation) Market Reports

0 notes

Text

U.S. Medical Bathtubs Market - Focused Insights 2024-2029

The U.S. medical bathtubs market was valued at USD 69.19 million in 2023 and is projected to reach USD 79.18 million by 2029, growing at a CAGR of 2.27% during the forecast period. The demand for medical bathtubs market is rising due to multiple factors, including the increasing prevalence of chronic diseases, the rising geriatric population, and technological advancements in medical bathtubs.

The study considers a detailed scenario of the present Medical Bathtubs market and its market dynamics for 2024−2029 in the U.S. It covers a thorough overview of several market growth enablers, restraints, and trends. The report offers both the demand and supply aspects of the market. It profiles and examines leading companies and other prominent players operating in the market.

MARKET DEFINITION

Medical bathtubs are designed to provide a safe and comfortable bathing experience for people who need assistance with personal hygiene tasks.

MARKET DRIVERS

Rising Awareness About Walk-In Bathtubs: As people become more aware of the health and safety benefits of walk-in bathtubs, they are increasingly likely to consider purchasing one for their home. Seniors and those with mobility issues benefit significantly from using a walk-in tub, which can help them stay safe and independent for longer. These tubs significantly lower the chances of falls or slips and provide a pleasant experience. Pain relief and muscle relaxation are two advantages of using a walk-in tub. As homeowners look for ways to make their homes safer and easier to navigate, installing a walk-in tub often becomes a top priority project during these renovations.

U.S. MEDICAL BATHTUBS MARKET KEY HIGHLIGHTS

The electric bathtubs segment is growing significantly, with the highest CAGR of 2.59% in the U.S. medical bathtubs market. The popularity of electrical bathtubs is increasing due to the rising adoption of technologically enhanced medical equipment and the rising need for convenient and effective therapeutic solutions. Also, the increasing incidence of chronic diseases and the aging population are paving the way for market growth.

The hospitals & clinics in the end-user segment hold the largest share of over 60% of the U.S. medical bathtubs market—the increasing demand for safe bathing facilities for hospital patients. Hospitals are also investing in innovative technologies to improve hospital beds so patients can experience comfort, thus resulting in segment growth.

By product, the walk-in bathtubs segment dominated the market by occupying the largest share in 2023 of the U.S. medical bathtubs market. The segment's growth is attributed to increasing demand for bath therapies, custom bathtubs, technological advancements, spa centers, the expansion of the hospitality industry, bathroom renovations, and home remodeling.

Due to the increasingly luxurious lifestyle among the U.S. people, companies are adopting various initiatives, including push strategies and lifetime free services, to drive the U.S. walk-in bathtubs market during the forecast period. Technological innovations, rising demand for IoT products, and therapy-based walk-in bathtubs are gaining traction in the market.

VENDOR LANDSCAPE

The U.S. medical bathtubs market report contains exclusive data on 22 vendors. Arjo, Beka, EGO Zlin, American Standard, and T.R. Equipment are the leading vendors operating in this market. Vendors, especially global players, must pursue inorganic growth strategies, such as acquisitions, to expand their presence, enhance product offerings, and improve expertise in the market. Overall, the market for medical bathtubs is characterized by diverse players focusing on innovation and product diversification to cater to customers' evolving needs and solidify their positions in the industry.

#industry data#market research#marketreports#industry#usa#healthcare industry#medicine#medical bathtubs#bathtub

0 notes

Text

Data Centre Equipment Market Demand, Opportunities and Forecast By 2029

This Data Centre Equipment market report has been prepared by considering several fragments of the present and upcoming market scenario. The market insights gained through this market research analysis report facilitates more clear understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. It consists of most-detailed market segmentation, thorough analysis of major market players, trends in consumer and supply chain dynamics, and insights about new geographical markets. The market insights covered in Data Centre Equipment report simplifies managing marketing of goods and services effectively.

The data centre equipment market is expected to witness market growth at a rate of 11.12% in the forecast period of 2022 to 2029.

Download Sample PDF Copy of this Report to understand structure of the complete report @ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-data-centre-equipment-market

Market Overview:

Data center equipment refers to various aspects of data center including architecture, design, architecture, incorporation of security mechanisms, and installation of electrical and mechanical systems.

The increase in need for construction and renovation of data center equipment across the globe acts as one of the major factors driving the growth of data centre equipment market. The convergence of mobile services, video, and cloud technologies resulting in the development of next-generation data center networks, and use of multiple operating systems running on virtual machines accelerate the market growth. The rise in need for efficiency and cost reduction of the datacenters, and technological advancements in the business model owing to cloud services further influence the market. Additionally, rapid infrastructural developments, expansion of end use industry, emergence of industry 4.0, and incorporation of security mechanisms positively affect the data centre equipment market. Furthermore, developments in virtualization technology extend profitable opportunities to the market players in the forecast period of 2022 to 2029.

Some of the major players operating in the Data Centre Equipment market are NTT Communication Corporation, Digital Realty Trust, Inc., Cyxtera Technologies, Inc., CyrusOne Inc., Global Switch, Equinix Inc., Huawei Technologies, Cisco Systems, Nokia, DELL, Juniper Networks, NetApp, EMC, Hewlett Packard, IBM, Oracle and Fujitsu Corporation, Brocade Communications Systems Inc., NEC Corporation, Meru Networks, and Alcatel Lucent, among others. among others.

Global Data Centre Equipment Market Scope

The data centre equipment market is segmented on the basis of product and end-user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

On the basis of product, the infrastructure monitoring market is segmented into storage devices, power distribution system, servers and network equipment.

On the basis of end-user, the data centre equipment market is divided into banking, financial services, insurance, telecommunication healthcare, retail, manufacturing, government, business enterprises and others.

Browse More About This Research Report @ https://www.databridgemarketresearch.com/reports/global-data-centre-equipment-market

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global Data Centre Equipment Market Landscape

Part 04: Global Data Centre Equipment Market Sizing

Part 05: Global Data Centre Equipment Market Segmentation By Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Browse Trending Reports:

Global Food Packaging Technology & Equipment Markethttps://www.databridgemarketresearch.com/reports/global-food-packaging-technology-equipment-market

Global Microtome Markethttps://www.databridgemarketresearch.com/reports/global-microtome-market

Global Waterproof Adhesives and Sealants Markethttps://www.databridgemarketresearch.com/reports/global-waterproof-adhesives-and-sealants-market

Global Herbicide Safeners Markethttps://www.databridgemarketresearch.com/reports/global-herbicide-safeners-market

About Data Bridge Market Research:

An absolute way to predict what the future holds is to understand the current trend! Data Bridge Market Research presented itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are committed to uncovering the best market opportunities and nurturing effective information for your business to thrive in the marketplace. Data Bridge strives to provide appropriate solutions to complex business challenges and initiates an effortless decision-making process. Data Bridge is a set of pure wisdom and experience that was formulated and framed in 2015 in Pune.

Data Bridge Market Research has more than 500 analysts working in different industries. We have served more than 40% of the Fortune 500 companies globally and have a network of more than 5,000 clients worldwide. Data Bridge is an expert in creating satisfied customers who trust our services and trust our hard work with certainty. We are pleased with our glorious 99.9% customer satisfaction rating.

Contact Us: -

Data Bridge Market Research

Email: – [email protected]

#Data Centre Equipment Market#Data Centre Equipment Market Growth#Data Centre Equipment Market Demand

0 notes

Text

House Valuation in Auckland: Understanding the Dynamic

The real estate market in Auckland, New Zealand, is renowned for its dynamism and resilience. House valuation in this bustling city is a multifaceted process, influenced by a myriad of factors ranging from location and property size to market trends and economic conditions. Understanding the intricacies of house valuation in Auckland is crucial for both homeowners and prospective buyers alike. Let's delve into the key aspects that shape house valuation in this vibrant metropolis.

Location, Location, Location:

house valuation auckland as in many other cities, location plays a paramount role in determining property value. Proximity to amenities such as schools, parks, shopping centers, and public transportation hubs can significantly enhance a property's valuation. Additionally, neighborhoods with low crime rates and a strong sense of community tend to command higher prices. The desirability of certain areas within Auckland, such as Ponsonby, Remuera, and Herne Bay, can lead to fierce competition among buyers, driving up property values.

Property Characteristics:

The physical attributes of a property also heavily influence its valuation. Factors such as size, layout, age, and condition all play a crucial role in determining its worth. Larger homes with more bedrooms and bathrooms generally fetch higher prices, especially in family-oriented suburbs. Likewise, properties with modern amenities and stylish finishes are often valued more favorably than those in need of renovation or repair. Additionally, features such as outdoor living spaces, views, and architectural uniqueness can further enhance a property's appeal and value.

Market Trends and Economic Factors:

The Auckland housing market is subject to fluctuations influenced by broader economic trends and market conditions. Factors such as interest rates, employment rates, population growth, and government policies all contribute to the ebb and flow of property values. For instance, a booming economy and low-interest rates typically stimulate demand for housing, leading to increased property values. Conversely, economic downturns or changes in government regulations can dampen market activity and put downward pressure on prices.

Comparable Sales Analysis:

One of the most common methods used to determine the value of a property is the comparative sales approach. This involves analyzing recent sales data of similar properties in the same area to establish a baseline value. Real estate professionals look at factors such as property size, location, condition, and amenities to identify comparable properties and assess their selling prices. By comparing these sales against the subject property, appraisers can estimate its market value with greater accuracy.

Supply and Demand Dynamics:

The principles of supply and demand also play a crucial role in determining house valuations in Auckland. Limited inventory coupled with high demand can lead to bidding wars and drive up prices, while an oversupply of properties can have the opposite effect. Understanding the balance between supply and demand in a particular area is essential for accurately assessing property values. Factors such as population growth, housing construction rates, and migration patterns all influence the supply-demand dynamics of the housing market.

Regulatory and Legal Considerations:

Regulatory factors and legal considerations can also impact house valuations in Auckland. Zoning regulations, building codes, environmental restrictions, and land use policies all shape the development potential and value of properties. Additionally, changes in taxation laws or government incentives can influence investor behavior and property values. Staying informed about the regulatory landscape is crucial for both homeowners and investors looking to maximize their property's worth.

Cultural and Demographic Trends:

Cultural and demographic trends can also have a significant impact on house valuations in Auckland. Changes in lifestyle preferences, demographic shifts, and cultural influences can shape the demand for certain types of properties. For instance, the growing popularity of sustainable living and eco-friendly housing options may increase the value of properties with energy-efficient features or green building certifications. Similarly, demographic trends such as an aging population or an influx of young professionals can drive demand for specific types of housing.

Conclusion:

House valuation in Auckland is a complex process influenced by a multitude of factors. From location and property characteristics to market trends and regulatory considerations, numerous variables come into play when determining the worth of a property. By understanding these dynamics and staying informed about the evolving real estate landscape, homeowners and investors can make informed decisions to maximize their property's value in Auckland's dynamic housing market.

0 notes

Text

Navigating India’s FDI Landscape: A Comprehensive Guide

Introduction

Foreign direct investment (FDI) plays a pivotal role in shaping India’s economic trajectory. As a nation with immense growth potential, India attracts investors from around the world. In this comprehensive guide, we’ll delve into the nuances of FDI, dissecting its impact, regulatory framework, and strategic considerations.

The Essence of FDI in India

Importance of FDI

Economic Growth Accelerator: FDI acts as a catalyst for economic growth. By injecting capital, technology, and expertise, foreign investors contribute to productivity gains, job creation, and overall development. India’s vibrant consumer base and diverse market opportunities make it an attractive FDI destination.

Sectoral Dynamics: FDI influences various sectors, including manufacturing, services, infrastructure, and technology. Let’s explore a few key sectors:

Manufacturing: One of the favorable sides of FDI is that it makes the production more expanded, as manufacturing companies are set up and hence the rise in employment and exports happen.

Services: Countries get various benefits from Foreign direct investment (FDI) in major sectors such as IT, healthcare, and education. Collaborative efforts with international origins contribute to benchmarking the degree of quality service and innovation.

Infrastructure: Forward foreign investment can be considered as a driving force in infrastructure renovation, that brings about connectivity improvement, transportation facilities, and better urban amenities.

Retail: It is the case for India’s retail sector that FDI* flows in, thereby impacting the consumer sphere.

Policy Reforms: India in course of time has been extending the FDI policies resembling the market economy. The authority announced the introduction of an automatics route which helped investors with simple procedures. Even after the reforms, the government still decides and approves whether a pro industry has any significance for the national interests.

Regulatory Framework for FDI in India

Routes and Caps

Automatic Route: The principle (of this route) is that even without a requirement on investors to seek prior consent there can be investments. Here, one can find sectors like IT, construction, and renewable energy or other branches that can absorb the talent of these professionals.

Government Route: Regulation in these sectors including defense, telecom and broadcasting is required hence government approval is needed.

Sectoral Caps: Some sectors are regarded as sensitive therefore the FDI is limited. On the one hand, the 51% capping is adopted for multi-brand retail, while 100% FDI is the upper limit allowed for single-brand retail.

Compliance and Reporting

Entities receiving FDI must adhere to reporting norms set by the Reserve Bank of India (RBI). Regular disclosures ensure transparency and regulatory compliance.

Fox&Angel: A Case Study

Fox&Angel your global expansion partner, exploring opportunities FDI in India:

Market Assessment: Fox&Angel use the advanced market researching strategies. It pinpoints the sectors that fit on its knowledge basis, which include AI, data analytics, automation and so on.

Legal Consultation: The Company engages legal advisers to manage the foreign investment laws. It is important to understand the barriers and every sector's rules as well as compliance requirements.

Investment Strategy: Just like the other startup (Fox&Angel) , it chooses the automatic route because it has tech-centered operations. It guarantees an organization free transaction of resources.

Operational Expansion: The firm moves into India setting up a subsidiary using FDI to enhance which of its activities, such as R&D , while getting a hold of the Indian consumer.

Conclusion

In conclusion, FDI in India is a dynamic force driving economic progress. Whether you’re a startup like Fox&Angel or an established multinational, India offers immense potential. Explore FDI avenues, collaborate, and contribute to India’s growth story. Contact us to explore FDI opportunities. Remember, this guide is a fictional creation, and any resemblance to real companies or events is coincidental. For accurate and up-to-date information, refer to official government sources and legal experts. If you have further questions or need personalized advice, feel free to ask!

0 notes

Text

Aerosols, Global Market Size Forecast, Top 12 Players Rank and Market Share

Aerosols Market Summary

Upright aerosols and inverted aerosols are two different types of aerosol products that are designed for different applications.

Upright aerosols are aerosol products that are designed to be used in an upright position. These products are usually packaged in containers with a valve that dispenses the product when the container is held in an upright position. Upright aerosol products include spray paints, lubricants, and cleaning products, among others.

Inverted aerosols are aerosol products that are designed to be used in an upside-down position. These products are packaged in containers with a specialized valve that allows the product to be dispensed when the container is inverted.

According to the new market research report “Global Aerosols Market Report 2023-2029”, published by QYResearch, the global Aerosols market size is projected to reach USD 13.33 billion by 2029, at a CAGR of 6.1% during the forecast period.

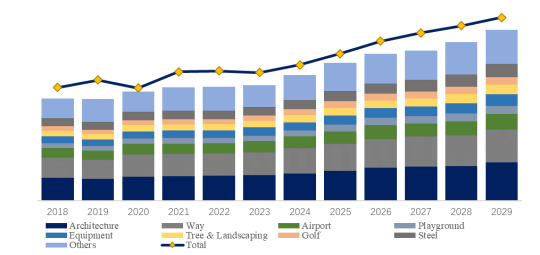

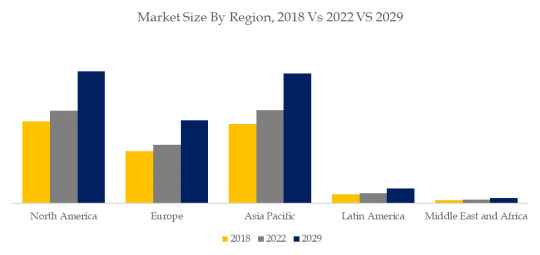

Figure. Global Aerosols Market Size (US$ Million), 2022-2029

Above data is based on report from QYResearch: Global Aerosols Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

Figure. Global Aerosols Top 12 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

Above data is based on report from QYResearch: Global Aerosols Market Report 2023-2029 (published in 2023). If you need the latest data, plaese contact QYResearch.

According to QYResearch Top Players Research Center, the global key manufacturers of Aerosols include Sherwin-Williams (Krylon), Nippon Paint, PPG, Rust-Oleum, 3M, Technima, SANVO Fine Chemicals Group, Seymour, Dy-Mark, LA-CO Industries, etc. In 2022, the global top five players had a share approximately 65.0% in terms of revenue.

Figure. Aerosols, Global Market Size, Split by Product Segment

Based on or includes research from QYResearch: Global Aerosols Market Report 2023-2029.

In terms of product type, Inverted Aerosols is the largest segment, hold a share of 53.5%,

Figure. Aerosols, Global Market Size, Split by Application Segment

Based on or includes research from QYResearch: Global Aerosols Market Report 2023-2029.

In terms of product application, Architecture is the largest application, hold a share of 22%,

Figure. Aerosols, Global Market Size, Split by Region

Based on or includes research from QYResearch: Global Aerosols Market Report 2023-2029.

Market Drivers:

Growth in demand in downstream industries: Demand in the construction and decoration industry is increasing, especially in areas such as interior decoration and furniture renovation. Furthermore, in the industrial sector, the need for spraying of small parts and temporary protective coatings has also increased the market demand for aerosol coatings.

Restraint:

Environmental regulations restrictions: Aerosol products, especially traditional aerosol coatings, often contain higher volatile organic compounds (VOCs), which are subject to strict environmental regulations in many countries and regions, such as the REACH regulations in Europe and the United States. EPA regulations, etc. These regulations require companies to reduce or replace hazardous substances, which increases product development costs and may affect sales.

About The Authors

Yunmei Sun---Lead Author

Email: [email protected]

Sun Yunmei has 2 years of industry research experience, focusing on research in the chemical industry chain related fields, including medical grade reagents, high-purity reagents for semiconductors, and chemical laboratory equipment.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Exploring Opportunities in the Azerbaijan Construction Market

The Azerbaijan construction market presents a landscape ripe with opportunities for both domestic players and international investors looking to participate in the country's burgeoning development projects. With a strategic location, favorable government policies, and a growing economy, Azerbaijan offers a conducive environment for the construction industry to thrive. In this comprehensive analysis, we delve into the key trends, challenges, and strategies that can unlock growth opportunities in the Azerbaijan construction sector.

Understanding Market Dynamics

The Azerbaijan construction market is characterized by a diverse range of projects spanning infrastructure development, residential construction, commercial real estate, and industrial facilities. With a focus on modernization and urbanization, the country is witnessing significant investments in transportation networks, energy infrastructure, and urban redevelopment initiatives, driving demand for construction services and materials.

Infrastructure Development: Driving Growth

Infrastructure development is a key driver of construction activity in Azerbaijan, supported by government initiatives aimed at enhancing connectivity, promoting trade, and fostering economic development. Major projects such as road and highway expansions, airport renovations, and port modernization efforts are creating opportunities for construction firms to participate in large-scale infrastructure projects and capitalize on the country's strategic location as a gateway between Europe and Asia.

Residential and Commercial Construction: Meeting Urbanization Demands

Rapid urbanization and population growth are fueling demand for residential and commercial real estate developments in Azerbaijan's major cities. From high-rise apartment complexes to mixed-use developments and commercial centers, construction firms are catering to the evolving lifestyle preferences of urban dwellers by offering modern amenities, sustainable design features, and innovative architectural solutions. Moreover, government incentives and mortgage financing programs are stimulating housing demand and driving investments in residential construction projects.

Key Market Trends

Sustainable Construction Practices

Sustainability is emerging as a prominent trend in the Azerbaijan construction market, driven by increasing awareness of environmental conservation and resource efficiency. Construction firms are incorporating sustainable design principles, energy-efficient technologies, and eco-friendly materials into their projects to minimize environmental impact and reduce operational costs over the long term. Moreover, green building certifications and sustainability standards are gaining traction, incentivizing developers to prioritize environmentally responsible construction practices.

Buy Full Report to Know More about the Azerbaijan Construction Market Forecast

Download a Free Report Sample

Digitalization and Technological Innovation

The adoption of digital technologies and construction innovations is reshaping the Azerbaijan construction industry, streamlining project management, enhancing productivity, and improving project outcomes. Building Information Modeling (BIM), virtual reality simulations, and drone surveys are enabling construction firms to optimize project planning, mitigate risks, and ensure quality control throughout the construction process. Furthermore, the integration of smart technologies, such as IoT sensors, automated machinery, and remote monitoring systems, is revolutionizing construction site operations and enabling real-time data analysis for informed decision-making.

Strategies for Success

Strategic Partnerships and Collaborations

Collaborations with local partners, government agencies, and international stakeholders are essential for navigating the complexities of the Azerbaijan construction market and accessing lucrative project opportunities. By forming strategic partnerships, construction firms can leverage local expertise, regulatory insights, and market knowledge to overcome entry barriers and establish a strong presence in the market. Moreover, joint ventures and consortiums enable firms to pool resources, share risks, and enhance project competitiveness, positioning them for success in the competitive landscape.

Talent Development and Capacity Building

Investing in talent development and capacity building is paramount for sustaining long-term growth and competitiveness in the Azerbaijan construction industry. Construction firms should prioritize recruitment, training, and skills development initiatives to build a skilled workforce capable of meeting the demands of complex construction projects. Additionally, fostering a culture of innovation, continuous learning, and knowledge sharing can drive organizational agility and foster a culture of excellence within the workforce.

Market Diversification and Risk Management

Diversifying market segments and geographic regions is crucial for mitigating risks and maintaining resilience in the face of economic uncertainties and market fluctuations. Construction firms should explore opportunities beyond traditional sectors and expand their portfolio to include niche markets, specialized projects, and alternative revenue streams. Moreover, implementing robust risk management strategies, including thorough due diligence, project feasibility assessments, and contingency planning, can safeguard against potential disruptions and ensure project success.

Conclusion

In conclusion, the Azerbaijan construction market offers abundant opportunities for growth and investment across diverse sectors and project types. By understanding market dynamics, embracing key trends, and implementing strategic initiatives, construction firms can position themselves for success in this dynamic and rapidly evolving landscape. With a focus on infrastructure development, sustainability, digitalization, and strategic partnerships, construction companies can unlock the full potential of the Azerbaijan market and emerge as leaders in the industry.

0 notes

Text

Analyzing Real Estate Investment Deals in the USA with the Experts at Craig Dipetrillo Properties

Investing in real estate can be a lucrative endeavor, but it requires careful analysis and consideration of various factors. In the United States, the real estate market offers numerous opportunities for investors, ranging from residential properties to commercial developments. However, success in real estate investment hinges on the ability to effectively analyze deals and make informed decisions. This guide will outline key strategies and considerations with the help of the professionals at Craig Dipetrillo Properties for analyzing real estate investment deals in the USA.

Market Research and Analysis

Before diving into any real estate investment deal, it's crucial to conduct thorough market research and analysis. This involves evaluating factors such as market trends, demand-supply dynamics, and economic indicators. Start by identifying target markets that exhibit strong growth potential and favorable investment conditions. Analyze historical data and current market trends to gauge the stability and profitability of the market. Additionally, consider factors such as population growth, employment rates, and infrastructure development, as these can impact the demand for real estate in a particular area.

Once you've identified potential markets, delve deeper into specific neighborhoods or submarkets within those areas. Assess factors like property appreciation rates, rental yields, and vacancy rates to determine the investment viability of different locations. By conducting comprehensive market research and analysis, Craig Dipetrillo Properties advises that you will identify promising investment opportunities and make informed decisions that align with your investment goals.

Financial Evaluation

Conducting a thorough financial evaluation is essential when analyzing real estate investment deals. This involves crunching the numbers to determine the potential return on investment (ROI) and assess the financial feasibility of a deal. Start by calculating key financial metrics such as cap rate, cash-on-cash return, and internal rate of return (IRR). These metrics provide valuable insights into the profitability and risk associated with a particular investment opportunity.

In addition to financial metrics, consider factors such as financing options, tax implications, and operating expenses. Evaluate different financing strategies, such as traditional mortgages, private financing, or partnerships, to determine the most cost-effective option for your investment. Factor in expenses such as property taxes, insurance, maintenance costs, and property management fees to accurately assess the cash flow potential of the investment. By conducting a comprehensive financial evaluation, the team at Craig Dipetrillo Properties are confident that you can determine whether a real estate investment deal aligns with your financial objectives and risk tolerance.

Property Analysis

Once you've identified a promising market and evaluated the financial aspects of a deal, it's time to conduct a thorough analysis of the property itself. This involves assessing both the physical condition of the property and its potential for value appreciation or income generation. Start by conducting a property inspection to identify any structural issues, maintenance requirements, or potential hazards that could impact the property's value or rental income.

In addition to the physical condition of the property, consider factors such as location, amenities, and potential for value-add opportunities. Evaluate the neighborhood demographics, proximity to schools, shopping centers, and transportation hubs, as these factors can influence the property's desirability and rental potential. Look for properties that offer unique features or value-add opportunities, such as distressed properties that can be renovated and flipped for a profit or multifamily properties that can be repositioned to increase rental income. According to Craig Dipetrillo Properties, by conducting a thorough property analysis you can identify investment opportunities that have the potential to generate long-term value and returns.

Risk Assessment

Every real estate investment carries inherent risks, and it's essential to assess and mitigate these risks before committing to a deal. Conduct a comprehensive risk assessment to identify potential pitfalls and challenges that could impact the success of your investment. Consider factors such as market volatility, economic downturns, regulatory changes, and environmental hazards that could affect the property's value or profitability.

In addition to external risks, evaluate internal factors such as financing risks, tenant turnover, and operational challenges. Consider implementing risk mitigation strategies such as diversifying your investment portfolio, maintaining adequate cash reserves, and securing appropriate insurance coverage. Conduct thorough due diligence on the property and seek professional advice from real estate agents, attorneys, and financial advisors to mitigate potential risks and ensure a successful investment outcome.

Exit Strategy

Having a clear exit strategy is crucial when analyzing real estate investment deals, as it allows you to plan for the future and maximize returns on your investment. Consider your investment goals and timeframe, and develop a strategic plan for exiting the investment when the time is right. Evaluate different exit strategies such as selling the property for a profit, refinancing to access equity, or holding the property long-term to generate rental income.

Consider factors such as market conditions, property appreciation rates, and tax implications when determining the most appropriate exit strategy for your investment. Create a contingency plan to address unforeseen circumstances or changes in market conditions that could impact your original exit strategy. By having a well-defined exit strategy in place, with the help of experts such as those at Craig Dipetrillo Properties, you can minimize risk and maximize returns on your real estate investment.

Analyzing real estate investment deals in the USA requires careful consideration of various factors, from market research and financial evaluation to property analysis and risk assessment. By following the strategies outlined in this guide and conducting thorough due diligence, investors can identify promising investment opportunities and make informed decisions that align with their financial objectives. Remember to continuously monitor market trends and adjust your investment strategy accordingly to maximize returns and mitigate risks in the dynamic real estate market.

0 notes

Text

Investing in Canadian Real Estate in 2024

Harnessing the Power of Canadian Real Estate: A Guide to Investing

Investing in real estate offers a pathway to long-term wealth generation, and the Canadian market provides a compelling environment for investors. Despite high purchase prices, as highlighted by the Canadian Real Estate Association's February 2024 data, opportunities abound within the nation's diverse real estate landscape. Let's delve into the current market, the pros and cons of investing, and proven strategies for success.

Understanding the Canadian Real Estate Landscape

Canada's real estate market is shaped by a variety of factors:

Urbanization: The Price of Popularity

Major Hubs, Major Costs: Densely populated metropolises like Toronto, Vancouver, and Montreal attract residents with employment opportunities, amenities, and cultural attractions. This high demand naturally drives up housing prices.

The Promise of Smaller Cities and Towns: Growing interest in less populated areas offers alternatives for those seeking lower housing costs and a different pace of life. These areas often have untapped development potential, making them interesting for future investment and growth.

Emmigration: A Driving Force in the Market

Canada's Welcoming Policies: Canada actively encourages immigration to boost its economy and fill labor gaps. This influx of new residents increases the need for housing.

Arriving with Capital: Many immigrants bring significant wealth to Canada. This financial advantage allows them to compete in the real estate market, particularly in desirable urban centers.

Regional Variations: The Importance of Targeted Research

No One-Size-Fits-All Market: Real estate trends differ across Canada's provinces and territories. Understanding local factors like economic growth, employment rates, and population shifts is vital when choosing investment locations.

Data is Your Friend: Resources like the Canadian Real Estate Association (CREA) offer regional market statistics and reports to guide your research.

The Case for Investing in Canadian Real Estate

The Power of Appreciation: Canadian real estate has a proven track record of steady increases in value. This means that, over time, your initial investment can potentially multiply, providing substantial returns.

Build Wealth with Passive Income: Owning rental properties provides a recurring revenue stream. Offset your mortgage, cover property expenses, and enjoy the potential to reinvest your profits and expand your portfolio.

Own a Tangible Asset: Unlike intangible assets like stocks, real estate offers a sense of ownership and control. You can leverage renovations and upgrades to actively increase your property's value and appeal.

Protection Against Inflation: Real estate prices tend to rise alongside inflation, helping your investment maintain its purchasing power. It's a smart way to shield your money against the eroding effects of rising prices within the economy.

Important Considerations: Risks and Challenges

Market Volatility: Economic downturns or shifts in demand can lead to declining property values. Investors must prepare for market fluctuations.

High Entry Costs: Prices in major cities can be a barrier. Smart budgeting and targeting less expensive regions are often necessary.

Ongoing Expenses: Maintenance, repairs, and property taxes add to ownership costs, eating into profit margins.

Time and Effort Commitment: Successful investing demands extensive research, deal negotiation, and potentially tenant or property management.

Strategies to Maximize Your Success

Here are some proven strategies to achieve your Canadian real estate investment goals:

1. Buy and Hold: The Long-Term Play

Focus: Capital appreciation and rental income over time.

Method: Acquire properties in areas with potential for growth, holding them for extended periods.

Ideal For: Investors seeking consistent passive income and long-term value growth.

2. House Flipping: Fast Profits, Calculated Risks

Focus: Quick returns through renovating and reselling undervalued properties.

Method: Identify properties with potential, undertake cost-effective renovations, sell for a profit.

Ideal For: Investors with construction/renovation knowledge and an eye for market trends.

3. House Hacking: Affordable Entry, Income Boost

Focus: Reducing living costs while entering the real estate market.

Method: Purchase a multi-unit property, live in one unit, and rent out the others.

Ideal For: First-time buyers and investors seeking reduced ownership expenses.

4. Real Estate Investment Trusts (REITs): Diversification and Ease

Focus: Passive income from a professionally managed portfolio of properties.

Method: Purchase shares in a REIT, receive dividends from rental income or property sale gains.

Ideal For: Investors seeking hands-off real estate exposure and consistent returns.

5. Private Real Estate Funds: Large-Scale, High Potential

Focus: Significant returns through investing in large commercial or development projects.

Method: Pool capital with other accredited investors, benefit from professional fund management.

Ideal For: Experienced investors with substantial capital and a higher risk tolerance.

Additional Factors to Consider

Financing: Research different mortgage products and shop around for the most competitive interest rates. A favorable rate can significantly impact your monthly costs and overall profitability.

Tax Implications: Canada offers tax deductions and benefits for real estate investors. Consulting a tax advisor can help you understand eligible expenses, depreciation calculations, and strategies to maximize your after-tax returns.

Local Regulations: Familiarize yourself with local bylaws including zoning, which dictates the permitted uses for a property, potential rental restrictions, and any relevant building codes and permits. This information is essential for avoiding costly fines or project delays.

Conclusion

Investing in Canadian real estate requires thorough research, careful planning, and a willingness to adapt to market dynamics. By understanding the advantages and risks, choosing a suitable strategy, and staying informed about local regulations, you can position yourself for long-term success in this dynamic asset class. Whether your goal is passive income, wealth accumulation, or active involvement in property development, the Canadian real estate market offers a wealth of opportunities for those who approach it with a strategic mindset.

Let me know if you'd like further expansion or focus on specific strategies!

1 note

·

View note

Text

The last Word Guide to Buying and Selling the very Best Houses In Real Estate

Introduction

Buying and selling mua xác nhà is an thrilling and worthwhile venture. With the real estate market consistently evolving, it is essential to stay knowledgeable about the most effective houses available for buy and sale. This comprehensive guide will present useful insights into the top methods, locations, and suggestions for successfully investing in real estate.

Section 1: Research and Preparation

1.1 Understanding the Market

Before diving into the world of real estate, it is essential to grasp the current market traits and housing demand. Conduct thorough analysis on local and nationwide real estate statistics, interest rates, and housing affordability. This data will assist you make informed selections when it comes to purchasing and promoting houses.

1.2 Creating a Real Estate Budget

Develop a price range that outlines your available funds for buying, promoting, and maintaining a property. This consists of factors similar to down funds, closing prices, and renovation expenses. A properly-planned budget is essential for defending your investment and ensuring monetary success.

1.3 Seeking Professional Advice

Consult with real estate brokers, financial advisors, and legal professionals to achieve worthwhile insights and advice in your investment strategies. These professionals have industry expertise and might show you how to navigate the complexities of the real estate market.

Section 2: Identifying the most effective Houses for Purchase

2.1 Location, Location, Location

The placement of a house plays a big role in its value and potential for growth. Consider factors comparable to proximity to varsities, public transportation, shopping centers, and recreational areas when evaluating a property's potential.

2.2 Unique Selling Points

Identify houses with distinct options and selling points, akin to architectural design, up to date amenities, or historic significance. These distinctive attributes can increase a property's value and attraction to potential consumers.

2.Three Renovation Potential

Buy houses with good bones and potential for renovations, as this could significantly enhance their value. Give attention to properties that require minimal repairs, permitting you to take a position in additional impactful improvements.

Section 3: Strategies for getting the very best Houses

3.1 Timing Your Purchase

Incorporate seasonal tendencies into your buying strategy. Typically, houses promote quickly in the course of the spring and summer season months, making it extra difficult to safe the most effective offers. Consider buying throughout the fall or winter months, when stock is larger and prices may be more aggressive.

3.2 Making a robust Offer

When making an offer on a home, be prepared to act rapidly and competitively. Present a well-researched, all-cash provide with minimal contingencies to exhibit your seriousness and improve your possibilities of securing the property.

3.3 Utilizing Financing Options

Consider varied financing choices, corresponding to loans, mortgages, or partnerships, when purchasing a property. These options can allow you to purchase the perfect houses at more affordable costs.

Section 4: Selling one of the best Houses for Profit

4.1 Preparing the House for sale

Spend money on crucial repairs and upgrades to increase the property's worth and enchantment to potential buyers. This includes important upkeep, landscaping, and interior design improvements.

4.2 Pricing the House Appropriately

Research the native real estate market and comparable properties to find out the optimum asking worth for your home. A nicely-priced property is extra likely to generate curiosity and promote rapidly.

4.3 Marketing Your house

Create an efficient advertising strategy that showcases your property's distinctive selling points. Utilize varied marketing channels, comparable to social media, on-line listings, and open houses, to reach a large audience of potential buyers.

Conclusion

Buying and promoting homes generally is a profitable funding alternative with the fitting methods and knowledge. By following this complete information, you may be effectively-outfitted to navigate the real estate market and identify one of the best houses for buying and selling. With diligent analysis, planning, and execution, you may achieve financial success on this planet of real estate.

1 note

·

View note

Text

The Silent Heroes: Generator Sets Shaping a Reliable Energy Future"

Generator Sets Market Overview

A generator is a device powered by gas or fuel that operates on the principle of rotational motion to produce temporary electricity. It is widely used in various sectors, including industries, agriculture, defense, science and technology, and daily life. Generators come in various variants, with the primary division being AC and DC generators. They are essential in areas where regular power supply infrastructure is lacking. The global generator sets market is expected to grow due to ongoing rapid industrialization, and the development of residential and commercial sectors. Increasing digitalization leads to greater demand for electricity by industries to facilitate their operations.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐁𝐫𝐨𝐜𝐡𝐮𝐫𝐞 : https://www.alliedmarketresearch.com/request-toc-and-sample/14173

Impact of COVID-19

The outbreak of the novel coronavirus has significantly impacted the global economy. Infrastructure projects, house construction, and renovation projects have been hampered due to the pandemic. However, the healthcare industry has seen a surge in demand for power supply to support hospitals operating at full capacity. This has led to increased demand for continuous power supply generators, particularly those rated at more than 750 kVa.

Top Impacting Factors

The increasing use of automatic devices and urbanization has driven the demand for generator sets, as electricity is required to power these devices. Bio-fuel generators that run on gas and diesel are expected to see growth, with diesel generators being commonly used in both residential and commercial settings. However, this increased use of diesel generators has environmental implications due to the emission of carbon gases, leading to a growing demand for cleaner sources of energy.

Market Trends

In developing countries such as India, where the focus is on building smart cities, there is a need for power supply backup during construction work. The construction industry demands power backups for construction tasks, including providing lighting for workers at night.

To address environmental concerns, manufacturers are developing dual-fuel generators that can run on both gas and diesel. Gas is a more cost-effective and environmentally friendly option.

In small-scale industries, emergency services, and the telecom industry, there is a consistent need for electricity backup, increasing the demand for generators with various capacity levels.

For household purposes, there is a significant market demand for small capacity generators for power backup in case of electric grid failure or natural disasters.

𝐄𝐧𝐪𝐮𝐢𝐫𝐲 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠 : https://www.alliedmarketresearch.com/purchase-enquiry/14173

Key Benefits of the Report

Analytical depiction of the Generator Sets Market along with current trends and future estimations.

Information on key drivers, restraints, and opportunities, including a detailed analysis of market share.

Quantitative analysis of the current market from 2020 to 2028, highlighting growth scenarios.

Porter's five forces analysis illustrating buyer and supplier potency in the market.

Detailed analysis of competitive intensity and the competition's likely evolution in the coming years.

Generator Sets Market Report Highlights

By Power Rating

< 50 kVA

50-125 kVA

125-200 kVA

200-330 kVA

330-750 kVA

750 kVA

By Application

Standby

Peak Shaving

Prime/Continuous

Others

By End User

Residential

Commercial

Telecom

Healthcare

Data Centers

Educational Institutions

Government Centers

Retail Sales

Real Estate

Commercial Complex

Oil & Gas

Manufacturing

Construction

Electric Utilities

Mining

Transportation & Logistics

Others

By Fuel

Diesel

Gas

Hybrid

By Region

North America (U.S, Canada, Mexico)

Europe (France, Italy, Germany, UK, Russia, Rest of Europe)

Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific)

LAMEA (Brazil, Saudi Arabia, South Africa, Rest of LAMEA)

𝐆𝐞𝐭 𝐚 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 @ : https://www.alliedmarketresearch.com/request-for-customization/14173

Key Market Players

Cummins

Yanmar

ABB

Aksa Energy

Wacker Neuson

Multiquip Inc

Kohler Co.

Caterpillar

Siemens Energy

Weichai Group

Mitsubishi Heavy Industries, Ltd

Denyo

Briggs & Stratton

0 notes

Text

Charting the Course: Future Predicting Insights into the Data Center Power Market Landscape

According to the latest research report released by Kings Research, the global data center power market generated USD 12.24 Billion in revenue in 2022. The study suggests the sector is poised to accrue USD 28.33 Billion in revenue by 2030, demonstrating a strong CAGR of 11.06 % from 2023 to 2030. The smart elevator market has been getting a lot of attention in recent years. The rapid growth of the sector and its impact on various industries has been highlighted in this report. The market extensively assesses the types of products, services, and technologies transforming how industries work.

By considering a number of factors, including market dynamics, research methodologies, segmentation analysis, growth factors, restraining factors, challenges faced by market participants, growth opportunities, regional analysis, and the competitive landscape, this in-depth market research report aims to provide detailed insights into the data center power market.

Request Sample PDF of the Report: https://www.kingsresearch.com/request-sample/data-center-power-market-223

Competitive Landscape

The competitive landscape of the data center power market is marked by intense rivalry, the emergence of innovative startups, and the dominance of key players. Leading businesses are promoting innovation, establishing standards for the sector, and adopting lucrative tactics to increase their market share. The competitive scenario is being shaped by strategic decisions, alliances, acquisitions, and product launches, which foster a dynamic environment for market participants.

Some of the prominent players reviewed in the research report include:

Cisco Systems, Inc.

Delta Electronics, Inc.

Eaton

Fujitsu Ltd

General Electric

Huawei Technologies Co., Ltd.

Microsoft

Mitsubishi Electric Corporation

Schneider Electric

NTT Limited

ABB

Key Developments

In June 2023: NTT Ltd. invested USD 300 million in its data center campus in Chennai to provide direct connectivity to or from India. The data center campus is spread over 6 hectares and has a total planned capacity of 34.8 megawatts (MW) of critical IT load from two data center buildings.

The global Data Center Power Market is segmented as:

By Product

Uninterruptible Power Supply (UPS)

Power Distribution Units (PDU)

Battery Monitoring Equipment

By End-User

IT & Telecommunications

Healthcare

Retail

Banking, Financial Services & Insurance (BFSI)

Others

Segmentation Analysis

An analysis of the data center power market segments has been carried out during the study in order to present an extensive overview of the industry. The market is divided into segments based on product type, end-users, and geography. This strategy made it possible to thoroughly examine each segment's distinctive traits, growth potential, and difficulties. The segmentation analysis identifies important insights or patterns prevalent in the global business.

The global Smart Elevator Market is segmented as:

By Setup

New Deployment

Renovation

Maintenance

By Application

Residential

Commercial

Industrial

Inquire Before Buying This Report:

Market Dynamics

The data center power market is characterized by a complex interplay of factors that influence its growth trajectory. Demand and supply forces, technological breakthroughs, regulatory frameworks, customer preferences, and economic trends are some of the key aspects covered in this comprehensive study.

On the other hand, the research highlights how market participants deal with various difficulties that have an impact on their plans and operations and are caused by the complexities, dynamics, and external factors influencing the market. Furthermore, the report studies the growth opportunities present in the industry, including companies tapping into emerging markets, stimulating innovation, and digital transformation.

Growth Drivers

The research conducted on the data center power market covers a number of driving forces that are expected to fuel the industry’s growth over the forecast period. Technological innovations, changing consumer preferences towards sustainability, and convenience, are some of the factors that will continue to propel the demand for data center power in the coming years.

Regional Analysis

The data center power market's geographical distribution significantly influences its dynamics. This report provides an in-depth analysis of key regional markets, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This analysis highlights regional patterns, emerging trends, key manufacturers, governmental frameworks, consumer behavior, and so forth.

About Us:

Kings Research stands as a renowned global market research firm. With a collaborative approach, we work closely with industry leaders, conducting thorough assessments of trends and developments. Our primary objective is to provide decision-makers with tailored research reports that align with their unique business objectives. Through our comprehensive research studies, we strive to empower leaders to make informed decisions.

Our team comprises individuals with diverse backgrounds and a wealth of knowledge in various industries. At Kings Research, we offer a comprehensive range of services aimed at assisting you in formulating efficient strategies to achieve your desired outcomes. Our objective is to significantly enhance your long-term progress through these tailored solutions.

0 notes

Text

Unlocking Opportunities: Investing in Commercial Real Estate for Success

Commercial real estate investment has long been a cornerstone of wealth generation and portfolio diversification. Unlike residential properties, which are primarily used for living, commercial real estate encompasses a broad spectrum of property types, including office buildings, retail centers, industrial spaces, and more. These diverse options provide investors with various opportunities to earn income and build long-term wealth. In this article, we will delve into the world of commercial real estate investment, exploring the reasons to consider it, the types of properties available, strategies for success, and the potential risks involved.

Why Consider Commercial Real Estate Investment?

Investing in commercial real estate offers several compelling reasons:

Income Potential: Commercial properties typically generate higher rental income compared to residential properties. This is especially true for office spaces and retail centers in prime locations.

Portfolio Diversification: Commercial real estate can be an excellent addition to your investment portfolio, diversifying risk and potentially providing a hedge against economic downturns.

Appreciation: Well-located commercial properties tend to appreciate in value over time, allowing investors to build equity and wealth. Visit https://www.oneworldcommercial.com/

Control: Unlike stocks and bonds, commercial real estate allows investors to have direct control over their investment, including property management decisions and value-enhancing strategies.

Tax Benefits: There are various tax advantages associated with commercial real estate, including depreciation deductions, 1031 exchanges, and the ability to write off expenses.

Types of Commercial Real Estate Properties

Before diving into the investment strategies, it's essential to understand the various types of commercial real estate properties:

Office Buildings: These include single-tenant or multi-tenant office spaces and can range from small suburban offices to large skyscrapers in urban centers.

Retail Centers: Retail properties encompass shopping malls, strip malls, and standalone stores. The success of these properties often depends on location and tenant mix.

Industrial Properties: This category includes warehouses, manufacturing facilities, distribution centers, and research parks. Industrial properties have gained popularity with the rise of e-commerce.

Multifamily Housing: While typically associated with residential real estate, apartment complexes and multifamily properties are also considered commercial real estate when they contain more than five units.

Hotels: Hotel investments can range from boutique hotels to large luxury resorts. The hospitality sector can be lucrative but is highly sensitive to economic cycles.

Special Purpose Properties: This category includes properties like healthcare facilities, data centers, and self-storage units, which cater to specific industry needs.

Strategies for Success in Commercial Real Estate Investment

To succeed in commercial real estate investment, consider the following strategies:

Location is Key: Choose properties in prime locations with strong demand and growth potential. Proximity to transportation, amenities, and a thriving business environment can significantly impact property value.

Thorough Due Diligence: Conduct comprehensive research, including financial analysis, tenant evaluations, and market studies, before making an investment. Evaluate the property's physical condition and potential for renovation or improvement.

Tenant Diversification: Diversify your tenant base to reduce risk. Avoid relying too heavily on a single tenant or industry. Long-term, stable leases can provide steady income.

Professional Management: Consider hiring professional property managers to handle day-to-day operations, tenant relations, and maintenance. Their expertise can help maximize returns and minimize headaches.

Financing Options: Explore financing options, such as commercial mortgages and partnerships, to leverage your investment and potentially increase returns.

Risk Management: Be prepared for potential risks, including economic downturns, tenant vacancies, and property maintenance issues. Building a cash reserve can help mitigate these risks.

Long-Term Perspective: Commercial real estate is a long-term investment. Be patient and have a clear exit strategy when the time comes to sell or reinvest.

Potential Risks and Challenges

While commercial real estate offers significant opportunities, it's essential to acknowledge the potential risks:

Economic Downturns: Commercial real estate can be sensitive to economic cycles. Recessions or market downturns can lead to tenant vacancies and declining property values.

Market Saturation: Oversupply of certain property types in a given market can lead to increased competition and reduced rental rates.

Tenant Vacancies: Tenant turnover and vacancies can impact cash flow, especially in retail and office spaces.

Regulatory Changes: Changes in zoning laws, building codes, or tax policies can affect property values and operational costs.

Property Maintenance: Regular maintenance and property improvements can be costly and time-consuming.

In conclusion, commercial real estate investment can be a lucrative avenue for building wealth and diversifying your portfolio. To succeed, conduct thorough research, choose properties wisely, and implement sound investment strategies. While there are risks involved, the potential rewards make commercial real estate an attractive option for investors seeking long-term financial success. Remember that success in this field often requires patience, diligence, and a willingness to adapt to changing market conditions.

#One_World_Commercial_Real_Estate#commercial_real_estate#retail_real_estate#lease_real_estate#commercial_investment_real_estate#business_commercial_real_estate

0 notes

Text

Demand for Dark Stone Market is Expected to Increase at a CAGR of 4.8% by 2032

“Dark Stone Market," The dark stone market size was valued at $3.7 billion in 2022, and is estimated to reach $5.8 billion by 2032, growing at a CAGR of 4.8% from 2023 to 2032. The rising need for home renovation and replacement is one of the major factors projected to fuel the global dark stone market growth. According to a January 2021 Harvard Joint Centre for Housing Studies report, the growth of house remodeling and repair expenditures is expected to increase from 3.5% at the end of 2020 to 3.8% by end of 2021 based on the most current Leading Indicator of Remodeling Activity (LIRA). Similar to this, representatives from the National Association of Home Builders' IBSx virtual event in February 2021 predicted that remodeling spending on owner-occupied single-family homes is anticipated to rise by 4% in 2021 and another 2% in 2022. Remodeling and refurbishment are variables that are expected to fuel the natural stone industry's profitable growth during the forecast period. Additionally, the growing consumer spending on home remodeling is boosting the demand for dark stones globally.

Global demand for dark stones is projected to rise significantly as a result of the rising demand from developing countries. As a result of rising government investments in infrastructure development and expanding FDI in nations like China, India, and Indonesia, there are more commercial real estate projects predicted to fuel the growth of the dark stone market. According to Savills India, the need for data center real estate will increase by 15 to 18 million square feet by 2025. "FDI in the real estate sector (including construction development & activities) stood at $55.5 billion from April 2000-December 2022," according to the India Brand Equity Foundation (IBEF).

Request For Sample :- https://www.alliedmarketresearch.com/request-sample/75125

According to the dark stone market analysis, the market is segmented on the basis of type, application, end user, and region. By type, the market is segregated into marble, granite, limestone, and others. On the basis of application, it is segmented into flooring, memorial arts, wall cladding, and others. Depending on the end user, the dark stone market is categorized into residential and commercial. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and the rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, and the rest of LAMEA).

As per the dark stone market forecast, the granite segment dominated the market, accounting for 42.4% of the dark stone market share in 2022 and is expected to sustain its dominance during the forecast period. Dark granite is frequently used for worktops, backsplashes, and bathroom vanities in residential buildings. It can be a magnificent focal point in these rooms due to its rich color and distinctive patterns. The flooring, fireplace surrounds, and outdoor paving made of dark granite give the overall design a polished aspect.

Depending on the end user, the commercial was the leading segment in 2022. The increase in investments in commercial real estate developments in developing countries like China and India is a major factor in the expansion of dark stone in the commercial sector. China saw a $24.8 billion increase in real estate investment in 2022. The IBEF reports that "the Government has allowed FDI of up to 100% for townships and settlements development projects."

Region-wise, Asia-Pacific was the leading market in 2022. The substantial increase in expenditures made in the industrialization and urbanization of rural areas in developing nations such as China and India had a significant impact on the development of the dark stone market in the area. "FDI in the real estate sector (including construction development & activities) stood at $55.5 billion from April 2000-December 2022," according to the India Brand Equity Foundation (IBEF). Blackstone, a private market investor that has invested $50 billion in the Indian real estate market, also plans to invest an additional $22 billion by 2030. As a result, it is anticipated that rising real estate investment in developing nations would serve as the primary growth driver for the dark stone market demand in the near future.

Request For Customization :- https://www.alliedmarketresearch.com/request-for-customization/75125

The key players operating in the global dark stone industry are constantly engaged in strategic developments such as partnerships, joint ventures, acquisitions, and mergers to exploit the prevailing dark stone market opportunities. Business expansion, acquisition, and collaboration have emerged as key strategies among the market players to strengthen their position and achieve growth in the long term. The major players operating in the market include Marble Trend, Polycor, Inc., Brachot-Hermant NV, Coldspring, Stone Source, LLC., Antolini Luigi and C. S.p.a., Pokarna Limited, UGM Surfaces, Tripura Stones Pvt. Ltd., Aravali India Marbles and Granites, Stoneville USA, Inc. Aro Granite Industries Ltd., Stone Group International, Bhandari Marble Group, and Levantina Y Asociados de Minerales, S.A.

Key findings of the study

The dark stone market was valued at $3,652.2 million in 2022 and is estimated to reach $5,816.2 million by 2032, growing at a CAGR of 4.8% during the forecast period.

On the basis of type, the limestone segment is estimated to witness the fastest growth, registering a CAGR of 5.9% during the forecast period.

By application, the flooring segment dominated the market in 2022, accounting for 35.6% of the market share.

As per end user, the residential segment is estimated to witness the fastest growth, registering a CAGR of 5.0% during the forecast period.

According to region, the U.S. was the most prominent market in North America in 2022 and is projected to grow at a CAGR of 5.0% during the forecast period.

Buy Now@checkout link :- https://www.alliedmarketresearch.com/checkout-final/86967c71780569874670a67da856942b

0 notes

Text

House Valuation in Auckland: Factors, Trends, and Insights

Introduction: