#Crypto Exchanges

Text

Governance Tokens DeFi: Empowering Decentralized Finance

Decentralized Finance, or DeFi, is a quickly growing industry of the blockchain sector that is revolutionizing traditional financing. It uses a variety of economic solutions, such as borrowing, trading, and also borrowing, without the requirement for intermediaries like financial institutions. However, to make certain the smooth functioning of DeFi methods, administration is crucial. This is where Governance Tokens enter into play.

What are Governance Tokens?

Governance Tokens are digital possessions that grant their owners the right to get involved in the decision-making procedure of a DeFi method. They permit token owners to suggest, vote, and implement changes to the protocol's procedures and also regulations. Governance Tokens are important for the decentralized governance of DeFi methods, as they allow an autonomous decision-making procedure without the requirement for centralized authorities.

How do Governance Tokens function?

Governance Tokens work with a Proof-of-Stake (PoS) consensus mechanism, which means that the more tokens an individual holds, the more ballot power they have. This makes sure that those that have a larger stake in the procedure have a greater say in the decision-making procedure. Governance Tokens are typically dispersed with Initial Coin Offerings (ICOs) or airdrops, where users can get them by staking other cryptocurrencies or by holding a specific quantity of symbols.

What are the advantages of Governance Tokens?

Governance Tokens supply numerous advantages to both DeFi procedures as well as token holders. Firstly, they supply a device for decentralized decision-making, ensuring that the protocol holds to its decentralized nature. This likewise makes certain that the method can adjust to altering market problems and also user demands, making it a lot more resistant and also sustainable over time.

Secondly, Governance Tokens incentivize active participation from token holders, as they have a direct risk in the success of the method. This ensures that token owners are more probable to participate in the decision-making procedure, causing even more informed and autonomous decisions.

Finally, Governance Tokens additionally supply a potential roi for token owners. As the method grows and also comes to be extra effective, the worth of the Governance Tokens may increase, resulting in resources gains for token holders.

What are the challenges of Governance Tokens?

While Governance Tokens offer several advantages, there are also some difficulties that need to be dealt with. https://manocoin.net/category/crypto-exchanges/ Firstly, the circulation of Governance Tokens might not constantly be fair, as those that have much more sources may be able to obtain a larger risk in the protocol. This can result in a focus of power, which might not be preferable in a decentralized system.

Secondly, the decision-making process might be sluggish and inefficient, as token owners might not always settle on the very best strategy. This can bring about hold-ups in implementing adjustments and might hinder the method's growth and also advancement.

Finally, Governance Tokens might also go through regulatory analysis, as they may be considered securities in some jurisdictions. This can cause legal challenges as well as might restrict the fostering of Governance Tokens in particular regions.

Conclusion

Governance Tokens are a crucial part of decentralized financing, making it possible for democratic decision-making and also incentivizing active engagement from token owners. While there are some challenges to be attended to, the benefits of Governance Tokens far surpass the drawbacks. As DeFi continues to grow and expand, Governance Tokens will certainly play a progressively essential function in ensuring the sustainability as well as durability of these methods.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

2 notes

·

View notes

Text

Storing And Securing Your Bitcoins: The Role of Wallets

Bitcoin wallets, also known as cryptocurrency wallets, are digital wallets that store your private and public keys, which are used to access your Bitcoins. As a decentralized digital currency, Bitcoin operates on a peer-to-peer network and transactions are made directly between users. A Bitcoin wallet is an essential tool for buying, selling, and storing Bitcoins. In this article, we will explore the basics of Bitcoin wallets and the different types available.

Read More...

#bitcoin#bitcoin exchange#bitcoin wallet#crypto wallets#virtual currency vs cryptocurrency#crypto currency#cryptography#crypto#cryptid#crypto exchanges

7 notes

·

View notes

Text

Exploring the Exciting Utility of NavC Token

What is NavC Token?

NavC is the native utility token of the NavExM exchange built on ERC- 20 standard. A crypto utility token is a digital asset that represents a specific utility or function on a blockchain-based platform. Utility tokens are used to access premium privileges of services offered by the platform. Similarly, NavC also has incredible utility on the platform. Also, unlike any other utility token, the benefit is not only limited to the services offered by the NavExM exchange. Instead, it acts as an excellent asset that can generate incredible returns in the future due its unique utility on the next-generation crypto exchange, NavExM.

The Exciting Utility of NavC Token

Incredible benefits are reserved for early NavC investors, such as Zero Trading Fees and Cashback Rewards. Further, being an early investor, you will be able to reap the maximum benefit of the capital appreciation that NavC provides.

1. Capital Appreciation

As mentioned above, the value of NavC appreciate every time a trade is being executed on the exchange. You may wonder how it is possible.

The unique Automated Market Maker (AMM) of NavExM ensures that all the transactions on the exchange pass through the NavC token creating demand for the token. The more you will trade, the more demand will be created.

Further, as per Tokenomics, NavC has a limited supply of 112.5 billion, out of which only 0.04% is available in the open market, and 88.89% will be locked in the NavExM ecosystem. The equation of consistent demand and limited supply will ensure consistent price appreciation for the token. Which means, with the rising trading volume on the NavExM crypto exchange, the value of NavC is also expected to rise.

2. Zero Transaction Fees*

NavExM is being built with the aim to increase trade participation in the ecosystem. Thus, instead of charging hefty transaction charges, the exchange offers a *zero-trading fee platform. It is a revolution in the industry as other contemporary exchanges have transaction fees of up to 0.10% — 1.00%. NavExM provides the next-generation crypto trading experience for free, which becomes possible because of the unique trading engine of the exchange. The AMM provides a reliable encapsulation of the trading pair value by NavC tokens which makes sure you bag more value of assets than that you have traded for, which will result in *zero trading fees.

3. Cashback Rewards*

How NavC Creates an Augmented Liquidity Pool in NavExM

The profitability of a trade depends on the liquidity in the market. Especially when you are trading cryptocurrencies, where the prices fluctuate every moment, it becomes crucial that the market has an extensive liquidity pool.

Liquidity in the market means how easily you can sell off your cryptocurrency or how easily you can swap one crypto token for another. An extensive liquidity pool provides a sufficient number of traders ready to buy and sell their tokens. As the number of traders increases, the spread between the bid and ask orders becomes narrow.

This provides the most appropriate selling and buying price to the sellers and buyers, respectively. The more traders trade on the platform, the higher the liquidity will be. As NavC provides an opportunity to earn assured cashback with each trade and trade with zero transaction fees, more and more traders will get attracted to trade on NavExM. The rising trade participation in the NavExM ecosystem will create deep liquidity in the exchange, which will make NavExM the preferred choice of crypto traders.

Conclusion

Incredible benefits of trading on NavExM, such as zero transaction fees, cashback rewards, and augmented liquidity pool, will encourage traders to increase their participation in the NavExM trading ecosystem, ensuring an exponential growth of its underlying currency. Thus, it is the best time to invest in NavC, as currently, it is available at a discounted price. Once the exchange goes live, the price of NavC is expected to rise by 60%, and after that, there is no looking back, and the current price will not be available again.

Crypto products are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions.

This is not an investment advice. Please do your own research before investing.

*T & C Apply

NavExM community members can trade without *trading fees and earn up to *0.10% of their trade value as *cashback rewards on every trade.

NavExM Beta will release very soon. You can join the thriving community of NavExM.

To learn more about this opportunity, AMA — https://t.me/nav_exm.

Sign-up on NavExM.com and get $3 NavC Tokens as welcome bonus.

2 notes

·

View notes

Text

Curated list of some of the best Crypto exchanges and apps for Singapore

https://agrtech.com.au/crypto-blockchain/best-crypto-exchanges-singapore/

0 notes

Text

Demystifying Crypto Basics: Unveiling the Magic Of Token Swaps

Introduction (50 words):.

In the ever-evolving globe of cryptocurrencies, token swaps have become a fascinating idea. This short article intends to clarify the basics of token swaps, supplying visitors with an extensive understanding of this process as well as its value in the crypto space.

Understanding Token Swaps (150 words):.

Token swaps, also called token conversions or token exchanges, refer to the procedure of trading one cryptocurrency for an additional. This exchange occurs on decentralized exchanges (DEXs) or centralized exchanges (CEXs) as well as is assisted in by clever contracts or trading systems.

The primary motivation behind token swaps is to improve the capability, scalability, or security of a specific cryptocurrency. Projects frequently initiate token swaps to upgrade their existing blockchain facilities, address scalability issues, or present brand-new attributes.

Token swaps can take place in two forms: soft forks and tough forks. Hard forks include creating a completely new blockchain with different guidelines, leading to a new cryptocurrency. On the other hand, soft forks maintain compatibility with the existing blockchain, making the new token backward-compatible.

Significance of Token Swaps (150 words):.

Token swaps play a crucial duty in the crypto ecological community for several reasons. Firstly, they allow jobs to advance and adapt, making certain that cryptocurrencies stay appropriate and affordable in a quickly transforming market. By updating their modern technology, projects can improve purchase speed, protection, and general customer experience.

Secondly, token swaps supply possibilities for investors and also investors. Swapping tokens allows them to diversify their holdings, accessibility brand-new jobs, or take part in token sales. https://manocoin.net/category/crypto-exchanges/ Additionally, token swaps can add to liquidity by consolidating trading quantities on specific exchanges, making it simpler for users to purchase as well as market cryptocurrencies.

Token Swap Process (150 words):.

https://manocoin.net/category/crypto-mining/ The token swap procedure generally entails a collection of actions. Firstly, the task reveals the swap, supplying information such as the swap proportion, timeline, as well as sustained exchanges. Users are then required to move their existing tokens to an assigned address or exchange budget.

Once the tokens are gotten, the job initiates the swap by melting the old tokens as well as dispersing the brand-new symbols to the individuals' wallets. This process is commonly automated with wise agreements, making sure transparency as well as precision.

It is essential for individuals to comply with instructions carefully during token swaps, guaranteeing they meet the defined target dates as well as use supported pocketbooks or exchanges. Failure to conform might result in the loss of symbols or an inability to participate in the swap.

Conclusion (50 words):.

Token swaps are a necessary aspect of the crypto ecosystem, permitting tasks to boost and adjust, while also providing chances for financiers and also traders. By understanding the fundamentals of token swaps, individuals can navigate this vibrant room with confidence as well as make use of its potential advantages.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Video

youtube

ARE THERE ANY CRYPTO EXCHANGES THAT DON'T REQUIRE KYC - BEST NO KYC EXCHANGES (WITH LOW FEES)

#cryptoexchanges #KYC #privacy #decentralization #cryptocurrency #BingX #anonymoustrading #AML #CTF #moneylaundering #identityverification #referralcode #911 #tradingrestrictions #anonymity #ChangeNOW #Bisq #LocalCryptos #HodlHodl #noncustodialexchange #evolvingregulations #alternatives #researchresponsibly #BingXwebsite #customersupport #cryptotrading #decentralizedfinance #empowerment #cryptocurrencyexchange #securetrading #cryptoenthusiasts

#youtube#cryptoexchanges#crypto exchanges#kyc#kyc verification#kyc compliance#decentralization#privacy#bingx#bingxcopytrade#cryptocurrency

0 notes

Text

Unleashing the Power of Crypto: Exploring the Basics Of Blockchain Gaming

Introduction (50 words):.

Welcome to the globe of blockchain video gaming, where cutting-edge modern technology fulfills immersive home entertainment. In this short article, we will dive into the fundamentals of crypto fundamentals and exactly how they converge with the interesting world of pc gaming. Brace on your own for an enlightening journey via the innovative landscape of blockchain pc gaming!

Understanding Crypto Basics (100 words):.

Before diving into the world of blockchain gaming, it is crucial to grasp the basics of cryptocurrency. Cryptocurrency, such as Bitcoin or Ethereum, is a digital or online type of money that uses cryptography for secure purchases. Unlike traditional money, cryptocurrencies are decentralized, meaning they are not controlled by any central authority like federal governments or financial institutions. This decentralized nature guarantees transparency, security, and also immutability of transactions, making it a perfect fit for the gaming market.

The Rise of Blockchain Gaming (100 words):.

Blockchain technology, the underlying framework behind cryptocurrencies, has actually reinvented numerous sectors, consisting of pc gaming. Blockchain video gaming leverages the openness and also safety of blockchain to develop unique video gaming experiences. By using non-fungible tokens (NFTs), blockchain gaming enables players to absolutely own and trade in-game properties, giving a new degree of value as well as possession. Additionally, blockchain modern technology makes sure reasonable play as well as avoids dishonesty, boosting the gaming experience for all players included. https://ManoCoin.net/

Benefits for Gamers (100 words):.

Blockchain gaming uses a number of advantages for players. Firstly, it enables true possession of in-game possessions. Unlike typical video games, where players do not have control over their acquired items, blockchain pc gaming allows players to trade, market, as well as also make real-world worth from their virtual belongings. This possession promotes a sense of financial investment and worth, boosting the overall gaming experience. Moreover, blockchain video gaming gets rid of the risk of scams as well as dishonesty, as all deals are taped on the blockchain and can not be modified. This produces a reasonable and safe atmosphere for players to appreciate their favored games.

The Future of Blockchain Gaming (100 words):.

As blockchain innovation proceeds to progress, the future of blockchain gaming looks extremely appealing. Developers are discovering cutting-edge ways to integrate blockchain into game mechanics, creating decentralized and also immersive pc gaming experiences. With the increase of digital fact (VR) and also increased reality (AR), blockchain pc gaming has the potential to transform the way we communicate with virtual worlds. Furthermore, the assimilation of blockchain in cross-platform video gaming can enable smooth gameplay throughout different devices and also environments. The opportunities are countless, as well as the future of blockchain gaming is definitely bright.

Conclusion (50 words):.

Blockchain pc gaming represents a new period in the gaming sector, merging the globes of cryptocurrency as well as pc gaming to create fulfilling and also one-of-a-kind experiences for gamers. By welcoming the power of blockchain, players can appreciate true possession, safety, and fairness in their favorite video games. So, get ready and prepare yourself to start an exciting trip into the world of blockchain video gaming!

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

Title: Unraveling the Collapse of FTX: Lessons Learned in the Crypto Space

The collapse of FTX, a leading cryptocurrency exchange, has sent shockwaves through the digital asset community, prompting reflection on the underlying causes and broader implications for the industry. In this blog, we’ll delve into the factors contributing to FTX’s downfall and extract key lessons for stakeholders navigating the volatile landscape of crypto finance.

The Rise of FTX:

FTX rose…

View On WordPress

0 notes

Text

💱💰 Maximize tax efficiency and ensure compliance in the world of cryptocurrencies with our essential tax strategies guide for exchanges and wallet providers! Learn how to navigate digital asset taxes and regulatory complexities effectively. #Cryptocurrency #TaxStrategies #Compliance

#Cryptocurrency#Tax Strategies#Digital Asset Taxes#Regulatory Compliance#Crypto Exchanges#Wallet Providers

0 notes

Text

A Closer Look at Costs Associated With Crypto Exchanges.

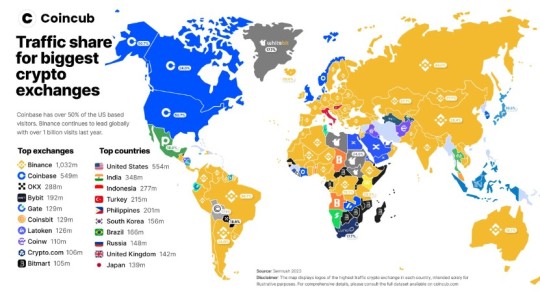

Exploring crypto exchanges goes beyond trading pairs. Take a closer look at the often-overlooked aspect costs. Aspects like transaction fees, withdrawal charges, and hidden costs can impact your overall returns. It is recommended to look at these intricacies wisely. For the insights and other information on optimizing costs, explore Coincub.

0 notes

Text

Unveiling the Crypto Frontier: Unlocking Lucrative Opportunities For Financial Gain

Introduction:

In the ever-evolving world of cryptocurrencies, possibilities to create substantial riches abound for those that have the expertise and acumen to navigate this vibrant landscape. With the best strategies and also an eager eye for arising patterns, people can take advantage of the capacity of this electronic phenomenon as well as earn money in crypto. In this post, we delve into some lesser-known approaches and also terms that can assist you open the doors to economic success within the crypto ball. https://GPUCoin.net/

1. Capitalize on Cryptocurrency Mining:

Cryptocurrency mining, a process that involves addressing complex mathematical problems to validate deals, continues to be a popular and also trusted approach to make crypto. By utilizing specialized equipment, called mining gears, individuals can add their computational power to safeguard the blockchain network and obtain incentives in the kind of freshly produced coins. However, it is essential to consider aspects such as electrical energy costs and also mining problem when identifying the success of this endeavor.

2. Embrace Staking for Passive Income:

Staking is an unique concept that allows crypto holders to earn easy revenue by merely holding as well as "betting" their coins in a compatible wallet. By participating in the agreement system of Proof-of-Stake (PoS) networks, individuals add to the network's security and, in return, obtain regular rewards. This method commonly supplies higher returns contrasted to traditional cost savings accounts, but it's important to research study and select trusted PoS jobs to mitigate risks.

3. Participate In Yield Farming and also Liquidity Mining:

For the even more adventurous crypto lovers, return farming as well as liquidity mining present interesting opportunities to optimize returns. Yield farming includes financing or locking up funds in decentralized financing (DeFi) protocols to make extra tokens as benefits. Liquidity mining, on the various other hand, incentivizes users to supply liquidity to decentralized exchanges by staking their assets. Both techniques need careful consideration of threats, rewards, as well as the underlying procedures entailed.

4. Explore NFTs and also Digital Collectibles:

The introduction of Non-Fungible Tokens (NFTs) has revolutionized the digital art and also collectibles market. https://gpucoin.net/ NFTs represent distinct digital possessions, such as art pieces, songs, or digital property, that can be acquired, offered, and also traded on blockchain systems. By buying NFTs, individuals can potentially make money from their appreciation or perhaps produce and also market their own digital developments.

5. Join Initial Coin Offerings (ICOs) as well as Initial Exchange Offerings (IEOs):

ICO and also IEO events offer chances to purchase promising blockchain tasks at an early stage. By buying symbols throughout these fundraising occasions, investors can potentially gain from their future worth gratitude. However, it is vital to conduct extensive due persistance on the job, its group, as well as its tokenomics to mitigate the intrinsic risks related to early-stage investments.

Conclusion:

As the crypto landscape proceeds to progress, the possibility for financial gain within this domain name stays substantial. By leveraging distinct methodologies such as mining, betting, produce farming, NFTs, and participating in ICOs or IEOs, people can position themselves at the forefront of this electronic transformation. However, it is important to approach these possibilities with cautious consideration, thorough research study, as well as a readiness to adjust to the ever-changing characteristics of the crypto market. With the appropriate expertise and methods, the world of crypto can end up being an entrance to unlocking considerable monetary rewards. https://www.gpucoin.net/defi/

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

The secret Of Bitcoin

Decentraland is a blockchain-based virtual world, in which customers can stroll around with associates, go to buildings, go to events and show their NFT artwork collections. This occasion is designed to identify exceptional tasks while also providing MEXC customers with airdrop advantages. MX also provides a 20% transaction payment discount on the MEXC platform, and it has launched many plans to enhance the MX token financial system and expand its utilization scenarios by providing further utilities similar to on-chain lending, liquidity mining, and DEX buying and selling, together with Launchpads, Kickstarter, MX Defi, Assessment Zone Voting, MEXC M-Day, and MEXC POS. Together with its flagship product, the Matic POS (Proof-of-Stake), Polygon as a platform has been designed to scale Ethereum and build Layer 2 infrastructure similar to Validium, zkRollups, Plasma, and Optimistic Rollups. Polygon is primarily categorized as a Layer 2 platform as a result of it works alongside the Ethereum network, and is thought for its capability to reduce the price of transacting and improve the velocity of transactions on the Ethereum blockchain. They proposed a token standard that received approval as an ordinary Ethereum token for specialised NFTs - the ERC-1155. Players can use NFTs as proof of possession of digital belongings in the sport. https://urlscan.io/result/bd269983-b03a-4c9b-92fc-895470c6709e/ Players can commerce these digital items on NFT marketplaces and combine them into their video games.

Like the Sandbox, Enjin distributes software improvement kits (SDKs) to builders to facilitate rapid integrations into games. Once the smart contract is deployed to the blockchain, DeFi dapps can run themselves with little to no human intervention (though in practice developers usually do maintain the dapps with upgrades or bug fixes). Binance Smart Chain, created by the Binance neighborhood in April 2019, has lately grow to be one among the preferred crypto exchange platforms. Smart contracts require real-world knowledge to be fed in to fulfill the necessities of conditions of a proposition. The market faced similar situations the previous year and then ultimately fought again. In 2014, Bloomberg named bitcoin one of its worst investments of the year. ’s sturdy 12 months and driving some crypto platforms into bankruptcy. GRT is an excellent crypto token so as to add to your portfolio. Is it worth investing in MX Token? There might be charges for exchanging cryptocurrency for fiat forex and transferring the funds out of the alternate or eradicating it to retailer it, however it is worth contemplating if you're not holding your cryptocurrency as an investment. But it’s value questioning the use cases for NFTs outside of megafans and speculators.

Developers use the open APIs of the Graph, which can easily entry the on-chain knowledge previously indexed by a network of node operators. The network relies on the InterPlanetary File System (IFPS) protocol. Aside from providing P2P sharing of storage, the network also acts as a layer to incentivize participation within the community. Participation in MEXC Launchpads is unique to MX token holders, with the one requirement being possession of MX tokens. Click Here MX has several purposes, together with getting used for expenses related to buying and selling and transactions, participation in voting for listed initiatives, and airdrop bonuses for MEXC users and traders. Additionally, KuCoin just isn't probably the most person-friendly platform and is likely to be troublesome to navigate for some novice traders new to crypto coins. The technology behind the platform is called the Subgraph. The Polish exchanged their data and technology with the Allies, who created their very own Enigma Machines and deciphered a lot of Germany's coded messages. Scala Blockchain additionally possess a premiere developer crew that wouldn't solely merely develop our personal apps (like all the other coders within the open developer group), we would be obtainable to supply providers to Doctors, Hospitals, and Medical Professionals alike who want to create healthcare apps on a platform devoted specifically to well being, medical, and health.

The staff working at Enjin specializes in NFTs. Why are NFTs getting so much attention? While NFTs can take many alternative types, all of them share one key characteristic: they’re all saved on a blockchain. All it's important to do is meet in individual and agree on a key. The process to switch BTC utilizing public-key cryptography has assured BTC customers and merchants of the piece of thoughts they will have when transferring and receiving currency. Bitcoins are exchangeable for fiat foreign money by way of cryptocurrency exchanges and can be utilized to make purchases from merchants and retailers that settle for them. While some view it as a scam, others consider it has the potential to exchange conventional fiat currencies just like the dollar and euro. While governments worldwide rally about regulations on digital assets, fixed efforts are being made to advance the Central Bank Digital Currencies (CBDC) tasks in numerous international locations. Critics initially dismissed Bitcoin as a futurist pipe dream - or worse, a boon to black market criminals - however now Bitcoin's underlying know-how is being hailed as the future of finance. Unfortunately, NFT sales took a hit in June 2022 with the bear market and falling greater than 80% (to round $167 million) from its peak of practically $1 billion in January.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

0 notes

Text

Margin Trading Basics: how to Trade Crypto With Leverage

Cryptocurrency trading has ended up being a popular way to make and also invest money in the digital world. However, for those who are new to trading, it can be challenging to understand the various trading techniques as well as terms entailed. One such strategy is margin trading, which enables traders to boost their possible revenues by using take advantage of. In this write-up, we will check out the fundamentals of margin trading in crypto trading.

What is Margin Trading?

Margin trading is a trading technique that entails loaning funds from a broker or an exchange to increase the dimension of a trader's placement. This technique enables traders to raise their prospective earnings by using leverage, which is the capability to control a larger amount of possessions with a smaller sized amount of funding.

In margin trading, the investor utilizes their very own capital as collateral to borrow funds from the broker or exchange. The obtained funds are made use of to raise the dimension of the trader's placement, which means that the prospective earnings or losses are likewise enhanced.

How Does Margin Trading Work in Crypto Trading?

Margin trading in crypto trading operate in the very same means as margin trading in standard markets. However, there are some distinctions that investors need to be knowledgeable about.

In crypto trading, the trader can borrow funds from the exchange or other traders to boost the size of their placement. The obtained funds are used to purchase even more cryptocurrency, and the trader can market the cryptocurrency at a greater rate to earn a profit.

Margin trading in crypto trading is typically done with futures contracts or continuous agreements. Futures contracts are contracts to offer a possession or get at a predetermined cost as well as date in the future. https://ManoCoin.net/ Perpetual contracts resemble futures agreements, however they do not have an expiration day.

When trading on margin, the investor needs to maintain a specific amount of security in their account to cover the obtained funds. This is recognized as the margin need, and also it is generally shared as a percentage of the complete position dimension.

For example, if the margin need is 10%, and the trader wants to buy $10,000 worth of cryptocurrency on margin, they require to have $1,000 in their account as security.

The trader can offer it for an earnings and pay back the borrowed funds with interest if the cost of the cryptocurrency goes up. However, if the rate of the cryptocurrency drops, the trader can endure substantial losses as well as may be required to market their placement to cover the obtained funds.

Advantages and also Disadvantages of Margin Trading

If done correctly, margin trading can be a lucrative trading approach. However, it likewise comes with its own collection of downsides as well as risks.

Advantages:

1. Increased Potential Profits: Margin trading allows investors to enhance their potential earnings by utilizing utilize to manage a larger amount of properties with a smaller quantity of resources.

2. Diversification: Margin trading allows investors to expand their profile by trading on numerous exchanges and markets.

3. Short Selling: Margin trading enables investors to benefit from falling costs by brief marketing, which is the method of offering a possession that the investor does not have in the hope of acquiring it back at a lower cost.

Disadvantages:

1. Increased Risk: Margin trading magnifies the possible earnings and losses, which suggests that investors can suffer considerable losses if the market moves against them.

2. Margin Calls: If the market moves versus the investor, they may receive a margin telephone call from the broker or exchange, which needs them to transfer more funds to cover the borrowed funds.

3. Interest and also Fees: Margin trading typically includes paying interest as well as costs on the borrowed funds, which can eat right into the investor's revenues.

Conclusion

Margin trading is a prominent trading strategy in crypto trading that allows traders to enhance their prospective earnings by using take advantage of. However, it also features its own collection of risks and downsides. Traders need to very carefully consider their danger resistance as well as trading experience prior to taking part in margin trading. It is additionally essential to choose a trusted broker or exchange that supplies margin trading with reasonable fees and also margin demands.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

Study the World of Crypto Mining Pools: Unveiling The Basics

Introduction (50 words):.

Cryptocurrency mining has actually come to be a preferred venture for people seeking to earn electronic possessions. However, the process can be resource-intensive as well as complex. In this article, we will untangle the principle of mining swimming pools, describing how they work and also their value in the crypto mining landscape.

Understanding Cryptocurrency Mining (100 words):.

Cryptocurrency mining entails using effective computers to solve complex mathematical issues, validating transactions on a blockchain network. Successful miners are rewarded with freshly minted coins. https://manocoin.net/ However, as the mining trouble rises, private miners might find it testing to contend and gain incentives consistently.

Introducing Mining Pools (100 words):.

Mining pools were presented to address the difficulties faced by individual miners. A mining pool is a collective effort where numerous miners incorporate their computational power to increase their chances of earning benefits. By merging their sources, miners can jointly resolve more blocks, leading to an extra predictable and consistent earnings stream.

How Mining Pools Operate (100 words):.

When joining a mining pool, individuals add their computer power to a shared network. The pool's computational power is then directed towards solving complicated mathematical troubles. Once a block is effectively mined, the benefits are distributed among the swimming pool members based upon their added computer power. This ensures that even miners with less powerful hardware can still receive a reasonable share of the rewards.

Advantages of Mining Pools (100 words):.

1. Increased Chances of Reward: By merging sources, miners have a higher possibility of successfully extracting a block and also gaining incentives.

2. Consistent Income: Mining swimming pools offer a stable revenue stream, as rewards are dispersed frequently among members.

3. https://manocoin.net/category/defi/ Reduced Hardware Costs: Joining a mining swimming pool enables miners to share the prices of costly mining equipment, decreasing the economic problem.

4. Lower Energy Consumption: Pool mining decreases energy intake given that individuals' combined computational power is used more effectively.

Selecting the Right Mining Pool (50 words):.

When choosing a mining pool, take into consideration factors such as swimming pool dimension, fees, payment techniques, and online reputation. A bigger pool might use more consistent incentives, however smaller sized pools can give a more customized experience. Additionally, make certain the pool aligns with your recommended cryptocurrency and also mining equipment.

Conclusion (50 words):.

Mining swimming pools play an important function in the cryptocurrency mining ecological community, allowing miners to jointly increase their possibilities of making benefits. By combining computational power, miners can appreciate a much more consistent earnings stream, decreased costs, and also a reasonable circulation of rewards. Joining the right mining pool can greatly improve your mining experience and possible earnings.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

1 note

·

View note

Text

Spot Bitcoin ETFs: A Deep Dive into the Pros and Cons of Purchasing and How to Get Started

Introduction:

The approval of spot Bitcoin ETFs by the SEC on January 10, 2024, marked a significant milestone in the cryptocurrency landscape. Investors and traders seeking a simplified way to invest in Bitcoin found a new avenue for diversifying their portfolios. This comprehensive guide explores the intricacies of Bitcoin ETFs, detailing their definition, functionality, differences from direct Bitcoin investment, where to buy them, and the various methods of purchase.

What Is a Bitcoin ETF?

A Bitcoin Exchange-Traded Fund (ETF) is a fund that holds various assets and is traded on the exchange like stocks. Unlike traditional investments, ETFs provide a blend of stocks, bonds, and mutual funds, allowing investors to trade them throughout the day at different prices. Bitcoin ETFs specifically focus on assets related to Bitcoin, with investment firms managing these funds.

How Does Bitcoin ETF Work?

Bitcoin ETFs operate similarly to other ETFs, where the asset management company purchases Bitcoin ETFs and issues shares. Investors, upon buying these shares, gain exposure to the fund, where Bitcoin ETFs are stored as assets. ETFs can be traded on traditional stock exchanges, simplifying the investment process. Investors pay an annual fund management fee to the institute managing the fund.

Difference Between Investing in a Bitcoin ETF and Bitcoin:

One major distinction is that Bitcoin ETFs can be traded through traditional brokerage accounts, eliminating the need for cryptocurrency exchanges. Bitcoin ETFs are regulated by the SEC, providing a level of oversight and reducing volatility compared to direct Bitcoin investments. While Bitcoin itself lacks regulatory oversight, Bitcoin ETFs offer a familiar environment to new investors.

Where Can You Buy Bitcoin ETFs?

Bitcoin ETFs, post-SEC approval, are available for purchase through major fund managers, listed on exchanges like NYSE, Nasdaq, and CBOE. Notable fund managers offering Bitcoin ETF shares include ARK, Bitwise, iShares, Fidelity, VanEck, Grayscale, Franklin, Hashdex, Invesco, WisdomTree, and Valkyrie. Each has its own expense ratio and waiver periods/asset limits.

Ways To Buy Bitcoin ETFs:

Investors have multiple options for purchasing Bitcoin ETF shares:

Online Brokerage Accounts: Utilize platforms like Robinhood, Charles Schwab, or others to buy Bitcoin ETF shares through a traditional brokerage account.

Financial Advisers: Seek guidance from financial advisers who can assist in the investment process, with a growing interest in ETFs among financial advisors.

ETF Issuers: Directly visit the issuer's portal to buy ETFs, requiring a brokerage account with affiliated brokerages.

Crypto Exchanges: Anticipate the launch of Bitcoin ETF services on major crypto exchanges like Coinbase and Kraken, expected in 2024.

How To Buy Bitcoin ETFs:

Follow these steps to purchase Bitcoin ETFs:

Create a Brokerage Account: Choose a brokerage supporting Bitcoin ETFs, such as Charles Schwab or Vanguard. Install the brokerage application or use the official portal to sign up.

Finance the Account: Fund the newly created account through electronic funds transfer, wire transfer, or cheques via mail.

Inspect All Bitcoin ETFs: Research key details like expense ratios, tracking strategy, and issuer information for each ETF before making a decision.

Choose Your Preferred Bitcoin ETF & Order: Select the ETF aligning with your investment goals, enter the ticker symbol on the brokerage platform, specify the number of shares, set orders, and confirm before submission.

Monitor Investments Regularly: Keep a close eye on investment performance through the brokerage account, adjusting strategies as needed based on market trends.

Pros and Cons of Bitcoin ETFs:

Pros:

Diversification: Bitcoin ETFs offer diversified portfolios, reducing risks for investors.

Accessibility: Traditional brokerage accounts simplify the buying and selling of Bitcoin ETFs.

Regulatory Oversight: SEC regulation enhances stability and reduces volatility compared to direct Bitcoin investment.

Tax Efficiency: ETFs are eligible for tax efficiency, contributing to potential cost savings.

Cons:

Management Fees: Investors might incur substantial management fees for heavily investing in Bitcoin ETFs due to competitive pressure.

Value Reflection: Bitcoin ETFs might not precisely reflect the true value of Bitcoin due to diversification with other assets.

Inability to Trade Bitcoin: Unlike Bitcoin itself, Bitcoin ETFs cannot be directly traded or swapped with other digital assets.

Conclusion:

Spot Bitcoin ETFs have opened new investment opportunities for traders and investors, offering a way to diversify portfolios. The SEC's approval of 11 spot Bitcoin ETFs on January 10, 2024, has sparked discussions about potential risks but also brings the promise of increased market liquidity and more stable prices. As the cryptocurrency landscape continues to evolve, Bitcoin ETFs provide a regulated and accessible avenue for those seeking exposure to the crypto world without the complexities of direct Bitcoin investment.

0 notes