#Copper Mining Market Trends

Text

Exploring the Dynamics of the Copper Mining Sector

Introduction:

The Copper Mining Market is a dynamic sector that plays a crucial role in powering various industries, from electronics to renewable energy. In this article, we delve into the intricate workings of the copper mining industry, examining key trends, challenges, and opportunities shaping its trajectory.

Market Overview:

Copper mining is a global industry with significant contributions from regions such as Latin America, Asia Pacific, and North America. The market is driven by the growing demand for copper across diverse end-use sectors, including construction, transportation, and telecommunications. As economies continue to develop and urbanize, the need for copper as a vital conductor of electricity and heat remains paramount.

Market Trends:

Several trends are reshaping the copper mining landscape. These include advancements in extraction technologies, increased emphasis on sustainable practices, and the rise of electric vehicles and renewable energy sources. Furthermore, geopolitical tensions, trade dynamics, and environmental regulations influence market sentiment and pricing trends, impacting the profitability of mining operations.

Production Landscape:

Leading copper-producing countries such as Chile, Peru, and China dominate global copper output. However, the industry faces challenges such as declining ore grades, resource depletion, and operational inefficiencies. To address these challenges, mining companies are investing in exploration activities, adopting innovative technologies, and pursuing strategic partnerships to enhance production capabilities.

Price Dynamics:

Copper prices are influenced by a myriad of factors, including supply-demand dynamics, macroeconomic indicators, and market speculation. Price volatility is inherent in the copper market, with fluctuations driven by factors such as trade tensions, currency movements, and inventory levels. Despite short-term fluctuations, the long-term outlook for copper remains positive, supported by its essential role in infrastructure development and technological innovation.

Environmental Considerations:

Environmental sustainability is increasingly becoming a focal point for Copper Mining Companies. Concerns regarding water usage, energy consumption, and greenhouse gas emissions have prompted industry players to adopt cleaner production methods, invest in renewable energy infrastructure, and engage with local communities to mitigate environmental impacts.

Technological Advancements:

Technological innovation is revolutionizing the copper mining sector, enabling companies to improve operational efficiency, reduce costs, and minimize environmental footprints. Automation, data analytics, and remote monitoring systems are being deployed to optimize mining processes, enhance safety standards, and maximize resource recovery rates.

Investment Opportunities:

Despite challenges, the copper mining market presents lucrative investment opportunities for stakeholders seeking exposure to the commodities sector. Strategic investments in exploration, infrastructure upgrades, and sustainable practices can drive long-term value creation and position companies for success in a competitive market environment.

Conclusion:

The copper mining market is characterized by its resilience, adaptability, and strategic importance to the global economy. While challenges persist, including geopolitical uncertainties and environmental concerns, the industry remains well-positioned to capitalize on emerging opportunities driven by technological innovation and sustainable development. By embracing innovation, fostering collaboration, and prioritizing environmental stewardship, copper mining companies can navigate market dynamics and contribute to the sustainable growth of this vital sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

Exploring the Future of Copper Mining: Trends, Challenges, and Opportunities

Introduction

The Copper Mining Industry serves as a cornerstone of the global economy, providing essential raw materials for a variety of sectors. In this analysis, we examine the evolving landscape of copper mining, identifying key trends, challenges, and opportunities shaping its future trajectory.

Trends Driving the Industry:

Infrastructure Development: The demand for copper continues to rise as countries invest in infrastructure projects such as transportation networks, energy grids, and urban development. Copper is indispensable for electrical wiring, piping, and construction materials, making it a vital component of modern infrastructure.

Renewable Energy Transition: The transition to renewable energy sources, including wind and solar power, is accelerating the demand for copper. As renewable energy installations expand, the need for copper for transmission lines, solar panels, and energy storage systems is expected to surge.

Electric Vehicle Revolution: The proliferation of electric vehicles (EVs) is driving unprecedented demand for copper in automotive applications. From electric motors to batteries and charging infrastructure, copper plays a critical role in enabling the transition to electric mobility.

Challenges Facing the Industry:

Resource Depletion: Copper mining faces challenges related to declining ore grades and increasing extraction costs. To sustain production levels, companies must invest in exploration efforts and adopt advanced mining technologies.

Environmental Concerns: Copper mining operations have significant environmental impacts, including habitat destruction, water pollution, and greenhouse gas emissions. Regulatory compliance and community engagement are essential for mitigating these impacts and maintaining sustainable operations.

Opportunities for Growth and Innovation:

Technological Advancements: Continued investment in innovation and technology will drive efficiency and productivity in the copper mining sector. Automation, robotics, and digitalization are poised to revolutionize mining operations, improving safety and reducing costs.

Sustainability Initiatives: Embracing sustainable practices such as energy efficiency, water conservation, and community development can enhance the long-term viability of copper mining operations. Companies that prioritize sustainability will benefit from improved stakeholder relations and reduced operational risks.

Market Expansion: Emerging economies represent untapped markets for copper, driven by rapid industrialization and urbanization. Strategic partnerships and market diversification efforts will enable companies to capitalize on growth opportunities in these regions.

Conclusion

The future of the Copper Mining Industry is characterized by both challenges and opportunities. While resource depletion and environmental concerns present significant hurdles, technological innovation and sustainability initiatives offer pathways to growth and resilience. By embracing innovation, sustainability, and market expansion, copper mining companies can navigate the evolving landscape and secure their position in a dynamic global market.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

The Copper Mining Market Size, Trends, and Top Players

Introduction

Copper mining is a fundamental sector in the global economy, providing the essential raw material for a wide range of industries, including construction, electronics, and transportation. This article explores the dynamics of the copper mining market, examining its outlook, research reports, market share, trends, size, challenges, major players, and competitors.

Copper Mining Market Outlook

The outlook for the Copper Mining Market is promising, driven by the increasing demand for copper in infrastructure development, renewable energy projects, and electric vehicles. Market analysts project steady growth in the coming years, supported by factors such as urbanization, industrialization, and technological advancements.

Copper Mining Market Research Reports

Market research reports offer valuable insights into the copper mining industry, providing in-depth analyses of market dynamics, production statistics, consumption patterns, and trade flows. These reports serve as essential tools for investors, mining companies, and policymakers to understand market trends and make informed decisions.

Copper Mining Market Size

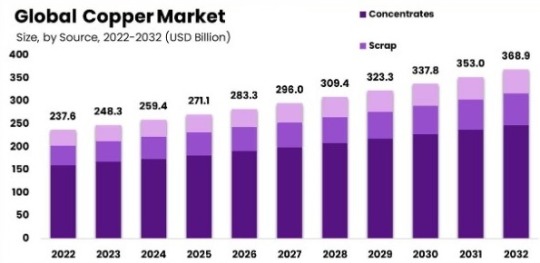

The global copper mining market is significant, with billions of dollars invested annually in exploration, development, and production. According to recent data, the global copper market was valued at approximately USD 150 billion in 2020. Copper production totaled over 20 million metric tons in the same year, with major copper-producing countries including Chile, Peru, China, and the United States.

The market size is expected to grow steadily in the coming years, driven by increasing demand for copper in infrastructure projects, electrical wiring, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several major players who command significant market shares. Key players include multinational mining corporations, state-owned enterprises, and junior mining companies, each contributing to the global copper supply chain.

Copper Mining Market Trends

Several trends are shaping the copper mining market, including:

Technological Advancements: Advances in mining technologies, such as automation, remote sensing, and data analytics, are improving operational efficiency, safety, and productivity in copper mining operations. Innovations in extraction methods and processing techniques are also enhancing resource recovery and reducing environmental impacts.

Sustainable Practices: There is a growing emphasis on sustainability in copper mining, with companies adopting eco-friendly technologies, implementing energy-efficient processes, and engaging with local communities to minimize environmental impacts and promote responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions caused by geopolitical tensions, trade policies, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and enhancing logistics capabilities to ensure resilience and continuity of operations.

Copper Mining Market Challenges

Despite its growth prospects, the copper mining industry faces several challenges, including:

Resource Depletion: Declining ore grades and increasing extraction costs pose challenges for copper mining companies, necessitating investments in exploration and technology to maintain production levels and reserves.

Environmental Regulations: Copper mining operations have significant environmental impacts, including water pollution, habitat destruction, and greenhouse gas emissions. Regulatory requirements related to environmental compliance, mine closure, and community engagement are becoming increasingly stringent, driving up compliance costs and operational risks.

Market Volatility: Copper prices are subject to volatility due to factors such as supply-demand dynamics, macroeconomic conditions, and geopolitical tensions. Fluctuations in copper prices can impact the profitability and investment decisions of mining companies, requiring robust risk management strategies and financial planning.

Copper Mining Market Major Players

Leading companies in the Copper Mining Market include:

Codelco: Codelco is the world's largest copper producer, with operations in Chile and international exploration projects.

BHP Group: BHP is a global mining company with significant copper assets, including mines in Chile, Peru, and Australia.

Rio Tinto: Rio Tinto is a diversified mining company with copper operations in Mongolia, the United States, and Australia.

Glencore: Glencore is a major copper producer with assets in Zambia, the Democratic Republic of Congo, and Peru.

Freeport-McMoRan: Freeport-McMoRan operates copper mines in the United States, Indonesia, and South America.

Conclusion

The copper mining market presents significant opportunities for growth and investment, driven by increasing demand for copper in various industries. Despite facing challenges such as resource depletion and environmental regulations, the industry is poised for steady expansion, supported by technological innovation, sustainability initiatives, and market resilience. Collaboration, innovation, and responsible mining practices will be essential for ensuring the long-term sustainability and success of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

Molybdenum Market Growth Strategies, Quality Assessment, and Trends by 2024-2031

The "Molybdenum Market" is a dynamic and rapidly evolving sector, with significant advancements and growth anticipated by 2031. Comprehensive market research reveals a detailed analysis of market size, share, and trends, providing valuable insights into its expansion. This report delves into segmentation and definition, offering a clear understanding of market components and drivers. Employing SWOT and PESTEL analyses, the study evaluates the market's strengths, weaknesses, opportunities, and threats, alongside political, economic, social, technological, environmental, and legal factors. Expert opinions and recent developments highlight the geographical distribution and forecast the market's trajectory, ensuring a robust foundation for strategic planning and investment.

What is the projected market size & growth rate of the Molybdenum Market?

Market Analysis and Insights

Molybdenum Market

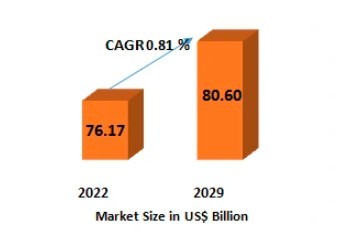

The molybdenum market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses the market to reach at an estimated value of USD 5.7 billion by 2029 and to grow at a CAGR of 2.50% in the above-mentioned forecast period.

Molybdenum is a chemical element with corrosion resistance, ability to hold shape, strength and ability to operate at high temperatures and a low degree of thermal expansion properties. Molybdenum is lightweight, silver-white lustrous metal and reminiscence to tin and is a by-product of copper mining.

The rise in the adoption of molybdenum in aerospace and defense sector, thermal spray coatings is the root cause fueling up the market growth rate. Additionally, the adoption of molybdenum in the medical equipment, electrical and electronic devices due to its high electrical conductivity will further carve the way for the growth of market. However, high price of molybdenum impede growth of the molybdenum market.

The growing demand for rising adoption of molybdenum and its alloys in electronics and electrical devices are estimated to generate numerous opportunities for the market. On the flip side, molybdenum is not suitable for continuous temperatures above 500 °C in an oxidized atmosphere unless it is protected by a coating pose as a major challenge to the growth of the molybdenum market.

This molybdenum market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on molybdenum market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 350 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

This research report is the result of an extensive primary and secondary research effort into the Molybdenum market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Molybdenum Market.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-molybdenum-market

Which are the driving factors of the Molybdenum market?

The driving factors of the Molybdenum market include technological advancements that enhance product efficiency and user experience, increasing consumer demand driven by changing lifestyle preferences, and favorable government regulations and policies that support market growth. Additionally, rising investment in research and development and the expanding application scope of Molybdenum across various industries further propel market expansion.

Molybdenum Market - Competitive and Segmentation Analysis:

Global Molybdenum Market, By Product Type (Steel, Chemicals, Foundries, Mo-Metals, Nickel Alloy and Others), Application (Full Alloy, Stainless-Steel, Cast Iron and Catalysis), End-Use (Steel, Oil and Gas, Chemical, Automotive, Energy and Power, Medical, Aerospace and Transportation), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2031.

How do you determine the list of the key players included in the report?

With the aim of clearly revealing the competitive situation of the industry, we concretely analyze not only the leading enterprises that have a voice on a global scale, but also the regional small and medium-sized companies that play key roles and have plenty of potential growth.

Which are the top companies operating in the Molybdenum market?

Some of the major players covered in the molybdenum market report are Freeport-McMoRan, China China Molybdenum Co., Ltd., BHP Billiton Group, Compania Minera Dona Ines De Collahuasi S.C.M., Antamina., Centerra Gold IncAntofagasta plc, American CuMo Mining, Grupo México, S.A.B. de C.V.,. Shaanxi Non-ferrous Metals Holding Group Co., Ltd., Antofagasta plc., Moly metal L.L.P, ENF Ltd., Jinduicheng Molybdenum Co,Ltd, CODELCO, Southern Copper Corporation, among others.

Short Description About Molybdenum Market:

The Global Molybdenum market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

North America, especially The United States, will still play an important role which can not be ignored. Any changes from United States might affect the development trend of Molybdenum. The market in North America is expected to grow considerably during the forecast period. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market.

Europe also play important roles in global market, with a magnificent growth in CAGR During the Forecast period 2024-2031.

Molybdenum Market size is projected to reach Multimillion USD by 2031, In comparison to 2024, at unexpected CAGR during 2024-2031.

Despite the presence of intense competition, due to the global recovery trend is clear, investors are still optimistic about this area, and it will still be more new investments entering the field in the future.

This report focuses on the Molybdenum in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Get a Sample Copy of the Molybdenum Report 2024

What are your main data sources?

Both Primary and Secondary data sources are being used while compiling the report. Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users. Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

What are the key regions in the global Molybdenum market?

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil, Argentina, Columbia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

This Molybdenum Market Research/Analysis Report Contains Answers to your following Questions

What are the global trends in the Molybdenum market?

Would the market witness an increase or decline in the demand in the coming years?

What is the estimated demand for different types of products in Molybdenum?

What are the upcoming industry applications and trends for Molybdenum market?

What Are Projections of Global Molybdenum Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

Where will the strategic developments take the industry in the mid to long-term?

What are the factors contributing to the final price of Molybdenum?

What are the raw materials used for Molybdenum manufacturing?

How big is the opportunity for the Molybdenum market?

How will the increasing adoption of Molybdenum for mining impact the growth rate of the overall market?

How much is the global Molybdenum market worth? What was the value of the market In 2020?

Who are the major players operating in the Molybdenum market? Which companies are the front runners?

Which are the recent industry trends that can be implemented to generate additional revenue streams?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Molybdenum Industry?

Customization of the Report

Can I modify the scope of the report and customize it to suit my requirements? Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

Inquire more and share questions if any before the purchase on this report at - https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-molybdenum-market

Detailed TOC of Global Molybdenum Market Insights and Forecast to 2031

Introduction

Market Segmentation

Executive Summary

Premium Insights

Market Overview

Molybdenum Market By Type

Molybdenum Market By Function

Molybdenum Market By Material

Molybdenum Market By End User

Molybdenum Market By Region

Molybdenum Market: Company Landscape

SWOT Analysis

Company Profiles

Continued...

Purchase this report – https://www.databridgemarketresearch.com/checkout/buy/singleuser/global-molybdenum-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- [email protected]

Browse More Reports:

Global Molybdenum Market – Industry Trends and Forecast to 2029

Global Endoscope Reprocessing Market – Industry Trends and Forecast to 2028

Global Bone Marrow-Derived Stem Cells (BMSCS) Market – Industry Trends and Forecast to 2029

Global Oxygen Therapy Market – Industry Trends and Forecast to 2029

Global Acute Hepatic Porphyria Treatment Market – Industry Trends and Forecast to 2030

#Molybdenum Market#Molybdenum Market Size#Molybdenum Market Share#Molybdenum Market Trends#Molybdenum Market Growth#Molybdenum Market Analysis#Molybdenum Market Scope & Opportunity#Molybdenum Market Challenges#Molybdenum Market Dynamics & Opportunities

0 notes

Text

Copper Sulphate Prices Trend, Pricing, Database, Index, News, Chart, Forecast

Copper sulphate prices are influenced by a myriad of factors, spanning from global economic conditions to regional demand-supply dynamics. As a key chemical compound, copper sulphate finds extensive application across various industries, including agriculture, mining, and chemical manufacturing. The fluctuation in its prices reflects the intricate balance between these sectors and external factors such as geopolitical tensions and environmental regulations.

In recent years, the agricultural sector has been a significant driver of copper sulphate demand. With its use as a fungicide and herbicide, farmers rely on copper sulphate to protect their crops and enhance yields. Consequently, any shifts in agricultural practices or weather patterns can significantly impact the demand for this compound, thereby affecting its price.

Moreover, the mining industry plays a crucial role in shaping copper sulphate prices. As a by-product of copper refining processes, the availability of copper ore directly influences the production of copper sulphate. Fluctuations in copper prices, driven by factors like supply disruptions and changes in global demand, can ripple through the copper sulphate market, leading to price volatility.

Get Real Time Prices of Copper Sulphate: https://www.chemanalyst.com/Pricing-data/copper-sulphate-1163

Environmental regulations also exert a considerable influence on copper sulphate prices. Concerns over water contamination and toxicity have prompted stricter regulations on its usage and disposal in many regions. Compliance with these regulations often entails additional costs for manufacturers, which can be reflected in the final price of copper sulphate.

On a global scale, economic conditions and trade dynamics play a pivotal role in shaping copper sulphate prices. Economic growth drives demand for various industrial products, including electronics and infrastructure, which in turn increases the demand for copper and its by-products like copper sulphate. Conversely, economic downturns can dampen demand, leading to downward pressure on prices.

Geopolitical tensions and trade disputes can also impact copper sulphate prices. Tariffs, sanctions, and trade agreements can disrupt the flow of copper and its derivatives across borders, leading to supply shortages or surpluses in certain regions. Uncertainty stemming from geopolitical events can create market volatility, causing prices to fluctuate unpredictably.

Furthermore, technological advancements and innovation have the potential to influence copper sulphate prices. Improvements in production processes or the development of alternative materials may alter the demand for copper sulphate, affecting its price competitiveness in the market.

In addition to these external factors, internal market dynamics also play a role in determining copper sulphate prices. Competition among manufacturers, changes in production costs, and inventory levels can all influence pricing decisions within the industry. Moreover, factors such as product quality, purity, and packaging can differentiate suppliers in the market, impacting their pricing strategies.

For investors and businesses involved in the copper sulphate market, staying abreast of these factors is essential for making informed decisions. Market analysis, trend forecasting, and risk management strategies can help mitigate the impact of price volatility and capitalize on emerging opportunities.

In conclusion, copper sulphate prices are subject to a complex interplay of factors, both internal and external. From agricultural demand to economic conditions, environmental regulations to technological advancements, a multitude of variables shape the dynamics of the copper sulphate market. Understanding these factors and their implications is crucial for stakeholders seeking to navigate this dynamic landscape effectively.

Get Real Time Prices of Copper Sulphate: https://www.chemanalyst.com/Pricing-data/copper-sulphate-1163

Contact Us:

ChemAnalyst

GmbH - S-01, 2.floor, Subbelrather Straße,

15a Cologne, 50823, Germany

Call: +49-221-6505-8833

Email: [email protected]

Website: https://www.chemanalyst.com

0 notes

Text

Admir Kadir: Basic Metals Market Analysis and Future Trends Forecast

Recently, the basic metals market has shown robust performance. The three-month copper price on the London Metal Exchange (LME) surged by 1.8%, reaching $10,511 per tonne. Additionally, LME aluminium prices rose by 1.6% to $2,703.50 per tonne, and tin prices soared by 22.3%, hitting a historical high. Admir Kadir from Ocean Finance Academy has conducted a comprehensive analysis to help investors deeply understand the precious metals market.

Drivers Behind Rising Basic Metals Prices

The prospect of interest rate cuts has provided significant support to the metals market. Key decision-makers at the European Central Bank have indicated that there is room for rate cuts as inflation slows. Lower interest rates typically stimulate economic activity, increasing demand for physical metals. Admir Kadir notes that interest rate cuts not only reduce borrowing costs but also boost investor risk appetite, driving capital into the metals market.

Following the rise in risk appetite, a weaker US dollar has made dollar-denominated metals cheaper for holders of other currencies, thus boosting metal prices. Admir Kadir believes that the weakening dollar has a profound impact on the global commodities market because most metal transactions are priced in dollars, and fluctuations in the dollar exchange rate directly affect international metal prices.

Additionally, supply chain issues and market expectations are also key factors driving prices up. Admir Kadir mentions that recent global supply chain problems, including mining production disruptions and transportation bottlenecks, have tightened metal supplies, further pushing up prices. Simultaneously, market expectations of economic recovery and increased infrastructure investment have also positively impacted metal demand.

Despite the overall positive market trend, the UK Commodity Research Unit (CRU) cautions that stimulus measures usually take some time to affect basic metals demand. Moreover, the premium for imported copper remains below zero, reflecting that actual demand may not be as strong as the market expects. Admir Kadir points out that this indicates a certain level of uncertainty in the market, and investors need to stay vigilant.

Risks and Opportunities in the Basic Metals Market

Admir Kadir emphasizes that although the outlook for the basic metals market is promising, investors must carefully navigate various risks within the market. Firstly, the market is highly volatile, with prices changing rapidly and significantly. Despite the strong recent performance of basic metal prices, the market may undergo significant adjustments due to policy changes or market sentiment shifts.

Admir Kadir advises that investors entering the basic metals market should closely monitor the policy directions of major global economies. As the global economy gradually recovers, policy changes by governments and central banks will directly impact the metals market.

Additionally, supply chain risks are another critical factor to watch. Recent global supply chain issues, including mining production interruptions and transportation bottlenecks, could tighten metal supplies and push prices higher. However, if supply chain problems ease, the market might adjust accordingly.

On the other hand, the basic metals market is also rife with opportunities. Admir Kadir believes that as the global economy gradually recovers, increased infrastructure investment and industrial production will drive up metal demand. For example, copper, an essential industrial metal, will see increased demand with the development of the power, construction, and manufacturing sectors. Similarly, the demand for metals like aluminium and tin, used in automobile manufacturing and electronic products, will also rise.

To manage market uncertainties, Admir Kadir recommends that investors adopt a diversified investment strategy. By spreading investments, they can reduce risks associated with a single market or asset class. Additionally, investors should focus on long-term market trends and not be swayed by short-term fluctuations. For high-growth potential projects, investors should remain patient and wait for market returns.

Admir Kadir points out that analysts from well-known institutions predict that copper prices might test the resistance level of $10,590 per tonne this week and could potentially rise further to the $10,707-$10,833 range. This forecast is based on an analysis of market wave patterns, indicating the upward potential of copper prices.

Long-Term Global Trends and Their Impact on the Basic Metals Market

Admir Kadir notes that long-term global trends are crucial for the future development of the basic metals market. With the digital transformation and the push of the global economy for sustainable development goals, the demand for basic metals as key materials will continue to rise.

Technological advancements are also a significant driver for the development of the basic metals market. Admir Kadir highlights that with the progress of technology and the development of new materials, the application fields of basic metals are continuously expanding. For instance, the development of 5G technology and the Internet of Things will drive demand for high-performance metal materials, further enhancing the potential of the basic metals market.

Admir Kadir suggests that investors should consider the following aspects when planning long-term investments:

Green Energy and Sustainable Development: Focus on investment opportunities in green energy, environmental industries, and related technologies, which will play an important role in future economic transformation.

Policy Risk Management: Closely monitor international political situations and policy changes, and adopt a diversified investment strategy to mitigate the impact of policy risks on investment portfolios.

Technological Innovation: Invest in high-tech fields and new material technologies to seize market opportunities brought by technological revolutions.

Global Economic Trends: Pay attention to global economic uncertainties and risks, and allocate safe-haven assets reasonably to ensure the stability of investment portfolios.

Admir Kadir concludes that the future market environment will be increasingly complex and volatile, requiring investors to continuously enhance their market analysis capabilities and risk management levels to deal with various uncertainties. In the context of global trends, only through scientific investment strategies and forward-looking market judgments can investors stand out in the competitive market and achieve long-term stable investment returns.

0 notes

Text

Handling the Market Dynamics: Revealing the Share Prices of Hindalco Industries and Britannia Industries

Investors look for trustworthy guides to help them understand the complexity and take advantage of growth opportunities in the complex stock market, where trends change daily. Among all other possibilities, Hindalco Industries Share Price and Britannia Industries Share Price are the industry leaders. In this examination, StockGro investigates the subtleties of their share prices, examining the elements that influence their paths and revealing the dynamics contributing to their everlasting success.

Hindalco Industries' Stock Price: Open Doors in the Metals Sector

Hindalco Industries, the Aditya Birla Group's backbone, is a global copper and aluminum market leader. Hindalco has attracted an international clientele since its foundation in 1958, thanks to its reputation for excellence, innovation, and sustainability.

Core Operations: Hindalco is active in the copper and aluminum value chains, including mining, refining, manufacturing, and distribution. By continually prioritizing efficiency and quality, Hindalco has proved its capacity to adapt to the changing demands of several industries, including construction, automotive, aerospace, and packaging, creating trust in its stakeholders.

Market Dynamics: Hindalco Industries' share price is influenced by global macroeconomic conditions, commodity pricing, and industry dynamics. Fluctuations in aluminum and copper prices, caused by supply-demand mismatches, geopolitical tensions, and economic indicators, can have an impact on market mood and, as a result, Hindalco stock price.

Furthermore, Hindalco's operational success, such as production volumes, cost structures, and market positioning, has a significant impact on its share price. Investors regularly watch important performance indicators to assess the company's growth potential, profitability, and durability in volatile market conditions.

Future Outlook: Hindalco Industries is poised for long-term prosperity, notwithstanding the volatility of metal prices. The company's strategic investments in technology, innovation, and sustainability, together with its strong financial position and global footprint, point to a promising growth trajectory.

As Hindalco builds on its strengths, seizes emerging opportunities, and navigates market obstacles, its share price reflects its durability, adaptability, and dedication to producing long-term value for stakeholders.

Britannia Industries Share Price: Favorable Growth in FMCG

Britannia Industries, a household name in India and elsewhere, has been associated with quality, taste, and trust for over a century. Founded in 1892, Britannia has led the packaged food business, delighting customers with a varied array of biscuits, cakes, dairy goods, and snacks.

Core Operations: Britannia's core operations prioritize innovation, consumer-centricity, and agility, resulting in a leading position in the competitive FMCG sector. With an emphasis on exceptional ingredients, hygienic standards, and product innovation, Britannia continues to establish industry standards and satisfy customers across demographics and continents.

Market Dynamics: Britannia Industries' stock price is affected by a number of variables, including market competition, consumer sentiment, macroeconomic swings, and regulatory actions. The revenue growth and market valuation of the company may be impacted by changes in consumer preferences, market dynamics, and profitability. These factors also affect Britannia Industries share price.

Future Outlook: Britannia's share price is also influenced by its ability to innovate, adjust to changing market trends, and diversify its product portfolio. Investors evaluate Britannia's development potential and competitive edge in the FMCG industry by closely monitoring the company's product launches, brand positioning, and market penetration.

Comparative Analysis: Britannia Industries and Hindalco Industries

Industry Dynamics: Hindalco and Britannia's financial performance, and hence their share prices, can be influenced by a number of industry-specific factors, such as consumer preferences, regulatory changes, commodity pricing, and competitive pressures.

Financial Performance: Investors closely monitor key financial metrics such as revenue growth, profitability, cash flows, and return on investment to evaluate the strength and sustainability of Hindalco and Britannia's business models, as well as their ability to generate long-term shareholder value.

Strategic efforts: The success of Hindalco and Britannia's investments in technology, innovation, expansion, and sustainability can have an impact on investor sentiment and confidence in their growth prospects. This may affect share prices.

In Nutshell

Finally, the share prices of Hindalco businesses and Britannia Industries are influenced by a variety of factors specific to their businesses, market dynamics, and strategic efforts. While Hindalco's share price represents investor sentiment toward global metal markets, commodities pricing, and operational performance, Britannia's share price reflects investor confidence in the company's brand equity, product innovation, and FMCG sector development potential.

As investors traverse the complexity of the stock market, knowing the fundamental dynamics that drive Hindalco and Britannia share prices is critical for making sound investing decisions. While previous success does not guarantee future outcomes, a detailed examination of these criteria can assist investors in determining the development prospects and investment potential of these two industry leaders. For more such interesting information, follow StockGro regularly!

0 notes

Text

Navigating the Seas of Opportunity: Understanding the Commodity Market

In the vast ocean of global finance, the commodity market stands out as a unique and indispensable entity. Comprising a diverse array of raw materials and primary goods, ranging from precious metals like gold and silver to agricultural products like wheat and coffee, the commodity market serves as the bedrock of our modern economy. This article aims to delve into the intricacies of the commodity market, exploring its functions, dynamics, and significance in the broader financial landscape.

Understanding the Basics:

At its core, the commodity market facilitates the trading of tangible goods, often referred to as commodities. These goods can be categorized into several broad groups, including energy (crude oil, natural gas), metals (gold, silver, copper), agricultural products (corn, wheat, soybeans), and livestock (cattle, pork). Unlike financial assets such as stocks or bonds, commodities are physical assets with intrinsic value derived from their utility and scarcity.

Market Participants:

A diverse range of participants engages in the commodity market, each with distinct motives and strategies. Producers, such as farmers and mining companies, utilize the market to hedge against price fluctuations and secure future revenues by entering into futures contracts. Speculators, on the other hand, seek to profit from short-term price movements, capitalizing on supply and demand imbalances and macroeconomic trends. Additionally, consumers and end-users, such as manufacturers and energy companies, utilize the market to manage input costs and mitigate risks associated with price volatility.

Market Instruments:

The commodity market offers various instruments for trading and risk management, with futures contracts being the most prevalent. Futures contracts enable market participants to buy or sell a specified quantity of a commodity at a predetermined price and date in the future. These contracts serve as vital risk management tools, allowing producers and consumers to protect themselves against adverse price movements. Options contracts, exchange-traded funds (ETFs), and commodity indices are other commonly traded instruments that provide exposure to commodity price movements.

Factors Influencing Prices:

Commodity prices are influenced by a myriad of factors, including supply and demand dynamics, geopolitical events, weather patterns, technological advancements, and macroeconomic indicators. Supply disruptions, such as natural disasters or geopolitical conflicts, can lead to sudden price spikes, while changes in global economic conditions and monetary policies can affect demand levels and inflation expectations, thereby impacting commodity prices.

Globalization and Interconnectivity:

In an era of increasing globalization, the commodity market is highly interconnected with other financial markets, including equities, currencies, and bonds. Economic developments in one region can have ripple effects across commodity markets worldwide, as demonstrated by the impact of China's economic growth on global demand for industrial metals and energy commodities. Additionally, the emergence of commodity trading hubs, such as Chicago, London, and Singapore, has facilitated the seamless exchange of commodities on a global scale.

Challenges and Risks:

Despite its importance, the commodity market is not without challenges and risks. Price volatility, geopolitical instability, regulatory changes, and environmental concerns are among the key challenges facing market participants. Moreover, the increasing finalization of commodities, characterized by the influx of speculative capital into the market, has raised questions about market integrity and price discovery.

Conclusion:

The commodity market occupies a central position in the global economy, serving as a vital conduit for the exchange of essential goods and resources. Its function as a price discovery mechanism and risk management tool is essential for ensuring stability and efficiency in various industries. As the world continues to evolve, understanding the complexities of the commodity market will be crucial for investors, businesses, and policymakers alike, as they navigate the seas of opportunity in pursuit of prosperity and growth.

0 notes

Text

Mathews Darcy: Analysis of Mining Stock Rebound and Performance of Interest Rate-Sensitive Sectors

Amid global economic turbulence, the Australian stock market has been influenced by multiple factors, showing significant recent volatility. Recently, the ASX 200 index fell by 84.2 points, a drop of 1.08%. Base metal and precious metal stocks have declined, particularly in interest rate-sensitive sectors. Mathews Darcy believes this phenomenon is primarily due to better-than-expected US economic data, causing concerns that interest rate cuts might be delayed.

Impact of Interest Rate Fluctuations on the Australian Stock Market

Despite the US economic data outperforming expectations, the market reacted negatively. This is mainly because investors are worried that the anticipated interest rate cuts will be delayed. Mathews Darcy notes that the Australian stock market has been affected, particularly sectors closely related to interest rates, such as finance and real estate, which have shown notable weakness. This reaction, though seemingly contradictory, actually reflects the uncertainty and high sensitivity of the market to future economic policies.

Base metal and precious metal stocks have also been impacted. These sectors had previously performed strongly but have recently shown a significant pullback. This trend indicates the volatility in global market expectations for commodity demand, especially in the context of potential interest rate changes affecting economic growth. Mathews Darcy believes investors should pay attention to changes in global economic data and interest rate policies, as these factors will directly impact the performance of the commodity market and related stocks.

Rebound of Mining Stocks and Market Expectations

Despite the overall market downturn, some mining stocks like Sandfire Resources and 29Metals have shown signs of rebounding. Mathews Darcy points out that this rebound is mainly due to the strong fundamentals of these companies and the optimistic expectations of the market for future mineral demand. With the global demand for electric vehicles and renewable energy increasing, the market outlook for base metals such as copper remains promising.

However, Mathews Darcy cautions investors that, despite the strong performance of certain individual stocks, it is still necessary to remain cautious in the context of broader market volatility. Investors should carefully assess the fundamentals of each company, paying attention to their financial status and market position to ensure the soundness of their investment decisions.

Investment Strategies and Risk Management

In the face of current market uncertainties, Mathews Darcy advises investors to adopt flexible investment strategies. Investors should diversify their funds across different industries and asset classes to reduce the impact of fluctuations in any single market on their investment portfolio. Diversification is particularly important in the context of increasing global economic volatility.

While market volatility is inevitable, companies with innovative capabilities and competitive market positions remain worthy investment targets. Mathews Darcy emphasizes that investors should make rational investment decisions based on in-depth analysis of the financial reports and market prospects of a company, rather than being swayed by short-term market sentiments.

0 notes

Text

I was cut off which is super interesting considering the prophetic was about cutting throats.

I wanted to continue to say the LORD is going to be silencing those who have been lying and slandering your name.

I wanted to also say that the home I was in felt cold and not filled with love. Is this someone’s family in the physical? If so, you may have to put up some boundaries and cut ties with them. On the outside it may seem as though these individuals are wealthy but it’s all a facade. Everyone both the “rich” and the poor (in this dream) were struggling financially and emotionally 😔

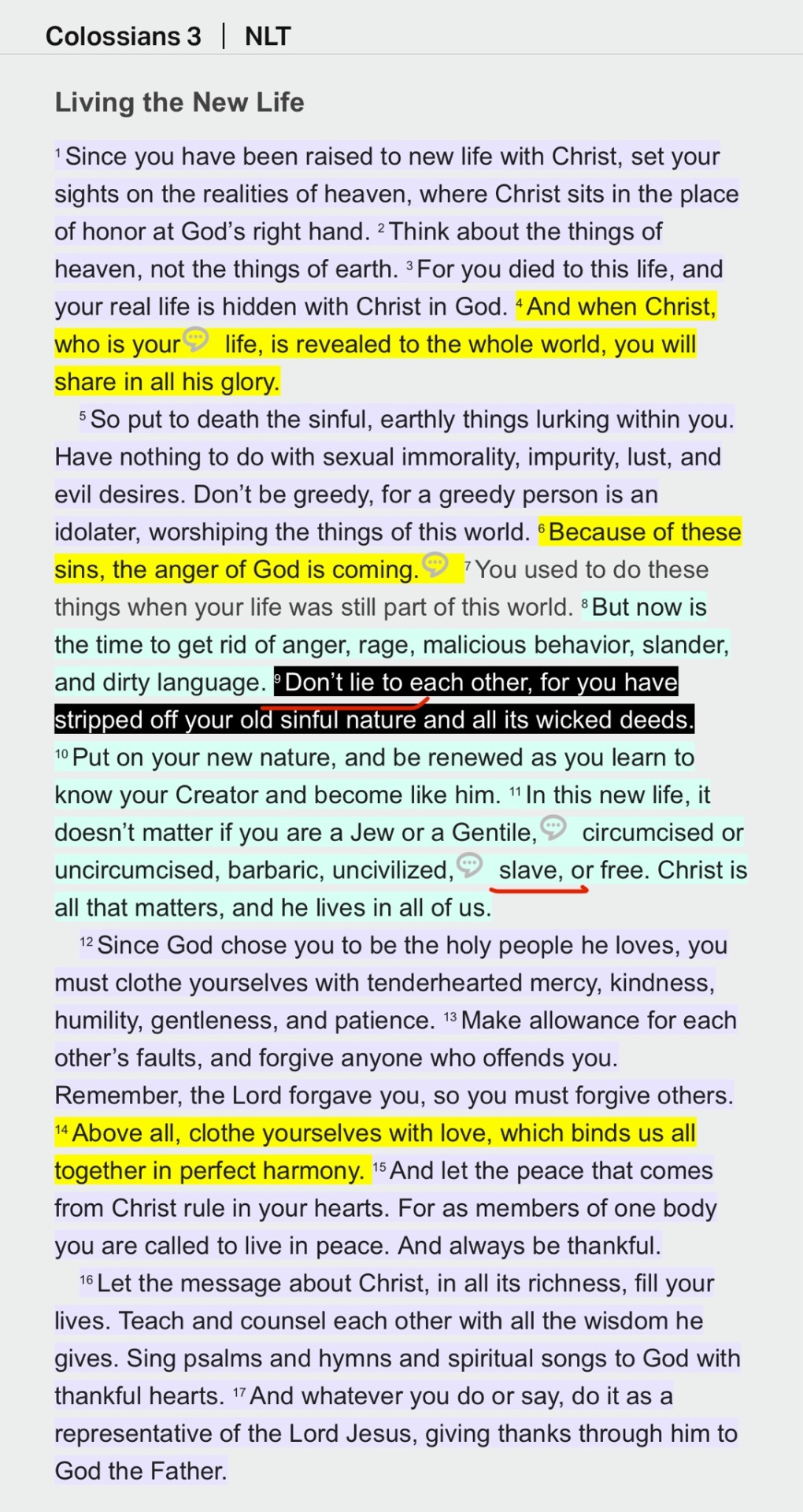

Scripture:

As I mentioned in the message that I felt some kind of way about the messages the LORD has been giving me lately and the fact the scripture says “because of these sins, the anger of God is coming” confirmed it all. We have got to do better to each other babes as the scripture says. Seriously!! 🥺 I am terrified!!! Recall Jesus said if your right hand causes you to sin, cut it off. It’s definitely time to cut off some people.

The copper is very important. I remember when I was young and copper was the biggest health trend. The late night infomercials and pharmacies had copper bracelets and kitchenware EVERYWHERE 🤣 Even as a child I noticed the heavy marketing 😂 The last child with the bulging eyes reminded me of a thyroid disease. A deficiency in copper can suppress the thyroid gland, cause depression and affect the spinal cord impacting someone’s ability to walk. This is the second time the LORD is showing us copper…

Now I’m not saying to try this supplement but look into this mineral and have yours and your children’s tested. I know more than half of us are deficient but this is one mineral you have to be careful about and it’s NOT recommended for children in supplement form. Perhaps yours or your baby’s may be too high/low depending on where you are in the world and the environmental conditions near you.

I pray this will make sense to someone especially to doctors who really care about their patients. What this has to do with children is beyond my understanding. Perhaps your child is not growing at a normal rate or is slow to speak/walk causing a disability

Please note that I was only allowed to spare the children and the mother in the dream 👀 There were no daughters here so this makes me think about boys and men their mental health and their upbringing.

I also felt like an assassin so don’t be surprised if we hear of death.

Here is an article about the importance of copper.

The original painting:

PS. Some of you in your own families were treated like a slave and lied on repeatedly. Your anger is justified but pls don’t let it lead you to violence. Trust the LORD is either removing these people in your life OR asking you to walk away. He will give you a new family who will love and respect you.

This song by LORDe comes to mind 🎶👀

The dagger 🗡️

Mine was much smaller, easy enough to conceal. This upcoming action the LORD is taking — though brutal — is justified and only he knows why. The LORD is silencing the liars no matter the age except the babies.

UPDATE:

The LORD led me to search up dagger and this is scripture I found.

For some of you you could have someone who is bigger than you attacking you as seen by that demon Beezlebub who someone sends to harass me OR perhaps someone is speaking on you because of your size but either way the LORD is about to shut them up permanently.

I feel someone who is much larger than you, did something horrible and you have asked for justice. They could have killed a person by stabbing them. This could be a family member.

The City of Palms in verse 13 reminds me of Florida and all their cities named after “palms” 😂

Some of you are going to be looking the best you ever have despite your age! Looking lean and trim and yummy 😋😂

Oops forgot to mention I saw an Egyptian man in a separate vision dropping dead 😵

In short anyone who is LYING on or about you is going to get it and this could be an entire family including your own. Shameful.

You could be a cut throat environment and looking for a way out. God will save you.

Whatever yall do going forward PLEASE do not lie nor twist the truth.

#colonialism#copper#health#rich or poor#putting to death old ways#new clothes#Royals#LIARS#Austria 🇦🇹#racism and discrimination#BODY

0 notes

Text

Exploring the Copper Mining Market Research Reports

Introduction

Copper mining serves as a cornerstone of the global economy, providing a vital raw material for numerous sectors including construction, electronics, and transportation. This article examines the dynamics of the copper mining market, encompassing its prospects, research findings, market share, trends, size, challenges, key players, and competitors.

Copper Mining Market Outlook

The outlook for the Copper Mining Market appears promising, fueled by escalating demand for copper in infrastructure development, renewable energy initiatives, and electric vehicles. Analysts anticipate sustained growth in the forthcoming years, bolstered by factors like urbanization, industrialization, and technological innovations.

Copper Mining Market Research Reports

Market research reports furnish valuable insights into the copper mining sector, offering comprehensive analyses of market dynamics, production figures, consumption trends, and trade patterns. These reports serve as indispensable resources for investors, mining entities, and policymakers to comprehend market trends and make informed decisions.

Copper Mining Market Size

The global copper mining market holds significant prominence, with substantial investments channeled annually into exploration, development, and production endeavors. Recent data indicates that the global copper market reached a valuation of around USD 150 billion in 2020. Concurrently, copper production surpassed 20 million metric tons during the same period, with notable copper-producing nations encompassing Chile, Peru, China, and the United States. The market size is projected to exhibit steady expansion in the ensuing years, propelled by escalating demand for copper in infrastructure ventures, electrical installations, and consumer electronics.

Copper Mining Market Share

The copper mining market is characterized by several prominent players, each wielding substantial market shares. Key participants include multinational mining conglomerates, state-owned enterprises, and junior mining firms, collectively contributing to the global copper supply chain.

Copper Mining Market Trends: Numerous trends are reshaping the copper mining landscape, including:

Technological Advancements: Ongoing advancements in mining technologies, such as automation, remote sensing, and data analytics, are enhancing operational efficiency, safety standards, and productivity in copper mining operations. Concurrent innovations in extraction methodologies and processing techniques are augmenting resource retrieval rates and curtailing environmental footprints.

Sustainable Practices: There is a burgeoning emphasis on sustainability within copper mining, with entities embracing eco-friendly technologies, deploying energy-efficient processes, and engaging with local communities to mitigate environmental impacts and foster responsible mining practices.

Supply Chain Resilience: The copper mining industry is adapting to evolving supply chain dynamics, including disruptions precipitated by geopolitical tensions, trade regulations, and the COVID-19 pandemic. Companies are diversifying their supply chains, investing in inventory management, and fortifying logistics capabilities to ensure resilience and operational continuity.

Copper Mining Market Challenges: Despite its growth trajectory, the copper mining sector grapples with several challenges, encompassing:

Resource Depletion: The diminishing ore grades and escalating extraction costs present formidable challenges for copper mining enterprises, necessitating investments in exploration endeavors and technological innovations to sustain production levels and reserves.

Environmental Regulations: Copper mining operations exert substantial environmental pressures, encompassing water contamination, habitat degradation, and greenhouse gas emissions. Stringent regulatory mandates pertaining to environmental compliance, mine closure protocols, and community engagement are escalating compliance costs and operational risks.

Market Volatility: Copper prices are susceptible to volatility, influenced by factors like supply-demand dynamics, macroeconomic conditions, and geopolitical upheavals. Fluctuations in copper prices can impact the profitability and investment decisions of mining entities, necessitating robust risk management strategies and financial planning.

Copper Mining Market Major Players

Key entities in the Copper Mining Market include:

Codelco

BHP Group

Rio Tinto

Glencore

Freeport-McMoRan

Conclusion

The copper mining market presents compelling growth prospects and investment opportunities, driven by escalating demand for copper across diverse industries. Despite encountering challenges such as resource depletion and environmental regulations, the industry is poised for sustained expansion, buoyed by technological innovations, sustainability initiatives, and market resilience. Collaborative endeavors, innovation, and conscientious mining practices are imperative for ensuring the enduring sustainability and prosperity of the copper mining sector.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Research Reports#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Outlook#Copper Mining Market Top Players#Global Copper Mining Market#Copper Mining Market Analysis

0 notes

Text

0 notes

Text

An In-Depth Exploration of the Copper Mining Market Growth, Share and Forecast

In the expansive world of mining, the Copper Mining Market emerges as a critical player, supplying a fundamental metal that finds applications across diverse industries. This exhaustive exploration aims to uncover the multifaceted aspects of major players, market share dynamics, trends, market size, challenges, global perspectives, and the future outlook that intricately shape the Copper Mining industry.

Major Players: Anchors in the Copper Mining Landscape

Dominating the Copper Mining Market major players whose influence, infrastructure, and technological prowess act as driving forces for the industry. These giants not only shape the market but also play a pivotal role in determining the global supply of copper.

Market Share Dynamics: Unveiling the Intricate Tapestry

The distribution of market share provides nuanced insights into the competitive landscape of the Copper Mining Market. While major players typically dominate, the strategic moves, innovations, and market entrants constantly reshape the share distribution.

Trends Steering Copper Mining: Navigating the Currents of Change

The Copper Mining Market is subject to trends influenced by technological advancements, sustainability imperatives, and the ebbs and flows of global economic conditions. Staying attuned to these trends is pivotal for stakeholders aiming to capitalize on emerging opportunities.

Guiding Lights in the Industry: Sustainable practices are taking center stage in the Copper Mining Market as the industry witnesses a shift towards eco-friendly and responsible mining methods. Simultaneously, technological advancements, including automation and data analytics, redefine operational efficiencies, contributing to a wave of innovation.

Sizing Up: Exploring the Expansive Landscape of Copper Mining Market

Quantifying the impact of the Copper Mining Market Size is crucial, reflecting not only the industry's economic influence but also its potential for growth. This metric is influenced by various factors, including global copper demand, geopolitical considerations, and exploration activities.

Quantifying the Industry's Influence: The Copper Mining Market Size surpassed a substantial USD 40 billion in the last fiscal year, underscoring its undeniable significance in the global economic landscape. Fluctuations in copper prices and geopolitical tensions contribute to the dynamic nature of the Copper Mining Market Size.

Challenges Faced: Navigating the Complex Terrain of Copper Mining

Inherent challenges in the Copper Mining Industry necessitate strategic approaches to ensure sustained operations and compliance with evolving regulations. Environmental concerns, regulatory complexities, and the volatility of copper prices present significant hurdles.

Facing Headwinds with Resilience: Regulatory compliance remains a persistent challenge, demanding adaptability to evolving environmental standards. Furthermore, the inherent volatility in copper prices poses a continuous risk, impacting profitability and investment decisions.

Global Perspective: Understanding the Interconnected Copper Mining Market

The term Global Copper Mining Market encapsulates the interconnected nature of copper extraction on a worldwide scale. A nuanced understanding of global dynamics becomes essential for stakeholders operating in diverse regions.

Global Mosaic Unveiled: The Global Copper Mining Market is characterized by diverse regional contributions, with South America, Asia-Pacific, and North America emerging as key hubs. Collaborations and partnerships between global players enhance the market's overall resilience.

Forecasting the Future: Copper Mining Market Outlook and Research Reports

Looking ahead, the Copper Mining Market Outlook is influenced by factors such as technological advancements, geopolitical shifts, and trends in market demand. Simultaneously, comprehensive Copper Mining Market Research Reports offer profound insights for informed decision-making.

Peering into the Future: The Copper Mining Market Outlook anticipates a steady 8% annual growth rate, driven by sustained global demand. Concurrently, ongoing research initiatives contribute to the development of insightful Copper Mining Market Research Reports, enriching the industry's knowledge base.

Conclusion

The Copper Mining Market emerges as a dynamic and indispensable contributor to the global economy. Navigating through major players, market trends, challenges, and future prospects becomes imperative for stakeholders seeking sustainable success in this essential industry.

#Copper Mining Market#Copper Mining Market Share#Copper Mining Market Trends#Copper Mining Industry#Copper Mining Market Size#Copper Mining Market Challenges#Global Copper Mining Market#Copper Mining Market Analysis#Copper Mining Market Outlook#Copper Mining Market Competitor#Copper Mining Market Forecast#Copper Mining Market Research Reports#Copper Mining Industry Research Reports#Copper Mining Market Major Players#Copper Mining Market Top Players

0 notes

Text

Thomas McGee: Latest Trends in the Australian Stock Market and Global Market Analysis

Amid the backdrop of global markets continually reaching new highs, the Australian stock market is also displaying a positive trajectory. The ASX 200 futures index rose by 21 points, marking a 0.26% increase. Thomas McGee highlights several notable recent market trends, including the uranium ETF hitting a 10-year high and the profits of Webjet soaring by 40%. Additionally, global commodities such as gold, silver, and copper are seeing price increases, providing robust support for the Australian stock market.

Global Market Trends and the Australian Stock Market Linkage

The continuous rise in global markets offers strong support to the Australian stock market. Thomas McGee notes that the S&P 500 and Nasdaq indices are repeatedly setting new records, while the prices of key commodities like gold, silver, and copper are steadily climbing. These trends reflect not only the global economic recovery but also the confidence of investors in the future market.

A particularly noteworthy development is the uranium ETF reaching a 10-year high, indicating the expectation of the market on growing demand for nuclear energy. In the context of energy transition, uranium, as a crucial energy resource, is anticipated to see sustained demand and price increases. Thomas McGee believes this presents significant growth opportunities for Australian uranium mining companies, suggesting investors focus on companies with competitive advantages in uranium mining and production.

Market Impact of The Profit Surge of Webjet

The latest financial report of Webjet shows a 40% year-over-year profit increase, surpassing market expectations. Thomas McGee points out that the strong performance of Webjet is primarily driven by the growth in the travel industry and the rising demand for online travel bookings. For the ASX 200 index, the performance of Webjet is undoubtedly a positive signal. This not only boosts market confidence in the tourism sector but also provides upward momentum for related stocks. Thomas McGee advises investors to closely monitor market dynamics in the travel and online services sectors, analyzing the financial reports and market trends of relevant companies to seize investment opportunities.

Future Market Outlook and Investment Strategies

The positive global market trends and the strong performance of local Australian companies provide solid support for the ASX 200 index. Thomas McGee suggests that investors maintain a positive investment attitude in the current market environment while emphasizing diversified investments to cope with potential market volatility. Specifically, in the uranium mining and tourism industries, investors should deeply analyze company fundamentals and industry trends to identify stocks with long-term growth potential. Additionally, staying attuned to global commodity prices and market dynamics and timely adjusting investment portfolios are crucial for achieving steady returns.

Despite market uncertainties, through scientific analysis and strategic investing, investors still have the opportunity to achieve good returns in the current market environment. Thomas McGee encourages investors to maintain keen market insight, actively respond to market changes, and achieve capital appreciation.

0 notes

Text

Copper Mining Market Analysis, Brands Statistics and Overview by Top Manufacturers 2030

The market research study titled “Copper Mining Market Share, Trends, and Outlook | 2030,” guides organizations on market economics by identifying current Copper Mining market size, total market share, and revenue potential. This further includes projections on future market size and share in the estimated period. The company needs to comprehend its clientele and the demand it creates to focus on a smaller selection of items. Through this chapter, market size assists businesses in estimating demand in specific marketplaces and comprehending projected patterns for the future.

The Copper Mining market report also provides in-depth insights into major industry players and their strategies because we understand how important it is to remain ahead of the curve. Companies may utilize the objective insights provided by this market research to identify their strengths and limitations. Companies that can capitalize on the fresh perspective gained from competition analysis are more likely to have an edge in moving forward.

With this comprehensive research roadmap, entrepreneurs and stakeholders can make informed decisions and venture into a successful business. This research further reveals strategies to help companies grow in the Copper Mining market.

Market Analysis and Forecast

This chapter evaluates several factors that impact on business. The economics of scale described based on market size, growth rate, and CAGR are coupled with future projections of the Copper Mining market. This chapter is further essential to analyze drivers of demand and restraints ahead of market participants. Understanding Copper Mining market trends helps companies to manage their products and position themselves in the market gap.

This section offers business environment analysis based on different models. Streamlining revenues and success is crucial for businesses to remain competitive in the Copper Mining market. Companies can revise their unique selling points and map the economic, environmental, and regulatory aspects.

Report Attributes

Details

Segmental Coverage

Mining Technique

Open-pit Mining

Underground Mining

Application

Equipment manufacturing

Building and Construction

Infrastructure and Transportation

Others

Geography

North America

Europe

Asia Pacific

and South and Central America

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Freeport-McMoRan

Glencore

Amerigo Resources Ltd.

BHP

Codelco

African Copper Plc

Southern Copper

Hindustan Copper Ltd

First Quantum Minerals Ltd.

Rio Tinto.

Other key companies

Our Unique Research Methods at The Insight Partners

We offer syndicated market research solutions and consultation services that provide complete coverage of global markets. This report includes a snapshot of global and regional insights. We pay attention to business growth and partner preferences, that why we offer customization on all our reports to meet individual scope and regional requirements.

Our team of researchers utilizes exhaustive primary research and secondary methods to gather precise and reliable information. Our analysts cross-verify facts to ensure validity. We are committed to offering actionable insights based on our vast research databases.

Strategic Recommendations

Strategic planning is crucial for business success. This section offers strategic recommendations needed for businesses and investors. Forward forward-focused vision of a business is what makes it through thick and thin. Knowing business environment factors helps companies in making strategic moves at the right time in the right direction.

Summary:

Copper Mining Market Forecast and Growth by Revenue | 2030

Market Dynamics – Leading trends, growth drivers, restraints, and investment opportunities

Market Segmentation – A detailed analysis by product, types, end-user, applications, segments, and geography

Competitive Landscape – Top key players and other prominent vendors

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Devices, Technology, Media and Telecommunications, Chemicals and Materials.

0 notes

Text

Copper Wire Prices Trend, Database, Chart, Index, Forecast

Copper Wire prices are influenced by a multitude of factors, making it a dynamic and sometimes volatile market. As a fundamental component in various industries, copper plays a crucial role in electrical applications, construction, telecommunications, and more. Consequently, any fluctuations in its price can significantly impact these sectors. The primary factors driving copper wire prices include global supply and demand dynamics, economic conditions, geopolitical events, and technological advancements.

Global demand for copper is a major determinant of its price. As economies grow, especially in emerging markets like China and India, the demand for copper increases. These countries are rapidly urbanizing and industrializing, leading to a surge in infrastructure projects that require substantial amounts of copper. Additionally, the push towards renewable energy sources and electric vehicles (EVs) has spurred increased consumption of copper. Solar panels, wind turbines, and electric vehicles all rely heavily on copper for their electrical components, thus driving up demand. As the world continues to transition towards greener energy solutions, this trend is expected to sustain the upward pressure on copper prices.

On the supply side, the availability of copper ore and the capacity to process it into usable forms, such as wire, are critical. Major copper-producing countries include Chile, Peru, and the United States. Any disruption in mining activities in these regions, whether due to labor strikes, environmental regulations, or geopolitical tensions, can lead to supply constraints and consequently higher prices. For instance, labor strikes in Chile, which is the largest producer of copper, have historically led to significant spikes in copper prices. Furthermore, mining operations are capital-intensive and environmentally challenging, often leading to delays and increased costs, which can also push up prices.

Get Real Time Prices of Copper Wire: https://www.chemanalyst.com/Pricing-data/copper-wire-1359

Economic conditions globally have a profound impact on copper wire prices. During periods of economic growth, the demand for copper increases as industries expand and infrastructure projects proliferate. Conversely, during economic downturns, the demand for copper tends to decrease as industrial activity slows down. Inflation rates and currency fluctuations also play a role; for instance, if the dollar strengthens, copper becomes more expensive for holders of other currencies, potentially reducing demand and lowering prices.

Geopolitical events can create volatility in copper prices. Trade tensions between major economies, such as the US and China, can lead to tariffs and trade barriers that affect the flow of copper and related products. Sanctions on countries that are major producers or consumers of copper can disrupt the supply chain, leading to price fluctuations. Additionally, political instability in mining regions can cause supply disruptions, further affecting prices.