#Contributory Retirement Board

Text

🗓️ This Week in Meetings 5/28 - 5/31

Here is the list of all the meetings with agendas currently scheduled for this week in Reading. As always, this list is only up to date as of Tuesday morning and new meetings or modifications can be added/revised at any time. For PDF’s of the agendas, please click on the meeting name. Please check out https://www.readingma.gov for any changes.

Tuesday

School Council (Barrows) –…

View On WordPress

#Contributory Retirement Board#Council on Aging#CPA#Finance Committee#Killam School Building Committee#Meetings#RECALC#School Council#Select Board#VASC

0 notes

Text

Lagos State Pays N57.7 Billion in Pension Benefits to 16,340 Retirees Over Five Years

The Lagos State government has disbursed a total of N57.7 billion in pension benefits to 16,340 retirees since the commencement of Governor Babajide Sanwo-Olu's administration in May 2019.

The disclosure came from Mr. Afolabi Ayantayo, the Commissioner for Establishments, Training, and Pension, during the 102nd Retirement Presentation held by the Lagos State Pension Commission (LASPEC) in Lagos on Tuesday.

The beneficiaries encompass retirees from various sectors, including Mainstream, Local Government, State Universal Basic Board (SUBEB), Teaching Service Commission (TESCOM), and state government parastatals. Commissioner Ayantayo emphasized that Lagos State has been at the forefront of efficiently managing the Contributory Pension Scheme (CPS) since its inception in 2007, demonstrating a commitment to meeting pension obligations.

Expressing gratitude for the retirees' hard work, Ayantayo stated, "The state government is truly grateful for your hard work and recognizes the need to protect your retirement benefits." He highlighted the government's commitment to the CPS, aiming to ensure retirees receive regular income during their retirement.

The commissioner presented retirement bonds during the ceremony, emphasizing that they symbolize enduring gratitude and respect for the retirees' years of dedication. Ayantayo remarked, "The bonds you have forged, the wisdom you have shared, and the legacy you have built would continue to inspire us."

Acknowledging the retirees' service, the commissioner assured that the state government remains dedicated to implementing policies supporting their well-being.

The Lagos State Pension Commission (LASPEC), established by the Lagos State Contributory Pension Scheme Law 2007, plays a crucial role in regulating, supervising, and ensuring effective pension administration in the state public service.

The objectives of the Pension Reform Law include assisting employees in saving for retirement, timely payment of retirement benefits, and establishing rules for pension administration in the public service.

The law also introduced a group life policy for death benefits during service and a Retirement Bond for employees with past service benefits, along with a Redemption Fund to meet bond payment liabilities.

Read the full article

0 notes

Text

Retired Haverhill Police Chief DeNaro Asks State to Overturn Local Board’s Denial of Disability Pension

Retired Haverhill Police Chief Alan R. DeNaro has asked the state to overturn the November decision of the Haverhill Retirement Board to deny him a disability pension.

Retirement Administrator David Van Dam confirmed Thursday the Haverhill Retirement Board voted Nov. 8 to deny DeNaro’s application for a publicly undisclosed health issue. The former chief filed his appeal to the state Contributory…

View On WordPress

0 notes

Photo

Retired actuary Charles Herbert has raised an alarm over the major decline in the number of people contributing to the National Insurance (NIS), as he questioned Government’s rationale for continuing to pay non-contributory pensions. “I don’t really understand the room for non-contributory pension. That doesn’t seem to be accountable to the public,” he said on Tuesday night during an Institute of Chartered Account of Barbados (ICAB) webinar on Our NIS - The Way Forward. The latest review of the NIS showed that the number of employees plus self-employed contributors to the scheme had fallen from 126 802 in 2007 to 105 585 last year, and could decline further this year to 104 384. The number of employers contributing also declined from 8 272 in 2007 to 5 909 in 2021. That figure is expected to remain the same this year. Herbert insisted that while Government could not avoid making adjustments to the structure of the NIS, he believed a “huge” part of the solution for the scheme was capturing self-employed individuals. “A big part of the discussion has to be how do we get the self-employed people on board,” he said, as he expressed alarm at the decline in the number of self-employed contributors in the last 15 years. “Where have these people dropped out? I don’t know what information National Insurance keeps, but where have these 20 000 people disappeared from? Is it one particular industry that has suddenly stopped employing people and instead employing some on contract where they are self-employed? We need to bring to bear on this problem more than has been brought to bear so far, and I believe that information is there,” he said. Describing the current situation facing the pay-as-you-go scheme as “a very slow tsunami”, Herbert said “there are many of us who have been raising these concerns for multiple years.” With Barbados’ ageing population, he said, it was critical for the number of contributors to remain high. However, he questioned if adjusting the retirement age to maintain the ratio between pensioners and contributors would be acceptable. Read the rest below 👇🏾 https://www.instagram.com/p/ChrpBEggesfyo6kHkGlKJc4iBGOF2QaoilCWeU0/?igshid=NGJjMDIxMWI=

0 notes

Text

The Pension Transitional Arrangement Directorate (PTAD) on Tuesday said it would verify more than 813 pensioners under the Defunct Benefit Scheme (DBS) of Bank of Agriculture Ltd., across the country. PTAD Executive Secretary, Dr Chioma Ejikeme said this in an interview with the News Agency of Nigeria (NAN) on the sideline of the South-West zone verification mop up exercise for Parastatal Payroll pensioners and Bank of Agriculture pensioners in Lagos. Ejikeme said that the directorate had made provision for the payment of the monthly pension of the pensioners in its 2022 budget. “In 2018, when the Bank of Industry approached PTAD to take over the pension of its defunct pensioners, we were given a list of 853 pensioners, but presently we have 813 pensioners. “This means the difference would have been deceased pensioners, but we are still making provision for the difference because some of them may be represented by their Next of Kin,” she said. According to her, many of the benefitting pensioners have retired way back before the introduction of the Contributory Pension Scheme (CPS) and were not part of the Treasury Funded Agencies but of the Poverty Alleviation Agencies. The executive secretary listed the Agencies that formed the Bank of Agricultural Ltd., to include; the Peoples Bank, Nigeria Agricultural Community Bank and the Family Economic Advancement Programme. Ejikeme said, “We have already unboarded the staff of People’s Bank. These are workers who retired before the June 2007 cut off line for the Defunct Benefit Scheme (DBS) and did not transit to the CPS. “We will validate the verification that we have done through laid down procedures, carry out further quality assurance, computation and placement on the payroll.’’ The executive secretary explained that the exercise was organised to address complaints from some pensioners that they were not verified and appropriately placed on the payroll during the last verification. Ejikeme said having concluded with the South-West zone within one week, the directorate would proceed to verify pensioners within the North-Central zone in Abuja and then to pensioners in the North-West zone which would be verified in Kano. “For the other zones, we are going to work out a mobile verification strategy because there are not too many pensioners there. “We actually looked at the geographical spread of the pension before taking a decision on how to go about it. “We have started working on the Parastatals Payroll Pensioners and quite a lot of them who are eligible to be on the payroll have been placed,” she said. The Head of Human Resources, Bank of Agriculture Ltd., Mrs Tsukunda Yakubu lauded PTAD and the Federal Government for taking over the payment of its defunct pensioners monthly benefits. “We have been working with PTAD for sometime to set out the timetable for the verification even before the appointment of the executive secretary, but she keyed into it as soon as she came on board. “The executive secretary had put all machineries in place to ensure that this happens and the pensioners are very happy about it. “Bank of Industry is happy that PTAD is taking over the pension of our retirees. “With this, the load the bank is carrying for years now is being taking off its shoulders, it will no longer worry about how to pay its pensioners, knowing that PTAD is in charge,” she said. The News Agency of Nigeria (NAN) reports that some pensioners or their Next of Kin across the South-West zone had showing up for the exercise. The exercise is expected to run for a week in the zone. (NAN)

The Pension Transitional Arrangement Directorate (PTAD) on Tuesday said it would verify more than 813 pensioners under the Defunct Benefit Scheme (DBS) of Bank of Agriculture Ltd., across the country. PTAD Executive Secretary, Dr Chioma Ejikeme said this in an interview with the News Agency of Nigeria (NAN) on the sideline of the South-West zone verification mop up exercise for Parastatal Payroll pensioners and Bank of Agriculture pensioners in Lagos. Ejikeme said that the directorate had made provision for the payment of the monthly pension of the pensioners in its 2022 budget. “In 2018, when the Bank of Industry approached PTAD to take over the pension of its defunct pensioners, we were given a list of 853 pensioners, but presently we have 813 pensioners. “This means the difference would have been deceased pensioners, but we are still making provision for the difference because some of them may be represented by their Next of Kin,” she said. According to her, many of the benefitting pensioners have retired way back before the introduction of the Contributory Pension Scheme (CPS) and were not part of the Treasury Funded Agencies but of the Poverty Alleviation Agencies. The executive secretary listed the Agencies that formed the Bank of Agricultural Ltd., to include; the Peoples Bank, Nigeria Agricultural Community Bank and the Family Economic Advancement Programme. Ejikeme said, “We have already unboarded the staff of People’s Bank. These are workers who retired before the June 2007 cut off line for the Defunct Benefit Scheme (DBS) and did not transit to the CPS. “We will validate the verification that we have done through laid down procedures, carry out further quality assurance, computation and placement on the payroll.’’ The executive secretary explained that the exercise was organised to address complaints from some pensioners that they were not verified and appropriately placed on the payroll during the last verification. Ejikeme said having concluded with the South-West zone within one week, the directorate would proceed to verify pensioners within the North-Central zone in Abuja and then to pensioners in the North-West zone which would be verified in Kano. “For the other zones, we are going to work out a mobile verification strategy because there are not too many pensioners there. “We actually looked at the geographical spread of the pension before taking a decision on how to go about it. “We have started working on the Parastatals Payroll Pensioners and quite a lot of them who are eligible to be on the payroll have been placed,” she said. The Head of Human Resources, Bank of Agriculture Ltd., Mrs Tsukunda Yakubu lauded PTAD and the Federal Government for taking over the payment of its defunct pensioners monthly benefits. “We have been working with PTAD for sometime to set out the timetable for the verification even before the appointment of the executive secretary, but she keyed into it as soon as she came on board. “The executive secretary had put all machineries in place to ensure that this happens and the pensioners are very happy about it. “Bank of Industry is happy that PTAD is taking over the pension of our retirees. “With this, the load the bank is carrying for years now is being taking off its shoulders, it will no longer worry about how to pay its pensioners, knowing that PTAD is in charge,” she said. The News Agency of Nigeria (NAN) reports that some pensioners or their Next of Kin across the South-West zone had showing up for the exercise. The exercise is expected to run for a week in the zone. (NAN)

By Aluta News

May 17, 2022

The Pension Transitional Arrangement Directorate (PTAD) on Tuesday said it would verify more than 813 pensioners under the Defunct Benefit Scheme (DBS) of Bank of Agriculture Ltd., across the country.

PTAD Executive Secretary, Dr Chioma Ejikeme said this in an interview with the News Agency of Nigeria (NAN) on the sideline of the South-West zone verification mop up…

View On WordPress

0 notes

Text

200 retirees get N331.7m benefits in Jigawa

200 retirees get N331.7m benefits in Jigawa

Jigawa State Governor, Mohammed Badaru Abubakar. Photo/FACEBOOK/PLSGov/

Jigawa State and Local Governments Contributory Pension Scheme have begun the payment of retirement benefits to 200 retirees.

The Executive Secretary of the scheme, Alhaji Kamilu Aliyu, disclosed this to newsmen in Dutse, while speaking on the activities of the board.

He said the beneficiaries were those who retired from…

View On WordPress

0 notes

Text

130 civil servants dead, 534 retired within one month in Jigawa

130 civil servants dead, 534 retired within one month in Jigawa

The Jigawa State Government says one hundred and thirty civil servants died while in active service in the state in the month of July 2021.

Executive Chairman, state and local government contributory pension scheme board, Hashim Adamu Fagam disclosed this while paying benefits of the deceased persons to their families.

He said those who died were from the state, local Government and local…

View On WordPress

0 notes

Text

ECHS Polyclinic Jamnagar Recruitment 2021 | Officer-in-Charge Posts

Ex-Servicemen Contributory Health Scheme Jamnagar has Published Advertisement For Officer-in-Charge Vacancy in Jamnagar And Rajkot. ECHS Invites Applications to Engage Following Staff on Contractual Basis. Retired Defence Officers Can Send their Application For this ECHS Jamanagr Jobs. Check out more details below.

ECHS Polyclinic Jamnagar Recruitment 2021

Job Recruitment Board

Ex-Servicemen…

View On WordPress

0 notes

Text

Employee Provident Fund

The

Employees' Provident Fund came into existence with the promulgation of the Employees' Provident Funds Ordinance on

the 15th November, 1951. It was replaced by the Employees' Provident Funds Act,

1952. The Employees' Provident Funds Bill was

introduced in the Parliament as Bill Number 15 of the year 1952 as a Bill to

provide for the institution of provident funds for employees in factories and

other establishments. The Act is now referred as the Employees' Provident Funds &

Miscellaneous Provisions Act, 1952 which extends to the whole

of India. The Act and Schemes framed there under are administered by a

tri-partite Board known as the Central Board of Trustees, Employees' Provident

Fund,consisting of representatives of Government (Both Central and State),

Employers, and Employees.

The Central

Board of Trustees administers a contributory provident fund,

pension scheme and an insurance scheme for the workforce engaged in the

organized sector in India. The Board is assisted by the Employees’ PF

Organization (EPFO), consisting of offices at 135 locations across the country.

The Organization has a well equipped training set up where officers and

employees of the Organization as well as Representatives of the Employers and

Employees attend sessions for trainings and seminars.The EPFO is under the

administrative control of Ministry of Labour and Employment, Government of

India (click here)

EPFO Organisation Structure (Annual

Report 2015-16)

The

Board operates three schemes - EPF Scheme 1952, Pension Scheme 1995 (EPS) and

Insurance Scheme 1976 (EDLI).

APPLICABILITY OF EPF

REGISTRATION under EPF is

compulsory:

For every factory engaged in

industry employing 20 or more employeesFor every other establishment having

20 or more employees during previous year.For every employee who is getting

less than INR 15000/- per month.

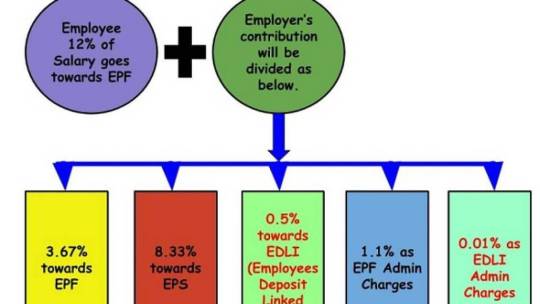

CONTRIBUTION

Every employee who joins any establishment which is covered under EPF scheme has to mandatorily contribute certain percentage of his salary. These contributions have to be made regularly. The Contribution made by an employee is pooled up in the form of saving or investment which is given to the employee at the time of his retirement or he switches his job.

Rate of Contribution for establishment hiring employees 20 or above Employer’s rate of contribution: Employer has to share his contribution at the rate of 12% of Employee’s basic salary plus dearness allowance.

Employee’s rate of contribution: Employer has to share his contribution at the rate of 12% of Employee’s basic salary plus dearness allowance.

Out

of total employer’s contribution, it is further bifurcated into 8.33% which is

converted to Employees’ Pension Scheme, and remaining 3.67% is converted into

EDLI account.

UAN

UAN stand for Universal Account Number which is allotted to employees at

the time of registering an employee under EPFO portal. This number is

allotted by completing the details such as name, father’s name, aadhar number,

Date of birth as per aadhar etc. This UAN can be used by an employee throughout

whether he changes his service or establishment.

EPS Pension Facts

Full

Pension age 58 yearsEarly

Pension age stars from 50 years. There will be 4% reduction for each year

before 58 years.Member

can apply for pension after retirement or after attaining 58 years, whichever

is earlier.If

member attains 58 years and don’t have 10 year service, will not be eligible

for member pension. He can withdraw pension amount.If

member retires before 50 year and have > 10 year service, can apply for

Scheme Certificate. This can submit after attaining 50 year and will get

pension.Out

of 3 Schemes of EPFO (EPS, EPF & EDLI), only EPS has retirement age, 58

years.If

Member continues working after 58 years, please stop 8.33% pension payment

towards EPS (A/c No. 10) and remit the same under EPF (A/c No.1 Employer’s

share - ie. 3.67+8.33 = 12%).(EPF

& EDLI must be paid till permanent retirement)

Read the full article

0 notes

Text

🗓️ This Week in Meetings 4/22 - 4/26

Here is the list of all the meetings with agendas currently scheduled for this week in Reading. As always, this list is only up to date as of Monday morning and new meetings or modifications can be added/revised at any time. For PDF’s of the agendas, please click on the meeting name. Please check out https://www.readingma.gov for any changes.

Monday

100b Medical Review Panel –…

View On WordPress

#Climate Advisory Committee#Conservation Commision#Contributory Retirement Board#Council on Aging#Meetings#RECALC#School Council#Town Meeting

0 notes

Text

Lagos State Pays N57.7 Billion in Pension Benefits to 16,340 Retirees Over Five Years

The Lagos State government has disbursed a total of N57.7 billion in pension benefits to 16,340 retirees since the commencement of Governor Babajide Sanwo-Olu's administration in May 2019.

The disclosure came from Mr. Afolabi Ayantayo, the Commissioner for Establishments, Training, and Pension, during the 102nd Retirement Presentation held by the Lagos State Pension Commission (LASPEC) in Lagos on Tuesday.

The beneficiaries encompass retirees from various sectors, including Mainstream, Local Government, State Universal Basic Board (SUBEB), Teaching Service Commission (TESCOM), and state government parastatals. Commissioner Ayantayo emphasized that Lagos State has been at the forefront of efficiently managing the Contributory Pension Scheme (CPS) since its inception in 2007, demonstrating a commitment to meeting pension obligations.

Expressing gratitude for the retirees' hard work, Ayantayo stated, "The state government is truly grateful for your hard work and recognizes the need to protect your retirement benefits." He highlighted the government's commitment to the CPS, aiming to ensure retirees receive regular income during their retirement.

The commissioner presented retirement bonds during the ceremony, emphasizing that they symbolize enduring gratitude and respect for the retirees' years of dedication. Ayantayo remarked, "The bonds you have forged, the wisdom you have shared, and the legacy you have built would continue to inspire us."

Acknowledging the retirees' service, the commissioner assured that the state government remains dedicated to implementing policies supporting their well-being.

The Lagos State Pension Commission (LASPEC), established by the Lagos State Contributory Pension Scheme Law 2007, plays a crucial role in regulating, supervising, and ensuring effective pension administration in the state public service.

The objectives of the Pension Reform Law include assisting employees in saving for retirement, timely payment of retirement benefits, and establishing rules for pension administration in the public service.

The law also introduced a group life policy for death benefits during service and a Retirement Bond for employees with past service benefits, along with a Redemption Fund to meet bond payment liabilities.

Read the full article

0 notes

Text

Pensions: Katsina, Imo, 19 others not remitting deductions from workers’ pay

By Tony Ademiluyi

Since the implementation of the Pension Reform Act in 2004 by the National Pension Commission, a total of 21 state governments have yet to remit pension deducted from workers’ pay.

Part of the objectives of the Pension Reform Act is to ensure that every person who worked either in the public service of the federation, Federal Capital Territory, states and Local Government Areas or the private sector receives his/her retirement benefits as and when due.

Through the Pension Reform Act, the commission has been able to establish a uniform set of rules, regulations and standards for all aspects of pension administration, including payment of retirement benefits to retirees among others.

An investigation by our correspondent showed that while 21 states were not remitting pension deducted from workers’ pay, 15 of them were remitting but at different stages of remittance.

The 21 states that are not remitting pension under the Contributory Pension Scheme are Ogun, Niger, Kano, Imo, Sokoto, Kogi, Bayelsa, Nasarawa, Oyo, Katsina, Akwa Ibom, Benue and Plateau.

Others are Cross River, Enugu, Abia, Ebonyi, Taraba, Bauchi, Borno and Adamawa.

A report on the compliance rate of states with the Pension Reform Act obtained from PenCom showed that Ogun State stopped remitting pension contributions with huge arrears of unremitted pension.

The report said while Ogun State was funding the accrued rights of employees, there was no valid group life insurance policy in place in the state for workers.

For Niger State, the commission in the report stated that it stopped remitting pension contributions in 2015, adding that the government of the state was also not funding accrued rights and no group life insurance policy in place.

Further analysis of the report showed that apart from not remitting pension deducted from workers’ pay, Imo, Kebbi, Sokoto, Bayelsa, Kogi, Nasarawa, Oyo, Katsina, and Akwa-Ibom states did not fund accrued rights neither did they have group life insurance policy for workers.

Also, Benue, Kwara, Plateau, Cross River, Enugu, Abia, Ebonyi, Taraba, Bauchi, Borno, Gombe and Adamawa have yet to fund accrued rights or put in place group insurance policy for workers.

Further findings revealed that out of the 15 states that are remitting pension contributions, only four states had been remitting the pension of their workers regularly.

The other nine states are at various stages of remittances. The four states with regular remittances of their workers’ pension deductions are Lagos, Edo, Kaduna and the Federal Capital Territory.

The states with staggering remittances are Jigawa, Delta, Zamfara, Osun, Rivers, Kano, Ekiti and Anambra.

For Jigawa State, the commission explained that the state was remitting contributions to selected Pension Fund Administrators but implementing a Contributory Defined Benefits Scheme.

For Delta State, it said the state was remitting complete and regular pension contributions for state employees, but remitting only employees’ portion for local government workers.

The commission added that the state-funded accrued pension rights of both local government and state workers but had huge arrears of accrued pension liabilities. The report said the state did not have group life insurance cover for its workers.

For Zamfara, analysis of the report showed the state was remitting pension contributions of employees with no funding of accrued rights nor had any group life insurance policy.

Osun State, according to the report, remitted pension contributions but in an inconsistent manner, “resulting in a backlog of pension contributions.”

It described the state government’s funding of accrued pension rights as inadequate, noting that this had resulted in huge arrears of accrued rights. Osun State, it added, had no group life insurance policy.

For Rivers State, it said the government of the state remitted only employees’ portion of pension contributions, adding that the state had a huge backlog of unremitted employer’s portion of pension contributions.

It added that the state had in 2012 set aside the sum of N300m with Premium Pensions for the payment of accrued rights.

For Kano State, the commission said the government was deducting pension contributions but under the management of the Board of Trustees. The state has yet to transfer the pension assets to a Licensed Pension Operator.

The commission in the report also said Ekiti remitted pension contributions for state and local government employees up to January 2019, adding that the government had yet to fund accrued rights of workers.

The PUNCH had on Thursday reported that states operating the Contributory Pension Scheme refused to remit about N3.4bn pension contributions deducted from their workers’ monthly remunerations into their respective Retirement Savings Accounts with their Pension Fund Administrators.

The acting Director-General, National Pension Commission, Aisha Dahir-Umar, disclosed this during the second quarter consultative forum for states in Lagos recently.

Dahir-Umar said, “Based on PFAs’ returns, over N3.4bn pension contributions are uncredited into state employees’ RSAs as of May 31, 2019, and the age analysis showed that over 38 per cent of this amount had been outstanding for over one year.

Dahir-Umar, who was represented by the Head, States Operations Department, PenCom, Dan Ndackson, said a major item, which should occupy a pride of place during deliberations, was the recurring issue of uncredited remittances, which denied concerned employees the investment income that should have accrued to them.

She added that it was heart-warming to observe the steady progress of the implementation of the CPS in the states, especially with regards to the remittance of pension contributions.

“Returns submitted to the commission by the PFAs showed that over N8.09bn was remitted to them as pension contributions of state employees in the first quarter of 2019,” she said.

The PenCom boss informed that the second quarter had recorded remarkable achievements in ensuring seamless implementation of the CPS in states.

In this regard, she said the commission, as part of its mandate of supervising the smooth implementation of the CPS and to ensure excellent service delivery, especially in state pension administration, introduced branch inspection of PFAs in states.

Read the full article

0 notes

Text

Jigawa releases N1.1b pension benefits to 570 beneficiaries

Ahmed Rufa’i, Dutse

THE Jigawa State and Local Government Contributory Pension Scheme Board on Wednesday commenced the payment of 570 retired workers amounting to N1.1 billion.

This was disclosed by the Executive Secretary of the board, Alhaji Hashim Ahmad Fagam while speaking to newsmen shortly after flagging-up the disbursement.

He said that the screening and payment process would be in…

View On WordPress

0 notes

Text

The Chase Files Daily Newscap 4/21/2019

Good MORNING #realdreamchasers! Here is The Chase Files Daily News Cap for Sunday April 21st 2019. Remember you can read full articles for FREE via Barbados Today (BT) or Barbados Government Information Services (BGIS) OR by purchasing by purchasing a Sunday Sun Nation Newspaper (SS).

BOARD DOWN TO 42 BUSES – Commuters should have cleaner bus terminals and improved toilet facilities come Tuesday, but Transport Board buses will still be in short supply. This Easter weekend, all the terminals were being cleaned, painted, and bottled water distributed to commuters. The bottled water distribution will continue until water fountains are installed. However, after starting with 48 working buses yesterday morning, six broke down, and by mid-afternoon only 42 were still operating. A Transport Board source, who requested anonymity, told the Sunday Sun the board was facing major challenges, none of which can be fixed overnight. (SS)

NIS BACKLOG SLASHED ��� The backlog of claims at the National Insurance Scheme (NIS) is finally being cleared. Government says 11 027 or 41 per cent of the outstanding claims were settled in the last three months. At the same time, $12.7 million was paid to 453 claimants since the new board assumed office last July – including $5.07 million paid to 100 former workers at the Caribbean Broadcasting Corporation and 22 at the Transport Board last December. The outstanding claims relate to contributory and non-contributory pensions, invalidity, sickness, disability, disablement, survivor/death, retirement, maternity, unemployment, severance, employment injury, medical/travel for employment injury and funeral grants. (SS)

US$300M BOOST – Another round of major funding is in the pipeline for Barbados. The Inter-American Development Bank (IDB) Group says it will give Government access to US$300 million in “sovereign-guaranteed loans” over the next five years. The financier also wants to have “dialogue” with the Mia Mottley administration about how it can help solve public transportation and health challenges. This latest funding will be channelled to Government via the 2019-2023 country strategy approved in recent days by the IDB’s Board of Executive Directors. (SS)

CHINA READY – The People’s Republic of China is ready to join hands with Barbados for the second phase of the Belt and Road Forum for International Cooperation in Beijing, China, from April 25 to 27. The theme of this year’s BRF is Belt and Road Cooperation Shaping a Brighter Shared Future, with advancing Belt and Road Initiative (BRI) cooperation toward quality development as its core. Chinese ambassador to Barbados Yan Xiusheng will attend the opening ceremony of the BRF and make a keynote speech. During the BRF, China will welcome thousands of representatives from more than 150 countries to Beijing, inclusive of Barbados, to take stock of what has been achieved and draw a blueprint for future cooperation to further enrich BRI cooperation. “China stands ready to enhance cooperation with Barbados within the framework of BRI, to elevate our bilateral relations and pragmatic cooperation to a new height, and benefit peoples in our two countries,” the ambassador said. “I am convinced that with the concerted efforts of all the participating parties, including China and Barbados, the second BRF will deliver fruitful outcomes, create more driving forces for the economic growth, provide more opportunities for international economic cooperation, and contribute more to the vision of a community with a shared future for mankind.” Barbados is among the first countries that established diplomatic relations with China in the Caribbean region. Since the establishment of the diplomatic relations in 1977, friendly bilateral relations between the two countries have maintained healthy and steady momentum, and plenty of fruitful achievements have been made in the pragmatic cooperation across areas. Last February, the two countries signed the Memorandum of Understanding on Cooperation within the Framework of the BRI in Beijing. Since the BRI was first proposed six years ago, it has advanced work with the guidance of a principle of consultation and cooperation for shared benefits, and focusing on connectivity in the five priority areas of policy, infrastructure, trade, finance and people-to-people ties, aiming to deepen international cooperation, safeguard multilateralism, and boost global growth. (SS)

FIRST GOLD – Caleb Massiah stood tall tonight as he leapt to Barbados’ first gold medal at the 48th CARIFTA Games at the Truman Bodden Sports Complex in Grand Cayman. The 15-year-old Massiah triumphed in the Under-17 Boys’ long jump with a lifetime best leap of 6.84 metres in his maiden outing at CARIFTA. Incredibly, Massiah, who hails from Oldbury, St Philip and attends The St Michael School, after switching from Harrison College, had one legal jump and it was a golden one. That winning leap came in his first attempt and he unbelievably fouled his next four attempts. With the gold medal assured, he was the final jumper and hit the board but landed in the sandpit on one leg on his sixth jump. By then his coach, Desiree Crichlow, and assistant, Ricky Carter, were already jumping for joy. (SS)

LEAN OPENING SESSION FOR BAJANS AT CARIFTA GAMES – BARBADOS endured a lean morning session when the 48th CARIFTA Games began at the Truman Bodden Sports Complex here today with perennial champions Jamaica already stamping their authority on proceedings. No finals were contested on the track but neither Shanice Hutson nor first-timer Kevon Hinds got on the podium in their field event finals - the only two finals involving Barbadians. Shanice Hutson was fifth overall in the Under-20 girls’ discus with a best effort of 36.61 metres, well short of her personal best 43.75 metres which she achieved at the Louis Lynch Championships. First-timer Kevon Hinds had to settle for fourth place with 14.93 metres in the Under-17 boys’ shot put, which he achieved on his first attempt. Advancing to the finals of the 400 metres were Savion Hoyte (49.72), Antoni Hoyte-Small (47.41) and Kyle Gale (47.77), as did Matthew Clarke in the Under-20 boys’ 100 metres in 10.76 seconds. However, there was disappointment for sprinter Julian Forde (11 seconds) in the Under-20 Boys’ 100 metres and Shemia Odaine who clocked 58.24 seconds in the Under-20 Girls’ 400 metres.

RESULTS FROM THE FIRST SESSION.

Under-17 Girls’ High Jump

1. Annishka McDonald (Jamaica) 1.74 metres, 2. Vanessa Mercera (Curacao) 1.74m, 3. Shaunece Miller (Bahamas) 1.68m

Under-20 Girls’ High Jump

1. Janique Burgher (JA) 1.77 metres, 2. Daniela Anglin (Jamaica) 1.77m, 3. Aijah Lewis (Cayman Islands)

Under-17 Girls’ Shot Put

1. Alicia Grootfaam (Suriname) 14.15 metres, 2. Treneese Hamilton (Dominica) 14.14m, 3. Jamora Alves (Grenada) 13.53m

Under-20 Boys’ Discus (Record)

1. Kai Chang (Jamaica) 59.36 metres, 2. Ralford Mullings (Jamaica) 54.91m, 3. Djimon Gumbs (British Virgin Islands) 54.76m

Open Girls’ Heptathlon 100M Hurdles

1. Safiya John (Trinidad and Tobago) 14.44 seconds, 2. Antonia Sealy (Trinidad and Tobago) 15.04, 3. Kasha Nielly (Bahamas) 15.10

Open Boys’ Octathlon 100 Metres

1. David Edmondson (Jamaica) 11.10 seconds, 2. Edvaughn Carey (Bahamas) 11.27, 3. Che Rochford (Trinidad and Tobago) 11.42

Open Girls’ Heptathlon High Jump

1. Thaila Wilson (Jamaica) 1.76 metres, 2. Safiya John (Trinidad and Tobago) 1.64m, 3. Arianna Hayde (British Virgin Islands) 1.58m

Open Boys’ Octathlon Long Jump

1. Anson Moses (Trinidad and Tobago) 6.60 metres, 2. Hemon Joseph (Grenada) 6.49m, 3. Patrick Johnson (Bahamas) 6.48m

Under-17 Boys’ Shot Put

1. Christopher Young (Jamaica) 16.00 metres, 2. Kobe Lawrence (Jamaica) 15.86m, 3. Jayden Scott (Trinidad and Tobago) 15.08m, 4. Kevon Hinds (Barbados) 14.93m

Under-20 Girls’ Discus (Record)

1. Marie Forbes (Jamaica) 47.63 metres, 2. Kimone Reid (Jamaica) 44.60m, 3. Kelsie Murrell-Ross (Grenada) 40.30m, 5. Shanice Hutson (Barbados) 36.61m (SS)

MURDE ACCUSED OFF TO DODDS – Murder accused Stephen Alvin Carrington, 18, of Kings Gap, Eagle Hall, St Michael has been remanded to HMP Dodds. Carrington, who is charged with the January 23 shooting death of the Corrie Parris, appeared before Magistrate Douglas Frederick this morning. Parris died while inside a vehicle at Baxter’s Road, St Michael The unemployed Carrington, who was not represented by an attorney, will return to the District “A” Magistrates’ Court on May 17. (SS)

For daily or breaking news reports follow us on Instagram, Tumblr, Twitter & Facebook. That’s all for today folks. There are 254 days left in the year. Shalom! #thechasefilesdailynewscap #thechasefiles# dailynewscapsbythechasefiles

1 note

·

View note

Text

2019 SCC Vol. 3 April 7, 2019 Part 3

Service Law — Appointment — Eligibility conditions/criteria — Cancellation of appointment — Non-fulfilment of eligibility criteria: In this case, appellant was working as Management Trainee and/or Assistant Company Secretary. The Supreme Court held that word “as” used in advertisement should be given literal meaning. Respondents, who were authors of advertisement and best judge to interpret usage of “as” specifically stating that intention was that applicant must have been appointed as Company Secretary and functioned as such for five years to be eligible for appointment. Hence, held, appellant’s appointment as Management Trainee cannot be equated and/or considered appointment “as” Company Secretary. When said period is excluded, appellant fails to fulfil stipulated eligibility criteria. Further held, submission by appellant that by performing duties as “Management Trainee” she was also performing some duties of “Company Secretary” and hence, said period should be counted to adjudge her eligibility liable to be rejected since such meaning would be changing eligibility criteria as stated in advertisement. It was further held that no interference with impugned order upholding appellant’s termination order was called for. [Ritu Bhatia v. Ministry of Civil Supplies, Consumer Affairs & Public Distribution, (2019) 3 SCC 422]

Entertainment, Amusement, Leisure and Sports — Entertainers/ Performers, Rights of — Dance performances in hotels/restaurants — Regulation by law: Impugned provisions of the Maharashtra Prohibition of Obscene Dance in Hotels, Restaurants and Bar Rooms and Protection of Dignity of Women (Working therein) Act, 2016 (12 of 2016) and Rules thereunder, though permitting dance performances, introduced certain regulatory measures and impossible licence conditions such that, not a single establishment could be issued licence under impugned legislation. Such impossible, vague, unreasonable, irrational, arbitrary and invalid provisions and licence conditions set aside. However, certain other provisions, though challenged, upheld. [Indian Hotel & Restaurant Assn. (AHAR) v. State of Maharashtra, (2019) 3 SCC 429]

Arbitration and Conciliation Act, 1996 — S. 15(2) and Sch. V: Appointment of a substitute arbitrator in contravention of the arbitration agreement, not permissible. Appointment/nomination of a retired employee a party to the agreement (the State herein) as an arbitrator cannot be assailed merely because arbitrator is retired/prior employee of one of the parties. Position of law obtaining for the period both prior to and post amendment of 2015, clarified. [State of Haryana v. G.F. Toll Road (P) Ltd., (2019) 3 SCC 505]

Service Law — Recruitment Process — Eligibility criteria/conditions — Acquisition of prescribed qualification after cut-off date — Validation of — Circumstances envisaged: In this case impugned judgment set aside selection and appointment of appellants as JEs who had put in service of nearly two decades on ground that they were not eligible for appointment since they had acquired prescribed qualification after cut-off date. Affirming correctness of reasoning of Division Bench that eligibility of candidates must be decided with reference to qualification possessed as on cut-off date, nevertheless held, interest of justice would require interference with impugned judgment considering long years of service put in by appellants and since they had already been selected and working, had not participated in subsequent three selections and now had become age-barred. Besides, as far as petitioner is concerned, more than efflux of time, fact was that he cannot secure selection because of his low marks even if appellants were ousted. [Rakesh Bakshi v. State of J&K, (2019) 3 SCC 511]

Penal Code, 1860 — Ss. 302 and 201 or Ss. 304 Pt. I and 201 [S. 300 Exception 1]: In this case, deceased was throttled to death with towel and dead body was burnt to conceal offence. It was held that everything occurred in fraction of a minute, depriving accused of power of self-control, conviction altered from Ss. 302 and 201 to Ss. 304 Pt. I and 201. [Nawaz v. State, (2019) 3 SCC 517]

Civil Procedure Code, 1908 — Or. 22 R. 4(2) — Impleadment of all legal heirs of the deceased defendant in appeal — When not necessary: If out of all the legal representatives, majority of them are already on record and they contest the case on merits, it is not necessary to bring other legal representatives on record for the reason that the estate and the interest of the deceased devolved on the legal representatives is sufficiently represented by those who are already on record. [Vijay A. Mittal v. Kulwant Rai, (2019) 3 SCC 520]

Kumaun and Uttarakhand Zamindari Abolition and Land Reforms Act, 1960 — S. 10(e): Asami/Sirdari right i.e. entitlement to take or retain possession of occupied land, held, cannot arise on the basis of forged/surreptitious revenue record entries. Entries in the revenue record ought, generally, to be accepted at their face value but presumption of correctness can apply only to genuine, not forged or fraudulent, entries. [Dharam Singh v. Prem Singh, (2019) 3 SCC 530]

Customs — Confiscation/Detention — Confiscation and redemption: Confiscation and redemption of restricted goods (as contrasted with prohibited goods) imported without requisite permission, on payment of fine, permissible. [Commr. of Customs v. Atul Automations (P) Ltd., (2019) 3 SCC 539]

Civil Procedure Code, 1908 — Or. 39 R. 2-A and Or. 21 R. 32(5) — Disobedience of temporary injunction — Punishment for: Violation of order of injunction was serious matter. Unless there is clear evidence showing party wilfully violated court order, he cannot be punished. There must be parity of treatment when parties similarly situated are accused of violating temporary injunction. [Ramasamy v. Venkatachalapathi, (2019) 3 SCC 544]

Service Law — Pay — Parity in pay/Pay scale — Claim to — Nature and Burden of proof: Employees claiming parity must prove that their nature of duties were similar but they were unjustly treated by arbitrary action or discriminated against. [Punjab State Power Corpn. Ltd. v. Rajesh Kumar Jindal, (2019) 3 SCC 547]

Civil Procedure Code, 1908 — Or. 9 R. 9 — Application for restoration of suit: Application for restoration of suit was dismissed on ground of continuous absence in court but as continuous absence, not made out on facts, civil suit restored. [Kusumben Indersinh Dhupia v. Sudhaben Biharilalji Bhaiya, (2019) 3 SCC 569]

Railways Act, 1989 — Ss. 124-A and proviso thereto and 124 — Right to compensation on account of untoward incident: Concept of “self-inflicted injury” would require intention to inflict such injury and not mere negligence of any particular degree. Further, invocation of the principle of contributory negligence cannot be done in the case of liability based on “no fault theory”. Held, death or injury in the course of boarding or de-boarding a train will be an “untoward incident” entitling a victim to compensation and will not fall under the proviso to S. 124-A merely on plea of negligence of victim as a contributing factor. [Union of India v. Rina Devi, (2019) 3 SCC 572]

Constitution of India — Art. 32: Writ petition before Supreme Court for enforcement of personal contractual rights, not maintainable. Writ petition filed by ex-employee seeking writ of mandamus directing CBI to investigate into alleged financial irregularities committed by employer company, with ulterior motive of enforcement of personal rights inter se employee and employer, cannot be allowed. [Ramesh Sanka v. Union of India, (2019) 3 SCC 589]

Civil Procedure Code, 1908 — Ss. 47 and 21 — Objection to territorial jurisdiction of court: Executing court has no jurisdiction to entertain Objection raised before executing court under S. 47 as to validity of decree sought to be executed on ground of lack of territorial jurisdiction of court which passed decree. [Sneh Lata Goel v. Pushplata, (2019) 3 SCC 594]

Penal Code, 1860 — S. 307 or S. 324 — Offence under S. 307 — Ingredients of: Proof of grievous or life threatening hurt is not a sine qua non for offence under S. 307. Intention of accused can be ascertained from actual injury, if any, as well as from surrounding circumstances. Among other things, nature of weapon used and severity of blows inflicted, can be considered to infer intent. [State of M.P. v. Kanha, (2019) 3 SCC 605]

Hindu Succession Act, 1956 — S. 30 Explanation: Disposal of undivided share in Mitakshara joint family properties by means of executing will, permissible. [Radhamma v. H.N. Muddukrishna, (2019) 3 SCC 611]

Penal Code, 1860 — Ss. 302/34 — Criminal Trial — Appreciation of Evidence: Minor contradictions or inconsistencies immaterial, as appellant alleged to have assaulted deceased with gupti on his neck and nearby area resulting in his death, hence, conviction confirmed. [Satya Raj Singh v. State of M.P., (2019) 3 SCC 615]

Recovery of Debts and Bankruptcy Act, 1993/Recovery of Debts Due to Banks and Financial Institutions Act, 1993 — Ss. 17 and 18 r/w S. 34 i.e. bar of jurisdiction under: A winding-up proceeding is not a proceeding that can be referred to as a proceeding for realisation of debts and since a winding-up proceeding under the Companies Act is not “for recovery of debts” due to banks, the bar contained in S. 18 r/w S. 34 of the Recovery of Debts Act would not apply. [Swaraj Infrastructure (P) Ltd. v. Kotak Mahindra Bank Ltd., (2019) 3 SCC 620]

Tweet

The post 2019 SCC Vol. 3 April 7, 2019 Part 3 appeared first on SCC Blog.

2019 SCC Vol. 3 April 7, 2019 Part 3 published first on https://sanantoniolegal.tumblr.com/

0 notes

Text

Osun Workers Return To Work After Warning Strike

Osun Workers Return To Work After Warning Strike

Workers in Osun on Monday, returned to work after the expiration of a three-day warning strike they embarked upon on the directive of the state Joint Labour Unions.

The press recalls that the Joint Labour Unions, comprise the Joint Negotiating Council, Nigeria Labour Congress (NLC) and Trade Union Congress (TUC).

The unions had on Tuesday, issued a notice, directing all civil servants to embark on a three-day strike to demand for the payment of their salary areas and other entitlements.

The strike became necessary to demand from the state government the payment of 34 months salary arrears of 50 per cent paid officers on Grade Level 08 and above, equaling 17 months full salary.

“The payment of 34 months pension arrears of retired workers in the state, remittance of 34 months contributory pension arrears, payment of outstanding gratuity to all pensioners;

“And payment of 2016 leave allowances across board to officers of the state government.

However, NAN observed that the workers were back to their offices on Monday, as the three-day warning strike ended on Friday, waiting for further directive from the Joint Labour Unions.

When Mr Jacob Adekomi, the Osun chairman of NLC was contacted by NAN to find out if the workers’ demands had been met, he replied by saying that they were yet to have a meeting with the government.

“They (the government) said they are in Abuja, and they would meet us when they return this week.

“We are waiting for them to meet with us, so that we will know the next line of action.” he said.

Read the full article

0 notes