#Central Banking system

Text

CBDC's will bring the technocracy.

Remember, "You'll own nothing and be happy."

Keep your money safe from tyrants

#cbdc#central bank digital currency#technocracy#central banking system#the federal reserve#the fed#end the fed#trump#president trump#president donald trump#donald trump#vivek ramaswamy#freedom#wealth#survival

0 notes

Text

The Federal Reserve System: A Pillar of the U.S. Economy

Written by Delvin

Established in 1913, the Federal Reserve System, commonly known as the Fed, stands as the central banking system of the United States. Over the past century, the Fed has played a crucial role in maintaining financial stability, promoting economic growth, and safeguarding the nation’s monetary system. In this blog post, we will explore the key functions and responsibilities of…

View On WordPress

#Bank Supervision and Regulation#Central Banking System#dailyprompt#Federal Reserve#Financial#Financial Literacy#Financial System Stability#knowledge#Monetary Policy#money#Money Fun Facts#Payment Systems and Services#Research and Economic Analysis#The Federal Reserve System: A Pillar of the U.S. Economy

0 notes

Video

CHRIS SKY - The CARBON CREDIT SCAM

#Chris Sky#Carbon Credit#WEF#World Economic Forum#Reset#Social Credit System#Central Bank Digital Currency#CBDC

37 notes

·

View notes

Text

youtube

When money drives almost all activity on the planet, it’s essential that we understand it. The documentary 97% Owned aims to answer questions like: Where does the money come from? Who creates it? Who decides how it gets used? And what does that mean for the millions of ordinary people who suffer when money and finance break down?

97% Owned reveals how the creation of credit and the mystery that surrounds it. The documentary goes at the root of our current social and economic crisis. Referring to the 97% of the world’s money supply that is represented by credit, this thought-provoking film presents serious research and verifiable evidence on our economic and financial system. Featuring frank interviews and commentary from economists, campaigners and former bankers, it exposes the privatized, debt-based monetary system that gives banks the power to create money, shape the economy, cause crises and push house prices out of reach. Fact-based and clearly explained, 97% Owned demonstrates how the power to create money is the piece of the puzzle that economists were missing when they failed to predict the crisis.

1 note

·

View note

Photo

#Info - Is the bank system sound?

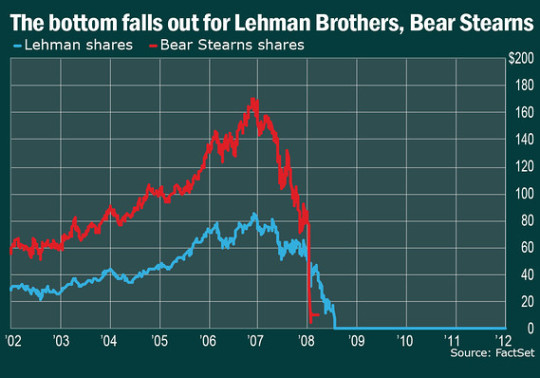

The institutions that are deemed “too big to fail” will always be bailed out. In his book, “Conspiracy of the Rich: The 8 New Rules of Money,” Robert Kiyosaki wrote that “bailouts are the name of the game.”

#gentlemans code#info#central banking#bank system#svb failure#finance#silicon valley bank#banking#moral hazard#economic crisis#robert kiyosaki#rich dad education#rich dad poor dad#bailout#lehman brothers#bear sterns

2 notes

·

View notes

Text

The federal reserve is also kinda a hard question because inflation is obviously bad but also interest rate hikes are a pretty bad way to fix it on the merits and they have tons of huge negative consequences, but actually most of inflation is a confidence game so major financial players will just "I don't believe you" into economic decline unless you punish some poor people for trying to unionize their local starbucks. so like I wouldn't actually want to be Jerome Powell unless I had a magic wand that would restructure the entire financial system from the ground up. But then you have to do that lmao

#i need to find some socialist takes on central banking bc like. im not against central government necessarily#so some kind of currency and banking system (one thats not hugely financialized obv) follows from that i think#but like. i would feel more confident in that opinion if i knew what that meant we did with something like a central bank

3 notes

·

View notes

Text

no but. I mean I'm asleep but why are we letting norm (to my knowledge an anthropologist and possibly a biologist) make medical diagnoses and just taking him at his word and also like he doesn't know for a fact after studying under grace that the collective consciousness the na'vi refer to as eywa is there, because it is observable and measurable, like

#this rly salts my papercut u know#like what do you MEAN that sounds like ''classsic epilepsy'' she is a nonhuman biped#who can plug her central nervous system into a planetwide memory bank that may have independent#consciousness and awareness of its own but regardless is millenia old and so so so SO vast#and would undoubtedly cause neural distress if something odd happened like#how is ANY of that ''classic'' to your understanding of neurological conditions norm? huh???#i think youre in uncharted goddamn waters actually

2 notes

·

View notes

Text

The 2008 Market Crash: Causes, Impacts, and Lessons Learned

l. Introduction

The 2008 market crash stands as one of the most significant financial upheavals in modern history, reshaping economies and livelihoods around the globe. Understanding the causes and impacts of this crisis is crucial for navigating future economic challenges.

ll. Background of the 2008 Market Crash

A. Economic conditions leading up to the crash

Prior to 2008, the United States…

View On WordPress

#2008 financial crisis#2008 market crash#economic impact#financial crisis#financial institutions#financial regulation#financial regulation failures#financial system flexibility#global financial meltdown#global recession#government dole#government intervention#housing market collapse#Lesson learned#Market Crash#Responsible lending practices#Risk Management#role of the central bank#subprime lending#subprime mortgage crisis

0 notes

Text

QUALITY HEATING SYSTEM REPAIR NEAR ME FROM EXPERIENCED PROFESSIONALS IN RED BANK, NJ

At Air One Heating & Cooling Pros, we provide professional heating repair services in Red Bank for all your heating needs. Our experienced technicians are trained to handle all types of heating systems, from central heating to HVAC systems. We offer quality repair services that are tailored to your specific needs, ensuring that your heating system is running efficiently and safely in Red Bank NJ.

0 notes

Text

Center's key decision removal of 70 lakh mobile numbers Repoted News..

The central government has taken a crucial decision. 70 lakh mobile numbers have been deleted across the country. Financial Services Secretary Vivek Joshi said that suspicious numbers have been suspended to prevent digital fraud. Regarding Aadhaar Enabled Payment System (AEPS) frauds, he said states have been asked to look into the issue and ensure data protection. Joshi expressed the opinion that there should be an increase in the awareness of cyber frauds in the society. On the other hand, it is known that digital frauds have taken place in public sector UCO Bank and Bank of Baroda (BOB) recently. Rs.820 crores were mistakenly transferred from UCO Bank to the accounts of the clients through IMPS, but the bank accounts were immediately identified and blocked and Rs.649 crores were recovered. But it is noteworthy that the bank has not yet given an explanation on how this happened. In this background, the Center has put special focus on suspicious financial transactions.

#central government#Aadhaar Enabled Payment System#UCO Bank#Bank of Baroda#Latest News#Telugu News#Repoted News

0 notes

Text

The U.S. Federal Reserve is seriously exploring the adoption of a central bank digital dollar known as a CBDC. Many are concerned if they could centralize American's financial information and holdings in a digital database controlled by the U.S. government. Then they would have complete discretion over how and whether people can use their own money. CBDCs could be modeled after the Chinese digital currency which also uses a social credit score for behavior enforcement. My new video entitled the "Fed Moving Quickly For New Digital Dollar CBDCs."

#US economy#the Fed#Federal Reserve#central bank digital dollar#CBDC#new monetary system#Fed would centralize Americans financial information#Fed would have control over everyone's money#Bitcoin#government will be our banker#control over our money#they can take and give money to us#social credit score#Fed to monitor our behavior#China digital dollar#Fed to have control of all our money#no limit to Feds control over our money

0 notes

Text

There is no government - It is all run by the central banks

#government control#Central Banks#DEFACTO power#governance#influence#authority#systemic control#financial institutions#hidden manipulation#policy decisions#societal impact#power dynamics#economic influence#covert control#defacto power planning#defacto global#defacto#types of financial institutions#what are financial institutions#Central Banks are DEFACTO#european central bank#central bank#who runs everything#GovernmentControl#CentralBankInfluence

0 notes

Text

Enable the efficient and secure flow of money across African borders.

The Pan African Payment System (PAPSS) in place is a centralised Financial Market Infrastructure enabling the efficient and secure flow of money across African borders. PAPSS works in collaboration with central banks in the continent to provide a payment and settlement service to which commercial banks, payment service providers and fintech organisations across the continent can connect as participants. The platform provides a simple, low-cost risk-controlled payment clearing and settlement system. It also serves as an avenue of expanding financial inclusion to cover the informal sector while monitoring funds transfers, thus reducing money laundering, which costs the continent several billions of dollars annually. As of June 2022, the PAPSS network consists of 8 central banks, 28 commercial banks and six switches. It will expand into the five regions of Africa before the end of 2023. All Central banks are to sign up by the end of 2024 and all commercial banks by the end of 2025. With 42 currencies on the continent, PAPSS will significantly reduce the costs of currency convertibility and save the continent an estimated $5 billion annually.

#Pan African Payment System (PAPSS)#Financial Market Infrastructure#funds transfers#creatingoneafrica#afcfta#financial inclusion#costs of currency convertibility#informal sector#money laundering#central banks#commercial banks

0 notes

Text

AI: The New Sheriff in Town, or Big Brother's Best Friend?

Artificial-Intelligence

Well, well, well, if it isn’t our old friend Artificial Intelligence (AI), stepping into the crime-fighting arena. It seems like there’s no end to the roles AI is willing to play. From being our personal assistants to driving our cars, and now, it’s donning the hat of a detective, a judge, and a jailer. But before we roll out the red carpet, let’s take a closer look at…

View On WordPress

#abstract#ai#artificial-intelligence#Banking#Banks#big-data#big-pharma#Business#Central Banks#CEO#class-struggle#communities#company#computers#control#convictions#Corporates#corruption#crime#crime-and-justice-system#dailyprompt#deception#discrimination#disinformation#equality#equity#fairness#Finance#freedom of speech#global

0 notes

Text

One (1) Way To Make Money from Crypto, CBDCs, and the New Global Financial System

https://stocksandrich.ca/finance-money-invest-crypto

#cbdcs#central bank digital currency#make money online#crypto#financial crisis#financial system#makemoney

0 notes

Text

CBDCs And Adoption Of Blockchain: Moving $5tn To Digital Currencies By 2030

CBDCs And Adoption Of Blockchain: Moving $5tn To Digital Currencies By 2030:

Cryptocurrencies and blockchain technology have disrupted the traditional finance industry in recent years, and central banks are now looking to get in on the action. The rise of central bank digital currencies (CBDCs) is set to bring about a new banking system for centralized digital currency and drive the mass adoption…

View On WordPress

#adoption of blockchain#central bank digital currency#centralized digital currency#new banking system

0 notes