Text

What Triggers An IRS Audit?

Preparing a tax return can be stressful. If you are being honest or use a professional you can breathe a little easier since IRS audits don’t happen to many people.

The IRS has audited fewer returns since 2010 due to federal budget cuts that have affected staff size. According to a 2022 GAO report, only 0.25% of all individual returns were audited in 2019, down from 0.9% in 2010.1

That said, taxpayers commonly make a few mistakes that increase the chance that an agent will take a second look at their returns.

IRS computer System Can Trigger An Audit.

The IRS computer system called the Discriminant Information Function (DIF) is designed to detect anomalies in tax returns. It scans every tax return the IRS receives. It’s looking for things like duplicate information—maybe two or more people claimed the same dependent—as well as deductions and credits that don’t make sense for the tax filer.

The computer compares each return to those of other taxpayers who earned approximately the same income. For example, most people who earn $40,000 a year don’t give $30,000 of that money to charity and claim a deduction for it, so your tax return is more likely to be flagged by the DIF system.

Can income Affects Triggering Of Audits?

The IRS isn’t going to waste its time on an audit unless agents are reasonably sure that the taxpayer owes additional taxes and there’s a good chance that the IRS can collect that money. This puts a focus on high-income earners.

According to the IRS Data Book, the majority of audited returns in 2019 were for taxpayers who earned $500,000 a year or more, and most of them had incomes of over $1 million. Additionally, the only income ranges that were subject to more than a 1% chance of an audit were $5,000,000 and over.

According to IRS statistics, you’re safest if you report income in the neighborhood of $25,000 to less than $500,000. These taxpayers were audited the least in 2019.

Additional Items That Can Trigger An Audit.

Large Cash Deposits Under the Bank Secrecy Act, various types of businesses are required to notify the IRS and other federal agencies whenever anyone engages in large cash transactions that involve more than $10,000. The idea is to thwart illegal activities.A side effect is that you can expect the IRS to wonder where that money came from if you plunk down or deposit a lot of cash for some reason, particularly if your reported income doesn’t support it. The IRS will be notified if you make a large deposit over the $10,000 amount. You should be prepared to show how and why you received that money if you file a tax return.Also “structuring” your deposit can trigger this. If you make two or more transactions that are less than $1,000 individually but that adds up to more than the $10,000 threshold. Banks are required to report deposits that are for amounts less than the threshold if they might indicate illegal activity.

Claiming Too Many Itemized Deductions You may trigger an audit if you’re spending and claiming tax deductions for a significantly larger amount of money than most people in your financial situation do.

You’re Self-Employed Deductions that are above the norm for your profession can trigger an audit. Don’t stretch the truth when filling out your tax returns. If you use your car for business and you want to deduct your expenses or mileage, don’t say that 100% of your travel was solely for business purposes if you have no other vehicle available for personal use. You presumably drove to do personal errands at some point.

Your Business Is Home-Base You must use your home office area only for business. You and your family members should not do anything else in that space. Review IRS Publication 587 if you’re planning to claim a deduction for a home office.

You Own A Cash Business Operating a mostly cash business can put you on the IRS’s radar as well. Businesses that fall into this category include salons, restaurants, bars, car washes, and taxi services, according to the IRS. Because there’s so much cash, it would be easier for these business owners to hide some of their income from the IRS.

You Have Investment Income Keep track of all your investment income so you can accurately report it to the IRS.

Have You Considered Hiring A Bookkeeper?

A professional bookkeeper does not need to be a full-time employee. These services are often best outsourced to firms who have strategies in place to help small to medium-sized businesses excel at what they do best, providing services and solutions to their clients. Bookkeepers are perfect workers to work remotely.

Stash Bookkeeping es has a knack for designing or re-designing bookkeeping systems that help owners take their business to greater levels. Using common sense as our greatest weapon, we love to find new ways to take the work out of paperwork.

Stash Bookkeeping has been established for nine-plus years, managing small to medium-sized businesses’ books ranging from $1,000,000 to $20,000,000 in annual revenue, and serving 100’s of happy clients in a variety of industries nationwide. With extensive experience in building/maintaining a solid set of books, we are able to produce an accurate set of financial statements every month.

0 notes

Text

Why Good Bookkeeping Is Vital To The Growth of Your Business.

Good bookkeeping leads To Good Business Management & Growth

Often small businesses prepare their bookkeeping purely to give to their accountant at the end of their tax year. This means that they are missing out on vital information to help make business decisions throughout the year.

What Vital Information Will Bookkeeping Give Me?

Are You Charging Enough? Without examining the costs involved in creating your product or providing your service how do you know you are covering your costs? Without regular bookkeeping, you may not find out what products or services are either making or losing you money until over a year after the start of your year. By keeping on top of your costs you will be able to adjust your fees accordingly and ensure you are making a profit.

Are You Able To Get Funded? That moment you realize you need additional capital, but your books are 6 months behind and you already have so much to do. The worst right? Keeping up with your bookkeeping on a weekly or monthly basis can save you the pain of having to do several months of cleanup at once, which usually results in errors and potentially flawed data. Investors will be impressed by a small business that knows where every penny has been spent or received. Ignorance of accurate recordkeeping is usually a trait found among small businesses right after beginning operation.

Managing Cash Flow Cash flow management is the key to the survival of a small business. Outside of looking at the bank balance every day, how can you know what your cash is doing? Regular bookkeeping ensures that you know which customers have paid and can chase late payments. By keeping up with your bank transactions regularly, you can accurately monitor your cash flow and calculate important metrics. You will know how much money you have coming in and will be able to budget for paying your suppliers, staff, and yourself. You will also be able to budget for larger investments.

Taxes Knowing how much profit you have made enables you to budget for your tax bill at the end of the year. If your books are up to date you can accurately calculate any tax due and track payments when they go out.

Business Planning By keeping up with the finances of your business you can monitor your plans and spot any issues before they escalate. By doing your finances once a year you may not be so lucky. Fundamental bookkeeping is not only the key to understanding your business, but it’s also being able to make proactive decisions to get back on track as changes come about.

Measuring Profitability and other Key Performance Indicators (KPIs) Without tracking your transactions and proper bookkeeping, your measure of profitability could be skewed. Without knowing how much money has been spent in each expense category, you can’t measure any area of your business accurately. A trusted advisor will have trouble assisting you with business decisions unless they see a complete set of financials.

Buyout Potential Is your business on the radar of being bought out by investors or an interested party? Having accurate financials will allow you to calculate your firm’s value in your industry. They will also give peace of mind to your investors who have made you a solid offer. It will offer assurances to help the buyout process be completed with the confidence of both sides. Having incomplete books will impede both your ability to calculate an accurate firm’s value and lose your buyer’s confidence.

0 notes

Text

Getting Back To The Basics: 15 Bookkeeping Terms Every Business Owner Should Know

15 Important Bookkeeping Terms To Know

Properly managed finances are key to long-term success for any business. Even though it is recommended that you hire a professional to help manage your business’s finances, it is important as a business owner to know the basics to ensure your finances are being managed properly. Become a more empowered business owner by familiarizing yourself with these accounting terms:

1. Financial Statements Financial Statements are records of your business’s financial situation. When you apply for a business loan, most lenders will want to see four financial statements: the balance sheet, income statement, cash flow statement, and statement of owners’ or shareholders’ equity.

2. Balance Sheet A balance sheet is a document that outlines your business’s financial status at a point in time. It reports assets, liabilities, and equity.

3. Income Statement An income statement shows revenues, expenses, and profit or loss for a specific period. Profit or loss is determined by subtracting expenses from revenue.

4. Cash Flow Statement A cash flow statement describes the sources of your business’s money and shows how that money was spent over some time.

5. Asset An asset is anything owned by your business that’s of monetary value. An asset can be tangible like land, equipment, or cash, or it can be intangible like a patent or franchise agreement. Assets are shown in terms of cash value on the balance sheet.

6. Liability Liability is a debt your business owes such as a loan, salary, income tax, or rent. On the balance sheet, liabilities are classified by current and long-term liabilities.

7. Equity Equity is the value of your business’s assets minus any liabilities. If your business is a sole proprietorship or partnership, equity is also known as “owner’s equity.”

8. Draw Also known as an “owner’s draw,” this is money you take out of your business for personal use. Business owners can do this by writing a check to themselves from a business checking account.

9. Revenue Revenue is the sum of all money collected for goods or services sold (before expenses are subtracted).

10. Expenses Expenses are the costs incurred by your business to generate income. Fixed expenses stay consistent, such as with rent or salaries, while variable expenses, like raw materials and commissions, fluctuate according to the market.

11. Accounts Receivable Accounts receivable is money owed to your business by your customers. This is considered an asset on the balance sheet.

12. Fiscal Year The fiscal year is a period that a business uses for accounting purposes and to prepare financial statements. It can coincide with the calendar year or take place during a different 12-month period.

13. Depreciation Depreciation is some of your business’s assets, such as vehicles or equipment, will decline in value, or depreciate, over time. Used as a tax deduction, depreciation can help your business recover the cost of some expenses.

14. Capital/Working Capital Capital is the money your business has for paying bills or investing. It equals current assets minus liabilities.

15. General Ledger The general ledger is a complete recording of your company’s financial transactions over its lifetime. This includes assets, equity, expenses, liabilities, and revenue.

Get a Handle on Your Business’s Finances

Do you still need more bookkeeping guidance and help? Contact the professionals at Stash Bookkeeping for all your bookkeeping needs. Together, we can look over your business’s finances and get you on track for success.

#payroll#bookkeepingservices#small business bookkeeping#bookkeepingtips#accounting#bookkeeping#smallbusiness#stashbookkeeping

0 notes

Text

How To Separate Your Personal & Business Finances

Now that we understand the importance of dividing between personal and business finances from our last article (read here), let’s get started on how to separate your finances from your business finances.

Determine How To Structure Your Business

The first step, if you are a new business or have yet to legally register your business, is to establish a legal structure for your business. This is the most important step to take in separating your finances. The legal structure of your business will dictate your risk and liability, and how the IRS will receive your business taxes. Some structures include sole proprietors, partnerships, LLCs, corporations, and small business corporations.

Depending on the corporate setup of your business, you can be held personally responsible for company debts, including seizing assets to satisfy creditors. To make the best decision, take the time to discuss your options with an attorney, CPA, and financial planner.

Maintain Separate Accounts

The ability to distinguish between personal and business finances is critically important. Creating an individual account for your business will help to tell the difference between personal and business expenses, as well as assist your case if the IRS ever questions the legitimacy of your business.

Pay Yourself A Salary

Paying yourself a regular salary can help business owners isolate the line between business and personal profits, instead of randomly pulling money from their business. Providing yourself with a regular paycheck will not only better the chances of your business succeeding, but keeping you on your budget.

Track Shared Expenses

The best way to steer clear of being audited is to track shared expenses. Separating receipts for your business expenses is vitally important when running a business, as co-mingling has the potential for dire tax consequences. The most efficient way to track expenses is to use separate credit cards and checking accounts.

For business expenditures use your business credit or debit card or checks, while personal expenses should be taken care of through your personal banking account. There are several apps and programs that help track expenses and keep digital receipts.

Dividing personal and business finances is the first step to transforming a business idea into reality. Once your company becomes a registered entity, your idea of owning a business becomes a reality — and separating finances will help to ensure it grows and succeeds.read more

0 notes

Text

Independent Contractor vs. Employee

Worker classification matters! 🚨 Understand the difference between independent contractors and employees to avoid costly mistakes. Independent contractors run their own business, set their own hours, and handle taxes. Employees follow employer instructions. Don't risk misclassification! read more

#small business bookkeeping#bookkeeping#bookkeepingtips#payroll#accounting#stashbookkeeping#bookkeepingservices

0 notes

Text

Business Expenses vs Personal Expenses

A business owner needs to know the difference between a business expense and a personal expense. Business expenses can be claimed against the profit to reduce taxes and save money. Personal expenses cannot reduce taxes for your business.

Definition Of A Business Expense

The IRS definition of a business expense. To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is common and accepted in your trade or business. A necessary expense is helpful and appropriate for your trade or business. An expense does not have to be indispensable to be considered necessary.

Example of Business Expenses

Employees’ Pay – You can generally deduct the pay you give your employees for the services they perform for your business.

Retirement Plans – Retirement plans are savings plans that offer you tax advantages to set aside money for your own, and your employees’ retirement.

Rent Expense – Rent is any amount you pay for the use of property you do not own. In general, you can deduct rent as an expense only if the rent is for property you use in your trade or business. If you have or will receive equity in or title to the property, the rent is not deductible.

Interest – Business interest expense is an amount charged for the use of money you borrowed for business activities.

Taxes – You can deduct various federal, state, local, and foreign taxes directly attributable to your trade or business as business expenses.

Insurance – Generally, you can deduct the ordinary and necessary cost of insurance as a business expense, if it is for your trade, business, or profession.

Travel expenses―If you are traveling for business for more than a day, your food and lodging a business expenses. Local transportation that involves travel between workplaces (cabs or public transit between offices)

Dues or subscriptions to professional or business organizations

Union dues

Uniforms or other work clothes that are required for work and are not suitable for other wear

Work-related educational expenses

Tools and any supplies necessary for your work

Home office expenses — only if the office is used exclusively for work

Business use of your car (mileage shouldn’t include personal trips)

Example of Personal Expenses

Commuting expenses – travel costs from home to work are your responsibility

Fines or penalties, e.g. parking tickets

Accreditation Fees – costs associated with continuing education are business expenses, but accreditation fees, such a bar or licensing exam, are considered personal expenses

Business attire(unless it’s a required uniform)

Travel expenses for spouse or children if bringing family along on a business trip

Additional Info

Business expenses are defined as costs that are ordinary and necessary for your trade or business. Ordinary means the expense must be a common one for your industry. Necessary means the expense must be helpful to your business. If you are ever in doubt determining if something is business the first place you should start is by asking yourself if it is ordinary and necessary.

The IRS does not have a formal definition of nonbusiness expenses, however, nonbusiness expenses will generally tend to not be ordinary and necessary, provide you with a significant personal benefit, provide a related party or family member with a significant benefit, or not meet specific IRS requirements for deduction.

One of the best ways you can help draw the line between your personal and business expenses is to open up a business bank account. Simply having a separate credit or debit card that you only use for business can greatly reduce the likelihood of mixing up business and personal. Additionally, be sure you keep good records.

If you use an asset for both business and personal, keep track of what percent of your use is related to your business activities. Picking a meaningful metric to track business use, such as mileage, square feet, or time can help you turn your estimate into a substantiated amount that can be used to help you divide costs accurately.

More often than not you will know right away what side of the line an expense falls on. If you don’t, ask your tax advisor or accountant.read more

0 notes

Text

Common Mistakes on Workman’s Comp Audits That Can Cost You.

If you pay for workman’s compensation insurance, you know that an insurance audit is inevitable and can be overwhelming. Unfortunately, we cannot hide from these audits or magically make them go away. But with the right steps, you can make them more manageable and less daunting.

Let’s take a deep dive into how you can keep tabs on your workman’s compensation to achieve a successful insurance audit.

What Is A workman’s Compensation Audit?

Before we can help you understand your insurance audit, it’s important to understand what it is. When you buy a workers’ compensation insurance policy, the premium payments are estimated by certain factors.

Your premiums are determined by:

Employee wages including bonuses and tips

Employee class codes

Cost of uninsured independent contractors

To check that the estimates are right, your insurance company can request a workman’s compensation audit. This audit will verify that the premium estimate matches your needs for insurance coverage.

If there is a difference between the estimates and what you actually need, it means you’re either overpaying or underpaying for your coverage. In that case, your insurance carrier will require a premium adjustment. An adjustment means you will either have to pay more or less for insurance.

If you overpaid for workers’ comp insurance because your premiums are too high, you’ll get money back, and if the premiums were too low, you’ll owe money back to the insurance policy.

A Final Audit Statement is sent to you after the audit is complete. The Final Audit Statement shows any premiums you must pay your insurance company or any refunds they owe you. Usually, adjustments result from errors in payroll calculations or incorrectly classifying the type of employee work or class codes.

Types of Workman’s Compensation Audits.

Generally, there are two categories of workman’s comp audits—physical audits and voluntary audits.

Physical Audits—Larger companies with higher insurance premiums likely need a physical audit. This means that the premium audit will take place at your headquarters.

Voluntary Audits—If you run a small business, your insurance company may only require a voluntary audit. With a voluntary audit, your insurer sends an audit form via mail. You’ll have to complete the audit form and provide supporting documentation.

What An Insurance Company Looks For In An Audit.

Insurance companies are making sure that your payroll and classifications are correct.

Here are some of the documents the insurance company’s auditor will review and verify during an audit:

Payroll records such as payroll journals and summaries, overtime payments, federal tax returns from the IRS, state tax returns, and state unemployment tax reports

Certificates of insurance for subcontractors and contractors

Employee records including Form 941, job roles of each employee, time worked, and your total number of employees

Cash disbursements for subcontractor payments, materials, and labor

Description of business operations

Remember, the insurance company wants to ensure their estimates match your actual payroll, which is why they’re requesting all these documents. You’ll also notice subcontractors on this list. Insurers will want to make sure they’re actively insured. If not, you will likely be charged an extra insurance premium for the subcontractors that don’t have coverage.

Common Mistakes To Avoid

Incorrect Payroll Estimates You’ll want to make sure your payroll estimates are as precise as possible. Accurate estimates make for a smooth auditing process. They also help you avoid a hefty bill after an audit. You must also make sure that your internal payroll matches the audited payroll. To do this, ensure the information you provide your auditor is correct and that you verify the auditor’s work.Work with an insurance agent or broker who understands the operations of your business and is aware of the changes that can happen during the policy term. Transparency may simplify the audit process.

Not Classifying Employees Correctly Class codes are used to calculate your workers’ compensation insurance premiums. Employees with a higher risk of injury on the job have class codes with higher insurance rates, which increases your premium. When in doubt, you can always contact your insurance agent if you have specific state-related questions.

Failing to Include Deductions Not everything on your payroll is considered when calculating workman’s comp premiums. For example, you can deduct severance pay and portions of overtime pay (if you pay more for overtime than regular hours).

Paperwork Errors Staying organized is key to a successful workman’s comp audit. Organizing and filing all payroll records and other documentation throughout your policy term can streamline the process.

Not Confirming All Subcontractors and Contractors Have Certificates of Insurance One requirement of a premium audit is to prove that your subcontractors and contractors have insurance. This is because your insurance carrier wants to make sure you’re only covering your own workers, not contractors.

Not Checking State Requirements and Deductions Unfortunately, workman’s compensation insurance requirements and exclusions vary by state. Small businesses operating in one state don’t have to worry about changes in other states as much, but multi-state corporations do. You can’t assume that the rules of one state will apply in another.

Be proactive In Your Insurance Audit.

To make sure you have the smoothest audit you possibly can, take the bull by the horns and be a proactive participant in the auditing process.

Being communicative with the auditor ensures they have everything they need for the audit. And, remember, when the audit is over, review the auditors’ worksheet for accuracy. If there is a need for a premium adjustment, make sure you understand the impact this change will have on your company. After you sign the worksheet, make a copy for your records.

However, if the workers’ comp policy worksheet is not complete, don’t sign it until it is. You want to understand what you’re signing before you do.

Knowing the common audit pitfalls and using these tips will streamline the audit process. Pairing your knowledge of your business operations with an insurance agent or broker’s expertise will increase your chances of success.

If you need some professional assistance with your next workman’s comp audit, contact the experts at Stash Bookkeeping to ensure your next audit goes smoothly.read more

0 notes

Text

Imagine you’re an entrepreneur planning a cross-country road trip – your business’s journey. You’ve got a map, you’ve filled up the tank, and you’re ready to hit the road.

But the route is long and complex, filled with detours, unexpected roadblocks, and opportunities to explore. You have a destination in mind, but you could use some guidance on the best path to take. That’s where a fractional CFO comes in.

What Is A Fractional CFO?

Think of a fractional CFO, also known as a part-time CFO or virtual CFO, as an expert navigator for your business journey.

A fractional CFO is a highly experienced professional who delivers high-level financial strategy, planning, leadership, and guidance when you need it most. They’re pros at improving your start-up’s financial health and creating in-depth financial plans that align with your business goals.

As financial strategists, fractional CFOs can help with whatever your business needs – chatting with investors, figuring out what your credit line should look like, and even getting into the nitty-gritty of pricing strategy. In a nutshell, their work spills over from pure accounting into finance.

But rather than helping one business full-time, a fractional CFO guides multiple businesses across a wide variety of landscapes.

Plus, they can offer the direction of a full-time CFO without the full-time salary, making them a cost-effective co-pilot.

Throughout this article, we’ll cover:

Roles within a financial team: bookkeepers, controllers, & CFOs

5 benefits of hiring a fractional CFO

How much fractional CFOs cost

When to hire a fractional CFO

How Acuity’s team can help

Roles Within Your Financial Team: Bookkeeper, Controller, & CFO

Your finance team plays a crucial part in ensuring your business’s success. It’s important to remember that each member of your financial team contributes in different ways:

1. Bookkeeper: A bookkeeper handles tactical tasks like paying invoices, processing payroll, or categorizing expenses.

They focus on when a transaction was paid, keeping a record of all financial transactions.

2. Controller: A controller brings the financial picture into focus.

They are responsible for tracking key performance indicators (KPIs), aligning revenues and expenses correctly, ensuring GAAP compliance, and preparing financial statements. They give each transaction context.

3. CFO: A CFO, whether full-time or fractional, contributes to the business strategy by dealing with potential investors, determining the appropriate line of credit, strategizing pricing, and forecasting financial performance.

Their role extends into finance, providing financial leadership beyond just accounting services.

Acuity’s CFOs bring extensive hands-on experience and diverse skill sets, with track records spanning 30-40 years across a variety of industries. No matter your business model, their entrepreneurial perspective drives strategy development and success.

5 Benefits of Hiring a Fractional CFO At Acuity

A fractional CFO can offer a range of financial management, advisory services, and consulting services – all on a part-time basis.

But how exactly does a fractional CFO benefit your business?

1. Help With Raising Money.

If you’re trying to raise money for your startup, a fractional CFO can really help. They know how to navigate the world of funding, they can help you make a great pitch, and they can even talk terms for you.

For example, Acuity’s fractional CFOs have been instrumental in helping startups raise the funds they need to grow.

2. Big Picture Financial Insights.

Using tools like financial modeling, a fractional CFO can take a deep dive into your financial statements and help you see the big picture. They can:

Spot trends

Find problem areas

Suggest ways to fix things

Help you understand your financial metrics

So, say you run a subscription-based business, and too many customers are canceling. A fractional CFO could dig into the data, uncover the root of the problem, and suggest strategic ways to improve customer retention.

With rich experience across multiple industries, our CFOs provide insights that lead to better strategic decisions.

3. Budget Planning, Predictions, And strategic Financial Planning.

It can be tough for growing businesses to plan their financial future. Luckily, a fractional CFO is a seasoned financial professional who can help you set goals and streamline your internal processes.

So, if you want to grow your startup into a new market, for example, a fractional CFO can help you figure out what that might cost and what kind of profit you could expect. That way, you can have reliable forecasts and budgets at your fingertips.

A fractional CFO can also help you map out long-term financial goals that align with your company vision, such as sustainable revenue growth. They’ll even assist in helping you achieve your goals through:

Developing action steps

Allocating resources

Progress monitoring

4. Sorting Out Cash Flow Issues.

A lot of startups have trouble with cash flow management. A fractional CFO can help you improve the way cash moves through your business, and make more informed decisions to optimize cash flow!

Let’s say your company is struggling to stay afloat because your clients pay at different times. A fractional CFO could come up with a new billing plan or negotiate better payment schedules.

With a CFO, you’ll get optimized cash flow, debt and equity financing, and alignment between your financial operations with strategic business goals.

5. Investor Relations And Tax Advice.

A fractional CFO can help your business stay compliant with relevant laws.

On the investor side, they:

Manage financial communications

Provide financial insights to investors

Keep you up to date with regulatory requirements

When it comes to tax expertise, a CFO oversees:

Strategic, long-term tax planning

Compliance with tax regulations

Relationships with tax authorities

How Much Do Fractional CFO Services Cost?

Most companies can’t stretch their budget to hire a full-time CFO. But every business, big or small, needs to lay down rules, procedures, and growth plans. That’s exactly where a fractional CFO can come into the picture.

So, let’s chat about the cost of Acuity’s fractional CFO services. We know financial stuff can be a bit complex, so we’ll keep it straightforward.

Hiring a full-time CFO can easily cost you around $250,000 per year. That’s a hefty amount, right? But here’s where our fractional CFO services come in handy, since you can get all the expertise you need, but on a part-time basis.

For as little as $40,000 to $50,000 per year or $4,000 per month, you can get top-notch insights from a CFO on a weekly cadence. That’s a great deal of financial wisdom at a fraction of the price.

And even if you lowered your cost to $2,500 per month, you’d still bag a professional who’s knee-deep in your business almost every week.

Now, if you want the expertise of a CFO for a shorter-term stint, Acuity’s fractional CFO services start at an hourly rate of $275.

With fractional CFO services, you get top-quality financial advice, tailored to your needs and without the price tag of a full-time hire. That guidance makes a world of difference when you’re growing your business.

When Should I Hire a Fractional CFO For My Startup?

The right time to hire a fractional CFO depends on your startup’s unique needs and circumstances. And while a fractional CFO can be an invaluable asset for startups and growing businesses, many businesses jump the gun and hire CFOs too early.

Consider bringing a fractional CFO on board if:

Your business is scaling rapidly

Financial decisions are becoming more complex

You’re planning for an IPO or acquisition

You’re seeking external funding, or

You lack in-house financial expertise

Ready To Get Started? We’re Here To Help

From strategic planning and financial modeling to improving investor relations and tax services, fractional CFOs offer invaluable expertise in finance that goes beyond the books.

At Acuity, we understand the financial challenges startups face as they grow. That’s why our fractional CFOs are equipped to provide the strategic financial guidance you need to be successful, while still offering a cost-effective solution.

Our CFOs adapt to your business’s specific needs – they don’t have a one-size-fits-all approach. Plus, they change their role as your business’s needs evolve.

Whether you’re a startup seeking to secure funding, a growing business needing to optimize cash flow, or a seasoned enterprise aiming for a significant financial milestone, our seasoned CFOs are ready to be your co-pilot on this exciting journey.

Ready to get started with a CFO? Schedule a call with our team today and discover how Acuity’s fractional CFO services can be your roadmap to financial success.

CFOs serve as trusted advisors, providing critical financial insights, mentoring the finance team, and executing various project services as required. They’re here to help you make sense of your numbers, and make smart business decisions.

Whether it’s time to hire a CFO or not, our team is committed to providing you with the perfect level of financial management services that are tailored to your unique business needs.

0 notes

Text

In the fast-paced business world, managing your finances with precision is not just an option—it's a necessity. At 𝐒𝐭𝐚𝐬𝐡 𝐁𝐨𝐨𝐤𝐤𝐞𝐞𝐩𝐢𝐧𝐠, we stand at the forefront of accounting excellence, delivering top-tier bookkeeping and financial services across the United States. 🇺🇸

Our adept network of Professional Accountants offers a comprehensive suite of services, ensuring your financial operations are streamlined and efficient. From the day-to-day details to the big picture, we’ve got you covered with:

✅ Accurate Bookkeeping

✅ Seamless Payroll Processing

✅ Diligent Accounts Payable/Receivable

✅ Proactive Budget Monitoring

✅ Professional Invoice Production

✅ Thorough Month-End/Year-End Closings

✅ Effective Customer & Vendor Communications

✅ Cutting-Edge Accounting Software Implementation & Maintenance

✅ Rigorous Audit & Assurance

✅ Strategic Tax Consulting

✅ Reliable Corporate Secretarial Services

✅ Advanced Technology Solutions including SAP & Sage 300

✅ Flexible Outsourcing Options

✅ Insightful Consulting

✅ Robust Risk Management

✅ Forward-Thinking Governance & Strategy

✅ Expert Transaction Advisory

📈 As your business evolves, so do your bookkeeping needs. Shifting from self-managed finances to professional accountancy with #StashBookkeeping not only enhances accuracy but also liberates your time to concentrate on what you do best—growing your business.

💼 We are currently seeking talented accountants to join our dynamic team. Interested? Forward your CV to [email protected].

Partner with us and experience the peace of mind that comes with flawless financial management. At 𝐒𝐭𝐚𝐬𝐡 𝐁𝐨𝐨𝐤𝐤𝐞𝐞𝐩𝐢𝐧𝐠, we don’t just keep your books—we empower your business's future. read more

0 notes

Text

Streamlining Your Financial Workflow with Smart Bookkeeping

In the fast-paced realm of business, efficiency is key, and one area where it can make a profound impact is bookkeeping. Streamlining your financial workflow not only saves time but also enhances accuracy and provides valuable insights into your company’s financial health. Let’s explore how embracing smart bookkeeping practices can revolutionize your approach to managing finances.

Embrace Digital Solutions: Bid farewell to the era of manual ledgers and paperwork. Embracing digital bookkeeping solutions brings your financial processes into the 21st century. Cloud-based accounting software, such as QuickBooks or Xero, centralizes your financial data, allowing for real-time access, collaboration, and automatic updates.

Automate Repetitive Tasks: Say goodbye to tedious manual data entry and let automation take the reins. Automate recurring transactions, invoice generation, and even payment reminders. This not only reduces the risk of errors but also frees up valuable time that can be redirected towards strategic decision-making.

Seamless Integration with Banking: Connect your bookkeeping software directly to your bank accounts. Automatic bank feeds eliminate the need for manual reconciliation, ensuring that your financial records are always up-to-date. This integration facilitates a seamless flow of data, minimizing the chance of discrepancies.

Efficient Expense Tracking: Keep a tight rein on your expenses by leveraging digital tools for efficient tracking. Capture receipts digitally using apps like ReceiptBank or Expensify. This not only reduces the clutter of paper receipts but also simplifies the process of categorizing and reconciling expenses.

Real-Time Financial Reporting: One of the most significant advantages of streamlined bookkeeping is the ability to generate real-time financial reports. Accessing up-to-the-minute insights into your company’s financial performance empowers you to make informed decisions promptly, contributing to the agility of your business.

Enhanced Collaboration: In a collaborative business environment, communication is key. Streamlined bookkeeping allows for seamless collaboration between different departments and stakeholders. Cloud-based platforms enable real-time sharing of financial data, fostering a more connected and informed team.

Security Measures: Digital bookkeeping solutions often come equipped with robust security measures. Protect sensitive financial data through encryption, secure login protocols, and regular data backups. This ensures that your financial information is not only easily accessible but also shielded from potential threats.

Scalability For Growth: As your business expands, so do your financial responsibilities. Streamlined bookkeeping processes are scalable, accommodating the growing complexities of your financial workflow. This adaptability ensures that your financial systems remain efficient and effective even in the face of expansion.

In conclusion, the era of cumbersome financial workflows is fading away. Embrace the power of streamlined bookkeeping to unlock efficiency, accuracy, and a deeper understanding of your business’s financial landscape. The right tools and practices not only simplify your day-to-day operations but also position your business for growth and success in an ever-evolving marketplace.

If you are looking for a small business bookkeeping service, contact the experts at Bookkeeping Enterprises in Irvine, CA. READ MORE

0 notes

Text

20 𝐌𝐨𝐬𝐭 𝐂𝐨𝐧𝐟𝐮𝐬𝐞𝐝 A𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐓𝐨𝐩𝐢𝐜𝐬 𝐘𝐨𝐮

🚀 Master Confused Financial Topics with Our AFinance Tutorials!

Dive into the world of finance clarity with our "20 Most Confused AFinance Topics You Need to Master." Unravel the complexities of cash flow, profit, assets, liabilities, and more in bitesize tutorials. From distinguishing CapEx and OpEx to demystifying ROI vs. ROE, each tutorial brings you closer to financial expertise. Elevate your financial IQ and conquer confusion with AFiannce Tutorials!

🎓 What's Covered:

💸 Cash Flow vs. Profit

🏦 Assets vs. Liabilities

🛠️ CapEx vs. OpEx

📈 Gross Margin vs. Net Margin

📊 EBITDA vs. Net Income

📊 ROI vs. ROE

💼 Profit vs. Revenue

💹 Market Cap vs. Enterprise Value

💡 Fixed Costs vs. Variable Costs

🔄 Financial Leverage vs. Operating Leverage

📊 Book Value vs. Market Value

📆 Accrual Accounting vs. Cash Accounting

💰 Liquidity vs. Solvency

🔍 Depreciation vs. Amortization

💲 Interest Rate vs. Annual Percentage Rate (APR)

📈 Dividends vs. Capital Gains

🔍 Inflation vs. Deflation

💳 Credit Risk vs. Market Risk

📈 Leverage Ratio vs. Coverage Ratio

📊 Budgeting vs. Forecasting

🌐 Start Learning Today!

Embark on your journey to financial mastery. Visit our website https://stashbookkeeping.com/

0 notes

Text

𝐂𝐅𝐎 𝐯𝐬. 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐚𝐧𝐭 𝐯𝐬. 𝐁𝐨𝐨𝐤𝐤𝐞𝐞𝐩𝐞𝐫

A CFO is not an Accountant. However, they need Accounting to drive effective financial strategy and policy.

An Accountant is not a Bookkeeper. But they need Bookkeeping to ensure the accuracy and compliance of financial reports.

--------

🎯 𝐂𝐅𝐎:

➡️ Requires strategic knowledge and involvement in accounting to shape financial strategy and policy.

➡️ Oversees financial reporting and compliance, risk management, and investment decisions.

➡️ Directs the financial future of the company and advises on strategic business initiatives.

🎯 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐚𝐧𝐭a:

➡️ Requires professional-grade knowledge of accounting to actively manage financial reports.

➡️ Ensures accuracy, timeliness, relevance and compliance of financial reports with accounting standards and tax laws.

➡️ Provides budgetary input and financial analysis.

🎯 𝐁𝐨𝐨𝐤𝐤𝐞𝐞𝐩𝐞𝐫:

➡️ Requires basic understanding of accounting to actively record financial transactions.

➡️ Records financial transactions, maintains the general ledger, prepares preliminary financial statements, and manages invoices and receipts.

➡️ Organizes financial data for review by accountants and auditors.

---------

🎯 For bookkeeping and accounting services visit our website or inbox

us https://stashbookkeeping.com/

#bookkeeping #accounting #smallbusiness #payroll #remotebookkeeping

0 notes

Text

𝐁𝐮𝐝𝐠𝐞𝐭𝐬 𝐯𝐬. 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭𝐬 𝐯𝐬. 𝐏𝐫𝐨𝐣𝐞𝐜𝐭𝐢𝐨𝐧𝐬

🎯 𝐁𝐮𝐝𝐠𝐞𝐭𝐬:

➡️ Align spending plans with revenue generation and strategic objectives.

➡️ Set the baseline for performance metrics.

➡️ Serve as a control mechanism for effective cost management.

🎯𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭𝐬:

➡️ Act as a navigational tool for short-term financial performance.

➡️ Integrate real-time market feedback, allowing for dynamic strategy adjustments.

➡️ Identify early warning signs and opportunities to support proactive measures.

🎯𝐑𝐨𝐥𝐥𝐢𝐧𝐠 𝐅𝐨𝐫𝐞𝐜𝐚𝐬𝐭𝐬:

➡️ Extend the forecast by continuously updating it to provide an always current, typically 12-month forward-looking perspective.

➡️ Are dynamic, recalibrating as new data becomes available, ensuring that the organization's financial outlook remains relevant.

➡️ Facilitate a more agile response to market changes, competitor actions

🎯 𝐏𝐫𝐨𝐣𝐞𝐜𝐭𝐢𝐨𝐧𝐬:

➡️ Encourage long-range thinking and future scenario planning.

➡️ Inform stakeholders of potential growth trajectories and risks.

➡️ Drive policy and strategic decisions at the highest organizational levels.

Which one do you use? And which one are you missing?

___________________

🎬 Visit our website for bookkeeping and accounting services

https://stashbookkeeping.com/

0 notes

Text

8 tool file managment

In the digital landscape, various file management tools cater to different needs. Windows File Explorer and Finder are built-in tools for Windows and MacOS, offering basic file organization. Google Drive and Dropbox are popular cloud-based services for storage and collaboration. Syncthing is an open-source, decentralized synchronization tool, while XYplorer and Double Commander provide feature-rich file management for Windows. Tresorit focuses on cloud security with end-to-end encryption. Choose a tool based on your specific requirements, whether for local file management or cloud-based collaboration.

0 notes

Text

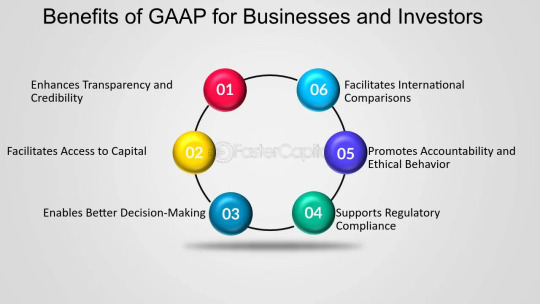

Maximizing Business Growth: The Role of GAAP Compliance in Pitching, Acquiring, And Scaling | Stash Bookkeeping

Understanding the significance of GAAP (Generally Accepted Accounting Principles) compliance in fostering business growth.

Exploring the direct impact of adhering to GAAP standards on pitching strategies, facilitating funding acquisition, and attracting investors.

Leveraging GAAP compliance as a strategic advantage in scaling operations and expanding business endeavors.

Insights from Stash Bookkeeping highlighting the pivotal role of GAAP in optimizing financial practices for sustained business development.

Unveiling the ways in which GAAP adherence serves as a fundamental tool for maximizing efficiency and credibility in the business landscape.

#stashbookkeeping#bookkeeping#accounting#BookkeepingTips#BookkeepingServices#smallbusiness#payroll#remotebookkeeping#https://stashbookkeeping.com/

0 notes

Text

Single Entry vs. Double Entry Bookkeeping: What Sets Them Apart?

👉 Single Entry Bookkeeping 📝📊:

In the world of accounting, single-entry bookkeeping is like a friendly postcard. It records each financial transaction once, often using simple spreadsheets or ledgers. This method suits small businesses with straightforward finances. 🏡💼

However, it's not as robust. Single entry can't juggle the complexities of larger businesses and doesn't provide the systematic checks and balances that double entry offers. It's a bit like trying to solve a Rubik's Cube with one color – you might miss out on the bigger picture. 🧩😕

👉Double Entry Bookkeeping 📚💼:

Double-entry bookkeeping is the meticulous accountant's symphony. It records every financial transaction twice – once as a debit and once as a credit. This method is the standard for larger businesses, providing a complete financial panorama. 🌄📈

It's the safety net of accounting, catching errors and ensuring that the fundamental equation (Assets = Liabilities + Equity) always adds up. It's like having both a map and a GPS on a cross-country road trip – you're never lost. 🗺️🚗 So, in a nutshell, a single entry is a friendly postcard, while a double entry is a meticulous symphony. The choice between them depends on your business's complexity and reporting needs. Whether you're in the world of postcards or symphonies, accuracy, and compliance are the keys to financial harmony. 🎶🔍🌟

https://stashbookkeeping.com/

0 notes

Text

Practical Budgeting Advice for Small Business Owners

Budgeting is the compass that guides your small business. Here's concise advice to help you navigate the financial waters:

1. Clear Business Plan 📝:

Start with a well-defined business plan. It's the foundation of your budget, outlining goals and revenue projections.

2. Separate Finances 🏦💼:

Maintain separate accounts for personal and business finances. This simplifies tracking income and expenses.

3. Meticulous Expense Tracking 📊💰:

Record every business expense accurately, using accounting software or apps for automation.

4. Realistic Budget 📅💡:

Set realistic goals based on historical data. Avoid underestimating costs for a balanced budget.

5. Contingency Fund 🌦️🌪️:

Include a contingency fund for unexpected expenses or income fluctuations.

6. Prioritize Essentials 🎯📊:

Ensure essentials like rent and salaries are covered before allocating funds elsewhere.

7. Monitor Cash Flow 🔄💸:

Regularly review your cash flow statement to identify potential shortages or surpluses.

8. Technology Adoption 📱💻:

Use budgeting and accounting software to automate tasks and gain real-time insights.

9. Tax Planning 🧾💲:

Allocate funds for taxes separately to be prepared for tax season.

10. Regular Review 📈🔄:

Frequently revisit your budget, adjust it as needed, and be proactive in cost savings.

11. Strategic Investments 🌱📈:

Allocate funds for growth initiatives, like marketing or equipment upgrades.

12. Professional Guidance 🤝👩💼:

Consider consulting with financial experts for valuable insights.

13. Discipline 🚀📋:

Stick to your budget, resist unnecessary expenses, and stay committed to your financial plan. Remember, budgeting is an ongoing process that empowers you to make informed decisions and steer your small business toward success. With careful planning and dedication, your financial ship will sail smoothly. ⚓💼🌊

0 notes