Text

Corporate Tax Exemptions in Singapore You Need To Know

Singapore has one of the most attractive corporate tax regimes in Asia, with low and transparent tax rates and an efficient tax filing/reporting system. The government of Singapore provides several incentives to promote entrepreneurship in the country. In collaboration with the Inland Revenue Authority of Singapore (IRAS) which is the tax authority of Singapore, it has implemented tax reduction schemes targeted at businesses, especially startups in Singapore. This article provides an overview of these provisions.

Singapore Tax Exemption 1: Start-up Tax Exemption (SUTE)

The SUTE is an excellent example of Singapore’s commitment to making starting a business as easy as possible. Any start-up company that qualifies for the SUTE will have its chargeable income reduced by up to 75% in its first three years of operation.

In order to qualify for SUTE, the start-up must:

Be incorporated in Singapore

Be tax resident in Singapore for that financial year

Ensure the company’s total shares are held by a maximum of 20 shareholders throughout that financial year where:

All of the shareholders are individuals, or;

At least one of the shareholders is an individual holding at least 10% of the issued ordinary shares.

Singapore Tax Exemption 2: Partial Tax Exemption

After those three years, all new companies and start-ups will also qualify for a Partial Tax Exemption (PTE). Companies that did not qualify for SUTE will still be able to benefit from the PTE, assuming you meet the criteria.

From 2020 onwards, qualifying companies will benefit from:

A 75 per cent exemption on the first $10,000 of normal chargeable income, and;

An additional 50 per cent exemption on the next $190,000 of normal chargeable income.

Singapore Tax Exemption 3: Corporate Income Tax (CIT) Rebate

Taking things further, all companies incorporated in Singapore will benefit from a Corporate Income Tax (CIT) rebate up to the value of $15,000 per annum. To qualify for the CIT, the entity simply needs to be incorporated in Singapore, which also includes non-tax resident companies, registered business trusts, and any companies already receiving income that is taxed at a reduced rate.

Singapore Tax Exemption 4: Foreign Sourced Income Exemption Scheme (FSIE)

While foreign-sourced income for Singapore companies is subject to tax in Singapore, the Foreign Sourced Income Exemption Scheme (FSIE) does a lot to mitigate tax responsibilities in this area.

To benefit from the FSIE, the foreign income must have already been taxed in the source country, at a headline corporate tax rate of at least 15%. The FSIE also needs to be shown to be beneficial to the particular resident taxpayers.

A Singapore incorporated company can benefit from the FSIE on the following revenue streams:

Foreign-sourced service income — any income that is generated by a resident taxpayer for services from a foreign country.

Foreign branch profits — any profits from a Singapore incorporated company that is registered as a branch of a foreign parent company. Non-trade or non-business income from a foreign branch does not qualify.

Foreign-sourced dividends — any dividends paid by a foreign company that has been deposited into a foreign custodian account before being sent into Singapore. Any dividends must be remitted into Singapore within one year of it being sent to the custodian account.

Learn more about Singapore tax exemptions at this Rikvin.com blog.

0 notes

Text

A beginner’s guide to incorporating tech startups in Singapore

Singapore is already the playground of Asia — a preferred destination of foreign investors and entrepreneurs to work, live and play. Now the government here has decided to develop Singapore into the world’s first truly “Smart Nation”.

Check out this Rikvin.com infographic.

0 notes

Text

How to File Corporate Taxes in 2021 – Form C-S Lite

The C-S (Lite) Form is a simpler way to file your income taxes. With this form, you only need to complete six fields if your company has straightforward tax matters.

The purpose of the form is to enhance the overall e-Filing experience. Especially for the smaller companies who might not be able to hire help. With the form, the process is much easier.

What Is Form C-S Lite, and When Can You File It?

As mentioned above, this form is submitted when filing corporate taxes in Singapore, and your company’s annual revenue is $200K or lower. This form must be submitted if your company sustained losses in the financial year or didn’t make any income in the previous year of assessment.

Unlike those who use Form C, this Form C-S Lite doesn’t require additional tax computations and financial statements. However, you should have them ready if the IRAS requests these documents.

Qualifying Conditions for This Form:

You only have revenue subject to the 17% Corporate Income Tax Rate.

Your business isn’t claiming a foreign tax credit, investment allowance, group relief, or carry-back of the current year’s capital allowances/losses.

When Submitting this form:

The form should include a statement declaring the company’s eligibility, relevant data from financial information, and tax adjustments. Form C-S Lite contains only six fields you need to fill before submitting.

You can submit this form via the IRAS website. In doing so, your company must authorize you for that action, and you will require a Singpass account to do so. The deadline for submitting corporate taxes is usually 30th November.

Check more information about Filing Corporate Taxes in Singapore at this Rikvin.com blog.

0 notes

Text

Guide to Easily Move Your Company From Hong Kong to Singapore

Hong Kong is being pushed further and further away from favourability within the Western business community. While there are other contenders for regional alternatives to Hong Kong, it is Singapore that stands as the obvious choice for companies looking to shelter from the ever-growing disarray in Hong Kong.

Why are Hong Kong businesses choosing Singapore?

Renowned as the 2nd best country in the world for ease of doing business, both Singapore and Hong Kong share a few similarities such as low corporate tax rates, minimal red tape and strategic location. A bonus advantage is that it takes less than a day to incorporate a company in Singapore, making the setup process really convenient for entrepreneurs.

While billions of assets have already been shifted and with COVID-19 measures being eased, now is the best time to relocate your Hong Kong business to Singapore.

In this guide, you will be able to learn the factors that make Singapore a business haven for entrepreneurs, what business structure options are available for you and the types of verticals that are performing at its peak.

As committed advisors, we are here to ensure you relocate to Singapore seamlessly.

Why should Hong Kong businesses relocate to Singapore?

The obvious choice for an alternative Asian hub, is of course Singapore, who has just overtaken Hong Kong to be the world’s freest economy. Both Singapore and Hong Kong have shared several inherent benefits as investment hubs — minimal red tape, low regulation, and simple tax systems to name a few.

That relative equality is now of course shifting with the erosion of Hong Kong’s viability as a secure hub for international investment, making Singapore the safer option.

A shift of assets and investments from Hong Kong to Singapore may seem daunting, but the process is actually rather straightforward, albeit increasingly urgent in its necessity. Let’s take a look at your options for moving your company from Hong Kong to Singapore.

Please keep in mind that you will need to partner with a reputable Singapore Company Incorporation service provider in order to comply with the Singapore Accounting and Corporate Regulatory Authority (ACRA). This is a good thing of course, as they will help make the process as quick and easy as possible, while advocating for you during the process.

First things first, and that is reviewing your options in order to choose the optimal business structure for relocating your Hong Kong business to incorporate in Singapore. While Singapore makes it relevantly easy to incorporate into the best possible structure, there are of course positives and negatives for each.

Read more about the reasons why you should move your Hong Kong company to Singapore now at Rikvin.com.

0 notes

Text

Engage a Professional Services Provider vs. Do It Yourself

Corporate service providers offer different specialties and services. A corporate service provider’s goal is provide exceptional business support services to other companies, whether in business operations, tax accounting, company incorporation, or legal liabilities, which is done through the use of technology, experience, and practices that serve to help the client's business.

Setting up and running a start-up business is certain to bring many challenges. The early stage of setting up will be more challenging than the subsequent course of running a business. For instance, you will need expert guidance on the type of entity that is most ideal for the nature of your business. Choosing the wrong entity type for your business may drive up your compliance costs, unduly escalate your personal liabilities, or even be inadequate to meet the vision and goals of your business. In addition, there are other legal formalities that should be appropriately addressed and adhered to during the incorporation phase.

To curb this problem, one may need a company that is well-versed in corporate secretarial work. In this, Rikvin can bridge the gap by offering quality corporate secretarial services that are timely, accurate, and completely compliant with legal and regulatory standards.

1. Managing compliance deadlines

In the world of corporate secretarial services, there are deadlines for everything. And if these deadlines are missed, penalties might be incurred. Certainly, these are just additional, unnecessary expenses that all companies do not want.

However, with Rikvin, this issue can easily be resolved. Rikvin’s experts are experienced and profoundly understand the intricacies of various secretarial processes. Hence, to avoid these pesky penalties, we will track, monitor, and update the clients on all deadlines, giving them a much-needed ease of mind.

2. Save time

Going from the previous point, we agree with the old saying, “Time is money.” At Rivkin, we understand that speediness is crucial in the world of business. Hence, we aim to do the hard part and simplify the corporate secretarial process in a timely and accurate manner.

3. Compliance Knowledge

Laws and regulations change here and there. For that reason, it can be tricky to constantly check these changes. Also, some companies may not have the manpower or industry knowledge to fully comprehend said changes.

Thus, if convoluted regulation changes leave you scratching your head, perhaps your saving grace may be approaching a firm like Rikvin.

Without fail, Rikvin keeps abreast on the latest regulatory changes. Our specialists have an in-depth knowledge of industry know-how. Additionally, Rikvin will offer the best, most comprehensive advice to assist its clients in achieving complete compliance.

Read the full version of this article as to why you should engage with a corporate solutions provider at this Rikvin.com blog.

0 notes

Text

How do I Establish a Business in Singapore Easily?

Singapore is still one of the World Bank’s best places to do business and the country has been listed as one of the top places to do business in the world, for a very long time.

Starting a business in the country is simply one of the best decisions that you can make.

Before doing a Singapore business registration, you will first need to have the following requirements:

1. Company Name

2. Registered Address

3. Shareholders

4. Paid Up Capital

5. Director

6. Company Secretary

What do I need to do after registering a Singapore business?

After registering a Singapore business, you should open a corporate bank account for your business and apply for the necessary business licenses and permits based on your business activity.

Set up a corporate bank account

Opening a corporate bank account keeps you protected and compliant with the law, and it also has advantages for your clients and workers.

Apply for necessary business licenses and permits

Although the majority of businesses do not need business licenses or permits to operate, a few do because they are regulated by the approving authorities.

Read more about starting a business in Singapore at this Rikvin.com blog.

0 notes

Text

Why Is It Necessary to Check the Credibility of a Singapore Company

All individuals and businesses have a credit history and a history of relations with government bodies. That is why it will be a good practice for business owners or individuals to check the credibility of an entities before they decide to transact with them as new partners and suppliers.

Careless choice of a business partner can lead to serious economic consequences, such as losses due to unfair behaviour of the counterparty, loss of money and time. As a result, the company may also suffer reputational risks.

How to verify a Singapore Registered Company?

To check if a company is registered in Singapore, you should conduct a due diligence check on ACRA. The Accounting and Corporate Regulatory Authority (ACRA) has a Singapore Registered Company List.

There are two foolproof ways of verifying if a company is registered in Singapore

ACRA’s company search tool

ACRA’s business profile function

Both functions provide you with

Name of business entity

Registration number (UEN)

Operational status of business

Registered business address

Principal business activities

The additional information that the ACRA’s company search tool provides you with would be the

Annual Returns (AR)

Annual General Meeting (AGM)

Financial Statements

However you would need to purchase the business entity’s profile if you require the

company’s date of incorporation,

business type, and

information of position holders or business owners.

Check more information on how you will be able to check the credibility of a Singapore company at this Rikvin.com blog.

0 notes

Text

How PEO services Adds Value to Businesses amid COVID Pandemic

Implementing recruitment initiatives and establishing retention strategies can get sidelined by the day-to-day HR responsibilities training employees, processing payroll and managing benefits. That is the primary reason why some businesses are increasingly partnering with Professional Employer Organizations (PEOs).

Singapore PEOs provide companies a comprehensive range of services to support administrative payroll, HR, and benefits responsibilities. Thus that the PEO services are highly beneficial for businesses; as PEO services help alleviate the problems posed by the most labor-intensive area of adhering to the requirements imposed by assisting you with any new HR-related administrative or compliance responsibilities. Additionally, PEO service providers place your employee as their priority regardless of the crises at hand, helping to retain your talented employees.

5 ways PEO services can support your business during a pandemic

1. Higher revenue growth and business continuity

A reputable PEO services provider will have systems and processes in place to help its clients maintain business as usual, even during a pandemic.

Although the pandemic is chaotic and may result in lower revenue, PEO services can assist businesses in overcoming any unexpected obstacles that prevent you from paying your employees on time or preventing them from accessing and using their benefits so that you can focus on growing your business.

2. Saves time by eliminating administrative processes

Keeping up with the numerous regulatory iterations is an important aspect of human resources.

In the midst of the COVID-19 pandemic, the Singapore government enacted new legislation to assist employers and employees, such as changing regulations governing second job arrangements.

The Ministry of Manpower (MOM) also implemented Safe Management Measures (SMM) at the workplace and revised their guidelines for salary and leave arrangements in light of the COVID-19 pandemic.

The numerous amendments in employment laws and regulations due to the pandemic, make it hard for business owners to effectively manage their businesses and monitor the changes.

Therefore, PEO services would enable business owners to eliminate the administrative processes of having to monitor the changes in employment laws and regulations.

Check out the other reasons why PEO can add value to a business at this Rikvin.com blog.

0 notes

Text

8 Businesses You Can Easily Start in Singapore

Many people have been dreaming being the boss of own business. That explains why entrepreneurship is on the rise in Singapore.

One thing you can do to overcome these inevitable risks is by preparing and planning. If you don’t know where to start, here are 10 simple steps on how to kickstart your business in Singapore.

Here are possible suggestions of some of the more affordable business fields in Singapore that you can pursue successfully as a sole proprietor.

1. Content Creation

One of the affordable ways to start a business in Singapore is to be a content creator. The existing 24-hour news cycle and the exponential growth of social media have resulted in a perfect business opportunity for creative professionals such as graphic designers and writers. These individuals have found that it is possible to use their talents to create shareable and high-quality content for various media and business outlets. The growing economy of contract and freelance workers has made it easier for individuals to market themselves as professional service providers.

2. Social Media Consultant

Many large companies in Singapore can hire agencies or full-time employees to run their Twitter and Facebook blogs and accounts, while small businesses on the other hand usually prefer to take care of their social media marketing. However, more and more business owners are finding it increasingly difficult to attend to their businesses while at the same time designing and creating social media strategies. Thus the need for the services offered by social media consultants to assist these companies to determine the best content, tactics, and posting schedules for their target audiences.

3. Online Courses and Tutoring

In this day and age, more consumers are turning to the internet to learn and acquire skills in all sorts of fields, such as in web design, baking, yoga, etc. With this in mind, you could opt to start a business in Singapore that offers virtual classes in areas where you are skilled or start up a home-based or virtual tutoring service. You can create instructional videos and packets, or even hold real-time lessons over Skype or Zoom with your clients.

Check out the full list at Rikvin.com.

0 notes

Text

2021 VCC Changes May Attract More Family Offices to Singapore

How Single Family Offices Can Use Variable Capital Companies

Variable capital companies, VCCs make it possible for various fund managers several benefits such as safeguarding them against commingling of liabilities and assets between sub-funds. The framework within Singapore now offers an alluring alternative to investment managers the world over.

There are two types of variable capital companies, these are, an umbrella structure and a standalone single fund. The umbrella structure of variable capital companies are usually made up of segregated ring-fenced sub-funds. Single-family offices use this umbrella structure to allocate sub-funds to the various family members whether by the matriarch or the patriarch.

At the umbrella structure of VCCs, the board of directors can view all the assets within all the sub-funds. Therefore, this kind of arrangement would be suitable for single-family offices but not suitable for multi-family offices.

VCC Changes in Singapore

The city-state of Singapore is looking into ways of updating and revamping the current variable capital company structure. This move could result in rising in its allure over Hong Kong as the destination to be for all kinds of single-family offices.

Once these VCC changes are implemented, the result may be that Lion City could become more alluring than Hong Kong as a potential base for family office operations. This is because Hong Kong’s image as an international financial epicenter has been severely impacted by the political incursion of Beijing into the city.

According to one chief executive officer, the Monetary Authority of Singapore has now become very aware that the situation on the ground in Singapore is not ideal for single-family offices. Therefore, This authority is considering the move to make amendments to the existing VCC framework. This move is designed to allow for more single-family offices to set up their own VCC umbrella or standalone structures.

Currently, the situation that exists on the ground is that many single-family offices are hampered by the current licensing requirements. This is because they can manage to have enough money only on their own family’s behalf, and many of these single-family offices prefer to retain their privacy.

Alternative asset fund managers can use VCCs as a kind of financial vehicle. In January 2020, the Monetary Authority of Singapore introduced various rules and procedures for VCC intending to lure offshore and private equity fund managers to use Singapore instead of other offshore alternatives such as the Cayman Islands for their fund domiciles. However, the existing rules continued to make it unappealing to single-family offices because they would be required to first have a local asset management license before being able to establish their VCCs. Therefore, the intended reforms that would allow for single-family offices without local asset management licenses to create VCCs are a welcome change.

However, these changes and reforms will not come easy and may take some good time before they come to pass. If anything, the Monetary Authority of Singapore has just begun to prepare to engage in the consultation process, therefore it will probably be another one or two years to come before any real changes are made to the VCC Act.

A spokeswoman from this authority admitted that at the moment they were in the process of studying the probability of widening the scope so that a greater number of asset managers could be free to use the various VCC structures. The pertinent question was how to do so in a manner that would prevent and mitigate the risk of abuse of the various VCC structures for fraudulent and illicit purposes. However, this same spokeswoman was not forthcoming as to the potential changes that would be made or that would take place in the coming future.

Rising VCC Interest

By the end of March, more than 250 VCCs had been launched since the launch of the framework in January 2020. This same spokeswoman for the Monetary Authority of Singapore indicated that there had been a lot of expressed desire for fund houses and single-family offices to launch VCCs of their own. Various asset managers as well as other single-family offices that are currently not under the regulation of the Monetary Authority of Singapore had expressed keen interest to use the prevailing VCC structure. One example one such asset managers are real estate fund managers who make investments solely in immovable properties.

Some believe that the Monetary Authority of Singapore should move to reform its rules so that it can be made easier for single-family offices to use the VCC structure. This is because as it is, the city-state of Singapore has been working hard to grow the existing number of single-family offices for the past few years. By the end of the year 2020, there were approximately 400 single-family offices that were operating within Singapore. This figure of 400 is inclusive of the Western families who had established satellite single-family offices within the city. It is roughly estimated that sixty percent of the aforementioned single-family offices were established within the past three or four years.

Some within the space of wealth managers believe that with these new reforms, Singapore is on a good track. The head and founder of Singapore Consultancy commented that the Monetary Authority of Singapore is now seen to be doing more to make it much much easier for single-family offices to be established within the city-state. He also added that Singapore was proving to be a more preferred and favored location than Hong Kong due to the prevailing geopolitical factors that have been seen within the region. Even more Chinese single-family offices were also seen to be setting up within the city-state of Singapore.

Examples of Single Family Offices

Some examples of some of the single-family offices that were set up within the region of Lion City, included Sergey, the co-founder of Google, James Dyson, the vacuum cleaner tycoon, and Ray Dalio, the founder of Bridgewater Associates. In 2019, one of the most widely known billionaires of Haidilao International Holding, Shu Ping, established and launched within Singapore, Sunrise Capital Management.

0 notes

Text

Why US HNWIs Should Set Up Family Office In Singapore

There is no question that the wealth of the world continues to grow, even amidst the rise of unprecedented and unexpected events of the 2020s. In 2019, the number of billionaires rose by a whopping 38.9%, and with this rise in figures, Asia became one of the major magnets for wealth. A growth of almost 7.9% in the regional high-net-worth sector has resulted in a rise in the number of family offices in Singapore.

This growth has also been accompanied by a rise in the number of high-net-worth individuals (HNWI) and ultra-high-net-worth individuals (UHNWI). These groups of people are looking to secure their financial interests and at the same time guarantee their legacy by working to ensure the succession of their wealth for the affluence of their grandchildren and children.

Why Is Singapore Preferred for Family Office Setup?

Conventionally, Hong Kong and Singapore have been the leading financial hubs within the region of Asia and thus have become the preferred location for wealth and asset management. In the case of Hong Kong, its geographical proximity to the mainland of China has contributed towards it becoming the ideal destination for offshore Chinese wealth. However, in the near recent past, the political situation within the country that has resulted in broader instability has driven a huge number of wealthy families and HNWIs towards the direction of Singapore.

We cannot ignore the fact that Hong Kong is the gateway to China, and therefore it continues to be an important wealth and financial management center. However, more and more wealthy families are increasingly seeking to spread their risks and diversify their wealth to other locations, with Singapore being the major location of choice.

Due to the ongoing uncertainties in Hong Kong and the continued rise in affluence within the region, Singapore as the location of choice for wealth and asset management for wealthy families and HNWIs is still expected to rise much further.

The major contributing factor that underpins Singapore’s attraction as one of the key centers for the wealthy and the rich is that the region has a very stable political environment that is known for its strong rule of law. This regional stability instills confidence among the wealthy and the rich and appeals to them as a haven where they are free to park their assets and wealth.

Singapore also has a business-friendly environment that is contributed to it in part by the presence of free trade agreements and double tax agreements.

The government of Singapore has brought into effect policies that are designed to ensure that the asset and financial management sector remains transparent and well regulated. The Monetary Authority of Singapore is always introducing new initiatives in addition to fine-tuning the schemes that are already in place to promote wealth and asset management industries. For instance, the introduction of the Variable Capital Company to allow for greater flexibility to fund and asset managers to start-up investment fund structures within Singapore.

Singapore has a competitive tax regime that has served to enhance its attractiveness. Within this tax regime, it does not impose capital gains or inheritance tax. There also exist several other tax incentives that are designed with the asset and wealth management sector in mind to provide incentives to various asset managers to domicile within Singapore the wealth and the assets that they manage.

Singapore is a common law jurisdiction, therefore it has put in place various trust laws and has worked to promote the trust industry. The result is that trusts are now being used widely for succession planning and inter-generational wealth.

Singapore is now the location of choice for HNWIs as it has grown its reputation as being a jurisdiction where it is now possible to engage in real commercial substance owing to its pro-business environment and developed infrastructure.

The region has a strong ecosystem of asset managers, banks, accountants, lawyers, and other service providers of a professional nature. The city is a world-renowned cosmopolitan city with a host of first-class amenities. Singapore also boasts a skilled and readily available workforce. All these serve to reinforce and increase the attractiveness of Singapore.

The region also has in place various policies that are designed to attract foreign investors and foreign talent who would desire to move to Singapore and take advantage of the vast growth opportunities. Singapore also has in place a Global Investor Programme where applicants who qualify are granted permanent residence.

Because of the emergence of wealthy families and HNWIs seeking to launch family offices within Singapore, the number of family offices that are being established within the region has increased sharply. For instance, the vacuum machine manufacturer and tycoon, as well as other popular billionaires responsible for the chain of hotpot restaurants have all launched and established single-family offices within Singapore.

Traditionally, wealthy families domiciled their assets and investments within special purpose vehicles or holding companies. These kinds of setups resulted in many challenges in terms of efficiency and management.

However, the advent of the family office serves to address many of these bottlenecks. The family office as an organization offers to wealthy families specialized and tailored services in a variety of aspects such as trust and estate planning, investment management, risk and compliance management, lifestyle services, succession planning, governance, and tax and financial planning.

Singapore Single Family Office

The idea behind single-family offices is that dedicated staff is employed to service and attend to the requirements of one single family, while at the same time coordinating and integrating all matters of the wealth of the family.

There does not exist a one-size-fits-all single-family office structure. Instead, each single-family office structure is designed with the specific needs of the family in mind. For instance, some single-family offices focus more on legacy building, whereas others are focused on investment management, family education, philanthropy, wealth transfer, etc.

0 notes

Text

Starting a Fintech Company in Singapore

You may have heard the word “fintech” being bandied around in common parlance. Perhaps you yourself may be interested in finding out more about fintech and even starting your own fintech business to join the wave. However, you may be uncertain as to how to go about doing so.

In Singapore, it is internationally renowned for its forward-thinking in the financial sector, so it should be of little surprise to see many fintech companies setting up in Singapore and the financial technology (fintech) sector booming on our shores.

Before the disruption of fintech to the traditional financial sector, it was a laborious and complicated process to incorporate a fintech company in Singapore. At the time, this was a major roadblock for fintech companies, but also a bottleneck for the Singapore economy.

Since then, MAS has more than accommodated the shifting tides of financial services in Singapore, through massive reductions in red tape and regulatory hurdles. In an effort to encourage innovation, and to make Singapore the global leader in fintech, MAS created a new fintech regulatory sandbox program for the fintech sector in 2016.

Given the freedom to experiment within this regulatory sandbox, a growing fintech company in Singapore can now work within specific ranges of operation to innovate in the sector.

MAS has allocated the resources to relax any specific regulatory requirements on a case-by-case basis for individual fintech experiments. These regulatory requirements are:

Reputation

Track record

Board composition

Credit rating

Financial soundness

Cash balances

Asset maintenance requirement

Fund solvency and capital adequacy

Relative size

MAS guidelines, such as technology risk management and outsourcing

Licence fees

Management experience

Minimum paid-up capital

Minimum liquid assets

Once an individual fintech company in Singapore has completed a successful experiment within this regulatory sandbox, it can then introduce any relevant service offerings on a broader scale, as long as they observe the full relevant regulatory and legal requirements.

Among the fintech startups in Singapore, an insurance firm PolicyPal was the first to “graduate” in 2017. Since then, MAS’ regulatory sandbox has helped dozens of fintech companies to help innovate the sector as a whole.

Read more about starting a fintech company in Singapore at this Rikvin.com blog.

0 notes

Text

New Work Pass in Singapore: The Tech.Pass

Singapore Tech.Pass is a visa that allows tech entrepreneurs, managers, leaders or technical professionals from around the world to come to Singapore to contribute innovations.

Individuals can apply for the pass directly. In the past, with work passes like the Employment Pass and S-Pass, candidates had to secure a job first, and then their employer would apply for the work pass on their behalf.The Tech.Pass is scheduled to be valid for two years, at which point the worker can apply for it to be renewed.

The pass is administered by the Singapore Economic Development Board.

Why Tech.Pass Has Been Created?

Before, Singapore has focused heavily on importing blue-collar works from overseas; now the Government has now established a clear shift towards fostering the science, technology, engineering, and technology (STEM) sectors.

Singapore Prime Minister Lee Hsien Long admitted the current lack of tech-talent, saying, “Talent is key as Singapore develops its technology ecosystem.”

Among many other high-level strategies, the Tech.Pass is part of this effort to foster technological innovation by attracting the world’s best talent. As the EDB put it, the Tech.Pass is part of a “multi-pronged approach to develop a strong base of technology companies and talent to ensure Singapore remains globally competitive”.

The Tech.Pass also offers benefits for existing Singapore individuals and organisations by creating opportunities for local talent through global collaboration and network sharing.

Learn more about Singapore Tech Pass at this Rikvin.com blog.

0 notes

Text

Guide to SG New Work Pass: The Tech.Pass

Guide to Singapore’s New Work Pass: The Tech.Pass

When it comes to attracting the world’s best workers, Singapore is in constant pursuit of innovation. Enter Singapore’s newest work pass, the Tech.Pass. While the current Employment Pass and S-Pass are primarily for blue-collar workers, the Tech.Pass is designed to attract foreign technology experts into Singapore’s ever-expanding tech sector.

In this article, we’ll take a look at exactly what Singapore’s new Tech.Pass is, who it’s for, and how you can get it to enter one of the world’s most exciting tech hubs.

What is the Singapore Tech.Pass?

The Singapore Tech.Pass was introduced by the Singapore Economic Development Board (EDB), and launched in January 2021. There will be a yearly quota of 500 Tech.Passes given to foreign tech professionals and will be assigned on a first-come-first-served basis.

The Tech.Pass is targeted towards attracting highly accomplished experts and entrepreneurs in the technology sector from around the world.

As an added benefit, candidates can apply for the Tech.Pass on their own accord. In the past, with work passes like the Employment Pass and S-Pass, candidates had to secure a job first, and then their employer would apply for the work pass on their behalf.

The Tech.Pass is scheduled to be valid for two years, at which point the worker can apply for it to be renewed.

Read more about Singapore Tech.Pass at this Rikvin.com blog.

0 notes

Text

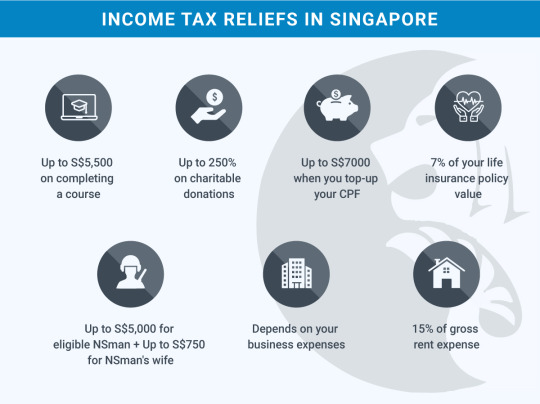

7 Methods to Legally Reduce Income Tax in Singapore (2021)

Who doesn’t dream of reducing their personal income tax in Singapore? Singapore has a variety of different tax relief initiatives that you can leverage to save some money. We have put together a list of 7 different ways you can reduce your income tax.

How reducing your Singapore income tax works

Singapore’s income tax system is progressive, which means that the more you earn, the more you will be taxed. The idea is to find things you can either write-off or claim tax relief for. While there are various ways to do that, there is also a personal income tax relief cap. This limit is currently set at S$80,000 and is the total amount of your tax relief for any given year of assessment.

1. Do a course and upgrade your skills

This first point is unknown to many Singaporeans. However, it is possible to get tax relief on courses that you have attended in 2020 – as long as the course is relevant for your employment and if you can prove that you have paid for it yourself. If that’s the case, you can get up to S$5,500 in tax relief.

If you have taken a course that will enable you to switch careers, you can still claim it. For example, if you are transitioning from an administrative role into finance, and you have taken a course that will help you in your new career, you can use it for your tax relief.

Check out the other reasons how to reduce income tax in Singapore at Rikvin.com.

0 notes

Text

Everything You Need To Know About Singapore Subsidiary Company Registration

A Singapore subsidiary is a private limited company incorporated in Singapore in which the majority shareholder is a foreign or a local company. It has a legal identity distinct from the parent company’s.

This page provides a detailed overview of a Singapore subsidiary company registration process. A properly structured subsidiary company is a very tax efficient corporate body; hence, this form is the most common type of entity registered in Singapore by foreign companies.

A Singapore subsidiary is the most preferred choice for foreign companies to establish their presence in Singapore. Singapore allows 100% foreign shareholding. The shareholder’s liability is limited to the value of the shares it subscribes to. Singapore does not restrict the repatriation of any profit or capital of a Singapore subsidiary.

Incorporation of a Singapore Subsidiary Company comes into existence upon registration under the Companies Act (Cap 50) with Accounting and Corporate Regulatory Authority (ACRA). A Singapore subsidiary company is also considered a resident company for tax purposes.

What are the Audit Exemption Criteria for Singapore Subsidiary Company?

All subsidiary companies must file an audit report unless it meets the new Audit Exemption criteria for a “small group”. For a group to be a “small group”, the parent and the subsidiary company must meet at least 2 of the 3 quantitative criteria on a consolidated basis:

aggregate turnover must be not more than SGD $10 million

the aggregate balance sheet total must be not more than SGD $10 million at the end of the financial reporting period

the number of employees at the end of each financial year does not exceed 50.

Read more about Singapore Company Subsidiary Registration at Rikvin.com.

0 notes

Text

Exploring Business Strategies and Expanding to Singapore

Singapore is an attractive commercial center with a strong and promising economy, currently ranked as the 2nd greatest country in the world to do business. Since Singapore is strategically located with world-class facilities, it is one of the most popular business destinations in Asia!

We have organized a FREE webinar for all --- those who are planning to start a business in the country.

Key takeaways:

An economic overview of Singapore’s market

Key industrial and commercial sectors in the country

Regulations that may impact your market entry

Route to market

Establishing a presence in Singapore

Taxation regime

Grants available

Watch our webinar about Exploring Business Strategies and Expanding to Singapore at Rikvin.com.

0 notes