Text

Fellow South Africans

Let me take the time to apologize for my absence in the last couple of weeks.

The National Lockdown has really weighed heavily on my shoulders and my table has been inundated with requests around doing my bid as an essential worker.

I have first-hand experience of the devastating effects the lockdown has had on businesses and individuals alike. It pains me to see how our already contracting economy is taking hits from all sides.

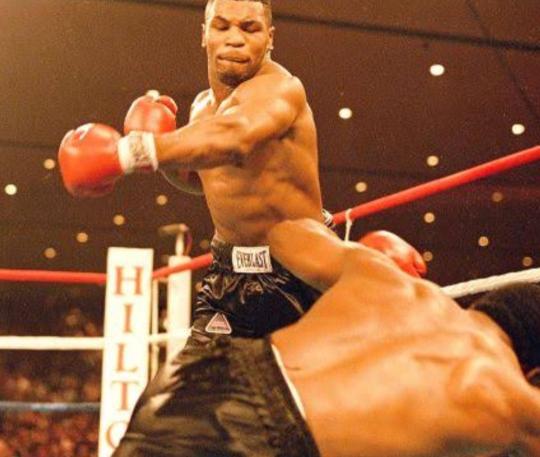

This amount of bashing reminds me of Mike Tyson’s killer punches in his prime. He was relentless, quick and vile, almost like a rabid animal when he smelled weakness in his opponents. That’s what we stand to become in the absence of good and decisive leadership…Mike Tyson’s opponents…laying on the floor, battered and bruised…KO’d without throwing a single punch.

Hahaha I just wanted to start today’s conversation with what has become synonymous with our president. Let me take the first couple of moments to applaud his efforts. By choosing to lockdown the country before the virus spread to precarious levels, to constantly employing mechanisms to protect and provide for the poor, to assist businesses and by remaining resolute in his stance on some of the issues that arose during this lockdown, I genuinely think he deserves so much credit.

I am truly proud to be led by you Cyril Matamela Ramaphosa. Bathi uCyril uphatha kamnandi…ehh bathi Cyril,Cyril,Cyril.

Hahaha see what I did there.

Now that I have your attention, I would like us to get to the real purpose of today’s Masterclass.

Unpacking the R500bn Stimulus package.

Disclaimer again, this presents my individual opinion and should not in any form or manner be misconstrued as advice nor does it present the opinions of any organization I am associated with.

To the real stuff.

I have long held the view that for our country to cap an increasing Debt/GDP ratio, unemployment rate, budget deficit and a widening gini coefficient, business needs to play huge role.

As forecasted, the Covid19 pandemic has really collapsed our economy and these unprecedented times have tested the core of our sovereignty. So how do we attempt to salvage a broken economy and position it to withstand Mike Tyson’s punches?

The president’s response:

R500bn stimulus package.

The number one question that all economists, analysts, researchers and normal citizens must have asked is WHERE WILL THE MONEY COME FROM MR PRESIDENT?

So the president advised that a huge chunk of it, 27% to be exact will be sourced from the reprioritization of our national budget. Which is fairly reasonable considering how cash strapped we are. Let me bring to your attention that for last couple of years, SARS has been under-collecting on taxes. This has had serious implications on the Fiscus and therefore expenditure, further widening our budget deficit. So essentially, we could not fully incur the whole R500bn.

Capital markets

So the idea that we could potentially pursue some form of instruments to raise the much needed capital was capitulated by the recent credit downgrade by Moodys. Moodys joined Fitch and Standard & Poor in downgrading South Africa’s credit rating to sub investment grade (colloquially known as junk). Furthermore, Moody’s labelled South Africa’s economic outlook as negative which basically prevents any form of a short-term recovery. This essentially means the cost of issuing new bonds to raise the much-needed capital will be higher than the actual capital. Meaning the amount of yields we would have to pay would be substantial than the principal amount raised. In layman terms WE CAN’T ISSUE NEW BONDS.

External Funders.

The president advised that conversations with the DBSA,BRICS BANK,IMF and World Bank have commenced around a relief package. It should be noted that no country decides to approach the likes of IMF and the World Bank if they have other options. These organizations are the lenders of last resort. A lot of it has to do with how they operate. Just a brief example: their lending comes with a form of analysis of a country’s policy framework, governance, economic situation, environmental and natural resource management, poverty and social factors. Therefore, they tend to get a high level understanding of a country and not really the intricacies involved. In our context, where we still have a heightened degree of policy uncertainty, contracting economy, bloated state wage bill, deteriorating SOES and a widening inequality curve…they can easily request that we cut the state wage bill in half, we sell off SOEs and cap social welfare spending in a bid to get financing from them. Now these are decisions that will throw the country into turmoil. COSATU and all trade unions will have a fit that their members are being retrenched, SOEs which have a social mandate to address previous imbalances will further augment them and the poorest of our nation will further be thrown into the dark trenches of poverty. The unending and unenviable consequences will be immense and that is not a price we should pay. Therefore, taking the relief packages offered by these organizations presents a better devil right now because they have relaxed their standards a bit and could offer up to no interest funding during this crisis.

Maybe one day we can have a debate around setting up a Sovereign Wealth Fund. To some of my guys that may not understand this term, it is basically like opening an extra savings account or a money market call account. So, the country will set aside funds, that will be held in a fund, the fund will then make investments on behalf of the South African government. The fund will have a variety of investment instruments however we should be able to liquify them (turn them into cash/withdraw) so we can finance any project we wish to embark on. This helps with reducing reliability on debt to finance things.

And perhaps the most unpopular of my suggestions is approaching pension funds. Pension funds are sitting on large cash reserves. Wouldn’t it be the most patriotic thing for them to do during this pandemic to lend money to the government. I mean the government will pay them back, there is minimal to no credit risk whatsoever. Think about it and perhaps we can engage on it.

I don’t really want to worry about a widening Debt/GDP ratio. I mean Japan has a 200% ratio. The challenge is whether we have the necessary mechanisms in place to ensure that we account for every cent borrowed and how its utilized. We can’t continue to lose money to corruption and malfeasance. That just puts us in a precarious position of need. Hence, we will always borrow. So, its important that during this process every cent is accounted for and is spent on what is meant for.

Comrades must stop stealing money the way they steal food parcels meant for the poor.

*ting ting ting ting ting*

This concludes ROUND 1 of my masterclass.

ROUND 2 will look at what we will be spending on and what we can potentially employ to mitigate certain risks.

Gustavo Signing out.

alutaaaa

2 notes

·

View notes

Text

Any financial blogger out there is probably licking their lips at the prospect of writing something about South Africa in its current state. Well I was licking mine when I saw a lot of misinfomation campaigns on social media. I was twitching my thumbs, with an overwhelmingly weird sensation that felt like walking out topless into a cold breeze. So I figured, why not share your thoughts man, I mean you said you want your people to learn, so teach them Rabbi’. Elon Musk did say that conventional education is a waste of time. It doesn’t equip you to survive in this jungle.

So this an attempt to conduct a virtual class, please bear with me, I am anti social so I am praying that this is relatable enough to the reader and conversational enough to force you to keep coming back for more.

Disclaimer though, yes I am FSCA rep, however that’s for a diffent thing. What I share in my blogs does not constitute any form of advice. This is strictly me sharing my thoughts on a lot of things. So please do not act recklessly and reference MyGustavo in your outlandish ways.

Thank you.

South Africa

The rainbow nation, Africa’s darling, the land of milk and honey for many. A country budding with so much potential to drive Africa forward. But hey we have had our fair share of troubles that have halted out advancement. Corruption,maldministration, poor governance and controls, cadre deployment, wait should I continue? The ripple effects have been catastrophic though, unemployment increased to 29%, my people are more poorer than ever, and oh Christo Wiese is no longer a dollar billionaire. That is too much drama than an isiBaya omnibus. I guess then you guys would understand why when COVID19 landed on our shores, the rand/dollar exchange plunged to R17.44, SASOL lost 95% of its market cap and Capitec lost R36bn market cap in a single session which peaked at R80bn over two days.

So what I want us to firstly look at the monetary policy and how the Reserve bank can help aid our recovery.

So Economics 101, the Reserve bank oversees the flow of money in the economy. Basic laws of demand and supply dictate that when there is an oversupply of something, demand is less and thereofore price is minimal. Contrary to the above though when there is a scarcity of a resource, Demand would be more and therefore there would be a corresponding increase in the price. So going back to the flow of money, when there is an oversupply of money in the economy then the price aka currency will be less, meaning the rand would depreciate against major currencies depending on their own monetary policies. Same way the inverse would occur if there was limited supply of the Rand. The flow of money in the economy is what drives economic activity. I mean if you have households providing labour, getting paid for it, buying goods and services from Businesses who require labour to produce more goods and services, then both these parties paying taxes to the government who then through the fiscus advance the much needed social responisbilites then logic prevails that economic growth would spike. But not in South Africa.

Households are struggling to find jobs, businesses are struggling to increase capacity and therefore hire more people, the government continues to under collect on taxes and resorting to overtaxing current taxpayers and the most messed up of this situation is that the fiscus continues to fall through the cracks of corruption and malfeasance. Dangerous terrain to try to navigate huh. Well that’s what Pres Ramaphosa and co find themselves in.

Covid19 has severly limited capacity. Businesses have scaled down, employees laid off and the overarching consequence is that an already contracting economy will contract ever further. Major banks have already announced spikes in impairments in their year end financials with FNB the worst hit. Essentially it means that the number of people defaulting on their debt repayments increased which poses significant risks to banks because they might have to right off the losses which is lost income. Governor Kganyago today announced a very bold move to slash the repo rate by 100 basis points. Well I would like to think that his and the MP committee’s view is that decreasing the repo rate will then encourage the much needed econ activity.

How?

So the repo rate is the rate that the reserve bank charges to lend money to banks. Banks will then add their margins on it and then based on your risk profile charge you an interest rate on your lending. So when the repo rate is high then banks charge you more, if its less then you are charged less. So to boost economic activity you want to decrease the rate so that households have less money to pay to banks and more disposal income to spend on goods and services. What the MPC wanted to achieve is to encourage us to spend as much as we can during these times so that our recovery once this pandemic subsides is smooth. It was a good decision however the offset is that as I explained above, the Rand will depreciate against some currencies due to its oversupply.

I am comfortable with this decision, albeit unpopular but it is a progressive decision that will yield benefits. Yes we are paying more for imports but we are still receiving more for exports as well as the Fiscus gaining some much needed boost in duties and tarrifs. Consumers spending more will also increase VAT collected.

So phambili Governor. We are happy with this progressive leadership you have provided.

In my next post I am going to explore the Oil price collapse, resulting in the capitulation of SASOL’s share price. Then the most interesting part of my blog will start….STOCKS/SHARES.

Thanks for taking the time to read this.

Do send through your comments and likes so we can continously improve our engagement.

Teboho Gustavo Makume

2 notes

·

View notes

Text

About the Author

Teboho “Gustavo” Makume

Age 25

Male

Educational Background

Bcom Fin Acc

Hon Bcom Fin Acc

FAIS certificate

Business Interests

Founder of MyGustavo- an incubation vehicle that identifies potential high growth start-ups, provides financial and strategic support, enhances market exposure, brand differentiation and value chain customization.

Co-founder YAGA BRAAIS- an upmarket Chisanyama that provides a sophisticated experience through creative and delicious meat recipes that are rooted in the mystery of exclusivity.

Co-founder BhekTee- a corporate gifting entity that embraces the quintessence of its customers through various designs of custom-made ties and accessories.

Background

To be quite honest, I never wanted to do this. I remember looking in my granny’s eyes just as she was about to give a customer his change. She was running a small-scale shop selling what was colloquially known as “Skelm-Gemmer”. This was fermented ginger beer to some of my “larney” members of the audience. She could make a killer recipe but unfortunately like any other African woman who was unfortunate enough to be born during the oppressive apartheid system, she couldn’t count money. And there I was, big eyed, skinny, with nothing but my grade 3 MLMMS knowledge running the finance department of what was a highly lucrative business.

With the deepest sense of nostalgia, that’s how my career in finance started. I have gone to achieve numerous academic awards in this field, I have grown frustrated with it, I have abandoned it, I have been depressed but ultimately this is probably the only thing I know better than myself. (I do tend to confuse myself sometimes). I started working for a bank that I would say probably shares the same vision as me especially in the advancement and development of Africa. My job entails analyzing more than a hundred financial statements and establishing whether the bank can advance depositors funds for whatever reason and of course at a premium whilst minimizing the probability of credit risks. Tough hey. Especially considering that we are managing R200m worth of funds whilst dealing with well above R1bn in customer turnovers.

I am an entrepreneur, a budding finance enthusiast, an avid reader, a passionate being who is more invested in the empowerment of my people. And yes, you can tell, a lot of it comes from people like my grandmother. Those who had the brains and willingness to start something but lacked the capacity and skills to manage and steer their ships. And hence my purpose, to live, learn and teach.

All I can say is watch out for the name. Forbes we are coming.

Rest in eternal peace OUMA, this one is for you.

3 notes

·

View notes