Text

What Are Employer Group Health Insurance Requirements?

#employee benefits#group health insurance#health insurance#employee engagement#medical insurance#healthcare

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

0 notes

Text

What Is Group Health Insurance Policy? How Does It Benefit?

One of the most interesting questions during the Covid-19 pandemic is “What is group health insurance?”

What Is Group Health Insurance Policy?

Group Health Insurance is a type of insurance that covers medical, surgical, hospital expenses, and other healthcare costs of employees.

Group health insurance is health insurance that is tied to an employer. If you work for a company, you are probably eligible for the group health insurance the company offers.

This is a way for your employer to save money on health insurance costs. This might not be true for every employee, but if you have a certain number of employees working for a company that has a group health insurance plan, then you might get it through your employer at a cheaper rate.

Caring about employees’ health is always on the cards for every type of organization. After all, a healthy employee is a happy employee. And happy employees result in higher productivity & maintaining a better culture within the organization. It sounds so beneficial, isn’t it?

Of course, Group coverage health insurance is beneficial for both employers and employees.

What Are The Benefits Of Group Health Insurance?

To understand the benefits of group health insurance plans, let’s take a real-life incident & then dissect it further.

Rohit was working with a multinational company called ACME Pvt. Ltd (HQ in Germany) as a senior marketing manager. He enjoyed a salary of 9 lakhs per annum & ACME gave its employees & their respective families, group health insurance coverage up to 10 lakh rupees. In his tenure of 4 years, he never used the coverage provided to him.

In January, he got an offer from MAC Pvt. Ltd to head their marketing efforts with a whopping package of 15 LPA. Their health benefits were different as compared to ACME, offering an employee-only coverage of 5 Lakhs. He accepted this offer.

Unfortunately, Rohit’s mother got diagnosed with cancer in March. After a rigorous line-of-treatment that went on for 6 months, sadly she passed away. The cost for the treatment went up to 13 lakh rupees. Paid out from Rohit’s savings since MAC didn’t provide a health benefit plan that would cover his family.

Even if they did, their cap of 5 lakhs would’ve still required Rohit to reach deep into his savings & pay the remaining 8 lakh rupees. Today, Rohit regrets leaving ACME & praises their people-centric health policy.

So employees value wonderful health benefits. Sometimes even more than their CTC. It boils down to just how has HR communicated the benefits to them. Stories like these are quite common & employees are well aware of it.

The takeaway from the story:

Employees value wonderful health benefits. Sometimes even more than their CTC. It boils down to just how has HR communicated the benefits to them. Stories like these are quite common & employees are well aware of it.

Employees with corporate health insurance can also get various benefits like maternity benefits and no waiting period for covering pre-existing conditions. Good health benefits help keep these valuable talents across departments.

Some of you might think that ACME really dodged a bullet there. The claim amount must have increased their premium amount in the next year. It’s partially true in this case but not every case is going to be this serious.

On average, over 60% of the total claims come in from easily preventable sicknesses like cold, cough, fever, etc. If you address these diseases early on then you can focus on these bigger unpreventable claims.

Currently, there are players in the market that bundle in these preventive care services for free with the Group health insurance, like Loop Health.

Partnering up with players like Loophealth will help in providing affordable, engaging & efficient health benefits, medical expenses irrespective of your organizations’ financial situation.

In the end, it is necessary for organizations to invest in group coverage health insurance.

So why not make the best of it & really make your health benefits work in favor of you, your work family & the organization. Companies offering group medical insurance to their employees can also receive tax benefits under several sections of the Income Tax Department. Get Best Group Health Insurance Quotes Here.

0 notes

Photo

Top 10 Best Whatsapp Status With Image

0 notes

Photo

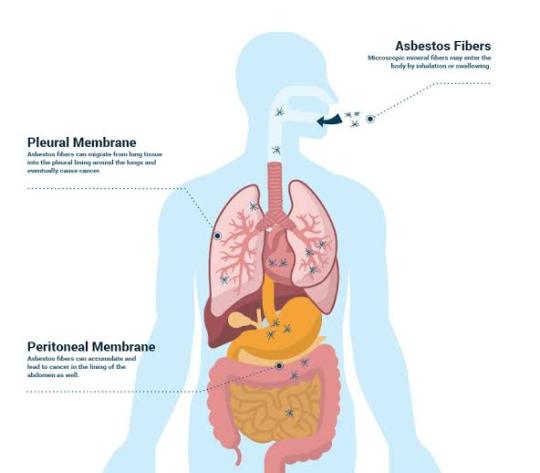

Mesothelioma Cancer Treatment | Symptoms | Staging Systems

1 note

·

View note