Text

STOXX 600 Earnings

First quarter earnings are expected to increase 6.7% from Q1 2022. Excluding the Energy sector, earnings are expected to increase 9.4%.

First quarter earnings are expected to increase 6.7% from Q1 2022. Excluding the Energy sector, earnings are expected to increase 9.4%.

First quarter revenue is expected to increase 0.5% from Q1 2022. Excluding the Energy sector, revenues are expected to increase 1.5%.

205 companies in the STOXX 600 have reported earnings to date for Q1 2023. Of these, 66.3% reported results exceeding analyst…

View On WordPress

0 notes

Text

Earnings Update

In the first quarter of the year, there was a semi-V-shaped pattern in aggregate earnings, with earnings growth reaching a low point of -5.2% at the beginning of earnings season, then significantly improving to -0.7%. If the remaining companies report an aggregate earnings surprise of at least 5.6%, then Q1 growth rate could turn positive, which would be the first time since Q4 of 2020 where the…

View On WordPress

0 notes

Text

#CS Update

Credit Suisse shares hit record low; biggest backer says can’t put up more money.

View On WordPress

0 notes

Text

Fed Actions

Currently, bank deposits are insured for an unlimited amount, although the official limit remains at $250,000.

Banks can now borrow from the Fed by using securities that have lost value at their original price. To explain this program in simpler terms, if a bank bought a bond for $1000 and it has since dropped in value to $700, the bank can still borrow $1000 using the $700 bond as…

View On WordPress

0 notes

Text

U.S. Treasury, Federal Reserve, and Federal Deposit Insurance Corp

FED and FDIC take control and confirm that the deposit will be available Monday.

Releads with Sunday evening announcement by federal regulators

By Andrea Shalal, Sarah N. Lynch and Lananh Nguyen

WASHINGTON, March 12 (Reuters) – Silicon Valley Bank SIVB.O customers will have access to their deposits starting on Monday, U.S. officials said on Sunday, as the federal government announced actions…

View On WordPress

0 notes

Text

#MSFT - 6 years revenue low

From #Reuters: Microsoft Corp is expected to report its slowest revenue growth in six years when it reports its second-quarter results, as a slowdown in cloud growth adds to declining sales of Windows and devices. Analysts will be looking out for comments on margin and focus areas, especially after the company eliminated 10,000 roles recently.

View On WordPress

0 notes

Text

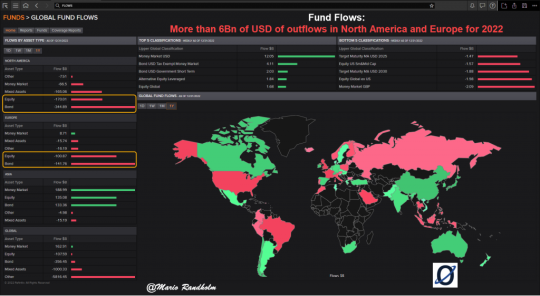

2022 Experienced Significant Outflows

2022 Experienced Significant Outflows

In 2022, the financial markets in Europe and North America experienced significant outflows, causing concern among investors and market analysts.

Experts that I talked to attributed the outflows to Fed policy and economic instability caused by the war. As the outflows persisted, in Q3 and Q4 some investors began to sell off their assets.

The markets remained volatile for much of the…

View On WordPress

0 notes

Text

Season's Greetings and Happy New Year

Season’s Greetings and Happy New Year

May peace and solidarity reach all!

2022 will be remembered

¡Que la paz y la solidaridad lleguen a todos!

Key learnings:

60/40 Portfolios recorded one of the worse yearly performances

Historical Inflation and Fed Rates deltas

Intraday swings with low VIX correlation

just to name a few…

View On WordPress

0 notes

Text

Happy Thanksgiving

Holidays through the centuries in Wall Street.

Here are three pictures that give a view of the market evolution.

18th

19th

20th

The market bottom might, or might not, be near. Whenever it happens it won’t be similar to the 666 SPX Level in the SPX from the financial crisis.

Best Regards,Mario

View On WordPress

0 notes

Text

Reuters Exclusive: At least $1 billion of client funds missing at FTX

Reuters Exclusive: At least $1 billion of client funds missing at FTX

FTX founder Bankman-Fried secretly moved $10 billion in funds to trading firm Alameda – sources

Bankman-Fried showed spreadsheets to colleagues that revealed shift in funds to Alameda – sources

Spreadsheets indicated between $1 billion and $2 billion in client money is unaccounted for – sources

Executives set up book-keeping “back door” that thwarted red flags – sources

Whereabouts of missing…

View On WordPress

0 notes

Text

Top Endowment Returns - YTD

Top Endowment Returns – YTD

Endowments

Here a two-news article worth my time

Columbia University Endowment Posts 7.6% Loss for Fiscal Year – BNN Bloomberg

Harvard predicts looming markdowns to private assets | Big Indy News

View On WordPress

0 notes

Text

Last trading day of Aug 2022

We would need a -7% to make a lower low for the year and near a +7% to take the high of Aug.

Aug was a “bipolar” month. First, we have a run of near 6% in 12 trading days and later are experiencing a -7.8% in 12 trading days. If today we end up having a flat day the SPX is likely to end up negative for the month and near -16% for the year.

SPX is near -16% YTD and shows 3 consecutive Quarterly Candles pic.twitter.com/pTkJihSYO1— Mario Randholm (@MarioRandholm) August 31, 2022

It is…

View On WordPress

0 notes

Text

Shorts are being force to cut exposure

Shorts are being force to cut exposure

Sentiment is getting positive again after the SPX went for -23 to -11% in the last few weeks.

Today inflation numbers created a GAP on the SPX. Will it be able to consolidate 4200? Time will tell.

Managers that did not purchase last bottom are lagging the Indexes performance and shorts that wanted to see a lower lower in July now can say that they were proven wrong and are not likely to add…

View On WordPress

0 notes

Text

FED Update --> 1.5% to 1.75%

FED Update –> 1.5% to 1.75%

From Refinitiv:

The action raised the short-term federal funds rate to a range of 1.50% to 1.75%, and Fed officials at the median projected the rate increasing to 3.4% by the end of this year and to 3.8% in 2023 – a substantial shift from projections in March that saw the rate rising to 1.9% this year.

The stricter monetary policy was accompanied with a downgrade to the Fed’s economic outlook,…

View On WordPress

0 notes

Text

How is the market bottom confirm?

How is the market bottom confirm?

Are you considering the the bottom might not occur during 2022? Of course, nobody knows with certainty.

The ultimate sign is that nobody wants to buy. The comments related to investing almost become toxic.

https://twitter.com/user/status/1536777346451222529

View On WordPress

0 notes

Text

Down Pressure

There will be a time for the bulls again. The largest institutional investors are modifying their macro view and target pricing around the US Equities, this will create events similar to what we experienced today.

Nobody that I know can predict with certainty future prices actions however the best way to know if a decision tree based on a probability…

View On WordPress

0 notes

Text

Inflation Path & Yellen Comments

Inflation Path & Yellen Comments

Yellen mentioned: “I think I was wrong then about the path that inflation would take.”

“https://www.reuters.com/markets/us/yellen-says-she-was-wrong-about-inflation-path-biden-supports-fed-actions-2022-05-31/

From the article:

“As I mentioned, there have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our…

View On WordPress

0 notes