Text

Texas LLC Name Search ([month] [year])

Learn how to look up an LLC in Texas with a Texas business name search on the Texas Comptroller's website.

Texas LLC Name Search (Steps)

To look up an LLC in the state of Texas, you can follow these steps:

- Go to the Texas Taxable Entity Search at https://www.sos.state.tx.us/.

- Click on the "Business & Filings" tab in the top menu.

- Select "Search Business Filings" from the dropdown menu.

- Choose "Search by Name" or "Search by File Number" to enter the LLC's name or file number.

- Enter the LLC's name or file number in the search field and click "Search."

- The search results will display the LLC's name, status, and registered agent information.

Note that the search results will only show LLCs that are registered with the Texas Secretary of State. If the LLC is not registered or has not filed its required paperwork, it may not appear in the search results.

What is a Texas Business Entity?

A Texas business entity refers to an organization that is formed and registered to conduct business in the state of Texas. As with other states, Texas recognizes several different types of business entities, each with its own set of rules, regulations, tax obligations, and liability structures.

These entities are governed by Texas state law and must be registered with the Texas Secretary of State's office.

Here are some common types of business entities in Texas:

- Sole Proprietorship: This is a business owned by a single individual. It's the simplest form of business entity, but the owner is personally liable for all business debts and obligations.

- Partnership: This includes general partnerships (GP), limited partnerships (LP), and limited liability partnerships (LLP). The liability and management structure differs between each type of partnership.

- Corporation: This is a separate legal entity owned by shareholders. Corporations provide liability protection to its owners and can be either a for-profit corporation (like a C corporation or S corporation) or a nonprofit corporation.

- Limited Liability Company (LLC): This is a hybrid structure that provides the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership.

- Professional entities: These include professional associations (PA), professional corporations (PC), professional limited liability companies (PLLC), and other entities designed for licensed professionals like doctors, lawyers, accountants, architects, etc.

Texas Secretary of State Business Name Search

To form a business entity in Texas, you typically need to file the appropriate formation documents (like Articles of Incorporation for corporations or Certificate of Formation for LLCs) with the Texas Secretary of State and pay any associated filing fees.

Can I Reserve a Business Name Online?

Yes. You can file a name reservation through the Texas Secretary of State's SOSDirect 24 hours a day, 7 days a week.

Texas Name Filings FAQs

Visit the Texas Secretary of State Name Filing FAQ page for a list of frequently asked questions.

Search Business Names in Texas (Texas LLC Lookup Guide)

Texas Name LLC Search - Texas Comptroller Website

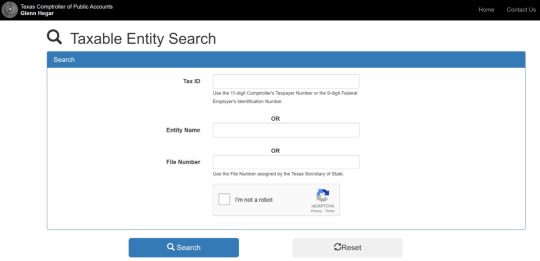

https://mycpa.cpa.state.tx.us/coa/

Choose a name for your business entity

Your business's brand name will be part of its identity. It doesn't make a difference if the business is an LLC/corporation, but a memorable name is what people will associate you with. Also, make sure your name is catchy and memorable.

How to find a great business name

It's not hard to understand that you need a business name. The process of coming up with a name is quite different. This is where you should sit down and consider different naming options.

This is the most effective way to achieve this goal, though it will likely take some time.

Texas Naming Guidelines

1. Texas's rules regarding business names

Before you pick a name for your business, read the Texas business naming rules. These rules are quite strict, and it is crucial to review them before making a list. Your Certificate of Formation with the Texas Secretary of State (SOS), can be denied if your proposed name does not conform to these rules.

The Rules

Texas has many rules for business naming. You can find them on the website Secretary of State. The following requirements must be met in general

- The business entity name must stand out from other names.

- The name does not have to imply affiliation with a government agency.

- The name cannot mean it will engage in illegal acts.

- If the name is to be used in a prohibited manner, such words as "university," "bank", or "bank", it must comply with certain conditions.

- Names can not be grossly offensive.

A complete list can be found in Title I, Part 4 - Chapter 1979 - Subchapter C ("Entity Names") of the Texas Administrative Code.

2. Perform a Texas business entity search

Search Texas businesses: Search for LLC or corporation names. Texas has an easy way for you to do it on their website.

How to conduct a corporation lookup or LLC lookup

Texas LLC Name Search Link https://mycpa.cpa.state.tx.us/coa/

To perform a Texas business name lookup, you must first go to the Texas Comptroller’s Website. Search for "taxable entity lookup" on the website. It will take you to the search engine that allows you to search for all taxable entities throughout Texas. This tool will help you determine if your desired business name is available.

This tool is free, and you don't even need an account. Just enter your potential name into the "EntityName” box. This will let you see if there is an existing business that uses your name.

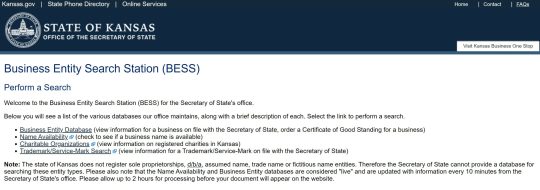

SOS Texas business search

Check name availability. SOS is another option. TX has limited business search options. If you want extra assurance that your potential company name is available even though the search tool indicates it, contact the SOS via phone at (512), 463-5555.

Search business names. These are the two most effective ways to search Texas for businesses. Websites of the Secretary of State and agencies from other states (depending on which state they are) provide a business search tool. You might also want to explore other states.

Texas Name Search in Spanish of Other Languages

The Texas business name search is in English only, but you can use Google Translate, or a Chrome extension for name translations. You can also contact the Texas Secretary of State office by phone at (512), 463-5555 and request a Spanish speaking clerk for assistance.

3. Choose a domain

Next, pick a domain name closely matching your Texas business. You can now get a domain by performing a corporation/LLC lookup. It's not necessary to have a domain address unless you intend to establish an online business. It doesn't matter what; now is the time for domain names.

What is a "domain name"?

A domain's "name" is what a website is called. When searching for a domain, ensure it matches your business's name.

Why should a domain be registered?

A domain name can be a great marketing tool. You can reach people beyond your brick-and-mortar location with a domain name. You can also promote your business through social media along with your website.

Why should I acquire a domain immediately and not later on?

It would be a huge hassle if your chosen business name was not available for registration and you later needed a website. It is possible to avoid this by agreeing on a domain now, so you can pick one that closely matches what your business stands for.

You can change your business name to another one if the domain isn't already registered.

4. Texas Business Name Reservation

The last step is registering Texas business names with the Secretary of state. File Form 501 General Information (Application of Reservation or Renewal of Reservation of Entity Name) This form allows you to reserve a business name for a corporation, LLC, or other entity.

Fill out Form 501

The Instructions for Filling Form 501 Included are some helpful tips. The information section is short. The following information must be included:

- Name of the entity to be reserved

- Which type of entity do you want to form? LLC, corporation, etc.

- Your name and address

- Your signature

Your name will be held for 120 consecutive days.

Texas: You can get an assumed surname

Business entity. In addition to a business name, you can also obtain an assumed name. While your company name can be used to do business, an assumed or "doing Business as Name" name will allow you to use a different name.

Texas Business Tips

When you're looking to form an LLC in Texas, conducting a Texas LLC name search is crucial to ensure that your desired business name is available and compliant with the state's requirements.

Once you've confirmed name availability, you can proceed with the formation process and get your Texas business name registered.

Drafting a Texas LLC operating agreement is highly recommended to establish the internal rules and regulations of your LLC. You have the option to act as your own registered agent in Texas, handling the receipt of important legal and tax documents on behalf of your LLC.

The length of time to get an LLC in Texas may vary based on several factors, including the filing method and the workload of the Texas Secretary of State. It typically takes around 2-3 weeks for the formation documents to be processed and the LLC to be officially recognized.

As part of the process, you will need to obtain an Employer Identification Number (EIN) for your TExas business from the Internal Revenue Service (IRS). This unique identifier is necessary for tax purposes, opening bank accounts, and hiring employees.

Several online platforms and registered agents offer comprehensive LLC services, including name availability searches, document preparation, and filing assistance. Researching and selecting the best LLC services and registered agents in Texas can help streamline the formation process and ensure compliance with state regulations.

Additionally, depending on the nature of your business activities, you may need to acquire specific Texas business licenses at the state or local level. The cost to form an LLC in Texas typically includes filing fees and any additional expenses related to name reservation, certified copies, or expedited processing. The cost is the same even for a single-member LLC in Texas.

Lastly, if you ever decide to change your registered agent or dissolve and close your LLC in Texas, there are specific legal requirements and procedures that must be followed to formally terminate the entity.

Additional Steps and Considerations

1. Trademark Search

When searching for a business name, it's important to note that availability doesn't necessarily mean the name is free to use if it's already a registered trademark.

To avoid potential complications down the line, it's wise to conduct a thorough trademark search using the Trademark Electronic Search System before finalizing a business name.

2. Choose a Registered Agent

After you have chosen an LLC name that is distinctive and unique, you can now choose your LLC's Registered Agent.

3. Check if the Domain Name is Available

To check if a domain name is available, you can follow these steps:

- Go to a domain registrar website, such as GoDaddy.com or Namecheap.com.

- In the search bar on the homepage, type in the domain name you want to check.

- Click on the search button to see if the domain name is available or not.

- If the domain name is available, you will be prompted to purchase it. If it's not available, the registrar will suggest some alternative options or you can try a different domain name.

It's a good idea to check the availability of multiple domain name options as your first choice may already be taken.

Additionally, if you are considering registering a domain name for your business, make sure to also check for any existing trademarks that may conflict with your chosen domain name.

4. Check if Social Media Name is Available

To check if a social media name is available for a new business, you can follow these steps:

- Start by choosing a social media platform where you would like to create an account for your business. Some of the popular options include Facebook, Twitter, Instagram, LinkedIn, Pinterest, and TikTok.

- Once you have selected the platform, go to the sign-up page and try to create an account using your desired social media name.

- If the name is already taken, the platform will display an error message indicating that the name is not available. In this case, you may need to consider alternative names for your social media account.

- If the name is available, the platform will allow you to create an account using that name.

- It's important to note that just because a social media name is available, it doesn't necessarily mean that it's free to use. You should still do your due diligence to ensure that the name is not already a registered trademark or being used by another business in your industry.

5. Register Texas Business Entity

When you complete the required documents for filing a new business entity, you then register your business and business name with the state. The state of Texas will either approve your business name or reject it.

If you hire a good LLC service like Northwest Registered Agent, ZenBusiness or Incfile, these LLC services have business name tools available for you to do a quick search. I recommend using any of these 3 services to assist you with forming a new business. They can save you time and provide you with guidance through the formation process.

6. Register an Employer ID Number (EIN) With the IRS

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify businesses and other entities for tax purposes.

Here's how you can get an EIN:

- Determine if you need an EIN: You'll need an EIN if you have employees, operate your business as a corporation or partnership, file employment tax returns, have a Keogh plan, or are required to file any of the following tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms.

- Apply for an EIN: You can apply for an EIN online, by fax, by mail, or by phone. The quickest and easiest way is to apply online through the IRS website.

- Provide the necessary information: When applying for an EIN, you'll need to provide your legal name, trade name (if applicable), business address, and the type of legal structure of your business (e.g., sole proprietorship, partnership, corporation, LLC).

- Wait for your EIN: If you apply online, you can receive your EIN immediately after completing the application. If you apply by fax or mail, it can take up to four weeks to receive your EIN.

Note that there is no fee to apply for an EIN. Once you receive your EIN, be sure to keep it safe and use it on all tax documents and forms.

7. Create a Brand Logo

Creating a business logo involves several steps. Here's a general overview of the process:

- Define your brand: Before you start creating a logo, you need to define your brand's personality, values, and mission. This will help you create a logo that accurately represents your brand.

- Determine the design style: Decide on the design style you want for your logo. Do you want it to be modern or classic, minimalistic or intricate, colorful or monochromatic? Consider your brand personality and target audience when making this decision.

- Choose the colors: Pick a color palette that reflects your brand personality and complements your design style.

Read the full article

0 notes

Text

19 Best LLC Services in Texas ([month] [year])

For business owners planning to form a Texas LLC, partnering with an entity filing service is the easy and affordable way to file.

Let the LLC service handle the paperwork with the Texas Secretary of State.

We tested 19 LLC services and ranked them based on features, client privacy, package pricing, customer service and BBB reviews.

Continue reading to discover the top-tier LLC services for your Texas business

Best LLC Services

- Northwest Registered Agent (Best-In-Class)

- Incfile

- ZenBusiness

- LegalZoom

The Best LLC Service in Texas

We recommend Northwest Registered Agent.

Northwest is Best-In-Class: Some of the other LLC services maybe cheaper but those other LLC services may also sell your private data.

Northwest is a professional firm with top-quality customer support and a policy of 'Privacy by Default' for their clients.

1. Northwest Registered Agent (Best LLC Service for Privacy)

Price: $225 $39

- Based: Spokane, Washington

- Experience: 20 Years

- Size: 3 million clients, 900+ employees

- 50 Offices in 50 States

My top pick for LLC formation service in Texas is Northwest Registered Agent.

Northwest provides business formations and registered agent services. Northwest has been providing LLC formation services for over 20 years.

They are known for exceptional customer service and are the industry leader in registered agent services.

Texas LLC formations with Northwest are discounted for our readers, just $39, and you also get a year of free registered agent service.

This keeps your start-up costs low. Northwest is our top choice, and it's an LLC service that puts customer service above all else.

- LLC Formation Plan: $225 $39

- Registered agent service: $125 per year, but the first is completely free

- Customer Support: Northwest assigns an account representative to each Texas customer, ensuring they receive prompt and personalized service.

- LLC Services: Northwest keeps the order form simple - no upsells clutter the process.

- User Reviews: Google reviews are great. Reviews on 3rd-party review websites are mostly positive.

Northwest RA Pros and Cons

Pros

- Industry-best customer support

- Discounted pricing

- Northwest has 50 offices in 50 states

- US-based customer service

- Registered Agent 1st year free with the business formation

- Google reviews are a very positive 4.7/5

- 900 employees, maintaining 3 million clients

Cons

- I honestly haven't found any yet

#2 Incfile (Best Budget LLC Service)

- Based: Houston, Texas

- Experience: 20 Years

- 1,000,000,000+ formations

Incfile is another LLC service that has been in business for nearly 20 years. can be a great choice if you are concerned about start-up costs.

They offer free Texas LLC filing and registered agent services for the first year. A "free LLC" may be good for some, but Incfile needs to make money somehow.

This can be done by upselling needed features at a lofty price.

If privacy is important to you, Northwest emphasizes customer privacy more than any other LLC service I know.

Incfile may not have as many bonus features as its competitors. Still, they offer all the essentials for an additional fee: filing an EIN and registering a DBA, filing annual reports, and others.

- LLC Formation plans: $0, $199, $299

- Registered agent service: First Year Free, then $119/year

- Customer Support: Incfile recently increased its customer service team, which improved its response times. This is a significant improvement in their previous performance.

- LLC Service: Everything is straightforward when ordering a package through Incfile. There are not a lot of pricey and confusing add-ons.

- Customer Reviews: Mostly positive. Incfile has over 5,000. reviews on Trustpilot. More than 98% of 21,000+ Shopper Approved reviews are positive.

Incfile Pros and Cons

Pros

- Register agent for free business formation

- I like their prices and a 20-year history of experience

- Excellent customer feedback

Cons

- I don't like that they are known for many upsells. It starts cheap but can add up.

#3 ZenBusiness (Best New LLC Service)

- Based: Austin, Texas

- Experience: 6 years

- 'Worry-free guarantee'

Thanks to competitive technology and a dedication to affordability, ZenBusiness has one of the most affordable LLC services available.

Formations start at $0 plus the state fee. ZenBusiness provides Texas registered agent services at an additional cost of $199/yr.

You can choose the Pro package ($199 annually) for a flat annual fee to get business formation, and an operating agreement template.

- LLC Formation plan: Starting from $0

- Registered agent service $199 annually

- Customer Support: ZenBusiness provides good customer service due to its smaller customer base and individual attention.

- LLC services: ZenBusiness provides useful tools to track annual reports. However, the ordering process can be confusing.

ZenBusiness Pros and Cons

Pros

- The 'worry-free guarantee' compliance feature

- Great customer feedback and reviews on Trustpilot

- Customer service 6 days a week

Cons

- Mark Cuban is a spokesperson

- ZenBusiness might outsource their registered agent service

- Registered agent service is a $199 add-on with LLC formations

- Only 6 years in business. Several competitors have more experience.

#4 LegalZoom (Best for Ongoing Legal Services)

- Based: Glendale, California

- Experience: 20+ years

LegalZoom is a great way to get involved with a well-known brand.

LegalZoom was founded in 2001 and has grown to offer hundreds of services. LegalZoom is more expensive than the other Texas LLC services listed in this guide.

LegalZoom is not the only option if you need a complete legal service. Rocket Lawyer is another option for LLC services and online legal services.

LegalZoom gets pricey after the add-ons.

- LLC Formation plans: Starting at $0 plus state fee

- Registered agent service $299/year.

- Customer Support: LegalZoom is a large company, so its customer service may not be as personal as the other listed companies.

- Easy of use: Many customers have complained that LegalZoom's ordering process is confusing and lengthy. Numerous upsells are offered before you can choose your package.

- User Reviews: Mixed. Most negative reviews are due to a misunderstanding of the ongoing fees and package offerings. Reviews have been improving though.

LegalZoom Pros and Cons

Pros

- Millions of customers served

- Support is available 7 days a week

- 100% satisfaction guaranteed

Cons

- Customer reviews are often negative but improving recently

- LegalZoom is a premium brand, and they charge a little more than others

I have a personal story to tell

In 2008 I started a business and hired an attorney to do the LLC formation paperwork. I thought it would be complicated.

I paid $600 plus a $50 state fee to the lawyer in his office. The lawyer got on his computer, entered my name, and some basic information, and then printed out several pieces of paper and said "sign here and here".

The whole process took about 10 minutes for $600. That same lawyer today probably charges $900 for these 10 minutes of work.

After that, I have only worked with online services.

LLC Formation Lawyers in Texas

If your business is particularly complex, or if you don't mind spending $100s of dollars more and want the peace of mind that comes with having an experienced business attorney to form your business entity, you could hire a lawyer instead of a formation service.

Business Attorneys in Texas

As I just mentioned, hiring an attorney is more expensive than using an online LLC service, but you will obtain a level of competence and experience that can only be provided by an attorney.

I evaluated a long list of Texas business attorneys on AVVO's website to find the most qualified LLC formation lawyers.

AVVO Home Page

From Avvo's 'best reviewed' top-rated business attorneys in Texas, these are my top five picks.

- Jennifer Ward

- Melanie Bragg

- Andrew Weisblatt

- David Gottfried

- James Dossey

Texas Business Tips

When you're looking to form an LLC in Texas, conducting a Texas LLC name search is crucial to ensure that your desired business name is available and compliant with the state's requirements.

Once you've confirmed name availability, you can proceed with the formation process and get your Texas business name registered.

Drafting a Texas LLC operating agreement is highly recommended to establish the internal rules and regulations of your LLC. You have the option to act as your own registered agent in Texas, handling the receipt of important legal and tax documents on behalf of your LLC.

The length of time to get an LLC in Texas may vary based on several factors, including the filing method and the workload of the Texas Secretary of State. It typically takes around 2-3 weeks for the formation documents to be processed and the LLC to be officially recognized.

As part of the process, you will need to obtain an Employer Identification Number (EIN) for your TExas business from the Internal Revenue Service (IRS). This unique identifier is necessary for tax purposes, opening bank accounts, and hiring employees.

Several online platforms and registered agents offer comprehensive LLC services, including name availability searches, document preparation, and filing assistance.

Researching and selecting the best LLC services and registered agents in Texas can help streamline the formation process and ensure compliance with state regulations.

Additionally, depending on the nature of your business activities, you may need to acquire specific Texas business licenses at the state or local level.

The cost to form an LLC in Texas typically includes filing fees and any additional expenses related to name reservation, certified copies, or expedited processing. The cost is the same even for a single-member LLC in Texas.

Lastly, if you ever decide to change your registered agent or dissolve and close your LLC in Texas, there are specific legal requirements and procedures that must be followed to formally terminate the entity.

Tier 2 - Other Texas LLC Services

Swyft Filings

Swyft Filings was launched in 2012 and are one of the latest services for LLC formation.

Prices start at $0 + state fee. If you need an EIN and LLC operating agreement, the price is $199 + state fee. Swyft Filings charges $199/year for registered agent services.

MyCompanyWorks

MyCompanyWorks has a basic LLC service package that costs $79 and includes assistance with Articles of Organization, Operating Agreement assistance, an online portal to store legal documents, compliance alerts, and assistance with registering with the Texas Secretary of State.

They have maintained mostly positive reviews online. You will need to buy their premium package for $279 if you want a Texas registered agent.

Inc Authority

Inc Authority, like Incfile, allows you to file your company formation paperwork free of charge, but each offer comes at an additional cost.

Ask the "free LLC" if they plan to sell your private information. I believe the "Free LLC" is a gimmick just to get you in the door. Yes, their filing service is "free" plus the state fee.

You will need to buy their $399 basic package if you require assistance drafting an Operating Agreement or accessing an EIN.

You will also need to buy their premium $799 package if you want to receive express processing.

Tailor Brands

Tailor Brands is a bit different than the others on my list.

Like their name says, they build brands. Tailor Brands promotes itself as a comprehensive business formation service that provides a complete list of services to entrepreneurs, including compliance and LLC formation, logo design, and branding features.

Tailor Brands offers three formation plans.

Incorporate.com

Incorporate.com offers a $99 base package that includes very few services, similar to Rocket Lawyer or LegalZoom. They offer an online account and assistance in filing your Articles of Organization, and that's nothing else.

CorpNet

CorpNet has been in business for over 20 years.

Read the full article

0 notes

Text

16 Best Registered Agents in Texas ([month] [year])

In this blog post, we aim to demystify the process of finding the perfect Texas registered agent for your LLC. We'll scrutinize the top options based on key aspects including price, features, experience, and customer support.

Best Texas Registered Agent Services of 2023

- Northwest Registered Agent Best Privacy, Best Overall

- Incfile Best Value

- ZenBusiness Best for Compliance Guarantee

- LegalZoom Best for Ongoing Legal Services

- Harbor Compliance Best for Multi-State Compliance

- InCorp Best for Simple Pricing

Our goal is to simplify your decision-making process, whether you're a budding entrepreneur or an expanding business.

Join us as we navigate the realm of registered agents in Texas, providing you with a comparative guide that's designed to help you make an informed, confident choice for your Texas LLC.

The best registered agent for most companies in Texas is Northwest Registered Agent $125/yr or 1st free with a $39 LLC formation.

When creating a new Texas LLC or updating your registered agent for an existing business, selecting a good registered agent in Texas is an important decision.

I have researched and tested 16 Texas registered agent services and picked the top 6 services to review and feature.

My Personal Experience With Registered Agents

Back in 2007, I had a small business in a state that I did not live in and I needed a registered agent to collect the mail for me. I signed up with LegalZoom as my first registered agent service.

The relationship was complaint-free for a solid three years. But around 2010, I began noticing their prices were edging towards the steep side compared to other options on the market.

I decided to make the switch to Northwest and boy, am I glad I did! From the get-go, the interaction was personal.

The first time I dialed their number, a real, live human answered - a delightful change. It was a Northwest representative who greeted me with such a pleasant voice, and from that point on, their service has been nothing short of exemplary.

I like Northwest but whoever you choose, I hope this article will assist you in choosing the right registered agent for your business.

Learn about the top 16 registered agent services in Texas that we hand-picked based on independent research.

If your LLC has not yet been formed, you can receive one year of registered agent services for no cost if your LLC is formed with Northwest Registered Agent ($39 + state fees).

Top Registered Agents In Texas

In most cases, you can be your registered agent in Texas but a reliable registered agent service will make sure that all important documents are received and sent to you, plus remind you of compliance dates.

If you want someone who is knowledgeable about the legal process and can help you comply when choosing a registered agent.

At the end of the day, I think Northwest Registered Agent is the best registered agent service in Texas.

Northwest R.A. has been helping small businesses start and grow for over 20 years.

1. Northwest Registered Agent (Best Premium Registered Agent)

Price: $125

First is Northwest Register Agent. This company offers a more premium registered agent service.

Northwest provides free mail forwarding with its registered agent service, and the importance of client privacy is expressed in its motto, 'Privacy by Default', a core part of the company's service.

Visit Northwest Registered Agent

Northwest Pros and Cons

Pros

- Industry-best customer support

- Family-owned business

- 900+ employees, 3 million clients

- Reasonable pricing

- Northwest has 50 offices in 50 states

- US-based customer service

- Volume discounts available

- Registered Agent 1st year free with the business formation

- Google reviews are a very positive 4.7/5

Cons

- I can't find any worth mentioning

Northwest Registered Agent is our recommendation. They offer everything you need to start your LLC, including an EIN, LLC operating agreement, and top-notch registered agent services. This company has been helping small businesses grow and start for over 20 years.

Northwest offers a 100% error-free guarantee. This guarantees outstanding customer service, extraordinary services, and prices that match. Northwest Registered Agent is a great option for your business if data privacy and customer support are important to you.

The outstanding customer service is the calling card of Northwest Registered Agent. Northwest does not outsource its support to a call center with untrained representatives.

Northwest offers a one-year registered agent service with a $39 business formation.

Northwest offers volume discounts on registered agent services. They'll reduce your rate by $125 to $100 per year if you need service in more than five states. They also have strong customer reviews and free annual report reminders.

2. Incfile (Best Value)

Price: $119

Incfile's biggest claim to fame is its free business formation service. This includes a year of registered agent service. Incfile is only one part of their offerings. Let's see what else they offer.

Visit Incfile

Incfile Pros and Cons

Pros

- Register agent for free business formation

- I like their prices and a 20-year history of experience

- Excellent customer feedback

Cons

- I don't like that they are known for many upsells. It starts cheap but can add up.

Incfile has over 30,000 reviews online. This makes them a top choice for registered agent service in Texas. We are unaware of any other company that receives this many reviews and the same high-quality feedback as Incfile.

Incfile can be a bit pushy with upsells. Incfile offers many add-on options, which will be a reminder to you several times as you go through their order process.

Incfile has been in business for almost 20 years, and they have assisted with forming over 500,000 businesses.

3. ZenBusiness ('Worry-Free' Compliance )

Price: $199

We love ZenBusiness in many ways. ZenBusiness offers a great deal if you aren't yet forming your Texas LLC/corporation. They will create your business entity and provide a full year of registered agent services for $199 This combination of features is at an unbeatable price!

Visit ZenBusiness

ZenBusiness charges $199 annually for ongoing registered agent services in Texas. Let's look at the pros and cons of ZenBusiness, and then talk about how they can impact your decision.

ZenBusiness Pros and Cons

Pros

- I like the price point of $199

- I like the "worry-free guarantee" compliance feature

- Great customer feedback

- Strong customer service

Cons

- ZenBusiness might outsource the registered agent service

- Registered agent service is a $199 add-on with LLC formations

- Some competitors have more experience than others.

Although the $199 price tag for Texas registered agent service is not the lowest, it is still very affordable. ZenBusiness offers a $199 package which includes an annual report service. This is a great deal.

ZenBusiness has received over 8,200 online reviews. Nearly all of these were positive. This gives them one of the highest customer satisfaction ratings in the industry. ZenBusiness also has a knowledgeable and helpful customer service department that can answer any of our difficult questions.

While ZenBusiness is a newer service. They have less experience than many competitors, including LegalZoom and Northwest. ZenBusiness is one of Texas's best registered agent services.

4. LegalZoom (Best for Ongoing Legal Services)

LegalZoom has many similarities to Rocket Lawyer. However, it is a large company that serves millions of customers and charges a high price for Texas registered agent services. LegalZoom's rates are almost double those of Rocket Lawyer and three times that of ZenBusiness.

Visit LegalZoom

LegalZoom Pros and Cons

Pros

- Millions of customers served

- The longest hours of support in the industry

- 100% satisfaction guaranteed

Cons

- Customer reviews are often negative but improving recently

- I don't like LegalZoom's very high prices

I liked LegalZoom's 100% customer satisfaction guarantee. It is much more robust than many other companies refund policies. They also have the longest customer service hours in the industry, with nine hours of availability on weekends and 14 hours on weekdays.

LegalZoom's extremely high cost of registered agent service is a problem. LegalZoom does not offer registered agent services as part of its business formation packages. This means that the value propositions for other options in this guide are significantly better than LegalZoom.

5. Harbor Compliance (Best Multi-State Compliance)

Price $99

Harbor Compliance is, in fact, a more premium service when it involves business formations. They only offer this service to large enterprises.

They offer outstanding value in registered agent service and have one of the lowest national prices we've ever seen. Are they worth the effort?

Harbor Compliance charges $89-$99 per year for registered agent service, depending on the state. This is a great price point. They offer volume discounts for service to multiple states or prepay for multiple years.

Harbor Compliance was founded in 2012 and is one of the newest companies in this sector. Harbor Compliance is a new company that has been around since 2012. They have served over 10,000 clients and are a rising star in the industry.

Harbor Compliance Pros and Cons

Pros

Harbor Compliance offers a great price and reminds you of annual reports well before the due date. This is a nice bonus for registered agents. Harbor Compliance has received high reviews from clients and even offers volume discounts.

Cons

We only found 100 reviews online, so while their reviews are very high quality, they are not as numerous.

6. InCorp

Price: $129

InCorp may be the best option for you if you are looking for the lowest prices for nationwide registered agent services. The base rate is quite high, but you can get your annual cost down to $87 with volume discounts.

InCorp will only charge $129.95 for a year of registered agent services. InCorp will offer deep discounts if you are willing to prepay additional years of registered agent service.

InCorp is America's fourth most popular registered agent service provider, with over 125,000 customers.

InCorp was established in 1998 and began offering registered agent services in 2001. They have served thousands of customers across the country since then.

InCorp Pros and Cons

Pros

Their prepaid discount system allows you to access some of our lowest prices for registered agent services.

They have a high volume of clients, making them one of the country's most sought-after registered agent providers.

Customers also receive a compliance calendar and their EntityWatch program, which monitors your business for identity theft signs.

Cons

InCorp only has a handful of reviews online. Their average rating is not very high. Their LLC formation service costs $99.

Other registered agents

There are many registered agent services available in Texas. The top 6 that I just mentioned above are the most popular options. However, I want to highlight a few other services available in Texas.

7. Rocket Lawyer

Rocket Lawyer is a cheaper option than LegalZoom. Registered agent service is a small part of their product offerings. They also offer online legal services, including talking to an attorney, documents, and ongoing legal services.

You can get a physical address in Texas for $149 to ensure state mail forwarding. Rocket Lawyer also accepts service of process on your behalf, but they offer fewer services and lower customer support than Northwest Registered Agent.

8. SunDoc Filings

SunDoc Filings offers basic Texas registered agent services at $159. This includes service of process and forwarding legal documents from the Texas Secretary of State.

There is also no dedicated customer support system such as 'Corporate Guides' offered by Northwest Registered Agent.

9. Swyft Filings

Swyft Filings provides registered agent services for your Texas LLC or business for $149. Not nearly as good as Northwest's best-rated customer service.

10. CSC

CSC, aka Corporation Service Company, is a premium Texas registered agent service that costs $299 per year. They don't have any premium features, except that you must pay the state fees to change your Texas registered agent.

You could easily switch to Northwest Register Agent and save money. CSC has a long history; they are just another option to consider when shopping for a Texas registered agent.

11. Registered Agents Inc.

Registered Agents Inc. costs $200 and includes the same features as Northwest Registered Agent at $125: online account access and compliance alerts that keep you in good standing with the Texas Secretary of State.

Additional Registered Agents to Consider

Legalinc

URS

Read the full article

0 notes

Text

How to Register a Business Name in Alabama

In Alabama, the process of business name registration is crafted to support entrepreneurial visionaries.

Whether setting the foundation for an LLC, a corporation, or traversing the "Doing Business As" (DBA) pathway, the first order of business is to confirm the chosen name's uniqueness within Alabama's confines.

Once the business entity structure is settled, the pathway leads to the Alabama Secretary of State for official registration.

While the state itself offers a comprehensive registration process, there are also specialized online services that can handle the paperwork, offering valuable insights and support for those stepping onto the business stage.

Registering a business name in Alabama involves several key steps to ensure legal compliance and proper establishment.

Here's a breakdown of the process:

- Determine Your Business Structure:

- Decide on the type of business entity (e.g., sole proprietorship, partnership, LLC, corporation) to determine the specific registration process.

- Choose a Business Name:

- Ensure the name is unique and distinguishable from other existing businesses in Alabama.

- If you're forming an LLC or corporation, typically, the name must include an identifier such as "LLC," "Incorporated," "Inc.," and so forth.

- Conduct a Name Search:

- Check the availability of your chosen name by searching the Alabama Secretary of State's business database.

- Name Reservation:

- Before officially registering your business, you can reserve the chosen name for up to one year by filing a Name Reservation Request with the Secretary of State and paying the required fee.

- Register the Business Name:

- For sole proprietorships or partnerships operating under a fictitious name, you'll need to file a DBA (Doing Business As) form, often known as a "Trade Name" in Alabama, with the county probate judge's office where your business is located.

- For LLCs or corporations, file the appropriate formation documents, like Articles of Organization (LLC) or Articles of Incorporation (corporation), with the Alabama Secretary of State.

- Pay Applicable Fees:

- Fees will vary based on the type of business entity and the specific forms required.

- Obtain Necessary Licenses and Permits:

- Some businesses may require additional licenses or permits to operate in Alabama, depending on the nature and location of the business.

- Stay Compliant:

- File annual reports or renewals as necessary to maintain your business's good standing.

- LLCs, for instance, need to file an annual report with the Secretary of State.

- Trademark Considerations:

- If your business name holds significant brand value, consider seeking state and/or federal trademark protections.

To ensure accuracy and adherence to all legal requirements, you may want to consult the Alabama Secretary of State's official website or seek guidance from a legal professional when registering a business name in Alabama.

Conducting a Business Name Availability Search in Alabama

Before finalizing a business name, it is essential to ensure its availability and legality.

Here's how you can conduct a name availability search in Alabama:

- Explore the Alabama Secretary of State's website: The Alabama Secretary of State's website provides valuable resources for checking the availability of business names. Utilize their online database to search for existing business names in Alabama. This will help you avoid duplicating names that are already in use.

- Visit the Alabama Business Entity Search Page: Utilize the online database to search for existing business names in Alabama. This will help you avoid duplicating names that are already in use.

- Select a unique and memorable name: Choose a name that reflects your business's identity, is easy to pronounce and remember, and resonates with your target audience. Be sure to read our next section on trademarks and naming restrictions.

To register a name and form a new business, we recommend Northwest Registered Agent for just $39

Considering Legal Restrictions and Trademark Issues

Alabama has specific guidelines and restrictions for business names.

Here's what you need to consider:

- Understand Alabama naming guidelines and restrictions: Familiarize yourself with the naming guidelines outlined by the state of Alabama. These guidelines may include requirements for including specific words or phrases in certain types of businesses or industries. Ensure compliance with these guidelines to avoid any legal complications.

- Conduct a thorough search for trademark conflicts: To safeguard your business name from trademark infringement issues, it is crucial to conduct a comprehensive search. Begin by checking the U.S. Patent and Trademark Office's database to ensure your chosen name does not infringe upon existing trademarks. This step will help protect your brand and avoid potential legal disputes.

Understanding Different Business Structures in Alabama

In Alabama, entrepreneurs have several options when it comes to choosing a legal structure for their business. If Each structure has its own set of characteristics, benefits, and considerations:

- Sole Proprietorship:

- Definition: A business owned and operated by a single individual.

- Advantages: Easy and inexpensive to set up, complete control over decision-making, and simple tax reporting.

- Disadvantages: Unlimited personal liability for business debts and obligations, limited ability to raise capital, and potential difficulty in attracting investors.

- Partnership:

- Definition: A business owned by two or more individuals who share profits, losses, and decision-making responsibilities.

- Advantages: Shared financial and managerial resources, simplified tax reporting (in the case of a general partnership), and potential for diverse skills and expertise.

- Disadvantages: Partners have joint and several liabilities for business debts, disagreements and conflicts between partners, and the potential for individual partner actions to affect the entire partnership.

- Corporation:

- Definition: A legal entity separate from its owners (shareholders) that offers limited liability protection.

- Advantages: Limited personal liability for shareholders, the potential for raising capital through the sale of shares, and longevity independent of its owners.

- Disadvantages: Complex formation and ongoing compliance requirements, double taxation (unless structured as an S Corporation), and increased administrative formalities.

- Limited Liability Company (LLC):

- Definition: A hybrid legal structure combining elements of a corporation and a partnership/sole proprietorship.

- Advantages: Limited personal liability for owners, flexible management structure, pass-through taxation (unless structured as a corporation), and simpler formation and compliance requirements compared to a corporation.

- Disadvantages: State filing fees and ongoing administrative responsibilities, the potential for disputes among members, and limited ability to raise capital compared to a corporation.

If you plan to form an LLC, visit our guide on the best LLC formation services.

Protecting Your Alabama Business Name

Protecting your business name is crucial for establishing a strong brand identity and safeguarding your intellectual property.

In Alabama, one of the key ways to ensure the legal protection of your business name is through trademark registration.

Understanding the Importance of Trademark Registration

When it comes to protecting your business name, it's essential to differentiate between business name registration and trademark registration.

While registering your business name with the state provides some legal rights, it doesn't grant exclusive ownership or protection nationwide. Trademark registration, on the other hand, offers stronger legal protections and nationwide recognition.

Conducting a Trademark Search

Before proceeding with trademark registration, it's crucial to conduct a thorough trademark search to ensure your business name is available and not already trademarked by another entity.

The U.S. Patent and Trademark Office (USPTO) provides a comprehensive database where you can search for existing trademarks. By utilizing this database, you can assess potential conflicts and avoid potential legal issues in the future.

Applying for a Trademark Registration

If your trademark search confirms the availability of your business name, you can proceed with applying for a trademark registration in Alabama. To navigate the registration process successfully, it is advisable to consult with an experienced intellectual property attorney who can guide you through the intricacies of the application.

They can provide expert advice on preparing and submitting a strong trademark application to the appropriate authority.

To register your trademark, you'll need to prepare the necessary documentation, including a clear representation of your business name and its associated goods or services.

The application will also require payment of the filing fees, which can vary based on the type of registration and the number of classes you choose to protect.

In Alabama, the appropriate authority for trademark registration is the USPTO. Their website offers comprehensive information and resources to help you navigate the registration process smoothly.

Updating a Alabama Business Name

When you decide to update your business name in Alabama, it's essential to inform the relevant government agencies and update your licenses, permits, and financial records accordingly.

This article will provide a step-by-step guide on how to update your business records and licenses seamlessly, ensuring compliance and a smooth transition.

Informing relevant government agencies about the business name change

To begin the process of updating your business name, it is crucial to inform the necessary government agencies. Here are the key steps to follow:

- Alabama Secretary of State:

- Visit the Alabama Secretary of State's website: Alabama Secretary of State.

- Access the appropriate forms to update your business name.

- Submit the required information, including your old and new business name, address, and other relevant details.

- Pay any applicable fees for the name change process.

- Internal Revenue Service (IRS):

- Visit the IRS website: Internal Revenue Service (IRS).

- Update your business name with the IRS by completing Form SS-4 (Application for Employer Identification Number) if you have an EIN (Employer Identification Number).

- Inform the IRS about the name change in your tax returns and other relevant documents.

- Other applicable agencies:

- Identify other government agencies related to your industry or business activities.

- Contact these agencies individually to update your business name in their records.

- Examples include the Alabama Comptroller's Office, industry-specific licensing boards, and regulatory bodies.

Updating business licenses and permits

Updating your licenses and permits is crucial to maintain compliance with local regulations.

Follow these steps:

- Review existing licenses and permits:

- Identify the licenses and permits your business currently holds.

- Determine if they need to be updated due to the name change.

- Take note of renewal dates and any additional requirements.

- Contact relevant licensing agencies:

- Research the appropriate licensing agencies associated with your industry.

- Reach out to these agencies via their official websites or contact information.

- Notify them about the business name change and inquire about the specific process for updating your licenses.

- Provide any required documentation, such as the updated Certificate of Formation or Assumed Name Certificate.

Updating business bank accounts and other financial records

To ensure a smooth transition, it's essential to update your financial records after changing your business name.

Follow these steps:

- Notify your bank and financial institutions:

- Contact your bank or financial institution where your business accounts are held.

- Inform them about the name change and request the necessary updates to your accounts.

- Provide any supporting documentation, such as the updated Certificate of Formation or Assumed Name Certificate.

- Update business checks, credit cards, and other financial documents:

- Order new checks and update them with your new business name.

- Notify credit card companies and update your business name on all relevant accounts.

- Update other financial documents, such as invoices, contracts, and billing systems.

Updating your business records and licenses in Alabama after a name change is crucial to maintain legal compliance and ensure a seamless transition.

Conclusion

Registering a business name in Alabama is an essential step in establishing your business and ensuring its legal protection.

Take the necessary steps to register your business name in Alabama and set your venture on the path to growth and recognition.

Read the full article

0 notes

Text

100 Best LLC Names, Examples, and Ideas - For Your Business

In the fast-paced and competitive world of business, where first impressions can make or break an opportunity, the significance of a well-crafted company name cannot be overstated.

When it comes to forming a Limited Liability Company (LLC), choosing the right name goes beyond mere identification – it becomes the foundation upon which your brand identity is built.

Discover the art of crafting a standout LLC company name! Explore 100 inspiring ideas & examples across diverse industries. Elevate your brand identity today.

100 Best LLC Names, Examples and Ideas

Here's a list of 100 catchy LLC names, including examples and ideas, across various industries to inspire your naming process:

LLC Name Ideas by Industry

Tech and IT LLC Name Ideas:

Tech LLC Name Ideas

- CodeGenius Solutions

- DataFusion Innovations

- NexaTech Ventures

- QuantumByte Technologies

- CyberScope Dynamics

- ByteWave Systems

- InnovateX Techworks

- RoboSync Innovations

- TechHorizon Labs

- LogicSphere Solutions

Health and Wellness LLC Name Ideas:

Health, Wellnes LLC Name Ideas

- VitalityWave Wellness

- PureSerenity Health

- MindfulPath Solutions

- LifeHarmony Wellness

- RenewYou Therapeutics

- HolisticPulse Ventures

- ReviveWell Collective

- RadiantLife Labs

- BlissfulBalance Health

- CompleteMind Wellness

Creative and Design LLC Name Ideas:

Creative and Design LLC Name Ideas

- CanvasCraft Studios

- ArtistryNook Creations

- ColorFusion Innovations

- DesignVista Studios

- ImagineXpress Designs

- CraftMuse Creations

- AestheticInk Ventures

- WhimsyWaves Studios

- InnovateArtistry Labs

- DreamScape Designs

Finance and Consulting LLC Name Ideas:

Consulting LLC Name Ideas

- ApexStrat Solutions

- InsightCrest Advisors

- CapitalWave Partners

- ProfitPulse Consulting

- QuantumFinance Solutions

- FinancialVista Consulting

- ProsperLink Advisors

- ApexAccord Consultancy

- VisionWealth Consultants

- MoneyWise Dynamics

Food and Beverage Name Ideas:

- FlavorFiesta Eats

- TastyBite Ventures

- CulinaryCraft Labs

- GourmetFusion Foods

- SpiceSymphony Kitchen

- FreshSavor Bistro

- EpicureanDelight Ventures

- SavorySecrets Cuisine

- NourishWave Dining

- DelectableHarbor Eats

Eco-Friendly and Sustainability Name Ideas:

- GreenScape Innovations

- EcoHarmony Ventures

- EarthEthic Solutions

- EcoVista Dynamics

- RenewEarth Labs

- SustainSphere Innovations

- EcoNexa Ventures

- GreenPulse Initiatives

- EverGreen Technologies

- EcoElevate Solutions

Real Estate and Construction Name Ideas:

- PrimeStone Realty

- UrbanCraft Properties

- DreamScape Developments

- ApexBuild Ventures

- SkywardConstruct Group

- HorizonBuild Estates

- QuantumProperty Labs

- LandmarkHorizon Realty

- PrestigeCraft Developments

- MajesticBuild Ventures

Fitness and Sports Name Ideas:

- ActiveZen Fitness

- MomentumFit Ventures

- PowerUp Dynamics

- FitSphere Innovations

- SportSync Labs

- AthletePulse Ventures

- VigorWave Wellness

- PeakForm Fitness

- AgileStride Athletics

- FlexElite Dynamics

Fashion and Apparel Name Ideas:

- VogueSense Designs

- ChicCraft Studios

- EleganceBlend Fashion

- ModaFusion Innovations

- StyleSymphony Creations

- GlamSphere Studios

- TrendSculpt Couture

- CoutureCraft Ventures

- EvolveElegance Designs

- RefinedThreads Fashion

Education and Learning LLC Name Ideas:

- MindCraft Learning

- EduSphere Innovations

- WisdomWave Dynamics

- SkillSync Labs

- LearnLinx Ventures

- QuantumLearn Solutions

- KnowledgeHarbor Labs

- GrowthWise Learning

- InsightEd Ventures

- IntellectWave Innovations

Feel free to mix and match elements from different names to create something unique to your business. Remember to consider your industry, target audience, and brand identity when selecting the perfect LLC name for your business entity.

The Importance of a Strong Company Name for an LLC

A strong company name serves as your business's introduction to the world. It's the initial touchpoint that potential clients, partners, and investors encounter. Imagine your company name as a firm handshake, a friendly smile, or an inviting nod – it conveys professionalism, trustworthiness, and competence. A compelling company name can pique interest, ignite curiosity, and set the tone for meaningful interactions.

Furthermore, a well-thought-out LLC company name helps you stand out in a sea of competitors. It's your opportunity to create a lasting impression that distinguishes your business from the rest. A strong name can resonate with your target audience, making it easier for them to remember and recall your brand when they require the products or services you offer.

Creating a Memorable and Relevant Brand Identity

Beyond its functional role, a company name contributes significantly to your brand identity. It encapsulates your business's values, mission, and vision into a succinct and memorable form. Think of iconic companies like Apple, Google, and Coca-Cola – their names aren't just labels; they're powerful symbols that evoke emotions, thoughts, and experiences.

Your company name is the first step in the journey of creating a brand that resonates with your audience. It's a chance to tell a story, evoke emotions, and create a connection. A memorable name can become synonymous with excellence, innovation, or trust, allowing you to establish a strong foothold in your industry.

Factors to Consider When Choosing an LLC Company Name

Selecting an LLC company name is not a decision to be taken lightly. Several crucial factors should guide your choice to ensure a name that aligns with your business's goals and values:

- Clarity and Simplicity: Your company name should be easy to understand and pronounce. A convoluted or overly complex name can lead to confusion and hinder word-of-mouth referrals.

- Relevance to Business: Your company name should offer a glimpse into what your business does. A name that reflects your products, services, or industry can help potential customers immediately grasp your value proposition.

- Uniqueness and Originality: Standing out in a crowded market requires a unique name. Avoid names that are too similar to existing businesses, as they could lead to legal complications or confusion.

- Memorable and Easy to Spell: A memorable name is one that's easy to remember, ensuring that potential clients can recall it when needed. Likewise, a name that's simple to spell contributes to online discoverability.

- Future-Proof and Scalability: Consider your company's growth trajectory. Will the name still be relevant and suitable as your business expands or diversifies its offerings?

As you embark on the journey of selecting the perfect LLC company name, remember that this choice is an investment in your brand's future. It's a decision that encapsulates your business's essence and sets the tone for relationships you'll forge in the years to come. So, take the time to explore, brainstorm, and reflect – the right name is waiting to be discovered, and with it, the potential for a thriving and impactful business.

Characteristics of a Great LLC Name for a Company

When it comes to choosing a company name for your LLC, several key characteristics contribute to making it not just good, but great. These attributes ensure that your name effectively communicates your brand's essence, resonates with your audience, and stands the test of time.

A. Clarity and Simplicity

The foundation of an exceptional company name lies in its clarity and simplicity. A name that is clear and easy to understand helps potential customers and stakeholders immediately grasp what your business is about. Avoid using overly complex or convoluted names that require explanation – you want your name to make an instant impact.

Consider iconic brands like Nike and Apple. These names are succinct and straightforward, leaving no room for ambiguity. A clear and simple name enhances your brand's visibility and recall, making it easier for people to remember and recommend your business.

B. Relevance to Business

Your company name should offer a hint of what your business does or the industry it operates in. A name that's closely tied to your products, services, or expertise provides immediate context for those encountering your brand for the first time.

For example, if your LLC specializes in tech solutions, a name like "TechSolutions LLC" leaves little doubt about your business focus. However, relevance doesn't mean you have to be overly explicit. You can employ creative wordplay or subtle references that still convey your industry without being overly literal.

C. Uniqueness and Originality

In a world filled with businesses vying for attention, standing out is paramount. A great company name is unique and original, setting you apart from competitors and making your brand memorable. Avoid common industry buzzwords and clichés, as they can dilute your brand's distinctiveness.

Conduct thorough research to ensure that your desired name isn't already in use by another business. A unique name not only helps with brand recognition but also minimizes the risk of legal disputes down the line.

D. Memorable and Easy to Spell

In the age of digital communication and rapid information consumption, a memorable and easily spellable name is crucial. People should be able to recall your name effortlessly, and it should be simple to type correctly when searching online or sharing it with others.

Names with tricky spellings or intricate pronunciations can lead to misunderstandings or make it difficult for potential customers to find you online. Strive for a name that rolls off the tongue and can be typed without hesitation.

E. Future-Proof and Scalability

As your business evolves and grows, your company name should remain relevant and adaptable. A great name is one that doesn't pigeonhole your business into a narrow niche but has the flexibility to accommodate future expansions or changes in focus.

Consider where you envision your business in five, ten, or even twenty years. Will your chosen name still resonate if your offerings expand or if you enter new markets? Avoid names that might feel limiting as your company's scope widens.

In essence, a great LLC company name embodies these characteristics, reflecting your business's values, identity, and aspirations. It's a powerful tool that communicates volumes about your brand in just a few words. As you embark on the journey of naming your LLC, keep these attributes in mind to ensure you choose a name that serves as a solid foundation for your brand's success.

Types of LLC Names for a Company

When it comes to naming your LLC, there's a world of creativity and possibilities at your fingertips. The type of name you choose can have a profound impact on how your business is perceived and remembered. Here are several categories of LLC company names, each with its unique approach and examples:

A. Descriptive Names

Descriptive names do exactly what their name suggests – they describe the nature of your business succinctly and directly. These names leave little room for confusion, immediately informing potential customers about what you offer.

Examples:

- TechSolutions LLC: This name communicates that the business specializes in technological solutions, making it clear to clients in the tech industry.

- EcoClean Ventures: With this name, the focus is on environmentally friendly cleaning solutions, capturing the essence of the business's commitment to sustainability.

- HealthTech Innovators: The name indicates a focus on innovative solutions in the healthcare technology sector.

B. Abstract Names

Abstract names take a more creative and artistic approach, evoking emotions, feelings, or concepts rather than explicitly stating the business's offerings. These names allow for more flexibility in interpretation and can leave a lasting impression.

Examples:

- Serenity Enterprises: This abstract name suggests a sense of calm and tranquility, which could be appealing for a wellness or relaxation-focused business.

- Quantum Dynamics Group: This name alludes to advanced and cutting-edge concepts, making it suitable for a research or technology-driven company.

- Nexus Innovations: "Nexus" implies a connection or central point, conveying the idea of innovative solutions bringing disparate elements together.

C. Acronym and Initials

Acronyms and initials condense longer business names or complex concepts into shorter, more memorable forms. These names can be particularly effective if the initials represent key words or phrases related to your business.

Examples:

- ARIA Holdings LLC (Advanced Robotics and Artificial Intelligence): This acronym reflects the company's specialization in robotics and AI, giving a sense of expertise and innovation.

- VISTA Systems (Virtual Imaging and Simulation Technologies Association): The name uses initials to succinctly capture the business's focus on virtual imaging and simulation technologies.

D. Combined Names

Combined names involve merging two or more words to create a unique and memorable company name. This approach often results in a name that is distinct and can convey a sense of dynamism or innovation.

Examples:

- SolarFlare Industries: This name combines "solar" with "flare," suggesting energy, brightness, and innovation – suitable for a solar energy company.

- FoodFusion Innovations: The merging of "food" and "fusion" implies creativity and culinary exploration, making it a fitting name for a cutting-edge food-related business.

- SwiftShift Logistics: The combination of "swift" and "shift" signifies agility and adaptability, which align well with the logistics industry.

In choosing the type of name that best fits your LLC, consider your business's values, target audience, and the image you want to portray. Each category has its strengths and can resonate differently with potential customers, so take your time to explore options that align with your brand identity and long-term goals.

Brainstorming Company Name Ideas

Brainstorming for LLC Name Ideas

Coming up with the perfect company name involves tapping into your creativity and exploring various avenues. Here are several effective strategies for brainstorming compelling name ideas:

A. Word Association and Mind Mapping

Start with a central concept related to your business and create a mind map with associated words. This technique helps generate ideas by branching out from a single word and exploring related terms.

B. Leveraging Industry Keywords

Identify keywords that define your business's offerings and incorporate them into your name. This approach ensures that your name is directly linked to your industry, making it easy for potential customers to understand your focus.

C. Incorporating Founders' Names

If your LLC is closely tied to its founders' expertise or reputation, consider using their names in the company name. This approach lends a personal touch and can highlight the people behind the business.

D. Utilizing Synonyms and Foreign Languages

Look up synonyms for key words related to your business. Additionally, consider using words from other languages that capture the essence of your brand. This can add an intriguing and unique touch to your company name.

E. Playing with Puns and Rhymes

Puns and rhymes can add a playful and memorable element to your name. These wordplay techniques can make your business name stand out and leave a lasting impression.

Examples of Catchy LLC Company Names

Here are some examples of catchy LLC company names across various industries to inspire your naming process:

A. Tech and IT

- ByteBridges Solutions

- CodeCraft Innovations

- DataNex Systems

- QuantumByte Technologies

- SparkCyber Labs

B. Health and Wellness

- VitaGlow Wellness

- MindfulHeal Solutions

- SereneLife Therapeutics

- WellSpring Integrative Care

- RadiantHealth Collective

C. Creative and Design

- ArtistryWave Studios

- PaletteMuse Designs

- ImagineInk Creations

- AestheticVisions Studio

- CraftedCanvas Concepts

D. Finance and Consulting

- ProsperLink Advisors

- QuantumFinance Consulting

- ApexStrat Solutions

- InsightCrest Consultancy

- FiscalEdge Partners

E. Food and Beverage

- TastyFusion Eats

- FlavorFiesta Catering

- GourmetHarbor Delights

- SpiceSymphony Kitchen

- SweetSavor Bakeshop

F. Eco-Friendly and Sustainability

- GreenScape Innovations

- EarthEthic Ventures

- EcoPulse Solutions

- RenewEco Dynamics

- EcoVista Ventures

G.

Read the full article

0 notes

Text

How to Form an LLC in New Jersey for $0

Forming a Limited Liability Company (LLC) in New Jersey is an easy process, but it involves a few steps.

Start an New Jersey LLC for $0 + state fee

To form an LLC in New Jersey for free + state fee, we have listed 3 options to consider:

You can go online and visit the New Jersey Secretary of State's website and do it yourself or you can use the 'free' service from Incfile or ZenBusiness.

- DIY $0 + state fee

- Incfile $0 + state fee

- ZenBusiness $0 + state fee

Want to Keep Things More Private?

- Northwest $39 + state fee 'Privacy by Default'

Our Top 3 Recommended Services

Northwest

Northwest R.A.

$39

Trusted by 3 Million Clients

Over 900 Employees

Registered Agent (Included)

Best Privacy Policy

Virtual Office, Business Phone

Learn More

Incfile

Incfile

$0

1 Million+ Businesses Formed

Registered Agent First Year Free

Get a Virtual Office

No Hidden Fees

20 Years Experience

Learn More

ZenBusiness

ZenBusiness

$0

300,000+ Businesses Formed

Worry-Free Compliance

Registered Agent $199

Business Website, Email

Get a Virtual Office

Learn More

Forming an LLC in New Jersey for $0 (DIY Summary)

Here's a brief step-by-step guide to help you through the DIY process, along with relevant links to official resources:

Step 1: Choose a Name for Your LLC

The first step in forming an LLC in New Jersey is selecting a unique name for your business.

Your chosen name must comply with New Jersey's naming requirements and should not be similar to any existing LLC name in the state.

You can check the availability of your desired name through the New Jersey Business Name Search tool provided by the New Jersey Division of Revenue and Enterprise Services.

Step 2: Appoint a Registered Agent

Next, you need to designate a registered agent for your LLC. A registered agent is responsible for receiving legal documents and official correspondence on behalf of your company.

The registered agent must have a physical address in New Jersey. You can act as your own registered agent or hire a professional registered agent service.

Step 3: File Certificate of Formation

To legally establish your LLC, you must file a Certificate of Formation with the New Jersey Division of Revenue and Enterprise Services.

This document contains essential information about your LLC, including its name, registered agent, and business address.

You can submit the Certificate of Formation online through the New Jersey Business Formation portal.

Step 4: Create an Operating Agreement

Although not required by the state, it is highly recommended to create an operating agreement for your LLC.

This agreement outlines the ownership structure, management responsibilities, and operating procedures of your company.

Having an operating agreement can help prevent conflicts and provide clarity on how your LLC will operate.

Step 5: Obtain the Required Permits and Licenses

Depending on your business activities, you may need to obtain specific permits and licenses to operate legally in New Jersey.

The New Jersey Business Action Center provides a comprehensive list of permits and licenses required for various industries.

Make sure to research and obtain all necessary permits to ensure compliance with state regulations.

Step 6: File Annual Reports

After forming your LLC, you are required to file an annual report with the New Jersey Division of Revenue and Enterprise Services.

The report includes updated information about your LLC, such as the names and addresses of members or managers.

Failure to file annual reports can result in penalties and may lead to the dissolution of your LLC.

For detailed information and official forms, it is recommended to visit the New Jersey Department of the Treasury website or consult with a professional business attorney.

New Jersey LLC: Definitions

- Limited Liability Company (LLC): A type of business structure that offers limited liability protection to its owners, known as members. It combines the flexibility and tax benefits of a partnership with the limited liability protection of a corporation.

- New Jersey Division of Revenue and Enterprise Services: The state agency responsible for overseeing the registration and regulation of businesses in New Jersey, including the formation and maintenance of LLCs.

- Articles of Organization: The legal document that is filed with the New Jersey Division of Revenue and Enterprise Services to officially form an LLC. It includes essential information about the company, such as its name, registered agent, purpose, and duration.

- Registered Agent: An individual or entity designated to receive legal documents and official correspondence on behalf of the LLC. The registered agent must have a physical address in New Jersey and is responsible for ensuring that the LLC stays informed of any legal matters.

- Operating Agreement: A written contract that outlines the internal operations, ownership structure, decision-making processes, and financial arrangements of the LLC. Although not required by law in New Jersey, having an operating agreement is highly recommended to clarify the rights and responsibilities of the members.