Text

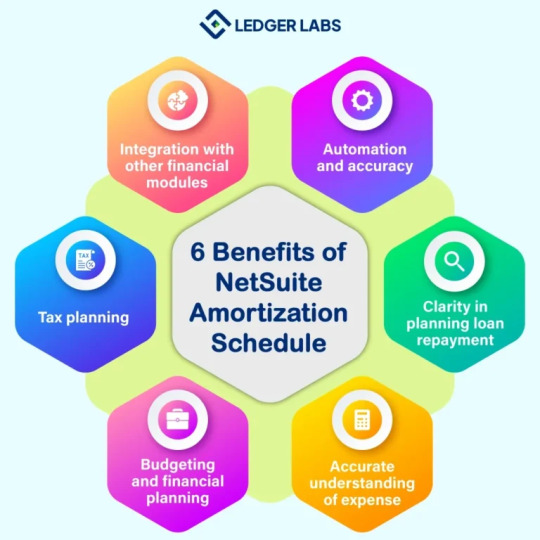

1. Automation and Accuracy

NetSuite makes the process of creating as well as managing amortization schedules easier. Moreover, the application provides accuracy in financial records as it minimizes human errors. Thanks to its ability to perform calculations automatically.

2. Clarity in Planning Loan Repayment

An amortization schedule outlines a clear plan for debt repayments. It specifies how much of each payment goes towards the principal amount and how much covers the interest.

3. Accurate Understanding of Expense

NetSuite amortization schedules allocate the cost of intangible assets like copyrights or patents over their useful life. It reflects the asset’s gradual consumption and is systematically included in the business’s expenses over the projected life of the asset.

Furthermore, if in case you want to eliminate the asset in the books and enter it as a loss, you can use NetSuite write off amortization schedule feature.

4. Budgeting and Financial Planning

You can easily check the NetSuite amortization schedule report containing the exact amounts and time of loan payments. It can allow you to manage your cash flow effectively. Read more about NetSuite Planning and Budgeting in this blogpost.

5. Tax Planning

Amortization is often used for tax planning. This process spreads the cost of an intangible asset over its useful life. It can help your business reduce its taxable income in each accounting period. So, an amortization financial strategy helps you save money on taxes while accounting for the gradual use of valuable assets over time.

6. Integration with Other Financial Modules

NetSuite makes financial management a lot smoother because of its ability to interrelate all financial modules. Rest assured the amortization schedule you create for a loan or intangible asset is connected with other essential financial processes.

Visit Ledger Labs for NetSuite ERP Services

1 note

·

View note