Text

Anthem Gold Group Review

What is Anthem Gold Group?Anthem Gold Group Locations, Timings, Email, Phone, Services

Anthem Gold Group is a recently established precious metals firm, founded in the year 2023. This company specializes in providing investors with an opportunity to acquire IRS-approved gold, silver, and platinum coins and bars that are eligible for inclusion in an individual retirement account (IRA). Additionally, Anthem Gold Group offers a selection of collector coins for those who wish to hold them privately, outside the confines of an IRA.

Find the Best Rated Gold IRA Company of your State

One unique feature of Anthem Gold Group is its commitment to mitigating the risks associated with precious metals investing. The company offers a lowest price/highest buyback guarantee, which ensures that investors can make informed and secure decisions when investing in precious metals.

Anthem Gold Group is headquartered in Woodland Hills, California, making it easily accessible to individuals seeking to explore the world of precious metals as part of their investment strategy.

The company was founded with the noble mission of providing Americans with a reliable solution to shield their IRAs, 401(k)s, and other eligible retirement accounts from the adverse consequences of market volatility and the erosive effects of inflation. The company's unwavering dedication to its customers and their financial security has made it the foremost provider of Gold and Silver IRAs in the country.

Anthem Gold Group takes great pride in its position as a trusted and respected partner in securing the financial stability of its clients' retirement accounts. The company's commitment to excellence and its mission of helping Americans protect and grow their wealth through the enduring value of precious metals continue to define its journey.

- Address: 6320 Canoga Ave #1600, Woodland Hills, CA 91367

- Phone: 888-444-2948

- Email: [email protected]

- Website: https://anthemgoldgroup.com/

People Behind Anthem Gold Group: CEO, Owner, Co-Founders & MoreWho owns Anthem Gold Group? What is the management team behind Anthem Gold Group?

One notable drawback of Anthem Gold Group is its lack of transparency when it comes to providing information about its management and key team members. In the realm of financial investments, trust and transparency are paramount, and investors often place a great deal of importance on understanding the leadership and expertise behind a company.

To address this drawback, Anthem Gold Group could consider providing more transparency about its management and key team members. This could be in the form of executive biographies, professional backgrounds, and qualifications, which would help potential investors make more informed decisions and build trust in the company.

Transparent communication about the company's leadership can ultimately contribute to the success and reputation of the business in the competitive world of precious metal investments.

Anthem Gold Group Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Anthem Gold Group

Anthem Gold Group offers a diverse array of precious metal products, encompassing a wide range of gold, silver, and platinum items, such as coins and bullion. Currently, their product catalog boasts approximately 50 different options, spanning across the spectrum of these valuable metals. Some of these products are approved by the Internal Revenue Service (IRS) for inclusion in precious metal Individual Retirement Accounts (IRAs), while others are intended for private ownership and investment.

To embark on your journey of precious metal investment through this company, the process begins with reaching out to the company to express your interest in collaboration. This can be initiated either online or by phone, providing you with flexibility and convenience. An account representative from the company will then guide you through the onboarding process, collecting your personal information and delving into your specific investment goals. This step is vital to ensure that the company can offer tailored recommendations and assemble a portfolio that aligns with your unique financial objectives.

Once your goals and preferences have been established, the next step involves funding your IRA account. This can be accomplished through various means, including cash deposits, rolling over funds from another IRA, or utilizing a distribution from a qualified retirement plan (QRPD). The flexibility in funding options is designed to accommodate your individual circumstances and preferences.

After you purchase precious metals, the company stores them in a secure facility that complies with IRS regulations. This ensures the protection and integrity of your assets, giving you peace of mind. Investors can engage in precious metals with confidence, knowing their financial future is in capable hands.

How to Invest in Anthem Gold Group IRA?Step-by-step guide for investing in Anthem Gold Group IRA

To invest in a precious metals IRA through Anthem Gold Group are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Anthem Gold Group to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Anthem Gold Group.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's important to get guidance from Anthem Gold Group in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to place your order for the desired precious metals.

In my opinion, it would be best to search for an alternative company since Anthem Gold Group because the company is totally new in this precious metals industry.

Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly.

Anthem Gold Group Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

Anthem Gold Group distinguishes itself by not displaying real-time pricing for precious metals on its website, which some may perceive as a limitation. The reason behind this decision is rooted in the inherent volatility of precious metal prices; they can fluctuate rapidly, rendering a price listed one day potentially invalid the next. To address this concern, the company has chosen not to provide static pricing information.

The company compensates for the absence of pricing by offering a valuable resource on its website in the form of interactive precious metal value charts. These charts enable visitors to monitor the dynamic performance of gold, silver, and platinum over time. By using these charts, prospective investors can gain insight into market trends and make informed decisions regarding the timing of their investments.

Also, the company claims to provide top-notch customer value and security. They have a lowest-price guarantee and free storage options for IRA holdings for up to 10 years, subject to eligibility criteria.

However, if you want to learn more about their fees, you would need to get in touch with one of their representatives.

The issue of storage fees is not to be underestimated when considering precious metal investments. These costs can significantly impact your overall returns. To make an informed choice, it is recommended that you compare storage fees across different companies. This way, you can ensure that your investment strategy aligns with your long-term financial goals and preferences.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. Anthem Gold Group on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

Freedom Shield Capital Review

What is Freedom Shield Capital?Freedom Shield Capital Locations, Timings, Email, Phone, Services

Freedom Shield Capital stands out as a prominent wealth preservation firm, specializing in alternative assets, notably precious metals such as gold and silver. One of the noteworthy offerings provided by Freedom Shield Capital is the opportunity to opt for self-directed gold and silver Individual Retirement Accounts (IRAs). This distinctive arrangement empowers individuals to take direct control over the management of their IRA accounts.

Find the Best Rated Gold IRA Company of your State

Under the self-directed IRA framework, investors benefit from the flexibility to diversify their portfolios across a wide array of IRS-approved asset classes, extending beyond the boundaries of traditional investment options. This expanded spectrum includes non-traditional and alternative investments, encompassing assets like gold, silver, and even cryptocurrency. This versatility empowers investors to tailor their portfolios to align with their specific financial objectives and risk tolerance.

One notable aspect of Freedom Shield Capital's fee structure sets it apart from many financial institutions. Instead of imposing commission fees, the firm operates on a transparent one-time service fee model. This approach underscores the company's dedication to providing clear and client-centric financial solutions, ensuring investors can make well-informed choices about their wealth preservation strategies.

Moreover, Freedom Shield Capital places a strong emphasis on ethical principles and safeguarding the financial well-being of its clients from the very outset.

- Address: 401 Wilshire Blvd #1200 Santa Monica, CA 90401-1456

- Phone: (855) 341-9222

- Website: www.freedomshieldcapital.com

- Hours:

- Monday-Friday: 9:00 A.M to 5:00 P.M

- Saturday-Sunday: Closed

People Behind Freedom Shield Capital: CEO, Owner, Co-Founders & MoreWho owns Freedom Shield Capital? What is the management team behind Freedom Shield Capital?

Cody Roeder (Founder):

Freedom Shield Capital owes its inception to the vision and determination of its founder, Cody Roeder. His inspiration to embark on the journey of establishing this company stemmed from a deeply personal experience. Witnessing the financial hardships his mother endured as a consequence of the 2008 recession deeply affected Cody. This familial struggle became a catalyst for his entrepreneurial aspirations, driving him to establish Freedom Shield Capital.

Cody's primary objective was to prevent others from encountering the same financial hardships that his mother had to endure during that challenging period. His commitment to ensuring financial security and well-being for individuals and families alike became the driving force behind the creation of Freedom Shield Capital. Cody's dedication to this cause has been instrumental in shaping the company's mission and values, which continue to guide the organization in its pursuit of financial stability and prosperity for all.

Devin Bradley (Executive Assistant):

Devin Bradley holds the position of Executive Assistant at Freedom Shield Capital, a prominent financial firm known for its commitment to client satisfaction and financial well-being. As an Executive Assistant, Devin plays a pivotal role in supporting the company's high-level executives and contributing to the smooth and efficient operation of the organization.

In this role, Devin is responsible for a diverse range of tasks that are essential to the company's day-to-day functioning. These tasks may include managing appointments and calendars for executives, coordinating meetings and conferences, handling correspondence, and serving as a point of contact between the executive team and other staff members.

Devin Bradley's role demands strong organizational skills, excellent communication, and a keen attention to detail. As an integral part of the Freedom Shield Capital team, Devin's contributions play a vital role in ensuring that the company can deliver on its mission of guiding clients toward financial success and security, all while upholding the highest standards of professionalism and service.

Freedom Shield Capital Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Freedom Shield Capital

Freedom Shield Capital offers a range of products designed to help individuals secure their financial futures. Among the notable offerings are bullion coins, bars, and rare coins. These products provide a diverse set of options for individuals looking to invest in precious metals and alternative assets as part of their wealth preservation and retirement planning strategies.

- Bullion Coins: Freedom Shield Capital provides access to a selection of bullion coins. Bullion coins are typically minted by government agencies and are valued for their intrinsic metal content. These coins are recognized and accepted worldwide, making them a popular choice for investors looking to diversify their portfolios with physical precious metals.

- Bullion Bars: In addition to bullion coins, Freedom Shield Capital offers bullion bars. Bullion bars, often referred to as ingots, are typically cast or minted in various weights and sizes. They are known for their high purity and are valued for their weight and precious metal content. Bullion bars can be a convenient and cost-effective way to invest in precious metals.

- Rare Coins: For collectors and investors interested in numismatics, Freedom Shield Capital also offers rare coins. These coins may have historical or collector's value in addition to their precious metal content. Rare coins can be a unique addition to an investment portfolio and offer the potential for both appreciation in value and historical significance.

These product offerings cater to a wide range of investor preferences and goals, allowing individuals to choose the assets that align best with their financial strategies and objectives. Freedom Shield Capital's commitment to providing a variety of options underscores its dedication to helping clients secure their wealth through alternative assets such as precious metals.

How to Invest in Freedom Shield Capital IRA?Step-by-step guide for investing in Freedom Shield Capital IRA

To invest in a precious metals IRA through Freedom Shield Capital are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Freedom Shield Capital to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Freedom Shield Capital.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's essential to get guidance from Freedom Shield Capital in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to order the desired precious metals.

However, I don't recommend opening an IRA with Freedom Shield Capital. Why? Because there are plenty of better options available for you.

Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. You can find the best precious metals dealer in your state and choose accordingly.

Freedom Shield Capital Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

When evaluating the pricing structure at Freedom Shield Capital, it's essential to take several factors into account beyond the spot price, which represents the current market value of one ounce of precious metals.

The comprehensive cost breakdown includes:

- Service Fee: Freedom Shield Capital imposes a one-time service fee upon the initiation of your investment. Notably, the firm operates on a fee-based model, so there are no commission fees associated with your investment.

- Storage Fees: For clients who opt to store their precious metals securely with Freedom Shield Capital, storage fees may apply. However, it's worth noting that these storage fees are waived for first-time investors who commit a minimum of $50,000 or more to their investment, thereby providing a significant incentive for larger investments.

- Shipping Costs: If you decide to have your precious metals physically delivered, Freedom Shield Capital extends complimentary shipping services for investments totaling $10,000 or more. However, it's important to be aware that investments falling below the $10,000 threshold will incur a shipping fee.

By considering all these factors in addition to the spot price, investors can make informed decisions regarding their precious metal investments with Freedom Shield Capital, taking into account the various fees and benefits associated with their chosen investment approach.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. Freedom Shield Capital on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

American Coin Co. Review

What is American Coin Co.?American Coin Co. Locations, Timings, Email, Phone, Services

American Coin Co., a gold IRA dealer based in Washington, offers comprehensive services to assist you in establishing a self-directed IRA. They can arrange for IRS-approved precious metals to be stored in secure depositories across the country or even delivered to your home. Additionally, the company facilitates precious metals purchases through cash transactions.

Dedicated to providing investors with valuable information, American Coin Co. offers educational resources on its website, including consultations, webinars, and real-time market data. The company is also a proud supporter of the K9s for Warriors program.

Find the Best Gold IRA Company in Your State

Specializing in gold and silver IRAs, American Coin Co. is a trusted name in the precious metals investment industry, catering to experienced investors seeking diversification. The company's core mission revolves around ensuring that every American can enjoy a worry-free retirement and leave a lasting legacy for their loved ones.

With this vision in mind, American Coin Co. is dedicated to assisting clients in safeguarding, managing, and growing their wealth through the strategic use of precious metals.

The team at American Coin Co. takes great pride in their customer-centric approach, offering educational resources to empower clients to make well-informed decisions and providing ongoing support and security for their investments.

- Address: 601 W 1st Ave Suite 1400 Spokane, WA 99201

- Phone: (888) 526-2039

- Email: [email protected]

- Website: https://www.americancoinco.com/

People Behind American Coin Co.: CEO, Owner, Co-Founders & MoreWho owns American Coin Co.? What is the management team behind American Coin Co.?

Brett Bultje (Vice President):

In his role as Vice President of Sales at American Coin Co., Brett Bultje plays a pivotal role in the organization. He is a recognized authority in the field, and his contribution extends beyond the usual duties associated with the position. Brett conducts informative webinars on a weekly basis, providing investors with valuable insights. With a wealth of experience spanning over a decade, his unwavering commitment is directed toward guiding Americans in making prudent investments in the realm of gold and silver.

What sets Brett apart is not only his expertise but also his dedication to continuous improvement and adherence to stringent quality standards. He has undertaken Six Sigma White Belt training, a rigorous program that underscores his resolve to instill a culture of compliance and excellence within the firm.

Before venturing into the world of finance, Brett had a distinguished career as an athlete. His achievements include securing the title of a Colorado 3A State Champion and earning the coveted distinction of being a two-time collegiate Track and field National Champion. Furthermore, his sporting prowess extends to completing the demanding LA Marathon not once, but three times. Brett Bultje's multifaceted background and unwavering commitment make him an invaluable asset in his role as Vice President of Sales at American Coin Co.

American Coin Co. Products: Bullion Coins, Bars, And Rare CoinsAll products offered by American Coin Co.

The company extends an opportunity for clients to convert their savings into tangible assets, such as gold or other precious metals, ensuring that you can embark on your retirement years with peace of mind.

Headquartered in California, this privately owned firm is dedicated to two primary objectives: educating and assisting clients in navigating the realm of gold IRAs. Through the strategic implementation of diversification, American Coin Co. empowers you to enhance the protection of your retirement savings, especially during times of economic uncertainty and market fluctuations.

When you choose American Coin Co., you gain access to a plethora of valuable resources, including the latest market information, exceptional customer support, and a diverse array of products to meet your investment needs. Moreover, the company takes pride in offering its clients a distinctive advantage – Price Protection, designed to provide both upside and downside investment security. While all investments inherently carry some level of risk, this protection mechanism is intended to instill greater confidence and security in your decision to invest in gold or other precious metals. It serves as a safeguard against the potential swings in the value of your investment, making your retirement savings more resilient to market dynamics.

The available investment options from the company encompass:

- Red Lion Gold Coin

- Red Lion Silver Coin

- 90% Silver U.S. Coin or Junk Silver

- Gold American Buffalo

- Silver Red-Tailed Hawk

- American Palladium Eagle

- American Eagle Platinum

- Silver American Eagle

- Gold American Eagle

- Red-Tailed Hawk

- Silver Sovereign

Despite the restricted range of investment options, it's worth noting that American Coin Co. excels in providing comprehensive IRA-related services. They offer expert guidance through complementary investment consultations and furnish detailed information on how IRA investments function.

As previously mentioned, one aspect that I found limiting in my experience of investing with this firm was the relatively constrained selection of IRS-approved precious metals investment options. Although the company maintains high standards for quality, its offerings in the realm of precious metals IRA investments are somewhat limited.

How to Invest in American Coin Co. IRA?Step-by-step guide for investing in American Coin Co. IRA

To invest in a precious metals IRA through American Coin Co. are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with American Coin Co. to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or roll over funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as American Coin Co.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's essential to get guidance from American Coin Co. in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to order the desired precious metals.

However, I don't recommend opening an IRA with them. Why? Because there are plenty of better options available for you.

Opening a precious metals IRA is a significant decision. That's why I suggest checking out our top gold IRA providers list. You can find the best precious metals dealer in your state and choose accordingly.

American Coin Co. Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

One distinctive feature that truly distinguishes American Coin Co. and has provided its customers with peace of mind during a real-life scenario is its exceptional price protection policy. In a recent investment he made in gold and silver through them, he encountered an unexpected market dip within just seven days, causing a decline in the value of his assets.

However, he thanks to their remarkable price protection policy, he was promptly compensated for the difference in value. They expediently delivered additional metals to offset the price decrease. It's worth highlighting that this invaluable service is exclusively available for approved investment accounts, making American Coin Co. a compelling choice for your precious metals investments.

Enjoy 100% Free Insured Shipping:

If you prefer to have your precious metals shipped to your chosen address, American Coin Co. offers this option at no cost.

In addition to providing third-party depository services, the company allows you to personally store your precious metals IRA at an IRS-approved location.

Furthermore, this delivery service is not only 100% free but also insured for your peace of mind.

With a self-directed American Coin Co. account, there are no management fees. If you opt to use their preferred custodian, Accuplan, you won't be charged custodial fees either. American Coin Co. covers all application fees and startup costs as part of its commitment to transparent and cost-effective services.

The actual cost of gold and silver purchases may vary based on current spot prices and market rates for premium coins. American Coin Co. maintains transparency by disclosing their ask-to-bid differential on purchases, fees, and transaction statuses.

For depository storage, fees typically amount to around $200 per year, though some clients may qualify for a no-fees-for-life arrangement with American Coin Co.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. American Coin Co. on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

Anthem Gold Group Review

What is Anthem Gold Group?Anthem Gold Group Locations, Timings, Email, Phone, Services

Anthem Gold Group is a recently established precious metals firm, founded in the year 2023. This company specializes in providing investors with an opportunity to acquire IRS-approved gold, silver, and platinum coins and bars that are eligible for inclusion in an individual retirement account (IRA). Additionally, Anthem Gold Group offers a selection of collector coins for those who wish to hold them privately, outside the confines of an IRA.

Find the Best Rated Gold IRA Company of your State

One unique feature of Anthem Gold Group is its commitment to mitigating the risks associated with precious metals investing. The company offers a lowest price/highest buyback guarantee, which ensures that investors can make informed and secure decisions when investing in precious metals.

Anthem Gold Group is headquartered in Woodland Hills, California, making it easily accessible to individuals seeking to explore the world of precious metals as part of their investment strategy.

The company was founded with the noble mission of providing Americans with a reliable solution to shield their IRAs, 401(k)s, and other eligible retirement accounts from the adverse consequences of market volatility and the erosive effects of inflation. The company's unwavering dedication to its customers and their financial security has made it the foremost provider of Gold and Silver IRAs in the country.

Anthem Gold Group takes great pride in its position as a trusted and respected partner in securing the financial stability of its clients' retirement accounts. The company's commitment to excellence and its mission of helping Americans protect and grow their wealth through the enduring value of precious metals continue to define its journey.

- Address: 6320 Canoga Ave #1600, Woodland Hills, CA 91367

- Phone: 888-444-2948

- Email: [email protected]

- Website: https://anthemgoldgroup.com/

People Behind Anthem Gold Group: CEO, Owner, Co-Founders & MoreWho owns Anthem Gold Group? What is the management team behind Anthem Gold Group?

One notable drawback of Anthem Gold Group is its lack of transparency when it comes to providing information about its management and key team members. In the realm of financial investments, trust and transparency are paramount, and investors often place a great deal of importance on understanding the leadership and expertise behind a company.

To address this drawback, Anthem Gold Group could consider providing more transparency about its management and key team members. This could be in the form of executive biographies, professional backgrounds, and qualifications, which would help potential investors make more informed decisions and build trust in the company.

Transparent communication about the company's leadership can ultimately contribute to the success and reputation of the business in the competitive world of precious metal investments.

Anthem Gold Group Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Anthem Gold Group

Anthem Gold Group offers a diverse array of precious metal products, encompassing a wide range of gold, silver, and platinum items, such as coins and bullion. Currently, their product catalog boasts approximately 50 different options, spanning across the spectrum of these valuable metals. Some of these products are approved by the Internal Revenue Service (IRS) for inclusion in precious metal Individual Retirement Accounts (IRAs), while others are intended for private ownership and investment.

To embark on your journey of precious metal investment through this company, the process begins with reaching out to the company to express your interest in collaboration. This can be initiated either online or by phone, providing you with flexibility and convenience. An account representative from the company will then guide you through the onboarding process, collecting your personal information and delving into your specific investment goals. This step is vital to ensure that the company can offer tailored recommendations and assemble a portfolio that aligns with your unique financial objectives.

Once your goals and preferences have been established, the next step involves funding your IRA account. This can be accomplished through various means, including cash deposits, rolling over funds from another IRA, or utilizing a distribution from a qualified retirement plan (QRPD). The flexibility in funding options is designed to accommodate your individual circumstances and preferences.

After you purchase precious metals, the company stores them in a secure facility that complies with IRS regulations. This ensures the protection and integrity of your assets, giving you peace of mind. Investors can engage in precious metals with confidence, knowing their financial future is in capable hands.

How to Invest in Anthem Gold Group IRA?Step-by-step guide for investing in Anthem Gold Group IRA

To invest in a precious metals IRA through Anthem Gold Group are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Anthem Gold Group to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Anthem Gold Group.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's important to get guidance from Anthem Gold Group in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to place your order for the desired precious metals.

In my opinion, it would be best to search for an alternative company since Anthem Gold Group because the company is totally new in this precious metals industry.

Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly.

Anthem Gold Group Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

Anthem Gold Group distinguishes itself by not displaying real-time pricing for precious metals on its website, which some may perceive as a limitation. The reason behind this decision is rooted in the inherent volatility of precious metal prices; they can fluctuate rapidly, rendering a price listed one day potentially invalid the next. To address this concern, the company has chosen not to provide static pricing information.

The company compensates for the absence of pricing by offering a valuable resource on its website in the form of interactive precious metal value charts. These charts enable visitors to monitor the dynamic performance of gold, silver, and platinum over time. By using these charts, prospective investors can gain insight into market trends and make informed decisions regarding the timing of their investments.

Also, the company claims to provide top-notch customer value and security. They have a lowest-price guarantee and free storage options for IRA holdings for up to 10 years, subject to eligibility criteria.

However, if you want to learn more about their fees, you would need to get in touch with one of their representatives.

The issue of storage fees is not to be underestimated when considering precious metal investments. These costs can significantly impact your overall returns. To make an informed choice, it is recommended that you compare storage fees across different companies. This way, you can ensure that your investment strategy aligns with your long-term financial goals and preferences.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. Anthem Gold Group on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

Freedom Shield Capital Review

What is Freedom Shield Capital?Freedom Shield Capital Locations, Timings, Email, Phone, Services

Freedom Shield Capital stands out as a prominent wealth preservation firm, specializing in alternative assets, notably precious metals such as gold and silver. One of the noteworthy offerings provided by Freedom Shield Capital is the opportunity to opt for self-directed gold and silver Individual Retirement Accounts (IRAs). This distinctive arrangement empowers individuals to take direct control over the management of their IRA accounts.

Find the Best Rated Gold IRA Company of your State

Under the self-directed IRA framework, investors benefit from the flexibility to diversify their portfolios across a wide array of IRS-approved asset classes, extending beyond the boundaries of traditional investment options. This expanded spectrum includes non-traditional and alternative investments, encompassing assets like gold, silver, and even cryptocurrency. This versatility empowers investors to tailor their portfolios to align with their specific financial objectives and risk tolerance.

One notable aspect of Freedom Shield Capital's fee structure sets it apart from many financial institutions. Instead of imposing commission fees, the firm operates on a transparent one-time service fee model. This approach underscores the company's dedication to providing clear and client-centric financial solutions, ensuring investors can make well-informed choices about their wealth preservation strategies.

Moreover, Freedom Shield Capital places a strong emphasis on ethical principles and safeguarding the financial well-being of its clients from the very outset.

- Address: 401 Wilshire Blvd #1200 Santa Monica, CA 90401-1456

- Phone: (855) 341-9222

- Website: www.freedomshieldcapital.com

- Hours:

- Monday-Friday: 9:00 A.M to 5:00 P.M

- Saturday-Sunday: Closed

People Behind Freedom Shield Capital: CEO, Owner, Co-Founders & MoreWho owns Freedom Shield Capital? What is the management team behind Freedom Shield Capital?

Cody Roeder (Founder):

Freedom Shield Capital owes its inception to the vision and determination of its founder, Cody Roeder. His inspiration to embark on the journey of establishing this company stemmed from a deeply personal experience. Witnessing the financial hardships his mother endured as a consequence of the 2008 recession deeply affected Cody. This familial struggle became a catalyst for his entrepreneurial aspirations, driving him to establish Freedom Shield Capital.

Cody's primary objective was to prevent others from encountering the same financial hardships that his mother had to endure during that challenging period. His commitment to ensuring financial security and well-being for individuals and families alike became the driving force behind the creation of Freedom Shield Capital. Cody's dedication to this cause has been instrumental in shaping the company's mission and values, which continue to guide the organization in its pursuit of financial stability and prosperity for all.

Devin Bradley (Executive Assistant):

Devin Bradley holds the position of Executive Assistant at Freedom Shield Capital, a prominent financial firm known for its commitment to client satisfaction and financial well-being. As an Executive Assistant, Devin plays a pivotal role in supporting the company's high-level executives and contributing to the smooth and efficient operation of the organization.

In this role, Devin is responsible for a diverse range of tasks that are essential to the company's day-to-day functioning. These tasks may include managing appointments and calendars for executives, coordinating meetings and conferences, handling correspondence, and serving as a point of contact between the executive team and other staff members.

Devin Bradley's role demands strong organizational skills, excellent communication, and a keen attention to detail. As an integral part of the Freedom Shield Capital team, Devin's contributions play a vital role in ensuring that the company can deliver on its mission of guiding clients toward financial success and security, all while upholding the highest standards of professionalism and service.

Freedom Shield Capital Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Freedom Shield Capital

Freedom Shield Capital offers a range of products designed to help individuals secure their financial futures. Among the notable offerings are bullion coins, bars, and rare coins. These products provide a diverse set of options for individuals looking to invest in precious metals and alternative assets as part of their wealth preservation and retirement planning strategies.

- Bullion Coins: Freedom Shield Capital provides access to a selection of bullion coins. Bullion coins are typically minted by government agencies and are valued for their intrinsic metal content. These coins are recognized and accepted worldwide, making them a popular choice for investors looking to diversify their portfolios with physical precious metals.

- Bullion Bars: In addition to bullion coins, Freedom Shield Capital offers bullion bars. Bullion bars, often referred to as ingots, are typically cast or minted in various weights and sizes. They are known for their high purity and are valued for their weight and precious metal content. Bullion bars can be a convenient and cost-effective way to invest in precious metals.

- Rare Coins: For collectors and investors interested in numismatics, Freedom Shield Capital also offers rare coins. These coins may have historical or collector's value in addition to their precious metal content. Rare coins can be a unique addition to an investment portfolio and offer the potential for both appreciation in value and historical significance.

These product offerings cater to a wide range of investor preferences and goals, allowing individuals to choose the assets that align best with their financial strategies and objectives. Freedom Shield Capital's commitment to providing a variety of options underscores its dedication to helping clients secure their wealth through alternative assets such as precious metals.

How to Invest in Freedom Shield Capital IRA?Step-by-step guide for investing in Freedom Shield Capital IRA

To invest in a precious metals IRA through Freedom Shield Capital are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Freedom Shield Capital to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Freedom Shield Capital.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's essential to get guidance from Freedom Shield Capital in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to order the desired precious metals.

However, I don't recommend opening an IRA with Freedom Shield Capital. Why? Because there are plenty of better options available for you.

Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. You can find the best precious metals dealer in your state and choose accordingly.

Freedom Shield Capital Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

When evaluating the pricing structure at Freedom Shield Capital, it's essential to take several factors into account beyond the spot price, which represents the current market value of one ounce of precious metals.

The comprehensive cost breakdown includes:

- Service Fee: Freedom Shield Capital imposes a one-time service fee upon the initiation of your investment. Notably, the firm operates on a fee-based model, so there are no commission fees associated with your investment.

- Storage Fees: For clients who opt to store their precious metals securely with Freedom Shield Capital, storage fees may apply. However, it's worth noting that these storage fees are waived for first-time investors who commit a minimum of $50,000 or more to their investment, thereby providing a significant incentive for larger investments.

- Shipping Costs: If you decide to have your precious metals physically delivered, Freedom Shield Capital extends complimentary shipping services for investments totaling $10,000 or more. However, it's important to be aware that investments falling below the $10,000 threshold will incur a shipping fee.

By considering all these factors in addition to the spot price, investors can make informed decisions regarding their precious metal investments with Freedom Shield Capital, taking into account the various fees and benefits associated with their chosen investment approach.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. Freedom Shield Capital on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

American Coin Co. Review

What is American Coin Co.?American Coin Co. Locations, Timings, Email, Phone, Services

American Coin Co., a gold IRA dealer based in Washington, offers comprehensive services to assist you in establishing a self-directed IRA. They can arrange for IRS-approved precious metals to be stored in secure depositories across the country or even delivered to your home. Additionally, the company facilitates precious metals purchases through cash transactions.

Dedicated to providing investors with valuable information, American Coin Co. offers educational resources on its website, including consultations, webinars, and real-time market data. The company is also a proud supporter of the K9s for Warriors program.

Find the Best Gold IRA Company in Your State

Specializing in gold and silver IRAs, American Coin Co. is a trusted name in the precious metals investment industry, catering to experienced investors seeking diversification. The company's core mission revolves around ensuring that every American can enjoy a worry-free retirement and leave a lasting legacy for their loved ones.

With this vision in mind, American Coin Co. is dedicated to assisting clients in safeguarding, managing, and growing their wealth through the strategic use of precious metals.

The team at American Coin Co. takes great pride in their customer-centric approach, offering educational resources to empower clients to make well-informed decisions and providing ongoing support and security for their investments.

- Address: 601 W 1st Ave Suite 1400 Spokane, WA 99201

- Phone: (888) 526-2039

- Email: [email protected]

- Website: https://www.americancoinco.com/

People Behind American Coin Co.: CEO, Owner, Co-Founders & MoreWho owns American Coin Co.? What is the management team behind American Coin Co.?

Brett Bultje (Vice President):

In his role as Vice President of Sales at American Coin Co., Brett Bultje plays a pivotal role in the organization. He is a recognized authority in the field, and his contribution extends beyond the usual duties associated with the position. Brett conducts informative webinars on a weekly basis, providing investors with valuable insights. With a wealth of experience spanning over a decade, his unwavering commitment is directed toward guiding Americans in making prudent investments in the realm of gold and silver.

What sets Brett apart is not only his expertise but also his dedication to continuous improvement and adherence to stringent quality standards. He has undertaken Six Sigma White Belt training, a rigorous program that underscores his resolve to instill a culture of compliance and excellence within the firm.

Before venturing into the world of finance, Brett had a distinguished career as an athlete. His achievements include securing the title of a Colorado 3A State Champion and earning the coveted distinction of being a two-time collegiate Track and field National Champion. Furthermore, his sporting prowess extends to completing the demanding LA Marathon not once, but three times. Brett Bultje's multifaceted background and unwavering commitment make him an invaluable asset in his role as Vice President of Sales at American Coin Co.

American Coin Co. Products: Bullion Coins, Bars, And Rare CoinsAll products offered by American Coin Co.

The company extends an opportunity for clients to convert their savings into tangible assets, such as gold or other precious metals, ensuring that you can embark on your retirement years with peace of mind.

Headquartered in California, this privately owned firm is dedicated to two primary objectives: educating and assisting clients in navigating the realm of gold IRAs. Through the strategic implementation of diversification, American Coin Co. empowers you to enhance the protection of your retirement savings, especially during times of economic uncertainty and market fluctuations.

When you choose American Coin Co., you gain access to a plethora of valuable resources, including the latest market information, exceptional customer support, and a diverse array of products to meet your investment needs. Moreover, the company takes pride in offering its clients a distinctive advantage – Price Protection, designed to provide both upside and downside investment security. While all investments inherently carry some level of risk, this protection mechanism is intended to instill greater confidence and security in your decision to invest in gold or other precious metals. It serves as a safeguard against the potential swings in the value of your investment, making your retirement savings more resilient to market dynamics.

The available investment options from the company encompass:

- Red Lion Gold Coin

- Red Lion Silver Coin

- 90% Silver U.S. Coin or Junk Silver

- Gold American Buffalo

- Silver Red-Tailed Hawk

- American Palladium Eagle

- American Eagle Platinum

- Silver American Eagle

- Gold American Eagle

- Red-Tailed Hawk

- Silver Sovereign

Despite the restricted range of investment options, it's worth noting that American Coin Co. excels in providing comprehensive IRA-related services. They offer expert guidance through complementary investment consultations and furnish detailed information on how IRA investments function.

As previously mentioned, one aspect that I found limiting in my experience of investing with this firm was the relatively constrained selection of IRS-approved precious metals investment options. Although the company maintains high standards for quality, its offerings in the realm of precious metals IRA investments are somewhat limited.

How to Invest in American Coin Co. IRA?Step-by-step guide for investing in American Coin Co. IRA

To invest in a precious metals IRA through American Coin Co. are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with American Coin Co. to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so.

Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or roll over funds into the new account.

Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as American Coin Co.

Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's essential to get guidance from American Coin Co. in this area.

Place Your Order Once the funds are available in your IRA account, you can call them to order the desired precious metals.

However, I don't recommend opening an IRA with them. Why? Because there are plenty of better options available for you.

Opening a precious metals IRA is a significant decision. That's why I suggest checking out our top gold IRA providers list. You can find the best precious metals dealer in your state and choose accordingly.

American Coin Co. Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

One distinctive feature that truly distinguishes American Coin Co. and has provided its customers with peace of mind during a real-life scenario is its exceptional price protection policy. In a recent investment he made in gold and silver through them, he encountered an unexpected market dip within just seven days, causing a decline in the value of his assets.

However, he thanks to their remarkable price protection policy, he was promptly compensated for the difference in value. They expediently delivered additional metals to offset the price decrease. It's worth highlighting that this invaluable service is exclusively available for approved investment accounts, making American Coin Co. a compelling choice for your precious metals investments.

Enjoy 100% Free Insured Shipping:

If you prefer to have your precious metals shipped to your chosen address, American Coin Co. offers this option at no cost.

In addition to providing third-party depository services, the company allows you to personally store your precious metals IRA at an IRS-approved location.

Furthermore, this delivery service is not only 100% free but also insured for your peace of mind.

With a self-directed American Coin Co. account, there are no management fees. If you opt to use their preferred custodian, Accuplan, you won't be charged custodial fees either. American Coin Co. covers all application fees and startup costs as part of its commitment to transparent and cost-effective services.

The actual cost of gold and silver purchases may vary based on current spot prices and market rates for premium coins. American Coin Co. maintains transparency by disclosing their ask-to-bid differential on purchases, fees, and transaction statuses.

For depository storage, fees typically amount to around $200 per year, though some clients may qualify for a no-fees-for-life arrangement with American Coin Co.

Companies like Augusta charge ZERO fees for up to 10 years, allowing you to choose your gold & silver. American Coin Co. on the other hand provides fewer options.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

US Money Reserve BBB

US Money Reserve has been in operation since 2001. It has since grown to become a well-known supplier of official precious metal items, specialising in gold, silver, and platinum coins.

The company is dedicated to offering excellent customer service and education to its clients. However, the purpose is to assist people in diversifying their investment portfolios and safeguarding their capital through precious metals.

Precious metals, like gold and silver, typically make attractive investments since their value typically increases over time. Online, there are many reputable sellers to choose from who can provide you with high-quality goods and services.

Many businesses provide services, such as U.S. Money Reserve. So that you can be sure you are getting the greatest service, you need to pick the one that most satisfies your demands. This analysis will examine U.S. Money Reserve to determine whether it will meet your demands or not.

In this article, we will look into US Money Reserve BBB reviews and see if any customers have filed complaints.

For a detailed review, check out: US Money Reserve Reviews

US Money Reserve BBB: Is US Money Reserve Legit?

The million-dollar question: Is US Money Reserve legit? A trustworthy and legal business in the precious metal sector is US Money Reserve. Several important considerations lend credence to their credibility.

Firstly of all, they have been in business for close to 20 years, solidifying their position as an industry leader. Their longevity attests to their capacity to deliver dependable services and goods over a protracted period of time.

Second, a substantial endorsement of their reliability comes from the fact that they are a US Mint-authorized dealer. The US Mint's strict standards have been met, and they are now qualified to distribute government-issued precious metal items including gold, silver, and platinum coins.

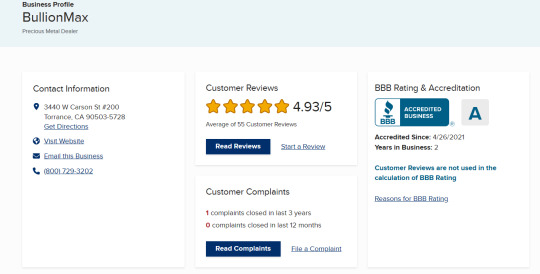

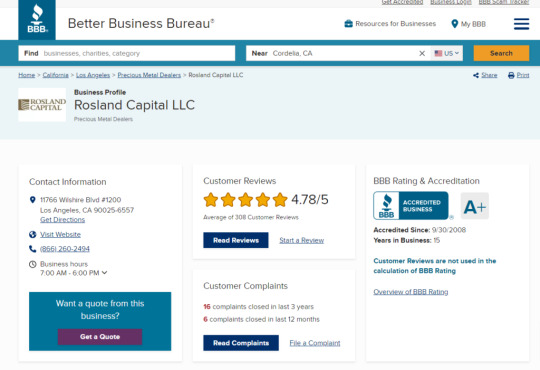

US Money Reserve has a 3/5 star and A+ rating on Better Business Bureau based on 53 customer reviews and 22 complaints.

The company has been accredited since April 20, 2020, and US Money Reserve has been in business for almost 21 years, according to the BBB.

The Better Business Bureau (BBB) rating is a reliable indicator of a business's dependability. This clearly demonstrates their dedication to providing excellent customer service.

A Closer Look at the Products of US Money Reserve

Understanding their product offers is crucial for our "US Money Reserve review," which is the core of this article. They provide a wide variety of gold, silver, and platinum items, including certified coins and bullion.

These government-issued coins and bars are guaranteed for their purity, weight, and content, giving the investor additional piece of mind.

US Money Reserve BBB: Conclusion

US Money Reserve might be a good choice for baby boomers or anyone thinking about investing in precious metals. They are a reliable option for people looking to diversify their investment portfolios and safeguard their cash with precious metals due to their knowledge and reputation in the market.

Their dedication to upholding high standards of customer service and ethics is further reinforced by their A+ BBB rating. They are renowned for providing a variety of items and giving special attention to client support and education.

It's important to note, nevertheless, that some potential consumers might find US Money Reserve's lack of online pricing and purchasing choices to be a deterrent. In the current digital era, many investors value the simplicity of online transactions and the simplicity of pricing comparison. Some people might look into other businesses that provide online shopping options as a result of this restriction.

Prospective investors should do extensive research before investing, regardless of the route they choose. Before making any decisions, it is crucial to comprehend the precious metals market, take into account one's own financial problems, and establish investing goals.

Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list.

You can check it out to see what the industry’s best has to offer.

On the other hand, you can also check out the top provider of your state below:

Read the full article

0 notes

Text

Is GoldSilver.com a reputable company?

GoldSilver is a New York-based bullion dealer. Their address is 750 Third Avenue, Suite 702, New York, NY 10017. Likewise, their phone number is +1 888-319-8166.

Since 2005, the company has provided customers with precious metals IRAs and products. Mike Maloney, a well-known financial influencer, founded it.

GoldSilver's services as an online precious metals holding company include secure storage, a choice of account settings, and a huge selection of gold and silver products.

In this article, we will examine, whether Is GoldSilver.com a reputable company?

For a detailed review, check out: GoldSilver.com Reviews

Management and credentials of the business

Mike Maloney, the company's CEO and founder, is key to its success. He is a well-known authority on gold and silver investing, a best-selling author, and the host of a financial online series. His background in financial planning lends credibility to GoldSilver.com and sets it apart from other precious metals dealers.

Storage Alternatives

One of gold's unique features is its independence from international banks and adequately insured vaults. This ensures the safety of consumers' assets and decreases the likelihood of taxation or government seizure.

Customers have exclusive access to their metals in their storage facilities due to their segregated storage practices. Vault management is handled by reputable firms with offices in Dallas, Salt Lake City, and other places, such as International Depository Services Group and Brinks.

GoldSilver.com Products

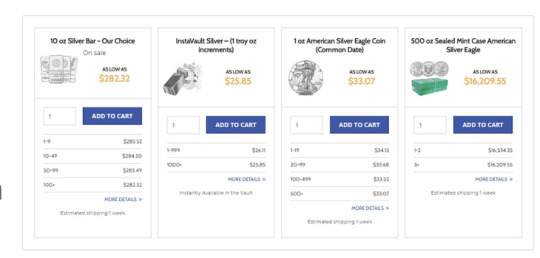

In comparison to many of its rivals, GoldSilver.com provides a wide range of options for buying gold and silver bullion.

Gold bars from one gram to one kilogram, including a gigantic 400-ounce gold bar, are available for purchase by customers. The business acquires bullion from authorized government mints, providing products that conventional government holdings don't often offer.

In addition to offering silver coins such as the American Eagle, Canadian Maple Leaf, Britannia, Austrian Philharmonic, and South African Krugerrand, we also provide gold coins like the Australian Kangaroo, American Eagle, and American Buffalo. There are several sizes of silver bars available, going up to 100 ounces.

GoldSilver.com Fees

Segregated and allotted storage are the two alternatives that GoldSilver.com provides. Despite being less expensive, allocated storage does not maintain holdings apart from one another.

Customers are required to pay a minimum monthly charge of $4 for the assigned storage cost, which is calculated as 0.06 percent of the account balance.

A minimum threshold of $35 per month is required for segregated storage with exclusive access to metals, and any excess holdings will incur fees of 0.08%. Even though Goldsilver's prices are fairly reasonable, some clients might prefer flat fee structures for accounts with bigger balances.

Service Fees

GoldSilver.com offers two storage choices: segregated storage and allotted storage. Even while allocated storage is less expensive, it does not maintain holdings apart from one another.

The monthly cost of allotted storage is equal to 0.06% of the account value, with a minimum charge of $4. Segregated storage with exclusive access to metals mandates customers to fulfill a minimum threshold of $35 per month, and holdings exceeding this minimum attract an additional fee of 0.08%.

Despite the fact that Goldsilver's rates are fairly reasonable, certain clients might prefer flat charge arrangements for higher-value accounts.

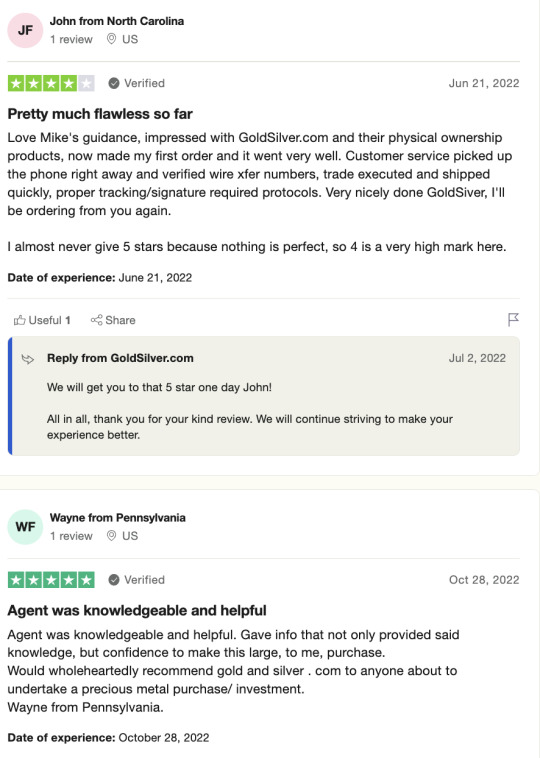

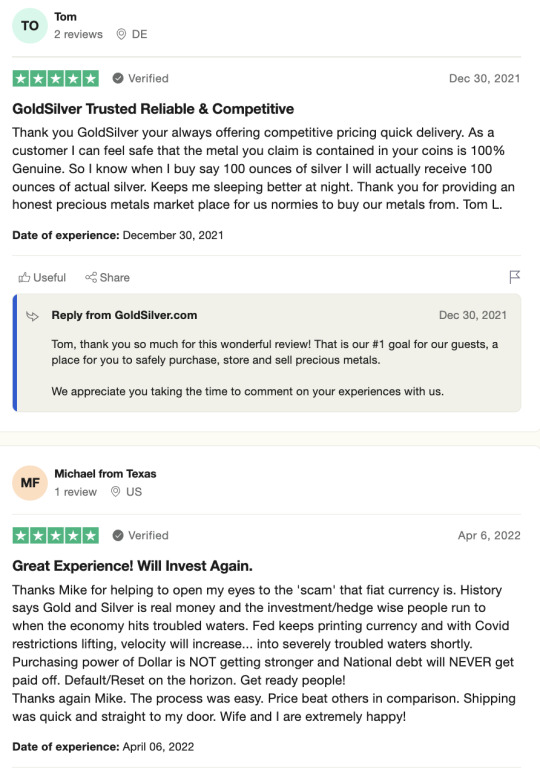

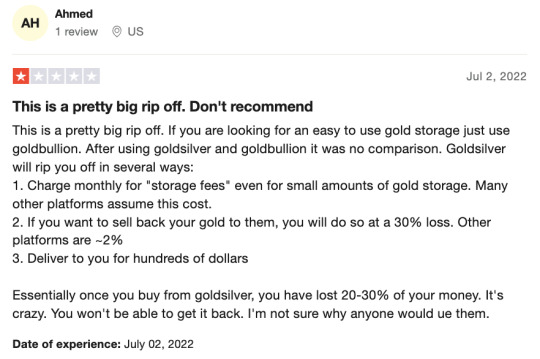

Is GoldSilver.com a reputable company? Customer Reviews

Below are a few GoldSilver.com customer reviews on Trustpilot:

Summary

A well-known online retailer of precious metals, Is GoldSilver.com a reputable company? Yes, it is as it provides a wide selection of goods and safe storage choices. Even though it is not a fraud, several unfavorable comments point out areas for improvement, like order processing and communication. When picking a dealer, you might also take the company's out-of-stock circumstances and pricing competition into account.

A respected precious metals dealer with a wide range of goods and storage choices, GoldSilver.com is supported by Mike Maloney's knowledge. Before making purchases, prospective buyers should investigate and take into account competing businesses with better track records and competitive prices.

It would be best to check out our GoldSilver.com review before you make any final decision.

Investing in precious metals can seem difficult. To help you find the best precious metals provider, we have created our top gold IRA companies list.

You can check it out to see what the industry’s best has to offer.

On the other hand, you can also check out the top provider of your state below:

Read the full article

0 notes

Text

Rocky Mountain Coin Inc

What is Rocky Mountain Coin Inc?

Rocky Mountain Coin Inc is a rare coin, money, and precious metals trader located in the centre of Denver, Colorado. Rocky Mountain Coin Inc, founded in 1976, has grown to become one of the country's largest dealers. Managing annual transactions involving millions of dollars in coins, banknotes, and precious metals.

In addition to coins, Rocky Mountain Coin also buys and sells gold jewellery, pre-owned Rolex watches, and various other valuables. RMC is also a leading reseller of Garrett and Minelab metal detectors in Colorado.

Rocky Mountain Coin Inc has always operated under the tenets of fairness and integrity. Proudly upholding a reputation for great service, knowledge, and unrivalled professional standards.

Rocky Mountain Coin Inc is the destination for investment in retirement saving options. Whether you are a collector of rare coins or uncommon currencies or investing in physical assets.

The company trades every day at the most affordable pricing. Perhaps you would like to sell and transform into cash a collection of antique rare coins, money, or bullion. You might choose to invest in precious metals or start a collection of rarer coins.

Rocky Mountain Coin Inc will provide you with a great bargain and a wide variety of bullion goods to pick from. In the state of Colorado, Rocky Mountain Coin Inc is the biggest of its kind. Their business moves goods often, so there is always something new in our stores. Ro

The American Numismatic Association (ANA), Numismatic Guaranty Corporation (NGC), Professional Coin Grading Service (PCGS), and Industry Council for Tangible Assets (ICTA) are among the other professional numismatic associations that Rocky Mountain Coin Inc belongs to. Additionally, the Better Business Bureau has given Rocky Mountain Coin an A+ rating.

For detailed information Read Rocky Mountain Coin Reviews.

Rocky Mountain Coin Inc- Coins

Rocky Mountain Coin Inc actively buys and sells these things every day and has thousands of rare and valuable U.S. And international coins that date from antiquity to the present era in RMC inventory.

The company welcomes people’s calls whenever they have questions. Regardless of where people are in Colorado, the United States, or the rest of the world. Rocky Mountain Coin Inc experienced professional numismatists are happy to help people in all honesty and integrity and without pressure.

Rocky Mountain Coin Inc- Currency

From the Ming Dynasty to the present, Rocky Mountain Coin Inc stocks hundreds of rare and collectible pieces of American and international paper money.

Economic factors during the American Civil War caused a shortage of gold and silver coins. Which were therefore hoarded for their bullion worth rather than their face value. The U.S. Treasury developed fractional currency to fend against currency speculation (and to provide a way of giving out little change). The 3, 5, 10, 15, 25, and 50 notes were initially given as postal currency to be exchanged for postage stamps between 1862 and 1876.

National Bank Notes

National banks chartered by the US government issued banknotes denominated in US dollars known as National Bank Notes. The bonds that the bank placed with the US Treasury often served as the notes' security. In addition, banks had to have a redemption reserve in gold or "lawful money" equal to 5% of any outstanding note balance. Although not generally accepted as legal cash, the notes were enough for almost all payments to and by the federal government.

The United States government discontinued the use of National Bank Notes as a form of currency in the 1930s, when silver certificates, Federal Reserve Notes, and United States Notes replaced them.

Gold Certificates

Instead of storing the actual gold, gold owners hold a gold certificate as proof of ownership. It has historical significance as American paper money (1863–1933) as well as contemporary significance as a means of investing in gold.

For gold that is allotted (non-fungible) or unallocated (fungible or pooled), banks may issue gold certificates. In the case of a run on the gold on deposit at the issuing bank, unallocated gold certificates, a type of fractional-reserve banking, do not ensure an equal exchange for metal. Although it might be challenging to tell whether a bank is inappropriately allocating a single bar to many parties, allocated gold certificates should be associated with particular numbered bars.

Silver certificates

Silver certificates are a sort of representational currency that was circulated in the United States between 1878 and 1964. They were created in response to public outrage over the Fourth Coinage Act, which effectively put the US on the gold standard, and in response to public demand for silver.

The certificates could be redeemed for their face value in silver dollar coins at first, and then (for a year, from June 24, 1967, to June 24, 1968) they could be redeemed for pure silver bullion. Although they are no longer acknowledged as legal tender because they can only be redeemed for Federal Reserve Notes after 1968, they are still valid legal tender at face value.

Large-size silver certificates

Large-size silver certificates (1878 to 1923) were issued initially in denominations from $10 to $1,000 (in 1878 and 1880) and in 1886 the $1, $2, and $5 were authorized. In 1928, all United States bank notes were re-designed, and the size reduced. The small-size silver certificate (1928–1964) was only regularly issued in denominations of $1, $5, and $10. The complete set is part of the National Numismatic Collection at the Smithsonian’s National Museum of American History.

Federal Reserve Bank Notes

Banknotes that were printed between 1915 and 1934 that are still accepted as legal tender in the US include United States Notes, Silver Certificates, Gold Certificates, National Bank Notes, and Federal Reserve Notes. They were outlined in the Federal Reserve Act of 1913 and were equal in value to other notes of a like denomination. In contrast to Federal Reserve Notes, Federal Reserve Bank Notes are backed by just one of the twelve Federal Reserve Banks, as opposed to all of them combined.

Transparency is Important

National Bank Notes were intended to be replaced with Federal Reserve Bank Notes, but this did not turn out to be the case. They were issued by Federal Reserve banks as opposed to National Banks but were backed similarly to National Bank Notes by U.S. bonds. Federal Reserve Bank Notes are no longer printed; since 1971, only Federal Reserve Notes have been in circulation in the United States.

Large Size Federal Reserve Bank

First released in 1915 in denominations of $5, $10, and $20, large-size Federal Reserve Bank Notes shared design cues with both the Federal Reserve Notes and the National Bank Notes of the time. In 1918, additional $1, $2, and $50 bills were printed as a temporary replacement for Silver Certificates, which the Pittman Act had temporarily banned from use.

Small Size Federal Reserve Bank Notes

In 1933, small-size Federal Reserve Bank Notes were manufactured on the same paper stock as 1929 National Bank Notes as a temporary emergency issue. They were printed in amounts ranging from $5 to $100. A National Bank Note features a line for the president of the national bank to sign, but as Federal Reserve Banks had governors rather than presidents, this line was printed as a bar on the lesser size Federal Reserve Bank Note.

After the sentence "Secured by United States bonds deposited with the Treasurer of the United States of America," the words "Or by like deposit of other securities" were added.

The public's hoarding of currency as a result of numerous bank failures that were taking place at the time led to this emergency note issue. The National Banks' capacity to produce their own notes was likewise constrained by this.

Federal Reserve Bank Notes in small size stopped being printed in 1934 and haven't been available in banks since 1945. They contain brown seals and serial numbers, just like the vintage National Bank Notes, which are modest size notes. Although they have the same wording "National Currency" at the top of the obverse and a very similar appearance, the bills were issued by different entities and are thought to be of entirely different kinds.

Federal Reserve Notes

The United States dollar is now printed on Federal Reserve Notes, often known as United States banknotes. The Federal Reserve Act of 1913 authorizes the United States Bureau of Engraving and Printing to print the notes. And at the Board of Governors of the Federal Reserve System's discretion, to issue them to the Federal Reserve Banks. The notes are subsequently distributed by the Reserve Banks to their member banks. At which time they are converted into Reserve Bank liabilities and US debt.

The words "this note is legal tender for all debts, public and private" are printed on each Federal Reserve Note, making them valid forms of payment. They took the place of National Bank Notes, which national banks issued between 1863 and 1935. With permission from the US Treasury. The Federal Reserve Banks guarantee financial assets as collateral for the notes. Mostly Treasury securities and mortgage agency securities, which they buy on the open market with fiat money.

United States Notes

From 1862 through 1971, the United States issued United States Notes, sometimes referred to as Legal Tender Notes. They were released for a longer period of time than any other type of U.S. paper money, lasting 109 years. The name "greenbacks" came from the older greenbacks, the Demand Notes, which they succeeded in 1862. They are frequently referred to as Legal Tender Notes. Although the First Legal Tender Act, which approved them as a form of fiat money, was renamed the United States Notes. In the 1860s, the notes' alleged second duty read as follows on the back:

This Note is payable in repayment of all loans made to the United States and is a legal tender for all debts, public and privat. With the exception of duties on imports and interest on the public debt.

When compared to contemporary American currency, United States Notes issued in the large-size format prior to 1929 look very different. But those issued in the small-size format beginning in 1929 look very similar to modern Federal Reserve Notes of the same denominations, with the exception of having red U.S. Treasury Seals and serial numbers in place of green ones.

The United States still recognizes existing United States Notes as legal tender; however, since no new United States Notes have been created since January 1971. They are become harder to find in circulation and are worth more as numismatic collectibles than their face value.

Bullion

If you're thinking about investing in silver or gold, visit Rocky Mountain Coin in Denver, Colorado, and Greenwood Village. We have been buying and selling gold, silver, and platinum coins and bars since 1976. Because we are one of the largest precious metals merchants in the country, you can expect affordable rates.

Rocky Mountain Coin Inc stocks thousands of bullion items because RMC is Colorado's largest precious metals exchange. If you're a Denver resident, From Littleton, Englewood, Arvada, Aurora, Centennial, or any other metropolis. You can reach RMC’s Denver or Greenwood Village store in about 30 minutes by car.

>>>Get in touch with the #1 rated gold IRA company of 2023

Read the full article

0 notes

Text

BullionMax Rating

What is BullionMax?

BullionMax is a company that provides trading services with the intention of selling precious metals. The platform of the organization provides trading services for precious metals such as gold, silver, platinum, and palladium. Providing clients with the ability to purchase gold coins, silver coins, platinum bars, and other related products directly from the manufacturer.

A subsidiary of the parent firm J M Bullion, a Dallas, Texas-based operator of an online precious metal retailer, is BullionMax. The company works directly with mints and distributors to provide customers. With insured bullion delivered discretely to doors throughout the USA. It also offers physical gold and silver items, including bars, rounds, and coins.

To build a business that is focused on the client experience, BullionMax invests in top-notch customer service, innovation, and leadership. This will provide their clients with a sense of assurance that BullionMax will fulfil their commitment to them.

BullionMax’s primary goal is to create lasting client connections by providing value. Through reasonable pricing, simplicity of use, a wide range of products, and individualized service. A secure portfolio, in BullionMax's opinion, must include investments in precious metals. BullionMax makes investing convenient, secure, and safe.

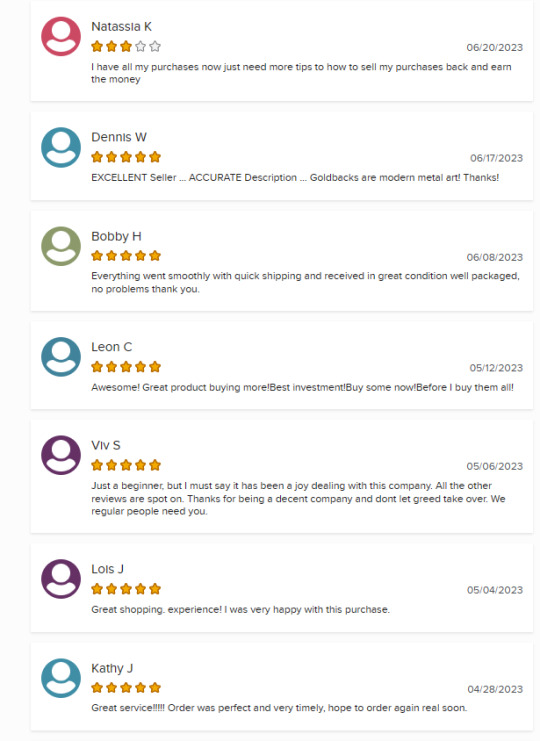

In this article, we will look into BullionMax Rating on BBB as well as on other rating platforms.

For detailed information read BullionMax Reviews.

BullionMax Rating

BBB- Better Business Bureau

Founded in 1912, the Better Business Bureau (BBB) is a private, nonprofit organization. The International Association of Better Business Bureaus (IABBB) in Arlington, Virginia. Coordinates the work of 97 separately incorporated local BBB organizations around the United States and Canada to advance marketplace confidence.