Text

Faltering Thursday (Again) – Trump Tantrum Spooks Markets

Faltering Thursday (Again) – Trump Tantrum Spooks Markets

Faltering Thursday (Again) – Trump Tantrum Spooks Markets

Courtesy of Phil of Phil’s Stock World

The President is losing it.

Yesterday, he invited the House and Senate Democrats to meet with him to discuss Infrastructure and they had been discussing $2Tn worth of it but, when they showed up, Trump demanded they drop their investigations or he would not spend any money on infrastructure – even…

View On WordPress

0 notes

Text

Faltering Thursday (Again) – Trump Tantrum Spooks Markets

Courtesy of Phil of Phil’s Stock World

The President is losing it.

Yesterday, he invited the House and Senate Democrats to meet with him to discuss Infrastructure and they had been discussing $2Tn worth of it but, when they showed up, Trump demanded they drop their investigations or he would not spend any money on infrastructure – even though it’s something America desperately needs action on.

Trump is not above holding America hostage to get what he wants – he shut the Government down for 35 days last year just to get funding for his wall and, so far, $1.57Bn has bought America 1.7 Miles of fence. President Donald Trump also commented on the progress of the wall construction on Twitter Wednesday, saying “tremendous work is being done.”

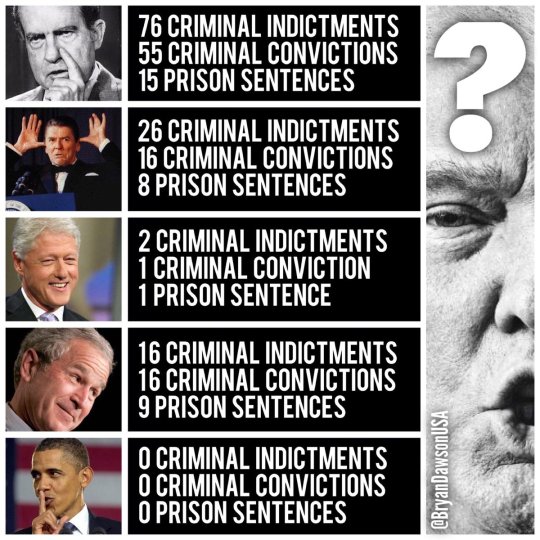

The Democrats did not agree to stop investigating Russian Interference into the US Elections which happens to also include potential charges of collusion and obstruction of justice on behalf of the President and his inner circle. One could say Trump’s actions yesterday were obviously yet another attempt to obstruct justice by threatening people involved in an ongoing investigation but, regardless of that – this man is clearly not acting rationally and, unfortunately, he’s our President.

It’s interesting that Trump is complaining about the Mueller Investigation costing $35M (his estimate, not a fact) when Trump has spent $102M of the taxpayers’ money playing golf in the past two years – and that is a FACT. In fact, Mueller has already collected $47M in fines so there’s a $12M+ PROFIT from the investigation, not to mention that there have already been 37 people indicted for criminal activity including 26 Russians who interfered with our Democracy and, so far, 7 people have already pled guilty, including several who were serving directly under the President.

youtube

I know people don’t like to talk about politics on investing sites but this is serious stuff, folks! When this happened yesterday I told our Members to “GET OUT!!!” of the markets as this was clearly going to lead to some serious selling as, if nothing else, we have a completely dysfunctional government which will be doing nothing to address many, many critical things AND we’re on a footing to start a war in Iran, threatening Venezuela, in a Trade War with China AND our economy is clearly slowing – how many more things will it take before people start selling in May and going away?

I talked about all this stuff in the Webinar so you can check out the replay here. Also, despite being down $1,000 per contract with an average entry of $1.9515 now, we’re still holding long on Gasoline (/RBN19) and we just added oil (/CL) at $60 as a long, but no conviction there and tight stops below the line. A lot of our premise to hold is based on the timing of the EIA Petroleum Status Report, which ended on the 17th and came in too soon to see the effects of the holiday weekend demand AND there’s a massive math error in the Total Petroleum Stocks:

There’s 23.5M barrels LESS oil than indicated – that’s quite a big difference and, while it does nothing to change the weak demand picture that’s very obvious (we import less and export more and still we have a surplus), it does mean we don’t have the kind of glut traders are fearing. However, this morning the NYMEX traders are dumping their remaining /RBM19 contracts, which expire on Tuesday and that and the strong Dollar (98.06) are putting downward pressure on commodities.

Despite that pressure, Silver (/SI) is hitting our $14.60 goal this morning from our featured play in Tuesday Morning’s PSW Report and an 0.25 gain on Silver Futures is good for $1,250 PER CONTRACT – not bad for a newsletter you can subscribe to for $3/day, right?

We are, of course, taking the money and running here – it’s very important not to get greedy – especially in Futures trades as they can go down as quickly as they go up. It’s surprising we got this high with the Dollar over 98, so consider it a gift and move on.

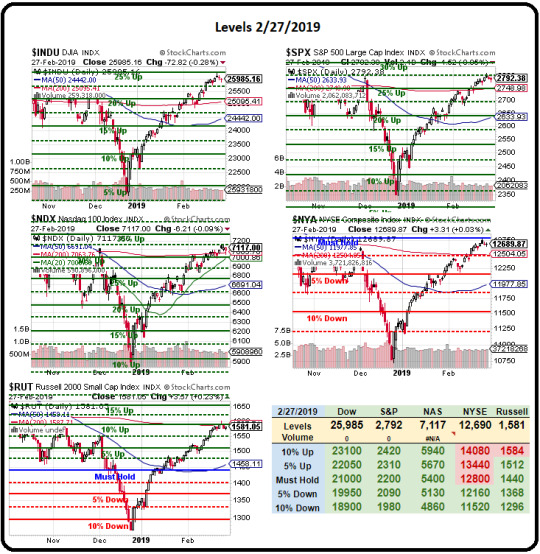

Meanwhile, the S&P (/ES) is firmly below 2,860 and the Dow (/YM) is just over the weak bounce line at 25,450 so, if it fails that – GET OUT!!! (or at least short /YM at that line with tight stops above) as it has another 250 points to go before it catches up with the other indexes at the 5% correction line. As I said yesterday morning, we were taking the “rally” with a huge grain of salt and now we’re in BIG TROUBLE if the NYSE fails it’s 200-day moving average at 12,500 and we’ll be really close at the open – so watch that line very closely.

The volume is so low this week that none of it matters but these big trend-lines can be self-fulfilling prophesies so we’ll be paying attention to what lines get broken and what sticks. Oil is already down to $59.50 and that’s going to be a huge disappointment in the Energy Sector (and our Futures Trades) but we’re giving it a day pass with the Dollar soaring to 95.20, even as I write this.

Be careful out there!

Faltering Thursday (Again) – Trump Tantrum Spooks Markets was originally published on MarketShadows

0 notes

Text

Monday Market Mayhem - Trade Lies Unravel and Take the Market with Them

Monday Market Mayhem – Trade Lies Unravel and Take the Market with Them

Courtesy of Phil of Phil’s Stock World

Well it turns out everything the White House said on Friday was BS.

That’s not too surprising but the market is acting like it’s surprised now that China has stated that no progress was made last week and there are no further meetings scheduled and now the White House is trying to spin the G20 Meeting in June as a summit between Trump and Xi because Xi WILL…

View On WordPress

0 notes

Text

Monday Market Mayhem - Trade Lies Unravel and Take the Market with Them

Courtesy of Phil of Phil’s Stock World

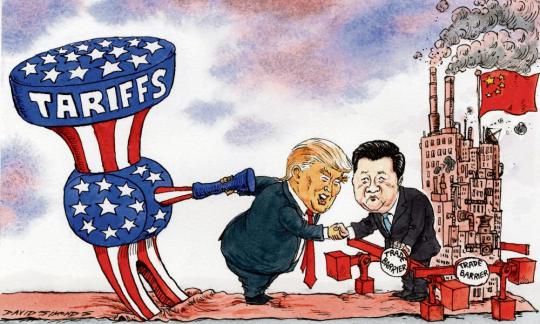

Well it turns out everything the White House said on Friday was BS.

That’s not too surprising but the market is acting like it’s surprised now that China has stated that no progress was made last week and there are no further meetings scheduled and now the White House is trying to spin the G20 Meeting in June as a summit between Trump and Xi because Xi WILL be there and Trump WILL be there but, at the moment, it doesn’t seem like Xi is very eager to speak to Trump, especially after Trump was blatantly insulting in his weekend tweet-storm:

Donald J. TrumpVerified account @realDonaldTrump May 11

I think that China felt they were being beaten so badly in the recent negotiation that they may as well wait around for the next election, 2020, to see if they could get lucky & have a Democrat win – in which case they would continue to rip-off the USA for $500 Billion a year….

Donald J. TrumpVerified account @realDonaldTrump 1h1 hour ago

I say openly to President Xi & all of my many friends in China that China will be hurt very badly if you don’t make a deal because companies will be forced to leave China for other countries. Too expensive to buy in China. You had a great deal, almost completed, & you backed out!

Donald J. TrumpVerified account @realDonaldTrump 1h1 hour ago

..There will be nobody left in China to do business with. Very bad for China, very good for USA! But China has taken so advantage of the U.S. for so many years, that they are way ahead (Our Presidents did not do the job). Therefore, China should not retaliate-will only get worse!

Donald J. TrumpVerified account @realDonaldTrump 57m57 minutes ago

The unexpectedly good first quarter 3.2% GDP was greatly helped by Tariffs from China. Some people just don’t get it!

Keep in mind that Trump and Xi haven’t actually spoken – THIS is how the President of the United States of America communicates with the World’s second-largest super-power regarding a very delicate issue. Now that we have China’s side of the story, it turns out everything the White House told us on Friday was a lie and there was ZERO progress made at last week’s trade talks – which is not surprising as Trump blew them up earlier in the week by suddenly imposing tariffs and threatening China with more tariffs. According to the WSJ:

By then, though, the U.S. team went into the talks not expecting to do a deal, figuring they would have a “non-meeting,” according to one person briefed on the discussions. U.S. officials at least wanted to make sure they didn’t leave with a complete break. The goal of the meeting was to be able to say the U.S. negotiators were still trying, this person said.

The goal of the meeting was to PRETEND negotiations were going well – that was the GOAL of the meeting – to lie to the American people and to fool market investors into buying stocks based on Government LIES. Is this really what you voted for?

We’re certainly going to re-test last week’s lows but I’ll be surprised if they hold as we are looking at enough evidence now to support a 10% and possibly even another 20% correction based on the complete breakdown of trade discussions and Trump went full-blown psycho on Saturday, saying China was “badly beaten” and threatening that the deal would be “far worse” for them if they wait until he is re-elected to concede to his trade demands.

Donald J. TrumpVerified account @realDonaldTrump May 11

I think that China felt they were being beaten so badly in the recent negotiation that they may as well wait around for the next election, 2020, to see if they could get lucky & have a Democrat win – in which case they would continue to rip-off the USA for $500 Billion a year….

Donald J. TrumpVerified account @realDonaldTrump May 11

….The only problem is that they know I am going to win (best economy & employment numbers in U.S. history, & much more), and the deal will become far worse for them if it has to be negotiated in my second term. Would be wise for them to act now, but love collecting BIG TARIFFS!

There is no reason for the U.S. Consumer to pay the Tariffs, which take effect on China today. This has been proven recently when only 4 points were paid by the U.S., 21 points by China because China subsidizes product to such a large degree. Also, the Tariffs can be…..

— Donald J. Trump (@realDonaldTrump) May 13, 2019

As I have said since day one of these “trade negotiations”, this has never been about making a deal with China but about taxing the poor and middle-class Citizens of THIS country through tariffs, which even Larry Kudlow admitted this weekend was nothing more than a tax on the American people. When you can’t even get Larry Kudlow to back up your BS – your BS must be TOTAL BS!

According to an Oxford Economics estimate, the tariff increase will cost the U.S. economy $62 billion by 2020, breaking down to up to $800 per household. Unfortunately, it costs the same $800 for the household making $25,000 as it does for households making $25M so it’s a very unfair tax on the poor that Trump is using to offset his massive tax cuts to the rich.

8:30 Update: Well China has retaliated with 25% tariffs on $60Bn of US Trade Goods AND China has also said they will stop buying ALL us agricultural products if the US doesn’t reverse their own tariffs – hitting Trump right in the farm belt. This is, of course, bad for Friday’s Soybean Trade Idea but, as I said at the time, it only works if Trump comes through on his promises and, unfortunately, it turned out he was lying through his teeth on Friday – what a shocker!

Meanwhile, we still have plenty of earnings to get through and it’s very possible likely that the White House will lie to us some more to boost the markets and even more likely that there are still idiots who will believe them and buy the markets back up – so all is not lost but watch those levels (also Friday) for failures that will signal a move down at least 5% more.

There will be TEN (10) Fed speakers this week along with Retail Sales, Empire State Manufacturing, Industrial Production, the Atlanta Fed, Housing and Business Inventories – and that’s just tomorrow! More housing and the Philly Fed on Thursday and more stuff on Friday – it’s a busy week and next week is pre-holiday so no one is going to care at all as we roll into Summer 2019 already!

Be careful out there.

Monday Market Mayhem – Trade Lies Unravel and Take the Market with Them was originally published on MarketShadows

0 notes

Text

Faltering Thursday – Tesla’s Big Miss Triggers One of our Great Market Fears

Faltering Thursday – Tesla’s Big Miss Triggers One of our Great Market Fears

By Phil of Phil’s Stock World

This will be a good test.

For a very long time I’ve said that TSLA may be the trigger that takes down the market by forcing investors to re-think the ridiculous valuations they have been giving to these “tech” stocks on the assumption of miraculous future growth. Our PSW Member Portfolios are now TSLA-free but our Hedge Fund still has short positions on the stock,…

View On WordPress

0 notes

Text

Faltering Thursday – Tesla’s Big Miss Triggers One of our Great Market Fears

By Phil of Phil’s Stock World

This will be a good test.

For a very long time I’ve said that TSLA may be the trigger that takes down the market by forcing investors to re-think the ridiculous valuations they have been giving to these “tech” stocks on the assumption of miraculous future growth. Our PSW Member Portfolios are now TSLA-free but our Hedge Fund still has short positions on the stock, which will open down about 10% this morning, back around the October lows.

Tesla jumped the shark last August, when Elon Musk claimed he had the funding to take the company private at $420/share, prompting me to write: “Wednesday’s Whopper – Musk Claims Some Idiot Offered Him $420/share for Tesla!”

I didn’t need weeks or even days to know Musk was full of crap because $420 valued TSLA at $72Bn and I know all the rich idiots from my M&A days and none of them are stupid enough to pay $72Bn for an unprofitable car company so our trade idea was:

Let’s take Elon at his word and sell 2 TSLA Jan $420 calls for $23 ($4,600) in the STP and buy 3 Jan $450 ($100)/420 ($79) bear put spreads for $21 ($6,300). That’s net $1,700 on the $9,000 spread.

Needless to say, we collected our full $9,000 for $7,300 (429%) and we got another chance to short them over $360 in December and now we’re back to the bottom and we’ll see if there are any dip buyers left or perhaps they are finally tired of being burned by Elon Musk’s BS. If so, it could be the beginning of the end for all the high-valuation Nasdaq companies that are being supported by similarly irrational investors.

I’m not going to autopsy their delivery report – it’s just what we thought it would be and you can open any paper and read that (yes, I said paper – I’m an old man!) but I will point out that you should notice the continuing pattern of qualifiers from TSLA that sound like the excuses of a child who turns in an incomplete project at school. “It’s this, it’s that” – on and on with the excuses but how many times do we fall for this nonsense?

The big excuse in this report is that is was HARD shipping Model 3s to China and Europe but, just like when you interrogate an 8 year-old about their excuse – the facts don’t add up. Let’s try to remember that TSLA bumped up their valuation by claiming they had orders and deposits for about 500,000 Model 3s yet, INCLUDING the 60,000 they shipped this quarter, TSLA has only delivered 221,517 to date. If they REALLY have 500,000 deposits in North America – why are they shipping speculative sales to China and Europe?

It’s not so much the production glitches or the slow sales that keep us short on TSLA – it’s the LYING! Companies are not supposed to lie to investors – it’s a crime. At best, TSLA is lying about their deposits but, if they are lying about deposits, are they also cooking the books to cover up the lies? That’s a much more serious crime, no wonder Musk is trying to escape to Mars before this all hits the fan.

If it’s uncovered that TSLA never had 500,000 deposits for Model 3s or that they took the deposits in bad faith, having no ability to deliver the cars as promised – then they defrauded the investors who bought the company’s stock up from $260 to $360 (and $260 was ridiculous anyway) for about $20Bn in losses. Even without worrying about the potential crimes and cover-ups, we’re still looking at a car company that’s delivering just 63,000 cars in their 64th quarter of operation (founded 2003) and they are STILL LOSING MONEY on each car they deliver. How does that justify a $50Bn valuation?

We had a valuation discussion way back on May 4th, 2017 and, at the time, I said they weren’t worth $300/share telling our readers at Seeking Alpha, where we were sharing our amazingly profitable Options Opportunity Portfolio, that we’d be better off buying GM instead and our Trade Idea there was:

Meanwhile, General Motors , a company that MADE $2.6 BILLION in PROFITS in Q1 (that’s right, TSLA’s entire sales, in profits alone!) is still being valued lower than TSLA and it’s just as ridiculous today as it was a month ago when I laid out the following bullish GM options spread idea:

Sell 10 GM 2019 $32 puts for $4.25 ($4,250)

Buy 25 GM 2019 $28 calls for $7.25 ($18,125)

Sell 25 GM 2019 $35 calls for $3.60 ($9,000)

That spread had a net cash entry of $4,875 and the 10 short puts required about $4,000 of ordinary margin and, as we expected, GM closed at $37.78 on Jan 22nd (the expiration day) and the spread paid back $17,500 for a gain of $12,625 (258%) in 20 months. You don’t have to put your money into idiotic momentum stocks to make great returns – simply using options spreads to leverage the return of blue chip stocks can give you fantastic gains and, when a blue chip stock goes down – they usually come back – because, unlike TSLA, they actually MAKE MONEY AND HAVE CASH FLOW!!!

Meanwhile, shorting the Nasdaq (/NQ) Futures at 7,575 is a great way to play the possible sell-off that TSLA may trigger and, of course, we already went over the Nasdaq Ultra-Short Hedges (SQQQ) in Tuesday Morning’s PSW Report.

Faltering Thursday – Tesla’s Big Miss Triggers One of our Great Market Fears was originally published on MarketShadows

0 notes

Text

Testy Tuesday - Trouble at 2,800 - Again!

Testy Tuesday – Trouble at 2,800 – Again!

Courtesy of Phil at Phil’s Stock World

You’re welcome!

In yesterday’s PSW Morning Report (subscribe here) I said:

7,200 on the Nasdaq (/NQ is a good shorting line for today as is 1,590 on /RTY, since that’s the 200 dma – tight stops above!

As you can see, the Nasdaq (/NQ) shorts were good for gains $2,000 for each Futures contract shorted while the Russell (/RTY) fell to 1,565 and that was good…

View On WordPress

0 notes

Text

Testy Tuesday - Trouble at 2,800 - Again!

Courtesy of Phil at Phil’s Stock World

In yesterday’s PSW Morning Report (subscribe here) I said:

7,200 on the Nasdaq (/NQ is a good shorting line for today as is 1,590 on /RTY, since that’s the 200 dma – tight stops above!

You’re welcome!

As you can see, the Nasdaq (/NQ) shorts were good for gains $2,000 for each Futures contract shorted while the Russell (/RTY) fell to 1,565 and that was good for gains of $1,500 per contract – not a bad way to start the week. In case you are wondering – in our Live Member Chat Room, at 12:16, I also called the bottom, saying:

Hopefully that will be it, 2,780 though is a terrible fail of 2,800 and down 100 points on the Nas is a quick $2,000 and /RTY 1,568 should be support but, if not, could see 1,550. Tight stops in any case but I’m happy with these gains!

Keep in mind that we are Fundamental, not Technical Traders. We call these tops and bottoms based mainly on the news cycle – even intra-day and the only Technical Indicator we follow is the 5% Rule™, which we invented to neatly summarize all the TA BS into one simple formula that FUNDAMENTALLY accounts for TA as a factor in our market calls. Turns out, it also does TA better than any other system I’ve seen – but I still think TA is BS.

It doesn’t matter if it’s BS though, because – as long as millions of people follow something – it becomes a Fundamental factor anyway. If crows flying east caused people to sell Apple, we’d be tracking crow migration as a Fundamental Indicator but not enough people trade on crows to make it relevant but enough people follow Elliot Wave, Ichimoku Clouds, Bollinger Bands, etc. to make it a signal we do pay attention to. When we see the news flow coincide with support-resistance lines for Technical Traders – THAT is when we like to make our Futures calls.

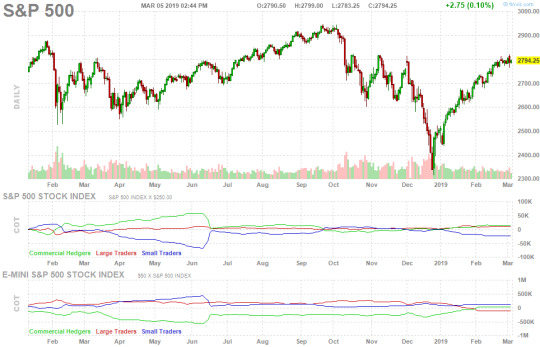

Meanwhile, the big call is WTF is going on with the S&P 500 at 2,800? Yesterday was the 4th time since October we’ve been rejected at that line and, earlier last year, it failed on 4 other occasions so we’re 1 for 9 crossing over 2,800 for more than two weeks in the last 52 weeks – that’s NOT GOOD!

As you can see, almost all the rejections sent us down 100-200 points so let’s not get too bullish as all we got yesterday was a bounce off the fall from 2,820 on Monday to 2,770 yesterday so that’s 50 points and that means, per the Fabulous 5% Rule™, that we can expect 10-point bounces to 2,780 (weak) and 2,790 (strong) so now we’re watching 2,790 as the fail line and, if we can’t hold that, we’ll be back to 2,770 and likely on the way to a full 1.25% pullback from 2,800 to 2,765 and, failing that, the next stop is the 2.5% line at 2,730, which we last tested on 2/15.

Notice how well the 5% Rule is being obeyed. That also tells us that 2,835 is the 1.25% line but we haven’t made that and we are finding resistance at the 0.625% line, which is 2,817.50. We don’t usually bother at that level but it is interesting that that’s exactly where we topped out yesterday, which indicates there is a LOT of technical resistance over 2,800 and it’s going to take a lot more than promises of trade progress to get us over that hump.

That’s why we look for opportunities to go short at that line and not long.

Meanwhile, China has lowered its GDP target (6-6.5%) and instituted $300Bn in Tax Cuts to spur growth, which indicates that currently they are growing at less than 6% and feel they need Tax Cuts to get there. China is also attempting to boost an already strong market because it too is run by Oligarchs who are extracting the wealth of the country to line their own pockets – who says we don’t have a lot in common?

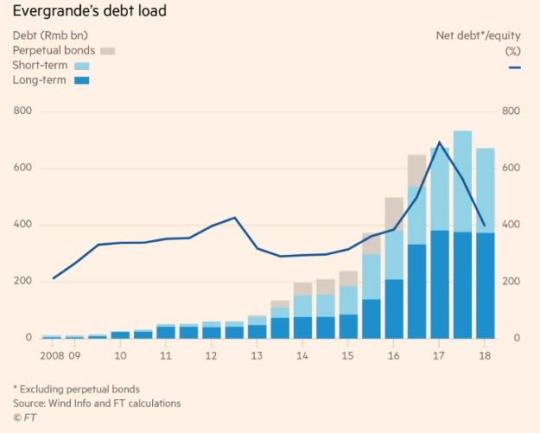

As in the US, the Chinese tax cuts will primarily boost Corporate Earnings and, as you can see from this chart, Corporate Debt in China is around 200% of their GDP and, if that ever hits the fan, there isn’t enough Yuan in the World to fix the flood of defaults that will sweep across Asia and China knows this – and fears it.

China’s largest property developer, Evergrande, which is owned by China’s 2nd richest person, Hui Ka Yan, announced they would be discounting their properties by 10% after home sales collapsed in January. This is beginning to look like the US S&L Crisis under Bush the First as Evergrande recently sold $1.8Bn of 5-year notes for 13.75% based on the assumption that anything they bought would go up more than that in value. Turns out the assumption was flawed…

Overall, Evergrande has $208Bn in liabilities, including $43Bn maturing this year and they can’t keep borrowing at 13.75% to cover it (and Hui had to buy $1Bn worth of the notes himself because no one really wanted to lend Evergrande more money – even at that rate). The company’s debt to equity ratio is roughly 400% and the equity is quickly losing value while the debt piles up.

The fact that China’ largest property developer is now slashing prices across the board by as much as 10%, means that a deflationary hurricane is about to blow across what most see as the most important sector in China’s economy, and worse, should other property developers follow in slashing prices launching a race to the bottom, nobody knows how far prices could truly fall should a liquidation domino effect ensue. China has MASSIVELY overbuilt homes and currently has a 22% vacancy rate – the most in the World.

And yes, that’s right, 12% of the homes in the US are unoccupied – so don’t believe your realtor when they tell you you’d better act fast! That’s 12M empty homes and we have 550,000 homeless people in this country. Gosh, I wish there was some way to figure out a solution but I’m just stumped…

Be careful out there.

Testy Tuesday – Trouble at 2,800 – Again! was originally published on MarketShadows

0 notes

Text

Despacito – How to Make Money the Old-Fashioned Way – SLOWLY!

Despacito – How to Make Money the Old-Fashioned Way – SLOWLY!

By Phil Davis of Phil’s Stock World

Are you ready to retire?

For most people, the purpose of investing is to build up enough wealth to allow you to retire. In general, that’s usually enough money to reliably generate a year’s worth of your average income, each year into your retirement so that that, plus you Social Security, should be enough to pay your bills without having to draw down on…

View On WordPress

0 notes

Text

Despacito – How to Make Money the Old-Fashioned Way – SLOWLY!

By Phil Davis of Phil’s Stock World

Are you ready to retire?

youtube

For most people, the purpose of investing is to build up enough wealth to allow you to retire. In general, that’s usually enough money to reliably generate a year’s worth of your average income, each year into your retirement so that that, plus your Social Security, should be enough to pay your bills without having to draw down on your principle.

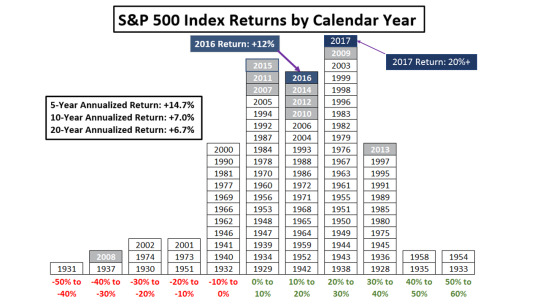

Unfortunately, as the last decade has shown us, we can’t count on bonds to pay us more than 3% and the average return from the stock market over the past 20 years has been erratic – to say the least – with 4 negative years (2000, 2001, 2002 and 2008) and 14 positives, though mostly in the 10% range on the positives. A string of losses like we had from 2000-02 could easily wipe out a decades worth of gains.

Still, the stock market has been better over the last 10 (7%) and 20 years (6.7%) than any other investing vehicle and, if that keeps up, a stock market portfolio may give you the best chance of obtaining a functional retirement. At 7% a year, if you want to generate a $70,000 annual income, you need to have $1M invested but it would be a tragedy if the market dropped 30% and then you had $700,000 and 7% of that is only $49,000 so you have less money coming in AND not enough to live on – keep that in mind when coming up with your “Comfort Number” and, by all means – speak to a Financial Professional who can help you plan by taking into account your own circumstances!

While some investors shy away from stock options because of their reputation for being akin to gambling, we disagree. Stock options are an important tool for supplementing your stock investing. Options, when used correctly and strategically, allow you to “Be the House, NOT the Gambler”. While no one in the casino always wins, the odds favor the dealer. We’ll show you how to structure your investments to keep the odds in your favor, like the dealer in a casino.

youtube

Even if we have a good system for wealth building – it’s still not magic beans. YOU have to do the work and YOU have to make a plan and YOU have to stick to that plan. Despacito Investing is not a free ride – you have to work hard and you have to accept the fact that the money will accumulate SLOWLY but, as we know from our fables – “Slow and Steady Wins the Race.”

To win the retirement race, how do we get to $1M? Well, as you can see from this compound rate table, if we start with $10,000 and collect 6% interest for 40 years, we’ll end up with $102,857 so, to get to $1M, we need to start with $100,000 and collect 6% for 40 years. Of course, if your average salary is $70,000, $100,000 is probably a lot of money but what you can do is start with $20,000 and add $3,500 a year (5% of your salary) and at 7% you would have $1.05M in 40 years (you can play with this calculator to get the idea under various conditions).

That is, of course, at 7%. Should you be able to average 15%, in just 20 years you would have $740,000 and, in 40 years, at that rate, you’ll have $12.5M. THAT is the difference an additional 7% can make! At Philstockworld.com, we try to average closer to 20% annual returns but you don’t make that kind of money just making deposits – you have to learn how to use stocks and options to your advantage…

Our goal is to slowly (not quickly!) accumulate wealth by selecting the right underlying stocks, at the right prices, and devising uniquely-structured option positions with favorable profits to risks metrics. One way to enhance your returns is by using dividend-paying stocks, like AT&T (T), which is back down below $30 as they are buying Time Warner (TWX) and will be doing some restructuring. The company pays a $2.04 dividend, which is 6.5% of the stock price but we can ENHANCE that through options, using the following combination:

Buy 500 shares of T for $30 ($15,000)

Sell 5 T 2021 $30 puts for $4.20 ($2,100)

Sell 5 T 2021 $30 calls for $3 ($1,500)

That nets you into 500 shares of T for $11,400, which is net $22.80 per share. The put contracts force you to buy 500 more shares of T for $30 ($15,000) if T is below $30 at the Jan 15, 2021 expiration date but it can be assigned to you at any time. If that happens, you have your first 500 at $11,400 and another 500 for $15,000 so $26,400 is your net cost of 1,000 shares or $26.40 per share. The “risk” you have selling the short puts is that you’ll end up with 1,000 shares of T at a $3.60 discount (12%) to today’s price.

On the upside, anything over $30 means you’ll get called away, or paid $30 per share for your 500 shares ($15,000) and the short puts expire worthless. And, in either case, you keep the money you collected plus any dividends you collect along the way. In the case of T, that’s going to be $3,600 more than you paid plus 8 dividend payments totaling $4.08 x 500 shares, which is another $2,040 for a net gain of $5,040 in less than two years. That’s 44.2% of the $11,400 you laid out and, even if you have an IRA and have to hold $15,000 in cash for the put sale, it’s still 19% of $26,400 – almost 10% a year!

That’s a very basic, conservative trade using a blue-chip stock that’s very unlikely to hurt you along the way.

We will not only teach you basic trades like this T trade, but more complex trades that can yield better results. A healthy portfolio will have a mix of conservative and risky trades – depending on your financial needs.

Here’s a higher risk/reward trade (for “fun” money, not rent money):

Frontier Communications (FTR) is a regional carrier we feel is undervalued and you can buy that stock for $3, not $30. FTR doesn’t pay a dividend so we don’t need to own the stock. Here, risking owning just $15,000 (5,000 shares) worth of FTR, we can construct the following options spread:

Sell 50 FTR 2021 $3 puts for $1.50 ($7,500)

Buy 100 FTR 2020 $1 calls for $2 ($20,000)

Sell 100 FTR 2021 $4 calls for $1.30 ($13,000)

The net cost of that spread is actually a $500 credit. Your worst case is having to buy 5,000 shares of FTR for $3 ($15,000) so you risk less on assignment than you do with T (but the trade is more risky as FTR COULD go bankrupt while T is not likely to). The upside is tremendous as you make up to $30,500 with FTR at $4. (The math: You’d buy 10,000 shares $1 and sell $10,000 shares at $4 (which is $30,000) but you also already paid $7000 for the spread and collected $7500 for the puts, so you’re ahead $30,000 – $7000 + $7500 = $30,500.)

Even if FTR stays at $3, you are $10,000 in the money for a potential gain of $10,500 which is 1,100% of your $500 cash credit and 72.4% of your $14,500 maximum risk (if FTR were to go bankrupt, all your shares would be worthless).

Of course, we don’t advocate putting ALL your money into the risker trade but putting just 10% of the AT&T risk into FTR would be $3,000 — i.e., selling 10 puts and buying 20 bull call spreads would be a net $100 credit and the upside potential would be $6,100 – that would still double the effective return of the T spread and bring you up to 20% annual returns on the same allocation, if all goes well.

Learning how to use options to enhance your stock portfolio’s returns is both practical and exciting. You only need a brokerage account, the motivation to learn, and the patience to wait for results (as opposed to over-active “trading”). Start SLOWLY, practice with play money, and get a feel for how options work. We’ll help show you how. Ask us questions.

Sign up for our Free newsletter here.

Despacito – How to Make Money the Old-Fashioned Way – SLOWLY! was originally published on MarketShadows

0 notes

Text

GDPhursday – Trump Finally Goes to Vietnam – And Loses

GDPhursday – Trump Finally Goes to Vietnam – And Loses

Courtesy of Phil of Phil’s Stock World

No deal!

Trump called an early end to his long-awaited summit with Kim Jong Un last night, 2 hours before the two were scheduled to have a “joint signing event” to conclude the negotiations. Our deal-maker in chief said they reached an impasse and “We actually had papers ready to be signed, but it just wasn’t appropriate.” Now I guess that sounds fine…

View On WordPress

0 notes

Text

GDPhursday – Trump Finally Goes to Vietnam – And Loses

Courtesy of Phil of Phil’s Stock World

No deal!

Trump called an early end to his long-awaited summit with Kim Jong Un last night, 2 hours before the two were scheduled to have a “joint signing event” to conclude the negotiations. Our deal-maker in chief said they reached an impasse and “We actually had papers ready to be signed, but it just wasn’t appropriate.” Now I guess that sounds fine to a farmer in Iowa but anyone who’s been top management at a company knows that when you schedule a closing for deal and people fly around the World to get it done and then it blows up at the last minute – that there was some seriously incompetent crap happening beforehand.

What really bothers me about North Korea is the implications it has for the China Trade Deal as that may end up not happening just as easily as Team Trump was assuring us up to the last second that North Korea was in the bag and Japan’s Shinzo Abe has already nominated Trump for a Nobel Peace Prize for “Bringing Peace to the Korean Peninsula” – which hasn’t actually been at war for 50 years – but who’s counting. Despite that very low bar of making it through year 51 – Trump has failed – capping off a very bad day where Trump’s lawyer provided Congress with a list of Felonies committed by the President, including: Bank Fraud, Tax Fraud and Campaign Finance Violations.

youtube

My working theory remains that Trump does not want a trade deal with China because he’s taxing AMERICANS hundreds of Billions of Dollars a year in order to balance the tax cuts in his budget. In other words, the tariffs are nothing more than Trump’s way of robbing the poor to give to the rich and, even though Farm Loan Delinquencies have skyrocketed to 19.4% of all loans – despite the $7.7Bn Socialist Government hand-out – yet Trump’s base is still too dumb to connect the dots!

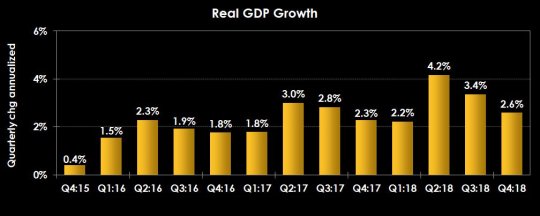

This morning, we see how the overall economy has been affected by the Trade War and it looks like Q4 GDP is coming in at 2.6% – better than the worst case but down 0.8% (23.5%) from Q3s 3.4%. If we can make a deal with China soon (the deadline was March 2nd but has been pushed back to no specific date), then we can expect GDP to rebound but it’s also possible that the number is fake and being used to put pressure on China, allowing Trump to say “See China, we still have 2.6% growth – we can continue the tariffs longer than you can.” This is how Trump negotiates – tricks and lies – something that Michael Cohen explained in great detail yesterday…

And, of course, there’s nothing rich people like doing more than foreclosing on farmers, who have millions of acres of land that is ready to be plowed over and turned into cookie-cutter communities and shopping malls. Trump is a real estate developer and so are most of his friends and family – bankrupting farmers is the best thing he can do to ensure their futures as it will provide them with cheap land they can build on for decades to come.

We’ll keep an eye on this crisis as it develops as well as the GDP data. Many economists expect a more muted pace of growth in 2019 due to weaker global growth and waning effects of 2017’s tax-cut boost, although the U.S. economy still has strong support from low unemployment and rising incomes. The Federal Reserve predicts 2.3% growth in 2019.

Consumer spending, which accounts for more than two-thirds of the economy, rose at an inflation-adjusted, annualized rate of 2.8% in the fourth quarter, pulling back from the third quarter when it rose at a 3.5% rate. While Americans boosted spending on big-ticket items, their spending on services and non-durable goods slowed. Exports rose at a 1.6% rate in the fourth quarter, after a 4.9% decline in the third. The Commerce Department attributed the upturn to petroleum and capital goods exports. The shutdown had little effect on Q4 as it began on 12/22 – it’s the Q1 GDP we should be worried about!

While 2.6% was stronger than expected, we’ll be lucky to break 2% in Q1 and, as I noted, I’m not sure I trust the Q4 numbers as this is only the initial estimate. We’re not over our lines yet and we’re already well-hedged so it’s mostly “Watch and Wait” into the weekend.

Visit me at Phil’s Stock World here.

GDPhursday – Trump Finally Goes to Vietnam – And Loses was originally published on MarketShadows

0 notes

Text

Turn Down Tuesday - Trump Crimes and Fed Testimony Reverse the Rally

Turn Down Tuesday – Trump Crimes and Fed Testimony Reverse the Rally

Courtesy of Phil of Phil’s Stock World

Criminal conduct!

Trump’s former lawyer, Michael Cohen will for the first time publicly accuse the President of criminal conduct while in office related to a hush-money payment to a porn star. According to the Wall Street Journal: “The President’s ex-lawyer will tell House Committee he witnessed Trump’s ‘lies, racism and cheating,’ role in hush…

View On WordPress

0 notes

Text

Turn Down Tuesday - Trump Crimes and Fed Testimony Reverse the Rally

Courtesy of Phil of Phil’s Stock World

Criminal conduct!

Trump’s former lawyer, Michael Cohen, will for the first time publicly accuse the President of criminal conduct while in office related to a hush-money payment to a porn star. According to the Wall Street Journal: “The President’s ex-lawyer will tell House Committee he witnessed Trump’s ‘lies, racism and cheating,’ role in hush payments.” This is contrary to Trump and the GOP’s position that his payments to the porn star he was cheating on his wife with were perfectly legal and just a normal part of any campaign process and, of course, he’s already been given a pass by the Evangelicals who support Trump 100% in all of his extra-marital affairs.

Criminal charges are new, and that opens up a whole new avenue of investigations for Trump – even if there isn’t enough evidence to prove that he’s a Russian Agent, placed in power through a coordinated effort that clearly came from Russia and Putin, with money that clearly came from Russia and Putin following through on an agenda that is clearly benefiting Russia and Putin BUT – we can’t PROVE that he’s purposely doing all this to pay back Putin or if it’s just a coincidence that his staff has already been found guilty of conspiring with Russia and none of that has anything to do with Trump himself.

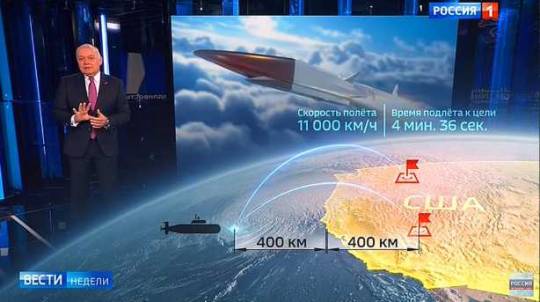

Sure, that’s the ticket, right? Well, the market has been willing to move along, even as Russian State TV on Sunday listed potential US cities that they could strike first with their new hypersonic Missiles. The report came days after Russian President Vladimir Putin warned the U.S. against deploying intermediate-range missiles in Europe. You would think the President (any other President) would be outraged but there was not a single tweet as Trump was busy calling for “retaliation” against Saturday Night Live for making fun of him and touting his trade progress with China, which boosted the markets yesterday.

While I know most of you reading this think this is all some sort of Liberal attack against the President (and yes, I am a Liberal), I don’t really see how that disqualifies me from being concerned when the Russian Propaganda Network has a whole special about how easily they can now wipe out America with their new missiles and how close they can park their subs to US waters – and our President says NOTHING! Are you really OK with that?

The problem with having a President who’s a Russian Puppet isn’t just the wanton economic destruction he causes at home or the decline in respect the rest of the World has for us or the loss of American leadership on the World stage… The very real consequence of a Putin Puppet leading the US is that – if Russia were to strike first with their terrible new weapons – the Putin Puppet could simply surrender and that’s that – the US is part of the Soviet Union. THAT is why we should be concerned enough to at least investigate whether or not the President of the United States is colluding with the Russians – he’s also the Commander-in-Chief of our Armed Forces and that means you can wake up tomorrow in a different country.

Markets don’t like uncertainty and not knowing whether they US will remain independent is a pretty big uncertainty. It’s very worrying to see Putin making these chess moves just when the Russian Investigation is about to release its findings but, no matter how guilty Trump is – you know the drill – he will be defended for being a Putin Puppet by the same people who defend his affairs and his racism and his fraudulent Universities and his vulgar attitude towards women and the Constitution. It doesn’t matter what Trump does – as long as he’s doing it for them…

The markets are taking some notice today, reversing yesterday’s gains (Monday’s never matter anyway) but make sure you are well-hedged ahead of Powell’s Fed Testimony on Capitol Hill – especially as he speaks to the House tomorrow – who may have a few questions about his $4.5 TRILLION Balance Sheet than the GOP has been giving him since he took office.

Speaking of Fed Chairman, the former head of the Federal Reserve thinks President Donald Trump doesn’t understand basic economics, the central banking system or international trade. But she said it in such a way that you might have missed it. In an interview with Marketplace that aired Monday, former Federal Reserve Chair Janet Yellen was asked if she thinks Trump “has a grasp of” macroeconomic policy, which encompasses everything from unemployment to the rates on bank loans. “No, I do not,” replied Yellen, who served under Trump during his first year in office.

Can you really believe that EVERY SINGLE PERSON who says something negative about the President has an “agenda“? Maybe some of them are right? Maybe we should be concerned?

Turn Down Tuesday – Trump Crimes and Fed Testimony Reverse the Rally was originally published on MarketShadows

0 notes

Text

Monday Market Momentum – Uptrend Continues with Trade Talk Hopes

Monday Market Momentum – Uptrend Continues with Trade Talk Hopes

Courtesy of Phil of Phil’s Stock World

Steve Mnuchin to the rescue?

Yes, I know it sounds ridiculous but that’s why the market is up half a point this morning as our Treasury Secretary lands in Beijing this morning and maybe I’d be more optimistic if he wasn’t accompanied by Trade Representative Robert Lighthizer, who lost the battle to keep China out of the WTO in 1997 and is now being given his…

View On WordPress

0 notes

Text

Monday Market Momentum – Uptrend Continues with Trade Talk Hopes

Courtesy of Phil of Phil’s Stock World

Steve Mnuchin to the rescue?

Yes, I know it sounds ridiculous but that’s why the market is up half a point this morning as our Treasury Secretary lands in Beijing this morning and maybe I’d be more optimistic if he wasn’t accompanied by Trade Representative Robert Lighthizer, who lost the battle to keep China out of the WTO in 1997 and is now being given his chance at revenge by suggesting the US pursue WTO action against China and threatens to leave the WTO if China is not sanctioned – ie. bullying.

Politico describes Lightizer as “a decades-long skeptic of Beijing.” He has accused China of unfair trade practices and believes that China needs to make “substantive and structural changes to its trade policies, as opposed to only minor changes it has offered in the past“. He wrote: “The icon of modern conservatism, Ronald Reagan, imposed quotas on imported steel, protected Harley-Davidson from Japanese competition, restrained import of semiconductors and automobiles, and took myriad similar steps to keep American industry strong. How does allowing China to constantly rig trade in its favor advance the core conservative goal of making markets more efficient? Markets do not run better when manufacturing shifts to China largely because of the actions of its government.”

Now, there’s nothing wrong with sending a tough negotiator to China but Lighthizer is more of an anti-China negotiator but even that may have a place if you have a highly skilled person keeping him in line but there’s no indication that’s the case with Mnuchin and, even if it were, it is complete folly for the markets to believe that this duo is going to be able to quickly resolve the many issues that the US and China are very far apart on in trade.

And when I say the US, unfortunately, I mean President Trump because the US and China were very much together for the past decade as both countries prospered and the trade deficit was widely considered to be “just a number” and China may have “stolen” factory jobs but no more so than Detroit stole them from New York in the early 20th Century. Jobs move and economies move on – unless you elect leaders who are stuck in the past and look to right perceived wrongs from long ago.

NAFTA was negotiated in 1994 and was the result of negotiations that had begun in 1980 (under the most sainted Ronald Reagan, who campaigned on it in 1979) yet Trump undid that in a year – only to replace it with almost the exact same agreement rebranded “brilliantly” as the USMCA, which only means the “US, Canada and Mexico Agreement” – I mean, WOW, what an improvement, right?

youtube

“It’s time we stopped looking at our nearest neighbors as foreigners.” Shame on you, Republican Party for betraying everything you stood for – SHAME!!!

Our trade negotiations with China took DECADES to cobble together and Trump is very good at tearing things down but seems to suck at building them up – especially without his Mexican contractors… Anyway, the point is that it’s not likely that there will be much progress in any meeting that involves Lighthizer and I think he’s only there because Trump doesn’t WANT any progress – he WANTS his Tariff money and he’s already realized that the people he is taxing with these tariffs are so stupid that they don’t even realize Trump is lying when he says the Chinese are paying for it.

The Congressional Budget Office estimates that in the last three months of 2018, U.S. Tariff Revenue increased by $8 billion, 83% compared with the same period last year, largely due to the tariffs imposed by Trump but tariffs paid by American companies in October alone amounted to $6.2 billion, an increase of 104% over the same period in 2017. If November and December were $6.2Bn (and they should be much bigger with Christmas) it means US companies were paying close to $20Bn (probably over) in order for Trump to collect $8Bn for the quarter.

Clearly it’s an idiotic system that doesn’t work but, sadly, we know logic and evidence will not work on Donald Trump and, like the Hulk, it only makes him angry. Trump is, in fact, looking to double down on his tariffs and, if he doesn’t, he will increase his budget deficit by 10% – right when the Democrats have oversight of his budget. If he does and the tariffs continue to hit US businesses 3 times worse than the money collected – he can single-handedly destroy the entire economy – finally undoing the last good thing Obama accomplished for us in 8 years of hard work.

It’s very easy to tear down, it’s the building that’s hard and, speaking of building, where’s that Infrastructure? In your dreams when we already have a $1.2Tn deficit on tap for 2019. That’s my estimate. Trump’s team, projects “only” a $985Bn deficit, including tariffs which assumes no damage to collections from the tariffis. In other words, Trump’s budget mirrors Trump’s words and works under the assumption that China will magically pay for the tariffs the way Mexico is paying for the wall!

youtube

Speaking of the wall, Team Trump can’t even get a country that’s already $22,000,000,000,000 in debt with a $1,200,000,000,000 deficit agree to spend $5,700,000,000 (seems like nothing, right?) on the first stage of a border wall to keep out the evil Mexicans and their caravan of 2,000 people seeking refuge in a country with 326,000,000 people that has a pressing need for workers and 1,367,793 unoccupied homes. In Flint Michigan alone, 7.5% of the homes are vacant and in Detroit 1 in 20 homes (5%) are unoccupied yet these are cities that march to keep out immigrants?

So I wouldn’t get too excited about today’s rally, it’s Monday and Monday’s don’t matter (and next Monday is a holiday!) and tomorrow we’ll be looking to see if the 200-day moving averages hold up. We have 5 Fed speakers this week and, finally, the Retail Sales Report on Thursday as we missed the critical Christmas Report due to the shutdown. Other than that, the big excitement is the Altanta Fed (Weds) and the Empire State Manufacturing Report with Industrial Production and Consumer Sentiment on Friday – so the most exciting day of the week will be the one before the 3-day weekend!

Also this week, we begin to wind our way down through the last of the 1,000 companies to report over the next three weeks. Still some big ones out there:

Monday Market Momentum – Uptrend Continues with Trade Talk Hopes was originally published on MarketShadows

0 notes

Text

He Displayed His Full Wannabe-Dictator Form

Trump, The Demagogue, Takes On Congress

He Displayed His Full Wannabe-Dictator Form

Courtesy of David Cay Johnston, DCReport

In the 2019 State of the Union address, Donald Trump revealed yet again that his administration is based on reality television practices, not the faithful execution of duties assigned by our Congress.

His speech was also bad with numbers—very bad, especially for…

View On WordPress

0 notes