Text

#GovReports#FBTGovReports#Taxreturns#FBT#Income tax return#tax return#https://govreports.com.au/stp/

0 notes

Video

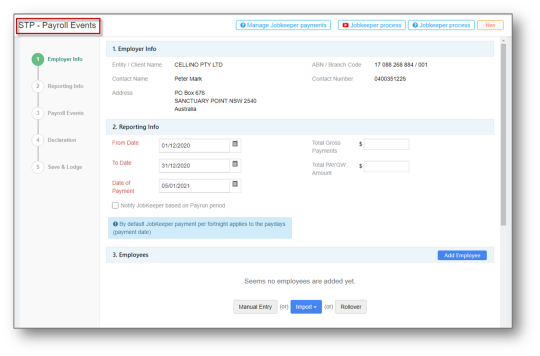

GovReports is the first Cloud based tax lodgment software and it is also SBR-enabled. So with this you can prepare your payroll and lodge your STP lodgements with this payroll software

0 notes

Link

Single Touch Payroll is submitted via Standard Business Reporting (SBR) software for most employers. You can lodge Single Touch Payroll (STP) using GovReports. We need to update the correct details and if any errors occur, we must first correct it within the payroll or SBR software and then we can lodged again with the ATO.

0 notes

Text

Jobkeeper Extension key dates | GovReports

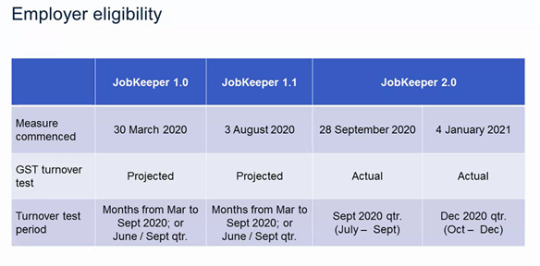

On 30 March, the Federal Government uncovered the JobKeeper Lodgement Program with an end goal to boost businesses to save laborers in work to the extent that this would be possible.

Preceding 28 September 2020, the JobKeeper Payment was $1,500 profit (before charge) per fortnight, paid to the business as an enhancement to help with the installment of pay and wages. The JobKeeper Lodgement plot has been stretched out from 28 September 2020 until 28 March 2021 and contains two separate augmentation periods. The pace of the JobKeeper installment in every expansion period will rely upon the number of hours a qualified worker works, or a qualified business member is effectively occupied with the business.

Expansion periods for JobKeeper 2.0

There are two separate augmentation periods for JobKeeper 2.0. For every expansion period, an extra real decrease in turnover test applies and the pace of the JobKeeper Lodgement installment is extraordinary.

The main quarter of the augmentation time frame runs from 28 September 2020 to 3 January 2021, containing 7 fortnights of:

Level 1: $1,200 per fortnight for those working 80 hours or more in any reference period; and

Level 2: $750 per fortnight for those working less than 80 hours in any reference period.

The second quarter of the augmentation time frame runs from 4 January 2021 to 28 March 2021, involving 6 fortnights of:

Level 1: $1,000 per fortnight for those working 80 hours or more in any reference period; and

Level 2: $650 per fortnight for those working less than 80 hours in any reference period.

N.B: Employers don't have to re-select to keep guaranteeing installments during the augmentation time frame in the event that they are now taken on JobKeeper.

Significant Dates

Jobkeeper 2.0 - Extension 1 period

28 September 2020: The JobKeeper expansion 1-period begins and the installment rates change for your qualified representatives. The principal augmentation covers the JobKeeper fortnights between 28 September 2020 and 3 January 2021. Organizations will be needed to reevaluate their qualification concerning their genuine GST turnover in the September quarter 2020 to be qualified for JobKeeper Payments from 28 September 2020 to 3 January 2021.

You'll additionally have to:

Show that your real GST turnover has declined in the September 2020 quarter comparative with a tantamount period (for the most part the relating quarter in 2019). See the real decrease in the turnover test.

Have fulfilled the first decrease in the turnover test. Notwithstanding, on the off chance that you were qualified to get a JobKeeper for fortnights before 28 September, you have just fulfilled the first decrease in the turnover test. In the event that you are taking on JobKeeper lodgement unexpectedly from 28 September 2020, on the off chance that you fulfill the genuine decrease in the turnover test, you will likewise fulfill the first decrease in the turnover test (with the exception of specific colleges). You can select on that premise.

Tell the ATO whether the level 1 (higher) or level 2 (lower) installment rate applies to each qualified representative, qualified business member, or qualified strict professional. In the event that you are now joined up with JobKeeper and qualified for the augmentation, you do this in your business month to month statement in November. You should likewise tell your qualified representatives, qualified business members, or qualified strict experts which installment rate applies to them within 7 days of advising the ATO of their installment rate.

30 September 2020: Enrolments close for September fortnights

To guarantee installments for the September JobKeeper fortnights, you should enlist by 30 September.

This should be possible through the accompanying stages:

ATO Business Portal. To utilize the Business Portal you will require a myGovID connected to your ABN in relationship Authorisation Manager (RAM). You can discover how to set this up at ato.gov.au/mygovid.

Online Services for Agents (for enrolled charge/BAS specialists). Your enlisted expense or BAS specialist can select, distinguish, and announce for JobKeeper for your sake.

Snap-on this connect to the pertinent page on the ATO site for a bit by bit guidelines on the most proficient method to select.

Somewhere in the range of 1 and 14 October 2020: Complete the October JobKeeper month to month business affirmation

You should distinguish your qualified workers, qualified business members, or qualified strict specialists every prior month making your business month to month presentation.

Make your business month to month announcement between the first and fourteenth of every month to guarantee JobKeeper installments for the earlier month. For instance, to be repaid for JobKeeper installments paid to your workers in August you should finish your announcement by 14 September.

Somewhere in the range of 1 and 31 October 2020: Check and present the business genuine decrease in turnover to the ATO

This should be possible online to be qualified for JobKeeper augmentation 1. It couldn't be any more obvious, the genuine decrease in the turnover test.

You have until 31 October 2020 to pay workers for JobKeeper fortnights finishing off with October

You need to tell the ATO the installment level being asserted for each qualified representative.

You should distinguish your qualified workers, qualified business members, or qualified strict professionals every prior month making your business month to month affirmation. You can do this utilizing the qualification report.

Make your business month to month presentation between the first and fourteenth of every month to guarantee JobKeeper installments for the earlier month. For instance, to be repaid for JobKeeper installments paid to your representatives in August you should finish your affirmation by 14 September.

Before you select to get JobKeeper installments, you need to tell each qualified representative that you mean to choose them as qualified workers under the JobKeeper Payment plot. You should tell those representatives that you have selected them as a qualified worker to guarantee the JobKeeper installment. They should consent to be named by you by finishing the JobKeeper worker selection notice.

#JobKeeperPayment#JobkeeperLodgement#GovReportsJobkeeperLodgement#JobkeeperExtension#JobkeeperExtensionPeriod

0 notes

Text

Do you know what is TPAR?

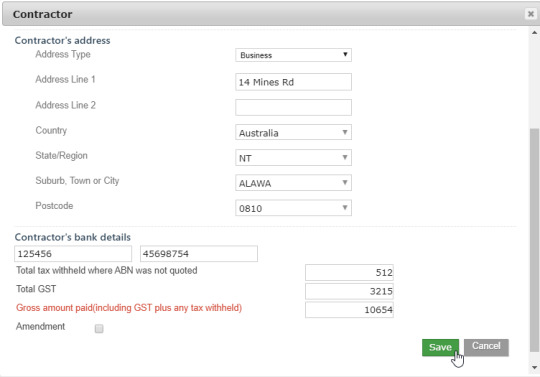

Presented on 1 July 2012 the Taxable Payments Reporting framework is utilized by the ATO to recognize temporary workers who haven't met their expense commitments. Notwithstanding, numerous organizations have been delayed to execute this cycle, as it has been hard to follow the lodgement of these reports. This might open numerous organizations to ATO punishments and reviews.

In the event that your business determines at any rate 10% of your GST turnover from one of the accompanying zones, you have to stop a TPAR for the 2020 money related year by 28 August:

Building and development administrations;

Cleaning administrations who make installments to contractual workers;

Dispatch administrations who make installments to contractual workers;

Street cargo administrations who make installments to temporary workers;

Data innovation (IT) administrations who make installments to temporary workers;

Security, examination, or observation administrations who make installments to contractual workers;

Blended administrations (a business that gives at least one of the administrations recorded previously).

The receipt you would have gotten from the contractual worker ought to have the subtleties you have to report.

This incorporates:

Their Australian Business Number (ABN);

Their name and address;

The gross sum you paid to them for the money related year (counting any GST).

This data is then utilized by the ATO GovReports to discover contractual workers who have detailed their pay mistakenly. The ATO framework is upheld by best in class information coordinating innovation that connects to banks and other outsider suppliers. The TPAR framework has seen the ATO as of now get more than $2.7 billion from the structure and development industry in the 2016 money related year.

Most present-day bookkeeping frameworks can follow TPAR data given, the framework is set up effectively. If you don't mind, contact our office on 1300 65 25 90 or email us at [email protected] for more data about your detailing necessities.

Disclaimer: This data is of an overall sort and ought not to be seen as speaking to monetary guidance. Clients of this data are urged to look for additional guidance in the event that they are indistinct concerning the importance of anything contained in this article. GovReports acknowledges no duty regarding any misfortune endured because of any gathering utilizing or depending on this article.

0 notes

Video

youtube

Know how to prepare STP with Jobkeeper | GovReports

#Jobkeeper#JobkeeperInstruction#JobkeeperPayment#Jobkeepereligibility#Jobkeeper2020#Jobkeeperlodgment#JobkeeperlodgmentSTP

0 notes

Video

The importance of STP lodgment

if STP or Single Touch Payroll to be lodged by small business 19 employees or lessor. It requires to send the employees payroll information including their salary payments, wages, superannuation.

In some cases many of the businesses with three to four employees don't use accounting or payroll software. So, here are some simple solutions to lodge STP for small business.

Our STP app allows you to submit your payroll information easily so that you can lodge your STP in no time. STP chance that you have representatives, finance obligations naturally become a piece of your schedule. Precise and opportune installment counts are a fundamental piece of the smooth and lawful working of any association. Finance programming bundles are a decent method to smooth out these issues for your organization.

Contingent upon the size and the complexities of your association, you will require a normalized method of managing your finance related errands. STP Finance programming turns out to be increasingly more significant as your firm develops, and PC innovation, appropriately saddled, can be a decent method to manage the unremarkable errands identified with wages and advantages.

On the off chance that your representatives are across the board spot, and work in a solitary area, things are less complex. STP In the event that they get a straight compensation, and there are no exceptional differentials, the errand is significantly less difficult. Then again, with an increasingly scattered workforce, hourly rates, extra time premiums, or move differentials, things begin to get increasingly muddled. Include different tax assessment laws for different states, association contracts, etc, and the prerequisite for finance programming turns out to be significantly progressively prompt.

As your business develops and advances, the finance needs of your business will likewise change after some time. STP at the point when the business is little, and you are working out of one office, it is attainable, even reasonable, to keep records physically or utilizing straightforward Windows applications like Excel sheets. You can likewise effectively print and appropriate checks directly from your work area and using STP.

Be that as it may, when your business begins to develop, staff increments, and you have workplaces in more areas, finance programming is a smart thought to keep refreshed and on target with an effective method of taking care of worker wages and advantages.

In the event that you don't get a completely robotized framework, an office in another area may very well mean a great deal of additional cost so as to recruit an uncommon representative at the new office to follow and enter all the subtleties of worker hours and pay grades into your current finance framework.

A superior arrangement is to think about purchasing finance programming, something where the finance subtleties of the considerable number of workplaces and all the representatives at those areas can be incorporated into the records kept by your general finance framework absent a lot of cost or inconvenience.

0 notes

Link

TPAR can be easily prepared using GovReports, we have more details for TPAR easy lodgement

The available installments yearly report (TPAR) reports data to the ATO about installments made to contractual workers for administrations inside specific businesses. TPAR this year, available installments were extended to incorporate three new enterprises: street cargo administrations, data innovation administrations and security, examination or observation administrations.

Any business that pays TPAR temporary to workers connected with to give street cargo related administrations must report installments to these contractual workers on the TPAR. Street cargo administrations incorporate expulsions, haulage, sending, taxi trucks and truck employ with a driver.

Messenger administrations were remembered for TPAR detailing in 2019. Numerous organizations in this industry offer both street cargo and dispatch administrations. The announcement for this industry has now been extended to incorporate street cargo with the goal that these administrations are presently considered one classification for available installments revealing. TPAR administrations incorporate programming improvement, structuring PC frameworks, PC offices, the board, equipment counseling, programming establishment and specialized help.

These administrations incorporate TPAR watching, security, guarding, alert checking, reinforced vehicle administrations, criminologist organizations, swarm control and screening hardware. This is the primary year that the new ventures of street cargo, IT and security businesses are required to present a TPAR.

The report is expected by 28 August 2020. Visit the ATO available installments yearly report page for full subtleties of what administrations are incorporated for the new enterprises.

We have TPAR reports for Business and Tax Practitioners.

0 notes

Link

Tax returns can be done electronically as online and also as Paper Tax returns.

Paper Tax return:

This Tax return may decrease the punishment to a sum that is equivalent to the assessment that is expected. Paper Tax Return form certifications to compute your assessment bill and let you know the outcome before the installment cutoff time of Tax return 31 January following the finish of the duty year, send your paper Tax Return by the recording date.

Online Tax Return:

The online Tax return administration is difficult to utilize and spares time contrasted with the paper variant. So as to have the option to utilize the online tax return help, you should initially enlist by setting off to the site and following the enrollment cycle. At that point you can send your Personal Identification Number (PIN) and this can take as long as seven days. In this manner, Lodging Tax return we energetically suggest you to don't leave enrolling for the online help until 31 January.

1 note

·

View note