Text

Tactical asset allocation — November 2020

Macro update

The return of the coronavirus across Europe and the Americas represents an important risk factor for the global economic recovery. We contemplated this risk back in the spring and outlined a baseline scenario of a meaningful second wave of COVID-19 infections across the northern hemisphere upon the return of colder temperatures. The probability of a double-dip recession in Q4 2020 is certainly increasing across multiple regions, but it does not need to translate into the same economic and financial shock experienced with the first wave. A combination of ample monetary and fiscal policy support, together with economic adjustments and measures implemented over the past seven months, is likely to reduce the uncertainty associated with this second wave compared to the first. While it is certainly too early to draw definitive conclusions, as the situation remains very fluid, our forward-looking measures of economic activity and market sentiment continue to suggest the global economy should remain in a recovery regime in the near term (Figure 1).

Figure 1: Leading economic indicators and market sentiment suggest the global economic recovery continues, with emerging markets moving to an expansion regime

Sources: Bloomberg, L.P., Macrobond as of Oct. 31, 2020. Invesco Investment Solutions research and calculations. Proprietary leading economic indicators of Invesco Investment Solutions.

The speed of the recovery is flattening across regions as the V-shaped rebound begins to normalize and most economies begin to approach trend-growth rates. Notably, the relative growth momentum between the United States and other developed markets has tilted in favor of the former, as a result of catch-up effects and the anticipation of new, selective lockdown measures implemented in the eurozone and the UK. Emerging markets, particularly Asia, continue to lead the cycle and, according to our framework, have now entered an expansion regime with growth above-trend and improving. Despite recent underperformance in equity markets and increased volatility, our measure of global market sentiment suggests some resilience and confidence in the marketplace on the global recovery for now. Current events ranging from the US election to the evolution of the pandemic will drive the path of investor confidence and growth expectations over the next couple of months. We will closely monitor the evolution of our framework and reposition our investment strategies accordingly.

Investment positioning

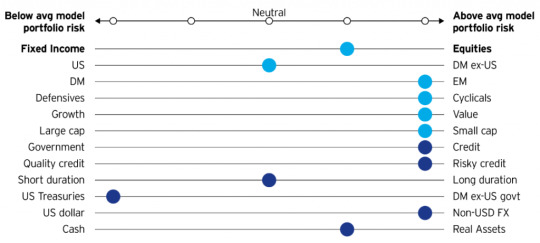

We have implemented one change this month, closing our overweight exposure to developed market equities outside the US. While local market and currency valuations remain supportive, their relative growth momentum is weakening, leading us to a neutral stance between the two regions (Figure 2).

Figure 2: Relative tactical asset allocation positioning

Source: Invesco Investment Solutions, Oct. 31, 2020. For illustrative purposes only. Allocations for Invesco Global Allocation Fund. Light blue represents equity risk categories, while dark blue represents fixed income. Risk measured by tracking error.

We maintain a higher risk posture than our benchmark1 in the Invesco Global Allocation Fund, sourced through an overweight exposure to equities and credit at the expense of government bonds. In particular:

Within equities, we hold large tilts in favor of emerging markets compared to developed markets, driven by favorable cyclical conditions, improving risk appetite, attractive local asset valuations, and an expensive US dollar.

In fixed income, we maintain an overweight exposure to US high yield credit, emerging markets sovereign dollar debt, and event-linked bonds at the expense of investment grade corporate credit and government bonds, particularly in developed markets outside the US. Overall, we are overweight credit risk and neutral duration2 versus the benchmark.

In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term US dollar depreciation. Within developed markets we favor the euro, the Canadian dollar and the Norwegian kroner. In emerging markets, we favor the Indian rupee, Indonesian rupiah, and Russian ruble.

1 Global 60/40 benchmark (60% MSCI All Country world Index / 40% Bloomberg Barclays Global Agg USD Hedged)

2 Credit risk defined as DTS (duration times spread).

Important information

Blog header image: Rodrigo Kugnharski / Unsplash

The MSCI All Country World Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets.

The Barclays Global Aggregate Index is an unmanaged index considered representative of the global investment grade, fixed income markets.

Credit risk defined as DTS (duration times spread).

Tracking error measures the divergence between price behavior of a portfolio and the price behavior of a benchmark.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. Junk bonds involve a greater risk of default or price changes due to changes in the issuer’s credit quality. The values of junk bonds fluctuate more than those of high quality bonds and can decline significantly over short time periods.

Issuers of sovereign debt or the governmental authorities that control repayment may be unable or unwilling to repay principal or interest when due, and the Fund may have limited recourse in the event of default. Without debt holder approval, some governmental debtors may be able to reschedule or restructure their debt payments or declare moratoria on payments.

The dollar value of foreign investments will be affected by changes in the exchange rates between the dollar and the currencies in which those investments are traded.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their financial professionals for a prospectus/summary prospectus or visit invesco.com.

The opinions expressed are those of the author as of Nov. 13, 2020, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations. Diversification does not guarantee a profit or eliminate the risk of loss.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/tactical-asset-allocation-november-2020/?utm_source=rss&utm_medium=rss&utm_campaign=tactical-asset-allocation-november-2020

0 notes

Text

SteelPath November MLP updates and news

Midstream equities outperformed the broader markets in October as third-quarter earnings season kicked off with better-than-expected results. Increasing midstream free cash flows are expected to bolster improve balance sheets in the years ahead as capital spending requirements have ebbed.

MLP market overview

Midstream MLPs, as measured by the Alerian MLP Index (AMZ), ended October up 2.9% on a price basis and up 4.3% once distributions are considered. The AMZ outperformed the S&P 500 Index’s 2.7% total return loss for the month. The best performing midstream subsector for October was the Gathering and Processing group, while the Diversified subsector underperformed, on average.

For the year through October, the AMZ is down 48.7% on a price basis, resulting in a 43.5% total return loss. This compares to the S&P 500 Index’s 1.5% and 3.1% price and total returns, respectively. The Propane group has produced the best average total return year-to-date, while the Diversified subsector has lagged.

MLP yield spreads, as measured by the AMZ yield relative to the 10-year US Treasury bond, narrowed by 73 basis points (bps) over the month, exiting the period at 1,337 bps. This compares to the trailing five-year average spread of 678 bps and the average spread since 2000 of approximately 415 bps. The AMZ indicated distribution yield at month-end was 14.2%.

Midstream MLPs and affiliates raised no new marketed equity (common or preferred, excluding at-the-market programs) or debt during the month. No new asset acquisitions were announced in October.

West Texas Intermediate (WTI) crude oil exited the month at $35.79 per barrel, down 11.0% over the period and 33.9% lower year-over-year. Natural gas prices ended October at $3.35 per million British thermal units (MMbtu), up 32.7% over the month and 27.4% higher than October 2019. Natural gas liquids (NGL) pricing at Mont Belvieu exited the month at $19.90 per barrel, 4.6% higher than the end of September and 9.6% lower than the year-ago period.

News

Energy Transfer making changes. Energy Transfer (ET) announced that Kelcy Warren will turn over the Chief Executive Officer position to long-time ET executives Mackie McCrea and Tom Long, effective Jan. 1, 2021. Warren will remain as Executive Chairman and Chairman of the Board of Directors. As Co-CEOs, McCrea and Long will work together in the manner of an “Office of the CEO” and will jointly direct the business of the Partnership. Warren will continue to be actively involved in the strategic direction of the Partnership. Later in the month ET elected to reduce its distribution by 50% and, likely, increase its focus on debt reduction. Standard and Poor’s immediately affirmed Energy Transfer’s investment grade rating (BBB-) and Moody’s affirmed its investment grade rating (Baa3) the following day.

Third-quarter earnings season commences. Third-quarter reporting season began in October. Through month-end, 47 midstream entities had announced distributions for the quarter, including four distribution increases, two reductions, and 41 distributions that were unchanged from the previous quarter. Through the end of October, 11 sector participants had reported third-quarter financial results. Operating performance has been, on average, better than expectations with EBITDA, or Earnings Before Interest, Taxes, Depreciation and Amortization, coming in 5.5% higher than consensus estimates and 9.9% higher than the preceding quarter.

TRP Proposes to Buy TCP. TC Energy (TRP CN) made a non-binding offer to acquire all outstanding common units of TC Pipelines (TCP) that it does not already own, with an exchange ratio of 0.65 common units of TRP for each unit of TCP, representing an implied value of $27.31/unit based on the Oct. 2 closing price of TRP, or a 7.5% premium to the 20-day weighted average price of TCP common units. A Conflicts Committee composed of independent directors of the TCP Board will be formed to consider the offer pursuant to its processes.

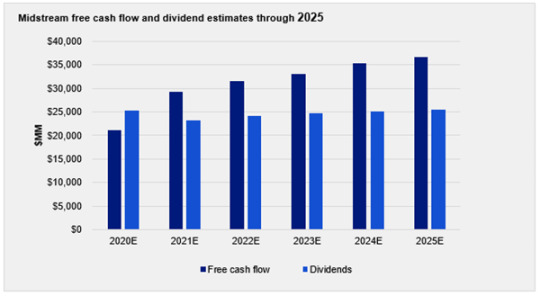

Chart of the month: rising free cash flow bolsters midstream balance sheets

As midstream cash flows have remained resilient, and as the industry continues to rationalize capital spending, estimates for sector free cash flow1 have significantly increased. Further, as market participants are no longer rewarding distribution growth, midstream energy sector participants are largely expected to hold distributions steady and let excess cash flow accrue to the balance sheet.

The chart below presents estimates from Wells Fargo for total free cash flow and distributions/dividends for the publicly traded US midstream companies through 2025. We believe the difference between each year’s free cash flow and the cash payouts to equity investors may be used to reduce borrowings and, to a lesser extent, buyback undervalued equity units.

Source: Wells Fargo as of 10/31/2020.Past performance does not guarantee future results. “E” represents estimates. No guarantee that estimates will come to pass. Free cash flow is defined as distributable cash flow less growth capital expenditures and acquisitions, where distributable cash flow represents cash flow generated by the company’s operations reduced by expenditures to maintain the assets.

Important Information

Image credit: Abstract Aerial Art / Getty

Source: All data sourced from Bloomberg as of 10/31/2020 unless otherwise stated.

Defined as distributable cash flow less growth capital expenditures and acquisitions, where distributable cash flow represents cash flow generated by the company’s operations reduced by expenditures to maintain the assets.

The opinions referenced above are those of the author as of Nov. 2, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

Midstream operators and companies are engaged in the transportation, storage, processing, refining, marketing, exploration, and production of natural gas, natural gas liquids, crude oil, refined products or other hydrocarbons.

The mention of specific companies, industries, sectors, or issuers does not constitute a recommendation by Invesco Distributors, Inc. A list of the top 10 holdings of each fund can be found by visiting invesco.com.

As of 9/30/2020, Invesco SteelPath MLP Alpha Fund, Invesco SteelPath MLP Income Fund, Invesco SteelPath MLP Select 40 Fund and Invesco SteelPath MLP Alpha Plus Fund held 13.91%, 12.47%, 4.98% and 13.79%, respectively in Energy Transfer LP.

As of 9/30/2020 Invesco SteelPath MLP Alpha Fund, Invesco SteelPath MLP Income Fund, Invesco SteelPath MLP Select 40 Fund and Invesco SteelPath MLP Alpha Plus Fund held 10.15%, 0.00%, 4.59% and 9.97%, respectively in TC Pipelines LP.

The S&P 500 Index is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States.

The Alerian MLP Index is a float-adjusted, capitalization-weighted index measuring master limited partnerships, whose constituents represent approximately 85% of total float-adjusted market capitalization. Indices are unmanaged and cannot be purchased directly by investors.

Index performance is shown for illustrative purposes only and does not predict or depict the performance of any investment. An investment cannot be made into an index. Past performance does not guarantee future results

A yield spread is the difference between yields on differing debt instruments of varying maturities, credit ratings, issuer, or risk level, calculated by deducting the yield of one instrument from the other.

Most MLPs operate in the energy sector and are subject to the risks generally applicable to companies in that sector, including commodity pricing risk, supply and demand risk, depletion risk and exploration risk. MLPs are also subject the risk that regulatory or legislative changes could eliminate the tax benefits enjoyed by MLPs which could have a negative impact on the after-tax income available for distribution by the MLPs and/or the value of the portfolio’s investments. Although the characteristics of MLPs closely resemble a traditional limited partnership, a major difference is that MLPs may trade on a public exchange or in the over-the-counter market. Although this provides a certain amount of liquidity, MLP interests may be less liquid and subject to more abrupt or erratic price movements than conventional publicly traded securities. The risks of investing in an MLP are similar to those of investing in a partnership and include more flexible governance structures, which could result in less protection for investors than investments in a corporation. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns.

Energy infrastructure MLPs are subject to a variety of industry specific risk factors that may adversely affect their business or operations, including those due to commodity production, volumes, commodity prices, weather conditions, terrorist attacks, etc. They are also subject to significant federal, state and local government regulation.

The opinions expressed are those of Invesco SteelPath, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their advisors for a prospectus/summary prospectus or visit invesco.com.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/steelpath-november-mlp-updates-and-news/?utm_source=rss&utm_medium=rss&utm_campaign=steelpath-november-mlp-updates-and-news

0 notes

Text

‘FOMO’ and the (extremely) high price of certainty

Emerging market (EM) growth stocks have had an unprecedented run versus value over the past decade. The pandemic has amplified the run of growth stocks and, in our view, led to pockets of excessive valuation. We believe the “certainty” of the COVID-19 trends may, in a number of spots, lead only to the certainty of significant loss at these valuation levels. Despite growth’s extraordinary bifurcation with value stocks, we recommend investors embrace greater nuance in thinking through the value versus growth debate.

Two trends that have boosted growth stocks

Growth stocks have been clear beneficiaries of the two big trends in financial markets under COVID-19 — negative real rates and great economic uncertainty. These twin forces have made extrapolation of the future incredibly challenging for investors, leading to a relentless search for certainty in obvious “digital” winners. Add to that a powerful case of FOMO (fear of missing out), and you have the ingredients for worrying levels of concentration and pockets of structurally overvalued companies.

COVID-19 has essentially amplified trends that were already underway in EM and accelerated the prospects of e-commerce, fintech, food delivery, ride-hailing, gaming, cloud, and other similar digitally driven companies. In many cases, the assumptions of what these disruptive growth companies can deliver and the valuations they have reached have become untethered from reality, in our view. Imagination is a critical trait in creating differentiated portfolio results, but much of the hyperbolic gravitas is conventional wisdom, divorced from rigorous diligence. The herculean assumptions being made to justify current valuations often fail to appreciate fierce competitive structures across many of these industries and the long and grinding battle companies face in their pursuit of market dominance. In essence, FOMO has become the primary investment motivation for many.

FOMO is on full display in Chinese stocks

An additional twist unique to EM is the focus on countries that have successfully contained the virus and had the administrative capacity to deal with the economic fallout. China is a great example. Having generated the plurality of worldwide growth for the past 10 years, we believe China is poised to deliver over 50% of global GDP over the next couple years as the rest of the world slowly recovers from the economic impact of COVID-19. We have argued for a structural bull market in China in one of our recent posts (Our hypothesis for a bull market in emerging markets equities), in part due to an increasing number of high-quality companies that are listing on local exchanges and offering better investment opportunities for China’s significant, and largely undiversified, pool of savings — which we believe will result in a major asset allocation shift into equities. However, China’s resiliency and growth this year have put it on the radar of many equity managers on the hunt for “certainty,” and those with clear FOMO. We have observed a rapid increase in investor interest in China, most notably from those with little experience and no visible mandate investing there. This heightened attention has led to pockets of excess.

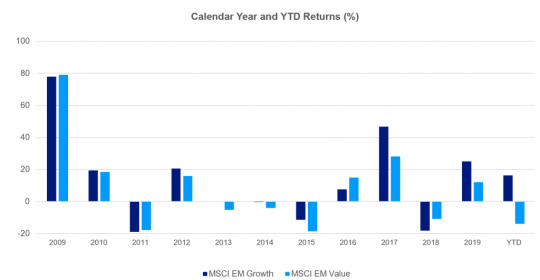

Figure 1: EM growth has generally outperformed EM value over the past decade

Source: Morningstar. Data as of 10/31/20. The calendar year returns above are for the MSCI EM Growth and MSCI EM Value Indexes. An investment cannot be made in an index. Past performance is no guarantee of future results.

We believe the massive gap that has formed between growth and value will likely collapse, probably painfully, but this does not mean that traditional value stocks will be in ascendancy. The classic mean reversion approach to value investing will likely prove unsuccessful, in our view, as many traditional industries face considerable structural challenges:

E-commerce is an existential threat that has adversely impacted returns and growth prospects for brick-and-mortar retailers that are unable to adapt to omnichannel requirements.

We expect fintech companies to persistently chip away at the funding and fee advantages of oligopolistic banks throughout EM.

Oil and thermal coal companies face long-term pressure from the shift to a green economy.

A different perspective on the search for value in EM

In this context, relying on historical or normalized valuation multiples and an extrapolation mentality may not produce desired outcomes. Therefore, we embrace a different perspective on value — one that appreciates nuance and probabilistic thinking, and looks beyond the obvious.

Nuanced value investing, in our view, is able to look beyond pandemic economic shock to companies and countries that are well-placed for rapid recovery, and to industries where consolidation may result in improved pricing, margins, and returns. These include companies such as hotels, restaurants, and airports, which we expect will more than mean revert under consolidation. This approach also looks to geographies dominated by informal economies like India, the Philippines, and Indonesia, which in our view will likely see V-shaped recoveries post-pandemic.

We believe this nuanced approach to value investing also works in companies that are suffering from heightened skepticism as a result of transient project delays or misplaced governance concerns, as well as in companies investing in adjacent, unproven business opportunities where uncertainty reigns. In all these, value investors must look beyond extrapolation of numbers and conduct differentiated research.

Our approach to investing in EM equities maintains a long-term orientation and a focus on differentiated research. We do not have a FOMO gene, which has resulted in an unwillingness to bend to fashion. And, alas, a year of reasonably middle-of-the-pack performance. However, we strongly believe that our continued focus on investing in high-quality companies with durable growth opportunities, sustainable competitive advantage, real options, and appropriate valuations will allow us to avoid common landmines and position us to generate compelling returns over time.

Important Information:

Image Credit: Jerry Wang

The MSCI Emerging Markets Value Index captures large and mid-cap securities exhibiting overall value style characteristics across 26 EM countries.

The MSCI Emerging Markets Growth Index captures large and mid-cap securities exhibiting overall growth style characteristics across 26 EM countries.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The opinions expressed are those of the author as of Nov. 11, 2020, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/fomo-and-the-extremely-high-price-of-certainty/?utm_source=rss&utm_medium=rss&utm_campaign=fomo-and-the-extremely-high-price-of-certainty

0 notes

Text

Five forces that could propel markets during a Biden presidency

While legal challenges are underway, the Associated Press on Saturday called Pennsylvania for Joe Biden, which would push him past the 270 Electoral Count threshold. While this process may feel like an eternity, Biden’s timing from a market perspective may be impeccable. Don’t get us wrong. There are challenges ahead. COVID-19 cases are rising, and the threat of economically damaging lockdowns is elevated. However, history has taught us that the presidents who have experienced outsized market returns typically were inaugurated in troubled economic environments. Presidents Reagan (high and rising inflation) and Obama (global financial crisis) immediately come to mind. Rather than dwell on the near-term negatives, let’s instead focus on the potential tailwinds that would likely be supportive to markets in a Biden administration.

Five potential tailwinds that could drive markets

Betting against an economic recovery is betting against medicine, science and human ingenuity. Significant progress has already been made in the fight against COVID, with scientists, government agencies and private industry working together to understand the virus, create and test potential vaccines, and pre-manufacture millions of doses of the most promising candidates to enable immediate distribution when a final vaccine is ready. The timing of a vaccine is still unclear, but is likely to emerge in the early years of the next presidential term.

The US Federal Reserve is poised to keep interest rates at, or near, zero for at least the first two years of Biden’s term. There is $4.3 trillion in money market assets, up from $3.6 trillion at the beginning of 2020, earning effectively nothing in interest.1 Among the Fed’s stated goals is to inflate away 2% of the value of that cash each year, thereby incentivizing consumers and investors to do something with that money. The adage about not fighting the Fed will likely apply over the next four years.

More fiscal support is likely forthcoming. While it may not be the outsized fiscal package that the Democrats had envisioned, it will likely be large enough to provide an additional boost to the economic recovery. Paradoxically, a more modest fiscal bill may serve to extend the market and business cycles, as it would be unlikely to bring forward the inflationary pressures that presage Fed tightening and the end of cycles.

Stocks are historically cheap to bonds2, and yet stocks have outperformed bonds over most time periods.3 Government-related bonds are not only overbought compared to stocks4 but may fall under pressure as interest rates rise in an economic recovery. Investors are likely to determine that in this type of environment, there few alternatives that offer the growth potential of equities.

Macro conditions do not need to be “good” for markets to trend higher. Instead, they need to be getting better. The US economy and S&P 500 Index recently experienced historic collapses. Economic activity and earnings growth are likely to be outsized during the next presidential term versus the 2020 comps.

Is this a “Goldilocks” environment?

Investors often ask strategists to compare the current environment to a period in the past. 2011 to 2014 comes to mind. Those years had a Democratic president, a divided Congress, an improving economic and earnings backdrop from very depressed levels, the Fed Funds Rate at zero, and stocks cheap to bonds. Forgive us for having déjà vu. That period proved to be favorable for equities and for credit.

In fact, this could be a Goldilocks environment — not too hot to cause inflation, but not too cold, either. A Biden presidency with a Republican Senate would be unlikely to see any increase in taxes, which was arguably the biggest fear investors had about a Biden presidency. And a Biden presidency could mean a return to a more traditional, predictable approach to trade policy, which would likely result in less volatile markets. But would it also mean stalled progress on other issues? Assuming a narrow Republican majority in the Senate, and a centrist approach by Biden, such a divided government might not mean total gridlock. In particular, Biden might be able to eke out a decent stimulus bill by forming a coalition with moderate Republican senators. While few may have expected this or wanted this outcome, it could prove to be a “best-case scenario.”

In short, Joe Biden has spent nearly half a century in politics, but his timing may yet prove impeccable.

1 Source: Investment Company Institute, as of Nov. 4, 2020

2 Source: Bloomberg, L.P., Standard & Poor’s, as of Sept. 30, 2020. As represented by the difference between the earnings yield of the S&P 500 Index and the 10-year US Treasury rate

3 Sources: Bloomberg, L.P., Standard & Poor’s, looking at 10-year time periods, rolling monthly, going back to 1957. Based on the S&P 500 Index and the Bloomberg Barclays US Aggregate Bond Index.

4 Sources, Bloomberg, L.P., Organization for Economic Cooperation and Development

Important information

Blog image credit: Stephen Morris / Stocksy

Past performance does not guarantee a profit or eliminate the risk of loss.

All investing involves risk, including the risk of loss.

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

The Bloomberg Barclays US Aggregate Bond Index is an unmanaged index considered representative of the US investment-grade, fixed-rate bond market.

The opinions referenced above are those of the authors as of Nov. 8, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/five-forces-that-could-propel-markets-during-a-biden-presidency/?utm_source=rss&utm_medium=rss&utm_campaign=five-forces-that-could-propel-markets-during-a-biden-presidency

0 notes

Text

Election 2020: Biden looks poised to win

Well, it’s all over but the shoutin’. In order for President Trump to remain in the White House, he will have to pull off a miracle in the remaining states that have yet to be called by a major network, and he will need to successfully navigate a recount process in Wisconsin (and perhaps elsewhere) better than any candidate in history, overturning tens of thousands of votes in his deficit. While we may face a few days or weeks of controversy and litigation, the signs point to Joe Biden becoming the next president of the United States.

I expect that outcome to soon become clear, but first we must address the noise coming from the Trump campaign. What form do their legal challenges take in the key battlegrounds, and what exactly is at the center of their case? Further, what is the process and timeline for resolution? Here is the breakdown1:

Pennsylvania

At this stage, we see the most viable challenge to ballots would be the case in Pennsylvania, in which the Trump campaign is attempting to invalidate mail-in ballots received after 8:00 p.m. on Tuesday, Election Day. Even though ballots postmarked on Election Day are eligible to be received as late as this Friday at 5:00 p.m., this has been challenged, and it is possible that the US Supreme Court could take up this case.

However, we see a few hurdles before the Supreme Court would consider taking up this case:

The Supreme Court would want to make sure that Pennsylvania is determinative to who wins the presidential election. If President Trump fails to turn Arizona back into his camp or cannot hold onto Georgia, the prevailing wisdom is that the Supreme Court would be hesitant to get involved in a state election issue that is not consequential.

The Supreme Court would also want to see if the counting of these contested ballots was determinative to the outcome in Pennsylvania. If Joe Biden wins Pennsylvania without the ballots in question, there would be no harm to remedy.

Absentee/ mail-in ballot deadline:

Nov. 3/Nov. 6

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Trump: 3,224,422

Biden: 3,088,796

91% reporting

Rules for triggering a recount:

Any three qualified electors may request a recount.

Or, an automatic recount takes place if the margin of victory is 0.5% or less for statewide candidates or for ballot questions.

Status of recount lawsuits:

Trump campaign lawsuit

Michigan

Absentee/ mail-in ballot deadline:

Nov. 3/Nov. 3

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Biden: 2,788,425

Trump: 2,639,035

98% reporting

Rules for triggering a recount:

A recount can be requested by a candidate in certain races. The candidate must allege that he or she is aggrieved on account of fraud or mistake in the canvass of the votes by the inspectors of election or the returns made by the inspectors of election, or by a board of county canvassers or the board of state canvassers.

The chairperson of a state political party may petition on behalf of a candidate when a state Senate race has a differential of 500 votes or less, or a state representative race has a differential of 200 votes or less.

Or, an automatic recount takes place if the margin of victory is 2,000 votes or less in a statewide primary or election

Status of recount lawsuits:

Trump campaign lawsuit

Wisconsin

Absentee/ mail-in ballot deadline:

Nov. 3/Nov. 3

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Biden: 1,630,535

Trump: 1,610,001

98% reporting

Rules for triggering a recount:

A recount can be requested by any candidate voted for at any election who is an aggrieved party, or any elector who voted upon any referendum question at any election.

Status of recount lawsuits:

Trump campaign to request a recount

North Carolina

Absentee/ mail-in ballot deadline:

Nov. 3/Nov. 12

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Trump: 2,732,120

Biden: 2,655,383

95% reporting

Rules for triggering a recount:

For statewide races, the margin of victory must be 0.5% of the votes cast in the ballot item, or 10,000 votes, whichever is less.

Status of recount lawsuits:

Final count expected on Nov. 12

Georgia

Absentee/ mail-in ballot deadline:

Nov. 3/Nov. 3

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Trump: 2,432,928

Biden: 2,414,782

96% reporting

Rules for triggering a recount:

Where paper ballots are used and it appears there is a discrepancy or error, the superintendent may order a recount, or any candidate or political party may petition for one.

When results are within 0.5% of total votes cast for the office, a losing candidate may request a recount.

Status of recount lawsuits:

Trump campaign lawsuit

Arizona

Absentee/ mail-In ballot deadline:

Oct. 20/Nov. 3

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Biden: 1,469,341

Trump: 1,400,951

86% reporting

Rules for triggering a lawsuit:

Can only be ordered by a county superior court.

Or, recounts are automatic if the margin of victory is less than or equal to the lesser of the following:

0.1% of the votes cast for both candidates or measures

In the case of an office to be filled by state electors or a statewide initiated or referred measure: 200 votes if more than 25,000 votes were cast; 50 votes if 25,000 or fewer votes were cast; 200 votes in the case of a measure

In the case of a member of the state legislature: 50 votes

Status of recount lawsuits:

Waiting on final count

Nevada

Absentee/ mail-In ballot deadline:

Oct. 19/Nov. 10

Vote counts/% reporting as of 11:30 a.m. EST on Nov. 5:

Biden: 588,252

Trump: 580,605

86% reporting

Rules for triggering a recount:

A recount can be requested by a candidate at any election, or any registered voter of the appropriate political subdivision.

Status of recount lawsuits:

Trump campaign joined an existing Republican lawsuit

1 Source for the vote totals: The New York Times and the National Conference of State Legislatures

Important information

Header image: Sean Locke / Stocksy

The opinions referenced above are those of the author as of Nov. 5, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/election-2020-biden-looks-poised-to-win/?utm_source=rss&utm_medium=rss&utm_campaign=election-2020-biden-looks-poised-to-win

0 notes

Text

What could a divided government mean for US stocks?

As we wait for the votes to be counted, and perhaps recounted, in some key states, we’ve gotten some questions about the potential for a divided government and what it could mean for markets if the White House and Congress are split between parties.

Senate implications

Kristina Hooper: Chief Global Market Strategist: It appears all but certain that the Senate will remain Republican. This means that:

Government will likely be divided, regardless of who wins the presidency. The stock market has historically reacted positively to divided government, as my colleague Brian Levitt explains below. I expect stocks to rise in this environment. This is especially so given that markets had feared a Democratic sweep. For example, as of Oct. 28, 34% of companies in the S&P 500 Index that had reported earnings mentioned the election – with taxes being the government policy most discussed in conjunction with the election.1 There was real fear about what policies such as higher taxes and a higher minimum wage would do to businesses. Now that those policies are very unlikely even with a Biden win, I would expect stocks to continue with a relief rally.

The US is far less likely to get a large fiscal stimulus package, regardless of who is president. This suggests a slower economic recovery for the US, which would likely mean defensives and secular growth stocks could outperform.

If Biden wins the presidency, I think we will see a new era of fiscal conservatism ushered in despite being in the midst of an economic recovery, as proposed spending measures would require approval by Senate Republicans. This would be similar to what we saw during the Obama administration with sequestration while the US economy was still recovering from the global financial crisis. This suggests a slower, less robust economic recovery. With lower government spending and borrowing, I would expect to see lower 10-year Treasury yields.

If Trump wins the presidency, I would expect to see less of an emphasis on fiscal conservatism by Senate Republicans, although I don’t believe there will be anything close to profligate spending. This suggests more spending and borrowing (though not nearly what we would have expected with a Democratic sweep), and potentially higher 10-year Treasury yields.

Market implications

Brian Levitt: Global Market Strategist: Gracie Allen famously quipped, “This used to be a government of checks and balances. Now it’s all checks and no balances.” Allen’s observation, while funny, is not applicable to the 2020 US election. For all the uncertainty surrounding the outcome of the presidential election, the partisan control of the US Congress was never really in question. For the next president, be it Donald Trump or Joe Biden, there will be balances on their power. The prospect of outsized fiscal support, Allen’s joke notwithstanding, has diminished.

The markets have initially responded favorably to the perception that little will get done in the first two years of the next administration. Incessant hand wringing over the key issues and concerns over the prospects of higher taxes, a Green New Deal, changes to the Affordable Care Act and much more appears to have been for naught. The US system is inherently designed for incrementalism, and gradual progress is about the most either party can now wish for in the coming two years.

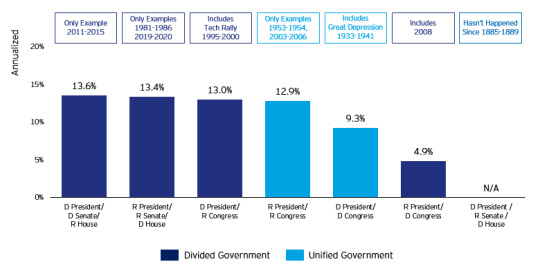

It is said that markets prefer divided government. The numbers bear that out, although I would argue that analysis is not all that statistically significant. Rather, the returns, in most instances, tend to be driven by a handful of notable years.

For example, as illustrated in the chart below, the second-best partisan control outcome for the S&P 500 Index has been when the Republicans have the presidency as well as the Senate, and the Democrats control the House of Representatives. It’s an interesting tidbit, especially for those hoping for a Trump victory, but is less impressive when we consider that combination has only happened during the early Reagan years and in 2019-2020.

As for a potential Biden victory: The combination of Democrats controlling the White House and House of Representatives, and the Republicans controlling the Senate hasn’t happened since 1885-1889, leaving it out of the time period of our analysis below.

Partisan control: US large-cap equity returns

Source: Yale University/Shiller database, Strategas Research Partners. US large-cap equities represented by the S&P 500 Index. Chart is meant for illustrative purposes only and is not meant to depict or predict the performance of any investment strategy. Indices cannot be purchased directly by investors. Past performance does not guarantee future results. R = Republicans, D = Democrats.

The confluence of factors currently supporting equity and credit markets — improving economic conditions, stocks trading cheap compared to bonds,2 and accommodative monetary policy — holds true irrespective of the ultimate outcome of the presidential election. Paradoxically, divided government could set the stage for more-protracted market and business cycles. I believe the recovery will still likely play out in the coming years, but at a more modest pace than had there been additional fiscal support. While that might not be ideal for near-term growth in the real economy, we are also unlikely to experience the inflation pressures that have historically brought forward Federal Reserve tightening and hastened cycles. The economic recovery from 2011 to 2015 amid divided government may be an appropriate analogy. For what it is worth, markets performed quite well during that period, as represented in the chart above.

In short, I believe that investors, at a minimum, can rest easy knowing that meaningful change is probably not forthcoming. And remember, as Gracie Allen said, “The president of today is just the postage stamp of tomorrow.”

1 Source: FactSet Earnings Insight (Oct. 30).

2 Source: Bloomberg, L.P., Standard & Poor’s, as of Sept. 30, 2020. As represented by the difference between the earnings yield of the S&P 500 Index and the 10-year US Treasury rate.

Important information

Blog image credit: Cameron Whitman / Stocksy

The S&P 500® Index is an unmanaged index considered representative of the US stock market.

Diversification does not guarantee a profit or eliminate the risk of loss.

Past performance does not guarantee a profit or eliminate the risk of loss.

All investing involves risk, including the risk of loss.

The opinions referenced above are those of the authors as of Nov. 5, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/what-could-a-divided-government-mean-for-us-stocks/?utm_source=rss&utm_medium=rss&utm_campaign=what-could-a-divided-government-mean-for-us-stocks

0 notes

Text

Election 2020: What we know and what comes next

With ballots still being counted, the US presidential election remains undecided. Our experts discuss the next steps in the process and the potential market and economic implications.

Important information

Blog header image: Cristian Bortes/ EyeEm / Getty

Opinions expressed are those of the speakers as of Nov. 4, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/election-2020-what-we-know-and-what-comes-next/?utm_source=rss&utm_medium=rss&utm_campaign=election-2020-what-we-know-and-what-comes-next

0 notes

Text

The counting continues as Trump and Biden pursue a path to victory

As of midnight EST, the 2020 presidential election remains up in the air. With ballots remaining to be counted in several states, an official result may not be known for some time. Below, our experts discuss the next steps in the political process, the policy issues that the markets will be watching, and two critical questions for investors to ask themselves right now.

The importance of the election process

Marty Flanagan, President and CEO, Invesco. While the US presidential election looked different this year, participating in the democratic process continues to be one of the most important responsibilities for all Americans. Participating in elections is one of the key freedoms for Americans, and it’s important that we allow the process to unfold, ensuring that the voice of the American people is heard.

The United States of America and the democratic process have endured times of uncertainty over our history, and I have complete confidence that we will do so again as the election results process continues.

The political process: What happens next?

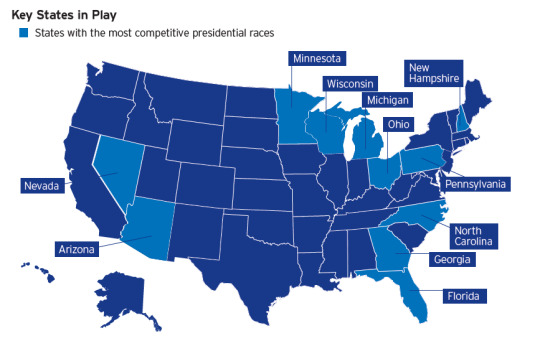

Andy Blocker, Head of US Government Affairs: As of midnight EST on Nov. 3, the results of the election remain unclear. President Trump was able to hold onto many of the early reporting contested states that he won in 2016 – Florida, Texas, Georgia, and Ohio. And as of this hour, Arizona and North Carolina are still too close to call.

If President Trump is able to hold onto Arizona and North Carolina, it will be déjà vu all over again. This election will once again come down to the same rust belt states of Wisconsin, Michigan and Pennsylvania that determined the 2016 election. As expected, they have yet to count all of their mail-in votes and are not ready to be called for either candidate. We would expect to have final results from Wisconsin and Michigan on Wednesday, but Pennsylvania will not have final results until Friday, the deadline for receiving mail-in ballots in Pennsylvania. As a result, at the time of this writing, neither candidate has yet reached the 270-vote threshold in the Electoral College that is needed to win.

Four policy issues the markets will be watching

Kristina Hooper, Chief Global Market Strategist: Whoever prevails in this contested election will face significant challenges ahead. These are four areas I’ll be watching closely, due to their potential to impact markets and the economy:

COVID-19. Since the start of the pandemic, I’ve written about the importance of a three-pronged policy response to coronavirus: 1) public health policy to contain the virus, 2) monetary measures to ensure financial liquidity and functionality, and 3) fiscal support to contain the real economic damage. The Federal Reserve has provided massive monetary policy accommodation throughout the crisis — but what about the other two prongs?

In terms of public health policy, Trump has suggested he might pursue a “herd immunity” strategy if there is another resurgence of the virus. In contrast, Biden has suggested that if recommended by medical experts, he would be open to implementing another widescale lockdown similar to the one experienced last spring. These approaches have the potential to significantly impact economic activity.

In terms of fiscal support, I believe the next president needs to think of pandemic-related stimulus as akin to coupon payments on a bond. In other words, stimulus payments need to be adequate and at regular intervals in order for the economy to continue to be supported in the face of serious headwinds until an effective vaccine is developed and widely distributed.

China. We will be very focused on the next president’s plans for engaging with China. The Trump administration’s approach has created significant volatility in markets, and there is fear that a second term would mean even more unpredictable and aggressive moves against China. On the other hand, there is some uncertainty about what a Biden administration might mean for the US-China relationship. In our view, there are two main possibilities: One is that a Biden presidency would hit the “reset” button on relations with China, while another is that Biden would continue to be aggressive with China, but in a more measured and multilateral way.

Taxes. If Biden prevails, markets will be monitoring the potential for taxes to increase. He has said he wants to raise taxes, but when? Clearly the economic recovery is still very fragile, so raising taxes next year could be problematic, in our view. On the other hand, markets did not seem deterred by October polls that projected a decisive Biden victory. I believe one critical reason is that a “Blue Wave” could very well mean a large stimulus package in 2021 — and in the final weeks of the campaign, that seemed to outweigh concerns about an increase in corporate taxes.

Infrastructure. This is one area that both candidates have said they would spend more on, but we haven’t gotten much in the way of details. I will be waiting for details from the next president on his infrastructure spending plan: the amount he plans to spend, how it will be financed, and perhaps even when it might be implemented. In the 1930s, government spending on infrastructure was used as a way to fight unemployment and put people back to work, and it was successful in reducing unemployment and helping the economy. Might the same be true going forward?

We have to recognize that market volatility is what we get when there is policy uncertainty, but we can’t let it shake us as we are experiencing this uncertainty against a backdrop of massive monetary policy accommodation, which has helped support stocks throughout the pandemic. While we work through the political and legal processes to determine the winner, I believe it is important to remain well diversified and stay the course — and of course to be on the outlook for opportunities if stocks experience any heavy bouts of downward volatility.

Two critical question for investors

Brian Levitt, Global Market Strategist: It’s officially the moment that many investors expected might occur. The outcome of the election is unknown and the counting may take some time.

It is said that the equity market and those who invest in it don’t like uncertainty, particularly policy uncertainty. As a result, the potential for near-term bouts of equity market volatility may be elevated. Critically however, the current political uncertainty is unlikely to change the trajectory of the economy and markets over the next years, in my view.

Providing the obligatory historical perspective of contested US elections is challenging. After all, the grand experiment is only 245 years old, and the 1876 election between Rutherford B. Hayes and Samuel Tilden may be of little significance to current investors. For what it’s worth, US large-cap equities fell 18% between the election of November 1876 and Hayes’ inauguration in March 1877, only to subsequently climb by 160% over his single term as president.1

In this century, the Nov. 7, 2000, election between George W. Bush and Al Gore didn’t have a victor declared until Dec. 13, 2000, when the US Supreme Court effectively ended the recount in Florida. The S&P 500 Index was down 4.9% between election day and the Supreme Court decision over a month later.2 Gold was up 3.9% over the same time frame, and the 10-year US Treasury rate fell 85 basis points from 5.85% to 5.00%.3 That’s not a great outcome but not a disaster either.

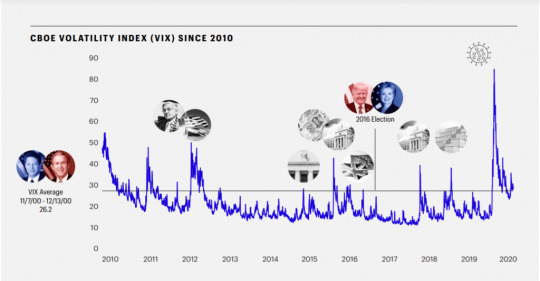

Notably, average market volatility in the 25 trading days between the 2000 election and the official result did not rise to the levels reached multiple times during the elongated business and market cycles of 2009-2019.4 In short, we have been through a lot of events in recent years that rattled markets more than the delayed election result of Bush v. Gore (see chart below). This includes, but is not limited to, the European debt crisis, the Chinese currency devaluation, the many shifts in US Federal Reserve policy, and the US-China trade war, not to mention the COVID-19 outbreak, which ultimately concluded the business cycle.

Source: Bloomberg, Chicago Board Options Exchange. The VIX Index is a financial benchmark designed to be an up-to-the-minute market estimate of the expected volatility of the S&P 500 Index and is calculated by using the midpoint of real-time S&P 500 Index (SPX) option bid/ask quotes.

In my view, when assessing the impact of specific events on the financial markets, investors should always ask themselves two primary questions:

Does the event change the trajectory of the world’s major economies over the next years?

Has monetary policy reserved course and/or does the event change the direction of monetary policy over the next years?

Seen from that lens, it is not surprising that the markets experienced greater volatility from the events listed above — the European Central Bank inexplicably raising rates in 2011, the US Federal Reserve raising rates in 2015, and an evolving and uncertain trade war between the world’s two largest economies in 2018 — than it did during Bush v. Gore. Election outcomes, as well as regional events (such as the Syrian Civil War), natural disasters (such as the hurricanes in Puerto Rico and Houston), massive protests and civil strife (such as Ferguson, Baltimore, Portland, and Kenosha), tend to not have the same impact on financial markets. This is because elections, regional events, natural disasters, and protests, while disconcerting, tend to not change the trajectory of the national or global economy nor of monetary policy.

In my view, the trajectory of the US economy in the next few years will be determined by the ability to compress COVID cases and re-engage in more segments of the US service economy. Plain and simple. Admittedly, the next president and his administration could hasten the US economic recovery through the right policy mix. Nonetheless, I believe that betting against that recovery over the next couple of years, irrespective of the ultimate outcome of the 2020 election, is akin to betting against medicine, science and human ingenuity. In addition, the Federal Reserve has telegraphed easy monetary policy conditions for at least the better part of the next presidential term.

As we stress over the outcome of the election and refresh foxnews.com or msnbc.com for the 50th time each day, remember there is a confluence of factors that I expect to favor stocks: The US economy is recovering and may continue to recover from a very depressed state. Stocks are cheap compared to bonds. 5 Cash yields little6 and the Fed intends to inflate away 2% of the value of that cash each year. In short, I see few alternatives to equities for investors seeking growth. Those factors are expected to stay the same, regardless of who is taking the oath of office in January.

Therefore, I’ll spend this unsettling time focusing on my two primary questions, rather than on the breaking news from the 24-hour news stations.

1 Source: Yale, Robert Shiller database

2 Source: Bloomberg, Standard & Poor’s

3 Source: Bloomberg. The gold spot price is quoted as US dollars per troy ounce.

4 Source: Bloomberg

5 Source: Bloomberg, Standard & Poor’s, as of 9/30/20. As represented by the difference between the earnings yield of the S&P 500 Index and the 10-year US Treasury rate.

6 Source: Bankrate.com, as of 9/30/20

Important information

Blog image credit: Roibu / Getty

Diversification does not guarantee a profit or eliminate the risk of loss.

Past performance does not guarantee a profit or eliminate the risk of loss.

The opinions referenced above are those of the authors as of Nov. 3, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/the-counting-continues-as-trump-and-biden-pursue-a-path-to-victory/?utm_source=rss&utm_medium=rss&utm_campaign=the-counting-continues-as-trump-and-biden-pursue-a-path-to-victory

0 notes

Text

It’s Election Day, and the Senate is definitely in play

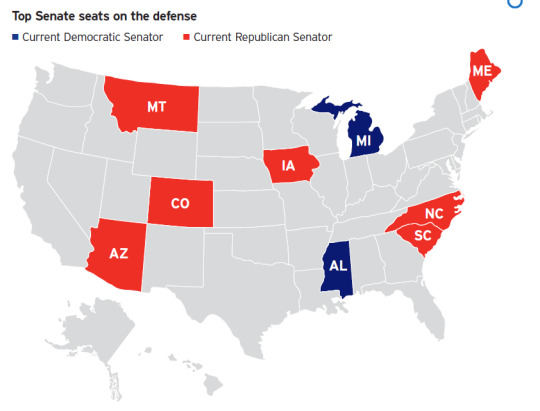

A year ago, anyone who looked at the map of Senate seats up in 2020 would have concluded that Democrats had a difficult path back to the majority. Fast forward a year and the persistent lead of former Vice President Joe Biden over President Donald Trump, along with a gusher of campaign cash for Democratic candidates, suddenly has Republicans playing defense in usually reliable red states.

The current split in the Senate is 53 Republicans to 45 Democrats along with two Independent senators, Angus King from Maine and Bernie Sanders from Vermont, who caucus with Democrats. Based on that ratio, Democrats need a net gain of three seats if Biden wins or a net gain of four if President Trump is re-elected.

Of the seats Democrats are defending, two are considered most likely to flip to the Republicans: Doug Jones of Alabama and Gary Peters of Michigan. On the Republican side, there are nine seats considered most likely to flip: Martha McSally in Arizona, Cory Gardner in Colorado, Joni Ernst in Iowa, Susan Collins in Maine, Steve Daines in Montana, Thom Tillis in North Carolina, and Lindsey Graham in South Carolina.

Separately, David Perdue finds himself in a neck-and-neck race with Democratic challenger Jon Ossoff in Georgia. Perdue’s tenuous situation is partially due to being overshadowed by an intense special election for the second Senate seat that is playing out in a “jungle primary” between Republicans Kelly Loeffler and Doug Collins and Democrats Raphael Warnock and Matt Lieberman. Both races must result in one candidate reaching a 50% threshold or face a January runoff.

The good news for Democrats is that there are more Republican seats in play than Democratic seats. The bad news for Democrats is that many of those seats are in usually reliable red states.

Today, on Election Day, let us consider the factors that give Democratic challengers hope and Republican incumbents cause for concern.

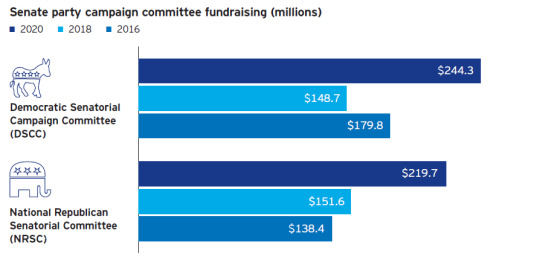

Money

It’s long been said that money is the mother’s milk of politics, and that could not be more accurate than this year. The Democratic Senatorial Campaign Committee (DSCC) has raised more than $244 million in this cycle compared to $148 million in 2018. The National Republican Senatorial Committee (NRSC) has raised a similar amount this year, bringing in nearly $220 million – about $70 million more than they raised in 2018. What does all this money do? It allows both parties to make their case on television, a lot. The NRSC and affiliated Republican groups have spent over $257 million on television spots across 10 battleground states. The DSCC and affiliated groups have, similarly, spent $256 million across the same 10 states.

Source: Federal Election Commission, as of Oct. 23, 2020

Individual candidates are raising eye-popping sums as well, changing the shape of races once thought safe. Take South Carolina, for example, in a race that six months ago, no one thought would be close. Democratic challenger Jaime Harrison has pulled within striking distance of longtime incumbent Senator Lindsey Graham. As of Sept. 30, Harrison had raised $86.8 million to Graham’s $59.4 million. In a dark red state that President Trump carried easily in 2016, Harrison has made a race of it. In fact, he shattered a three-month, $38 million fundraising record previously held by Beto O’Rourke in 2018 by raising an eye-popping $57 million in the third quarter of 2020.

In neighboring North Carolina, Army veteran and former state legislator Cal Cunningham has raised $43.4 million, outpacing Senator Thom Tillis, who has raised less than half of that. Outside prognosticators have this race as a toss-up or leaning Democratic, but late revelations of an extramarital affair may damage some of Cunningham’s standing with voters.

Yet more money does not always equal electoral success. Senator Doug Jones in Alabama has raised nearly $25 million, three times the amount raised by his challenger, former Auburn football coach Tommy Tuberville. Yet, Jones continues to trail Tuberville by double digits in recent polls.

This pattern of Democrats significantly outraising Republicans is playing out in battlegrounds across the country. The notable exception is in Michigan, where Senator Gary Peters is in a close race with businessman and Army veteran John James. Peters has raised $35.6 million to James’ $33.9 million. While outside observers rate this race as leaning Democratic, it is the race that keeps Democratic strategists up at night, and a loss here could complicate the Democrats’ path to the majority.

Three potential Senate scenarios

1. Blue Wave

The dream scenario for Democrats is a blue wave that washes over the nation, carries Biden to the White House and gives him a majority in both the Senate and House of Representatives. The key questions in this scenario are how large a Senate majority and will it be enough to allow Biden to enact some of his more ambitious agenda items.

It seems unlikely that Democrats would achieve a “supermajority” of 60 or more votes necessary to break any filibuster and, if past is prologue, then Minority Leader Mitch McConnell (R-Kentucky) will use all the tools at his disposal to try to stop the Democratic agenda.

This concern gives rise to talk of ending the filibuster, the procedure that gives any individual senator the ability to prevent the Senate from moving forward on legislation. While this seems like a simple thing for a new majority to do at the beginning of the Congress, it is not easy procedurally or politically. Eliminating the filibuster by changing the rules would require two-thirds of senators to be present and voting, or 67 votes if all 100 senators are present and voting. It is unlikely that any senator in the minority would vote to give away their leverage over the Senate’s agenda. Democrats could choose to modify the filibuster instead by banning it on certain proceedings, as was done for judicial nominations, or make it more difficult to use by requiring senators to filibuster in person.

For example, Democrats could choose to eliminate the filibuster on “motions to proceed,” which are the motions that allow the Senate to move to debate. This would preserve a senator’s right to object to passage of the underlying matter without preventing the Senate from considering it at all. A new Senate majority could limit the time for debate on certain kinds of legislation as has been done for the annual budget resolution, to prevent arms sales to foreign governments or to ratify trade agreements. Because of the two-thirds requirement to change the standing rules, the new majority would have to rely on creating a new “precedent,” which can be done by a simple majority. This process involves having the Senate’s presiding officer rule on a point of order, then appealing the ruling and voting to overturn it. This vote requires only a simple majority. Former Majority Leader Harry Reid (D-Nevada) used this process in 2013 for certain judicial nominations. Majority Leader Mitch McConnell (R-Kentucky) used the same process in 2017 for Supreme Court nominations.

The Senate could also return to the form of the filibuster abandoned in the 1970s. Before that, senators who objected to legislation had to do so in person on the Senate floor. This was because the Senate considered bills in sequence and could not move on to other business until the current matter had been disposed of. A change in Senate procedure proposed by then-Majority Whip Robert Byrd (D-West Virginia) allowed the majority leader under unanimous consent, or with agreement of the minority leader, to set aside the pending issue and move on to other business. Changing it back would preserve the filibuster but force senators to be particular about when they object.

Politically, there are Democrats who have expressed either misgivings with or outright objection to changing the rule. Senator Joe Manchin (D-West Virginia), for example, has come out against changing the filibuster. Senators John Tester (D-Montana) and Angus King (D-Maine) have both suggested that modification is preferable. The conventional wisdom is that if Democrats take the Senate, incoming Majority Leader Chuck Schumer (D-New York) will wait to see how opposition to Biden’s agenda materializes before making any significant changes to Senate rules.

An alternative would be for Democrats to use a process under the Budget Control Act of 1974 called “reconciliation.” It expedites the passage of certain budget-related items without the threat of the filibuster. For reconciliation to be used, both the House and Senate would have to pass a concurrent budget resolution (not an easy task these days). This process has been used in the past, including for tax cuts passed during the George W. Bush and Trump administrations and – contrary to popular belief – only to make a series of discrete budgetary changes to Obamacare (not to pass the actual law). In fact, progressive groups have already called for Congress to use this process to enact climate change legislation.

2. Republicans Hold Senate

A second scenario is a Biden victory and Republicans retaining the Senate. In this case, the Senate will continue to be the place where Democratic agenda items go to die. Neither the Green New Deal (nor any form of major climate change legislation) nor Medicare for All will be considered, let alone pass in a 117th Congress controlled by Senate Republicans. There could be agreement on an infrastructure package, but even that would be fraught with disagreements of the size, focus, and how to pay for it.

3. Status Quo

A third scenario is status quo — Trump is re-elected, Republicans retain control of the Senate, and Democrats retain control of the House of Representatives. In this scenario, there may be opportunities for progress on COVID-19 relief and infrastructure spending. However, look for many of the same pitched battles on contentious issues like health care, more confirmation of conservative federal judges (appointment by the president and confirmation by the Republican Senate), and President Trump turning to executive orders and regulatory fiat to overcome the overall stalemate in Congress.

Regardless of who wins the presidency, the fortunes of the next administration rest solely in the hands of the Senate.

Important information

Blog header image: ElevenPhotographs / Unsplash

The opinions referenced above are those of the authors as of Oct. 27, 2020. These comments should not be construed as recommendations, but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations.

from Expert Investment Views: Invesco Blog https://www.blog.invesco.us.com/its-election-day-and-the-senate-is-definitely-in-play/?utm_source=rss&utm_medium=rss&utm_campaign=its-election-day-and-the-senate-is-definitely-in-play

0 notes

Text

Should investors spend more time considering the upside risks?

Since the dark days of March and April, I have remained steadfast in looking across the valley to better times ahead, and this time is no exception. Regardless of near-term turbulence, I continue to favor portfolio positioning for optimistic, long-term outcomes by emphasizing the “recovery” trade and embracing cyclicality. Fortunately, key barometers of global growth have validated this positive outlook.

Each month, the JPMorgan Global Manufacturing Purchasing Managers Index (PMI) takes the first pulse of business conditions and executive sentiment across the worldwide manufacturing sector. Not only has the PMI enjoyed a literal V-shaped recovery, but it has achieved levels of optimism higher than those immediately preceding the Great Lockdown (Figure 1).

Similarly, South Korea is the first major exporting nation to release monthly trade data, providing an early gauge of international commerce. Improving planetary demand for chips, computers and cars are supporting shipments from this high-tech, industrialized and global growth-sensitive economy. Indeed, South Korean exports are growing faster now than they were before the pandemic (Figure 1).

Figure 1. Key barometers of global growth have validated the ‘recovery’ trade

Source: Bloomberg L.P., Invesco, 10/28/20. Note: Diffusion indices have the properties of leading indicators, and are convenient summary measures showing the prevailing direction and scope of change. Shaded areas denote global manufacturing contractions.

In North America, US retail sales have rebounded to a high single-digit pace unseen since the aftermath of the Great Recession and Global Financial Crisis of 2008-2009. Clearly, fading government support, delays over further stimulus payments, and still over 700,000 people filing for initial jobless claims each week haven’t stopped American consumers from spending.

Downside risks

Have my views changed given the recent risk-off tone in markets? No. But responsible stewards of capital must contemplate the downside risks. In order to derail the cyclical advance, I believe something devastating would have to happen.

True, the rise of new COVID-19 cases has been weighing on risk assets, including the overall stock market. In response to increasing infection rates, Germany, France and Canada have renewed lockdowns and social restrictions to curb the spread of the coronavirus.

Despite virus-related concerns, however, S&P 500 industries that previously profited from the shutdown (i.e., Biotechnology, Hypermarket & Super Center, Interactive Home Entertainment, Internet & Direct Marketing Retail, and Internet Service & Infrastructure stocks) have been underperforming those that stand to gain from reopening (i.e., Airline, Casino & Gaming, Hotel, Resort & Cruiseline, and Restaurant stocks) since early July. In other words, when the dark blue area declines, it means the “reopening” beneficiaries outperformed the “shutdown” beneficiaries (Figure 2).

Perhaps these leading indicators of potential economic activity are sensing another peak in the case count, as they did back in June/July and February/March? If so, I would prefer to take a cue from such intra-stock market trends and stick to the broader “recovery” trade.

Figure 2. Despite virus-related concerns, the US ‘reopening’ trade has been outperforming the ‘shutdown’ trade since early July

Source: Bloomberg L.P., Invesco, 10/28/20. Notes: The shutdown trade is based on an equally-weighted basket of the official Biotechnology, Hypermarket & Super Center, Interactive Home Entertainment, Internet & Direct Marketing Retail and Internet Service & Infrastructure Sub-Industry components of the S&P 500 Index. The reopening trade is based on an equally-weighted basket of the official Airline, Casino & Gaming, Hotel, Resort & Cruiseline and Restaurant Sub-Industry components of the S&P 500 Index. An investment cannot be made in an index. Past performance does not guarantee future results.

Upside risks

Is it possible to spend too much time worrying about the downside risks and not enough time considering the upside risks? For this exercise, let’s explore some “what if” scenarios:

What if potential treatments and/or vaccines for the virus materialize, and meaningfully alter trends in the case count? According to CNBC, the US Food and Drug Administration (FDA) has already approved Gilead Science’s remdesivir as the first COVID-19 treatment.1

Granted, there’s a stalemate in Washington over the next round of fiscal stimulus, but I see this as an ebbing tailwind for now rather than a gathering headwind. What if a “blue wave” materializes on Election Day, but delivers another round of significant fiscal stimulus as opposed to higher taxes? Recall that Obama extended the Bush-era tax cuts a few times in the recovery stage of that business cycle.

What if volatility were to decrease and stocks were to increase following the election, helped by typical year-end seasonal patterns (read: the “January” effect) and election-year tailwinds? In spite of all the fears about persistent volatility around the election, history shows that the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) has fallen the most in November (during all calendar years since 1986) and even more in US presidential election years (Figure 3).

Figure 3. Historically, volatility has fallen the most in November during US presidential election years

Source: Bloomberg L.P., Invesco, 10/28/20. An investment cannot be made in an index. Past performance does not guarantee future results.

As a result, I’m inclined to interpret the recent shakeout as a temporary risk-shedding event, as opposed to a sinister change of trend, and I continue to treat such short-term pullbacks as buying opportunities for stocks. In fact, this technical indicator suggests S&P 500 industry breadth or participation has essentially fallen to washout levels (Figure 4), and a playable rally may ensue.

Figure 4. US stock market breadth has fallen to washout levels, and a playable rally may ensue

Source: Bloomberg L.P., Invesco, 10/28/20. Notes: Price returns. 50 DMA = 50 day moving average. The magenta ellipses highlight past instances when extremely weak industry breadth/participation coincided with major lows in the US stock market. An investment cannot be made in an index. Past performance does not guarantee future results.

Stick to cyclical growth

Within the economy-sensitive sectors of the stock market, the real debate still centers on “growth” cyclicals (e.g., Information Technology, Consumer Discretionary) versus “deep value” cyclicals (e.g., Financials, Energy).

I’m watching the yield curve or spread between 10- and 2-year government bond yields for signs of a persistent rotation into deep value cyclicals. True, the yield curve has steepened a bit recently, but has failed to break out above 0.7% so far in the economic recovery.2

From my lens, Financial and Technology stocks seem unconvinced the economy’s about to rapidly shift into sustainably higher gears. Until it does, I’m staying committed to cyclical growth. (No, the bottom of the chart doesn’t equal technical support.)

Figure 5. Technology was ground zero for the recent sell-off, but I’m unconvinced the economy’s about to rapidly shift into sustainably higher gears

Source: Bloomberg L.P., Invesco, 10/28/20. Notes: The Financials and Information Technology sector indices are sub-components of the S&P 500 Index, and the Value and Growth indices are sub-components of the S&P 500 Index (see definitions for all below). An investment cannot be made in an index. Past performance does not guarantee future results.

For price-conscious investors, it might be more palatable — and maybe just as effective — to consider participating in this prolonged, low-altitude recovery and cyclical advance through the Industrial and Material sectors.

Footnotes

1 Source: CNBC, 10/22/20.

2 Source: FRED, 10/28/20.

Definitions

The CBOE VIX or investor “fear” gauge is a real-time index that measures expectations for US stock market volatility over the coming 30 days.

The S&P 500 Index is a capitalization-weighted measure of 500 stocks representing leading companies across the major industries of the US economy.

The S&P 500 Financials Index is a capitalization-weighted measure of large-cap stocks within the financial sector of the US economy. It’s a sub-component of the broader S&P 500 Index.

The S&P 500 Information Technology Index is a capitalization-weighted measure of large-cap stocks within the tech sector of the US economy. It’s a sub-component of the broader S&P 500 Index.

The S&P 500 Value Index measures the performance of US large-cap value stocks as defined by companies with lower price-to-book ratios.

The S&P 500 Growth Index measures the performance of US large-cap growth stocks as defined by companies with higher forecasted earnings growth rates.

Important Information

Blog Header Image: Lucas Ottone / Stocksy

All investing involves risk, including risk of loss.