Text

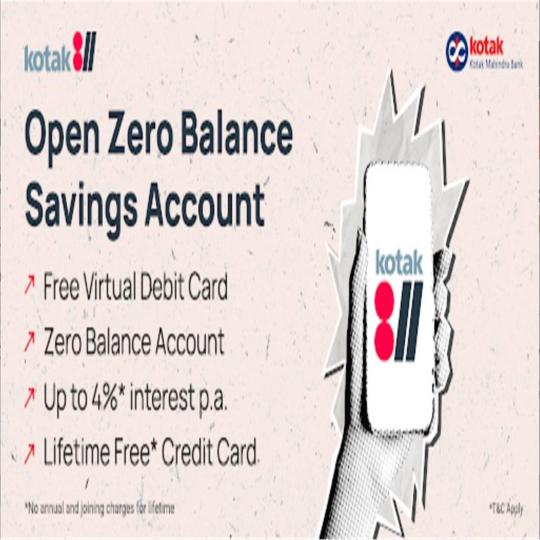

Open a zero balance savings account online in a few simple steps!

Welcome To Your Online Zero Balance Savings Account From Kotak!

Get an instant online bank account number & CRN (Customer Registration Number) so you can start banking immediately on the Kotak 811 app.

#opening bank account#saving account apply online#saving account opening#saving bank accounts#open an bank account online#open a savings account

0 notes

Text

What should you consider when opening a bank account?

Opening a bank account is a crucial financial choice that greatly impacts your financial goals and well-being. It is imperative to approach this decision with the utmost care and consideration, whether you are starting this path for the first time or thinking about switching between banking organizations. Choosing the right account opening app is the best option, and it significantly impacts your capacity to manage your money, affecting everything from short-term savings objectives to daily financial activities. It serves as the cornerstone of your financial journey. Therefore, it is crucial that you carefully consider your alternatives, evaluate your objectives, and choose the account that best suits your individual financial goals and circumstances.

24*7 banking facility:

Customers of the majority of banks have access to Internet banking services. However, many of the most popular transactions still need to be permitted by all institutions when done online. Some banks give online access to all required transactions, but the user interfaces for their Internet and mobile banking could be better. If you want to conduct most of your banking activities online, confirm that the bank provides 24-hour banking services and whether it allows for completing most transactions using Internet and mobile banking.

Debit card deals:

Most banks provide promotions on their debit cards, ranging from cash-back offers to insurance coverage, to set themselves apart from rivals. Nevertheless, some banks charge annual fees for their debit cards, while others waive them if annual transactions reach a particular threshold. Banks provide gold and platinum debit cards with several advantages but frequently have a yearly fee.

Availability of credit facilities:

Getting loans from the bank where you have your basic savings account is always simpler. Banks consider your previous banking experience with them when granting loans to you. A positive and lasting banking connection is a big asset when applying for a loan. Finding the account opening app helps to have a safe transaction, and they provide account holders with solid credit histories and positive account balances with pre-qualified and pre-approved loans. With no paperwork required, you can apply for loans online and immediately receive the funds in your account. So, if you might need credit in the future, check out the bank's credit options.

Discounts and offers:

Pay attention to the savings and promotions the bank gives on debit cards, credit cards, wallets, and other online transactions if you wish to pay your bills and purchase without using cash. Most top banks occasionally provide generous discounts and promotions, particularly during holidays. These offers can save you money or net your reward points if used carefully. To take advantage of these deals to the fullest, consider opening a savings account with a bank that has a relationship with your favored retailer or provides the most overall savings on your preferred category of goods.

Wrapping it up:

From the above mentioned, a financial choice like opening a bank account can affect both your short- and long-term financial objectives. Before choosing, consider your needs, contrasting bank services, and asking questions. Axis zero balance account open online best fits your financial condition and goals by considering these things. Making an informed decision is crucial for your financial security because your bank should be a trusted partner in managing your funds.

#account open instantly#account open online#bank account online#0 balance account open online#bank online application#bank account opening procedure#online account opening

0 notes

Text

Contactless payment and the details of its working

The process of transacting is becoming simpler each year. Payments can be made in a variety of simple methods, and the contactless payment mechanism is one of these. Contactless payment methods are one of the important inventions of this era. Customers can use their debit or credit cards with RFID technology to make contactless payments for goods and services.

When making an in-store purchase, using contactless banking is among the most widely used payment options. Because the customer can use these cards to pay without making physical contact, transactions go more smoothly.

To learn more about contactless payment and how it functions, continue reading.

What is contactless payment?

Customers can make purchases utilizing contactless payment instead of cash or card swipes. Tapping and waving on the card reader is required to pay using contactless payment. The terminal will then establish a connection with the bank account, and the payment will be processed immediately.

How does contactless payment work?

Radio Frequency Identification (RFID) technology is used in contactless payment cards. The card connects with the scanner when it is in close proximity to one to complete the transaction.

When tapped or waved over the reader, the card reader verifies the information on the card. Following that, the transaction is sent to the card issuer by the merchant's point-of-sale system. After reviewing it, the card issuer approves the transaction.

If individuals desire to do financial transactions using their phones, contactless payment is an additional choice.

The invention of contactless banking has taken payment methods to a whole new level. The quickness and security of contactless banking is unbeatable. The features of contactless banking will get better in the coming years.

Strong authorization

People could believe that contactless payment is hazardous since anyone can take cardholder data. Contactless payments, however, are quite secure. Contactless payment is difficult to hack or breach because they need validation to be completed.

On the card, the information is encrypted. As a result, it is more challenging to steal card information and perform unauthorized logins.

It’s a secure payment method.

Due to its ability to let users complete transactions fast, contactless payments are growing in popularity. Customers can make payments faster because they don't need to input their PIN.

Customers also don't need to carry cash. Contactless payments eliminate this bother, making transactions simple.

What benefits do contactless payments offer?

Contactless payments, facilitated by a bank account app, can significantly expedite the checkout process while also enhancing security. These payments are not only quicker than cash transactions but also take less time compared to typical credit card payments. As a result, contactless payments are particularly well-suited for micropayments and other low-value transactions, making the bank account app a convenient and efficient tool for managing your finances.

Using contactless payment methods can speed up transactions at parking garage checkout stations, turnstiles for public transportation, and toll booths. Although the actual amount of time saved for every transaction may be less than a minute, the minutes saved can pile up and drastically lessen the amount of time clients must wait in queues.

Final thoughts

Institutions and third-party payment processors are experimenting with ways to make checkout more seamless as upi money transfer app technology becomes more widely used. To assist mobile users in finding ATMs, certain payment providers offer GPS technology. Other carriers give clients the option to participate in loyalty marketing run through focused geofenced campaigns.

#bank account online#create bank account online#bank open account online#open account online#bank accounts to open online#online account opening bank#new bank account open#phone banking app#online bank account opening

0 notes

Text

zero balance account opening app

The Kotak Digital Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#mobile banking account app#digital account opening app#zero balance account app#best banking app#best mobile banking app

1 note

·

View note