Text

What Are The Key Drivers Behind China's Expanding Influence In Africa?

China's influence in Africa has grown significantly over the past few decades, making it a crucial player in the continent's economic and political landscape.

This expansion of Chinese influence raises questions about the motivations and drivers behind Beijing's engagement with African nations. In this blog post, we will explore the key factors driving China's expanding influence in Africa, shedding light on the dynamics of this complex relationship.

Economic Interests

At the core of China's engagement with Africa lies its economic interests. China views Africa as a vast market for its goods and services, a source of raw materials, and a destination for its investments. Africa is rich in natural resources such as oil, minerals, and agricultural products, which are vital for China's growing economy. African markets provide opportunities for Chinese companies to expand their reach and generate profits.

Infrastructure Development

China has heavily invested in infrastructure projects across Africa, including building roads, railways, ports, and telecommunication networks. These projects not only facilitate the transportation of goods and resources but also stimulate economic growth in the host countries. Improved infrastructure benefits both China's trade and the African economies.

Diplomacy And Soft Power

China's diplomacy in Africa is characterized by its non-interference policy in domestic affairs, a sharp contrast to the historical baggage of Western colonialism. This approach resonates with African leaders and governments, who appreciate China's respect for sovereignty. Furthermore, China has extended soft power through initiatives such as the Confucius Institutes, cultural exchanges, and scholarships, promoting a positive image of China in African societies.

Resource Acquisition

China's demand for natural resources has driven it to secure access to African commodities. Through a combination of trade agreements and investments in resource-rich countries, China ensures a steady supply of key resources, including oil from Angola and Nigeria, copper from Zambia, and minerals from the Democratic Republic of Congo.

Belt And Road Initiative (BRI)

Africa plays a vital role in China's ambitious Belt and Road Initiative. The BRI aims to enhance connectivity between China and other regions of the world, and many African countries are strategically located along the proposed BRI routes. Chinese investments in African infrastructure contribute to the success of this global project.

Market Expansion

China's global economic strategy involves diversifying its markets and reducing reliance on the Western world. African countries offer a growing middle-class consumer base, making it an attractive destination for Chinese goods and investments. By expanding its market presence in Africa, China can reduce its vulnerability to economic downturns in other regions.

Political Alliances

China has strategically cultivated political alliances with African nations. Through aid, development projects, and diplomatic support, China has garnered favor with various African governments. This has allowed Beijing to secure valuable contracts, access to resources, and political backing on international platforms.

Investment In Human Capital

China has invested in human capital development in Africa by providing scholarships, training programs, and technical assistance. This investment creates goodwill among African professionals, fostering lasting ties and strengthening China's presence on the continent.

Conclusion

China's expanding influence in Africa is driven by a complex interplay of economic, political, and strategic interests. While China's engagement offers opportunities for African development, it also raises concerns about debt sustainability, environmental impacts, and potential loss of sovereignty. African countries must carefully navigate these relationships to maximize the benefits while mitigating the risks. China's role in Africa is likely to continue evolving, shaping the continent's future in profound ways and reinforcing its status as a global economic powerhouse.

#ChinaInAfrica#EconomicInfluence#BeltAndRoadInitiative#AfricanTrade#InfrastructureProjects#ResourceAcquisition#InvestmentInAfrica#Sino-AfricanRelations#GeopoliticalStrategy#DevelopmentPartnerships

0 notes

Text

How Does China's 'Wolf Warrior' Diplomacy Impact Its International Relations?

In recent years, China has adopted a more assertive and confrontational approach to diplomacy, often referred to as "Wolf Warrior" diplomacy.

Named after a popular Chinese action movie series, this approach is characterized by a more aggressive tone in international discourse, a willingness to engage in public spats, and a departure from the traditional Chinese policy of "keeping a low profile" in global affairs.

In this blog post, we will delve into the concept of 'Wolf Warrior' diplomacy, examine its impact on China's international relations, and consider the implications for the broader world stage.

Understanding 'Wolf Warrior' Diplomacy

'Wolf Warrior' diplomacy represents a significant shift in China's approach to international relations. It is marked by the following key characteristics:

Aggressive Rhetoric: Chinese diplomats, both official and unofficial, have adopted a more confrontational and assertive rhetoric in their public statements. This includes sharp criticisms of other nations, especially those that question or criticize China's policies.

Nationalistic Tone: 'Wolf Warrior' diplomacy often carries a strong nationalist tone, appealing to a domestic audience and portraying China as a global power that will not be bullied by other nations.

Use of Social Media: Chinese diplomats are active on social media platforms, using them to communicate directly with global audiences and to counter what they perceive as biased narratives in Western media.

Economic Coercion: China has sometimes used its economic leverage to punish countries that take actions it disapproves of, such as trade restrictions or bans on imports.

Impact On China's International Relations

The 'Wolf Warrior' diplomacy approach has had several notable impacts on China's international relations:

Increased Tensions: This aggressive diplomacy has contributed to increased tensions with multiple countries, including the United States, Australia, India, and many European nations. Public spats and disputes have become more common.

Economic Consequences: China's willingness to use economic leverage for diplomatic purposes has raised concerns among its trading partners. Some countries have sought to diversify their trade relationships to reduce dependence on China.

Nationalism and Unity: 'Wolf Warrior' diplomacy has garnered support among some segments of the Chinese population who view it as a source of national pride. It has also contributed to a sense of unity within the country.

Isolation Concerns: There is a growing concern that China's assertiveness could lead to its isolation on the global stage, as it risks alienating potential allies and partners.

Implications For The Global Stage

The impact of 'Wolf Warrior' diplomacy extends beyond China's immediate bilateral relations. It has broader implications for global politics and diplomacy:

Geopolitical Competition: China's assertiveness has exacerbated geopolitical competition, particularly with the United States. This competition affects various issues, including trade, technology, and regional conflicts.

Challenges to Multilateralism: China's confrontational stance challenges the norms of multilateral diplomacy and institutions like the United Nations. It has sometimes obstructed international cooperation on global challenges such as climate change and pandemic response.

Bilateral and Regional Dynamics: The effects of 'Wolf Warrior' diplomacy vary from one region to another. For example, it has strained relations in the South China Sea and contributed to territorial disputes.

Global Perception: China's image on the global stage has been influenced by this new diplomacy. While some see it as a strong, assertive nation, others view it with suspicion and concern.

Conclusion

China's 'Wolf Warrior' diplomacy represents a notable departure from its past approach to international relations. While it has garnered support domestically and projected an image of strength, it has also strained relations with key partners and raised concerns about China's long-term global standing.

The path ahead for China will require a careful balancing act between asserting its interests and maintaining constructive international relations. The world watches closely as China navigates this new era of diplomacy, with the hope that dialogue, cooperation, and diplomacy will ultimately prevail over confrontation.

#WolfWarriorDiplomacy#ChinaDiplomacy#InternationalRelations#Geopolitics#DiplomaticRelations#GlobalDiplomacy#SoftPower#ChineseForeignPolicy#DiplomaticStyle#GlobalInfluence

0 notes

Text

Is China's Belt And Road Initiative A Global Game-Changer Or A Debt Trap?

China's Belt and Road Initiative (BRI) has emerged as one of the most ambitious and controversial infrastructure projects in modern history.

Launched in 2013 by President Xi Jinping, the BRI aims to connect Asia, Europe, Africa, and beyond through a network of railways, roads, ports, and pipelines.

While it promises significant economic opportunities and improved connectivity for participating countries, it has also garnered criticism for its potential to create unsustainable debt burdens and geopolitical tensions.

In this blog post, we will delve into the complexities of the BRI, exploring its objectives, benefits, challenges, and the global impact it has had thus far.

Understanding The Belt And Road Initiative

The BRI comprises two main components: the Silk Road Economic Belt, which is a land-based network, and the 21st Century Maritime Silk Road, which is a sea-based initiative. These routes are designed to enhance trade and connectivity between China and other regions of the world. To achieve this, China has committed massive financial resources to fund infrastructure projects in more than 140 countries.

Key Objectives Of The BRI

Economic Expansion: China seeks to open up new markets for its goods and services, stimulate economic growth, and reduce overcapacity in domestic industries. By connecting markets in Asia, Europe, and Africa, the BRI aims to facilitate the flow of goods and promote international trade.

Geopolitical Influence: Through the BRI, China aims to expand its influence on the global stage. By investing in infrastructure projects and fostering closer ties with participating countries, China can wield significant political influence in these regions.

Infrastructure Development: Many countries along the BRI routes lack modern infrastructure. The initiative aims to bridge this infrastructure gap by building roads, railways, ports, and energy facilities, which can promote economic development and poverty reduction.

Benefits Of The Belt And Road Initiative

Infrastructure Improvement: Participating countries benefit from much-needed infrastructure development, which can boost economic growth, create jobs, and improve living standards.

Trade Facilitation: The BRI promotes trade by reducing transportation costs and transit times, making it easier for goods to move between regions.

Foreign Direct Investment: Chinese investment in BRI countries can attract other foreign investors, potentially leading to increased capital flows and economic development.

Challenges And Concerns

Debt Sustainability: One of the most significant concerns is the potential for participating countries to accumulate unsustainable debt. Chinese loans for BRI projects can lead to a debt trap, where countries struggle to repay their obligations, leading to loss of assets or even geopolitical concessions.

Lack of Transparency: Critics argue that the BRI lacks transparency, making it difficult to assess the terms and conditions of loans and investment agreements. This opacity raises concerns about corruption and unequal partnerships.

Environmental Impact: Large-scale infrastructure projects can have detrimental environmental effects, including deforestation, habitat destruction, and increased carbon emissions. Balancing development with environmental sustainability is a challenge.

Geopolitical Tensions: The BRI has led to geopolitical tensions, particularly in regions where China's expanding influence clashes with the interests of other global powers, such as the United States and India.

Global Impact Of The BRI

The BRI has already had a substantial global impact, shaping the economic and geopolitical landscape in several ways:

Economic Growth: Participating countries have seen increased economic activity, with improved infrastructure supporting trade and investment.

Debt Challenges: Some countries have faced difficulties in repaying their BRI-related debt, leading to concerns about China's debt diplomacy and the potential loss of strategic assets.

Geopolitical Realignment: The BRI has prompted realignments in global geopolitics, with countries seeking to balance their relationships with China, the United States, and other regional powers.

Conclusion

China's Belt and Road Initiative is undoubtedly a global game-changer, but whether it is a positive or negative force depends on various factors, including transparency, debt management, environmental sustainability, and geopolitical dynamics.

As the BRI continues to evolve and expand, it is crucial for participating countries to carefully assess the risks and rewards of their involvement and for the international community to closely monitor its progress.

If managed effectively and responsibly, the BRI has the potential to bring about transformative economic development and improved connectivity for millions of people worldwide.

However, if mishandled, it could lead to economic vulnerabilities, geopolitical tensions, and environmental degradation. The path ahead requires careful navigation and international cooperation to ensure that the BRI fulfills its promise as a global game-changer rather than a debt trap.

#BeltAndRoad#GlobalInfrastructure#DebtTrap#EconomicDiplomacy#GlobalConnectivity#InfrastructureDevelopment#BRIProjects#Geopolitics#SustainableDevelopment#TradeNetworks

0 notes

Text

Revolution On Wheels: Tesla's Remarkable Journey Toward Electric Mobility!

In the world of automobiles, one name has emerged in recent years as a harbinger of change, innovation, and sustainability: Tesla.

Founded by Elon Musk in 2003, Tesla has become synonymous with electric mobility and has embarked on a remarkable journey to revolutionize the automotive industry.

In this blog, we will delve into Tesla's fascinating story, highlighting its achievements, challenges, and its pivotal role in shaping the future of electric mobility.

The Birth of a Vision

Tesla's journey began with a bold vision: to accelerate the world's transition to sustainable energy.

Elon Musk, a visionary entrepreneur with a penchant for ambitious goals, set out to prove that electric cars could not only match but surpass traditional gasoline-powered vehicles in performance, range, and desirability.

The Road Less Traveled

One of the defining characteristics of Tesla's journey was its willingness to take the road less traveled.

While established automakers were hesitant to embrace electric mobility due to concerns about range limitations, charging infrastructure, and consumer demand, Tesla charged ahead.

In 2008, they introduced the Tesla Roadster, the world's first high-performance electric sports car.

This groundbreaking vehicle demonstrated that electric cars could be both exhilarating and practical.

Innovations That Set Tesla Apart

Tesla's success can be attributed to its relentless pursuit of innovation. Some of the key innovations that set Tesla apart include:

Supercharger Network: Tesla invested in building a global network of Supercharger stations, allowing drivers to quickly charge their vehicles on long-distance journeys.

Autopilot and Full Self-Driving: Tesla pushed the boundaries of autonomous driving technology, offering advanced driver-assistance features and laying the foundation for fully autonomous vehicles.

Energy Storage Solutions: Beyond cars, Tesla ventured into energy storage with products like the Powerwall and Powerpack, revolutionizing the way we store and utilize renewable energy.

Gigafactories: Tesla's Gigafactories are sprawling manufacturing facilities designed to produce batteries and electric vehicles at an unprecedented scale, driving down costs and making electric vehicles more affordable.

Market Disruption And Competition

Tesla's success has not gone unnoticed by traditional automakers. As demand for electric vehicles (EVs) grew, major players began to invest heavily in EV technology.

While this competition is healthy for the industry and the planet, it also posed challenges for Tesla.

However, Tesla's first-mover advantage, brand loyalty, and constant innovation have helped it maintain a strong market position.

Global Impact

Tesla's remarkable journey has had a global impact. It has forced the automotive industry to rethink its approach to sustainable transportation.

Governments around the world are now incentivizing electric vehicle adoption, investing in charging infrastructure, and setting ambitious emission reduction targets.

Conclusion

Tesla's journey toward electric mobility is nothing short of remarkable. From a visionary idea to a market leader, Tesla has transformed the way we think about cars, energy, and the environment.

While challenges lie ahead, including scaling production, improving affordability, and addressing environmental concerns related to battery production, there is no doubt that Tesla's impact on the world of electric mobility will continue to be felt for generations to come.

As we look to the future, Tesla's story serves as an inspiring reminder that innovation, determination, and a commitment to sustainability can indeed spark a revolution on wheels, paving the way for a cleaner, greener, and more exciting future of transportation.

#TeslaInnovation#ElectricMobility#SustainableTransport#CleanEnergyRevolution#TeslaElectricCars#FutureOfMobility#GreenTechnology#TeslaJourney#ElectricVehicleRevolution#TeslaImpact

0 notes

Text

Tesla's Fiscal Fortunes: A Look At Revenue, Profitability, And Expansion

Tesla, the electric vehicle (EV) and clean energy company founded by Elon Musk in 2003, has become a global phenomenon.

Its sleek electric cars and innovative energy products have not only changed the automotive industry but have also influenced the way we think about sustainable energy solutions.

In this blog, we'll take a closer look at Tesla's fiscal fortunes, examining its revenue, profitability, and expansion strategies.

Revenue Growth: A Remarkable Journey

Tesla's revenue growth has been nothing short of remarkable. Since its inception, the company has consistently increased its annual revenue.

In 2020, Tesla recorded total revenue of over $31 billion, a substantial increase from the previous year, and this growth trend continued into 2021.

One of the key drivers of Tesla's revenue growth is its expanding product portfolio.

The company started with the Roadster, a high-end electric sports car, and has since introduced the Model S, Model 3, Model X, and Model Y, catering to a wider range of consumers.

Additionally, Tesla's energy products, such as solar panels and the Powerwall, have contributed to its revenue diversification.

Profitability Challenges

While Tesla's revenue growth has been impressive, its profitability has been a subject of scrutiny.

The company's journey to profitability has been marked by periods of losses, as it invested heavily in research, development, and expansion.

However, in recent years, Tesla has made significant strides in this regard.

One factor contributing to Tesla's improved profitability is economies of scale.

As production volumes increase, the cost per unit of electric vehicle decreases, resulting in higher profit margins.

Additionally, Tesla's inclusion in the S&P 500 index in December 2020 boosted its stock price and market capitalization, further strengthening its financial position.

Global Expansion And Market Dominance

Tesla's expansion strategy is a testament to its ambition. The company has been actively expanding its footprint around the world, opening manufacturing facilities in strategic locations.

The Gigafactories in Nevada, Shanghai, Berlin, and Texas are all part of Tesla's plan to increase production capacity and reduce costs.

Moreover, Tesla's focus on autonomy and self-driving technology could potentially revolutionize the transportation industry.

The company's Autopilot and Full Self-Driving (FSD) features are paving the way for a future where vehicles are not just electric but also autonomous.

Tesla's lead in this field positions it as a frontrunner in the race to develop fully autonomous vehicles.

Challenges And Competition

Despite its successes, Tesla faces its fair share of challenges. The EV market is becoming increasingly competitive, with traditional automakers like Ford, Volkswagen, and General Motors investing heavily in electric vehicle technology.

Regulatory hurdles, supply chain disruptions, and global economic uncertainties also pose challenges to Tesla's continued growth.

Additionally, Tesla's market dominance has drawn regulatory scrutiny in various countries, leading to debates about fair competition and market practices.

Navigating these challenges while maintaining its innovative edge will be crucial for Tesla's long-term success.

Conclusion

In conclusion, Tesla's fiscal fortunes have been characterized by impressive revenue growth, improving profitability, and a bold global expansion strategy.

The company's ability to innovate, adapt to market dynamics, and lead the EV revolution has positioned it as a significant player in the automotive and clean energy sectors.

However, the road ahead is not without its challenges, and how Tesla responds to these challenges will shape its fiscal fortunes in the years to come.

One thing is clear: Tesla's impact on the world extends far beyond the balance sheet, as it continues to drive the transition to a sustainable future.

#Tesla#ElectricCars#FiscalFortunes#RevenueGrowth#Profitability#TeslaExpansion#SustainableTransport#EVIndustry#TeslaFinancials#CleanEnergyFuture

0 notes

Text

How To Save Money: Effectively And Efficiently

Saving money is a cornerstone of financial stability and a pathway to achieving future goals. In a world where financial uncertainties can arise unexpectedly, having a robust savings plan can provide a safety net and peace of mind.

This blog explores the art of frugal living and presents a comprehensive guide to the best ways to save money. By adopting these strategies, you can not only bolster your financial well-being but also lay the groundwork for realizing your dreams and aspirations.

As we delve into the intricacies of saving money, we will uncover a plethora of valuable insights and actionable tips. From budgeting techniques that allow you to stretch your dollar further, to lifestyle adjustments that help you cut unnecessary expenses, this guide is designed to empower you with the knowledge and tools to navigate your financial journey more effectively.

Before we dive into the specifics, let's take a moment to understand the significance of saving money and why it's worth dedicating time and effort to master the art of prudent financial management. By implementing the frugal saving strategies discussed in this blog, you can create a solid foundation for achieving both short-term financial stability and long-term dreams.

So, without further ado, let's embark on this enlightening exploration of the best ways to save money.

The Best Ways To Save Money

Saving money is a financial goal that many of us strive to achieve. Whether you're looking to build an emergency fund, make a big purchase, or simply improve your financial security, finding the best ways to save money can make a significant difference in your financial well-being.

In this first part of our guide, we'll explore some of the most effective strategies to help you save money smartly and efficiently.

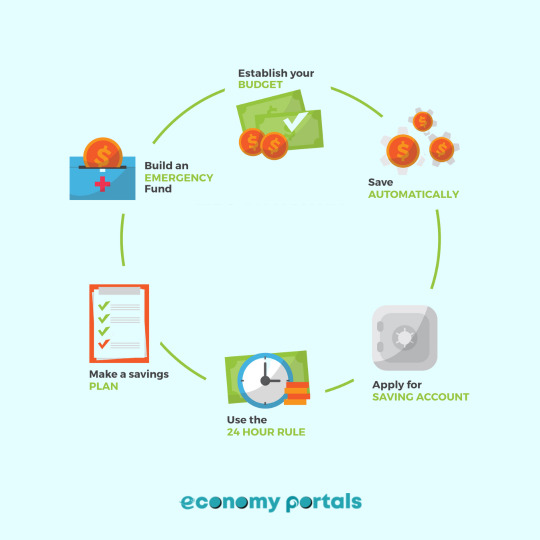

1. Create a Detailed Budget:

One of the foundational steps in effective money-saving is creating a comprehensive budget. Track your income and expenses meticulously to understand where your money is going. This clarity will allow you to identify areas where you can cut back and allocate more funds towards savings.

2. Set Clear Savings Goals:

Establish specific savings goals for different purposes, such as an emergency fund, vacation, or down payment for a house. Having clear goals in mind motivates you to stay committed to your saving journey.

3. Embrace Frugality:

Practicing frugality doesn't mean sacrificing your quality of life; it's about making conscious spending choices. Look for ways to reduce discretionary expenses, such as dining out or entertainment, without compromising on things that truly matter to you.

4. Automate Savings:

Take advantage of technology by setting up automatic transfers from your checking to your savings account. This "set it and forget it" approach ensures that a portion of your income goes directly into savings before you even have the chance to spend it.

5. Comparison Shopping:

Amidst the current economic downturn, Whether you're shopping for groceries, clothing, or electronics, compare prices from different retailers to ensure you're getting the best deal. Utilize apps and websites that help you find discounts and coupons to save even more.

6. Cut Down Unnecessary Subscriptions:

Review your monthly subscriptions and eliminate those that you no longer use or need. This could include streaming services, magazines, or software subscriptions that can quietly drain your finances.

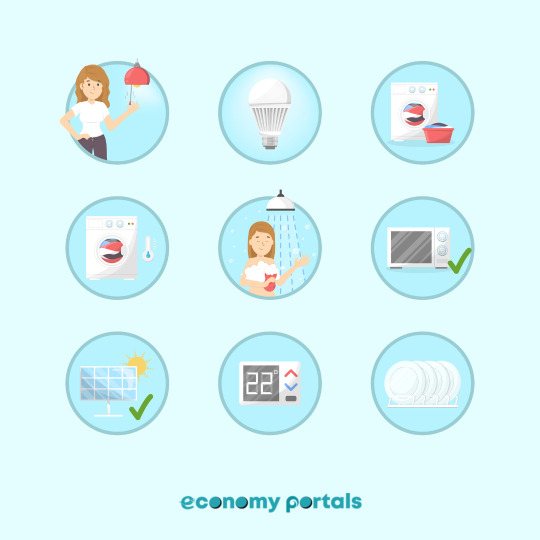

7. Reduce Energy Consumption:

Lower your utility bills by adopting energy-efficient practices. Switch to LED light bulbs, unplug electronics when they're not in use, and adjust your thermostat to save on heating and cooling costs.

By incorporating these best ways to save money into your lifestyle, you'll be well on your way to achieving your financial goals. In the next part of our guide, we'll provide you with a step-by-step guide to saving money effectively using these strategies and optimizing your saving efforts.

Money-Saving Mindset

When it comes to achieving smart financial savings, cultivating a frugal mindset is a foundational step that paves the way for successful money-saving endeavors. A frugal mindset is not about deprivation; it's about making intentional choices that align with your financial goals and values.

By consciously evaluating your spending habits and redefining your relationship with money, you can embark on a journey of intelligent financial management.

One of the cornerstones of this mindset is recognizing the immense value of small savings in the grand scheme of things. It's easy to dismiss the impact of cutting back on minor expenses, such as daily coffee runs or impulse purchases.

However, when you compound these seemingly insignificant savings over time, you'll be amazed at the substantial sum they can add up to. Imagine redirecting the money you'd otherwise spend on impulse buys towards a dedicated savings account or an investment portfolio.

This shift in perspective not only empowers you to take control of your finances but also opens doors to more significant opportunities down the road. In essence, cultivating a frugal mindset and acknowledging the significance of small savings lays a solid foundation for your journey towards effective and efficient money-saving.

It's about recognizing that every financial decision, no matter how trivial it may seem, contributes to the larger goal of achieving smart financial savings.

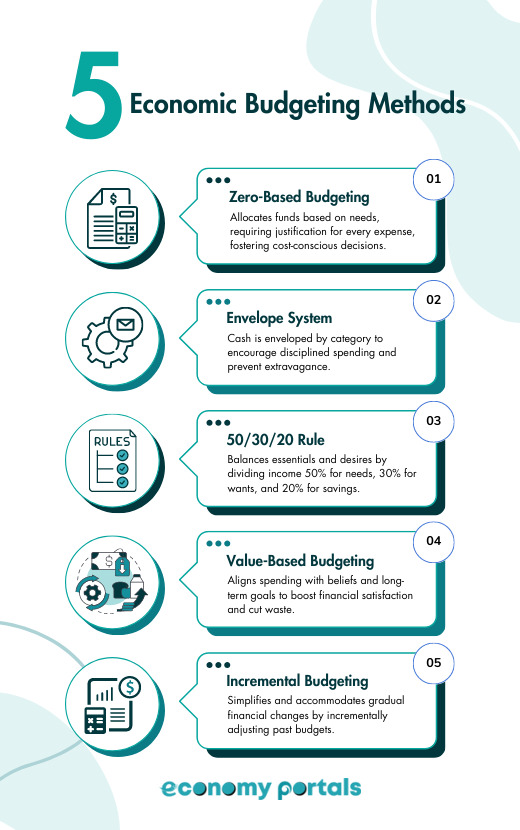

Economic Budgeting Methods

When it comes to mastering the art of saving money, one of the most foundational strategies is creating a well-structured, balanced Budget. An economic budget serves as your financial roadmap, helping you navigate through your income and expenses with precision. This section delves into the best ways to save money by effectively and efficiently managing your finances through budgeting.

Creating A Realistic Budget Tailored To Your Income And Expenses

Crafting a budget that genuinely reflects your financial situation is the cornerstone of effective money management. The process begins by thoroughly assessing your income sources and understanding your regular expenses.

This includes fixed costs like rent or mortgage payments, utilities, insurance, and loan repayments. Factor in variable expenses as well, such as groceries, entertainment, and discretionary spending. To ensure the utmost accuracy, utilize budgeting tools and apps that are designed to streamline the process.

These tools can categorize your expenses, track your spending patterns, and provide valuable insights into where your money is going. The best ways to save money often stem from the ability to visualize your financial landscape clearly.

Allocating Funds For Necessities And Identifying Areas For Cutbacks

Once you've established a clear picture of your income and expenses, it's time to allocate funds strategically. Necessities such as housing, utilities, and groceries should be prioritized. This ensures that you're covering your fundamental needs before indulging in discretionary spending.

The key to effective budgeting is identifying areas where cutbacks can be made without sacrificing your quality of life. Analyze your spending patterns and pinpoint expenses that might be draining your finances unnecessarily.

This might involve evaluating subscription services you rarely use, dining out less frequently, or finding more cost-effective alternatives for certain products or services.

By strategically reallocating funds from non-essential areas, you can channel these savings into more impactful endeavors, such as establishing an emergency fund, reducing debts to enhance your debt-to-income ratio, or making investments for your future.

The beauty of this approach lies in its adaptability; you can adjust your budget over time as your financial goals evolve.

Money-Saving Hacks For Daily Life

In today's fast-paced world, managing your finances has become more important than ever. If you're looking to bolster your savings and secure your financial future, incorporating effective money-saving habits into your daily routine is a smart choice.

In the context of financial planning, we will delve into a pair of potent approaches that can assist you in attaining your financial goals. These approaches involve the reduction of superfluous subscriptions and services, as well as the adoption of home cooking and meal planning practices, aiming to curtail expenses related to dining out.

Cutting Unnecessary Subscriptions And Services

In the digital age, we're surrounded by a plethora of subscription services, ranging from streaming platforms and software subscriptions to beauty boxes and gym memberships.

While each individual service might seem affordable, their cumulative costs can sneak up on you, making a significant dent in your budget over time.

Here are some tips for effectively cutting down on unnecessary subscriptions and services:

Subscription Audit: Take some time to review all your subscriptions and categorize them as essential or non-essential. Cancel any services that you rarely use or that no longer provide value to you.

Bundling Services: Consider bundling services that you frequently use from the same provider. This can often lead to discounted rates and help you save money.

Free Alternatives: Explore free alternatives for certain services. For instance, if you have multiple streaming subscriptions, you might find that there are free platforms that offer similar content.

Rotating Subscriptions: If you're a fan of different subscription boxes or services, consider rotating them on a monthly basis. This way, you can enjoy variety without paying for everything simultaneously.

Cooking At Home And Embracing Meal Planning

Dining out frequently can quickly become a major drain on your finances. Preparing meals at home not only helps you save money, but it also allows you to have better control over your diet and nutrition.

Here's how you can effectively incorporate home cooking and meal planning into your lifestyle:

Weekly Meal Planning: Set aside some time each week to plan your meals. Create a menu, make a shopping list, and stick to it. This reduces impulse buying and minimizes food waste.

Batch Cooking: Cook in larger quantities and freeze extra portions for later. This is not only cost-effective but also saves you time on busy days.

Use Coupons and Discounts: Keep an eye out for grocery store coupons, loyalty programs, and special discounts. These can significantly reduce your grocery bill over time.

Try New Recipes: Experimenting with new recipes can be fun and cost-effective. You might discover delicious meals that you can recreate at a fraction of the cost of dining out.

By applying these best ways to save money and tips for effective money saving in your daily life, you'll gradually notice a positive impact on your finances.

Cutting down on unnecessary subscriptions and services and embracing home cooking through meal planning are practical strategies that can help you achieve your financial goals while still enjoying a fulfilling lifestyle.

Utility Savings: Effective Ways To Save For The Future

When it comes to finding efficient ways to save money for your future goals, optimizing your utility usage can have a significant impact on your financial journey.

Two key strategies that align with your goal involve conserving energy and water. Not only do these strategies contribute to a greener environment, but they also lead to substantial savings on your utility bills, bringing you closer to achieving your desired future milestones.

Conserving Energy And Water: Building Blocks Of Effective Savings

Efficiency starts with mindfulness. Being mindful of your energy and water consumption can go a long way in reducing your monthly expenses.

Start by making subtle changes in your daily routines, such as turning off lights when they're not needed, ensuring doors and windows are closed to maintain indoor temperatures, and utilizing natural light during daylight hours.

Leveraging technology can also play a pivotal role. For instance, consider utilizing smart thermostats that empower you to manage your home's temperature remotely, adapting it to your schedule.

This not only enhances your living comfort but also curbs unnecessary energy consumption.

Unplugging Electronics: A Simple Yet Potent Strategy

Were you aware that electronics continue to draw power even when switched off, as long as they're plugged in? This phenomenon, often termed "phantom energy" or "vampire power," can impact your utility costs.

Combat this by adopting the habit of unplugging chargers, appliances, and devices when they're not in use. This seemingly minor action can accumulate into substantial savings over time, bolstering your financial preparation for the future.

Embracing Energy-Efficient Appliances: A Long-Term Investment

Another strategy that aligns seamlessly with efficient savings is upgrading your appliances to energy-efficient models. When acquiring new electronics or appliances, prioritize those adorned with the ENERGY STAR label.

This label signifies that the product meets stringent energy efficiency criteria outlined by the Environmental Protection Agency. While the initial cost might be marginally higher, the enduring savings on your utility bills transform it into a prudent investment.

Within the realm of water conservation, even modest adjustments such as repairing leaky faucets and incorporating low-flow showerheads can yield a remarkable impact on your water expenses.

Moreover, embracing practices like collecting rainwater for gardening and non-potable purposes introduces an eco-friendly and budget-conscious dimension to your approach.

By embracing these efficient ways to economize on utilities, you're not only nurturing a sustainable future but also taking meaningful strides towards realizing your financial ambitions.

Keep in mind, the cumulative effect of these minor changes is what paves the way for substantial, lasting savings. Your commitment to these strategies sets you on a promising path towards securing your future goals.

Tips For Effective Money-Saving In Daily Life

Saving money doesn't have to be an arduous task; in fact, it can seamlessly become a part of your daily routine. By incorporating practical and mindful habits into your lifestyle, you can achieve substantial savings without sacrificing your comfort or enjoyment.

Here are some succinct yet impactful effective money-saving ways in your everyday life:

Budgeting Brilliance: Create a detailed budget outlining your income and expenses. This proactive approach allows you to allocate funds for necessities while curbing overspending.

Smart Shopping Strategies: Before making a purchase, compare prices, utilize coupons, and take advantage of loyalty programs to score the best deals.

Meal Planning Mastery: Plan your meals and snacks for the week, make a shopping list, and stick to it. This prevents impulse buys and reduces food waste.

Energy Efficiency Excellence: Conserve energy by turning off lights, unplugging devices, and using energy-efficient appliances. This not only benefits the environment but also trims your utility bills.

Transportation Tactics: Opt for public transport, carpooling, biking, or walking whenever possible. Minimizing fuel and parking costs contributes to significant savings.

Delectable Dining In: Cut back on eating out and embrace home-cooked meals. Cooking at home is not only healthier but also substantially cheaper.

Subscription Scrutiny: Review your subscription services and cancel those you rarely use. Streaming platforms, magazines, and apps can accumulate expenses over time.

Secondhand Success: Explore thrift stores, online marketplaces, and garage sales for clothing, furniture, and other items. Quality secondhand finds can save you a bundle.

Cash in on Free Time: Engage in free or low-cost leisure activities such as hiking, picnics, and visiting museums on discount days.

Automate Savings: Set up automated transfers to your savings account. This "out of sight, out of mind" tactic ensures consistent savings.

DIY Delights: Take up basic repairs and simple DIY projects. Learning to fix minor issues around the house can spare you hefty service fees.

Credit Caution: Pay off credit card balances in full to avoid high interest charges. Responsible credit card usage can prevent unnecessary debt.

Bulk Buying Benefits: Purchase non-perishable items in bulk. This is particularly advantageous for products you use regularly and have a long shelf life.

Financial Goals Focus: Keep your financial goals at the forefront of your mind. Whether it's a vacation or a down payment, visualizing your objectives can reinforce your commitment to saving.

Track and Adjust: Regularly review your spending patterns and adjust your budget as needed. This ongoing evaluation ensures you stay on track with your savings goals.

Efficiency in money-saving arises from these practical tips seamlessly blending into your daily routine. Incorporating them into your life can gradually pave the way for a healthier financial future, empowering you to achieve your goals and aspirations with confidence.

Conclusion

In conclusion, a variety of money-saving tactics makes personal finance management easier. This comprehensive book covers the best ways to save money, stressing their efficacy and efficiency. Let's conclude by reviewing the several strategies and emphasizing the need for a diversified approach to financial goals.

From cutting wasteful spending to developing mindful spending habits, financial stability is a multifaceted journey. The best ways to save money is to build a tapestry, with each thread contributing to financial success.

One major lesson is that frugality and foresight go together. Cutting discretionary spending, adopting the sharing economy, and using energy-efficient techniques can save money over time. These acts are the "best ways to save money," we've found, helping people protect their finances.

It's crucial to note that financial growth requires multiple approaches. Tracking spending can help discover areas for improvement, but investing intelligently and developing new revenue streams can speed up financial goals.

A diversified investment portfolio reduces risk, and a variety of money-saving methods reduces financial instability. Implementing these tactics into daily life may seem difficult, but with commitment and consistency, they may become habits.

These methods maintain a steady pace toward financial freedom and stability, which is a marathon, not a sprint. Individuals can optimize their savings and improve their financial future by making smart decisions. By following advice from financial experts, individuals can effectively enhance their savings and cultivate a more promising financial future through astute decision-making.

#MoneySavingTips#BudgetingHacks#FinancialPlanning#SavingsStrategies#FrugalLiving#SmartSpending#FinancialGoals#PersonalFinance#MoneyManagement#SavingsJourney

0 notes

Text

Can International Students Get Student Loans In The US?: Here Is What You Need To Know

As pursuing higher education becomes increasingly global, more international students are setting their sights on studying in the United States. The allure of prestigious universities and diverse academic programs has drawn countless individuals worldwide to American campuses.

However, financing an education abroad can be a daunting challenge. One burning question that often arises is, "Can international students get student loans in the us?"

In this blog, we will delve into this question, providing you with a comprehensive understanding of the opportunities and challenges that international students face when seeking student loans in the United States.

From deciphering the types of loans available to understanding eligibility criteria and interest rates, we aim to equip you with the information necessary to make informed decisions about financing your American education.

We'll explore the options provided by both federal and private lenders, shed light on the role of creditworthiness and co-signers, and even tackle specific scenarios, such as obtaining student loans for advanced degrees like master's and Ph.D. programs.

Whether you're an aspiring international student dreaming of studying in the US or a current student seeking financial solutions, this blog will serve as a roadmap to help you navigate the intricate landscape of student loans.

Join us as we uncover the possibilities and realities of international students acquiring student loans in the US.

Understanding International Student Loans

Explanation Of International Student Loans

International student loans are financial tools designed to assist students from foreign countries in funding their education in the United States. Unlike domestic student loans that might be backed by government entities, international student loans are usually offered by private lenders. These loans cover a range of education-related expenses, including tuition, living costs, books, and other essentials.

However, a key distinction between international and domestic student loans lies in the eligibility criteria and requirements. International students often encounter stricter conditions due to their lack of credit history and, in many cases, absence of a co-signer with established credit in the U.S. This makes the process of obtaining international student loans more complex and challenging.

Discussion About International Students' Loan Challenges

The journey to securing student loans for international students is fraught with hurdles. One of the primary challenges stems from the absence of a credit history in the United States.

Credit ratings and history are crucial to lenders' creditworthiness assessments. Lenders have trouble assessing the ability of new U.S. international students to repay loans because they lack a credit history.

Additionally, citizenship status poses another obstacle. Many loan programs require borrowers to be U.S. citizens or permanent residents. International students, by definition, do not hold this status, which limits their access to certain loan options.

Can International Students Get Student Loans In The US?

When it comes to pursuing higher education in the United States, the question of financial support often looms large for international students. Navigating the intricate web of student loans can be particularly daunting, given the differing regulations and eligibility criteria.

In this section, we will delve into the possibilities, concepts, and misconceptions surrounding international students' access to student loans in the US.

Exploring The Feasibility Of International Students Obtaining Student Loans

The notion of international students securing student loans in the US might raise eyebrows, considering the complexities involved. However, the reality is that, under certain circumstances, this option is indeed available.

While federal student loans, which are often more accessible and affordable for domestic students, might be out of reach for international students, there are alternative routes to explore.

Private lenders and financial institutions recognize the value of international education and have tailored loan options to cater to the unique needs of non-citizen students.

Unveiling The Concept Of International Student Loans

The landscape of international student loans is distinctive and warrants a closer examination. Unlike their American peers, international students might not have a credit history or a cosigner within the US, which are often crucial elements for securing loans.

Consequently, specialized international student loans come into play. These loans are designed to consider the financial circumstances of non-citizen students, requiring a more holistic evaluation of their potential for repayment rather than focusing solely on credit scores.

Dispelling The Misconception: International Students And US Student Loans

One of the prevailing myths in the realm of international education is that non-citizen students are categorically ineligible for student loans in the US. While this myth has perpetuated due to the complexities involved, it's important to clarify that international students are not entirely excluded from accessing financial assistance.

By shedding light on the nuanced options available, we can debunk this misconception and empower international students to make informed decisions about their higher education journey.

Student Loans For International Students: Understanding The Options

Studying in the United States can be a dream come true for international students seeking quality education and diverse cultural experiences. However, the financial aspect of pursuing education abroad can be challenging.

In this section, we will delve into the various options available to international students in the US when it comes to obtaining student loans. Understanding these possibilities is essential for making educated school financing decisions.

Overview Of Available Options For Student Loans For International Students

When it comes to financing education in the US, international students have several pathways to explore. While federal loans are generally reserved for US citizens and eligible non-citizens, there are alternative routes that international students can consider. These include private lenders who specialize in offering loans to international students.

Explanation Of Private Lenders Offering Loans To International Students

Private lenders have recognized the demand for financial assistance among international students and have designed loan products tailored to their needs. These loans often cover tuition, living expenses, and other education-related costs.

Private lenders may have their own application processes, unlike federal loans, which require an FAFSA. To make an informed decision, investigate and compare private lenders' conditions, interest rates, and repayment choices.

Highlighting The Importance Of Having A US Co-Signer For Most International Student Loans

One significant aspect that international students need to consider when applying for loans in the US is the necessity of having a US co-signer for many loan types. A co-signer is typically a US citizen or permanent resident who assumes shared responsibility for the loan.

Their involvement provides a level of security for lenders, as it increases the likelihood of loan repayment. The co-signer's credit history and financial stability play a crucial role in determining the loan's terms and interest rates.

Mentioning The Eligibility Criteria And Process For Applying For International Student Loans

The eligibility criteria and application process for international student loans vary among lenders. Common requirements include enrollment in an eligible educational institution, proof of immigration status, and a co-signer who meets the lender's criteria.

Some lenders might also consider the applicant's academic progress and potential future earnings. Prospective borrowers should gather all necessary documents, such as proof of enrollment, visa information, and financial statements, to streamline the application process.

Navigating the landscape of student loans as an international student can be intricate, but with thorough research and a clear understanding of the available options, you can take meaningful steps towards financing your education in the United States.

Student Loan Interest Rates For International Students

When it comes to pursuing higher education in the United States, one of the most pressing concerns for international students is how to finance their studies. Student loans can be useful, but you must understand interest rates before borrowing.

In this section, we will delve into the intricacies of student loan interest rates for international students, exploring how they work, the factors that influence them, and offering valuable tips for securing favorable rates.

Explanation Of How Interest Rates For International Student Loans Work

Interest rates determine student loan costs. An interest rate is the cost of borrowing money from a lender. For international students, securing a student loan involves the lender providing a certain amount of money to cover educational expenses. In return, the borrower agrees to repay the borrowed amount along with an additional percentage, which constitutes the interest.

Interest rates for international student loans can be fixed or variable. Fixed rates remain constant throughout the life of the loan, offering stability and predictability in monthly payments. Variable rates, which fluctuate with a financial index, may save money in the short term but may increase payments in the future.

Discussing Factors That Influence Interest Rates For International Student Loans

Several factors influence the interest rates assigned to international student loans. One of the primary determinants is the borrower's creditworthiness. Lenders assess the financial history and ability to repay the loan before setting an interest rate. International students might face unique challenges in this regard, as they might not have an extensive credit history in the United States.

Furthermore, the type of lender and loan program can impact the interest rate. Government-backed loans, such as those provided by the U.S. Department of Education, typically come with fixed interest rates that are regulated by federal laws. Private lenders, on the other hand, have more flexibility in setting rates, often considering market conditions and competition.

Providing Tips For International Students To Secure Favorable Interest Rates

Securing a favorable interest rate on a student loan can significantly alleviate the financial burden of higher education. International students can adopt several strategies to enhance their chances of obtaining a competitive rate:

Build a Strong Credit History: International students should create a U.S. bank account, get a credit card, and pay on time to build credit, which affects interest rates.

Seek a Cosigner: Having a creditworthy U.S. citizen or permanent resident as a cosigner can boost the likelihood of approval and help secure lower interest rates.

Research Loan Options: Thoroughly research both federal and private loan options to identify the ones with the most favorable terms, including interest rates and repayment plans.

Compare Multiple Lenders: Don't settle for the first loan offer you receive. Compare rates from various lenders to ensure you're getting the best deal available.

Consider Loan Terms: Longer repayment terms might come with lower monthly payments, but they could also lead to higher overall interest costs. Evaluate the trade-offs before committing.

Student Loan Resources For International Students

As an international student aspiring to study in the United States, financing your education can be a challenging endeavor. However, there are various resources available to assist you in understanding and obtaining student loans to help fund your academic journey. Navigating these resources effectively can make a significant difference in ensuring that you have the financial support you need.

In this section, we will introduce you to the essential resources, websites, organizations, and government assistance that can provide valuable information about international student loans. We'll also provide you some practical advice on how to investigate and evaluate loan possibilities to help you make financial decisions.

Introducing Various Resources

Before delving into the specifics of international student loans, it's crucial to be aware of the wealth of resources designed to aid you in this process. These materials can illuminate student loan eligibility, conditions, and applications.

Not only do they shed light on the financial aspects, but they also offer guidance on responsible borrowing and managing your finances as a student. As you navigate the complexities of student loans, keep in mind that arming yourself with knowledge is the first step toward making informed choices.

Websites, Organizations, And Government Resources

Numerous websites, organizations, and government entities are dedicated to assisting international students in their pursuit of higher education in the United States. These platforms serve as comprehensive hubs of information, addressing various aspects of student loans and financial aid. Websites like collegeavestudentloans.com and ascentfunding.com offer detailed guides on understanding different loan types, repayment plans, and interest rates.

Organizations like prodigyfinance.com specialize in providing personalized guidance to international students, helping them find suitable loan options based on their unique circumstances. Additionally, government resources such as the U.S. Department of Education's Federal Student Aid website provide up-to-date information on federal loan programs available to eligible international students.

Researching And Comparing Loan Options

Given the diverse range of loan options available, it's essential to adopt an effective approach to researching and comparing them. Start by creating a checklist of your financial needs and goals, including tuition fees, living expenses, and any other educational costs. Next, compare loan providers' interest rates, payback periods, and loan limitations.

Utilize online comparison tools to streamline this process and gain a clear understanding of the pros and cons of each option. Remember to take into account the reputation of the lender, customer reviews, and the availability of customer support for international students.

Specific Scenarios: International Students And Student Loans

When it comes to pursuing higher education in the United States, international students often have questions about financing their studies. In this section, we will delve into the specifics of various scenarios that international students might encounter while considering student loans.

Student Loans For Different Academic Levels

Obtaining a master's degree in the US can open doors to advanced career opportunities and specialized knowledge. However, for international students, the question remains: Can they secure student loans for a master's degree? We'll explore the possibilities and limitations surrounding this academic level.

Studying for a master's degree involves a significant investment, from tuition fees to living expenses. We will discuss the avenues through which international students can potentially access financial aid, grants, and scholarships to support their education.

Possibilities And Challenges For International Students With Good Credit

Having a good credit history can be an advantage when seeking financial assistance. International students who have built a strong credit profile during their time in the US might find themselves in a more favorable position to obtain student loans. However, it's crucial to understand the specific criteria and requirements that lenders might have for extending loans to non-citizens.

We will discuss good credit, responsible financial management, and the benefits of a good credit score. Additionally, we'll address the potential challenges that international students might face, such as limited credit history and unfamiliarity with the US financial system.

Process And Feasibility Of Obtaining Student Loans

1. Can International Students Get Student Loans For A Master's Degree In The US?

Securing student loans as an international student pursuing a master's degree in the US involves navigating through a complex process. We will break down the steps involved, from researching loan options to gathering necessary documentation. It's essential to understand the eligibility criteria, interest rates, repayment terms, and any limitations associated with these loans.

2. Can International Students Get Student Loans For A Ph.D. In The US?

Pursuing a Ph.D. is a significant academic endeavor that requires substantial financial support. For international students aspiring to earn a doctorate in the US, the availability of student loans can impact their decision-making process. We'll delve into the nuances of securing loans for doctoral studies, highlighting potential sources of funding and outlining the challenges that might arise.

3. Can International Students Get Student Loans With Good Credit In The US?

Building on the discussion of creditworthiness, this section will explore the feasibility of obtaining student loans for international students with good credit. We will guide you through the application process, including the necessary paperwork and financial documents. Understanding the intricacies of interest rates, repayment plans, and loan terms will empower international students to make informed decisions about financing their education.

By examining these specific scenarios, we aim to provide international students with a comprehensive understanding of the opportunities and challenges associated with obtaining student loans in the US. Whether pursuing a master's degree or a Ph.D., and regardless of credit history, informed decision-making is key to achieving academic and financial success.

Tips For International Students Applying For Student Loans

As an international student pursuing education in the United States, the prospect of financing your studies through student loans might seem daunting. However, with careful planning and the right strategies, securing student loans as an international student can become a feasible and manageable option.

In this section, we will provide valuable tips and insights to help you navigate the process of applying for student loans effectively.

Offering Practical Advice For International Students Considering Student Loans

When contemplating student loans as an international student, it's essential to approach the decision with clarity and informed choices. Here are some practical pieces of advice to consider before proceeding with the loan application process:

Assess Your Needs: Begin by evaluating your financial needs for tuition, living expenses, and other education-related costs. This assessment will help you determine the loan amount you should apply for.

Research Loan Options: Research the various types of student loans available for international students. Federal loans, private loans, and institutional loans are some options to explore. Understand the terms, interest rates, and repayment plans associated with each option.

Discussing The Importance Of Financial Planning, Budgeting, And Understanding Repayment Terms

Navigating the realm of student loans involves more than just obtaining the funds. It's crucial to have a solid financial plan in place to manage the borrowed amount effectively. Here's why financial planning and budgeting matter:

Avoiding Overborrowing: Plan your budget carefully to ensure you only borrow what you truly need. Overborrowing can lead to unnecessary debt that could burden you in the future.

Understanding Repayment: Gain a clear understanding of the repayment terms and conditions of the loan. Be aware of the grace period after graduation, interest rates, and monthly payment amounts.

Suggesting Strategies For Building A Strong Credit History While Studying In The US

Establishing a positive credit history in the United States is not only beneficial for securing student loans but also for various financial endeavors in the future. Here are strategies to help you build a strong credit history during your time as an international student:

Open US Bank Account: Opening a US bank account is crucial to building credit. Use this account carefully for payments and transactions.

Secured Credit Card Application: Apply for a secured credit card, which costs a deposit but helps develop credit. Timely payments demonstrate creditworthiness.

Become an Authorized User: Be an authorized user on a family or friend's credit card. This lets you use their good credit.

Conclusion

In conclusion, the question "Can international students get student loans in the US?" is a complex issue with no definitive answer. While the majority of international students do not qualify for federal student loans due to citizenship and residency requirements, there are still alternative avenues to explore. Private lenders and institutions might offer loans to eligible international students, often requiring a creditworthy cosigner with US citizenship or permanent residency.

It's crucial for international students aspiring to study in the US to thoroughly research and understand their financial options before committing to an education. Scholarships, grants, part-time jobs, and on-campus employment opportunities can also assist in alleviating the financial burden. Moreover, engaging with the university's financial aid office can provide valuable insights into available resources.

Ultimately, the ability of international students to secure student loans in the US depends on various factors, including individual circumstances, institutions, and available financial products. As the landscape of higher education financing continuously evolves, staying informed about policy changes, loan availability, and alternative funding sources will empower international students to make well-informed decisions about their education and financial future.

#studentloan#studentloans#internationalstudent#usa#education#finance#money#college#university#scholarship#financialaid#debt

0 notes

Text

Best Student Loan For International Students In USA: Find Out Now

Studying in the United States is a dream for many international students, but it often comes with a hefty price tag. Tuition fees, accommodation, and living expenses can add up quickly.

Fortunately, there are various financial options available to help international students achieve their educational goals.

In this comprehensive guide, we'll explore the best student loan options and financial aid resources tailored specifically for international students in the USA. Let's dive in!

Best Student Loans For International Students In The USA

For international students pursuing higher education in the USA, finding the right student loan is crucial. Here are the top options:

1. Federal Student Loans

When it comes to student loans for international students, federal loans are often the first consideration:

Eligibility Criteria: Federal loans are generally not available to international students unless they have a U.S. cosigner or meet specific criteria. These criteria may include refugees, asylees, or individuals with certain visa statuses.

Pros and Cons: Federal loans offer competitive interest rates and flexible repayment options. However, they can be challenging to secure due to eligibility constraints.

Application Process: International students must complete the Free Application for Federal Student Aid (FAFSA) with their co-signers information. The cosigner must be a U.S. citizen or permanent resident.

2. Private Student Loans For International Students

Private lenders also offer student loans to international students:

Explanation: Private student loans, provided by banks and lending institutions, can be an alternative when federal loans are not an option. These loans typically require a cosigner.

Key Lenders: Explore options from well-known lenders like Sallie Mae, Discover, and Wells Fargo, which offer loans for international students.

Interest Rates and Terms: Interest rates and terms vary by lender, so it's crucial to shop around for the best rates and conditions.

Eligibility Requirements: Private lenders may require a creditworthy cosigner, proof of income, and a U.S. bank account.

Best Government-Backed Student Loans For International Students

When it comes to financing their education in the United States, international students often face unique challenges, especially when it comes to government-backed student loans.

Unlike U.S. citizens or permanent residents, international students typically do not qualify for federal student loans.

However, there are some government-backed loan options available to international students in certain cases:

Scholarships And Grants For International Students

Apart from loans, international students can seek scholarships and grants to ease the financial burden:

1. Fulbright Program

The Fulbright Program is a prestigious international exchange program funded by the U.S. government. It offers scholarships for graduate study, research, and teaching assistantships.

Eligibility Criteria: Eligibility varies by country, but applicants typically need a bachelor's degree or equivalent.

Application Process: Applicants must apply through the Fulbright Commission in their home country.

Benefits and Limitations: Fulbright scholarships cover tuition, living expenses, and health insurance. However, competition is fierce, and the application process is rigorous.

2. University-Specific Scholarships

Many U.S. universities offer scholarships specifically for international students. These scholarships can be merit-based, need-based, or both.

How to Find and Apply: Research universities and their scholarship opportunities. Follow the specific application guidelines for each scholarship.

Tips: Improve your chances of receiving university-specific scholarships by maintaining a strong academic record and submitting compelling application essays.

Financial Aid Options For International Students

Financial aid can come from other sources as well:

1. On-Campus Employment

Explanation: International students in the USA are often allowed to work part-time on-campus while studying.

Work Restrictions and Regulations: Understand the work restrictions and regulations set by your visa type.

How to Balance Work and Study: Prioritize your studies while managing part-time work to cover living expenses.

2. Optional Practical Training (OPT)

Information: OPT is a program that allows F-1 visa holders to work off-campus in their field of study for up to 12 months after graduation.

Eligibility and Application Process: OPT is typically available after completing at least one academic year. Application is through U.S. Citizenship and Immigration Services (USCIS).

How OPT Helps Finance Education: OPT provides international students with valuable work experience and income to help cover educational expenses.

Student Loans For International Students With A Work Permit

International students in the United States who hold a valid work permit, typically through Optional Practical Training (OPT) or Curricular Practical Training (CPT), have an advantage when it comes to financing their education.

With a work permit, they can explore various options to manage their educational expenses:

1. Income to Cover Expenses: Students on OPT or CPT can use their earned income to cover tuition, living costs, and other educational expenses. This reduces the need for loans.

2. Reduced Loan Amounts: With the ability to contribute through work, international students may need to borrow less, which can lead to lower loan amounts and reduced interest over time.

3. Private Student Loans: Some private lenders in the U.S. may be willing to provide loans to international students on OPT or CPT. Having a source of income can strengthen your loan application and improve your chances of approval.

4. Loan Repayment: With a work permit, students can also start repaying any existing loans, reducing their financial burden after graduation.

However, it's crucial to exercise caution when taking on loans, even with a work permit. Consider the interest rates, repayment terms, and your future financial outlook.

Maintaining a budget and saving during your OPT or CPT period can help ensure a smooth financial transition while studying in the U.S. and beyond.

Tips For Managing Student Loan Debt As An International Student

Taking out student loans can be a significant financial commitment. Here are some tips for managing student loan debt:

1. Create A Budget

Creating and sticking to a budget is a vital financial skill that can significantly impact your financial well-being. Here's why it's crucial and how to do it effectively:

Importance Of Budgeting:

Budgeting provides a clear snapshot of your income and expenses, helping you:

Control Spending: It prevents overspending by setting limits on discretionary expenses.

Achieve Goals: A budget helps you save for future goals, whether it's an emergency fund, a vacation, or paying off student loans.

Reduce Stress: Knowing where your money goes reduces financial anxiety and uncertainty.

Emergency Preparedness: Budgeting ensures you're financially prepared for unexpected expenses.

Tips For Creating And Sticking To A Budget:

List Income and Expenses: Document your income sources and all expenses, both fixed (rent, bills) and variable (entertainment, dining out).

Set Realistic Goals: Define achievable financial objectives, considering your income and expenses.

Categorize Spending: Group expenses into categories to identify areas where you can cut back.

Track Spending: Regularly monitor your expenses to stay on course.

Adjust as Needed: Be flexible and adjust your budget when circumstances change.

Budgeting Tools And Apps:

There are numerous digital tools and apps, such as Mint, YNAB (You Need a Budget), and Personal Capital, that automate budget tracking and provide insights into your spending patterns.

These tools make it easier to create, manage, and stick to your budget, enhancing your financial control and stability.

2. Explore Loan Forgiveness And Repayment Programs

Loan forgiveness and repayment programs are financial lifelines for borrowers struggling with student debt. They offer relief by either reducing the outstanding loan balance or forgiving it entirely. Here's what you need to know:

Eligibility Criteria:

Eligibility varies widely based on factors like loan type, profession, and repayment plan. Common programs include Public Service Loan Forgiveness (PSLF), Teacher Loan Forgiveness, and Income-Driven Repayment (IDR) plans.

How To Apply And Benefit:

To benefit from these programs, follow these steps:

Research Eligibility: Understand the specific requirements of the program you're interested in. Ensure your loans qualify.

Meet Employment Criteria: Many programs require you to work in a certain field or for a specific employer for a set number of years. Fulfill these requirements.

Submit Required Documentation: Complete and submit the necessary forms and documentation, such as employer certification or income verification.

Stay Consistent: Keep making on-time payments and meeting program requirements while waiting for forgiveness or reduced payments.

Reap the Rewards: After meeting the program's conditions, you can enjoy reduced monthly payments, loan forgiveness, or a substantial reduction in your remaining loan balance.

These programs offer financial relief and can make student loan repayment more manageable, but it's crucial to understand and meet their criteria to reap the benefits fully.

Conclusion

Navigating the world of student loans and financial aid as an international student in the USA can be challenging, but it's not impossible.

By exploring federal and private loans, seeking scholarships, and considering on-campus work or OPT, you can make your American dream a reality while effectively managing your finances.

Remember to budget wisely and explore loan forgiveness programs when the time comes. With careful planning, you can pursue your education in the USA without drowning in debt.

Frequently Asked Questions:

1. Can international students get student loans in the USA?

Yes, international students in the USA can get student loans, but they typically require a creditworthy cosigner who is a U.S. citizen or permanent resident.

2. What are the best options for international student loans in the USA?

Some of the popular options include private lenders like Sallie Mae, Discover, and Wells Fargo. Additionally, some schools may offer institutional loans or scholarships for international students.

3. What is the FAFSA, and do international students need to fill it out?

The Free Application for Federal Student Aid (FAFSA) is primarily for U.S. citizens and eligible non-citizens. International students generally do not need to fill out the FAFSA, as they are not eligible for federal financial aid.

4. How do I find a cosigner for a student loan?

You can ask a family member or friend who is a U.S. citizen or permanent resident to be your cosigner. They should have a good credit history to increase their chances of loan approval.

5. What is the interest rate on international student loans in the USA?

Interest rates on international student loans can vary significantly depending on the lender and the cosigner's creditworthiness. Generally, they may range from 4% to 12% or more.

#studentloan#studentloans#internationalstudent#usa#education#finance#money#college#university#scholarship#financialaid#debt

0 notes

Text

How To Survive The Impact Of The Economic Crisis

The "impact of the economic crisis" reverberates through time, leaving a lasting impression on societies and individuals alike. As financial systems experience upheavals and markets falter, it becomes crucial to understand how to navigate these tumultuous times.

In this blog, we will explore effective strategies for not only surviving but also thriving in the face of economic adversity. By exploring the "economic crisis," we can gain insights that help us make smart financial decisions.Are you a Tax Lawyer in USA?

Understanding The Economic Crisis

An economic crisis is a period of rapid economic downturn that often has negative effects on society. This section aims to provide a comprehensive understanding of the economic crisis, delving into its core aspects and shedding light on its historical context.

Defining The Economic Crisis: Unraveling The Fundamentals

At its core, an economic crisis refers to a severe disruption in the normal functioning of an economy, resulting in adverse effects on production, consumption, investment, and employment.

This disruption can be triggered by a multitude of factors, including financial imbalances, external shocks, market speculation, and policy failures.

By grasping the essence of an economic crisis, we can better comprehend its far-reaching impacts and devise strategies to navigate through its challenges.

Lessons From History: Exploring Pivotal Economic Crises