Text

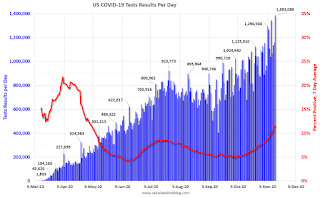

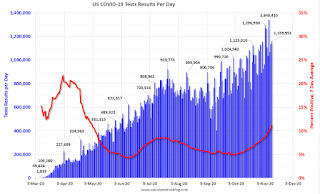

November 13 COVID-19 Test Results; Record Cases, Record Hospitalizations

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,383,088 test results reported over the last 24 hours.

There were 170,333 positive tests. This is a new record.

Over 13,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.3% (red line is 7 day average). The percent positive is calculated by dividing positive results by the sum of negative and positive results (I don't include pending).

And check out COVID Exit Strategy to see how each state is doing.

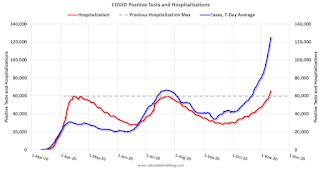

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

Now, there are many more tests, and many cases are being detected earlier - so hospitalizations have lagged. Hospitalizations are now at a new record.

This is a new record 7-day average cases for the USA.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/november-13-covid-19-test-results.html

0 notes

Text

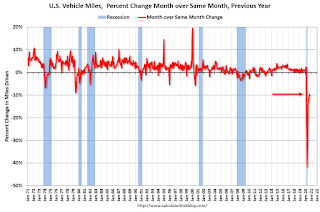

DOT: Vehicle Miles Driven decreased 9.7% year-over-year in September

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -8.6% (-23.4 billion vehicle miles) for September 2020 as compared with September 2019. Travel for the month is estimated to be 248.3 billion vehicle miles.

The seasonally adjusted vehicle miles traveled for September 2020 is 247.2 billion miles, a -9.7% (-26.7 billion vehicle miles) decline from September 2019. It also represents 2.8% increase (6.7 billion vehicle miles) compared with August 2020.

Cumulative Travel for 2020 changed by -14.5% (-355.5 billion vehicle miles). The cumulative estimate for the year is 2,093.1 billion vehicle miles of travel.

emphasis added

Click on graph for larger image.

This graph shows the rolling 12 month total vehicle miles driven to remove the seasonal factors.

Miles driven declined during the great recession, and the rolling 12 months stayed below the previous peak for a record 85 months.

Miles driven declined sharply in March, and really collapsed in April.

This graph shows the YoY change in vehicle miles driven.

Miles driven rebounded in May through August, but is still down 9.7% YoY (seasonally adjusted).

Based on gasoline consumption, I expect the year-over-year decline in vehicle miles to be about the same in October as in September.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/dot-vehicle-miles-driven-decreased-97.html

0 notes

Text

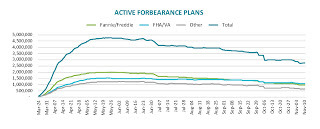

Black Knight: Number of Homeowners in COVID-19-Related Forbearance Plans Decreased

Note: Both Black Knight and the MBA (Mortgage Bankers Association) are putting out weekly estimates of mortgages in forbearance.

This data is as of November 10th.

From Black Knight: Another Week of Strong Forbearance Improvement

After declining by 5% last week, the number of loans in active forbearance saw another week of strong improvement.

According to the latest weekly snapshot of Black Knight’s McDash Flash daily forbearance tracking data, active forbearance plans fell by 121,000 (-4%) over the last week. Overall, that puts forbearance volumes down 9% (-416,000) since the start of November..

...

As of November 10, there are now 2.74 million homeowners in active forbearance plans, representing approximately 5.2% of all active mortgages, down from 5.4% from last week. Together, they represent $559 billion in unpaid principal.

Click on graph for larger image.

Forbearance starts pulled back, with the week’s 68,000 starts marking the lowest weekly total since the first week of October. New forbearance starts (excluding restarts) hit a COVID-era low of just 31,000. Another 98,000 homeowners had their forbearance plans extended this week.

...

Of the 2.74 million loans still in active forbearance, 81% have had their terms extended at some point since March.

With COVID-19 cases rising across the country, it will be important to keep an eye on unemployment numbers and forbearance starts over the coming weeks. Black Knight will continue to monitor the situation and report our findings on this blog.

emphasis added

from Calculated Risk http://www.calculatedriskblog.com/2020/11/black-knight-number-of-homeowners-in_13.html

0 notes

Text

A comment on Q4 GDP

Most economists are revisiting their Q4 forecasts. In their previous forecasts, many assumed some additional disaster relief in Q4, and many underestimated the current surge in COVID.

Goldman Sachs economists noted this morning:

European and US economies are likely to slow significantly in Q4/Q1 as colder weather puts upward pressure on case growth, in turn triggering restrictions, but reaccelerate sharply in Q2/Q3 following warmer weather, the end of European lockdowns, and mass vaccination.

One well known private forecaster (with a great track record) in now forecasting negative GDP in Q4. Depending on further delays in disaster relief, and the impact of the COVID surge, we might see others move to negative GDP soon.

From the NY Fed Nowcasting Report

The New York Fed Staff Nowcast stands at 2.86% for 2020:Q4. [Nov 13 estimate]

And from the Altanta Fed: GDPNow

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2020 is 3.5 percent on November 6, up from 3.2 percent on November 4. [Nov 6 estimate]

from Calculated Risk http://www.calculatedriskblog.com/2020/11/a-comment-on-q4-gdp.html

0 notes

Text

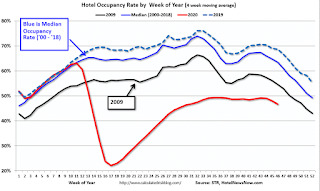

Hotels: Occupancy Rate Declined 35.9% Year-over-year

From HotelNewsNow.com: STR: US hotel results for week ending 7 November

U.S. weekly hotel occupancy was relatively flat from the previous week, according to the latest data from STR through 7 November.

1-7 November 2020 (percentage change from comparable week in 2019):

• Occupancy: 44.2% (-35.9%)

• Average daily rate (ADR): US$91.40 (-31.1%)

• Revenue per available room (RevPAR): US$40.36 (-55.8%)

Down slightly from 44.4% the prior week, the country’s occupancy level was its lowest since the week of June 14-20.

emphasis added

Since there is a seasonal pattern to the occupancy rate - see graph below - we can track the year-over-year change in occupancy to look for any improvement. This table shows the year-over-year change since the week ending Sept 19, 2020:

Week EndingYoY Change, Occupancy Rate9/19-31.9%9/26-31.5%10/3-29.6%10/10-29.2%10/17-30.7%10/24-31.7%10/31-29.0%11/7-35.9%

This suggests no improvement over the last 8 weeks, and occupancy might be getting worse. Some of the recent decline in the occupancy rate is just seasonal.

The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

Click on graph for larger image.

The red line is for 2020, dash light blue is 2019, blue is the median, and black is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Seasonally we'd expect the occupancy rate to decline into the new year. Note that there was little pickup in business travel that usually happens in the Fall.

Note: Y-axis doesn't start at zero to better show the seasonal change.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/hotels-occupancy-rate-declined-359-year.html

0 notes

Text

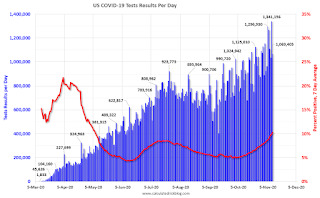

November 12 COVID-19 Test Results; Record Cases, Record Hospitalizations

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,159,951 test results reported over the last 24 hours.

There were 150,526 positive tests. This is a new record.

Over 12,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 13.0% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

Now, there are many more tests, and many cases are being detected earlier - so hospitalizations have lagged. Hospitalizations are now at a new record.

This is a new record 7-day average cases for the USA.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/november-12-covid-19-test-results.html

0 notes

Text

Lawler: Recent Slowdown in US Population Growth Accelerated in 2020

From Tom Lawler: Recent Slowdown in US Population Growth Accelerated in 2020

US population growth, which slowed significantly over the past few years, almost certainly grew at an even slower pace in 2020. All three key components of growth – births, death, and net international migration – should contribute to the slower population growth. Before discussing each, here are the latest estimates (“Vintage 2019) of the US resident population, as well as the estimated components of change, from July 1, 2015 to July 1, 2019.

US Resident PopulationYearly Change% ChangeBirthsDeathsNet International Migration7/1//2015320,635,1632,334,1550.73%3,992,3762,699,8261,041,605 7/1/2016322,941,3112,306,1480.72%3,962,6542,703,2151,046,709 7/1/2017324,985,5392,044,2280.63%3,901,9822,788,163930,409 7/1/2018326,687,5011,701,9620.52%3,824,5212,824,382701,823 7/1/2019328,239,5231,552,0220.48%3,791,7122,835,038595,348

So what do we know about each component of change since July 1, 2019?

1. Births: The CDC estimated that the number of US births during the calendar year 2019 was 3,745,540, down from 3.791,712. 2019 was the fifth consecutive year that the number of US births fell. While I have not seen any data on births so far in 2020, it is probably reasonable to assume that births over the 12 month period ending 6/30/2020 was about the same as in calendar year 2019.

2. Deaths: There is little doubt that deaths in 2020 will be substantially higher than in 2019, mainly by solely because of deaths directly attributable to Covid-19. While the CDC has not yet released the official “US Mortality” report for 2019, it has been releasing provisional weekly estimates of deaths for 2020, in part to estimate the number of “excess deaths,” or deaths higher than one would have projected based on trends, for this year. While the data are provisional and are not complete because of reporting lags, below is a tabulation of provisional death estimates by broad age groups that corresponds closest to the same calendar period as that used in the official Census population estimates.

CDC Provisional Estimates of US Deaths by Selected Age Groups52 Weeks Ending:Under 2525-4445-6465-7475-8485+Total 7/2/201663,970129,045533,133499,219626,580836,0842,688,031 7/1/201765,147139,131541,372522,102647,667870,7252,786,144 6/30/201862,488140,377543,927540,434667,830883,4572,838,513 6/29/201960,072139,837536,890547,891678,081863,8632,826,634 6/27/202061,293156,400566,785593,714729,344919,6033,027,139

Note that the increase in deaths in 2020 is not just limited to the elderly age groups. In fact, in the largest % increase in deaths was in the 25-44 year old category.

While these data are by no means final, and the overall total for 2020 will probably be a bit higher in 2020, a conservative estimates for US deaths from 7/1/2019 to 6/30/2020 would be about 3.03 million, up by over 203 thousand from the previous year.

3. Net International Migration: Net International Migration (NIM) was estimated to have declined significantly over the past two years, at least in part reflecting Administration actions. The pandemic, combined with additional Administration actions, almost certainly resulted in substantial declines in NIM from February to June, but I am unaware of any data that would enable one to e/1/2stimate the drop in NIM. It is probably not unreasonably to assume that net international migration from 7/1/2019 to 6/30/2020 was no more than about 300 thousand. (Note that NIM estimates are subject to very significant measurement errors, for a host of reasons.)

If one assumes, births over the 12 month period ending June 2020 totaled 3,745,450, deaths over that period totaled 3,030,000, and net international migration over than period totaled 300,000, then the US resident population estimate for 7/1/2020 would be as follows:

US Resident

PopulationYearly

Change%

ChangeBirthsDeathsNet Intl

Migrate 7/2015320,635,1632,334,1550.73%3,992,3762,699,8261,041,605 7/2016322,941,3112,306,1480.72%3,962,6542,703,2151,046,709 7/2017324,985,5392,044,2280.63%3,901,9822,788,163930,409 7/2018326,687,5011,701,9620.52%3,824,5212,824,382701,823 7/2019328,239,5231,552,0220.48%3,791,7122,835,038595,348 7/2020329,255,0631,015,5400.31%3,745,5403,030,000300,000

For those who like to use “official Census population projections either to describe likely future demographic changes of the forecast other variables dependent on population total below is a comparison of the Census 2017 Population Projections (the last official long-term population projection) with the Vintage 2019 Population Estimates and my estimate for 2020.

Census 2017

ProjectionVintage 2019

Estimate/2020

LEHC EstimateDifference 7/2017325,511,184324,985,539525,645 7/2018327,891,931326,687,5011,204,430 7/2019330,268,840328,239,5232,029,317 7/2020332,639,102329,255,0633,384,039

As the table above shows, the Census 2017 population projections even before 2020 were way above the latest estimates, and that gap probably surged in 2020 to almost 3.4 million. This highlight why competent analysts do not use the Census 2017 population projections either to describe likely future demographic trends or as inputs into forecasts of other variables dependent upon population projections.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/lawler-recent-slowdown-in-us-population.html

0 notes

Text

Many Millions could lose unemployment benefits at the End of 2020

In addition to regular weekly unemployment claims, there are two COVID related programs that end on December 26th.

The first is the Pandemic Unemployment Assistance (PUA) Program. This is a special program that provides up to 39 weeks of benefits for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

PUA is not payable for any week of unemployment ending after December 31, 2020. Accordingly, in states where the week of unemployment ends on a Saturday, the last week that PUA may be paid is the week ending December 26, 2020. For states where the week of unemployment ends on a Sunday, the last week that PUA is payable is the week ending December 27, 2020.

As of October 24th - the most recent report - there were 9,433,127 receiving PUA benefits (there are questions about these numbers).

The second is the Pandemic Emergency Unemployment Compensation (PEUC) Program. This program "provides up to 13 additional weeks of benefits to individuals who have exhausted their regular unemployment compensation (UC) entitlement". Just like the PUA, this program ends on December 26th. There are currently 4,143,389 people receiving these extended benefits, and this has been increasing sharply. On October 1st, about 1.8 million people were receiving benefits from the PEUC, so this has most than doubled over the last month as people exhaust their regular benefits. This number will probably continued to increase over the next month.

Note that if people get laid off again, as COVID surges, many more people could exhaust their regular benefits.

So there is a significant fiscal cliff looming at the end of December.

Meanwhile, it is looking less likely that another disaster relief package will be passed before the end of the year. Goldman Sachs noted today:

We continue to expect Congress to approve additional fiscal support in the range of $1 trillion, but political and vaccine-related developments make this more likely to come in early 2021 than in the lame-duck session of Congress

A surging pandemic and no disaster relief will make for a very hard winter. Hopefully some sort of relief will be passed in the lame-duck session.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/many-millions-could-lose-unemployment.html

0 notes

Text

Cleveland Fed: Key Measures Show Inflation Eased Year-over-year in October

The Cleveland Fed released the median CPI and the trimmed-mean CPI this morning:

According to the Federal Reserve Bank of Cleveland, the median Consumer Price Index rose 0.2% October. The 16% trimmed-mean Consumer Price Index rose 0.1% in October. "The median CPI and 16% trimmed-mean CPI are measures of core inflation calculated by the Federal Reserve Bank of Cleveland based on data released in the Bureau of Labor Statistics’ (BLS) monthly CPI report".

Note: The Cleveland Fed released the median CPI details for October here. Car and Truck rentals increased at a 136% annualized rate in October.

Click on graph for larger image.

This graph shows the year-over-year change for these four key measures of inflation. On a year-over-year basis, the median CPI rose 2.5%, the trimmed-mean CPI rose 2.2%, and the CPI less food and energy rose 1.6%. Core PCE is for September and increased 1.5% year-over-year.

Overall inflation will not be a concern during the crisis.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/cleveland-fed-key-measures-show.html

0 notes

Text

Weekly Initial Unemployment Claims decreased to 709,000

The DOL reported:

In the week ending November 7, the advance figure for seasonally adjusted initial claims was 709,000, a decrease of 48,000 from the previous week's revised level. The previous week's level was revised up by 6,000 from 751,000 to 757,000. The 4-week moving average was 755,250, a decrease of 33,250 from the previous week's revised average. The previous week's average was revised up by 1,500 from 787,000 to 788,500.

emphasis added

This does not include the 298,154 initial claims for Pandemic Unemployment Assistance (PUA) that was down from 361,959 the previous week. (There are some questions on PUA numbers).

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 755,250.

The previous week was revised up.

The second graph shows seasonally adjust continued claims since 1967 (lags initial by one week).

At the worst of the Great Recession, continued claims peaked at 6.635 million, but then steadily declined.

Continued claims decreased to 6,786,000 (SA) from 7,222,000 (SA) last week and will likely stay at a high level until the crisis abates.

Note: There are an additional 9,433,127 receiving Pandemic Unemployment Assistance (PUA) that increased from 9,332,610 the previous week (there are questions about these numbers). This is a special program for business owners, self-employed, independent contractors or gig workers not receiving other unemployment insurance.

An additional 4,143,389 are receiving Pandemic Emergency Unemployment Compensation (PEUC) that increased from 3,983,613 the previous week.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/weekly-initial-unemployment-claims.html

0 notes

Text

BLS: CPI unchanged in October, Core CPI unchanged

From the BLS:

The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in October on a seasonally adjusted basis after rising 0.2 percent in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.2 percent before seasonal adjustment.

...

The index for all items less food and energy was unchanged in October following an increase of 0.2 percent in September. The index for shelter increased 0.1 percent in October, which was offset by a 0.4-percent decrease in the index for medical care. The indexes for airline fares, recreation, and new vehicles were among those to rise, while the indexes for motor vehicle insurance, apparel, and household furnishings and operations declined.

The all items index rose 1.2 percent for the 12 months ending October, a slightly smaller increase than the 1.4-percent rise for the 12-month period ending September. The index for all items less food and energy rose 1.6 percent over the last 12 months after rising 1.7 percent in September.

emphasis added

Overall inflation was lower than expectations in October. I'll post a graph later today after the Cleveland Fed releases the median and trimmed-mean CPI.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/bls-cpi-unchanged-in-october-core-cpi.html

0 notes

Text

Thursday: CPI, Unemployment Claims

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is initial claims decreased to 725 thousand from 751 thousand last week.

• Also at 8:30 AM, The Consumer Price Index for October from the BLS. The consensus is for a 0.2% increase in CPI, and a 0.2% increase in core CPI.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/thursday-cpi-unemployment-claims.html

0 notes

Text

November 11 COVID-19 Test Results; Record Cases, Record Hospitalizations

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,134,101 test results reported over the last 24 hours.

There were 144,270 positive tests. This is a new record.

Almost 11,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.7% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

Now, there are many more tests, and many cases are being detected earlier - so hospitalizations have lagged. Hospitalizations are now at a new record.

This is a new record 7-day average cases for the USA.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/november-11-covid-19-test-results.html

0 notes

Text

Houston Real Estate in October: Sales Up 31.5% YoY, Inventory Down 26% YoY

From the HAR: Houston Real Estate Soars Again in October

Even with an ever-dwindling supply of housing and a lingering pandemic, consumers bought homes at a frenzied pace in October, keeping the Houston real estate market on the path to a record year. The high end of the market once again registered the greatest sales volume increase, with mid-range homes also attracting heavy activity.

According to the latest Houston Association of Realtors (HAR) Market Update, 9,287 single-family homes sold in October compared to 7,187 a year earlier. That represents a 29.2 percent increase and marks the fifth straight month of positive sales.

...

Sales of all property types totaled 11,232 – up 31.5 percent from October 2019. Total dollar volume for the month rose 46.1 percent to $3.5 billion. The lease market had mixed results in October with a 5.1 percent decline in single-family housing while townhouse/condo leases jumped 11.0 percent.

emphasis added

Inventory declined 25.9% year-over-year from 42,374 in October 2019 to 31,384 in October 2020.

Note that the closed sales in October were for contracts that were mostly signed in August and September.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/houston-real-estate-in-october-sales-up.html

0 notes

Text

First Look: 2021 Housing Forecasts

Towards the end of each year I collect some housing forecasts for the following year. This is just a beginning (I'll gather many more).

The table below shows a few forecasts for 2021:

From Fannie Mae: Housing Forecast: October 2020

From Freddie Mac: Freddie Mac Quarterly Forecast: Housing Market Continues to Rebound as Mortgage Rates Hover at Record Lows

From NAHB: Housing and Interest Rate Forecast, 11/10/2020

From NAR: U.S. Economic Outlook: September 2020

Note: For comparison, new home sales in 2020 will probably be around 820 thousand, and total housing starts around 1.360 million.

Housing Forecasts for 2021New Home Sales (000s)Single Family Starts (000s)Total Starts (000s)House Prices1Fannie Mae8571,0941,4332.1%2Freddie Mac

2.6%2NAHB8439861,321NAR9501,0701,4304.1%3 1Case-Shiller unless indicated otherwise

2FHFA Purchase-Only Index

3NAR Median Prices

from Calculated Risk http://www.calculatedriskblog.com/2020/11/first-look-2021-housing-forecasts.html

0 notes

Text

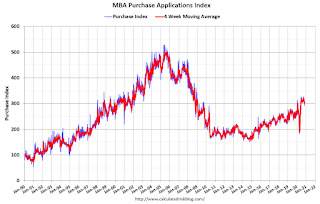

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 6, 2020.

... The Refinance Index increased 1 percent from the previous week and was 67 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 16 percent higher than the same week one year ago.

“Mortgage application activity was mixed last week, despite the 30-year fixed rate decreasing to 2.98 percent – an all-time MBA survey low. The refinance index climbed to its highest level since August, led by a 1.5 percent increase in conventional refinances,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The purchase market continued its recent slump, with the index decreasing for the sixth time in seven weeks to its lowest level since May 2020. Homebuyer demand is still strong overall, and activity was up 16.5 percent from a year ago. However, inadequate housing supply is putting upward pressure on home prices and is impacting affordability – especially for first-time buyers and lower-income buyers. The trend in larger average loan application sizes and growth in loan amounts points to the continued rise in home prices, as well as the strength in the upper end of the market.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased to a survey low of 2.98 percent from 3.01 percent, with points decreasing to 0.35 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index remains up significantly from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 16% year-over-year unadjusted.

Note: Red is a four-week average (blue is weekly).

from Calculated Risk http://www.calculatedriskblog.com/2020/11/mba-mortgage-applications-decrease-in.html

0 notes

Text

November 10 COVID-19 Test Results; Record Cases, Record Hospitalizations

The end of the pandemic is coming, possibly by Q2 2021! Please be careful, especially over the holidays. Thanksgiving, Christmas and New Years will be tough this year, but keep your guard up - plan now to have safe holidays.

The US is now averaging over 1 million tests per day. Based on the experience of other countries, for adequate test-and-trace (and isolation) to reduce infections, the percent positive needs to be well under 5% (probably close to 1%), so the US still needs to increase the number of tests per day significantly (or take actions to push down the number of new infections).

There were 1,069,405 test results reported over the last 24 hours.

There were 130,989 positive tests. This is a new record.

Over 9,000 US deaths have been reported so far in November. See the graph on US Daily Deaths here.

Click on graph for larger image.

This data is from the COVID Tracking Project.

The percent positive over the last 24 hours was 12.2% (red line is 7 day average).

For the status of contact tracing by state, check out testandtrace.com.

And check out COVID Exit Strategy to see how each state is doing.

The second graph shows the 7 day average of positive tests reported and daily hospitalizations.

The dashed line is the previous hospitalization maximum.

Note that there were very few tests available in March and April, and many cases were missed, so the hospitalizations was higher relative to the 7-day average of positive tests in July.

Now, there are many more tests, and many cases are being detected earlier - so hospitalizations have lagged. Hospitalizations are now at a new record.

This is a new record 7-day average cases for the USA.

from Calculated Risk http://www.calculatedriskblog.com/2020/11/november-10-covid-19-test-results.html

0 notes