Text

Social Security's growing reliance on the internet to deliver services and benefits adds to the challenge of reaching tribal communities.

0 notes

Text

The brief’s key findings are:

When the employer cost for employer-sponsored health insurance (ESHI) rises, it slows wage growth and erodes Social Security’s tax base.

Both these effects were evident from 1996-2005, but the situation stabilized during 2005-2019.

Why did the ESHI-to-compensation ratio stabilize?

During both periods, the major driver was the general rise in national health costs.

From 2005-2019, this impact was largely offset by less ESHI participation by lower earners and less demand for family plans.

Going forward, rising health costs could again push up the ESHI-to-compensation ratio, unless the factors that have been offsetting this growth continue.

0 notes

Text

The brief’s key findings are:

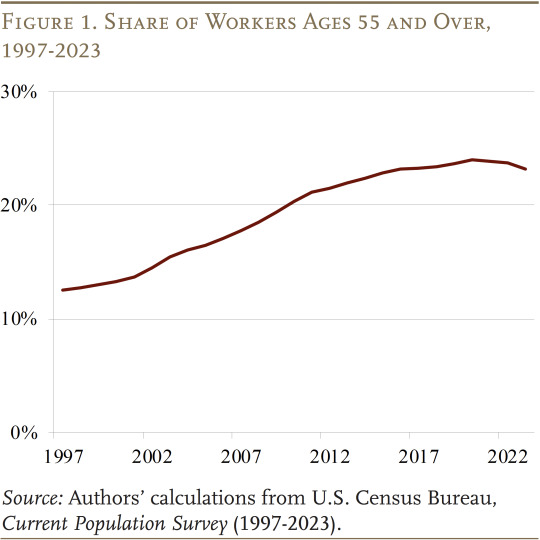

Many older workers are inclined to work longer, but will employers hire and retain them – today and in the future?

A series of CRR studies on this topic provide a case for tempered optimism.

First, hard data suggest that older workers are at least as productive as younger ones, though they do cost more.

Second, survey data show that employers’ views are largely in line with these hard data, and job postings confirm a willingness to hire.

Finally, while the jobs that older workers do today may be less prevalent in the future, jobs that they have the skills for should be available.

0 notes

Text

A more generous Social Security formula for calculating retirement benefits for low-income workers would be the most effective option.

0 notes

Text

The brief’s key findings are:

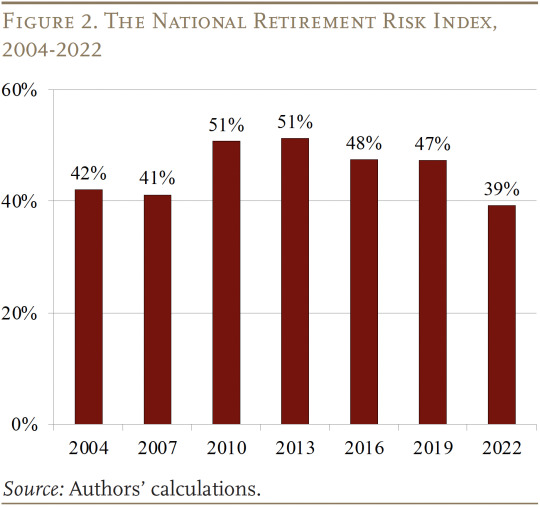

From 2019 to 2022, the National Retirement Risk Index improved substantially, dropping from 47 percent to 39 percent.

Weathering the pandemic turmoil, households were buoyed by government stimulus, strong employment, and rising asset markets.

The single biggest factor driving the improvement was soaring home values.

Though these results are encouraging, most people do not tap their home equity in retirement and prices may not stay at such high levels.

Importantly, even with what may be a temporary improvement, the NRRI shows that 2 in 5 of today’s working households could fall short.

#retirement#retirement planning#household finances#housing#home values#employment#research#older workers

0 notes

Text

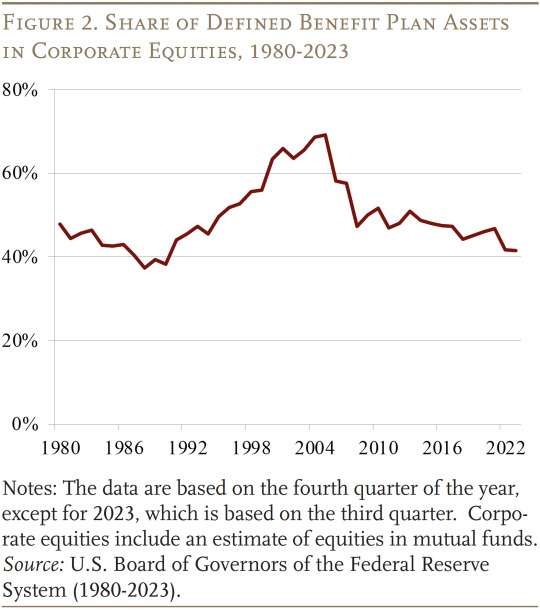

IBM has reopened its defined benefit plan to use the plan’s surplus – rather than corporate cash – to fund retirement contributions.

This shift has been fueled by a more favorable regulatory environment and the improved funded status of defined benefit plans.

While using “trapped surpluses” helps the firm, workers may well come out behind unless the gains are shared.

Interestingly, the analysis finds that only a handful of other large companies are likely candidates to follow IBM’s lead.

Thus, the move should be viewed as a financial maneuver, not a meaningful change in the provision of retirement income.

0 notes

Text

The Center for Retirement Research at Boston College recently released 10 working papers

Can Incentives Increase the Writing of Wills? An Experiment

Jean-Pierre Aubry, Alicia H. Munnell, and Gal Wettstein

The Case for Using Subsidies for Retirement Plans to Fix Social Security

Andrew G. Biggs, Alicia H. Munnell, and Michael Wicklein

Understanding the Characteristics and Needs of Tribal Community Members for Social Security Delivery

Barbara A. Butrica, Stipica Mudrazija, and Jonathan Schwabish

The Impact of Past Incarceration on Later-Life DI and SSI Receipt

Gary V. Engelhardt

Take-Up and Labor Supply Responses to Disability Insurance Earnings Limits

Judit Krekó, Dániel Prinz, and Andrea Weber

How Can Changes to Social Security Improve Benefits for Black and Hispanic Beneficiaries?

Richard W. Johnson and Karen E. Smith

The Impact of High-Pressure Labor Markets on Retirement Security

Stipica Mudrazija and Barbara A. Butrica

How Many Medicaid Recipients Might Be Eligible for SSI?

Michael Levere and David Wittenburg

Perceptions of Beneficiaries with Mental Illness and Family Representative Payees Regarding Satisfaction and Challenges

Travis Labrum

Estimating Disparities Using Structural Equation Models

Stipica Mudrazija and Barbara A. Butrica

0 notes

Text

The brief’s key findings are:

The value of Social Security’s retirement program to individuals is often measured by comparing expected benefits to payroll taxes.

But this approach ignores the program’s insurance value, which is larger for those with more uncertain lifespans.

The analysis estimates the insurance value using a lifecycle model for stylized households by race, education, and marital status.

Accounting for insurance value, the results show that the program is significantly more valuable than lifetime taxes for almost all household types.

Social Security’s insurance component also increases racial equity, because lifespans vary more among Black individuals.

0 notes

Text

The brief’s key findings are:

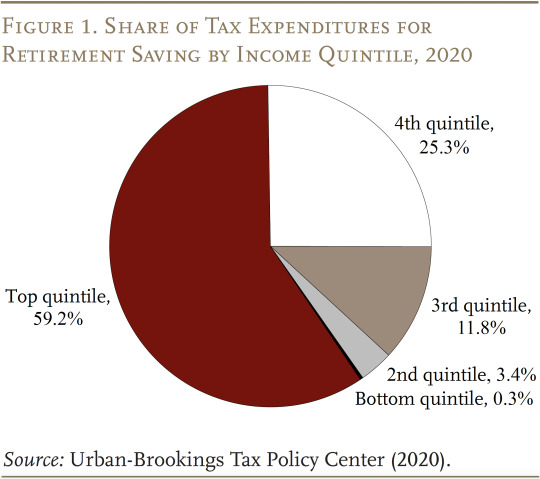

Tax preferences for saving in retirement plans are expensive – about $185 billion in 2020, according to Treasury estimates.

Strikingly, they also seem a bad deal for taxpayers, primarily benefiting high earners while failing to significantly boost national saving.

Thus, the case is strong for eliminating or reducing these preferences.

The resulting increase in tax revenues could be reallocated to fixing Social Security’s finances.

0 notes

Text

The brief’s key findings are:

While annuities offer retirees a reliable stream of lifetime income, few people purchase them.

To probe people’s perceptions of annuities, a new survey queried those near or in retirement with over $100,000 in financial assets.

About half of respondents say they would be willing to buy an annuity at prevailing market rates, while just 12 percent actually do so.

The study tested whether low annuity take-up could be explained by a lack of liquidity or the inability to make bequests, but found no such evidence.

In short, people may be deterred not by a lack of interest in annuities but by a lack of knowledge of the product and how to buy it.

0 notes

Text

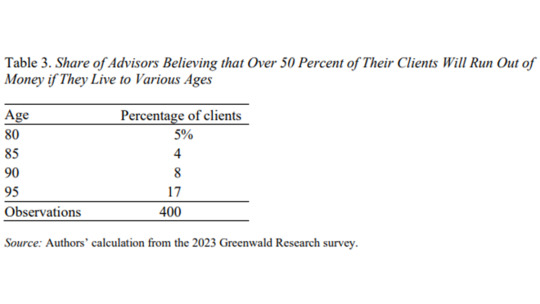

The brief’s key findings are:

While annuities offer retirees guaranteed lifetime income, few people have them.

A new survey asked financial professionals about the value of annuities for their clients.

The results suggest that financial professionals are concerned that many of their clients could deplete their savings too quickly.

But the majority of them do not recommend annuities to their clients and, when they do, many clients do not take the advice.

These findings point to both the promise and limitations of reliance on financial professionals to guide clients to greater use of annuities.

0 notes

Text

The brief’s key findings are:

The 2022 Survey of Consumer Finances shows how 401(k)/IRA saving fared from 2019-2022.

The answer is not obvious given all that went on: COVID, economic disruption, seesawing markets, a huge fiscal response, and strong employment.

The good news: for working households nearing retirement with a 401(k), median combined 401(k)/IRA balances rose from $144,000 to $204,000.

The bad news: these gains for older savers were mainly among the higher income, and younger savers generally did not do well.

Moreover, half of households do not even have a 401(k), so the overall news on retirement saving remains disappointing.

0 notes

Text

Abstract

The U.S. workforce is aging, which has raised concerns about the implications of older workers for businesses and the economy. However, little research has been conducted on the quantitative value of older workers in recent years. This paper attempts to fill that gap by linking employee and employer data from the U.S. Census Bureau’s Longitudinal Employer-Household Dynamics, Longitudinal Business Database, and Business Register. The analysis finds that in general, older workers are as productive as younger workers, however they do earn higher wages. Furthermore, the relationship between the share of older workers, productivity, and profitability varies substantially by industry.

0 notes

Text

The brief’s key findings are:

A common concern is that an aging workforce will reduce productivity and firm profitability, yet the evidence to date is mixed.

This analysis examines the issue using a large sample from the most recent available Census data that links employees to their employers.

The results show little evidence that older workers reduce productivity or profitability, although wide variation by industry exists.

Thus, concern about an aging workforce hampering economic performance may be overblown.

0 notes

Text

The report’s key findings are:

As life expectancy at 65 rises, outliving one’s resources poses a growing challenge.

This study explores how people perceive their life expectancy, options for handling longevity risk, and why few insure against it.

A survey of investors with over $100,000 in financial assets sheds new light on this topic:

About half of respondents would be willing to buy an annuity at prevailing market rates but just 12 percent actually do so.

Reasons for the gap may be that financial professionals do not routinely recommend annuities and actually buying them can be hard.

0 notes

Text

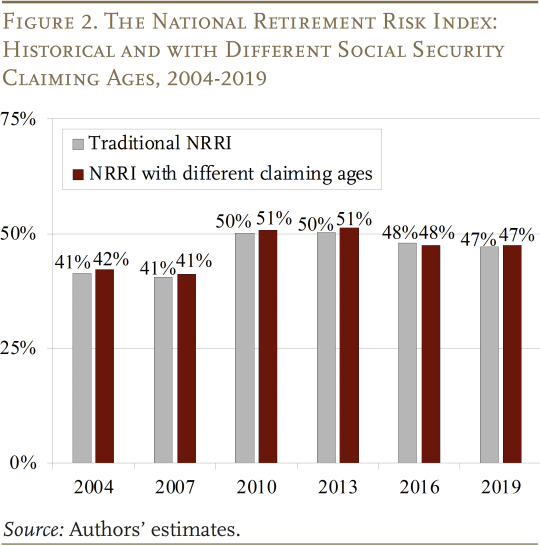

The brief’s key findings are:

Households ages 62-75 have substantial earnings.

The National Retirement Risk Index, which assumes all households claim Social Security – and retire – at 65, does not count earnings after 65.

So, about half of all earnings for those 62-75 are excluded from the Index and could distort the results.

Introducing more realistic claiming ages for low-, middle-, and high-income households solves two problems:

Increases the earnings in the Index to two-thirds, with the rest going mainly to high earners where it has little impact.

Produces a more sensible pattern of percentage “at risk” by income group.

One thing that doesn’t change is the overall percentage of today’s working households at risk: that’s still about 50 percent.

0 notes

Text

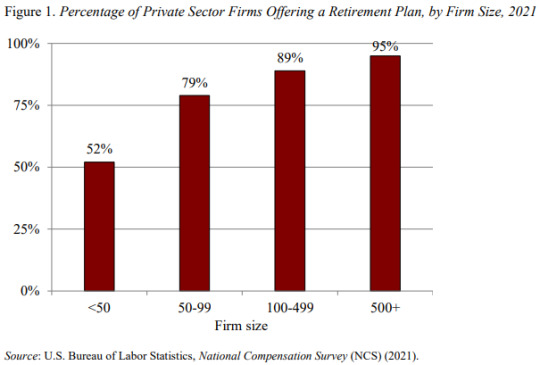

The report’s key findings are:

Our 2023 Small Business Retirement Survey provides an in-depth look at why small firms do or do not offer a retirement savings plan.

Firms that believe retirement plans help with hiring and retention are much more likely to offer a plan now or in the near future.

The main barriers to offering a plan are concerns about the stability/size of the firm and the perceived costs of a plan.

Concerns about costs are driven by misperceptions; many firms are unaware of lower-cost options for employers and tax credits.

The survey results also suggest that state auto-IRA programs do not deter firms from offering a plan and may even encourage it.

0 notes