Text

Indian Automotive Sector Updates

Passenger Vehicle sales dropped by 31% in July 2019, compared to off take over similar period of previous year. July 2019 was the ninth straight month witnessing the decline in auto sales. The glimpses of slowdown in auto industry started actually a year back from now (from Q2-FY19) and started worsening from Q1-FY20 till first month of Q2-FY20.

Sales Performance:Vehicle TypeJuly, 2019 (in Units)% decline in July 2019 over July 2018Passenger Vehicles2,00,79030.98%Commercial Vehicles56,86625.71%Two Wheelers15,11,69216.82%Three Wheelers55,7197.66%

Though the slowdown in Indian auto industry is more of cyclic nature, the July 2019 saw the steepest decline of last two decades. Previous slowdowns were recorded in 2009 and 2014. The so called “cyclic” natured slowdown was intensified by a combination of things as listed below coming at a SAME TIME. These points

Regulations by central government

Sharp rise in insurance cost due to judicial intervention

Liquidity issues from Banks and NBFCs

Drastic fall (near to the 1/3rd) in auto financing capabilities

Increase in collateral demand by financial institutions from dealers; impacting negatively on inventory holding ability of dealers

Higher interest rates

Multifold increase in road tax by number of state governments

Mandatory safety regulations such as Airbag, ABS etc.

All these factors, coming at a same time, led to sharp increase in vehicle prices. When looked carefully, it appears that there is a marginal increase in showroom price but around 7% to 8% increase in customer buying price primarily due to government regulations and other initiatives.

The “Deferred” implementation of such governmental initiatives would have had reduced the severity of slowdown. The Indian Auto industry is demanding a rate cut in GST, a similar action which was done in slowdown of 2009 and 2014. Another key areas that may revive the situation is reducing the finance cost. The OEMs, on their front, are currently offering the all-time high discounts to customers.

Industry experts opine that the situation revival is likely to be in place from Q4-FY20. To know more- https://bdbipl.com/index.php/business-divisions/industrial-business-market-research/automotive-market-research/

0 notes

Text

Agritech boom in India

The agriculture industry has profoundly changed throughout the course of recent years. Progress in machinery has extended farm equipment’s scale, speed, and efficiency, prompting more productive development of more land. Seed, water systems, and composts likewise have improved, assisting farmers with expanding yields. Presently, farming is at the beginning of one more transformation, at the core of which lie information and network. Artificial intelligence, analytics, connected sensors, and other arising advances could additionally increment yields, improve the efficiency of water and other inputs, and construct sustainability and flexibility across crop cultivation and animal husbandry.

Digitization has been the popular expression this year and innovation-driven arrangements have gradually begun changing all areas of the economy. The agriculture sector which adds to almost 20% of India’s GDP was a special case not long ago. The ascent of agri-tech has achieved better efficiencies, network, information sharing and different crucial as well as supporting exercises accessible at the click of a button.

Agritech in India

India is home to the world’s second-biggest population and a huge supporter of worldwide agricultural production. However, to satisfy the developing needs of a blossoming worldwide population, which is assessed to outperform 9.8 billion by 2050, India should make some major changes and take steps to support its agricultural sector. Taking into account that around 58% of the Indian people depend on agriculture as their primary source of livelihood, farm productivity and profitability should collectively and sustainably be improved to meet future demands.

The development of AgriTech in India has engaged numerous farmers to embrace new farming techniques that help efficiency and lessen the environmental effect. Innovative mediation and computerized change have led to accuracy farming which harnesses data, artificial intelligence, automation, sensors and drones to optimize farm production and returns. Farmers are presently teaming up with new businesses to send sensors and wireless gadgets to their fields that assist them with consistently observing soil health, and crop growth and detecting pests and diseases, thereby enabling them to take action as and when needed.

Technology can possibly jump these difficulties and lead to another modern and futuristic model. Directed by the development of Indian startups and supported by government mediation, the elements of farming in India are now evolving. Ready for disturbance, the Indian AgriTech area is projected to impel approximately US$ 20-25 billion by 2025. By utilizing technology, India can additionally further develop its agrarian and food frameworks while improving people’s livelihoods and producing healthier ecosystems. Nano-technology is changing Indian agriculture further and can make Indian farmers as useful as those in other areas of the planet. Nano innovations can likewise be utilized to improve soil properties and the removal of toxins.

Considering that about 58% of the Indian populace relies on agriculture as their primary source of livelihood, farm productivity and profitability should collectively and sustainably be improved to meet future demands.

Innovative Agricultural Technology in India

1. Automated Irrigation

Automated irrigation is finished through a water system regulator, that is utilized to work the programmed water system frameworks like lawn sprinklers and drip irrigation systems. The domestic irrigation controllers are for cultivating applications, and professional irrigation controllers are for more demanding agricultural applications.

2. Hydroponics

Hydroponics is a method of horticulture and hydroculture. It involves the process of growing crops without soil. It is done by the use of mineral nutrient solutions in water that is obtained from various sources.

3. Soil Moisture Sensors

Soil moisture sensors are the sensors that are used to measure the water content in the soil. Soil moisture sensors typically refer to sensors that estimate water content. Moisture content in water might vary depending on environmental factors such as soil type, and temperature. There are tools to capture data related to moisture, soil conditions, weather, nutrients etc. at a very micro level so that farmers only have to use very specific fertilizers or agrochemicals in dedicated land areas instead of using everything on the entire land. This would save their input cost as well as maintain the fertility of the soil.

4. Agricultural Drone

An agricultural drone is a remote-controlled drone specialized with micro-sensors that is used in various agricultural aspects mostly in monitoring crop growth and crop production. The usage of an agricultural drone in agriculture can assist in gaining information on the growth stage of the crop and crop health.

5. Transaction opportunities creation

Farmers have limited options to do transactions in any vertical. For example, for input buying, they are dependent on a few local retailers and sometimes have to travel far to a different district or a different state altogether to explore better quality seeds. For cattle trading, their only options are local agents or animal trade fairs which are not very frequent. Similarly, for output selling, farmers don’t have a direct reach beyond the local aggregators to explore better prices for their produce. With technology coming into play, farmers will have more options to do their day-to-day business, be it in any domain.

For more details -https://bdbipl.com/

Contact No.-+91-20-6868 0700

Email id- [email protected]

0 notes

Text

Trends in Aerospace Sector

Indian aerospace manufacturing sector could become the sunshine sector for India and create thousands of high-end jobs if it is nurtured by the right policies and actions. It is at an inflection point, like the automotive and telecom sector three and two decades back respectively. It would require sustained support from government to develop critical mass, skill sets and research and development (R&D) capability.

There is a great potential for Indian Aerospace sector to grow in coming years. India has a unique advantage of being one of the biggest markets for Commercial Aviation as well as Defence. Major OEMs are now actively looking to develop supply chain in India and source Engineering services as well as components & assemblies. Driven by the Make in India initiative and powered by State Government support, potential for growth is foreseen.

The aerospace sector demands perhaps the highest degree of fail-proof quality standards. This combined with unpredictable demand, lumpy orders and extreme pressure on pricing makes the risk of aerospace business significantly high. Aerospace manufacturing for the defence sector is even tougher given that there’s only one ultimate client per country – the Ministry of Defence (MoD); the orders are even more unpredictable and lumpy; and the negotiations, approvals and payments can be really test one’s patience.

We are living in a globalized world where capital will flow to the most attractive destination in terms of sustained order-book, cost and ease of doing business. India therefore faces stiff competition from places like China, South East Asia, Latin America, and Eastern Europe in addition to the home countries of the global OEMs.

In June 2016, the Indian government eased foreign direct investment (FDI) norms for the Defence sector, permitting foreign companies to own 100% of domestic ventures with the approval of the government when access is provided to modern technology. The term “modern technology” is not specifically defined in the policy and could be subject to interpretation by various Indian regulatory agencies.

Coupled with progress that India has made in space technology and commercial aerospace manufacturing, incentives under the government’s Make in India initiative, as well as recent escalation in security concerns, are creating ripe conditions for significant progress in the aerospace sector in India.

Global Aerospace sector companies have been directing capital to India to benefit from strong long-term growth prospects. There have been various JV announcements in the sector during 2015–2016, prior to the relaxation of FDI norms. After the relaxation of FDI regulation, the Indian Aerospace sector is likely to record an increase in JVs, as well as a rise in foreign firms establishing manufacturing facilities in India.

Major Aerospace companies such as Airbus, Boeing, Lockheed Martin, and Safran already have a footprint in the Indian market, and some of them are planning further investments. For example, Airbus announced a JV with Mahindra Defence Systems last year to manufacture helicopters for the Indian military. Similarly, Boeing entered into a JV with Tata Advanced Systems in 2015 focused on manufacturing the fuselage of Apache Helicopters in India. In 2016, Lockheed Martin announced interest in moving its entire production of F-16 fighter jets to India to reap the benefits of lower cost of production, enabling them to lower the selling price and increase the global demand for F-16s. As the sector opens up further, there will likely be an increase in global A&D companies entering the Indian market, either through JVs or independently, with 100% FDI now allowed in the A&D sector.

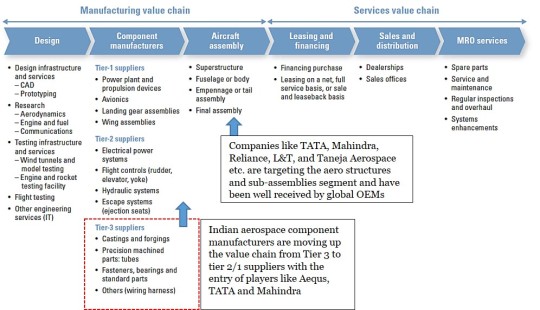

Aerospace sector value chain

The aerospace value chain comprises activities ranging from design and assembly to, ultimately, MRO services (see below figure). As OEMs and tier-1 suppliers struggle to improve profitability, tier-2 and tier-3 products will likely shift to emerging markets such as India and China.

The Indian aerospace supply base is fairly new. While Indian companies have a significant advantage in engineering and design, they do not yet have the capabilities to handle highend design and development. The government owned Hindustan Aeronautics Limited (HAL) operates across the value chain. However, no other Indian company boasts integrated capabilities.

Design : Several Indian information technology firms have been operating in the aerospace sector over the past few years, with HCL, Infosys, TCS, Honeywell and Wipro leading the pack. These firms have been providing design and integrated software for the aerospace sector. Development services to major aircraft companies. Indian IT firms, however, are expected to develop their capabilities to offer higher end complex design services in the near future. Companies such as Honeywell, L&T Infotech, Wipro etc are already gearing up to emerge as aircraft design and development houses.

Component manufacturing : Indian companies were primarily tier-3 suppliers till the entry of large organized players like Aequs Aerospace, Dynamatic technologies in the component manufacturing which have significant manufacturing capabilities along with in-house design and development capabilities.

However still majority of the manufacture parts as per specifications provided. Further, there are only a few companies’ large companies like Aques aerospace in this segment, as the component industry is still fairly new. With more business expected to flow into India due to offset agreements, tier-1 and tier-2 players will no doubt have a larger role in the global aerospace value

chain.

The emergence of Indian suppliers with integrated tier-1 and tier-2 capabilities will allow global aerospace companies to leverage India as a low- cost option, thus increasing their ability to honor the offset agreements.

Indian aerospace component manufacturers are moving up the value chain from Tier 3 to tier 2/1 suppliers with the entry of players like Aequs, TATA and Mahindra Companies like TATA, Mahindra, Reliance, L&T, and Taneja Aerospace etc. are targeting the aero structures and sub-assemblies segment and have been well received by global OEMs

India’s skilled labor wage rates are up to 60% lower than the United States and Europe. Key to cost savings is the ability to develop manufacturing processes using automation and labor productivity improvements while ensuring quality standards. For example, tier-2 components suppliers offers a 15 to 30% cost advantage to supply product like landing gear components due to a labor intensive manufacturing process while delivering similar quality levels. In aircraft assembly, assessments indicates a potential cost advantage of 15 to 25%.

It is expected that manufacturing of small structural components, hard metal components – aerospace steel, titanium and Inconel, to be used in manufacturing single aisle, brackets and hinges, avionics racks , wiring harnesses, mountings, blades and vanes, to be the key growth area in this segment. This is similar to the evolution in the Chinese aerospace supply base, which leveraged joint ventures with Boeing and Airbus to supply $1 billion in components from 1995 to 2008.

Aircraft sub-assemblies : HAL is the only company with complete aircraft manufacturing capabilities, and companies like Mahindra Aerospace, Tata Group, Taneja Aerospace are ramping up to compete in the segment. To meet industry demands, several private firms plan to enter the market both organically and via mergers and acquisitions. Moreover, several automotive firms may enter aircraft component manufacturing. Reliance, Tata, Mahindra, MRF, Lumax and Minda have already announced plans to do so. Global aerospace majors have started focusing on India to source components for their Indian & Global requirements and Auto component manufacturers in India, with their proven manufacturing capabilities make ideal candidates as supply chain partners in Aerospace & Defence.

MRO services opportunity : INDIA, with its growing aircraft fleet size, strategic location, rich pool of engineering expertise and lower labor cost, has a huge potential to be the global Maintenance, Repair and Overhaul (MRO) hub on a long-time horizon. The current market size of MRO is estimated at about $700-800 million which is expected to reach $1.2 billion by 2020. India has the potential to become the third largest aviation market by 2020 and the largest by 2030. The growth of the industry is being propelled by the development of airports, presence of several low-cost carriers, a liberalized FDI policy, increasing adoption of information technology and focus on improving regional connectivity.

With over 1,000 aircraft on order, India is poised to become the third largest buyer of commercial passenger planes in the world, with only the US and China ahead of it. Having received huge orders from Indian carriers, aircraft manufacturers such as Airbus plan to build MRO facilities in India. In January 2017, Spice Jet finalised a deal worth $22 billion to buy 205 aircraft from Boeing and has tied up with Air India Engineering Services Limited (AIESL) for MRO facility at Nagpur. Key players in the Indian MRO market are Air India, Lufthansa, Boeing, Taneja, HAMCO, Eaton Aerospace, Air works, Max Aerospace, Thales International, Sabena Technics, Jupiter Aviation, Mas Aerospace etc. who operate independently or through a JV.

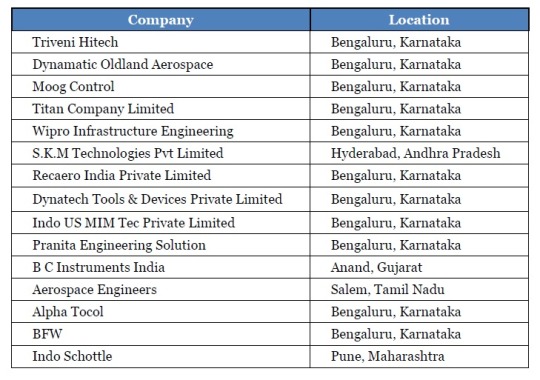

Key Private Players in the Indian Aerospace Manufacturing Sector :

Tata Advanced Systems (TASL), Hyderabad

Mahindra Aerospace, Mumbai

Reliance Naval and Engineering Limited, Mumbai

Tata Automation Limited, Pune

Other private participants in the aerospace manufacturing sector

Below are some of the key component manufacturing companies catering to the aerospace sector :

Key clusters for aerospace manufacturing :

Bengaluru, Nagpur and Hyderabad are the key aerospace clusters in India primarily driven by the presence of established end users, talent pool and supportive policies. Karnataka is the key state which has given special attention to the aerospace sector including the aerospace policy and the

aerospace park being set up in Devanahalli. Karnataka is the only state in the country which has formulated an aerospace policy and is home to several aerospace component manufacturing units.

Systems Controls, G.L. Polyurethane Company Private Limited, Micron Engineers, Priyaraj Electronics Limited and Pacific Natura Biotech Private Limited are ready to invest in aerospace component units in the aerospace SEZ at Devanahalli. Hindustan Aeronautics Limited’s (HAL) proposal to set up a ₹2,095 Crore unit in Devanahalli to manufacture aero-engines and provide MRO facilities.

Telangana boasts of the country’s first Aerospace and Precision Engineering SEZ at Adibatla in Ranga Reddy district near Hyderabad, and has also announced plans to set up two more similar aerospace parks to accommodate prospective companies.

Currently, several home-grown and multi-national companies such as Zen Technologies, Tata Advanced Systems Limited (TASL), Mahindra & Mahindra, Sikorsky, Pratt & Whitney and Lockheed Martin have operations at the Aerospace SEZ.

Currently, the aerospace SEZ is spread across 350 acres of which only 250 acres has been notified as SEZ. Besides TASL, the state had allotted 30 acres in the SEZ to Nova Integrated Systems, a Tata enterprise, 25 acres to Punj Lloyd, 20 acres to Mishra Dhatu Nigam (Midhani) and 96 acres to Samuha, a consortium of manufacturers including MTAR Technologies Pvt Limited.

0 notes

Text

"Emerging Supply Chain Trends in 2020 and Beyond " an overview - by BDB India.

BDB India carries out extensive primary market research and growth strategy consulting in India & abroad for over 3 decades

#BDBIndia#MarketResearch#BusinessConsulting#PrimaryResearch#SupplyChain#SCM#Logistics#Transportation#IoT#BigData#Drone

0 notes

Text

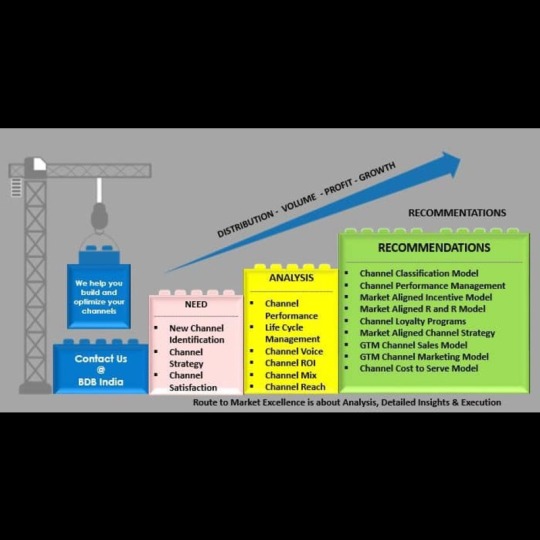

Know More to Grow More – Your Channel Quality & Reach!

Channel Quality is equally as important as the Product Quality. Performance, Efficiency, Reach, Spread, Resources, Service, Customer Relations and Retention are few of the hygiene parameters which define the quality of your channel!

Drop a comment and reach out to us at BDB India Private Limited to optimize your channels!

0 notes

Text

Indian Cold Chain Industry

BDB India carries out extensive primary market research and growth strategy consulting in India & abroad for 30 years.

#BDBIndia#MarketResearch#BusinessConsulting#PrimaryResearch#Industrial#ColdChain#ColdStorage#WednesdayWisdom#Manufacturing#Food&Beverages#Agriculture

0 notes

Text

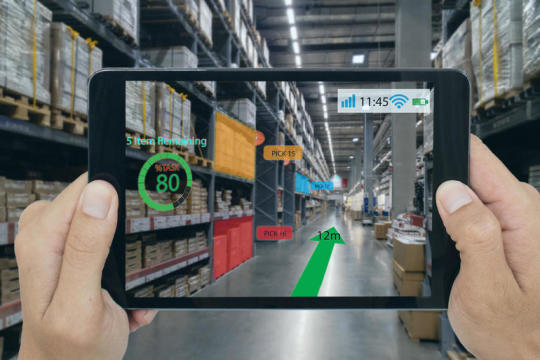

Logistics Automation – Opportunities & Trends blog by BDB India

BDB carries out customized market studies and provides growth strategy consulting across emerging markets in Asia and Africa.

#BDBIndia#MarketResearch#BusinessConsulting#GrowthStrategy#Logistics#Warehouse#LogisticsAutomation#Asia#Africa

0 notes

Video

"Gateways in Industrial Automation" in India - by BDB India.

BDB India carries out extensive primary market research and growth strategy consulting in India & abroad for over 3 decades

#BDBIndia MarketResearch BusinessConsulting PrimaryResearch Industrial Automation IndustrialAutomation WednesdayWisdom#MarketResearch#PrimaryResearch#IndustrialAutomation

0 notes

Photo

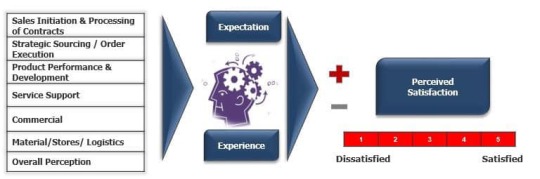

Know More to Grow More – Know Your Customer!

Customer Retention is more profitable than finding new markets, new customers. And knowing your customer’s perception cannot be assumed – it needs to be studied.

We at BDB India Private Limited use our "Expectation Dis-confirmation Model" to help you measure customer satisfaction, to help you grow more! Connect to us!

0 notes

Video

"IoT for Transportation" an overview - by BDB India.

BDB India carries out extensive primary market research and growth strategy consulting in India & abroad for over 3 decades

0 notes

Text

Marketing Process Engineering

We all are living in a VUCA World. VUCA is an acronym coined by the American Army for volatility, uncertainty, complexity and ambiguity. The term VUCA originated in the US Army War College, but spread to the business world as there are striking similarities in terms of rapid change and uncertainty. The digital age has helped to accelerate the evolution of businesses and disrupt the basic principles that were taken for granted.

The VUCA parameters earlier would be seen in a business cycle but now we witness it as a consistent phenomenon. Change is the new constant and uncertainty is the new certainty. What it means is, irrespective of their size and scale, corporations are working hard to fight this. Hence, there is a need for a paradigm shift in how we look at the marketing function.

Experts predict that India shall continue on the growth path and shall register one of the highest rates of development globally between now and 2025. This prophecy seems to be bearing out if one extrapolates the current economic trends although the growth may not be linear.

In the natural course therefore, such a national growth path shall automatically create opportunities for every business enterprise in India, especially those that are sensitive and responsive to external change. Organizations that are also dynamic and market driven, will quickly hitch their wagons to the marketplace so that external growth proportionately translates in to the growth of their own enterprise.

Growth in sales and growth in profits, both come from the marketplacenot from any other place. While savings can come from optimizing your operations, cutting costs, value engineering your products, automating your systems, streamlining your supply chain etc, real growth in sales, turnover and profits always come from the marketplace. So if you want fundamental growth of your business, the marketplace is what you should be looking at.

Intricate analyses of marketplace dynamics almost always reveal gaps between what is available and what the customers’ expectations are. These factors form the inputs into a Marketing Strategy. A multitude of variables determine customers’ buying pattern – some of which may be unbelievably subjective like “satisfaction”, even in the industrial marketplace!

All successful organizations accept that growth in turnover (more sales) and growth in profits (better sales) both come from the marketplace. Marketing processes in every ambitious and customer driven organization should therefore be an area of constant vigilance. Differentiating your offering quantitatively and qualitatively; and attuning it to your customer needs (often through customization) is the key secret.

Planned growth is any day better than accidental growth. In planned growth, the entire enterprise moves in tandem. Every activity in an enterprise grows proportionally in response to the market, and resource utilization is optimized. Rise in turnover reflects in profits not merely in size!

To achieve planned growth, successful enterprises have a mechanism to comprehensively engineer their marketing process. This ensures balanced and sustained organizational evolution, which is seamless across the organization and that creates long lasting corporate value.

The marketing process of a business enterprise comprises its entire marketing value chain, starting with the satisfied customer and ending with the sales team. In between lies the organization’s internal and external marketing matrix.

Internal marketing initiatives include customer relationship management, product or service characteristics and reliability, its delivery mechanism, ability to adapt to changing customer needs, product and organizational branding and its perceived equity, customer sensitivity of the sales team and their response effectiveness.

Add to this matrix, the external factors – rate of growth of demand, opportunity gaps and new opportunities, competition, product or service delivery network, differentiation of “bottom of the pyramid” features from the rest of the market, maximizing returns from existing customers, enlarging the share of the pie from new customers, after-market support, price sensitivity, and robust and vibrant communication with external stake holders in the marketplace.

It is imperative that organisations design customer centric marketing processes and implement these processes to deliver real organizational growth in a competitive marketplace and to expand their businesses along a predetermined growth curve, on a three to five year time line.

Key aspects of such a multi-pronged marketing strategy include :

1: Quantification of optimum goals and targets for the enterprise, derived from thorough systematic and scientific research in the marketplace; and projection of demand trends over a three to five year time frame, such that the enterprise can painlessly achieve.

0 notes

Photo

BDB India Private Limited is a leading global business strategy consulting and market research company in India.

0 notes

Video

BDB India Pvt Ltd

0 notes

Video

BDB India Private Limited

1 note

·

View note