Text

How to Reset Your Balance: A Comprehensive Guide to Balance Transfer

Introduction

Introduction: It’s that time of year again when people are trying to find ways to save money and improve their financial situation. How can you do this without having to make any sacrifices? The answer is simple; you can do it by resetting your balance. This means finding ways to reduce your spending and increase your savings, without sacrificing your quality of life. If you want to be successful in this endeavor, it’s important to have a plan in place and follow through with it. Here are five tips to help you achieve balance:

How to Reset Your Balance.

A balance transfer is a financial process in which you borrow money from a bank and then spend that money within a certain time period. When you complete the process, the money that you borrowed will be returned to your bank account with a negative balance.

When you reset your balance, there are some important things to remember. First, always inform your bank of your intent to do a balance transfer and provide all of the necessary information, including your name and contact information for each person involved in the transaction (including your authorized representative). Next, make sure that all of your financial resources are ready for this type of transaction. You may need to prepare for a short-term loss on top of any other risks associated with this type of move. Finally, be sure to take steps to protect yourself financially if something goes wrong during or after the transfer. For more information on how to reset your balance, visit our website or speak with one of our representatives at an upcoming meeting.

Resetting Your Balance: What to Expect.

When you reset your balance, you will need to pay back all of the money that you borrowed from your previous bank account. This may take some time, but it is important to be prepared for the process. In order to begin the process of resetting your balance, you will need to contact your bank and provide them with your new financial information. You will also need to provide a copy of your driver’s license, social security number, and other important documents.

How to Reset Your Balance

Once you have provided all of the required information, your bank will start the process of processing your request for a balance adjustment. This may take some time, but ultimately you will be able to receive your refund in a timely manner. When resetting your balance, make sure that you are familiar with all of the terms and conditions associated with the process. Be sure to read through the instructions carefully before beginning!

What to Expect When Resetting Your Balance

When resetting your balance, there are a few things that you should keep in mind:

-You may experience some inconvenience as this process can take some time

-Be prepared for an increase in bank fees as well as any interest that may apply

-Make sure that you understand all of the terms and conditions associated with the resetting process before beginning

Resetting Your Balance: How to Do It.

When you reset your balance, you will need to follow a set of steps to complete the process. These steps include setting up your new bank account and filling out a few basic paperwork.

How to Reset Your Balance

Once you have completed these steps, you will be able to start using your old account again. However, keep in mind that some changes may need to be made to your personal information before you can use the account again.

Visit the website for more information.

Conclusion

Resetting your balance can be a great way to start over and regain some of the lost income that you may have suffered in the past. However, it is important to be prepared for the process and to expect what might happen. By following some simple steps, you can reset your balance and start fresh again.

0 notes

Text

cancel visa credit card payments without penalty

Introduction

Introduction: threatening to cancel visa credit card payments without penalty can be a effective way to coerce someone into doing something they don't want to do. Sometimes, threats are all that's necessary to get someone on your side. If you're a business owner who needs to make quick, reliable Visa credit card payments,threatening to cancel them can be the best tool in your arsenal. By canceling the payments early, you'll force the debtor into a bind and likely acquiesce to your demands. This will ensure that you receive the money you need and no damage is done.

How to Cancel Visa Credit Card Payments without Penalty.

There are a few ways to cancel Visa credit card payments without penalty. To cancel a payment online, visit one of the following websites:

- VISA

- Mastercard

- American Express

- Discover

How to Cancel Credit Card Payments Online

To cancel a payment by phone, call one of the following numbers:

- VISA at 1-800-VISA or 1-800-Mastercard

- American Express at 1-800-American Express or 1-800-Discover

- Discover at 1-800-Discover or 1-800-DELVE

How to Cancel Visa Credit Card Payments Easily.

To cancel Visa credit card payments by phone, firstdial 1-800-528-8283 and ask for cancellation. After confirming your account information and payment plan, you will be able to cancel the payments through the phone.

How to Cancel Visa Credit Card Payments by Email

To cancel Visa credit card payments by email, firstwrite a letter of cancellation to the billing address on your visa card and send it to the following address:

Visa credit card company

Cancellation Department

123 Main Street

Suite 1004

Chicago, IL 60611-5004

You may also want to consider using something like Amazon’s cancellation service, which allows customers to cancel their payments without any penalty. To use this service, go to https://www.amazon.com/gp/pdp/B00FGKFZLO and input your account information. After clicking on the “cancel my order” button, you will be taken to an Amazon page that explains how to cancel your order without any penalty.

Tips for Cancel Visa Credit Card Payments.

When you want to cancel a credit card payment, there are a few methods you can use. You can call the credit card company and ask to have the payments cancelled, or you can email the credit card company and ask to have the payments cancelled.

If you cancel by phone, make sure to follow these tips:

- Call from a time that is convenient for the credit card company so that they can understand your request.

- Be polite and explain why you want to cancel the payment.

- Be sure to confirm your cancellation before hanging up.

- Make sure to include all of the information needed for the credit card company to process your cancellation, such as your name, account number, and expiration date.

Conclusion

Whether you're trying to cancel credit card payments or have any other questions about the process, read these tips to get started. By following these simple steps, you can easily cancel Visa credit card payments and avoid any potential penalties.

0 notes

Text

Chase Bank Identification Number: What You Need To Know In order to Use The Service

Introduction

Introduction: In order to use Chase Bank Identification Number (CBN) services, you will need to have a Chase bank account. In addition, you will also need to provide your Chase bank identification number when requesting services from the bank. Please be sure to provide your CNDP at the time of call or visit so that our team can verify your account and begin providing service. Thank you for your continued support!

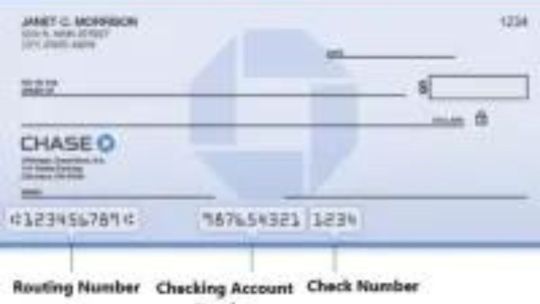

What is the Chase Bank Identification Number.

The Chase Bank Identification Number is a unique number that is assigned to each account holder. You must have this number in order to use the bank's services.

How to Get a Chase Bank Identification Number

In order to get a Chase Bank Identification Number, you will need to complete and submit an application form and pay a $5 fee. Once you have received your Chase Bank Identification Number, you will be able to use the bank's services as usual.

How to Use the Chase Bank Identification Number.

In order to use the Chase Bank Identification Number, you will need to first contact the bank and request a number. The bank will then issue you a number and you can start using it immediately. You can find the Chase Bank Identification Number on their website or in the customer service area of your account.

How to Get a Chase Bank Identification Number

If you want to get a Chase Bank Identification Number, you will need to go through the process of applying for one and then being approved by the bank. The application process may take some time, so be patient! Once you have been approved, you will be able to begin using your new number.

How to Use the Chase Bank Identification Number.

The Chase Bank Identification Number (CBN) is a six-digit number that you can use to identify yourself when using the Chase bank website and other Chase products. To get your CN, you must complete and submit a numbered application form and payment for the required fees.

You can find the CN in your account statement or on the inside of your plastic card holder. You should also carry an example of your CN with you while using the Chase bank website and other Chase products.

If you have been issued a CN, but feel uncomfortable using it or if it has not yet expired, you may want to consider seeking out help from aCN instruction center or from a representative at your local branch. If you have any questions about how to use or expire your CN, please contact our customer service team at 1-800-Chase (1-800-722-2444).

Conclusion

The Chase Bank Identification Number is a unique number that you can use to identify yourself and your business on popular marketplaces. By using the Chase Bank Identification Number, you can boost sales and protect your identity. Use the Chase Bank Identification Number wisely so that you can continue to grow your business.

0 notes

Text

The Indian Sportsperson of the Year 2018

Introduction

Introduction: The Indian sportsperson of the year 2018 is an acknowledgement of excellence in sport. It’s a recognition that goes beyond the usual medals and honours, and it comes from within. This year’s recipient is PV Sindhu, who became the first woman to win a singles gold medal at the Commonwealth Games. Sindhu has set an example for others and has shown us that there’s no box we can’t tick when it comes to being a good sport. So congratulations, PV!

The Indian Sportsperson of the Year 2018.

The Indian Sportsperson of the Year is an award given to individuals who have made a significant impact in the field of sport. The award is named after former BCCI President and Prime Minister of India, Lalit Modi, who was instrumental in creating the sport in India. The award honours individuals who have made an impact in both amateur and professional sport, and whose work has helped improve cricket and other sports in India.

Who is the Indian Sportsperson of the Year 2018

The Indian Sportsperson of the Year 2018 is composed of individuals from a wide range of backgrounds. Some of these people include former cricketers Sachin Tendulkar and VVS Laxman, Paralympian Dipak Chatterjee, Olympic gold medalist Sushil Kumar, fashion designer Anjum Malik, and many more. Through their work within sport, these people have shown that there is nogrenade that cannot be used to achieve success both professionally and personally.

The Indian Sportsperson of the Year 2018.

The Indian Sportsperson of the Year 2018 is an award that is given to a person who has made a significant contribution to the sport in India. The award is determined by a panel of experts and is presented at a Awards Ceremony.

What is the Indian Sportsperson of the Year 2018

The Indian Sportsperson of the Year 2018 is a position that has been created in order to recognize and reward individuals who have contributed to sport in India. The position starts with nomination and then evaluation, before being elected for two years. The role entails responsibility for multiple aspects of sport, from organising events and working with associations, to developing new grassroots sports initiatives.

The Indian Sportsperson of the Year 2018.

The Indian Sportsperson of the Year 2018 is an award given to a person who has made an outstanding contribution to the sport of India. The award is judged on a number of factors, including sportsmanship, achievements in the sport, and public speaking.

For more information, click here

Who is the Indian Sportsperson of the Year 2018

Conclusion

The Indian Sportsperson of the Year 2018 is an award bestowed on individuals who have excelled in their field of sport. The award is given out every year and goes to a variety of athletes, including Paralympians, boxers, and wrestlers. This year's recipient is the Bangalore-based Saina Nehwal, who has won multiple gold medals at international tournaments. In addition to her successful sporting career, Saina has also become well known for her charitable work in her home city of Bangalore. With this in mind, she has been chosen as the Indian Sportsperson of the Year 2018. Thank you for reading!

0 notes

Text

Texas Indian Banks: A Look At Some of the Best! | Texas Indian Banks

Introduction

Introduction: Texas Indian Banks is a new resource for those interested in the history and culture of the Native American people in Texas. We’ve collected some of the best information about these banks and what they do today, as well as how you can get involved.

Texas Indian Banks: A Look At Some of the Best.

Texas Indian banks are national, federally insured institutions that provide banking and financial services to Native American tribes and their members. They play a critical role in the economic development of Native American tribes, by providing access to credit, business opportunities, and other resources.

What Are Some of the Benefits of Investing in Texas Indian Banks

- Increased access to capital

- Increased access to assets

- easier borrowing and lending procedures

- Increased chance for repayment

- More stability in tribal businesses

What Are Some of the Benefits of Investing in Texas Indian Banks

Some of the benefits of investing in Texas Indian Banks include:

- More stability in tribal businesses

- Increased access to capital

- Increased access to assets

- easier borrowing and lending procedures

- Increased chance for repayment

- More access to information and resources

What to Look for When Investing in Texas Indian Banks.

When looking to invest in Texas Indian banks, it’s important to understand the terms of the stock market. The stock market is a global marketplace where investors can buy and sell stocks. In order to do so, you must first understand the terms of the stock market.

Research the Stock Market

To get the most out of your investment in Texas Indian banks, it’s important to research the stock market. You can find information about how to buy stocks online or by visiting a traditional securities firm. Once you have a basic understanding of how the stock market works, you can start shopping for Texas Indian bank stocks.

Find the Right Company to Invest In

Once you have identified a Texas Indian bank that you are interested in investing in, it’s important to find an appropriate company to do business with. This will vary based on your specific goals and interests. However, some tips for finding an appropriate company include doing your research on company history, financial statements, and other key criteria; checking for public offerings (when available); and contacting potential partners directly if you feel confident that they would be a good fit for your business venture.

Get the most out of Your Investment

The best way to maximize your investment in Texas Indian banks is by getting as much return on your investment (ROI) as possible. To achieve this goal, it’s important to use proper risk-management techniques when investing in TexasIndian banks. These techniques include choosing an appropriate Investments vehicles (like bonds or equity), diversifying among different investments, and managing risks carefully using effective management tools like stop loss orders and margin protection strategies!

Advice forTexas Indian Banks Investors.

To invest in a Texas Indian bank, consider the size of your investment. Do you want to invest in a small company or a large one? Are you looking for a bank that will have an impact on the community or one that will just be there to make money? Consider the nature of the business and what it is concentrate on. For example, are you looking for a traditional banking business or something more innovative?

Consider the Nature of the Business

If you want to invest in a Texas Indian bank, research the business thoroughly and find out its goals and objectives. Are you interested in helping Native American businesses grow? Or are you just looking for an easily accessible source of financial aid? The nature of the business should be considered when assessing whether or not this particular Texas Indian bank is right for you.

Consider the Investment climate

storefronts in downtown Wichita Falls, TX) TIAB (TexasIndian Banks)

"The goal at TIAB is to build strong relationships with our customers and help them achieve success both within our industry and outside it." - Shawn Siegel, President and CEO, TIAB

"Our goal is to provide our customers with the best possible experience through banking and financial products." - Don Fryman, President and COO, TIAB

Conclusion

Texas Indian Banks are a great way to invest in a highly profitable business. By researching the company and considering the size of your investment, you can get the most out of your investment. Additionally, advice from experienced Texas Indian Banks investors can help guide you through tough financial decisions. With careful consideration of the above factors, it is easy to see why Texas Indian Banks are one of the most successful businesses in the country.

0 notes

Text

Get Paid to Do What You Love with the Bank of America Cash Rewards Card Program!

Introduction

Introduction: The Bank of America Cash Rewards Card is an amazing opportunity for anyone looking to make money. Whether you’re a small business owner, busy mom, or just want to get paid to do what you love, the Cash Rewards Card has you covered! With no initial investment required, the card provides convenient rewards that can help you grow your business. Plus, if you ever hit a snag in your business—like starting a new one—the bank is always there to help!

How the Bank of America Cash Rewards Card Program Works.

The Bank of America Cash Rewards Card is a credit card that rewards you for doing what you love. You can earn cash back on all your transactions, and you can also redeem your rewards in various ways. The program has several different reward tiers, so there’s sure to be something that’s perfect for you.

What Are the Benefits of the Bank of America Cash Rewards Card Program

The benefits of the Bank of America Cash Rewards Card include:

- Free checked luggage

- No foreign transaction fees

- $50 sign up bonus

- 20% off first purchase with the card

- 100% interest rate on balance paid back within 2 years (plus any applicable fees)

How to Get Started with the Bank of America Cash Rewards Card Program

To get started with the Bank of America Cash Rewards Card, you’ll first need to create an account and start filling out your rewards information. Once you have everything setup, you can then start earning points on your transactions. You can also redeem your points in various ways, including for free checked luggage, a $50 sign up bonus, or 100% interest on balance paid back within 2 years (plus any applicable fees).

How to Get Paid to Do What You Love with the Bank of America Cash Rewards Card Program.

To get paid to do what you love, it takes a little bit of effort and some creativity. You can start by submitting your skills and interests to the Bank of America for consideration. Once you’ve been given a nomination, you’ll need to complete an application and submit it along with your resume to be considered for the cash rewards card program.

After you’ve been approved for the bank card, you’ll be able to earn rewards based on how much work you complete each month. You can find out more about the rewards program here or contact customer service to learn more about earning points or cash back.

How to Get Paid to Play with the Bank of America Cash Rewards Card Program

If you love spending time online and using your Barron’scard in select merchants, then this is the perfect bank card for you! The Bank of America Cash RewardsCard offers up to $50 in store credit each time you make a purchase at participating merchants – so there are plenty of opportunities for happy spending! Plus, if that doesn’t enough incentive for you, get ready to rack up points fast! Earn 1 point per dollar spent at participating merchant locations – so even small purchases add up quickly! And if that isn’t incentives enough, take advantage of special offer codes that can net you even bigger discounts on your next purchase. Check out our blog post for more information on this amazing card!

How to Get Paid to Visit the Bank of America

If there’s one thing we know aboutBankofamerica customers, it's that they love going into our stores and shopping around our products! So why not reward them with free or discounted items when they visit our stores? That's where the Bank of America Cash Rewards Card comes in: not only do we offer free merchandise when customers visit our stores (up to $100 per visit), but we also give away free food when customers spend over $50 at any one time at participating restaurants nationwide! So whether your reason is justto buy something new orto help support local businesses, the Bank of America Cash RewardsCard has gotyou covered! Check out our blog post for more information on this amazing card!

How to Get Paid to Serve the Bank of America

There are a few things that you need to do in order to be paid to serve the Bank of America. First, you’ll need to complete an application and submit it along with your resume to be considered for the cash rewards card program. After you’ve been approved for the bank card, you’ll be able to earn rewards based on how much work you complete each month. You can find out more about the rewards program here or contact customer service to learn more about earning points or cash back.

How to use the Bank of America Cash Rewards Card Program.

The Bank of America Cash Rewards Card program is designed to reward you for your hobby or passion. To use the card, simply fill out an application and then pay back your debts on time. You can also earn rewards for spending money on activities that you enjoy, such as dining out, shopping, and travel.

How to Use the Bank of America Cash Rewards Card Program to Get Rewards

The Bank of America Cash Rewards Card program offers a variety of rewards for spending money on different things. You can earn points for spending money at participating merchants, or you can redeem those points for cash or other prizes. To get started, simply enter your spending information into the bank’s website and click on the “Receive Reward Points” tab.

How to Use the Bank of America Cash Rewards Card Program to Save Money

One of the best ways to save money with the Bank of America Cash Rewards Card program is by using it to rack up credits towards future expenses. Simply spend enough points in a given month and you’ll be able to receive a discount on your next purchase! To get started, visit the bank website and click on “Redeem YourPoints” under the “Spend Now” tab.

Conclusion

The Bank of America Cash Rewards Card Program is a great way to get paid to do what you love. By using the card to get paid and earn rewards, you can save money and make more money. Use the Bank of America Cash Rewards Card Program to get Paid, Get Rewards, or Serve the Bank of America.

#america cash rewards#america cash rewards card#bank of america#bank of america cash#bank of america cash rewards#Post navigation

0 notes

Text

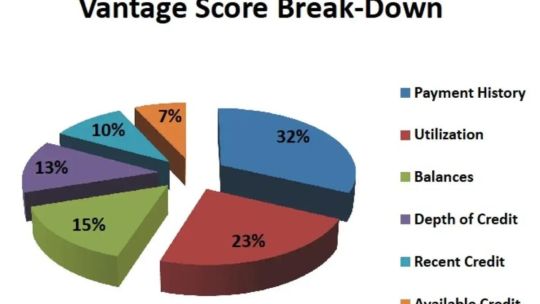

The Future of Shopping - Vantage score 0 offers an innovative shopping experience that is sure to make your shopping trips a breeze!

Introduction

Introduction:

If you're looking for a shopping experience that is sure to make your shopping trips a breeze, look no further than Vantage score 0. This innovative shopping platform offers an innovative shopping experience that is sure to make your shopping trips a breeze. For one, Vantage score 0 features an intuitive interface that makes it easy to find what you're looking for. Additionally, the platform offers ample search options so you can quickly and easily find the best deals on the items you need. Finally, the platform offers a variety of payment options so you can get your Shopping spree on without spending a fortune!

What is Vantage score 0.

Vantage score 0 is a new shopping experience that allows users to save on their shopping trips by rating and reviewing products. This innovative system offers customers an innovative shopping experience that is sure to make their shopping trips a breeze! By rating and reviewing products, Vantage score 0 helps shoppers find the perfect product for them and saves them money on their next purchase. There are many benefits of using Vantage score 0, including:

- Saving time - By rating and reviewing products, shoppers can save time on their shopping trips. This allows them to shop more efficiently and stay within their budget.

- Finding the best deal - By rating and reviewing products, shoppers can find the best deals on products. This allows them to save money while still enjoying their Shopping trip.

- feeling like they own the product - by ratings and reviews, shoppers feel like they own the product they are purchasing. This allows them to feel like they are making a real difference in the product they are buying and helping others enjoy it too!

How to Get Started with Vantage score 0.

To start shopping with Vantagescore 0, you first need to set up your shopping accounts. You can create an account for free or use a subscription model. In either case, you will need to enter your personal information and select your shopping preferences. Once you have set up your accounts, you can start shopping!

Shop from Anywhere in the World

As mentioned earlier, Vantagescore 0 offers a revolutionary shopping experience that is sure to make your shopping trips a breeze! You can shop from any location in the world, and get a free shipping code if you want! Simply enter the code at checkout when placing your order.

Get a Free Shipping Code

If you're looking to save even more on your next purchase, be sure to add Vantagescore 0 to your cart and receive a free shipping code! Just enter the code at checkout and enjoy standard shipping rates as well!

Tips for Enjoying the Best Shopping Experiences with Vantagescore 0.

When planning your shopping trip, try to schedule time for shopping. This will help you find the best deals and enjoy the experience of Shopping with Vantagescore 0. By heading to one or more designated stores, you can save a lot of money on your shopping trips.

Cookiecutter Shopping Sheets

To make your shopping experiences even easier, use cookiecutter shopping sheets. These templates will help you plan your favorite shopping trips in a snap! Just print out the sheet and cut out the items you need for each visit. You’ll be ready to go from there!

Find the Right Place to Shop

If you’re looking for an amazing shopping experience but don’t have time to spend in a store, consider finding a place to shop online. With Vantage score 0, there are plenty of options available that will let you shop without feeling rushed or stressed out. Check out our website or use our search bar to find what you’re looking for quickly and easily! More information can be found on the website

Conclusion

Vantage score 0. is a powerful shopping platform that allows you to shop from anyplace in the world. By setting up your accounts and shopping from anywhere, you can enjoy the best shopping experiences possible. Additionally, Cookie cutter Shopping Sheets make it easy to find the best deals on products online. Finally, make sure to check out our other posts for more helpful tips!

#fico score#New vantagescore 0#vantagescore 3.0#vantagescore 3.0 calculation#vantagescore 3.0 scoring system#vantagescore 4.0#Post navigation

0 notes

Text

Credit Card Balance Checker: A simple guide for keeping your money safe

Introduction

Introduction: Keeping your money safe is key to creating a successful financial life. And that’s why credit card balance checkers are so important. By going through your credit card statement and checking for any outstanding balances, you can keep yourself and your loved ones safe from potential financial harm. There are many different credit card balance checkers on the market, but this one is designed specifically for podcast listeners. So whether you’re looking to keep up with your favorite shows or just want peace of mind in knowing where all your hard-earned money is going, we recommend our pick.

How Credit Card Balance Checker Works.

Credit card balance checker is a tool that helps you track your credit card's outstanding balances. This information can be helpful if you have questions about your account or if you want to improve your credit score.

How to Use Credit Card Balance Checker

To use the credit card balance checker, you first need to create an Account and Login. Then, select the type of account (credit or debit) and click on the "Create Balances" button. You will then be asked to enter your details such as your name, address, date of birth, etc. After entering all of these data, hit the "Select Account" button and wait for the results to appear.

How to Keep Your Credit Card Balance Safe

In order to keep your credit card balance safe, you should follow some simple tips:

-Make sure that you always pay all debts in full each month

-Use a valid credit card number and expiration date

-Be sure that you have updated your contact information (e.g., maiden name, phone number) at least once a year

How to Keep Your Credit Card Balance Safe.

The first thing you need to do is choose the right credit card for your needs. Make sure you have enough money available to cover your regular expenses and that the credit card company has a good reputation. Next, use the credit card balance checker to keep track of your credit card's activity and make sure you're always compliant with its terms and conditions.

Use Credit Card Balance Checker to Keep Your Credit Card Safe

If there is any doubt about whether or not you're meeting your monthly requirements, use the credit card balance checker to check your credit score and see if there are any red flags associated with your account. If everything looks good, then continue using the card! However, if there are any signs of trouble, pull out yourcreditreportandreporttheinfringementsyounotice.

Keep Your Credit Card Balance as Safe as Possible

When keeping your credit card balance safe requires more than just following simple rules, follow these tips:

-Make a payment plan – This will help protect both you and the bank from any potential financial losses in the event that something goes wrong with your account (like an unexpected charge).

-Be responsible with your spending – Do not overspend on vacation trips or other expenses that you don't really need; this will help reduce your chances of having to pay back a loan early.

-Don't share personal information – Don't give out too much personal information about yourself or allow others access to it without proper consent (like giving outlogin info or passport numbers).

How to Keep Your Credit Card Balance Safe.

When you choose a credit card, you need to make sure that the card is safe for your personal use. One of the most important measures you can take to protect your finances is to choose a credit card that offers high-deductible credit, low annual fees, and other protection features.

Use Credit Card Balance Checker to Keep Your Credit Card Safe

In order to keep your credit card balance safe, be sure to regularly check your account and report any suspicious activity to yourcreditcardcompany. You can also use the credit card balance checker service offered by some companies in order to monitor your credit score and keep track of any recent changes in your account. Finally, always store all of your sensitive information in a secure place so that it is not accessible by unauthorized individuals.

Conclusion

Keeping your credit card balance safe is important, especially if you have any questions about it. Credit Card Balance Checker can help you do just that. Use it to keep track of your current credit card debt and make necessary adjustments as needed. By following these simple steps, you can protect yourself and your credit score.

0 notes

Text

How to extend your credit cards expiration date

Introduction

Introduction:

Extending your credit card expiration date is a common request from customers. Unfortunately, it can be difficult to get the information you need to do this without causing inconvenience or causing possible damage to your credit score. This guide will teach you how to extend your credit card expiration date without any hassle and damage.

How to Extend Your Credit Cards Expiration Date.

If you’ve had your credit card extended multiple times and the expiration date is coming up soon, it can be helpful to extend your card for another year. To do this, follow these steps:

1. Login to your account and select the “extend my credit card” option.

2. Enter in the new expiration date and click on “submit”.

3. Your extension will be processed and you’ll receive an email notification that your extension has been successfully submitted.

4. If all goes well, your extension should start processing shortly after and will be announced on your account page as a successful update. If not, please check back later as updates may become available.

How to Extend Your Credit Card Expiration Date.

To extend your credit card expiration date, you may need to contact your credit card company in order to have the expiration date extended. This process can be done by contacting your account number or by writing a letter to the credit card company.

Extend Your Credit Card Expiration Date by Mail

If you would like to extend your credit card expiration date by mail, you will first need to send a request along with a copy of your passport and driver’s license to the credit card company. The deadline for receiving this request is typically 3-4 weeks after the original expiration date of the card.

Subsection 2.3 Extension Your Credit Card Expiration Date by Calling the Credit Card Company.

If you would like to extend your credit card expiration date by calling the credit card company instead of mailing a request, there is an window of up to 14 days in which you can do so. You will need to call the customer service number on yourcreditcardwellnessguide and provide them with information about your specific situation and how they can help you extend your time limit.

How to Extend Your Credit Card Expiration Date.

If you’ve been using your credit card for a while and it’s about to expire, you can extend your expiration date by contacting your credit card company. To do this, you will need to go to the website or phone number of the credit card issuer and request an extension. usually, this extension will be in the form of a letter or email.

Extend Your Credit Card Expiration Date by Mail

If you want to extend your credit card expiration date by mail, you will need to send a copy of your current account statement and all supporting documents (like IDs) along with a $50 check or money order to the credit card company. The company will then process the extension and issue a new bill that has the expired date removed from it.

Extend Your Credit Card Expiration Date by Calling the Credit Card Company

If you don’t have access to your current account statement or other supporting documentation, you can also try extending your expiration date by calling the credit card company. usually, this is done through a call center or online interface. When trying this option, make sure that you are aware of all of your rights and that you are prepared for any potential questions or disputes that may arise during the conversation.

Conclusion

You can extend your credit card expiration date by contacting your credit card company, extending your credit card expiration date by mail, or calling the credit card company. By doing so, you can maximize your chances of getting extensions on your expired cards.

0 notes

Text

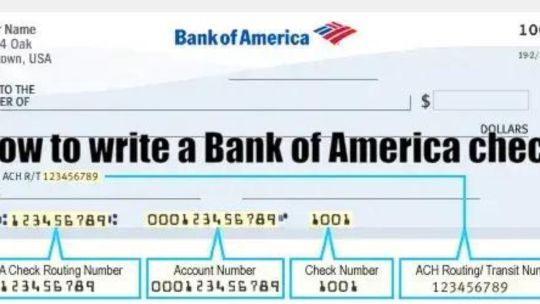

Bank of America review: Tips for writing a check

Introduction

Introduction: You just received a new bank account and want to make sure you’re getting the best deal. What do you do first? Here are some tips for writing a check:

-Start by reading the fine print

-Check out the fees involved

-Check out the different types of checks available

-Look for offers that are tailored to your budget

How to Write a Check.

The check writing process begins with the buyer and the bank. The buyer will identify themselves, provide their account number, and ask for a check. Once the bank has received the request, they will prepare the check and issue it to the buyer.

Different types of checks can be used in different situations. For example, a money order can be used for transactions that are less than $5,000, while a check can be used for transactions that exceed $5,000.

What are the Different Types of Checks

Check types include:

- Cashier's Check

- Personal Check

- Money Order

- Cheque

- Drafts and E-Bills

1. Write the check using a normal letter-size paper.

2. Place the name of the bank, account number, and amount of the check below the line.

3. Use a space between each number and phrase.

4. Type the signature of the bank president or other valid authentication authority for checking purposes only.

How to Avoid Fraud in the Check Writing Process.

When writing a check, be sure to take caution against fraud. Scammers use false statements on bank statements to try to get you to hand over money they don’t have. Be sure to review your bank statement regularly and look for suspicious transactions. If you spot any errors, report them immediately to your bank.

Be Vigilant about Your Bank Statement

Be sure to keep your bank statement up-to-date by checking for changes in your account balances and transactions. This will help you identify any potential fraudsters who may be attempting to steal your money.

Check for Errors in Your Check Writing

If you find any errors in your check writing process, Reporting these errors can help prevent others from following in your footsteps and abusing their position of trust at the bank. Make sure you proofread all checks before printing them, and make sure each one is signed by both the writer and the recipient!

Tips for Writing a Check Faster.

The average check writing process can take a bit longer than you’d like. To speed up the process, use modern terms and break news to help simplify things. For example, instead of writing "please state your order number" enter "thank you for your order, please provide your order number." Additionally, try to use common terms in your check writing so clerks will understand what you’re asking for without having to read between the lines.

UseBREAKING News to Help Speed Up the Check Writing Process

Breaking news can also help speed up the check writing process by providing a quick update on the latest events that are happening in the world. For example, if there is an attack on a prominent city, breaking news would alert bank clerks that they need to get started on checking account transactions as soon as possible.

Use Common Terms in Your Check Writing

When it comes time to write a checks, be sure to use common terms that everyone will understand. This way, clerks won’t have to spend time trying to figure out what you’re trying to say when processing your transactions. By using these commonterms, you can save yourself some time and make sure your checks are processed correctly each time.

For more information, click here.

Conclusion

Fraud is a major concern when writing checks. To help avoid fraud, be vigilance about your bank statement, check your financial history, and check for errors in your check writing. By following these tips, you can write a check faster and without fear of being scammed.

0 notes

Text

The Truth About Credit Card Closing Dates

Introduction

Introduction: You may have heard about the credit card closing dates and how they can impact your business. If you're not sure, it's time to learn more. Here are some things you need to know before your cards close:

-Your account will close on the date that is set by the credit card company. This date could be different depending on the type of credit card you have, so make sure you understand what's happening when your account expires.

-If you've been approved for a new card and haven't used it yet, your account will still be active but won't be considered for closing until after all other approvals have been processed.

-Your account may also close if there are any outstanding payments on your old card or if there are any questions about your financial history or credit score.

What is a Credit Card Closing Date.

When a credit card company closes a card, it means the creditor has decided that the customer is not able to meet their financial obligations. This can happen for a variety of reasons, such as if the customer does not make enough payments on time, or if they have violated the terms of the card agreement.

In most cases, closure follows a process called "credit expansion." In this process, the creditor buys back some of the outstanding debt from the customer. This allows them to reduce their losses and continue serving customers. However, in some rare cases, closure may also mean that customers are unable to pay all their debts. In these cases, creditors may sell off any assets they own in order to liquidate and close down these accounts.

What is the Difference Between a Credit Card and a Credit Expansion

There are two types of credit cards: personal and corporate. A personal credit card is linked directly with your name and is used for small purchases only. A corporate credit card is connected with an organization and can be used for larger purchases than what you would be able to do with a personal credit card.

The biggest difference between a personal and corporate credit card is that corporate cards often have higher interest rates than personal cards. Additionally, Corporate Cards often offer features like free travel insurance and access to special deals or products from the issuer's partner companies.

What is the Process of Closing a Credit Card

The process of closing a credit card generally follows these steps:

1) The creditor sells off any assets they own in order to liquidate and close down these accounts

2) The customer must reach an agreement with their creditor(s) under which they will repay all their debt

3) The account must finally be closed by either midnight on the last day of each month or 5 days after all debts have been paid in full

4) The creditor may also sell off any assets that they own in order to liquidate and close down these accounts

What to Do If My Credit Card is Close.

If your credit card subscription is ending and you don’t have time to renew it, please file a complaint with your credit card company. Your credit card company may be able to extend your subscription or increase the number of months you have left on your account for up to $50 per month. Please be sure to update your credit card agreement to reflect this change so that you are aware of any potential changes. You can also contact your credit card company directly if you have any questions about the closure of your account.

Get a Credit Expansion

If you want to get more miles on your cards, it might be a good idea to get a new credit expansion. A newcredit expansion allows you to increase the number of miles that you earn by spending money on eligible purchases from participating banks and issuers. To find out more about our latest offerings, go to our website and enter “credit expansion” in the search bar.

Update Your Credit Card Agreement

Make sure that all of the terms of your current contract are still in place before updating them- this will help ensure that everything remains legal and valid when you apply for a new contract or expand your account with another bank or issuer. If there are any changes made in our terms of service, we would highly recommend that you take immediate action so that you continue using our services lawfully and without penalty!

Contact Your Credit Card Company

It’s always best practice to contact your creditor as soon as possible should there appear to be any issues with either their products or services; however, in some cases (e.g., when an account has been closed for fraud) it may not be possible or desirable to do so immediately. Please contact us at [email protected] for more information about how we can help resolve these situations quickly and efficiently!

How to File a Complaint If Your Credit Card is Close.

If your credit card is close, it’s important to write a Complaint. This will help your credit card company understand what happened and how you can get your account reopened. You also need to update your Credit Card Agreement to reflect the new terms of service. And finally, contact your credit card company to ask for a credit expansion.

Conclusion

If your credit card is close, you should follow the steps listed in this section to get a new credit card or update your existing credit card agreement. Additionally, you should contact your credit card company to file a complaint if necessary. By following these steps, you can have a smooth closure of your account and avoid any future issues.

0 notes

Text

How to get the most out of your credit card with cashback!

Introduction

Introduction: With so many options out there for getting cash back on your credit card, it can be tough to know which option is the best for you. But here’s one thing you should keep in mind: cashback is a great way to boost your wallet and increase your spending power. Not only that, but it can also help you build credit history and improve your odds of scoring a great credit card. So whether you’re looking for a high-yield card or just some extra cash back, read on!

What is Cash Back.

Cash back is a type of rewards card that gives you money back on every purchase you make. You can earn cash back on your credit cards in a variety of different ways, including spending your points on merchandise, making purchases with your points, or using them to pay for travel.

How Does Cash Back Work

Cash back works pretty much the same way as any other credit card reward program: You get rewarded for your spending by getting cash back on your next purchase. However, there are a few key differences that will affect how often and how much you'll receive cash back.

First and foremost, the size of your purchase affects how often you'll be able to get cash back. For example, if you buy something at a store and then spend money within 24 hours later, the store will likely give you a redemption code to use towards your next purchase. If you spend more than $50 in a single day (or within 7 days from the time you made the purchase), however, then the store may not give you any cashback for that purchase.

Second, what type of product(s) are being purchased can also influence how often you'll be able to receive cash back. For example, if you're spending money on cigarettes but then switch to vaping products later on in the day (and therefore end up earning nicotine-free dollars instead of just cashback dollars), then those vaping products might be eligible forcashback while other products might not be eligible for this type of award. Finally, some stores offer different levels of benefits which can also influence whether or not an item qualifies for cashback eligibility- such as free shipping when redeemed through checkout or special offers which are available only to certain customers during specific periods of time (like during Thanksgiving or Christmas).

How Can You Get Cash Back on Your Credit Cards

You can get cash back on your credit cards through various methods including spendingYourpointsonmerchandise,spendingYourpointsonpurchaseswithyourpoints,orusingthemetopayfortravel。There are also several different types of rewards programs which offer greater cash backs per dollar spent- such as airline miles or hotel points which can be redeemed for free or discounted rates when redeemed through one of their affiliated programs .

It's important to remember that each individual credit card company has its own policies and restrictions regarding how they allow their members to earn cashbacks- so it's best not to expect too much from any given rewards program just because someone else did!

How to Get the most out of your credit card with cashback.

When using your credit card to get cash back, it’s important to understand how the process works. To get the most out of your rewards, try to use the card for approved transactions only and make sure you have a high credit score. Also, be sure to keep track of your spending so you can see where you can cut back on your spending. Finally, always use caution when withdrawing money from your account- do it in a way that protects your financial interests.

How to Get the Most Out of Your Cash Back

To get the most out of your cash back, be sure to redeem your rewards in a timely manner and use them wisely. Use cash backinstead of gift cards or other forms of loyalty points because they can often be more expensive and offer less redemption opportunities.also, redeem chase points or other great offers first before using those points towards travel expenses--this will help save on travel costs overall!

Tips for getting the most out of your credit card with cashback.

If you have a credit card, turning it into a cash back machine can be a great way to get the most out of your rewards program. To do this, simply follow these simple steps:

1) Add money to your account and use the card to make purchases. This will give you points that can be redeemed for cash back.

2) Use your points to get more cash back on future transactions.

3) Display your earned points on your account page so that people can see how much money they've been able to save with their credit card rewards program.

Conclusion

Cash back is a popular program available on many credit cards. It allows cardholders to receive cashback on their purchase charges, which can be very helpful in reducing the overall cost of your purchase. However, it's important to take some time to understand how cash back works and how you can get the most out of it. By understanding the different types of cards that offer cash back, you can find the perfect one for you. Additionally, by turning your credit card into a cash back machine, you can get significant discounts on your total purchase. Finally, credit card tips related to getting the most out of your cash back are a great way to help save money on your next purchase.

0 notes

Text

Chase Bank How to open an account: Everything you need to know

Introduction

Introduction:

Chase Bank is one of the largest banks in the United States, and they offer a wide range of account options. If you’re looking to open an account, we’ve got everything you need to help get started. From checking accounts to mortgages, we have something for everyone. Plus, if you have any questions about Chase Bank opening an account or anything else related to banking, our team is here to answer them!

How to open an account at Chase Bank.

The first step in opening an account with Chase Bank is to provide your name, address, and other required information. After that, you’ll be able to complete the online application process.

The Chase Bank Online Application process can take anywhere from a few minutes to hours, so be patient and don’t hesitate to ask questions if you have any doubts about your account opening.

Once your application is approved, you’ll be sent a confirmation email. You can then start the next step by clicking on the link in the email to open your account.

There are several different ways to open an account at Chase Bank including by phone, online banking, or in person. It really depends on what type of account you want and how much money you want to invest. So make sure to check out our account openings page for more information on how to open an account with Chase Bank.

What Are the Benefits of Opening an Account at Chase Bank.

Chase Bank offers a variety of benefits to account holders, including discounts on account fees, cash back rewards, and more. To learn more about these benefits and how to take advantage of them, read through the following sections.

How Can I Save on My Account Fees

Chase Bank offers a variety of account fee savings options that you can use to save on your fees. You can find accounts with lower fees by checking the Chase bank website or by calling customer service. Some account-fee savings options include:

-Free Checking: This option allows you to open an account with Chase and pay no monthly fees or annual fees. With this perk, you'll also have no interest paid on your loans until they mature, which can be up to five years!

-No Minimum Deposit: Another great account fee savings option is the No Minimum Deposit option. This option allows you to open an account without having to deposit any money at all! As long as you have some available funds, this is a great way to get started in banking!

-Interest-free introductory membership: If you're looking for an even easier way to make your first purchase or withdraw money from your bank account, try out the Interest-free introductory membership program from Chase Bank. This program lets you qualification for free access to all of their products and services starting at $25 per month! In addition, qualifying members receive exclusive deals and discounts on most products and services within Chase Bank."

How Can I Save on My Bank Fees

Chase Bank offers a variety of ways for its customers to save money when it comes time to bankroll their travels - one way is by opening anaccount with them and paying no monthly fees or annual costs! Other ways that customers can save money include earning rewards points through purchases made at participating Chase stores or withdrawing cash from their accounts free of charge!

"To qualify for free access to all of their products and services starting at $25 per month*, qualifying members receive exclusive deals and discounts on most products and services within Chase Bank."

Tips for Opening an Account at Chase Bank.

Chase Bank requires that you have a driver's license or passport to open an account. If you don't have either of those things, you will not be able to open an account. To verify your identity, Chase Bank require you to complete a process called a Driver's License Check. This process takes about 10 minutes and must be done in person at your nearest Chase bank branch.

To open an account with Chase Bank, you will need to provide the following information:

-Your name

-Your address

-Your driver's license or passport number

-Your bank account number and type

-The terms of the account (checking or credit card).

If all of these requirements are met, Chase Bank will issue you a driver's license key and instructions for opening your new account. You can find these documents online or at your local Chase bank branch.

Conclusion

Opening an account at Chase Bank can provide you with a number of benefits, including lower bank fees and the ability to save on your account fees. It's important to be sure you have all the necessary information before opening an account, especially if you're not familiar with the process. Be sure to ask your bank representative any questions you may have about opening an account or using your Chase Bank account. Thank you for reading!

0 notes

Text

How to Deposit Checks by Phone with Bank of America

Introduction

Introduction:

If you're anything like most people, you probably have at least one bank account. Whether it's with American Express, Visa, or Mastercard, everyone needs a checking account at some point in their lives. But what if there was an easier way to deposit checks by phone with a bank? That's where Bank of America comes in! They offer a convenient and fast check deposit service that'll let you make a deposit without having to go to the bank. Plus, their rates are incredibly competitive compared to other banks. So why wait? Deposit your checks today and start enjoying the benefits of being a part of the banking community!

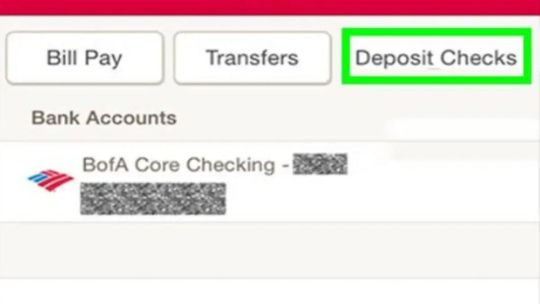

How to Deposit Checks by Phone with Bank of America.

To deposit checks by phone with Bank of America, you will need to complete the following steps:

1. Call the bank and ask to be transferred to a customer service representative.

2. On the phone, provide your name, account number, and check number.

3. The bank will transfer the check to your account and prepare the payment for you.

4. After paying for the check, return the check to the bank and receive a confirmation letter from the bank that shows that it was deposited successfully.

How to Get Started with Deposit Checks.

To deposited checks, you will need to have an investor account with Bank of America. You can either open one using a broker or use the bank’s online banking service.

Open a Brokerage Account

If you’re planning to deposit checks through a brokerage account, be sure to learn about the basics of stock investing before doing so. This will help you understand how stocks work and make better financial decisions when depositing checks with Bank of America.

Learn the Basics of Deposit Checks

Before beginning your deposits, it’s important to understand the basics of Deposit Checks. This section will explore how to deposit checks, learn about our terms and conditions, and find out more about our deposit options.

Start Deposit Checks with Bank of America

When depositing checks with Bank of America, always remember to keep your deposit money safe by using a security such as a personal check or a Mastercard® card that has been registered with our company. We also recommend storing your money in a insured account like Fidelity Investments or Vanguard National Financial Corporation for added protection against theft or other losses incurred while depositing yourchecks with us).

Tips for Successfully Deposit Checks.

When depositing checks, be sure to have a long-term investment strategy in place. By diversifying your investments, you can reduce the chance of losing money on your check deposited. Additionally, stay up-to-date on financial news so you can be prepared for any volatility that may arise during your transaction. Finally, be sure to have a receipt for the check so you can prove that you deposited it correctly.

Diversify Your Investments

By diversifying your investments, you’re also less likely to lose money on your check deposit. This means keeping a diverse mix of assets in order to minimize potential losses. Additionally, by investing in different types of assets rather than just cash, you may enjoy lower risk levels and greater returns over time.

Stay Up-to-date on Financial News

Keep up with financial news by staying informed about current events and financial developments via social media and other sources. This will help keep you informed about changes in the market and how these could affect your checking account transactions. Plus, by being aware of upcoming legislation and how it might impact your finances, you’ll be well-informed for when things get tricky – which they inevitably do!

You can find more information by clicking here

Conclusion

Deposit checks are a great way to easily and quickly send money to your investors. However, it's important to have a long-term investment strategy and be prepared for volatility when deposited. Additionally, be sure to stay up-to-date on financial news and keep an eye on the market when depositing checks. By following these tips, you will be able to deposit checks successfully and grow your business.

0 notes

Text

Activate Zelle at TD Bank with easy steps!

Introduction

Introduction: TD Bank is a big bank, and they have some great activation methods for their apps. We’ll show you how to activate your app with ease, so you can stay connected and stay ahead of the curve.

Activate Zelle at TD Bank.

To activate your Zelle account at TD Bank, follow these simple steps:

1. Log into your account on the website.

2. In the "Account" tab, click on the blue "Activate Zelle."

3. Enter your required information and click on the "Activate Zelle Now" button.

4. Click on the "Finish Activation" button to complete youractivation process.

5. You will now be able to use your new Zelle account!

What is Zelle.

Zelle is a new mobile payment platform that allows customers to make quick and easy transactions with their smartphones. With Zelle, you can easily pay for your groceries, gasoline, and more with just a few taps of your phone. To use Zelle, simply open the app and type in the purchase or service you need to purchase. You can also use Zelle to pay for items online or by using the bank’s website.

If you want to learn more about Zelle, we suggest checking out our outline on how to use it. In addition, be sure to check out our other articles on this topic:

- How to Use Zelle for Grocery Shopping

- How to Use Zelle for Gas Prices

- How to Use Zelle for Online Transactions

What is Zelle.

Zelle is a mobile app that allows people to buy insurance and save money on groceries. The app works with TD Bank, so you can activate Zelle at your bank account.

What is the Zelle Coverage

The Zelle Coverage provides protection against financial losses if you are hit by a car or other casualty while traveling. You will be required to purchase this coverage separately from your other insurance products.

What is the Zelle Service

The Zelle Service allows you to shop for and buy health care plans through the app without having to go to a clinic or doctor. You can also use the service to find affordable travel health care when planning your next trip.

How to Use Zelle.

1. activation - After signing in to Zelle, you will need to provide your unique username and password. Please see the activation guide for more information.

2. use - Once activated, Zelle will be ready to use! You can use it to access your account, view your account history, and make transactions.

3. manage - To manage your account, you can visit the Accounts section of your profile or contact us via chat if there are any questions or concerns about your account.

How to Use Zelle.

To use Zelle, start by opening the account and logging in. You’ll need to provide your name, email address, and other required information. After you’ve logged in, you can begin using the program by clicking on the “Create Account” link in the top left corner of the main screen.

After creating an account, you’ll be able to access all of the features of Zelle. To get started, click on one of the main buttons at the top of the screen:

-Zelle Coverage: This button will show you all of the benefits that come with being covered by Zelle. This includes health insurance, protection from liability claims, and more.

-Zelle Service: This button will take you to a page that shows you how to use Zelle to cover your needs. You can find this page at any time by clicking on the “Account Settings” link at the bottom of the screen. On this page, you’ll find a number of options including how long to have coverage for (in days or weeks), whether to have annual or monthly premiums set up, and how much coverage each individual is allowed to receive.

After looking at these options and deciding which ones best suit your needs, you can click on either of two buttons:

-Apply For Coverage: This button will take you through a step-by-step process that will help you get started Covering Your Family!

-Change Plans: This button will let you decide which plan fits best for your family and budget. You can pick either an annual or monthly plan.

You can find more details here.

Conclusion

Zelle is a great way to get coverage for your business in the TD Bank system. By activating Zelle, you can get access to the Zelle Program and Coverage, as well as the Zelle Service. Use Zelle to reach more customers and boost sales!

0 notes

Text

How to save up to $5,000 in Chase

Introduction

bank

Introduction: If you're like most people, you probably use your Chase bank account for a variety of purposes. You may have a checking account, an debit card, or even an online bank account. Whether you use your Chase bank account to pay bills, make purchases, or withdraw cash, it's important to keep track of the activities and transactions that occur in your account. keeper track of my chases

How to Save Money on Your Chase Cards.

A Chase card is a credit card that allows holders to save money on their transactions. The most common Chase cards are the American Express, Discover, and Diners Club cards.

One way to save money on your Chase cards is by eating out. When you dine out, you can use your Chase card to pay for your meal and then save the cash equivalent of the meal into your account. This technique can be very helpful when trying to manage a budget or saving money on travel expenses.

How to Save Money on Your Chase Cards through travel

Another way to save money on your Chase cards is through travel. By using your Chase card as an online payment method when traveling, you can save even more money by paying for your meals and hotelslesi with bitcoin or other cryptocurrencies instead of traditional currency. This technique is especially beneficial if you’re looking to make some serious Travel spending cuts!

How to Save Money on Your Chase Cards.

The first step to saving money on your Chase cards is to shop around and find the best deals. To save on your next card purchase, make sure to use Chase credit cards as often as possible. You can also save by making your card payment on time and by using a Chase credit card in conjunction with other Chase cards.

Save on All Your Chase Cards at the Same Time

To save even more money, you can combine your various Chase cards into one payment plan. This will let you pay off all of your cards in one fell swoop, making it easier to budget and save money overall.

Make Your Card payment on time

If you’re able to make your card payments on-time, you’ll be able to save even more money and still maintain a high credit score. Make sure that everything you need for your bank account—cards, checks, etc.—is received within 24 hours of being sent!

Save on Your Cards by using a Chase Credit Card

One great way to save money on your Chase cards is by using a Chase credit card as part of a combined plan with other similar banks like American Express or Discover. This will let you get lower interest rates and consolidate all of your accounts into one place so that you can save even more money over time!

How to Save Money on Your Chase Cards.

One of the best ways to save money on your Chase cards is by shopping around and finding the best deals on your next purchase. To get the most out of your Chase card, make sure to take advantage of its special offers and discounts.

SAVE ON ALL YOUR CHASE CARD PURCHASES AT THE SAME TIME

When you combine your Chase card transactions into one batch, you can save even more money. By buying items multiple times, you can create a “stack” that becomes a paying transaction that qualifies for special savings rates.

MAKE YOUR CHASE CARD PAYMENT ON TIME

Make sure you pay your Chase card bills on time so that you qualify for added savings on future purchases. By doing this, you can save up to $5,000 in total each year!

SAVE ON YOUR CASH CARD BY USING A CHASE CREDIT CARD

You can also use a Chase credit card as a payment method for cash withdrawals and other transactions – this is called "cash advance." This helpsyou save even more money by taking advantage of low interest rates on these types of transactions.

Conclusion

Save money on your Chase Cards through eating out, travel, and credit card payment. By following these simple tips, you can save money each month on your account.

0 notes

Text

Holiday full working hours: What to expect when bank is closed for holidays

Introduction

Introduction: Bank holidays are a time when many businesses close down. It can be difficult to run a business during these times, and it’s especially tough if you’re closed for lunch or dinner. Here’s what you need to know about full working hours during bank holidays.

What is the Bank Holiday Policy.

The Bank Holiday Policy states that the bank will be closed on the following holidays: Christmas, Boxing Day, New Year's Eve, and Easter. This means that most banks will be closed on these days. The exception is the Central Bank in Dublin which will be open until 5pm on Christmas and Easter days.

What Time the Bank Is Open

The bank is open from 9am to 4pm from Monday to Friday, and from 9am to 12pm on Saturday and Sunday.

The Bank Holiday Schedule

The bank holiday schedule shows when the bank is open for each day of the week: Monday-Friday 9am-4pm, Saturday 9am-12pm, and Sunday 10am-4pm.

How to Get Around the Bank Holiday Policy.

If the bank is closed for holidays, you will need to find a different way to get around. Some banks have holiday hours that are different from normal business hours, so be sure to check ahead. For example, the National Bank of Scotland has special holiday hours that begin at 4pm on Boxing Day and go until 10pm.

How to Get Around the Bank Holidays

Some other ways to get around the bank holiday policy include using public transportation or taking a taxi. If you can’t get to the bank by car or bus, you may want to consider using a mobile app like Uber or Lyft to take you there instead.

How to Get to the Bank When the Bank Is Closed

If the bank is closed because of a snowstorm, some banks may have restrictions on how customers can access cash and other funds. Be sure to consult with your bank before traveling for an estimated timeline of when closures will be in effect.

How to Make the Most of the Bank Holiday Policy.

When bank is closed for holidays, it can be hard to pay your bills. One way to make sure you have enough money to cover your needs is to try and plan ahead and save as much money as possible. For example, if you're a student, consider studying during the week before bank closures so that you have enough money saved up to cover your tuition and other expenses during the holiday period.

Make sure you have enough money to buy things you need

Another way to savemoney on bills is by shopping early in the week before the holiday rush hits. Many stores close early on Bank Holidays, so it's important to check ahead of time if you want to buy any items. Another option is buying items at discounted rates online or in store before leaving for home.

Make sure you have enough money to buy things you want and want to sell

If selling items from your apartment or house, be sure to take into account potential buyers' budget constraints and put a price limit on how much merchandise can be sold at once. Additionally, think about what kind of items people might not want or need during the holiday season such as decorations or gifts. By setting thresholds for how much items can be sold, you'll be able to ensure that your property remains clean and unoccupied until after the holiday season has ended.- Subsection 3.4 Make sure you have enough money to buy things you want and sell them quickly.

Another way ofsaving money on bills is by selling items as soon as possible after they are made available in market conditions (that is, when there isn't too much competition). This means selling products as soon as they become available at a fair price with no further discounting necessary. By doing this, you'll be able to sell products and make a profit, even if the market is slow.

Conclusion

The Bank Holiday Policy provides an easy way for people to get around the bank holiday policy. Make sure you have enough money to pay your bills, make sure you have enough money to buy things you need, and make sure you have enough money to sell things quickly so that you can get through the holiday season with some extra cash.

1 note

·

View note