Text

Tokenization at the crossroads of the trucking industry to ensure efficient payments

The trucking industry is one of the most important sectors in the world. According to recent statistics, the global freight trucking market was worth over $2.7 trillion in 2021. In addition, it’s been found that millions of commercial driver’s license holders are employed by trucking companies within the United States, a market that is responsible for delivering 70% of all freight.

Given these statistics, it shouldn’t come as a surprise that technology has become a critical component for ensuring the advancement of the trucking industry. Yet while GPS tracking, autonomous driving and other mainstream technologies may be apparent, a couple of organizations are aiming to bring tokenization and decentralized finance (DeFI) to the trucking sector to advance its payment systems.

Faster, fairer payments for trucking companies

Philip Schlump, chief commercial officer and lead developer of TruckCoinSwap (TCS) — a Wyoming-based fintech and freight company — told Cointelegraph that there are more than one million trucking companies and third-party logistics firms in the United States relying on banking entities to get paid. Schlump, who is also a former truck driver, explained that this has become the case due to how the full truckload industry’s payment system operates. He explained:

“When a truck picks up a full load of potatoes, for instance, a bill of lading is generated. This is essentially proof that the trucker and the trucking company are responsible for the potatoes during the shipment period. Once the potatoes are delivered, the bill of lading becomes account receivable, yet it often takes a net 30 to 180 days for trucking companies to receive payments.”

While Schlump pointed out that smaller full truckload companies tend to have better payment terms, 45 days is the average time it takes within the United States for truck drivers to get paid. As a result, trucking companies have become reliant on factoring firms to help truckers receive quicker payments, as these entities ensure payments are made within 10–14 days.

Yet, Schlump noted that this alternative eats away at drivers’ salaries. “Factoring companies typically charge 3% gross on every invoice, so a 20–25% interest rate is annualized over the term. These banking entities are collecting up to 90% of net revenue on every load simply because most carriers cannot wait the industry standard of 30–180 days to be paid directly by shippers,” he remarked.

Schlump believes that tokenization can potentially solve this problem. For example, Schlump explained that TCS replaces factoring companies with a token-based settlement service that allows trucking companies to get paid at face value within a few days. In order to ensure this, Schlump explained that TCS launched its “TCS Token” on the CrossTower crypto exchange in September this year. TCS will then work directly with trucking companies to buy a bill of lading using the tokens. He said:

“We are swapping the bill of lading for tokens. We are now able to pay trucking companies at the face value for their bill of lading, and they get instant liquidity in return by selling TCS Tokens.”

TCS CEO Todd Ziegler explained that when TCS swaps TCS tokens for collection rights in a shipper invoice, the trucking company is settled and can then sell their TCS on the crypto exchanges to get U.S. dollar liquidity. TCS then owns the collection rights in the shipper invoice and waits for the shipper to pay TCS. He noted that TCS does not engage in any sort of lending or financing.

Although this process may sound complex, Schlump believes that such a model could result in a $20,000 to $60,000 income increase for truck drivers. Ziegler said that the firm is beta-testing the mobile app with trucking companies “to ensure the process is totally frictionless.”

TCS isn’t the only company using tokenization to advance trucking payment systems. Myron Manuirirangi, founder of Truckonomics — an organization focused on fair salaries for long-haul truck drivers — told Cointelegraph that he also believes cryptocurrency, combined with blockchain technology, can be extremely beneficial for truck drivers.

Like Schlump, Manuirirangi is a former truck driver. Through this experience, Manuirirangi became aware of the fact that there is a shortage of truck drivers across the globe. “I started researching why this was the case and came to the conclusion that there is a shortage of truck drivers due to inadequate compensation.”

To put this in perspective, a FrieghtWaves article published in 2018 noted that a trucker in 1980 earned an average of $38,618. Almost 40 years later, in 2018, they earned around $41,000.

“The driver shortage isn’t a problem, but rather a symptom of a much larger issue that Truckonomics aims to solve with a token-based model,” said Manuirirangi.

By connecting GDPC with freight shipments, Manuirirangi believes that this will add intrinsic value to Truckonomic’s token. “As more trucking companies use GDPC, the more the price will be impacted.” In turn, truck drivers will be able to receive payments faster at much higher rates — as long as the token is used and becomes implemented on a crypto exchange. At the same time, Manuirirangi thinks that the blockchain component will help advance the trucking industry’s infrastructure.

“The trucking industry has needed blockchain for a while, yet no one has found a way to properly implement this technology. Having the GDPC token associated with Truckonomics can modernize the industry by helping pay the high costs associated with blockchain implementation, while also bringing transparency to freight shipments,” he said.

Is the trucking industry ready for DeFi?

Although tokenization and DeFi concepts have the potential to revolutionize payments within the trucking sector, a number of challenges remain.

First and foremost, getting truck companies and drivers involved with such business models could be difficult since cryptocurrency remains misunderstood by many individuals. Schlump is optimistic, however, noting that 21% of Americans are familiar with using cryptocurrency. He added that TCS has conducted internal surveys and has found that 17% of truck drivers are open to receiving crypto payments. He said:

“It becomes less challenging when there are a million trucking companies and you only need to work with about 500 to be successful. In terms of value, this can add thousands of dollars per year to trucker drivers’ salaries, so this generates positive attention as well.”

From a regulatory perspective, Schlump further mentioned that TCS Token is not an investment, as it functions as a commodity with a fixed supply. Moreover, he mentioned that TCS is a Wyoming-based company, a factor that has helped TCS gain regulatory clarity due to the state’s crypto-friendly stance.

While these points are notable, some industry experts believe that DeFi adoption by enterprises and institutions will be slow, given the sector is still in development. For example, Mike Belshe previously told Cointelegraph that while he believes DeFi will overtake traditional financial institutions, it will take at least another two to three years before real progress is made.

Yet real-world tokenization use cases may help speed up adoption. “We have a real-world use case, unlike many crypto-based projects. TCS is targeting a $500 billion a year market, with a significant dollar-value added when trucking companies run payments through our settlement service,” highlighted Schlump.

Meanwhile, trucking companies have been successfully implementing blockchain without cryptocurrencies. For example, Xavier Fernandez, chief technology officer and technical lead for Smart EIR — a blockchain-based container management system — told Cointelegraph that Smart EIR uses the Antelope blockchain network (previously EOSIO) to document the history of containers.

“We focus on the equipment interchange receipt, which is a form that is generated every time a container goes from one interchange point to another.” According to Fernandez, photographic data from these containers are stored on a private IPFS network, while metadata is stored on the Antelope blockchain network.

While Fernandez mentioned that this use case comes in handy for dispute resolutions, there is no cryptocurrency element involved: “Crypto volatility and regulatory concerns have created too much controversy. We are just using blockchain as a ledger, and a single source of truth to create trust within an ecosystem.”

CREDITS: Rachel Wolfson

DATE: Nov. 06, 2022

SOURCE: https://cointelegraph.com/news/defi-at-the-crossroads-of-the-trucking-industry-to-ensure-efficient-payments

1 note

·

View note

Text

7 reasons why you could end up with multiple life insurance policies

Life insurance needs change as you age, and starting a family triggers the need for more coverage.

A divorce can also require additional life insurance as security for child or spousal support.

Life insurance can be used to cover private student loans and business debts.

Your life insurance needs change as you age — and having children, getting married, divorced, or retiring can also have an impact on the coverage you require. Some people start off with a simple term life policy in their 20s and then expand their coverage as they start families and businesses.

Therefore, it’s common to end up with multiple life insurance policies and some overlapping coverage. In fact, some financial advisors even recommend a combination of term life and permanent life insurance policies for maximum coverage.

That said, you’ll want to avoid applying for multiple insurance policies at the same time. Otherwise, insurance companies may think you are committing fraud to get more coverage than you qualify for. This is the benefit of having an insurance specialist or financial planner help you go over life insurance options.

Below are the most common reasons people have multiple life insurance policies.

1. Your employer-provided insurance is not enough

Most employers offer some sort of group life insurance, usually equal to your salary, for free or at a low cost. One disadvantage of employer-provided group life insurance is that if you leave your job — resign, retire, or are terminated — you lose coverage.

Another disadvantage is that it may leave you underinsured. Half of Americans who have life insurance are underinsured, meaning their death benefit would not cover expenses like mortgage, college, food, debts, and clothing for dependents.

Typically, group life insurance won’t allow you to get 10 times your income. That’s why it is recommended that you have a personal individual life insurance policy outside of your work group life insurance. Many people may start off with a group life plan and then get an individual policy that offers a larger death benefit.

2. Your family is growing

If you purchased life insurance while you were single, you probably selected a lower death benefit because it was affordable. But if you now have dependents or a partner and a mortgage, you will want a larger death benefit to take care of your family and cover expenses like the mortgage and college if you die.

If you have a term life policy that you’ve been paying on for years, unless you have a “return of premium” rider, you do not get any of that money back. So if the policy is still affordable, most people just get a new policy with a larger death benefit. The overlapping coverage will be welcomed should tragedy happen.

3. You have health concerns

If you have certain health issues, you may not qualify for traditional life insurance, because traditional life insurance policies require underwriting that includes a medical exam. However, no medical exam life insurance is an option. It typically has a low death benefit amount, known as final expense insurance or funeral insurance.

Individuals with health concerns or recent nonsmokers may have annual renewable term policies until they qualify for cheaper rates from a traditional life insurance policy. There may be overlap between the annual renewal term policy and when coverage for a traditional life insurance policy starts.

4. You’re looking to build wealth

If you want to build wealth, there are life insurance products to help you do just that. Although most people probably have term life insurance, permanent life insurance products — like whole life, universal life, and variable life — never expire and have a cash value component that you can use during your lifetime.

It’s wise to consult a financial advisor, accountant, and estate planning attorney to make sure you have the proper insurance coverage you need for your goals and budget. They will provide a comprehensive assessment that includes whether you need long-term care life insurance, disability insurance, and a combination of permanent and term life insurance.

A combination of term life and permanent life insurance offers maximum coverage because at some point term life insurance expires, but your permanent life insurance lasts for your lifetime.

5. You’re planning for retirement

“A financial plan is built on a strong foundation of life insurance and risk management holding everything up — premature death, and loss of income due to illness or disability,” said Silvia Tergas, a financial planner with Prudential.

Ask yourself where you’re going to be in 5, 10, and 35 years. Tergas said this exercise requires an understanding that the decisions you make today will impact you down the road. Planning for retirement should start when you’re young and healthy.

Your life insurance should complement your other retirement planning accounts like 401(k)s and IRAs. Those who start planning for retirement later in life may already have a life insurance policy, but not one that helps them in retirement.

6. You’re getting married — or divorced

“A prenuptial agreement is like a life insurance policy in itself — you don’t need it until you need it,” said divorce lawyer Kimberly A. Cook, principal mediator at Dovetail Conflict Resolution. She noted life insurance in the early stage of premarital planning offers some level of protection.

Cook said cash value life insurance policies (permanent life insurance) are counted as an asset for financial disclosures and property allocation for spousal and child support during divorce proceedings. She noted that in certain states life insurance is actually required as security for child support or spousal support.

You may already have life insurance, but a divorce decree may require separate life insurance as a guarantee for child support and alimony payments, in which case you’d end up with multiple policies.

7. You have large loans or private debt

If a person has substantial private student loans or private debt, life insurance is often used to wipe the slate clean for the surviving business partner, spouse, or estate. Some lenders may require separate life insurance to secure your business or personal loan. This will cause you to have multiple policies.

Decreasing term life insurance policies are connected to a mortgage, business loan, or personal loan. The amount of the death benefit is equal to the mortgage or loan, with the length equal to the timeframe of the debt. If you die, it pays off the remaining debt.

The bottom line

If you want to build wealth, plan for your retirement, or protect a family-owned business, life insurance can provide the protection you need. Consult an accountant and financial advisor to determine which policies are best for you and the tax benefits and implications.

Find someone you trust with knowledge of the different types of life insurance products along with a background in estate planning. See Insider’s guide to finding a financial planner, and our picks for best term life insurance companies.

Credits: Ronda Lee

Date: Feb 27, 2021

Source: https://www.businessinsider.com/personal-finance/can-you-have-multiple-life-insurance-policies

0 notes

Text

Can You Have More Than One Life Insurance Policy?

Owning multiple life insurance policies makes sense if you have different goals for the coverage.

In short, yes, you can have multiple life insurance policies, but insurers may limit the total amount of coverage you can buy. You need life insurance if your death would place a financial burden on others. For many people, one policy is enough.

But two or more policies can make sense if you have various coverage goals. Your needs should drive the number and type of policies you buy.

How many life insurance policies can you have?

You can own multiple life insurance policies from the same or different companies. But when you apply, insurers tend to look at any existing coverage you have to make sure the policy you’re buying won’t cause you to exceed your insurability limit. This limit is typically set at 20 to 30 times your annual income.

The insurability limit exists because life insurance is designed to replace your earning power, not to considerably increase the wealth of your beneficiaries. In short, insurers don’t want your death to look too appealing to others.

Buying multiple life insurance policies: How it works

Having more than one life insurance policy is often referred to as laddering. This is when you buy multiple policies to cover different needs. Term life insurance is often used for laddering as it’s cheaper than permanent life and you can buy different term lengths.

For example, say you’re the breadwinner and want to cover your income, your mortgage payments and your kids’ college debt. Instead of buying a $1 million life insurance policy, you could buy three term policies of different lengths and amounts to match each need:

A 10-year, $500,000 term life policy.

A 20-year, $300,000 term life policy.

A 30-year, $200,000 term life policy.

If you die within the first 10 years, all three policies will pay out, providing your family with a $1 million death benefit. These funds can help replace your income and pay off large debts like a mortgage while your kids are still at home.

If you die within the second decade, the first policy has expired but the other two have not, and your family will receive $500,000. The payout can help cover college costs or living expenses for anyone who still relies on your income.

If you die within the third decade, only the third policy remains in force, and your beneficiaries will receive $200,000. By this time, your financial position may have reduced how much life insurance you need. Your kids may be financially independent, and the smaller life insurance payout can cover any remaining costs like mortgage payments.

This laddering strategy can save you money if you know your coverage needs won’t change. For example, if a 30-year-old in excellent health bought the above three policies, they’d end up paying a total of $10,470 in premiums after 30 years, according to Quotacy, a brokerage firm. To compare, if the same applicant bought one 30-year policy with $1 million of coverage, they’d end up paying $16,260 after 30 years.

However, if your coverage needs aren’t as straightforward or predictable, you may be better off buying one policy and adjusting your coverage over time. Many insurers will let you decrease the coverage and pay less, within limits. You can also buy more coverage if your needs increase, but you may have to complete a life insurance medical exam or answer questions about your health to do so.

Why you may need more than one life insurance policy

Here are some examples of when you may want to buy more than one policy.

You own a small business. You may want a term policy to take care of the family and another to cover business loans or operational costs were you to die unexpectedly.

You need to cover final expenses. You may want a separate burial life insurance policy to cover final expenses like funeral costs. These policies are a type of permanent life insurance and pay out a small death benefit regardless of when you die, as long as the premiums are paid.

You want to leave an inheritance. If you want to leave a lump sum to someone no matter when you die, you may want a separate permanent policy, such as whole life insurance.

Credits: Georgia Rose

Date: Apr 25, 2022

Source: https://www.nerdwallet.com/article/insurance/can-you-have-more-than-one-life-insurance-policy

0 notes

Text

5 Mistakes Life Insurance Mistakes That You Should Avoid

Some Life Insurance Advice to Consider

There are many good reasons to consider buying a life insurance policy, such as a recent marriage, a new baby, or taking on a large debt (like a house) loved ones would have trouble paying off if something happened to you. Or perhaps you have witnessed first-hand the impact that a death has on surviving family members’ finances.

If you’re in the market for life insurance or have recently bought a policy, make sure you don’t put your family’s finances in jeopardy by making these mistakes.

KEY TAKEAWAYS

Life insurance can offer a measure of financial reassurance to your loved ones if something were to happen to you.

The younger and healthier you are when buying life insurance, the lower your premiums are likely to be.

It’s important to compare various types of life insurance to find the policy that’s right for you and your financial situation.

Permanent life insurance covers you for your entire life and accumulates cash value over time. Term insurance only lasts for a certain number of years (e.g., 20 years) and has no cash value.

It’s possible to own more than one life insurance policy, though you may be required to complete a medical exam to qualify for each one.

Getting Life Insurance

Life insurance is a financial contract that pays out a death benefit to one’s heirs or other beneficiaries in the event of their death. The purpose of this death benefit is to replace any current and future income lost due to that death, to cover any outstanding debts and obligations of that person, and to leave some additional money as an inheritance or legacy.

Life insurance today exists in a competitive marketplace, with many companies offering several types of policies and products. Term life insurance is the most basic form of coverage, providing a level death benefit for a set period of years (e.g., 20 years). Once the term runs out, you will need to re-apply for new coverage if you so choose. Permanent life insurance can last your entire life, and often comes with a cash accumulation component. The premiums on these types of policies tend to be more expensive compared to term, but also come with additional benefits and value.

Regardless of which type of insurance you decide to go with, the application process will be similar. You will need to provide your basic information, financial picture, and complete a health survey. In addition to the survey, you will often have to undergo a paramedical exam, during which a trained healthcare professional will examine you and may request a sample of blood and urine for analysis. This is because life insurance rates are linked to the statistical probabilities that you will die and the insurer will have to pay out a claim.

As a result, insurance premiums are often the lowest for younger people (who are often healthier and have longer to live) and for healthier people. Those with health conditions or who have riskier lifestyles (e.g., smokers) can expect to pay more.

Once approved, you will have to pay regular policy premiums (which can be set anywhere from monthly to annually). So long as you continue to pay your premiums, the policy will remain in-force; otherwise, it may lapse and your coverage will be forfeited.

Mistake #1: Waiting to Buy Insurance

When purchasing life insurance, it’s important to consider the amount of coverage you need as well as the cost. Life insurance premiums are based on a number of factors, including your age and overall health.

Buying a life insurance policy sooner, rather than later, can work in your favor if you’re hoping to secure a policy at the lowest possible cost. Life insurance rates generally increase as people age or their health deteriorates. And, in some cases, illnesses or health problems may make you ineligible for coverage. The longer you put off the buying decision the more the insurance will probably cost — if you can buy it at all.

In addition to completing a health questionnaire, you may be required to complete a paramedical exam as part of the life insurance underwriting process.

Mistake #2: Buying the Cheapest Policy

While it is important to shop for a policy that’s affordably priced, it’s important to consider what you’re getting in return, in terms of coverage. Life insurance policies can be a bit complicated, so it’s a good idea to learn about their features and benefits.

For example, term life insurance tends to be cheaper than permanent life insurance. But there’s a caveat: term life insurance only covers you for a set time period while permanent life insurance can cover you until death, as long as your premiums are paid.

If you believe you’ll only need life insurance for a set period, say 20 or 30 years, then a term life policy can be an affordable option. On the other hand, if you’re interested in lifetime coverage or you want to own a life insurance policy that builds cash value as an investment vehicle, then it could be worth it to pay more in premiums for permanent coverage. Try comparing the quotes of different life insurance policies to determine what you might be giving up in exchange for a cheaper deal.

The question of whether term or permanent coverage is better will depend on a case-by-case basis, depending on your insurance needs and financial situation. If you buy a term life insurance policy and then later decide you want lifetime coverage, you may be able to convert your existing policy to permanent life insurance.

Mistake #3: Allowing Premiums to Lapse

When purchasing life insurance, you’re expected to pay a premium in return for coverage. Again, these premiums can be based on your insurance risk class, which correlates to your age, health, and other factors. If you’re considering buying a universal life policy with secondary guarantees — low-premium guaranteed death benefits for life or for a specified period of time — a late payment can impact the policy benefits.

Universal life is a special type of permanent policy that has been marketed as having long-term guaranteed protection at the lowest possible rate — it is very different from term insurance. While many of these types of policies have a cash surrender value, universal life with secondary guarantees focuses on maximizing the amount of insurance available per dollar of premium.

Some of these policies can be sensitive to the timing of premium payments. For example, if you happen to miss a monthly payment — or are more than a month late sending in your check — your guaranteed policy may no longer be guaranteed. A policy purchased with guaranteed coverage to age 100 might only provide protection to age 92 if one payment is late or missed, which could be problematic if you live longer.

Check with your company if you think you’re going to be late on a payment; many will allow 30 to 60 days without changing the policy’s guarantee.

Mistake #4: Forgetting Insurance Is an Investment

The Financial Industry Regulatory Authority (FINRA) considers a variable life insurance policy an investment, so it is important for you to treat it as one too.

A variable life insurance policy is a permanent type of policy that provides life insurance protection with cash value. Part of the premium goes toward life insurance, and part goes into a cash-value account that is invested in various investments similar to mutual funds that you choose. Like mutual funds, the value of these accounts fluctuates and is based on the performance of the underlying investments. People often look to these policy values in the future as a source of funds to supplement their retirement income.

You must fund a variable life policy sufficiently to maximize its cash value growth. This means continuing to make adequate premium payments, especially during times of poor investment returns. Paying less than originally planned can have a big impact on the cash value available to you in the future. It’s also important to monitor your policy’s performance and periodically rebalance your accounts to your desired allocation, just as you would with any investment account. This will help ensure you’re not taking on more risk than you had planned when you set up your account.

Mistake #5: Borrowing From Your Policy

Permanent life insurance policies that accumulate cash value could be a source of funds when you need to borrow money. The cash value of a permanent policy can generally be used for any reason you see fit, including tax-free withdrawals and loans, if done properly.

This is a great benefit, but it must be carefully managed. If you take too much money out of your policy and your policy lapses, or runs out of money, all the gains you’ve taken out will become taxable. Not to mention, you may significantly reduce the death benefit that’s available to your beneficiaries when you pass away.

If you have taken too much money out and your policy is about to lapse, you may be able to maintain the policy by making additional premium payments, assuming you can afford them. When accessing your life insurance policy’s cash value, be sure to monitor it closely and consult your tax advisor to avoid any unwanted tax liability.

Note

Taking a life insurance loan is different from tapping policy benefits prematurely through an accelerated death benefit rider.

Can You Have Multiple Life Insurance Policies?

There’s no rule issued by life insurance companies that disallows you from owning multiple life insurance policies. And there are some scenarios where it may make sense to do so.

For instance, you may have purchased a $250,000 term life policy at age 30, only to decide at age 40 that you need more coverage. You may choose to purchase a second $250,000 term life policy to close any gaps in your financial plan. Or, you may opt to own both a term life policy and a permanent life insurance policy.

There are some things to keep in mind about owning multiple life insurance policies, however. First, multiple policies mean multiple premiums. If you’re purchasing different policies at different times, you may see a wide range between the highest and lowest premiums, depending on your age and health.

Applying for multiple policies may also mean having to submit to multiple paramedical exams. These exams are conducted as part of the underwriting process and typically involve submitting blood and during samples, as well as having your blood pressure and other vitals checked. While these exams are usually brief, scheduling several of them may be inconvenient.

Keeping up with multiple policies can also complicate things, especially if you’re using several permanent life policies as an investment tool. It could increase the odds of overlooking a premium due date, which could cause one of your policies to lapse.

Consider talking to your insurance agent or financial advisor about the pros and cons of owning multiple life insurance policies and what tax implications that might have, if any.

What Is the First Thing You Should Do Before Buying Life Insurance?

Buying life insurance is a process, and there is a market for insurance products. First, evaluate your financial needs and goals, and what type of coverage is best for you in order to cover those needs and goals in the event of an untimely death. Make sure you decide on both the right type of coverage (e.g., term vs. permanent) and the correct death benefit amount. Then, shop around for the most affordable coverage from a reputable insurer that can meet your needs.

How Long Does It Take to Receive a Life Insurance Death Benefit?

Life insurance companies typically pay out death benefit money within 60 days of making a valid claim.

*Sample pricing for healthy, 35-year-old, non-smoking female with a 20-year term life policy.

What Factors Should I Consider When Getting Life Insurance?

First, determine how much coverage you need. There are several rules of thumb for arriving at the right amount of coverage, such as replacing several years of lost income along with any debts and other obligations you may owe now or in the future.

Next, decide whether term or permanent insurance is best for you. Term policies have lower premiums but they expire after a set number of years. They also do not accrue any cash value.

Regardless of type, insurance premiums will increase with age and are more expensive for those in inferior health.

Are Life Insurance Payouts Taxed?

Death benefits on life insurance policies are given to beneficiaries income tax-free. If, however, the death benefit increases the value of the deceased’s estate over the estate tax limit, it may be subject to estate tax.

What Is the Best Age to Buy Life Insurance?

The younger and healthier you are, the lower the premiums on any life insurance will be. Therefore, many recommend buying a policy in your 20s if possible, even if you feel that you don’t “need” it at the time.

The Bottom Line

The decision to buy life insurance is an important one. Before committing to a policy, make sure you do your homework, read your insurance contract carefully, and understand all of its provisions. While losing or never buying life insurance may not ruin your life, it will certainly hurt the people you’re buying it to protect.

Credits: BARRY HIGGINS

Date: July 04, 2022

Source: https://www.investopedia.com/articles/pf/08/five-insurance-mistakes.asp

0 notes

Text

How Split Dollar Life Insurance Works

Split-dollar life insurance isn’t an insurance product or a reason to buy life insurance. Split-dollar is a strategy that allows the sharing of the cost and benefit of a permanent life insurance policy. Any permanent life insurance policy that builds cash value can be used.

KEY TAKEAWAYS

Typically split-dollar life insurance plans are created by an employer and employee, or a shareholder and a corporation.

A qualified attorney or tax advisor should be consulted or used when creating a split-life plan’s legal documents.

A split-life insurance plan isn’t actually a policy, it is a contract used to show how life insurance will be shared among beneficiaries.

Split-dollar plans are terminated in two ways: at either the employee’s death or a future date included in the agreement.

What Is Split-Dollar?

Most split-dollar life insurance plans are used in business settings between an employer and employee (or corporation and shareholder). However, plans can also be set up between individuals (sometimes called private split-dollar) or by means of an irrevocable life insurance trust (ILIT). This article primarily discusses arrangements between employers and employees; however, many of the rules are similar for all plans.

In a split-dollar plan, an employer and employee execute a written agreement that outlines how they will share the premium cost, cash value, and death benefit of a permanent life insurance policy. The agreement lays out what the employee needs to accomplish, how long the plan will stay in effect, and how it will be terminated. It also includes provisions that restrict or end benefits if the employee leaves the job or fails to hit agreed-upon performance metrics.

Since split-dollar plans are not subject to Employee Retirement Income Security Act (ERISA) rules, latitude exists in how an agreement can be written. They must still adhere to specific tax and legal requirements. An attorney or tax advisor should be consulted when drawing up the documents.

Split-dollar plans are frequently used by employers to provide supplemental benefits for executives and to help retain key employees.

Split-dollar plans also require record-keeping and annual tax reporting. Generally, the owner of the policy, with some exceptions, is also the owner for tax purposes. Limitations also exist on the usefulness of split-dollar plans depending on how the business is structured (for example as an S Corporation, C Corporation, etc.) and whether plan participants are also owners of the business.

History and Regulation of Split-Dollar Plans

Split-dollar plans have been around for years. In 2003, the IRS published new regulations which outlined two different acceptable split-dollar arrangements: economic benefit and loan.2 While some tax benefits were removed that year, split-dollar plans still offer advantages such as:

Term insurance: This is based on the IRS’ interim table of one-year term premiums for $1,000 of life insurance protection (Table 2001 rates), which may be at a lower cost than the actual cost of the coverage, particularly if the employee has health issues or is rated.

The ability to use corporate dollars to pay for personal life insurance: Plans can leverage the benefit, especially if the corporation is in a lower tax bracket than the employee is.

Low-interest rates: They are available if the applicable federal rate (AFR) is below current market interest rates when the plan is implemented. Plans with loans can maintain the interest rate in effect when the plan was adopted, even if interest rates rise in the future.

Options to help minimize gift and estate taxes.

Economic Benefit Arrangement

Under the economic benefit arrangement, the employer is the owner of the policy, pays the premium and endorses or assigns certain rights or benefits to the employee. For example, the employee is allowed to designate beneficiaries who would receive a portion of the policy death benefit. The value of the economic benefit the employee receives is calculated each year.

Term insurance is valued using the Table 2001 annual renewable term rates, and the policy cash value is any increase that occurred during the year. The employee must recognize the value of the economic benefit received as taxable income every year. However, if the employee makes a premium payment equal to the value of the term life insurance or cash value received, then there is no income tax due.

A non-equity arrangement is when an employee’s only benefit is a portion of the term life insurance. In an equity split-dollar plan, the employee receives the term life insurance coverage and also has an interest in the policy cash value. Plans may allow the employee to borrow against or withdraw some portion of cash value.

Loan Arrangement

The loan arrangement is significantly more complicated than the economic benefit plan. Under the loan arrangement, the employee is the owner of the policy, and the employer pays the premium.

The employee gives an interest in the policy back to the employer through a collateral assignment. A collateral assignment places a restriction on the policy that limits what the employee can do without the employer’s consent. A typical collateral assignment would be for the employer to recover the loans made upon the employee’s death or at the termination of the agreement.

The premium payments by the employer are treated as a loan to the employee. Technically each year, the premium payment is treated as a separate loan. Loans can be structured as term or demand and must have an adequate interest rate based on the AFR.

But the rate can be below current market interest rates. The interest rate on the loan varies, depending on how the arrangement is drafted and how long it will stay in force.

Terminating Split-Dollar Plans

Split-dollar plans are terminated at either the employee’s death or a future date included in the agreement (often retirement).

At the premature death of the employee, depending on the arrangement, the employer recovers either the premiums paid, cash value, or the amount owed in loans. When the repayment is made, the employer releases any restrictions on the policy and the employee’s named beneficiaries, which can include an ILIT, receive the remainder as a tax-free death benefit.

If the employee fulfills the term and requirements of the agreement, all restrictions are released under the loan arrangement, or ownership of the policy is transferred to the employee under the economic benefit arrangement.

Depending on how the agreement was drafted, the employer may recover all or a portion of the premiums paid or cash value. The employee now owns the insurance policy. The value of the policy is taxed to the employee as compensation and is deductible for the employer.

Who owns a split-dollar policy?

That depends on the arrangement. Under a “loan” arrangement, the employee owns the policy and the employer pays the premium. Under an “economic benefit” arrangement, the employer owns the policy, pays the premium and endorses or assigns certain rights or benefits to the employee

What are the benefits to the employee of a split-dollar plan?

First of all, the employer pays the premium. Tax-free loans and withdrawals may be made and cash values may grow on a tax-deferred basis.

What are the benefits to the employer?

The employer can choose who gets the benefit. There are fewer restrictions that traditional plans and plan costs may be lower.

The Bottom Line

Like many non-qualified plans, split-dollar arrangements can be a handy tool for employers looking to provide additional benefits to key employees.

Credits: RICHARD ROSEN

Date: March 10, 2022

Source: https://www.investopedia.com/articles/professionals/010616/split-dollar-life-insurance-how-it-works.asp

0 notes

Text

Voluntary Life Insurance

What Is Voluntary Life Insurance?

Voluntary life insurance is a financial protection plan that provides a cash benefit to a beneficiary upon the death of the insured. It’s an optional benefit offered by employers. The employee pays a monthly premium in exchange for the insurer’s guarantee of payment upon the insured’s death.

Employer sponsorship generally makes premiums for voluntary life insurance policies less expensive than individual life insurance policies sold in the retail market.

KEY TAKEAWAYS

Voluntary life insurance is an optional benefit provided by employers that provides a death benefit to a beneficiary upon the death of an insured employee.

It is paid for by a monthly premium that often takes the form of a payroll deduction.

It is available to an employee immediately upon hiring or shortly thereafter.

It is usually less expensive than life insurance policies purchased in the retail market.

This benefit will cease upon the employee’s termination or if they quit.

Understanding Voluntary Life Insurance

Many insurers provide voluntary life insurance plans with additional benefits and riders. For example, a plan might feature the option to purchase insurance above the guaranteed issue amount. Depending on the amount of increase, policyholders may be required to submit proof that they meet minimum health standards.

Another is coverage portability, which is the ability of a policyholder to continue the life policy upon termination of employment. Each employer has guidelines for porting a policy. However, it is typically between 30 and 60 days after termination, and it requires the completion of paperwork.

A third option is the ability to accelerate benefits, whereby the death benefit is paid during the life of the insured if they are declared terminally ill. There is also the option to purchase life insurance for spouses, domestic partners, and dependents, as defined by the insurance company.

Lastly, an immeasurable benefit offered by most employers is the option to deduct premiums from salary. Payroll deductions are convenient for the employee and allow for the effortless and timely payment of premiums.

Special Considerations

In addition to these benefits, some insurers provide optional riders, such as waiver of premium and accidental death and dismemberment riders. Riders are most often executed at issue and for an additional fee.

Voluntary life insurance is often available to employees immediately or soon after hire. For employees who opt out, coverage may next be available during open enrollment or after a qualifying life event, such as marriage, the birth or adoption of a child, or divorce. Selecting the right type of voluntary life insurance requires examining current and anticipated needs and is dependent on each person’s circumstances and goals.

Additionally, it’s also worth comparing an employer’s offering with the plans of other firms to ensure it’s among the best life insurance policies currently available.

Types of Voluntary Life Insurance

There are two types of voluntary life insurance policies provided by employers: voluntary whole life and voluntary term life. The latter is also known as group term life insurance. Face amounts may be in multiples of an employee’s salary or stated values, such as $20,000, $50,000, or $100,000.

Voluntary Whole Life Insurance

Voluntary whole life protects the entire life of the insured. If whole life coverage is elected for a spouse or dependent, the policy protects that person’s entire life as well. Typically, amounts for spouses and dependents are less than amounts available for employees.

Just as with permanent whole life policies, cash value accumulates according to the underlying investments. Some policies only apply a fixed rate of interest to the cash value, whereas others allow for variable investing in equity funds.

Voluntary Term Life Insurance

Voluntary term life insurance is a policy that offers protection for a limited period, such as five, 10, or 20 years. Building cash value and variable investing are not characteristics of voluntary term insurance. As a result, premiums are less expensive than their whole life equivalents. Premiums are level during the policy term but can increase upon renewal.

Voluntary life is often paid with pre-tax dollars. If it is paid with after-tax dollars it may be tax-deductible.

Example of Voluntary Term Life Insurance as a Supplement

Some participants choose voluntary term life as a supplement to their whole life insurance. For example, Jordan is married with children and has a $50,000 whole life insurance policy. After receiving a financial needs analysis, it is determined that their life insurance is insufficient. The life insurance broker suggests that Jordan maintain at least $300,000 in life insurance while their children are minors.

Jordan’s employer offers voluntary term life insurance with reasonable premiums, and Jordan elects the coverage to supplement their existing coverage until their children reach the age of majority.

What Is Voluntary Dependent Life Insurance?

This employee benefit can cover a spouse, children, and any other eligible dependents, depending upon the rules laid out in the plan. In the event that a dependent dies, the employee would receive the death benefit.

Is Voluntary Term Life Group Insurance?

Yes. Voluntary life insurance is covered via a group policy put in place by an organization. Because of this, most individual employees can purchase a policy under the umbrella plan without underwriting or a medical exam. Additionally, the cost of the premiums will typically be less than for an individual policy.

How Much Voluntary Term Life Insurance Do I Need?

While you may want or need a larger death benefit, voluntary term life is usually limited by an employer to either 1x-2x the amount of your annual compensation. Other companies will set a cap at between $50,000 — $250,000 in coverage.

What Is the Difference Between Group Term and Voluntary Term Life Insurance?

Voluntary life insurance and group life insurance are often used interchangeably.

Credits: JULIA KAGAN

Date: April 25, 2022

Source: https://www.investopedia.com/terms/v/voluntary-life-insurance.asp

0 notes

Text

Co-Signing Student Loans? Consider Life Insurance

Between October 1 and December 31, 2015, private debt collection companies hired by the Department of Education garnished more than $176 million in wages from defaulted student loan borrowers in order to pay back their debts.

These garnishments were all related to federal student loans which never need a cosigner, but private student loans are co-signed by a parent 90% of the time. What happens if you co-sign your child’s student loan and they are unable to pay? Private student loans do not have the same garnishment powers that federal student loans have, but the lender can still pursue you and even take you to court to try to collect the amount due because you co-signed the loan.

Even if your child has great career prospects post-college, there is one scenario in which your child, despite their best intentions, won’t be able to repay their loans: an untimely death. Sallie Mae, the largest private student lender, provides automatic private loan forgiveness if a student passes away, but not all private lenders offer such protection. Unlike federal student loans, private student loans are not automatically discharged upon the death of the student. If a parent co-signed the loan, they are on the hook for it, too. Imagine dealing with the death of your child and finding out that you are also responsible for repaying tens of thousands of dollars in outstanding private student loans. Fortunately, there is one simple, and relatively inexpensive, safeguard against this scenario: life insurance.

Many parents don’t consider purchasing life insurance for a child, but if you’re co-signing private student loans you should verify what happens in the event of the borrower’s death. If the loan will not be discharged, you should seriously consider taking a policy out yourself or requiring your child to purchase a policy.

Life insurance rates depend on factors such as age, health, and size of the death benefit you want. The younger and healthier your child is when they purchase the policy, the lower the premiums will be. A 20-year term life insurance policy with a death benefit of $100,000 could be as low as $10 per month.

Although you may be able to add coverage for your child as a rider on your own life insurance policy, this is probably not the best option for covering student loans. Most riders will cover the child only until they reach the “age of maturity” which is often age 21, but may vary among carriers. Unless the policy is converted once the child reaches the age of maturity, they could be left without coverage and several years of student loan payments ahead of them.

Of course, with $1.2 trillion in outstanding student loan debt, even with life insurance it’s wise to think twice about how much student loan debt your child should really take on. You should also explore all federal student loan options before taking out a private loan, but if you do need to turn to private student loans, life insurance should be part of the plan. It’s an inexpensive solution but the penalty for not buying life insurance can be emotionally and financially devastating.

Credits: Janet Berry-Johnson

Date: Mar 28, 2016

Source: https://www.forbes.com/sites/janetberryjohnson/2016/03/28/co-signing-student-loans-consider-life-insurance/?sh=2b5e84a547a5

0 notes

Text

Life Insurance Planning for Parents of Children Living With a Disability

For parents of a child with a disability, long-term planning is essential to help create a secure future.

Life insurance can help secure the financial future of a child whose functional needs may require ongoing assistance. But to ensure your child also remains eligible for important government benefits, you’ll need a good plan. Rest assured, if you’re in this situation and you’re someone who needs life insurance, you don’t have to do it alone. There are tools to help, and attorneys and financial advisors who specialize in assisting clients like you.

Here’s what you need to know before buying life insurance as the parent or guardian of a child living with a disability.

Calculate your child’s cost of care

Identify the costs: The first step is to think about your child’s ongoing needs and estimate the costs of meeting them. Expenses might include medications, therapy, transportation, schooling or adaptive equipment.

Estimate the costs over the child’s anticipated lifetime: Medical, transportation and living expenses can add up over time. The mean health care costs for an adult living with a disability are roughly five times higher than someone without a disability, according to a 2017 study by the University of Texas and Washington State University.

Subtract government assistance: Government programs, such as Medicaid and the Children’s Health Insurance Program (CHIP) can help cover medical costs for a child living with a disability. Eligibility is often based on income and varies among states.

Once you’ve calculated the expenses associated with your child’s disability, subtract the estimated government benefits they’ll likely receive, and that’s the amount to plan on providing.

Choose the right type of policy for your situation

There are two main types of life insurance: term and permanent. Unlike term life insurance, which expires after a certain number of years, permanent life insurance, such as whole life or universal life, provides lifelong protection. As such, permanent policies are often recommended for parents caring for a child with disabilities, as the death benefit pays out regardless of when you die.

Survivorship life insurance, sometimes called second-to-die life insurance, is a type of permanent coverage that insures two people, typically a couple, under one policy, and pays out after the second person dies. These policies are often cheaper than covering both parents separately.

Set up a special needs trust for the child

If you name your child as the beneficiary of a life insurance policy or leave valuable assets directly to the child through your will, you may disqualify them for government benefits, like Supplemental Security Income. This is because people living with disabilities generally cannot have more than $2,000 of assets in their names to be eligible for government benefits.

But you can provide life insurance benefits for the child and still preserve eligibility for government programs by setting up a special needs trust, sometimes called a supplemental needs trust. The trust holds assets for your child, and the trust document spells out how the money should be used. You appoint a trustee to manage the money on behalf of your child, and name them — in their capacity as trustee — as the beneficiary of the life insurance policy.

The trustee could be the same person as the child’s guardian. Alternatively, you can appoint a relative, attorney or other professional to serve as trustee. It’s important to choose someone who is good with money and will implement your wishes effectively.

Plus, the trust can be used for any assets you want to leave your child, not just the insurance payout.

Get help from life insurance and special needs trust experts

General estate attorneys and financial planners may not understand all the nuances involved with planning for a child living with a disability or setting up a supplemental needs trust. Therefore, you may want to seek help from an attorney, financial advisor or life insurance expert with authority in this area.

You can find attorneys and other professionals through groups such as the Special Needs Alliance and the Academy of Special Needs Planners.

Besides helping you set up a supplemental needs trust, an attorney can help you write a will and draft a letter of intent, which is like a guidebook for caregivers.

If you want coverage for your child, look into child life insurance policies. While not right for everyone, these policies can act as investment vehicles for minors, and help secure future insurability when they reach adulthood.

Credits: Georgia Rose

Date: Mar 4, 2021

Source: https://www.nerdwallet.com/article/insurance/life-insurance-parents-special-needs-children

0 notes

Text

If you have student loan debt, you may want to get yourself a cheap life insurance policy

While federal student loans are generally discharged if the borrower dies, that’s not always the case for private loans.

If you cosign a student loan, you could be liable for payments even if the student is no longer alive.

Life insurance for a young student could be very inexpensive and protect you from losses if a student you cosigned for dies.

If you cosign student loans with your child or another loved one, you are accepting equal responsibility to pay off that loan. While most people go into a cosigner relationship with the best of intentions, things don’t always go as planned.

While a student dying is already a worst-case scenario, leaving behind big student loan balances can make things even worse. Life insurance is a strategy to protect yourself from shouldering massive student loan debt in this terrible circumstance.

Not all student loan debt dies with the borrower

“I have always shared with clients that there are differences between federal student loans and private student loans,” said Michael Anderson, a financial adviser and host of the radio program “Big Money in the 805.”

“Federal loans are typically discharged if the borrower dies,” Anderson explained. “But that is not the case with all student loans. You may be required to pay back loans of deceased borrowers if you are a co-signer on the loan.”

If you are cosigning a loan, it’s important to review the fine print and understand what happens in varying scenarios. Once you sign, you are liable for the debt and it is reported on your credit report and credit score. Only cosign if you are willing to accept that burden.

Life insurance protects cosigners if the student dies

Because of the major liabilities involved, few people are willing to cosign student loans outside of a parent or a spouse. This type of connection is usually lifelong and already intertwines your finances. But what happens if the student dies?

In most cases, the cosigner has to pay back any outstanding loan balances. If they don’t have enough cash lying around, that may not be an easy thing to do. Life insurance on the student could protect you against this unlikely situation.

“A simple 10-year term policy with limited underwriting could be purchased discreetly and for a very reasonable price,” according to Anderson. He shared that a 10-year, $100,000 term policy for a 20-year-old could cost as little as $8 to $12 per month.

Getting life insurance at a young age is a good idea in any case

The cost of life insurance tends to go up with age. Because the monthly cost of term life insurance is locked in when the policy starts, a young person could save a lot by getting life insurance during college. While a family and kids may seem a long way off, getting long-term, high-value life insurance early is often a wise decision.

Every family should look a the numbers and compare before signing up for life insurance, but getting a policy for your child in college could be a great gift for them and a prudent protection for your finances.

Life insurance is for the things you can’t predict. While it’s unlikely someone in their early 20s will die, accidents and illnesses happen.

Hopefully, you never need it. But in the rare case someone finds themselves paying for the student loans of a deceased student, the opportunity to get life insurance has already passed. If you are cosigning a student loan, think ahead about protecting your money and credit from problems with the loan.

Credits: Eric Rosenberg

Date: Dec 18, 2019

Source: https://www.businessinsider.com/why-you-should-get-life-insurance-if-you-have-student-loans

0 notes

Text

Why Single Parents Need Life Insurance and How to Afford It

You need life insurance for as long as your children depend on you financially.

It may take a village to raise a child, but as a single parent, it can feel like it’s all up to you. Paying the bills, keeping the fridge stocked, teaching and nurturing — there’s a lot to shoulder.

So what would happen if you were no longer around? It’s a crucial question to consider.

Buying life insurance is an important step to making sure the kids would be OK if something happened to you. Here’s what you need to know.

Life insurance isn’t just for married couples

A common misconception is that married parents need life insurance more than single parents. In a recent survey, 82% of respondents said married parents with young children needed life insurance, compared to just 60% who said the same for single parents. That finding came in the 2017 Insurance Barometer Study, a nonprofit supported by insurance companies and brokerages, and LIMRA, a global life insurance research and development organization.

The truth: If your death would hurt anyone financially, then you need life insurance.

“There’s no question that the actual need for life insurance by single parents is, at a minimum, equal to married parents, if not greater,” says Todd Silverhart, corporate vice president at LIMRA.

You should have coverage whether you’re the sole provider or you share financial responsibility with your child’s other parent. If the other parent helps support the kids, then that parent should have coverage, too.

Types of life insurance

Life insurance pays out if the person insured by the policy dies. The money goes to the life insurance policy’s beneficiary, who is named by the person who buys the coverage. There can be more than one beneficiary.

There are two main types of life insurance — term and permanent, such as whole life.

Term life is designed to cover you only for the years you think you’ll need life insurance, such as when your kids are growing up. You buy a policy to cover you for a certain period, such as 10, 20 or 30 years. The policy pays out if you die within the term. Term life is sufficient for most families, and it’s cheap. You can compare life insurance quotes online.

Whole life insurance and other types of permanent policies cover you for your entire life. They also include a savings component known as “cash value,” which grows slowly tax-deferred. After years of growth, the policy owner can borrow against the cash value or give up the policy for the cash value. Permanent life insurance is more expensive and complicated than term life. It’s best to work with a financial advisor if you’re interested in permanent coverage.

How to afford life insurance

Term life is affordable and fits the bill for most single parents.

A healthy 30-year-old can buy $250,000 of coverage for 20 years for about $160 a year, according to LIMRA. That’s less than $14 a month.

The price of life insurance is based primarily on your age, health, lifestyle and the amount of coverage. The younger and healthier you are, the cheaper the price.

“Buy now before it gets more expensive,” says Brian Madgett, vice president at New York Life Insurance Co.

Life insurance prices vary by company, so get life insurance quotes from several insurers to find the best price.

Deciding how much to buy

Think about your kids’ financial needs to decide how much life insurance to buy.

Add the following:

The cost to pay off the mortgage and other debts.

Your annual income multiplied by the number of years you’d like it replaced. A common recommendation is at least seven years.

Long-term expenses, such as the cost of sending your kids to college

Then subtract any savings or other life insurance coverage you already have to estimate how much to buy.

When buying term life insurance, choose a term that lasts until the youngest child has graduated from college.

Naming the life insurance beneficiary

Take care in naming the beneficiary. Life insurance companies cannot pay money directly to minors. If naming your children as beneficiaries, you’ll also need to name an adult custodian on the policy to handle the money for their benefit, Madgett says. The children will receive any unspent life insurance money when they reach the legal age of adulthood.

If only the children are named, the court will have to appoint a custodian. That process will cost time and money, and may not result in the person you’d want, he says.

Another option is to work with an attorney to set up a trust for the benefit of the children and name the trust as the beneficiary. When creating the trust, you spell out the rules for how the money should be used and name a trustee to manage the money according to the trust directions.

“With a trust, you’re in control even though you’re not living,” Madgett says.

Although 18-year-olds are legal adults in many states, most parents wouldn’t want their kids at that age getting a large sum of money. With a trust, you can have the money managed by the trustee until the children reach a set age, such as 25 or 30.

Credits: Barbara Marquand

Date: Mar 22, 2018

Source: https://www.nerdwallet.com/article/insurance/single-parents-guide-life-insurance

0 notes

Text

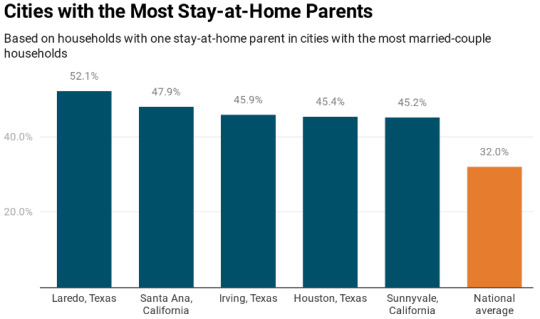

Why Stay-at-Home Parents Need Life Insurance

One of the primary reasons to buy life insurance is to help replace your income if your family counts on your paycheck. But if you’re not working at a paying job, should you bother getting coverage? In a word, yes.

Because couples might assume that only an income-earning parent needs life insurance, they often skip coverage for the stay-at-home parent, says Jason Hill, founder and president of Client Focused Advisors. It’s a mistake to overlook the financial support a stay-at-home parent provides. “If I had to replace what my wife is doing, it would cost me a fortune,” says Hill, whose wife is a stay-at-home mom.

How Stay-at-Home Parents Provide Financial Support

Although stay-at-home parents don’t bring home a paycheck, they provide substantial support for their families. If they weren’t around to take care of children, make meals, run errands or manage other household tasks, someone might need to be hired to fill those roles.

Salary.com estimates that the median annual salary for all of the jobs that stay-at-home moms perform is $184,820. Granted, you wouldn’t necessarily have to hire someone to handle some of the jobs that Salary.com included in its estimate — such as a logistics analyst, consumer loan officer or conflicts manager.

But you might need to pay for daycare or a nanny if something were to happen to the stay-at-home parent in your family. And that’s a pretty hefty expense by itself.

According to Care.com’s Cost of Care Survey, the average weekly cost for a child care center was $226 in 2021. The average weekly cost for after-school care was $261 and the average weekly cost for a nanny was $694. Based on these figures, a family could pay an average of $11,752 to $36,088 a year per child for childcare. And child care costs are only rising over time.

That’s a cost the working parent might have to shoulder if something happened to the stay-at-home parent. If that parent had ample life insurance, the death benefit could cover the cost of childcare so the family’s finances wouldn’t take a hit.

What a stay-at-home parent may provide

Beyond child care, stay-at-home parents cover a lot of other household tasks that a working parent may not be able to take on. The surviving spouse may need to pay for additional services to keep the house running, such as:

Housekeeper

Laundry service

Gardener

Pet sitter or dog walker

Meal service

Tutor

Driver

Some seemingly little things stay-at-home parents handle would add up if you had to pay someone to replace these household duties.

Other Reasons to Consider Life Insurance

Not only will a life insurance payout provide the surviving parent with the funds to cover child care costs, but it can also help cover final expenses. The median cost of a funeral with burial is $7,848, according to the National Funeral Directors Association. This does not include cemetery, monument or marker costs. Plus, there could be lingering medical bills or other expenses that need to be covered.

In addition to providing a financial safety net, the stay-at-home parent might also want a life insurance policy to leave a legacy for the children, says Stephen F. Lovell, president of Lovell Wealth Management. By putting life insurance in a trust for your children, you can pass on an inheritance to them.

And while it’s not a reason that people buy coverage, having life insurance in case of a divorce is valuable. It’s better to get coverage while you’re young and healthy because you can qualify for a lower rate, says Lovell, no matter what your reason is for buying coverage. If a divorce happens later, either parent without a policy might find it difficult to find affordable coverage at that point — or even get coverage if she or he has developed health issues.

How Much Coverage Do Stay-at-Home Parents Need?

When figuring out how much life insurance you need, income often is a key consideration. That’s because you want a death benefit that will replace your salary for a certain period of time that you choose.

Coming up with a coverage amount might seem like more of a challenge if you’re a stay-at-home parent without an income. There is no one-size fits all approach, Hill says. But there are a few key questions you can ask yourself to determine how much coverage you need.

How many children do you have?

“The bigger the family, the bigger the life insurance policy that family should have,” Hills says. That’s because child care costs will be higher. Find out the cost of childcare facilities, after-school care or a full- or part-time babysitter where you live.

You’ll want to have a life insurance amount that’s large enough to cover that cost for all of your children until they’re old enough to no longer need care. If your spouse will need to hire a house cleaner, lawn mower or others to handle the tasks you currently manage, factor those costs into your life insurance calculation, too.

Will you return to work?

If the stay-at-home parent plans to return to a paying job, consider what their income likely will be. That’s because your household spending will likely rise as your household income does, Hill says.

You’ll want enough life insurance to replace the income you expect when you return to the workforce so your family can continue living the lifestyle they’re accustomed to. By getting ample coverage now, you can lock in a lower rate than what you’d pay if you waited to buy more coverage upon returning to work.

Ideally, you should work with a financial advisor who can help you review your household assets and expenses to calculate how much coverage you need. You can find a fee-only planner through the National Association of Personal Financial Advisors or a planner who charges by the hour through the Garrett Planning Network.

What Type of Life Insurance Should You Buy?

There are two primary types of life insurance: term life and permanent life. A term life policy provides coverage for a certain period of time — typically 10, 15, 20 or 30 years. A permanent life insurance policy provides lifelong coverage. The type you choose will depend on your family’s financial situation and goals.

The Case for Term Life

Hill says that he typically recommends that stay-at-home parents buy a term life policy because it’s an affordable way for families to get the protection they need. For example, he says a healthy 30- to 35-year-old woman could get a 20-year term life policy with a $500,000 death benefit for about $20 to $30 a month.

You can choose a term that’s long enough to cover the years until all of your children have graduated high school or even college. Then you’ll know that funds will be available to pay for your children’s care if something were to happen to you while they were young.

The Case for Permanent Life

A permanent life insurance policy — such as whole life or universal life — will cost more than a term life policy.

Permanent life insurance can make sense for higher-income families who have covered other financial planning bases, such as maxing out retirement savings, having an emergency fund and saving for children’s college education.

One benefit of a permanent life insurance policy is that it builds cash value. It’s money you can use later in life if the policy builds up enough cash value. For example, you could tap a policy for retirement income — which might be appealing for stay-at-home parents who can’t contribute to a workplace retirement savings plan.

“That cash value policy will give them planning flexibility later in life,” Lovell says.

Still, the high cost of a permanent life insurance policy that will build substantial cash value can be a deterrent to a young family that’s juggling other expenses.

If you are interested in a permanent life insurance policy but can’t afford one now, be aware that term life policies typically offer a term life conversion option that lets you switch to a permanent life policy.

You might be able to take advantage of that option if you go back to work and have a bigger household budget.

Buying a Life Insurance Policy

It’s best to work with an independent insurance broker who can get you quotes and compare policies from several insurance companies. If you prefer to take a DIY approach, shop around for the best policy at the best price.

You will have to provide a lot of information about yourself during the application process so insurers can calculate your rate.

Your lack of income shouldn’t hurt your ability to get coverage as long as your spouse has life insurance. Where you’ll run into problems is if you’re trying to buy a policy, but the income-earning spouse doesn’t have one or isn’t also applying for coverage, Hill says.

You’ll also raise a red flag if you’re trying to get more coverage than your spouse has. Typically, insurers will issue a policy for a dependent spouse that’s worth 75% to 100% of an in-force policy on the employed spouse, he says.

If you do run into problems getting coverage, having an independent insurance broker on your side can help. That broker can write a letter to the insurer explaining your situation and why you need life insurance even though you’re not the household income earner.

Credits: Penny Gusner

Date: Aug 16, 2022

Source: https://www.forbes.com/advisor/life-insurance/stay-at-home-parents/

0 notes

Text

Understanding Final Expense Life Insurance

If you’re older, you may not have life insurance any longer. Maybe you took out a term life policy and it expired. You decided you’re in a good place financially, so you don’t need to pay the premiums for another policy.

That’s a great position to be in.

But then you get older, and life happens. You realize you don’t have the money for your loved ones to cover your final expenses.

What can you do?

There’s a policy called final expense life insurance. It’s a life insurance policy strictly for people over age 50 and just for final expenses. Here’s everything you should know about it.

What is Final Expense Life Insurance?

Final expense life insurance, as the name suggests, is for final expenses only. It’s a policy for elderly people to take out to cover their final expenses. This includes things like your funeral, cremation, burial, or even your final medical expenses.

It’s a permanent life insurance policy which means it lasts for your lifetime — it doesn’t expire, but you must pay the premiums. It’s not a policy that will leave your loved ones with a financial legacy, but if you’ve already taken care of that and just need funds to cover your final expenses, this could be a good option.

Final expense insurance isn’t for hundreds of thousands of dollars or millions of dollars like regular life insurance. Keep that in mind, as you decide if final expense insurance is right for you.

How Does Final Expense Life Insurance Work?

Final expense life insurance works a little differently than most other life insurance policies. It starts with an application like all other policies, but the similarities end there.

You don’t need a medical exam for final expense insurance. You can apply for one of two types which will determine the next steps:

Simplified final expense insurance — Simplified insurance means you answer some medical questions and if you answer ‘no’ to these questions honestly, you get coverage. The questions are about any chronic or terminal illnesses you may have. It’s important to answer the questions honestly otherwise it’s insurance fraud.

Guaranteed final expense insurance — Guaranteed insurance means anyone can get approved. There aren’t any medical questions or exams. If you apply and meet the age requirements, you qualify even if you have a terminal or chronic illness, but it costs more since the insurance company takes a higher risk.

There’s another thing you should know about final expense life insurance.

It has a waiting period.

If you apply and are approved today, you won’t get full coverage for 2 years from today. This means if you died between today and 2 years from now, your beneficiaries would not receive the payout amount of your insurance policy. They would only receive a return of the premiums you paid to that point. Some companies also pay a small bonus, such as 10% of the amount you paid.

How Much Coverage can you Get?

This is another area final expense insurance differs from any other life insurance policy. The coverage amount is limited to your final expenses — usually around $20,000. Policies generally range from $5,000 — $50,000, but the average person gets around $20,000 in coverage.