Text

Why it is important to file ITR on time?

Why it is important to file ITR on time?

The income tax department has made the process of filing of Income tax return extremely convenient for taxpayers by introducing the online facility. This e-filing facility is speedy and accurate, and provides convenience not just for local residents in India but non-resident Indians (NRIs) as well.Tax consultant Dubai and authorised intermediaries offer services for electronically filing I-T returns on behalf of taxpayers, under the Electronic Furnishing of Return of Income Scheme, 2007. A registered e-return intermediary, Alankit Limited has over 13 years of industry presence in the UAE and offers professional ITR filing services.

When should taxpayers file their returns?

The last date of filing of income tax return (ITR) for a financial year, say, 1st Apr 2018 to 31st March 2019, is 31st July 2019, unless extended by the I-T department. Taxpayers can e-file their tax returns any time before the specified date.

Avoid penalty

If taxpayers do not submit their income tax return (ITR) on or before the deadline, they are liable to pay a penalty of up to Rs 10,000 for late payment. If they file their returns after 31st July and on or before 31st December, they are required to pay Rs 5,000 as a penalty. Also, in case taxpayers file their returns after 31st December, the penalty levied on them will be Rs 10,000 which is applicable for those who have taxable income of over Rs 5 lakh. If the taxable income of taxpayers is up to Rs 5 lakh and they have delayed their ITR process, they must pay a penalty of Rs 1,000.

Avoid one percent monthly interest

Besides the penalty stated above, taxpayers must file income tax return (ITR) in order to avoid additional interest charges. By not making timely payments and having tax dues, taxpayers need to pay 1 percent penal interest on the tax amount which is due. This is in addition to a higher penalty of Rs 5,000 or Rs 10,000, whichever is applicable.

Avoid last-minute hassles or stress

Although the online facility makes things a lot easier for professionals, yet, the task of e-filing should not be done at the last minute. This is because the chances of errors or missing out on one or more tax savings which were due to you could become higher. Moreover, a taxpayer gets enough time to arrange relevant documents viz. TDS certificates, loan repayment statements, interest certificates, Form 26AS, etc. Also, one should try to e-file early in order to avoid heavy website traffic.

Avoid mistakes

work to support taxpayers who usually tend to make mistakes in terms of overlooking income, extra tax paid or missing important tax benefits. Revising the returns after the due date is not possible. Such mistakes can often result in fines imposed by the IT Department or loss of tax refunds. Thus, taxpayers must ensure they file their well in advance so that they have sufficient time to file the revised returns any time before the end of the current financial year. This means, if a taxpayer has filed his or her returns by 31st July 2019, he or she can file the revised returns any time before 31st March 2020.

Avoid interest loss on refunds

When taxpayers file within the due date, the interest accrued on refund would be calculated from 1st April of the Assessment Year to the date at actual processing of refund amount is done. But, in times of late filing by taxpayers, the interest would be computed from the actual date of filing up to the date at which refund was processed. This would result in interest loss of about four months from April to July leading to a substantial loss in case of large tax refund due to a taxpayer.

In order to ensure financial discipline, it is highly recommended to file income tax return well before the specified due date.

0 notes

Text

MOTOR INSURANCE

In today’s world, the roads have become very unsafe and are more prone to accidents due to a number of reasons like uneven roads, ill-lit areas causing low visibility, bad road conditions like potholes or broken patches, etc. and even road rage. We need to safeguard our vehicles against accidents by taking suitable motor vehicle insurance. Vehicle insurance is also a must-have to protect your vehicles against any loss or theft.

Types of Motor Insurance-

● Car Insurance- Motor Car Insurance is a must for all the people who own a car and it protects your car against any loss, theft or accident coverage for both the car and the passenger.

● Two Wheeler Insurance - It is the same as Car Insurance and provides insurance cover to scooters and motorbikes. It safeguards the two-wheelers against any loss, theft or accident coverage for both the vehicle and the passenger, thus acts as prevention against overall financial loss.

● Commercial Vehicle Insurance- This is an Insurance coverage for all commercial vehicles from light to heavy such as trucks etc., that carry the goods for commercial purposes. It safeguards the commercial vehicles against all economic loss.

● Third-Party Insurance Policy- The third party insurance is a policy which protects the car owner or driver of the vehicle against any legal liability, accidental liability, financial loss or property damage, medical expense cover in the event of an injury to or even death of any third party arising out of their vehicle. Third party insurance is a mandatory insurance required as per the Motor Vehicles Act, 1988 for anybody owning, buying or driving a motor vehicle.

Benefits of Motor Insurance- Higher volume of vehicles coupled by poor road conditions and stressful road rage incidents make motor insurance a must for everyone. Following aspects need to be ensured while taking an insurance coverage

● �� A number of inclusions including loss due to riots, strikes, fire or burglary, any terrorist act, and other natural conditions.

● Cashless claim procedure.

● Provides an appropriate depreciation cover in proportion to the amount insured in the plan.

● It also gives coverage to engine protection in case of any loss or theft.

● 24*7 continued assistance.

● It also gives towing facilities etc.

Alankit Advantage-

● As Alankit has tied-up with renowned insurance companies in the industry, Alankit team will help you choose the best insurance plan as per your need.

● Expert Analysis by market professionals provides a balanced view of the insurance market.

● Taking into consideration the type of requirement by the client, guidance is provided to the client on the best insurance plan to buy.

● Best after-sales services to make sure that you do not face any problems after purchasing the insurance policy. Alankit takes full accountability against its client’s benefits.

● You can browse through insurance-specific information on our website. ‘www.alankitinsurance.com’ and make an informed choice. You can simply search, compare, and buy the insurance policy as per your requirement, without any hassle.

0 notes

Text

What is ITR 1 and how to fill it online?

Filing of income tax returns is a must for all taxpaying individuals and entities. The task of ITR filing has become easy with the introduction of e-filing facility. Moreover, authorised e-return intermediaries provide valuable support in ensuring smooth ITR filing process that starts with submission of the ITR form. Alankit Limited is a registered e-return intermediary which delivers professional & efficient e-filing services. Based on their income source, individual taxpayers must know how to fill itr 1 or other forms namely ITR 2, ITR 3, ITR 4 and ITR 4S (SUGAM).

There are different forms which are applicable for different assessees, and the factors depend not only on income source but quantum of income, type of income, residential status of the taxpayer, etc. Many taxpayers, especially first-timers ask the question what is ITR 1 Form? Here is a comprehensive explanation.

What is ITR 1?

Before we proceed to understand how to fill itr 1, it is important to know the answer to the question — what is ITR 1 Form? Also called SAHAJ, the ITR 1 Form is applicable for salaried individuals who file their Income Tax Returns. They include individuals who are Resident and Ordinarily Resident (ROR) having annual income amounting to Rs 50 lakh. The income could be through the below-mentioned sources.

Income from salary or pension, family pension and interest income.

Income from a single House Property (excluding losses brought forward from previous years).

Income from other sources excluding income from winning lottery/ horse racing.

In case of clubbed I-T returns, the income from spouse and a minor child is also included, in such cases the ITR 1 can only be filed if the aggregate income of assessment year fulfils the above-mentioned specifications.

Some facts about ITR 1

The ITR 1 was initially applicable for all Residents, Residents Not Ordinarily Resident (RNOR) and Non-residents. However, now Resident and Ordinarily Resident (ROR) can file this form.

In the financial year 2017–18, a major change was announced regarding requirement to provide a break-up of salary components along with the details of exemptions claimed by the taxpayer. These details, earlier, were only reflected in the Form 16 and there was earlier no requirement of disclosing them in the I-T return.

In addition, the assessee will be required to provide a break-up of Income under House Property which was earlier mandatory only for ITR 2 and other forms.

Who cannot file ITR for AY 2019–20?

Individuals with income above Rs 50 lakh.

Individuals — either a company’s director who has invested in unlisted equity shares cannot use this form.

Residents not ordinarily resident (RNOR) and non-residents.

Individuals having earned income from sources as mentioned below:

More than one House Property

Lottery, Racehorses, Legal Gambling, etc.

Taxable capital gains (short term and long term)

Agricultural income exceeding Rs. 5,000

Business and Profession

Individuals who are Residents and have assets (including financial interest in any entity) outside India or signing authority in any account located outside India

Individual claiming relief of foreign tax paid or double taxation relief under Section 90/90A/91

How to fill ITR 1

The information mentioned above provide a clear answer to what is ITR 1 Form? The next step is to understand how to fill itr 1? The ITR 1 can be filed through both the online and offline mode as explained below:

Offline mode

Only individuals, as mentioned in the category below, can file the return in paper form.

Individuals aged 80 years or above can file return in paper form anytime during the previous year.

Individual or HUF (Hindu Undivided Family) having income which does not exceed Rs 5 lakhs and those who have not claimed any refund in the return of income, can file return in paper form.

The income tax return, in the offline method, is furnished in the physical/ paper form. An acknowledgment will be issued by the Income Tax Department, at the time of submission of physical tax returns.

Online Mode

It involves transmitting the data electronically and then submitting the verification of the return in the form of ITR-V to CPC Office in Bengaluru.

The process involves filing the online income tax returns and e-verifying the ITR-V through net banking/Aadhaar OTP/EVC.

An acknowledgement is sent to the taxpayer’s registered e-mail Id, in case ITR-1 Form is submitted electronically.

0 notes

Video

A myriad of milestones achieved in 2019!

Glimpses of Alankit Achievements in 2019

From affiliations, conferences, exhibitions, collaborations, awards and recognition to getting featured in leading publications, the bygone year proved extremely gratifying for Alankit's growth trajectory. Look forward to more achievements in the year ahead.

#AlankitMoments2019 #GlimpseOf2019 #Achievements

#Alankit#Alankit Group#Alankit Group Achievements#Alankit Group Services#Alankit tax news#Alankit group tax news#Alankit raid#Alankit group scam#Alankit tax fraud#Alankit tax scam#Alankit group tax fraud#Alankit group tax scam#Alankit scam news#Alankit raid news

0 notes

Text

Things to Keep in Mind Before Filling Aadhar Card Application Form

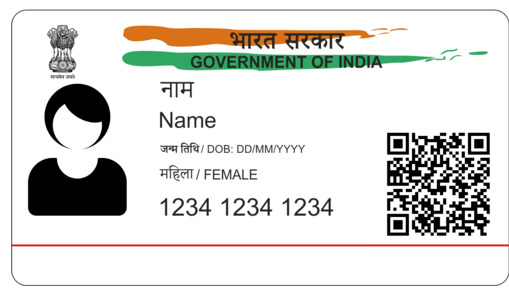

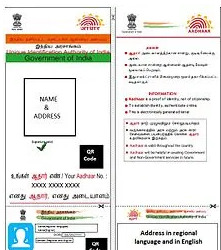

Aadhar Card is a legal document that comes with a unique 12-digit Aadhar number issued by the Government of India. The card is not a mandatory document; however, it is a universal identity proof across the country. Following certain steps are vital for an Aadhar Card application.

After successful verification of documents and biometric, the Government gives you an Aadhar Card. There is only one type of Aadhar Card application form, but UIDAI has categorized it in two forms, namely the Aadhar Enrolment and the Aadhar Correction form.

A person should use Aadhar Enrolment form while applying for the first time to issue a 12-digit Aadhar number from the Government of India. Whereas, to correct the wrong Date of Birth, change of address, etc. in the already existing Aadhar Card use Aadhar Correction form. Both the forms are easily available at the Aadhar Card Kendra near your house or even on the official UIDAI website.

While filling the form, keep the following points in your mind:

Whether you are filling the form offline or online, always fill the form in bold capital letters. Especially with offline submission, it becomes easy for the official to read what you have written.

You can only correct Date of Birth once. Hence, carefully approach this column.

You need to enter your registered mobile number. In case if you do not have your number, then enter the mobile number of someone in your family.

Documents that you submit as an ID proof should not have any mismatch with any details in other submitted documents.

If you are filling the correction form, then only enter the fresh data. There is no need to write the old wrong data in the form.

Even after submitting the correction form with the required document, there is no guarantee for the acceptance of your submission. Only after the complete verification of all the details, UIDIA approves the correction.

Filling the Aadhar Enrolment correctly will not lead to the corrections. Therefore, before filling the form, carefully know all the contents, as shown below:

Full name

Address

Age

Gender

TIN Number/NPR Receipt Number

Pre-enrolment ID

Father/Mother/Guardian’s details

Details of the supporting documents submitted

Details of the introducer/HoF details

Thumb imprint/Signature of the applicant

Time and Date of the enrolment.

Wrong data entered while filling the Aadhar Card application form will reflect incorrect information on your Aadhar Card. To correct this, you will need to fill the Aadhar Correction form. Keep the following points in your mind when you fill this form:

Specify which data you must improve.

Enter only the right details of the wrong data.

There is no language barrier. You have the freedom to fill the form in your local language.

Attach the correct supporting documents that show the correct data which you must improve.

After attesting the form, post it on the address mentioned on the form.

0 notes

Text

How to Protect Yourself by Pan Card Fraud

PAN, or permanent account number, it is a unique 10-digit alphanumeric identity allocated to each taxpaying citizen by the Income Tax Department with the supervision of the Central Board of Direct Taxes. It also serves as an identity proof. PAN is essential for financial transactions such as receiving a taxable salary or professional fees, sale or buying of assets above specified limits, buy mutual funds and more.

Where can I use my PAN Card?

Your PAN Card is an incredibly significant document in respect with the following matters:

• Tax Deductions: The employees who pay more than Rs.1,00,000 rent per annum are expected to submit PAN details to declare deductions.

• Claiming Refunds from Income Tax (IT) Department: A PAN card is essential for the filing of IT returns.

• Buying a Car: If one wishes to purchase or retail a motor automobile costing more than Rs. 5,00,000, they must furnish their PAN details when performing the bargain.

• Opening a Bank or a Demat Account: A PAN card is needed to open a new bank account, whether savings or a current account.

• Making Investments: If you are contemplating investing in which you are buying, you would have to provide your PAN details for any agreements amounting to above Rs. 50,000.

• Purchasing Foreign Currency: Details of your PAN at the money exchange bureau is required where the conversion is being made.

• Cash Deposits: If you are putting together a cash deposit that amounts above Rs. 50,000 at a time, you will need to submit your PAN details.

• Buying and Selling of Immovable Property: Purchasing, selling or leasing property in India now needs PAN card proof.

How to Prevent PAN Card Fraud?

There are various ways to be safe from PAN Card fraud:

In case any documents have been misplaced, then report a First Information Report at the earliest possible.

The details like date of birth, place of birth, PAN Card number does not need to be public data.

Besides, you could also click a snapshot of the papers being submitted with the date for future consideration.

Ensure that you are convinced about where and why you are submitting your PAN Card facts. Always inscribe the date on the copies.

What is Alankit and what PAN Card Services it provides?

Alankit Limited, the flagship corporation of Alankit, stands firm as the prominent e-Governance Service provider of the nation. Alankit excels at rapidly providing e-governance outcomes to millions of residents in the country by an active system across the nation. Alankit works as a single outlet for all assistance related to the PAN card application and all other processes.

Permanent Account Number (PAN), the ten-digit number handed out by the Income Tax Department in India, figures as one of the most significant articles as the personal identification number allocated to each taxpayer of the nation.

How to File a Complaint against a Fraud PAN Card?

The income-tax bureau has an electronic portal for lodging PAN Grievances via Aaykar Sampark Kendra (ASK). By utilizing this portal one can fulfill their complaint regarding for PAN sent to either UTITSL or NSDL. One can even surrender the duplicate PAN through Alankit complaints portal.

Protocol for Submitting PAN Grievances:

Visit https://incometax.intelenetglobal.com/pan/pan.asp

Click on submit option and fill out the requisite details like Nature of Complaint, Receipt Number etc.

Click on submit button to Submit the Grievance.

You can go on their website or the Alankit complaints portal to redress your grievances.

0 notes

Text

Best Health Insurance Companies in India

At times of severe illness high costs of health care can come to be the size of a mountain, and you might not be able to take care of such huge expenses on your own. There is where health insurance comes in. You simply pay a premium amount every month and your insurer pays for a portion of the covered medical costs. The insurer might be able to negotiate better rates from doctors and hospitals. Health risks and uncertainties are embedded into life. With ever increasing costs of healthcare and increasing instances of diseases, health care seems like a necessity.

Now comes the question of which insurance company to choose? Which is the one you can place your trust in?

Here are 5 top health insurance providers in India are:

1. Alankit Health Care TPA ltd.

2. Apollo Munich Health Insurance Company Limited

3. Star Health & Allied Insurance Company Limited

4. Max Bupa Health Insurance Company Limited

5. ICICI Lombard General Insurance Company Limited

Alankit Health Care Limited - It is a Licensed Third Party Administrator (TPA) started its operations in 2003. Alankit Health Care entered the market with the mission to play an important role by offering smooth health insurance services to the beneficiaries. It provides hassle free services to all the stakeholders ensuring reduction in claim cost and control on fraudulent claims.

Alankit Health Care Limited (AHCL) is an ISO 9001 certified company by KPMG for quality systems and a process driven organization ensuring minimum scope of errors and increased efficiency. The Company is equipped to handle over 1 million policy holders. With State of the Art technology and in- house software, the company has managed to bring down process time for the various services it provides to its customers.

Apollo Munich Health Insurance Company Limited - Headquartered in Gurugram, Apollo Munich Insurance has offices in majorly all the metro cities. The company aims to make health insurance easily available and uncomplicated for all. Apollo Health Insurance plans are valid in around 4,000 trusted hospitals across 831 cities and towns that include 50 Apollo Hospitals, which provide Cashless Hospitalization service.

Star Health & Allied Insurance Company Limited - Star Health and Allied Insurance Co. Ltd. began its operations in the year 2006 in India. Since Star Health Insurance in India has no other category of insurance to center and separate their attention to, they generally employ their resources to aim at providing excellent services, designed products and use core proficiency of innovation to offer the best to their customers. With more than 400 offices all over India and around 8500 + hospitals network, Star Health Insurance Company Limited ranks amongst one of the largest providers of health insurance plans.

One of the factors by which you can judge the insurance company can be the premium income (sales turnover of insurance companies). The company has to be financially stable and strong.

Few other figure you would want to check is the number of policies issued or number of claims registered/paid, claims disposal rate, number of claims repudiated, number of claims pending for more than a year, grievances against the insurer with IRDA (Regulator).

The claims incurred ratio is not a direct indicator. A lower claims ratio does not give the customer any advantage. In fact, be wary with companies that have very low incurred claim ratios. Either their premium rating is loaded against the consumer or they are controlling claims artificially. The ideal Incurred Claims ratio hovers between 65 to 75%, if the company is fair and there is no deliberate intervention to lower claim pay-outs.

The number of claims registered and paid will give you an idea about how the claims are being handled by the company which will point to the insurer’s attitude towards settlement. The repudiation percentage is a strong indicator as it will put the insurer in perspective as to their approach on claim settlement.

Ageing of claims is another indicator. You don’t want to be insured by the company which has claims pending over a long period for their insured customers. Loop in the number of consumer complaints as well here by which you can judge the anti-customer nature of the company.

0 notes

Text

E-Governance Services & Solutions

Alankit Limited is a flagship company of Alankit, laid by Mr. Alok Aggarwal in the year 1995. From there on in, over the last 25 years, we have grown to become a global federation of ten companies with a diversified portfolio in health and wealth services. has emerged as a top player among the country’s e-Governance Service Providers. Alankit is a combination, including 13 distinct organizations with expanded exercises spread crosswise over 4 essential verticals, in particular, e-Governance, Financial Services, Insurance and Healthcare. The company is listed on leading exchanges of the country — the National Stock Exchange of India Limited (NSE) and the Bombay Stock Exchange Limited (BSE).

Alankit exceeds expectations at quickly conveying e-administration answers for many residents in the nation through a solid system crosswise over in excess of 673 urban communities and 6120 business areas. The organization successfully liaises with different government divisions in India to guarantee straightforwardness and productivity in the conveyance of different administrations to individuals. Having over two decades of experience, Alankit has evolved over the years and emerged as an industry leader by building a robust infrastructure and competent workforce to keep pace with the changing times as well as to fulfil the needs of customers.

The taxpayer driven organizations gave by Alankit incorporates many e-governance services and solutions to the citizens that are:

New enrolment of PAN Card and PAN Card Corrections

SBI Kiosk

GST Services to help business tasks

NPS (National Pension Scheme)

Aadhaar Services including new enrolments and updating existing Aadhaar holders

DSC (Digital Signature Certificate) registration

Manpower consultancy

E-recording of Income Tax Returns

E-TDS services

E-waste management

NSR Registration

Alankit Limited ensures efficiency, reliability and transparency. They have improved organizational processes. Alankit delivers high-quality information and services to the public. Alankit Group reinforce the credibility, accountability and transparency. Along with providing quality products and services, Alankit limited also promotes democratic standards of practice.

0 notes

Text

How To Fill PAN Card Application Form 49a

With the government getting stricter on keeping tabs of tax paying citizens to reduce the occurrence of black money, citizens are finding themselves in a rather stressful situation; needing to apply for Aadhaar, linking Aadhaar to bank accounts where applicable and most importantly linking PAN number with Aadhaar.

In order to do so, one must first obtain a PAN Card. PAN stands for Personal Account Number and is a mandatory document for all Indian Citizens. This holds true especially in the case of Tax paying citizens. Individuals can apply for a PAN Card and so can organizations, registered companies and firms that hold current accounts in Banks.

In case you do not have a PAN Card and don’t know how to fill PAN application form 49a, you need not worry as it is quite simple to apply for one.

Understanding the PAN Card Application Forms:

There are two types of PAN Application forms namely 49A and 49AA. 49A is the form required by Indian Citizens and Indian companies within India. 49AA is only meant for entities and Individuals outside of India. Unless you are a foreign national or a company, you only need to download form 49A.

How to get form 49A:

The form can be downloaded from the Alankit website in PDF format and can be printed out to be submitted in hard-copy format at any of the TIN-FCs or PAN Centers managed by NSDL. If you prefer to proceed online ensure that you have a functioning credit card or net banking facilities.

What to fill:

Fill up all the required fields and double check the proof of identity and address proof to make sure they are acceptable ones. Ensure to crosscheck with the checklist provided online on the website. Proofs must be legibly scanned and attached.

Here is what needs to be filled:

1. Fields that are marked with * symbol must be filled and filled only in English

.2. Fill in your Last name, Middle name and First name in the respective boxes.

3. Fill in any alias that you may have

.4. Specify your gender.

5. Enter in your date of birth.

6. Details of parents and spouse will also be asked so be ready to fill in that information.

7. You will also need to specify which name is to be printed on the PAN card (Mother’s/Father’s)

8. Provide the address that is available on the address proof you are submitting without any discrepancy. Also indicate your communication address.

9. Other contact information such as e-mail, telephone number can also be provided.

10. It is mandatory to indicate the source of income and provide a profession code. Refer to the chart or check the drop-down list for the appropriate profession category and respective code. (basic instructions given below)•

To avoid mistake (s), please follow the instructions below before filling up the PAN Card form 49a. There are some basic instructions given below:

a) Form to be filled neatly in BLOCK LETTERS with BLACK INK pen.

b) Form should be filled in English language only.

c) Each box should contain only one (1) character (Be it a number/letter or punctuation mark). Leave a blank box after each word.

d) Applicants should affix two (2) recent photographs with white background (standard size- size 3.5 cm x 2.5 cm) in the space provided in the form. The photo quality should be good; face of the applicant should be visible properly and not stapled.

e) Signature should be done in such a manner that half portion of the signature is on the photo rest on the form.(left side of the form)

f) Signature (right side of the form) should be within the box provided.

g) If thumb impression (left hand) will be used, then it should be attested by a Magistrate or a Notary Public or a Gazetted Officer with an official seal / stamp.

h) Applicant must fill AO code (Area Code, AO Type, Range Code and AO Number) of the Jurisdictional Assessing Officer.

Regarding Payments: In order to process PAN Cards within India, the fee is around Rs.110. If you are submitting the hard-copy and do not prefer to make payments online, then you may easily make the payment in cash at Alankit’s authorized TIN-FCs or PAN Centers managed by NSDL (in return you will get a payment slip).

• Acknowledgement Number: Upon submission you will receive an acknowledgement number which is crucial to ensure the successful submission of your application. However this number is not a substitute for PAN number. But with this, you can track the status of the PAN application online.The PAN card will be sent to your residential address.

In the case of businesses seeking PAN cards, the help of an auditor can be enlisted for safe and proper filling of PAN Application form 49A. But for an individual, this step-by-step walk through would surely help.

To know more, visit- https://www.alankit.com/blog/how-to-fill-pan-card-application-form-49a

0 notes

Text

Commenting on the outcomes of 35th Mtg of GST Council, Chandrajit Banerjee, Director General, CII, said, “By chairing the GST Council Meeting within a month of assuming charge, Finance Minister Nirmala Sitharaman has reassured industry that GST remains top priority for the Government. We warmly welcome her strong commitment to ensuring a smooth GST regime,” he noted. He commented that the GST Council’s approval of e-invoice system and integration with e-way bill system shall greatly add to ease in logistics and reduce transaction cost. “The GST Council’s decision to introduce e-invoices shall increase efficiency in paying taxes and further boost the formal economy,” he stated.

In place of multiple documents required presently, introducing GST registration with Aadhar number shall add to ease of doing business. The extension of due date for filing of annual return is widely appreciated as industry found it cumbersome to file the first return having multiple registrations. "Initial delay in tax refunds on export goods has been significantly addressed through special clearance drives. Doing away with multiple authorities and ensuring single point refund disbursement to tax payers shall address the issue of delays, said Banerjee. "With the related institutional systems now in place, the time is right for the GST Council to consider further improvement in GST such as coverage of all sectors and convergence of tax slabs", Banerjee added.

Waman Parkhi, Partner, Indirect Tax, KPMG in India

Proposal for reduction in GST rate on electric vehicles will be sent to the Rate Fitment Committee for recommendations. This is a welcome move, as electric vehicles are definitely the technology for the future and will reduce consumption of fossil fuels and therefore should be incentivized. However, certain other categories of vehicles like auto rickshaws, trucks also need to be incentivized considering their impact on the common man Extending the tenure of the Anti-profiteering body by two more years was a necessity considering pending cases. However, demand by industry for clarity on methodology for anti-profiteering, has still not been addressed by the Government. Moreover after two years of GST , market forces would have already equalized prices making pricing investigations superfluous now.

Abhishek Jain, Tax Partner, EY India

The extension of two months for annual return and audit were much sought for by the industry and its approval comes for as a big relief to businesses; especially in light of the recent clarifications issued. Other in principle approvals of e-ticketing and electronic invoicing, where enforced well, should also help posing checks in tax evasion; but businesses would be keen to understand the precise mechanism of its implementation.

Sachin Menon, Partner and Head, Indirect Tax, KPMG in India

Extension of due date for filing of the first-ever GST annual returns, shall provide a much-needed relief and support to the stakeholders, considering that the returns require to undertake various reconciliations. The two-year extension to the anti-profiteering authority primarily aims to ensure that the benefits of change in rate of tax and benefit of ITC are passed on to the recipient. It would have been more apt if appropriate methodology was also prescribed for determining the profiteering amount.

Mekhla Anand, Partner, Cyril Amarchand Mangaldas

The extension of the NAA’s tenure was logical given the rate reductions that have been announced over the past few months as well as the Government’s intention of rationalising the tax slabs and rates. However the fundamental premise for its existence and operation does continues to be a debatable issue. It is interesting note that the decision on rate reduction for

electric motor vehicles has been referred to a fitment committee. This shows a methodical approach to the issue.

Pratik Jain, Partner & Leader, Indirect Tax, PwC India

It is good to see that the decision of the GST council has been taken again with consensus which augment the future of GST in the country. Decision to use aadhar for the purpose of registration is a significant step and could lead to similar linkages with income tax as well in times to come. Decision to implement e-invoicing model means that technology will continue to play a critical role in tax administration. While this system could initially be implemented for B2B segment only, but with e-ticketing for multi-screen cinema halls a similar mechanism is also proposed for B2C segment. If this experiment turns out to be successful, one could see this mechanism getting extended to other B2C segments as well.

The decision to extend timelines for filing annual return and audit report for FY 2017-18 is a welcome move as the industry was not prepared for the current deadline of 30 June. While the extension of term of National Anti-profiteering Authority (NAA) by two years was expected, one would hope that the government would come up with detailed guidelines and seek to restrict the same only in case of consumer complaints. There is now a need for GST Council to draw a long-term agenda as to what kind of GST does India need in the coming years.

Santosh Dalvi, Partner and Deputy Head, Indirect Tax, KPMG in India

Reference to the fitment committee by the GST council on the issues concerning various facets of electrical vehicles, Solar Power and wind turbines will promote use of non- conventional energy segment. The road map for transition to the new simplified return system will provide sufficient time to the taxpayer to get accustomed to and adopt the new system of compliance.

Ankit Agarwal, Managing Director, Alankit Ltd

The decisions made in the GST’s Council Meeting are a welcome move. In particular, the extension of the due date for filing of the Annual Returns and Reconciliation statement which has been extended to 31 August 2019 is seen as a positive outcome. Many taxpayers in the SME segment who have not done matching of the Input Tax Credit with the GSTR-2A are forced to reverse the ITC, which is a huge loss to the trade and industry. This again proves that GST is not a tax reform but a business process reform. The introduction of e-invoicing is also a major reform which has been proposed to evade tax evasion and it has been implemented globally, and trade has reaped benefits out of it.

Reference News: https://www.firstpost.com/business/gst-council-meet-industry-experts-hail-move-to-extend-tenure-of-anti-profiteering-body-approval-of-e-invoice-system6863141-6863141.html

0 notes

Text

Increase exemption limit, give rebate under Sec 80C

The Modi government will present the first Union Budget of its second term on July 5. In the present circumstances when the tax collection was below the target in May, giving any relief to taxpayers would be a challenge, but the assessees pin hopes on getting some relief.

The Tribune spoke to masses about their expectations on the personal taxation front.

Benefits for taxpayers

“We are anticipating a Budget proposal that clearly defines the priorities of the government, something which aims to bring a lot of benefits not only for the taxpayers but also for MSMEs, traders, pensioners, poor and backward sections of the society. We expect the proposals will steer towards its successful implementation after the Budget session in July,” said Ankit Agarwal, Managing Director, Alankit Ltd.

Higher exemption limit

In the Interim Budget, the government had announced that there would be no tax for individuals having income up to Rs 5 lakh (after deductions). However, the government did not increase the basic exemption limit from Rs 2.5 lakh to Rs 5 lakh. Taxpayers were of the view that tax for income up to Rs 5 lakh would be NIL, 10% for income up to Rs 10 lakh, 20% for income up to Rs 20 lakh and 25% for income beyond Rs 20 lakh. Also, the exemption for reimbursement of medical expenses and transport allowance may be reintroduced along with a standard deduction of Rs 40,000.

Deduction u/s 80C

The current deduction limit of Rs 1.5 lakh for investments under Section 80C has not changed in the past five years. With the increase in cost of living and to boost savings, the limit of deduction under Section 80C needs to be hiked from Rs 1.5 lakh to Rs 2.5 lakh to provide saving opportunities for public at large.

Higher rebate on home loan

“To support home buyers, we expect the government to increase the deduction on home loan interest, thus reducing the EMI burden. With three consecutive repo rate cuts in the RBI policy, the government has taken measures to improve the flow of money. In this Budget we expect the government to frame some concrete policy which will help the home buyers,” said LC Mittal, Director, Motia Group.

No tax on interest income

Investments made through mutual fund debt scheme offers tax advantage over bank deposits, postal saving scheme or bonds. “We suggest that this tax arbitrage should be done away with. Interest income in the hands of the end-user should be made tax-free. This relaxation will give banks and financial institutions leeway to raise deposits at lower cost and will also increase credit offtake,” said Nandakumar, MD & CEO, Manappuram Finance.

Reference News: https://www.tribuneindia.com/news/archive/increase-exemption-limit-give-rebate-under-sec-80c-794648

0 notes

Text

GST benefits will start accuring to economy in the coming yrs, say experts

The goods and service tax (GST), which was launched two years ago, has stabilised quicker than expected and its benefits will accrue to the economy in the years to come, say experts on Monday.

Experts further said the way the GST Council has functioned by taking every decision on the basis of consensus suggests that the Centre and the states are on the same page when it comes to GST, which augurs well for its further movement.

The indirect tax reform was rolled out two years ago on the midnight of June 30 and since then, the government has decided to celebrate July 1 as the GST Day.

"The GST has stabilised quicker than expected and its benefits will accrue to the economy in the years to come," V Lakshmikumaran, founder and managing partner of Lakshmikumaran & Sridharan, said.

"Software and IT (information technology) glitches are getting remedied quickly", he said while commenting on the two years of the GST roll-out.

He further said benefits of the GST such as higher economic growth, increased consumption and better tax compliance will start accruing to the economy in the years to come.

According to EY India Tax Partner Abhishek Jain, the last two years of the GST journey has been a roller-coaster ride with the track being comparatively smooth in the last miles of the journey.

"While the initial few months witnessed various modifications, representations, discussions, etc, (as is the case with any change) to address business concerns including rate rationalisation, the government's focus in the recent times has been on checking tax evasion," Jain said.

Appreciating the efforts of the GST Council to simplify the return forms, Lakshmikumaran said that in the end, it would help those who are on the right side of the law and bring to book habitual offenders.

He further said compliance norm should neither be too soft nor too burdensome. "Those who comply with the law should not be penalised because of those who avoid paying taxes," he added.

On the issue of two-year extension to the National Anti-profiteering Authority (NAA), Lakshmikumaran said it was much-needed as several cases were pending before the authority. He also suggested that the state governments should immediately set up the appellate authorities as it would increase the confidence of taxpayers in the system.

Besides, Lakshmikumaran also made a strong case for setting up of a central tribunal to reconcile the different orders of the Authority for Advance Rulings (AARs) with a view to bring in uniformity on the issues raised.

Describing the GST as landmark structural reform, Assocham President B K Goenka said its impact on the economic efficiency might be seen in a gradual but decisive manner.

Alankit Managing Director Ankit Agarwal said the numbers of registered taxpayers have increased by almost 80 per cent, which is a positive sign of it as it increases the tax collections in the long run and paves way for tax rate reduction.

Unlike other nations where GST or value-added tax have been rolled out, there is no significant increase in the inflation rate in the first year, he said.

1 note

·

View note