Text

Simplifying Operations: The Power of Back Office Management Software

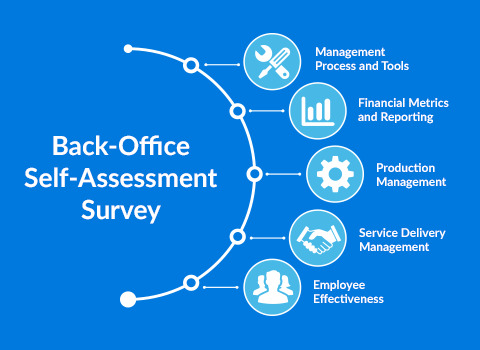

Introduction: In today's fast-paced business environment, the efficiency of back-office operations plays a crucial role in overall organizational success. Back-office tasks, such as accounting, human resources, and inventory management, are essential for smooth business operations but can be time-consuming and prone to errors if not managed effectively.

Fortunately, advancements in technology have led to the development of back-office management software, offering businesses a powerful tool to streamline operations and improve efficiency. In this blog, we'll explore the transformative power of back-office management software and how it can simplify operations for businesses of all sizes.

Centralized Data Management: One of the key benefits of back-office management software is centralized data management. Instead of scattered spreadsheets and paper documents, all relevant information is stored in a single, accessible platform. This allows employees to quickly access data, collaborate more effectively, and make informed decisions based on real-time information.

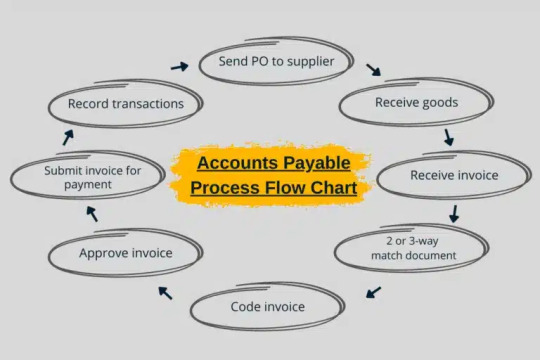

Automation of Routine Tasks: Back-office management software automates repetitive and time-consuming tasks, such as data entry, invoice processing, and payroll management. By automating these processes, businesses can reduce manual errors, increase productivity, and free up valuable time for employees to focus on more strategic tasks that drive business growth.

Streamlined Communication: Effective communication is essential for smooth operations, especially in large organizations with multiple departments. Back-office management software often includes built-in communication tools, such as chat features and notification systems, that facilitate seamless collaboration and information sharing among team members.

Enhanced Financial Management: Financial management is a critical aspect of back-office operations, and back-office management software offers powerful tools to streamline financial processes. From budgeting and forecasting to accounts payable and receivable management, businesses can gain better control over their finances, improve accuracy, and make data-driven financial decisions.

Improved Compliance and Security: Compliance with regulations and data security are top priorities for businesses, particularly in industries with strict regulatory requirements. Back-office management software often includes built-in compliance features and robust security measures to ensure that sensitive data is protected and regulatory standards are met, reducing the risk of costly fines and penalties.

Scalability and Flexibility: As businesses grow and evolve, their back-office needs may change. Back-office management software offers scalability and flexibility to adapt to changing business requirements. Whether it's adding new users, integrating additional modules, or expanding into new markets, businesses can easily scale their back-office operations with the software.

Real-Time Analytics and Reporting: Access to real-time analytics and reporting is essential for informed decision-making and performance tracking. Back-office management software provides businesses with comprehensive dashboards and reporting tools that offer insights into key metrics and performance indicators, empowering them to make data-driven decisions and optimize operations for greater efficiency and profitability.

youtube

Conclusion: Back-office management software is a powerful tool that can revolutionize the way businesses manage their operations. By centralizing data management, automating routine tasks, streamlining communication, and enhancing financial management, businesses can simplify operations, increase productivity, and drive growth. With its scalability, flexibility, and robust features, back-office management software is a valuable asset for businesses looking to stay competitive in today's dynamic business landscape.

SITES WE SUPPORT

Account Management - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Overcoming 10 Common Challenges in the Accounts Payable Process

Introduction: The accounts payable process is a critical aspect of financial management for businesses of all sizes. However, it often comes with its fair share of challenges that can hinder efficiency and accuracy. From manual data entry errors to late payments, these challenges can impact cash flow and vendor relationships. In this blog, we'll explore 10 common challenges in the accounts payable process and provide practical strategies for overcoming them.

Manual Data Entry Errors: Manual data entry is prone to errors, leading to discrepancies in invoices and payments. To overcome this challenge, businesses can invest in automated accounts payable solutions that streamline data entry processes and minimize human error.

Missing or Inaccurate Invoices: Missing or inaccurate invoices can delay payments and cause frustration for both vendors and accounts payable teams. Implementing robust invoice tracking systems and establishing clear communication channels with vendors can help mitigate this challenge.

Invoice Approval Delays: Delays in invoice approval can result from inefficient approval workflows and bottlenecks in the process. By implementing automated approval workflows and setting clear deadlines for approval, businesses can expedite the invoice approval process and prevent delays.

Duplicate Invoices: Duplicate invoices can lead to overpayments and reconciliation issues. Implementing duplicate invoice detection mechanisms within accounts payable software can help identify and flag duplicate invoices before they are processed.

Late Payments: Late payments can strain vendor relationships and damage business reputation. To avoid late payments, businesses can implement payment reminders, negotiate favorable payment terms with vendors, and prioritize payments based on due dates.

Poor Cash Flow Management: Inadequate cash flow management can lead to liquidity issues and hinder business operations. Businesses can overcome this challenge by implementing cash flow forecasting tools, optimizing payment schedules, and negotiating extended payment terms with vendors.

Compliance and Regulatory Issues: Non-compliance with regulatory requirements can result in penalties and legal consequences. To ensure compliance, businesses should stay updated on relevant regulations, implement internal controls, and conduct regular audits of accounts payable processes.

Lack of Document Management: Poor document management practices can result in lost or misplaced invoices and payment records. Implementing a centralized document management system can help businesses organize and track invoices, contracts, and other important documents more effectively.

Inefficient Vendor Communication: Lack of communication with vendors can lead to misunderstandings and delays in the accounts payable process. Establishing regular communication channels, providing vendors with clear payment terms and contact information, and promptly addressing any inquiries or concerns can help improve vendor relationships and streamline the accounts payable process.

Limited Visibility and Reporting: Limited visibility into accounts payable data can make it challenging for businesses to track expenses, identify trends, and make informed financial decisions. Investing in accounts payable software with robust reporting capabilities can provide businesses with real-time visibility into payment status, cash flow, and vendor performance.

Conclusion: The accounts payable process is essential for maintaining financial health and vendor relationships. However, it comes with its fair share of challenges. By addressing common challenges such as manual data entry errors, missing invoices, late payments, and compliance issues, businesses can streamline their accounts payable processes, improve efficiency, and ensure accuracy in financial transactions.

youtube

Investing in automated accounts payable solutions, implementing efficient workflows, and fostering strong vendor relationships are key strategies for overcoming these challenges and achieving success in accounts payable management.

SITES WE SUPPORT

Account Management Process - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Assessing Talent: The Role of Pre-Employment Assessment Tools in Hiring

Introduction: In the competitive landscape of today's job market, finding the right talent is more challenging than ever. Employers are constantly seeking innovative ways to identify candidates who not only have the right skills and experience but also fit seamlessly into their organizational culture. This is where pre-employment assessment tools come into play.

These tools offer valuable insights into candidates' abilities, personalities, and work styles, helping employers make informed hiring decisions. In this blog, we'll explore the role of pre-employment assessment tools in the hiring process and how they can benefit both employers and candidates.

Understanding Candidate Fit: One of the primary roles of pre-employment assessment tools is to assess candidate fit. These tools evaluate candidates based on a variety of factors, including their skills, competencies, values, and behavioral traits. By comparing candidates against predefined criteria and job requirements, assessment tools help employers identify individuals who are the best fit for the role and the organization. This ensures that new hires not only have the necessary skills to excel in their positions but also align with the company's culture and values.

Predicting Job Performance: Pre-employment assessment tools are designed to predict candidates' job performance based on their responses to various assessments. These assessments may include cognitive tests, personality assessments, situational judgment tests, and job simulations, among others. By analyzing candidates' responses, assessment tools can gauge their likelihood of success in the role and their potential to thrive within the organization. This predictive insight enables employers to make more informed hiring decisions and select candidates who are likely to perform well in the position.

Reducing Bias in Hiring: Bias in hiring can have detrimental effects on diversity, equity, and inclusion within organizations. Pre-employment assessment tools help mitigate bias by providing objective, data-driven insights into candidates' qualifications and capabilities. Unlike traditional hiring methods, which may be influenced by unconscious biases, assessment tools evaluate candidates based on standardized criteria, reducing the risk of bias in decision-making. This promotes fairness and equality in the hiring process and helps organizations build more diverse and inclusive teams.

Enhancing Candidate Experience: The hiring process can be stressful for candidates, especially when they're required to complete multiple rounds of interviews and assessments. Pre-employment assessment tools can enhance the candidate experience by providing a structured and streamlined process. Candidates appreciate the opportunity to showcase their skills and abilities through assessments tailored to the role, rather than relying solely on resumes and interviews. Additionally, assessment tools often provide timely feedback to candidates, keeping them informed and engaged throughout the hiring process.

Saving Time and Resources: Traditional hiring methods can be time-consuming and resource-intensive, requiring significant investment in screening, interviewing, and evaluating candidates. Pre-employment assessment tools streamline the hiring process by automating repetitive tasks and providing actionable insights into candidates' qualifications. This saves employers time and resources, allowing them to focus their efforts on evaluating top candidates and making final hiring decisions. Additionally, assessment tools help reduce turnover by selecting candidates who are well-suited to the role and the organization, ultimately saving costs associated with employee turnover.

youtube

Conclusion: Pre-employment assessment tools play a crucial role in modern hiring practices, offering valuable insights into candidates' abilities, predicting job performance, reducing bias, enhancing the candidate experience, and saving time and resources for employers. By leveraging these tools effectively, organizations can identify and select top talent that aligns with their needs and culture, driving success and innovation in the workplace. As the job market continues to evolve, pre-employment assessment tools will remain essential for employers seeking to make informed hiring decisions and build high-performing teams.

SITES WE SUPPORT

Account Management - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedI

0 notes

Text

Exploring the Benefits: The Role of Back Office Management Software in Modern Businesses

Introduction: In today's fast-paced business environment, organizations face increasing pressure to streamline operations, reduce costs, and enhance productivity. One area where businesses can achieve significant improvements is in back office management. Back office functions, including accounting, human resources, and administrative tasks, are essential for supporting day-to-day operations but are often prone to inefficiencies and errors.

Fortunately, back office management software offers a solution to these challenges, providing organizations with the tools they need to optimize their processes and drive business success. In this blog, we'll explore the benefits of back office management software and its role in modern businesses.

Enhanced Efficiency: One of the primary benefits of back office management software is enhanced efficiency. By automating repetitive tasks, such as data entry, invoice processing, and payroll administration, software streamlines workflows and reduces the time and effort required to complete tasks. This allows employees to focus on more strategic activities, such as analyzing data, making informed decisions, and driving business growth. Additionally, software eliminates manual errors and ensures consistency and accuracy across back office functions, improving overall operational efficiency.

Improved Accuracy and Compliance: Back office management software helps organizations maintain accurate and up-to-date records, ensuring compliance with regulatory requirements and industry standards. By centralizing data and standardizing processes, software minimizes the risk of errors and discrepancies, reducing the likelihood of compliance violations and costly penalties. Furthermore, software often includes built-in compliance features, such as audit trails and reporting capabilities, to facilitate regulatory compliance and support internal and external audits.

Streamlined Communication and Collaboration: Effective communication and collaboration are essential for smooth back office operations. Back office management software provides a centralized platform for sharing information, collaborating on projects, and coordinating tasks across departments and teams. This fosters transparency, accountability, and teamwork, enabling employees to work more efficiently and effectively together. Additionally, software often includes communication tools, such as messaging and document sharing features, to facilitate real-time communication and collaboration, regardless of location or time zone.

Enhanced Decision-Making: Back office management software provides organizations with valuable insights into their operations, enabling informed decision-making and strategic planning. By capturing and analyzing data from various sources, including financial transactions, employee records, and customer interactions, software generates actionable insights that drive business growth and innovation. Decision-makers can use these insights to identify trends, assess performance, and make data-driven decisions that align with organizational goals and objectives.

Scalability and Flexibility: As businesses grow and evolve, their back office needs change as well. Back office management software offers scalability and flexibility to adapt to changing business requirements and accommodate growth. Whether adding new users, expanding into new markets, or integrating with other systems, software can scale seamlessly to meet the needs of businesses of all sizes and industries. Additionally, software often includes customization options and integrations with third-party applications, allowing organizations to tailor the software to their specific needs and workflows.

youtube

Conclusion: Back office management software plays a crucial role in modern businesses, providing organizations with the tools they need to optimize their back office operations and drive business success. From enhancing efficiency and accuracy to improving communication and collaboration, software offers a wide range of benefits that help organizations streamline their processes, reduce costs, and stay competitive in today's dynamic business environment. By embracing back office management software, organizations can unlock new opportunities for growth, innovation, and long-term success.

SITES WE SUPPORT

Account Management -Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

0 notes

Text

Understanding the Essentials: A Deep Dive into Accounts Payable Process

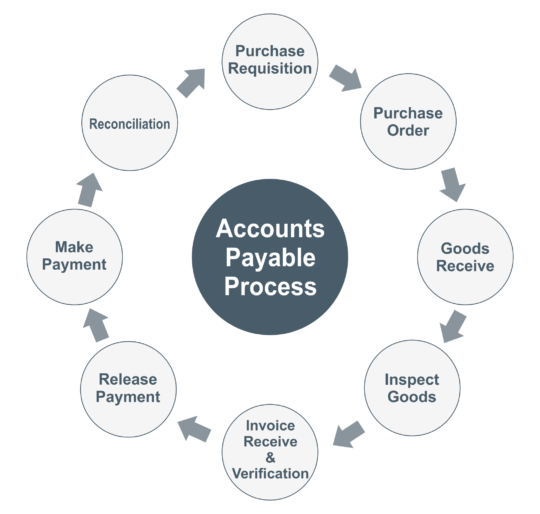

Introduction: Accounts payable is a critical function within any organization, responsible for managing the company's outstanding bills and invoices. While it may seem straightforward on the surface, the accounts payable process involves several essential steps and considerations. In this blog, we'll take a closer look at the essentials of the accounts payable process, from invoice receipt to payment, and explore how organizations can optimize their accounts payable workflows for greater efficiency and accuracy.

Invoice Receipt and Verification: The accounts payable process typically begins with the receipt of invoices from vendors and suppliers. Upon receipt, invoices must be carefully reviewed and verified to ensure accuracy and validity. This involves matching the details on the invoice, such as the billing amount, purchase order number, and payment terms, with corresponding purchase orders and receiving reports. Any discrepancies or errors must be promptly addressed to avoid payment delays or overpayments.

Invoice Approval and Coding: Once invoices have been verified, they must be approved for payment by the appropriate individuals within the organization. Depending on the organization's approval hierarchy, this may involve obtaining authorization from department heads, project managers, or other stakeholders. Additionally, invoices must be accurately coded to allocate expenses to the correct general ledger accounts and cost centers, ensuring accurate financial reporting and budget tracking.

Invoice Processing and Payment: After approval and coding, invoices are processed for payment according to the agreed-upon payment terms. This may involve entering invoice details into the organization's accounting system, scheduling payments, and issuing checks or initiating electronic funds transfers (EFTs) to vendors and suppliers. Organizations may also take advantage of early payment discounts or negotiate extended payment terms to optimize cash flow and improve vendor relationships.

Reconciliation and Reporting: Once payments have been made, it's essential to reconcile accounts payable transactions with bank statements and vendor statements to ensure accuracy and completeness. Reconciliation involves matching payments with corresponding invoices and verifying that all transactions have been properly recorded in the accounting system. Additionally, organizations must generate regular accounts payable reports to track expenses, monitor payment trends, and identify any outstanding liabilities or discrepancies.

Vendor Management and Communication: Effective vendor management is crucial for maintaining strong supplier relationships and ensuring timely payments. Organizations should establish clear communication channels with vendors and suppliers to address any issues or concerns promptly. This may involve responding to inquiries, resolving disputes, and negotiating payment terms to optimize cash flow for both parties. By fostering open and transparent communication, organizations can build trust and goodwill with their vendors, reducing the risk of supply chain disruptions.

Automation and Optimization: To streamline the accounts payable process and improve efficiency, many organizations are turning to automation solutions. Accounts payable automation software can automate repetitive tasks, such as data entry, invoice routing, and payment processing, reducing manual errors and accelerating cycle times. Additionally, automation can provide greater visibility into accounts payable workflows, allowing organizations to track invoice status, monitor approvals, and analyze spending patterns more effectively.

youtube

Conclusion: The accounts payable process plays a vital role in the financial health and operational efficiency of organizations. By understanding the essentials of the accounts payable process and implementing best practices for invoice receipt, approval, processing, and payment, organizations can optimize their accounts payable workflows, improve accuracy, and enhance vendor relationships. With the right tools, technologies, and strategies in place, organizations can streamline their accounts payable operations and position themselves for long-term success in today's dynamic business environment.

SITES WE SUPPORT

Account Management - Wix

SOCIAL LINKS

Facebook

Twitter

LinkedIn

1 note

·

View note