#tax preparation companies dallas

Text

The Best Payroll Companies for Small Businesses in 2024

Payroll management is a critical aspect of running a successful small business. Ensuring accurate and timely payments to employees, as well as proper tax withholding and compliance, can be a daunting task for many small business owners. Fortunately, there are a variety of payroll companies that offer comprehensive solutions to streamline this process. In this blog, we'll explore the best payroll companies for small businesses in 2024, highlighting their key features, benefits, and considerations to help you make an informed decision.

The Importance of Payroll Services

Payroll is more than just cutting checks or direct deposits. It involves a complex web of tax calculations, withholdings, and regulatory compliance that can quickly become overwhelming for small business owners. Outsourcing payroll to a professional service provider offers several advantages:

Accuracy and Compliance: Payroll companies have the expertise and resources to ensure accurate calculations, timely tax payments, and adherence to ever-changing labor laws and regulations.

Time Savings: Handling payroll in-house can be time-consuming, taking valuable focus away from core business activities. Payroll services handle the entire process, freeing up your time.

Reduced Liability: Payroll mistakes can lead to costly penalties and fines. Partnering with a reputable payroll provider mitigates this risk and protects your business.

Scalability: As your business grows, a reliable payroll service can seamlessly accommodate your evolving needs, from managing a larger workforce to offering more comprehensive benefits.

Top Payroll Company for Small Businesses

SG INC CPA:

SG INC CPA is a distinguished CPA firm renowned for its specialization in tax planning and income tax services, catering specifically to small businesses. Established in Dallas, Texas, for over a decade, the firm boasts a team of seasoned professionals including financial advisors, certified public accountants, financial analysts, auditors, and business consultants. This diverse team enables SG INC CPA to offer a comprehensive suite of services tailored to meet the unique financial needs of small businesses and startups.

Key Services Offered by SG INC CPA:

Accounting: The firm provides expert accounting services to ensure accurate financial records and compliance with accounting standards.

Taxation: Specializing in tax planning, preparation, and compliance, SG INC CPA assists clients in optimizing their tax strategies.

Bookkeeping: Offering meticulous bookkeeping services, the firm helps businesses maintain organized financial records.

Payroll: SG INC CPA streamlines payroll processing, ensuring timely and accurate payment to employees.

Virtual CFO: Providing virtual Chief Financial Officer Services, the firm offers strategic financial guidance to enhance business performance.

Business Advisory: With a focus on providing insightful business advice, SG INC CPA assists clients in making informed decisions to drive growth and profitability.

Client-Centric Approach:

SG INC CPA prides itself on delivering high-quality services that not only meet but exceed clients' expectations. The firm's commitment to client satisfaction is evident through its long list of satisfied small business clients, positioning it as one of the premier CPA firms in Dallas. By offering personalized services that align with clients' budgets and financial goals, SG INC CPA has established itself as a trusted partner for small businesses seeking expert financial guidance.

Expertise and Strategic Guidance:

With a wealth of experience spanning a decade, SG INC CPA brings a strategic approach to managing business finances. The firm's expertise lies in providing tailored solutions that help small businesses and startups achieve their financial objectives. By offering expert advice and guidance, SG INC CPA empowers clients to make informed decisions that drive success and financial stability.

Factors to Consider When Choosing a Payroll Company

When selecting the best payroll company for your small business, consider the following factors:

Ease of Use: Look for a payroll platform with an intuitive and user-friendly interface, making it easy for you and your employees to navigate.

Pricing and Scalability: Evaluate the pricing structure and ensure it aligns with your current and future business needs. Look for a solution that can scale as your company grows.

Compliance and Tax Management: Ensure the payroll provider has the necessary expertise and resources to handle tax calculations, filings, and regulatory compliance on your behalf.

Integration Capabilities: Assess the payroll company's ability to integrate with your existing accounting, HR, and other business software, creating a seamless workflow.

Customer Support: Consider the quality and responsiveness of the payroll provider's customer support, as you may need assistance during the onboarding process or when addressing any issues.

Industry Reputation and Reviews: Research the payroll company's reputation, industry standing, and customer reviews to gauge their reliability and quality of service.

Conclusion

Choosing the best payroll company for your small business is a crucial decision that can have a significant impact on your operations, compliance, and overall financial management. By considering the factors outlined in this blog and evaluating the top payroll providers, you can find a solution that streamlines your payroll processes, ensures accuracy and compliance, and allows you to focus on the core aspects of your business. Whether you opt for Gusto, ADP Run, Paychex Flex, QuickBooks Payroll, or OnPay, the right payroll partner can be a valuable asset in driving the growth and success of your small business.

0 notes

Text

At Bruce E Bernstien & Associates, PLLC, we understand that tax laws are constantly changing, and staying up-to-date with these changes is crucial for maximizing tax savings and avoiding penalties. Our team of experienced tax professionals is here to provide personalized and comprehensive tax preparation services tailored to your specific needs. Call us at (214) 706–0837 for more information about tax preparer Dallas or visit our website.

Bruce E Bernstien & Associates, PLLC

10440 N. Central Expressway, Suite 1040, Dallas, Texas 75231

(214) 706–0837

My Official Website: https://www.taxattorneyandcpa.com/

Google Plus Listing: https://www.google.com/maps?cid=6940393556934426635

Our Other Links:

tax controversies Dallas: https://www.taxattorneyandcpa.com/practice-areas/federal-irs-state-tax-disputes/

tax exempt attorney Near ME: https://www.taxattorneyandcpa.com/practice-areas/tax-exempt-non-profit/

start up business services Dallas: https://www.taxattorneyandcpa.com/practice-areas/start-up-service/

Service We Offer:

Start-Up Services for Businesses and Non-Profits

Federal IRS and State Tax Disputes

Tax Planning, Returns and Compliance

Tax Exempt and Non-Profit Organizations

Complex Estate Planning

Asset Protection

Wills and Trusts

Probate Services

Follow Us On:

Linkedin: https://www.linkedin.com/company/bruce-e.-bernstien-&-associates-p.c.

Facebook: https://www.facebook.com/pages/category/Lawyer---Law-Firm/Bruce-E-Bernstien-Associates-PC-155180994496530/

Twitter: https://twitter.com/BrucePllc

Pinterest: https://www.pinterest.com/bruceebernstienassociatespllc/

Instagram: https://www.instagram.com/bruceebernstien/

#tax preparer dallas#tax controversies Dallas#tax exempt attorney near me#start up business services dallas#tax lawyer dallas

0 notes

Text

[ad_1]

Texas Luxurious Actual Property Surge: The Obsession with Million-Greenback Mansions

Texas is infamous for its larger-than-life character, and its luxurious actual property market is not any exception. Lately, the Lone Star State has witnessed a surge in demand for million-dollar mansions, with patrons exhibiting an unprecedented obsession for extravagant, opulent properties. This obsession has not solely remodeled the Texas housing market however has additionally put the state on the map as a hub for luxurious residing.

One of many essential drivers behind the surge in Texas luxurious actual property is the state's thriving economic system. Texas boasts a business-friendly surroundings with low taxes and minimal rules, attracting entrepreneurs, company titans, and high-income people from everywhere in the nation. These rich people are greater than prepared to spend their hard-earned cash on extravagant houses that boast the newest in design, expertise, and facilities.

The most important cities in Texas, reminiscent of Dallas, Houston, and Austin, have seen a major inflow of high-net-worth people, resulting in a growth within the luxurious actual property market. These city facilities supply a novel mix of cultural points of interest, world-class eating, and thriving job markets. As extra corporations arrange headquarters or broaden their operations in Texas, the demand for luxurious houses has skyrocketed, and builders have responded accordingly.

One other issue contributing to the obsession with million-dollar mansions in Texas is the state's vastness and variety. Texas presents a variety of luxurious properties, from sprawling ranches with huge acreage to glossy trendy penthouses within the coronary heart of downtown. Whether or not it is a waterfront property on Lake Austin or a sprawling mansion within the prestigious Highland Park neighborhood in Dallas, Texas has one thing to fulfill each luxurious homebuyer's style and choice.

The COVID-19 pandemic has additional fueled the surge in luxurious actual property as householders search more room, privateness, and facilities inside their very own residences. With distant work changing into the brand new norm, Texas's spacious mansions supply the perfect setting for patrons seeking to create their very own luxurious sanctuaries. Expansive outside areas, personal swimming pools, film theaters, and residential gyms are simply among the options that cater to the brand new calls for of luxurious residing.

The obsession with million-dollar mansions in Texas extends past locals and has additionally attracted rich patrons from different states. The absence of state earnings tax in Texas is a major draw for high-net-worth people seeking to relocate from states burdened with excessive taxes, reminiscent of California and New York. These out-of-state patrons deliver with them a requirement for unique properties that exhibit the grandeur and opulence they're accustomed to.

Whereas the surge in luxurious actual property is undoubtedly thrilling for sellers, it does elevate considerations about affordability and inequality. With property costs reaching astronomical heights, many fear that common homebuyers are being priced out of the market. As extra emphasis is positioned on catering to the luxurious section, the provision of inexpensive housing might dwindle, resulting in decreased affordability and social imbalance.

Texas's obsession with million-dollar mansions is right here to remain, at the least for the foreseeable future. The state's distinctive mix of financial prosperity, various choices, and spacious landscapes proceed to draw rich patrons who're desirous to make a press release with their luxurious houses. Nevertheless, it's essential to make sure that the housing market stays inclusive and addresses the necessity for inexpensive housing to keep up a balanced and sustainable future. Solely by putting this delicate steadiness can Texas preserve its popularity as a luxurious haven whereas remaining accessible to all.

0 notes

Text

Purpose of Outsourcing Tax and Accounting Services For Real Estate Developers And Brokers in Austin and Dallas, TX

Dealing with property is a lucrative profession. Unfortunately, the people doing the groundwork disagree with such a statement. It is pretty surprising to know that there are inconsistencies galore in realtors' accounting books and records. Keeping them as it is not going to be beneficial. On the contrary, it can land the concerned professional in trouble. Obtaining tax and accounting services for real estate developers and brokers in Austin and Dallas, TX, can be effective in the long run, especially during the tax season.

However, it is best to steer away from wannabe accountants. Instead, getting in touch with an accounting firm specializing in services for the real estate industry is the way to go. The accounting professionals will likely go through all records and check the odd receipts and bills. Again, it is essential to remember that the pro may be used to provide a single service or solve multiple issues. The variety of accounting services that a realtor or developer needs are diverse. It is heartening to know that such accounting professional provides the following to their clients dealing with the real estate business:

· Property Management Accounting- Managing a property on behalf of the customer is painstaking work. Unfortunately, the realtor or developer acting as the manager often forgets to keep the business accounts in order. The accountant can help streamline the entire process by ensuring bookkeeping tasks and day-to-day accounting.

· Reporting and Preparation of Financial Statements- All relevant information is collected painstakingly from the office of the concerned realtor. The data is recorded and stored properly, and accessibility is ensured as well. The accountant finally creates the reports along with the required financial statements that are accepted by the IRS and other authorities

· Cash Flow Analysis and Management- Cash is a valuable component of the real estate business. The accountant has the expertise to manage and balance the inflow and outflow of cash superbly. Management of cash flow by the professionals ensures both security and scalability of the cash flow. There is compliance with all related standards

· Payroll Processing- Most real estate professionals have to remain out of the office throughout the day. Most of them find no time to process their financial earnings and expenses. Employee payment is an aspect that cannot be ignored. Thankfully, the financial team hired to help will take on this onus, too. The outsourcing company will use proper tools and advanced technology to achieve accurate and timely payroll processing

· Tax Returns- Real estate agencies have to file tax returns like other business entities. The accounting pro will have the requisite skills to assist with filing tax returns as and when needed, including tax preparation, tax processing, and submission of sales tax. Multiple tax filing can be done accurately as well

While one may get by without outsourcing the accounting tasks, getting in touch with touch with professionals providing tax and accounting services for real estate developers and brokers in Austin and Dallas, TX, can enable the real estate agency or individual to remain focused on the core business.

0 notes

Text

Maximizing Your Airbnb Investment: A Comprehensive Guide to Property Management in Dallas

Introduction:

Dallas, Texas, with its vibrant culture, thriving economy, and diverse attractions, has become a hotbed for Airbnb investment. As more property owners recognize the potential for lucrative returns in the short-term rental market, effective property management becomes a key factor in ensuring success. In this guide, we'll explore the essential aspects of Airbnb property management in Dallas, helping you optimize your investment and provide a top-notch experience for your guests.Understanding the Dallas Airbnb Market: Before diving into property management, it's crucial to understand the local market trends in Dallas. Identify popular neighborhoods, peak seasons, and events that draw visitors. Tailor your property management strategy to align with the unique demands of the Dallas market. Legal and Regulatory Compliance: Ensure your property complies with all local regulations and zoning laws related to short-term rentals. Dallas, like many cities, may have specific rules governing Airbnb properties. Stay informed about permits, taxes, and any other legal requirements to avoid potential issues in the future. Professional Photography and Listing Optimization: First impressions matter on Airbnb. Invest in high-quality professional photography to showcase your property in the best light. Craft a compelling and informative listing that highlights the unique features of your home and its proximity to Dallas attractions. Pricing Strategy: Develop a dynamic pricing strategy that considers factors such as seasonality, local events, and market demand. Tools like Airbnb's Smart Pricing can help you adjust rates in real-time, maximizing your income while remaining competitive. Effective Communication with Guests: Prompt and clear communication is vital for guest satisfaction. Respond to inquiries and messages promptly, provide detailed check-in instructions, and be available to address any concerns during your guests' stay. Positive reviews and repeat bookings often result from excellent communication. Cleaning and Maintenance: Maintaining a clean and well-maintained property is crucial for guest satisfaction and positive reviews. Consider hiring professional cleaning services between guest stays and conducting routine maintenance checks to address any issues promptly. Guest Amenities and Experience: Enhance the guest experience by providing thoughtful amenities and personal touches. Consider local recommendations, provide a welcome guide, and ensure your property is well-stocked with essentials. A positive experience can lead to positive reviews and increased bookings. 24/7 Support and Emergency Response: Be prepared to handle emergencies and unexpected situations. Having a reliable support system in place, whether it's a local property manager or a dedicated contact person, ensures that guests feel secure and well taken care of during their stay. Continuous Improvement: Regularly evaluate guest feedback, analyze performance metrics, and stay updated on industry trends. Implement changes and improvements based on this feedback to enhance the overall guest experience and keep your property competitive in the Dallas market. Building a Trusted Team: If managing your property becomes overwhelming, consider hiring a professional property management company with experience in the Dallas Airbnb market. A reputable team can handle day-to-day operations, allowing you to focus on expanding your portfolio or other ventures.

Conclusion:

Successfully managing an Airbnb property in Dallas requires a strategic and comprehensive approach. By understanding the local market, staying compliant with regulations, and providing an exceptional guest experience, you can maximize your investment and establish a strong presence in this thriving short-term rental market. With attention to detail and a commitment to continuous improvement, your Airbnb property in Dallas can become a lucrative and rewarding venture.Learn More https://www.hoststarter.net/

1 note

·

View note

Text

Streamlining Business Finances: Dallas, TX Bookkeeping Services You Need

Hey there, fellow business enthusiasts! I'm excited to share some valuable insights about bookkeeping services right here in Dallas, Texas. Whether you're a small startup, a growing enterprise, or an established company, you'll want to pay close attention to how professional bookkeeping services in Dallas, TX, can help streamline your business finances.

Why Bookkeeping Matters

Bookkeeping might not be the flashiest aspect of running a business, but it's undeniably one of the most crucial

Keeping Your Financial Ship Afloat

Running a business is like steering a ship through turbulent waters. Clear financial records are your navigation tools. Without them, you risk hitting hidden financial reefs. Professional bookkeeping services in Dallas, TX, are like your trusty compass, guiding you through the fiscal storms.

Tax Time Saviors

Come tax season, many businesses find themselves in a whirlwind of receipts and spreadsheets. Accurate and organized financial records, courtesy of bookkeeping services in Dallas TX, can be your ticket to smoother sailing during tax time. You'll be better prepared to maximize deductions and minimize headaches.

The Benefits of Local Expertise

When it comes to business success, the advantages of tapping into local expertise cannot be overstated.

Tailored to Texas Laws

The Lone Star State has unique tax regulations that may trip up the uninitiated. Dallas, TX bookkeeping services are well-versed in these laws, ensuring your business stays compliant and avoids costly mistakes.

Personalized Service

Working with local bookkeepers in Dallas, TX, means you get personalized attention. They take the time to understand your business's unique needs, helping you make informed financial decisions.

How Dallas Bookkeeping Services Can HelpWhen it comes to managing your business's finances in Dallas, TX, professional bookkeeping services can be your invaluable allies.

Financial Accuracy and Organization

Dallas, TX bookkeeping services excel at keeping your financial records in tip-top shape. They ensure accuracy in every transaction, maintain organized records, and reconcile your accounts to perfection.

Cost-Efficiency

Hiring a full-time in-house bookkeeper can be expensive. With Dallas bookkeeping services, you pay for what you need, when you need it. No need to worry about salaries, benefits, or downtime.

Focus on Your Core Business

When you delegate your bookkeeping to experts in Dallas, TX, you free up your time and energy to focus on what you do best—growing your business. Let them handle the numbers while you strategize for success.

Choosing the Right Dallas, TX Bookkeeping Services

When it comes to selecting the right Dallas, TX bookkeeping services for your business, there are several key factors to keep in mind. Making the right choice can greatly impact your financial efficiency and success.

Referrals and Reviews

Start by asking fellow business owners in Dallas for recommendations. Online reviews and testimonials can also provide insights into a company's reputation.

Experience and Expertise

Look for bookkeepers who have a proven track record in Dallas, TX. Experience in your industry is a big plus.

Technology Integration

Modern bookkeeping goes beyond spreadsheets. Ensure your chosen service leverages technology for efficiency and real-time insights.

Conclusion

In the vast landscape of business finances, Dallas, TX bookkeeping services are your trusted guides. They help you navigate the complexities, stay compliant with Texas laws, and ultimately drive your business toward financial success.

So, if you're looking to streamline your business finances and set sail toward prosperity, consider the expertise of bookkeeping services in Dallas, TX. Your financial ship will thank you, and you'll have more time to enjoy the sunny skies of business growth.

#bookkeeping services dallas tx#dallas bookkeeping services#bookkeeper dallas#bookkeeper dallas tx#bookkeeping services fort worth tx#bookkeeper fort worth

0 notes

Text

#texas today#news#usa#trending news#latest news#daily news#news updates#technology#business#entertainment

0 notes

Text

0 notes

Text

How Airbnb Property Management Services Can Help You Maximize Your Income

Dallas Airbnb property management services can be a great way to maximize your income by renting out short-term stays in your home, or an investment property. These companies can also take over the day-to-day operation of your short-term rental, including booking, cleaning, maintenance, and guest support services. They can help you create a competitive pricing strategy and handle all the tax compliance and reporting required to keep your property compliant with local laws.

Not all Airbnb management companies are created equal. Some are geared toward managing luxury vacation rentals, while others focus on smaller properties and aim to be more hands-on. Some also charge a flat fee, while others are based on a commission model, which can range anywhere from 20-50% of your host revenues.

To find the best Airbnb property management company for you, read reviews online and ask other owners what they’ve experienced with each company. Be wary of reviews that sound too positive or negative, but don’t be afraid to contact those reviewers and ask for more details. This will allow you to see if the negative review is warranted and was earned, or if it may have been the result of a bad rental experience or other circumstances that are out of the property manager’s control.

Many Airbnb property management companies offer a free consultation to discuss your needs and the potential of your short-term rental property. During the meeting, they’ll walk you through their process, and explain their fees. They’ll then give you a quote for their management services, so you can decide if it’s right for you.

A quality Airbnb management company will have a team that can respond to guest inquiries within minutes, 24 hours a day, to ensure that your guests have the best experience possible. They will coordinate calendars, answer questions about the property and local attractions, provide turn-over service, and clean and prepare your property for each guest.

In addition to the Airbnb platform, your short-term rental management company will use software and programs to track bookings, communicate with guests, handle guest services, and collect taxes. They’ll be able to provide you with reports that show your average nightly rate, occupancy rate, and total revenue. They can also assist you in applying for a business license if necessary.

0 notes

Text

Target 'sortation' center coming to Detroit fairgrounds site

By Kirk Pinho I July 11, 2023 I Crain’s Detroit

A Target Corp. distribution facility is expected to open on the former Michigan State Fairgrounds site in Detroit.

The building would clock in at about 180,000 square feet on a portion of the sprawling property at Eight Mile Road and Woodward Avenue, where the state's largest Amazon.com Inc. distribution facility has been constructed after being announced almost three years ago, the Minneapolis-based retail giant confirmed Tuesday.

The Target facility was first reported by The Detroit News on Monday.

Through a spokesperson, a message was sent to Detroit-based developer and landlord The Sterling Group, who is co-developing the majority of the property with Dallas-based Hillwood Enterprises LP.

Target did not respond to additional questions about the building.

A sign on the site — generally referred to as Parcel A — says a logistics-style building is expected to be open in June. A rendering shows a new building with some red on its front, but no tenant identified.

The contractors listed are Oliver/Hatcher Construction and MiG Construction.

In February, Target said it was opening more than a half-dozen sortation centers in a $100 million investment in markets across the U.S.

Those new facilities, expected to be online by 2026, add to its fleet of existing sortation centers in Minnesota, Texas, Colorado, Illinois, Georgia, Pennsylvania and Illinois. Its three most recent centers opened around Chicago and Denver. At the time, the company said its new facilities will end up "creating hundreds of new jobs in local metro areas with market-leading wages."

The sortation centers are a way to help Target compete with the rise in e-commerce. They receive orders prepared by store employees and send them out through a delivery network, whether that's Shipt or another third-party provider. Target refers to it as part of its "stores-as-hubs" strategy, using its brick-and-mortar big-box stores "as a launchpad for online orders."

The company said last year that its online sales rose nearly $13 billion from 2019 to 2021 and stores fulfilled more than 95% of total sales in 2021. Some 50 million packages are expected to go through Target sortation centers this year, double from last year, the company said.

Frank Hammer, a co-chair of the State Fairgrounds Development Coalition, which has been vocal in criticizing various components of the 142-acre property's redevelopment plan over many years, said the Target facility is going on the site of the old Joe Dumars Fieldhouse/Agricultural Building, demolition of which came as a surprise to his organization. He and members of the community first became aware of the incoming Target building when told by a city official during a Zoom meeting in May, Hammer said.

The Target facility would join the gargantuan Amazon facility, which is the size of approximately 20 typical Walmart stores.

"The idea that the fairgrounds can be turned into this mammoth logistics center ... We have a lot of feelings about that, because the fairgrounds actually plays a very critical role in Detroit and in the region, and the state," Hammer said.

The Sterling Group/Hillwood JV is also working on another building already under construction on the site, although its ultimate occupant is not yet known. It's expected to be about 292,000 square feet, per marketing materials from the Southfield office of Colliers International Inc., which has the listing.

Sterling Group and Hillwood paid $9 million for the fairgrounds site and no city tax breaks or incentives have been involved. The city paid $7 million for it in April 2020. The lack of tax incentives and the fact that the JV paid the appraised value of the land allowed it to skirt the city's community benefits ordinance process, which is triggered at $75 million.

"Our efforts from the very, very beginning was the notion of community input into what would become of the fairgrounds," Hammer said. "That was really our premise, in terms of our involvement. When the community benefits ordinance passed in 2016, we saw that as an opportunity ... That was something that was legislated, that this development, certainly Amazon would have, you know, come under the terms of the community benefits ordinance."

The $400 million Amazon facility started construction in late 2020.

To read this article on Crain’s Detroit Business: https://www.crainsdetroit.com/real-estate/target-bring-warehouse-michigan-state-fairgrounds

0 notes

Text

CPA Tax Services in Plano: Navigating the Complexities of Tax Compliance

As a thriving business hub in the Dallas-Fort Worth metroplex, Plano is home to a diverse array of companies, from small startups to large corporations. In this dynamic environment, the need for reliable and expert CPA tax services has never been more crucial.

Navigating the ever-changing landscape of tax laws and regulations can be a daunting task, but with the right CPA tax services in Plano, businesses can ensure compliance, maximize their tax savings, and focus on their core operations.

The Importance of CPA Tax Services in Plano

Plano's business community is characterized by its entrepreneurial spirit, innovative mindset, and rapid growth. This vibrant environment presents both opportunities and challenges when it comes to tax compliance and financial management. CPA tax services in Plano play a vital role in supporting businesses of all sizes in the following ways:

Ensuring Compliance: CPA tax professionals in Plano possess in-depth knowledge of local, state, and federal tax laws and regulations, helping businesses navigate the complex tax landscape and avoid costly penalties or legal issues.

Maximizing Tax Savings: CPA tax services in Plano can identify deductions, credits, and tax-planning strategies that businesses may not be aware of, enabling them to minimize their tax liabilities and keep more of their hard-earned profits.

Providing Specialized Expertise: CPA tax professionals in Plano often have industry-specific expertise, allowing them to offer tailored solutions and guidance to businesses operating in various sectors, such as technology, healthcare, or real estate.

Enhancing Financial Visibility: CPA tax services in Plano can provide businesses with comprehensive financial reporting, analysis, and forecasting, empowering them to make informed decisions and plan for future growth.

Reducing Administrative Burden: By outsourcing tax preparation, planning, and compliance to CPA tax services in Plano, businesses can free up valuable time and resources to focus on their core operations and strategic initiatives.

Services Offered by CPA Tax Firms in Plano

CPA tax firms in Plano offer a wide range of services to meet the diverse needs of businesses and individuals, including:

Tax Preparation: CPA tax professionals in Plano can prepare and file federal, state, and local tax returns for businesses, ensuring accuracy and compliance.

Tax Planning: CPA tax services in Plano can develop comprehensive tax strategies to minimize a business's tax liability, optimize cash flow, and align tax planning with long-term financial goals.

Tax Consulting: CPA tax professionals in Plano can provide expert advice and guidance on a variety of tax-related issues, such as entity selection, international taxation, or tax audits.

Payroll and Employment Tax Services: CPA tax services in Plano can handle payroll processing, payroll tax calculations, and compliance with employment tax regulations.

Tax Controversy and Resolution: CPA tax professionals in Plano can represent businesses in tax disputes with the IRS or state tax authorities, negotiating payment plans, offers in compromise, or penalty abatement.

Business Advisory Services: CPA tax services in Plano can offer strategic business advisory services, such as financial forecasting, budgeting, and mergers and acquisitions support.

Choosing the Right CPA Tax Service in Plano

When selecting a CPA tax service in Plano, it's essential to consider the following factors:

Credentials and Experience: Look for CPA tax professionals with the necessary certifications, licenses, and extensive experience in serving businesses in the Plano area.

Industry Specialization: Consider CPA tax services in Plano that have specific expertise in your industry, as they can provide more tailored and relevant guidance.

Technology and Innovation: Evaluate the CPA tax service's use of technology, such as cloud-based accounting software and data analytics tools, to streamline processes and provide real-time insights.

Communication and Responsiveness: Choose a CPA tax service in Plano that communicates effectively, responds promptly to your inquiries, and demonstrates a commitment to understanding your unique tax and business needs.

Reputation and References: Research the CPA tax service's reputation in the Plano business community, read client testimonials, and ask for references to gauge the quality of their services and client satisfaction.

The Benefits of Partnering with CPA Tax Services in Plano

By partnering with CPA tax services in Plano, businesses can enjoy a range of benefits, including:

Maximized Tax Savings: CPA tax professionals in Plano can identify tax-saving opportunities, such as deductions, credits, and strategic planning, to help businesses minimize their tax liabilities.

Improved Compliance: CPA tax services in Plano can ensure that businesses comply with all relevant tax laws and regulations, reducing the risk of audits, penalties, and legal issues.

Enhanced Financial Visibility: CPA tax services in Plano can provide businesses with comprehensive financial reporting, analysis, and forecasting, enabling them to make informed decisions and plan for future growth.

Reduced Administrative Burden: By outsourcing tax-related tasks to CPA tax services in Plano, businesses can free up time and resources to focus on their core operations and strategic initiatives.

Access to Local Expertise: CPA tax professionals in Plano have a deep understanding of the local business landscape, tax laws, and regulatory environment, allowing them to provide tailored solutions and guidance.

Conclusion

In the dynamic business environment of Plano, CPA tax services play a crucial role in supporting the success and growth of local companies. By leveraging the expertise of CPA tax professionals, businesses can navigate the complexities of tax compliance, maximize their tax savings, and enhance their overall financial management.

When selecting a CPA tax service in Plano, it's essential to consider factors such as credentials, industry specialization, technology, communication, and reputation. By partnering with the right CPA tax service, businesses can gain a competitive edge, mitigate risks, and focus on their core operations with confidence.

Whether you're a small startup or a large corporation in Plano, CPA tax services can provide the guidance and support you need to thrive in the ever-evolving business landscape. Invest in your company's financial well-being by exploring the CPA tax services available in the Plano area today.

0 notes

Text

[ad_1]

Texas Luxurious Actual Property Surge: The Obsession with Million-Greenback Mansions

Texas is infamous for its larger-than-life character, and its luxurious actual property market is not any exception. Lately, the Lone Star State has witnessed a surge in demand for million-dollar mansions, with patrons exhibiting an unprecedented obsession for extravagant, opulent properties. This obsession has not solely remodeled the Texas housing market however has additionally put the state on the map as a hub for luxurious residing.

One of many essential drivers behind the surge in Texas luxurious actual property is the state's thriving economic system. Texas boasts a business-friendly surroundings with low taxes and minimal rules, attracting entrepreneurs, company titans, and high-income people from everywhere in the nation. These rich people are greater than prepared to spend their hard-earned cash on extravagant houses that boast the newest in design, expertise, and facilities.

The most important cities in Texas, reminiscent of Dallas, Houston, and Austin, have seen a major inflow of high-net-worth people, resulting in a growth within the luxurious actual property market. These city facilities supply a novel mix of cultural points of interest, world-class eating, and thriving job markets. As extra corporations arrange headquarters or broaden their operations in Texas, the demand for luxurious houses has skyrocketed, and builders have responded accordingly.

One other issue contributing to the obsession with million-dollar mansions in Texas is the state's vastness and variety. Texas presents a variety of luxurious properties, from sprawling ranches with huge acreage to glossy trendy penthouses within the coronary heart of downtown. Whether or not it is a waterfront property on Lake Austin or a sprawling mansion within the prestigious Highland Park neighborhood in Dallas, Texas has one thing to fulfill each luxurious homebuyer's style and choice.

The COVID-19 pandemic has additional fueled the surge in luxurious actual property as householders search more room, privateness, and facilities inside their very own residences. With distant work changing into the brand new norm, Texas's spacious mansions supply the perfect setting for patrons seeking to create their very own luxurious sanctuaries. Expansive outside areas, personal swimming pools, film theaters, and residential gyms are simply among the options that cater to the brand new calls for of luxurious residing.

The obsession with million-dollar mansions in Texas extends past locals and has additionally attracted rich patrons from different states. The absence of state earnings tax in Texas is a major draw for high-net-worth people seeking to relocate from states burdened with excessive taxes, reminiscent of California and New York. These out-of-state patrons deliver with them a requirement for unique properties that exhibit the grandeur and opulence they're accustomed to.

Whereas the surge in luxurious actual property is undoubtedly thrilling for sellers, it does elevate considerations about affordability and inequality. With property costs reaching astronomical heights, many fear that common homebuyers are being priced out of the market. As extra emphasis is positioned on catering to the luxurious section, the provision of inexpensive housing might dwindle, resulting in decreased affordability and social imbalance.

Texas's obsession with million-dollar mansions is right here to remain, at the least for the foreseeable future. The state's distinctive mix of financial prosperity, various choices, and spacious landscapes proceed to draw rich patrons who're desirous to make a press release with their luxurious houses. Nevertheless, it's essential to make sure that the housing market stays inclusive and addresses the necessity for inexpensive housing to keep up a balanced and sustainable future. Solely by putting this delicate steadiness can Texas preserve its popularity as a luxurious haven whereas remaining accessible to all.

0 notes

Text

Need For Tax Audit Services in Dallas and Austin, TX

The process of verifying the tax returns and ensuring that everything complies with the regulations is known as a tax audit that is done by the IRS. Trying to do it singlehandedly without any outside support may lead to mistakes. The IRS may request a hearing and listen to explanations related to the errors and omissions. This is not a pleasant situation to find oneself in, though. It is essential to hire a committed financial professional to assist with the details of accounting and returns submitted for a specific year. The professional will be able to provide the following tax audit services in Dallas and Austin, TX, thus helping the client to remain compliant with the taxation norms. The professional account is sure to bring the following to the table:

· Expertise- Almost all business entities and the company owner must deal with varied tax issues. The IRS is particularly concerned with tax fraud. The IRS may accuse the taxpayer of FICA and FUTA tampering when filing the returns. The taxation professional will be able to check the records and uncover discrepancies. Rectifying the mistakes is a matter of hours. The concerned taxpayer can thus be absolved with the accusation withdrawn after an IRS Audit.

· No Violations- Sure, taxation is a complex process with the rules being changed too regularly for comfort. The tax professional remains well aware of the present regulations and will be able to help the clients as closely as possible. Such professionals will also ensure that there are no inadvertent violations committed when filing the returns. The IRS often audits companies with several risk factors to uncover instances of fraud and non-compliance. The professional will go through the records and help with the filing without allowing the client to commit any violations.

· Submission of documents- Storing all money-related documents is advisable for a taxpayer. The taxation professional is sure to be aware of the documents that the IRS would demand during an audit. Sure, claiming tax deductions is commonplace for taxpayers. A company or business owner asked to appear for an IRS Audit may reveal the necessary documents as advised by the tax professionals. This will help the IRS to understand the validity of the claims. It is a good idea to have the tax professional accompany the audited person whether the IRS conducts a field audit, correspondence audit, or an office audit.

· Resolution of off-Shore Issues- The IRS will question a business owner about the offshore accounts held in the name of individuals or the company. It is advisable to request the taxation professional to go through the related documents and prepare the paperwork meant for disclosure. Not being able to account for such investments may result in punitive measures. A seasoned accountant well versed in IRS Audits can resolve all issues well before answering the audit.

The experts hired to provide useful tax audit services in Dallas and Austin, TX, can save taxpayers from anxiety and penalties.

0 notes

Text

Dallas Law Agency Headed To Downtowns Financial Institution Of America Plaza

Susheela was very friendly and took the time to completely understand our state of affairs. She gave me a transparent answer whereas other law workplaces I tried to contact would not even speak to me earlier than organising an appointment. Suppose a judge has determined that the circumstances of a divorce are acceptable to include spousal assist probate lawyer mckinney tx. In that case, the decide will then order one ex-spouse to pay the opposite monthly payments, referred to as spousal assist, as soon as the wedding has legally ended. In some cases, if there's a prenuptial or postnuptial agreement, the amount is set through this settlement somewhat than by a choose.

He devotes a good portion of his litigation practice to cases involving the acquisition and sale of residential real estate, representing each Plaintiffs and Defendants. Rex limits his apply to estate planning, estate and reward tax planning, business planning, asset protection planning, probate, and estate administration, working with estates up to $300 million. As a law agency in Virginia and Maryland that often handles divorces cases for clients from India, we get numerous probate lawyer frisco tx questions about how a divorce in Virginia or Maryland will affect them in India. Susheela Verma is one finest lawyer I really have been working with for over the past 16 Years. The first time I went to her was within the year 1998 in connection with a litigation issue, Ever since she had been part of my success all thru rightfully defending my Business & Personal pursuits.

Can help you find and avoid the pitfalls of any buy, lease, or real estate enterprise. Our firm has participated in over $1.5 Billion in real estate within the final 4 years and continues to take action, representing everything from small residential ventures to NYC Broadway project developments. Our attorneys will help probate lawyer richardson tx you in navigating the promoting and closing processes effectively, guaranteeing your safety now and in the future. Once your preliminary settlement is executed, we are going to assist with the paperwork wanted to formalize the deal.

In addition, child boomers, born after World War II, and their kids put together to cross their property and wealth to the subsequent era. Therefore, wealth switch from technology to technology is a big authorized problem. Real estate has at all times been about capitalizing on alternatives. But profitable plano real estate lawyer investment in real estate also demands wholesome due diligence and problem-solving to consummate deals. Snyder & Snyder has an extensive and numerous follow in residential and commercial real estate law. Tenant purchasers ahead their lease with amendments together with the expense documentation.

If you wish to change part of the lease, discuss it with the landlord. If the landlord agrees, the two of you need to resolve how you wish to word the change after which write it into the agreement probate attorney plano. For example, many normal leases prohibit pets, but your landlord may be prepared to accept a pet when you put down extra money as safety.

What are the standards for payment of the agreed upon allowance? Making certain the tenant receives one of the best deal possible and making the stated incentives obtainable is set out in my lease recommendations. I evaluate the expense provisions to verify they are correctly probate lawyer plano tx disclosed and the tenant might be charged an inexpensive amount for gadgets properly designated for widespread bills. I am the CEO and attorney at my law agency that I began in June 2020 (as other companies have been shuttering because of Covid-19).

I am more than happy, and would advocate her to anybody needing a household lawyer. A department of Southern Methodist University (SMU) is situated in Plano and enrolls 3,000 graduate students who main in enterprise, schooling, and technical work like engineering. Plano is house to excellent colleges and corporations making it a really fascinating neighborhood in the United States. Unsurprisingly, there's also an excellent plano real estate attorney forged of recent and seasoned legal professionals who're familiar with native Collin County and Texas State Courts. If you need an experienced and adept Lawyer in Plano, LegalMatch can help match you with one. A Plano Christian Attorney could be readily available that can assist you together with your case and give you meaningful authorized recommendation and guidance.

Here at Christman Ramsey & Foster P.C., our boutique law agency is a trusted useful resource for clients facing this state of affairs. As long-time real estate attorneys in Plano TX, we have in depth expertise working with real estate owners, buyers probate attorney plano and sellers. Harris Law Firm, PLLC handles many real estate and property law points within the Plano metro. The firm represents landlords, apartment house owners, real estate brokers, commercial property house owners, and householders' associations.

0 notes

Text

Why America is Going to Look More Like Texas? Lessons From the Surge of the Lone Star State

— Leaders | Lean, Mean and Surprisingly Green | March 16, 2023

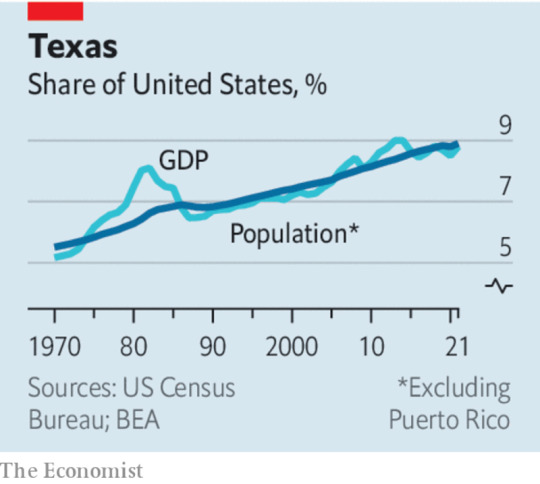

Texas keeps getting bigger. In the year to June 2022 the Lone Star State added 471,000 people, nearly as many as live in Atlanta, Georgia. More than one in three of the net new jobs created in America since February 2020 was created there. A thriving energy industry has helped, but, as our briefing explains, the boom is remarkably broad-based. Sometime in the 2040s, Texas is likely to pass California in population. Like it or not, America is becoming a bit more Texan every day.

With 38 members of Congress and 40 electoral-college votes in 2024 (around 15% of those required to win the presidency), Texas will have a mighty say in national politics. If people and firms continue moving there, as looks likely, Texas will take on an even greater prominence in the American economy. It will also influence how the country navigates its energy transition, because Texas leads not just in oil and gas but also in renewables such as wind and solar. And America’s demography will increasingly resemble that of Texas today (where, already, 60% of the population is non-white).

If Texas points to the future, what lessons does it offer? One is that its leaders understood earlier than most that companies and people are mobile. Rick Perry, a former governor, went on “hunting trips” in search of business prey in other states; Greg Abbott, today’s governor, has followed suit. Covid-19 highlighted the attractions of a state which was quicker to leave lockdown than many others, such as California, and boasts a cheaper cost of living and fewer restrictions. Texas has offered some incentives to firms, but much of the growth has been down to the lure of a place with no income tax, lots of land for expansion, less red tape and a pro-business attitude. Granted, liberals and moderates abhor the state’s shrill, deep-red politics. Mr Abbott courts headlines by, for example, sending busloads of unauthorised immigrants to New York. Such stunts do not seem to have deterred many individuals or companies from moving to Texas, however; it remains to be seen whether recent draconian abortion laws will.

Another lesson from Texas is that nurturing one golden goose is not enough. The oil shock of the 1980s was painful, but the state has since diversified its economy. Finance and property have blossomed. The big cities all have different strengths: tech in Austin, energy in Houston, finance and more in Dallas. Instead of relying solely on oil and gas until the wells run dry, Texas has positioned itself on the cutting edge of new energy technologies (although listening to the rhetoric of the state’s politicians, you would not always know it). Places that have only one strong industry should start thinking about how they can use it as a platform to launch the next new thing.

The last lesson, however, is a cautionary one. For much of its history, Texas has had an exceptionally lean government. It has been loth to invest in the people and projects required for the future, including education and roads. Of late, as its formidable growth shows, it has got away with this. But the lean approach almost certainly has its limits, which it would be complacent to ignore. The people moving to Texas have been better educated than native Texans and filled many of the higher-skilled jobs. The state should invest more in its workforce.

The Perot Precedent

That is what it did in 1984, when a bill promoted by Ross Perot, a businessman and politician, played a big part in the state’s successful economic diversification, by revamping education funding and better preparing Texan students for jobs in industries other than energy and agriculture. Texas today has its biggest two-year surplus ever, worth $33bn (larger than the annual budget of 24 states), so there could be no better time to do something similar for the next stage of the state’s development. The debates around culture-war issues are distractions from this task.

Texas is not a blueprint for all of America. It has oil and gas, enabling it to forgo a state income tax. Vast amounts of land help it accommodate companies’ expansion. And Texas has plenty of problems. It might be home to more Fortune 500 companies than any other state, but it also has the largest number of people who lack health insurance. Its politics have shifted to the extreme right, with rules that curb freedom (such as the abortion ban) and are at odds with the state’s traditions of small-government pragmatism (such as its blacklisting of financial firms that boycott hydrocarbons).

Texas’s politicians should climb out of the trenches of the culture wars and focus on what the state really needs to secure its prosperity. Astute, targeted investments in its people and infrastructure will help the Lone Star State shine even more brightly. The future of Texas, as with other states, depends on leaders taking the long view. ■

— This article appeared in the Leaders section of the print edition under the headline "Lean, Mean and Surprisingly Green"

0 notes

Text

Property Taxes Financial Highlights

HB 2311) has been proposed to limit yearly appraisal will increase to 5% for Homestead Exemption and no extra than 10% for other householders. If your mortgage company escrows funds for the payment of taxes, they should pay your tax bill. You might need dallas property tax to ship them a duplicate yourself to insure they are correctly notified of the amounts and due dates. This comes at a time when assessments are in, and some householders are very concerned about what they are paying.

We estimate the magnitude of the delinquency low cost utilizing a number of alternative estimation methods, in each case controlling for native foreclosure exercise. Our most popular methodology is a matching estimator, as it works to get rid of the potential for omitted variable bias that is common in this kind of estimation. We find large, negative, and statistically significant results of delinquent properties for which the native dallas property tax government has placed a tax lien and has put the lien up on the market to private investors. For properties with a tax lien that are not successfully bought, we estimate an adverse spillover of 5.1% ($12,872) on surrounding properties. Properties with a tax lien that are sold to private investors have a smaller, but still adverse influence on surrounding property values of 2.5% ($6310).

If the property is your major residence, you may have the ability to claim a homestead exemption, which can reduce the taxable worth. Disabled veterans and property house owners who are over 65 or disabled may qualify for an exemption. Businesses can benefit from freeport exclusions, in addition to charitable, nonsecular dallas property tax, and air pollution management exemptions. Also, remember that your mortgage firm might not deal with every tax invoice. Even when your mortgage company handles property tax funds, it may nonetheless be possible to obtain a further tax invoice from the assessor’s office.

True crime followers might already know Dallas is where Bonnie and Clyde have been born and buried. Many areas of Bexar County are subject to a levy that pays for certainly one of a dozen Emergency Services Districts. A financial advisor can help you understand how homeownership matches your overall financial targets. SmartAsset’s free tool matches you with up to three vetted monetary advisors who serve your space, and you may interview your advisor matches at no cost to resolve which one is right for you. If you’re ready to find an advisor who might help you obtain your financial goals, get began now. To ensure that your tax dollars are accurately and effectively collected with the utmost integrity and honesty.

The Gregg County Appraisal District has prepared this doc to help you in complying with this essential law. The appraisal district can only automatically process the over sixty-five exemption if it has the appropriate documentation readily available. Your native appraisal district will require proof of age to grant an over sixty-five exemption.

In his free time, you might find Brad quoting Monty Python productions and trying to calculate the airspeed velocity of an unladen swallow. If you have met all necessities for filing for an exemption, including assembly the deadline, and are denied, then you'll have the ability to file a protest and have listening to earlier than the ARB. You may need to protest when the Chief Appraiser denies you a requested exemption.

0 notes