#semiconductor fab

Text

Dozen thanks to GoI (government of India) that we would now have a USB type C charging port to power-fuel all types of digital gadgets in the country. Tech news updates in India.

Other than the consumers, who will get relief, this will also help control the e-waste generation in the country. Tech news updates in India to thrill you.

#Tags: ASSOCHAM EY#ISMC#Semiconductor Fab#Semiconductor Fab in India#Semiconductor Fabrication Unit#Semiconductor Manufacturing Plant in India#Type C charging Point Must In India#USB Type C Port

0 notes

Text

Intel first came to Hillsboro in 1974, buying the 35-acre parcel that became Aloha, because all its existing factories at the time were along California fault lines, the San Andreas Fault and Hayward Fault. (Photo - Ben Fox Rubin, CNET)

5 notes

·

View notes

Text

i had my first performance review today and it was a blast, they don’t want me to leave so it was just my boss groveling for 45 minutes and then giving me a raise

3 notes

·

View notes

Text

0 notes

Link

#predictive maintenance software#Predictive Maintenance#vacuum pump predictive maintenance#PredictiveMaintenance#PredictiveMaintenanceforManufacturing#AI_MLpredictivemaintenanceforafactory#Predictive Maintenance of semicondector#Predictive Maintenance Of FAB#visibility analytics semiconductor#visibility analytics FAB#visibility monitoring FAB#visibility monitoring semiconductor

0 notes

Note

What are some of the coolest computer chips ever, in your opinion?

Hmm. There are a lot of chips, and a lot of different things you could call a Computer Chip. Here's a few that come to mind as "interesting" or "important", or, if I can figure out what that means, "cool".

If your favourite chip is not on here honestly it probably deserves to be and I either forgot or I classified it more under "general IC's" instead of "computer chips" (e.g. 555, LM, 4000, 7000 series chips, those last three each capable of filling a book on their own). The 6502 is not here because I do not know much about the 6502, I was neither an Apple nor a BBC Micro type of kid. I am also not 70 years old so as much as I love the DEC Alphas, I have never so much as breathed on one.

Disclaimer for writing this mostly out of my head and/or ass at one in the morning, do not use any of this as a source in an argument without checking.

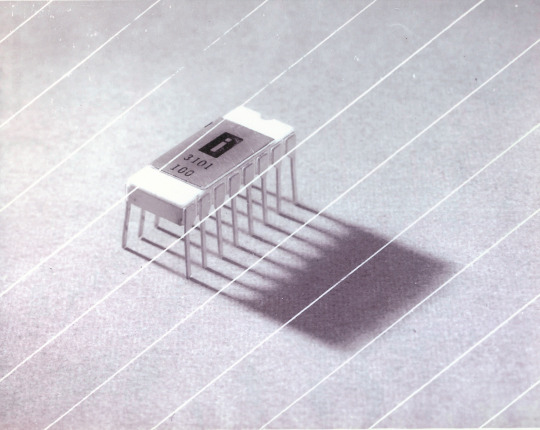

Intel 3101

So I mean, obvious shout, the Intel 3101, a 64-bit chip from 1969, and Intel's first ever product. You may look at that, and go, "wow, 64-bit computing in 1969? That's really early" and I will laugh heartily and say no, that's not 64-bit computing, that is 64 bits of SRAM memory.

This one is cool because it's cute. Look at that. This thing was completely hand-designed by engineers drawing the shapes of transistor gates on sheets of overhead transparency and exposing pieces of crudely spun silicon to light in a """"cleanroom"""" that would cause most modern fab equipment to swoon like a delicate Victorian lady. Semiconductor manufacturing was maturing at this point but a fab still had more in common with a darkroom for film development than with the mega expensive building sized machines we use today.

As that link above notes, these things were really rough and tumble, and designs were being updated on the scale of weeks as Intel learned, well, how to make chips at an industrial scale. They weren't the first company to do this, in the 60's you could run a chip fab out of a sufficiently well sealed garage, but they were busy building the background that would lead to the next sixty years.

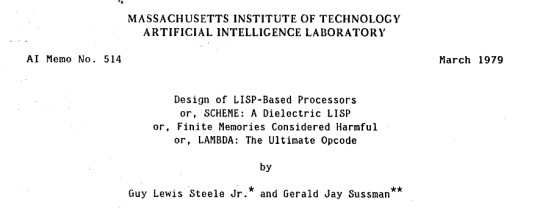

Lisp Chips

This is a family of utterly bullshit prototype processors that failed to be born in the whirlwind days of AI research in the 70's and 80's.

Lisps, a very old but exceedingly clever family of functional programming languages, were the language of choice for AI research at the time. Lisp compilers and interpreters had all sorts of tricks for compiling Lisp down to instructions, and also the hardware was frequently being built by the AI researchers themselves with explicit aims to run Lisp better.

The illogical conclusion of this was attempts to implement Lisp right in silicon, no translation layer.

Yeah, that is Sussman himself on this paper.

These never left labs, there have since been dozens of abortive attempts to make Lisp Chips happen because the idea is so extremely attractive to a certain kind of programmer, the most recent big one being a pile of weird designd aimed to run OpenGenera. I bet you there are no less than four members of r/lisp who have bought an Icestick FPGA in the past year with the explicit goal of writing their own Lisp Chip. It will fail, because this is a terrible idea, but damn if it isn't cool.

There were many more chips that bridged this gap, stuff designed by or for Symbolics (like the Ivory series of chips or the 3600) to go into their Lisp machines that exploited the up and coming fields of microcode optimization to improve Lisp performance, but sadly there are no known working true Lisp Chips in the wild.

Zilog Z80

Perhaps the most important chip that ever just kinda hung out. The Z80 was almost, almost the basis of The Future. The Z80 is bizzare. It is a software compatible clone of the Intel 8080, which is to say that it has the same instructions implemented in a completely different way.

This is, a strange choice, but it was the right one somehow because through the 80's and 90's practically every single piece of technology made in Japan contained at least one, maybe two Z80's even if there was no readily apparent reason why it should have one (or two). I will defer to Cathode Ray Dude here: What follows is a joke, but only barely

The Z80 is the basis of the MSX, the IBM PC of Japan, which was produced through a system of hardware and software licensing to third party manufacturers by Microsoft of Japan which was exactly as confusing as it sounds. The result is that the Z80, originally intended for embedded applications, ended up forming the basis of an entire alternate branch of the PC family tree.

It is important to note that the Z80 is boring. It is a normal-ass chip but it just so happens that it ended up being the focal point of like a dozen different industries all looking for a cheap, easy to program chip they could shove into Appliances.

Effectively everything that happened to the Intel 8080 happened to the Z80 and then some. Black market clones, reverse engineered Soviet compatibles, licensed second party manufacturers, hundreds of semi-compatible bastard half-sisters made by anyone with a fab, used in everything from toys to industrial machinery, still persisting to this day as an embedded processor that is probably powering something near you quietly and without much fuss. If you have one of those old TI-86 calculators, that's a Z80. Oh also a horrible hybrid Z80/8080 from Sharp powered the original Game Boy.

I was going to try and find a picture of a Z80 by just searching for it and look at this mess! There's so many of these things.

I mean the C/PM computers. The ZX Spectrum, I almost forgot that one! I can keep making this list go! So many bits of the Tech Explosion of the 80's and 90's are powered by the Z80. I was not joking when I said that you sometimes found more than one Z80 in a single computer because you might use one Z80 to run the computer and another Z80 to run a specialty peripheral like a video toaster or music synthesizer. Everyone imaginable has had their hand on the Z80 ball at some point in time or another. Z80 based devices probably launched several dozen hardware companies that persist to this day and I have no idea which ones because there were so goddamn many.

The Z80 eventually got super efficient due to process shrinks so it turns up in weird laptops and handhelds! Zilog and the Z80 persist to this day like some kind of crocodile beast, you can go to RS components and buy a brand new piece of Z80 silicon clocked at 20MHz. There's probably a couple in a car somewhere near you.

Pentium (P5 microarchitecture)

Yeah I am going to bring up the Hackers chip. The Pentium P5 series is currently remembered for being the chip that Acidburn geeks out over in Hackers (1995) instead of making out with her boyfriend, but it is actually noteworthy IMO for being one of the first mainstream chips to start pulling serious tricks on the system running it.

The P5 comes out swinging with like four or five tricks to get around the numerous problems with x86 and deploys them all at once. It has superscalar pipelining, it has a RISC microcode, it has branch prediction, it has a bunch of zany mathematical optimizations, none of these are new per se but this is the first time you're really seeing them all at once on a chip that was going into PC's.

Without these improvements it's possible Intel would have been beaten out by one of its competitors, maybe Power or SPARC or whatever you call the thing that runs on the Motorola 68k. Hell even MIPS could have beaten the ageing cancerous mistake that was x86. But by discovering the power of lying to the computer, Intel managed to speed up x86 by implementing it in a sensible instruction set in the background, allowing them to do all the same clever pipelining and optimization that was happening with RISC without having to give up their stranglehold on the desktop market. Without the P5 we live in a very, very different world from a computer hardware perspective.

From this falls many of the bizzare microcode execution bugs that plague modern computers, because when you're doing your optimization on the fly in chip with a second, smaller unix hidden inside your processor eventually you're not going to be cryptographically secure.

RISC is very clearly better for, most things. You can find papers stating this as far back as the 70's, when they start doing pipelining for the first time and are like "you know pipelining is a lot easier if you have a few small instructions instead of ten thousand massive ones.

x86 only persists to this day because Intel cemented their lead and they happened to use x86. True RISC cuts out the middleman of hyperoptimizing microcode on the chip, but if you can't do that because you've girlbossed too close to the sun as Intel had in the late 80's you have to do something.

The Future

This gets us to like the year 2000. I have more chips I find interesting or cool, although from here it's mostly microcontrollers in part because from here it gets pretty monotonous because Intel basically wins for a while. I might pick that up later. Also if this post gets any longer it'll be annoying to scroll past. Here is a sample from a post I have in my drafts since May:

I have some notes on the weirdo PowerPC stuff that shows up here it's mostly interesting because of where it goes, not what it is. A lot of it ends up in games consoles. Some of it goes into mainframes. There is some of it in space. Really got around, PowerPC did.

153 notes

·

View notes

Text

[TIME is US Media]

U.S. and European officials are growing increasingly concerned about China’s accelerated push into the production of older-generation semiconductors and are debating new strategies to contain the country’s expansion.

President Joe Biden implemented broad controls over China’s ability to secure the kind of advanced chips that power artificial-intelligence models and military applications. But Beijing responded by pouring billions into factories for the so-called legacy chips that haven’t been banned. Such chips are still essential throughout the global economy, critical components for everything from smartphones and electric vehicles to military hardware.

That’s sparked fresh fears about China’s potential influence and triggered talks of further reining in the Asian nation, according to people familiar with the matter, who asked not to be identified because the deliberations are private. The U.S. is determined to prevent chips from becoming a point of leverage for China, the people said.

Commerce Secretary Gina Raimondo alluded to the problem during a panel discussion last week at the American Enterprise Institute. “The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips—that’s a problem that we need to be thinking about and working with our allies to get ahead of,” she said.[...]

Legacy chips are typically considered those made with 28-nm equipment or above, technology introduced more than a decade ago.

Senior E.U. and U.S. officials are concerned about Beijing’s drive to dominate this market for both economic and security reasons, the people said. They worry Chinese companies could dump their legacy chips on global markets in the future, driving foreign rivals out of business like in the solar industry, they said.[...]

domestic producers may be reluctant to invest in facilities that will have to compete with heavily subsidized Chinese plants. [...]

“The United States and its partners should be on guard to mitigate nonmarket behavior by China’s emerging semiconductor firms,”

While the U.S. rules introduced last October slowed down China’s development of advanced chipmaking capabilities, they left largely untouched [sic] the country’s ability to use techniques older than 14-nanometers. That has led Chinese firms to construct new plants faster than anywhere else in the world. They are forecast to build 26 fabs through 2026 that use 200-millimeter and 300-mm wafers, according to the trade group SEMI. That compares with 16 fabs for the Americas.

So what's the problem? is it that you suck at manufacturing & want more neoliberalism? That's what it seems like to me [31 Jul 23]

137 notes

·

View notes

Quote

Specifically, what’s frustrating me is America’s seeming inability to build the things it needs to build in order to prosper and flourish in the 21st century. From housing to transit to solar power to transmission lines to semiconductor fabs, the U.S. has little trouble marshalling the financial and physical capital to create what it needs, but ends up stymied by entrenched local interests who exploit a thicket of veto points to preserve the built environment of the 1970s.

The Build-Nothing Country

116 notes

·

View notes

Text

Inflation is caused by too little capacity

Inflation is here, and there are a lot of explanations for it. People who worry about the monetary supply — especially people in the deflation-loving cryptocurrency world — blame it on excessive money creation during the pandemic and uppity workers demanding higher wages:

https://www.businessinsider.com/elon-musk-remote-work-makes-you-less-productive-wrong-2022-6

Anti-monopolists blame inflation on price-gouging. This is a persuasive argument. After all, CEOs of companies in highly concentrated industries keep giving investor presentations where they chortle, rub their hands, twirl their mustaches, and announce that their profits are sky-high thanks to their ability to raise prices:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#overinflated

Some take a middle road and blame inflation on covid’s supply-chain shocks, or, translated into normal human speech: “China makes everything. China locks down every time there’s a covid outbreak. When that happens, China stops sending us stuff, which drives prices up”:

https://www.ft.com/content/483ef3bc-e600-4c2d-bbf3-15208e52020c

There’s a Russia/Ukraine version of this, too: “Russia exports a lot of gas. Ukraine exports a lot of wheat. Russia’s invasion of Ukraine triggered economic sanctions on Russia and disrupted farming in Ukraine, therefore prices of wheat and gas (and everything we make from wheat and gas) are going up”:

https://www.cnbc.com/2022/04/21/from-food-to-inflation-the-russia-ukraine-war-has-a-global-impact.html

All of these can be true at once. The Trump administration’s decision to pump trillions into the capital markets definitely triggered massive asset inflation, including and especially inflation in shelter, with Wall Street landlords buying up houses and jacking up rents:

https://pluralistic.net/2022/03/17/shareholder-socialism/#asset-manager-capitalism

And yeah, the decision to centralize manufacturing in China, wheat production in Ukraine, and energy production in Russia means that when they stop exporting, other countries face shortages, which leads to bidding wars, which leads to inflation.

Likewise, it’s undeniable that industries dominated by one company or a small cartel of companies are raising prices because they think we think prices are going up and so we will blame their excess profit-taking on the abstract forces of “inflation,” rather than the greed of eminently guillotinable corporate execs:

https://pluralistic.net/2022/03/15/sanctions-financing/#soak-the-rich

Is there a way to synthesize all of these factors into one explanation? Writing for Employ America (“Tight labor markets, higher wages, and better jobs”), Alex Williams gives it a go, with “The Physical Capacity Shortage View of Inflation”:

https://www.employamerica.org/researchreports/the-physical-capacity-shortage-view-of-inflation/

Williams turns the question of whether Chinese lockdowns or Russian invasions caused supply-chain shocks on its head and says, “Why can’t America respond to these shocks by making the stuff we need on-shore?”

The answer? Because of decades of deliberate American de-industrialization, undertaken by private firms who chased lax regulation and low wages overseas. Take semiconductors (AKA “microchips”): nearly all chip fabrication is in China and Taiwan. Building a new chip fab and training workers to operate it takes a long time.

When the supply of chips from Taiwan stops, we can’t just offer higher wages to tempt workers to quit their jobs as Uber drivers and come to work in a chip factory. Chip shortages aren’t being driven by workers demanding outrageous wages, quitting their jobs to play video-games and live off their stimmies. Shortages aren’t being driven by an unwillingness of chip companies to offer competitive wages to get workers into their factories. The workers aren’t trained and the factory doesn’t exist.

For decades, US policy-makers have deliberately pursued a strategy of moving “low value-add” industries offshore. The underlying ideology of this move is that if the market doesn’t attribute high valuations to a process or product, then we can safely assume that we can hand off that work to someone else.

But markets have clearly mispriced these “low value-add” activities and products. There’s actually a bigger shortage in the low-end chip market (embedded chips used in cars, appliances, etc) than in the high-end chip market. Not coincidentally, products that integrate low-end chips are experiencing high inflation. These chips may be “low value-add” but they’re definitely not low-value.

Williams also looks at the housing market. He points out that after 2008, the US government bailed out the banks that loaned money for housing speculation, but largely neglected the new housing supply chain, from lumber mills to house builders. Unsurprisingly, the data over the past 15 years shows the a steady reduction in on-shore capacity to produce the raw materials and finished goods that go into new housing.

Indeed, if you want a symbol of the erosion of onshore capacity as a deliberate policy choice, the spectacle of ex-factories being turned into luxury condos for offshore investors who want an investment, not a home, is just about ideal:

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

That means that the sky-high prices you’re being quoted for a kitchen renovation, an ADU, or a new condo aren’t just the product of price-gouging, competition from cash-flush REITs, or wage demands from skilled tradespeople — they’re the product of sky-high prices for the stuff that your house will be built from.

The collapse of onshore manufacturing capacity was a choice, not an accident. It was part of the financialization of our economy, which was heralded as a source of efficiency and abundance.

But the polycrisis of disease and war and economic collapse have shown us that the core thesis of Modern Monetary Theory is indisputable: governments that issue their own currency aren’t constrained by how much money they have (because they can make more whenever they need it). They’re constrained by what things are for sale in the currency they issue:

https://pluralistic.net/2020/06/10/compton-cowboys/#the-deficit-myth

Financialization insists that we should treat money as scarce — rather than goods, or capacity. Financialization is why California gave away its $200m stockpile of ventilators, N95s and mobile pandemic hospitals in 2008 — rather than spending $5m/year to maintain it:

https://locusmag.com/2020/07/cory-doctorow-full-employment/

But when the covid crisis struck 12 years later, Calfornia’s $60m in savings cost it tens of billions in losses because it needed stuff, not money, and it had given away that stuff in order to save money.

This same dynamic has played out in the corporate world as companies have merged to monopoly in the name of “efficiency” — then realized that efficiency by firing workers and hiring temps, selling buildings and renting them back, raiding cash reserves for stock buybacks — anything to reduce the amount of stuff and increase the amount of money.

Financialization dismantles productive companies and turns them into balance-sheets. In Anand Giridharadas’ interview with David Gelles about his book “The Man Who Broke Capitalism,” about former GE CEO and financialization pioneer Jack Welch, there’s a striking illustration of this:

https://the.ink/p/like-capitalism-itself-business-journalism

In that golden age of capitalism, major corporations understood their employees were their most valuable asset. They treated them as such, giving them excellent pay and sterling benefits far beyond what most companies offer today. Then Welch arrived, and he came to the job with this explicit view that GE employed too many people. And what did he do about it? In his first couple of years on the job, he fired more than 100,000 people in a series of jarring mass layoffs that fundamentally destabilized the American working class and set a precedent for other CEOs to follow in his footsteps.

In a financialized economy, the ability to make money is explicitly pitted against the ability to make stuff. A large, skilled, productive workforce is a cost, not an asset.

I found Williams’ tactic of zooming out from proximate causes of inflation to underlying causes a powerful and illuminating way for understanding inflation. But I must disagree with how he sorts underlying causes from immediate ones, because of the role that monopoly plays in all of this.

It’s true that monopolists’ price-gouging can’t account for all inflation, and that inflation is, at root, a capacity issue. But the dismantling of American onshore capacity is also a monopoly issue.

The most acute shortages — chips, cars, building supplies — are all in sectors that are heavily monopolized, dominated by firms that bought or crushed their rivals, stamping out any domestic capacity before it could develop. These monopolists — heavily backed by private equity — led the pack when it came to selling off, laying off, and draining reserves.

Just as importantly, monopolists are able to ignore prudent policies and pursue their self-interest despite the risks they impose on the rest of us. Exhibit A: the shipping industry, controlled by four giant cartels who pursued economies of scale in the form of ever-larger ships, ignoring warnings that these could get stuck in the Suez Canal:

https://pluralistic.net/2021/03/29/efficient-markets-hypothesis/#too-big-to-sail

Corporations pursue monopoly because they can charge more, sure — but they also pursue monopoly because monopolies have political power, the power to suborn or ignore or capture regulators, so they can offload their costs onto us, extract subsidies from us, and regulate their competitors out of existence.

https://marker.medium.com/we-should-not-endure-a-king-dfef34628153

Yes, inflation is a capacity issue. But capacity is a monopoly issue.

[Image ID: The classic WPA image of Black out-of-work people standing in a breadline in front of a billboard depicting a white family in a luxury car, captioned 'World's Highest Standard of Living...There's no way like the American Way.' The billboard's image has been replaced with a picture of ruined, abandoned factories.]

173 notes

·

View notes

Photo

Number of semiconductor fabrication plants ("fabs") per country.

89 notes

·

View notes

Text

The Biden administration recently promised it will finally loosen the purse strings on $39 billion of CHIPS Act grants to encourage semiconductor fabrication in the U.S. But less than a week later, Intel announced that it’s putting the brakes on its Columbus factory. The Taiwan Semiconductor Manufacturing Company (TSMC) has pushed back production at its second Arizona foundry. The remaining major chipmaker, Samsung, just delayed its first Texas fab.

This is not the way companies typically respond to multi-billion-dollar subsidies. So what explains chipmakers’ apparent ingratitude? In large part, frustration with DEI requirements embedded in the CHIPS Act.

Commentators have noted that CHIPS and Science Act money has been sluggish. What they haven’t noticed is that it’s because the CHIPS Act is so loaded with DEI pork that it can’t move.

…

Handouts abound. There’s plenty for the left—requirements that chipmakers submit detailed plans to educate, employ, and train lots of women and people of color, as well as “justice-involved individuals,” more commonly known as ex-cons. There’s plenty for the right—veterans and members of rural communities find their way into the typical DEI definition of minorities. There’s even plenty for the planet: Arizona Democrats just bragged they’ve won $15 million in CHIPS funding for an ASU project fighting climate change.

That project is going better for Arizona than the actual chips part of the CHIPS Act. Because equity is so critical, the makers of humanity’s most complex technology must rely on local labor and apprentices from all those underrepresented groups, as TSMC discovered to its dismay.

Tired of delays at its first fab, the company flew in 500 employees from Taiwan. This angered local workers, since the implication was that they weren’t skilled enough. With CHIPS grants at risk, TSMC caved in December, agreeing to rely on those workers and invest more in training them. A month later, it postponed its second Arizona fab.

Now TSMC has revealed plans to build a second fab in Japan. Its first, which broke ground in 2021, is about to begin production. TSMC has learned that when the Japanese promise money, they actually give it, and they allow it to use competent workers. TSMC is also sampling Germany’s chip subsidies, as is Intel.

…

In short, the world’s best chipmakers are tired of being pawns in the CHIPS Act’s political games. They’ve quietly given up on America. Intel must know the coming grants are election-year stunts — mere statements of intent that will not be followed up. Even after due diligence and final agreements, the funds will only be released in dribs and drabs as recipients prove they’re jumping through the appropriate hoops.

For instance, chipmakers have to make sure they hire plenty of female construction workers, even though less than 10 percent of U.S. construction workers are women. They also have to ensure childcare for the female construction workers and engineers who don’t exist yet. They have to remove degree requirements and set “diverse hiring slate policies,” which sounds like code for quotas. They must create plans to do all this with “close and ongoing coordination with on-the-ground stakeholders.”

No wonder Intel politely postponed its Columbus fab and started planning one in Ireland. Meanwhile, Commerce Secretary Gina Raimondo was launching a CHIPS-funded training program for historically black colleges.

…

This is the stuff declining empires are made of. As America pursues national security by building a diverse workforce, China does it by building warships.

The CHIPS Act’s current identity as a jobs program for favored minorities means companies are forced to recruit heavily from every population except white and Asian men already trained in the field. It’s like fishing in all the places you aren’t getting bites.

4 notes

·

View notes

Text

whys it so hard to find a good breakdown of how semiconductor fabs work. it just feels like a factory tour or smthn should be easier to find? like im not expecting blueprints or anything but youd think at least a how-it's-made episode would be floating around

2 notes

·

View notes

Text

The Future of Semiconductors: Unveiling a World of Possibilities

**The Future of Semiconductors: Unveiling a World of Possibilities**

As we stand on the brink of a new era, the semiconductor industry finds itself at the heart of a technological revolution. The impact of semiconductors on our lives has been profound, driving advancements across industries and shaping the very fabric of our modern civilization. But what lies ahead for this dynamic and transformative field? Let's delve into the future of semiconductors and the boundless possibilities that await us.

**1. Quantum Leap in Computing:**

The race towards quantum computing is intensifying, and semiconductors will play a pivotal role in unlocking its true potential. Quantum processors, built on novel semiconductor materials, have the power to process vast amounts of data in a fraction of the time it takes traditional computers. The future of computing will transcend current limitations, empowering us to solve complex problems previously deemed insurmountable.

**2. AI and Machine Learning:**

The era of artificial intelligence is upon us, and semiconductors will serve as the backbone of AI and machine learning applications. With the growing demand for AI-driven technologies in autonomous vehicles, robotics, healthcare, and more, the semiconductor industry is set to witness an unprecedented surge in AI-focused chip designs. Neuromorphic computing, inspired by the human brain's architecture, could unlock revolutionary AI capabilities, paving the way for cognitive computing and self-learning systems.

**3. The Internet of Things (IoT) Revolution:**

As IoT proliferates, the demand for energy-efficient and high-performance semiconductor devices will skyrocket. We envision a future where billions of interconnected devices communicate seamlessly, facilitated by advanced semiconductor technologies. Ultra-low-power processors, sensors, and wireless communication chips will define the landscape of the IoT revolution, shaping smart cities, wearables, and an interconnected world.

**4. Green and Sustainable Semiconductors:**

Sustainability will be a driving force in the semiconductor industry's future. Innovations in materials and manufacturing processes will lead to environmentally friendly and energy-efficient semiconductor solutions. From eco-friendly chip packaging to renewable energy-powered fabs, the industry will strive to minimize its carbon footprint, contributing to a greener tomorrow.

**5. Silicon Photonics and Beyond:**

The integration of photonics with silicon promises a new era of ultra-high-speed data transmission and processing. Silicon photonics will revolutionize data centers, enabling faster communication between chips and reducing data bottlenecks. Moreover, emerging technologies like 2D materials and carbon nanotubes offer exciting possibilities for futuristic semiconductor devices that could outperform traditional silicon-based chips.

**6. Security and Privacy:**

With the increasing dependence on connected devices, security and privacy will be paramount. Future semiconductor designs will prioritize hardware-based security features to protect against cyber threats and safeguard sensitive data. Trusted execution environments and secure enclaves will become integral components of semiconductor devices, ensuring user confidence in an interconnected world.

**7. Global Collaboration and Talent Development:**

The future of semiconductors will thrive on global collaboration and talent development. International partnerships will foster innovation, as countries pool their resources and expertise. Companies will invest in nurturing a diverse and skilled workforce, driving advancements and promoting a culture of inclusion and creativity.

The future of semiconductors is bright, brimming with possibilities that have the potential to redefine our world. As innovators, engineers, and visionaries, let's embrace this transformative journey together. Let's harness the power of semiconductors to build a future that empowers, connects, and inspires generations to come.

*The future is here, and it's in the hands of those who dare to dream and innovate with semiconductors as their guiding light.*

2 notes

·

View notes

Text

0 notes

Text

As military tensions flare between the U.S. and China over Taiwan, it’s easy to put all eyes on Nancy Pelosi and her visit to the island. Symbolism matters deeply in international relations, and this event is setting the direction for how Chinese and U.S. leaders will relate to one another. But six weeks ago, an obscure military bureaucrat named Cameron Holt offered another, equally important signal about this relationship. Holt is the head of acquisitions for the Air Force, which means he oversees the buying of everything from drones to nuclear missiles. And in a fascinating and spicy speech, he said that if the U.S. doesn’t get better at buying weapons, America will lose in a future conflict to China. “It’s simply math,” he argued.

The reason is that China is better at procurement. China is getting weapons “five to six times” more rapidly than the United States. “In purchasing power parity,” he said, “they spend about one dollar to our 20 dollars to get to the same capability.” This problem is directly related to market power in the U.S. Holt went over the business strategy of U.S. defense contractors, noting their goal is to lowball contracts but keep control of intellectual property. Then, he said, they create vendor lock-in, and raise prices later. In other words, they underprice upfront so they can eventually exploit pricing power over the Pentagon. Chinese acquisition strategies are more efficient and less brittle, which means over time their military will overtake ours.

Nothing Holt said is a surprise. Everyone knows how screwed up U.S. procurement is, the warnings come in almost daily. For instance, the U.S. can’t replace its stocks of Javelins and Stinger missiles sent to Ukraine, it’s going to take years to restart some of the assembly lines. Raytheon and Lockheed are having supply chain issues, and are unable to deliver weapons despite strong orders. We can’t even make the chips for weapons systems like the B-2 bomber, because semiconductor firms are shutting down the fabs that made the old parts. One could argue these are anomalies, unusual situations, but war is the ultimate moment of supply chain disruption, so that’s cold comfort.

supply chain issues driven by market consolidation as usual

13 notes

·

View notes