#plus i've tried managing more than one blog site. it's not easy

Text

on a whim i'm looking through the blogs of everyone i follow and realizing just how important this aspect of tumblr is. it's your space! your own little room in this ever-expanding house! customization is the heart of tumblr. rearrange the furniture and paint the walls whatever colour you like! that's why combing through these blogs and seeing all the themes made me realize how much this site means to me. it's the last place where i can be myself. so if they remove this precious element... i'm outta here.

#sekwar says a thing#tumblr#i'm serious#i've found my alternative to move to if this happens#a backup plan#i just gotta export this blog and take it along with me over there#cohost isn't as customizable as tumblr but it looks much cozier#i mentioned this already in a post but i'm not ready for the withdrawals#plus i've tried managing more than one blog site. it's not easy#it really sucks to see the internet be this homogenous slab#at the same time it's awesome to see these other sites go against the grain and try to combat this!#i'm with the latter#i'll stop here before i go on another internet rant#have a good day everyone

2 notes

·

View notes

Text

@its-whitetomorrow

I appreciate that you take the time out of your day to read my witterings, and respond to them in detail, but I'm somewhat intellectually limited and it takes a while to write an answer.

The final one is a bit of a problem. The original post is long, your bit is long, and my addition is probably twice both put together.

Did you know Tumblr has a limit: no more than two hundred and fifty text blocks per post? I discovered this from experience, unsurprisingly.

I think the only solution is to split it across several posts.

I wasn't going to say anything, but I suppose I should.

I started this blog last May, to relieve the boredom of my main embarrassment, whose only likes (all three of them) were from porn bots.

It wasn't even meant to be about Pokémon. I'd left the fandom years previously. It was odds and ends, but I happened to find a few silly screen shots so wrote a couple of joke remarks, not expecting a ripple of interest.

Within a couple of hours I got more notes than t'other's managed even to this day. I had the idea this was where I was more at home, so I started taking it seriously.

My pseudonym was just daft thing I'd made up previously, to reflect that, whilst still in love with old days, I'm not exactly pleased with how it's gone.

I thought it might stand out as memorable, plus I like acronyms, so it affords me the opportunity to call myself 'T.A.P.'

In the early days the focus was on the 'maniac' aspect. Anger as a description didn't fit at all. The farther back you go, the more stupid and clownish it gets. It's not been like this all the way through!

Seriously, it used to be an entertainment blog, designed to make people laugh. It's all ages: no swearing, no porn, nothing to put anyone off.

(This post under discussion contains the only profanity I've ever deployed. I thought saving it up might add some oomph.)

I mean it, it's was all light-hearted ridicule. Every so often, there would be a slightly cutting remark, but mild compared to now.

Then, last September, someone I spoke to regularly, who assured me we were friends, suddenly cut off all contact.

At first I wasn't aware of it, but by October it became too glaring a silence to ignore.

I thought rifts started because of massive disagreements, but as far as I remembered our last exchange ended normally.

I found out by accident that the reason for it was because I am repugnant and morally inferior and so swollen with my own ego that the existence of others doesn't register. Instead they are but soulless droids built to worship the great T.A.P. mollusc.

Well that was news to me. I had no idea I came across like that. As far as I knew, I was on my best behaviour when we interacted.

I was polite. I tried to be ingratiate myself. I kept talk to the fandom. I didn't pry. I attempted humour when the opportunity arose.

I thought I'd done all I could to be liked, but apparently I hadn't. It was a revolting experience for them, for all of saying they loved me and I was 'honey'.

It really, really, really got to me, and the feeling hasn't abated, if anything it's worse.

As I said, I don't know what I did wrong, and because I don't, I can't mend my ways. If I am this repellant waste of flesh I'd like to change, but if I'm not told my offence, what am I meant to do?

If what I thought was the best I could be wasn't good enough, and instead was so sickening I don't deserve their presence, then I have no idea how to interact with people.

Maybe every time I respond to someone, thinking I'm at worst, civil, is really grotesque conceit, because my arrogance is so extreme I'm not even aware it's there. In my head it sounds normal.

It'd be too easy to scoff that they were the one with the problem, but, given all the arguments that happen in life, it can't always be someone else's fault. It's got to be you at least once.

They obviously think they were justified, so who's to say they weren't?

You may say not to let it worry me, that I should just get over it, and you'd be totally right. Being bothered makes me feel pathetic and petty on top of the rest, but this is me you're talking to, not a sane person. Self-hatred is more instinctive to me than breathing.

I always dwell on the negative. If one hundred people were assembled, ninety-nine of whom declared me the most wonderful being ever to live, and one remarked I wasn't all that special, it's him I'd remember.

It's called ghosting because that's what happens. There comes a moment when you accept that, no, it's over, rejected again, and it's like realising I'd died, and had been gone for a while.

Except I hadn't noticed the process, so I was always dead in a way, and they spoke to the silvery silhouette left behind, until that too dispersed into untraceable nothingness. Again, the silence is my fault for dying, not theirs.

I feel there's no point in messaging anyone, because I'll only disgust them too. Some blogs encourage contact, and when I see it I always think:

Yeah, but they don't mean YOU.

If it's another person I already spoke to, I can't shut up. I bombard them with text in the hope they know I don't think they're a menial droid. Every one I immediately regret, and wish I could take back, because that will irritate them until I'm just a sad, nagging past.

The Ghost-Maker used to reblog 99% of my work. This dropped to nothing overnight, so not only am I worthless, but so is everything I do.

Posts G.M. didn't like got 0-5 notes. Ones they did had 20+. Many a time, it took their reblog for anyone else to notice.

It was like others used that blog as a filter to pull the fool's gold from the murk of this one. Once their favour evaporated, so did a lot of the goodwill from elsewhere, so it's was as if Tumblr agreed I was scum.

Saying that above just shows they were right, because it takes one smug bastard to believe their existence registers with anyone else.

Please don't think I'm demanding likes, that my stuff deserves them, although as I'm arrogant I am. It's just that 99% to 0% is a bit of a fall.

Up til then, I held back much of what I thought about the current state of the anime, as they liked it, but now I have no reason to stop.

If I'm to be accused of all these vices I might as well have them. I'm dead, so who cares what I say? No one listens to a ghost.

It's not that I'm unconcerned if I upset anyone, it's just the truth that I don't matter enough for what I write to be valued enough to offend.

As a ghost, I think of this blog as invisible. It's there, but not really, so how can anyone mind?

Incidentally, the first week I was here I got blocked by someone who hates all fans from the Nineties. I don't care about that, as they sound like a cretin, and I'd have to be defective to gain their approval.

I just want to say I find that moronic. I don't hate new fans at all. I wouldn't block someone because we disagreed.

Blocking denies people access to your blog, stating they don't deserve your ART. That's arrogant to me.

Blocker likes Ghost-Maker, but...

Ever since around October, I've progressively become angrier and angrier. Whenever I'm here or Pokémon enters my head, it just reminds that I'm pond slime, about the most crude, malformed half-life freak you can envision.

I don't like being here anymore. I keep intending to leave, the site and the fandom, and set fire to it all before I go, wipe away the slug trail to spare people's stomachs.

I kept quiet until now, but holding it in just made it more intense. If I may describe myself in ridiculously flattering terms, I feel like a shaken champagne bottle, but the cork is welded in, so the only option is for the glass to shatter.

If anyone's reading this, wondering where the fun went, well this is why I flipped. The red mist won't clear. I can't see beyond it.

I won't name Ghost-Maker, because I don't want to start anything, plus most will take their side. They may see this as they still rifle round these parts occasionally for posts that aren't mine.

Well done, Ghostie. You're the lucky one. We'll never meet and you haven't seen me. Pity the poor sods I've encountered. There must be vomit trails across the land provoked by my vile condition. I wasn't aware of this until you let me in on the secret.

There's an English television presenter called Caroline Flack. She killed herself yesterday and everyone loved her. I feel guilty that I'm alive and she's not.

1 note

·

View note

Text

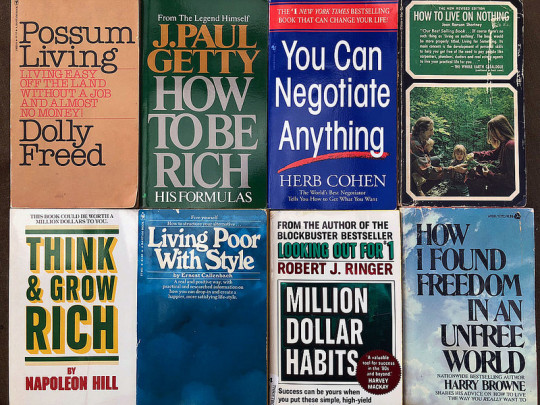

An index to every money book I've reviewed during the past twelve years

147 Shares

I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn't purged hundreds of money books when I sold this site in 2009, I'd have even more books and no place to put them.)

Last week, a GRS reader named Lindsay dropped a line with an interesting question:

I'm really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I'm wondering: Do you have a list of all the money books you've reviewed? I've been poking around to try and find one)?

As it happens, I've been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I'd like to pursue is a free nicely-formatted PDF download that compiles every review I've written.

To answer Lindsay's question and to satisfy my own curiosity I sifted through the GRS archives yesterday to compile a list of every money book I've reviewed during my 12+ years at this site. In this post, I've linked to those reviews, plus I've included a short summary of each book.

Note: I'm certain that about half of the reviews are missing from the archives. The folks who purchased this site from me unpublished hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I'll eventually find them and list them here, but it's far too cumbersome to find them at the moment.

For each book below, I've included a link to Amazon. I've also assigned each a book a letter grade and, in some cases, a star .

My letter grades might seem harsh. That's because I've tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field.

If I grade a book an A, I think it's excellent. It offers excellent advice with no real flaws.If I give a book a B, it's a good book with good advice, but something about it holds it back. Maybe it's poorly written or maybe it's off-base on a topic or two.If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There's nothing drastically wrong with the book, and it's worth reading.If I give a D grade, the book is flawed in some major way. It still has some value to it maybe a core concept that you can't find elsewhere but I'm hesitant to recommend this to average folks.If I give a book and F, I don't think it has any sort of value. I don't give many Fs because I think nearly every book has some nugget of wisdom in it.

Note that all of my letter grades were assigned today. They're based on who I am and what I know now, not when I wrote the reviews. And they're based on how valuable the book's info will be to a modern reader. (Some money books that were awesome in 1978 haven't aged well because their advice is specific to that era.)

When I've marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don't have a review of Dave Ramsey's Total Money Makeover here. If I did, it'd get a C or lower because the book's quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.)

Ultimately, though, you shouldn't let the letter grades and stars guide your decision to read a book. Use my reviews instead. They're much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference.

Finally, I've sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there's a gap here between 2010 and 2016.) If, like me, you prefer older money books, you'll find them closer to the end of this list.

That's enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

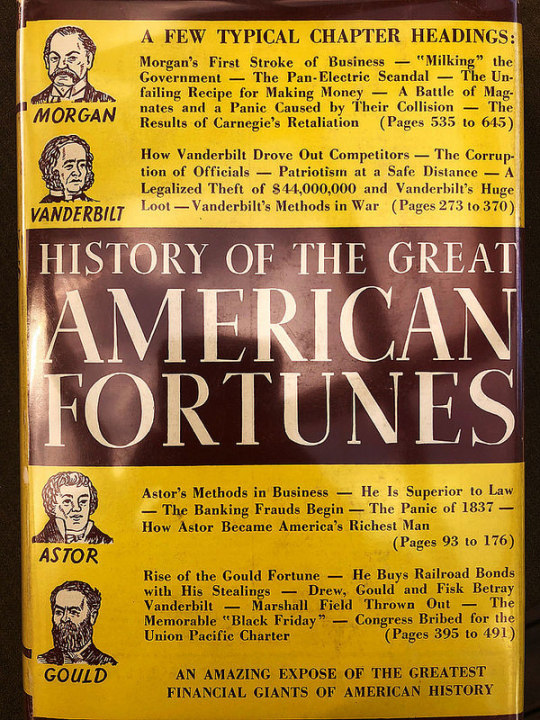

Get Money by Kristin Wong (2018)Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money and win. It's a useful money manual from a favorite former GRS staff writer. [my review] BThinking in Bets: Making Smarter Decisions When You Don't Have All the Facts by Annie Duke (2018)For a long time, Ive argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. Its not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)Meet the Frugalwoods isnt a money manual. It isnt fiction. Its memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers its possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn't achieve financial independence through frugality; they achieved it through a high income. [my review] CYou Need a Budget by Jesse Mecham (2017)You Need a Budget is a simple book, but its excellent. It doesnt try to throw the entire world of personal finance at you. Its laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, hes learned a lot about what works and what doesnt. Hes constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A The Simple Path to Wealth by J.L. Collins (2016)The Simple Path to Wealth presents the advice from the author's blog in a coherent, unified package. Its an easy-to-understand primer on stock-market investing and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think its at its best when Collins covers retirement investing. [my review] B+ Early Retirement Extreme by Jacob Lund Fisker (2010)Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, thats what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isnt a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B The Simple Dollar by Trent Hamm (2010)This book isnt really about personal finance. Theres personal finance in it, sure, but like Hamms blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and its sure to be useful to many people, but the content is so jumbled that its difficult to see the Big Picture. [my review] C-Mind Over Money by Ted and Brad Klontz (2009)Mind Over Money wont teach you how to budget and it doesnt ever mention index funds. This isnt a book about the nuts-and-bolts of personal finance. Its a book about how we relate to money. The strength of the book isnt in the answers it provides, but in the questions it provokes. If you're looking for a book about the psychology of personal finance, this is worth reading. [my review] CEscape from Cubicle Nation by Pam Slim (2009)Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with whats important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+The Happiness Project by Gretchen Rubin (2009)On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life marriage, work, attitude, and so on and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isnt lame. Rubins style is warm and engaging, and the material here is useful. [my review] BI Will Teach You to Be Rich by Ramit Sethi (2009)This book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it's packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A- Spend Til the End by Scott Burns and Larry Kotlikoff (2008)Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest lifetime living standard per adult. Their aim is to find a way to balance today and tomorrow, to pursue what's known as consumption smoothing. Much of the books advice is geared toward those nearing retirement, but theres still plenty for readers of every age. [my review] C+Increase Your Financial IQ by Robert Kiyosaki (2008)The problem with the standard financial advice is that its bad advice. Youve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete so argues Robert Kiyosaki in Increase Your Financial IQ. I'll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)When I picked up The 4-Hour Workweek, I was worried it was some sort of get rich quick book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it's become a modern classic. [my review] B- The Quiet Millionaire by Brett Wilder (2007)The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It's like a textbook for personal finance. It isnt really a book for beginners. Its targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] BDebt Is Slavery by Michael Mihalik (2007)Debt is Slavery is a deceptively simple book. Its short. Its advice seems basic. And its self-published, so how good can it be? Well, I think its great. In fact, I found myself wishing that I had written it. Mihaliks advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but its sweet. Especially great for recent graduates, I think. [my review] B+Overcoming Underearning by Barbara Stanny (2007)Overcoming Underearning isn't what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a how-to book, keep looking. If you need to get started, or are started, but have hit a wall and you dont know why, this might be the book for you. [my review] C-The Secret by Rhonda Byrne (2006)The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation only scattered cherry-picked anecdotes. Its the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] FThe Millionaire Maker by Loral Langmeier (2006)The Millionaire Maker attempts to codify Langemeiers proprietary Wealth Cycle Process. She believes there are better places to put your money than in mutual funds. This book is a mixed bag. While it preaches what ought to be preached, and Langemeier provides more specifics than some authors, her message sounds hollow. There is some good information here, but theres stuff that raises red flags, too. [my review] D+Work Less, Live More: The Way to Semi-Retirement by Bob Clyatt (2005)For years, Work Less, Live More has been my go-to book for info about early retirement. I give away copies several times a year. I recommend it when replying to email. I refer to it myself when I have questions. I like this book because it strikes a balance between the high-level Big Picture stuff and the low-level nitty-gritty numbers crunching. (See also: Bob Clyatt's guest post here at GRS about his life since writing the book.) [my review] A All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Tyagi (2005)This book was written by the mother-daughter team of Elizabeth Warren and Amelia Warren Tyagi. (Warren is now a U.S. Senator from Massachusetts!) The authors dont get bogged down in the details of frugality and investing. Theyre more interested in changing behavior, in fixing the big stuff. They offer a framework around which the reader can build lasting financial success. The book's advice is solid, if sometimes flawed. To me, its lasting legacy is the introduction of the Balanced Money Formula (which some now call the 50-30-20 budget), a concept I promote extensively in my public speaking gigs. [my review] B- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker (2005)Many people would dismiss Secrets of the Millionaire Mind as useless. Theres not a lot of concrete information here about how to improve the details of your financial life. (Though the scant advice presented is sound). Instead, this book encourages readers to adopt mental attitudes that facilitate wealth. Its about changing your psychological approach to money, success, and happiness. (This book is the source of my money blueprint concept.) [my review] CMoney Without Matrimony: The Unmarried Couple's Guide to Financial Security by Sheryl Garrett and Debra Neiman (2005)As difficult as marriage and money can be, things are even tougher for unmarried couples, both gay and straight. Its difficult for these folks to get good advice in a society thats geared toward married couples. Money Without Matrimony is a great book with sound suggestions. Its non-judgmental, practical, and packed with advice. If youre in a committed unmarried relationship, I highly recommend you track down a copy. [my review] AThe Automatic Millionaire by David Bach (2005)David Bach is perhaps best known for coining the term the latte factor, a phrase that has almost become a joke in personal finance circles. Thats too bad, really, because Bach has some good ideas. And the latte factor is a marvelous concept, applicable to many people who casually spend their future a few dollars at a time. This book encourages readers to eliminate debt, to live frugally, and to pay themselves first. But the core of his book is unique: rather than develop will power and self-discipline, Bach says, why not bypass the human element altogether? Why not make your path to wealth automatic? [my review] C Luck Is No Accident: Making the Most of Happenstance in Your Life and Career by John D. Krumboltz and Al S. Levin (2004)Luck Is No Accident is a short book. Nothing in it is groundbreaking or revolutionary. Yet its common-sense wisdom is a powerful motivator. Whenever I read it, I cannot help but come away inspired, ready to make more of my situation, and to try new things. If youre the sort of person who wonders why good things only happen to other people, I encourage you to read it. [my review] B+The Random Walk Guide to Investing: Ten Rules for Financial Success by Burton Malkiel (2003)Malkiels advice can be stated in a few short sentences: Eliminate debt. Establish an emergency fund. Begin making regular investments to a diversified portfolio of index funds. Be patient. But the simplicity of his message does not detract from its value. If you want to invest but dont know where to start, pick up a copy of this book. [my review] A-

The Bountiful Container by Rose Marie Nichols McGee and Maggie Stuckey (2002)The Bountiful Container beats most gardening books hands-down in several key areas. It focuses on growing plants that give a beginning gardener the most bang for the buck, plants that are both edible and decorative and can be grown with limited space. It is splendidly organized and easy to read, and has a great index, too. And the level of detail is just right for almost any skill level, and the writing is pleasant to read and easy to understand. [my ex-wife's review] B+The Four Pillars of Investing by William Bernstein (2002)In this book, Bernstein describes how to build a winning investment portfolio. He doesnt focus on the details he tries to explain fundamental concepts so that readers will be able to make smart investment decisions on their own. The Four Pillars of Investing is challenging in places, but it provides an excellent introduction to the theory, history, psychology, and business of investing. If youre able to finish, youll have a better grasp of investing than 99% of your peers. [my review] B Why We Buy: The Science of Shopping by Paco Underhill (2000)In this book, Paco Underhill an environmental psychologist describes what he learned through years of research into consumer behavior and retail marketing. Like it or not, youre manipulated all of the time while youre shopping, and in ways you dont even suspect. But by taking Underhills lessons for marketers and flipping them around, you can make yourself immune to marketers manipulations. (Well, maybe not immune, but less likely to succumb to their ploys, anyhow.) [my review] BWhy Smart People Make Big Money Mistakes (and How to Fix Them) by Gary Belsky and Thomas Gilovich (1999)In this short book, Belsky and Gilovich catalog a menagerie of mental mistakes that cause people to spend more than they should. What might have been a boring topic becomes fascinating thanks to an engaging style and plenty of anecdotes and examples. This book covers a couple dozen psychological barriers to wealth. [my review] B+ The Millionaire Next Door by Thomas Stanley and William Danko (1998)The Millionaire Next Door has earned its place in the canon of personal-finance literature. It's built on years of research, on a body of statistics and case studies. It doesnt make hollow promises. That said, the book is a flawed classic. It offers a fascinating portrait of the wealthy, but it buries this beneath mountains of detritus. The book is poorly organized, repetitive, and dull. (The section on car-buying seems to go on forever.) A patient reader will be rewarded with a glimpse at what it takes to become a millionaire, but I cant help but feel this book could have been something more. Warning: Avoid the audiobook, which suffers even more in the tedious sections. [my review] C+ Yes, You Can Achieve Financial Independence by James Stowers (1992)Yes, You Can Achieve Financial Independence is informative without being dense. Its accessible without being condescending. Its advice is solid. The book is filled with investment advice, but it gives equal time to thrift and savings. Best of all, it asks as many questions as it provides answers. It prompts the reader to think, to evaluate his priorities. Its message is that yes, you can achieve Financial Independence, but you cant get there overnight, and you cant get there without setting goals and making sacrifices. [my review] A-How to Retire Young by Edward M. Tauber (1989)How to Retire Young is one of the oldest books Ive found on the subject of early retirement. Taubers premise is that many people can retire early if they plan and remain dedicated to the plan. I wish I could say that this is a great book. Sadly, its not. Its good (dont get me wrong), but it suffers from being first. [my review] C-Cashing In on the American Dream: How to Retire at 35 by Paul Terhorst (1988)Cashing In on the American Dream is a seminal early retirement book and its advice was spot-on for 1988. But that strength is now its weakness. Some of the advice is thirty years out of date. If you dont need specific advice but are instead interested about theory (and story), then seek out this title. (The last half of the book is filled with stories from folks who made early retirement happen.) [my review] BHow to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis (1988)How to Get Out of Debt is built on the principles of Debtors Anonymous, a twelve-step program founded in 1971 to help those who struggle with compulsive debt. Mundis was himself a debtor, and he based this book on his own experience. This isnt purely theoretical information from the mind of some Wall Street finance whiz who has never struggled; this book contains real tips and real stories from real people. [my review] A- You Can Negotiate Anything by Herb Cohen (1980)Whether you like it or not, your life is filled with negotiations. You negotiate your salary, for the price of a car, for the cost of a couch. You negotiate with your wife about where to spend your summer vacation, with your husband about what color to paint the babys bedroom, with your daughter about what time she should be home from the football game. Of all the books Ive recommended at Get Rich Slowly over the years, You Can Negotiate Anything is one of the best. [my review] A How to Get Rich and Stay Rich by Fred J. Young (1979)This book is built around a single principle: Spend less than you earn and invest the difference in something that you think will increase in value and make you rich. It reads like homespun advice from your favorite uncle. While theres plenty of good advice in these pages and lots of amusing anecdotes, theres very little polish. [my review] CThe Incredible Secret Money Machine by Don Lancaster (1978)Though the title smacks of get-rich-quick schemes, The Incredible Secret Money Machine is really about starting and running a small business. To Lancaster, a money machine is any venture that generates nickels. Nickels are small streams of revenue from individual customers. If your goal is simply to earn a comfortable income for yourself by doing something you love, then this book can help you explore the idea of business ownership. Its not going to help you launch the next Google or Microsoft, though. Lancaster is all about nickels, not about dollars. [my review] C+Hard Times: An Oral History of the Great Depression by Studs Terkel (1970)In 1970, writer Studs Terkel published Hard Times: An Oral History of the Great Depression, which features excerpts from over 100 interviews he conducted with those who lived through the 1930s. Terkel spoke with all sorts of people: old and young, rich and poor, famous and not-so-famous, liberal and conservative. The book is fascinating. Its one thing to read about the Great Depression in textbooks, or to hear it used as leverage in political speeches, but its another thing entirely to read the experiences of the people who lived through it. [my review] A-

That's it! If you find any reviews I missed, let me know so that I can add them to this index.

I consider this a living article. I plan to add to it with time. As I re-publish old reviews that are currently unpublished, I'll add them here. And as I write new reviews in the future, those will get added to the list too.

Know of a money book that I should read and review? Drop a line to let me know!

147 Shares

https://www.getrichslowly.org/money-books-index/

0 notes

Text

An index to every money book I've reviewed during the past twelve years

Shares 139

I read a lot of money books. As a result, a large section of my large library is devoted to books about personal finance. (And if I hadn't purged hundreds of money books when I sold this site in 2009, I'd have even more books and no place to put them.)

Last week, a GRS reader named Lindsay dropped a line with an interesting question:

I'm really enjoying your work back at GRS, the email newsletter, and your most recent FB live video! I'm wondering: Do you have a list of all the money books you've reviewed? I've been poking around to try and find one)?

As it happens, I've been wanting a list of reviews myself. I know I have a million billion different projects around here, but one that I'd like to pursue is a free nicely-formatted PDF download that compiles every review I've written.

To answer Lindsay's question and to satisfy my own curiosity I sifted through the GRS archives yesterday to compile a list of every money book I've reviewed during my 12+ years at this site. In this post, I've linked to those reviews, plus I've included a short summary of each book.

Note: I'm certain that about half of the reviews are missing from the archives. The folks who purchased this site from me unpublished hundreds of articles (including many book reviews, apparently) during the time they owned GRS. Those reviews still exist, and I'll eventually find them and list them here, but it's far too cumbersome to find them at the moment.

For each book below, I've included a link to Amazon. I've also assigned each a book a letter grade and, in some cases, a star .

My letter grades might seem harsh. That's because I've tried to really think about these on a sort of curve, where the vast majority of books are average and only a few merit As or Fs. As a result, some important titles get average (or low) grades despite their contribution to the field.

If I grade a book an A, I think it's excellent. It offers excellent advice with no real flaws.If I give a book a B, it's a good book with good advice, but something about it holds it back. Maybe it's poorly written or maybe it's off-base on a topic or two.If I give a grade of C, the book is average. That means it gives reasonable money advice in a typical way. There's nothing drastically wrong with the book, and it's worth reading.If I give a D grade, the book is flawed in some major way. It still has some value to it maybe a core concept that you can't find elsewhere but I'm hesitant to recommend this to average folks.If I give a book and F, I don't think it has any sort of value. I don't give many Fs because I think nearly every book has some nugget of wisdom in it.

Note that all of my letter grades were assigned today. They're based on who I am and what I know now, not when I wrote the reviews. And they're based on how valuable the book's info will be to a modern reader. (Some money books that were awesome in 1978 haven't aged well because their advice is specific to that era.)

When I've marked a book with a star , that indicates I believe regardless of my grade, the title should be considered part of a core personal-finance library. (I don't have a review of Dave Ramsey's Total Money Makeover here. If I did, it'd get a C or lower because the book's quality is mixed and it has certain drawbacks. But the book would also merit a star because it should be in any serious library of money books.)

Ultimately, though, you shouldn't let the letter grades and stars guide your decision to read a book. Use my reviews instead. They're much more nuanced than an arbitrary grade. The grades are meant as a sort of quick reference.

Finally, I've sorted the titles into roughly reverse-chronological order based on year of publication. I think most readers are interested in recent titles. (Because of my hiatus from money-blogging, there's a gap here between 2010 and 2016.) If, like me, you prefer older money books, you'll find them closer to the end of this list.

That's enough explanation. Here then is a list of (nearly) all of the book reviews from the archives here at Get Rich Slowly!

Get Money by Kristin Wong (2018)Get Money is all about applying game-playing principles to money management. Most money books tend toward boring and stale. Not this one. Get Money is both funny and wise, packed with practical tips for how to play the game of money and win. It's a useful money manual from a favorite former GRS staff writer. [my review] BThinking in Bets: Making Smarter Decisions When You Don't Have All the Facts by Annie Duke (2018)For a long time, Ive argued that the best money books are often not about money at all. Thinking in Bets is an example of this. Duke says that there are exactly two things that determine how our lives turn out: The quality of our decisions and luck. She uses plenty of personal finance examples, but the book itself is about self-improvement. Its not specifically about personal finance, yet the info here could have a profound impact on your financial future. [my review] A-Meet the Frugalwoods: Achieving Financial Independence through Simple Living by Elizabeth Willard Thames (2018)Meet the Frugalwoods isnt a money manual. It isnt fiction. Its memoir. The book covers ten years in the lives of Liz and her husband Nate, from their post-college job-hunting experiences in Kansas to purchasing a 66-acre homestead in Vermont. Through their story, Liz shows readers its possible to move from a life of consumerism to a life built around frugality and purpose. My chief complaint? The Frugalwoods didn't achieve financial independence through frugality; they achieved it through a high income. [my review] CYou Need a Budget by Jesse Mecham (2017)You Need a Budget is a simple book, but its excellent. It doesnt try to throw the entire world of personal finance at you. Its laser-focused on one thing: building a better budget. Because Mecham has been reading and writing about budgets since 2004, hes learned a lot about what works and what doesnt. Hes constantly receiving feedback from the tens of thousands of people who follow his program. This book is a culmination of that experience, and it shows. If you need a budget, I highly recommend this book. [my review] A The Simple Path to Wealth by J.L. Collins (2016)The Simple Path to Wealth presents the advice from the author's blog in a coherent, unified package. Its an easy-to-understand primer on stock-market investing and financial independence. Although the book is intended to offer wide-ranging advice about the journey to financial freedom, I think its at its best when Collins covers retirement investing. [my review] B+ Early Retirement Extreme by Jacob Lund Fisker (2010)Imagine a personal-finance book written by a theoretical physicist. What would it be like? Full of formulas and figures, right? Well, thats what you get with Early Retirement Extreme. This feels like a book written by an engineer for other engineers. This isnt a bad thing, but it is unique. Some people will love it; others will hate it. Also, this book could use a professional editor. These caveats aside, ERE is packed with excellent information, and is one of the key books in the Financial Independence movement. [my review] B The Simple Dollar by Trent Hamm (2010)This book isnt really about personal finance. Theres personal finance in it, sure, but like Hamms blog, The Simple Dollar is about personal and professional transformation. This is a book about change. The information in the book is good, and its sure to be useful to many people, but the content is so jumbled that its difficult to see the Big Picture. [my review] C-Mind Over Money by Ted and Brad Klontz (2009)Mind Over Money wont teach you how to budget and it doesnt ever mention index funds. This isnt a book about the nuts-and-bolts of personal finance. Its a book about how we relate to money. The strength of the book isnt in the answers it provides, but in the questions it provokes. If you're looking for a book about the psychology of personal finance, this is worth reading. [my review] CEscape from Cubicle Nation by Pam Slim (2009)Escape from Cubicle Nation starts at the beginning of the entrepreneurial journey: deciding what to do with your life. Slim spends several chapters discussing how to get in touch with whats important to you. At times, this almost seems touchy-feely. Almost. Thankfully, the book packs in ton of practical info on how to start a successful small business that matches you and your lifestyle. [my review] B+The Happiness Project by Gretchen Rubin (2009)On paper, The Happiness Project may seem sort of lame. Rubin decided to spend one year consciously pursuing happiness. Each month, she tackled one specific aspect of life marriage, work, attitude, and so on and during that month, she attempted to meet a handful of related resolutions she hoped would make her happier. Fortunately, the book isnt lame. Rubins style is warm and engaging, and the material here is useful. [my review] BI Will Teach You to Be Rich by Ramit Sethi (2009)This book is great, but its not for everyone. First of all, its targeted almost exclusively at young adults. If youre under 25 and single, and if you make a decent living, this book is perfect. But if youre 45 and married with two children, and if you struggle to make ends meet, this book is less useful. That said, it's packed with solid advice, cites its sources, and provides scores of tactical tips for managing money. [my review] A- Spend Til the End by Scott Burns and Larry Kotlikoff (2008)Burns and Kotlikoff analyze dozens of hypothetical scenarios as they seek to discover which choices provide the greatest lifetime living standard per adult. Their aim is to find a way to balance today and tomorrow, to pursue what's known as consumption smoothing. Much of the books advice is geared toward those nearing retirement, but theres still plenty for readers of every age. [my review] C+Increase Your Financial IQ by Robert Kiyosaki (2008)The problem with the standard financial advice is that its bad advice. Youve been told to work hard, save money, get out of debt, live below your means, and invest in a well-diversified portfolio of mutual funds. But this advice is obsolete so argues Robert Kiyosaki in Increase Your Financial IQ. I'll be blunt: Kiyosaki is full of shit. I worry about his financial IQ. [my review] D-

The 4-Hour Workweek by Timothy Ferriss (2007)When I picked up The 4-Hour Workweek, I was worried it was some sort of get rich quick book. Ferriss makes a lot of bold promises, and some of the details along the way read like the confessions of an internet scammer. Ultimately, though, I found tons of value that I could apply to my own entrepreneurial ventures. In fact, this has become one of my most-bookmarked books of all time! An intelligent reader can easily extract a wealth of useful here, which is why it's become a modern classic. [my review] B- The Quiet Millionaire by Brett Wilder (2007)The Quiet Millionaire is different from most of the other money books I review. Though Wilder includes behavioral finance and life planning concepts, this is a numbers book. It's like a textbook for personal finance. It isnt really a book for beginners. Its targeted at folks who are out of debt and building wealth. I suspect many people will find this book boring. But then, smart personal finance is boring. [my review] BDebt Is Slavery by Michael Mihalik (2007)Debt is Slavery is a deceptively simple book. Its short. Its advice seems basic. And its self-published, so how good can it be? Well, I think its great. In fact, I found myself wishing that I had written it. Mihaliks advice is spot-on, and he covers a lot of topics that other authors shy away from, such as the effects of advertising, the weight of possessions, and the soul-sucking misery that comes from a bad job. This book may be short, but its sweet. Especially great for recent graduates, I think. [my review] B+Overcoming Underearning by Barbara Stanny (2007)Overcoming Underearning isn't what I expected it to be. When I read the title, I expected a book about how to stretch your dollars and how get more from what you do earn. This book is about asking for more, creating more, and working your way through the psychological pitfalls that lead to being satisfied with less in the first place. But the book contains few actionable steps that will help you make more money or invest well. If you need a how-to book, keep looking. If you need to get started, or are started, but have hit a wall and you dont know why, this might be the book for you. [my review] C-The Secret by Rhonda Byrne (2006)The Secret is all about the so-called Law of Attraction, which is not actually a law of anything. The Law of Attraction states that your life is a result of the things you think about. From a psychological perspective, this notion has some merit. But this book offers no evidence of any kind: no scientific discussion, no experimentation only scattered cherry-picked anecdotes. Its the worst kind of pseudo-scientific baloney. And its money advice is actively harmful rather than helpful. [my review] FThe Millionaire Maker by Loral Langmeier (2006)The Millionaire Maker attempts to codify Langemeiers proprietary Wealth Cycle Process. She believes there are better places to put your money than in mutual funds. This book is a mixed bag. While it preaches what ought to be preached, and Langemeier provides more specifics than some authors, her message sounds hollow. There is some good information here, but theres stuff that raises red flags, too. [my review] D+Work Less, Live More: The Way to Semi-Retirement by Bob Clyatt (2005)For years, Work Less, Live More has been my go-to book for info about early retirement. I give away copies several times a year. I recommend it when replying to email. I refer to it myself when I have questions. I like this book because it strikes a balance between the high-level Big Picture stuff and the low-level nitty-gritty numbers crunching. (See also: Bob Clyatt's guest post here at GRS about his life since writing the book.) [my review] A All Your Worth: The Ultimate Lifetime Money Plan by Elizabeth Warren and Amelia Tyagi (2005)This book was written by the mother-daughter team of Elizabeth Warren and Amelia Warren Tyagi. (Warren is now a U.S. Senator from Massachusetts!) The authors dont get bogged down in the details of frugality and investing. Theyre more interested in changing behavior, in fixing the big stuff. They offer a framework around which the reader can build lasting financial success. The book's advice is solid, if sometimes flawed. To me, its lasting legacy is the introduction of the Balanced Money Formula (which some now call the 50-30-20 budget), a concept I promote extensively in my public speaking gigs. [my review] B- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker (2005)Many people would dismiss Secrets of the Millionaire Mind as useless. Theres not a lot of concrete information here about how to improve the details of your financial life. (Though the scant advice presented is sound). Instead, this book encourages readers to adopt mental attitudes that facilitate wealth. Its about changing your psychological approach to money, success, and happiness. (This book is the source of my money blueprint concept.) [my review] CMoney Without Matrimony: The Unmarried Couple's Guide to Financial Security by Sheryl Garrett and Debra Neiman (2005)As difficult as marriage and money can be, things are even tougher for unmarried couples, both gay and straight. Its difficult for these folks to get good advice in a society thats geared toward married couples. Money Without Matrimony is a great book with sound suggestions. Its non-judgmental, practical, and packed with advice. If youre in a committed unmarried relationship, I highly recommend you track down a copy. [my review] AThe Automatic Millionaire by David Bach (2005)David Bach is perhaps best known for coining the term the latte factor, a phrase that has almost become a joke in personal finance circles. Thats too bad, really, because Bach has some good ideas. And the latte factor is a marvelous concept, applicable to many people who casually spend their future a few dollars at a time. This book encourages readers to eliminate debt, to live frugally, and to pay themselves first. But the core of his book is unique: rather than develop will power and self-discipline, Bach says, why not bypass the human element altogether? Why not make your path to wealth automatic? [my review] C Luck Is No Accident: Making the Most of Happenstance in Your Life and Career by John D. Krumboltz and Al S. Levin (2004)Luck Is No Accident is a short book. Nothing in it is groundbreaking or revolutionary. Yet its common-sense wisdom is a powerful motivator. Whenever I read it, I cannot help but come away inspired, ready to make more of my situation, and to try new things. If youre the sort of person who wonders why good things only happen to other people, I encourage you to read it. [my review] B+The Random Walk Guide to Investing: Ten Rules for Financial Success by Burton Malkiel (2003)Malkiels advice can be stated in a few short sentences: Eliminate debt. Establish an emergency fund. Begin making regular investments to a diversified portfolio of index funds. Be patient. But the simplicity of his message does not detract from its value. If you want to invest but dont know where to start, pick up a copy of this book. [my review] A-

The Bountiful Container by Rose Marie Nichols McGee and Maggie Stuckey (2002)The Bountiful Container beats most gardening books hands-down in several key areas. It focuses on growing plants that give a beginning gardener the most bang for the buck, plants that are both edible and decorative and can be grown with limited space. It is splendidly organized and easy to read, and has a great index, too. And the level of detail is just right for almost any skill level, and the writing is pleasant to read and easy to understand. [my ex-wife's review] B+The Four Pillars of Investing by William Bernstein (2002)In this book, Bernstein describes how to build a winning investment portfolio. He doesnt focus on the details he tries to explain fundamental concepts so that readers will be able to make smart investment decisions on their own. The Four Pillars of Investing is challenging in places, but it provides an excellent introduction to the theory, history, psychology, and business of investing. If youre able to finish, youll have a better grasp of investing than 99% of your peers. [my review] B Why We Buy: The Science of Shopping by Paco Underhill (2000)In this book, Paco Underhill an environmental psychologist describes what he learned through years of research into consumer behavior and retail marketing. Like it or not, youre manipulated all of the time while youre shopping, and in ways you dont even suspect. But by taking Underhills lessons for marketers and flipping them around, you can make yourself immune to marketers manipulations. (Well, maybe not immune, but less likely to succumb to their ploys, anyhow.) [my review] BWhy Smart People Make Big Money Mistakes (and How to Fix Them) by Gary Belsky and Thomas Gilovich (1999)In this short book, Belsky and Gilovich catalog a menagerie of mental mistakes that cause people to spend more than they should. What might have been a boring topic becomes fascinating thanks to an engaging style and plenty of anecdotes and examples. This book covers a couple dozen psychological barriers to wealth. [my review] B+ The Millionaire Next Door by Thomas Stanley and William Danko (1998)The Millionaire Next Door has earned its place in the canon of personal-finance literature. It's built on years of research, on a body of statistics and case studies. It doesnt make hollow promises. That said, the book is a flawed classic. It offers a fascinating portrait of the wealthy, but it buries this beneath mountains of detritus. The book is poorly organized, repetitive, and dull. (The section on car-buying seems to go on forever.) A patient reader will be rewarded with a glimpse at what it takes to become a millionaire, but I cant help but feel this book could have been something more. Warning: Avoid the audiobook, which suffers even more in the tedious sections. [my review] C+ Yes, You Can Achieve Financial Independence by James Stowers (1992)Yes, You Can Achieve Financial Independence is informative without being dense. Its accessible without being condescending. Its advice is solid. The book is filled with investment advice, but it gives equal time to thrift and savings. Best of all, it asks as many questions as it provides answers. It prompts the reader to think, to evaluate his priorities. Its message is that yes, you can achieve Financial Independence, but you cant get there overnight, and you cant get there without setting goals and making sacrifices. [my review] A-How to Retire Young by Edward M. Tauber (1989)How to Retire Young is one of the oldest books Ive found on the subject of early retirement. Taubers premise is that many people can retire early if they plan and remain dedicated to the plan. I wish I could say that this is a great book. Sadly, its not. Its good (dont get me wrong), but it suffers from being first. [my review] C-Cashing In on the American Dream: How to Retire at 35 by Paul Terhorst (1988)Cashing In on the American Dream is a seminal early retirement book and its advice was spot-on for 1988. But that strength is now its weakness. Some of the advice is thirty years out of date. If you dont need specific advice but are instead interested about theory (and story), then seek out this title. (The last half of the book is filled with stories from folks who made early retirement happen.) [my review] BHow to Get Out of Debt, Stay Out of Debt, and Live Prosperously by Jerrold Mundis (1988)How to Get Out of Debt is built on the principles of Debtors Anonymous, a twelve-step program founded in 1971 to help those who struggle with compulsive debt. Mundis was himself a debtor, and he based this book on his own experience. This isnt purely theoretical information from the mind of some Wall Street finance whiz who has never struggled; this book contains real tips and real stories from real people. [my review] A- You Can Negotiate Anything by Herb Cohen (1980)Whether you like it or not, your life is filled with negotiations. You negotiate your salary, for the price of a car, for the cost of a couch. You negotiate with your wife about where to spend your summer vacation, with your husband about what color to paint the babys bedroom, with your daughter about what time she should be home from the football game. Of all the books Ive recommended at Get Rich Slowly over the years, You Can Negotiate Anything is one of the best. [my review] A How to Get Rich and Stay Rich by Fred J. Young (1979)This book is built around a single principle: Spend less than you earn and invest the difference in something that you think will increase in value and make you rich. It reads like homespun advice from your favorite uncle. While theres plenty of good advice in these pages and lots of amusing anecdotes, theres very little polish. [my review] CThe Incredible Secret Money Machine by Don Lancaster (1978)Though the title smacks of get-rich-quick schemes, The Incredible Secret Money Machine is really about starting and running a small business. To Lancaster, a money machine is any venture that generates nickels. Nickels are small streams of revenue from individual customers. If your goal is simply to earn a comfortable income for yourself by doing something you love, then this book can help you explore the idea of business ownership. Its not going to help you launch the next Google or Microsoft, though. Lancaster is all about nickels, not about dollars. [my review] C+Hard Times: An Oral History of the Great Depression by Studs Terkel (1970)In 1970, writer Studs Terkel published Hard Times: An Oral History of the Great Depression, which features excerpts from over 100 interviews he conducted with those who lived through the 1930s. Terkel spoke with all sorts of people: old and young, rich and poor, famous and not-so-famous, liberal and conservative. The book is fascinating. Its one thing to read about the Great Depression in textbooks, or to hear it used as leverage in political speeches, but its another thing entirely to read the experiences of the people who lived through it. [my review] A-

That's it! If you find any reviews I missed, let me know so that I can add them to this index.

I consider this a living article. I plan to add to it with time. As I re-publish old reviews that are currently unpublished, I'll add them here. And as I write new reviews in the future, those will get added to the list too.

Know of a money book that I should read and review? Drop a line to let me know!

Shares 139

https://www.getrichslowly.org/money-books-index/

0 notes