#p sure it was a very low like 0.1 chance of it

Note

Is it actually worth it to invest in stocks? Not like crypto, but like five dollars a month with something like "acorns" (I saw it recommended on that budgeting app "mint" that I use)

Oh also with the stocks question, is it worth it to get a 401k or IRA or whatever? Thanks xxxx

Quick disclaimer up front: I'm not an investment professional, advisor, or financial planner. This is just what I've gathered from the research I've done, so make sure to do your own research before making any financial decisions. If you're interested in learning more about investment options, Investopedia is a good place to start.

Whether or not you should invest depends somewhat on your personal financial situation, but in general, it's a good idea as long as you're approaching it the right way.

That said, investing in general is a good idea. Investing allows you to "put your money to work"- basically, it allows you to use money you're not using to make more money. For example, if you invest $5000 in the stock market and get a 10% return reach year, after 5 years, you'll have $8,053. And if you contributed $100 each month for those 5 years, at the end you'd have $15,394. If you do that for 30 years, your investment will grow to $284,799. That's a huge amount of money for a pretty small up-front investment. If you contributed $100 up front and then $5 a month for 5 years, you'd have $556 at the end of that 5 year period. The potential for money to "grow" is why investing is worth it. There are a few other reasons why people invest their money as well. It allows people to save for retirement, it can help them to reach their fiancial goals for the future, and it can allow people to reduce the amount of money that they're taxed on.

There are a number of different options for how you can invest money. The investment option that will work best for you depends on how much risk you're willing to take on- the chance that your investment will produce a lower-than-expected return or that your investment will lose value. Investing in something like crypto is high risk, since the market is volatile, but it can also be high-return. For example, in 2021, Bitcoin increased in value by 63%, but in 2022, it lost more than 50% of its value. Something like a saving's account is very low-risk, but the return is also low, about 0.1% a year.

I want to take a quick detour here to talk about high-risk investments. I think a lot of people, especially young people, treat investing kind of like gambling, where it's a get-rich-quick scheme. They're interested in high-risk, high-reward investments because they think that they can become millionaires if they just pick the right stocks. But that's not really the case. A 2020 report found that over a 15-year period, nearly 90% of actively managed investment funds failed to beat the market- meaning that if a person had invested their money in the S&P 500, they would have made more money than if they invested their money with a professional who's paid to pick stocks. So unless you're an professional with a great track record, hand-picking stocks to invest in is almost always a bad idea. It's unlikely that you'll buy stock for a "unicorn" company, and if you're being given advice to invest in a certain asset, it's almost definitely too late for that advice to be profitable. It's boring, but the best approach is usually to invest in something safer and to wait for it to become profitable over time.

The first type of "investment" you'll want to make is just a saving's account. This account should have enough savings to get you through six months of being unemployed. Once you have a "rainy day" account, then you can start thinking about other investment options.

Here are a few investment options you might consider, and a few pros and cons for each one:

Savings account: an account you have at a bank or a credit union

Risk free

very low interest rates- currently about 0.1%

can withdraw money whenever you want

Certificate of Deposit (CD): an investment product where you let banks borrow your money for a low interest rate over a period of time

low risk

better interest rates than a savings account- currently about 0.4% for a 1-year CD and 0.6% for a 5 year CD.

can't withdraw money over the length of the period of time where the bank has the money. This time period can be between one month and several years. The longer the period of time, the higher the interest rate that you get.

Bonds: loans that are made to raise capital for projects or to finance business operations.

lower returns than stocks- between 5-6% for long-term government bonds

some risk: the borrower might not be able to pay the money back.

bonds can struggle to keep up with inflation. For example, if a bond pays a 4% yield and inflation is 3%, the bond's real rate of return is 1%.

Bonds from governments are low-risk, since they're unlikely to run out of money. Bonds from companies like Apple, Amazon, or Netflix have higher risk, but can also have higher returns.

The return on a bond will also depend on the length of the bond. Short term bonds have a smaller return than long term bonds.

Stocks: an investment where you purchase a small part of a company and get access to the company's earnings.

a compounded return of 7-8% each year, accounting for inflation

can pull money out any time if you need it for something else

if the company becomes very successful, you can sell your stocks for more money than you spent on them

higher risk, since companies can lose value or go bankrupt

the stock market can crash, such as in 2008-2009

investments are not insured, so if the stock market crashes, you lose the money you had invested

you will likely see loses over short periods of time, but over long periods of time, stocks are typically profitable

risk can be lowered if you invest in a fund

Mutual Fund : stocks from many different companies are pooled together in one fund

reduces risk because it allows investors to not be dependent on the success of one company

Index Fund: buys stocks and assets that make up a "market index" such as the S&P 500 or Dow Jones

reduces risk because these companies are stable

requires less management than other types of stock investing

Cryptocurrency:

high risk, since the crypto market is volatile

high reward; individuals who bought Bitcoin for ten cents in 2009 could have sold for $17,527 in 2018

difficult to predict when to sell

Retirement plans: a plan that allows you to save for retirement. It's important to have one of these plans because Social Security benefits are typically not enough to live off of once a person retires.

401K: a retirement plan that is offered by an employer

you contribute a portion of your paycheck or income to the 401k and choose savings or investment options to help your account grow

contributions are pre-tax, which reduces annual taxable income and tax liability, but 401k is taxed when you withdraw it

federal legal protection

many employers will match the contributions that you make to your 401k, which doubles the money you have in your account

if you want to withdraw your money early, you have to pay a fee (typically 10%)

higher annual contributions than an IRA

IRAs: a retirement savings tool

no matching from employer

future withdrawals are tax-free for Roth IRAs but are taxed upon withdrawal for traditional IRAs

maximum annual contribution of $6000

more investing options than a 401k

more control over costs

6 notes

·

View notes

Link

https://link.medium.com/w3EzDMrcj8

There’s no other way to say it, so let me just speak frankly. Thanks to Donald Trump’s stunning lack of leadership, America’s in a state that can only be described as free fall. Rarely in history has a nation descended into chaos, depression, despair, and mass death at all. But this fast? It’s unprecedented — outside of true authoritarian implosions, that is.

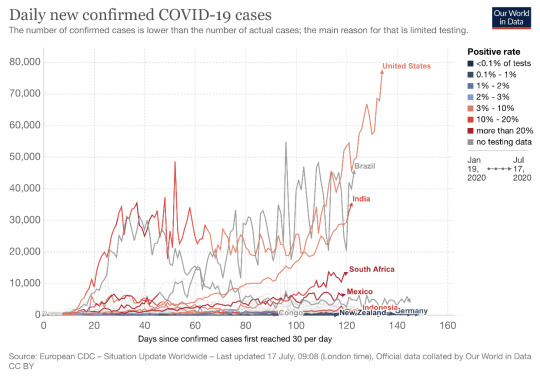

How bad are things in America? Unbelievably, shockingly, incredibly bad. Let’s begin with Coronavirus, and then proceed through economics, to politics and society.

America recorded its highest number of cases ever just yesterday. 76,000. Seventy six thousand. That’s edging perilously close to the threshold at which a society breaks down — somewhere north of 100,000 or so. At that point, schools and universities shut down, hospitals are overwhelmed, depression sets in, job losses go permanent, there’s a widespread and long-term loss of confidence, faith, and trust. “Wait,” you might say, “all of that’s already happening!” Exactly. The threshold is being reached, day by day. A vicious spiral of social collapse is now setting in.

So how bad is 76,000 new cases a day — apart from igniting a chain reaction of social collapse — in global terms? America still has the highest number of new cases in the world — higher than Brazil’s 50K, or India’s 30K. where individual Red States have worse outbreaks than many of the world’s poor countries with far higher populations. Florida, for example, has close to 15,000 new cases alone. That’s more than Pakistan, where even if you quadruple the official number, 2,000, Florida’s close to more than twice that.

The EU — as a whole — had about 5,000 new cases. America has more than fifteen times the number of cases Europe has. Texas alone had more than twice the number of cases — at more than 10K — than the entire EU. The population of Texas is 7% of the EU’s.

Coronavirus is a catastrophe of epic, surreal, nightmarish, global proportions in America. America is now the world’s biggest Coronavirus incubator — and its greatest failure. Sure, Brazil and India are about to give it a run for its money — but that isn’t saying much, only getting to the root of the problem. All these countries have authoritarian, nationalist, neofascist leaders — whose supremacist, Darwinist pseudo-philosophies — the weak must perish so the strong survive — have allowed a lethal pandemic to go thermonuclear.

That brings me to deaths. There was a faction of Americans who, just a few weeks, ago, seemed to glibly believe that even if the virus ticked back up, deaths wouldn’t. The unspoken reasoning was, again, Social Darwinist: “All the weak — the elderly, frail, sick — have been killed off! The death rate won’t go back up! So there’s nothing to worry about!” This was the illogic and amorality of the American Idiot at its most egregious.

The death rate is now spiking back upwards.

After falling to a low of about an average of 500ish per day, it’s back to close to 1,000.

The death rate lags the infection rate by about two to three weeks. And so as the virus exploded in America over the last two to three weeks, it was eminently predictable that the death rate was going to spike, too. That is exactly what happened: after a short lag, deaths are now exploding all over again. They are going to continue exploding, just like the daily infection numbers are.

Why? Because Covid is a lethal virus. In America, it has a mortality rate of up to about five percent so far. Now, perhaps that number doesn’t take into account those with Coronavirus who haven’t been tested. Go ahead and make that number lower. 4%. 3%. Fine — half it. 2.5%. That’s still shockingly high. That’s orders of magnitude more deadly than the flu. It’s not the flu. It’s deadly. It doesn’t just kill off the elderly and weak. It kills, period. Sure, you might have a smaller chance of dying if you’re young and strong. Or you might not, depending on how much of a dose you get, and how fast you get treatment. Covid is not the joke it’s been made out to be.

That brings me to political leadership. Nobody much in America seems to have done the most basic work when it comes to understanding Coronavirus, certainly not its leaders. Why isn’t the mortality rate to date — which is unbelievably high — the stuff of everyday knowledge? Even if you want to halve it, by imagining that testing isn’t widespread enough to establish a decent estimate, you still get to a mortality rate of 2.5 percent.That’s still…shockingly high. The flu, by contrast, has a mortality rate of about 0.1%.

And yet when that kind of basic knowledge hasn’t sunk into people’s brains — especially American Idiots — you can expect that people won’t understand they’re playing with fire, and they’re going to get burned.

Nobody is discussing these basic facts because, well, even the good guys are too busy trying to fight the Idiot-in-Chief’s stupidity. A decent President — just a sane and civilized human being, whatever their politics — would have said three things by now.

“This is not the flu, my fellow Americans. This is a killer virus with a mortality rate fifty times that of the flu. You are at real and serious risk of dying, and so are your loved ones. It does lasting damage, too. You don’t want to get this virus. Everything you do these days should begin with that. And then you should think: you don’t want to spread this virus, either. We are in serious trouble, and we need to work together now to get out of it.”

But Trump, of course, hasn’t said any of that. He’s done just the opposite — denied, minimized, pretended it will magically go away, told people to drink bleach…and then he’s headed off to the golf course. What the? So of course Americans have no idea how bad Coronavirus really is — who’s telling them? Not their President. Not their political leaders. And I don’t read about it in the pages of American media, either.

Hence, without an understanding of how deadly and serious this disease really is, three fatal things have happened.

One, America still has no national strategy to beat the virus — without which it will just go on exploding, which is what global success stories like New Zealand and South Korea tell us, having had swift, decisive national strategies. America’s having a Coronapocalypse precisely because even now there’s nothing — nothing — resembling a national strategy of best practices.

Two, the American Idiot has free reign, since there’s no general understanding that yes, Covid really is a killer virus. Just yesterday, the governor of Georgia made it illegal to make people wear masks. Wait, what? Made it illegal not to wear a mask, surely. Nope — to make people wear one. This is the kind of thing that drops the jaws of my friends from…everywhere. Canada, Europe, Asia, Africa.

But the American Idiot is spreading this virus. The American Idiot has turned America into the world’s greatest viral incubator, precisely because there’s no real understanding in America of how deadly Covid is, and so the American Idiot can respond with his usual…idiocy. “Freedom! It’s not a big deal! It’ll go away! Stop being such a p*ssy!! Man up!!”

Somebody needs to say right back to this kind of massive, massive idiot…the truth. Corona is a lethal virus with a shockingly high mortality rate which does lasting and serious damage even if you survive it. It is not a joke. It is like a tiny nuclear bomb: something with the power to wreck a society.

That brings me to my third point. America now stands on the brink of lasting and historic ruin.

While we’ve all been focused on how fast and far the virus is spreading, economically, a shocking and terrible thing has happened. Unemployment claims have stayed north of a million per week…since the pandemic began. This week, again, they came in at 1.3 million.

These numbers are astonishing, jaw-dropping, unreal. How many Americans is that, unemployed now? Easily north of 25%. The weekly numbers are coming in so fast that it’s impossible to say for sure. For now, it’s a Biblical deluge of economic pain with no end in sight.

What does a sudden wave of mass unemployment do? It causes a sudden stop in spending. While much is made of retail sales going back up, that’s neither here nor there — real personal consumption expenditures have fallen off a cliff, and aren’t at anywhere near normal levels. The reason for that is simple: people are getting poorer, as their jobs simply disappear.

As consumption falls, businesses shutter their doors, for good, especially the small and medium sized ones which are the backbone of a healthy economy. There are clear signs that’s beginning to happen, too.

And as that happens, unemployment goes permanent. An economy is poorer for the long-term, less dynamic, creative, fulfilled, employed, able. Bang! Now there’s a depression — another kind of chain reaction, falling spending leading to bankruptcies which causes unemployment and so on.

And that Biblical deluge of economic pain, like the pandemic, is almost impossible to stop, too. At least without a plan. Yet just as there’s no plan to end the pandemic in America, there’s no plan to end the economic pain, either. The $600 a week some Americans — too few — are able to get, after much difficulty, is about to come to an end. They were only offered one week in additional support, anyways. Contrast that with Europe — where, for example, in France, people were furloughed at 80% of their incomes up to about $10K a month, or Italy, which froze mortgage payments and rents. The Trump Administration and Congress have done literally the least they could get away with in America, and the result is that a depression is now very clearly emerging.

And there’s no plan to offer economic help now, at the precisely the moment it’s needed most — when the virus is going thermonuclear, and the tiny, tiny aid package offered a few months ago is running out. What happens then? A massive depression does, just like the which is obviously beginning to hit now. Walk down the street and tell me how many local shops are closed. How many are never going to reopen. Tell me you feel happy and safe and confident spending money these days. I didn’t think so.

America’s in free fall. It’s having a public health crisis, an economic crisis, a social implosion, and a political implosion all at once. And all those things have been brought to you by Donald Trump, whose negligence, irresponsibility, recklessness have allowed them to flourish. He’s had plenty of help from his Army of American Idiots, too — who believe free-dumb is the right to get and spread a deadly virus, like Georgia’s flagrant moron of a governor, who made it illegal to make people wear masks. Trump and his Idiot Army have made America into something even worse than a Third World Country — which is a mildly insulting term, I’m told, but let’s go with it. Even far, far poorer countries are doing better than this combination of catastrophes.

None of this is happening anywhere else in the rich world. It is only happening in countries run by men like Trump — Brazil, India, Russia. But sane and civilized societies? Canada, Europe, New Zealand? They look at America with a kind of horrified disbelief. My European friends literally don’t believe me when they ask, and I try to tell them the state of play in America, because it’s not been allowed to happen in their happier nations. It’s literally beyond their capacity to process. They stand there, dumbstruck.

And yet even far, far poorer countries like Vietnam, or rising ones, like South Korea have beaten back the virus, and are lifting their economies back up. Nobody in the world is in free fall like America.

But America is led by a Psychopath-in-Chief, who’s backed by an Idiot Army, who are fighting for the virus, its depression, its social implosion — not against all that. And so how much more pain is yet to come? Economic, human, social, psychological? So, so much.

Umair

July 2020

0 notes

Link

FxPro Group Limited, a Forex and CFD broker, which is based in Cyprus and is regulated by CySEC, ASIC and FSA UK. The main client base of FxPro consist of retail clients, traders like me and you, however currently FxPro aims to grow in the institutional Forex market. The broker was established in 2006 in Limassol, Cyprus and it is currently headquartered there. In addition to Cyprus, FxPro offices are located in Australia, Austria, France, Spain, Russia and UK.

MetaTrader 4

cTrader

Live Support

Islamic Account

US Traders

Please note that traders from the US and Canada are not accepted, thus if you are a resident of these countries, it is recommended to look at other top brokers.

FxPro Key Fetaures

FxPro is extremely innovative and a trustworthy online broker. It is considered to be one of the best Forex brokers due to the outstanding services, great trading conditions and wide selections of the trading platforms.

Trading currencies online with FxPro is a great experience due to the following reasons:

Wide range of trading platforms available, including MetaTrader4 and cTrader

Live chat and support in more than 15 languages

No limitations; Forex scalping, high frequency trading and expert advisers are allowed

Direct market orders

Full market depth

Numerous downloadable books and trading tools

Extensive range of deposit and withdrawal methods

These items make FxPro one of the best forex brokers on the market. Nevertheless, we are strongly aiming for telling you the truth, thus the negative points will be also covered.

FxPro Weak Points

In general, beginners are looking for deposit bonuses to boost their trading balance and unfortunately deposit bonuses are not applicable with FxPro. The main reason for this is that FxPro tries to attract high volume traders by providing superior trading conditions. However, it is also understandable that the bonuses can be of a primary importance for beginners in the world of financial instruments trading.

Trading accounts

FxPro has a relatively simple range of the trading accounts, but the trading conditions of these accounts will suit anyone.

Demo Account

When you are just beginning your trading activities and you are still not sure if this broker is right for you, click here to open your free practice account with FxPro and preview all of the available platforms and account set ups.

The registration process is rather easy, you only have to disclose your name and e-mail address. Also, at this stage you are allowed to select a trading platform, account balance and currency, as an example below:

The good thing about FxPro Demo account registration is that you have a chance to remove yourself from their mailing lists straight away and you receive extensive amount of services even as a demo user:

This account will give you an overview of trading conditions, introduce you to trading platforms and will allow you to start trading with zero risk involved.

If you open a practice account, you will always have an option to upgrade to a real trading account.

FxPro Real Account

This type of account is will provide you with an access to MT4 and cTrader trading platforms, as well as numerous mobile trading applications and web traders.

Registering a real account would be rather more time consuming, since the regulators require a broker to collect quite some personal information from you, including you address, employment data, trading experience, investment knowledge, copy of your ID and the proof of residence.

Do not be afraid when you see such a bulky registration form, it generally means that you are dealing with a financial organisation rather than a scam.

After you have completed the registration, you will be able to choose from one of two following accounts:

MetaTrader 4 Account

The minimum deposit for MT4 trading account is 500 USD or equivalent in any accepted currency.

It is possible to trade Spot Forex, CFDs on spot gold and silver, futures contract for oil, gas, wheat, soya beans and corn, as well as CFDs on indices.

Forex spreads at MT4 account are quite lucrative, starting from 1.2 pips.

The leverage can be set manually, up to 1:500.

A minimum size of an order is 0.1 lots, which is rather large, since most of the brokers offer a minimum of 0.01 lots.

There are numerous currency pairs offered at FxPro with extremely attractive spread. Also you can trade with some exotic pairs like USD/ZAR, but the average spread for exotic pairs can be rather large.

When it comes to CFDs on stocks trading, FxPro also does a great job as for the trading conditions, a spread as low as 0.04 is offered while an additional 0.1% commission is charged on the of the deal. These CFDs can be traded anytime between 16-30 and 23-00 server time, from Monday to Friday.

FxPro offers a great variety of the most popular trading indices, like S&P 500, DJ, Nikkei 225, Dax and much more. All of the trades are executed with a fixed commission of 15 USD per one standard lot. A required margin to open 1 lot size deal starts from 500 USD.

In addition to the desktop version, FxPro offers MT4 Multi terminal, MT4 WebTrader and MT4 available at any mobile device.

cTrader Account

If it is your first hearing about cTrader, you should just go ahead and check out the demo now. Trading with cTrader becomes very comfortable, intuitive and efficient.

cTrader accounts is ECN based, meaning it provides you with the fastest speed of execution as well as with assurance of never receiving a requite.

One of the best thing about cTrader is the offered spread, which can be so low as 0 and is averaged to 1 on the major currency pairs. However, to compensate such an attractive spread, FxPro charges a small commission, around 6.5 USD per opening and closing a position.

There are numerous currency pairs available for trading with cTrader and spot metals are also offered. If you are looking to trade indices and CFDs for stocks, then you would rather look at FxPro MT4 account, however if you execute fx trades, then cTrader will be your paradise.

There are numerous powerful charting tools available at this platform, possibility to make screenshots of your charts and even stream them! Moreover, cTrader is available for as a web version, so if you are always on a go or you simply have an Apple computer, then cTrader is right for you.

Besides that, an analogue of MT4 Expert Advisors – cAlgo is offered. Generally saying, cAlgo provides traders with enormous possibilities for making trading robots and custom indicators using a programming language c#. Also, there numerous developers sharing their code, so one can easily apply the ready-made robots and indicators and even back test them.

To apply for a real cTrader account a minimum deposit of 1000 USD is required.

FxPro Bonus Conditions

Generally, FxPro does not offer any bonuses. However, if you are looking to make a reasonably large deposit, it would make sense to contact their sales or even a support chat and ask for a bonus. If you are planning to deposit more than 10,000 USD, then you can easily get 10% bonus upon the completion of a certain trading volume.

FxPro Trading Software

In general, FxPro offers two types of trading software – MT4 and cTrader, however if we calculate all of the versions, we will come to the result that 10 trading platforms are offered.

Let’s examine these trading platforms below:

FxPro Deposits and Withdrawals

FxPro does a great job providing its clients with the most flexible ways of placing the money on the trading account and getting them back.

Following Deposit/Withdrawal methods are available:

Credit/Debit cards – Visa, MasterCard, processing time is up to 1 hour

Neteller – E-wallet system, usually processed within one hour

PayPal – very common E-wallet system, processing time up to 1 hour

Skrill – previously known as Moneybookers, processed within an hour

Wire Transfer – a simple transfer from one bank account to another takes 3-5 days

FxPro Support

All of the clients of FxPro are provided with excellent customer service via e-mail, live chat and call back options. Also, FxPro provides access to the knowledge center, where you can find answers to the questions on your own. According to our research, FxPro live support response time and waiting time is one of the best in the industry. As for the level of support friendliness, FxPro scored the first!

FxPro Review Summary

FxPro is a broker for professional high volume traders and it provides superior trading condition. As for the licenses, it is authorized by numerous authorities, CySec (Cyprus) and FSA (UK), as well as AISIC (Australia). Besides that, FxPro is one of the most awarded broker, which has been elected as a most innovative Cyprus broker, best institutional broker and many more!

The practice accounts are available for free and the minimum deposit required for real account trading is 500 USD. FxPro supplies the tightest spreads starting from 0, stable trading environment and greatest support.

As for the trading conditions and software, FxPro currently has the most innovative trading platform – cTrader. Also, MT4 trading via desktop and web applications is possible. Besides that, mobile trading on any device is supported.

It can be said that this forex broker is highly recommended for experienced traders. However, new traders are also advised to try FxPro, even if your deposit is small, you can still benefit by trading with the best. So sign up for a free demo account here and check out one of the most outstanding foreign exchange broker!

via Kenya Forex Firm LTD

0 notes

Text

Why The NFL Can’t Rely On Defense

In an NFL season marked by historic offensive production and a championship round that was conspicuously absent a top-10 defense,1 aficionados of low-scoring rock fights, filled with punts and field goals, have been left disappointed. The best defensive teams to make the playoffs were eliminated early in the tournament, with the Bears, Ravens and Texans all losing in the wild-card round. A week later, Joey Bosa and the emerging Chargers defense were dismantled by the Patriots, and the Cowboys — perhaps the best defensive team left in the divisional round based on their end-of-season play — lost to the Rams. Extracting the strong defensive teams with relatively weak offenses led to historically exciting playoff football, producing two overtime games in the championship round for the first time in NFL history. Now we have a Patriots and Rams Super Bowl pitting perhaps the greatest QB of all time in Tom Brady against the hottest young offensive mind in the league in Sean McVay.

We shouldn’t be surprised that great offensive teams have made it this far. Teams are more reliably good — and bad — from game to game and year to year on offense than on defense. Individual defenders often have wild swings in performance from season to season, and defensive units forecast to be dominant often end up being merely average. The Jacksonville Jaguars’ defense took them as far as the AFC championship a year ago, but that same defense led them to five wins this season. Meanwhile, performance on offense is generally easier to forecast, making investments on that side of the ball more reliable.

Even then, football is largely unpredictable. When an otherwise sure-handed Alshon Jeffery2 lets a well-thrown Nick Foles pass sail through his fingers for an interception to end the Eagles season, or when Cody Parkey double-doinks a partially blocked field goal to end the Bears’ playoff hopes, we are essentially cheering, or bemoaning, randomness. Most vexing for forecasters and league observers trying to make sense of things is that the plays that matter the most in football are often the most unpredictable. But again, this is particularly true on the defensive side of the ball.

Turnover margin is the canonical example. Teams that win the turnover battle go on to win their games at a very high rate. Home teams win about 73 percent of their games when they are plus-1 in turnover differential, according to data from ESPN’s Stats & Information Group, and the home team win rate climbs to more than 86 percent when it’s plus-2 or better.

Yet despite their clear importance, the number of turnovers a team creates in one season has no bearing on how many turnovers the team will create in the next. Both interceptions and fumbles are completely unpredictable from season to season at the team level. And this pattern holds true for defense in general. If we measure the stability of defensive stats from one year to the next,3 we find that compared with offensive performance, most defensive stats are highly variable from year to year.

Defensive performance is unpredictable

Share of performance across various team-level metrics predicted by the previous season’s performance in the regular season, 2009-2018

metric Share predicted Total offensive DVOA 18.9% Offensive passing DVOA 18.8 Defensive passing DVOA 10.0 Offensive rushing DVOA 9.7 Total defensive DVOA 9.7 Defensive rushing DVOA 8.3 Sacks 3.6 Interceptions 2.4 Fumbles 1.6

Source: Football Outsiders

High-impact plays on defense turn out to be the least predictable. And while we’re by no means great at identifying which teams will succeed on offense, offensive DVOA is about twice as good at forecasting future performance as defensive DVOA.4

For teams like the Chicago Bears, who won 12 games despite fielding the 20th best offense in the NFL, this has major ramifications. The Bears were third in the league in turnover margin and third in sacks — feats we shouldn’t expect to repeat based solely on this season’s results. (Just ask the Jags.) Casting even more doubt on their ability to field an elite defense in back-to-back years, Chicago also lost its defensive coordinator, Vic Fangio, who left to become the head coach in Denver, further destabilizing the strength of the team.

Still there is some hope for lovers of the three-and-out. While rare, there are plays a defense makes that do tend to carry over from year to year. One of the most stable defensive stats is hits on the quarterback, which has a relatively impressive year-to-year r-squared of 0.21 — better even than total offensive DVOA, which is the gold standard for stability in team metrics. Quarterback hits include sacks — 43.5 percent of QB hits end in a sack, and those by themselves tend to not be predictive — but also plays in which the passer is contacted after the pass is thrown, and that contact is incredibly disruptive to a passing offense.

When a quarterback is hit, his completion percentage is affected on a throw to any part of the field.5 Teams that can generate pressure that ends with contact on the opposing QB greatly improve their chances of causing incompletions and getting off the field. And best of all, teams that are good at generating hits on the quarterback tend to stay good at it.

Philadelphia led the league in QB hits but not sacks

Total quarterback hits, sacks and expected sacks for teams’ defensive lines in the regular season, 2018

Team qb hits Sacks expected sacks Difference Philadelphia 123 44 53.5 -9.5

–

Pittsburgh 110 52 47.9 +4.1

–

N.Y. Jets 109 39 47.4 -8.4

–

Seattle 105 43 45.7 -2.7

–

Kansas City 101 52 43.9 +8.1

–

L.A. Rams 99 41 43.1 -2.1

–

Baltimore 96 43 41.8 +1.2

–

Chicago 95 49 41.3 +7.7

–

New Orleans 95 49 41.3 +7.7

–

New England 93 30 40.5 -10.5

–

Dallas 92 39 40.0 -1.0

–

Washington 91 46 39.6 +6.4

–

Jacksonville 90 37 39.1 -2.1

–

Tampa Bay 88 38 38.3 -0.3

–

Denver 86 44 37.4 +6.6

–

Houston 86 43 37.4 +5.6

–

Minnesota 86 49 37.4 +11.6

–

San Francisco 85 37 37.0 +0.0 Arizona 83 49 36.1 +12.9

–

Buffalo 83 36 36.1 -0.1

–

Cleveland 83 37 36.1 +0.9

–

N.Y. Giants 81 30 35.2 -5.2

–

Cincinnati 80 34 34.8 -0.8

–

Tennessee 80 39 34.8 +4.2

–

L.A. Chargers 77 38 33.5 +4.5

–

Detroit 74 43 32.2 +10.8

–

Indianapolis 74 38 32.2 +5.8

–

Atlanta 73 37 31.8 +5.2

–

Miami 73 31 31.8 -0.8

–

Green Bay 71 43 30.9 +12.1

–

Carolina 68 35 29.6 +5.4

–

Oakland 48 13 20.9 -7.9

–

Show more rows

Sources: NFL, Elias Sports Bureau

The Eagles, Jets and the Seahawks all appear to have better days ahead of them on defense. Each team racked up more than 100 QB hits in 2018. But they also experienced bad fortune, converting their hits into sacks at a rate below what we’d expect. If these teams generate similar pressure next season, we shouldn’t be surprised to see their sack totals rise just based on reversion to the mean. Meanwhile, Chicago, New Orleans and Kansas City experienced good fortune in 2018, converting their QB hits at a rate higher than we’d expect. Assuming the defensive lines return largely intact, we probably shouldn’t be surprised to see their sack totals dip next season.

Stats like QB hits are rare to find on defense. And because of the high variance in defensive performance, teams built with a defense-first mindset end up controlling their own destinies less than we might expect. When it comes to team-building, this suggests that investments on offense are better long-term bets for stability. The results this year are particularly encouraging. Lighting up scoreboards by focusing on scoring points instead of preventing them has proved to be both successful and incredibly entertaining to watch. For this season at least, defense isn’t winning anyone a championship.

Check out our latest NFL predictions.

from News About Sports https://fivethirtyeight.com/features/why-the-nfl-cant-rely-on-defense/

0 notes

Text

Cash Management Is Really All About Stress Management

At any given time, every investor must always decide three things:

1) How to invest their new cash flow

2) How to invest their existing cash

3) How to reposition their existing investments if at all

As long as enough money is coming in to cover your expenses, life is fairly good. As our cash hoard grows, there’s also less financial stress because you can more easily cover unanticipated emergencies like a furlough.

In general, having 6 – 12 months of living expenses in cash or cash equivalents is good enough for the average person to sleep soundly.

There might come a point, however, when you will have excess cash. Perhaps you were undisciplined in your monthly dollar cost averaging strategy or maybe you got a bigger windfall than anticipated.

Whatever the case may be, your financial anxiety will be replaced with the fear of missing out on potentially bigger gains in risk assets like stocks and real estate. Given your peers are all getting rich, you will want to follow suit.

If enough greed kicks in, you will end up taking on more risk than you can comfortably withstand, and sometimes bad things will happen. Your financial stress returns once again. Hence, one benefit of following Financial SEER.

No matter how much money you have or how much you make, you will always have to work on managing your financial stress. After all, the more money you have, the more you have to lose! When you are broke, you’ve only got upside.

Money is mental. Psychology is why during market sell-offs, there will be headlines about stocks re-testing Great Depression lows. And during bull runs, there will be headlines about how the sky is the limit and you just can’t lose.

I didn’t do much right financially in 2018 except for continuing to aggressively save. But I did make one move with my existing savings that helped reduce financial stress.

Managing Stress Through Savings

Back in early 2018, I was getting nervous about the stock market. We’d seen an almost 10% pullback in February that jolted me awake. Ever since I left my day job in 2012, I’d been regularly plowing the majority of my cash flow into the stock market and San Francisco real estate market.

After all, my #1 goal is to earn enough passive income so neither my wife or I have to go back to work. With the likelihood of private school expenses coming up in 2022, we have a goal of earning at least $250,000 a year in passive income to stay jobless.

When the correction hit in February 2018, I realized my risk exposure was too high for my comfort. As a result, I slowly started reducing my stock allocation from 70% to 52% as stocks recovered into the summer.

But when you reduce your stock exposure during a rising market, you begin to question your decision because you start getting greedy. You start imagining whether you’re missing out on more gains by being too conservative. I was tempted to take on more risk again.

But when I got an e-mail from CIT Bank that they had raised their money market rate to 1.85% and their 12-month CD rate to 2.25%, I beat back my greed. Just a year earlier, money market rates averaged well below 1%. I still remember only receiving a 0.1% money market rate circa 2015.

1.85% for a money market rate and 2.25% for a 12-month CD rate seemed pretty good. As a result, I decided to lock in a 2.25% guaranteed return for 12 months on July 16, 2018, instead of investing the money in the S&P 500 or the forever tempting FAANG stocks, which I was already heavily overweight, given I live in San Francisco.

As soon as I bought the 12-month CD, I felt a sense of relief. I remember thinking to myself, “Ah hah! Nobody can take away my money now!” I felt my stress melt away as I could now focus on more enjoyable things in life.

Although I’m only earning about ~$190 a month in interest income, it feels wonderful to know my money is secure. Because I generate excess cash flow every month, I constantly have to figure out where to invest the money in order to at least keep up with inflation.

Locking up money in long-term private investments or illiquid investments like real estate enables me to stop worrying so much about how to reinvest my cash flow.

Stay Financially Disciplined

As an investor, you must not only come up with some reasonable earnings and valuation forecasts, you must also take action based on your forecasts.

My analysis said that 2,800 on the S&P 500 was close to fully valued. We were almost back to the peak seen in January and I told myself if we got past 2,800, I would dial down risk, and that’s what I did in July.

The S&P 500 continued to rise until September when it reached 2,929 as the bull market raged on.

Was I fighting the urge to chase the momentum? Of course. But I still had 52% of my public investment portfolio in stocks, so I was still benefitting, although not to the fullest.

It was also important for me to remain disciplined and look at my overall risk exposure and net worth. I never want to have more than 30% of my net worth in equities. However, I was bumping around that upper limit due to the reinvestment of part of my house sale proceeds in equities.

If I had invested $100,000 in the S&P 500 on July 16, 2018, it would have been worth roughly $104,600 by September 30, 2018. But on December 17, 2018, it would have declined in value to just $86,000.

At the end of the year, the $100,000 would have rebounded to $90,600, but still down a hefty 9.4% since July 16, 2018.

Meanwhile, since opening the 12-month CD, it has thus far earned $1,038 in interest for a return of 1.038%. In other words, the difference between this 2.25% CD and the S&P 500 was roughly 10.438%, or $10,438 from July through Dec 21, 2018. Not bad.

Therefore, the next time you scoff at a money market or CD account rate, don’t. Not only can a money market or CD account drastically outperform risk assets, but they also have the added benefit of giving you incredible peace of mind during a downturn.

All I was thinking during the 4Q2018 meltdown was why I didn’t put more money into a CD or money market account. If I had invested my entire House Sale Fund, it would have earned $3,750 a month, or $45,000 a year with absolutely zero stress.

During 4Q2018, there were many mornings where I’d naturally awaken by 4am because my mind couldn’t rest knowing that another meltdown might possibly be right around the corner. That wasn’t very healthy and a sign that I still had to much at risk.

Time To Lock In Another Win

After such a long bull run, my goal all year is to use ~70% of my cash flow to lock in wins and use the remaining 30% of my cash flow to invest in risk assets when opportunities arise.

I’m excited I recently got another message from CIT Bank saying they have raised their Savings Builder account rate to 2.45% from 1.85%. That’s right. Their money market account, not their CD account, is paying 2.45%. No 12-month lockup is required.

2.45% is solid because it is almost as high as the 10-year treasury bond yield currently 2.65%. But with the 10-year treasury bond, you’ve got to hold it for 10 years to guarantee yourself a 2.65% annual return. During this time, you might lose or gain principal.

Earning 2.45% isn’t going to make you rich. But earning 2.45% is better than earning a negative 6.4% in the S&P 500 in 2018 (-4.8% with dividends).

There’s a good chance we could see a 10%+ rebound in the S&P 500 in 2019. But I also wouldn’t be surprised one bit if the S&P 500 declined by 10% in 2019 either.

The higher money market rate is a blessing because I’m cashed up looking for a nicer house this year. Given I don’t know when I’ll find the next house, it’s nice to have the flexibility of withdrawing my cash at any time, while also earning a high interest rate.

Take advantage of the Federal Reserve’s rate hikes.

I’m sure there are plenty of other banks, especially online banks, that are now providing higher rates this year. You’ve just got to ask around. There’s nothing wrong with protecting your wealth after making so much since 2009.

As for my financial stress this year, it’s way down from 4Q2018 because not only is my cash earning a much higher return, the stock market has rebounded by over 11% since December 24, 2018. Just like that, it’s back to good times and I plan to keep it that way.

My overall public investment portfolio is up a modest 4% for the year and I’m seriously considering locking in gains and reinvesting all the proceeds in a 2.45% savings account to end the year up a guaranteed~6.3%.

To feel no investment stress for the rest of the year would be amazing!

After all, my theme for 2019 is: live the good life. All I want is restful sleep every night so I have the energy to happily spend time with my family and write.

Doubling my net worth every 14 years with a modest 5% annual growth target is good enough for me.

Related: How Much Savings You Should Have Accumulated By Age

Readers, are you taking advantage of higher savings rates? What type of money decisions did you make in 2018 that saved you from the stock market meltdown? What type of money decisions will you make this year to ensure you grow your wealth?

The post Cash Management Is Really All About Stress Management appeared first on Financial Samurai.

from Finance https://www.financialsamurai.com/building-savings-war-chest-is-about-stress-management/

via http://www.rssmix.com/

0 notes

Text

Cash Management Is Really All About Stress Management

At any given time, every investor must always decide three things:

1) How to invest their new cash flow

2) How to invest their existing cash

3) How to reposition their existing investments if at all

As long as enough money is coming in to cover your expenses, life is fairly good. As our cash hoard grows, there’s also less financial stress because you can more easily cover unanticipated emergencies like a furlough.

In general, having 6 – 12 months of living expenses in cash or cash equivalents is good enough for the average person to sleep soundly.

There might come a point, however, when you will have excess cash. Perhaps you were undisciplined in your monthly dollar cost averaging strategy or maybe you got a bigger windfall than anticipated.

Whatever the case may be, your financial anxiety will be replaced with the fear of missing out on potentially bigger gains in risk assets like stocks and real estate. Given your peers are all getting rich, you will want to follow suit.

If enough greed kicks in, you will end up taking on more risk than you can comfortably withstand, and sometimes bad things will happen. Your financial stress returns once again. Hence, one benefit of following Financial SEER.

No matter how much money you have or how much you make, you will always have to work on managing your financial stress. After all, the more money you have, the more you have to lose! When you are broke, you’ve only got upside.

Money is mental. Psychology is why during market sell-offs, there will be headlines about stocks re-testing Great Depression lows. And during bull runs, there will be headlines about how the sky is the limit and you just can’t lose.

I didn’t do much right financially in 2018 except for continuing to aggressively save. But I did make one move with my existing savings that helped reduce financial stress.

Managing Stress Through Savings

Back in early 2018, I was getting nervous about the stock market. We’d seen an almost 10% pullback in February that jolted me awake. Ever since I left my day job in 2012, I’d been regularly plowing the majority of my cash flow into the stock market and San Francisco real estate market.

After all, my #1 goal is to earn enough passive income so neither my wife or I have to go back to work. With the likelihood of private school expenses coming up in 2022, we have a goal of earning at least $250,000 a year in passive income to stay jobless.

When the correction hit in February 2018, I realized my risk exposure was too high for my comfort. As a result, I slowly started reducing my stock allocation from 70% to 52% as stocks recovered into the summer.

But when you reduce your stock exposure during a rising market, you begin to question your decision because you start getting greedy. You start imagining whether you’re missing out on more gains by being too conservative. I was tempted to take on more risk again.

But when I got an e-mail from CIT Bank that they had raised their money market rate to 1.85% and their 12-month CD rate to 2.25%, I beat back my greed. Just a year earlier, money market rates averaged well below 1%. I still remember only receiving a 0.1% money market rate circa 2015.

1.85% for a money market rate and 2.25% for a 12-month CD rate seemed pretty good. As a result, I decided to lock in a 2.25% guaranteed return for 12 months on July 16, 2018, instead of investing the money in the S&P 500 or the forever tempting FAANG stocks, which I was already heavily overweight, given I live in San Francisco.

As soon as I bought the 12-month CD, I felt a sense of relief. I remember thinking to myself, “Ah hah! Nobody can take away my money now!” I felt my stress melt away as I could now focus on more enjoyable things in life.

Although I’m only earning about ~$190 a month in interest income, it feels wonderful to know my money is secure. Because I generate excess cash flow every month, I constantly have to figure out where to invest the money in order to at least keep up with inflation.

Locking up money in long-term private investments or illiquid investments like real estate enables me to stop worrying so much about how to reinvest my cash flow.

Stay Financially Disciplined

As an investor, you must not only come up with some reasonable earnings and valuation forecasts, you must also take action based on your forecasts.

My analysis said that 2,800 on the S&P 500 was close to fully valued. We were almost back to the peak seen in January and I told myself if we got past 2,800, I would dial down risk, and that’s what I did in July.

The S&P 500 continued to rise until September when it reached 2,929 as the bull market raged on.

Was I fighting the urge to chase the momentum? Of course. But I still had 52% of my public investment portfolio in stocks, so I was still benefitting, although not to the fullest.

It was also important for me to remain disciplined and look at my overall risk exposure and net worth. I never want to have more than 30% of my net worth in equities. However, I was bumping around that upper limit due to the reinvestment of part of my house sale proceeds in equities.

If I had invested $100,000 in the S&P 500 on July 16, 2018, it would have been worth roughly $104,600 by September 30, 2018. But on December 17, 2018, it would have declined in value to just $86,000.

At the end of the year, the $100,000 would have rebounded to $90,600, but still down a hefty 9.4% since July 16, 2018.

Meanwhile, since opening the 12-month CD, it has thus far earned $1,038 in interest for a return of 1.038%. In other words, the difference between this 2.25% CD and the S&P 500 was roughly 10.438%, or $10,438 from July through Dec 21, 2018. Not bad.

Therefore, the next time you scoff at a money market or CD account rate, don’t. Not only can a money market or CD account drastically outperform risk assets, but they also have the added benefit of giving you incredible peace of mind during a downturn.

All I was thinking during the 4Q2018 meltdown was why I didn’t put more money into a CD or money market account. If I had invested my entire House Sale Fund, it would have earned $3,750 a month, or $45,000 a year with absolutely zero stress.

During 4Q2018, there were many mornings where I’d naturally awaken by 4am because my mind couldn’t rest knowing that another meltdown might possibly be right around the corner. That wasn’t very healthy and a sign that I still had to much at risk.

Time To Lock In Another Win

After such a long bull run, my goal all year is to use ~70% of my cash flow to lock in wins and use the remaining 30% of my cash flow to invest in risk assets when opportunities arise.

I’m excited I recently got another message from CIT Bank saying they have raised their Savings Builder account rate to 2.45% from 1.85%. That’s right. Their money market account, not their CD account, is paying 2.45%. No 12-month lockup is required.

2.45% is solid because it is almost as high as the 10-year treasury bond yield currently 2.65%. But with the 10-year treasury bond, you’ve got to hold it for 10 years to guarantee yourself a 2.65% annual return. During this time, you might lose or gain principal.

Earning 2.45% isn’t going to make you rich. But earning 2.45% is better than earning a negative 6.4% in the S&P 500 in 2018 (-4.8% with dividends).

There’s a good chance we could see a 10%+ rebound in the S&P 500 in 2019. But I also wouldn’t be surprised one bit if the S&P 500 declined by 10% in 2019 either.

The higher money market rate is a blessing because I’m cashed up looking for a nicer house this year. Given I don’t know when I’ll find the next house, it’s nice to have the flexibility of withdrawing my cash at any time, while also earning a high interest rate.

Take advantage of the Federal Reserve’s rate hikes.

I’m sure there are plenty of other banks, especially online banks, that are now providing higher rates this year. You’ve just got to ask around. There’s nothing wrong with protecting your wealth after making so much since 2009.

As for my financial stress this year, it’s way down from 4Q2018 because not only is my cash earning a much higher return, the stock market has rebounded by over 11% since December 24, 2018. Just like that, it’s back to good times and I plan to keep it that way.

My overall public investment portfolio is up a modest 4% for the year and I’m seriously considering locking in gains and reinvesting all the proceeds in a 2.45% savings account to end the year up a guaranteed~6.3%.

To feel no investment stress for the rest of the year would be amazing!

After all, my theme for 2019 is: live the good life. All I want is restful sleep every night so I have the energy to happily spend time with my family and write.

Doubling my net worth every 14 years with a modest 5% annual growth target is good enough for me.

Related: How Much Savings You Should Have Accumulated By Age

Readers, are you taking advantage of higher savings rates? What type of money decisions did you make in 2018 that saved you from the stock market meltdown? What type of money decisions will you make this year to ensure you grow your wealth?

The post Cash Management Is Really All About Stress Management appeared first on Financial Samurai.

from Money https://www.financialsamurai.com/building-savings-war-chest-is-about-stress-management/

via http://www.rssmix.com/

0 notes

Text

Cash Management Is Really All About Stress Management

At any given time, every investor must always decide three things:

1) How to invest their new cash flow

2) How to invest their existing cash

3) How to reposition their existing investments if at all

As long as enough money is coming in to cover your expenses, life is fairly good. As our cash hoard grows, there’s also less financial stress because you can more easily cover unanticipated emergencies like a furlough.

In general, having 6 – 12 months of living expenses in cash or cash equivalents is good enough for the average person to sleep soundly.

There might come a point, however, when you will have excess cash. Perhaps you were undisciplined in your monthly dollar cost averaging strategy or maybe you got a bigger windfall than anticipated.

Whatever the case may be, your financial anxiety will be replaced with the fear of missing out on potentially bigger gains in risk assets like stocks and real estate. Given your peers are all getting rich, you will want to follow suit.

If enough greed kicks in, you will end up taking on more risk than you can comfortably withstand, and sometimes bad things will happen. Your financial stress returns once again. Hence, one benefit of following Financial SEER.

No matter how much money you have or how much you make, you will always have to work on managing your financial stress. After all, the more money you have, the more you have to lose! When you are broke, you’ve only got upside.

Money is mental. Psychology is why during market sell-offs, there will be headlines about stocks re-testing Great Depression lows. And during bull runs, there will be headlines about how the sky is the limit and you just can’t lose.

I didn’t do much right financially in 2018 except for continuing to aggressively save. But I did make one move with my existing savings that helped reduce financial stress.

Managing Stress Through Savings

Back in early 2018, I was getting nervous about the stock market. We’d seen an almost 10% pullback in February that jolted me awake. Ever since I left my day job in 2012, I’d been regularly plowing the majority of my cash flow into the stock market and San Francisco real estate market.

After all, my #1 goal is to earn enough passive income so neither my wife or I have to go back to work. With the likelihood of private school expenses coming up in 2022, we have a goal of earning at least $250,000 a year in passive income to stay jobless.

When the correction hit in February 2018, I realized my risk exposure was too high for my comfort. As a result, I slowly started reducing my stock allocation from 70% to 52% as stocks recovered into the summer.

But when you reduce your stock exposure during a rising market, you begin to question your decision because you start getting greedy. You start imagining whether you’re missing out on more gains by being too conservative. I was tempted to take on more risk again.

But when I got an e-mail from CIT Bank that they had raised their money market rate to 1.85% and their 12-month CD rate to 2.25%, I beat back my greed. Just a year earlier, money market rates averaged well below 1%. I still remember only receiving a 0.1% money market rate circa 2015.

1.85% for a money market rate and 2.25% for a 12-month CD rate seemed pretty good. As a result, I decided to lock in a 2.25% guaranteed return for 12 months on July 16, 2018, instead of investing the money in the S&P 500 or the forever tempting FAANG stocks, which I was already heavily overweight, given I live in San Francisco.

As soon as I bought the 12-month CD, I felt a sense of relief. I remember thinking to myself, “Ah hah! Nobody can take away my money now!” I felt my stress melt away as I could now focus on more enjoyable things in life.

Although I’m only earning about ~$190 a month in interest income, it feels wonderful to know my money is secure. Because I generate excess cash flow every month, I constantly have to figure out where to invest the money in order to at least keep up with inflation.

Locking up money in long-term private investments or illiquid investments like real estate enables me to stop worrying so much about how to reinvest my cash flow.

Stay Financially Disciplined

As an investor, you must not only come up with some reasonable earnings and valuation forecasts, you must also take action based on your forecasts.

My analysis said that 2,800 on the S&P 500 was close to fully valued. We were almost back to the peak seen in January and I told myself if we got past 2,800, I would dial down risk, and that’s what I did in July.

The S&P 500 continued to rise until September when it reached 2,929 as the bull market raged on.

Was I fighting the urge to chase the momentum? Of course. But I still had 52% of my public investment portfolio in stocks, so I was still benefitting, although not to the fullest.

It was also important for me to remain disciplined and look at my overall risk exposure and net worth. I never want to have more than 30% of my net worth in equities. However, I was bumping around that upper limit due to the reinvestment of part of my house sale proceeds in equities.

If I had invested $100,000 in the S&P 500 on July 16, 2018, it would have been worth roughly $104,600 by September 30, 2018. But on December 17, 2018, it would have declined in value to just $86,000.

At the end of the year, the $100,000 would have rebounded to $90,600, but still down a hefty 9.4% since July 16, 2018.

Meanwhile, since opening the 12-month CD, it has thus far earned $1,038 in interest for a return of 1.038%. In other words, the difference between this 2.25% CD and the S&P 500 was roughly 10.438%, or $10,438 from July through Dec 21, 2018. Not bad.

Therefore, the next time you scoff at a money market or CD account rate, don’t. Not only can a money market or CD account drastically outperform risk assets, but they also have the added benefit of giving you incredible peace of mind during a downturn.

All I was thinking during the 4Q2018 meltdown was why I didn’t put more money into a CD or money market account. If I had invested my entire House Sale Fund, it would have earned $3,750 a month, or $45,000 a year with absolutely zero stress.

During 4Q2018, there were many mornings where I’d naturally awaken by 4am because my mind couldn’t rest knowing that another meltdown might possibly be right around the corner. That wasn’t very healthy and a sign that I still had to much at risk.

Time To Lock In Another Win

After such a long bull run, my goal all year is to use ~70% of my cash flow to lock in wins and use the remaining 30% of my cash flow to invest in risk assets when opportunities arise.

I’m excited I recently got another message from CIT Bank saying they have raised their Savings Builder account rate to 2.45% from 1.85%. That’s right. Their money market account, not their CD account, is paying 2.45%. No 12-month lockup is required.

2.45% is solid because it is almost as high as the 10-year treasury bond yield currently 2.65%. But with the 10-year treasury bond, you’ve got to hold it for 10 years to guarantee yourself a 2.65% annual return. During this time, you might lose or gain principal.

Earning 2.45% isn’t going to make you rich. But earning 2.45% is better than earning a negative 6.4% in the S&P 500 in 2018 (-4.8% with dividends).

There’s a good chance we could see a 10%+ rebound in the S&P 500 in 2019. But I also wouldn’t be surprised one bit if the S&P 500 declined by 10% in 2019 either.

The higher money market rate is a blessing because I’m cashed up looking for a nicer house this year. Given I don’t know when I’ll find the next house, it’s nice to have the flexibility of withdrawing my cash at any time, while also earning a high interest rate.

Take advantage of the Federal Reserve’s rate hikes.

I’m sure there are plenty of other banks, especially online banks, that are now providing higher rates this year. You’ve just got to ask around. There’s nothing wrong with protecting your wealth after making so much since 2009.

As for my financial stress this year, it’s way down from 4Q2018 because not only is my cash earning a much higher return, the stock market has rebounded by over 11% since December 24, 2018. Just like that, it’s back to good times and I plan to keep it that way.

My overall public investment portfolio is up a modest 4% for the year and I’m seriously considering locking in gains and reinvesting all the proceeds in a 2.45% savings account to end the year up a guaranteed~6.3%.

To feel no investment stress for the rest of the year would be amazing!

After all, my theme for 2019 is: live the good life. All I want is restful sleep every night so I have the energy to happily spend time with my family and write.

Doubling my net worth every 14 years with a modest 5% annual growth target is good enough for me.

Related: How Much Savings You Should Have Accumulated By Age

Readers, are you taking advantage of higher savings rates? What type of money decisions did you make in 2018 that saved you from the stock market meltdown? What type of money decisions will you make this year to ensure you grow your wealth?

The post Cash Management Is Really All About Stress Management appeared first on Financial Samurai.

from https://www.financialsamurai.com/building-savings-war-chest-is-about-stress-management/

0 notes

Text

The 5 Stages From Grief In Divorce

Video Game Day Sneak Peek: The Kelowna Firecrackers open a three video game trip tonight along with a stop in Royal prince George versus the Cougars. Ordinarily I press one of the two bakers off my dining table to make sure that I can start quiches or even pies; today I'm at the computer until noon arranging with the 250 online purchases that came in over the weekend break - on any other Monday, there might merely be a dozen or so. Complicating things: our company simply upgraded the internet site and there are actually plenty of goofs: individuals are getting, obtaining inaccuracy notifications and afterwards reordering, while the authentic order came through merely great.

Recently, Redbox, the provider behind all those motion picture rental stands, extended its own circulation deal with Universal, The studio had previously hung on on a 28-day window in between when it released motion pictures for house purchase and when individuals might rent all of them from Redbox.

Of course, many people do not possess a collection therefore sizable that any sort of private holding, particularly http://be-fit-and-health.pt/uncategorized/o-que-e-na-verdade-o-titan-gel/ one along with a relatively low yield, would certainly generate enough dividends each quarter to make such a targeted method functional. Along with a supply price above $60 Intended cannot be identified as deal more, but I would certainly contribute to my position if the supply will fall to the low 50s once again.

In my sight, investing goes to least as a lot about paying for a respectable price compared to it is about discovering a growth business. Sells started the week little altered from where they finished last Friday, along with the S&P FIVE HUNDRED and also Dow eking out miniscule increases while the Nasdaq (-0.1%) slid for a 3rd straight treatment.

Also I have actually read a lot of books that opened my eyes to brand new dimensions in life as well as produced me discover new techniques. The rules of the activity have changed in basic methods - as well as people today expect (as well as requirement) more from company than merely that they optimize their revenues without pertaining to pain through some offense of regulation.

In a large bowl, whisk all together eggs, oil, buttermilk, food items color, vanilla extract and also white vinegar. That aims to relocate out of the 'cash vs market' mindset. The only tricky one for me is 10. White colored folks possess an "excessive influence" in many Oriental as well as African countries that they reside in, also today.

That is actually not worth aiming to save as well as this's definitely not worth your finite time as well as life on this planet trying to quit people which dislike you and are trying to live off from you. Nonetheless, I am right now choosing my absolute best to make clients familiar with the downside risk of some preferred intermittent inventories in the chances that might spare them some torment as well as despair when the cycle eventually turns down.

Considering that an adjustment is actually very likely to blow when costs are higher, this suggests I am going to be actually confined to acquiring a small variety of high-yield inventories during the course of that time. I can easily not perform ordinarily in outfits that I experience create my physical body look even more clearly female, as a result of the quantity from trouble my appearance creates me under those conditions.

8 of the ten top 'much safer' dividend-yielding Industrials pets through turnout (shaded in the graph above) were verified as being actually amongst the best ten gainers for the coming year based upon analyst 1 year intended rates. Inventories floated lower in range-bound exchanging, as clients held back to make moves ahead of comments coming from Fed Chair Janet Yellen as well as ECB Head of state Mario Draghi tomorrow at the Jackson Gap seminar.

Marvel claimed Salizar was being actually examined concerning some things and acknowledged Thursday to undergo a polygraph exam, however was a no show" at test opportunity. My passion for Reddish Velour Covered began many, several years just before I transferred to the South, where that is actually probably one of the most well-liked covered of perpetuity.

0 notes

Text

Crypto for beginners

Hello guys, pls read crypto tips for beginners

I have started my crypto journey in Jan 2018. Have learnt lot of things by losing money :P .

Total i bought 0.114 btc for around 1500 USD.

Now after experimenting and losing iam having 0.4 btc.

Lost btc because of trading, because of experimenting pump and dumps and joining trading groups

What i learnt

Lesson 1: Invest what you can afford to lose

Read about topics fomo and fud on internet

I have invested during fomo and when btc was all time high. So lesson learnt

Lesson2: invest when markets are low not high

Recently when btc fell to 6k usd the rich bought more btc and beginners like you and me sold in fear. Research more about this on internet.

Later alts lost very badly and my portfolio value decreased.

Lesson: Dont see profits in terms of usd see in terms of btc.

Suppose today ur btc is 0.01 and usd = 100usd and tomorrow if btc is 0.012 but usd = 90 usd then you are at profit

Reserch about short term trading on crypto exchanges on internet to get more clarity.

Research about whales in cryptos and how they manipulate the prices. Always small fish like us lose.

Also research about pumps and dumps

I made my 0.02 to 0.004 in few seconds. In greed of making more money i lost more by joining free pump and dump. Research on how pump and dump works and how free members lose .

Also reserch about bots that do automatic trading during pumps.

If we want to win in pumps whe should be fast, better use bots. Now pump and dump time has been coming to an end but as long as new innocent users join it will continue. Now a days pump name is replaced by short term HODL but the process is same.

Lesson : nothing comes free. If we want to win in trading we have to spend of technical and fundamental anlysis, bots groups etc.

Then i started spending money and joined such groups. Some of them just looted my money and are fake and luckily i was able to find some genuine groups. Ziam yet to find whales group for that we need lot of money and experimentation.

One more lesson: Never sell in panic and make sure you move out and not get struck. I was struck in tron and still waiting for it to recover. If had cut my loss and invested that money in day trading i could have earned more.

My opinion: Benefit maximum before pump season is over. And before govts start crypto regulation. Ico bubble will last till 1.5 yr and crypto bubble will continue for 2 yrs. Before that we have to get maximum and get out of this.

Research about icos and how they give 100X 500X returns. But this year we have to be careful as there are and will be lots of scams and finding correect ico will be difficult. Now a days genuine ico are fulfilling in private sale before they are open for public. So small fish cant invest in this. We can get in only if we have min amount of btc. Research on this as well i.e private vs public sale of icos.

One more point when alts are bleeding and your portfolio is decreasing you get lot of stress anxiety and unable to sleep etc. even in dreams you see your cryptos falling. So proper approach is must. Dont go for free advices like i did and lose your money. Free sucks your money. Nothing is free.

Once agin i repeat Crypto bubble and ICO bubble will last only for 1-3 years . Try to get maximum before the bubble finishes. Bubble means 10x 20x 100x returns.

Research about what happened during dotcom bubble.

If you see past years, Every year same story is repeating, remember now during this bearish market right have bought more Bitcoins. While small fish like us sold. We mostly get driven by fomo. Research on this.

Do your own research is correct but opposite is also true. No need to listen to someone who says invest in things which you understand. But you need not understand digestion liver intestine etc to get your food digested. I have made this mistake and missed the opportunity to buy btc at 1000usd now it is 10000usd and peak was around 20k usd. I think everyone who is reading this uses internet but dont know about tcp ip protocol. So our target is to get max profits are new users are growing exponentially and come out of this with in an year.

Thats all bro. End of tips. If you want to invest in this season read below. I suggest you to take a break and read below only after every concepts mentioned above are clear to you.

Finally i have found some genuine group where there is scope of 3to 5X during bull run and 1.5x during bear run in a span of month. Remember our traget is to increase btc worth so during bull run we will invest in better running alts and during bear run what we do is something like sell all our btc for usd at 20000 and rebuy at 10000 so that our btc value doubles during such bear run. That group uses bots and gives good technical analysis. I will join another group also where we get information and all analysis of best icos that gives around 5 to 500X returns. My experience these icos when they get lsited on exchanges go 10X very short term because of fomo. You can reserch by seeing what happend to certain coin when it got listed on exchange. See the charts on coinmarketcap. End of this year im expecting btc to reach 50k usd to 100k usd. And till sep the whole crypto market cap becomes 3x and by the time we ill come out of our ico. Just like every year markets shoot moon from nov dec. that is when we make max profits and rebuy when market dips. At that time im expecting icos give 500X returns like. Till that time getting 5X 20x is great.

My opinion is lets say we invested 1 usd in 10 icos, even if 9 fail and we get 1 100x return the over all return is s90x. So ill take such risk diversifications during bullish markets.

Now although i have lost half of my btc i have gained immense knowledge which will help us grow exponentially.

Small fish always die. Only big whales survive markets. So what im doing is combine 10-2- investors so that we become huge whale. My max capacity is over. I cant invest more. Remeber lesson 1 . dont invest what you cant afford to lose.

If we 20 ppl join we can start with good capital so that we can start our own pumps or invest in icos which have min cap.

Why work with me? I have better capability than you to know what is scam and which group is genuine not fake etc.i have lost some amount in joining fake group.

Why 100x returns is better because even if you lose remaining 9 1 success will give 90x

Half I'll invest in ICO and half in trading. Remember ICO are now getting finsihed before public sale.

ICO immediately after getting listed in exchange going 3x 4x in very short term.

Am I beat or bull. Im opportunist both bear and bull.

I repeat some things again.

And as ever one day don't believe everyone blindly do your own research. I have made it cake walk for you on what topics to research and how system works. Once research on what topics I mentioned and read this article once again you will get lot of clarity. Remember rule no. 1 oce again, risk is proportional to returns whether it is saving account or fixed deposit or mmutualfund or shares or crypto my strategy is simple . If you put your bet in 10 different and one becomes 100x your bet profit bs 90x.

Why iam going as group not alone? As I can't invest what I can't afford to lose, remember rule no. 1 . I observed a minimum amount is needed for trading as big whales only survive and small fish drown . So let all of us small fish form a whale and survive the market.

If you think you can afford to lose , I suggest you let's trade. And risk to become rich. The more capital you put the more returns you get exponential.

Most of the groups are fake and involve cross promotion. Every person is claiming profits but only few will deliver.