#cryptoranking

Text

Bitcoin Breaks $61K Amidst Broader Crypto Downturn: Market Dynamics Unfold

The crypto market has recently experienced a notable surge as Bitcoin surpasses the $61,000 mark, marking a significant milestone. However, CryptoRank, a prominent crypto industry research and analytics platform, suggests that the broader market is currently characterized by cautious investor sentiment. This nuanced situation, where Bitcoin dominates but the overall market exhibits hesitation, provides an intriguing snapshot of the current state of digital assets.

The total market capitalization stands at approximately $2.39 trillion, indicating a slight decline of 1.48%. This dip reflects a sense of caution prevailing among investors, a sentiment further echoed by the Bitcoin dominance index at 50.66%. The Fear & Greed Index, currently at 80, signifies a phase of 'Extreme Greed,' indicating heightened speculative interest and investor optimism predominantly focused on Bitcoin.

While Bitcoin demonstrates robust performance, other major cryptocurrencies have faced declines. Dogecoin, Ethereum, and Binance Coin have seen reductions in their values by 7.73%, 2.75%, and 2.54%, respectively. This divergence in market behavior underscores a scenario where Bitcoin's rise contrasts with the more subdued or declining performance of other prominent cryptocurrencies.

The crypto market is not devoid of volatility, especially among lesser-known digital assets. Aerodrome, Sanko GameCorp, and Taki have emerged as the top gainers, experiencing impressive gains of 50.1%, 49.2%, and 45.8%, respectively. These movements highlight the dynamic nature of the crypto market, where emerging tokens can swiftly gain prominence and offer substantial returns.

Token unlocks play a significant role in influencing market liquidity and shaping investor strategies. Currently, dYdX, Biconomy, and Hooked Protocol are undergoing token unlocks, valued at $111 million, $11.9 million, and $8.85 million, respectively. Monitoring these events is crucial as they can inject substantial liquidity into the market, potentially impacting the price and availability of these tokens.

The cryptocurrency market presents a multi-faceted picture, with Bitcoin leading the charge amid a broader market correction. The volatility among emerging tokens and the strategic implications of token unlocks contribute to the intricate landscape, offering both challenges and opportunities to investors.

0 notes

Text

The Most Secure Blockchain

“We've been thinking for a long time on which blockchain to build the Metaverse. The speed of transaction processing, the cost of transactions and, of course, the degree of protection against potential hacker attacks are very important. And finally, the choice has been made. Am I wrong?», says Lado Okhotnikov, Meta Force CEO.

Those who want to stay in the DeFi sector prefer Ethereum. This blockchain is a platform for many tokens and projects ranging from ICOs to NFTs. A rich ecosystem and a variety of options for users give a possibility of choice and this is the most important thing.

Vladimir Okhotnikov aka Lado believes that success depends on how correctly the blockchain is chosen, “Since we are preparing large-scale proposals, coverage is very important for us. The Royalty NFT program has already been launched while a decentralized wallet, its own marketplace and the Metaverse are preparing to launch.”

According to the CEO of Meta Force, Ethereum strives for decentralization, so control and decision-making are not concentrated in one hand. This increases network security and reduces risks of censorship.

0 notes

Text

The collapse of the global crypto market and other news of the past week

Researchers at the CryptoRank analytical platform have published their 164th weekly report on the situation in the cryptocurrency market, based on data from August 14 to 20, 2023. They noted that the most important event was the global drop in quotes of the leading digital coins and tokens. Experts said that approximately $1.04 billion of positions were liquidated due to the sudden collapse of the Bitcoin (BTC) rate.

Recall that in the period from August 17 to 18, the quotes of the flagship cryptocurrency fell from $29,000 to $25,400. However, a little later, the BTC rate stabilized and recovered to a value of $26,200, which is kept around for the next few days. In addition, industry analysts recalled that the Coinbase trading platform received regulatory approval for access to cryptocurrency futures for US citizens.

Among other things, several events related to the US Securities and Exchange Commission (SEC) were noted among the news. For example, representatives of the organization said that the decision on the status of the Ripple cryptocurrency (XRP) requires additional consideration in the Court of Appeal. The management of the institution also announced that the first futures ETF fund on Ethereum may be approved in the near future.

And, here are the representatives of the Binance crypto exchange themselves sued the SEC for abuse of office.

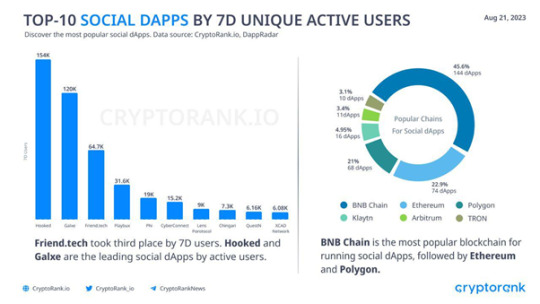

Finally, CryptoRank analysts reported that the average daily fee rate in the FriendTech protocol rose to $1.4, second only to Ethereum and Lido in this indicator. Binance's OpBNB developers have finally announced the mainnet launch for Layer 2 Scaling Protocol. Last week, the leading cryptocurrency exchange began trading 2 major projects - CyberConnect (CYBER) and Sei (SEI). They attracted a lot of attention from investors and traders and were trending in terms of the number of search queries.

Read the full article

0 notes

Link

Hey, Have you entered this competition to win 🥳Celebrate SpaceX has landed at Coinbase Airdrop yet? If you refer friends you get more chances to win :) https://wn.nr/UrbvRz

9 notes

·

View notes

Link

Hey, Have you entered this competition to win 🥳Celebrate SpaceX has landed at Coinbase Airdrop yet? If you refer friends you get more chances to win :) https://wn.nr/LcEAHn

4 notes

·

View notes

Text

Airdrop #19/05.24

Attarius Network / Tabi / Scroll / Over Protocol / Holograph / Cryptorank / Layer3 / ByBit x NOTcoin / Param Labs / Zorb Lens Network

0 notes

Text

Top 15 DeFi Projects by Active Users in the Last 30 Days

Decentralized Finance (DeFi) has emerged as a transformative force in the financial industry, offering a decentralized alternative to traditional financial services. While Bitcoin (BTC) remains a prominent player, DeFi encompasses a broader spectrum of projects. CryptoRank's analysis of the top 15 DeFi projects, based on active users in the past 30 days, sheds light on the ecosystem's diversity.

PancakeSwap (CAKE) leads the pack with 1.85 million active users, followed by Uniswap (UNI) with 405K users. Other notable projects include 1INCH Network, Stargate Finance (STG), and TT Mining, each attracting significant user engagement.

The DeFi landscape spans multiple blockchain networks, with Binance Smart Chain (BNB) hosting the largest share of dApps. Ethereum, Polygon, Fantom, and Avalanche also serve as prominent platforms for DeFi innovation.

Despite the market's volatility, many DeFi tokens have experienced notable price changes, reflecting the sector's dynamic nature. While some projects have witnessed substantial growth, others have faced challenges.

Overall, the rise of DeFi signifies a paradigm shift in finance, empowering users with greater control over their assets and transactions. As the ecosystem continues to evolve, the diversity of projects and user engagement underscores DeFi's potential to reshape the future of finance.

0 notes

Text

CryptoRank Analysis Reveals Market Trends: Bitcoin Surges Above $63K

The cryptocurrency market has witnessed a surge in activity, with Bitcoin reclaiming the spotlight by surging above the $63,000 mark. A recent analysis by CryptoRank sheds light on the underlying market trends driving this upward momentum and provides insights into the broader dynamics shaping the crypto landscape.

Bitcoin's rally to new highs comes amid growing institutional adoption and increasing mainstream acceptance of cryptocurrencies. Institutional investors, including hedge funds and corporations, continue to allocate significant capital to Bitcoin as a hedge against inflation and a store of value in uncertain economic times.

According to CryptoRank's analysis, the influx of institutional capital into Bitcoin has been a key driver of its recent price appreciation. Institutional investors are attracted to Bitcoin's scarcity, decentralization, and growing network effect, viewing it as a hedge against traditional fiat currencies and a portfolio diversification tool.

Furthermore, CryptoRank's data reveals a growing trend of corporate treasuries adding Bitcoin to their balance sheets as a reserve asset. High-profile companies such as Tesla and MicroStrategy have publicly disclosed their Bitcoin holdings, signaling confidence in the long-term value proposition of the digital asset.

Moreover, CryptoRank's analysis highlights the role of macroeconomic factors in driving demand for Bitcoin and other cryptocurrencies. Amid unprecedented monetary stimulus measures by central banks and concerns about inflation, investors are increasingly seeking alternative stores of value outside the traditional financial system.

The recent surge in Bitcoin's price also coincides with positive sentiment surrounding the broader cryptocurrency market. Ethereum, the second-largest cryptocurrency by market capitalization, has also experienced significant gains, reflecting growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs).

CryptoRank's analysis indicates that Ethereum's rally is driven by its utility as a platform for smart contracts and decentralized applications (dApps). The Ethereum network has seen a surge in activity, with developers and users flocking to build and interact with various DeFi protocols, NFT marketplaces, and blockchain-based games.

Additionally, CryptoRank's data reveals a trend of increasing adoption of stablecoins, such as Tether (USDT) and USD Coin (USDC), within the cryptocurrency ecosystem. Stablecoins provide a bridge between traditional fiat currencies and digital assets, facilitating seamless trading and liquidity provision on cryptocurrency exchanges.

Despite the positive trends observed in the cryptocurrency market, CryptoRank's analysis also highlights potential risks and challenges. Regulatory uncertainty remains a key concern for investors and market participants, with regulatory agencies worldwide grappling with how to classify and regulate cryptocurrencies.

Moreover, CryptoRank emphasizes the importance of risk management and caution amid the volatility of the cryptocurrency market. While Bitcoin's rally to new highs is a bullish signal for the overall market, investors should be prepared for price corrections and fluctuations in the short term.

In conclusion, CryptoRank's analysis provides valuable insights into the market trends driving Bitcoin's surge above $63,000 and the broader dynamics shaping the cryptocurrency landscape. Institutional adoption, macroeconomic factors, and growing interest in decentralized finance and non-fungible tokens are among the key drivers fueling the cryptocurrency market's upward momentum. As the market continues to evolve, investors and stakeholders will closely monitor these trends and developments to navigate the ever-changing landscape of digital assets.

0 notes

Text

Bitcoin new start in the 47000$

On February 9th, the cryptocurrency market saw a surge in major positions. Bitcoin initially jumped to $46,000 and then tested the $47,000 level. Ethereum, on the other hand, surpassed the $2,500 mark. The Fear and Greed Index increased by six points within a day.

On February 9, 2024, the price of Bitcoin tested the $47,000 mark, but then retraced. This marked the second price jump within the last day. Meanwhile, Ethereum broke through the $2,500 mark.

At the time of writing, Bitcoin is trading at $46,943, according to TradingView. At one point, the price of Bitcoin reached $47,019:

The BTC/USDT exchange rate on the Binance exchange. Source: TradingView.

It is worth noting that earlier on February 9, the coin's price surpassed the $46,000 mark. Against this backdrop, both the dominance of the asset and the Fear and Greed Index increased significantly.

Ethereum, meanwhile, is currently trading at $2,503:

The ETH/USDT exchange rate on the Binance exchange. Source: TradingView.

The Bitcoin dominance indicator approached its maximum level since the beginning of January 2024 amidst this surge:

Bitcoin dominance indicator in the cryptocurrency market. Source: TradingView.

The volume of liquidations on futures contracts in the cryptocurrency market exceeded $134 million, with nearly $100 million accounted for short positions:

Volume of liquidations on futures contracts in the cryptocurrency market. Source: CoinGlass.

Amidst Bitcoin's latest surge, all assets in the top 10 by market capitalization experienced growth, according to CryptoRank:

Top 10 cryptocurrencies by market capitalization. Source: CryptoRank.

The Fear and Greed Index remained unchanged, with a six-point increase from February 8th to 9th, 2024:

Fear and Greed Index in the cryptocurrency market. Source: CoinStats.

Earlier, we covered the forecast by Bernstein experts who predicted a potential rise in Bitcoin miner stocks ahead of the halving event.

Read the full article

0 notes

Text

Market Momentum Unveiled: CryptoRank's Overview on Bitcoin's Surge and Altcoin Performance

In the dynamic crypto landscape, CryptoRank's overview reveals a market surge led by Bitcoin, confidently surpassing $43,000. The top 10 cryptocurrencies, all in the green zone, echo a bullish sentiment. Notable performers include Cardano (ADA) with an 8.37% gain, Solana (SOL) up by 5.79%, and Ripple (XRP) with a 1.56% uptick, contributing to a $1.74 trillion market cap, a 2.36% increase.

Bitcoin's dominance at 48.88% sees a slight boost, aligning with a Fear & Greed Index at 61, indicating a prevailing positive outlook. CoinMarketCap data reveals Bitcoin at $43,377, ADA at $0.5278, SOL at $103.36, and XRP at $0.5321, each charting a distinctive trajectory.

High-performing cryptocurrencies showcase Solidus (AITECH) leading with an extraordinary 30.8% surge, followed by FC Barcelona Fan Token (BAR) at 29.6%, and Veloce VEXT securing a notable 24.4% increase.

CryptoRank's insights extend to token unlocks, unveiling substantial amounts, including Optimism (OP) at $3.34 million, Illuvium (ILV) at $2.94 million, and BLUR contributing $1.57 million. As Bitcoin propels positive momentum, CryptoRank remains a reliable guide in navigating the evolving crypto market intricacies for investors and enthusiasts alike.

0 notes

Text

Investor Optimism Soars as Report Reveals BTC Surge and Altcoins' Impressive Gains

Bitcoin's recent surge beyond $62,000 has not only marked a significant milestone for the leading cryptocurrency but has also set the entire cryptocurrency market on a positive trajectory, as per the latest analysis by CryptoRank. The comprehensive overview reveals that the top 10 cryptocurrencies have entered the green zone, indicating an overall positive trend.

Leading the market gains are notable cryptocurrencies, with Dogecoin (DOGE), Solana (SOL), and Cardano (ADA) standing out with impressive surges of up to 33.8%. These substantial increases underscore a robust period of growth in the cryptocurrency sector, contributing to the overall market capitalization soaring to an impressive $2.42 trillion, reflecting a 7.15% increase.

The report emphasizes Bitcoin's dominance at 50.82%, signifying its central role in shaping the market's dynamics. With a rise of 1.46%, Bitcoin's dominance highlights its proportionate value compared to the total market capitalization of all cryptocurrencies.

CryptoRank's analysis also provides insights into market sentiment through the Fear & Greed Index, which currently stands at 80, categorizing the market sentiment as "Extreme Greed." This indicates a highly favorable outlook among investors, showcasing increased optimism for future gains.

The report lists the top gainers in the market, with Arkham (ARKM), Bonk (BONK), and The Doge NFT (DOG) leading with significant increases. These figures illustrate the dynamic nature of the cryptocurrency market, where emerging tokens can swiftly rise to prominence.

Additionally, CryptoRank's analysis delves into the latest token unlocks, revealing significant amounts for Orange (ORNJ), WOO, and Illuvium (ILV). Token unlocks are pivotal events that can influence liquidity and prices, offering both opportunities and challenges for investors.

In conclusion, CryptoRank's analysis provides a snapshot of a vibrant and evolving cryptocurrency market fueled by Bitcoin's surge, positive sentiment among investors, and crucial movements in token unlocks. These insights serve as valuable perspectives for investors navigating the intricate landscape of digital currencies.

0 notes

Text

CryptoRank tarafından hazırlanan yeni bir rapor, yatırımcıların ‘pasif gelir’ için birinci olarak Ethereum’a (ETH) başvurduğunu gösteriyor. Bu eğilime Ethereum ağında stake edilen altcoin ölçüsünde yeni bir tepe eşlik ediyor.CryptoRank, altcoin yatırımcılarının ‘pasif gelir’ için Ethereum’a güvendiğini bildirdiEthereum’un 2020 periyodunda stake edilen ETH’leri özgür bıraktığı Şangay yükseltmesi ile birlikte daha fazla yatırımcı kripto paralarını ETH ağında kilitlemeyi tercih ediyor. Kelam konusu yükselme, 12 Nisan’da yayınlandı ve staking para çekme süreçlerini faal hale getirdi. Yükseltmeden bu yana staked ETH ölçüsü süratle artıyor. Bu eğilim, dün yeni bir tepe ile taçlandırıldı.Analiz platformu CryptoRank, dün yeni bir raporda, staked ETH ölçüsünün 25,8 milyon ETH’yi aşarak yeni bir ATH kaydettiğini bildirdi. Ethereum ağı şu anda 48 milyar doların üzerinde bir bedele sahip.Özellikle, Ethereum mevduat kontratı bakiyesi, Mayıs ayı sonlarında 40 milyar doları geçerek, PoS’a geçişi sırasında mevcut olmayan kritik özelliğin getirilmesinden bu yana keskin bir yükseliş gösterdi.Altcoin balinaları daha yüksek ETH düzeylerine müsaade vermediLookonchain’den yakın tarihli bir tweet, balinaların son yükseliş esnasında yüklü ETH sattığını gösterdi. cointahmin.com’dan takip ettiğiniz üzere, bu esnada yüklü satın alım gören coin’ler ortasında UNI ve AAVE yer aldı.https://twitter.com/lookonchain/status/1673922952637878272 Bununla birlikte, CryptoQuant’a nazaran ETH’nin döviz rezervi artıyordu. Metrikteki bir artış, yatırımcıların varlıklarını sattığı manasına gelir ki bu bir düşüş sinyalidir.Santiment’in grafiği, Ethereum’un borsalardaki arzının ve borsa dışındaki arzın da birbirine yakın olduğunu gösteriyor. Bu da önümüzdeki günlerde birincisinin ikincisini bilakis çevirme mümkünlüğü olduğu için düşüş eğilimine işaret ediyor.Satıcılar yakında oyunlarını hızlandırabilirEthereum’un günlük grafiğine bakış, ayıları destekleyen oldukça metrik ortaya çıkarıyor. Örneğin, Para Akışı Endeksi (MFI) çok alım bölgesine girmek üzere. ETH’nin Göreli Güç Endeksi (RSI) ise düşüş kaydetti. Ek olarak, MACD düşüş eğilimi mümkünlüğünü göstererek düşüş trendinin devam etme mümkünlüğünü artırdı.İlginç bir biçimde, Üstel Hareketli Ortalama (EMA) Şeridi, yükseliş eğilimi gösterdiği için alıcıları desteklemeyi seçti.EMA şeridi üzere, on-chain metriklerden birkaçı da yükselişe geçti. CryptoQuant’a nazaran, ETH’nin alım/satım oranı yeşildi. Metrik, türev piyasasında satın alma hassaslığının baskın olduğunu gösteriyor. Birebir vakitte, ETH’nin ağ büyümesi de yüksek kalıyor.Bununla birlikte, Ethereum’un MVRV Oranı değerli ölçüde düştüğü için kesin olarak hiçbir şey söylenemez, ki bu düşüş eğilimi gösteriyordu.

0 notes

Text

Інвестори вклали всього $68 млн у криптостартапи

Згідно з даними CryptoRank, на тижні з 25 по 31 грудня 2023 року було проведено всього лише 9 інвестиційних раундів у криптовалютні стартапи. Загальна сума зібраних коштів склала скромні $68,1 млн.

Цей показник впав приблизно в 5 разів порівняно з показниками минулого тижня. Тоді було зафіксовано суму в розмірі $329,9 млн.

Найбільшим за звітний період став раунд на $35 млн, закритий 25 грудня, керівництвом стартапу Grape. Ця компанія отримала інвестиції за участю глобальної альтернативної групи LDA Capital. Розробники проекту планують використати кошти для прискорення і розвитку проекту, а також проведення стратегічного зворотного викупу токенів, щоб скоротити суму емісії власного токена GRP в обігу.

Крім того, успішно завершила раунд фінансування і компанія Hive Blockchain. Творці організації залучили $21,7 млн, через 2 роки після того, як їхня установа отримала $110 млн у листопаді 2021 року.

HIVE - технологічна компанія в індустрії блокчейнів, що розвивається. Її акції торгуються на фондовій біржі, а творці проєкту будують міст між сектором цифрових валют і традиційними ринками капіталу. Керівництво HIVE відкрило кілька центрів обробки даних у Канаді, Швеції та Ісландії. Вони функціонують на екологічно чистій енергії.

Нарешті, ще одна компанія Cess успішно завершила раунд серіалу А на $8 млн. Участь у ньому взяли DFW Labs, Web3 Foundation. HTX Ventures та інші великі інвестиційні організації.

CESS - це стартап, орієнтований на розробку розподіленої хмарної системи зберігання даних на базі технології блокчейн. Розробники намагаються запропонувати надійні та ефективні послуги зберігання з використанням технології віртуалізації.

Розробники з Blockchain Foundation запевнили, що їхній стартап спирається на ланцюгову структуру, забезпечуючи безпечну та прозору основу для розподіленої системи.

Read the full article

0 notes

Text

⚡️Новости криптомира

📎Аргентина выбрала нового лидера, который обещает решить хронические экономические проблемы страны. Хавьер Милей, в частности, является сторонником биткоина как криптовалюты, которая, по его мнению, возвращает деньги в руки частного сектора.

📎По словам руководителя управления принудительного взыскания и банкротства Сбербанка, российские должники теряют свои криптовалюты из-за сотрудничества иностранных бирж с арбитражными управляющими. Среди таких площадок названы Bybit, Bitstamp, Bitrue, Gate и OKX.

📎Около $9 млн из страхового фонда децентрализованной биржи dYdX были использованы для покрытия ликвидаций позиций пользователей на рынке токена Yearn Finance (YFI). Команда заверила, что фонд с остатком $13,5 млн по-прежнему хорошо профинансирован.

📎Объем торгов токенами проектов с ИИ, вырос за неделю более чем на 300% и достиг $4,13 млрд, по данным CryptoRank. Рыночная капитализация токенов из этой категории за то же время выросла на 120%, превысив $3,49 млрд.

📎Mastercard заключила партнерство с ИИ-компанией Feedzai, занимающейся выявлением финансового мошенничества в интернете. В рамках партнерства Feedzai будет интегрирована на платформу Mastercard CipherTrace Armada, которая помогает отслеживать транзакции с криптобирж для выявления подозрительных действий.

#новости #биткоин #криптовалюта

0 notes

Text

[ad_1]

Hellow everybody, in as we speak’s article we're going to try the pretend information about Blackrock ETF software that shook the cryptospace.The occasionOn October sixteenth, at 13:25 UTC, the official Cointelegraph Twitter (X) account made the next publish :Supply : Twitter (X)With none supply and realizing it is going to be an enormous information that may include enormous penalties.Instantly after, everybody else on Twitter (X) began spreding the pretend information bringing much more individuals to FOMO (concern of lacking out).The implicationsThis information instantly made skyrocket the value of Bitcoin from 28k to almost 30k in lower than 20 minutes !Supply : TradingviewIn fact, 2 hours later all of this pump was gone and the value stabilized at 28k. This made almost 100 hundreds of thousands of dollars of buying and selling place vanish in lower than an hour, in keeping with CryptoRank Platform :Supply : Twitter (X)The Aftermathhalf-hour after the tweet, Coinlegraph modified it to incorporate the truth that they don't seem to be the unique supply :Supply : Twitter (X)A number of moments later, they definitively erased it and made this assertion :Supply : Twitter (X)Folks began making assumption that it was a deliberate manipulation with the intention to acquire cash from the pump and dump. Nonetheless, a number of hours later Cointelegraph made an article summarizing hour by hour the account of what occurred for this information to be revealed, even going as far as to show the non-public conversations their ‘journalists’ had with the intention to show their honesty :Supply : CointelegraphAs you possibly can see their “supply” was a message ship in a telegram group by a now deleted consumer who claimed that in keeping with Bloomberg, Blackrock’s BTC ETF was accredited by the SEC. Sadly, with out even verifying this info, a workforce member nonetheless posted the information.This episode made lots of people react, Larry fink for exemple, said on FoxBusiness that “this (pretend information) is an instance of the pent-up curiosity in cryptocurrencies”.Unsure what to think about that as a result of this pretend information confirmed that the value of bitcoin may be simply manipulated and we all know that it is without doubt one of the the reason why the SEC refused to approve an ETF BTC.Speaking concerning the SEC, they’ve additionally reacted on the pretend information :Supply : Twitter (X)I’ll allow you to ponder it.ConclusionThis occasion confirmed the potential BTC has if an ETF BTC is lastly approve, nevertheless it has additionally train us to not make emotion-based motion. And also you what do take into consideration this pretend information ?Will it influence the choice of the SEC ?As All the time thanks for studying !Follow me on twitterLearn unique articles on publish0x and if you wish to help me at no cost you possibly can register with this linkDisclaimer : This isn't a monetary recommendation, you want to do your individual analysis !

[ad_2]

0 notes

Text

Как найти гем на 100 иксов?

Рынок, как известно, больше расположен к новым токенам, чем к старым из предыдущих циклов. Правда, пробиться к ним непросто, и нередко оказываешься позади каждый раз, когда новый гем обновляет исторические максимумы снова и снова. CryptoRank разобрался, как находить гемы на ранних этапах, чтобы получать распределения и не стать жертвой синдрома упущенной выгоды (FOMO).

0 notes