#The Benami Transactions(Prohibitions) Act 1988

Text

What will happen to Physical Shares Certificate after 31st March 2023?

The shares will become worthless. This means that you will not be able to sell them, transfer them, or claim any dividends or other benefits.

The shares may be frozen by the company. This means that the company will not allow you to sell or transfer the shares, and you may not be able to claim any dividends or other benefits.

You may be treated as a Benami holder under the Benami Transactions (Prohibitions) Act, 1988. This means that you may be subject to penalties and fines.

In addition to these consequences, there are a few other things that you should be aware of if you have physical shares certficate:

You will not be able to vote at shareholder meetings. This means that you will not have a say in how the company is run.

You will not be able to benefit from corporate actions such as bonus shares or rights issues. This means that you will miss out on opportunities to increase your shareholding or acquire new shares at a discounted price.

If you have physical shares, it is important to convert them to demat form as soon as possible. This will ensure that you do not lose your investment and that you are able to participate fully in the market.

Here are some of the benefits of converting your physical shares to demat form:

Demat shares are more secure. They are held in electronic form in a depository, which is a regulated entity. This makes them less vulnerable to theft or loss.

Demat shares are more convenient to trade. They can be bought and sold online, which makes it easier for investors to participate in the market.

Demat shares are more efficient. They do not require the physical movement of certificates, which saves time and money.

If you are not sure how to convert your physical shares to demat form, you can contact your broker or a depository participant. They will be able to help you through the process.

0 notes

Text

How Can I Report Criminal Activities Of Public Servant?

A healthy democracy is attacked at its very core by the evil of corruption. It fosters inequality and poses a significant obstacle to inclusive development. In other words, corruption involves using one's position of power or influence improperly to benefit oneself or others.

Laws Pertaining to Corruption by Public Servants

Indian Penal Code of 1860

According to the Indian Penal Code, a "public servant" is a person employed by the government, an officer in the military, navy, or air force, a police officer, a judge, a member of the Court of Law, or any other local authorities established by a state or federal law.

A public servant who buys or bids on the property without authorization is in violation of Section 169 of the Indian Penal Code. If a public servant breaks the law, they could receive a fine, a prison sentence of up to two years, or both.

The criminal breach of trust by any public servant is covered under the virtue of Section 409 of the Indian Penal Code. The public servant will get a fine and a sentence of life imprisonment or up to 10 years.

The Prevention of Corruption Act of 1988

In addition to the parties covered by the IPC, the term "public servant" also refers to officials working for banks, universities, the Public Service Commission, and cooperative societies that receive government funding.

A public servant who accepts gratification other than his legal salary in exchange for performing official duties or trying to persuade other employees faces a minimum jail sentence of six months, a maximum of five years in prison, and a fine. A public servant is also punished under the act because he used his official power for personal gain and to influence the public illegally.

A public servant who accepts something valuable from someone in his or her official capacity without compensating for it or paying insufficiently for the valuable thing will be punished with a minimum of six months and a maximum of five years in imprisonment and a fine.

Prior approval from the federal or state governments is required to prosecute a public servant.

Benami Transactions (Prohibition) Act of 1988

Except when a person buys property in his wife's or unmarried daughter's name, the Act forbids any benami transaction (purchasing property in the name of another person but not paying for it).

Anyone who engages in a benami transaction is subject to a fine and/or a sentence of up to three years in jail.

Any property that is considered to be benami could be obtained by a designated authority, and no money needs to be paid in the process.

Prevention of Money Laundering Act of 2002

According to the Act, money laundering is committed whenever a person participates in any procedure involving the proceeds of crime and presents those proceeds as untainted property. The term "proceeds of crime" refers to any assets acquired by an individual as a result of criminal activity connected to specific offenses enumerated in the Act's schedule. Only after being accused of committing a scheduled offense may someone be charged with money laundering.

Money laundering is a crime that carries a harsh three - seven years prison sentence and a maximum fine of 5 lakh rupees. If someone is found guilty of a crime under the Narcotics Drugs and Psychotropic Substances Act of 1985, they might face up to a maximum term of confinement of up to ten years.

Procedure followed to Charge Dishonest Public Servants

Under the Indian Penal Code of 1860 and the Prevention of Corruption Act of 1988, the Central Bureau of Investigation (CBI) and the state Anti-Corruption Bureau (ACB) look into cases of corruption.

The Central Vigilance Commission (CVC) is a legislative organization that oversees corruption investigations in government agencies. This department has the authority to decide whether to take any punitive proceedings against a public servant.

An investigating agency can only file charges after receiving the state or federal government's approval. Government-appointed prosecutors carry out the prosecution process in courts.

Special Judges chosen by the federal or state governments preside over all trials conducted according to the Prevention of Corruption Act of 1988.

You can hire a lawyer to report criminal activities of a public servant. If you want to report criminal activities of a public servant in Pune, then a Criminal Lawyer in Delhi can be hired and if you want to report criminal activities of a public servant in Ghaziabad, then a Criminal Lawyer in Ghaziabad can be hired. Similarly, a Criminal Lawyer Delhi can be hired if you want to report criminal activities of a public servant in Delhi.

At Lead India, you can talk to a lawyer. You can obtain free legal advice and ask a legal question online free to lawyers at Lead India.

SOURCE:-

Visit us: — https://www.leadindia.law

Call Us: +91–8800788535

Email: [email protected]

YouTube: — https://www.youtube.com/c/LeadIndiaLawAssociates

Facebook: — https://www.facebook.com/leadindialaw

LinkedIn: — https://www.linkedin.com/company/76353439

Twitter: — https://twitter.com/leadindialaw

Pinterest: — https://in.pinterest.com/lawleadindia

Instagram: - https://www.instagram.com/leadindialawofficial

0 notes

Text

SC: No confiscation of Benami properties transacted b / w '88 -16

SC: No confiscation of Benami properties transacted b / w ’88 -16

New Delhi: In a landmark decision, the Supreme Court on Tuesday ruled that the Benami Transaction ( Prohibition ) Amendment Act of 2016 will apply prospectively to save from confiscation Benami properties transacted between 1988 when the original law was enacted, and 2016 when the law came into being while shielding perceived offenders from mandatory three – year jail term.

Terming as illegal…

View On WordPress

0 notes

Text

SC: Provision of jail sentence in 1988 benami legislation unconstitutional

The Supreme Court on Tuesday held unconstitutional a provision within the Benami Transactions (Prohibition) Act, 1988, which had prescribed jail time period for getting into into benami transactions.

A bench of Chief Justice of India NV Ramana and Justices Krishna Murari and Hema Kohli additionally noticed that the Act amended in 2016 can solely be enforceable prospectively and quash all…

View On WordPress

0 notes

Text

IT News

IT News the due date for completion of penalty proceedings under the IT Act has also been extended from September 30, 2021 to March 31, 2022. Further, the time limit for issuance of notice and passing of order by the 'Adjudicating Authority under the Prohibition of Benami Property Transactions Act, 1988' has also been extended to 31st March, 2022. Visit on Varindia site to get News IT, IT News, Latest Technology News, Latest Technology News India, Live Tech News, IT News in India, IT Magazines Online, IT Magazines https://www.varindia.com/

1 note

·

View note

Text

Jaago Investor Jaago !! – What The New SEBI Announcement Means For You

Securities and Exchange Board of India (SEBI) is responsible for overseeing the regulation of all participants in the Indian capital market. It tries to safeguard investors’ interests and grow capital markets by implementing a variety of laws and regulations. In the wake of increasing frauds related to the share market, SEBI has been trying to make regulations more robust to protect investors. In this regaird, the most tricky aspect for SEBI to deal with has been fraud related to unclaimed shared and unclaimed dividends, especially in the physical shares format. This change will help reduce the danger of fraud and manipulation in the physical transfer of securities by unscrupulous individuals. Furthermore, holding shares in demat form simplifies and secures transactions for investors. With that in mind, SEBI recently released a new notification.

SEBI ISSUES NOTIFICATION FOR INVESTOR PROTECTION

SEBI issued Circular No. SEBI/HO/MIRSD/MIRSD RTAMB/P/CIR/2021/655 on November 3, 2021, outlining the common and simplified norms for Registrar & Share Transfer Agents (RTAs) to process any service request from shareholders, as well as providing an electronic interface for RTAs to process investor queries, complaints, and service requests.

In the same circular, SEBI also detailed the forms for physical shareholders to submit requests for registration, changes/updates of PAN, KYC, nomination, and banker’s attestation of the shareholder’s signature in the case of a substantial discrepancy in the shareholder’s signature.

The furnishing of PAN, email address, mobile number, bank account details and nomination by holders of physical securities has now been mandated by SEBI. Folios wherein any one of the cited documents/details are not available on or after April 01, 2023, shall be frozen by the Registrars and Transfer Agent of the Company (RTA) and you will not be eligible to lodge a grievance or avail service request from the RTA and will not be eligible for receipt of dividend in physical mode.

SHOULD YOU BE ALARMED?

If you are a physical shareholder, here’s how the notification could impact you.

The RTA shall not process any service requests or complaints received from the holder(s)/claimant(s), till PAN, KYC and Nomination documents/details are

Frozen folios shall not be eligible for any payment including dividend, interest or redemption payment in physical mode. Such payments shall be made only through electronic mode, upon complying with the requirements of furnishing all the cited documents/details.

Securities in the frozen folios shall be referred by the RTA/Bank to the administering authority under the Benami Transactions (Prohibitions) Act, 1988 and/or Prevention of Money Laundering Act, 2002, if they continue to remain frozen as on December 31,

TRACK IT AND GET IT RIGHT

As mandated by the circular, in order to avoid folio freezing, holders of physical securities are urged to update the following details/documents with their respective RTA, as soon as possible, if they have not already done so:

Valid PAN

KYC Details (Postal address with PIN, Mobile number, E-mail address, Bank account details, Specimen signature)

Nomination details

Linking of PAN with Aadhar number

These documents can be sent directly to the RTA in any of the following manners:

Shareholders can submit their needed documentation to RTA regional offices around the country via ‘In Person Verification’ (IPV).

Shareholders can send duly self-attested and dated physical copies of the essential documentation to the RTA’s

Shareholders can provide the appropriate papers via E-sign from their registered email address, as per SEBI’s

Alternatively, holders of tangible securities can have their shares dematerialized to avoid having their folios frozen. As per the SEBI guidelines, it takes approximately 21 days for the demat process to complete; however, it may vary in the case of some companies.

CONFUSED? WE ARE HERE TO GET YOU SORTED !

If all the above sounds a bit complicated to understand, don’t worry; the team at Infiny Solutions is always available at your beck and call to safeguard your interests as an investor. We help simplify the process and make it easy for you to keep up with the ever-evolving regulatory landscape. Our team makes it convenient for you by collecting the relevant information and documents from your home and get everything processed while you sit comfortably at home.

0 notes

Text

Latest Guidelines of RBI For recovery of shares in India

SEBI, the industry regulator, has issued simplified and standardised guidelines for investor service requests, including establishing a framework for providing PAN, KYC details, bank details, signature, concern of duplicate shares, change of status for NRIs, nomination description, and other information by holders of physical shares. SEBI has also urged corporations and RTAs to execute such requests using papers received via registered emails and E-signature. In this article we will discuss important and latest guidelines regarding the IEPF unclaimed shares.

SEBI has made it essential for all physical shareholders to provide their PAN, nomination (for all eligible folios), contact information, bank account information, and specimen signature. If any of the above-mentioned facts or documentation are not accessible, the RTA will freeze the Folio on or after April 1, 2023. Recovery of shares in India has become the easiest and fastest process due to Government of India’s latest guidelines and investors' friendly regulation, these days one can easily access IEPF unclaimed shares funds.

It further specifies that the frozen accounts will be submitted to the administering authorities under the Benami Transactions (Prohibitions) Act, 1988 and possibly the Prevention of Money Laundering Act, 2002 if they remain frozen until December 31, 2025.

In light of the new legislation, it is critical that all holders of physical shares begin the process of amending their information in the company's records and recovering their shares as soon as possible.

Process

of recovery of shares in India from iepf unclaimed shares

The Investor Education and Protection Fund Rules, 2017, were published by the Ministry of Corporate Affairs. According to the provisions of these rules, any amount transferred to the company's Unpaid Dividend Account pursuant to Section 124(1) of the Companies Act. 2013, which remains unpaid or unclaimed for more than 7 years from the date of declaration dividend shall be transferred to the Investor Education and Protection Fund, along with any interest accrued (IEPF). The corporation must submit a statement to the IEPF Authority detailing the specifics of the transfer in the appropriate format, and the authority must provide a receipt as verification of the transfer.

In the instance of shares where the dividend has not been paid or claimed for more than 7 years, the corporation must transfer the shares to the IEPF and attach a document detailing the transfer.

Procedure for Filing an iepf unclaimed shares for recovery of shares in India

Any shareholder whose stocks, unclaimed dividends, matured deposits or debentures, application money to be reimbursed and interest accumulated on the same, if any, money raised of fractional shares, etc. have been transmitted to the IEPF can claim the shares under the procedure outlined in subsection (6) of section 124 or can apply under clause (a) of subsection (3) of section 125 to the concerned officials.

Important note:

§ In a financial year, a claimant can only make one consolidated claim for a firm against one Aadhaar Number. The aggregated claim must include data from numerous Folios from the same firm.

§ If the claimant is the legal heir, successor, or nominee of the registered shareholder, he or she must first guarantee that the firm completes the transmission procedure and issues an entitlement letter to the legal heirs before filing the IEPF Claim with the authorities.

Now, let’s understand the process of recovery of share and find lost shares

Step 1: The Authority Claimant

A person who wishes to claim the shares back in his or her name should submit an IEPF Form-5 to MCA. The following information must be included on the form:

I. The applicant's/personal claimant's information.

II. The company's information, including the CIN number

III. Information on the shares to be claimed

IV. Information about the amount of the dividend to be claimed

V. Deposits and securities details are shown by year.

VI. If the applicant is an Indian citizen, they must provide their Aadhaar number; if the applicant is an NRI or foreigner, they must provide their passport/OCI or PIO card number. Any other kind of identification must first be approved by the Authority.

VII. Details of the bank account that is connected to Aadhaar and to which the claim would be refunded if the claimant is a Resident Indian. (Following a recent Supreme Court of India decision, Aadhaar linking is no longer required.)

There is no opportunity to attach extra documents in the form.

Step 2: Presenting the Claimant to the Company

After completing the online refund form as directed, the claimant should email it to the company's Nodal Officer/Registrar, together with the documents listed below. This should be mailed in an envelope labelled "Claim for reimbursement from IEPF authority." This is essential for the claim to be verified. The following papers must be attached:

I.Printout of a correctly filled-out IEPF-5 with the claimant's signature on each page (bottom).

II.A copy of the acknowledgment with the SRN number SRN#SRN#SRN#SRN#SRN#S

III.Original indemnification bond with the claimant's signature: If the claim exceeds Rs. 10,000, a non-judicial stamp paper bond shall be used. Plain paper can be used for the bond if the claim is smaller than this amount. Non-judicial stamp paper of the amount stated in the Stamp Act should be used if the claim is for a return of shares.

IV. Original Advance Stamped Receipt with claimant's and witnesses' signatures. (Affix your signature to the revenue receipt.)

V. Original certificates in the event of a matured deposit or debenture being refunded. (Duplicate formalities should have been performed in case of loss.)

VI.For Indian nationals, an Aadhaar card is required, as well as a copy of their passport, OCI, and PIO cards for NRIs and foreigners.

VII. Proof of entitlement. This might be the number of the initial stock/interest warrant application.

VIII. Cancelled cheque leaf for the IEPF Form-5 bank account.

IX. Copy of your demat account's client master list that has been self-attested.

Step 3: From the company to the authority

Within 15 days of receiving the Claim form, the responsible firm must prepare a verification report and transmit it to the authorities in the appropriate format, along with the claimant's documentation.

Step 4: Delegation of authority to the claimant

The authority and the Drawing and Disbursing Officer of the authority shall send a bill to the Pay and Accounts Officer for payment based on the guidelines after completing the verification of the claimant's entitlement.

If the claimant is entitled to the shares, the authority will issue a refund sanction order with the permission of the competent authority. The shares will be credited to the claimant's demat account or to the extent of the claimant's entitlement. If the shares are physical certificates, the duplicate certificates are annulled and the shares are handed to the claimant.

The authorities receive the claimant's reimbursement application, which has been validated by the corporation. The authorities must make a decision within 60 days after obtaining the verification report from the relevant firm.

The ministry is seeking legal change to make it easier for businesses to transfer their stock to the government.

The change, according to authorities, will centralise and streamline the share transfer procedure, as well as address the problem of unclaimed dividends, which now total Rs 2,000 crore. The Ministry of Corporate Affairs (MCA) is pressing for a change to the Firms Act that would allow the government to take over the work of transferring shares from companies. Officials said the change will centralise and streamline the share transfer procedure, as well as address the problem of unclaimed dividends, which total Rs 2,000 crore. According to top ministry officials, the claimant would have to ask the government to transfer shares into his or her name as a result of the revisions to the Companies Act.

Through this blog, we hope you understand the process of recovery of shares in India with India’s leading legal consultation firm MUDS Management. You can find lost shares via booking consultation with our legal advisors.

0 notes

Text

Know About Benami Property Act

Often we hear in the news about fake names registered on the purchase of a property or a property bought on a person’s name but that fellow is not aware of this transaction. Such properties are known as Benami Properties and the government has introduced a proper Act and laws to track such properties. Let’s know more about this term.

1. What is a Benami Property

A ‘Benami Property’ is one which is purchased on behalf of a person who is not the actual owner of that property. This person is known as ‘benamidar’. The price of the property is paid by a third person. Actually the term ‘benami’ means without a name. In some real estate transactions, a person who is actually paying money to buy a property does not buy it on his name. Instead that property is purchased either under a fake name or under the name of a third person. The person who finances this transaction is its real owner but legally the benamidar will be called as the real owner.

2. Know About Benami Property Act

Benami properties have to face penalties, not only under Benami Property Act but also under the laws from Income tax department. Though ‘Benami Transactions Act’ was passed in 1988, it never came into function till it got amended in 2016 as ‘Benami Transactions Amendment Act 2016’. The law in 1988 was expected to eliminate corruption and black money but it was never implemented. The new amended act of 2016 will deal with benami properties.

Benami Transactions Amendment Act 2016 is a step taken by the government to tackle the issues of black money, its related illegal activities, money laundering etc. It defines benami transactions, prohibits them and also declares that any violation of this law is punishable with imprisonment and fine.

3. Exceptions to Benami Property Law

There are a few exceptions where a person can purchase a property on the name of his family members but through known sources. A husband has the right to purchase a property through valid funds under the name of his wife. This does not count in benami property. It is legally permitted to buy an immovable property in the name of spouse but from his known sources. Even if a property is held for the benefit of one or more members of the family in a Hindu Undivided Family, then this property is not a benami property. Similarly a transaction made by a trustee, executor, partner, director of a company under the Depositories Act, 1996 is not a benami transaction. Even a property which has joint owners and the payment is made through valid sources is also not included in benami property.

4. Winding up

A property which is purchased in the name of a person who is not the real beneficiary is known as benami property and that person is known as benamidar. A benami property is purchased for direct or indirect benefit of the person who is paying for the deal. As benamidar is the legal owner of the property, he has to pay the tax as per the rules.

The person who has paid for the deal has not really purchased it for the benefit of the benamidar. The purpose of benamidar property is to satisfy illegal intentions. This is a way to get away with the land ceiling laws, so that the real owner can have more land than provided in the laws. It is a corrupt practice to conceal black money.

Therefore it is necessary to uproot corruption and unveil benami properties. Get hold of black money as it is like Black Fungus of today that expands and reaches the roots of the brain. So also black money destroys the economy of the nation. Black money and corruption has to be noosed if we dream to live in a well-developed and advanced country. Know about the Benami Property Act and take a step forward to report benami properties if you come to know about any. Snub every corruption that feeds on economy of the country and express your love towards your country.

Wrritten By

Kishore Reddy

0 notes

Text

HC restrains revenue from taking action as property was purchased prior to enactment of Benami Amendment Act, 2016

HC restrains revenue from taking action as property was purchased prior to enactment of Benami Amendment Act, 2016

INCOME-TAX/BENAMI ACT: Where petitioner challenged show cause notices issued under sub-section (3) of Section 24 of the Prohibition of Benami Property Transactions Act, 1988 on ground that immovable property, which had been designated as a benami property under the 1988 Act was purchased much prior to the coming into force of Benami Transactions (Prohibition) Amendment Act, 2016INCOME-TAX/BENAMI…

View On WordPress

0 notes

Text

A Complete Guide on Guidelines for Share recovery in India

SEBI has made it mandatory for all physical shareholders to submit their PAN, nomination (for all eligible folios), contact details, bank account details and specimen signature and if any of the documents are not accessible, RTA will freeze the folio on or after April 1, 2023. Recovering units in India has become the easiest and fastest procedure due to the latest guidelines from the Indian government and investor- friendly regulations; nowadays, one can easily access unclaimed IEPF unit funds.

It also states that the frozen accounts will be submitted to the administrative authorities under the Benami Transactions (Prohibitions) Act, 1988 and possibly the Prevention of Money Laundering Act, 2002 [1] if they remain frozen till December 31, 2025. Under the new legislation, it is critical that all holders of physical shares begin the process of amending their information in the Company's records and recovering their shares as soon as possible.

Submission of unclaimed shares to recover shares of IEPF in India

A unit holder whose unclaimed dividends, debentures, shares or debenture stock, application money to be refunded and interest thereon, if any, money derived from fractional units, etc., is forwarded to IEPF may claim the units, etc., may IEPF claim the units in accordance with the procedure laid down in sub-section (6) of section 124 or may make an application under clause (a) of sub-section (3) of section 125.

Note: If the claimant is the legal heir, successor or agent of the registered shareholder, he/she must ensure that the Company completes the transfer procedure and issues a claim letter to the legal heirs before submitting the IEPF application to the authorities.

Procedure for reclaiming shares - Guidelines for reclaiming shares in India

A person wishing to reclaim shares must submit an IEPF Form-5 with the following information to MCA:

Applicant's details;

Details of the company;

Details of the shares to be reclaimed;

Amount of dividend to be claimed;

If the applicant is an Indian citizen, the Aadhar number is required and if the applicant is a foreigner or an NRI, he/she must provide his/her passport or PIO card number;

Once the online refund form is filled, the applicant must email it to the company's Nodal Officer along with the essential documents. The following documents must be attached:

Copy of the receipt with the SRN;

Original indemnity statement signed by the applicant;

Original stamped advance receipt signed by the claimant and witnesses;

Original certificates in the case of a matured deposit or bond that is being refunded;

Proof of eligibility;

Self-certified copy of the client master list of your DEMAT accounts;

The relevant firm must prepare an audit report within 15 days of receipt of the application form and submit it to the authorities in the prescribed form;

The Subscription and Disbursement Officer shall send an invoice to the Payment and Account Officer for payment based on the share recover policy after the completion of the verification of the claimants' claims;

The Authority issues a refund notice with the approval of the competent authority if the claimant is entitled to shares;

The shares shall be credited to the DEMAT account of the claimant or to the extent the claimant is entitled to them. If the shares are physical certificates, the duplicates shall be declared invalid and the shares shall be delivered to the applicant.

The authorities shall have the applicant's refund request confirmed by the Company.

The authorities must decide within 60 days or 2 months of receiving the verification report from the company concerned.

Conclusion

After discussing the guidelines for the confiscation of shares, it is concluded that the Ministry is seeking an amendment to the law to make it easier for companies to transfer their holdings to the state. The amendment, according to officials, will streamline the stock transfer process and solve the problem of unclaimed dividends. The MCA is pushing for an amendment to the Companies Act that would allow the GOI to take over the transfer of shares in companies.

0 notes

Text

Direct Tax Alert: Extension of various Income Tax due dates by CBDT

Extension of various due dates by CBDT for passing of orders under the Income Tax Act, 1961 and the Benami Transactions (Prohibition) Act, 1988 vide Notification No. 10/2021 dated 27th February, 2021

Time limits for passing of any order for assessment or reassessment under section 153 or section 153B of the Income Tax Act (‘ITA):

Time limit expiring on 31st March, 2021 due to extension by the earlier notification No. 93/2020 dated 31st December, 2020 has been further extended to 30th April, 2021; and.....

Continue reading go here:- Income Tax Due Dates

#income tax#income tax due dates#due dates of income tax#direct tax alert#extension of various income tax#income tax due dates by cbdt

0 notes

Text

Union Budget 2021: Detaching banks from attachments under economic offences laws is need of the hour

Union Budget 2021: Detaching banks from attachments under economic offences laws is need of the hour

Legislations dealing with economic offences like the Prevention of Money Laundering Act, 2002 (‘Money Laundering Law’) and the Prohibition of Benami Property Transaction Act, 1988 (‘Benami Property Law’) have remained dormant for many years in the past. In fact, the latter legislation got its teeth only in the year 2016, when it was amended to its current form.

These legislations are being used…

View On WordPress

0 notes

Text

CARO 2020: Another Step Towards Effective Auditing Of Financials Of Corporates

MCA has notified new Companies (Auditor’s Report) Order, 2020 (hereafter referred to as CARO, 2020) on February 25, 2020 replacing the previous Companies (Auditor’s Report) Order, 2016. CARO and is applicable from immediate effect. As per CARO 2020, Auditor has to highlight the qualification in the report in Italics. CARO will be annexed to the main Audit Report in which an Auditor gives assurance of the compliances of the Accounting Standard and Companies Act made.

CARO, 2020 is divided into four sections viz. New Clauses, Re-instatement from old CARO versions, deletion of Clauses and brief Comparison with CARO, 2016.

1. NEW CLAUSES

1.1. Fixed Assets – Immovable Properties [Clause 3(i)]

1.1-1. Disclose immovable properties whose title is not held by the company [Clause 3(i)(c)]

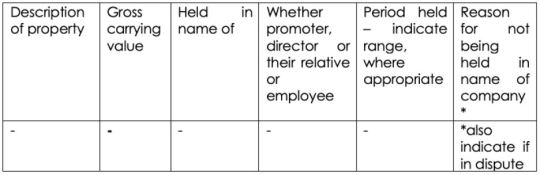

CARO 2020 requires disclosure of land and building and other immovable properties which are recognised as fixed assets but the title of such assets is not with the body corporate. In case immovable properties exist but in the Co’s name, then disclosure is required regarding Property description with ownership title ( Name and relation with the company executives), range of period for which property is held and the amount capitalised, the rationale for not holding the property in the name of the company. MCA has suggested the following format in this case:

One of the rationales is that accounting provisions apply only in case the title of the asset is held in the name of the company. Another rationale for such disclosure is to protect the interest of the lenders as Loans given by lenders to entities are based upon certain ratios which are dependent upon the amount of fixed assets recognised in the financial statements. With this disclosure, lenders would be in a better position to take a decision for financing the company when the title does not belong to the company.

1.1-2. Disclose revaluation for fixed assets or intangible assets happened during the year[Clause 3(i)(d)]

The company has to disclose if it’s Property, Plant and Equipment (including Right of Use assets) or intangible assets or both have been revalued during the year :

a) Whether the revaluation is based on the valuation by a Registered Valuer

b) Specify the amount of change, if change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment or intangible assets

Ind AS10 allows companies to follow either the cost model or the revaluation model. In case a company follows a revaluation model then a revaluation surplus is recognised in the balance sheet as a revaluation surplus. Further changes in the revalued amount are recognised in revaluation surplus or statement of profit and loss depending upon certain conditions and Auditors are required to highlight this upfront in the CARO report.

1.1-3. Disclosure required for Benami Transactions [Clause 3(i)(e)]

CARO 2020 requires disclosure for transactions even if proceedings are initiated (even if not complete) OR proceedings are pending against a company for holding any benami property. Since audit firms are required to sign the audit report, Auditors shall now be more stringent about the application of Benami Transactions (Prohibition) Act, 1988 (45 of 1988) and rules made thereunder.

Now management as well audit firms cannot take the shield of materiality and probability and have to provide notes to accounts in financial statements. Even if a transaction is not material, CARO requires disclosure in financial statements for proceedings regarding benami transactions in notes to accounts.

1.2. Working capital loan above Rs 5 crore – Auditors to tally returns or statements filed with banks with accounting books [Clause 3(ii)(b)]

Companies file a lot of accounting data (past information and projected statements) to banks and financial institutions to obtain working capital limits. The lender, on the other hand, is concerned about the accuracy of such data filed. The government has now stipulated that if the sanctioned limit(s), by combining limits of all banks/ FIs (Present/Proposed), exceed Rs 5 crores, then auditors are required to certify that quarterly results or the statements filed by the company with the banks are in line with the accounting books.

Considering the above provisions, auditors shall now be doing a pre-audit whenever the management is obtaining a new working capital loan or increasing their existing limits. Although CARO shall be filed by the end of the financial year the auditors shall insist upon management to get approval.

1.3. Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties [Clause 3(iii)]

MCA intends to tighten the disclosures regarding repayment and realization of loans and advances given by entities.

It needs to be checked whether during the year the company has made investments in, provided any guarantee or security or granted any loans or advances in the nature of loans, secured or unsecured, to companies, firms, LLPs or any other parties. If yes, indicate aggregate amount during the year,

– to subsidiaries, joint ventures and associates;

– to parties other than subsidiaries, joint ventures and associates;

whether the investments made, guarantees provided, security given and the terms and conditions are not prejudicial to the company’s interest;

whether the schedule of repayment of principal and payment of interest has been stipulated and whether the repayments or receipts are regular;

if the amount is overdue, state the total amount overdue for more than 90 days, and if reasonable steps have been taken by the company for recovery of the principal and interest;

whether any loan or advance granted which has fallen due, has been renewed or extended or fresh loans granted to settle the overdues of existing loans given to the same parties, if so, specify the aggregate amount of such dues renewed or extended or settled by fresh loans and the percentage of the aggregate to the total loans or advances

whether the company has granted any loans or advances in the nature of loans either repayable on demand or without specifying any terms or period of repayment, if so, specify the aggregate amount, percentage thereof to the total loans granted, aggregate amount of loans granted to Promoters, related parties as defined in clause (76) of section 2 of the Companies Act, 2013;

The focus of CARO 2020 is more towards highlighting any non-repayment or non-compliance by any errant party. From an accounting perspective [no change in accounting], any default in loans and advances made are accounted for by making a provision against the unrecoverable amount in the financial statements.

An auditor is required to report the aggregate amount and balance outstanding; whether the terms are prejudicial or not; whether the repayment plan has been specified and the repayment is in accordance with the terms agreed; the amount overdue; any extension or renewal of the amount fallen due during the period; and whether any loan or advance is granted to promoters or related parties without specifying repayment terms.

1.4. Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts[Clause 3(viii)]

1.4.1. Case A: Income was properly recognised in books of accounts but the income tax was not offered correctly. In case a company properly recorded income but while calculating income tax, income was not included or incorrect amount was included for assessing income tax and such income was offered to tax during the income tax assessments then auditors are required to consider such income. Proper accounting is to be ensured or to report in CARO disclosure.

1.4.2. Case B: Income was offered during income tax assessment and such income was not correctly recorded as per accounting provisions.

In case a company surrendered or offered income during income tax assessment and such income was either not recorded at all or recorded at incorrect amount or recorded in incorrect accounting period as per the accounting provisions then auditor needs to Treat such income as per the provisions of AS 5 and to report such income in CARO.

1.5. Default in repayment of loans or other borrowings or in the payment of interest [Clause 3(ix)(a)]

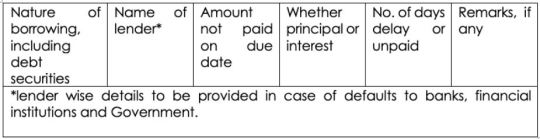

CARO 2016 specified the default on repayment of principal of financial institution, bank, Government or dues to debenture holders and CARO 2020 covers all the lenders and specifies the following format of disclosure:

1.6. Wilful defaulter [Clause 3(ix)(b)]

A wilful defaulter is defined as a company/ individual that has an ability to repay the loan but fails to do so. In case, a company defaults in repayments of loans, other borrowings or interest then the company is required to make such disclosure in the CARO report. Further, in case an entity has been disclosed as wilful defaulter by any financial institution (including banks) then auditor needs to highlight such fact in the CARO 2020 report.

This provision is introduced in view of the fact that number of wilful defaulters in nationalised banks have increased by over 60 per cent during the last five years.

1.7. Reporting of Whistle-blower complaints[Clause 3(xi)(c)]

This is one of the key steps introduced for marching towards corporate whistleblowers as at present, the Whistleblower Protection Act, 2014 is not applicable to corporates, government bodies, projects and offices.

CARO 2020 requires an auditor to report whistle-blower complaints received against the company.

1.8. Utilization of short-term funds for long-term purposes [Clause 3(ix)(d)]

CARO 2020 has even highlighted the requirement of disclosing the nature and amount of funds raised on short term basis and which has been utilised for long term purposes. This clause would protect the company and the stakeholders from the misutilisation of funds of the company and resulting in reduction of the defaults in repayment.

1.9. Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures [Clause 3(ix)(e)]

Another important addition in the recent CARO is if the company has taken any funds from any entity or person on account of or to meet the obligations of its subsidiaries, associates or joint ventures, it needs to disclose the details and nature along with the amount of transactions.

1.10. Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies [Clause 3(ix)(f)]

Now the Auditors need to specify in their report if the company has raised loans during the year on the pledge of securities held in its subsidiaries, joint ventures or associate companies, along with the details thereof and also report if the company has defaulted in repayment of such loans raised.

1.11. Fraud by and on the company [Clause 3(xi)(a)]

CARO 2020 has widened the scope of earlier Clause 3(x) of the CARO 2019 by deleting the words ‘by its officers or employees’ from the disclosure requirements in case any fraud by the company or any fraud on the company has been noticed or reported during the year. The auditors need to record the nature and the amount involved in the transaction.

1.12. Report under sub-section (12) of section 143 of the Companies Act, 2013 [Clause 3(xi)(b)]

The auditors need to record whether any report under sub-section (12) of section 143 of the Companies Act has been filed by the auditors in Form ADT-4 as prescribed under rule 13 of Companies (Audit and Auditors) Rules, 2014 with the Central Government.

1.13. Default in payment of interest on deposits or repayment [Clause 3(xii)(c)]

MCA has inserted this additional reporting requirement in case there is any default in payment of interest on deposits or repayment thereof for any period by the Company.

1.14. Internal Audit [Clause 3(xiv)]

An Auditor need to report if the company has an internal audit system commensurate with the size and nature of its business and if the reports of the Internal Auditors for the period under audit were considered by the statutory auditor.

This clause has been inserted to systemise the audit procedure and effectively implement the same in the Company.

1.15. Carrying on NBFC Business or becoming a Core Investment company[Clause 3(xvi)]

Core investment companies (CIC) are NBFCs holding at least 90% of their net assets in the form of investment in equity shares, preference shares, debt or loans, debentures, bonds in group companies. CARO 2020 requires an auditor to check whether an entity which is carrying on NBFC business, housing finance activities without a valid Certificate of Registration from Reserve Bank of India (RBI) or does a CIC fulfil the criteria of a CIC, and in case the company is an exempted or unregistered CIC, whether it continues to fulfil such criteria. If there are a group of CICs, then the auditor is required to provide number of CIC companies under that group.

The main rationale behind this disclosure requirement in CARO 2020 is because large CIC companies have recently defaulted.

1.16. Cash losses [Clause 3(xvii)]

An auditor now will have to report if the company has incurred cash losses in the financial year and in the immediately preceding financial year along with the amount of loss incurred.

1.17 Resignation of Statutory auditors [Clause 3(xviii)]

Presently, section 139 of the Companies Act, 2013 prescribes various compliances with respect to an auditor resignation. The new CARO requires disclosure by the new auditor in case a statutory auditor has resigned with the reasons and the issues raised by the previous auditor. If the reasons behind the resignation is something like hiding of material information by management, code of ethics is being violated or involvement of entity in accounting scandals then in such cases, it becomes important for the new auditor to communicate with outgoing auditor to consider the facts before deciding to accept the audit assignment.

Practically, this requirement is fulfilled by sending a courtesy letter by the new auditor to the previous auditor regarding their appointment seeking any objection or issue the previous auditor wants to highlight.

1.18 Uncertainty in repayment of Liabilities [Clause 3(xix]

Disclosure required in this clause would enable the auditor to determine whether an entity is financially stable. This clause is more about assessing the validity of fundamental accounting assumption of going concern in accordance with Standards on Auditing (Revised) 570 and then respond to the CARO clause.

CARO 2020 requires a specific certification that no material uncertainty exists in a company to pay its liabilities within a period of one year from the due date. This new clause has increased the auditor’s responsibility to determine and disclose the financial health of an entity to meet its liabilities existing in the balance sheet.

1.19 Unspent amount on Corporate Social Responsibility (CSR) expenditure [Clause 3(xx)]

Section 135 of the Companies Act, 2013 requires certain class of companies to spend 2% of their average net profits of past 3 years in pursuance of its Corporate Social Responsibility Policy.

Any amount remaining unspent on CSR activities (except due to some ongoing projects) shall be transferred within a period of thirty days from the end of the financial year to a special account to be opened by the company in that behalf for that financial year in any scheduled bank in the name of “ Unspent Corporate Social Responsibility Account”, and such amount shall be spent by the company in pursuance of its obligation towards the CSR Policy within a period of three financial years from the date of such transfer, failing which, the company shall transfer the same to a Fund specified in Schedule VII of the Companies Act, 2013, within a period of thirty days from the date of completion of the third financial year.

In case the company contravenes such provision, then there are penal provisions in the Act and disclosure of any unspent amount is to be reported by the auditor in CARO report.

1.20 CARO for Consolidated Financial Statements [Clause 3(xxi)]

In case of multiple subsidiaries, joint ventures and associates, it is possible that one audit firm may take all the audits of group entities or various audit firms may be involved for the audit of the entire group. CARO 2020 requires that in case respective auditors have made any qualifications or adverse remarks then the following disclosure should be made:

a) Details of such companies [Name and relationship – Subsidiaries, Joint venture and Associates]

b) Clause no. of respective CARO report of such companies containing such qualifications and adverse remarks.

CARO 2020 recognises the fact that there can be few matters which should be addressed via CARO report for consolidated financial statements.

2. REINSTATEMENT OF CLAUSES FROM PREVIOUS CARO VERSIONS

Following clauses have been re-instated from previous CARO versions:

a) Cash losses incurred [Clause 3(xvii)]

b) Internal audit system [Clause 3(xiv)]

3. DELETION OF CLAUSE FROM CARO, 2016

The clause Managerial remuneration [Clause 3(xi))] has been deleted from CARO, 2016.

4. BRIEF COMPARISON OF CARO, 2020 WITH CARO, 2016

The previous CARO did not cover the records showing full particulars of intangible assets and was not applicable to disclosures on Fixed Assets – Immovable Properties, Working capital loan above Rs 5 crore where auditors need to tally returns or statements filed with banks with accounting books, Disclosure of investments made in companies, firms, Limited Liability Partnerships or any other parties, Highlighting incomes disclosed in tax assessments but not properly accounted in books of accounts, Default in repayment of loans or other borrowings or in the payment of interest, Wilful defaulter, Reporting of Whistle-blower complaints, Utilization of short-term funds for long-term purposes, Purpose of funds obtained to meet obligations of subsidiaries, associates or joint ventures, Funds obtained on the pledge of securities held in its subsidiaries, joint ventures or associate companies, Report under sub-section (12) of section 143 of the Companies Act, 2013, Default in payment of interest on deposits or repayment, Internal Audit system, Carrying on NBFC Business or becoming a Core Investment company, Cash losses, Resignation of Statutory auditors, Uncertainty in repayment of Liabilities, Unspent amount on Corporate Social Responsibility (CSR) expenditure and CARO for Consolidated Financial Statements which have now been made part of CARO 2020 and altered the reporting requirements in case of any Fraud by and on the company in the current CARO.

Conclusion

CARO 2020 is one of the Government’s major initiatives with the primary objective of necessitating greater transparency by fortifying corporate governance under the Companies Act, 2013 as applicable for the audit of financial statements of eligible companies. Earlier it was applicable for the financial years commencing on or after the 1st April 2019 but keeping in view the massive effect of Covid19 and the recent lockdown, the Government has decided to make it effective for the next Financial Year i.e. FY 2020-21.

Written and compiled by

CA Sunil Kumar Gupta

Founder Chairman, SARC Associates

0 notes

Text

IT News

IT News the due date for completion of penalty proceedings under the IT Act has also been extended from September 30, 2021 to March 31, 2022. Further, the time limit for issuance of notice and passing of order by the 'Adjudicating Authority under the

Prohibition of Benami Property Transactions Act, 1988' has also been extended to 31st March, 2022. Visit on Varindia site to get News IT, IT News, Latest Technology News, Latest Technology News India, Live Tech News, IT News in India, IT

Magazines Online, IT Magazines https://www.varindia.com/

0 notes

Link

CARO 2020 was introduced on February 25, 2020, and made effective for all the reports to be issued for the financial years commencing on or after April 1st, 2019.

This publication highlights key takeaways for Auditors, CFO, and other senior management.

Considering a very short time given for companies to comply with this Order, the implementation of this order is going to be an uphill battle for companies. When the companies have to look back certain policies that never existed in the last 11 months and comply the same in the next 1 month, it is likely that the application for this order may be deferred for few quarters.

The regulators have definitely given a thought for Small business and have exempted CARO 2020 for below private companies including certain specific categories of the company like banking, insurance, section 8 companies, and one person company:

Private companies excluding holding/subsidiary companies with paid-up capital of less than or equal to Fifty Lakhs Rupees and turnover less than Rupees two crores during previous Financial Year (Both conditions must be satisfied)

Private companies having a paid-up capital and reserves and surplus not more than one crore rupees as on the balance sheet date and which does not have total borrowings exceeding one crore rupees from any bank or financial institution at any point of time during the financial year and which does not have a total revenue as disclosed in Scheduled III to the Companies Act (including revenue from discontinuing operations) higher than ten crore rupees during the financial year as per the financial statements (all three conditions must be satisfied).

Consolidated Financial statement has also been exempted except certain reporting related to Fraud reporting which must be included by the auditor for consolidated financial statements as well.

Below are in-depth analysis of our expert team related to certain key matters of CARO 2020:

Intangible Assets: Similar to erstwhile reporting on Fixed Assets, the CARO 2020 requires management to maintain complete details about intangible assets. Although the order is currently silent on the details to be maintained, however, it will be expected to maintain details such as Name, in which process /business of the company it is being used, their useful life, cost involved in developing of acquiring and most importantly if the intangible assets are internally generated then how the accounting standard requirements related to capitalization of intangibles are adhered to. This may pose certain challenges to various start-up companies who have been capitalizing on certain intangible assets in their business. Management and auditor both have to be vigilant to ensure that the proper record of capitalization is maintained. Companies may consider adopting certain Project Management Software including an integrated Time Sheet and expense management tool to establish the authenticity of the amount capitalized.

Immovable properties other than leased property: Auditors are required to report if the title deeds of all the immovable properties disclosed in the financial statements are held in the name of the company. This reporting may pose a significant business risk to real estate companies who have been reporting a significant amount of immoveable properties without the title deed in their name or otherwise. The auditors are also required to report whether any proceedings have been initiated or are pending against the company for holding any Benami property under the Benami Transactions (Prohibition) Act, 1988 (45 of 1988).

Reporting related to working capital loan: If the company has been sanctioned working capital loan in excess of rupee five crores on the basis of security of current assets, auditors will be required to report if various statements submitted by the companies to Bankers agree to their books of account or not. This may increase the work of the auditor who has been focussing on auditing numbers on an annual basis. They need to start focusing on quarterly numbers as well to ensure reporting for this clause.

Reporting related to loans, advances, and investments: The auditors are required to report the aggregate amount of transactions during the year related to loans, advances, and investments, etc with group companies and other than group companies. Further, an auditor needs to report in respect of loans and advances in the nature of loans, whether the schedule of repayment of principal and payment of interest has been stipulated and whether the repayments or receipts are regular. In addition to above, certain other critical reporting related to loans and advances are required such as amount overdue, overdue more than 90 days, renewal of loans, granting of fresh loans to repay previous loans, any loan repayable on demand which may ultimately lead to identify potential risk on the balance sheet of the company. This reporting was primarily being asked from Bank Auditors till now and which seems to have extended to the company auditor under CARO 2020.

Reporting related to a loan taken: The auditors are required to disclose default in repayment of such loans and interest thereon or if the amount of loan was diverted for the purpose other than the purpose for which the loan was taken if the loan was taken for the use of group companies etc.

Share issue related compliances: CARO 2020 requires an auditor to report on whether the company has made any preferential allotment or private placement of shares or convertible debentures (fully, partially or optionally convertible) during the year and if so, whether the requirements of section 42 and section 62 of the Companies Act, 2013 have been complied with and the funds raised have been used for the purposes for which the funds were raised, if not, provide details in respect of amount involved and nature of non-compliance. It is critical to understand various compliances required under section 42 and 62 of the Companies Act, 2013. The Auditor must train themselves properly to be able to report under this clause.

CARO 2020 reporting is going to be tougher for the auditor as well as companies. On the other hand, it will bring more transparency in the dealings of the companies.

0 notes

Text

Hostile to Money Laundering - Indian Perspective

The Guidelines as outlined underneath gives a general background regarding the matters of Laundering money and fear based oppressor financing condenses the main arrangements of the appropriate laundering money and against psychological militant financing enactment India and gives direction on the viable ramifications of the Act. The Guidelines likewise sets out the means that an enlisted intermediary and any of its delegates, should execute to dishearten and recognize any money laundering fear monger financing exercises. These Guidelines are intended for use principally by intermediaries enrolled under Section 12 of the SEBI Act, 1992. While it is perceived that a "one-size-fits-all" approach may not be proper for the protections industry in Country, each enrolled intermediary ought to think about the particular idea of its business, authoritative structure, sort of clients and exchanges, and so on when implementing the recommended measures and systems to guarantee that they are viably connected. The overriding principle is that they ought to have the option to fulfill them that the measures taken by them are sufficient, fitting and pursue the soul of these measures and the prerequisites as enshrined in Prevention of Money laundering Act, 2002

Back Ground:

The Prevention of Money laundering Act, 2002 has happened from 1stJuly 2005. Essential Notifications/Rules under the said Act have been distributed in the Gazette of India on 1stJuly 2005 by the Department of Revenue, Ministry of Finance, Government of India.

According to the arrangements of the Act, each banking organization, financial institution (which includes chit reserve organization, a co-usable bank, a housing finance institution and a non-banking financial organization) and intermediary (which includes a stock-dealer, sub-specialist, share move operator, broker to an issue, trustee to a trust deed, recorder to an issue, trader financier, guarantor, portfolio director, investment consultant and some other intermediary related with protections showcase and enlisted under segment 12 of the Securities and Exchange Board of India Act, 1992) will need to maintain a record of the considerable number of exchanges; the nature and estimation of which has been recommended in the Rules under the PMLA. Such exchanges include:

All money exchanges of the estimation of more than Rs 10 Lacs or its comparable in outside cash. All arrangement of money exchanges integrally associated with one another which have been esteemed beneath Rs 10 lakhs or its proportionate in remote cash where such arrangement of exchanges happen within one schedule month.

Every single suspicious exchange whether made in real money and including, inter-alia credits or charges into from any non financial record, for example, d-tangle account, security record maintained by the enlisted intermediary.

It might, be that as it may, be explained that with the end goal of suspicious exchanges reporting, aside from 'exchanges integrally associated', 'exchanges remotely associated or related' ought to likewise be considered.

What is money laundering?

Money laundering involves disguising financial resources so they can be utilized without discovery of the criminal behavior that delivered them. Through money laundering, the launderer changes the financial continues got from criminal movement into assets with a clearly lawful source.

Strategies and Procedures to Combat Money Laundering and Terrorist

Financing:

These Guidelines have considered the prerequisites of the Prevention of the Money laundering Act, 2002 as material to the intermediaries enrolled under Section 12 of the SEBI Act. The nitty gritty guidelines have outlined important measures and laundering methods to direct the enlisted intermediaries in preventing money and fear based oppressor financing. A portion of these recommended measures and methodology may not be material in each situation. Every intermediary ought to consider cautiously the particular idea of its business, hierarchical structure, sort of client and exchange and so forth to fulfill itself that the measures taken by them are satisfactory and fitting to pursue the soul of the proposed measures and the necessities as set down in the PML Act, 2002.

Commitment to build up strategies and methods:

International initiatives taken to battle medication trafficking, fear based oppression and other sorted out and genuine wrongdoings have presumed that financial institutions including protections showcase intermediaries must build up strategies of internal control planned for preventing and impeding Money Back Plan laundering and psychological militant financing. The said commitment on intermediaries has additionally been committed under the Prevention of Money laundering Act, 2002. In request to satisfy these necessities, there is likewise a requirement for enlisted intermediaries to have a framework set up for identifying, monitoring and reporting speculated laundering or psychological oppressor financing exchanges to the law implementation specialists.

Methods for Anti Money Laundering:

Each enlisted intermediary ought to embrace composed strategies to actualize the Anti Money Laundering arrangements as visualized under the Prevention of Money laundering Act, 2002. Such strategies ought to include inter alia, the following three explicit parameters which are identified with the generally speaking 'Customer Due Diligence Process:

a. Policy for acknowledgment of customers

b. Methodology for identifying the customers

c. Exchange monitoring and reporting particularly Suspicious

Exchanges Reporting (STR)

What is a Money Laundering offense?

Whosoever legitimately or indirectly endeavors to indulge or knowingly helps or knowingly is a gathering or is really involved in any procedure or action associated with the returns of wrongdoing and projecting it as untainted property will be blameworthy of offense of money laundering.

Individual includes:

(i) an individual

(ii) a Hindu unified family,

(iii) a organization,

(iv) firm,

(v) an relationship of people or an assortment of individuals whether incorporated or not,

(vi) every counterfeit juridical individual not falling within any of the preceding sub-provisions, and

(vii) any organization, office or branch possessed or constrained by any of the above people referenced in the preceding sub-statements;

Laws regarding hostile to money laundering methods

o The Prevention of Money Laundering Act 2002 (PMLA 2002)

it shapes the center of the legitimate structure set up by India to battle money laundering. PMLA 2002 came into power with impact from July 1, 2005. It forces a commitment on banking organizations, financial institutions and intermediaries to check the personality of customers maintain records and outfit information to FIU-IND.

o Foreign Exchange Management Act, 1999 it recommends checks and restrictions on certain remote trade settlements.

o Benami Transactions (Prohibition) Act, 1988 it forbids exchanges in which property is moved to one individual for thought paid or given by someone else.

o The Narcotics Drugs and Psychotropic Substances Act, 1985 it accommodates confiscating deal continues procured in connection to any opiate sedate or psychotropic substance and any products used to hide such medications. It accommodates relinquishment of any wrongfully obtained property.

o The Prevention of Illicit Traffic in Narcotic Drugs and Psychotropic Substances Act, 1988 it approves detaining people to counteract illegal traffic in opiate drugs and psychotropic substances.

o Know-Your-Customer Guidelines it was introduced by The Reserve Bank of India to banks in India to lessen financial cheats and recognize money-laundering exchanges. The commitments forced by these guidelines were diminished in October 2007 to permit outsiders and non-occupant Indians to get money installments of up to $3,000 from money changers. Adequate character documentation was additionally extended to enable money changers to acknowledge a more extensive class of reports as proof of a business relationship.

o Guidelines for against money laundering estimates The Securities and Exchange Board of India (SEBI) has distributed guidelines for capital market intermediaries under the PMLA 2002. The guidelines concern all intermediaries enlisted with SEBI - a grouping that includes institutional investors, representatives and portfolio supervisors.

"In November 2006, India's Insurance Regulatory and Development Authority issued hostile to money laundering guidelines that excluded general insurance organizations from the need to consent to certain section level minds clients."On 17 April 2008, India finalized alterations to expand the scope of its AML laws. The revisions will stretch out these laws to bring international charge card exchanges, money moves, and offenses with "cross fringe suggestions" within their ambit. The alterations take into account "single criminality", whereby an exchange just should be illicit in India, and not in the other state involved, in request to hazard arraignment for money laundering offenses. The alterations will likewise grow the compass of the counter money laundering laws to include casinos, charge card organizations, and money changes. It has been accounted for that India's Union Cabinet has affirmed the alterations for introduction to parliament.Under what conditions is a legal advisor under commitment to report?At present, there is no particular law obliging an attorney to report a money laundering offenseLegal advisor's duty?No present commitments for customer recognizable proof and checkCustomer's recognizable proof and checkIndian legal advisors regularly do as such, however not on the grounds that there is any commitment. Segment 12 of the PMLA 2002, requires each banking organization, financial institution and intermediary to check and maintain the records of the personality of every one of its customers, as recommended by Rule 9 of the Rules informed by Notification No.9/2005 best money back policy in india

0 notes