#State Bank of India Internet Banking service

Text

Lately, the government and the top banks of Australia have been pushing for the eradication of payments by cash, leaving phone apps alone, and possibly a medical implant as well.

I have fought against it as best I can, buy there's not much I can do.

It's illegal to have large amounts of cash, and self defense is a crime, so storing at home is not really an option. Besides, I am a disabled pensioner, and the government decided long ago that going through the bank is mandatory.

Covid was the best opportunity they ever had to eliminate personal freedom - I mean, to force everyone to use insecure apps on insecure phones that had insecure operating systems on insecure hardware.

There were scandal when apps were exposed data harvesting, accessing information they didn't have the rights to, and even hacking the microphone and camera of the phone.

https://www.consumerreports.org/electronics-computers/privacy/how-to-protect-yourself-from-camera-and-microphone-hacking-a1010757171/

But the push to do the thing was relentless. You can't stop progress! Nobody else is complaining, the bank told me.

Except people do complain, helpless and hopeless. I worked in tech support, and would hear all day long the agony of those whose assets were cleaned out, and that was in the days of internet banking, when the scammer call centers of India were just a sparkle in Satan's Eye.

You see, the reason banks existed was that they took money in exchange for the service of PROTECTION.

Now, they take your money, and if you get robbed, that's a YOU problem.

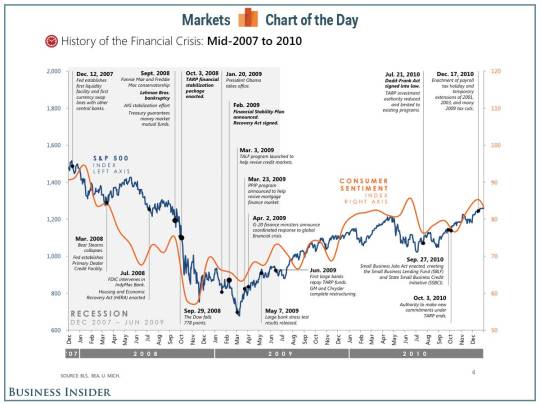

And the government is backing them up. Remember the GFC, when most governments expressed their hatred of capitalism by backing banks no matter how badly they embezzled customers?

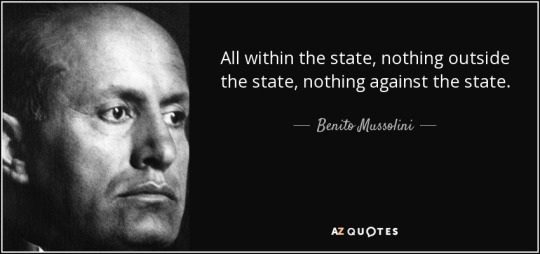

The Bank and the State had merged.

Mussolini's vision had succeeded.

Fascism took a century, but it in the end, it won. But I am not sure even the 1930s fascists could see this coming.

youtube

21 notes

·

View notes

Text

Top Ten Web Development Companies in India

Although many organisations strive to minimise the benefits of web development to the global market, statistics indicate the truth. According to statistics, everybody with an internet connection can browse around 1.88 billion webpages.

Given that the majority of websites increase firm sales and ROI, web development can create exceptional outcomes for any business. Web development can benefit both a start-up and a huge organisation. Custom Web Development Companies in India that are skilled in web development are best equipped to handle business needs because they always have enough talent to meet all the demands.

The Best Web Development Companies in India keep their resources up to date with the most recent trends and technologies in the digital world, in addition to their skill sets. Despite the fact that every other web development firm claims to be the finest, it's straightforward to identify the top web developers in India based on their service offerings and work portfolios.

We've produced a list of the top 10 web development companies in India so you can pick the finest one for your next project! So, let's get started.

1. Connect Infosoft Technologies Pvt. Ltd.

Connect Infosoft Technologies Pvt. Ltd. is a well-known web development service company that provides a comprehensive range of web development services. Our web creation services are targeted to your company's specific demands, allowing you to create a website that fits those objectives. We offer website design, development and Digital marketing organization situated in New Delhi. We were established in 1999 and have been serving our customers everywhere throughout the world. Connect Infosoft's Head Office is based in New Delhi, India and has Branch Office in Orissa. It also has a portrayal in the United States.

Our skilled web developers are well-versed in the latest web technologies and can provide you with the best web development solutions that match your budget and schedule restrictions. We also have a team of SEO and digital marketing professionals who can assist you in improving your search .

Major Service Offerings:

Web Application Development

ETL Services -SaaS & MVP Development

Mobile App Development

Data Science & Analytics

Artificial Intelligence

Digital Marketing

Search Engine Optimization

Pay-Per-Click advertising campaigns

Blockchain

DevOps

Amazon Web Services

Product Engineering

UI/UX

Client Success Stories:

Our success is intricately woven with the success stories of our clients. We take pride in delivering successful projects that align with client requirements and contribute to their growth.

We are always ready to start new projects and establish long-term work relationships. We work in any time zone for full-time and part-time-based projects.

Hire Developer for $10 per hour approx.

Book Appointments or Start To Chat:

Email: [email protected]

M: +1 323-522-5635

Web: https://www.connectinfosoft.com/lets-work-together/

2. Infosys

Infosys is a well-known global leader in IT services and consulting based in India. Founded in 1981, Infosys has grown to become one of the largest IT companies in India and has a strong presence worldwide. The company offers a wide range of services, including web development, software development, consulting and business process outsourcing.

In the field of web development, Infosys provides comprehensive solutions to its clients. They have expertise in building custom web applications, e-commerce platforms, content management systems and mobile-responsive websites. Their web development team is skilled in various programming languages, frameworks and technologies to create robust and scalable web solutions.

Infosys has a track record of working with clients from diverse industries, including banking and finance, healthcare, retail, manufacturing and more. They leverage their deep industry knowledge and technical expertise to deliver innovative web development solutions tailored to meet their clients' specific requirements.

Additionally, Infosys focuses on utilizing emerging technologies like artificial intelligence, machine learning, blockchain and cloud computing to enhance the web development process and deliver cutting-edge solutions.

3. TCS (Tata Consultancy Services)

TCS (Tata Consultancy Services) is one of the largest and most renowned IT services companies in India and a part of the Tata Group conglomerate. Established in 1968, TCS has a global presence and provides a wide range of services, including web development, software development, consulting and IT outsourcing.

TCS offers comprehensive web development solutions to its clients across various industries. Their web development services encompass front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites. They have expertise in various programming languages, frameworks and technologies to build robust and scalable web solutions.

TCS has a customer-centric approach and works closely with its clients to understand their business requirements and goals. They leverage their deep industry knowledge and technological expertise to provide innovative and tailored web development solutions that align with their clients' specific needs.

4. Wipro

Wipro is a prominent global IT consulting and services company based in India. Established in 1945, Wipro has evolved into a multinational organization with a presence in over 60 countries. The company offers a wide range of services, including web development, software development, consulting and digital transformation.

In the realm of web development, Wipro provides comprehensive solutions to its clients. They have a team of skilled professionals proficient in various programming languages, frameworks and technologies. Their web development services cover front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

Wipro emphasizes delivering customer-centric web development solutions. They collaborate closely with their clients to understand their specific requirements and business objectives. This enables them to create tailored solutions that align with the clients' goals and provide a competitive

5. HCL Technologies

HCL Technologies is a leading global IT services company headquartered in India. Established in 1976, HCL Technologies has grown to become one of the prominent players in the IT industry. The company offers a wide range of services, including web development, software development, digital transformation, consulting and infrastructure management.

HCL Technologies provides comprehensive web development solutions to its clients worldwide. They have a dedicated team of skilled professionals proficient in various programming languages, frameworks and technologies. Their web development services cover front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

HCL Technologies has a broad industry presence and serves clients across various sectors such as banking and financial services, healthcare, retail, manufacturing and more. They leverage their deep industry expertise to deliver web solutions that are not only technologically robust but also address the unique challenges and requirements of each industry.

6. Mindtree

Mindtree is a global technology consulting and services company based in India. Founded in 1999, Mindtree has grown to become a well-known player in the IT industry. The company offers a wide range of services, including web development, software development, digital transformation, cloud services and data analytics.

Mindtree provides comprehensive web development solutions to its clients. They have a team of skilled professionals with expertise in various programming languages, frameworks and technologies. Their web development services encompass front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

One of the key strengths of Mindtree is its focus on delivering customer-centric solutions. They work closely with their clients to understand their specific business requirements, goals and target audience. This enables them to create tailored web development solutions that meet the clients' unique needs and deliver a seamless user experience.

Mindtree serves clients across multiple industries, including banking and financial services, healthcare, retail, manufacturing and more. They leverage their industry knowledge and experience to provide web solutions that align with the specific challenges and regulations of each sector.

7. Tech Mahindra

Tech Mahindra is a multinational IT services and consulting company based in India. Established in 1986, Tech Mahindra is part of the Mahindra Group conglomerate. The company offers a wide range of services, including web development, software development, consulting, digital transformation and IT outsourcing.

Tech Mahindra provides comprehensive web development solutions to its clients across various industries. They have a team of skilled professionals proficient in various programming languages, frameworks and technologies. Their web development services cover front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

Tech Mahindra focuses on delivering customer-centric web development solutions. They work closely with their clients to understand their specific requirements, business objectives and target audience. This enables them to create customized web solutions that meet the clients' unique needs, enhance user experience and drive business growth.

The company serves clients across diverse sectors, including telecommunications, banking and financial services, healthcare, retail, manufacturing and more. They leverage their industry expertise and domain knowledge to provide web solutions that are tailored to the specific challenges and requirements of each industry.

Tech Mahindra embraces emerging technologies in their web development services. They leverage artificial intelligence, machine learning, blockchain, cloud computing and other advanced technologies to enhance the functionality, security and scalability of the web solutions they deliver.

8. Mphasis

Mphasis is an IT services company headquartered in India. Established in 2000, Mphasis has a global presence and offers a wide range of services, including web development, software development, digital transformation, consulting and infrastructure services.

Mphasis provides comprehensive web development solutions to its clients worldwide. They have a team of skilled professionals proficient in various programming languages, frameworks and technologies. Their web development services encompass front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

Mphasis focuses on delivering customer-centric web development solutions tailored to meet their clients' specific requirements. They work closely with their clients to understand their business objectives, target audience and desired outcomes. This allows them to create customized web solutions that align with their clients' goals and provide a competitive edge.

9. L&T Infotech

L&T Infotech (LTI) is a global IT solutions and services company headquartered in India. LTI is a subsidiary of Larsen & Toubro, one of India's largest conglomerates. The company provides a wide range of services, including web development, software development, consulting, digital transformation and infrastructure management.

L&T Infotech offers comprehensive web development solutions to its clients. They have a team of skilled professionals who are proficient in various programming languages, frameworks and technologies. Their web development services cover front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

One of the key strengths of L&T Infotech is its customer-centric approach. They work closely with their clients to understand their specific business requirements, objectives and target audience. This enables them to create tailored web development solutions that align with the clients' unique needs and deliver tangible business value.

10. Cybage

Cybage is a technology consulting and product engineering company headquartered in Pune, India. Established in 1995, Cybage has grown to become a global organization with a presence in multiple countries. The company offers a range of services, including web development, software development, quality assurance, digital solutions and IT consulting.

Cybage provides comprehensive web development solutions to its clients. They have a team of skilled professionals who are proficient in various programming languages, frameworks and technologies. Their web development services encompass front-end and back-end development, web application development, e-commerce platforms, content management systems and mobile-responsive websites.

Cybage focuses on delivering customer-centric web development solutions. They collaborate closely with their clients to understand their specific business requirements, goals and target audience. This enables them to create customized web solutions that meet the clients' unique needs, enhance user experience and drive business growth.

The company serves clients across diverse industries, including healthcare, retail, e-commerce, banking and finance and more. They leverage their industry knowledge and domain expertise to provide web solutions that address the unique challenges and requirements of each industry.

Cybage emphasizes the use of emerging technologies in their web development services. They incorporate artificial intelligence, machine learning, cloud computing, blockchain and other innovative technologies to enhance the functionality, scalability and security of the web solutions they deliver.

#web developer#web development#webdesign#web design#web app development#custom web app development#web application development#web application services#web application security#connect infosoft

3 notes

·

View notes

Text

Commercial Office Space in Andheri West: A Thriving Hub for Business Growth

In the bustling metropolis of Mumbai, Andheri West stands out as a key destination for businesses looking to capitalize on the city’s dynamic market opportunities. Known for its vibrant culture, excellent connectivity, and thriving commercial landscape, Andheri West offers a compelling proposition for companies seeking to establish or expand their presence in India's financial capital. This article explores the advantages of choosing commercial office space in Andheri West and why it is considered a hotspot for business growth and innovation.

Prime Location and Connectivity

Andheri West's geographical placement is one of its biggest advantages. Strategically located close to the Mumbai International Airport, it offers excellent connectivity to both domestic and international markets. This proximity makes it particularly attractive to businesses that require frequent travel and global networking. Moreover, Andheri West is well-connected to other parts of Mumbai through an extensive network of roads, including the Jogeshwari-Vikhroli Link Road (JVLR) and the Western Express Highway, as well as the Mumbai Metro. The ease of accessibility reduces travel time and increases efficiency for daily commuters, making it an ideal location for employee satisfaction and retention.

Diverse Commercial Spaces

Andheri West offers a wide array of commercial spaces that cater to a diverse range of business needs. From modern high-rise office complexes to flexible co-working spaces, businesses can choose from a variety of options that align with their specific requirements. These office spaces are equipped with state-of-the-art facilities and infrastructure to support the needs of modern businesses, including high-speed internet, advanced security systems, and contemporary meeting and conference facilities.

Hub for Media and Entertainment

Andheri West is renowned as the heart of Mumbai’s flourishing media and entertainment industry. It hosts numerous production houses, television studios, and the offices of leading entertainment companies. This concentration of creative industries creates a vibrant, dynamic environment that is ideal for businesses involved in media, advertising, public relations, and related fields. The presence of these industries also facilitates networking opportunities, collaborations, and access to a creative talent pool.

Thriving Business Ecosystem

The business ecosystem in Andheri West is bolstered by the presence of numerous startups, SMEs, and multinational corporations. This diversity fosters a competitive yet collaborative business environment where companies can leverage synergies across various sectors including technology, finance, and service industries. The area is also supported by a robust infrastructure of business services, including banks, legal firms, consultancies, and marketing agencies, providing everything a business might need to thrive.

Quality of Life and Amenities

Andheri West does not just excel in business facilities; it also offers a high quality of life with its plethora of amenities. The area is home to a range of shopping malls, restaurants, cafes, and recreational spots, providing plenty of options for dining and leisure. Such amenities not only make life easier for employees but also serve as great spots for business lunches and informal meetings. Moreover, the presence of several residential areas nearby makes it a convenient option for staff looking to live close to their workplace, thereby reducing commute times and enhancing work-life balance.

Investment Potential

Investing in commercial office space in Andheri West is also seen as a sound financial decision. The demand for office space in this part of Mumbai continues to grow, driven by the area’s business-friendly environment and its status as a commercial hub. This demand leads to appreciating property values, offering lucrative opportunities for real estate investments and high rental yields for property owners.

Conclusion

Choosing commercial office space in Andheri West is more than just a logistical decision; it’s a strategic one that can influence the future trajectory of a business. With its unmatched connectivity, diverse office spaces, and vibrant local economy, Andheri West is not just a place to work; it's a place to grow and thrive. For businesses aiming to make a significant impact in the competitive landscape of Mumbai, Andheri West offers a perfect blend of opportunities and amenities to foster success and innovation.

0 notes

Text

These Should Be the Global Trend Set Policies tin the Next 40 Years 2020-2060

Freedom of the media, the Internet, social platforms, algorithms, and blockchain.

Free markets and no subsidizing tariffs on products and services.

Social Security will be saved by immigration influx and more liberal immigration policies, anti-abortion policies.

African development and stabilization.

Weaning off of oil from the Middle East to make oil wars a thing of the past

Deregulation of nanotechnology and biotechnologies to further human life and health care causes.

Religion vs the free Internet, Tree of Life vs Tree of Knowledge, should not be regulated by governments or religion.

Deregulation of biotechnology and nanotechnologies for food production and plant adaptation

Deregulation of cannabis and marijuana, where cannabis will take over cotton, paper, oil, and big pharma industries.

Globalization within the cooperation of open trade, lax border and over-the-border exchange of products, free markets, andlax immigration policies.

Information flow should not be interfered with by governments, especially oppressive governments.

Artificial intelligence should be allowed to advance as fast as possible for human adaptation.

Deregulation of banks, health care, energy, biotechnology, nanotechnology, and education industries worldwide

Worldwide democratization.

Freedom of art, entertainment, and expression worldwide.

The eradication of extremism, fanaticism, and religious prohibitions for advancing human liberties.

Worldwide end to the drug wars, oil wars, and peaceful collectivism worked out through the UN.

Large investment in robots and space travel.

Deregulation of worldwide food imports, eastern medicines, and drugs

Deregulation of the worldwide pharmaceutical trade.

Worldwide research on diabetes and cancer to find a cure to end the diseases instead of prolonging them for profit

Individuals worldwide have the right to express their personal free spirit and free thought.

Deregulation of the transportation and communications sectors for products and information flow to promote competition.

Deregulation for the food and agricultural sectors to feed a growing world population.

Global warming actually increases crop yield, so the deregulation of carbon emissions, more trees needed, and less climate global regulation.

Fracking increases to keep the OPEC nations at bay from high oil prices.

Getting rid of subsidies in the energy sector and letting the consumer decide what energy source suits their needs

Diplomacy first over war and the military-industrial complex, for war is a racket and expensive.

Economic growth over ideological religion and prohibitions which extend from it, freedom from religion, and promoting the individual free thought and spirit

Recycling not to benefit the local governments through recycling programs but for the consumers and the private citizens who actually paid for the resources

Open borders for commerce and immigration. this would increase global economic activity by 2.5 times.

White and black nationalism will harm American economic growth. Nationalism is socialism

Population growth should be encouraged with incentives and free cost of pregnancy delivery. There should be an anti-abortion policy set in place and liberal immigration policies to bring immigrants in to stimulate population in countries where it is needed.

Brazil, Russia, China, and India will grow at a rapid pace, and the United States should not miss the opportunity for growth, which can be done through lenient immigration information flow, open borders, and multiculturalism policies

The legalization of prostitution but the outlawing of pimping and the modern slave trade of human trafficking.

Prison depopulation that puts a burden on the taxpayer end private prisons and the minimum term incarceration.

No human being should be denied the right to vote or to participate in a free election.

A world priority to tackle the world refugee and homeless

.

0 notes

Text

Exploring the Legality and Potential of Sports Betting Game Development in India

The recent exponential rise of the global sports betting business is driven by legislative changes and technological advancements. With sports enjoying immense popularity in India, the prospect of creating sports betting websites has attracted considerable attention. However, prospective developers need to navigate the legal framework surrounding gambling activities in the country. Let's examine the legitimacy and potential of sports betting game development in India.

Understanding the Legal Landscape

In India, the legal status of sports betting is governed by various federal and state laws, including the Public Gambling Act of 1867. Under this archaic legislation, most forms of gambling, including sports betting, are prohibited. However, there are exceptions. States have the authority to enact their gambling laws, and several have legalized certain forms of gambling, such as horse racing and lotteries.

Additionally, the emergence of online betting platforms has raised complex legal questions. While the Public Gambling Act predates the Internet era, courts have interpreted its provisions to apply to online gambling activities. As a result, online sports betting remains a legally gray area in India, with no clear regulations governing its operation.

Despite the legal ambiguity, the popularity of sports betting persists, driven by offshore betting platforms and the proliferation of mobile betting apps. Recognizing the potential economic benefits, some states have initiated discussions on legalizing sports betting to regulate and capitalize on this lucrative market.

Opportunities for Sports Betting Game Development

Amidst the legal uncertainty, the demand for sports betting experiences in India continues to grow. Developing sports betting websites allows entrepreneurs and developers to tap into this burgeoning market. By leveraging innovative technologies and adhering to best practices, developers can create engaging and user-friendly platforms that cater to the preferences of Indian sports enthusiasts.

Key Considerations for Developers

For developers considering sports betting game development in India, several key considerations must be addressed:

1. Legal Compliance:

Prioritize legal compliance by thoroughly researching and understanding the applicable laws and regulations at both the federal and state levels. Consult legal experts to ensure that your platform adheres to the relevant legal requirements.

2. Payment Solutions:

Integrate secure and reliable payment solutions that facilitate seamless deposits and withdrawals for users. Consider partnering with payment service providers that support popular payment methods in India, such as UPI, wallets, and bank transfers.

3. User Experience:

Focus on delivering an exceptional user experience by designing intuitive interfaces, optimizing performance across devices, and offering a wide range of betting options on popular sports events.

4. Responsible Gaming:

Implement robust responsible gaming measures to promote safe and responsible betting practices among users. Provide tools for setting betting limits, self-exclusion options, and access to support resources for individuals experiencing gambling-related issues.

5. Data Security:

Prioritize data security and privacy by implementing industry-standard encryption protocols, secure authentication mechanisms, and regular security audits to safeguard user information and transactions.

Conclusion

While the legal status of sports betting in India remains uncertain, the potential for sports betting game development is undeniable. By navigating the legal landscape thoughtfully and adhering to best practices, developers can create innovative and engaging platforms that cater to the country's growing demand for sports betting experiences. With careful planning and execution, sports betting game development in India holds promise as a lucrative and exciting opportunity for developers and entrepreneurs alike.

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Leading Payment Gateway Solutions: Enabling Transactions in the Digital Economy of India

The effectiveness and dependability of payment gateway systems are critical to enabling smooth transactions for both consumers and companies in the developing Indian digital economy. The need for reliable payment gateway solutions has increased as companies work to adjust to the quickly changing digital landscape. Amidst this demand, several leading payment gateway solutions have surfaced, completely changing the way that transactions in India's thriving digital ecosystem are carried out.

Paytm Payment Gateway: In India, Paytm Payment Gateway is a top option for companies looking for dependable payment methods. Businesses of all sizes may easily accept payments through a variety of channels thanks to the Paytm Payment Gateway's user-friendly interface, abundant features, and smooth integration capabilities. Designed to meet the demands of contemporary enterprises, Paytm Payment Gateway provides an extensive range of services for online, in-store, and mobile commerce transactions.

Razorpay: With cutting-edge solutions to improve customer satisfaction and expedite transactions, Razorpay has made a name for itself as a leader in the Indian payment gateway business. Razorpay's state-of-the-art technological stack allows companies to take payments via credit/debit cards, UPI, net banking, wallets, and other methods. In addition, Razorpay's strong security protocols and instantaneous analytics enable companies to streamline their payment procedures and spur expansion.

Instamojo: Instamojo has established itself as one of India's top suppliers of payment gateway solutions for SMBs, or small and medium-sized enterprises. SMBs can easily build personalized payment links, set up online stores, and take payments with Instamojo's user-friendly platform. A complete solution for SMBs wishing to create a digital presence, Instamojo also provides value-added services like inventory management, invoice production, and subscription pricing.

CCAvenue: For more than 20 years, CCAvenue has been a mainstay in the Indian payment gateway market, offering reliable payment solutions to companies in a range of industries. Reputable for its dependability, scalability, and rich feature set, CCAvenue serves a wide spectrum of merchant demands, from small businesses to multinational corporations. With support for several payment methods, global transactions, and cutting-edge fraud prevention techniques, CCAvenue continues to be a reliable partner for companies looking for seamless and safe payment processing.

PayU: With a broad range of services catered to the requirements of Internet businesses, PayU has become one of India's top providers of payment gateway solutions. PayU enables seamless and secure transactions through a variety of channels, including websites, mobile apps, and POS terminals, thanks to its cutting-edge technology stack and wide network. Furthermore, PayU's flexible checkout choices, recurring billing options, and extensive reporting tools enable companies to streamline their payment procedures and boost sales.

Atom Technologies: With a strong infrastructure, cutting-edge security features, and easy integration capabilities, Atom Technologies is another well-known player in the Indian payment gateway business. Atom Technologies provides a wide range of payment options that are customized to meet the needs of varied business sectors, including e-commerce, retail, hotel, and healthcare. Atom Technologies offers businesses the online payment, IVR, and mobile point-of-sale (POS) solutions they need to thrive in the modern digital economy.

EBS (E-Billing Solutions): An Ingenico Group company, EBS is a top Indian supplier of payment gateway solutions, providing a full range of services to companies of all kinds. Businesses can accept payments through a variety of channels, including credit/debit cards, net banking, and mobile wallets, thanks to EBS's sophisticated payment gateway technology. EBS is a top option for companies that operate in the worldwide marketplace since it offers features like configurable checkout pages, recurring payment options, and support for many currencies.

To sum up, these leading payment gateway options are leading the way in streamlining transactions in India's digital economy, enabling companies to accept digital payments and seize fresh development chances. These payment gateway solutions are essential to the digital transformation of businesses nationwide because of their cutting-edge technology, easy integration capabilities, strong security features, and large feature sets. These leading payment gateway options will continue to be vital allies for companies looking to prosper in the digital era as India embraces the digital revolution.

0 notes

Text

Rummy Game Development: A Comprehensive Guide to Unlocking Your Gaming Potential

Rummy Game Development:

Over the last ten years, there has been a notable rise in the popularity of online casino gaming, driven by ongoing advancements to cater to the needs of players worldwide. Today, operators have the opportunity to capitalize on emerging trends and gaming regular updates in payment technology to enlarge their customer base and maintain player loyalty. One of the latest trends in the gaming industry involves incorporating Bitcoin APIs into the payment gateways of online gaming platforms. Bitcoin, a decentralized cryptocurrency, offers a unique peer-to-peer online payment system that operates independently of traditional banking institutions. The acquisition of Bitcoins primarily occurs through a process called mining, which involves individuals using specialized software to add transaction records to Bitcoin's public ledger, known as the "blockchain." The legitimacy of Bitcoin transactions is confirmed by network nodes, and upon approval, new Bitcoins are generated and awarded to the miner via a proof-of-work mechanism. This mechanism governs the creation of new Bitcoins and the utilization of existing ones.

What about Rummy game development in future?

The digital rummy industry is a lively mosaic characterized by strategic card competitions, & captivated players, and rapidly increasing profits. Let's explore the present state of affairs and take a glimpse into the future to anticipate its direction.

Present Scenario of Rummy game app development:

Exponential growth: The worldwide online rummy market is forecasted to achieve an impressive $2.5 billion mark by 2025, driven by rising smartphone usage and the burgeoning appeal of online gaming in developing nations such as India.

Mobile Dominance: Smartphones hold a dominant position, contributing to more than 90% of online rummy gameplay. This supremacy is projected to persist as mobile technology progresses and internet availability grows.

Diverse Demographics: Online rummy appeals to individuals across various age groups and genders, drawing in a diverse player base that spans from tech-savvy youth to experienced card aficionados.

Fierce Competition: The industry is filled with both well-established entities and fresh entrants, competing to capture player interest through feature-packed applications, enticing bonuses, and loyalty initiatives.

Regulatory scrutiny: As online gaming experiences a surge in popularity, regulatory frameworks are adapting to promote responsible gaming practices and safeguard consumer interests.

Future Scenario of Rummy game app development:

Tech-Driven Advancements: Anticipate witnessing transformative advancements in online rummy gameplay, including immersive 3D features, integration of augmented reality, and enhanced security through blockchain technology.

Evolving Player Preferences: There will be a growing expectation from players for tailored experiences, social engagement options, and skill-focused competitions to maintain their interest.

Regional Growth Potential: Regions such as Southeast Asia and Africa offer significant opportunities for expansion due to their youthful demographics and rising internet connectivity.

Focus on Responsible Gaming: The focus of the sector will be on prioritizing initiatives for responsible gaming to tackle addiction concerns and advocate for ethical conduct.

Consolidation and Mergers: Anticipate witnessing consolidation and mergers as businesses aim to increase their market presence and broaden their range of services.

Conclusion:

Here, the Breedcoins is a best rummy game development company that provides you the best game software development solutions. Whether you're in search of a dependable collaborator to turn your vision of a rummy game app into reality or aiming to maintain a competitive edge, this company provides all the essential insights you need in one convenient location. Prepare to explore top-notch rummy game development firms, ignite your entrepreneurial drive, and become part of the dynamic digital rummy scene!

Explore Now:

1 note

·

View note

Text

5 Reasons Every Business Needs an Office Space in Vizag: Boost Your Business Today!

Introduction:

In today's dynamic business landscape, having a dedicated office space in Vizag can significantly impact your company's productivity and success. Vizag, also known as Visakhapatnam, is a burgeoning business hub on the eastern coast of India, offering a plethora of opportunities for businesses of all sizes and industries. In this article, we'll delve into the five compelling reasons why every business needs to consider investing in an office space in Vizag.

No Distractions of Working at Home

Working from home undoubtedly has its perks, but it often comes with numerous distractions that can hinder productivity. From household chores to family interruptions, staying focused on work can be challenging.

However, by transitioning to a dedicated office space in Vizag, you can create a conducive environment that fosters productivity and minimizes distractions. With a quiet and professional setting, you can fully immerse yourself in your work without the disruptions commonly encountered at home.

Networking Opportunities

One significant advantage of having an office space in Vizag is the ample networking opportunities it offers. Surrounded by like-minded professionals and businesses, you gain access to valuable connections, collaborations, and partnerships.

Whether attending industry events, networking mixers, or interacting with neighboring businesses, Vizag's vibrant business community fosters growth opportunities.

Opting for a Plug n play office in Visakhapatnam enhances networking further, providing a convenient and flexible workspace solution designed for collaboration. With shared meeting rooms, communal areas, and networking events, these offices facilitate meaningful connections, making them ideal for tapping into Vizag's thriving business ecosystem.

Professional Meeting Space

Impressions matter, especially when it comes to client meetings and presentations. While conducting business meetings in coffee shops or remotely may suffice occasionally, having a professional meeting space can elevate your company's image and credibility.

With a dedicated office space in Vizag, you'll have access to well-equipped meeting rooms and conference facilities, providing the perfect setting to host clients, investors, and stakeholders with confidence and professionalism.

Additionally, considering a Plug n play office in Visakhapatnam offers added convenience and flexibility for your meeting needs. These modern office spaces not only enhance your company's image but also provide a versatile environment for conducting successful meetings and presentations.

Credibility

Establishing credibility and trustworthiness is paramount for any business, particularly in competitive markets. By securing an office space in Vizag, you demonstrate your commitment to your business's growth and stability.

A physical office not only enhances your company's professional image but also instills confidence in clients, partners, and employees. Whether you're a startup looking to make a mark or an established enterprise expanding its presence, having a prestigious address in Vizag can significantly enhance your brand's credibility and reputation.

High-Level Amenities for a Low Cost

Contrary to popular belief, acquiring an office space in Vizag doesn't have to break the bank. Vizag offers a range of office spaces equipped with high-level amenities at affordable prices, making it an attractive destination for businesses seeking cost-effective solutions.

From modern coworking spaces to fully serviced offices, Vizag caters to diverse business needs while offering state-of-the-art facilities, including high-speed internet, ergonomic workstations, and professional support services—all at a fraction of the cost compared to larger metropolitan cities.

Additionally, considering a Plug n play office in Visakhapatnam provides even more flexibility and convenience, allowing businesses to access premium amenities without the hefty price tag often associated with traditional office leases.

FAQs

1. What are the leasing options available for office spaces in Vizag?

In Vizag, businesses can choose from various leasing options, including short-term leases, long-term leases, and coworking memberships, depending on their specific requirements and budget.

2. Are there any tax benefits associated with having an office space in Vizag?

Yes, businesses leasing office spaces in Vizag may be eligible for certain tax incentives and deductions, subject to local regulations and compliance requirements. It's advisable to consult with a tax advisor for personalized advice.

3. How can I find the ideal office space for my business in Vizag?

Conduct thorough research, consider your budget and space requirements, visit potential locations, and consult with real estate experts specializing in commercial properties in Vizag to find the perfect office space that aligns with your business goals.

4. Are there networking events and business communities in Vizag?

Absolutely! Vizag boasts a vibrant business ecosystem with numerous networking events, industry associations, and business communities where professionals can connect, collaborate, and exchange ideas.

5. Can I customize my office space in Vizag to reflect my brand identity?

Yes, many office spaces in Vizag offer customization options, allowing businesses to tailor their workspace layout, design, and branding elements to reflect their unique identity and corporate culture.

6. What amenities are typically included in office spaces in Vizag?

Office spaces in Vizag often come equipped with essential amenities such as high-speed internet, meeting rooms, coworking areas, kitchen facilities, security services, and administrative support, ensuring a seamless and productive work environment for tenants.

Conclusion

Investing in an office space in Vizag is a strategic move that can propel your business to new heights. From enhancing productivity and fostering professional networks to bolstering credibility and enjoying cost-effective amenities, Vizag offers a conducive environment for businesses to thrive and succeed.

Whether you're a budding startup or an established enterprise, Vizag's dynamic business ecosystem provides the perfect backdrop for growth, innovation, and success.

Additionally, considering a Plug n play office in Visakhapatnam adds another layer of flexibility and convenience, allowing businesses to quickly establish a presence in the city's thriving commercial landscape while enjoying the benefits of a fully equipped workspace without the hassle of long-term leases.

#qubexpro#coworkspacevizag#manageofficevizag#qubexprobusinesscentre#plugnplayofficevizag#coworkingspace#officeinvizag#plugnplayspacevizag#visakhapatnam

0 notes

Text

Karur Vysya Bank Jobs In Salem – Bank Zone Jobs

Karur Vysya Bank Jobs In Salem

Karur Vysya Bank is a Scheduled Commercial Bank headquartered in Karur, Tamil Nadu. It was founded in 1916 by M. A. Venkatarama Chettiar and Athi Krishna Chettiar. The bank primarily operates in the treasury, corporate/wholesale, and retail banking segments. The bank later expanded out of Karur in search of additional business opportunities and established a presence across India. KVB provides personal, corporate, and agricultural banking services to NRIs and SBMs. The Reserve Bank of India recognizes it due to its commitment to innovating new and thoughtful services and products in the banking sector. This bank had approximately 800 branches and 1,650 ATMs on 31 March 2020. KVB has recorded a Total Business of ₹107,591 crore with deposits of ₹59,075 crore and advances of ₹48,516 crore.

Some of the services provided by Karur Vysya Bank include:

Corporate Banking

Services constructed for businesses, corporate entities, and institutions, which may include current accounts, trade finance, working capital loans, term loans, and various finance services.

Online Banking Services

It offers Internet banking facilities, allowing customers to perform various banking transactions online, including fund transfers, bill payments, account management, and more.

Retail Banking

Services catering to individual customers, including savings accounts, current accounts, fixed deposits, and loans, such as home loans, personal loans, vehicle loans, debit cards, and Internet banking facilities.

NRI Banking

Services and Facilities for non-resident Indians, such as NRI savings accounts, NRI fixed deposits, remittance services, and other specialized financial solutions.

Investment And Insurance Products

The bank may also offer investment products like mutual funds, insurance products like life insurance, health insurance, and other wealth management services.

However, specific services and features offered by the bank differ, and it’s advisable to contact the bank directly or visit their official Website for the most accurate and updated information about their services, branch locations, and offerings. It is known for its customer-centric approach and its efforts to provide a wide range of financial solutions tailored to the needs of its diverse customer base. It operates with a network of branches across various states in India, offering a range of banking and financial services to its customers. To apply for this recruitment, just update your resume in Bank Zone Jobs, the most trusted and genuine private banking job placement agency in Salem.

Eligibility Criteria

Citizens of India are must

Degree holder with a minimum 50%

For Senior post, it needs post-graduation or experience in a relevant field

Excellent communication skill in English and the local language is a must

The age limit for the position is 21 years and does not exceed 35 years.

Available Bank Job Roles In KVB Bank Jobs Salem

Bancassurance

Executive/Manager

Gold Loan Officer

Accountant

Investment Banking Operations

Data Entry/Computer

Operator/Front Office

Branch Manager

Relationship Manager

Sales Officer CASA

Area Manager -Banca | Life Insurance

HR Professionals

Credit Analyst

Marketing professionals

Legal Professionals

Teller

Customer service representative

How Do Bank Zone Jobs Help You Get The Job?

Bank Zone Jobs has experienced professionals to help you prepare for the interview with helpful advice and tips to answer the questions and present yourself as a professional in a bank interview. Here, we have provided services like creating a majestic resume and cover letter and practice sessions for face-to-face and mock interviews. If you are a bank job seeker, Bank Zone Jobs is the best place to build a career or to recreate a career in the banking sector; now, KVB has offered various jobs; it’s an excellent opportunity to become a bank officer by dropping your resume on our Website.

0 notes

Text

Online Payment Gateway Market Surges: Projected to Reach US$ 117.5 Billion in 2023

The online payment gateway market size is projected to be valued at US$ 117.5 Bn in 2023 and is expected to rise to US$ 293.9 Bn by 2033. The sales of online payment gateway are expected to grow at a significant CAGR of 9.6% during the forecast periodFuture Market Insights, Inc., Tuesday, December 27, 2022, Press release picture

One of the main drivers of the market’s expansion is the growing digital transformation of organisations all over the world. Additionally, growing technical breakthroughs have made it possible for financial service providers to supply customers with novel digital offerings.

Governments around the world are working to spread awareness of internet services in rural areas.

In order to deliver fast internet services, the British government invested USD 5.9 billion in the nation’s rural areas in 2020. A shared rural mobile phone network project that the government invested USD 606.3 million in in 2020 was intended to provide 4G connectivity to 95% of the nation’s rural areas in the upcoming years.

Request a Sample Copy of the Report:

https://www.futuremarketinsights.com/reports/sample/rep-gb-4331

To provide merchants and customers with a digital payment’s infrastructure, e-commerce enterprises are collaborating with payment service providers. Due to the volume of transactions managed by merchants, gateway systems have been increasingly incorporated into their sales channels.

In order to provide real-time payment options to customers and businesses, numerous banks worldwide are working to form alliances with payment gateway service providers.

Yes Bank announced in November 2021 that it will be working with Amazon Pay and Amazon Web Services (AWS) to offer a real-time payment system via the Unified Payment Interface (UPI) transaction capability.

Key Takeaways from the Online Payment Gateway Market

In the United States, it is predicted that in 2022, more than 80% of transactions are unlikely to involve cash due to growing acceptance from SMEs. Additionally, it is predicted that online payment transaction values would increase by more than 15% between 2020 and 2025.

In 2020, Europe accounted for roughly 25% of the global market for payment gateways. The region’s market is underpinned by a strong regulatory environment for payments and a highly saturated card use rate.

Due to the rise in smartphone usage, Asia-Pacific is far outpacing other areas in terms of the adoption of online transactions. According to the GSMA, Asia’s mobile internet penetration will increase from 45% in 2018 to 62% in 2025.

The ORF research claims that start-ups and several young entrepreneurs are propelling. In the Indo-Pacific region as of 2020, there will be 55,200 start-ups. Due to mergers and acquisitions and intra-ASEAN investments, digital start-ups are expanding regionally.

In 2021, the hosted segment dominated the market and generated more than 57.0% of total revenue. Due to elements like simple payment setup processes and decreased merchant liability, the demand for hosted payment gateways is rising among retailers.

With the top six suppliers controlling more than 70% of the market’s revenue, the payment gateway market is still largely consolidated. The majority of the market was accounted for by PayPal, Stripe, and Square.

Competitive Landscape

With the existence of well-known firms like PayPal and Stripe, the Online Payment Gateway Market is very competitive. Other businesses, meanwhile, are attempting to achieve greater market shares by engaging in mergers and acquisitions in order to attract more customers.

PayU stated in January 2020 that it will buy a majority share in PaySense, a digital credit platform. LazyPay and PaySense, two of PayU’s consumer lending companies, will combine their business activities as part of the acquisition in order to create a full-stack digital lending platform in India.

In a partnership announced in January 2020, PayPal Holding Inc. and UnionPay International (UPI) will collaborate to hasten the expansion of their respective networks. In accordance with the contract, PayPal agreed to support UPI acceptance everywhere PayPal is accepted, giving UnionPay cardholders more options when they shop.

Request for Customization:

https://www.futuremarketinsights.com/customization-available/rep-gb-4331

Market Segmentation

Online Payment Gateway by Application:

Online Payment Gateway for Large Enterprises

Online Payment Gateway for Small and Medium Enterprises

Online Payment Gateway by Mode of Interaction:

Hosted Payment Gateway

Pro / Self-hosted Payment Gateway

API / Non-hosted Payment Gateway

Local Bank Integration

Direct Payment Gateway

Platform-based Payment Gateway

By Region:

North America

Latin America

Europe

South Asia & Pacific

East Asia

Middle East & Africa (MEA)

0 notes

Text

https://www.advancemarketanalytics.com/reports/30997-global-network-engineering-services-market

Network Engineering Services Market Future Scope Demands and Projected Industry Growths to 2025

Advance Market Analytics released a new market study on Global Network Engineering Services Market Research report which presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Network Engineering Services Forecast till 2029*.

Network engineering also known as computer architecture. It is the service used in small and large scale industry to provide entrance and information about the company’s technical terms. Regulate the accessibility of the internet access and the network across the place is the important job of network engineer. There are two transmission mode of network engineering including wired and wireless.

Key Players included in the Research Coverage of Network Engineering Services Market are:

Accenture (Ireland), Ericsson (Sweden), IBM (United States), Huawei (China), Juniper Networks (United States), Dell (United States), Cisco (United States), Fujitsu (Japan), Tech Mahindra (India), VMware (United States)

What's Trending in Market: Increasing Dependency on ICT Sector

Evolution in The Communication Space

Challenges: Network Scalability in Large Network Deployment

Opportunities: Adoption of IOT Technology

Introduction of Advanced Networking Solutions

Market Growth Drivers: High Demand of High Speed Network

Rising Demand of Network Services across World

The Global Network Engineering Services Market segments and Market Data Break Down by Type (Network Assessment, Network Design, Network Deployment), Transmission Mode (Wired, Wireless), Organisation Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), End User (Banking, Financial Services, and Insurance (BFSI), Telecom, Information Technology, Healthcare, Education, Media and Entertainment, Energy and Utilities, Manufacturing, Others)

Get inside Scoop of the report, request for free sample @: https://www.advancemarketanalytics.com/sample-report/30997-global-network-engineering-services-market

To comprehend Global Network Engineering Services market dynamics in the world mainly, the worldwide Network Engineering Services market is analyzed across major global regions. AMA also provides customized specific regional and country-level reports for the following areas.

• North America: United States, Canada, and Mexico.

• South & Central America: Argentina, Chile, Colombia and Brazil.

• Middle East & Africa: Saudi Arabia, United Arab Emirates, Israel, Turkey, Egypt and South Africa.

• Europe: United Kingdom, France, Italy, Germany, Spain, Belgium, Netherlands and Russia.

• Asia-Pacific: India, China, Japan, South Korea, Indonesia, Malaysia, Singapore, and Australia.

0 notes

Text

Understanding CIF Code in SBI: Everything You Need to Know

Introduction: In the realm of banking, CIF code is an essential element, particularly within the State Bank of India (SBI) system. CIF, or Customer Information File, serves as a unique identification number for each customer, holding crucial details regarding their banking transactions and accounts. This article aims to delve into the intricacies of CIF code, its significance within SBI, and how customers can navigate its usage.

What is CIF Code? CIF code, short for Customer Information File code, is a unique numerical identifier assigned to each customer by banks. It serves as a repository for storing comprehensive details about the customer's accounts, transactions, and interactions with the bank. This code facilitates efficient data management and streamlines various banking processes.

Significance of CIF Code in SBI: Within the State Bank of India, CIF code holds paramount importance. It acts as a fundamental link between the customer and the bank's database, enabling seamless access to pertinent information. Here are some key aspects highlighting the significance of CIF code in SBI

Account Management: CIF code serves as a cornerstone for managing multiple accounts held by a single customer. Whether it's savings accounts, fixed deposits, or loans, all associated accounts are linked through this unique identifier.

Streamlined Services: With CIF code integration, SBI ensures smooth delivery of banking services. Whether customers opt for internet banking, mobile banking, or visit the branch in person, their CIF code ensures consistent access to their account details and transaction history.

Enhanced Security: CIF code enhances security measures by accurately identifying customers and safeguarding their financial information. This helps in preventing unauthorized access and fraudulent activities.

Personalized Offerings: Utilizing CIF data, SBI can analyze customer preferences and behavior to tailor personalized banking solutions. From targeted offers to customized loan options, CIF code aids in enhancing customer satisfaction.

How to Find CIF Code in SBI? For SBI customers, locating their CIF code is a straightforward process. Here are the common methods to find CIF code:

Passbook: CIF code is often printed on the first page of the passbook issued by the bank. Customers can refer to their passbook to find this unique identifier.

Online Banking Portal: Customers can log in to SBI's online banking portal or mobile app to access their CIF code. It's usually displayed along with other account details upon successful login.

Visiting the Branch: Alternatively, customers can visit their nearest SBI branch and request assistance from the banking staff to retrieve their CIF code.

Conclusion: In the digital age of banking, CIF code stands as a vital component ensuring seamless customer-bank interactions. Understanding its significance within SBI empowers customers to navigate banking processes efficiently. By grasping how CIF code operates and where to find it, SBI customers can harness its benefits for a smoother banking experience.

0 notes

Text

Easy Tips on Planning an overseas relocation from Australia

Forging a fresh start is a life-changing experience. Making choices that directly impact an overall quality of life has given rise to job mobility in both the public and private sectors.

Whether switching jobs, an expanding family, or undergoing other lifestyle or financial changes—many households are choosing to move or relocate for various reasons.

Relocating overseas for the long term can be a big decision. And it becomes essential to have realistic expectations when you travel or live abroad.

Create a to-do list of 11 points to Start Planning for Overseas:

Check passport validity:

To avoid the hassles of dealing with renewal while overseas, keep a note of your relevant documents handy for verification in case of any unforeseen disruption in cheeking.

See if a new visa is to be applied for a purpose, or if you can renew the existing Visa. The Tourist Visa is non-extendable and non-convertible.

2. Apply for work permits and visas:

Make sure that you have the correct Visa for the purpose. Every country has its own requirements and processing time, so make sure your Visa is approved and issued in print timely. All relevant applications should be submitted well before you are due to move or start work/studies/vacation.

3. Check the cost of living:

A practical budget would account for the cost of delay and the volume of items to be moved. Any priorities set in haste can leave you wrestling among options and bring confusion to upcoming relocation abroad.

4. Start saving

Importantly, arrange financing for travel insurance. Researching for sources of income, loan, debt and advances and discounting for substantiating formal risk assessment. Get a security plan. If you happen to move overseas without confirming a job, set a conservative benchmark for the saving.

5. Set aside a budget for relocation costs:

Make a smart move by factoring in the value delivered by International Movers and Packers Serving Australia, Singapore, Canada, Germany, India, etc to handle the daunting task involved in packaging and moving inter-states and abroad under a well–planned budget.

6. Start planning for tax:

Depending on taxation in your current country, you may need to inform the tax authorities about your overseas relocation plans to find essential steps involved to get your taxes in order.

7. Complete a medical health check:

Undergoing medical examination on Overseas Visa Applications includes reports on physical and medical checks. The exam includes blood tests, X-rays, an electrocardiogram, and an abdominal ultrasound scan, as well as standard check-up procedures such as height and weight measurements, and a blood pressure test.

8. Organise storage and/or shipping

Keep what is necessary and essential by De-cluttering. Suppose you’re beginning to be overwhelmed by some of your consumer durables, such as furniture and other household items, to pack and send overseas. In that case, you probably shouldn’t deliberate over International Moving Services Australia.

Settled for a price quotation that authentically validates transparency, and all disclosure goes for it. Seek the fine print of any agreement before you sign. Make sure the fine print are related to insurance of the shipment are taken into account and not added as liability later.

9. Set up your banking:

Do not assume your funds from your new home country would transfer on their own. Apply for an international services bank account online before you arrive, or choose to open an international bank account before you leave.

10. Gather key documents:

Arrange your documented proofs before arriving, such as an international driving/driver’s licence, accommodation and education.

11. Pay off all your outstanding utility bills:

Clear payment due of all your utility accounts – like internet, gas pipelines, electricity– before leaving home

Conclusion:

The zeal to move abroad can often come with a false sense of spending. A wholesome experience of working abroad with cultural immersion shouldn’t cause you financial strains while your settling.

#agarwakpackersinaustralia#removalscompaniesinaustralia#internationalmovingservices#moversinaustralia#interstateremovalcompaniesinaustralia

0 notes

Text

SIFY's State-of-the-Art Data Centers in Mumbai: Driving Digital Transformation in India's Financial Capital

Nestled in the bustling metropolis of Mumbai, SIFY Technologies’ advanced data centers stand as symbols of the company’s unwavering commitment to innovation and excellence. With a rich legacy of contributing to India’s digital revolution, SIFY now sets its sights on Mumbai to establish world-class data centers that cater to the region’s growing demand for secure, reliable, and sustainable infrastructure.

Strategic Location and Accessibility

SIFY’s data centers in Mumbai are strategically located near the city’s central business district, ensuring quick and convenient accessibility for clients. This location also allows for reduced latency, benefiting users who require real-time data processing and delivery.

Cutting-Edge Technology and Expertise

SIFY’s data centers in Mumbai offer a host of unique advantages, including:

TIA-942 Tier 3 Compliance: SIFY’s data centers conform to rigorous international standards, providing clients with peace of mind regarding the safety and integrity of their mission-critical data.

Environmental Consciousness: SIFY places great emphasis on reducing its carbon footprint and conserving natural resources. Its data centers utilize advanced cooling systems, such as air and liquid cooling, to minimize energy consumption and lower operating expenses.

Power Usage Effectiveness (PUE): SIFY targets a PUE of 1.10, demonstrating exceptional energy efficiency and cost savings.

Carrier Neutrality: Clients have the freedom to choose their preferred telecommunications service providers and Internet Exchange Points (IXPs), fostering greater flexibility and control.

Built-to-Suit Options: For those needing specialized data center configurations, SIFY offers bespoke solutions tailored to individual client requirements.

Comprehensive Solutions: Beyond traditional data center hosting, SIFY delivers a host of additional services, including cloud computing, managed services, and cybersecurity solutions.

Client Testimonials

ABC Bank, a leading financial institution headquartered in Mumbai, recently migrated its entire IT infrastructure to SIFY’s data centers in the city. According to Mr. XYZ, CIO of ABC Bank, “We were impressed by SIFY’s ability to deliver a fully integrated solution that meets our strict compliance requirements and enables us to scale quickly and efficiently. Their commitment to environmental sustainability was another decisive factor in our decision to partner with them.”

Future Plans and Growth Prospects