#EveryDollar

Text

I am trying out EveryDollar and Mint to help me budget my money. I like them both and kinda wish I could combine features from both.

Mint allows you to connect your bank account and Paypal so you can see exactly how much you have and how much you have yet to pay for the month. Unfortunately my PayPal and bank account are linked and so Mint has a lot of duplicate transactions.

EveryDollar is very simple and clean. A lot easier to parse the data. But it requires you to manually enter purchases and the bills you pay. On the one hand, I like that kind of control and it can prevent the automatic screwups I noticed a lot of on Mint. But I can imagine going through a slump and not being able to keep it updated and falling behind. I could pay the monthly fee to link up my bank, but I'm not sure it is worth the cost yet.

I'm going to use them both for a while and see how they function over the course of a month.

Do you all use anything to help you keep track of your budget?

25 notes

·

View notes

Text

Books to Read to Become a Millionaire

Millionaires is a dream that most people want to achieve, however, only a handful of people achieve it. Millionaires have several streams of income which reduce their risk and increase their income. Most women, however, settle for a comfortable life. There are many books you can read to earn more money and make a change in your lifestyle.

The book Secrets of the Millionaire mind is a great read for understanding the mindset of wealthy people. The book explains how they approach money , and how their habits are shaped by their childhood. Our parents are our primary model in the management of our finances. The Secrets of the Millionaire Mind can help you build habits that will lead to financial success.

The author has learned the art of personal financial management and shared his knowledge with millions of people. To help people keep in check their spending habits, he created a financial app for personal use called EveryDollar. Dave was a former bankrupt who had the ability to change his financial circumstances and turn into millionaire. He offers strategies to assist you in becoming debt-free and earn wealth.

The best method to attain wealth is to master your mind. Learn the tricks of the trade and overcome any mental obstacles that hinder you from earning the money you want to make. The book will show you how to save money and invest it wisely. This book will not just assist you in building wealth but also tackle the common misconceptions regarding millionaires.

The Secrets of the Millionaire Mindset can be a fantastic method to gain an understanding of how wealthy people make their money. It can help you set goals and formulate strategies to achieve these goals. This book can be useful for those looking to establish a company.

If you are interested in learning more about millionaire lifestyles, The Millionaire Next Door is a fantastic book. The authors have studied households in the United States and have identified the behaviors of successful people. The author shares the secrets of making it a millionaire, and shows you how to avoid costly mistakes.

The classic book, Think and Grow Rich was published in 1937. It has assisted many people to become wealthy than any other. This book is highly recommended for women who wish to succeed. Napoleon Hill spent 25 years studying the lives of a few of the most successful people of his day, such as Alexander Graham Bell and Thomas Edison. Then, he discovered the 13 steps to making money.

youtube

Built Not Born by Tom Golisano is another popular book. The book details the journey of his company from three thousand to a multi-billion dollar business. The success tips he offers are useful and powerful. Golisano provides practical tips on building great teams and creating the right business model. A business is an excellent method of building wealth.

YouTube Video Here

1 note

·

View note

Text

How To Stop Wasting Money On: Food, Clothes, Travel and More!

You cannot build wealth and achieve your financial goals if you keep wasting money on food, clothes, and travel. Although these expenses are inevitable, there are still ways you can cut down on them in order to leave more room for savings and investment.

The expenses you make on groceries, subscriptions, transportation, food, and more may seem insignificant, but when added up, they cost a lot. To help you prevent wasteful spending, this article goes into detail on how to save money.

It provides a breakdown of how to stop wasting money on food, clothes, travel, cars, subscriptions, utilities, gym membership, transportation, and more.

General Tips On How To Stop Spending Money

1. Create a Budget

To avoid spending unnecessarily, make a budget. There are different types of budgeting plans, some of which include zero-based budgeting, 50/30/20 plan, envelope method, no-budget plan, and reverse budgeting plan.

- Zero-based Budgeting Plan: This is when you assign a purpose, task, or plan to every dollar you earn.

- 50/30/20 Plan: This budgeting plan states that you should assign 50% of your take-home pay to needs, 30% to wants, and 20% to savings, investment, or debt payment.

- Envelope Method: This method uses envelopes to categorize expenses. It involves labeling an envelope (grocery, utilities, or rent envelope) and stashing the envelope with cash.

- No-budget Plan: This plan demands you to know your monthly income and the exact amount you spend each month. Once you know this, all you have to do is save the difference between your income and expenses.

- Reverse Budgeting: Once you receive your monthly income, set aside money for monthly expenses, and save the rest.

If you cannot create a manual budget, use budgeting apps like YNAB, GoodBudget, PocketGuard, EveryDollar, and more.

Another Interesting Article: The #1 Key To A Successful Budget

2. Have A Goal Partner

If you want to put an end to your wasteful spending on food, clothes, and travel, then have a partner with similar goals.

A goal partner can be a friend, family member, work colleague, or anyone who shares similar interests as you.

Once you have a goal partner, you're less likely to engage in wasteful habits. The both of you can act as each other's guide.

3. Avoid The Use Of Credit Cards

You are bound to waste money on food, clothes, and travel if you keep using your credit cards.

Additionally, credit card incurs interest on every purchase you make. To avoid paying interest, use cash or a debit card.

4. Use A Prepaid Card

A Prepaid card is similar to a debit card. It's a card that allows you to spend whatever money you store in it.

It is advisable to use a prepaid card as it only allows you to spend what you have - this is unlike a credit card.

Here's how to use a prepaid card:

Once you receive your monthly income, set aside money for expenses and deposit it into a prepaid card. Save the rest of your income in a locked account to avoid falling into temptation.

Use the prepaid card for your daily expenses.

5. Set Financial Goals

A financial goal helps you stay motivated and committed to your budget and savings plan.

With a realistic goal in mind, you can make adjustments to your spending, track expenses, avoid debt traps, and know what to prioritize.

6. Pay Off Debts

Once you focus on paying off debts, you'll become less likely to waste money on food, clothes, travel, and whatnot.

7. Track Your Finances

Keeping track of all your finances allows you to become conscious of your financial situation. And once you gain knowledge of your situation, you'll be less likely to make unnecessary expenses.

How To Stop Wasting Money On Food

1. Buy In Bulk

Buying food items or groceries in bulk allows you to save money due to the lower per-unit cost of bulk items.

Some food items and groceries to buy in bulk include eggs, canned goods, butter, olive oil, rice, cereal, fish, pet food, toilet paper, batteries, laundry detergent, soap, and a lot more.

Although the price for bulk items is often expensive, it's worth the money. Local supermarkets like Costco, Sam's Club, and Walmart are well-known bulk-friendly stores to visit.

2. Avoid Eating Out

Restaurant meals are convenient but expensive. So if you're trying to stop wasting money on food, avoid eating out.

If you do the calculations right, it is cheaper to prepare food at home than eat at restaurants.

When you make your own meals, you can take advantage of food and grocery discounts, which helps you save money.

3. Plan Your Grocery List

Do not go grocery shopping without a plan or grocery list.

Make a list of everything you want to buy. And review it strictly. Remove an item that you deem unnecessary. It is also important to know the exact prices of items to avoid being frustrated when you get to the store.

To avoid overspending during grocery shopping, drop your credit or debit card at home and go shopping with the exact amount you need for items.

Note: Do not go shopping on an empty stomach. You can be tempted to make unnecessary expenses.

4. Take Advantage Of Grocery Coupons And Discounts

With coupons and discounts, you can stop wasting money on food. Visit stores like Walmart, Costco, Aldi, and Sam's Club to enjoy multiple discounts on groceries. With a Costco membership, you can have access to more discounts and exclusive deals.

To easily find grocery coupons, install extensions like Honey on your mobile device. This extension helps you locate discounts and coupons whenever you shop online.

You can participate in online surveys to receive coupon rewards.

5. Reduce Food Waste and Plan For Left Over

If you decide to cook at home rather than eat out, you can save more money by reducing your food waste and making plans for leftovers.

Always buy canned or frozen products to prevent spoilage. And keep leftovers refrigerated.

Another Interesting Article: How Much Should I Budget For Food?

How To Stop Wasting Money On Clothes

1. Shop the End-of-Season Sales

End-of-season sales period is a great time to shop for clothes. During this period, most clothing stores offer up to 50% discounts.

End-of-season sales are sales that occur at the end of each season. For example, winter clothes are often popular from December to February. From the start of March, the demand for winter clothes decreases. In a bid to sell off old stocks, most stores will offer discounts - this is called end-of-season sales.

2. Host a Clothing Swap

Hosting a cloth-swapping event is a good way to stop wasting money on clothes.

A cloth swapping event is a get-together where people bring their old and unwanted clothes in order to swap/trade them with another. So rather than buy new clothes, you can exchange them for another.

Meet up with your friends, family, or colleagues and suggest hosting a cloth-swapping event with them.

3. Ask for a Discount on Damaged Clothing

Most clothing stores are willing to sell damaged clothes for a way lower price. So when you get to a clothes store, make inquiries about their damaged clothes.

Once you buy a damaged cloth, you can get a tailor to amend or redesign it.

You can also check out a store's clearance section for old stocks. The clothes in this section are often cheap but out of season,

4. Look for Coupon or Promo Codes

Many clothing brands offer coupons and promo codes. Take advantage of it.

Use a coupon extension like Honey to find online stores that offer special deals, coupons, and promo codes.

5. Wash Your Clothes and Mend Them

Rather than buy new clothes, you can mend your old clothes to save money.

Wash your clothes, iron or fold them properly, and store them - doing this will make your clothes last longer. Thus preventing you from needing more or new clothes.

6. Visit Marketplaces and Negotiate With Sellers

When you shop for clothes online or in-store, prices are likely to be fixed and non-negotiable. However, this isn't the case in most marketplaces.

If you want to stop wasting money on clothes, visit popular marketplaces.

Online marketplaces like Craiglist and Facebook also allow you to bargain the price of items with sellers.

7. Buy Generic Brands

Avoid brand clothes if you want to save money. Do not be influenced by designer products.

Patronize local brands and unfollow influencers and celebrities to avoid temptation.

It is also recommended to remove your credit card from all online shopping stores.

8. Borrow Clothes

Regardless of what you think, borrowing clothes from a friend or family member is a good way to stop yourself from buying and wasting money on new clothes.

Another Interesting Article: Poshmark Review: Is It Worth It to Buy and Sell Used Clothes?

How To Stop Wasting Money On Travel

Traveling to new places is often exciting. You get to try out new delicacies and visit tourist attractions. If you don't want to waste money while having fun, here are tips to help you.

1. Avoid Weekend Flights

When making travel plans, avoid weekend flights.

Airlines increase the price of flights during weekends due to increased demand. However, flights during the middle of the week (Tuesdays, Wednesdays, and Thursdays) are often cheaper.

So if you plan on using flights, avoid Fridays, Saturdays, and Sundays flight tickets.

2. Find Cheap Hotels

Hotel costs can easily eat deep into your travel budgets. Patronizing luxurious hotels can make you go broke in no time. So to avoid wasting money, find cheap hotels.

Here's a guide on how to find cheap hotels when you visit a new area:

- Open your search browser and type the name of the city you're in + hotels. For example, "California Cheap Hotels."

- Click on the "View More Hotels" tab that appears on the search results.

- In the new section, use the search functionality and filter to narrow down your search to your price budget, and exact location.

3. Avoid Excess Baggage

Excess baggage attracts extra fees. If you don't to waste money during your travel trips, be selective with what you carry.

Some of the important to pack in your travel packs include a passport, foreign cash, a boarding pass, a map, a few clothes, a credit card, hygiene items, and a prescription.

4. Use A Map

It is easy to get lost during a travel trip. To avoid getting lost and wasting transport money, get yourself a map of the new area.

5. Hire A Car

Make your calculations. If it saves more to use public transportation, then ditch the idea of hiring a car.

However, if hiring a car saves you more money, then make a car hire.

6. Book Local Tours

Well-known tour companies charge higher rates than local companies. Although they offer better services, it's advisable to book with local tour guides if you want to save money.

7. Make Friends With Locals

To make the trip enjoyable, make friends with the locals. They can direct you to cheap hotels and restaurants. They can also provide you with information on how to save money during your trip.

How To Stop Wasting Money on Cars

1. Buy A Used Car

When getting a car, go for a used car. brand-new cars are expensive and often require you to take auto loans.

To avoid spending money on auto loan payments, go for what you can afford. Do not waste your money on getting a brand-new car.

2. Be Consistent With Car Maintenance

Conduct regular inspections and maintenance on your car. Although the cost of maintenance is pricey, it is important to consider the future. If you check up on your car and conduct regular maintenance, it'll prevent your car from needing major repair.

2. Do Not Go For Cheap Maintenance

In a bid to save money, most people buy cheap car parts/tools for repair or maintenance - this can cause greater damage to your car in the long run.

Do not be stingy with your money during car repairs or maintenance. If you use high-quality car parts, your car will stay in good condition for a long time.

3. Get A Skilled Mechanic

Be careful in your choice of mechanic. Do not settle for cheap and unskilled mechanics. Always rely on recommendations from friends with cars.

4. Do Not Lease A Car

A car lease allows you to rent a car for some time, usually two to four years.

Leasing a car is often expensive. If you want a car, opt for a used car.

Note: Do not make unnecessary modifications to your car and stop buying non-essential car accessories if you want to save money.

Another Interesting Article: Should I Sell My Car To Pay Off Debt?

How To Stop Wasting Money On Subscriptions

Cable and TV subscriptions may seem like a small amount, but they can quickly add up and take a significant portion of your income.

To stop wasting money on subscriptions, here are tips to follow:

1. Cancel Hidden Subscriptions In App Stores

If you uninstall an app from your device without canceling your subscriptions, the app will continue to automatically deduct subscription fees until you personally unsubscribe from it.

So if you download an app and use its free trial, remember to unsubscribe. Go through your app store and review your credit card statement to prevent wasting money on unnecessary subscriptions.

2. Unsubscribe From Apps And Services

One of the best ways to stop wasting money on subscriptions is by unsubscribing from all premium services.

Remove your credit card information from your app store to avoid being lured into a subscription.

Before you make a subscription, compare the pricing plan with other apps to know if you're getting a good deal.

3. Set A Reminder

Most apps automatically deduct payment from your credit card without your knowledge. To avoid wasting money on a subscription that you no longer need, set reminders for cancellation of a subscription.

4. Look For A Cheaper Plan

Streaming services, TV apps, and cell phone services offer different pricing plans for their service. Each plan comes with a unique feature and benefits.

Before making a subscription, review all the pricing plans and decide on a convenient plan.

You can also negotiate for a cheaper plan or request a longer trial period, bundle deal, referral bonus, or an upgrade.

Note: Not all subscriptions are negotiable. Cell Phone services, car insurance, and credit card interest rates are subscriptions that can be negotiated.

5. Go For Family or Shared Plan

To stop wasting money on subscriptions, always consider shared or family pricing plans.

A shared plan is a pricing plan that allows two or more people to share in a subscription. Each member of the shared plan can enjoy personalized features.

Since shared plans are less expensive. You can agree with a trusted friend or family member to contribute to a shared subscription plan.

6. Use Free Trial

If you need a service for a one-time purpose, there's no need to waste money. Enjoy the free trial period and cancel the subscription once the trial period is over.

7. Use Apps

Apps like Rocket Money (TrueBill), AskTrim.com, Bobby, and Mint offer features that track all your subscriptions. They negotiate subscriptions on your behalf, provide updates on cheaper plans, and prevent automatic deductions on services that you rarely use.

How To Stop Wasting Money On Utilities

1. Reduce Your Electricity Usage

Reducing your electricity usage can decrease your utility bills by up to 20% to 30%.

Energy-efficient lightbulbs, LED lighting, or solar panels can help you save on electricity bills. Other ways to reduce electricity usage include:

- Use energy-efficient appliances

- Adjust and configure your thermostat

- Ask for an electricity audit

- Wash laundry with cold water and reduce the use of water heater

- Switch appliances off when not in use

2. Save On Gas, A/C, and Heating

Heating and cooling can greatly impact your utility bills. To stop wasting money, always lower your thermostat, fix leaky ductwork, replace old windows with energy-efficient windows, close unused vents, and avoid overcooking.

3. Lower Water Bills

Water usage can also affect your utility bills. Use less hot water, add aerators to faucets, use WaterSense-labeled showerheads, take shorter showers, and install low-flow toilets to reduce your water usage.

Another Interesting Article: How to Save Money on Utilities This Winter

How To Stop Wasting Money On Transportation

1. Buy A Bicycle

If your workplace isn't too far from your home, consider getting a bike. This is one of the best ways to avoid spending on transportation. You won't need to make a budget for gasoline, repair, maintenance, or insurance.

2. Buy A Monthly Public Transport Pass

If you take transit every day, you can stop wasting money by using monthly public passes rather than daily tickets.

Read the full article

0 notes

Text

A Guide to Creating a Personal Budget (3/3)

Tips, Tricks, and Tools

sometimes, we make a budget and it just doesn't seem to work for us. here are some common struggles we have when budgeting:

not keeping up with transactions as they happen

part of the budgeting process is upkeep - it's tedious and pretty unpleasant if you're using a software that requires you to manually copy and paste transaction info

by keeping up with your transactions, you'll have a better understanding of what's going on when you're spending! i like to add transactions to my budget about every 3 days, or when I notice a bill should have come out

money is scary, knowing that you're not quite making enough or that your payments are high is an intimidating experience. the point of the budget is to make room for yourself within your finances, and give you more freedom to make decisions that won't negatively impact you later

estimating using outliers

some months are more expensive than others, some are less expensive

maybe in january you had to buy more food than usual, so you spent an additional $150. if you used this month to create your food budget, it wouldn't be an accurate reflection of what you need for food costs on a regular monthly basis

it can be the opposite as well; maybe you only had to fill your gas tank once during november, and you usually fill it 2 or even 3 times. if you used this month to create your gas budget, you'd feel stranded after reaching your limit within the first two weeks!

not making changes when it doesn't work

because of the previous point, sometimes our estimations just don't work. if you're noticing that you're reaching some limits faster than others, adjust them as you go while trying to maintain as close to the same total expenses as possible.

in our example, we had $2,400 worth of necessary expenses, with $130 going to cat food and $120 going to gas/transportation. halfway through the month, we notice that we've spent $80 on cat food so far (62%) but only 50$ on gas (42%) with a third of a tank left still.

because we're keeping up with our transactions and tracking our budget, we know we can afford to add $20 to the cat food fund from the gas fund.

now, instead of having used 62% of our cat food budget, we've used 53%

and instead of having used 42% of our gas budget, we've used 50%

these two percentages are much more reasonable for where we're at in the month!

budgeting software comes in all shapes and sizes

a popular way to budget is to use a spreadsheet, and there are a tonne of templates to choose from! (i'm currently working on a Google Sheets template that i'll post at some point)

if you're looking for something more app-like:

Rocket Money has both paid and free versions, i tried it and it's alright, but i definitely prefer my spreadsheet lol

YNAB is a paid app, so it's not really my style. i've heard it be compared to Mint (owned by Intuit/Credit Karma and is now shut down), but I haven't tried it... if you have, please let me know in the comments!!

EveryDollar is an app created by Dave Ramsey's company, who's become quite popular from his podcast.

at the end of the day, a budget isn't going to change anything in your life all by itself

but, if you give it time and some energy, get into the dirty parts of your finances, and set goals, you'll have a lot of success using one!

also u should show me your budget templates or tell me abt it in the comments!! thank you!!!

#financial literacy#budgeting#personal finance#financial#money#budget#goals#eat the rich#anti capitalism#late stage capitalism#anti capitalist#leftism#anarchism#anarchist#poverty

1 note

·

View note

Text

Is It God’s Money? part 1 | Juicing | Gym | Lunch | EveryDollar App | Ch...

youtube

0 notes

Text

More Research

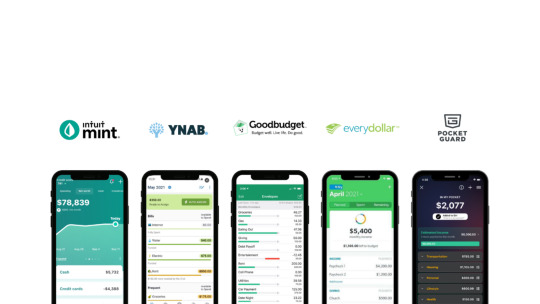

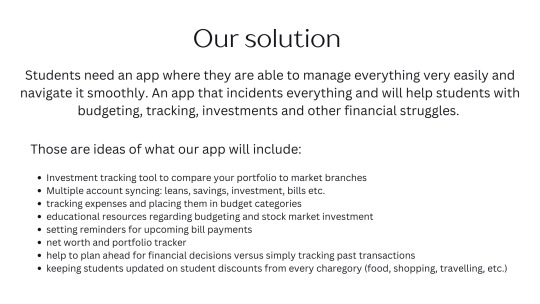

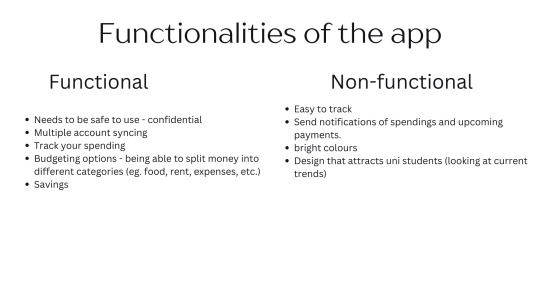

We did some further research to understand how our competitors were presenting themselves in the market. Existing apps such as Mint, YNAB, GoodBudget, everydollar & Pocket Guard all have some unique features that make them stand out. We created a list of functionalities for our app and decided to include some features that solely focused on investing, budgeting and setting future goals in order to incentivise savings. By doing so we were able to then design the key wireframes for our app and start creating the UI.

1 note

·

View note

Text

EveryDollar vs. YNAB [Which Budgeting App is #1?]

Budgeting helps you spend less than you earn and set aside cash for upcoming goals. An easy-to-use budgeting app like You Need a Budget (YNAB) or EveryDollar can provide the confidence you need to reach your spending and saving goals.

There are many similarities between both apps, including bank account syncing and customizable plans. However, each platform has its unique strengths that can make…

View On WordPress

0 notes

Text

7 Things You Should Know Before You Buy Wedding Ring

Whether you are on a budget or you’ve splurged on a designer piece, buying the perfect wedding ring is an important investment for any couple. Here are a few things you should know before you start shopping:

Set a budget

A ring can be very expensive, so it’s important to have a realistic idea of how much you want to spend on the item. This can be done through setting up a budget with EveryDollar so you know how much money is needed to reach your goal.

Determine what you want to buy

Once you have a clear idea of what you’re looking for, it’s time to find a jeweler. Choosing a good jeweler will ensure that the ring is of high quality and fits your budget. Make sure you do your research and visit a few jewelers in person before deciding on one, asking questions about certifications provided and contracts. Visit this shop to discover more Tungsten rings.

Choose your stone

The stone of your engagement ring will be the most important part, so make sure to choose it carefully. The most popular stone is a diamond, but other precious and semi-precious stones such as sapphires or emeralds can also be considered. If you do decide to go with a diamond, it’s important to consider the size, color and clarity of the stone before you purchase the ring.

Consider your fiancé's style

If you have a good rapport with your fiancee, she probably already knows what kind of jewelry she likes. Ask her what she wears and what she has in her jewelry box to get a better idea of her style.

Don’t be afraid to ask a friend or family member for a jewelry store recommendation that they trust, as they may have used the same jeweler themselves and can give you an honest appraisal of the ring you’re considering.

Having a trusted friend or family member to help you with your purchase will not only save you money, it can also be a lot of fun! If you’re going to be splurging on the ring, you might as well do it with someone who will be proud of it and have positive comments for years to come. To find the right black tungsten ring , view this homepage.

Shop around

You can always shop for an engagement ring online, but you’ll want to do your homework and compare prices before you make a final decision. The best way to do this is to go to multiple jewelers in person and online, checking out their certifications, customer reviews and the overall experience of the store.

Consider the ring’s setting

The type of ring setting you choose can affect the look of your ring and its durability over time. A gold ring with platinum prongs will hold the diamond in place stronger, while a halo setting can make the stone appear larger and more radiant. The right setting can help your fiancee feel more special, and it can also be a great option if you aren’t comfortable with a diamond solitaire. You can get more enlightened about this topic here: https://www.britannica.com/dictionary/wedding-ring.

1 note

·

View note

Link

The EveryDollar app is a complete game-changer for our finances. Find out how to use everydollar to take control of your money.

0 notes

Link

0 notes

Text

Recommendations to ensure that the stable finances of a business are maintained

Having healthy finances within a business means achieving a balance between the income, expenses, debts and investments of an organization. To achieve this objective, it is necessary to have an accurate planning and administration of resources.

Establishing budgets and financial plans is one of the most important tasks in a venture. Take into account that 16% of companies that fail do so due to financial problems, according to information from the Failory website.

61% of small businesses do not make annual budgets and this problem increases in companies with one to 10 workers. Of these, only 26% carry out these processes, according to information from Small Business Trends.

To have profitable businesses, the first step is to have healthy finances that allow you to constantly improve and grow. Business owners have the obligation to know the financial status of their companies so that, in this way, they can undertake strategic actions to meet capitalization needs.

How do I identify if my business has stable finances?

The first indicator that can give you certainty of sound financial management is being in the black, that is, more money coming in than you spend. But within this indicator, you must also observe how other relevant aspects behave to consider that a company is profitable. Take note:

Income is constantly increasing

Expenses are stable and exceed variable expenses

You have a good cash balance

The percentage of indebtedness is low

good profit margin

You generate new monthly customers and keep your recurring customers

The best action you can implement to establish the financial status of your company properly is to hire an accountant to analyze and order your financial information. You can call on temporary professionals specialized for this task.

Tips for making, monitoring and meeting my budgets

If you know the capital you have, you will be able to prepare realistic and accurate budgets for the operation and administration of your company. Get to know some digital tools that will help you prepare and monitor budgets in your company:

Mint

It is an app in which you can synchronize your bank accounts, credit cards, loans, investments and invoices. As a budgeting tool it is highly functional. Among its benefits stands out the possibility of adding the categories in order of relevance, as well as automatically ordering your expenses and income. It is one of the top-rated apps on the App Store and Google Play.

You Need a Budget

This digital tool is focused on future planning of expenses. It suggests, taking into account your income, what amounts you should allocate for savings, investments, expenses and more indicators according to your objectives. Additionally, it offers resources and educational content on business budgeting on its website.

EveryDollar

In its free version you will have to add your income and expenses manually, but with the premium version you can synchronize accounts and cards automatically. Additionally, it is an excellent tool for budgeting from scratch. This app is ideal for keeping track of your expenses and achieving profitable businesses.

Strategies to improve profitability

The economic profitability within a company depends on achieving the highest average profit or utility with respect to the investment made. Here are some tips that will lead your company's ship to a safe harbor.

Reduce expenses: Within the administrative and operational processes of your company there are expenses that can be reduced without having to sacrifice quality, identify and eliminate them.

Optimize your production: On many occasions the costs of raw materials or products are modified, we absorb this change and do not reflect it in the final price. Analyze your production costs and update your prices.

Periodically review your business plan: No plan is written on stone. Sometimes it is better to redirect your effort to the products that give you the best profits or the ones that are most popular, than to try to revive one that is not generating the results you expected.

Be part of the gig economy: Outsourcing labor will help you employ specialized workers, without having to include them on the payroll and hire them only per project.

The Credit Score can be improved

LC Consultant in Dubai

0 notes

Text

Best Printing Flyers For Today In Cheap

Printing flyers is one of the most straightforward ways of collecting more client service for a specific organization, cause or extraordinary occasion. Contingent upon which course you wish to take with your showcasing effort, printing flyers can be a basic arrangement. Publicizing is generally essential for persuading individuals to make a move on something. Before you set out on requesting quality print items from your believed internet based printer, ensure you're hitting on these chambers.

Online printed flyers have free plan layouts for your imaginative soul. It likewise assists in the pre-press with handling as the professional will not need to control anything - your substance will be generally on paper prepared structure. Additionally, it gives you complete command over your own design with regards to building pictures, foundations, text and textual style styles and that's just the beginning. Maybe you're a material organization or other project worker who gives out free gauges (utilize that while printing flyers!) or another shop around offering limits and different advancements to the initial 250 clients. Anything that it is, make it adequate for individuals to follow up on. All things considered, your last objective is to transform interest into change. Give them something they can dive into and you'll have individuals gnawing all of a sudden. We as a whole need a little assistance getting our business going. 48HourPrint.com offers modest printed flyers that work for a spending plan.

Flyers are as yet one of the most famous printed publicizing devices essentially in light of the fact that they work. With flyer printing, you can upgrade your deceivability among your objective market, interface with your clients, and advance really without burning through everydollar. Assuming you want something eye-getting, go for great club flyers or conspicuous metallic printed flyers. With club printed flyers you can look over three sorts of thick, solid cardstock in gleaming, matte, or serious shine UV covering. Metallic flyers add shimmer to plans so clients will without a doubt pause and read your message.

0 notes