#Asset Recovery and Offshore Legal Experts

Text

How to recover lost money from scammers.

Captain Web Genesis Recovery was founded by Crypto Intelligence, Crypto Investigations, Asset Recovery and Offshore Legal Experts. With over 40 years of experience in these fields individually they came together to form a boutique Cyber and Crypto Intelligence Group focused on providing results.

#hire a hacker#bitcoin mining#crypto scam recovery#bitcoin recovery#Captainwebgenesis#best crypto recovery experts

51 notes

·

View notes

Text

How To Recover Stolen Cryptocurrency // Hire a Genuine Recovery Experts Lost Recovery Masters

Cyber Intelligence, Crypto Investigations, Asset Recovery, and Offshore Legal Experts created Lost Recovery Masters Intelligence. They came together with over 40 years of experience in these sectors to develop a boutique Cyber and Crypto Intelligence Group focused on results.They deliver Actionable Intelligence to all of their clients by utilizing the most recent Cyber tools, Open Source…

View On WordPress

0 notes

Text

Unveiling Hidden Assets: Navigating the Maze After Divorce

Divorce is undoubtedly one of life's most challenging experiences, fraught with emotional turmoil and logistical hurdles. Amidst the emotional upheaval, the division of assets can often become a contentious issue, especially when one party suspects the other of concealing wealth. Uncovering hidden assets post-divorce requires diligence, persistence, and the assistance of seasoned professionals. Let's delve into the intricacies of finding hidden assets after divorce and explore some strategies to navigate this challenging terrain.

Understanding Hidden Assets

Hidden assets can take various forms, ranging from offshore bank accounts and undisclosed income to undervalued assets and sham transactions. Spouses may resort to a myriad of tactics to conceal wealth, driven by a desire to minimize financial obligations or gain an unfair advantage in the divorce settlement. Identifying these concealed assets is crucial to ensuring a fair and equitable distribution of marital property.

Signs of Hidden Assets

Detecting hidden assets often involves careful scrutiny of financial records and behaviors that may indicate attempts to conceal wealth. Some red flags to watch out for include:

Sudden changes in spending habits or lifestyle despite reported financial difficulties.

Unexplained discrepancies or inconsistencies in financial statements and tax returns.

Transfers of assets to family members, friends, or business associates without a legitimate explanation.

Complex ownership structures involving trusts, offshore accounts, or shell companies.

Seeking Professional Assistance

Given the complexity and sensitivity of uncovering hidden assets, enlisting the services of experienced professionals is paramount. Forensic accountants, private investigators, and family law attorneys specializing in asset recovery can provide invaluable expertise in tracing concealed wealth. These professionals possess the skills and resources necessary to conduct thorough investigations and unearth hidden assets effectively.

Document Gathering and Analysis

Gathering comprehensive documentation is the foundation of any successful asset investigation. This includes bank statements, tax returns, business records, investment portfolios, and any other relevant financial documents. Forensic accountants meticulously analyze these records, identifying anomalies and discrepancies that may indicate attempts to conceal assets.

Utilizing Discovery Tools

In legal proceedings, discovery tools such as subpoenas, interrogatories, and depositions can be powerful instruments for uncovering hidden assets. These legal mechanisms compel parties to disclose financial information under oath, providing opportunities to uncover concealed wealth. Additionally, forensic experts can utilize specialized software and techniques to trace electronic financial transactions and unearth hidden accounts.

Negotiation and Resolution

Once hidden assets are uncovered, negotiations for a fair and equitable division of marital property can commence. Armed with evidence of concealed wealth, spouses can pursue legal remedies to ensure a just outcome. In some cases, reaching a settlement may involve compromise and concessions, guided by the advice of legal counsel and financial experts.

Uncovering hidden assets after divorce is a complex and often arduous process, requiring meticulous attention to detail and strategic planning. By enlisting the assistance of seasoned professionals and leveraging the tools and techniques at their disposal, individuals can navigate this challenging terrain with confidence. Ultimately, the goal is to achieve a fair and equitable resolution that safeguards the interests of both parties and lays the groundwork for a fresh start.

#bank account asset search#asset search bank accounts#Asset search companies#hidden asset search#asset investigation services#Asset search company#bank account searches

0 notes

Text

Top Investment Scam Recovery: Restoring Financial Justice

Investment scams can leave victims devastated, both financially and emotionally. However, with the help of top investment scam recovery services, there is hope for reclaiming lost funds and seeking justice. Our expert team specializes in navigating the complexities of investment fraud cases to recover assets and provide relief to victims.

Expertise in Investment Fraud

Recovering from an investment scam requires the knowledge and expertise to unravel complex financial schemes and legal intricacies. Our top investment scam recovery services are staffed with professionals experienced in investment fraud investigations and asset recovery. We understand the deceptive tactics employed by fraudsters and employ cutting-edge techniques to trace and recover misappropriated funds. Our team collaborates with forensic accountants, legal experts, and law enforcement agencies to build strong cases against perpetrators. With our in-depth understanding of investment fraud, we maximize the chances of recovering assets and providing victims with the justice they deserve.

Comprehensive Asset Tracing and Recovery

Asset tracing is a critical component of investment scam recovery. Our top recovery services employ advanced techniques and industry-leading tools to trace and locate hidden or misappropriated assets. Through meticulous investigation and analysis, we identify offshore accounts, complex financial transactions, and fraudulent activities. With our extensive network of contacts in financial institutions and regulatory bodies, we have the resources to track and recover funds across borders. Our comprehensive approach ensures that no stone is left unturned in the pursuit of recovering assets for victims of investment scams.

Legal Advocacy and Litigation Support

Investment scam recovery often involves navigating complex legal landscapes. Our top recovery services work closely with experienced attorneys and legal experts who specialize in investment fraud cases. We provide victims with legal advocacy and litigation support throughout the recovery process, assisting in filing claims, pursuing legal actions, and representing their interests. Our team leverages its knowledge of investment laws, regulations, and precedents to build strong legal strategies that maximize the chances of success. With our comprehensive legal support, victims can pursue justice and seek compensation for their financial losses.

Negotiation and Settlement Expertise

Recovering from investment scams often involves negotiation and settlement discussions with perpetrators or third parties holding misappropriated funds. Our top recovery services possess strong negotiation skills and extensive experience in dealing with fraudsters and their representatives. We advocate on behalf of victims to secure the best possible settlement terms and maximize the recovery amounts. With our expertise in negotiation techniques, we strive to provide victims with the financial relief they deserve, ensuring they recoup as much of their investment as possible.

Confidentiality and Compassionate Support

We understand the sensitive and emotional nature of investment scam recovery. Our top recovery services prioritize confidentiality and treat victims with compassion and empathy throughout the process. We maintain strict confidentiality to protect victims' identities and personal information, creating a safe environment for them to share their experiences. Our team provides ongoing support and guidance, offering reassurance and information at every stage of the recovery journey.

For More Info:-

Fast online Fund recovery services

Secure online Fund recovery providers

Personalized online Fund recovery support

Comprehensive online Fund recovery assistance

0 notes

Text

CNCIntel - Bitcoin Tracing & Recovery

Cncintel was founded by Cyber Intelligence, Crypto Investigations, Asset Recovery and Offshore Legal Experts. With over 40 years of experience in these fields individually they came together to form a boutique Cyber and Crypto Intelligence Group focused on providing results. Read Cncintel Review & Testimonial Today!

#cncintel#CNC Intelligence Inc#CNC Intelligence#Cncintel Review#Cncintel Review 2021#Cncintel Reviews

22 notes

·

View notes

Text

CNC Intel

CNC Intelligence was founded by Cyber Intelligence, Crypto Investigations, Asset Recovery and Offshore Legal Experts. With over 40 years of experience in these fields individually they came together to form a boutique Cyber and Crypto Intelligence Group focused on providing results. Visit the website for more

https://cncintel.com/

1 note

·

View note

Text

FIA Officials will be assisting in Broadsheet commission

The government has tasked two seasoned officials of the Federal Investigation Agency (FIA) to assist the Broadsheet Commission in its probe.

The investigation officers include FIA Economic Crime Wing Headquarters Islamabad Assistant Director Muhammad Amanullah Khan and FIA Anti-Corruption Circle Lahore Zone Assistant Director Ahsan Ali Hani Bajwa. Khan is recipient of the Pride of Performance award.

The services of both the officials were placed at the disposal of the Broadsheet Commission on the directions of FIA Director General Wajid Zia. A notification in this regard has also been issued.

The Broadsheet inquiry commission led by Justice (retd) Azmat Saeed will complete the probe in six weeks and hand over the report to Prime Minister Imran Khan.

The commission has started its work in the secretariat set up in the Federal Shariat Court. The head of the commission has also been empowered to constitute committees of experts under which, the services of two FIA officials have been sought.

As per the terms of reference, the commission will examine the process of selection and appointment of assets recovery firms — Trouvons LLC, Broadsheet LLC and International Asset Recovery Limited (IAR) — and execution of agreements in 2000 to trace the offshore assets of Pakistanis stashed abroad.

It will also probe into the circumstances, reasons and effect of cancellation of agreements with Broadsheet LLC and IAR in 2003.

The commission will also identify the persons or officials responsible for making wrong payment of $1.5 million to the wrong person in 2008 who was not entitled to receive such payment.

In December 2020, a high court in the UK had ordered debiting Rs4.5 billion from the accounts of the Pakistan High Commission in London over non-payment of a penalty by the National Accountability Bureau (NAB) to the foreign asset recovery firm Broadsheet LLC.

The inquiry will determine as to whether after finalisation of the award and appellate proceedings before the High Court at London and the process of making payments to the claimant was legal and in accordance with the prescribed rules and procedure.

https://ift.tt/2YOjk8o

0 notes

Text

A missing ingredient in COVID oversight: Equity

New Post has been published on http://khalilhumam.com/a-missing-ingredient-in-covid-oversight-equity/

A missing ingredient in COVID oversight: Equity

By Joseph Foti, Norman Eisen The response to COVID-19 is not just record-level spending and borrowing. It may already constitute a wealth reallocation of historic proportions. The implications for equity, future growth, and climate are tremendous. The health and economic crises – and in some cases, the government response to them – have not only been felt more acutely in particular businesses and industries. They have also disproportionately hurt black- and minority-owned businesses and the communities they serve. As experts at watchdog organizations as well as our own respective organizations have pointed out, transparency and oversight are essential to ensuring a fair recovery that meets the needs of those who are struggling the most. The 20th century transparency toolkit will not be enough by itself. Moving forward, the “holy trinity” of transparency and anti-corruption reform – fighting against waste, fraud, and abuse – needs a fourth element: striving for equity. The case for this approach remains fundamental; more efficient spending means money for other programs or lower taxes that benefit the average citizen. To capture the differential impacts of federal actions, oversight institutions must ask and answer the right questions as a matter of racial, social and economic justice. They must be able to gather and generate the data they need and guide implementation at agencies. This will help inform citizens about who received the money, why, and who benefited from it. Critics on the left and the right, as well as non-partisan observers have raised questions of distributional appropriateness in stimulus spending. The concern, then should not be partisan, but rather a basic element of policy analysis. Examples from the CARES Act (Pub.L. 116-136) show why we need to better prioritize considerations about equity.

Bond buying rejuvenated financial markets, but left citizens and small businesses behind. The CARES Act directs the Federal Reserve Bank (Fed) to buy bonds to support markets and employment. The Fed projects holding $9T in assets by the end of the year, a four-fold increase over the decade. The Fed began large capital bond buying well before it began supporting small and mid-sized companies. This came shortly on the heels of a regulatory process exempted from the Administrative Procedures Act seen by some to have favored large capital and the oil industry. This bears particular relevance to minority-owned businesses: according to McKinsey, because these businesses are smaller and have less access to traditional banks, they were considerably less able to access capital.

Tax refunds allowed executives to profit from the crisis. The problem of inequality is not only that smaller or minority-owned businesses get less access to relief. The problem is also the disproportionate and sometimes questionable relief at the top. A legal, but questionable, example stands out. The CARES Act authorized oil companies to obtain tax refunds on net operating losses from prior years. As a result of this, Diamond Offshore Drilling, already in bankruptcy proceedings, saw an immediate benefit of $9.7M in tax rebates. Shortly thereafter, the company asked the bankruptcy judge to permit a coincident $9.7M bonus to nine executives. This was discovered through Securities and Exchange Commission Proprietorships or other legal vehicles are not subject to the same requirements of non-profits or publicly traded companies.

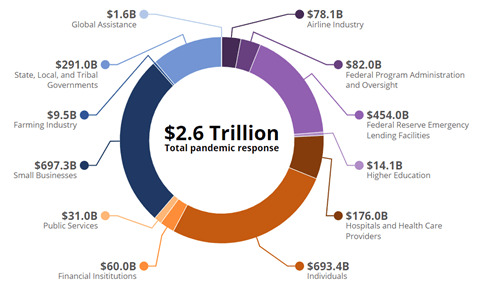

Without accountability for misuse of funds, some companies applied for and received Paycheck Protection Program (PPP) loans despite having ready access to ample capital. The fiscal elements of stimulus ($2.6 trillion) include loans, grants and direct assistance to individuals and organizations. Intended recipients of PPP funding are those companies that, without federal assistance, would be unable to retain their workforces. However, some businesses that received hefty credit extensions or additional loans shortly before the pandemic hit also received a federal loan. For example, Legacy Housing, a Texas-based manufacturer of pre-built homes, announced on April 1 its access to $25 million in credit. On April 10, it received an additional $6.5 million S.B.A loan from the federal government. (In response to reporting, Legacy returned the $6.5 million in federal assistance, according to the company’s executive chairman. The chairman added that “Legacy is a highly leveraged company without cash on hand. Here was a way to get a cash infusion.”)

Black and minority-owned businesses struggled to get relief under the CARES Act. While lawmakers intended for the program to prioritize “underserved” markets and business owners of color, independent analyses indicate that counties with higher ratios of black-owned businesses tended to have lower rates of PPP allocation.

Reducing operational barriers for companies creates health, safety, and environmental risks for vulnerable groups. According to a recent cross-national comparison, the US has been found to have had one of the least green stimulus packages— with serious environmental justice and generational consequences. While a detailed list of tax expenditures is not available, a worldwide survey showed they include foregone revenue, subsidies, waivers of regulation, participation, and oversight, and weakened safety or environmental liability. These non-financial elements of stimulus are estimated at $298 billion and may disproportionately benefit industries which do significant damage to the environment and human health. Evidence shows that such environmental damage is most severe in communities of color.

Another questionable tax expenditure: the rate of depreciation for most commercial real estate was lowered from 39 to 15 years. It is unclear how this will affect federal coffers, how this addresses the effects of COVID-19 and whether such generous changes in tax code will sunset after time.

Despite strong work by some reporters, think tanks, and some legislators, no official agency is tasked with identifying whether money reached those individuals, businesses, and communities hardest hit by the pandemic and its economic effects. It is not enough to have non-profits and the media sector ask questions about who benefits from record spending. It requires big data and the stamp of official, impartial review, and clear guidance for civil servants making policy. The Pandemic Response Accountability Committee (PRAC) has taken some positive steps in tracking who received major sources of spending. (See figure below for their reporting.) While a good start, many of the categories leave questions about whether these benefitted the most affected or the most connected. FIGURE: A promising start: PRAC reporting on the destination of US Stimulus Money Various reforms could be undertaken to monitor the distributional impacts of the recovery.

Create or adapt oversight institutions: This could require a new institution (an “Office of Distributional Impacts”) or modifying an existing institutional mandate (such as OMB or the PRAC), not necessarily requiring legislation.

Track costs and benefits for minority communities: A core aspect of these institutions’ mandates would be public reporting on distribution of costs and benefits of federal actions across race, class, gender, generation, geographic region, and size of enterprise. A variety of tools and methods could be used, whether integrated into existing informational assessments (environmental or cost-benefit analysis) or as standalone documents.

Develop new standards of adequacy: Early stages of reporting might focus only on whether benefits went to communities with the greatest COVID-19 impacts. A more complex process might report on whether costs and benefits change depending on the discount rate. Over time, standards of adequacy and quality would develop.

None of this would predetermine whether a program should be undertaken. Rather, like other forms of impact assessment, this would be a set of responsibilities and processes to identify, predict, evaluate, and potentially mitigate the distributional effects of an action or major decision. Americans deserve transparency about whether their money was leveraged effectively. While many have done yeoman’s work of researching these difficult issues, it should not primarily remain the work of non-governmental actors alone to ask basic questions about whether tax dollars are driving people together or apart. Joseph Foti is the Chief Research Officer of the Open Government Partnership. He leads the Analytics and Insights team which is responsible for major research initiatives, managing OGP’s significant data resources, and ensuring the highest quality of analysis and relevance in OGP publications. Ambassador Norman Eisen (ret.) is a senior fellow in Governance Studies at Brookings and an expert on law, ethics, and anti-corruption.

0 notes

Text

How Asset Searches Work and When You Should Use Them

Does someone owe you money but you are unsure of how to perform a New York asset search because of changes in the Financial Services Modernization Act of 1999? If a person is unable to obtain banking records, how will an asset search help recover a debt owed? It is a question that asset recovery experts get asked every day. Not only will we search legally for international bank records, but our asset research professionals will also look for real estate, automobiles, airplanes, boats or anything of value like trusts, professional licenses and trademarks that you can leverage for payment. Here is how asset searches work and when you should use them.

How Are Asset Searches Performed?

Asset recovery is a normal process used by both private individuals and companies for a number of financial motives, including background checks, investments, judgments, bank loans, credit trustworthiness, stolen possessions or establishment of one’s wealth for debt recovery. Asset recovery documents also establish a blueprint of someone’s capital for legal proceedings.

Asset recovery experts focus on four things when attempting to identify financial records.

Is there any money or tangible assets associated with the debtor?

Where is it located? Depending on the location, how does jurisdiction affect recovery?

Will it satisfy the debt owed?

Are there any liabilities?

Sometimes, it becomes a complicated process because the more that is owed, the harder a person works to hide it in unlikely places, which is why it is of value to hire an asset recovery professional who has the knowledge, skills and expertise to navigate global financial structures and use investigative and forensic accounting techniques to conduct thorough search queries.

Types of Asset Searches

There are two primary asset searches that a person will request: corporate and personal.

Corporate Asset Searches

Before you make an investment, make a loan or agree to any financial transactions, you will want to establish the debtor is creditworthy. Most especially in business, people tend to fudge their numbers. Asset investigation helps you determine and make the best decisions based on the likelihood that you will be able to recover your losses if needed.

Businesses often use the court system to receive judgments, which are worth tens of millions. While the court system helps you get a decision, they do not help you with the collection of the award. Having an asset recovery team to locate resources quickly will strengthen the retrieval of a verdict or provide evidence of hidden assets to the court.

Employers and investors also hire asset recovery experts when they believe there is possible fraud, hidden money, shell companies, embezzlement, offshore accounts or misappropriated resources. In these cases, you must first locate the evidence before you will know how to proceed with where the assets are and how much of it remains.

Personal Asset Searches

Any time there is a doubt about your personal finances, it is best to allow a third-party such as an asset recovery company to handle the search on your behalf. Not only is it stressful dealing with multiple transactions, asset searches and worldwide jurisdictions, you may also lack the right resources to investigate your case correctly or thoroughly.

Whether there are legal or financial implications involved, asset recovery companies are well-trained to investigate for you, which makes it a safer and more secure process. Most especially when schemes, fraud or scams are involved, the person you were dealing with is unknown, so you will need experts who are experienced with false identities.

While 90 percent of people marry before the age of 50, as many as 50 percent of them will end in divorce according to the American Psychological Association. Legally, a separated couple must share the property that often includes assets acquired before marriage, during separation and until the end of the divorce proceeding. Hiding assets to gain an advantage is a common practice in many cases and often ends with the judge ordering a further investigation into a spouse’s claim. Unfounded claims rarely go anywhere, so an asset recovery agent will get the proof you need to proceed in the court system.

Heirs also often require the help of asset recovery companies when they believe a will was not executed accurately. An investigator will be able to check on the assets and determine where and to whom they were given. This type of asset investigation ensures transparency and fairness while also making it comfortable for a family to communicate.

What Do Investigators Look for During Asset Searches?

Asset searches vary depending on who the client is and why a person needs an asset search. Some people may feel more comfortable hiding money overseas while others choose to stuff it in their mattresses. The goal is to find both tangible and intangible assets regardless of where they are located and help the client irrespective of whether there is a court order, a multi-state or country jurisdiction or forensic accounting involved. An investigator usually performs duties like:

Establishes a debtor’s net worth

Locates property in debtor’s name or an intermediary

Deferred compensation of debts

Corporate and board connections

Stocks or broker accounts

An indication of capital flight

Pensions and insurance policies

Credit score changes

Antique collections or artwork

Loans that generally require collateral

Interviews of family, friends or co-workers

Intangible property like intellectual property or patents

Searches for international estates, bank accounts or stocks

Identifies bank accounts or hidden safety deposit boxes

Determines hidden wealth through financial obligations and contracts

Performs forensic accounting on financial records to find discrepancies

While these are general duties, asset recovery investigators are highly skilled in assisting clients with any type of search. While some cases are quickly resolved, others require in-depth scrutiny and a higher level of expertise. Anytime you are in doubt about your personal situation, it is best to hire an investigator to discover the truth and gain a better understanding of where you stand. Not only will you identify the facts that help you make decisions, but you will also determine any possible liabilities, such as liens, lawsuits, judgments or bankruptcies that will make it diffilcult.

The post How Asset Searches Work and When You Should Use Them appeared first on Legal Desire.

How Asset Searches Work and When You Should Use Them published first on https://immigrationlawyerto.tumblr.com/

0 notes

Text

Abu Dhabi Powers Ahead

Abu Dhabi’s economy remained stable in 2018 and looks set for growth this year

Despite declining oil prices and a slowing world economy, Abu Dhabi’s economy has retained its strength and looks set for a year of robust growth in 2019. S&P Global Ratings assigned Abu Dhabi a stable outlook in December, based on the expectation that the UAE capital’s economic growth will “steadily recover” and the UAE’s fiscal position will remain strong through 2019-2020, it said in a report. S&P affirmed its ‘AA/A-1+’ sovereign credit ratings on Abu Dhabi based on its strong fiscal and external positions. “The exceptional strength of the government’s net asset position provides a buffer to counteract the effect of oil price swings on economic growth, government revenues, the external account, and increasing geopolitical uncertainty,” the organization said in a statement.

Experts from sectors including banking and finance, film and TV production, real estate as well as consultancy firms offer their perspectives on the year ahead for Abu Dhabi.

THE EXPERTS

Rola Abu Manneh, CEO, UAE, Standard Chartered,

Emilio Pera, Partner and Head of Audit and Financial Services, KPMG in the Lower Gulf

Sameer Lakhani, Managing Director, Global Capital Partners

Dr. Ryan Lemand, Senior Executive Officer and Board Director at ADS Investment Solutions, Global Head of Wealth Management at ADSS

Greg Rung, Partner, Financial Services, Oliver Wyman

Amr El Saadani, Managing Director, Financial Services, Middle East, Accenture

How has Abu Dhabi’s economy performed in 2018 in your opinion and what are your expectations for 2019?

Lemand: In line with most of the oil exporting countries Abu Dhabi has seen moderate economic activity in 2018, which is in-line with the lower than expected oil prices in 2017 and early 2018. The level of economic activity, as with previous years, has been made possible by the diversification of the economy away from oil. This has been driven by a number of important Government initiatives.

Emilio Pera, KPMG

The continued consolidation in the banking sector has been noteworthy and will help banking and financial institutions run more efficiently. This has been supported by the performance of the Abu Dhabi Exchange which has had a good year, compared to other stock markets in the region, which has also had a positive impact on the financial sector as a whole.

Lakhani: For Abu Dhabi, the fact that the pace of development is gradual, increasingly diverse and enticing enough to encompass the mid income spectrum of the market implies that the upside potential will become a factor in the decision making for investors. It is important to recognize in this context that institutional money flows are expected to increase as well (albeit gradually) into the real estate sector, especially now that the Central Bank has removed the 20% exposure cap on the real estate sector; we opine that this will imply increased money flows towards the asset class. Again this is likely to be gradual, given the headwinds that the sector has faced over the last three years. In the final analysis, given the structural improvements in the economy, as well as the reforms that have been announced, there is reason to increase exposure, as the economy gathers steam in 2019.

Which areas of the banking industry have the most room for growth and development in Abu Dhabi?

Rola Abu Manneh: We continue to see interest for a range of financing products in the market. In particular, Debt Capital Markets, is an area where we see good business momentum in the region. As a matter of fact, Standard Chartered has been the top manager for bonds and sukuk in the Gulf region this year, according to Bloomberg data.

Rola Abu Manneh, Standard Chartered, UAE

The drop in oil price, resulting in low supply of capital, has given us the opportunity to tap our international network and attract investors from outside the emirates. Another area of growth is wealth management where there is a demand for tailored investment and insurance products. Our products are structured with the client in mind which is one of the reasons why despite the market softening with oil prices dropping, our volumes have picked up last year.

The stimulus plan in Abu Dhabi as well as the numerous infrastructure projects that are currently taking place are a big boost in driving economic activity in the UAE as well. The EXPO 2020 will see the banking sector play a significant role as it will likely have positive implications on three key parts of the economy: housing, infrastructure and hospitality.

Pera: There is opportunity to further grow in most segments within the bank, however, in order to remain competitive in the retail banking sector and attract new customers, it appears like banks will have to consider investing in new digital solutions to remain relevant. In addition, by enhancing internal processes, cross-selling may also be improved. For corporate customers, large exposure limits and a slowdown in some segments of the economy will require banks to look for opportunities outside the traditional geographic focus in order to maintain strong growth momentum.

What are the main challenges facing the banking sector in Abu Dhabi? How can these challenges be overcome?

Rung: The main challenges to be overcome internally continue to be a customer centric approach and operational efficiency. Most banks have a clear opportunity to maximize the revenue from their client base by developing a 360 degree view of those and marketing them the products they need at the right time and with the right channel. Getting new clients and new products is very competitive and expensive. In addition, significant operational automation opportunities exist that help cost efficiency as well as provide better process control.

Greg Rung, Partner, Financial Services, Oliver Wyman.

Alsadani: Well, the GDP growth is expected to rebound in 2018, however, business sentiment remains cautious. The lending and the deposit volume from the private sector have increased marginally over the last three years, and trade volumes have also remained relatively stable since 2014. There is no peak.

Bank credit has been steadily growing, with Islamic finance growing at the rate of four times faster than the conventional finance. But digital banking will require lots more investment from all the banks and that’s part of the reason why we now see these mergers happening.

How is Abu Dhabi developing as a financial center?

Lemand: The sustained development of the Abu Dhabi Global Market (ADGM), which is becoming a strong emerging market financial centre, is supporting international and local financial and banking institutions. This emergence has been strengthened by the passporting agreement between the Dubai International Financial Centre’s (DIFC) the Dubai Financial Services Authority (DFSA), the onshore Securities and Commodities Authority (SCA) and ADGM’s Financial Services Authority (FSRA). This retrospective agreement allows authorised companies to practice activities across the three UAE jurisdictions, which is one of the most important regulatory milestones since 2011.

The ADGM is now recognised as being better regulated than other comparable offshore financial centers. Having a legal system based on England law and having a fast to market turnaround is attracting many renowned businesses to the ADGM. So, it is no surprise that several tier 1 international financial and banking institutions have established a presence in the ADGM. This is in addition to Abu Dhabi Investment Authority (ADIA), Abu Dhabi’s sovereign wealth fund, and other Emirati banks, which are taking advantage of the benefits the ADGM provides.

We have already seen significant consolidation in Abu Dhabi’s banking sector with the creation of FAB in 2017.

Do you expect to see more consolidation in 2019? What will the effects be?

Alsadani: This consolidation will drive local players to become more efficient. They cannot sustain just single banks and they need this basis to grow significantly, and mergers allow this. Moreover the emergence of larger and more sophisticated players will increase the standing of Abu Dhabi as an international financial hub. The UAE and Saudi both want to become financial hubs. We’re seeing a merger start in Saudi Arabia: They’ve realized only the stronger will survive. The smaller players require more investments and they cannot sustain it.

Rung: The consolidation trend has continued with proposed merger between ADCB, UNB and Ali Hilal. There are ~50 banks for a population of 9 million people. We expect this trend to continue, likely involving smaller banks which are running sub-scale operations. Mergers are a welcome trend that bring higher efficiencies, reduced funding costs and new business opportunities due to larger balance sheet and capabilities.

Pera: In addition to the merger of NBAD and FGB to form FAB in 2017, in Abu Dhabi we are also currently seeing the three-way merger of ADCB, UNB and Al Hilal. With additional regulations and the need to invest in technology to remain relevant in an increasingly competitive environment, there is an expectation to see further consolidation, or banks re-focusing on their niche segments of the market.

What are the key strengths of Abu Dhabi’s major banks, and of Abu Dhabi as a banking hub?

Pera: Increased consolidation appears to be creating critical mass. Individual players in the market and those with a stronger capital base would be better positioned to participate in transactions of scale. Consolidation of resources also allows for attraction and retention of more competent employees.

Rung: The local banks are well-capitalized, with good liquidity profiles and good cost-income ratios which shows good efficiency. Overall the UAE and Abu Dhabi banking sector has a stable outlook, recovering gradually over the past year. We expect gradual credit recovery in corporate sector due to an improving economic outlook. In retail we expect a major push on digitalization and automation. Within the SME sector, we expect banks to wait and continue being cautious in the near term. In corporate banking, we expect an increasing focus and opportunities in transaction banking.

Alsadani: ADCB, FAB and Al Hilal, they have been driving innovation agendas for their countries. We are seeing now the Neo banks, with the objective of increasing financial inclusion in the area. And Hilal executed the first Sukuk transaction using blockchain technology. I believe that we will see more FinTech solutions adopted by the large players.

Retail banking and that of the small medium enterprises will be the first adopters, I think in the first wave of innovation. Typically, mobile first will start, so mobile banks and Neo banks will become the new paradigm in the consumer banking space and wealth management.

Do you expect the AED 50 billion stimulus announced earlier this year to have much of an impact? What will be the role of banks in this stimulus, and will banks benefit much?

Rola Abu Manneh: Abu Dhabi’s recent announcement of AED 20 billion (USD 5.45 billion) spending next year reiterates the Emirate’s confidence that it will achieve the economic goals set out in its Vision 2030. This is part of the original announcement in June of Abu Dhabi’s three-year AED 50 billion economic reform and stimulus programme.

For the banking sector, the plan is expected to include a credit guarantee scheme to support businesses that face challenges in accessing bank financing. Generally speaking, liquidity conditions in the banking system have improved as deposit growth has outpaced loan growth. However, there are initial signs of a recovery in credit to the private sector. The Central Bank of the UAE’s latest Credit Sentiment Survey suggests that demand for loans from corporates and small businesses increased in Q3 2018.

We see these measures by Abu Dhabi government as confident and proactive in the need to make cyclical and structural changes to support the domestic economy. We think that the use of counter-cyclical fiscal policy is likely seen as regional competition for human and financial capital as the region picks up. We believe that the UAE is well positioned to benefit economically from the planned changes, given the already-diversified nature of the economy.

Lemand: This was a targeted stimulus which will have great benefits for specific sectors and projects, helping to drive these forward, and was not intended to have a direct impact on the overall economy. However, the improved legal and regulatory framework, with the introduction of the bankruptcy laws, will allow banks to play a bigger role in financing SMEs, which is the main driver of sustainable economic growth in any emerging economy.

Alsadani: It’s a tough question but I would say it will become the cornerstone of the development of the banking sector because we expect to see more SME activity around that investment, and as a result increased banking lending to the sector. The Abu Dhabi stimulus plan follows a similar approach that was being implemented in Dubai. So the combination of these two measures is expected to increase the benefits to the overall UAE private sector.

The post Abu Dhabi Powers Ahead appeared first on Bloomberg Businessweek Middle East.

from WordPress http://bit.ly/2FlNE1k

via IFTTT

0 notes

Text

Types of Irrevocable Trusts

As an estate lawyer, I have explained that there are many types of irrevocable trusts that can help you secure your assets and reduce taxes.

They include the following:

Asset Protection Trust An asset protection trust is used as a fortress to keep creditors from seizing assets. There are asset protection trust laws in states such as Nevada, Wyoming, Delaware, Alaska and North Dakota. In practice, we have found that they can provide a fair level of protection, especially, for residents of those states. However, they have the disadvantage of being under US court jurisdiction. Judge’s do not always follow the law and there are ever-expanding legal theories of liability. So, we have seen assets in domestic trusts seized on numerous occasions. Offshore irrevocable trusts in jurisdictions such as the Cook Islands and Nevis have a perfect or near-perfect track record for protecting assets from judgment creditors. Because US judges do not have jurisdiction over foreign trustees, the trustee need not comply with US court orders.

Bypass Trust This type of trust that married people use. When one spouse dies, the property goes into the trust. The surviving spouse can use the property, but does not own it. This means that it is not part of the estate when the surviving spouse dies. This equates to tax savings.

QTIP Trust Another trust designed for married couples, a QTIP trust typically provides income to the surviving spouse when one spouse dies. When the second spouse dies, other named beneficiaries receive the assets. This is typically the settlor’s children. QTIP stands for Qualified Terminable Interest Property.

QDOT Trust A QDOT trust is similar to a QTIP trust. The difference is that noncitizens use it. QDOT stands for Qualified Domestic Trust.

Life Insurance Trust With this type of trust, the trust is both the owner and the beneficiary of the life insurance policy. Anyone, in turn, can be the beneficiary of the trust. The grantor must typically create the trust at least three years before death. It lets a person reduce or eliminate estate taxes so more of the proceeds go to the beneficiaries. The trustee, then, administers insurance proceeds for one or more beneficiaries.

Generation-Skipping TrustWealthy families often use this tool. As the name implies, the trust skips a generation. The final beneficiaries are the grandchildren instead of the children. The children are beneficiaries of the income, but do not own the property. This means that when the children die, their trust property is not subject to estate tax. However, a generation skipping transfer tax may apply.

Charitable Trust If you don’t have any family – or maybe you do have family but don’t want to give them an inheritance – you can opt for a charitable trust. If you are not married and have no children this may be a good choice. This type of irrevocable trust allows you to give gifts to charity as a way to lower income and estate taxes. The charity benefits from your donation as well, so it’s advantageous to both parties. There are three types of charitable trusts.

youtube

Types of Charitable Trusts

Pooled income trust:This trust allows you to pool your money with other grantors and receive income for a specified amount of time. For these trusts, the charity is the trustee and beneficiary.

Charitable lead trust:You put property into a trust. Next, you name a charity to receive income from the trust for a certain amount of time. However, you name someone else as the final beneficiary.

Charitable remainder trust:You put property into a trust. Then, you can receive a tax deduction for putting the asset into the trust. You name someone to receive income from the trust for a certain amount of time. The trust specifies a charity as the final beneficiary.

Trusts for Special Needs

If your goal is to protect assets and income for loved ones, choose one of these trusts:

Special Needs Trust If you have a child or other loved one with special needs, a special needs trust can help provide financial support for this person in the event of your death. Property – particularly money – is placed into this irrevocable trust. You appoint a trustee to distribute the funds to buy necessities for the disabled person. The beneficiary never owns the property. This works to his or her advantage because the money is not considered as asset. The beneficiary does not make too much income and therefore can still qualify for government benefits.

Spendthrift Trust Maybe you don’t have a disabled relative, but maybe you have a sibling or child who is horrible with money. Some people are just irresponsible with money, but that doesn’t mean that you need to leave them out of your inheritance. With a spendthrift trust, you can protect and control the money that you gift to family members who have trouble managing their finances. The settlor places assets into a trust. A trustee doles them out based on the terms in the trust. For example, you may allow the beneficiary to receive only a certain amount per week or month. The beneficiary cannot access the trust property, so the assets are protected from creditors. However, once the beneficiary receives money or assets, they become fair game.

Irrevocable Trust – The Way to Go?

Irrevocable trusts offer many asset protection, estate planning and tax advantages. For the general public, an irrevocable trust may be very useful in protecting assets from lawsuits, securing financial help for a special needs child or providing for children after the death of the parents.

You need to be able to trust your trustee. What happens if you have a falling out with your trustee? Change them. The beneficiaries can simply vote in a new trustee. The trustee must not be you. The trustee also must not be someone up or down the family tree, cannot be a controlled employee and cannot be an agent of yours. If any of these parties were trustees it would lose its asset protection advantages because the courts would consider these people your alter ego.

Should you choose an irrevocable trust, some wise advice is to have it skillfully drafted by an experienced professional. This is extremely important, since a poorly worded document may not do what you intended for it to do and ruin your asset protection and estate planning goals. Contact an estate planning expert to see if an irrevocable trust will meet your needs based on your unique situation.

Free Consultation with a Trust Lawyer

If you are here, you probably have a trust or estate matter that you need help with. If so, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC8833 S. Redwood Road, Suite CWest Jordan, Utah

84088 United StatesTelephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

What is Estate Planning?

About Chapter 7 bankruptcy

Utah Registered Agent Services

Kids and Divorce

Tax Lawyer

Family Lawyer

Source: http://www.ascentlawfirm.com/types-of-irrevocable-trusts/

0 notes

Text

The Road to Financial Recovery: Detecting Concealed Assets in Divorce

Introduction

Divorce is often one of life's most emotionally and financially challenging experiences. Beyond the emotional turmoil, there's the practical matter of dividing assets and property. In many cases, one party may attempt to conceal or undervalue assets, complicating the already complex process. This article explores the critical issue of uncovering hidden assets and provides guidance on financial recovery after divorce.

Understanding Hidden Assets

Hidden assets can take various forms, including offshore accounts, undisclosed income, undervalued property, or even secret investments. The motivation behind hiding assets varies but often involves attempts to reduce spousal support or child support obligations, skew property division, or protect assets from being part of the marital estate.

Recognizing Red Flags

Identifying hidden assets begins with recognizing common warning signs. These may include sudden changes in financial behavior, unexplained debt, or discrepancies in financial disclosures. It's crucial to stay vigilant and consult with a financial advisor or attorney if something seems amiss.

Gather Comprehensive Financial Records

To uncover hidden assets, start by gathering comprehensive financial records. This includes tax returns, bank statements, investment portfolios, real estate documents, and any prenuptial or postnuptial agreements. Thorough documentation is your best weapon against concealed assets.

Consult Financial Experts

Enlist the help of financial experts, such as forensic accountants, who specialize in uncovering hidden assets. They can examine financial records, trace transactions, and identify irregularities that may indicate concealed wealth.

Investigate Online and Offline

In today's digital age, it's essential to investigate online as well. This includes scrutinizing social media, online marketplaces, and public records for any indications of undisclosed assets or income streams. Additionally, don't overlook traditional methods of investigation, like interviewing acquaintances or employers who might have pertinent information.

Legal Recourse

If you suspect hidden assets, consult with your attorney about your legal options. They can advise you on the best course of action, which may involve petitioning the court for a more thorough financial investigation or requesting subpoenas to access financial records.

Negotiation and Settlement

In some cases, the discovery of hidden assets may lead to negotiations or mediation to reach a fair settlement. Your attorney can help you navigate this process to ensure your financial interests are protected.

Protection for the Future

Finally, once hidden assets are uncovered and addressed, consider taking steps to protect your financial future. This might involve updating your estate plan, revising your budget, and seeking financial counseling to ensure long-term financial security.

Conclusion

Uncovering hidden assets after divorce is a challenging but necessary step in achieving a fair and equitable financial outcome. By staying informed, seeking professional assistance, and advocating for your financial rights, you can embark on the path to financial recovery and a more secure future. Remember that you don't have to face this daunting task alone; consult with legal and financial experts who can guide you through the process.

#bank account asset search#asset search bank accounts#Asset search companies#hidden asset search#asset investigation services

0 notes

Text

Asset Recovery Services: Maximizing Returns for Fund Investors

Asset recovery services play a crucial role in maximizing returns for fund investors by identifying and retrieving hidden or misappropriated assets. With our specialized expertise and extensive network, we provide comprehensive asset recovery solutions that help investors regain their financial footing.

Efficient and Strategic Asset Tracing

Asset recovery begins with thorough and strategic asset tracing, where our experts utilize advanced techniques to locate hidden or misappropriated funds and assets. Through meticulous investigation and analysis, we uncover complex financial trails, identify undisclosed accounts, and trace assets across jurisdictions. Our team collaborates with legal professionals and forensic accountants to gather evidence and build a strong case for recovery, ensuring the highest chances of success. By employing efficient and strategic asset tracing methods, we enable fund investors to regain control of their investments and maximize their potential returns.

Legal Expertise and International Network

Asset recovery often involves navigating complex legal frameworks and international jurisdictions. Our asset recovery services leverage the expertise of experienced attorneys and professionals well-versed in international law and asset recovery regulations. We work closely with legal experts who specialize in recovering funds from offshore entities, uncovering fraud, and pursuing legal actions against wrongdoers. Additionally, our extensive network of international contacts allows us to collaborate with law enforcement agencies, financial institutions, and regulatory bodies worldwide. This network strengthens our ability to trace and recover assets efficiently, ensuring that fund investors receive the compensation they deserve.

Tailored Recovery Strategies

Every asset recovery case is unique, requiring a tailored approach to maximize success. We understand that fund investors have specific goals and circumstances. Our asset recovery services offer customized strategies that align with your investment objectives and risk tolerance. We carefully evaluate each case, considering factors such as asset type, jurisdiction, and legal considerations. Based on this assessment, we develop recovery strategies that prioritize efficiency, effectiveness, and the protection of investor rights. Our comprehensive approach ensures that each recovery effort is optimized for success, enabling fund investors to reclaim their assets and achieve the best possible financial outcome.

Negotiation and Settlement Expertise

Asset recovery often involves negotiations and settlements with counterparties holding the misappropriated assets. Our team possesses strong negotiation skills and extensive experience in dealing with financial institutions, legal entities, and other parties involved in the recovery process. We leverage this expertise to negotiate favorable settlement terms on behalf of our clients, aiming for the highest possible recovery amounts. Through skilled negotiation techniques, we maximize the returns for fund investors, ensuring that they recoup as much of their investment as possible.

Confidentiality and Professionalism

We understand the sensitive nature of asset recovery and the importance of maintaining strict confidentiality. Our asset recovery services operate with the utmost professionalism, ensuring that all client information and discussions are kept confidential. We handle each case with discretion and integrity, respecting our clients' privacy and protecting their interests throughout the recovery process. You can trust us to navigate complex legal landscapes and recover your investments while maintaining the highest standards of confidentiality and professionalism.

For More Info:-

Fund recovery specialists for investors

Reliable online Fund recovery solutions

Affordable online Fund recovery options

Trusted online Fund recovery companies

0 notes

Text

CNC Intelligence or CncIntel Review

CNC Intelligence or CncIntel Review was founded by Cyber Intelligence, Crypto Investigations, Asset Recovery and Offshore Legal Experts. With over 40 years of experience in these fields individually they came together to form a boutique Cyber and Crypto Intelligence Group focused on providing results.

Using the latest Cyber tools, Open Source Intelligence (OSINT), Human Intelligence (HUMINT), cutting edge technology and Cyber Tools, we provide Actionable Intelligence to our clients.

Based out of Washington, DC, CNC Intelligence has an operational center in Tel Aviv, Israel and a regional branch office in Orem, Utah.

CNC Intelligence: Countering the Cyber Attacks Effectively

CncIntel Review Best Asset and Fund Recovery Industry

Email: [email protected]

Phone: +1 202-773-4704, (202) 754-8981

Address: 2000 Pennsylvania Ave NW, Washington DC

Zip Code: 20006

Timing: Monday-Friday: 8am – 5pm

#CNC Intelligence was founded by Cyber Intelligence#CncIntel Review#Crypto Investigations Asset Recovery#Crypto Intelligence Group focused on providing results#cutting edge technology and Cyber Tools

0 notes

Text

Types of Irrevocable Trusts

As an estate lawyer, I have explained that there are many types of irrevocable trusts that can help you secure your assets and reduce taxes.

They include the following:

Asset Protection Trust An asset protection trust is used as a fortress to keep creditors from seizing assets. There are asset protection trust laws in states such as Nevada, Wyoming, Delaware, Alaska and North Dakota. In practice, we have found that they can provide a fair level of protection, especially, for residents of those states. However, they have the disadvantage of being under US court jurisdiction. Judge’s do not always follow the law and there are ever-expanding legal theories of liability. So, we have seen assets in domestic trusts seized on numerous occasions. Offshore irrevocable trusts in jurisdictions such as the Cook Islands and Nevis have a perfect or near-perfect track record for protecting assets from judgment creditors. Because US judges do not have jurisdiction over foreign trustees, the trustee need not comply with US court orders.

Bypass Trust This type of trust that married people use. When one spouse dies, the property goes into the trust. The surviving spouse can use the property, but does not own it. This means that it is not part of the estate when the surviving spouse dies. This equates to tax savings.

QTIP Trust Another trust designed for married couples, a QTIP trust typically provides income to the surviving spouse when one spouse dies. When the second spouse dies, other named beneficiaries receive the assets. This is typically the settlor’s children. QTIP stands for Qualified Terminable Interest Property.

QDOT Trust A QDOT trust is similar to a QTIP trust. The difference is that noncitizens use it. QDOT stands for Qualified Domestic Trust.

Life Insurance Trust With this type of trust, the trust is both the owner and the beneficiary of the life insurance policy. Anyone, in turn, can be the beneficiary of the trust. The grantor must typically create the trust at least three years before death. It lets a person reduce or eliminate estate taxes so more of the proceeds go to the beneficiaries. The trustee, then, administers insurance proceeds for one or more beneficiaries.

Generation-Skipping TrustWealthy families often use this tool. As the name implies, the trust skips a generation. The final beneficiaries are the grandchildren instead of the children. The children are beneficiaries of the income, but do not own the property. This means that when the children die, their trust property is not subject to estate tax. However, a generation skipping transfer tax may apply.

Charitable Trust If you don’t have any family – or maybe you do have family but don’t want to give them an inheritance – you can opt for a charitable trust. If you are not married and have no children this may be a good choice. This type of irrevocable trust allows you to give gifts to charity as a way to lower income and estate taxes. The charity benefits from your donation as well, so it’s advantageous to both parties. There are three types of charitable trusts.

youtube

Types of Charitable Trusts

Pooled income trust:This trust allows you to pool your money with other grantors and receive income for a specified amount of time. For these trusts, the charity is the trustee and beneficiary.

Charitable lead trust:You put property into a trust. Next, you name a charity to receive income from the trust for a certain amount of time. However, you name someone else as the final beneficiary.

Charitable remainder trust:You put property into a trust. Then, you can receive a tax deduction for putting the asset into the trust. You name someone to receive income from the trust for a certain amount of time. The trust specifies a charity as the final beneficiary.

Trusts for Special Needs

If your goal is to protect assets and income for loved ones, choose one of these trusts:

Special Needs Trust If you have a child or other loved one with special needs, a special needs trust can help provide financial support for this person in the event of your death. Property – particularly money – is placed into this irrevocable trust. You appoint a trustee to distribute the funds to buy necessities for the disabled person. The beneficiary never owns the property. This works to his or her advantage because the money is not considered as asset. The beneficiary does not make too much income and therefore can still qualify for government benefits.

Spendthrift Trust Maybe you don’t have a disabled relative, but maybe you have a sibling or child who is horrible with money. Some people are just irresponsible with money, but that doesn’t mean that you need to leave them out of your inheritance. With a spendthrift trust, you can protect and control the money that you gift to family members who have trouble managing their finances. The settlor places assets into a trust. A trustee doles them out based on the terms in the trust. For example, you may allow the beneficiary to receive only a certain amount per week or month. The beneficiary cannot access the trust property, so the assets are protected from creditors. However, once the beneficiary receives money or assets, they become fair game.

Irrevocable Trust – The Way to Go?

Irrevocable trusts offer many asset protection, estate planning and tax advantages. For the general public, an irrevocable trust may be very useful in protecting assets from lawsuits, securing financial help for a special needs child or providing for children after the death of the parents.

You need to be able to trust your trustee. What happens if you have a falling out with your trustee? Change them. The beneficiaries can simply vote in a new trustee. The trustee must not be you. The trustee also must not be someone up or down the family tree, cannot be a controlled employee and cannot be an agent of yours. If any of these parties were trustees it would lose its asset protection advantages because the courts would consider these people your alter ego.

Should you choose an irrevocable trust, some wise advice is to have it skillfully drafted by an experienced professional. This is extremely important, since a poorly worded document may not do what you intended for it to do and ruin your asset protection and estate planning goals. Contact an estate planning expert to see if an irrevocable trust will meet your needs based on your unique situation.

Free Consultation with a Trust Lawyer

If you are here, you probably have a trust or estate matter that you need help with. If so, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC8833 S. Redwood Road, Suite CWest Jordan, Utah

84088 United StatesTelephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

What is Estate Planning?

About Chapter 7 bankruptcy

Utah Registered Agent Services

Kids and Divorce

Tax Lawyer

Family Lawyer

Source: http://www.ascentlawfirm.com/types-of-irrevocable-trusts/

0 notes

Text

Types of Irrevocable Trusts

As an estate lawyer, I have explained that there are many types of irrevocable trusts that can help you secure your assets and reduce taxes.

They include the following:

Asset Protection Trust An asset protection trust is used as a fortress to keep creditors from seizing assets. There are asset protection trust laws in states such as Nevada, Wyoming, Delaware, Alaska and North Dakota. In practice, we have found that they can provide a fair level of protection, especially, for residents of those states. However, they have the disadvantage of being under US court jurisdiction. Judge’s do not always follow the law and there are ever-expanding legal theories of liability. So, we have seen assets in domestic trusts seized on numerous occasions. Offshore irrevocable trusts in jurisdictions such as the Cook Islands and Nevis have a perfect or near-perfect track record for protecting assets from judgment creditors. Because US judges do not have jurisdiction over foreign trustees, the trustee need not comply with US court orders.

Bypass Trust This type of trust that married people use. When one spouse dies, the property goes into the trust. The surviving spouse can use the property, but does not own it. This means that it is not part of the estate when the surviving spouse dies. This equates to tax savings.

QTIP Trust Another trust designed for married couples, a QTIP trust typically provides income to the surviving spouse when one spouse dies. When the second spouse dies, other named beneficiaries receive the assets. This is typically the settlor’s children. QTIP stands for Qualified Terminable Interest Property.

QDOT Trust A QDOT trust is similar to a QTIP trust. The difference is that noncitizens use it. QDOT stands for Qualified Domestic Trust.

Life Insurance Trust With this type of trust, the trust is both the owner and the beneficiary of the life insurance policy. Anyone, in turn, can be the beneficiary of the trust. The grantor must typically create the trust at least three years before death. It lets a person reduce or eliminate estate taxes so more of the proceeds go to the beneficiaries. The trustee, then, administers insurance proceeds for one or more beneficiaries.

Generation-Skipping TrustWealthy families often use this tool. As the name implies, the trust skips a generation. The final beneficiaries are the grandchildren instead of the children. The children are beneficiaries of the income, but do not own the property. This means that when the children die, their trust property is not subject to estate tax. However, a generation skipping transfer tax may apply.

Charitable Trust If you don’t have any family – or maybe you do have family but don’t want to give them an inheritance – you can opt for a charitable trust. If you are not married and have no children this may be a good choice. This type of irrevocable trust allows you to give gifts to charity as a way to lower income and estate taxes. The charity benefits from your donation as well, so it’s advantageous to both parties. There are three types of charitable trusts.

youtube

Types of Charitable Trusts

Pooled income trust:This trust allows you to pool your money with other grantors and receive income for a specified amount of time. For these trusts, the charity is the trustee and beneficiary.

Charitable lead trust:You put property into a trust. Next, you name a charity to receive income from the trust for a certain amount of time. However, you name someone else as the final beneficiary.

Charitable remainder trust:You put property into a trust. Then, you can receive a tax deduction for putting the asset into the trust. You name someone to receive income from the trust for a certain amount of time. The trust specifies a charity as the final beneficiary.

Trusts for Special Needs

If your goal is to protect assets and income for loved ones, choose one of these trusts:

Special Needs Trust If you have a child or other loved one with special needs, a special needs trust can help provide financial support for this person in the event of your death. Property – particularly money – is placed into this irrevocable trust. You appoint a trustee to distribute the funds to buy necessities for the disabled person. The beneficiary never owns the property. This works to his or her advantage because the money is not considered as asset. The beneficiary does not make too much income and therefore can still qualify for government benefits.

Spendthrift Trust Maybe you don’t have a disabled relative, but maybe you have a sibling or child who is horrible with money. Some people are just irresponsible with money, but that doesn’t mean that you need to leave them out of your inheritance. With a spendthrift trust, you can protect and control the money that you gift to family members who have trouble managing their finances. The settlor places assets into a trust. A trustee doles them out based on the terms in the trust. For example, you may allow the beneficiary to receive only a certain amount per week or month. The beneficiary cannot access the trust property, so the assets are protected from creditors. However, once the beneficiary receives money or assets, they become fair game.

Irrevocable Trust – The Way to Go?

Irrevocable trusts offer many asset protection, estate planning and tax advantages. For the general public, an irrevocable trust may be very useful in protecting assets from lawsuits, securing financial help for a special needs child or providing for children after the death of the parents.

You need to be able to trust your trustee. What happens if you have a falling out with your trustee? Change them. The beneficiaries can simply vote in a new trustee. The trustee must not be you. The trustee also must not be someone up or down the family tree, cannot be a controlled employee and cannot be an agent of yours. If any of these parties were trustees it would lose its asset protection advantages because the courts would consider these people your alter ego.

Should you choose an irrevocable trust, some wise advice is to have it skillfully drafted by an experienced professional. This is extremely important, since a poorly worded document may not do what you intended for it to do and ruin your asset protection and estate planning goals. Contact an estate planning expert to see if an irrevocable trust will meet your needs based on your unique situation.

Free Consultation with a Trust Lawyer

If you are here, you probably have a trust or estate matter that you need help with. If so, call Ascent Law for your free consultation (801) 676-5506. We want to help you.

Ascent Law LLC8833 S. Redwood Road, Suite CWest Jordan, Utah

84088 United StatesTelephone: (801) 676-5506

Ascent Law LLC

4.9 stars – based on 67 reviews

Recent Posts

What is Estate Planning?

About Chapter 7 bankruptcy

Utah Registered Agent Services

Kids and Divorce

Tax Lawyer

Family Lawyer

Source: http://www.ascentlawfirm.com/types-of-irrevocable-trusts/

0 notes