#verizon

Photo

(source)

#toycore#kidcore#plush#bear#teddy bear#verizon#voice mail#under 20#this is my son Voice Mail#paid link

4K notes

·

View notes

Text

Beyonce’s commercial for Verizon!

#beyonce#beyonce knowles#music#blue ivy#celebrities#queen bey#renaissance#jay z#beyonce giselle knowles#rnb#super bowl#commercial#ad#verizon#pop#legend

329 notes

·

View notes

Text

gameryoncé 💗

#beyonce#act ii#twitch#twitch live stream#gameryonce#slayonce#verizon#verizon ad#pink aesthetic#pink headphones#gamergirl

243 notes

·

View notes

Text

Beyoncé's Verizon Super Bowl 2024 Commercial

228 notes

·

View notes

Text

202 notes

·

View notes

Text

It a great day 😊and Friday is always lovely 🥰… We could get to spend some time together though 😍❤️… Happy international women’s day🎉..

#beauty#pay me to be cute#cute#so cute#cashapp#paypal#pay to meet#so hot and sexy#sexy content#sexy tease#sexy pose#slim and sexy#mumblr#verizon#i love you#i love him#can we please have fun

197 notes

·

View notes

Text

ATLA cast @ the Netflix Geeked Kickoff (with Verizon)

#netflix#avatar the last airbender#entertainment spotlight#netflixgeeked#ntflix geeked#verizon#kiawentiio#gordon cormier#ian ousley#dallas liu#atla

195 notes

·

View notes

Text

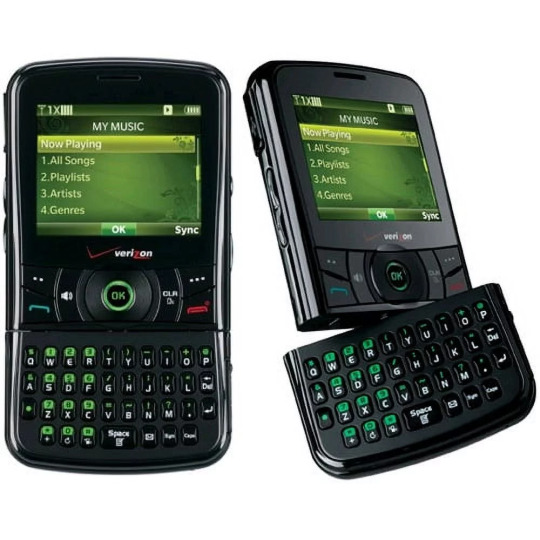

Pantech Razzle TXT8030 Replica Dummy Phone / Toy Phone (Black)

#art#black#cellphone#design#frutiger aero#graphic design#graphics#green#mobile#pantech#phone#razzle txt8030#tech#technology#verizon

159 notes

·

View notes

Text

BEYONCÉ

Verizon Commerical for the Super Bowl (2024)

#beyoncé#beyonce#verizon#can't b broken#superbowl commercial#superbowl#beyonceedit#dailywomen#dailywoc#dailymusicians#filmedit#renaissance#renaissance act ii

92 notes

·

View notes

Text

111 notes

·

View notes

Text

361. icons without psd: advertisement icons. // verizon can’t b broken, 2024.

#icons beyoncé#beyoncé icons#icons beyonce#beyonce icons#icons bey#bey icons#beyoncé#beyonce#screencaps#advertisements#verizon#verizon commercial#wavy hair#headphones#2024

80 notes

·

View notes

Text

She carries!!

#gamer girl Beyoncé was not smth I was expecting today#but I will never ever take it for granted#Beyoncé#Verizon#art#fanart#digital art#fan art#my art#super bowl#super bowl 58#super bowl lviii

57 notes

·

View notes

Text

#beyonce#beyonce knowles#music#blue ivy#celebrities#queen bey#renaissance#jay z#beyonce giselle knowles#rnb#fashion#beauty#superbowl#verizon

141 notes

·

View notes

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

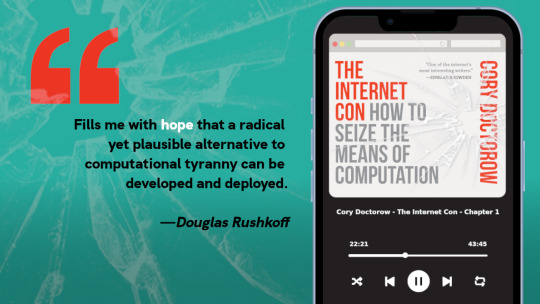

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

136 notes

·

View notes

Text

#beyonce#beyoncé#queen bey#beyoncé giselle knowles carter#bey hive#beyhive#renaissance#verizon#super bowl#yoncé#my house#texas holdem#16 carriages#beyonce renaissance

50 notes

·

View notes

Text

#beyoncé#beyonce#website#update#verizon#commercial#behind the scenes#superbowl#super bowl#february 2024

97 notes

·

View notes