#texas personal property tax

Text

There are a series of elements to defining market value which we will discuss. However, the accounting calculations for depreciation have never been intended to be a reliable indicator of market value by the IRS or business. To know more about Personal Property Taxes visit:- https://www.poconnor.com/why-is-personal-property-valued/

0 notes

Photo

How To Protest Property Taxes - O'Connor

Being charged more in taxes for not protesting yearly? This is true, and there are many ways to avoid this. Visit https://www.poconnor.com/how-to-protest-property-taxes/ to know how.

#property tax#property tax protest#O'Connor#o connor & associates#harris county appraisal#houston property tax#property tax reduction#Texas personal property tax#Texas property tax exemption#texas personal property tax Rate

0 notes

Text

As Alex Jones continues telling his Infowars audience about his money problems and pleads for them to buy his products, his own documents show life is not all that bad — his net worth is around $14 million and his personal spending topped $93,000 in July alone, including thousands of dollars on meals and entertainment.

The conspiracy theorist and his lawyers file monthly financial reports in his personal bankruptcy case, and the latest one has struck a nerve with the families of victims of Sandy Hook Elementary School shooting. They're still seeking the $1.5 billion they won last year in lawsuits against Jones and his media company for repeatedly calling the 2012 massacre a hoax on his shows.

“It is disturbing that Alex Jones continues to spend money on excessive household expenditures and his extravagant lifestyle when that money rightfully belongs to the families he spent years tormenting,” said Christopher Mattei, a Connecticut lawyer for the families. “The families are increasingly concerned and will continue to contest these matters in court.”

In an Aug. 29 court filing, lawyers for the families said that if Jones doesn’t reduce his personal expenses to a “reasonable” level, they will ask the bankruptcy judge to bar him from “further waste of estate assets,” appoint a trustee to oversee his spending, or dismiss the bankruptcy case.

On his Infowars show Tuesday, Jones said he’s not doing anything wrong.

“If anything, I like to go to nice restaurants. That is my deal. I like to go on a couple of nice vacations a year, but I think I pretty much have earned that in this fight,” he said, urging his audience to donate money for his legal expenses.

Jones' spending in July, which was up from nearly $75,000 in April, included his monthly $15,000 payment to his wife, Erika Wulff Jones — payouts called “fraudulent transfers” by lawyers for the Sandy Hook families. Jones says they’re required under a prenuptial agreement.

Also that month, Jones spent $7,900 on housekeeping and dished out more than $6,300 for meals and entertainment, not including groceries, which totaled nearly $3,400 — or roughly $850 per week.

A second home, his Texas lake house, cost him nearly $6,700 that month, including maintenance and property taxes, while his vehicles and boats sapped another $5,600, including insurance, maintenance and fuel.

Sandy Hook families won nearly the $1.5 billion in judgments against Jones last year in lawsuits over repeated promotion of a false theory that the school shooting that killed 20 first graders and six educators in Newtown, Connecticut, never happened.

Relatives of the victims testified at the trials about being harassed and threatened by Jones' believers, who sent threats and even confronted the grieving families in person, accusing them of being “crisis actors” whose children never existed.

Collecting the astronomical sum, though, is proving to be a long battle.

20 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Jan. 9, 2024

"Almost nobody says we should have the richest pay the least. And yet when we look around the country, the vast majority of states have tax systems that do just that."

Nearly every state and local tax system in the U.S. is fueling the nation's inequality crisis by forcing lower- and middle-class families to contribute a larger share of their incomes than their rich counterparts, according to a new study published Tuesday.

Titled Who Pays?, the analysis by the Institute on Taxation and Economic Policy (ITEP) examines in detail the tax systems of all 50 U.S. states, including the rates paid by different income segments.

In 41 states, ITEP found, the richest 1% are taxed at a lower rate than any other income group. Forty-six states tax the top 1% at a lower rate than middle-income families.

"When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least," said ITEP research director Carl Davis. "And yet when we look around the country, the vast majority of states have tax systems that do just that."

"There's an alarming gap here between what the public wants and what state lawmakers have delivered," Davis added.

In recent years, dozens of states across the U.S. have launched what the Center on Budget and Policy Priorities recently called a "tax-cutting spree," permanently slashing tax rates for corporations and the wealthy during a pandemic that saw billionaire wealth skyrocket and company profits soar.

A report released last week, as Common Dreamsreported, showed ultra-rich Americans are currently sitting on $8.5 trillion in untaxed assets.

According to ITEP's new study, tax systems in just six states—California, Maine, Minnesota, New Jersey, New York, and Vermont—and the District of Columbia are progressive, helping to reduce the chasm between rich taxpayers and other residents.

Massachusetts, which has one of the more equitable tax systems in the nation, collected $1.5 billion in revenue last year thanks to its recently enacted millionaires tax, a measure that improved the state's ranking by 10 spots in ITEP's Tax Inequality Index. Minnesota has also ramped up its taxes on the rich over the past several years while expanding benefits for lower-income families, ITEP's study observes.

"The regressive state tax laws we see today are a policy choice, and it's clear there are better choices available to lawmakers."

But the full picture of U.S. state and local systems is grim. In 44 states, tax laws "worsen income inequality by making incomes more unequal after collecting state and local taxes," ITEP found.

Florida has the most regressive tax code in the U.S., with the richest 1% paying a mere 2.7% tax rate while the poorest 20% pay 13.2%.

Florida is among the U.S. states that don't have personal income taxes, which forces them to rely on consumption and property taxes that are "nearly always regressive," ITEP notes in the new analysis.

"Eight of the 10 most regressive tax systems—Florida, Washington, Tennessee, Nevada, South Dakota, Texas, Arkansas, and Louisiana—rely heavily on regressive sales and excise taxes," the study says. "As a group, these eight states derive 52% of their tax revenue from these taxes, compared to the national average of 34%."

Aidan Davis, ITEP's state policy director, said that "we've seen a lot of states shift their tax systems to become even more regressive in recent years by enacting deep tax cuts for the wealthiest."

The report points to Kentucky's adoption of a flat tax and repeated corporate tax cuts, which "delivered the largest windfall to families in the upper part of the income scale and have been paid for in part through new or higher sales and excise taxes on a long list of items such as car repairs, parking, moving services, bowling, gym memberships, tobacco, vaping, pet care, and ride-share rides."

Davis said that "we know it doesn't have to be like this," arguing there is a "clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off."

"The regressive state tax laws we see today are a policy choice," said Davis, "and it's clear there are better choices available to lawmakers."

#regressive tax code#progressive tax code#tax the rich#wealth inequality#income inequality#tax law#politics#itep#public policy

9 notes

·

View notes

Text

Alex Jones’ personal spending is frustrating families who are trying to collect on the $1.5 billion in judgments against him for calling the 2012 Sandy Hook elementary school shooting a hoax.

The conspiracy theorist and Infowars host has been paying his own wife, Erika Wulff Jones, $15,000 a month, according to the most recent spending report he filed in his bankruptcy case — payouts called “fraudulent transfers” by lawyers for some of the shooting victims’ families. Jones says they’re required under a prenuptial agreement.

In July, Jones spent $7,900 on housekeeping. He dished out more than $6,300 for meals and entertainment, not including groceries, which totaled nearly $3,400 — or roughly $850 per week.

A second home, his Texas lake house, cost him nearly $6,700 that month, including maintenance and property taxes, while his vehicles and boats sapped another $5,600, including insurance, maintenance and fuel.

His total personal expenses for July topped $93,000, up from nearly $75,000 in April, not including legal fees and other costs for his court cases, according to bankruptcy filings.

“It is disturbing that Alex Jones continues to spend money on excessive household expenditures and his extravagant lifestyle when that money rightfully belongs to the families he spent years tormenting,” said Christopher Mattei, a Connecticut lawyer for the families. “The families are increasingly concerned and will continue to contest these matters in court.”

In an Aug. 29 court filing, the lawyers for the families said that if Jones doesn’t reduce his personal expenses to a “reasonable” level, they will ask the judge to bar him from “further waste of estate assets,” appoint a trustee to oversee his spending, or dismiss the bankruptcy case.

15 notes

·

View notes

Text

Herschel Walker has been accused of committing "election fraud" following reports he received a primary residence tax exemption for his home in Dallas, Texas, whilst running for the Senate in Georgia.

Walker faces Democratic incumbent Raphael Warnock in a runoff election on December 6, after neither candidate won an absolute majority of the vote in the initial poll on November 8.

Analysis of tax records by CNN showed Walker got a homestead tax exemption for a property in Dallas this year, saving him around $1,500.

Under Texan law the exemption is only valid on a person's "principal residence."

This was claimed despite Walker registering to vote in Georgia in 2021, ahead of his Senate bid.

According to the 2020 Georgia code, residence of the state can be rescinded if an individual moves to another state "with the intention of making it such person's residence."

It adds: "If a person removes to another state with the intention of remaining there an indefinite time and making such state such person's place of residence, such person shall be considered to have lost such person's residence in this state."

Arguably by listing a property in Dallas as his "principal residence" Walker made the property his "place of residence" under Georgia state law.

Speaking to CNN a tax official from Tarrant County, where Walker's Dallas home is located, confirmed the former NFL running back claimed a principal residence tax exemption for the property in both 2021 and 2022.

Newsweek has approached Walker for comment regarding the allegations.

#us politics#news#newsweek#2022 midterms#2022 elections#2022#georgia#herschel walker#texas#primary residence tax exemption#election fraud#cnn#us senate#sen. raphael warnock

44 notes

·

View notes

Note

I was able to read most of the comments on the birthday post for Elta before it was deleted as there is more than is showing here on tumblr. My question is do you still believe there is going to be a divorce? I have a feeling there will be more so now especially with the condo being sold. He seems unusually quiet at the moment.

Hello Anon thank you for the ask. So a lot of people have been asking me about this lately and have been wondering why on Earth he bought the house in CT and whatnot. I myself did read a lot of the comments on the Instagram post. I also did reach out to that guy who made the comments about Danneel doing black magic and have been in contact with him for example and another who talked about Danneel coming up with some good captions for this post ha ha. Someone told me months ago they asked their attorney uncle if it's easier to divorce in Connecticut than in Texas and he said much easier actually. Now, I suspect that Danneel is who really wanted this house more than Jensen did but as others have said, it seems that after you sell a house you have about 6 months or so to buy another house before you get taxed for the equity you walk away with after the house closing or so called "paying taxes on capital gains". It is my understanding that when the offer was placed on the CT house it had been about this 6 months time period in which their offer was placed on the house to abide by this 180 days period after they had sold their Telluride property in November 2022. As for why Jensen is so quiet, I don't know. If you are so inclined to mention some of the Instagram comments, that psychic guy did tell me via PM "disaster is coming" for Danneel (is said to be health and financially related) and is said to happen around May or June according to his guides and visions he received. We also know that Jensen is currently named in The Winchesters lawsuit and also was named as a witness in Alec Baldwin's trial coming up later this year. I am aware the next conference/meeting for The Winchesters lawsuit Danneel and Jensen were named in is happening July 23.

Jensen was never very big on spilling all of the juicy details on his personal life but I am pretty sure that his silence isn't for so called "positive" reasons if you catch my drift. I suppose we will eventually find out at some point.

5 notes

·

View notes

Text

Property Tax Protection Program™:-

\You also gain access to tax tips, assistance with exemption questions, as well as alerts to any disaster notices that may allow you to qualify for reduced valuations.

If you have questions about your enrollment, please contact our property tax experts at (713) 290-9700 or (877) 482-9288.

How to Appeal Your Property Taxes:-

It’s your right to challenge the appraisal district “guesstimate of value,

You have a right to lower property taxes! State law prescribes a procedure for protesting the assessed value of your property.

Why O’Connor for Property Tax Reduction?

We protest your taxes year after year. Once you sign up with us, we will continue to fight for your tax reduction. You don’t pay unless we save you money.

Why O’Connor - Greater Protection:-

Aggressive approach to protesting during all 3 phases of the appeals process and the

expertise to be successful. 1.Informal hearing.

2.Formal hearing before the Appraisal Review Board. 3.Litigation and Binding Arbitration.

#property tax protest#texas property tax exemptions#protest taxes#texas property taxes#texas property tax#texas personal property tax#homestead exemption texas#property tax reduction

0 notes

Photo

Reduce Your Personal Property Taxes

Do you know that? By reducing your BPP taxes, you can keep a competitive advantage over your competitors who do not do this. Learn what you need to know about personal property valuation for free! Visit https://www.cutmytaxes.com/business-personal-property-tax/ for more information.

#Cut my taxes#personal property valuation#property tax protest houston#how to reduce property tax#property tax consultant texas

0 notes

Text

Some things I did this March:

Beat Baldur's Gate 3 on Honor Mode

Got real into Balatro

Paid property tax

Guested on an episode of 2Rash2Unadvised

Picked up resized engagement ring

Started playing in a new weird homebrew RPG campaign

Visited the Torpedo Factory

Went to Texas to visit my partner's family

Wrote a short story for a friend

Played Personal Portraits with bash'mates

Got someone who I approve of to join the condo board; avoided rejoining it myself

Went to Artomatic twice

Made sure to be visibly trans for TDOV

Higher steps per day than last month, but just barely (7798 vs. 7773)

Read Necessity (reread), The Unraveling, The Employees, The Past is Red, OKPsyche, and We Have Always Lived in the Castle

Watched Dirty Pair: Project Eden, Street Fighter Alpha: The Animation, and some episodes of Ghost in the Shell: Standalone Complex

3 notes

·

View notes

Text

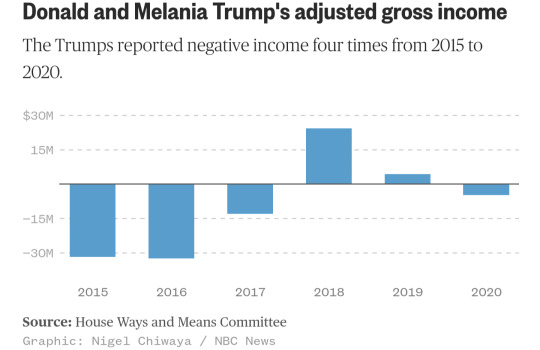

A House committee on Friday made public six years of former President Donald Trump's tax returns, which showed he paid relatively little in taxes in the years before and during his presidency.

The House Ways and Means Committee had voted to make the thousands of pages of returns public in a party-line vote last week, but their release was delayed while staffers redacted sensitive personal information like Social Security numbers from the documents. Friday's release, the culmination of years of legal wrangling and speculation, included both personal and business records.

Trump on Friday blasted the release in a statement and on his Truth Social platform, saying “the Democrats should have never done it, the Supreme Court should have never approved it, and it’s going to lead to horrible things for so many people."

He also maintained the returns he fought to keep hidden — despite modern precedent that Presidents make their returns public — "show how proudly successful I have been and how I have been able to use depreciation and various other tax deductions as an incentive for creating thousands of jobs and magnificent structures and enterprises.”

The panel’s top Republican, Rep. Kevin Brady of Texas, called the release of the documents “unprecedented,” and said Democrats had unleashed “a dangerous new political weapon that reaches far beyond the former President, overturning decades of privacy protections for average Americans.”

“This is a regrettable stain on the Ways and Means Committee and Congress, and will make American politics even more divisive and disheartening. In the long run, Democrats will come to regret it,” Brady said.

The returns confirm much of what was contained in a 39-page report from the Joint Committee on Taxation released last week, including summaries from Trump’s personal tax forms and business entities.

For example, in 2020, Trump appeared to owe nothing in taxes, the report showed. That was thanks to Trump claiming $15 million in business losses, which resulted in him having negative $4 million in adjusted gross income. Trump then claimed a $5 million refund.

Trump reported millions in negative income in 2015, 2016, 2017 and 2020, and he paid only $750 in federal income taxes in 2016 and 2017.

In 2019, Trump and his wife, Melania, reported significant losses of more than $16.4 million but reported a total income of $4.4 million.

The returns also show Trump had numerous foreign bank accounts between 2015 and 2016, including in China, the United Kingdom, Ireland and St. Martin. The existence of the China account was first reported by the New York Times in 2020. Trump Organization lawyer Alan Garten told the paper then that the company had “opened an account with a Chinese bank having offices in the United States in order to pay the local taxes” after opening an office “to explore the potential for hotel deals in Asia.”

The other accounts were in countries where Trump had properties. His 2018 through 2020 returns only note having an account in the U.K. “I have many bank accounts and they’re all listed and they’re all over the place,” Trump said during an Oct. 2020 presidential debate. “I was a businessman doing business.”

The committee report also listed several overarching issues it believed the IRS should have investigated. For example, Trump claimed large cash donations to charities, but the report said the IRS did not verify them. The report also said that while Trump’s tax filings were large and complicated, the IRS does not appear to have assigned experts to work on them.

The Ways and Means Committee separately released a 29-page report summarizing its investigation into an IRS policy that mandates audits of returns filed by presidents and vice presidents. The committee found that the IRS had largely not followed its own internal requirements, beginning to examine Trump’s returns only after the House panel inquired about the process. Just one year of Trump’s returns was officially selected for the mandatory review while he was in office, and that audit of Trump's 2016 taxes was not complete by the time he left the White House, according to the report.

An audit of Trump's 2015 taxes was started shortly before the 2016 audit in 2019 — the same day the Ways and Means committee asked for information on the mandatory audits. Neither the 2015 audit nor audits of Trump's 2017-19 taxes that began after he left office were marked as being part of the audit program, and as of last month, none had been marked as completed either, the committee said.

The committee obtained Trump's tax returns in November, following a yearslong court fight for documents that other presidents have routinely made public since the 1970s.

The dispute ended up at the Supreme Court, which rejected Trump’s last-ditch plea to block the release of his tax records to House Democrats in a brief order handed down just before Thanksgiving.

Trump's refusal to release his returns led to a swirl of suspicions about what he might be trying to hide — foreign business dealings, a smaller fortune than he'd claimed publicly or paying less in taxes than the average American.

During the 2016 campaign, Trump maintained that he couldn't release his returns because they were under audit, and that he would make them public when it was completed — a vow he walked away from after he took office.

Information about his taxes has dripped out over the years.

In October 2016, The New York Times published some of Trump's 1995 state taxes and reported that he'd declared a $916 million loss that year. Three tax experts hired by the paper said the size of the loss and tax rules governing wealthy filers at the time could have allowed Trump to legally pay no federal income taxes for 18 years.

After Trump took office in 2017, reporter David Cay Johnston went on MSNBC's "The Rachel Maddow Show" with what he said were two pages of Trump's Form 1040 from 2005.

The documents, which were published on Johnston's site DCReport.org, showed that Trump had paid $38 million in federal income tax on more than $150 million in income.

In September 2020, the Times reported that it had obtained two decades of Trump’s tax information, which showed he had not paid any income taxes in 10 of the prior 15 years, mostly because he reported significant losses. In the year he won the presidency and his first year in office, he paid just $750 in federal income tax, the paper found.

Asked about the report at the time, the then-president said the story was “made up" and that he’s “paid a lot of money in state” taxes. He later tweeted that he’d “paid many millions of dollars in taxes but was entitled, like everyone else, to depreciation & tax credits.”

Trump also fought unsuccessfully to keep his tax information out of the hands of investigators in New York, who were probing his business practices. That clash also went all the way to the Supreme Court, which denied Trump's attempt to block a grand jury from getting Trump’s personal and corporate tax returns in February of last year.

Those returns helped prosecutors from the Manhattan district attorney's office build a tax fraud case against Trump's company, the Trump Organization. The company was convicted this month of carrying out a 15-year tax fraud scheme that prosecutors said was orchestrated by top executives at the company.

During the trial, Trump's accountant Donald Bender testified that the former President had losses totaling $900 million in 2009 and 2010.

The company is scheduled to be sentenced on Jan. 13. Trump, who was not charged in the case, has dismissed the allegations and conviction as part of a politically motivated "witch hunt."

#us politics#news#donald trump#2022#trump tax returns#trump taxes#trump administration#irs#internal revenue service#presidential audit program#house ways and means committee#truth social#Rep. Kevin Brady#Joint Committee on Taxation#trump organization#trump organization scandal#Alan Garten#melania trump#Donald Bender#nbc news

5 notes

·

View notes

Note

So I guess they really did move! I’m so curious why Connecticut. Seems like a far move with all they had going on in Texas and fbbc. Thoughts?

The article said “The buyer is a trust tied to the actor Jensen Ackles.” What does that mean?

So, there are a lot of advantages to buying and selling houses with trusts. All the rich people do it. It's not that hard to set up a trust and I recommend it.

When they sold the Colorado house, they would have had to pay high taxes. By buying, renovating, and selling properties with the trust, they make more and more money without paying the taxes that most people would have to pay. This is something that's super common for the wealthy, although many don't sell their other properties

One of the reasons I gather information from a lot of different sides of fandom and share publicly what I can share is because it's fun to compare what people predicted with what actually happened. One of my Jensen sources called out Connecticut from the beginning and knew about this property before it went public.

You can bet that I'll be paying more attention to that person's guesses for future Jensen moves.

5 notes

·

View notes

Text

does vpn get rid of texas online tax

🔒🌍✨ Get 3 Months FREE VPN - Secure & Private Internet Access Worldwide! Click Here ✨🌍🔒

does vpn get rid of texas online tax

VPN tax evasion

Title: Navigating the Legal Gray Area: VPNs and Tax Evasion

In the digital age, where borders blur and online transactions transcend geographical boundaries, the use of Virtual Private Networks (VPNs) has become increasingly common. While VPNs offer users privacy, security, and access to geo-restricted content, they also present a potential avenue for tax evasion.

Tax evasion through VPNs involves individuals or businesses using VPN services to conceal their true location and identity, thereby avoiding taxation in their home jurisdictions. By masking their IP addresses and routing their internet traffic through servers in other countries with lower tax rates or lax regulations, users can exploit legal loopholes to minimize their tax obligations.

However, the legality of using VPNs for tax evasion varies depending on jurisdiction. While some countries have stringent laws against tax evasion and unauthorized use of VPNs for such purposes, others may have lax enforcement or ambiguous regulations. This legal ambiguity creates a gray area that individuals and businesses may exploit, but it also exposes them to the risk of legal repercussions if caught.

Governments and tax authorities are increasingly cracking down on tax evasion facilitated by VPNs. They employ sophisticated detection techniques, such as monitoring unusual IP addresses and tracing financial transactions, to identify and prosecute offenders. Additionally, international cooperation among law enforcement agencies enables the sharing of information and coordination of efforts to combat cross-border tax evasion schemes involving VPNs.

To mitigate the risk of inadvertently engaging in tax evasion through VPNs, individuals and businesses should ensure compliance with tax laws and regulations in their respective jurisdictions. Transparency, honesty, and responsible use of VPN services are essential to avoid legal troubles and maintain ethical integrity in the digital realm. Ultimately, while VPNs offer valuable benefits, users must tread carefully to avoid falling afoul of the law and facing the consequences of tax evasion.

Texas online taxation

Title: Navigating Online Taxation in Texas: What You Need to Know

In the digital age, where e-commerce is thriving, understanding online taxation is crucial for businesses and consumers alike, especially in a state as economically significant as Texas. With its robust economy and diverse online marketplace, Texas imposes certain tax obligations on digital transactions to ensure fair revenue collection and fund public services.

Sales Tax:

Texas imposes a sales tax on most retail sales of tangible personal property and certain services. This tax applies not only to traditional brick-and-mortar stores but also to online retailers selling to Texas residents. Online sellers with a physical presence in Texas, such as a warehouse or office, are required to collect and remit sales tax on sales made to Texas customers. This includes both in-state and out-of-state businesses selling to Texas residents.

Remote Sellers:

Even if an online seller does not have a physical presence in Texas, they may still be required to collect and remit sales tax if they meet certain economic nexus thresholds. As of 2024, Texas requires remote sellers with annual Texas sales exceeding $500,000 to collect and remit sales tax. This threshold applies to total sales made into Texas, including both taxable and nontaxable transactions.

Marketplace Facilitators:

In addition to individual sellers, Texas also holds marketplace facilitators responsible for collecting and remitting sales tax on behalf of third-party sellers using their platform. This means that platforms like Amazon, eBay, and Etsy are required to collect and remit sales tax on behalf of their sellers if they meet certain criteria.

Compliance:

To comply with Texas online taxation laws, businesses should register for a sales tax permit with the Texas Comptroller of Public Accounts. They must then collect the appropriate amount of sales tax from Texas customers and remit it to the state on a regular basis, typically monthly or quarterly.

By understanding and adhering to Texas's online taxation regulations, businesses can operate legally and contribute to the state's revenue stream, ensuring a fair and level playing field for all retailers, whether online or offline.

VPN legality in Texas

Title: Navigating VPN Legality in Texas: What You Need to Know

In the digital age, where online privacy concerns are at the forefront of discussions, Virtual Private Networks (VPNs) have become increasingly popular. However, the legality of VPN usage varies from one jurisdiction to another. In Texas, as in many other parts of the world, the legal landscape surrounding VPNs is nuanced and subject to interpretation.

At its core, using a VPN in Texas is legal. There are no specific laws that prohibit the use of VPNs for individuals seeking to enhance their online privacy and security. VPNs serve a variety of legitimate purposes, such as safeguarding personal information from hackers, accessing geo-restricted content, and maintaining anonymity while browsing the internet.

However, while the use of VPNs itself is legal, it's essential to understand that the legality of certain activities conducted through VPNs may be subject to existing laws. For instance, using a VPN to engage in illegal activities such as hacking, fraud, or copyright infringement remains illegal in Texas, as it does elsewhere.

Furthermore, businesses offering VPN services in Texas must adhere to relevant laws and regulations, such as data protection and privacy laws. This includes implementing measures to protect user data and comply with government requests for information when necessary.

In recent years, there has been growing concern over government surveillance and data privacy, prompting individuals and businesses alike to seek out VPN services. As such, the use of VPNs in Texas is not only legal but increasingly necessary for safeguarding digital privacy in an interconnected world.

In conclusion, while VPN usage is generally legal in Texas, individuals should use VPNs responsibly and be mindful of the activities they conduct while connected to a VPN server. By understanding the legal implications and exercising good judgment, Texans can enjoy the benefits of enhanced online privacy and security afforded by VPN technology.

Tax avoidance with VPN

Title: Navigating Tax Avoidance with VPN: What You Need to Know

In today's digital age, the use of Virtual Private Networks (VPNs) has become increasingly common for various reasons, including privacy protection, accessing geo-restricted content, and enhancing online security. However, there's another area where VPNs are being utilized – tax avoidance.

Tax avoidance refers to legally minimizing tax liability by using various strategies and loopholes within the law. While tax avoidance itself is not illegal, it often operates in a gray area, and certain tactics may attract scrutiny from tax authorities.

One such tactic involves using VPNs to mask one's online presence and location, thereby potentially avoiding taxes in certain jurisdictions. By routing internet traffic through servers located in different countries, individuals can conceal their true location and access online services or conduct business without being subject to the tax laws of their actual physical location.

For example, a freelancer or digital nomad may choose to establish residency in a tax-friendly jurisdiction while physically residing elsewhere. By using a VPN to make it appear as though they are located in the tax-friendly jurisdiction, they can potentially reduce their tax burden legally.

However, it's essential to proceed with caution when considering such tactics. Tax laws vary significantly from one jurisdiction to another, and intentionally misleading tax authorities can have serious legal consequences. Furthermore, tax authorities are increasingly utilizing sophisticated technology and data analysis techniques to identify instances of tax evasion and avoidance.

Ultimately, while VPNs can offer privacy and security benefits, using them for tax avoidance purposes requires careful consideration of legal and ethical implications. Individuals should consult with tax professionals or legal advisors to ensure compliance with applicable tax laws and regulations while minimizing tax liability responsibly and ethically.

Texas internet tax regulations

Title: Navigating Texas Internet Tax Regulations: What You Need to Know

In the digital age, the landscape of commerce is evolving rapidly, and along with it, tax regulations are undergoing significant transformations. For businesses operating in Texas, understanding internet tax regulations is crucial to ensure compliance and avoid potential penalties. Here's a comprehensive overview of the key aspects of Texas internet tax regulations.

Sales Tax on Online Purchases: In Texas, online retailers are required to collect sales tax on purchases made by customers within the state. This tax applies to tangible personal property as well as certain services delivered electronically.

Economic Nexus Threshold: Following the South Dakota v. Wayfair Supreme Court decision in 2018, Texas implemented economic nexus laws. Businesses with either $500,000 in annual Texas revenue or 500 or more separate transactions in the state must collect and remit sales tax.

Taxability of Digital Products and Services: Texas taxes various digital products and services differently. While some are subject to sales tax, others may be exempt. For instance, software delivered electronically is generally taxable, whereas certain digital subscriptions may be exempt.

Remote Seller Responsibilities: Remote sellers without a physical presence in Texas but meeting the economic nexus threshold must register for a Texas sales tax permit, collect applicable taxes, and file regular sales tax returns.

Marketplace Facilitator Laws: Texas requires marketplace facilitators, such as Amazon or eBay, to collect and remit sales tax on behalf of third-party sellers using their platforms, simplifying tax compliance for smaller sellers.

Use Tax Obligations: Businesses and individuals in Texas are also subject to use tax on out-of-state purchases if sales tax was not collected at the time of purchase.

Navigating the complexities of Texas internet tax regulations can be daunting, but staying informed and ensuring compliance is essential for businesses operating in the digital realm. Seeking guidance from tax professionals or utilizing automated tax compliance solutions can help businesses effectively manage their tax obligations in Texas' ever-changing regulatory environment.

0 notes