#tax bill

Text

De Adder

* * * *

Republicans ready to defeat tax bill to help Trump

February 1, 2024

ROBERT B. HUBBELL

A tax bill with bipartisan support passed in the House on a 357 to 70 to vote. The bill, if approved by the Senate, would be a significant achievement because it expands the amount of the child tax credit available to lower-income families—a key Biden objective. In exchange, the bill would maintain business tax deductions scheduled to expire. The details are here: WaPo, House votes to expand child tax credit, beef up corporate tax breaks. (Accessible to all.)

The fact that the bill made it through the fractious House should be a good sign of likely passage in the Senate. Sadly, it is not. Why? Because Senate Republicans don’t want to give President Biden a “win” in an election year. Sound familiar? See USA Today, GOP senator doesn’t want to pass a tax bill because it could make Biden ‘look good’.

Per USA Today, Senator Grassley said,

Passing a tax bill that makes the president look good — mailing out checks before the election — means he could be re-elected, and then we won’t extend the 2017 tax cuts.

Not to be outdone, Senator Mitt Romney said he would oppose the bill because it would turn into “another entitlement program which is massively expensive.”

Grassley’s comment is telling on many levels. First, it contains the naked admission that Republicans are no longer working to serve the American people but are, instead, concerned only with serving their overlord, Donald Trump.

Moreover, Grassley is wrong in asserting that the bill will “send checks” to Americans in an election year. The child tax credit is just that—a tax credit offsets taxes owed. If a taxpayer owes no tax, then the tax credit can generate a refund (up to $1,600).

Worse, Grassley opposes the bill in the hope that Trump will be able to extend his 2017 tax cuts for millionaires—which added $3.5 trillion to the deficit (through 2033). Extending those tax cuts would increase the deficit even more.

To increase the likelihood of granting windfall tax cuts to the nation’s top income earners in another Trump administration, Senators Grassley and Romney want to deprive tax benefits to the working poor—benefits that Romney derisively calls “entitlements.”

Romney, a former hedge fund manager, has no problem with the “carried interest deduction” for hedge fund managers, which generates billions in tax deductions for the nation’s wealthiest billionaires. In Romney’s view, the carried interest deduction isn’t an “entitlement” because billionaires and millionaires should get to keep their money free of taxes because they are “special.”

We once again stand at the precipice of legislative action that will benefit the American people—but Republicans oppose it because doing so is contrary to Donald Trump's partisan interests. Don’t believe me? Just ask Senator Chuck Grassley.

Robert B. Hubbell Newsletter

#tax bill#US Senate#US House of Representatives#congress#Tax credit#Radical Republicans#Grassley#MAGA Speaker Mike Johnson

12 notes

·

View notes

Text

Appeal property taxes in Jefferson County by enrolling with O'Connor.

The deadline to appeal your property taxes in Jefferson County is fast approaching. Don't wait until it's too late – enroll in O'Connor today and take control of your tax bill.

0 notes

Text

#hmrc#uk tax#self employed#self employed workers#tax bill#tax payment#taxpayers#tax accountant#london#tax advisory

0 notes

Text

As a small business owner, finding ways to minimize your tax bill is crucial for maximizing your profits and financial stability. Here are 8 practical strategies that can help you achieve just that

With tax filing software, you can create a w2 form with the help of eformscreator.com and other tax documents without missing or adding unnecessary data. They provide a comprehensive and user-friendly approach to tax preparation, reducing the possibility of error and helping to maintain financial efficiency.

0 notes

Video

He didn’t invent anything

#tiktok#bill gates#technology history#technology#tech bros#tech billionaires#philanthropy#billionaire#taxes#it industry#india#wages and salaries#wages#outsourcing

14K notes

·

View notes

Text

Understanding India's New Tax Regime: Benefits for Earners Above Rs 15 Lakhs

In the past few years, India’s tax laws have changed a lot. These changes were made to make the system easier to understand and to offer lower tax rates and fewer exemptions.

According to Nitin Gupta, head of the Central Board of Direct Taxes, the new tax regime, which is now the default option, is expected to provide numerous benefits to individuals earning more than Rs 15 lakhs.

In this…

View On WordPress

#Benefits for Earners Above Rs 15 Lakhs#Choosing the Right Tax Option#Comprehensive Understanding of Financial Situation#Effective Tax Rate#Expert Advice for Optimal Tax Decisions#Family Pension Income#India&039;s New Tax Regime#Informed Tax Decisions#Minimize Tax Bill#Optimize Tax Savings#Reduced Surcharge for High Earners#Significant Changes in India&039;s Tax Laws#Specific Income Level#Standard Deduction#Tax Bill#Tax Exemptions#Tax Expert#Tax Rates#Tax Rebates#Tax Savings for Salaried Taxpayers#Tax Situation

0 notes

Link

Its right time to lower your cook county tax bill. Get it done with the help of tax reduction experts. Reach https://www.cutmytaxes.com/illinois/cook-county-property-tax-reduction/

0 notes

Link

GCAD has overtaxed 19 Dana Dr by 50%. Want to know more such updates on overtaxed percentage? Get it from Gcad county property tax trends. Read more @ https://galvestoncountypropertytaxtrends.com/19-dana-dr-homeowner-in-galveston-county-faces-massive-over-taxation-by-50-percentage/

0 notes

Text

They traded massive tax cuts for the world's biggest businesses in exchange for the child tax credit. Sigh.

1 note

·

View note

Text

Reduce your property taxes | Lake County

Is your property tax bill is high? We are here to help you with the tax reduction experts, appeal,get reduced your tax bill and save your money. Reach us at https://www.cutmytaxes.com/illinois/lake-county-property-tax-reduction/

0 notes

Text

my “if something bad happened to them i’d kill everyone in the room and then myself” gang from the masquerade series (…..yeah i’m still in denial over [redacted] shut up)

#id in alt text#alternatively: baru and some of the ppl whose lives she fucked up 🤪#alternatively (2): mentally unstable blorbini from my books <3#seth dickinson i’m in your walls#myken i’m Also in your walls i’m going to send u the therapist bill since you’re the one who convinced me to suffer so much 😤#i want to be clear that something bad happens to these characters Constantly#lgbt stands for laundering grifting bankruptcy taxes#aminata#iraji#tau-indi bosoka#tain hu#baru cormorant#svirakir#the traitor baru cormorant#the monster baru cormorant#the tyrant baru cormorant#the masquerade#my art

2K notes

·

View notes

Text

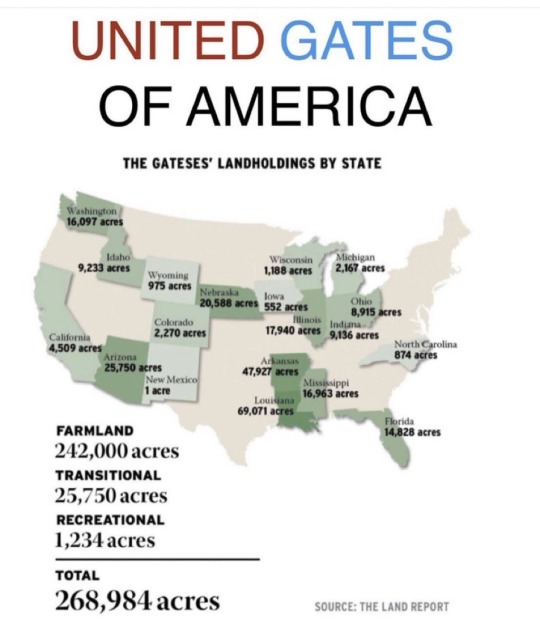

Source

#eat the rich#elon musk#bill gates#tax the rich#billionaires should not exist#farms#current events#news#agriculture

16K notes

·

View notes

Text

adult responsibilities are gross but i do like the fact that i can decide i want a piercing and then just like. get that piercing???

#all my best decisions have been made on impulse and that’s what i call aries behavior#and i might have to file taxes and pay bills but at least i can do this much#/astro posts

210 notes

·

View notes