#shuyi tan

Text

Pricing Convertible Bonds Using a Neural Networks Based Approach

A convertible bond is a bond that can be converted into a certain amount of the company's stock at specified prices and dates. Convertible bonds are usually issued by young, growing companies that want to raise capital without giving up too much control of their company. For example, a company might issue a $1,000 bond that can be converted into 100 shares of the company's stock at $10 per share. If the company's stock price increases to $20 per share, the bondholder can convert their bond into shares and immediately sell them for a $1,000 profit.

Since a convertible bond is part debt, part equity, its valuation is more complex. Reference [1] summarized well the challenging problems when pricing a convertible bond,

Convertible bonds are an important segment of the corporate bond market, however, as hybrid instruments, convertible bonds are difficult to value because they depend on variables related to the underlying stock, the fixed-income part, and the interaction between these components. Besides, embedded options, such as conversion, call, and put provisions are often restricted to certain periods, may vary over time, and are subject to additional path-dependent features of the state variables. Moreover, the most challenging problem in convertible bond valuation is the underlying stock return process modeling as it retains various complex statistical properties.

The usual methods for pricing convertible bonds are:

Binomial or trinomial trees

Partial Differential Equations

Monte-Carlo simulations

The article proposed a novel approach for pricing convertible bonds,

In this paper, we propose DeepPricing, a novel data-driven convertible bonds pricing model, which is inspired by the recent success of generative adversarial networks (GAN), to address the above challenges. The method introduces a new financial time-series generative adversarial networks (FinGAN), which is able to reproduce risk-neutral stock return process that retains the unique statistical properties such as the fat-tailed distributions, the long-range dependence, and the asymmetry structure etc., and then transit to its risk-neutral distribution. Thus it is more flexible and accurate to capture the dynamics of the underlying stock return process and keep the rich set of real-world convertible bond specifications compared with previous model-driven models.

The authors tested their method in the Chinese market and the results are promising.

References

[1] Xiaoyu Tan , Zili Zhang, Xuejun Zhao, and Shuyi Wang, DeepPricing: pricing convertible bonds based on financial time-series generative adversarial networks, Financial Innovation (2022) 8:64

Originally Published Here: Pricing Convertible Bonds Using a Neural Networks Based Approach

from Harbourfront Technologies - Feed https://harbourfronts.com/pricing-convertible-bonds-neural-networks/

0 notes

Text

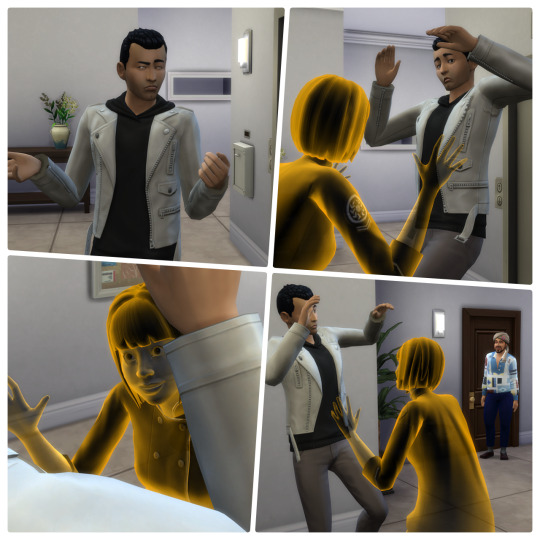

Excuse me, what are you doing? A startled Zoubi wondered.

And then, as her bowl of cat food floated into the air: Noooooooo!

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 cats#ts4 ghosts#shuyi tan#zoubi#18 culpepper house#san myshuno

49 notes

·

View notes

Text

Improbable Research » Blog Archive

Improbable Research » Blog Archive

Bat Chat, the podcast produced by the Bat Conservation Trust, visited with Ig Nobel Prize winner Gareth Jones. The 2010 Ig Nobel Prize for Biology was awarded to Libiao Zhang, Min Tan, Guangjian Zhu, Jianping Ye, Tiyu Hong, Shanyi Zhou, and Shuyi Zhang of China, and Gareth Jones of the University of Bristol, UK, for scientifically documenting fellatio in fruit bats.

The team documented that…

View On WordPress

#hot-air#hotair#humor#humour#ig-nobel#ignobel#improbable research#science#science humor#science humour

0 notes

Text

Soufiane looked at the second raging fire since they'd moved in. She's doing this deliberately isn't she, he said darkly to himself. So he got his revenge the only way he knew how and extinguished Shuyi's head.

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#soufiane toure#18 culpepper house#san myshuno

43 notes

·

View notes

Text

Oussie joined Soufiane and Shuyi at the table.

'It's his favourite place,' said Soufiane. Shuyi was not about to accept this.

'Get off this table at once,' she lectured the cat.

The cat did not move.

'Get off this table or I will call the police!'

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#ts4 cats#soufiane toure#shuyi tan#oussie#18 culpepper house#san myshuno

37 notes

·

View notes

Text

I suppose in theory a ghost should be able to do this but I'm guessing they're not meant to 🤔

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#18 culpepper house#san myshuno

36 notes

·

View notes

Text

She looks a bit intimidating but I like to think Zoubi was encouraging Oussie to join her at the window to admire the wonderful view of a brick wall which she has been enjoying all this time. Oussie decided to stay on the floor though.

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 cats#ts4 ghosts#zoubi#oussie#shuyi tan#18 culpepper house#san myshuno

32 notes

·

View notes

Text

the action in Shuyi's queue said admire but she didn't seem very admiring of Soufiane's autograph of Judith Ward.

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#18 culpepper house#san myshuno

31 notes

·

View notes

Text

Shuyi has got to be the angriest sim I have ever played.

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#18 culpepper house#san myshuno

29 notes

·

View notes

Text

...and we all know why!

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#soufiane toure#shuyi tan#18 culpepper house#san myshuno

30 notes

·

View notes

Text

It was somehow inevitable that Shuyi's childish prank was witnessed by Raj who was just leaving number 18. Today's incident would get a mention on the noticeboard that was for sure.

35 notes

·

View notes

Text

'So how are you finding it in San Myshuno? I'm new to the city myself!' said Jordan Mayer cheerfully.

'Well,' Amandine began cautiously, avoiding looking at her ghostly flatmate. 'The apartment isn't exactly... what we were expecting.'

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#amandine toure#shuyi tan#jordan mayer#18 culpepper house#san myshuno

43 notes

·

View notes

Text

Shuyi may be angry but she's always got time for the cats 👍

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#ts4 cats#shuyi tan#oussie#18 culpepper house#san myshuno

27 notes

·

View notes

Text

Geoffrey didn't appreciate Shuyi laughing at his terror.

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#geoffrey landgraab#san myshuno

31 notes

·

View notes

Text

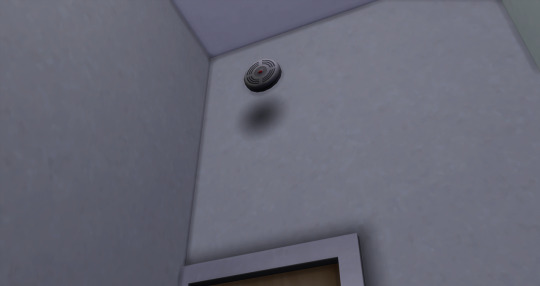

Shuyi possessed the smoke alarm next 😁

Didn't know they could do that... what has she got in mind?

#the sims 4#ts4#ts4 gameplay#ts4 nocc#ts4 vanilla#ts4 ghosts#shuyi tan#18 culpepper house#san myshuno

41 notes

·

View notes

Text

And now she's angry again.

37 notes

·

View notes