#power bank price in qatar

Text

Saturday, May 6, 2023

Canada mulls expelling China diplomat for targeting lawmaker

(AP) Canada’s foreign minister said Thursday the country is considering the expulsion of Chinese diplomats over an intelligence agency report saying one of them plotted to intimidate the Hong Kong relatives of a Canadian lawmaker. Foreign Minister Melanie Joly said her department was summoning China’s ambassador to a meeting to underline that Canada won’t tolerate such interference. She said the intelligence agency report indicated that opposition Conservative lawmaker Michael Chong and his Hong Kong relatives were targeted after Chong criticized Beijing’s human rights record. “We’re assessing different options including the expulsion of diplomats,” Joly said before a Parliament committee. Many governments, the United Nations, and human rights groups accuse China of sweeping a million or more people from its Uyghur community and other predominantly Muslim ethnic minority groups into detention camps, where many have said they were tortured, sexually assaulted, and forced to abandon their language and religion. China denies the accusations, which are based on evidence including interviews with survivors and photos and satellite images from Uyghur’s home province of Xinjiang, a major hub for factories and farms in far western China.

Smaller Banks Are Scrambling as Share Prices Plunge

(NYT) A cluster of regional banks scrambled on Thursday to convince the public of their financial soundness, even as their stock prices plunged and investors took bets on which might be the next to fall. The tumult brought questions about the future of the lenders to the fore, suggesting a new phase in the crisis that began two months ago with the collapse of Silicon Valley Bank and Signature Bank, and was punctuated on Monday by the seizure and sale of First Republic Bank. PacWest and Western Alliance were in the eye of the storm, despite the companies’ protestations that their finances were solid. PacWest’s shares lost 50 percent of their value on Thursday and Western Alliance fell 38 percent. Other midsize banks, including Zions and Comerica, also posted double-digit percentage declines. Unlike the banks that failed after depositors rushed to pull their money out, the lenders now under pressure have reported relatively stable deposit bases and don’t sit on mountains of soured loans. The most immediate threat the banks face, analysts said, is a crisis of confidence.

Oil boom starts to transform Guyana

(AP) Villagers in this tiny coastal community lined up on the soggy grass, leaned into the microphone and shared what they wanted: a library, streetlights, school buses, homes, a grocery store, reliable electricity, wider roads and better bridges. “Please help us,” said Evadne Pellew-Fomundam—a 70-year-old who lives in Ann’s Grove, one of Guyana’s poorest communities—to the country’s prime minister and other officials who organized the meeting to hear people’s concerns and boost their party’s image ahead of municipal elections. The list of needs is long in this South American country of 791,000 people that is poised to become the world’s fourth-largest offshore oil producer, placing it ahead of Qatar, the United States, Mexico and Norway. The oil boom will generate billions of dollars for this largely impoverished nation. It’s also certain to spark bitter fights over how the wealth should be spent in a place where politics is sharply divided along ethnic lines: 29% of the population is of African descent and 40% of East Indian descent, from indentured servants brought to Guyana after slavery was abolished. Change is already visible. In the capital, Georgetown, buildings made of glass, steel and concrete rise above colonial-era wooden structures, with shuttered sash windows, that are slowly decaying.

Beyond King Charles

(Washington Post) Though the British monarchy attracts the most global attention, there are wealthier, more powerful royals among the 28 monarchs around the world. Seventeen of them are kings. Margrethe II of Denmark is the only queen. The microstate of Andorra has co-princes, the president of France and a Spanish bishop. Japan has an emperor. Brunei and Oman have sultans. Liechtenstein and Monaco have princes. Qatar and Kuwait have emirs. Luxembourg has a grand duke. And the United Arab Emirates has a president, though he is a monarch. Although Charles is estimated to have a personal net worth between $750 million and $1.44 billion, others far surpass him. Leaders in Thailand, Saudi Arabia and Brunei are estimated to be worth well over $10 billion.

Italian foreign minister calls off Paris trip after French ‘insults’

(Reuters) Italian Foreign Minister Antonio Tajani called off a trip to Paris on Thursday, saying the French interior minister had offended Italy and its Prime Minister Giorgia Meloni with unacceptable “insults”. Earlier, the French minister, Gerald Darmanin, told RMC radio that Meloni was “unable to solve the migration problems on which she was elected” and accused her of “lying” to voters that she could end a crisis over growing numbers of boat migrants. News of his comments came as Tajani was preparing to fly to Paris to see his French counterpart—a trip that was aimed partly at improving relations between the two European Union countries that have grown increasingly brittle. France swiftly issued a statement in which it sought to reassure Rome of its willingness to work closely with Italy, but it was not enough to persuade Tajani to catch his plane. It was the latest in a series of clashes between Paris and Rome since Meloni took office last October at the head of a nationalist, conservative government which has a very different world vision to that of French President Emmanuel Macron.

Kremlin accuses Washington of directing drone attack on Putin

(Washington Post) The Kremlin spokesman on Thursday accused the United States of ordering what Moscow alleges was an assassination attempt on President Vladimir Putin with two drones that were sent to attack the Russian president’s official residence. “We know very well that decisions about such actions, about such terrorist attacks, are made not in Kyiv, but in Washington, and Kyiv does what it is told,” Dmitry Peskov told reporters Thursday. John Kirby, the spokesman for the U.S. National Security Council, said Peskov “is just lying.”

Russian mercenary chief Prigozhin says his forces will leave Bakhmut next week

(Reuters) Yevgeny Prigozhin, leader of Russia’s Wagner Group mercenary force, said in a sudden and dramatic announcement on Friday that his forces would leave the Ukrainian city of Bakhmut that they have been trying to capture since last summer. Prigozhin said they would pull back on May 10—ending their involvement in the longest and bloodiest battle of the war—because of heavy losses and inadequate ammunition supplies. He asked defence chiefs to insert regular army troops in their place. “I’m pulling Wagner units out of Bakhmut because in the absence of ammunition they’re doomed to perish senselessly,” Prigozhin said in a statement. Prigozhin has vented increasing anger at what he describes as lack of support from the Russian defence establishment. Earlier on Friday he appeared in a video surrounded by dozens of corpses he said were Wagner fighters, and yelling and swearing at Defence Minister Sergei Shoigu and Chief of General Staff Valery Gerasimov. He said they were to blame for Wagner’s losses because they had starved it of ammunition.

Earthquake-Proof, Not Corruption-Proof: Turkey’s Needless Deaths

(NYT) The building began convulsing at 4:17 a.m. Firat Yayla was awake in bed, scrolling through videos on his phone. His mother was asleep down the hall. The region along Turkey’s border with Syria was known for earthquakes, but this apartment complex was new, built to withstand disaster. It was called Guclu Bahce, or Mighty Garden. Mr. Yayla’s own cousin had helped build it. He and his business partner had boasted that the complex could withstand even the most powerful tremor. So, as the earth heaved for more than a minute, Mr. Yayla, 21, and his 62-year-old mother, Sohret Guclu, a retired schoolteacher, remained inside. At that very moment, though, Mr. Yayla’s cousin, the developer, was leaping for safety from a second-story balcony. What Mr. Yayla and his mother had not known was that the system to ensure that buildings were safely constructed to code had been tainted by money and politics. A developer won zoning approval for the project after donating more than $200,000 to a local soccer club, where the mayor is an honorary president. The building inspector said that, even after the project had failed its inspection, the developers used political influence to get the doors open. The Feb. 6 earthquake revealed the shaky foundation on which so much growth was built. More than 50,000 people died as buildings toppled, crumbled or pancaked. Guclu Bahce, the mighty earthquake-proof complex, was among them. An estimated 65 people died there.

8 Are Dead in Shooting in Serbia, a Day After School Massacre

(NYT) The Serbian police arrested a suspect early Friday after an hourslong overnight manhunt for a gunman who killed eight people and injured at least 14 others near Belgrade, according to Serbia’s Interior Ministry. The attack late Thursday was the nation’s second mass shooting in two days and rattled a country still reeling from an attack at a school that killed eight students and a security guard. Hundreds of police officers had gone door to door in the search for a 21-year-old male suspect, according to RTS, Serbia’s public broadcaster. They deployed helicopters and surrounded the area where they believed he was hiding, the report said. The gunman, who was in a moving vehicle, used an automatic weapon and fled the scene, according to RTS, which said the attack took place around Mladenovac, a municipality in the southern part of the capital, Belgrade.

Press group: China biggest global jailer of journalists

(AP) China was the biggest global jailer of journalists last year with more than 100 behind bars, according to a press freedom group, as President Xi Jinping’s government tightened control over society. Xi’s government also was one of the biggest exporters of propaganda content, according to Reporters without Boarders. China ranked second to last on the group’s annual index of press freedom, behind only neighbor North Korea. The ruling Communist Party has tightened already strict controls on media in China, where all newspapers and broadcasters are state-owned. Websites and social media are required to enforce censorship that bans material that might spread opposition to one-party rule.

Israelis call out perks for ultra-Orthodox in latest protests

(Washington Post) Israel’s protest movement, having forced the government to pause its attempt to overhaul the national judiciary system, pivoted to other targets in demonstrations across the country Thursday, including the exemption from military service and other special privileges long granted to the growing ultra-Orthodox community. Thousands marched for a “Day of Disruption to Demand Equality” focused on the unequal burdens of citizenship and status of the ultra-Orthodox, or Haredim as they are known in Israel. Ultra-Orthodox citizens are largely shielded from the country’s mandatory draft and educational standards and their families benefit from heavy public subsidies that allow boys and men to devote years to religious study instead of working and paying taxes in the mainstream economy. Demonstrators blocked roads, lined bridges and picketed the homes of cabinet members. While many still chanted against the judicial overhaul, which some ministers are seeking to revive, most focused on other concerns, including spiking inflation and rising crime. The anger against the special status of the Haredi has long been a dynamic in Israeli politics, but it has grown more intense as the community has ballooned to roughly 13 percent of Israel’s total population, making them the country’s fastest growing demographic.

Fighting rages in Khartoum, civilians complain of being forgotten

(Reuters) Heavy gunfire echoed around Khartoum again on Friday as civilians trapped by fighting in the Sudanese capital said the army and rival paramilitary forces were ignoring their plight. “It’s been four days without electricity and our situation is difficult... We are the victims of a war that we aren’t a part of. No one cares about the citizen,” said Othman Hassan, 48, a resident of the southern outskirts of Khartoum. Despite multiple ceasefire declarations, the army and the paramilitary Rapid Support Forces (RSF) appeared to be battling each other for control of territory in the capital ahead of proposed talks. The sudden collapse into warfare has killed hundreds, triggered a humanitarian disaster, sent an exodus of refugees to neighbouring states and risks dragging in outside powers, further destabilising an already restive region.

3 notes

·

View notes

Text

Hegy Cleaning Company in Qatar

At Hegy Cleaning Company, we understand the importance of a clean and welcoming environment. A tidy space not only enhances the overall aesthetic but also contributes to a healthier and more productive atmosphere. As a leading cleaning company, we take pride in offering comprehensive cleaning services tailored to meet the unique needs of our clients.

Our Services:

Residential Cleaning: Our dedicated team of cleaning professionals ensures that your home is a haven of cleanliness. From thorough room cleaning to specialized services like carpet and upholstery cleaning, we take care of every corner to create a pristine living space.

Commercial Cleaning: A clean workplace fosters productivity and leaves a positive impression on clients and employees alike. We provide customized commercial cleaning solutions, including office cleaning, floor maintenance, and janitorial services, ensuring your business premises are spotless.

Move-in/Move-out Cleaning: Moving can be stressful, but our team is here to make it easier. Whether you're moving in or out, our detailed cleaning services ensure that the property is sparkling clean, leaving you with peace of mind.

Specialized Cleaning: We offer specialized cleaning services for unique needs such as post-construction cleaning, event cleanup, and more. No task is too big or small for our experienced team.

Why Choose Us:

Professionalism: Our team consists of trained and experienced cleaning professionals dedicated to delivering the highest standards of service. We arrive on time, equipped with the latest cleaning tools and environmentally friendly products.

Customized Solutions: We understand that every space is unique, and our services are tailored to meet your specific requirements. Whether you need a one-time deep cleaning or a regular maintenance schedule, we've got you covered.

Reliability: Count on us to consistently deliver quality results. We take pride in our reliability and commitment to exceeding our clients' expectations.

Affordability: Quality cleaning services shouldn't break the bank. We offer competitive pricing to make professional cleaning accessible to all.

Contact Us Today:

Ready to experience the transformative power of a clean space? Contact Hegy Cleaning Company today for a personalized quote and let us take care of the dirty work, so you can focus on what matters most. Your satisfaction is our priority, and we look forward to making your space shine!

1 note

·

View note

Text

Hegy Cleaning Company in Qatar

At Hegy Cleaning Company, we understand the importance of a clean and welcoming environment. A tidy space not only enhances the overall aesthetic but also contributes to a healthier and more productive atmosphere. As a leading cleaning company, we take pride in offering comprehensive cleaning services tailored to meet the unique needs of our clients.

Our Services:

Residential Cleaning: Our dedicated team of cleaning professionals ensures that your home is a haven of cleanliness. From thorough room cleaning to specialized services like carpet and upholstery cleaning, we take care of every corner to create a pristine living space.

Commercial Cleaning: A clean workplace fosters productivity and leaves a positive impression on clients and employees alike. We provide customized commercial cleaning solutions, including office cleaning, floor maintenance, and janitorial services, ensuring your business premises are spotless.

Move-in/Move-out Cleaning: Moving can be stressful, but our team is here to make it easier. Whether you're moving in or out, our detailed cleaning services ensure that the property is sparkling clean, leaving you with peace of mind.

Specialized Cleaning: We offer specialized cleaning services for unique needs such as post-construction cleaning, event cleanup, and more. No task is too big or small for our experienced team.

Why Choose Us:

Professionalism: Our team consists of trained and experienced cleaning professionals dedicated to delivering the highest standards of service. We arrive on time, equipped with the latest cleaning tools and environmentally friendly products.

Customized Solutions: We understand that every space is unique, and our services are tailored to meet your specific requirements. Whether you need a one-time deep cleaning or a regular maintenance schedule, we've got you covered.

Reliability: Count on us to consistently deliver quality results. We take pride in our reliability and commitment to exceeding our clients' expectations.

Affordability: Quality cleaning services shouldn't break the bank. We offer competitive pricing to make professional cleaning accessible to all.

Contact Us Today:

Ready to experience the transformative power of a clean space? Contact Hegy Cleaning Company today for a personalized quote and let us take care of the dirty work, so you can focus on what matters most. Your satisfaction is our priority, and we look forward to making your space shine!

0 notes

Text

The Israel-Hamas war unfolded amid an apparent regional trend of peaceful coexistence. The Middle East’s transformation along these lines has been represented by the seemingly ever-closer alliance between Saudi Arabia and the United Arab Emirates, as symbolized by the apparent friendship between their respective de facto leaders, Mohammed bin Salman and Mohamed bin Zayed. The two countries united to counter Qatar’s expanding soft power in the Arab world, as exemplified by the unsuccessful blockade they imposed on it in 2017. They have been on the same side in their military campaign against the Iranian-backed Houthis in Yemen since 2014. And they have mutually approached Beijing and Moscow, adopting a more independent policy that diverges from their traditional alliance with the United States.

But what lurks beneath the surface of this apparent fraternal alliance is a quiet struggle, as both countries vie for leadership within the Arab world. Behind the scenes, Saudi Arabia and the UAE are waging an active geoeconomic competition in multiple dimensions.

First, there is a massive competition for foreign investment. The rivalry traces back to 2009, when Abu Dhabi objected to the proposed location of the headquarters for a Gulf Cooperation Council (GCC) central bank in Riyadh, which ultimately played a role in thwarting the establishment of the bank itself. Between 2012 and 2022, the UAE’s influx of investment-to-GDP has been nearly 3.5 times greater than that of Saudi Arabia, and Dubai has become the favored location for some 70 percent of Middle Eastern headquarters of major multinational companies. Meanwhile, the surge in oil prices in 2022, thanks to the Russian invasion of Ukraine, propelled the Saudi economy to grow by 8.7 percent, the highest among G-20 countries, which has produced its own substantial influx of capital. And Saudi Arabia has actively encouraged foreign companies operating in the Persian Gulf area to relocate their headquarters to its territory, issuing warnings that companies failing to relocate their headquarters risk discontinuation of business relations with Riyadh.

Energy politics between Saudi Arabia (the world’s largest oil exporter) and the UAE (the fifth-largest) has further intensified this competition. In the summer of 2021, a clear dispute emerged between Riyadh and Abu Dhabi regarding a Saudi-led plan within OPEC+ to prolong production cuts, with the UAE rejecting the proposition. Although an apparent resolution to this tension was quickly achieved, subsequent rumors circulated regarding Abu Dhabi’s objection to Riyadh’s dominance within OPEC+ and the potential consideration of withdrawal from OPEC.

The competition for global prestige has also driven a wedge between Saudi Arabia and the UAE. Both countries are strategically investing in efforts to augment their soft power by hosting prominent international gatherings. Saudi Arabia has established the Future Investment Initiative conference, while Abu Dhabi has played host to the World Investment Forum, an annual event organized by the United Nations. Both forums and conferences serve as platforms to convene global leaders and investors, facilitating the proposal of innovative solutions to global challenges. After the UAE convened Expo 2020 in Dubai, the first of its kind in the Middle East, Saudi Arabia made history by securing the rights to host Expo 2030. Furthermore, Dubai was chosen as the venue for the pivotal annual U.N. climate change conference last year. This commitment to summit hosting continues, with Abu Dhabi set to host the World Trade Organization ministerial conference in February. Following Qatar’s successful hosting of the 2022 FIFA World Cup, Riyadh has undertaken initiatives to elevate the profile of its national soccer league by attracting elite players. Since early 2021, Saudi Arabia has committed a minimum of $6.3 billion in sports agreements, surpassing the total expenditure of the preceding six years by more than fourfold. It could be the first manifestation of the geopolitics of soccer in the new era. Dubai has been recognized for its relatively open, cosmopolitan society, attracting celebrities to host concerts and performances. This privilege, however, is no longer exclusive to the UAE. In December 2023, Riyadh successfully hosted MDLBEAST Soundstorm, marking the largest music festival in the Middle East. Collectively, these endeavors reflect the deliberate efforts made by these two countries to reshape their international image and promote positive perceptions of themselves on the global stage.

The last and the most pivotal competition pertains to the “vision” strategies pursued by the two countries. The UAE, having embarked on its diversification journey years ago, has established itself as a global transportation and business hub through strategic initiatives related to the ports of Khalifa and Jebel Ali, complemented by the success of its air carrier Emirates. Nevertheless, Mohammed bin Salman launched Vision 2030, an ambitious road map for Saudi economic diversification, in 2016. The flagship project within this vision is the NEOM initiative, a multibillion-dollar endeavor aimed at positioning Saudi Arabia as the preeminent infrastructure, transportation, technology, business, and financial hub in the region. Riyadh has also committed more than $100 billion to transform itself into a sea and air logistics hub, marked by the initiation of Riyadh Air. This involves challenging the dominance of Emirati ports through substantial investments in the Jeddah Islamic Seaport, slated to become the largest and busiest port in the Middle East and North Africa region. Phrased differently, the “vision” competition has propelled Riyadh and Abu Dhabi into a modernization and diversification race, often at the expense of each other.

Interestingly, rapprochement with Iran might intensify this competition. The Beijing-led detente between Tehran and Riyadh has effectively eliminated the primary shared threat in the region for Saudi Arabia and the UAE, thereby reducing the long-standing geopolitical conflicts between the northern and southern parts of the Persian Gulf. Moving forward, the region may enter a new era where the focus shifts from geopolitical competition between Iran and the GCC to geoeconomic competition between Saudi Arabia and the UAE.

Both countries are also adopting trade policies that amount to direct challenges to each other. In July 2021, Saudi Arabia implemented protectionist policies to bolster its local industrial production. These regulations stipulate that goods manufactured in free zones or utilizing Israeli inputs are excluded from preferential tariff concessions. This stance directly challenges the economic free zones that constitute a cornerstone of the Emirati economy. These regulations, designed to attract foreign investors to establish businesses within the country, stand as a clear rebuttal to the growing trade relations between the UAE and Israel.

Policy toward Israel is another potential terrain for divergence. While the UAE officially recognized Israel in 2020, Saudi Arabia has refrained so far from joining the Abraham Accords. Israel and the UAE strengthened bilateral relations by signing a comprehensive economic partnership agreement. This economic progress put Riyadh in a comparatively vulnerable position. The Israel-Hamas war has now decelerated the Saudi-Israeli normalization process; however, the dialogues will likely revive as Riyadh is supposed to be the cornerstone of the accords. It would not be surprising if Mohammed bin Salman sought additional concessions, particularly in nuclear programs and security guarantees, to normalize relations with Israel; such a move could then exert pressure on Mohamed bin Zayed’s Israel policy.

As the rift between Saudis and Emiratis widens, there is a likelihood that their improving relations with Moscow, Beijing, and even Iran may accelerate as a counterweight to each other. This, in turn, could weaken the effectiveness of the U.S. strategy in the Middle East and prompt a reevaluation by the White House of the region’s significance. Within this context, the alignment of Abu Dhabi and Riyadh with U.S. policies in the region should not be taken for granted. Just like the outbreak of the Israel-Hamas war, the rising geoeconomic competition between Saudi Arabia and the UAE could challenge the simplistic view that the Middle East is destined to become more peaceful.

1 note

·

View note

Text

The Natural Gas Tango: Dancing Between Boom and Bust (with a Few Methane Hiccups)

Remember that feeling of staring at your bank account after a particularly gas-guzzling road trip? Well, multiply that by, like, a billion, and you've got the global natural gas market. This $109.48 billion behemoth in 2021 is projected to balloon to a whopping $220.68 billion by 2030 – enough green (both the leafy and paper kind) to make even the most hardened cynic raise an eyebrow (and maybe check their investment portfolio).

But before we all get gassy about all that moolah, let's peek under the hood of this hydrocarbon behemoth and see what makes it tick (and potentially leak, but we'll get to that later).

Fueling the Flames:

Cleaner(ish) Darling: Compared to its fossil fuel frenemies like coal, natural gas burns less dirty, making it the "cool kid" of the energy transition party. As the world tries to kick its coal habit, gas is stepping in to keep the lights on (and the factories humming) with a slightly less grimy conscience.

Industrial Thirst: Industries, particularly in Asia-Pacific, guzzle energy like there's no tomorrow. And what's their drink of choice? You guessed it – natural gas, readily available and versatile enough to power factories and generate electricity like a caffeinated Olympian on a sugar rush.

Throwing Sand in the Gears:

Geopolitical Jitters: Unrest in major gas-producing regions like the Middle East can send supply chains haywire and gas prices on a rollercoaster ride more thrilling than a faulty elevator. Nobody likes a volatile market,especially not investors whose blood pressure rivals that of a pressure cooker about to explode.

Regulation Blues: Stringent environmental regulations and concerns about methane leaks (a potent greenhouse gas that makes even Greta Thunberg cry) can put the brakes on gas development and use. Green concerns, as noble as they are, can sometimes act like a speed bump on the road to gas-powered glory.

Pricey Rollercoaster: The price of natural gas is about as stable as a toddler on a sugar rush. Supply-demand imbalances and geopolitical events can send it soaring like a SpaceX rocket or plummeting like a deflated soufflé, making long-term planning a bit of a gamble (one that could leave you with empty pockets and a rumbling stomach).

Shaking Up the Dance Floor:

Conventional King: Conventional natural gas, extracted the old-fashioned way, still reigns supreme, but unconventional sources like shale gas are making a play for the throne. Watch this space for a potential shale shake-up that could redefine the energy landscape.

Power Play: The power generation sector is the gas guzzler extraordinaire, but don't sleep on transportation.As natural gas vehicles and infrastructure gain traction, expect this segment to roar like a lion on a caffeine bender (which, trust me, is loud).

LNG: The Global Gas Trotter: Liquefied natural gas (LNG) is basically gas in a travel mug, allowing it to be shipped around the world like never before. This opens up new markets and trade possibilities, making the world a gassier (and potentially more interconnected) place.

Regional Rockstars:

Middle East: These guys have been in the gas game for a long time and boast reserves that would make Scrooge McDuck blush. Think Qatar and Iran, the OPEC of natural gas (except not really, but you get the picture).

Asia-Pacific: This economic powerhouse is hungry for energy, and natural gas is on the menu. China and India are leading the charge, with their ever-growing populations and industries demanding more and more gas (like bottomless brunch enthusiasts at a buffet).

Future Footprints:

LNG Boom: Expect to see more LNG terminals popping up like mushrooms after a rainstorm. This will make gas even more accessible and global trade even gassier (I know, I'm milking this metaphor like a dairy farmer on steroids).

Green Gas Gambit: Renewable natural gas (RNG), made from organic waste, is the new kid on the block. It's carbon-neutral and has the potential to make gas greener and more sustainable. Watch this space for some exciting developments that could change the game.

Tech Transformation: From smarter drilling to digital pipelines, technology is transforming the gas industry.Expect efficiency gains, environmental improvements, and maybe even gas-powered robots (okay, maybe not that last one, but hey, a man can dream, right?).

For More Information: https://www.skyquestt.com/report/natural-gas-market

The Bottom Line:

The global natural gas market is a dynamic beast with its fair share of opportunities and challenges. While it's not without its hiccups (and leaks), the rising demand for cleaner energy, coupled with technological advancements and regional growth, paints a promising picture for the future. Just remember, with great power (and gas) comes great responsibility. Let's develop and use this resource responsibly, keeping both the environment and the economy in mind. After all, even the hottest tango needs a bit of grace to avoid stepping on toes (and carbon footprints).

About Us-

SkyQuest Technology Group is a Global Market Intelligence, Innovation Management & Commercialization organization that connects innovation to new markets, networks & collaborators for achieving Sustainable Development Goals.

Contact Us-

SkyQuest Technology Consulting Pvt. Ltd.

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 617–230–0741

Email- [email protected]

Website: https://www.skyquestt.com

0 notes

Text

Smartphone Online Shopping for Business Owners in Qatar: Unlocking Opportunities

In today's fast-paced business landscape, owning a smartphone is not just a luxury; it's a necessity. For business owners in Qatar, staying connected, managing operations, and keeping an eye on the latest trends in the market are vital aspects of running a successful enterprise. Smartphone online shopping has emerged as a game-changer, offering convenience, accessibility, and many options to cater to the unique needs of business owners in Qatar. In this blog, we will delve into the world of smartphone online shopping, explore the options available in the Qatar phone market, discuss mobile price in Qatar, and highlight the advantages of choosing the right mobile phone for your business needs.

The Qatar Phone Market: A World of Possibilities

The Qatar phone market is a vibrant and diverse space where you can find a wide range of mobile phones to suit your business requirements. Whether you run a small startup, a retail store, or a large corporation, there's a smartphone to match your specific needs. From Android mobiles to the latest iOS devices, the options are abundant.

Mobile Prices in Qatar: Balancing Budget and Features

One of the first considerations for business owners when shopping for a smartphone is the cost. Mobile prices in Qatar vary depending on the brand, model, and features. It's essential to strike a balance between your budget and the functionality you require. Here are a few things to keep in mind:

Budget-Friendly Options: Qatar's phone market offers a range of budget-friendly smartphones that provide excellent value for money. These devices may not have all the bells and whistles of flagship models, but they can still meet your business needs effectively.

Flagship Models: For business owners who require top-of-the-line performance, flagship models from renowned brands like Apple and Samsung are available. While these devices come with a higher price tag, they offer the latest technology, robust security features, and outstanding performance.

Mid-Range Gems: Mid-range smartphones are gaining popularity in Qatar due to their balanced combination of price and features. These devices offer good performance, decent cameras, and long-lasting batteries without breaking the bank.

Smartphone Online Shopping: Convenience at Your Fingertips

Online shopping for mobile phones in Qatar has gained significant traction in recent years. Business owners can explore a wide variety of options from the comfort of their office or home, making the purchasing process hassle-free. Here are some advantages of smartphone online shopping:

Extensive Selection: Online stores offer a vast selection of mobile phones, including the latest releases and hard-to-find models, ensuring you can find the perfect fit for your business.

Price Comparisons: You can easily compare mobile prices in Qatar across different online retailers, helping you find the best deals and discounts.

User Reviews: Online platforms provide access to user reviews and ratings, allowing you to make informed decisions based on the experiences of other buyers.

Convenience: Online shopping is available 24/7, so you can browse, compare, and make purchases at your convenience, saving you time and effort.

Secure Transactions: Reputable online retailers ensure secure payment methods, protecting your financial information during the transaction process.

Choosing the Right Smartphone for Your Business

Selecting the right smartphone for your business involves considering various factors beyond the price tag. Here are key features to look for:

Performance: A powerful processor and ample RAM are essential for smooth multitasking and quick app launches.

Battery Life: Long battery life ensures your phone can keep up with your busy workday without needing frequent recharging.

Camera Quality: For businesses that rely on visual content, a smartphone with a high-quality camera is a must.

Operating System: Consider whether you prefer Android mobiles or iOS devices, as your choice will impact app compatibility and user experience.

Security: Robust security features, such as biometric authentication (fingerprint or facial recognition), protect your sensitive business data.

Storage: Sufficient storage capacity is vital for storing business documents, photos, videos, and apps.

Mobiles Online: The Future of Business Connectivity

Mobiles online have transformed the way business owners in Qatar operate and stay connected. These pocket-sized powerhouses are more than just communication devices; they are essential tools for managing operations, tracking trends, and seizing opportunities in a competitive market.

In conclusion, smartphone online shopping for business owners in Qatar opens up a world of possibilities, offering a diverse range of options to cater to various budgets and needs. By carefully evaluating mobile prices in Qatar and considering the features that matter most to your business, you can make a well-informed choice that enhances your productivity and connectivity in the dynamic world of entrepreneurship. Embrace the convenience of online shopping, explore the Qatar phone market, and equip yourself with the perfect smartphone to unlock new horizons for your business.

0 notes

Text

Best Coupe Cars to Buy in Qatar

Coupe automobiles are ideal for those who wish to travel in elegance because they are sleek, sporty, and lightweight. Along with outstanding aesthetics, coupes typically consume less gasoline than sedans. Coupe cars use a lot less gas than their larger counterparts, which is better for both the environment and your wallet.

The only major challenge you'll have if you want to purchase a coupe is deciding which one to do so. We have some amazing models available as the leading used car retailer in Qatar. To simplify matters, let's examine what we believe to be the Best Coupe Cars To Buy In Qatar.

Mustang GT by Ford

The Ford Mustang GT is the best option if glitz and glam are what you're after. Being an instant attention-grabber, you'll get some very jealous looks as you log the miles. But this stunning coupe provides both substance and style. When you have a 5.0l engine, you'll find that you never want for power or that additional "oomph" when you need to press the gas pedal. Similar to the outside, the interior delivers where it counts. With this model, electric doors and mirrors are standard, and the cruise control feature makes driving simple. The Ford Mustang GT has rear cameras, paddle shifters, and contemporary navigation systems for greater agility. Overall, this is the fulfilment of a petrolhead's fantasy.

Mini Cooper Coupe

The Mini Cooper Coupe, dubbed "the most driver-focused car in its class," is swift, entertaining, and adaptable. Although most people think of Mini Cooper Coupes as run-arounds or vehicles for commuting within cities, they have enough power beneath the hood to allow you to go at high speeds on highways. The Cooper's size and weight make it incredibly maneuverable, and thanks to its low centre of gravity, it will handle corners much better than you may expect. Everything you need to cruise comfortably is within. While the CD player and speaker system provide all the noises you require, climate control and ventilated seats guarantee that you can travel at the ideal temperature. The Mini Cooper Coupe is a stylish, a little cheeky, and a dynamic small automobile for those who prefer to stand out.

AMG Mercedes-Benz C250

Mercedes coupes are designed for people who prefer their vehicles to be attractive but unapologetically modern. The roof progressively slopes into the windscreen without any rear passenger doors to worry about, making it effortlessly aerodynamic and capable of amazing speeds when you can open things up. 18-inch alloy wheels give the automobile a feeling of gravitas and class in addition to enhancing its flawless appearance. All the amenities found in Mercedes coupes are present as you go inside. While the CD and Bluetooth systems put all of your favourite sounds at your fingertips, the leather upholstery provides for a comfortable journey.

When you buy your coupe car through Tazweed, purchasing one doesn't have to break the bank. We have the largest collection of used cars in Qatar, so we're sure to have something to suit your tastes. You can be confident that your new coupe will be free of issues and prepared to go on the road because every vehicle we sell is put through a 99-point service inspection. Additionally, if you're selling your car, we can give you an instant quote and deduct the price of your new purchase from the value of your car's resale.

0 notes

Text

The Pearl Island

The Pearl Island( Arabic جزيرة اللؤلؤة, romanized jazirat alluwlua) in Doha, Qatar, is an artificial island with an area of nearly four square kilometers. It's the first land in Qatar to be available for freehold power by foreign citizens. As of 2018, there were 27,000 residents. formerly fully completed, The Pearl was anticipated to produce over 32 kilometers of the new bank, for use as a domestic estate with an anticipated 18,831 places and 45,000 dwellers by 2018. In 2004, when the design was first revealed, the original cost of constructing the island stood at$2.5 billion. It's now believed the design will bring$ 15 billion upon completion. You can choose Gallivant Yacht Exemptions in Qatar to know the private yacht Qatar price.

0 notes

Text

Welcome to a New Era of Petrodollar Power! What are the Hundreds of Billions of Oil Riches Being Spent On?

— Finance & Economics | Sovereign-Stealth Funds | April 9th, 2023

DOHA, QATAR - November 16: Doha Bay with the skyline of the city in the background taken from the Museum of Islamic art ahead of the FIFA World Cup Qatar 2022 at on November 16, 2022 in Doha, Qatar. (Photo by Buda Mendes/Getty Images)

Apack of hungry headhunters has descended on Europe’s financial quarters. Over coffee in the mid-morning lull, they tempt staffers at blue-chip investment funds with tax-free jobs, golden visas and gorgeous vistas at the firms’ clients: sovereign-wealth funds in the Gulf.

A decade in Doha was once a hard sell, but the roles are juicy enough that many would-be recruits volunteer for desert-bound “business trips” to see headquarters. In October recruiters nabbed the second-in-command at Amundi, Europe’s biggest money manager, to deploy artificial intelligence at the Abu Dhabi Investment Authority (adia), which oversees assets worth $1trn. Now they are chasing others to invest in infrastructure for the Qatar Investment Authority (qia) and oversee finance for Saudi Arabia’s Public Investment Fund (pif). Together these two funds manage another $1trn.

War and sanctions have buoyed hydrocarbon prices, meaning fuel exporters are swimming in money. During previous booms they would recycle the proceeds in Western capital markets, snapping up pedestrian, uber-liquid assets via banks based offshore. Underpinning this was an unspoken agreement: America would offer military aid and buy oil from Saudi Arabia and friends, in exchange for which they would plug Uncle Sam’s gaping current-account deficit with petrodollars. The talent-hunting party suggests the deal is crumbling. Uncle Sam, now a major oil exporter, is a less watchful partner. Gulf states, lured by Asia and eager to mend ties with Israel and, lately, Iran, no longer feel compelled to woo the White House. On April 2nd Saudi Arabia and its allies angered America by deepening crude-output cuts to nearly 4m barrels a day, equivalent to 4% of global production, which helped lift prices. They also feel freer to use their mountains of cash however they wish.

We estimate that in 2022-23 the current-account surplus of the Gulf’s petrostates may hit two-thirds of a trillion dollars. Yet outside central banks, which no longer collect much of the bounty, the region’s treasure troves are notoriously opaque. To map where the money is going, The Economist has scrutinised government accounts, global asset markets and the deal rooms of companies tasked with investing the windfall. Our investigation suggests that less of the money is returning to the West. Instead, a growing share is being used to advance political aims at home and gain influence abroad, making global finance a murkier system.

The Gulf is not alone in enjoying a windfall. Last year Norway, which cranked up gas exports to Europe as Russia cut supplies, earned a record $161bn in tax from hydrocarbon sales, a 150% jump from 2021. Even Russia, under sanctions, saw such revenue rise by 19%, to $210bn. But it is the Gulf states, which benefit from low production costs, spare capacity and convenient geography, that are hitting the jackpot. Rystad Energy, a consultancy, reckons they pocketed $600bn in tax from hydrocarbon exports in 2022.

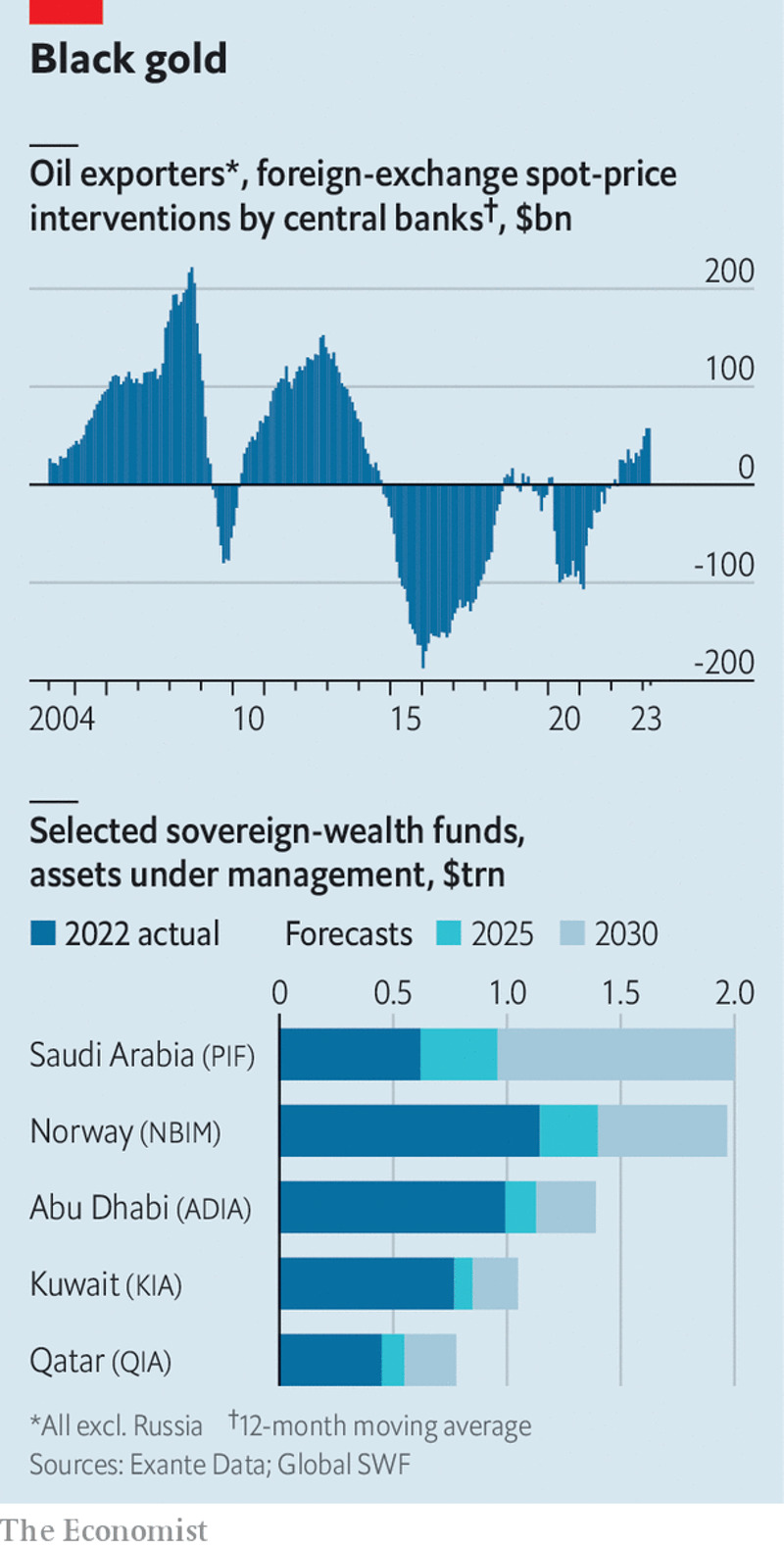

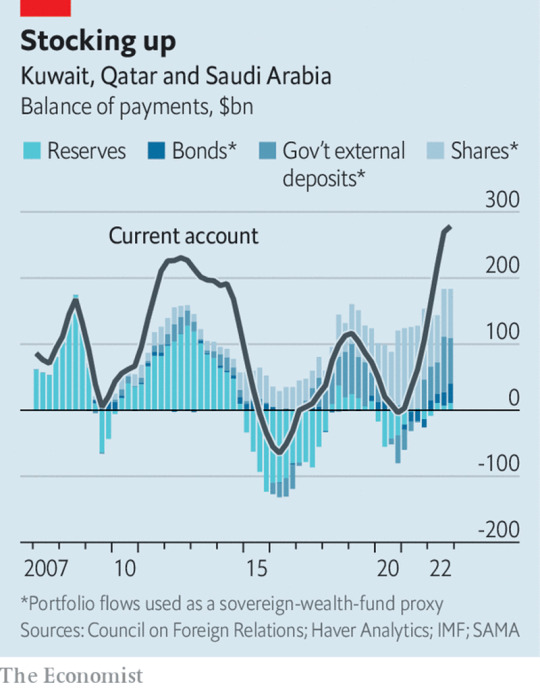

Not all of them are in a position to truly benefit. Governments in Bahrain and Iraq are so bloated that even as higher revenues flow in, they barely break even. Most of the bounty is instead being accrued by the four biggest members of the Gulf Co-operation Council (gcc): Kuwait, Qatar, the uae and Saudi Arabia. Alex Etra of Exante, a data firm, estimates their combined current-account surplus in 2022 was $350bn. Oil prices have fallen since last year, when Brent crude, the global benchmark, averaged $100 a barrel. Yet assuming it stays near $85—a conservative bet—Mr Etra reckons the four giants could still pocket a $300bn surplus in 2023. That makes a cumulative $650bn over the two years.

In the past the majority of this would have gone straight into central banks’ foreign-exchange reserves. Most members of the gcc peg their currencies to the dollar, so they must set aside or invest hard currency during booms. This time, however, central-bank reserves seem to be hardly growing. Interventions on foreign-currency markets have also been rare, confirming that the usual guardians of state riches are not getting the surplus.

So where have the elusive billions gone? Our research finds they have been used in three novel ways by a variety of actors that include national governments, central banks and sovereign-wealth funds. These are to pay back external debt, lend to friends and acquire foreign assets.

Start with debt. Between 2014 and 2016 a petroleum glut fuelled by America’s shale boom caused the oil price to fall from $120 a barrel to $30, the steepest decline in modern history. In 2020, as covid-19 lockdowns depressed demand, prices cratered again, to $18 in April. To withstand the earnings shock, Gulf states liquidated some foreign assets and their central banks sold part of their foreign-currency stash. But this was not enough, so they also borrowed a lot of hard currency on Western capital markets.

Now some petrostates are taking advantage of higher prices to shore up their balance-sheets. Abu Dhabi, the uae’s richest emirate, has repaid $3bn since the end of 2021—about 7% of the total outstanding, according to Alexander Perjessy of Moody’s, a ratings agency. Qatar’s load has shrunk by $4bn, or about 4%. Kuwait’s has halved since 2020. This broad deleveraging is a new phenomenon: gcc countries had little debt in the late 2000s, when the previous oil boom got going.

Gulf states are also lending a hand to friends in need—the second use of the new oil money. In early 2022 the central bank of Egypt, a big food importer squeezed by high grain prices, received $13bn in deposits from Qatar, Saudi Arabia and the uae. In recent years, Saudi Arabia has also allowed Pakistan to defer payment for billions of dollars in oil purchases. This money is more conditional than in the past. Eager to see at least some of its cash return, Saudi Arabia recently demanded Egypt and Pakistan implement economic reforms before giving them more help. Some of the Gulf support also comes in exchange for stakes in state-owned assets these embattled countries are putting up for sale.

So Pumped

The real novelty in this regard is Turkey. When squeezed, Ankara used to turn to the imf, or European banks, for emergency-cash injections. Recently, as surging inflation and earthquakes have pushed the country to the brink, it is Gulf states that have been holding the syringe. The support takes various forms. On March 6th Saudi Arabia said it would deposit $5bn at the country’s central bank. Qatar and the uae have also set up $19bn in currency swaps with the institution, according to an estimate by Brad Setser of the Council on Foreign Relations, a think-tank. All three have pledged to participate in Turkey’s forthcoming auctions of government bonds.

Qatar is a long-standing ally of Turkey. Saudi Arabia and the uae, which until recently had a frosty relationship with the republic, are now competing for influence. All sense an opportunity to gain sway over Recep Tayyip Erdogan, the country’s president, who faces a tough election in May. The Turkish case sets a precedent. As more neighbours face crunches, bilateral credit will become core to gcc statecraft, predicts Douglas Rediker, a former imf official.

Yet for all their geopolitical significance, such loans account for only a fraction of the oil jackpot. That leaves the main escape channel: foreign investments.

In past booms the central banks of the world’s two largest petrostates—Russia and Saudi Arabia—did much of the recycling, meaning that the assets they purchased were labelled as reserves. All these countries wanted was stable yields and few surprises. Most often they parked the cash at Western banks or bought super-safe government bonds—so many that Gulf appetite, along with China’s, is credited for helping to create the loose monetary conditions that fed the 2000s sub-prime bubble. Only Qatar, known then as the “cowboy of the Middle East”, did anything more daring: buying a football club here, a glitzy skyscraper there.

Today the Russian central bank’s reserves are frozen. And since 2015, when Muhammad Bin Salman (mbs) became de facto ruler, the Saudi central bank has received far less money than pif, which mbs chairs. In just a few years pif and its peers across the region have swelled in size. If hydrocarbons stay expensive, and more of the bounty flows to them, they could grow much bigger still. Everything indicates that their way of recycling riches is very different. It is more adventurous and political, and less Western-centric.

Figuring out what Gulf sovereign-wealth funds have been up to is much more difficult than it would be for, say, Norway’s fund. The Gulf institutions do not update their strategy, size and holdings live on their websites, as the one in Oslo does. But there are clues. Data from the Bank for International Settlements, a club of central banks, suggests that, initially, most of the cash was parked in foreign bank accounts. In the Saudi case, such deposits were worth $81bn in the year to September, equivalent to 54% of the current-account surplus over the period, calculates Capital Economics, a consultancy.

Perhaps sovereign-wealth funds have been waiting for interest rates to peak before piling into bonds. More likely they are after less conventional assets, which take time to select. Data from the Treasury International Capital system, which tracks flows into American securities, suggest oil exporters have been buying fewer Treasury bonds than would previously have been expected. But they have been hungrier for stocks—and such numbers understate their appetite, because Gulf sovereign-wealth funds often buy American shares through European asset managers. An executive at one such firm says his Gulf clients have topped up their American-stock accounts copiously in recent months.

Sovereign-wealth funds largely invest in stocks via index funds, which are low cost and offer diversification. But they also like riskier bets. Today “alternative assets”—private equity, property, infrastructure and hedge funds—represent 23-37% of total assets for the three largest funds in the Gulf, according to Global swf, a data firm. These shares have jumped at the same time as war chests have grown.

Although such investments are often done through funds, “direct” investments—private-market deals, or acquisitions of stakes in listed companies—are growing very fast, says Max Castelli of ubs, a bank. pif’s alone reached $18bn in the year to September, against $48bn for more classic “portfolio” investments. Sovereign-wealth funds have also begun to provide debt to finance large takeovers, including by buy-out groups. On April 4th pif disclosed that it had acquired dozens of stakes in private-equity firms themselves.

Sovereign-wealth funds can do all this because they now have the ability to manage investments. “Unless we have something extraordinary, we are forbidden from pitching anything to them,” says a European asset manager. adia has cut its workforce from 1,700 to 1,300 since 2021, but new recruits include a group of maths whizzes co-led by an Ivy League professor. The current hiring offensive suggests funds will grow more independent, retaining investment firms only for specific services and market intelligence.

Since last year sovereign-wealth funds have been dumping European stocks, to the benefit of America. But locals notice a newer eastward tilt. Gulf funds have created specialist teams to survey China, India and South-East Asia. “This is where they’re going to sell more oil, so they want to invest in industries that will use that oil,” says the boss of a large investment-banking franchise. And at a time when others are walking back from China, nervous of rising tensions with America, they are doubling down. “Our Gulf clients see an enormous opportunity to take space away from Western investors,” says the boss of a private-markets giant.

All of which points to an important plank in the sovereign-wealth funds’ new approach: advancing Gulf states’ strategic goals. One such objective has been to project soft power. pif may have lost a big chunk of the $45bn it invested in 2016 in the Vision Fund, a gigantic vehicle for tech investments that has been rocked by bad bets and market shocks. But the mammoth cheque did a great deal to raise Saudi Arabia’s profile among global investors, says one who recently opened an office in Riyadh. Funds are also setting aside capital to shower on neighbours, boosting their regional sway. pif has set up subsidiaries in Bahrain, Egypt, Iraq, Jordan, Oman and Sudan to deploy $24bn in the Arab countries.

A Vision of the Future! This picture taken on October 18, 2022 shows a view of solar panels at the newly-inaugurated al-Kharsaah solar power plant in Qatar. — Gas-rich Qatar inaugurated its first solar plant on October 18, which organisers of the World Cup have said will provide clean energy for its stadiums. The solar farm in al-Kharsaah, west of the capital.

Greater standing opens up fresh opportunities to invest in firms in “strategic” industries, including renewable energy. In October Mubadala, an Emirati sovereign-wealth fund, splashed $2.5bn on a German offshore-wind developer. qia bought 10% of rwe, a German utility, to help it acquire a solar business in America. These investments are often made with a view to reimporting knowledge or capital.

Last year Lucid, an American electric-car maker, some 61% of which is owned by pif, said it would build its first overseas factory in Riyadh. The fund plans to splash $38bn on gaming to try to bring entertainment to Saudi Arabia. Not all such bets turn out well. Saudi National Bank, owned by pif, lost 80% of its investment in Credit Suisse when the firm was acquired by ubs, undermining the Kingdom’s ambition to steer a global banker. Some sovereign-wealth funds are also being leant on to invest at home, so as to help economies cut their reliance on oil. pif is bankrolling futuristic Saudi settlements, including Neom, a new city in the desert, which the Kingdom’s rulers dream will one day be home to a floating industrial complex, global trade hub and luxury holiday resorts.

The best illustration of the sovereign-wealth funds’ evolving strategy is Abu Dhabi. Insiders say that adia, the uae’s oldest and starchiest fund, is getting less of the oil windfall than it used to enjoy. Instead, the lion’s share is going to adq, a four-year-old $157bn fund which snaps up firms in energy, food, transport and pharma—industries the emirate deems core to its security. Other cash is going to Mubadala, which had just $15bn in assets in 2008 but now oversees nearly $300bn. Originally heavy on commodities, its portfolio favours renewables and tech. Two-thirds of its investments are in private markets; a quarter are domestic. “There is no limit to their ambition,” says a dealmaker.

Blended Finance

These shifts are blurring the line between ruling families’ personal wealth and that of the sovereign. The fastest-growing funds tend to be run by royals, or members of their clan. In March Sheikh Tahnoon bin Zayed, the uae’s national-security adviser, was made chairman of adia (he already chairs adq; his brother will soon run Mubadala). More money is going on pet projects, often through special-purpose vehicles. New “family offices”, which manage the private wealth of the mega-minted, have joined the deal-fest. Armed with war chests “in the ten digits”, they routinely buy $500m-1bn stakes in single firms, says a local banker. It is becoming ever harder to see where oil money goes.

All this is bad news for the West. That it gets less of the bounty is the smaller problem. A murkier financial system makes it easier for funds to move around unnoticed. Financial sleuths reckon that a share of Russia’s oil earnings is deposited into banks in the Gulf, where it is mixed with dollars owned by others so as to become untraceable. More geopolitically astute petrostates also create the chance for wavering countries, like Turkey, to get financing outside of Western-led institutions, giving them an extra degree of freedom. Two decades ago, when sovereign-wealth funds became fashionable, many in the West worried they might be used to pursue political agendas. At the time, such fears were overblown. They now seem more reasonable—but few are paying attention. ■

— This article appeared in the Finance & Economics section of the print edition under the headline "A New Era of Petrodollar Power"

0 notes

Text

+27640409447 SSD CHEMICAL SOLUTION&ACTIVATION POWDER

+27640409447

BUY PURE 99% SSD CHEMICAL SOLUTION&ACTIVATION POWDER+27640409447 IN DUBAI, RIYADH, AMMAN, ISLAMABAD JAKARTA, , ABU DHABI, ANKARA, NUR-SULTAN, BAGHDAD, BAKU, BANGKOK, BEIJING, BEIRUT, BISHKEK, DAMASCUS, DHAKA, DOHA, HANOI, JERUSALEM, KABUL, KATHMANDU, KUALA LUMPUR, KUWAIT CITY, MALE, MANILA, MOSCOW, MUSCAT, NEW DELHI, PHNOM PENH, PYONGYANG, SANAA, SEOUL, SINGAPORE, TAIPEI, TASHKENT, TBILLISI, TEHRAN, TOKYO, ULAANBAATAR, YEREVAN, VIENTIANE, THIMPHU, NAYPYIDAW, LHASA, DUSHANBE, DILI, COLOMBO, BANDAR SERI BEGAWAN, ASHGABAT. BLACK CLEANING SOLUTION%ACTIVATION POWDER, TEMPERATURE CONTROLLERS ACTIVATION POWDER, BLACK CURRENCY CLEANING MACHINE, BLACK CURRENCY CLEANING, BLACK CLEANING AGENT, CURRENCY CLEANING SOLUTION FOR SALE, GENUINE CURRENCY CLEANING SOLUTIONS, LABORATORY&PARTNERSHIP, CLEANING BLACK CURRENCY FOR COMPANIES

BUY PURE 99% SSD CHEMICAL SOLUTION IN Kuwait, Bahrain Cyprus, Lebanon, Syria, Iraq, Iran, Israel, Jordan, Saudi Arabia, Kuwait, Qatar, Bahrain, United Arab Emirates, Oman, Yemen.

BUY PURE 99% SSD CHEMICAL SOLUTION&ACTIVATION POWDER China, India, Indonesia, , Bangladesh, Japan, Philippines, Vietnam, Iran, Thailand, Myanmar, South Korea, Uzbekistan, Malaysia, Yemen, Nepal, North Korea, Sri Lanka, Kazakhstan, Cambodia, Azerbaijan, Tajikistan, Israel, Laos, Kyrgyzstan, Turkmenistan, , Georgia, Mongolia, Armenia, Timor-Leste, Cyprus, Bhutan, Maldive, Brunei.

This is solution for anti-breeze bank notes, designed to remove excess coated substance. This universal solution work better when combine with activation powder. You will be amazed by the power and rapidity of this solution. It is capable of cleaning notes currency with breeze capacity

SSD Solution is the main chemical used in cleaning stained and coated currency. It is mainly found in 1 litre, 1,5litre and two litre metal insulated containers. it is necessary to keep it in such SSD Solution is a milky white liquid chemical Compound used in the cleaning and delivproducts to buyers destinations afte notes, ta conhulishemical compound can be enhanced by adding other catalyst oxides and can be diluted with paste to increase its pool of cleaning, to increase the number of bills you are to clean.

We lead the industry in cleaning bank stained currency. We have great Automatic laser V-Q 375 Machines to do the large cleaning and delivery of products to buyers destinations after a consultation fee Countries like, American, united kingdom, Europe, Africa, Middle east And Many More.

Black currency cleaning machine suppliers, Full Automatic Curency Cleaning Machine For All Ction fee Countries like, American, united kingdom, Europe, Africa, Middle east And Many More.

Black currency cleaning machine suppliers, Full Automatic Curency Cleaning Machine For All Currencies, black money cleaning machine for sale, money cleaning machine price, black dollar cleaning machine for sale, black dollar cleaning machine in india, how to clean black money with vitamin c, how to wash black money, black dollar cleaning chemical formula, Activation powder & ssd solution, Blacrrency, stain adefan d bcleanine ssd chemical solution laboratory contact or call directly on we supply the latest automatic ssd, universal chemicals, activating powders and specialize in cleaning all types of defaced notes, black notes

Black currency cleaning material, We sell this Solution used to clean all type of black and any color currency, stain and defaced bank notes with any others equipment being bad. Our technicians are highly qualified and are always ready to handle the cleaning perfectly. Our Chemical is 100% pure. Black currency cleaning chemical We clean all currencies like the Euro, USD, GBP and many other currencies.+27640409447

We are the major SSD solution suppliers in South, Central and North America, Europe and Oceania for black dollar cleaning, black money cleaning chemicals. We have in stock, 100% concentrated SSD solution for sale and our SSD solution price is affordable based on company rates.

We are renowned as a worldwide certified manufacturer for SSD solution chemical for sale purposes that provides a quality cleaning solution. We are the largest provider of cleaning chemical solutions which are used for black dollar cleaning chemicals recommended by all the qualified and skilled technicians in cleaning black money

Call/Whatsapp: +27640409447

Email [email protected]

0 notes

Text

New Post has been published on All about business online

New Post has been published on http://yaroreviews.info/2022/12/cutting-energy-prices-will-take-years-power-boss

Cutting energy prices will take years - power boss

Getty Images

By Jonathan Josephs

Business reporter, BBC News

It “will take years” to get energy prices back to pre-Ukraine war levels, the boss of one of the world’s biggest energy firms has told the BBC.

Enel’s Francesco Starace said bringing prices down depends on new sources of energy such as renewables and heat pumps.

Governments across Europe are spending billions helping business and households afford energy bills.

They are also scrambling to secure new supplies.

Mr Starace said the company, which produces and distributes electricity and gas, tried to shield its 20 million European customers from energy market volatility this year.

It did its best to stick to the fixed-price contracts it had agreed, he said.

Breaking customer trust would inflict greater damage on the firm than a hit on one year’s results, he said.

The Italian energy giant sells power to more than 70 million homes and businesses in over 30 countries.

Germany helps pay energy bills as prices soar

High UK energy bills blamed on decades of mistakes

Why is there a global energy crisis?

But Enel is planning to leave many of those countries as it focuses on renewable energy and becoming carbon neutral by 2040.

It also wants to cut its huge debts of around $63bn (£52bn).

It is investing heavily in making solar panels as it expands an existing factory in Sicily and builds a new one in the US.

Getty Images

Soaring energy prices have been the biggest contributor to inflation and the cost of living crisis in the UK, the US and the eurozone.

The global energy crisis triggered by Russia’s invasion of Ukraine “showed very clearly how dependence on one single source of energy is dangerous for Europe”, Mr Starace said.

The future will be “extremely decarbonised” and depend on nuclear and renewable energy, he said.

However, that shift to renewables also has risks.

In July, the International Energy Agency said that China’s dominance of solar and wind turbine production creates “potential challenges that governments need to address”.

Mr Starace said the West has been over-reliant on China for renewables and other goods.

“Some rebalancing needs to be happening because it is healthy,” he said, when asked about geopolitical tensions interfering with energy supplies.

This has helped drive Enel’s investment in solar panels, although the expansion of the Sicilian factory will still meet only 10% of Europe’s needs, he said.

This video can not be played

To play this video you need to enable JavaScript in your browser.

Political leaders have also acknowledged that Europe needs to get its energy from more places.

According to the European Council on Foreign Relations, the EU and its member states have signed 56 energy deals with 23 countries this year.

Among the latest was a 15-year deal for Germany to get liquefied natural gas (LNG) from Qatar through a contract with ConocoPhillips.

Norway is also boosting natural gas production and the world’s biggest producer, the US, has been pumping out record amounts.

This means the chances of Europe repeating its dependence on Russia with another country are “quite low”, according to Megan Richards, a former director of energy policy at the European Commission.

“A lot of work has been done” to replace Russian energy, she added, before warning: “I think Europe will not be completely domestically independent for a very, very long time, if ever” even though “renewables will increase dramatically”.

You can watch Francesco Starace’s interview in full on Talking Business with Aaron Heslehurst on BBC iPlayer.

More on this story

Shares rise on hopes cost-of-living crisis easing

11 November

Energy bill help for all is too costly – World Bank

26 October

US suggests Russia could be behind gas pipe leaks

30 September

0 notes

Text

[ad_1]

General view of Emirates NBD Bank on January 3, 2017 in Dubai, United Arab Emirates.Tom Dulat | Getty ImagesDUBAI, United Arab Emirates — Banks with publicity to Turkey have confronted losses ever for the reason that nation's forex started steeply depreciating in 2018; now, lenders in a number of oil-rich Gulf states specifically are set to take successful within the subsequent 12 months due to their hyperlinks to the nation, in accordance with a latest report by rankings company Fitch.Banks within the Gulf Cooperation Council — that is Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the United Arab Emirates — with Turkish subsidiaries needed to undertake "hyperinflation reporting" within the first half of 2022, Fitch wrote this week, as cumulative inflation in Turkey during the last three years surpassed a whopping 100%. Fitch calculates that GCC banks with Turkish subsidiaries posted internet losses of roughly $950 million on this 12 months's first half. Among the toughest hit had been Emirates NBD — Dubai's flagship financial institution — and Kuwait Finance House, the second-largest financial institution in Kuwait. Turkish publicity for Kuwait Finance House and Emirates NBD is 28% and 16% of their property, respectively. Qatar National Bank was additionally amongst these affected."Fitch has always viewed GCC banks' Turkish exposures as credit-negative," the rankings agency wrote. "Turkish exposures are a risk for GCC banks' capital positions due to currency translation losses from the lira depreciation."The lira has misplaced 26% of its worth in opposition to the dollar year-to-date, making imports and the acquisition of fundamental items far more difficult for Turkey's 84 million residents. Why is Turkey's forex falling?This time 5 years in the past, one greenback purchased roughly 3.5 Turkish lira. Now, a greenback buys about 18 lira. The slide started as Turkey's economic system grew quickly however its central financial institution declined to boost rates of interest to chill rising inflation. That and issues like a worsening present account deficit, shrinking overseas trade reserves and rising power prices — plus occasional spats with the U.S. that almost resulted in sanctions on Turkey — pressured the forex additional. Turkish lira and U.S. greenbackResul Kaboglu | NurPhoto through Getty ImagesEconomists overwhelmingly blame Turkish President Recep Tayyip Erdogan, who has vocally rejected the thought of elevating charges and has known as them the "mother of all evil," and who traders blame for throttling the central financial institution's independence. If a central financial institution chief went in opposition to Erdogan's coverage of protecting charges low, they had been ultimately changed; by the spring of 2021, Turkey's central financial institution had seen 4 totally different governors in two years.Erdogan's authorities has as an alternative devised different strategies to attempt to prop up its forex and enhance income, like promoting its FX, imposing strict rules on lira loans, and improving relations with wealthy Gulf states to attract investment. The UAE and Qatar have each pledged billions of dollars of funding in Turkey's economic system. Billions in lossesIn mid-August, Turkey shocked markets by lowering its key interest rate by 100 foundation factors — from 14% to 13% — regardless of inflation at practically 80%, a 24-year excessive. With little answer to the lira's woes in sight, the banks with Turkish publicity are set to see extra hassle, analysts say."We calculate that GCC banks' aggregate currency translation losses through 'other comprehensive income' were USD6.3 billion in 2018–2021, mainly due to lira depreciation," Fitch wrote, including that the whole internet revenue of the banks' Turkish subsidiaries, in the meantime, was simply over half that quantity at $3.3 billion. "We expect currency losses to remain high until at least 2024 due to further lira depreciation," the company wrote.

President of Turkey, Recep Tayyip Erdogan, arrived in Abu Dhabi as a part of his go to to the United Arab Emirates on February 14, 2022 in Abu Dhabi, United Arab Emirates.Presidential Press Office | dia pictures through Getty ImagesStill, Fitch does not see itself having to downgrade the viability rankings of the GCC banks which have Turkish subsidiaries, because it says "those banks have good loss-absorption capacity."It additionally does not count on them to go away Turkey altogether, largely as a result of there aren't sufficient potential patrons, regardless of Turkish banks buying and selling at half of their unique ebook worth."GCC banks would be willing and able to provide their Turkish subsidiaries with financial support, if needed, and this is reflected in the ratings of the subsidiaries," Fitch wrote, including that its outlook for his or her publicity stays credit score unfavourable specifically because of the rising danger of presidency intervention in Turkish banks.

[ad_2]

Source link

0 notes

Text

Sunday, July 31, 2022

California exodus continues

(Los Angeles Times) After living in the Bay Area for nearly seven years, Hari Raghavan and his wife decided to leave for the East Coast late last year. They were both working remotely and wanted to leave California because of the high cost of living and urban crime. So they made a list of potential relocation cities before choosing Miami for its sunny weather and what they perceived was a better sense of safety. Raghavan said that their Oakland house had been broken into four times and that prior to the pandemic, his wife called him every day during her seven-minute walk home from the BART station because she felt safer with someone on the phone. After moving to Miami, Raghavan said they accidentally left their garage door open one day and were floored when they returned home and found nothing had been stolen. California ranks second in the country for outbound moves—a phenomenon that has snowballed during the pandemic, according to a report from the Federal Reserve Bank of Chicago, which tracked data from moving company United Van Lines. Between 2018 and 2019, California had an outbound move rate of 56%. That rate rose to nearly 60% in 2020-21. California lost more than 352,000 residents between April 2020 and January 2022, according to California Department of Finance statistics.

Death Toll Rises in Devastating Kentucky Flooding

(NYT) Shirley Stamper, 74, awoke to the sound of wild banging beneath her house. Floodwaters were swallowing her remote mountain community and Ms. Stamper, along with her mother-in-law, Ethel Stamper, 94, needed to get out, immediately. The rain continued to fall in parts of eastern Kentucky on Friday, and creeks and rivers were still swelling. But where the floodwaters were receding, the destruction of the past two days was coming slowly but dreadfully into view. At least 25 people had died, according to reports from the governor’s office and local officials. In the rugged topography of central Appalachia, many places were still cut off on Friday, and determining the toll of devastation could take weeks. There was more rain in the forecast for early next week, adding even greater urgency to rescue efforts. “We’ve got to act quickly after the water recedes tomorrow,” Mr. Beshear said, “certainly before it rains again.” In Breathitt County, Jeffrey Noble, the judge executive, said the storm and the flooding had knocked out the phones for miles around. “They’re saying around 250 people are missing,” he said. “I don’t even want to talk about deaths. “Homes are washed away, communities are washed away, roads are washed away,” Mr. Noble said. “I’ve heard of hundred-year floods, but this is way beyond that. In the history of Kentucky, our county has never seen anything like this.”

Britain’s trains disrupted in second widespread rail strike in a week

(Reuters) Around 5,000 train drivers across almost a quarter of Britain’s rail network went on strike on Saturday, as part of a campaign for higher pay after the country’s inflation rate hit its highest in 40 years. The 24-hour strike organised by train drivers’ union ASLEF is the second significant industrial action this week on Britain’s rail network, after 40,000 members of the RMT and TSSA unions—which represent other rail staff—held a major strike on Wednesday. Soaring inflation—consumer price inflation is currently 9.4%—and patchy wage rises have exacerbated labour tensions across sectors including postal services, health, schools, airports and the judiciary.

Europe’s Race to Secure New Energy Sources Is on a Knife’s Edge

(NYT) As Russia tightens its chokehold on supplies of natural gas, Europe is looking everywhere for energy to keep its economy running. Coal-fired power plants are being revived. Billions are being spent on terminals to bring in liquefied natural gas, much of it from shale fields in Texas. Officials and heads of state are flying to Qatar, Azerbaijan, Norway and Algeria to nail down energy deals. Across Europe, fears are growing that a cutoff of Russian gas will force governments to ration fuel and businesses to close factories, moves that could put thousands of jobs at risk. So far, the hunt for fuel has been met with considerable success. But as prices continue to soar and the Russian threat shows no sign of abating, the margin for error is thin. “There is a very big and legitimate worry about this winter,” said Michael Stoppard, vice president for global gas strategy at S&P Global, a research firm.

A disputed blast kills Ukrainian P.O.W.s

(NYT) Russia and Ukraine traded blame for an explosion at a prison camp in the Russia-occupied eastern Donetsk region that killed at least 40 Ukrainian prisoners of war. The attack took place yesterday in the town of Olenivka, where Russia is holding thousands of Ukrainian prisoners of war. Russia’s defense minister claimed that Ukraine had used a U.S.-made High Mobility Artillery Rocket System, or HIMARS, to strike the prison. Ukraine’s motive, Russia said, was to intimidate Ukrainian soldiers who might consider surrendering. Ukraine rejected the claim, accusing Russia of bombing the facility to hide evidence of torture and extrajudicial executions and calling it a false-flag operation to discredit Ukraine.

North Korea claims no new fever cases amid doubts over COVID data

(AP) North Korea on Saturday reported no new fever cases for the first time since it abruptly admitted to its first domestic COVID-19 outbreak and placed its 26 million people under more draconian restrictions in May. There have been widespread outside doubts about the accuracy of North Korean statistics as its reported fatalities are too low and its daily fever cases have been plummeting too fast recently. Some experts say North Korea has likely manipulated the scale of illness and deaths to help leader Kim Jong Un maintain absolute control amid mounting economic difficulties. The North’s anti-epidemic center said via state media it had found zero fever patients in the latest 24-hour period, maintaining the country’s total caseload of about 4.8 million. Its death count remains at 74, with a mortality rate of 0.0016% that would be the world’s lowest if true.

China announces military exercise opposite Taiwan