#i have so many stories from that pmg

Note

Seeing Twitter users recommending the People Make Games documentary as a good way to get insight on the issue is so….

I know, I’m always extremely disappointed whenever I come across someone who thinks it’s the end all be all explanations regarding the Studio ZA/UM situation.

Recommending that video always comes with a heavy caveat from me that the person needs to stop around the 40 minute mark since the interviewer shows a very clear bias that’s unbecoming of a journalist.

Regardless, now that more people are finding out about these layoffs, which might take out members of the studio that have been there since the beginning, it could finally help smack some sense into those Twitter users that actually thought, FOR SOME REASON, Rostov, Kurvitz, and Hindpere were lying for shits and giggles rather than seeing what's ACTUALLY going on which is that the investors have a very obvious agenda against the real wronged party. Hopefully this'll also open their eyes to how the People Make Games video fed into this twisted narrative that Kurvitz was somehow at fault/responsible for the theft of his own IP, but that might be asking too much from their concrete brains. Here's hoping though!

#disco elysium#studio za/um#za/um#people make games#and I’m not even getting into Bratt’s response to the criticism he got#this man deleted so many YouTube comments that pointed out the inconsistencies and bias#it’s such a reddit conspiracy theory but at the time I briefly thought Kompus paid him off to push the narrative in his favor#now I’ve talked about this before in a post from almost a year ago#but i truly believe Bratt’s heart was initially in the right place but let his anger cloud his judgement#after kurvitz rightfully denied him a way to wrap up his video in a neat little bow cause he knew the studio would use his words against hi#something in Bratt must've snapped cause all the blame got pushed on Kurvitz for no reason other than he felt slighted by his response#it's kinda tainted PMG's work for me b/c moving forward I'll have doubt if the story truly is being accurately reported#my response#mp

221 notes

·

View notes

Text

- the devil is in the details.

┈⋆⭒ daniel ricciardo x fem!reader [1.2k]

┈⋆⭒ part 1 !

.𖥔 ݁ ˖ ⎯ find all parts here!

.𖥔 ݁ ˖ ⎯ blurb: you knew him before he got famous, he got famous, you got a job. now years later, your job just so happens to be near him, but how will this fare on the way you left things years ago?

.𖥔 ݁ ˖ ⎯ chapter contents: nothing, literally nothing

.𖥔 ݁ ˖ ⎯ future warnings: will be smut. ( will probably be very filthy ). will be angsty, will be periods of niceness, maybe fluff but i’m a cold hearted bitch so.

.𖥔 ݁ ˖ ⎯ brief background: this is not a y/n story i’m sorry i cant do that. so its an original character her name is dylan tait, she was born in perth but lives in melbourne, okay mwah. this is based from the years 2018-2021, but there will be flashbacks, but i’ll try and make the timeline as easy as i can to follow. i’m not all knowing about formula one, yes i know things, but if i don’t know the real scientific names just shush. ty.

.𖥔 ݁ ˖ ⎯ a/n: his is a multi part fic and will probably be long LOL

present day: december 1st, 2017

you could feel your sweat slowly beading on your skin as you walked towards the mercedes building, holding the folder with all the things they said were required to secure the job. it was terrifying, absoultely nerve wracking, you’ve been to many job interviews in your life, but this one. this would be the worst, you were sure of it.

you were grateful as you opened the door and were hit with the freezing cold atmosphere of the waiting room, waiting to meet with the man who you had heavily engaged with over email, but never face to face. you sat there for an appropriate amount of town, recalling your rehearsed answers for the reasons you’d be good for the job etc, your experience, where you went to university, where you got your masters, your (acceptable) hobbies, how you work as a team, how you work individually. all the good stuff.

this calmed your nerves a bit and when the man opened the door and ushered you inside, shaking your hand introducing himself and gesturing to the folder of documents under your arm, you felt slightly more at ease than before.

the interview went as well as you could’ve hoped, he was impressed with your interest and experience in engineering at such a young age (27). you even managed to ease in your (slightly exaggerated almost) fluency in german, which he was loudly impressed with and responded “toto will love that”.

you left with a “thank you so much for this opportunity” and a “i’ll be in contact soon, thank you again”.

you couldn’t help smiling as you left, feeling proud of how you managed to not mess anything up initially. having a job in f1 being a dream of yours and working for mercedes. well shit. who wouldn’t dream of this. you’d applied for performance engineer, but wouldn’t be surprised if you got control engineer instead. the reminder that you were a woman in engineering applying for a widely male dominated area was a common unfriendly reminder, but that was honestly apart of the appeal.

“grace” you say

“GRACE grace grace grace”

“yes what i just woke up” she groaned

shit you forgot about time zones

“oh sorry, yeah, love you- anyway.”

you paused a bit

“I JUST HAD THE INTERVIEW AND IT WENT REALLY GOOD”

you heard some shuffling and then

“PMG SHIT YES I DIDNT. I FORGOT IT WAS TODAY, OMG FUCK YES YSS YES FUCKING MERCEDES FPRMULA ONE EMGINNER COMING THEOUGH HOLY SHIT”

“i know, i think i’m gonna scream when i get in my car”

“i don’t blame you”

“i just cant believe it, you know you have to fly over and visit me sometimes”

“hmmmm with what money dyl “

“i’ll literally pay for you once i’m a millionare, because you’ll still be my only friend”

“oh shut up”

“love you”

“i’m going back to sleep now, you’re amazing, have a drink or two for me, good whatever time it is there, you’re amazing”

“bye love you bye”

that was probably the cheesiest thing you’d done, admittedly, but what else does one do other than call their only friend on the other side of the world after a good interview.

——————————————————————————

3 days later:

there was still no response back about the job and honestly you were losing hope slightly. albeit finding ways to justify the belated response. because maybe, yes, you were being slightly impatient. but staying in london of all places by yourself, isn’t that much fun, you mainly just drank and took photos and than went back to your hotel, ( lamely ) reviewed blue prints of engines and aerodynamic rules or alternatively watched a documentary about the job you applied for. your days were blurry and you’d haven’t given much thought to the job you’d taken forcing the proximity of coming back into contact with your once good friend (complicated) daniel ricciardo until one night, after youd had your couple drinks and was on your walk home that his name “dannnnnniiieeellll🥸” illuminated your screen, the same contact name he set for himself approximately 7 years ago. you needed to change that, jesus. you didn’t really know what to do, but not answering at all was probably worse and you were drunk and hadn’t talked to anybody apart from grace and the interview man all week.

you pause your unsteady walk and swipe the screen and bring the phone to your ear, waiting for him to say something. but after he’s quiet for what felt like too many seconds you can’t help yourself.

“helllllloooooooooooooo”

“dan’el” the slur in your voice unmissable when you say his full name.

“hey” he says, flat and fast.

your swaying had been worse than you’d imagined when you’d brushed shoulders with someone, turning your head over your shoulder.

“oh, sorry”

“no problem love” tone thick with beer and blokeness.

the phone hanging at your leg brought back up to your ear to hear a small laugh, familiar and rhythmic and then.

“are you in london?” his first full sentence and the first multiple words he’s actually said to you in years.

“what how do you-“

“yes i’m in london” i give up

he hums in response,something you hated about him, the constant inability to shut up.

“why do you care” you say notebly less bitter than you mean.

“haven’t talked in a while”

“oh really”

you look at your messages, texts from you all left on delivered or read:

************ ************ ************ ************ *****

sun may 29. 2016

hey dan just wanted to reach out and say what happened in monaco was so unfair, i know your hurting you deserved that win. i’m here if you need.

july 1. 2016

happy birthday dan, getting so old

hey, tough day, wanna call?

sun. oct 2016

hey just finished watching, first malaysian win and against roseberg too, proud of you, !!!!

nov. 2016

i cant do this anymore, can you please talk to me?

i’m sick of this shit

dec. 2016

i miss you so fucking bad

(1) missed call from “dannnnnniiieeellll🥸”

feb. 2017

i’m gonna be in perth next month, can we please talk

(1) voicemail left

——————————————————————————

“yeah i know” he says, you can see him tugging his hair, frustrated, a small groan leaving his mouth

“okay im hanging up, i’ve tried talking to you, i don’t know what what you want” this isn’t fair for you.

“no- just- quickly- are you working at mercedes?”

you stop walking. what, how did he-

“uhhhh— no” you squeeze out, feigning as much honesty as you can.

“really?”

“hmmmmm” you pretend to ponder your answer

“goodbye daniel” it’s all you can muster up to say your self control nearly snapping everytime he speaks

“wait-“

you hang up, before he can squeeze another word in, before he can say anything that might bring back an inkling of what you felt for him, what you still feel for him. you can’t do it, not tonight.

(1) new voicemail from “dannnnnniiieeellll🥸”

god you need to change that name.

you’ll listen to it in the morning, not sure you’ll fully process it, in the state you are. you put your phone away, get to your hotel and go to sleep. thankfully.

#daniel ricciardo#f1#f1 fic#daniel ricciardo fic#daniel ricciardo angst#daniel ricciardo smut#daniel ricciardo x you#daniel riccardo x reader#daniel ricciardo imagine#f1 2023#f1 x you#f1 x reader#Daniel Ricciardo series#lando norris

177 notes

·

View notes

Text

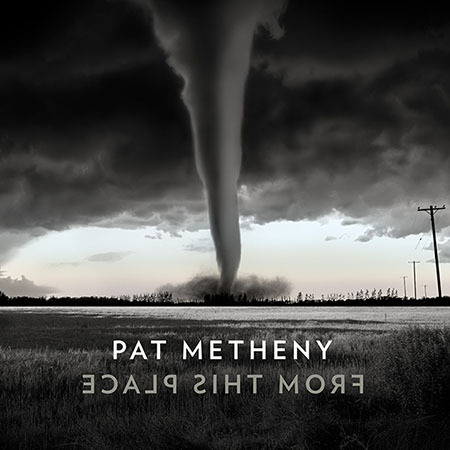

A deeper look at: Pat Metheny: From This Place (Nonesuch/Metheny Group Productions, 2020)

Pat Metheny: guitars, keyboards; Gwilym Simcock: piano; Linda May Han Oh: bass; voice, Antonio Sanchez: drums with the Hollywood Studio Symphony conducted by Joel McNeely. Special guests: Luis Conte: percussion; Gregoire Maret: harmonica; Meshell Ndegeocello: vocals.

This review is dedicated to the memory Lyle Mays (1953-2020). Your brilliance, and contribution to Metheny’s music, and the world of music as a whole will never be forgotten.

Pat Metheny enters a new phase of his career and era with From This Place. The guitarist has been regularly performing for the past several years be it with the stellar quartet that graces this release, Welsh pianist Gwilym Simcock, Malaysian-Australian bassist Linda May Han Oh and drummer of choice, Antonio Sanchez, in addition to duos with bass legend Ron Carter, and the experimental Side Eye project prominently featuring acclaimed up and coming young musicians. However, From This Place is the guitarist's first recording in six years since Kin (↔) with the Pat Metheny Unity Group. To round out the core group, Metheny enlisted Metheny Group alumni Luis Conte on percussion, in addition to harmonica ace Gregoire Maret who played on and toured behind The Way Up. The guitarist also welcomes back arranger Gil Goldstein to the fold who appeared on Secret Story as well as the tour that followed, and the legendary Alan Broadbent. Meshell Ndegeocello sings on the title track with lyrics written by her partner Alison Riley.

Metheny has been no stranger to touring and constant playing, although the 66 year old has scaled back his once massive nearly year round touring schedule to about 150-200 dates around the world to accommodate family life, the fact that From This Place is the first album in six years is a bit of anomaly in his release history. The music industry has rapidly changed in recent years: the rise of streaming sites like Spotify, Amazon HD Music, and Qobuz in addition to Youtube has changed the way the public consumes music. CD sales have rapidly declined, although they still outsell vinyl, which is continuing it’s resurgence. Metheny has been an example of an artist where physical releases are truly special, almost an event. Going back to his days on ECM, he has always benefited from striking cover art, often being involved directly in the process itself, something rare nowadays. He has adopted not only streaming, but usage of Bandcamp and offers up audiophile high resolution mastering of the new recording on platforms like HD Tracks and Pro Studio Masters, though the advent of Youtube almost a decade ago and frequent camera phone videos (as well as bootlegs in general) have been an impediment to the guitarist and thus resulted in the controlled studio environments that spawned The Orchestrion Project and Unity Sessions video and album releases reflective of how he approached the music live on tour.

The guitarist has also in the past decade drastically changed his approach to music. While his recordings with the Pat Metheny Group featuring co founder, keyboardist and writing partner, the late Lyle Mays were and continue to be his most popular works balancing complex forms with memorable melodies. Since the PMG's final recording The Way Up in 2005, the guitarist has focused on increasingly complex, harmonically dense music that has entered new arenas. This music, featured on albums like Orchestrion, Tap (where he played the music of John Zorn) and Kin(<->) while bearing his inimitable melodic stamp, if one were to peruse various internet discussions, some fans felt that these albums had a higher barrier of entry and wished for more melodic material-- while all these albums, plus Unity Band featured exemplary writing, occasionally the melodies took their time to unfold. While many of these melodies contained Metheny’s unmistakable essence, From This Place for the most part, goes back to where his melodies are instantly memorable and singable. Because the album features backing from the Hollywood studio symphony, in addition to the core quartet, some listeners may automatically assume it is a direct sequel to Secret Story, the album is anything but. Though it at times conjures moods of the earlier album, the similarities end beyond surface comparisons. The fact is Metheny has moved far beyond that period in his writing, and improvisational abilities, and his writing is the best it's ever been. The album is somewhat of a career summation, but like many others in his discography like Speaking Of Now, or Imaginary Day, the contents also show a new path forward. This album is firmly rooted in the interplay and solos of a quartet, as Unity Band was, though the the backing of the orchestra, with arrangements centered on what the quartet played, change the complexion considerably. It is also the first time the guitarist has had a pianist for a foil in his own bands since Lyle Mays.

The genesis for how this music came to be is fascinating. Around December of 2017, Metheny went into the studio with Simcock, May Han Oh and Sanchez, and laid down sixteen new compositions, of which ten are on this release. As the music began to be played, he began to hear things inside of it that had yet to be manifested. The guitarist had logged considerable road time with bassist Ron Carter, whom he played several duo gigs. During the travel time, Metheny asked Mr. Carter, a lifelong hero of his about the process of playing in the Miles Davis Quintet from 1963-1968-- more specifically, why did they stick to Davis' standard book in concert? The bassist has frequently described the nightly experiences of playing with Davis as being a laboratory, and they developed a certain code on the bandstand, where through playing standards, they were able to use said code in the creation of new music in the studio.

From that inspiration, Metheny toured the quartet on the road playing selections from his vast songbook. They too, would use their own code, something not entirely unfamiliar. After all, the first recording that Antonio Sanchez participated in was Speaking of Now (2002) with the Pat Metheny Group, and that album, like From This Place was an evolutionary album, which set the stage for the larger territory tackled in The Way Up. The seeds sown in the compositional processes found there would be in Orchestrion and Kin (↔). The present quartet has really inspired him, and arguably is closest in conception and flavor to the original PMG in terms of broad stylistic conception. Longtime Metheny fans who have been at shows in that period, or in collector's circles are quite familiar that the early PMG experimented with new tunes before recording, including standards into the set list as well as playing fan favorite tracks. Something quite similar to the current quartet. As Metheny explained vis a vis the approach to add orchestration to flesh out the playing of the quartet he notes:

As much as folks might describe the sonic language of the avant-garde movement of the sixties as falling into an identifiable generic sound, I have always regarded the general expansion of creativity of that era in a more ecumenical way.

The stylistic changes that occurred then in our community included not only the obvious examples of individual players utilizing extended techniques on their instruments in new ways, or new types of ensembles, but also the wildly new approaches that technology, particular recording technology, offered.

Multi-track recording allowed for entirely new kinds of music to be made.

It is unlikely that the recordings of the CTI label of that time would likely never be thought of as “avant-garde” by garden variety jazz critics of that (or probably any other) era. But from my seat as a young fan, the idea of an excellent and experienced arranger like Don Sebesky taking the improvised material of great musicians like Herbie Hancock and Ron Carter and weaving their lines and voicings into subsequent orchestration was not only a new kind of arranging; it resulted in a different kind of sound and music.

It was a way of presenting music that represented the impulses of the players and the improvisers at hand through orchestration in an entirely new way. I loved those records.

This will not be the first recording of mine where that equation—record first, orchestrate later—has come up. But it is by far the most extensive one, and I would offer the most organic. From the first notes we recorded, this was the destination I had in mind.

Don Sebesky's arranging skills, found on recordings such as First Light (1971) by Freddie Hubbard, Sunflower (1972) by Milt Jackson and his own Giant Box (1974) illustrate the approach Metheny had in mind. The track “Wide and Far” is not the first Metheny track to feature an overt homage to the CTI sound. “So May It Secretly Begin” from the classic (Still Life) Talking (1987) was also an Sebesky homage, particularly in the rich Synclavier string arrangement, but “Wide and Far” positioned as the second cut on From This Place takes that arranging influence to a far deeper level. The melody is simply prime Metheny, with string, reed and brass sections that in some ways are reminiscent of Freddie Hubbard's Sky Dive (1972) album. The guitarist, spurred by Sanchez's liquid ride and May Han Oh's of the earth bass takes an inspired solo, amidst soaring orchestral harmonies. There is a deep in the cut funkiness aspect of Metheny's playing here that not only exhibits the sheer joy of playing with this special class of musicians, but his nods to George Benson here appear more overt than they did on “Here To Stay” from the Metheny Group's We Live Here (1995). It is a beautiful homage, and the handoff to Gwilym Simcock on the bridge section is seamless, where the pianist weaves, fresh lines in his very individual voice. The Welsh pianist was a late bloomer to the jazz world, as he began playing the music in his twenties. Over the course of two decades with associations such as former reedist with Chick Corea's Origin, Tim Garland and the Steve Rodby produced Impossible Gentlemen, Simcock has been one of the most in demand pianists. During the quartet's 2017 performance at the Beacon Theater it was amply evident how much the guitarist enjoyed having a pianist against as co conspirator and solo voice. The quality is evident in spades on From This Place and one wonders the possibilities were Metheny and Simcock to become co writers. Also in the Davis Quintet mold, Metheny had each member have input on the material and three of the four members arrange pieces, save Sanchez who acts as an arranger in real time crafting colors and textures based on what the music calls for. While the recording has several trademark cinematic numbers, perhaps none so than “America Undefined” a defiant statement against the election of Donald Trump as U.S. President. The piece draws on the more complex material found on Orchestrion and Kin (↔). Linda May Han Oh, a wonderful leader and composer in her own right, most recently used strings in provocative ways on her latest work Aventurine, and brings that deep orchestral awareness and attention to shading found in her own work to From This Place.

A Sanchez cymbal roll leads into May Han Oh's ascending arco bass melody, which bears some similarity and extends on a bit, the post solo interlude section of the Kin (↔) title track featuring Giulio Carmassi's ascending vocals in tandem with guitar in piano. May Han Oh's arco melody sets a prominent melodic thread through the piece, and Metheny adds signature hollow body guitar over a rubato foundation that gives way to him once again stating the melody with orchestra behind him in a 5/8 time signature. During the melodic statement, Simcock and May Han Oh play a stunning unison counterpoint line, reminiscent of Bach. Simcock's piano solo begins with the rubato foundation, Sanchez adding provocative rim clicks and fascinating comping underneath. From there, Simcock is vaulted into a burning 4/4 swing and samba section sans bass drum accents, the orchestra reminding listeners of the melodic cel behind them. Simcock's solo is filled with vigorous single note ideas, he is a devotee of Metheny's entire catalog, also bearing out why he is an evolution in Metheny's concept of a pianistic foil—something the guitarist clearly relishes. Metheny follows with a soaring, inspired hollow body solo, the orchestra's harmonies providing a huge lift.

May Han Oh returns with the initial melodic figure at the top, and then around 8 minutes into the piece, what sounds like Orchestrion vibes introduce a much darker, brooding mode. Shades of the sound effect and musique concrete driven sections of “As Falls Wichita, So Falls Wichita Falls” are here, with some of the strangeness of the soundscape section of “Are We There Yet?” from Letter From Home in terms of eerie sounds wafting in and out of the mix. The sounds of clunking, and railroad tracks dominate as the strings remind of the melody once again, May Han Oh's thunking pedal point from earlier in the composition is yet another thematic thread. Metheny uses slide and ebow guitar as a constant distant drone, and provides disembodied strands of further distanced electric guitar in the sound stage bouncing between speakers (or headphones). At first listen it seems to be a call back to “Cathedral in a Suitcase” from Secret Story (1992), but upon further listens is more reminiscent of the distorted guitar deeply embedded into the mix at the start of “Psalm 121” on the soundtrack of The Falcon And The Snowman (1985). The bluesiness of these disembodied lines somehow evokes uncertainty, and the loud bells of a railroad sign, as the orchestra spins variations on the main theme, let you know something is coming. Suddenly, Sanchez' slightly gated drums, a not so subtle Phil Collins and 80's production reference, and reminder of Steve Ferrone's toms on “Cathedral in a Suitcase” thunder in, to the sound of a loud train whistle, panning through the speakers. Sanchez's driving, John Bonham inspired rock beat along with the symphonies' restatement of a portion of the melody makes things truly epic. The five minutes of orchestral investigation is truly thrilling and shows how deep of a writer Metheny has become. Indian flavored strings play portamento glissando with microtonal elements, like those used on “Within You, Without You” from The Beatles are an unexpected but pleasant element in a breathtaking finale. The piece dies down with the fluttering of castanets, like birds flying away in a flock, eerie sampled vocal sounds in the left channel, fluttering and processed abrupt flutes and strings. It's an unexpected end to a piece using some variant of a sonata form but never resolves itself completely. Make no mistake about it, the piece is foreboding and dark, tapping into a new area of Metheny's writing, but strangely, there is also a trace of hope.

“You Are” is one of the most striking offerings on the recording. Since Bright Size Life (ECM, 1975) on every album, the guitarist has had a melodic idea that his pushes to the breaking point through motivic development. Simcock's piano quietly begins the track doubled by chiming orchestra bells, a tip toeing two note figure is stated in unison, with sparse brushed cymbal work from Sanchez. Metheny's dark hollow body tone announces the melody, as the two note figure is enhanced by a wall of synthesizers, and strings. May Han Oh's soprano voice is added to the density as she and Metheny state an arresting three note idea that builds and builds to a dramatic climax, before gentle strings sing in hushed tones as the original two note motif returns to close the piece.

Flutes double May Han Oh's resonate bass for the gentle melancholic theme of “Same River”. The acoustic sitar guitar makes it's first appearance since “Wherever You Go” from Speaking of Now, and Metheny's double tracked guitar and sitar make use of one of his favorite devices, the glissando. Simcock plays a tasteful brief piano solo before the guitarist takes a trademark flight on Roland GR300 guitar synth, gorgeous ascending french horn and string harmonies-- the CTI reference is indeed very clear in this track with strong doses that will recall listeners of the PMG at their peak and some flavors of Secret Story (1992).

“Pathmaker” represents some of Metheny's most adventurous writing on record. The track, along with “Everything Explained” bear a strong Chick Corea influence. Metheny is positively lyrical on his first solo, then Simcock is at once melodic and knotty. One of the most exquisite aspects of the track is the unison line between Metheny and Simcock following the second guitar solo as Sanchez frames a volcanic dialogue around their line. The provocative dreamy coda, sounding something out of a French film score, utilizes choice coloration from bass clarinet amidst butterfly esque clarinet string trills and some electronics popping in and out. Atop all that, Metheny's heavily reverbed slide guitar offers a longing melodic aside as the composition finishes. PMG alum and frequent Phil Collins percussionist Luis Conte's omnipresent colorations are a tremendous asset to the track.

If anything will make listeners make direct comparisons to Secret Story it will be the track “The Past In Us”. PMG alumni Gregoire Maret's reflective harmonica solo may remind some of the late Toots Thielemans' unforgettable eight bar contribution to “Always and Forever”, with the swelling strings behind him. Metheny graces the track with an absolutely gorgeous nylon string guitar solo. The final tracks are also perfectly programmed. The title track stands as one of the guitarist's prettiest ballads, gorgeous strands of Bach inspired baroque strings frame a long intro, from which hymn like harmonies emerge. Ndegeocello's rich voice in alto and soprano ranges paints a picture of despair and hopelessness with tender lyrics related to the current cultural climate-- yet like much of Metheny's music over the years stands a bright ray of hope. He takes an exquisite nylon string solo here as well.

“Sixty-Six” is a beautiful reminder of the midwestern tinges returning to the fore in Metheny's music. The train motif is once again stated, with Sanchez' brushes on snare, and the guitarist spins a wonderful, singable melody over the top, and mixes the lyrical with the more harmonically rich approach to improvisation that has marked his work over the past decade. Linda Oh's initial solo is full of ripe ideas, and her double tracked bass interlude following the guitarist's solo is an affectionate wink to Eberhard Weber. To close the album, the Sebesky arranged CTI vibe returns on “Love May Take A While”, a wonderful ballad that if one closes their eyes, one can almost imagine Metheny's nuanced hollow body solo to be a horn, in his assurance of ideas.

Sound

From This Place was principally recorded and mixed by Pete Karam at Avatar Studios (now Power Station, Berklee) with the orchestral parts recorded by Rich Breen in Los Angeles. Karam has inherited the very rich sonic world found on Metheny recordings that was originally created and perfected from the Geffen era on by Rob Eaton. Metheny's guitars take front and center in the sound stage with the delay from his multiple amp set up panning between the left and right speakers-- the effect is not as pronounced as say Travels, Question and Answer or Letter From Home, but is still there and has evolved as Metheny's tone has changed through the first two decades of the 21st century. Linda May Han Oh's basslines appropriately showcase the deep woodiness of an acoustic bass sound and is quite accurate to the real thing. Antonio Sanchez' drums are very present and forward in the mix with the main ride cymbal in the left channel, and his multiple snare drums being placed across the sound stage.

Luis Conte's percussion is also quite forward in the mix, and Simcock's piano is rich. Orchestra placement is subtle to the rear of the soundstage. What is apparent though is unlike earlier Metheny albums, the mix, like Kin (↔) the previous studio album is heavier on the mids, with not as much treble sparkle up top though this may be clearly system dependent. Also interesting, while the album will be released in high res, the promo copies that were distributed by Nonesuch are 16 bit WAV files with a 48 KhZ sample rate equivalent to DVD quality, so while not hi res, the quality is a step from CD quality. Thankfully Ted Jensen's mastering maintains a strong sense of dynamics which is imperative for music of this scope.

Final thoughts:

In what has been a career spanning nearly a half century, and filled with gems and milestones from both solo work and the Pat Metheny Group combined, From This Place may very well be one of the best albums of Metheny's career, if not the best. His writing is clearly on another level, and as great as recordings with orchestra accompaniment have been like The Falcon and The Snowman, Secret Story and A Map of The World have been, the combination of one of his best ensembles in years, the inspired memorable tunes, great solos and the high level of arranging prowess, represent the guitarist at his best. The music is as much a summary of what has been to this point as it is pointing some new directions into the future. Those who take the time to listen, understand the music for what it is, rather than what it should be, or is not, will be greatly rewarded.

Music: 10/10

Sound: 9/10

Edit: I made an addendum to the date of the recording which I previously stated as December 2016. After the NYC Beacon Theater show in June 2017, Antonio Sanchez told me they were going into the studio to record, that December.

youtube

2 notes

·

View notes

Photo

Honored to be the cover story for @sistahtalkemag 🥰 Thank you for the feature! I love telling my story about #pr #branding to inspire others and your magazine is so aligned with that mission! #sistahtalkemag #swipeleft⬅️ . . Excerpt What is Your Back Story in PR & Marketing? ➡️ I am a graduate of Wayne State University School of Journalism - with a concentration in Advertising & Public Relations. Graduated with Honors many moons ago- while at Wayne I worked at the school newspaper, radio station, WDET, an ad agency and before I graduated I got a job at the Detroit Free Press. Going to a school in the city offered me "real world" experience in a major media market. 👉🏾What made you decide to go in the Public Relations & Marketing? It's something I felt 'called to" - I am very good and promoting. Noticed it when I was a teen at #CassTech and while I was a member of my childhood church, Corinthian. I was the person people called on to promote something, write something or bring people together for an event. I was always a "people" person and loved to write. I had the gift of communication. When did you decide to start your business? I always wanted to have my own business. I started 3 business before I started the one I now have had for over 20 years. My first business was when I got fired from an agency - and I started "PPC" - Pam Perry Consulting. Never registered it. Just got business cards. I was 28 or so. It was a mess. Then I started Special Events & Meeting Planners (SEMP)... at 30 - that was a hot mess too. I hated planning events - I only really like promoting them. So that didn't work out. Then I worked with my husband, we owned Perry Marketing Group. It was an ad agency - and I was the VP of Public Relations. After our daughter was born, I left my job at Public Relations Director of The Salvation Army and joined Marc at PMG. I did that for four years before the company went out of business. I really was developing my business idea while at PMG. The agency worked with automotive type of clients - and I wanted to work with nonprofits, churches and authors/speakers. (More in issue) #motivationalspeakers #pamperrypr (at National Speakers Association) https://www.instagram.com/p/CQXkhXzMOMn/?utm_medium=tumblr

0 notes

Text

I ever told y’all about how I fell for my husband in particular?

There’s no real written record of this. I don’t know why I want to write it out, but I did. The buildup to the moment where I fell in love with the man I was going to marry for some reason feels nice to write out right now. It’s personal, but no names are mentioned, so I don’t mind if you reblog/comment!

When I was a freshman in high school, I had this one friend who has always been and will probably always be my idea of pretty. I didn’t know this girl well AT ALL when we got to talking, because unlike everyone else in my podunk high school she had just moved to our small town at the start of freshman year... and for some reason she picked me to say hi to.

She was the color mint personified and she walked like glamour but talked like trailer trash, and she literally only owned thong underwear and knew everything there was to know about makeup, and she backtalked her mom like they were the same age and smelled like expensive perfume even during gym class, and to be honest she scared me a bit more than a little bit, but that was exciting. I don’t know why she liked me.

So anyway, it got to where we slept over regularly and we would always trade whose house we stayed at. I think I was too self-involved to see she wanted a place to get away from Friend-Mom, who sassed her own daughter in ways that made me blush. So one time she was sleeping over at mine and we rented “But I’m A Cheerleader” from Blockbuster.

I know.

I spent the whole movie confused because I was in a relationship with a bad guy at the time, and therefore felt nothing when I was with him. But around this friend of mine I had flutteries sometimes, which I attributed to wanting to actually BE her instead of wanting to be WITH her. I was in my “girly things are not for me” phase, stubbornly not doing the things I wanted to do because they were “for other girls”.

I KNOW.

So naturally I was sweating bullets next to Pretty Mint Girl while she lay on the floor nonplussed, kind of making fun of the movie at times. I barely moved throughout the whole thing, like I was scared she would find out I was a Liar if I breathed funny. Like I should convince myself I was not a Liar, but then why did I like it when my friend leaned on me with her oldest dog-smelling sweatshirt on? Only Liars have to pretend to not be Liars.

Looking back on it now, I think this was the moment I knew I wasn’t straight, but had no idea what I was besides that-- so I pushed it down. It was tough, because on top of fluttery Pretty Mint Girl feelings, I also had fluttery feelings for the tall boy whose mom brought his pet kitten in their pickup truck when she picked him up from school, and for the boy two grades ahead of me that was going to join the Army and called me ‘honey’ like he was going to protect me, and for the girl who liked Kitten Boy also and wore too much eyeliner and ran her fingers through my hair during lunch.

I KNOW.

We go to sleep, Pretty Mint Girl on the floor and me in my bed, and life moved on. We actually didn’t have too much in common, PMG and me, so we drifted over time. She was a smoker, which led to me having some bad habits later in high school, and even though I bought my first thong because of her urging, she was too intense for me. I don’t know when I realized I wasn’t thinking of her anymore. I had applied for the dance elective to hang out with her when we had been friends, but by the time the new semester rolled around, we weren’t talking a lot and we were placed in separate dance classes.

Most of the girls in dance elective knew each other because they also took dance classes from the local studio. Or they were there to goof off. But one girl, Serious Girl, was there to learn and didn’t seem to have just one clique or group. She moved around talking to everyone.

Around this time was when I became friends with Hubs. He was in a sad relationship with an older girl. I was still in a bad relationship with a homeschooled kid. We were both really into writing long notes detailing our thoughts, and he became one of my best friends really quickly even though he was mad popular and had more people to talk to besides me. Sometimes we would go days without seeing each other, but our conversations when we did talk were always really deep and fulfilling. I wanted to tell him what I was thinking, I really did. But I could never write it down, even though our notes talked about everything else under the sun. Plus his girlfriend kind of scared me.

I wanted to talk to someone, anyone, about how different two girls could be even while making me feel the same way. Pretty Mint Girl had been explosive and wild, and I had liked being near her because it was better than catching an ember in the eye from standing on the outskirts. She knew what she liked about herself and flaunted it happily, very proud of all things girly and pretty and glitz, and made me want to be more. Serious Girl was like a cool drink from a water fountain-- she seemed necessary, but not glamorous, and that was refreshing. She was taller than me, intense, and a complete dork. She also looked like a model, but unlike PMG she didn’t know much about playing that up.

I KNOOOOOW...

And a small part of me knew then. Kind of. Not in so many words. I remember thinking, “I’m going to try it. Let’s see which feelings are the Liars.”

I was gearing up to ask Serious Girl out (which... I didn’t have a car, or money, or a mom who would let me stay out after dark, so I don’t know what that meant, but boy howdy I was going to do it) when I overheard her and another group chatting about our school’s loudest attention-seeker. Everyone was dressing for class, and I was in the corner like always.

“Did you hear that ----- says she’s bi now?”

“What even is that?”

“You sometimes kiss girls.”

“So a lesbian in denial?”

“Yeah. Just like she said she was related to the Smallville actress,” SG said. “Liar.”

“She’s dating a girl at another school.”

“That’s disgusting,” SG said. “People like that...”

...

...

... I know.

I didn’t ask her out.

I didn’t think about her, or Pretty Mint Girl, at all. In fact, I began to push away other close female friends who felt too Comfortable.

I kissed the guy who called me ‘honey’, and he would have called me every day and written me letters from basic had I felt something when our lips touched. I kissed a friend of mine who other girls wanted to date, whose binders of printed-at-the-library original erotica I edited for grammar mistakes during chemistry class, and he would have dated me for a little while had I felt something when our lips touched. I kissed a boy I thought was dumb, because he looked like Kitten Boy, but he was only half as nice and would never have done anything for me even if I had felt something when our lips touched.

Life moved on. I broke up with Homeschool after he told me that girls who like girls AND boys just double the chances of cheating on their partner. I got a bit emo and I wrote a lot of stories about girls falling through dimensions and fighting their way home. I went on field trips to the water treatment plant and the rec center, and I participated in School Spirit Week. I did homework. I stayed almost every weekend with my one best friend who knew me too well to let me push her away when things got too Comfortable, because her mom didn’t ask questions and ordered me crab rangoon and we could play videogames until our thumbs hurt. And slowly, flutteries came back.

I started to realize that I thought of Hubs all the time, every day, sometimes for hours a day.

We talked more now. So much so that his girlfriend started to try to edge me out. Hubs told me to ignore her, that he liked me just fine, that she was weird to do that to his friend. I used my friend’s cell phone to text him, then to try to flirt with him. He flirted back, but I was convinced it was just his personality. Guys or girls, he always responded as saucily as possible, unless it was a serious topic that we had outlined deserved serious answers. He listened to me. Not just that, but he advised, or distracted, or joked depending on what I said I needed. That’s what best friends do, I realize, but then he broke up his girlfriend.

Our notes changed in tone. He told me how he felt around me, but never asked me out. He hinted, tentative, and I chased. He was on another level than me: whereas I was looking inward he was always thinking of others. He was extroverted, wild, compassionate, and I could NOT track him worth a damn. But for some reason he called me during his work breaks, wrote me notes during History, and drove me to the gas station to get drinks cups full of M&Ms during lunch. He skipped school, but brought me back Oreos. He slept in class, but helped me study. He was a bit of a bad boy, in the nicest way.

I decided to skip school with him and some of his friends and one of my friends. We went to the state fair. His friend, let’s call him Dead Tooth, was a player despite literally having a dead tooth. Hubs watched him watch me, but didn’t say anything. I think he worried I would be angry, in a romance-novel-esque “I can take care of myself” way. I would have been; I was stubborn. But knowing Hubs had my back should something happen was a confidence boost. I flirted with Hubs, who responded like he always did.

The girl I was with pulled me aside and confessed she liked Hubs. I offered to back off with the flirting, told her we were just friends, and she waved me away as she smoked.

“No, go for it,” she said. “He’s into you. Go for it.”

I didn’t, but Dead Tooth did. We were all in a group getting airbrush tattoos with glitter when he caught me and surprised me with a kiss. I expressed surprise, told him not to do that again.

Hubs said nothing, just pulled me to his side and caught my hand. He didn’t let go for the rest of the day, and when I asked him about why, he told me that he didn’t like that Dead Tooh had done that. He said Dead Tooth had done it to get to him. I half-jokingly told him he could kiss me too, if he wanted. He leaned over and immediately kissed my cheek.

Flutteries. Crazy flutteries.

The ride home, he sat me by the window while Dead Tooth drove, putting himself in the middle. The next day at school, he avoided me during lunch. Later that week, I wrote him a note that I wanted to skip school with him again. Maybe with just him. He told me in another note passed back during lunch, “I don’t know that we should be alone together. We can skip school if you bring someone else.”

I did. He kissed me anyway, and it tasted like my bubblegum lipgloss.

Months later, after he’d asked me out in his bedroom with both of us laying on his bed staring up at his walls that were painted rich, bright green, we started to talk about getting kinda physical. What did we like, what was okay, what had we done before, all of that fun communicative stuff. And it ate at me. I could tell him everything, but I had never told anyone out loud how I’d had flutteries for girls. Not just one girl either. I knew it was me. I was defective. From the moment I used google to look up “can girls kiss each other”, to the moment when I begged my best friend to dare another girl to kiss me at a sleepover, to the moment when I bought my first thong with Pretty Mint Girl--

I know.

So I told him. We went to see a movie, then afterwards we drove to the local park to make out, and I couldn’t wait to tell him. It was dark, intimate in a confining sort of way in the cab of his messy pickup truck, and I focused on the silly fuzzy dice he had hanging from his rearview while I talked. Couldn’t look at him. I literally could only choke out, “I don’t... think... I’m straight.” And then tears came. I geared up almost like it was a breakup waiting to happen, because I thought he would end it right there. I wasn’t just telling him that I wasn’t straight, I was admitting that I never had been. I was not who he’d thought, I was going to someday discover that I had no interest in men, I was a hopeless ex waiting to happen.

Laying kind of on his lap, the stick shift biting into my side as I cried, I remember him lightly petting me. It reminded me of the way someone pets an animal they are trying not to scare off.

“We don’t have to talk about it now,” he said. “But I don’t believe anybody is 100% straight.” He paused, then asked, “Do you care about me?”

I nodded.

“Want to keep dating me?”

Nod.

“Then that’s what’s important.”

His voice was tight, like he was uncomfortable at the situation, but his hand was on my head and he was trying his best to reassure me. He wasn’t angry. He didn’t accuse me, or ask me if I would cheat on him. He didn’t light up as if this was his own personal chance at a fetish. He was uncomfortable because as a teenager, he didn’t know how to tell another teenager more than ‘you are not abnormal’. But when he said that, it helped. It was enough, and it was comforting.

And thanks to that moment where he wanted to be sure I knew I was okay, a moment I would appreciate even if I hadn’t fallen in love with him...

I really do know.

#personal#bi identity#coming out#sexuality#romance#my story#hubs#i joke about these moments#but this is the buildup#and why i worried so much when i told him#and why it meant so much to me when he reacted how he did#and why i have literally never kept anything a secret from him besides his surprise birthday party last year since#bisexuality#figuring out sexuality#tw: biphobia#tw: homophobia

9 notes

·

View notes

Text

OTT in the time of COVID-19: Using social to drive adoption

30-second summary:

Historically, OTT brands excel in social media marketing by using their original content as the centerpiece of their ads. While many are consuming content on social channels, OTT brands can utilize this unique content to persuade users to tune into their offering.

In addition to the number of eyeballs available via social media at this time, another opportunity for OTT brands is presented in the fact that the space is less crowded with many pausing media efforts due to affected business operations, sensitives and more.

As OTT platforms and studios are promoting their new movies, they must take well thought out steps. First, they must figure out what their objective is. Next, identify the target audience for the movie itself and align it to which social platform makes the most sense.

Video is always the best option for OTT platforms since that is their primary output. For shows and films alike, trailer-specific content is readily available and can be adjusted into six second or 30 second cuts to post across various social media outlets.

For OTT brands, direct to home releases could be a norm for them going forward. As such, during this time they should build good partnerships with movie studios while they have the upper hand.

Amidst the COVID-19 pandemic, OTT platforms are experiencing a unique moment. With millions at home, people are craving new content.

According to PMG partner insights, Pinterest has seen incredible YOY spikes in engagement, including a 60% jump in searches, a 30% boost in sign-ups and a 43% increase in board creation. Meanwhile, YouTube captures 10M search queries and billions of views worldwide related to COVID-19 authoritative news coverage every day and Reddit is experiencing double-digit growth in site visits.

Considering how much you’ve likely seen about ‘Tiger King’ on Twitter, Instagram, and Facebook, it’s no surprise that many are turning to the likes of Netflix, Amazon Prime, and Hulu to bide their time.

Because of the major disruptions caused by COVID-19, these OTT platforms have even become landing pads for feature films and studios as they respond to movie theater closures.

As such, we’ve seen rapid home releases of Invisible Man, The Hunt and Emma, and SXSW will premiere its film lineup on Amazon Prime Video.

Additionally, with fans yearning for sports content, ESPN has announced that the release of its anticipated 10-part series about Michael Jordan, The Last Dance, has been pushed from June to April.

As OTT offerings continue to grow and change, social media platforms are an effective channel to drive OTT adoption rates while offering much-needed escapist content.

The social media landscape during COVID-19

With events and entertainment in the outside world put on hold, people are turning to social media for escape and distraction, whether it be watching celebrities and musicians on Instagram Stories or tagging each other in memes across a variety of platforms.

Content creation is on the rise – TikTok and Twitch, two of the main creator channels, are experiencing a significant jump in videos and streams as creators and consumers alike seek an outlet.

This increased consumption creates a massive opportunity for OTT brands to get in front of a large and engaged audience.

Historically, OTT brands excel in social media marketing by using their original content as the centerpiece of their ads. While many are consuming content on social channels, OTT brands can utilize this unique content to persuade users to tune into their offering.

This is all part of the continued trend of growing OTT promotion via social media. Being a competitive landscape, OTT brands are fighting hard for people’s subscriptions.

Quibi, a mobile short-form video platform, spent millions on social media advertising, even before its April 6th launch. They clearly understood the stakes and wanted to take advantage of a wide audience at home.

Cautious opportunities for OTT brands

In addition to the number of eyeballs available via social media at this time, another opportunity for OTT brands is presented in the fact that the space is less crowded with many pausing media efforts due to affected business operations, sensitives and more.

However, advertising during this crisis, of course, requires a hypersensitive evaluation of tone. Internal teams must adopt a heightened scrutiny of their messaging and approach to ensure that content strategy is relevant, effective, and sensitive to the situation at hand.

Navigating OTT promotion via social media

For movie studios, an OTT platform release is very different from a typical theater release. Historically, studios would get the word out that a movie was available through a spray and pray approach with high impact media placements.

With OTT listings, they also need to educate the audience on which platform it’s available through. This adds another element to get across in promotions and requires studios to analyze if they’re actually convincing people to adopt streaming services.

As OTT platforms and studios are promoting their new movies, they must take well thought out steps.

First, they must figure out what their objective is. Is it awareness of the movie or movie streams? Ideally, it’ll be a solid mixture of both. It’s important that people know the movie exists but also to know exactly where it’s available so they can act on it.

Next, identify the target audience for the movie itself and align it to which social platform makes the most sense.

YouTube, Facebook, and Instagram are already major players and should be part of every social media plan due to these platforms’ expansive reach and targeting capabilities — but there are other options to explore.

For example, younger audiences can be reached through TikTok and Snapchat. Pinterest is traditionally a great avenue for mothers who are looking for ideas of what to do with kids at home, making it great for promoting family-focused content.

Meanwhile, Twitch and Reddit can reach tech-driven and male-skewed audiences. It’s important that teams think carefully to ensure they’re reaching the right people, in the right way, during this sensitive time.

Video is always the best option for OTT platforms since that is their primary output. For shows and films alike, trailer-specific content is readily available and can be adjusted into six second or 30 second cuts to post across various social media outlets.

Another way to be creative includes slide shows with three to five static images to flip through on Facebook and Instagram.

The increase in livestreaming during this time provides an opportunity for marketers to leverage their content, as well as actors and directors. Doing so on Facebook and Instagram and other daily apps offers a more personal connection than clean, edited videos.

The new normal – OTT brands beyond COVID-19

My husband and I have a movie night every other week where we are loyal to one dine-in theater. We decided to replicate this during our quarantine as we heard The Hunt was available on Amazon Cinema.

We saw that it was $20 to stream which is similar to how much we would spend for two theater tickets. We had dinner delivered through UberEats, sat down on our couch, and watched the movie. This was a definite change, but one we might do in the future if we can watch new movies right at home.

For OTT brands, direct to home releases could be a norm for them going forward. As such, during this time they should build good partnerships with movie studios while they have the upper hand.

With the world rapidly changing, the world post COVID-19 will be a different one. However, we can be certain that OTT platforms will continue to bring people together with content that everyone can share. And while the Tiger King memes will fall off eventually, there will be plenty of OTT promotion and chatter on social media right around the corner.

Ting Zheng is a social account lead at PMG where she leads channel strategy and execution for some of the world’s biggest B2B, travel, technology and retail brands.

The post OTT in the time of COVID-19: Using social to drive adoption appeared first on ClickZ.

source http://wikimakemoney.com/2020/05/14/ott-in-the-time-of-covid-19-using-social-to-drive-adoption/

0 notes

Text

Developers are banking on co-living, but will it catch on?

Grove Central

When Pebb Capital principal James Jago attended Tulane University in the early 2000s, he lived in “a dumpy house” with three roommates.

But now, college students increasingly have the option to live off-campus in luxury student housing loaded with amenities like resort-style pools with cabanas, coffee bars, game rooms, movie theaters and fitness centers with yoga and indoor cycling studios. In Miami, near Florida International University and the University of Miami, developers are building high-end housing for affluent students. And when those students depart for the real world, they don’t want to downgrade their living arrangements.

“Students graduating have high expectations,” Jago said.

Therefore, Boca Raton-based Pebb Capital is investing in co-living developments, the grown-up version of dorm living that is taking off in South Florida. Pebb has injected $10 million into Property Markets Group’s 1,200-unit X Las Olas development, currently under construction in Fort Lauderdale, and plans to invest in the firm’s X project at 400 Biscayne Boulevard in downtown Miami.

Jago and other developers are betting on Florida’s growing population of recent graduates and those new to the workforce — specifically, those in the 25-to-35-year-old range — who want to live in the urban cores but can’t afford to pay sky-high rents. In the co-living buildings, renters pay about 20 percent less than they would for a studio apartment, but developers make more by fitting more bedrooms in one unit.

RELATED STORY: WATCH: Developers and co-living operators shed light on the growing industry

Typically housing three to four tenants, co-living units feature bedrooms that are much smaller than those in traditional apartments, but each usually has its own bathroom.

And to sweeten the deal for tenants, co-living projects offer a slew of amenities. X Miami in downtown Miami boasts a gym, dog park, screening lounge, co-working lab and pool deck that’s known to host frequent pool parties. Cocktail bar Jaguar Sun is located in its lobby.

“What co-living does is it enables the elevation of their standard of living for young professionals. You can lower your monthly [cost] by renting a bedroom. It creates a sense of community,” Jago said.

Brian Koles, director of brand and marketing for Miami X developer PMG, said that while “we build buildings to make money, we firmly believe that it can be a win for everyone.”

PMG is the biggest developer of rent-by-the-bedroom apartment housing in South Florida and was the first to open a large-scale project when it delivered X Miami in 2018. The 32-story, 464-unit tower is now 97 percent leased.

Only 20 percent of PMG’s co-living projects — the three- and four-bedroom units — are actually reserved for co-living, Koles said. That allows renters to “graduate” from leasing bedrooms to their own units as they get promotions or move in with significant others.

Now that X Miami has been up and running for over a year, PMG is launching a division to expand across the country. The venture, called Society, includes X Las Olas, 400 Biscayne, a Wynwood project, one in Phoenix and another in Orlando. All five buildings will be branded Society. (See sidebar.)

But Koles and PMG will soon have some competition from another local developer who sees similar opportunities in the micro-apartment format. Miami-based Terra Group and Grass River Property, currently developing 401-unit Grove Central, inked a deal to bring in national co-living startup Common to manage a portion of the project — 22 units with 106 bedrooms.

“Co-living is supposed to garner more revenue in less space but at the same time deliver an affordable rent that is below the AMI [area median income] of a neighborhood,” said Terra Group president David Martin.

Co-living also allows multifamily developers to differentiate themselves from the competition, said Luis Flores, an attorney at Saul Ewing Arnstein & Lehr whose clients include PMG.

Even Richard Branson, who’s known to look into the future for his next big idea, will brand a Virgin hotel and residential tower with 150 furnished micro and co-living rental units, which will start at under 400 square feet. Scheduled for a 2023 delivery, the Brickell project is expected to break ground in 2020.

Startups surge

The affordability crisis nationwide and in Miami specifically creates an opportunity for builders and startup operators of co-living, who have been flocking to the region. According to an exclusive report from the Miami Herald, an October 2019 study by Florida International University’s Jorge M. Pérez Metropolitan Center found that more than half of cost-burdened renters — households that spend more than 30 percent of their income on rent — are spending more than 50 percent of their paychecks on rent.

Common Coliving Melrose

Startups like Common and Ollie are eager to swoop in with solutions. The two co-living operators have expanded throughout the U.S. and are now signing local long-term lease deals with apartment landlords and developers.

“You have a lot of supply that’s really geared toward luxury renters. It’s clear that there is really a need for affordable housing,” said Brian Lee, senior director of real estate at Common.

New York-based Ollie, which has raised $15 million, will manage 400 beds in one of three buildings at Gables Station, NP International’s mixed-use project in Coral Gables. Life Time Fitness is opening at the development, which will include about 120,000 square feet of retail space. (Read more about the project on page 46.)

Led by founder and CEO Brad Hargreaves, Common rents out rooms in furnished, shared apartments on flexible lease terms in 32 locations in New York City, Chicago, Los Angeles, San Francisco, Oakland, Seattle and Washington, D.C. It signs leases for ground-up new developments and will also work with owners of existing buildings to convert larger two-bedroom units into three-bedrooms, and so on.

It then leases out bedrooms for rents that are 15 to 20 percent below what a studio in the same neighborhood is being marketed for. Rents in Miami will start at about $1,000 a month, Lee said. Common uses technology that generates leads, matches roommates and schedules tours.

The company sells annual memberships to residents who can transfer between properties if they’re moving to another city with Common locations. It has more than 1,000 members, according to a spokesperson.

In October, Common investor Six Peak Capital announced it had hired Cushman & Wakefield to raise $1 billion in debt and equity to fund its expansion of co-living in the U.S. Common has raised over $65 million since it was founded in 2015, from investors that include Norwest, Maveron, 8VC and LeFrak.

Common has yet to open a location in Miami, but it has about 800 bedrooms in the local pipeline. It’s also negotiating deals for roughly 2,500 bedrooms throughout South Florida.

The startup’s first location will open in late 2020 or early 2021 in a cluster of homes in Little Havana that will total 130 bedrooms.

At Terra and Grass River Property’s Grove Central, where Common is leasing a small portion of the apartment component, workforce housing apartments and retail space are also part of the mix. The development features easy access to the Coconut Grove Metrorail station.

Construction at Grove Central is expected to go vertical in the second quarter of next year. Martin said the developers worked with Common to design the units with smart kitchens, shoe and shirt storage, suites for couples, efficient bathrooms and “as much community space as possible.”

The project will have theaters, gyms, lounges, co-working space and coffee shops in addition to the retail space that’s already planned.

‘Urbin’ infill

Though it’s more common in European markets, co-living is still a fairly new asset class in the U.S., so Terra said it is testing the market by leasing only 10 to 15 percent of the units to Common. Cities also have different caps on how many unrelated families can live in one housing unit, or do not allow co-living at all.

“It’s a test, but it’s also what I think works,” Martin said. “Traditional apartments have a certain cap rate. For co-living, there has not been that much trading. We don’t really understand how the capital markets are going to treat it.”

Martin is also an investor in Urbin, a co-living, co-working and wellness real estate platform led by developer Rishi Kapoor, the CEO of Miami-based Location Ventures. The company is moving forward with a co-living project at 1234 to 1260 Washington Avenue in Miami Beach after the City Commission there passed legislation allowing co-living in November 2019.

Urbin has raised $85 million in funding from the Murphy family of Coastal Construction, former NFL player Jonathan Vilma, Rudy Touzet of Banyan Street Capital and others. At least three locations are in the pipeline for South Florida, and Kapoor said he hopes to open 100 locations in the coming decade.

Mitash Kripalani, director of investment services at Colliers International South Florida, is listing the 61-bedroom building at 800 South Dixie Highway for sale. Location Ventures took it over two and a half years ago, renovated it and put an ad up on Craigslist to rent out the bedrooms, geared toward attracting students from the University of Miami. Kapoor said he used the building as a model for Urbin.

Co-living projects are in some cases getting “higher rents than Class A product in Brickell” because developers are able to rent a bedroom out for $1,300 a piece, according to Kripalani.

“Some people say it’s a fad,” Kripalani said. “But I think as rents grow, if you’re a young millennial and you want to live downtown for [$1,300] a month, your best option is co-living.”

The post Developers are banking on co-living, but will it catch on? appeared first on The Real Deal Miami.

from The Real Deal Miami https://therealdeal.com/miami/2020/02/17/developers-are-banking-on-co-living-but-will-it-catch-on-2/

via IFTTT

0 notes

Text

Developers are banking on co-living, but will it catch on?

Grove Central

When Pebb Capital principal James Jago attended Tulane University in the early 2000s, he lived in “a dumpy house” with three roommates.

But now, college students increasingly have the option to live off-campus in luxury student housing loaded with amenities like resort-style pools with cabanas, coffee bars, game rooms, movie theaters and fitness centers with yoga and indoor cycling studios. In Miami, near Florida International University and the University of Miami, developers are building high-end housing for affluent students. And when those students depart for the real world, they don’t want to downgrade their living arrangements.

“Students graduating have high expectations,” Jago said.

Therefore, Boca Raton-based Pebb Capital is investing in co-living developments, the grown-up version of dorm living that is taking off in South Florida. Pebb has injected $10 million into Property Markets Group’s 1,200-unit X Las Olas development, currently under construction in Fort Lauderdale, and plans to invest in the firm’s X project at 400 Biscayne Boulevard in downtown Miami.

Jago and other developers are betting on Florida’s growing population of recent graduates and those new to the workforce — specifically, those in the 25-to-35-year-old range — who want to live in the urban cores but can’t afford to pay sky-high rents. In the co-living buildings, renters pay about 20 percent less than they would for a studio apartment, but developers make more by fitting more bedrooms in one unit.

RELATED STORY: WATCH: Developers and co-living operators shed light on the growing industry

Typically housing three to four tenants, co-living units feature bedrooms that are much smaller than those in traditional apartments, but each usually has its own bathroom.

And to sweeten the deal for tenants, co-living projects offer a slew of amenities. X Miami in downtown Miami boasts a gym, dog park, screening lounge, co-working lab and pool deck that’s known to host frequent pool parties. Cocktail bar Jaguar Sun is located in its lobby.

“What co-living does is it enables the elevation of their standard of living for young professionals. You can lower your monthly [cost] by renting a bedroom. It creates a sense of community,” Jago said.

Brian Koles, director of brand and marketing for Miami X developer PMG, said that while “we build buildings to make money, we firmly believe that it can be a win for everyone.”

PMG is the biggest developer of rent-by-the-bedroom apartment housing in South Florida and was the first to open a large-scale project when it delivered X Miami in 2018. The 32-story, 464-unit tower is now 97 percent leased.

Only 20 percent of PMG’s co-living projects — the three- and four-bedroom units — are actually reserved for co-living, Koles said. That allows renters to “graduate” from leasing bedrooms to their own units as they get promotions or move in with significant others.

Now that X Miami has been up and running for over a year, PMG is launching a division to expand across the country. The venture, called Society, includes X Las Olas, 400 Biscayne, a Wynwood project, one in Phoenix and another in Orlando. All five buildings will be branded Society. (See sidebar.)

But Koles and PMG will soon have some competition from another local developer who sees similar opportunities in the micro-apartment format. Miami-based Terra Group and Grass River Property, currently developing 401-unit Grove Central, inked a deal to bring in national co-living startup Common to manage a portion of the project — 22 units with 106 bedrooms.

“Co-living is supposed to garner more revenue in less space but at the same time deliver an affordable rent that is below the AMI [area median income] of a neighborhood,” said Terra Group president David Martin.

Co-living also allows multifamily developers to differentiate themselves from the competition, said Luis Flores, an attorney at Saul Ewing Arnstein & Lehr whose clients include PMG.

Even Richard Branson, who’s known to look into the future for his next big idea, will brand a Virgin hotel and residential tower with 150 furnished micro and co-living rental units, which will start at under 400 square feet. Scheduled for a 2023 delivery, the Brickell project is expected to break ground in 2020.

Startups surge

The affordability crisis nationwide and in Miami specifically creates an opportunity for builders and startup operators of co-living, who have been flocking to the region. According to an exclusive report from the Miami Herald, an October 2019 study by Florida International University’s Jorge M. Pérez Metropolitan Center found that more than half of cost-burdened renters — households that spend more than 30 percent of their income on rent — are spending more than 50 percent of their paychecks on rent.

Common Coliving Melrose

Startups like Common and Ollie are eager to swoop in with solutions. The two co-living operators have expanded throughout the U.S. and are now signing local long-term lease deals with apartment landlords and developers.

“You have a lot of supply that’s really geared toward luxury renters. It’s clear that there is really a need for affordable housing,” said Brian Lee, senior director of real estate at Common.

New York-based Ollie, which has raised $15 million, will manage 400 beds in one of three buildings at Gables Station, NP International’s mixed-use project in Coral Gables. Life Time Fitness is opening at the development, which will include about 120,000 square feet of retail space. (Read more about the project on page 46.)

Led by founder and CEO Brad Hargreaves, Common rents out rooms in furnished, shared apartments on flexible lease terms in 32 locations in New York City, Chicago, Los Angeles, San Francisco, Oakland, Seattle and Washington, D.C. It signs leases for ground-up new developments and will also work with owners of existing buildings to convert larger two-bedroom units into three-bedrooms, and so on.

It then leases out bedrooms for rents that are 15 to 20 percent below what a studio in the same neighborhood is being marketed for. Rents in Miami will start at about $1,000 a month, Lee said. Common uses technology that generates leads, matches roommates and schedules tours.

The company sells annual memberships to residents who can transfer between properties if they’re moving to another city with Common locations. It has more than 1,000 members, according to a spokesperson.

In October, Common investor Six Peak Capital announced it had hired Cushman & Wakefield to raise $1 billion in debt and equity to fund its expansion of co-living in the U.S. Common has raised over $65 million since it was founded in 2015, from investors that include Norwest, Maveron, 8VC and LeFrak.

Common has yet to open a location in Miami, but it has about 800 bedrooms in the local pipeline. It’s also negotiating deals for roughly 2,500 bedrooms throughout South Florida.

The startup’s first location will open in late 2020 or early 2021 in a cluster of homes in Little Havana that will total 130 bedrooms.

At Terra and Grass River Property’s Grove Central, where Common is leasing a small portion of the apartment component, workforce housing apartments and retail space are also part of the mix. The development features easy access to the Coconut Grove Metrorail station.

Construction at Grove Central is expected to go vertical in the second quarter of next year. Martin said the developers worked with Common to design the units with smart kitchens, shoe and shirt storage, suites for couples, efficient bathrooms and “as much community space as possible.”

The project will have theaters, gyms, lounges, co-working space and coffee shops in addition to the retail space that’s already planned.

‘Urbin’ infill

Though it’s more common in European markets, co-living is still a fairly new asset class in the U.S., so Terra said it is testing the market by leasing only 10 to 15 percent of the units to Common. Cities also have different caps on how many unrelated families can live in one housing unit, or do not allow co-living at all.

“It’s a test, but it’s also what I think works,” Martin said. “Traditional apartments have a certain cap rate. For co-living, there has not been that much trading. We don’t really understand how the capital markets are going to treat it.”

Martin is also an investor in Urbin, a co-living, co-working and wellness real estate platform led by developer Rishi Kapoor, the CEO of Miami-based Location Ventures. The company is moving forward with a co-living project at 1234 to 1260 Washington Avenue in Miami Beach after the City Commission there passed legislation allowing co-living in November 2019.

Urbin has raised $85 million in funding from the Murphy family of Coastal Construction, former NFL player Jonathan Vilma, Rudy Touzet of Banyan Street Capital and others. At least three locations are in the pipeline for South Florida, and Kapoor said he hopes to open 100 locations in the coming decade.

Mitash Kripalani, director of investment services at Colliers International South Florida, is listing the 61-bedroom building at 800 South Dixie Highway for sale. Location Ventures took it over two and a half years ago, renovated it and put an ad up on Craigslist to rent out the bedrooms, geared toward attracting students from the University of Miami. Kapoor said he used the building as a model for Urbin.

Co-living projects are in some cases getting “higher rents than Class A product in Brickell” because developers are able to rent a bedroom out for $1,300 a piece, according to Kripalani.

“Some people say it’s a fad,” Kripalani said. “But I think as rents grow, if you’re a young millennial and you want to live downtown for [$1,300] a month, your best option is co-living.”

The post Developers are banking on co-living, but will it catch on? appeared first on The Real Deal Miami.

from The Real Deal Miami & Miami Florida Real Estate & Housing News | & Curbed Miami - All https://therealdeal.com/miami/2020/01/09/developers-are-banking-on-co-living-but-will-it-catch-on/

via IFTTT

0 notes

Text

Plight of persons with myasthenia gravis

#PHnews: Plight of persons with myasthenia gravis

MANILA -- Weakness of the whole body and drooping eyes prodded Marivic Joy Franco eight years ago to consult a health expert at the Philippine General Hospital.

“Dati nakakapanahi pa ako ng mga costumes at madali ako makatapos pero nakaramdam ako ng panghihina lalo na kapag mainit kaya naisip ko magpatingin at nalaman ko na may myasthenia gravis (MG) ako (I use to easily sew costumes but one time felt weakness particularly when the weather is hot, so I decided to have a check-up and found out that I have myasthenia gravis) ,” Franco told the Philippine News Agency (PNA) in an interview.

According to the United States National Institute of Neurological Disorders and Stroke, MG is a chronic autoimmune neuromascular disease that causes weakness in the skeletal muscles.

Its symptoms include difficulty in breathing, swallowing, talking, climbing, jumping, and lifting things. It also results in having hoarse voice, drooping eyelids, double vision, fatigue, and facial paralysis.

The disease affects both men and women, but more on women under 40 years old worldwide.