#futurestrading

Text

youtube

6 notes

·

View notes

Video

youtube

BINGX MADE ME A MILLIONAIRE! SHARING MY TRADING STRATEGY AND REFERRAL CODE FOR YOU TO JOIN THE PLATFORM

#BingX #CryptocurrencyExchange #TradingStrategies #ReferralCode #FinancialFreedom #CryptoMillionaire #SpotTrading #FuturesTrading #CopyTrading #UserFriendlyInterface #AdvancedTradingTools #SocialTrading #Diversification #StayInformed #CryptoMarket #RiskManagement #StopLossOrders #AdvancedTradingTools

#youtube#bingx#bingxcopytrade#cryptocurrencyexchange#tradingstrategies#referralcode#referral code#financialfreedom#cryptomillionaire#spottrading#futurestrading#futures trading

0 notes

Text

Stock Futures Show Minimal Movement Following Dow’s Consecutive Decline in New Quarter

U.S. stock futures showed little change on Wednesday morning following the Dow Jones Industrial Average’s decline for a second consecutive day, marking a rocky start to the new quarter. Dow futures slipped by 56 points, equivalent to 0.14%, while S&P 500 futures saw a slight decrease of 0.15%. Similarly, Nasdaq 100 stock futures experienced a marginal dip of 0.2%.

Concerns over Federal Reserve Actions

The recent downturn on Wall Street follows a session marked by persistent inflation data from the previous week, alongside robust economic indicators, which fueled concerns among investors regarding the Federal Reserve’s potential delay in interest rate cuts. Concurrently, Treasury yields surged, with the 10-year note rate reaching its highest level since November. Furthermore, oil prices surged to five-month highs, adding to market uncertainties.

On Tuesday, the Dow Jones Industrial Average plummeted nearly 400 points, reflecting a 1% decline. The broader S&P 500 index experienced a 0.7% drop, while the tech-heavy Nasdaq Composite registered a substantial decline of nearly 1%.

Optimism amidst Market Volatility

Despite the recent market volatility, some analysts maintain an optimistic outlook on equities, attributing the downturn to a natural phase of consolidation following a robust start to the year. Notably, the S&P 500 recorded its strongest first quarter performance since 2019. Kristen Bitterly, Global Wealth Head of Investment Solutions at Citi, emphasized the constructive fundamentals supporting risk assets amidst geopolitical concerns and yield fluctuations.

Upcoming Market Events

Investor focus remains on key economic indicators, with the ADP private payrolls report scheduled for release, offering insights into the labor market ahead of Friday’s March jobs data. Additionally, the ISM services index is anticipated after market open. Federal Reserve Chair Jerome Powell is scheduled to speak, alongside various central bank officials, including Fed Governors Michelle Bowman and Adriana Kugler. Chicago Fed President Austan Goolsbee and Fed Vice Chair for Supervision Michael Barr are also slated to address upcoming events. Furthermore, attention will be on Levi Strauss’ earnings report following market close.

As market participants navigate through evolving economic dynamics and central bank communications, the stability of stock futures reflects cautious sentiment amidst broader market uncertainties. Analysts continue to monitor key indicators and corporate earnings, looking for signals of stability amidst fluctuating market conditions.

Despite recent fluctuations, many analysts remain cautiously optimistic about the broader market trajectory, viewing the recent downturn as a healthy correction following an extended period of gains. The robust performance of the S&P 500 in the first quarter of the year underscores underlying strength in the economy, despite short-term fluctuations.

Kristen Bitterly’s comments highlight the importance of maintaining a long-term perspective amid market volatility. She emphasizes the resilience of risk assets, underpinned by favorable economic fundamentals, including declining inflation and improving earnings prospects.

Looking ahead, investors are closely watching upcoming economic data releases, particularly the ADP private payrolls report and the ISM services index. These reports will provide crucial insights into the health of the labor market and broader economic activity, helping investors gauge the Federal Reserve’s future policy decisions.

In addition to economic data, market participants are closely monitoring central bank communications, with Federal Reserve Chair Jerome Powell scheduled to speak. Powell’s remarks, along with those of other central bank officials, are expected to provide further clarity on the Fed’s monetary policy stance and its implications for financial markets. Overall, while market volatility may persist in the near term, many analysts remain optimistic about the longer-term outlook for equities. With supportive economic fundamentals and ongoing vaccination efforts, investors are hopeful that the economy will continue to recover, supporting further gains in the stock market.

Read More: Microsoft’s Business-focused Surface Devices Unveiled

0 notes

Text

Abstract:Webull's latest upgrade introduces futures and commodities trading, enhancing portfolio options and signaling global expansion, as the platform prepares for a potential $7.3 billion Nasdaq listing via a SPAC later this year.

0 notes

Text

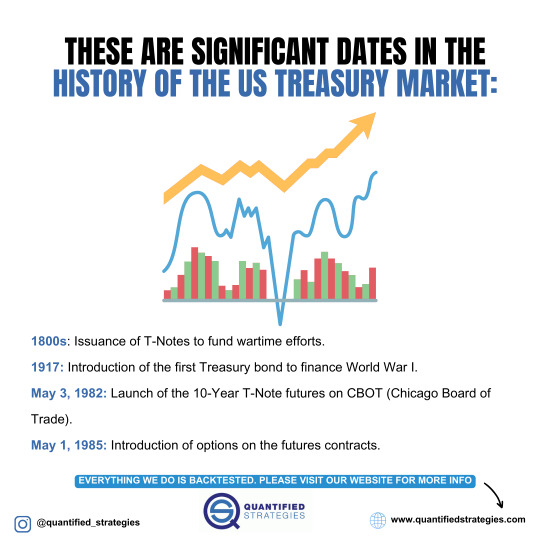

THESE ARE SIGNIFICANT DATES IN THE HISTORY OF THE US TREASURY MARKET

Key dates in the US Treasury market include the 1800s introduction of T-Notes for wartime funding, the 1917 debut of Treasury bonds for World War I financing, the 1982 launch of 10-Year T-Note futures on CBOT, and the 1985 introduction of options on futures contracts, each marking significant milestones in Treasury market evolution.

#tradingstrategies#tradingstrategy#USTreasury#FinancialHistory#FuturesTrading#tradingtips#algotrading

0 notes

Text

Mastering Cryptocurrency Trading: Basics, Strategies, and Risks

Understanding the Fundamentals of Cryptocurrency Trading

Cryptocurrency trading involves the buying and selling of Bitcoin and other crypto assets with the aim of making a profit. Depending on a trader's goals and strategy, cryptocurrency can be traded over various timeframes, ranging from seconds to several years.

It's crucial to recognize that cryptocurrency markets can be highly speculative and volatile. Therefore, it's beneficial to assess the situation, formulate a clear trading plan, and grasp the basics of cryptocurrency trading. While each trader's approach to cryptocurrency trading may differ, there are several fundamental principles applicable to all market participants.

Key Principles of Cryptocurrency Trading:

- Choice of Cryptocurrencies: Traders individually select the cryptocurrencies they want to trade. Bitcoin (BTC) and Ethereum (ETH) are among the most popular choices, but there are thousands of different crypto assets.

- Selection of Trading Platform: To execute trades, traders use cryptocurrency exchanges or trading platforms. These platforms facilitate the buying and selling of cryptocurrencies.

- Exchange Registration: On each traditional cryptocurrency trading platform, creating an account is necessary. This process involves providing personal information, undergoing Know Your Customer (KYC) identification, and creating a wallet for storing cryptocurrencies.

- Account Funding: To initiate trading, funds need to be deposited to purchase cryptocurrencies on the exchange. This can be done with fiat currencies (such as dollars or euros) or stablecoins like USDT or USDC. Cryptocurrencies can also be deposited directly into wallets supported by the exchange.

- Order Placement: During trading, traders place orders on the exchange (buy or sell orders). Various types of orders exist, including market orders (buy or sell at the current market price), limit orders (buy or sell at a specific price), and stop-loss orders (triggered at a specified price level).

- Analysis and Strategy: Traders often employ technical and fundamental analysis to decide when to buy or sell cryptocurrencies, applying various trading strategies such as day trading, swing trading, long-term investing, and others.

- Risk Management: Cryptocurrency trading involves risks and market volatility. Effective risk management includes portfolio diversification, setting stop-loss orders, employing hedging strategies, and investing only what one can afford to lose.

- Order Monitoring and Execution: Cryptocurrency traders vigilantly monitor the market and execute their orders when pre-defined conditions are met. Prices in the cryptocurrency market can change rapidly.

- Security Measures: Taking security measures to protect accounts on exchanges and wallets is crucial to prevent hacking and fraud.

Choosing a Cryptocurrency Exchange

When entering cryptocurrency trading, one of the initial and critical steps is selecting a suitable cryptocurrency exchange. The exchange serves as the marketplace where buyers and sellers interact for cryptocurrency trading.

Considerations for Choosing a Cryptocurrency Exchange in 2024:

Different exchanges offer varying features, making the choice dependent on individual trading needs and goals. Some may have user-friendly interfaces, while others offer more assets and higher liquidity. Additionally, security is a crucial factor. Most platforms implement robust security measures, including two-factor authentication and cold storage for user funds.

It's essential to consider trading fees, including fees for trading, depositing funds, and withdrawing funds. Before creating an account, check the exchange's availability in your region and its compliance with local regulatory requirements. Some major cryptocurrency exchanges may not support traders from specific regions and may not allow deposits in local currencies.

Crafting a Trading Strategy

A trading strategy is a comprehensive plan outlining a trader's financial goals, acceptable risks, and specific methods for buying and selling cryptocurrencies.

Common Cryptocurrency Trading Strategies:

- Day Trading: Intraday trading involves making multiple trades within a single day to profit from short-term price fluctuations.

- Long-Term Investing ("HODL"): This strategy involves buying and holding onto cryptocurrencies for an extended period with the expectation that their value will increase over time.

- Futures Trading: Trading futures contracts allows traders to buy or sell a specified amount of cryptocurrency at a predetermined price on a future date, providing a way to hedge against market volatility.

- Arbitrage Trading: Arbitrage involves exploiting price differences of the same asset on different exchanges to make a profit.

- Scalping: Scalping is a strategy where traders aim to profit from small price changes, making numerous trades throughout the day.

Choosing the right strategy depends on market conditions, a trader's experience, and knowledge of the cryptocurrency market.

Conclusion: Mastering cryptocurrency trading involves continuous learning, thorough analysis, and regular adjustments to one's trading strategy in response to the dynamic nature of the cryptocurrency market. Success is not guaranteed with any strategy, but a combination of approaches tailored to market trends often proves effective.

Read the full article

#AccountFunding#AnalysisandStrategy#ArbitrageTrading#ChoosingaCryptocurrencyExchange#ChoosingCryptocurrencies#CryptocurrencyTradingBasics#DayTrading#ExchangeRegistration#FuturesTrading#Long-TermInvesting#OrderMonitoringandExecution#OrderPlacement#riskmanagement#SecurityMeasures#TradingPlatforms#TradingStrategies#TradingStrategy

0 notes

Video

youtube

A Comprehensive Guide on How to Register on the BingX Exchange?

📈 #BingXExchange #CryptocurrencyTrading #Bitcoin #Ethereum #Solana #DerivativesTrading #SpotTrading #FuturesTrading #CopyTrading #CryptoCommunity #BingX

#youtube#bingx#bingxexchange#futurestrading#futures trading#copytrading#copy trading#cryptocommunity

0 notes

Text

The Evolution and Future of Commodity Pools in Market Trading

#CommodityPools#FuturesTrading#MarketStrategies#RiskManagement#InvestmentTrends#TradingEvolution#FinancialMarkets#MarketAnalysis#TradingInsights#InvestmentStrategies#upcomingtradera#futures trading#day trading#investing#investments#finance#financial literacy#investors#personal finance

0 notes

Text

🙏 WELCOME TO JV TRADE 🙏

📊 START EARNING IN ZERO BROKERAGE & BECOME A BROKER TAKE 100% BROKERAGE RETURN 💯🎁

#crudeoiltrading#investment#sharemarkettips#sharemarketnews#technicalanalysis#forextrading#mcx#forextrader#niftyfifty#stockmarketindia#nse#futurestrading#business#sharemarketindia

0 notes

Text

How to Day Trade Futures l From Zero to $1010

youtube

Embark on a thrilling journey from trading novice to futures master with our latest video, "Day Trading Futures: From Zero to $1010!" 📈💰 Watch as we demystify the world of futures trading, providing essential tips, strategies, and real-life examples to help you navigate the markets and turn every trade into a winning one. 🚀 Don't miss out on this educational rollercoaster that could transform your financial future!

#DayTrading101#FuturesTrading#FinancialFreedom#StockMarketSuccess#TradingStrategies#LearnToTrade#ProfitableFutures#TradingJourney#InvestingTips#MarketMastery#MakeMoneyTrading#Youtube

0 notes

Text

0 notes

Text

How to Day Trade Futures l From Zero to $1010

youtube

Learn the art of day trading futures from ground zero to achieving an impressive $1,010 milestone. In this comprehensive guide, we cover essential strategies, risk management, and real-life examples to help you succeed in the fast-paced world of futures trading. Get ready to embark on your trading journey!

#DayTrading#FuturesTrading#FinancialEducation#TradingStrategies#FromZeroTo1010#ProfitMilestone#RiskManagement#TradingJourney#TradingSuccess#TradingTutorial#Youtube

0 notes

Text

New assets for Crypto exchange

While the SEC is suing CoinBase, the crypto exchange is not going to stop the business, moreover, is actively expanding it and opening new directions.

The National Futures Association has approved a request for futures trading. Now, in addition to ordinary Crypto the additional instruments like derivatives will be presented on trading board. This will significantly expand the potential market, including hedging of Crypto deals.

The NFA is a self-regulating organization authorized to issue appropriate permits. NFA documents are recognized by the American regulator.

Lado Okhotnikov, Crypto expert, Founder and CEO of Meta Force platform noted that trading in futures will help revive optimism of crypto community.

«Trading in direct assets is the oldest version of the bourse. Modern trading uses many derivatives. Some of them are purely speculative and some of them really work for business development. For example, futures allow hedging the price risks of transactions, which may be useful for various projects with deferred income, like startups. In any case, the emergence of cryptocurrency derivatives is the great success of the crypto community...»

0 notes

Text

How to Day Trade Futures l From Zero - STOP OUT - $3050

Dive headfirst into the world of day trading futures with our comprehensive guide, "From Zero to STOP OUT - $3050." Whether you're a complete beginner or a trading enthusiast aiming to enhance your skills, this resource is designed to empower you on your trading journey. Starting from scratch, we demystify the intricacies of futures trading, covering essential topics such as market analysis, technical indicators, risk management, and the psychological aspects of trading. By following a step-by-step approach, you'll learn to create effective trading strategies, make informed decisions, and manage potential losses wisely. Join us in exploring the thrilling realm of day trading futures as we equip you with the knowledge and tools to navigate the markets confidently.

#FuturesTrading#DayTradingGuide#TradingFromZero#TradingSkills#RiskManagement#TradingPsychology#MarketAnalysis#FinancialEmpowerment#ProfitPotential#TradeSmart

0 notes

Text

Discover key strategies for integrating stock options with futures trading, enhancing your portfolio's versatility and resilience in the financial markets.

#stockmarket#optionstrading#futurestrading#daytrading#investing#riskmanagement#finance#capitalmarkets#capitalism#upcomingtradera#investments#futures trading#day trading#financial literacy#investors#personal finance

0 notes