#fungibility

Text

THE LAST MANAGER

“Once men turned their thinking over to machines in the hope that this would set them free. But that only permitted other men with machines to enslave them.” — Frank Herbert, Dune

We thought that poetry, painting, and the arts, in general, would be the last occupations the robots would get. Why? Because we think creativity is “special.” I don’t know if postmodernism’s downplaying of originality…

View On WordPress

#ai#art#artificial inteligence#authoritarianism#corporations#fungibility#increase shareholder value#laid off#last man#manager#Nietzsche#postmodernism#socialism#the arts#ubermensch

0 notes

Text

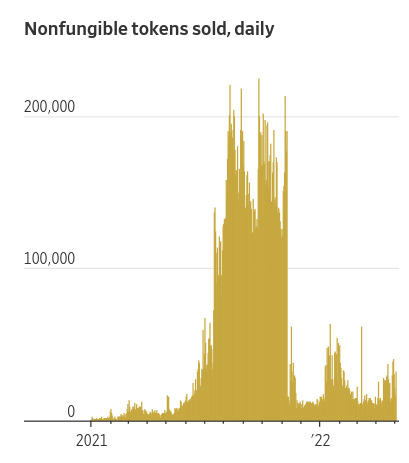

“Dead NFTs: The Evolving Landscape of the NFT Market” is a new report from dappGambl, a community of experts in finance and blockchain technology. Upon analysis of 73,257 NFT collections, the authors found that 69,795 have a market cap of zero Ether (ETH), the second most-popular cryptocurrency behind Bitcoin. In practical terms, that means 95 percent of NFTs wouldn’t fetch a penny today — a spectacular crash for assets that reached a trading volume of $17 billion amid a frenzied bull market in 2021. The study estimates that some 23 million investors own these tokens of no practical use or value.

[...]

The “Dead NFTs” report observes that the nearly 200,000 NFT collections “with no apparent owners or market share” identified by the study caused carbon emissions equivalent to the annual output from 2,048 houses, or 3,531 cars.

10K notes

·

View notes

Photo

293 notes

·

View notes

Text

I went digging through youtube, old posts, and shitty websites, along with my memories, and here you go! Hopefully these are accurate.

2013 — Unoffical Tumblr event “Mishapocalypse” happened, an online flash mob event wherein which Tumblrinas change their profile pictures to a specific picture of Misha Collins of Supernatural fame.

2014 — Users were given the option to get Tumblr Pro for free, and those who accepted were given top hats on their icons. Prompty after this, @staff announced that “Everyone with a top hat is now marked for account deletion. This is the only way we could destroy this horrible website. Happy April Fools day.”

2015 — The “Executive Suite 2016 Productivity Edition” essentially changed Tumblr into office software, allowing spreadsheets for memes, calculators that gave incorrect answers, and Coppy. Who gave “helpful tips”.

2016 — Tumblr voted to select the “new lizard king”, from Rick, Debrah, Mop and Wretched Tooth. However, more famously, an edited @staff post reads “for april fools we’re deleting this entire site sayonara you weeaboo shits”.

2017 — The Tumblr Horse Game was a feature that, when clicked, took users to a game wherein you had to collect shit from a pixelated horse. If you failed to do so, the horse died.

2018 — The answer to Bitcoin, is Tumblcoin! A parody of crytocurency.

2019 — Tumblr Memories, in which Tumbeasts were set loose. Remember them? The mascot from 2011, for service interruption announcements.

2020 — There was seemingly no prank this year. This was COVID-19.

2021 — Tumblr released “non-fungible tumblcryptids”, a parody of NFTs. There was a supposedly limited amount of them.

2022 — A light switch, when activated, would open up a variety of colourful things on the desktop dashboard, including a “Summon Crab!” button, which would summon a crab when activated. Other buttons made different sounds.

2023 — A feature similar to the Discord reaction function was temporarily added, using basic emojis.

2024 — Every user was given the option to opt-in to the boop o meter, and could boop, super boop, and evil boop other users who also opted in, earning up to three badges by doing so.

#april fools#tumblr meta#boop o meter#tumblr memories#tumbeasts#non fungible tumblcryptids#summmon crab#tumblcoin#coppy#tumblr horse game#tumblr pro#mishapocalypse#new lizard king#boop

36 notes

·

View notes

Text

rich folks are often deeply confused about the value of money

the richer they are the more susceptible they are to the disorder, and the more extreme its symptoms will manifest

most of them are truly planning on how to buy their way past doom, right now - Cheney and W both placed in the top 6 of "Greenest homes in the world" not so long ago, it's a tradition for that set

turning off the heat in december won't make july more tolerable,

and the price tag on survival is so low that the rich just aren't interested in paying for it

they truly will die before they'll voluntarily stop destroying the world. they do it deliberately, in order to make their wealth feel more valuable

16 notes

·

View notes

Text

Lucky🤖 Robots🍀 Foundation🏦 Welcomes Newcomer: bg10bo03ha03ar17he04

#nftartist#opensea#nftart#nftcollection#nftoftheday#nftproject#token#fungible#nftpictures#lucky#robot#foundation#discover

19 notes

·

View notes

Text

woke up thinking about a modern-day ASOUE that involves an art scheme and Verified Fungible Drawings

#a series of unfortunate events#yes I know they should not be funged#but a) I can't make that joke work and b) I'm gonna pretend the fungibility is somehow PART of the meta joke#just imagine it's really good okay

161 notes

·

View notes

Photo

"Cloud.Memory" 2023 by Fateh Avtar Singh

from the “Reboot” collection

“With love for art, respect for artists and collectors, when every day for development, self-improvement and work”

link to the item܄ OpenSea

#Non-fungible token (NFT)#NFT Trending#nfts#NFT#nft crypto#nft update#nftcommunity#nft news#nftproject#crypto#Cryptoart#crypto art#CryptoAssets#nftcrypto#nftart#digital collage#digital art#digital painting#Digital Illustration#digital#digital artwork#digital aritst#Abstract Artwork#abstract#abstraction#abstract art#abstract expressionism#digital assets#digitaldesign#artist

34 notes

·

View notes

Text

Governance Tokens DeFi: Empowering Decentralized Finance

Decentralized Finance, or DeFi, is a quickly growing industry of the blockchain sector that is revolutionizing traditional financing. It uses a variety of economic solutions, such as borrowing, trading, and also borrowing, without the requirement for intermediaries like financial institutions. However, to make certain the smooth functioning of DeFi methods, administration is crucial. This is where Governance Tokens enter into play.

What are Governance Tokens?

Governance Tokens are digital possessions that grant their owners the right to get involved in the decision-making procedure of a DeFi method. They permit token owners to suggest, vote, and implement changes to the protocol's procedures and also regulations. Governance Tokens are important for the decentralized governance of DeFi methods, as they allow an autonomous decision-making procedure without the requirement for centralized authorities.

How do Governance Tokens function?

Governance Tokens work with a Proof-of-Stake (PoS) consensus mechanism, which means that the more tokens an individual holds, the more ballot power they have. This makes sure that those that have a larger stake in the procedure have a greater say in the decision-making procedure. Governance Tokens are typically dispersed with Initial Coin Offerings (ICOs) or airdrops, where users can get them by staking other cryptocurrencies or by holding a specific quantity of symbols.

What are the advantages of Governance Tokens?

Governance Tokens supply numerous advantages to both DeFi procedures as well as token holders. Firstly, they supply a device for decentralized decision-making, ensuring that the protocol holds to its decentralized nature. This likewise makes certain that the method can adjust to altering market problems and also user demands, making it a lot more resistant and also sustainable over time.

Secondly, Governance Tokens incentivize active participation from token holders, as they have a direct risk in the success of the method. This ensures that token owners are more probable to participate in the decision-making procedure, causing even more informed and autonomous decisions.

Finally, Governance Tokens additionally supply a potential roi for token owners. As the method grows and also comes to be extra effective, the worth of the Governance Tokens may increase, resulting in resources gains for token holders.

What are the challenges of Governance Tokens?

While Governance Tokens offer several advantages, there are also some difficulties that need to be dealt with. https://manocoin.net/category/crypto-exchanges/ Firstly, the circulation of Governance Tokens might not constantly be fair, as those that have much more sources may be able to obtain a larger risk in the protocol. This can result in a focus of power, which might not be preferable in a decentralized system.

Secondly, the decision-making process might be sluggish and inefficient, as token owners might not always settle on the very best strategy. This can bring about hold-ups in implementing adjustments and might hinder the method's growth and also advancement.

Finally, Governance Tokens might also go through regulatory analysis, as they may be considered securities in some jurisdictions. This can cause legal challenges as well as might restrict the fostering of Governance Tokens in particular regions.

Conclusion

Governance Tokens are a crucial part of decentralized financing, making it possible for democratic decision-making and also incentivizing active engagement from token owners. While there are some challenges to be attended to, the benefits of Governance Tokens far surpass the drawbacks. As DeFi continues to grow and expand, Governance Tokens will certainly play a progressively essential function in ensuring the sustainability as well as durability of these methods.

#Blockchain#Crypto Mining#Crypto Security#Crypto Wallets#Decentralized Finance#Crypto Exchanges#Non-Fungible Tokens#Cryptocurrency#DeFi#NFTs

2 notes

·

View notes

Note

Fun fact, the most valuable (to collectors) shinies are very low CP guys that can evolve but have not evolved. There's no way to catch these under levelled boys except in Go!

I am not super conversant with the concept of how to digitally collect things, which i suppose is funny given that i'm playing a game that is fundamentally about digitally collecting things. but like. how would you even. get these outside of the game. i don't know.

anyway i admit i am also slightly befuddled by the obsession with shinies. i mean i get that they're cute and it's fun to have a different one but like.

well i have a couple of shinies and boy are they low-level ones, LOL

the "hatchu"s, the guys in costumes etc., kind of drive me nuts because on the one hand that's so cute that they have a flower crown but on the other hand this is a buneary with terrible stats and now i feel weird deleting it congrats on making me buy additional storage i guess??

i admit i'm just bitter i haven't caught a pikachu in a flower crown yet.

#hatchu#pokemon go#shinies#collectibles#digital collectibles#these are fungible digital tokens pretending to be non fungible#i don't really understand those words i just made it up

13 notes

·

View notes

Text

19K notes

·

View notes

Text

You're kidding me

172 notes

·

View notes

Text

Introducing Pretty Ponzis, a collection by naurtNFT!

Pretty Ponzis will be available on the FAKEZ Marketplace and can be minted for 0.15 $SCAM

Get in on the ground floor and join the Ponzi Posse! Come with us as we shoot for the moon!

Ponzi Schemes are fraudulent investment opportunities that draw in new investors with promises of abnormally consistent high returns and little-to-no risk, and pay those returns to old investors with the funds from new investors.

[Read more about Ponzi Schemes on Wikipedia]

An example of a cryptocurrency Ponzi scheme (also called a "smart Ponzi") is the TerraUSD "algorithmic stablecoin"--and its partner coin TerraLUNA--that lost its peg to the dollar and collapsed in 2022. The collapse wiped out $45 Billion in a week, and had rippling effects on other currencies and exchanges.

[Read more about the Terra Blockchain on Wikipedia]

6 notes

·

View notes

Text

I loves the part where the gougar said "it's gougin' time" and gouged all over the place

32 notes

·

View notes

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

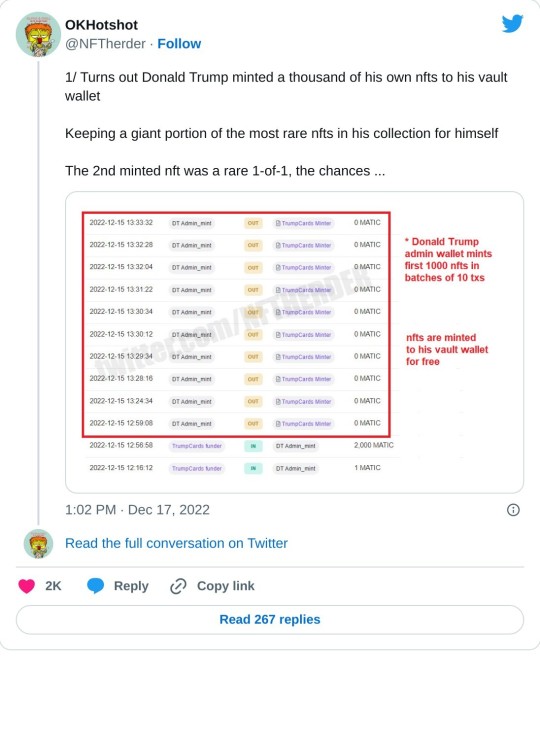

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

Lucky🍀 Robots🤖Foundation🏦 Welcomes👋 Newcomer:bg10bo19ha15ar02he12

#nftartist#opensea#nftart#nftcollection#nftoftheday#nftproject#token#fungible#nftpictures#lucky#robot#foundation#discover

14 notes

·

View notes