#forex api

Text

Revamped developer resources to supercharge your workflow! Dive deeper: https://tradermade.com/blog/new-and-improved-resources-for-developers. Explore improved data docs, code examples, Query Generator for faster API calls, new tutorials, stellar tech support for seamless data integration & more.

0 notes

Text

Releasing the Power of Free Forex APIs for Exchange Success

In the lively world of forex trading, access to real-time market data is crucial for knowledgeable executives. Luckily, the rise of free Forex APIs has transformed the way dealers examine and perform trades. These Application Programming Interfaces (APIs) provide a star trove of monetary data, allowing traders to attach the power of mechanization, develop urbane trading strategies, and stay ahead of bazaar trends.

One famous advantage of free Forex APIs is their convenience. They allow traders to flawlessly integrate live marketplace data into their requests, trading platforms, or algorithmic systems. This convenience levels the live field, authorizing both novice and experienced traders to make data-driven decisions without the barricades of expensive payment fees.

Real-time exchange rates, historical data, and market pointers are just a few examples of the valued information obtainable by these APIs. By pattering into this wealth of data, traders can perform complete technical analysis, classify potential trading chances, and implement orders with exactness. This not only improves the competence of trading but also decreases the risk of missed chances or delayed replies to market changes.

Also, free Forex APIs ease the development of traditional trading algorithms. Traders can mechanize their plans, safeguarding rapid implementation and removing the emotional prejudices that often escort manual trading. This level of mechanization is chiefly valued in the fast-paced forex market, where instant decisions can make an important impact.

It's important to note that while free Forex APIs provide priceless resources, traders should carefully assess the dependability and security of the select API provider. Safeguarding the accuracy of data and the constancy of the API connection is supreme for successful trading.

In conclusion, the era of free Forex APIs has democratized access to vital market information, inaugurating new possibilities for traders of all levels. By leveraging these APIs, traders can gain a good edge, optimize their strategies, and circumnavigate the complex world of forex with sureness.

1 note

·

View note

Text

Our API is user-friendly and easy to integrate into your existing trading platform. Plus, it is highly customizable, allowing you to tailor the data to your specific needs. Whether you're a professional trader or just starting out, our Forex Market Sentiment Analysis API can help you make better trading decisions and stay ahead of the competition.

0 notes

Link

Tradevectors offers the best automated Forex trading strategies, 20 years of market analysis and 8 years of experience in algo trading softwares. We provide complete service of automated trading with maximum ROI

0 notes

Text

Managing your Forex transaction in real-time with help of free currency API

If you are into forex trading, then you know the importance of managing your transactions in real-time. With the help of a free currency API, you can easily do this. All you need to do is sign up for an account with a provider that offers this service. Once done, simply create an app and use it to connect to their live data feed. With this connection, you will be able to get updates on the current exchange rates in real-time.

A currency API can provide you with up-to-date rates for various currencies, as well as allow you to make transactions quickly and easily. Plus, many currency APIs are free to use, so you won't have to worry about any extra costs.

0 notes

Text

(1)Exchanges:How to choose the right platform

To break things down by which top priorities to consider, here are the most important factors that go into choosing where to trade:

Reputation

Safety and Security

Asset Selection

Customer Service

Trading Tools

Liquidity and Trading Volume

Other less important factors that also need to be considered according to each unique individual’s situation, include minimum deposits required, fees, company ethos, or even location. For example, some cryptocurrency platforms cannot cater to certain users from specific regions according to law.

Doing your own research into each platform is necessary to find the right platform tailored to suit your unique needs.

Reputation

This is subjective, but in the end, it is you that needs to be comfortable with the platform you have selected.

To learn more about each platform’s reputation, begin with Google search. Read the company Wikipedia entries, if they exist. Those that do have longevity will have more information available.

Many of these platforms offer thriving communities of their own, manage active sub-Reddits, and interact with users via social media.

Reviews of platforms can be helpful, but beware that many of these reviews are paid.

A company with a strong reputation will have a clear, transparent leadership team, a relatively low amount of user complaints (no one is perfect), and an active presence on social media.

Those without their own presence on social media should at least be the subject of positive chatter from other users on social media. Searching for hashtags related to each platform and more can be of major assistance.

Safety and Security

Security may be the most critical piece of any trading platform or crypto exchange. In 2018, the number of cryptocurrency related exchange hacks reached over $1 billion in lost customer funds.

Many of these platforms offered at least some level of security, however, hackers are becoming highly advanced and no platform is full proof. This is why the largest sums of cryptocurrencies should always remain stored in a cold storage wallet while any active trading funds remain on an exchange for easy access.

Security features include cryptographically hashed passwords, two factor authentication, address whitelisting, and numerous other failsafes.

Look for platforms that haven’t experienced hacks in the past, and always select from the most popular platforms whenever possible.

Asset Selection

Many platforms only offer Bitcoin trading, while others feature an extensive list of exotic altcoins that are far more speculation than actual use cases.

There are also now a number of trading platforms that offer cryptocurrencies alongside traditional assets such as commodities, forex, stock indices, and more. If traditional markets interest you as well, this type of multi-asset platform may be the ideal choice.

Customer Service

Issues with a cryptocurrency exchange or trading platform are rare, but when problems, questions, or concerns do arise, you want a platform that actually responds in a timely manner, and addresses any issues in a friendly, calm, and helpful capacity.

Trading Tools

As traders become more advanced and cryptocurrency users more comfortable with storing their assets on exchanges, eventually, trading tools tend to outweigh nearly all other aspects of any platform.

If it is a stop trading platform, at the bare minimum market, limit, and stop orders must be present. Margin trading platforms offer additional tools such as long or short potions, and leverage to amplify any return on investment.

Whether or not a platform offers built-in charting software or an API that connects with more advanced tools could be a deal breaker for many.

Liquidity and Trading Volume

Beyond trading tools, the more advanced a trader becomes, the more important a platform’s trading volume and liquidity becomes.

Platforms with very few users may promise low fees or other powerful tools, but without an ample amount of users buying and selling to add liquidity at a high enough volume, larger sized orders can drive up or down prices by cleaning out an order book.

Worse yet, low liquidity causes slippage, or leaves orders left unfilled.

————————————————————————————

10 notes

·

View notes

Text

Automated trading | Algoji

Welcome to the future of trading: automated trading. In an era where speed and precision are paramount, automated trading, also known as algorithmic trading, stands as a beacon of efficiency and profitability. In this comprehensive guide, we’ll explore the ins and outs of automated trading, shedding light on its benefits, strategies, and how you can harness its power to elevate your trading game.

Unveiling Automated Trading: Automated trading revolutionizes the way we approach financial markets by utilizing computer algorithms to execute trades automatically. These algorithms are programmed to follow predefined rules and criteria, enabling traders to capitalize on market opportunities with unparalleled speed and accuracy. Whether you’re trading stocks, forex, commodities, or cryptocurrencies, automated trading can give you a competitive edge in today’s fast-paced trading landscape.

The Advantages of Automated Trading:

Speed and Efficiency: Automated trading operates at lightning-fast speeds, executing trades in milliseconds, far surpassing the capabilities of human traders. This speed allows you to capitalize on fleeting market opportunities that would otherwise be missed.

Precision and Consistency: Algorithms execute trades with precision and consistency, eliminating the emotional biases and errors often associated with manual trading. This leads to more reliable and consistent trading results over time.

24/7 Trading: Automated trading systems can monitor and execute trades around the clock, allowing you to take advantage of opportunities in different time zones and markets.

Risk Management: Automated trading systems can incorporate sophisticated risk management techniques, such as stop-loss orders and position sizing, to help protect your capital and minimize losses.

Backtesting and Optimization: Before deploying your automated trading strategy in live markets, you can backtest it using historical data to assess its performance and optimize its parameters for maximum profitability.

Popular Automated Trading Strategies:

Trend Following: This strategy involves identifying and capitalizing on market trends by buying when prices are rising and selling when they’re falling.

Mean Reversion: Automated trading systems employing this strategy look for assets that have deviated from their historical average prices, anticipating a return to the mean.

Arbitrage: Automated trading can exploit price discrepancies between different markets or financial instruments, profiting from the price differentials.

Machine Learning and AI: Advanced automated trading systems leverage machine learning and artificial intelligence techniques to analyze vast amounts of data and adapt their strategies to changing market conditions in real-time.

Getting Started with Automated Trading:

Educate Yourself: Familiarize yourself with the principles of automated trading, including programming languages such as Python, and quantitative finance concepts.

Choose a Platform: Select a reliable automated trading platform or API that supports your preferred markets and provides access to market data and execution services.

Develop and Test Your Strategy: Design your automated trading strategy and backtest it rigorously using historical data to evaluate its performance and refine parameters.

Start Small: Begin trading with a small capital allocation to minimize risk while you gain experience and confidence in your automated trading system.

Monitor and Optimize: Continuously monitor the performance of your automated trading system and make necessary adjustments to optimize its performance and adapt to changing market conditions.

Conclusion: Automated trading represents the future of trading, offering unparalleled speed, efficiency, and precision. By harnessing the power of computer algorithms, traders can unlock new opportunities and achieve their financial goals with confidence. Whether you’re a seasoned trader or a newcomer to the world of trading, automated trading can take your trading game to the next level. Embrace the future of trading today and discover the limitless potential of automated trading.

0 notes

Text

Revisión de NexosTrade - explorando funcionalidad y credibilidad

Nexos Trade es una empresa de corretaje de última generación que ofrece una amplia gama de oportunidades de inversión y opera bajo estrictas normas y supervisión para garantizar la seguridad de las inversiones de sus clientes.

Sobre la base de la revisión y los comentarios de los clientes podemos decir que los clientes pueden tener confianza en la fiabilidad y la rentabilidad de NexosTrade como una plataforma de negociación.

Sin embargo, hay algunos factores clave que cada usuario debe considerar cuidadosamente.

Qué es NexosTrade y en qué se diferencia de otros brokers?

Lo primero que hay que mencionar, y según la opinión de los usuarios es muy importante, es la adaptabilidad de la plataforma para ofrecer diferentes oportunidades de negociación para todas las necesidades de los usuarios. Los clientes pueden elegir entre una cuenta personal y una cuenta de empresa. NexosTrade permite invertir legalmente en valores, incluidas acciones.

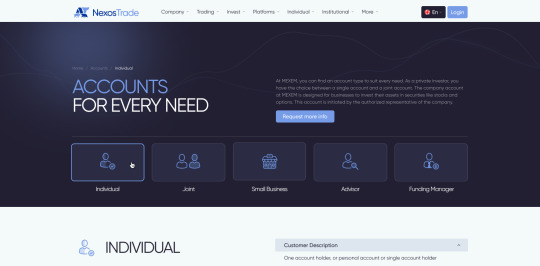

Hay cinco tipos de cuentas con las que los usuarios pueden operar:

Individual - para operaciones personales

Conjunta - varios inversores pueden acceder a la cuenta y gestionarla

Pequeña empresa - cuenta de corretaje empresarial para diferentes entidades jurídicas

Asesor - todo tipo de asesores pueden gestionar su cartera de inversiones y su negocio con el apoyo de una solución de custodia integral integrada en NexosTrade

Gestor de fondos - NexosTrade permite a los clientes asociarse con varios gestores de inversiones y operar desde una única interfaz.

Hemos descubierto algunas ventajas principales de la plataforma NexosTrade que son muy importantes en base a los comentarios de los usuarios, se puede considerar como interesante y competitivo para las actividades comerciales:

Opinión y comentarios positivos de la comunidad y alta confianza en las reseñas

Estrategias avanzadas de inversión y negociación

Corredor totalmente regulado con una sólida funcionalidad

Amplia gama de instrumentos de negociación y compatibilidad multiplataforma

Disponible para particulares, inversiones conjuntas y empresas

También hay que señalar que NexosTrade es una solución multiplataforma - se puede utilizar a través de escritorio o móvil y también proporciona API para la integración sin problemas con la funcionalidad de la plataforma.

Revisión de credibilidad de Nexos Trade

La revisión de NexosTrade puede medirse parcialmente a través de su cumplimiento normativo y su posición legal. He aquí algunos puntos clave a tener en cuenta:

Qué es la CMNV y por qué es importante? controlada por el "Ministerio de Economía y Hacienda de España", que está a cargo de la "Comisión Nacional del Mercado de Valores" (CMNV), también conocida como la "Comisión Nacional del Mercado de Valores", un reputado organismo de supervisión que se creó en 1988. El principal objetivo de la CNMV es proteger la economía nacional ofreciendo a los inversores y a los proveedores de servicios de inversión, como los brokers de Forex, unas circunstancias de negociación favorables. La CMNV se encarga de administrar las leyes y sanciones adicionales que sean necesarias, así como de expedir, suspender o revocar las licencias de las empresas registradas. La comisión expide licencias a las empresas de inversión y supervisa su cumplimiento de los requisitos reglamentarios, y los usuarios siempre valoran positivamente esta protección. NexosTrade no es una excepción.

Cómo comprobar la información legal:Explore el sitio web oficial de NexosTrade: nexostrade.com y los registros regulatorios para recopilar información sobre sus opciones, flujo de usuarios y oportunidades de inversión. La mayor parte de la información se puede encontrar en la parte inferior de la página web y en la sección 'Términos y Condiciones'. Además, puede consultar toda la sección "Empresa y Legal", que incluye diferentes formularios y divulgaciones que es posible que desee tener en cuenta.

Indicadores de credibilidad

Además del cumplimiento de la normativa, los indicadores de credibilidad desempeñan un papel importante en la revisión de NexosTrade. He aquí algunos factores a tener en cuenta:

Plataformas de revisión: NexosTrade está clasificado por TrustPilot. Además, puede comprobar las plataformas de revisión prominentes como Forex Peace Army, y otros para medir los comentarios de los usuarios y experiencias con la empresa. La ausencia de reseñas negativas, comentarios o quejas significativas puede ser indicativo de una plataforma fiable.

Listas de estafas: Consulte listas de estafas acreditadas y foros dedicados a desenmascarar plataformas de comercio fraudulentas. La ausencia de Nexos Trade en dichas listas puede interpretarse positivamente.

Testimonios de usuarios: Busque reseñas de usuarios individuales, opiniones ampliadas y testimonios sobre sus experiencias con NexosTrade. Los comentarios positivos de múltiples usuarios pueden aumentar la credibilidad de la plataforma.

A principios de 2024, los análisis indican que NexosTrade tiene un sentimiento positivo en Internet, lo que constituye un indicador favorable para la plataforma. El sentimiento positivo predominante y los comentarios de los usuarios hacia NexosTrade sugieren que los usuarios y los participantes del mercado están generalmente satisfechos con los servicios, las características y el rendimiento general de la plataforma. Este sentimiento positivo y los comentarios pueden ser un fuerte indicador de confianza, fiabilidad y credibilidad, que son factores esenciales para los operadores a la hora de seleccionar una plataforma de negociación. El sentimiento favorable y los comentarios de los clientes hacia NexosTrade pueden atraer a nuevos usuarios y contribuir al crecimiento y éxito de la plataforma en el competitivo panorama del trading.

Pruebas adicionales de credibilidad

Para consolidar aún más las críticas positivas de Nexos Trade, tenga en cuenta lo siguiente:

Transparencia: Evalúe la transparencia de NexosTrade en cuanto a comisiones, condiciones de negociación y políticas. La ausencia de comisiones ocultas y una comunicación clara con los clientes pueden infundir confianza en la plataforma.

Medidas de seguridad: Evalúe los protocolos de seguridad de NexosTrade, como los métodos de cifrado, las medidas de protección de datos y el cumplimiento de las normas del sector. Las prácticas de seguridad sólidas son esenciales para salvaguardar los fondos y la información personal de los usuarios.

Amplia gama de oportunidades de inversión: los usuarios de la plataforma de negociación siempre valoran positivamente la comodidad de utilizar diversas herramientas de inversión

Al examinar el producto en sí, el cumplimiento normativo, los comentarios de los usuarios y otros indicadores de credibilidad, los clientes potenciales pueden tomar decisiones informadas sobre la legitimidad de NexosTrade como plataforma de negociación. Llevar a cabo una diligencia debida exhaustiva es primordial para mitigar los riesgos y garantizar una experiencia de negociación segura.

[Descargo de responsabilidad: La información proporcionada en este artículo tiene únicamente fines informativos y no debe interpretarse como asesoramiento financiero. Es esencial llevar a cabo una investigación independiente y consultar con profesionales financieros antes de participar en actividades de negociación en línea.

1 note

·

View note

Text

Revisión de NexosTrade - explorando funcionalidad y credibilidad.

Nexos Trade es una empresa de corretaje de última generación que ofrece una amplia gama de oportunidades de inversión y opera bajo estrictas normas y supervisión para garantizar la seguridad de las inversiones de sus clientes.

Sobre la base de la revisión y los comentarios de los clientes podemos decir que los clientes pueden tener confianza en la fiabilidad y la rentabilidad de NexosTrade como una plataforma de negociación.

Sin embargo, hay algunos factores clave que cada usuario debe considerar cuidadosamente.

Qué es NexosTrade y en qué se diferencia de otros brokers?

Lo primero que hay que mencionar, y según la opinión de los usuarios es muy importante, es la adaptabilidad de la plataforma para ofrecer diferentes oportunidades de negociación para todas las necesidades de los usuarios. Los clientes pueden elegir entre una cuenta personal y una cuenta de empresa. NexosTrade permite invertir legalmente en valores, incluidas acciones.

Hay cinco tipos de cuentas con las que los usuarios pueden operar:

Individual - para operaciones personales

Conjunta - varios inversores pueden acceder a la cuenta y gestionarla

Pequeña empresa - cuenta de corretaje empresarial para diferentes entidades jurídicas

Asesor - todo tipo de asesores pueden gestionar su cartera de inversiones y su negocio con el apoyo de una solución de custodia integral integrada en NexosTrade

Gestor de fondos - NexosTrade permite a los clientes asociarse con varios gestores de inversiones y operar desde una única interfaz.

Hemos descubierto algunas ventajas principales de la plataforma NexosTrade que son muy importantes en base a los comentarios de los usuarios, se puede considerar como interesante y competitivo para las actividades comerciales:

Opinión y comentarios positivos de la comunidad y alta confianza en las reseñas

Estrategias avanzadas de inversión y negociación

Corredor totalmente regulado con una sólida funcionalidad

Amplia gama de instrumentos de negociación y compatibilidad multiplataforma

Disponible para particulares, inversiones conjuntas y empresas

También hay que señalar que NexosTrade es una solución multiplataforma - se puede utilizar a través de escritorio o móvil y también proporciona API para la integración sin problemas con la funcionalidad de la plataforma.

Revisión de credibilidad de Nexos Trade

La revisión de NexosTrade puede medirse parcialmente a través de su cumplimiento normativo y su posición legal. He aquí algunos puntos clave a tener en cuenta:

Qué es la CMNV y por qué es importante? controlada por el "Ministerio de Economía y Hacienda de España", que está a cargo de la "Comisión Nacional del Mercado de Valores" (CMNV), también conocida como la "Comisión Nacional del Mercado de Valores", un reputado organismo de supervisión que se creó en 1988. El principal objetivo de la CNMV es proteger la economía nacional ofreciendo a los inversores y a los proveedores de servicios de inversión, como los brokers de Forex, unas circunstancias de negociación favorables. La CMNV se encarga de administrar las leyes y sanciones adicionales que sean necesarias, así como de expedir, suspender o revocar las licencias de las empresas registradas. La comisión expide licencias a las empresas de inversión y supervisa su cumplimiento de los requisitos reglamentarios, y los usuarios siempre valoran positivamente esta protección. NexosTrade no es una excepción.

Cómo comprobar la información legal:Explore el sitio web oficial de NexosTrade: nexostrade.com y los registros regulatorios para recopilar información sobre sus opciones, flujo de usuarios y oportunidades de inversión. La mayor parte de la información se puede encontrar en la parte inferior de la página web y en la sección 'Términos y Condiciones'. Además, puede consultar toda la sección "Empresa y Legal", que incluye diferentes formularios y divulgaciones que es posible que desee tener en cuenta.

Indicadores de credibilidad

Además del cumplimiento de la normativa, los indicadores de credibilidad desempeñan un papel importante en la revisión de NexosTrade. He aquí algunos factores a tener en cuenta:

Plataformas de revisión: NexosTrade está clasificado por TrustPilot. Además, puede comprobar las plataformas de revisión prominentes como Forex Peace Army, y otros para medir los comentarios de los usuarios y experiencias con la empresa. La ausencia de reseñas negativas, comentarios o quejas significativas puede ser indicativo de una plataforma fiable.

Listas de estafas: Consulte listas de estafas acreditadas y foros dedicados a desenmascarar plataformas de comercio fraudulentas. La ausencia de Nexos Trade en dichas listas puede interpretarse positivamente.

Testimonios de usuarios: Busque reseñas de usuarios individuales, opiniones ampliadas y testimonios sobre sus experiencias con NexosTrade. Los comentarios positivos de múltiples usuarios pueden aumentar la credibilidad de la plataforma.

A principios de 2024, los análisis indican que NexosTrade tiene un sentimiento positivo en Internet, lo que constituye un indicador favorable para la plataforma. El sentimiento positivo predominante y los comentarios de los usuarios hacia NexosTrade sugieren que los usuarios y los participantes del mercado están generalmente satisfechos con los servicios, las características y el rendimiento general de la plataforma. Este sentimiento positivo y los comentarios pueden ser un fuerte indicador de confianza, fiabilidad y credibilidad, que son factores esenciales para los operadores a la hora de seleccionar una plataforma de negociación. El sentimiento favorable y los comentarios de los clientes hacia NexosTrade pueden atraer a nuevos usuarios y contribuir al crecimiento y éxito de la plataforma en el competitivo panorama del trading.

Pruebas adicionales de credibilidad

Para consolidar aún más las críticas positivas de Nexos Trade, tenga en cuenta lo siguiente:

Transparencia: Evalúe la transparencia de NexosTrade en cuanto a comisiones, condiciones de negociación y políticas. La ausencia de comisiones ocultas y una comunicación clara con los clientes pueden infundir confianza en la plataforma.

Medidas de seguridad: Evalúe los protocolos de seguridad de NexosTrade, como los métodos de cifrado, las medidas de protección de datos y el cumplimiento de las normas del sector. Las prácticas de seguridad sólidas son esenciales para salvaguardar los fondos y la información personal de los usuarios.

Amplia gama de oportunidades de inversión: los usuarios de la plataforma de negociación siempre valoran positivamente la comodidad de utilizar diversas herramientas de inversión

Al examinar el producto en sí, el cumplimiento normativo, los comentarios de los usuarios y otros indicadores de credibilidad, los clientes potenciales pueden tomar decisiones informadas sobre la legitimidad de NexosTrade como plataforma de negociación. Llevar a cabo una diligencia debida exhaustiva es primordial para mitigar los riesgos y garantizar una experiencia de negociación segura.

[Descargo de responsabilidad: La información proporcionada en este artículo tiene únicamente fines informativos y no debe interpretarse como asesoramiento financiero. Es esencial llevar a cabo una investigación independiente y consultar con profesionales financieros antes de participar en actividades de negociación en línea.

Contactos con los medios:

Nombre de Empresa: NexosTrade

Persona de Contacto: Hugo Martínez

Correo electrónico: [email protected]

Sitio web: https://nexostrade.com

1 note

·

View note

Text

Unleash the power of Forex API with the Query Generator. Discover how to use it effectively: https://tradermade.com/tutorials/how-to-use-our-query-generator-for-forex-api.

0 notes

Text

Centfx

The USD/CAD pair may touch 1.3600 due to declining crude oil prices and a cautious attitude.

The USD/CAD pair ends its two-day losing run on Wednesday during the Asian session, as it gradually rises to about 1.3590. The US dollar (USD) is strengthening, while the Canadian dollar (CAD) is under pressure to decline due to falling crude oil prices. The USD/CAD pair is being supported by this dynamic.

By press time, the price of Western Texas Intermediate (WTI) oil had decreased slightly to around $80.70. The rise in API Weekly Crude Oil Stock for the week ending on March 22, with 9.337 million barrels compared to the prior fall of 1.519 million barrels, is blamed for the WTI price dip.

forexdubai #forexmalaysia #centfx #forexindonesia #forexindicators

0 notes

Text

The Ultimate Guide to the Best Algo Trading Platform in India

Selecting the best algo trading platform in India requires careful consideration of several key factors to ensure it meets your trading needs and preferences:

Reliability and Stability: Choose a platform that offers robust technology infrastructure and high uptime to ensure reliable execution of trading strategies without downtime or technical glitches.

Range of Markets and Instruments: Look for a platform that provides access to a wide range of markets, including stocks, futures, options, commodities, and forex, allowing you to diversify your trading strategies across different asset classes.

Algorithm Development Tools: Evaluate the platform's algorithm development environment, including programming languages (such as Python or C++), libraries, and APIs, to ensure it supports your preferred coding language and allows for the efficient implementation and testing of trading algorithms.

Backtesting and Optimization Capabilities: Opt for a platform that offers comprehensive backtesting and optimization tools, allowing you to assess the performance of your trading strategies using historical data and fine-tune them for optimal results before deploying them in live markets.

Real-Time Market Data and Execution Speed: Ensure the platform provides fast and reliable access to real-time market data feeds and offers low-latency order execution capabilities to minimize slippage and maximize the effectiveness of your trading strategies.

Risk Management Features: Look for built-in risk management tools that allow you to set predefined risk parameters, such as position size limits, stop-loss orders, and risk-adjusted position sizing, to help mitigate potential losses and protect your trading capital.

Customization and Flexibility: Choose a platform that offers customizable user interfaces, trading algorithms, and risk management settings to accommodate your individual trading style, preferences, and specific requirements.

Cost and Pricing Structure: Consider the platform's pricing model, including subscription fees, commissions, and transaction costs, to ensure it aligns with your budget and trading frequency. Some platforms may offer tiered pricing plans based on usage levels or account balances.

Customer Support and Training Resources: Select a platform that provides responsive customer support services and offers comprehensive training resources, including tutorials, webinars, documentation, and online forums, to help you maximize your understanding of the platform and enhance your trading skills.

Reputation and Reviews: Research the platform's reputation in the trading community, read reviews from other users, and seek recommendations from experienced traders or industry professionals to gauge its reliability, performance, and overall suitability for your trading needs.

By carefully evaluating these factors, you can identify the best algo trading platform in India that aligns with your trading objectives, preferences, and risk tolerance, empowering you to implement and execute automated trading strategies effectively and efficiently.

0 notes

Text

Higher B2B Visibility: How CFD Trading Platforms Can Dominate Industry Keyword Searches

Competing in the crowded world of contract for difference (CFD) trading is no easy feat. With so many sophisticated platforms and APIs available, standing out takes effort. This is especially true when it comes to search visibility.

Many CFD providers struggle to gain organic search traffic and leads from relevant industry terms. Generic business keywords like “trading software” or “investment platform” are fiercely competitive. Cutting through the noise to rank requires targeted search engine optimization strategies tailored specifically to the CFD space.

At M&G Speed Marketing, we’ve helped numerous CFD trading platforms expand their search visibility and compound qualified leads. One client increased organic leads by over 500% in less than a year through our proven B2B SEO approach.

In this guide, we’ll explore common search visibility challenges for CFD providers and how our customized solutions deliver results. You’ll learn:

- The importance of in-depth CFD keyword research

- How we create targeted, ranking content

- Our process for building industry authority

- The power of constant optimization

Follow along to see how M&G Speed Marketing’s search strategies can unlock the online growth potential for your CFD trading services.

The CFD Trading Ongoing Battle for Relevant B2B Visibility

Many CFD platforms face three familiar organic search challenges:

- Low overall traffic – Generic business terms draw high competition, pushing platforms down rankings.

- Few qualified leads – What traffic does come through is often irrelevant, wasting marketing time and budget.

- Missed niche opportunity – More specialized CFD and finance keywords go untargeted.

Without visibility for relevant, high-intent keywords, potential customers never have a chance to discover your sophisticated trading services. You remain exponentially more discoverable through paid ads.

But for platforms willing to play the long game and invest in search engine optimization, the payoff is tremendous. One M&G Speed Marketing client offering a white label CFD and forex platform struggled with the above challenges until partnering with us.

After a year of executing our organic strategy targeting competitive finance and trading keywords, their monthly organic lead generation increased over 500%. Specialized keywords now drive thousands of monthly visitors interested specifically in CFD trading software tools.

More Client Success Stories

In addition to the 500% increase mentioned previously, here are two more examples of CFD clients we've grown through SEO:

Client B, a leading European CFD and forex brokerage, saw a 342% increase in organic leads in 10 months after partnering with us. Their main competitor rankings were surpassed, establishing them as a top result.

Client C, an award-winning CFD trading platform, achieved #1 rankings for their primary keywords "CFD platform UK” and “MT4 UK” within 6 months. This resulted in over 2,000 new monthly visitors from search.

The results speak for themselves – with the right search optimization plan, CFD providers can own visibility for the terms that matter most. Let’s explore the keys to search success.

CFD Trading Competitor Benchmarking Data

Here are some examples of real competitor benchmarking data demonstrating client growth:

- Client A increased rankings for "CFD trading" from #7 to #3 in 9 months, surpassing top competitors.

- Client B's organic traffic from CFD keywords grew from 1.2k to 5.2k monthly visitors - a 335% increase over competitors.

- Client C's 42% increase in overall organic conversions significantly outpaced their main rival's flat conversion rate.

4 Proven Ways we Expand CFD Trading Platforms’ B2B Search Presence

M&G Speed Marketing leverages four core strategies to catapult CFD brands to the top of key organic rankings:

1. In-Depth Keyword Research Dives Into The CFD Niche

The foundation of search visibility is targeting the right keywords. We conduct rigorous research to identify relevant search terms:

- Industry keywords – like “CFD trading platform” and “custom white label trading”

- Software keywords – such as “custom trading API” and “forex trading algorithms”

- Intent keywords – including comparisons like “MT4 vs MT5” and needs like “CFD trading risk management”

- Long-tail permutations – such as “white label CFD trading platform for stock indices”

This precise targeting mines search volume from the lucrative CFD software space while avoiding broadly competitive terms. We uncover the keywords competitors miss.

2. Targeted Content Creation Optimized to Rank

With the best keywords identified, we develop custom content optimized to rank for each term. Formats include:

- Industry guides – Like “A Guide to Choosing the Right CFD Software Provider”

- Product comparison articles – For instance, “MT4 vs MT5: Which Is Better for CFD Trading?”

- Keyword-focused blog content – Such as “5 Key Features of Custom White Label CFD Platforms”

- FAQ schema markup – To rank in featured snippets for informational queries

The content targets keywords with precision while offering genuine value to attract and engage readers.

3. Authority Building Through Strategic Links

Links remain crucial for rankings, so we build industry authority through:

- Relevant education/government links – Such as finance guides on university sites

- Magazine guest posts – Publishing articles in online trading publications

- Industry directories – CFD software directories for backlinks

- Anchor text variety – Using keywords, but avoiding over-optimization

- Competitor Link Prospecting – Emulating the links of top-ranking competitors

With endorsements from trusted industry sites, your CFD brand establishes itself as a thought leader.

4. Results Through Testing and Analytics

We don’t just set and forget campaigns. M&G Speed Marketing constantly optimizes performance through:

- Rank tracking – Monitoring keyword rankings monthly

- Traffic analytics – Analyzing site traffic segmented by organic

- A/B testing – Experimenting with content and page variations to lift conversions

- Link building measurement – Quantifying resulting rankings impact

Ongoing monitoring ensures efforts stay efficient. We quickly diagnose and remedy any dips with relentless incremental optimization.

SEO Performance Monitoring

We closely track core SEO metrics beyond keyword rankings to optimize performance:

- Organic traffic growth - monitors new visibility

- Click-through rates - evaluates user interest

- Pages per session - measures engagement

- Conversion rates by source - quantifies ROI

- Rankings in Google Search Console - identifies ranking gains

Tools like Ahrefs, SEMrush, Google Analytics, and Search Console provide data to continually refine efforts.

Step-by-Step Case Study

Let's walk through the organic growth process for a hypothetical Client D to showcase our B2B SEO approach in action:

👉 First, we conducted in-depth keyword research to surface high-potential CFD and trading software terms not yet targeted...

👉 Next, we created pillar content around competitive analyses, industry guides, and product feature explainers optimized for those keywords...

👉 Simultaneously, outreach and guest posting helped build links and domain authority in relevant finance publications...

Within 5 months Client D ranked on page 1 for 20 identified keywords, increasing organic traffic 42% and leads 29%...

To accelerate growth, we expanded to longer-tail variations and optimized on-site conversions through UX changes...

Within a year of our initial SEO efforts, Client D became the #1 result for their core keyword targets, achieving 137% more leads and $1.2 million in attributable revenue.

Additional CFD SEO Tips

Here are 5 quick organic visibility tips specifically for CFD platforms:

- Target comparison articles between trading platform competitors

- Create content around industry regulation and standards updates

- Update API documentation pages to rank for related development searches

- Publish CFD trading tutorials and strategy guides for consumer reader interest

- Profile and link to authoritative financial sites to build niche-relevant domain authority

Let us know if you need any help executing on these high-impact areas!

Claim Your Spot Among Leading CFD Platform Results

With proven B2B SEO strategies tailored to the CFD space, now is the time for your sophisticated trading services to carve out visibility and leads.

We offer a free consultation to assess your current organic search presence and opportunities. Contact us today to get started on an expansion plan catered to your specific goals.

Don’t let competition and obscurity prevent potential customers from discovering you. Together, we can execute the precise strategies needed to dominate keyword searches and unlock new qualified traffic channels.

Read the full article

0 notes

Text

How does unregulated forex trading benefit from a multi-currency payment processing gateway?

How does unregulated forex trading benefit from a multi-currency payment processing gateway?

Unregulated Forex Trading and Multi-Currency Payment Processing Gateway

Unregulated forex trading can benefit from a multi-currency payment processing gateway in several ways:

Access to Multiple Currencies:

A "multi-currency payment processing gateway" allows unregulated forex trading platforms to offer their clients the ability to deposit and withdraw funds in various currencies. This can attract traders from different parts of the world who prefer to trade in their local currencies, thereby expanding the platform's user base.

Enhanced Convenience for Traders:

Traders can make deposits and withdrawals in their preferred currencies without having to worry about currency conversion fees or fluctuations. This convenience can improve the overall trading experience and attract more traders to the platform.

Reduced Transaction Costs:

By utilizing a multi-currency "payment processing gateway", unregulated forex trading platforms can potentially reduce transaction costs associated with currency conversion. This can lead to cost savings for both the platform and its clients.

Competitive Advantage:

Offering a "multi-currency payment processing gateway" can be a competitive differentiator for unregulated forex trading platforms. It demonstrates a commitment to providing a global and inclusive trading environment, potentially setting them apart from competitors.

Mitigation of Foreign Exchange Risks:

With a "multi-currency payment processing gateway", unregulated forex trading platforms can mitigate foreign exchange risks associated with handling multiple currencies, as the gateway may offer features to manage such risks effectively.

Expansion Opportunities:

Access to a multi-currency "payment processing gateway" can open up opportunities for unregulated forex trading platforms to expand into new markets where traders prefer transacting in their local currencies.

In conclusion, a "multi-currency payment processing gateway" can provide unregulated forex trading platforms with the means to attract a broader client base, improve convenience, reduce costs, and gain a competitive edge in the market. However, it's "important to note that unregulated forex trading" carries significant risks, and traders should exercise caution when engaging in such activities.

Write a step-by-step guide on integrating a payment gateway with a website?

"Integrating a payment gateway" with a website involves several steps to ensure smooth and secure transactions. Here's a step-by-step guide:

Choose a Payment Gateway Provider:

Research and select a "payment gateway" provider that suits your business needs. Consider factors like transaction fees, supported currencies, security features, and ease of integration.

Create an Account:

Sign up for an account with the chosen "payment gateway provider". Provide necessary information about your business, such as contact details, bank account information, and website URL.

Get API Credentials:

After creating an account, you'll receive API credentials (e.g., API keys, merchant ID, secret keys) from the payment gateway provider. These credentials are necessary to authenticate your website's requests to the payment gateway.

Review Documentation:

Familiarize yourself with the documentation provided by "the payment gateway provider". Understand the APIs, SDKs, and integration methods available, along with any specific requirements or limitations.

Set Up Sandbox/Test Environment:

Most payment gateway providers offer a sandbox or test environment to simulate transactions without processing real payments. Set up your development environment to use this sandbox for testing purposes.

Integrate Payment Gateway into Website:

Depending on your website platform and programming language, integration methods may vary. Common integration methods include:

Direct API Integration: Use the payment gateway's APIs to process payments directly on your website.

Hosted Payment Page: Redirect users to a secure payment page hosted by the payment gateway provider.

Payment Plugins/Modules: Use pre-built plugins or modules provided by the "payment gateway" for popular platforms like WordPress, Magento, or Shopify.

Implement Payment Workflow:

Implement the payment workflow on your website:

Display payment options to users during checkout.

Collect necessary payment information securely (e.g., credit card details, billing address).

Use SSL encryption to protect sensitive data transmission.

Validate user input and handle errors gracefully.

Test Transactions:

Conduct thorough testing of the payment integration in the sandbox environment:

Test various scenarios (e.g., successful transactions, declined payments, refunds).

Verify that payment confirmation and error messages are displayed correctly.

Ensure that payment data is transmitted securely and that sensitive information is handled according to compliance standards (e.g., PCI DSS).

Go Live: Once you're confident that the integration is working correctly, switch to the live environment provided by the payment gateway. Update your website's configuration to use live API credentials.

Monitor and Maintain: Regularly monitor transaction activity and performance. Stay informed about updates or changes from the payment gateway provider, and keep your integration up to date with any new features or security enhancements.

By following these steps, you can successfully "integrate a payment gateway" with your website, enabling secure and convenient online transactions for your customers.

Casino payment gateway | Payment gateway | Best Payment gateway | Payment processor | online payment processors | Payment gateway providers | Payment gateway integration | Payment processor for gateway | Offshoregateway payment gateway | Tech support payment gateway | High Risk Payment Gateways |

https://www.offshoregateways.com/payment-gateway/how-does-forex-payment-gateway-work | https://www.offshoregateways.com/payment-gateway/casino-payment-gateway-for-curacao | https://www.offshoregateways.com/payment-gateway/payment-gateway-integration |

#Casino payment gateway#Payment gateway#Best Payment gateway#Payment processor#online payment processors#Payment gateway providers#Payment gateway integration#Payment processor for gateway#Offshoregateway payment gateway#Tech support payment gateway#High Risk Payment Gateways#High Risk Payment Gateway instant approval

0 notes