#double negative = positive or something like that english is great in that domain

Text

brain has been an asshole for the past few days

#and keeps behaving like one#personal#'you don't need exterior validation only yours matters' but consider. i have none.#external not exterior sdjfs wtf#at least i haven't had some for this week lmao#and the good old 'i don't want to force my friends to say nice things but also i'll shut up about my need for reassurance'#'and i won't communicate'#'i don't want to be a burden they must have other things to do'#'they are busy they may not be in the mood'#'what if they're having a bad time too'#oh my goodness how stupid am i#flashnews brain: they cannot guess!!! they cannot read my mind!!!#worst thing we're all having a bad time together#which automatically makes it less bad#double negative = positive or something like that english is great in that domain#worser thing we're all miserable in our corners and you know what. fck it.#if i could spit properly i would. (but i can't)#(plus it's disgusting but also that's the damn goal)#(so instead y'all have to deal with my glares instead)

4 notes

·

View notes

Link

News24 How coloured are you? 2008-06-30 13:07 Cape Town - I am fairly dark-skinned with dark hair and have often been mistaken for being Portuguese, Greek, Italian and Israeli (but mostly Portuguese). I am actually half-German and half-Afrikaans. So when I told friends at the office that I had once also been mistaken for being coloured, they all burst out laughing. I was deeply and profoundly offended. So they took pity on me, and a few of my coloured co-workers began introducing me to the complex and evolved life of the Cape coloured. (I was told if you want to be coloured, you have to be from Cape Town). Apparently coloured people from Joburg don't really qualify. Sorry. The coloured lifestyle is an intricate and complicated puzzle with millions of confusing little pieces. It involves things like gatsbys, the Galaxy club, where you live, not only how you drink, but what you drink - and where. You've gotta like gatsbys For instance, a gatsby (for the uninitiated, this is a large roll with polony - I'm not calling it ham - and deep-fried chips. If it doesn't spill onto the ground when you try to eat it, it's not a gatsby). I like gatsbys, no problem. Ok, says a friend, but you have to drink brandy too. "With Klippies?", asks another colleague innocently, joining in the Coloured Education of Andrea. "No!" scream the coloured friends in horror...(as all Afrikaners know, Klipdrift is the exclusive domain of the Boerevolk.) No, I'm informed, with Betrams. So far so good, I'm prepared to do all that. The problem starts when I hear that I wouldn't be able to be a sturvey (that's an uppity coloured), which I was gunning for of course. I don't want to be a gangster from the Badlands! But my colleague is firm on this, I couldn't be a sturvey because apparently, I "rafel uit too much". At this point I'm beginning to get despondent. Then I hear that, as a coloured, I wouldn't be able to take my gatsby home and eat it with a knife and fork in front of the telly. No, it must be eaten on top of the bonnet of your car. Also, this has to happen late at night when you come back from a night at the Galaxy club. This is another problem - I'm not a clubber, after all, I'm virtually in an old-age home, being over thirty. How big are your mags? Then it gets more complicated - I'm asked how big the mags are on my car, what kind of music I listen to and whether I'd be prepared to undergo an intensive language course. Because, yes, for those of you who thought coloured people speak Afrikaans and English, think again. If you are really coloured you will know that anyone asking you "waar brand dit" is not referring to a fire in the neighbourhood, but is asking you where "it's happening" or the party is going on. I couldn't help wondering if the Chinese community in SA would be feeling the same sort of despair I was. In the past week, a Pretoria court ruled that they should from now on be classified as coloured and be included in the definition of "black people" in laws, including black economic empowerment legislation, which has been established to help previously disadvantaged groups. Following this groundbreaking ruling, the Labour Minister made some strange comments in the media, saying that he was now expecting Chinese people to behave more like black people (seeing as how they are now coloured people, I assume he meant - behave like coloured people.) I'm not sure if he thought they should start eating gatsbys and going to the Galaxy club. He also said they should start assimilating the coloured culture by learning a local language, which put in my mind some Chinese people driving up to an Asian noodle bar in a car with huge, shiny mags and asking the fella behind the counter, "Hoezit my bra, ek't lis vir 'n dite".* *Translation. Dite (pronounced like "date" with an i refers to being hungry and wanting some grub, mostly though, it refers to - you guessed it - a gatsby." (** Oh, before you type me the hate mail, I know not ALL coloured people drink Betram's and eat gatsbys or go to the Galaxy. Only the cool ones, of course...) Send your comments to Andrea. Disclaimer: News24 encourages freedom of speech and the expression of diverse views. The views of columnists published on News24 are therefore their own and do not necessarily represent the views of News24. News24 editors reserve the right to edit or delete any and all comments received. Comments Former Cape Coloured - 2008-06-30 15:13 So all the bruinmense in Worcester, PE, Noord-Kaap, George, Beaufort West, East London, Plett, etc don't count as coloured? Tell your narrow-minded TIK-brain friends to travel and see the world, and along the way to get an education. If they stare at you blankly, just tell them: "Djy moet wys raak". Smile back in a friendly manner but don't encourage further engagement. Boetie Buck - 2008-06-30 15:13 Nay Nay jtulle klippies brand a man se keel. LOL :) dis viceroy met water. Betrams is virrie sturvies. En die Space het geruk. Boetie Buck Monique - 2008-06-30 15:20 Geez dude chill with the whole "I'm educated" schpiel. You're embarrassing yourself. Degree, degree, whiskey but you can't spell to save your life. I'm coloured and also have a degree. Difference is, my english are very good hahahaha. Why is it so important for sturvy coloureds to "other" themselves from the bertrams-drinking, gatsby-eating, slang-spewing lot? In doing so you imply that they are less than you. And in that you prove them to be already better. Poepol - 2008-06-30 15:20 Looking at some of these comments I have no more doubt that there is no pot of gold at the end of the rainbow nation. We are so sensitive and self-centered we cannot see the funny in anything. Kolobe, please find another hobby. duidelik - 2008-06-30 15:21 Cape coloured now staying in Durban for the past four years.This article diffently took me back to home to Gatsby and Bertys not forgetting the Gala as we use to call it. Coloured people in Durban are secluded to Wentworth i hardly get to see them much in the city...dont know why Marcy - 2008-06-30 15:24 Your article is light hearted and should be interpeted as such. Please people, stop pulling out the race card every time someone says something you don't like. PS... I do believe it should be Red Heart Rum & Coke, not so? Ladnar - 2008-06-30 15:26 The whole race classification thing is crazy, man! Although in order to get BBBEE clearance it is very important to get this right. And all the comment posters (or should I say posers) with their negative comment - Get a gatsby en coke, en chill. jack - 2008-06-30 15:32 Hey Kolobe, In every column you deign to say something, it's always complaining. Do you have anything nice to say? Do you perhaps have a contribution to make? Well, if the answer to either question is yes, don't be shy - make a positive contribution or put a sock in it! Skapie - 2008-06-30 15:33 nice humour well written!! You forgot one thing we wash that gatsby down with frulatie or Double O. This suites my pallet. And that proud coloured with his accounting degree that drinks whiskey that tell him my Nike takkies cost more than his education. Dee - 2008-06-30 15:34 This is to Colin, I'm also an educated coloured but that doesn't mean that I've lost my sense of Humour. Andrea is writing about stereotypes, which if you didn't know doesn't apply to every single coloured! So no need to take offence! Dale - 2008-06-30 15:36 It's awesome to see, from a South African, living abroad that we can still have a laugh at ourselves. (well some of us of course). I would think that if we as the youth, 18-30's can have a laugh at each other, in reason, surely you guys could too? nicky - 2008-06-30 15:40 Small things amuse small minds and you 2 are at the top of the line when it comes to stereotyping your own. Sies!!!!!!! Don't call me names cause I don't do what you do.... CPT - 2008-06-30 15:42 I went to primary school in the 80's, Afrikaans with fair skin, blue eyes and light hair. Shape of my eyes looks Oriental and some of the kids used to tease me and ask if my father was a Chinese? Even the Grade 1 teacher contacted my mother to ask if my father was an Asian. As a 7 year old I had first hand experience of how racist people can be and I always felt like a outcast among my "own people". Education starts at home, parents should be a role model for their children.... cL - 2008-06-30 15:43 I must say, people have lost their sense of humour, i reaLLy enjoyed this piece..very funny, peepLe must wake up and LOL a bit...One thing that this article has proven is that we dont stand together. Look at the remarks you are making to each other, does this describe unity to you? Proudly Coloured - 2008-06-30 15:43 Well it must be said, we are the best looking people on the planet, best looking guys and great looking honey's. Most people are to scared or ashamed to say this...BUT THIS IS A FACT!! Al - 2008-06-30 15:51 YOU'RE COLOURED!!! What up with half and half ? We all half and half..PLZEE Coloured..Yes the coloured from Joburg are Fakes.LOL ...byebye Coloured mp3's mentor - 2008-06-30 15:53 judging from your spelling i'd say your degree isnt worth the paper its printed on "my bra"... SQ - 2008-06-30 15:54 Clearly the people complaining that this is racist are the sturvy 'kullits' or the non-coloureds - lol. Just because we love gatsbies and use our own slang, doesn't mean we're barbaric. A lot of us can relate and for goodness sake, with all the depressing news we have to read every day and see on the news, articles like this are a good laugh. And for the record I'm a Cape coloured living in Jozi now - the thing I miss most is coloured people. Cape Town Coloured - 2008-06-30 15:54 I fully agree with Franman, we dont stick together. I too have the degree and moved out of the hood a long time ago but like it or not - a large majority of our people DO eat still gatsbys and drink Berties... trust me, there is nothing better than a gatsby from Dish after a big night out(that was last Saturday night - IN 2008). Our slang English/Afrikaans combo is colourful and I am not offended by the article at all. Would it have been different if the article was written by a coloured person? vanniekaap - 2008-06-30 15:55 We be more than the Sister on the wireless tirelessly feeding perceptions deceiving herself that she be representing the mindset of us. We be more. We be more than the slaves, jiving to the rhythm of the tik, tik, tik, fogging our minds as it dims the instruments of illumination casting darker shadows in the recesses of our castles hiding my blood that sits in the chair downing his Castle confining his dreams within the golden bricks of his mind. We be more. We be more than the toothless ones enriching the tooth fairies and the goldsmiths enslaving us with ideas of climatic passion of our toothless smiles. We be more. We be more than the merchants and charlatans of impossible dreams riding the intoxicating perfumes of the white-pipe offered at the altars of the self-proclaimed high priest and priestesses. We be more We be more than the rainbow-coloured-sun-umbrella swirling masses with their technicolour costumes dancing the dance of the oft forgotten forebearers immersed in the strings of the banjo and calling of the goema drums. Singing Hie ko die Alabama! We be more. We be more than the places where we rest our tired bodies crammed in like sardines eking out an existence educating our young to be more. We be nurturers of young minds defenders of the law gazers of the stars explorers of the worlds creators of governments masters of letters and numbers. We are more. Roger - 2008-06-30 15:56 All coloureds are different. Don't stereotype. Not all coloureds drink and talk kombuis Afrikaans or are gangsters. This article might be funny but it is racism in disguise. Ferril - 2008-06-30 15:57 Ayeyaaaaa... You know my website has gotten flack for being too coloured!! What is being coloured? I think the author of this article got the basic, but then also mentions the complexities of being a coloured! And there are so many people that would love to discuss this topic further, so should you wish to... don't hesitate to go to www.kakduidelik.co.za and praat julle in julle ma jits van kullid wies! LOL!!! Nunzio - 2008-06-30 16:00 Good article I must say. Remembered the days we used to go to Goodhope centre for the Cape malay choir fest. then go down to the Grand Parade for a lekker gatsby and Fiesta juice. Dredger - 2008-06-30 16:01 Very funny,a good read after all the other depressing news around. We know its just stereotypes on the coloured community,but all races have stereotypes which get used for humour. Ferril - 2008-06-30 16:02 Exactly... I agree with Ekke!! Its not to degrade anyone. The article, and many more people like to reminisce about the good old days. Never to forget where they come from! Good grief, and what makes coloureds 'kwaai' in my opinion... is the fact that they are people who think for themselves and BETTER themselves not forgetting where they come from! Respek n disiplinne! Puffy - 2008-06-30 16:03 We the only country in the world where there are blacks, coloureds. Everywhere there are only two groups you either black, asian, caucasion or latin. I hate this term coloured. It make people think like in the past that they are better than a certain race. tauzty - 2008-06-30 16:16 I'm pne proud coloured not blck but coloured lekker article bra... You forgot to mention the car's soos die Toys Opel bins aka datsuns nissans and die res... soe Next time stiek uit by us and we'll gooi you some moves . Kevin - 2008-06-30 16:20 No wonder South Africa is stuffed. All those who took this article seriously and thought that "coloured" people in general are being stereotyped, have had a sense of humour failure. You are not as important as you think you are and if your sensitivities have been offended, then all I can say is.. shame, you poor, serious, sanctimonius, boring as hell, filled with self-importance plonkers much like the accountant fellow who drinks whiskey (I rest my case). bogi - 2008-06-30 16:23 I'm a 27yr old coloured male from Corrie. I'm educated, successful and a home owner in a 'white area'. Most of my coloured friends are in the same position. But, I love my coloured people. I loved my childhood. Walking home from s'gal, visiting the meddies, oupa specials, rum dashed with coke and a china fruit... I could go on! Weather it's Athlone, Eldo's, Eersterust or Die Kas, keep on keeping on, my bruino's. Oh, before I forget, you cannot touch the beauty of a coloured sister. HOLA HOSH!!! Lemming - 2008-06-30 16:24 Loved the article Andrea. Sounds like you have a great sense of humour. Coupled with your "fairly dark skin", you're probably my type. Are you busy Friday night? The fisherman - 2008-06-30 16:25 What the hell is wrong with people? Half of you are a bunch of sensitive ar*e wipes with no sense of humour. I don't cry when I get called "soutie" or "rooinek" or whitey etc. I laugh along and respond accordingly. STOP BEING ANAL South Africa. Zola - 2008-06-30 16:27 people this is funny and nice those who say this is racist needs to get a life dont take everything personal pleaseee Jaco - 2008-06-30 16:29 This was a very, very enjoyable piece and I thank you for it. Scanning the comments, it is clear that so many of our citizens are filled with bitterness and nothing else, but please know that anyone with a decent sense of interpretation will know that you intended absolutely no malice or stereotyping, and your affection for the 'gam' lifestyle was also well evident between the lines. High fives, and thanks once again. Tygerburger - 2008-06-30 16:38 They were not white enough in the bad days, however, they are black enough in the new days. Congratulations my Chinese brothers and sisters! kaiser - 2008-06-30 16:38 the only thing i know about coloured they get drunk,fight..swear's break things, stabs sanything that moves Valda - 2008-06-30 16:39 read the article in anticipation that after your sensless steriotypical drivel there would be some positive highlights to being coloured...like our contribution to the struggle, the arts and Cape Towns positive charms in general. Names like Taliep Petersen spring to mind. I dont know about being a "sturvey". In all other races its considered progress to rise above - get an education and speak proper English but no not when you are coloured! U know nothing so "HOU JOU BEK" Hows that for coloured? Mokaobere - 2008-06-30 16:41 I think I appreciate the diversity of S.A. and the passion of humanity. To me personal identity is very important. I am a proudly Mosotho South African, Finish en klaar. I am not gonna be fooled by people who preached about abolishing of the colour. I am always aware what other races' perceptions are on S.A. Africans. So I won't turn a blind eye on that... kam - 2008-06-30 16:42 Butbutbut now I wanna be a coloured from Cpt :( nWo - 2008-06-30 16:43 Comeon get a sense of humour and stop being so tight arsed out everything... Q80 - 2008-06-30 16:50 Now pay attention, this is how you spell: educated, coloured,neighbourhood, won't. The free lesson ends here. So, here is also the answer to your question: YOU BET we don't believe you! Dom doos. Pensive - 2008-06-30 16:54 Maybe what she meant was: "she was offended that ppl were laughing at her being mistaken for a colored" and not "she was offended at being mistaken for a colored" Why not clarify first before you jump to conclusions? Pensive - 2008-06-30 16:58 Colin, i believe she states at the beginning that her "education" was from her "colored co-workers". Whats with you ppl not reading the entire article. Your like a dog with a bone, you pick on something and cant let go... JR - 2008-06-30 17:13 There is a lot love/hate going on about being a coloured or not,but in all honesty if you have not experienced the culture then you will not and cannot understand the humour in it. Identifying with your culture is as important as breathing, some things are instinctive and this often mistaken as being racist.Black, brown, white or coloured I am proud to be South African. So what if you have not eaten a gatsby or had some klippies and cola.Proudly SA Confused - 2008-06-30 17:16 Amien : What do you prefer to be referred to as regards to racial group then? LMAO - 2008-06-30 17:22 The best thing about this article and the reason why so many people seem offended by it, is that it in so many aspects so true. If you cannot laugh at this then it proves that you are not from Cape Town or just don't get Cape Town. Here in the Cape we can laugh at ourselves. And if I may be blunt without the people being described in this article Cape Town will stop existing, next you will start shouting that the klopse on new years is racist. Dubai Expat - 2008-06-30 17:23 What a lekker article. I'm not from CT but did the Gal and Gatsby and ooh so many Bertrams. So the article brought about a chuckle and fond memories of a funfilled youth as a coloured laaitie. so far from home it's great to have a laugh at who we really are, even if now we drink Blue Label and wear Armani - dont forget your roots and stop being so damn touchy... Fast Dave - 2008-06-30 17:27 I can't believe the okes beetching and moaning here... This is quite a funny article (although I've seen funnier). Come now, chill out, have a laugh. Stereotypful jokes can very funny. If you don't see the funny side of this, you can't be a true South African... GailC - 2008-06-30 18:24 As one of the educated coloured poets of our country would say, Christopher van Wyk, we can learn to laugh at each other. I was born in Zambia in the same year of apartheid creation and I want to get to know the people I wasn't permitted to know then and yes I have been into a township or two or three. People need people, race should be unimportant, that's what we voted for. We're all one blood when we are cut. I have friends of varying colours. GailC - 2008-06-30 18:31 like crazy, retard, racist. I walked past a display in a big bookstore not so long ago and got sick to my stomach for the people who were so discriminated against because of colour and hair. Can you believe it was a bench with "Whites Only"? What poor and offensive taste they showed using that as their centrepiece even if it was to do with 16 June and SA week. Rodders - 2008-06-30 18:50 Couldn't agree more, our coloured honeys are some of the best - but that's what I like best about our Rainbow nation: we've got gorgeous chocolate babes, lovely coloured honeys, stunning Indian chicks, and that's before I even get on to the Asian and pale-skinned ladies that live here... ...Damn, but it's good to live in SA!!! pages: 1234

0 notes

Text

How to Manage Marketing Campaigns like a Financial Currency Trader

KPIs are due EOD.

Profit and loss statements need to be generated.

Budget status updates have been requested.

Juggling multiple marketing campaigns is stressful. But more importantly, it’s also incredibly risky.

Soon enough, you’ve depleted your budget to the last few cents, and you have nothing to show for it.

Or worse, you didn’t spot the right trends in a successful tactic before spending too much on the underperforming ones.

And now you don’t have enough money to re-allocate to top-tier mediums.

Curiously enough, adopting the same methodical mindset of a financial currency trader can help you better manage results.

Here’s how.

Start With a Currency Arbitrage Mindset

Here’s the problem with digital marketing.

It changes every day. Old stuff gives way to new stuff.

And you never really know how a campaign will perform until you try it.

That saying (1) is unhelpful and (2) requires extra money to experiment with potentially budget-draining activities.

But it’s true.

You really don’t know which playbook, game plan, or actionable tip is going to work until you experiment. The stuff that worked last year almost certainly won’t work the same this year.

Not to mention that every business is structured differently. Each caters to diverse audiences. So copying your competitors or that awesome tactic you read about is also out.

What works for Company X might bankrupt Company Z.

If there were set-in-stone tactics that produced million-dollar businesses overnight, every dude on GrowthHackers.org would be rich.

PPC might be amazing for your friend’s business. But that doesn’t mean investing in PPC is instantly going to turn you into the next Zuckerberg.

So where do people turn when they hit this realization? A/B testing.

You all know those case studies that promise a mythical pot of gold at the end of a rainbow.

I did X and generated a 40000000000% increase in conversions!

Okay, maybe that’s a slight exaggeration, but it’s not that far off.

Most A/B tests fail, though.

They take too long to get results. Plus that whole “bias” thing. And of course, sample size.

You need a minimum of 1,000 conversions monthly for statistical significance.

So what should you do instead?

Implement a currency arbitrage mindset.

Currency arbitrage is a strategy in which the trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

Different spreads imply a gap between the bid and ask prices. Meaning, they can buy and sell pairs to make more money.

What does this mean in English?

Place lots of small bets on different tactics, channels, platforms, and mediums so that you can evaluate their effectiveness in real-time.

Once you see specific trends developing (either positive or negative), you double down on the winners and cut your losses on the rest.

This way, you can test multiple experiments at once without the bias and lack of statistical significance that comes with A/B testing.

You get in and out fast. And you come out on the other side with specific campaigns to focus on rather than a mixed bag.

For example, you can’t always control the end result. But you can control the inputs that eventually get you there. And you can monitor, forecast, or predict where those will fall based on just a few days’ worth of performance.

Then, you can fine tune and adjust each ‘level’ accordingly to squeeze out the best results.

Adjusting Your Budget Based on Market Movement

The first banner advertisement ever appeared on HotWired in 1994.

Look at this gem:

Image Source

By today’s standards, it looks like a joke, right?

Is that tie-dye? Yes, yes it is.

But it gets worse:

See that subliminal “YOU WILL” message on the right???

Super subtle. Lord have mercy on us all.

But guess what?

This banner ad debuted with a click-through rate of 78%.

Yes, you read that right. Seventy. Eight. Percent.

If you told any marketer today that your banner ads are getting a 78% CTR, you’d get laughed out of the room.

Why? It’s inconceivable. It’s probably impossible in today’s world.

Today, the average display ad CTR is 0.05%.

Image Source

This all brings me back to one concept coined by Andrew Chen:

The law of shitty click-throughs:

All marketing strategies over time will result in shitty click-through rates.

As more and more people use these tactics, the market becomes saturated.

Users get sick of it, and they don’t click. Or they go banner blind.

You can see trends that follow this concept with almost any marketing activity.

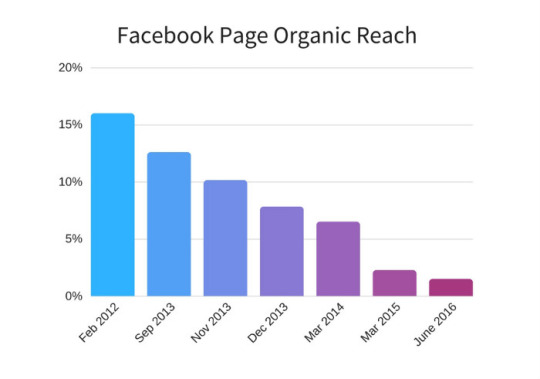

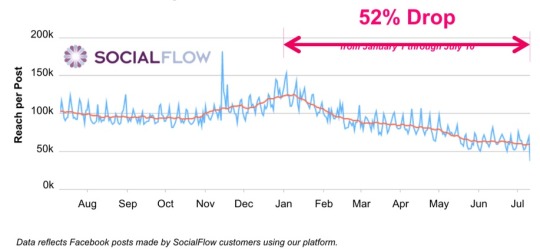

Remember the good old days when Facebook organic reach was insane?

You paid nothing and reached thousands or millions of eager users.

Now, organic reach is almost nothing:

Image Source

As more and more marketers use the concepts put in place, it results in fewer and fewer results.

This is a perfect example of market movement and active management in currency trading.

You can’t hold certain trades forever and expect exponential performance.

Just because something is generating an insane ROI now, doesn’t mean you can ride it off into the sunset.

Markets are constantly shifting, just like marketing tactics.

What was hot one day (banner ads) isn’t now.

If you don’t adjust your strategy based on analytic research and forecasts, you risk declining performances associated with passive management.

Passive management is when you sit idly by and attempt to cruise to the finish line on your current strategy.

Active management relies on analytical performance data over time to spot trends and make informed decisions about what needs to change.

If you notice a decline in organic reach on Facebook, you probably shouldn’t be dumping your campaign dollars into it.

Unfortunately, us marketers (including me) fall into this trap more often than we’d like to admit.

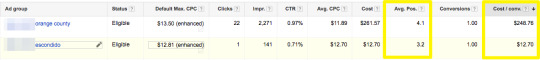

You log in to Google AdWords or Analytics and see some great conversion data:

Your plans are working as you’d hoped.

But that doesn’t mean you can sit back and let the good times roll.

Sure, you can do that for a little bit. But over time, as markets, tactics, and consumers shift, you’ve gotta take an active role in managing campaigns.

Adjust based on trends.

A great way to do this is by analyzing specific topics on Google Trends:

Or even keeping up to date with the latest studies on popular marketing tactics by conducting a basic Google search:

Stay up-to-date with market movement and look at the underlying trends or patterns. Because when people are blogging about it, tweeting it, favoriting it, or liking it, it’s already too late.

Be Cautious in a Bull Market

When everything is running smoothly, it’s referred to as a bull market.

Investor confidence and financial optimism are at an all-time high.

On the surface, everything is running like a well-oiled machine.

Unemployment is low. The economy’s GDP is growing steadily. Stocks are rising.

And your marketing tactics are getting more traction.

But with all of this surface-based optimism comes serious potential side effects:

It now becomes difficult to predict potential shifts and trends or when tactics might change.

Facebook’s organic reach was booming just a few years ago. Until, of course, it didn’t.

Image Source

Now? Good luck. We’ve crapped out.

There is actually a pretty easy explanation for it. Simple supply vs. demand.

User growth is slowing while the number of content pieces has exploded exponentially. Too much supply, not enough demand.

Guess what’s going to repeat now on Instagram?

Right now it’s the place to be for your content. Just give it a minute.

And don’t get swept up by the bull market.

Find your own Big Short

Have you ever seen The Big Short?

If not, I highly recommend it. It’s a great movie.

Not just because it’s an incredible, intense account of the 2005 housing crisis.

Mainly because it features Steve Carell:

via GIPHY

Inspirational as always, Prison Mike.

In all seriousness, it’s a great movie that heavily relates to digital marketing.

The main concept of the movie was based on the true story of Michael Burry, a hedge fund manager who shorted the housing crisis of 2005.

He believed there was a housing bubble, leading him to short sell and bet against the banks who thought he was a chump, taking his deals like candy.

The idea of short selling is motivated by the belief that a security’s price will decline, enabling it to be bought back at a lower price point for maximum profit.

And people thought Michael (Burry, not Prison) was insane.

Who in their right mind bets against the housing market when prices are nearly doubling year after year?

But Burry noticed a few troubling trends. He saw that subprime home loans were in danger of defaulting. And many adjustable rate mortgages with balloon payments were all adjusting around the same time.

He decided to throw more than one billion dollars into credit default swaps.

It’s safe to say that the banks weren’t too happy in the end.

Here’s the moral of the story:

Very few people believed him. But Burry discovered the mystical unicorn that most marketers strive to find.

The main point as it relates to marketing campaigns is this:

You need to find your own big short.

Your own diamond in the rough that you can tap into before anyone else.

Your own display ad invention that generates a 78% CTR.

Finding the tactic that brings your conversions up by 10x.

Sounds wonderful. But you know it’s not easy. Because it hasn’t been blogged about or shared at conferences just yet.

But examples of it do already exist in the marketing world today.

For example, Brian Dean of Backlinko raised the link-building bar with his skyscraper technique.

He took a spin on a classic link-building tactic that increased his search traffic by 110% in just two weeks.

Image Source

On top of a massive increase in traffic, he generated countless backlinks from thousands of different referring domains:

Image Source

He effectively took his link-building strategy to the next level by going against the grain.

He didn’t sit back and ride the wave of guest blogging or other outdated, declining strategies.

He found his own big short.

While small marketing tactics like A/B testing and creating new ads or creative for your campaigns is a step in the right direction, it isn’t the end-all-be-all. Small bets don’t move the needle.

They merely help you figure out if you’re on the right track (or not). And help to show you when it’s time to go all-in.

Conclusion

Managing marketing campaigns is a stressful task.

Big, splashy, high-budget campaigns have high expectations. Bosses and clients expect big, lofty performance to go with it.

Money can get away from you fast if you aren’t careful.

Even worse, you can get so caught up in data that you miss the right trends.

Trends that tell you which aspects of your campaign are winning and which are losing.

Instead of flying blind or crossing your fingers, think like a financial currency trader.

Analyze the data with a currency arbitrage mindset. Keep up with market movement by taking an active management role in your campaigns. Be cautious in a bull market when everyone’s saying the same things.

And don’t be afraid to bet big when the time comes.

About the Author: Brad Smith is the founder of Codeless, a B2B content creation company. Frequent contributor to Kissmetrics, Unbounce, WordStream, AdEspresso, Search Engine Journal, Autopilot, and more.

from Search Results for “analytics” – The Kissmetrics Marketing Blog http://ift.tt/2l0mCVr

#Digital #Analytics #Website

0 notes

Text

How to Manage Marketing Campaigns like a Financial Currency Trader

KPIs are due EOD.

Profit and loss statements need to be generated.

Budget status updates have been requested.

Juggling multiple marketing campaigns is stressful. But more importantly, it’s also incredibly risky.

Soon enough, you’ve depleted your budget to the last few cents, and you have nothing to show for it.

Or worse, you didn’t spot the right trends in a successful tactic before spending too much on the underperforming ones.

And now you don’t have enough money to re-allocate to top-tier mediums.

Curiously enough, adopting the same methodical mindset of a financial currency trader can help you better manage results.

Here’s how.

Start With a Currency Arbitrage Mindset

Here’s the problem with digital marketing.

It changes every day. Old stuff gives way to new stuff.

And you never really know how a campaign will perform until you try it.

That saying (1) is unhelpful and (2) requires extra money to experiment with potentially budget-draining activities.

But it’s true.

You really don’t know which playbook, game plan, or actionable tip is going to work until you experiment. The stuff that worked last year almost certainly won’t work the same this year.

Not to mention that every business is structured differently. Each caters to diverse audiences. So copying your competitors or that awesome tactic you read about is also out.

What works for Company X might bankrupt Company Z.

If there were set-in-stone tactics that produced million-dollar businesses overnight, every dude on GrowthHackers.org would be rich.

PPC might be amazing for your friend’s business. But that doesn’t mean investing in PPC is instantly going to turn you into the next Zuckerberg.

So where do people turn when they hit this realization? A/B testing.

You all know those case studies that promise a mythical pot of gold at the end of a rainbow.

I did X and generated a 40000000000% increase in conversions!

Okay, maybe that’s a slight exaggeration, but it’s not that far off.

Most A/B tests fail, though.

They take too long to get results. Plus that whole “bias” thing. And of course, sample size.

You need a minimum of 1,000 conversions monthly for statistical significance.

So what should you do instead?

Implement a currency arbitrage mindset.

Currency arbitrage is a strategy in which the trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

Different spreads imply a gap between the bid and ask prices. Meaning, they can buy and sell pairs to make more money.

What does this mean in English?

Place lots of small bets on different tactics, channels, platforms, and mediums so that you can evaluate their effectiveness in real-time.

Once you see specific trends developing (either positive or negative), you double down on the winners and cut your losses on the rest.

This way, you can test multiple experiments at once without the bias and lack of statistical significance that comes with A/B testing.

You get in and out fast. And you come out on the other side with specific campaigns to focus on rather than a mixed bag.

For example, you can’t always control the end result. But you can control the inputs that eventually get you there. And you can monitor, forecast, or predict where those will fall based on just a few days’ worth of performance.

Then, you can fine tune and adjust each ‘level’ accordingly to squeeze out the best results.

Adjusting Your Budget Based on Market Movement

The first banner advertisement ever appeared on HotWired in 1994.

Look at this gem:

Image Source

By today’s standards, it looks like a joke, right?

Is that tie-dye? Yes, yes it is.

But it gets worse:

See that subliminal “YOU WILL” message on the right???

Super subtle. Lord have mercy on us all.

But guess what?

This banner ad debuted with a click-through rate of 78%.

Yes, you read that right. Seventy. Eight. Percent.

If you told any marketer today that your banner ads are getting a 78% CTR, you’d get laughed out of the room.

Why? It’s inconceivable. It’s probably impossible in today’s world.

Today, the average display ad CTR is 0.05%.

Image Source

This all brings me back to one concept coined by Andrew Chen:

The law of shitty click-throughs:

All marketing strategies over time will result in shitty click-through rates.

As more and more people use these tactics, the market becomes saturated.

Users get sick of it, and they don’t click. Or they go banner blind.

You can see trends that follow this concept with almost any marketing activity.

Remember the good old days when Facebook organic reach was insane?

You paid nothing and reached thousands or millions of eager users.

Now, organic reach is almost nothing:

Image Source

As more and more marketers use the concepts put in place, it results in fewer and fewer results.

This is a perfect example of market movement and active management in currency trading.

You can’t hold certain trades forever and expect exponential performance.

Just because something is generating an insane ROI now, doesn’t mean you can ride it off into the sunset.

Markets are constantly shifting, just like marketing tactics.

What was hot one day (banner ads) isn’t now.

If you don’t adjust your strategy based on analytic research and forecasts, you risk declining performances associated with passive management.

Passive management is when you sit idly by and attempt to cruise to the finish line on your current strategy.

Active management relies on analytical performance data over time to spot trends and make informed decisions about what needs to change.

If you notice a decline in organic reach on Facebook, you probably shouldn’t be dumping your campaign dollars into it.

Unfortunately, us marketers (including me) fall into this trap more often than we’d like to admit.

You log in to Google AdWords or Analytics and see some great conversion data:

Your plans are working as you’d hoped.

But that doesn’t mean you can sit back and let the good times roll.

Sure, you can do that for a little bit. But over time, as markets, tactics, and consumers shift, you’ve gotta take an active role in managing campaigns.

Adjust based on trends.

A great way to do this is by analyzing specific topics on Google Trends:

Or even keeping up to date with the latest studies on popular marketing tactics by conducting a basic Google search:

Stay up-to-date with market movement and look at the underlying trends or patterns. Because when people are blogging about it, tweeting it, favoriting it, or liking it, it’s already too late.

Be Cautious in a Bull Market

When everything is running smoothly, it’s referred to as a bull market.

Investor confidence and financial optimism are at an all-time high.

On the surface, everything is running like a well-oiled machine.

Unemployment is low. The economy’s GDP is growing steadily. Stocks are rising.

And your marketing tactics are getting more traction.

But with all of this surface-based optimism comes serious potential side effects:

It now becomes difficult to predict potential shifts and trends or when tactics might change.

Facebook’s organic reach was booming just a few years ago. Until, of course, it didn’t.

Image Source

Now? Good luck. We’ve crapped out.

There is actually a pretty easy explanation for it. Simple supply vs. demand.

User growth is slowing while the number of content pieces has exploded exponentially. Too much supply, not enough demand.

Guess what’s going to repeat now on Instagram?

Right now it’s the place to be for your content. Just give it a minute.

And don’t get swept up by the bull market.

Find your own Big Short

Have you ever seen The Big Short?

If not, I highly recommend it. It’s a great movie.

Not just because it’s an incredible, intense account of the 2005 housing crisis.

Mainly because it features Steve Carell:

via GIPHY

Inspirational as always, Prison Mike.

In all seriousness, it’s a great movie that heavily relates to digital marketing.

The main concept of the movie was based on the true story of Michael Burry, a hedge fund manager who shorted the housing crisis of 2005.

He believed there was a housing bubble, leading him to short sell and bet against the banks who thought he was a chump, taking his deals like candy.

The idea of short selling is motivated by the belief that a security’s price will decline, enabling it to be bought back at a lower price point for maximum profit.

And people thought Michael (Burry, not Prison) was insane.

Who in their right mind bets against the housing market when prices are nearly doubling year after year?

But Burry noticed a few troubling trends. He saw that subprime home loans were in danger of defaulting. And many adjustable rate mortgages with balloon payments were all adjusting around the same time.

He decided to throw more than one billion dollars into credit default swaps.

It’s safe to say that the banks weren’t too happy in the end.

Here’s the moral of the story:

Very few people believed him. But Burry discovered the mystical unicorn that most marketers strive to find.

The main point as it relates to marketing campaigns is this:

You need to find your own big short.

Your own diamond in the rough that you can tap into before anyone else.

Your own display ad invention that generates a 78% CTR.

Finding the tactic that brings your conversions up by 10x.

Sounds wonderful. But you know it’s not easy. Because it hasn’t been blogged about or shared at conferences just yet.

But examples of it do already exist in the marketing world today.

For example, Brian Dean of Backlinko raised the link-building bar with his skyscraper technique.

He took a spin on a classic link-building tactic that increased his search traffic by 110% in just two weeks.

Image Source

On top of a massive increase in traffic, he generated countless backlinks from thousands of different referring domains:

Image Source

He effectively took his link-building strategy to the next level by going against the grain.

He didn’t sit back and ride the wave of guest blogging or other outdated, declining strategies.

He found his own big short.

While small marketing tactics like A/B testing and creating new ads or creative for your campaigns is a step in the right direction, it isn’t the end-all-be-all. Small bets don’t move the needle.

They merely help you figure out if you’re on the right track (or not). And help to show you when it’s time to go all-in.

Conclusion

Managing marketing campaigns is a stressful task.

Big, splashy, high-budget campaigns have high expectations. Bosses and clients expect big, lofty performance to go with it.

Money can get away from you fast if you aren’t careful.

Even worse, you can get so caught up in data that you miss the right trends.

Trends that tell you which aspects of your campaign are winning and which are losing.

Instead of flying blind or crossing your fingers, think like a financial currency trader.

Analyze the data with a currency arbitrage mindset. Keep up with market movement by taking an active management role in your campaigns. Be cautious in a bull market when everyone’s saying the same things.

And don’t be afraid to bet big when the time comes.

About the Author: Brad Smith is the founder of Codeless, a B2B content creation company. Frequent contributor to Kissmetrics, Unbounce, WordStream, AdEspresso, Search Engine Journal, Autopilot, and more.

0 notes

Text

How to Manage Marketing Campaigns like a Financial Currency Trader

KPIs are due EOD.

Profit and loss statements need to be generated.

Budget status updates have been requested.

Juggling multiple marketing campaigns is stressful. But more importantly, it’s also incredibly risky.

Soon enough, you’ve depleted your budget to the last few cents, and you have nothing to show for it.

Or worse, you didn’t spot the right trends in a successful tactic before spending too much on the underperforming ones.

And now you don’t have enough money to re-allocate to top-tier mediums.

Curiously enough, adopting the same methodical mindset of a financial currency trader can help you better manage results.

Here’s how.

Start With a Currency Arbitrage Mindset

Here’s the problem with digital marketing.

It changes every day. Old stuff gives way to new stuff.

And you never really know how a campaign will perform until you try it.

That saying (1) is unhelpful and (2) requires extra money to experiment with potentially budget-draining activities.

But it’s true.

You really don’t know which playbook, game plan, or actionable tip is going to work until you experiment. The stuff that worked last year almost certainly won’t work the same this year.

Not to mention that every business is structured differently. Each caters to diverse audiences. So copying your competitors or that awesome tactic you read about is also out.

What works for Company X might bankrupt Company Z.

If there were set-in-stone tactics that produced million-dollar businesses overnight, every dude on GrowthHackers.org would be rich.

PPC might be amazing for your friend’s business. But that doesn’t mean investing in PPC is instantly going to turn you into the next Zuckerberg.

So where do people turn when they hit this realization? A/B testing.

You all know those case studies that promise a mythical pot of gold at the end of a rainbow.

I did X and generated a 40000000000% increase in conversions!

Okay, maybe that’s a slight exaggeration, but it’s not that far off.

Most A/B tests fail, though.

They take too long to get results. Plus that whole “bias” thing. And of course, sample size.

You need a minimum of 1,000 conversions monthly for statistical significance.

So what should you do instead?

Implement a currency arbitrage mindset.

Currency arbitrage is a strategy in which the trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

Different spreads imply a gap between the bid and ask prices. Meaning, they can buy and sell pairs to make more money.

What does this mean in English?

Place lots of small bets on different tactics, channels, platforms, and mediums so that you can evaluate their effectiveness in real-time.

Once you see specific trends developing (either positive or negative), you double down on the winners and cut your losses on the rest.

This way, you can test multiple experiments at once without the bias and lack of statistical significance that comes with A/B testing.

You get in and out fast. And you come out on the other side with specific campaigns to focus on rather than a mixed bag.

For example, you can’t always control the end result. But you can control the inputs that eventually get you there. And you can monitor, forecast, or predict where those will fall based on just a few days’ worth of performance.

Then, you can fine tune and adjust each ‘level’ accordingly to squeeze out the best results.

Adjusting Your Budget Based on Market Movement

The first banner advertisement ever appeared on HotWired in 1994.

Look at this gem:

Image Source

By today’s standards, it looks like a joke, right?

Is that tie-dye? Yes, yes it is.

But it gets worse:

See that subliminal “YOU WILL” message on the right???

Super subtle. Lord have mercy on us all.

But guess what?

This banner ad debuted with a click-through rate of 78%.

Yes, you read that right. Seventy. Eight. Percent.

If you told any marketer today that your banner ads are getting a 78% CTR, you’d get laughed out of the room.

Why? It’s inconceivable. It’s probably impossible in today’s world.

Today, the average display ad CTR is 0.05%.

Image Source

This all brings me back to one concept coined by Andrew Chen:

The law of shitty click-throughs:

All marketing strategies over time will result in shitty click-through rates.

As more and more people use these tactics, the market becomes saturated.

Users get sick of it, and they don’t click. Or they go banner blind.

You can see trends that follow this concept with almost any marketing activity.

Remember the good old days when Facebook organic reach was insane?

You paid nothing and reached thousands or millions of eager users.

Now, organic reach is almost nothing:

Image Source

As more and more marketers use the concepts put in place, it results in fewer and fewer results.

This is a perfect example of market movement and active management in currency trading.

You can’t hold certain trades forever and expect exponential performance.

Just because something is generating an insane ROI now, doesn’t mean you can ride it off into the sunset.

Markets are constantly shifting, just like marketing tactics.

What was hot one day (banner ads) isn’t now.

If you don’t adjust your strategy based on analytic research and forecasts, you risk declining performances associated with passive management.

Passive management is when you sit idly by and attempt to cruise to the finish line on your current strategy.

Active management relies on analytical performance data over time to spot trends and make informed decisions about what needs to change.

If you notice a decline in organic reach on Facebook, you probably shouldn’t be dumping your campaign dollars into it.

Unfortunately, us marketers (including me) fall into this trap more often than we’d like to admit.

You log in to Google AdWords or Analytics and see some great conversion data:

Your plans are working as you’d hoped.

But that doesn’t mean you can sit back and let the good times roll.

Sure, you can do that for a little bit. But over time, as markets, tactics, and consumers shift, you’ve gotta take an active role in managing campaigns.

Adjust based on trends.

A great way to do this is by analyzing specific topics on Google Trends:

Or even keeping up to date with the latest studies on popular marketing tactics by conducting a basic Google search:

Stay up-to-date with market movement and look at the underlying trends or patterns. Because when people are blogging about it, tweeting it, favoriting it, or liking it, it’s already too late.

Be Cautious in a Bull Market

When everything is running smoothly, it’s referred to as a bull market.

Investor confidence and financial optimism are at an all-time high.

On the surface, everything is running like a well-oiled machine.

Unemployment is low. The economy’s GDP is growing steadily. Stocks are rising.

And your marketing tactics are getting more traction.

But with all of this surface-based optimism comes serious potential side effects:

It now becomes difficult to predict potential shifts and trends or when tactics might change.

Facebook’s organic reach was booming just a few years ago. Until, of course, it didn’t.

Image Source

Now? Good luck. We’ve crapped out.

There is actually a pretty easy explanation for it. Simple supply vs. demand.

User growth is slowing while the number of content pieces has exploded exponentially. Too much supply, not enough demand.

Guess what’s going to repeat now on Instagram?

Right now it’s the place to be for your content. Just give it a minute.

And don’t get swept up by the bull market.

Find your own Big Short

Have you ever seen The Big Short?

If not, I highly recommend it. It’s a great movie.

Not just because it’s an incredible, intense account of the 2005 housing crisis.

Mainly because it features Steve Carell:

via GIPHY

Inspirational as always, Prison Mike.

In all seriousness, it’s a great movie that heavily relates to digital marketing.

The main concept of the movie was based on the true story of Michael Burry, a hedge fund manager who shorted the housing crisis of 2005.

He believed there was a housing bubble, leading him to short sell and bet against the banks who thought he was a chump, taking his deals like candy.

The idea of short selling is motivated by the belief that a security’s price will decline, enabling it to be bought back at a lower price point for maximum profit.

And people thought Michael (Burry, not Prison) was insane.

Who in their right mind bets against the housing market when prices are nearly doubling year after year?

But Burry noticed a few troubling trends. He saw that subprime home loans were in danger of defaulting. And many adjustable rate mortgages with balloon payments were all adjusting around the same time.

He decided to throw more than one billion dollars into credit default swaps.

It’s safe to say that the banks weren’t too happy in the end.

Here’s the moral of the story:

Very few people believed him. But Burry discovered the mystical unicorn that most marketers strive to find.

The main point as it relates to marketing campaigns is this:

You need to find your own big short.

Your own diamond in the rough that you can tap into before anyone else.

Your own display ad invention that generates a 78% CTR.

Finding the tactic that brings your conversions up by 10x.

Sounds wonderful. But you know it’s not easy. Because it hasn’t been blogged about or shared at conferences just yet.

But examples of it do already exist in the marketing world today.

For example, Brian Dean of Backlinko raised the link-building bar with his skyscraper technique.

He took a spin on a classic link-building tactic that increased his search traffic by 110% in just two weeks.

Image Source

On top of a massive increase in traffic, he generated countless backlinks from thousands of different referring domains:

Image Source

He effectively took his link-building strategy to the next level by going against the grain.

He didn’t sit back and ride the wave of guest blogging or other outdated, declining strategies.

He found his own big short.

While small marketing tactics like A/B testing and creating new ads or creative for your campaigns is a step in the right direction, it isn’t the end-all-be-all. Small bets don’t move the needle.

They merely help you figure out if you’re on the right track (or not). And help to show you when it’s time to go all-in.

Conclusion

Managing marketing campaigns is a stressful task.

Big, splashy, high-budget campaigns have high expectations. Bosses and clients expect big, lofty performance to go with it.

Money can get away from you fast if you aren’t careful.

Even worse, you can get so caught up in data that you miss the right trends.

Trends that tell you which aspects of your campaign are winning and which are losing.

Instead of flying blind or crossing your fingers, think like a financial currency trader.

Analyze the data with a currency arbitrage mindset. Keep up with market movement by taking an active management role in your campaigns. Be cautious in a bull market when everyone’s saying the same things.

And don’t be afraid to bet big when the time comes.

About the Author: Brad Smith is the founder of Codeless, a B2B content creation company. Frequent contributor to Kissmetrics, Unbounce, WordStream, AdEspresso, Search Engine Journal, Autopilot, and more.

http://ift.tt/2AtSj02

from MarketingRSS http://ift.tt/2yfhxcO

via Youtube

0 notes

Text

How to Manage Marketing Campaigns like a Financial Currency Trader

email marketing a/b testing

KPIs are due EOD.

Profit and loss statements need to be generated.

Budget status updates have been requested.

Juggling multiple marketing campaigns is stressful. But more importantly, it’s also incredibly risky.

Soon enough, you’ve depleted your budget to the last few cents, and you have nothing to show for it.

Or worse, you didn’t spot the right trends in a successful tactic before spending too much on the underperforming ones.

And now you don’t have enough money to re-allocate to top-tier mediums.

Curiously enough, adopting the same methodical mindset of a financial currency trader can help you better manage results.

Here’s how.

Start With a Currency Arbitrage Mindset

Here’s the problem with digital marketing.

It changes every day. Old stuff gives way to new stuff.

And you never really know how a campaign will perform until you try it.

That saying (1) is unhelpful and (2) requires extra money to experiment with potentially budget-draining activities.

But it’s true.

You really don’t know which playbook, game plan, or actionable tip is going to work until you experiment. The stuff that worked last year almost certainly won’t work the same this year.

Not to mention that every business is structured differently. Each caters to diverse audiences. So copying your competitors or that awesome tactic you read about is also out.

What works for Company X might bankrupt Company Z.

If there were set-in-stone tactics that produced million-dollar businesses overnight, every dude on GrowthHackers.org would be rich.

PPC might be amazing for your friend’s business. But that doesn’t mean investing in PPC is instantly going to turn you into the next Zuckerberg.

So where do people turn when they hit this realization? A/B testing.

You all know those case studies that promise a mythical pot of gold at the end of a rainbow.

I did X and generated a 40000000000% increase in conversions!

Okay, maybe that’s a slight exaggeration, but it’s not that far off.

Most A/B tests fail, though.

They take too long to get results. Plus that whole “bias” thing. And of course, sample size.

You need a minimum of 1,000 conversions monthly for statistical significance.

So what should you do instead?

Implement a currency arbitrage mindset.

Currency arbitrage is a strategy in which the trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

Different spreads imply a gap between the bid and ask prices. Meaning, they can buy and sell pairs to make more money.

What does this mean in English?

Place lots of small bets on different tactics, channels, platforms, and mediums so that you can evaluate their effectiveness in real-time.

Once you see specific trends developing (either positive or negative), you double down on the winners and cut your losses on the rest.

This way, you can test multiple experiments at once without the bias and lack of statistical significance that comes with A/B testing.

You get in and out fast. And you come out on the other side with specific campaigns to focus on rather than a mixed bag.

For example, you can’t always control the end result. But you can control the inputs that eventually get you there. And you can monitor, forecast, or predict where those will fall based on just a few days’ worth of performance.

Then, you can fine tune and adjust each ‘level’ accordingly to squeeze out the best results.

Adjusting Your Budget Based on Market Movement

The first banner advertisement ever appeared on HotWired in 1994.

Look at this gem:

Image Source

By today’s standards, it looks like a joke, right?

Is that tie-dye? Yes, yes it is.

But it gets worse:

See that subliminal “YOU WILL” message on the right???

Super subtle. Lord have mercy on us all.

But guess what?

This banner ad debuted with a click-through rate of 78%.

Yes, you read that right. Seventy. Eight. Percent.

If you told any marketer today that your banner ads are getting a 78% CTR, you’d get laughed out of the room.

Why? It’s inconceivable. It’s probably impossible in today’s world.

Today, the average display ad CTR is 0.05%.

Image Source

This all brings me back to one concept coined by Andrew Chen:

The law of shitty click-throughs:

All marketing strategies over time will result in shitty click-through rates.

As more and more people use these tactics, the market becomes saturated.

Users get sick of it, and they don’t click. Or they go banner blind.

You can see trends that follow this concept with almost any marketing activity.

Remember the good old days when Facebook organic reach was insane?

You paid nothing and reached thousands or millions of eager users.

Now, organic reach is almost nothing:

Image Source

As more and more marketers use the concepts put in place, it results in fewer and fewer results.

This is a perfect example of market movement and active management in currency trading.

You can’t hold certain trades forever and expect exponential performance.

Just because something is generating an insane ROI now, doesn’t mean you can ride it off into the sunset.

Markets are constantly shifting, just like marketing tactics.

What was hot one day (banner ads) isn’t now.

If you don’t adjust your strategy based on analytic research and forecasts, you risk declining performances associated with passive management.

Passive management is when you sit idly by and attempt to cruise to the finish line on your current strategy.

Active management relies on analytical performance data over time to spot trends and make informed decisions about what needs to change.

If you notice a decline in organic reach on Facebook, you probably shouldn’t be dumping your campaign dollars into it.

Unfortunately, us marketers (including me) fall into this trap more often than we’d like to admit.

You log in to Google AdWords or Analytics and see some great conversion data:

Your plans are working as you’d hoped.

But that doesn’t mean you can sit back and let the good times roll.

Sure, you can do that for a little bit. But over time, as markets, tactics, and consumers shift, you’ve gotta take an active role in managing campaigns.

Adjust based on trends.

A great way to do this is by analyzing specific topics on Google Trends:

Or even keeping up to date with the latest studies on popular marketing tactics by conducting a basic Google search:

Stay up-to-date with market movement and look at the underlying trends or patterns. Because when people are blogging about it, tweeting it, favoriting it, or liking it, it’s already too late.

Be Cautious in a Bull Market

When everything is running smoothly, it’s referred to as a bull market.

Investor confidence and financial optimism are at an all-time high.

On the surface, everything is running like a well-oiled machine.

Unemployment is low. The economy’s GDP is growing steadily. Stocks are rising.

And your marketing tactics are getting more traction.

But with all of this surface-based optimism comes serious potential side effects:

It now becomes difficult to predict potential shifts and trends or when tactics might change.

Facebook’s organic reach was booming just a few years ago. Until, of course, it didn’t.

Image Source

Now? Good luck. We’ve crapped out.

There is actually a pretty easy explanation for it. Simple supply vs. demand.

User growth is slowing while the number of content pieces has exploded exponentially. Too much supply, not enough demand.

Guess what’s going to repeat now on Instagram?

Right now it’s the place to be for your content. Just give it a minute.

And don’t get swept up by the bull market.

Find your own Big Short

Have you ever seen The Big Short?

If not, I highly recommend it. It’s a great movie.

Not just because it’s an incredible, intense account of the 2005 housing crisis.

Mainly because it features Steve Carell:

via GIPHY

Inspirational as always, Prison Mike.

In all seriousness, it’s a great movie that heavily relates to digital marketing.

The main concept of the movie was based on the true story of Michael Burry, a hedge fund manager who shorted the housing crisis of 2005.

He believed there was a housing bubble, leading him to short sell and bet against the banks who thought he was a chump, taking his deals like candy.

The idea of short selling is motivated by the belief that a security’s price will decline, enabling it to be bought back at a lower price point for maximum profit.

And people thought Michael (Burry, not Prison) was insane.

Who in their right mind bets against the housing market when prices are nearly doubling year after year?

But Burry noticed a few troubling trends. He saw that subprime home loans were in danger of defaulting. And many adjustable rate mortgages with balloon payments were all adjusting around the same time.

He decided to throw more than one billion dollars into credit default swaps.

It’s safe to say that the banks weren’t too happy in the end.

Here’s the moral of the story:

Very few people believed him. But Burry discovered the mystical unicorn that most marketers strive to find.

The main point as it relates to marketing campaigns is this:

You need to find your own big short.

Your own diamond in the rough that you can tap into before anyone else.

Your own display ad invention that generates a 78% CTR.

Finding the tactic that brings your conversions up by 10x.

Sounds wonderful. But you know it’s not easy. Because it hasn’t been blogged about or shared at conferences just yet.

But examples of it do already exist in the marketing world today.

For example, Brian Dean of Backlinko raised the link-building bar with his skyscraper technique.

He took a spin on a classic link-building tactic that increased his search traffic by 110% in just two weeks.

Image Source

On top of a massive increase in traffic, he generated countless backlinks from thousands of different referring domains:

Image Source

He effectively took his link-building strategy to the next level by going against the grain.

He didn’t sit back and ride the wave of guest blogging or other outdated, declining strategies.

He found his own big short.

While small marketing tactics like A/B testing and creating new ads or creative for your campaigns is a step in the right direction, it isn’t the end-all-be-all. Small bets don’t move the needle.

They merely help you figure out if you’re on the right track (or not). And help to show you when it’s time to go all-in.

Conclusion

Managing marketing campaigns is a stressful task.

Big, splashy, high-budget campaigns have high expectations. Bosses and clients expect big, lofty performance to go with it.

Money can get away from you fast if you aren’t careful.

Even worse, you can get so caught up in data that you miss the right trends.

Trends that tell you which aspects of your campaign are winning and which are losing.

Instead of flying blind or crossing your fingers, think like a financial currency trader.

Analyze the data with a currency arbitrage mindset. Keep up with market movement by taking an active management role in your campaigns. Be cautious in a bull market when everyone’s saying the same things.

And don’t be afraid to bet big when the time comes.

About the Author: Brad Smith is the founder of Codeless, a B2B content creation company. Frequent contributor to Kissmetrics, Unbounce, WordStream, AdEspresso, Search Engine Journal, Autopilot, and more.

Youtobe

0 notes

Text

How to Manage Marketing Campaigns like a Financial Currency Trader

KPIs are due EOD.

Profit and loss statements need to be generated.

Budget status updates have been requested.

Juggling multiple marketing campaigns is stressful. But more importantly, it’s also incredibly risky.

Soon enough, you’ve depleted your budget to the last few cents, and you have nothing to show for it.

Or worse, you didn’t spot the right trends in a successful tactic before spending too much on the underperforming ones.

And now you don’t have enough money to re-allocate to top-tier mediums.

Curiously enough, adopting the same methodical mindset of a financial currency trader can help you better manage results.

Here’s how.

Start With a Currency Arbitrage Mindset

Here’s the problem with digital marketing.

It changes every day. Old stuff gives way to new stuff.

And you never really know how a campaign will perform until you try it.

That saying (1) is unhelpful and (2) requires extra money to experiment with potentially budget-draining activities.

But it’s true.

You really don’t know which playbook, game plan, or actionable tip is going to work until you experiment. The stuff that worked last year almost certainly won’t work the same this year.

Not to mention that every business is structured differently. Each caters to diverse audiences. So copying your competitors or that awesome tactic you read about is also out.

What works for Company X might bankrupt Company Z.

If there were set-in-stone tactics that produced million-dollar businesses overnight, every dude on GrowthHackers.org would be rich.

PPC might be amazing for your friend’s business. But that doesn’t mean investing in PPC is instantly going to turn you into the next Zuckerberg.

So where do people turn when they hit this realization? A/B testing.

You all know those case studies that promise a mythical pot of gold at the end of a rainbow.

I did X and generated a 40000000000% increase in conversions!

Okay, maybe that’s a slight exaggeration, but it’s not that far off.

Most A/B tests fail, though.

They take too long to get results. Plus that whole “bias” thing. And of course, sample size.

You need a minimum of 1,000 conversions monthly for statistical significance.

So what should you do instead?

Implement a currency arbitrage mindset.

Currency arbitrage is a strategy in which the trader takes advantage of different spreads offered by brokers for a particular currency pair by making trades.

Different spreads imply a gap between the bid and ask prices. Meaning, they can buy and sell pairs to make more money.

What does this mean in English?

Place lots of small bets on different tactics, channels, platforms, and mediums so that you can evaluate their effectiveness in real-time.

Once you see specific trends developing (either positive or negative), you double down on the winners and cut your losses on the rest.

This way, you can test multiple experiments at once without the bias and lack of statistical significance that comes with A/B testing.

You get in and out fast. And you come out on the other side with specific campaigns to focus on rather than a mixed bag.

For example, you can’t always control the end result. But you can control the inputs that eventually get you there. And you can monitor, forecast, or predict where those will fall based on just a few days’ worth of performance.

Then, you can fine tune and adjust each ‘level’ accordingly to squeeze out the best results.

Adjusting Your Budget Based on Market Movement

The first banner advertisement ever appeared on HotWired in 1994.

Look at this gem:

Image Source

By today’s standards, it looks like a joke, right?

Is that tie-dye? Yes, yes it is.

But it gets worse:

See that subliminal “YOU WILL” message on the right???

Super subtle. Lord have mercy on us all.

But guess what?

This banner ad debuted with a click-through rate of 78%.

Yes, you read that right. Seventy. Eight. Percent.

If you told any marketer today that your banner ads are getting a 78% CTR, you’d get laughed out of the room.

Why? It’s inconceivable. It’s probably impossible in today’s world.

Today, the average display ad CTR is 0.05%.

Image Source

This all brings me back to one concept coined by Andrew Chen:

The law of shitty click-throughs:

All marketing strategies over time will result in shitty click-through rates.

As more and more people use these tactics, the market becomes saturated.

Users get sick of it, and they don’t click. Or they go banner blind.

You can see trends that follow this concept with almost any marketing activity.

Remember the good old days when Facebook organic reach was insane?

You paid nothing and reached thousands or millions of eager users.

Now, organic reach is almost nothing:

Image Source

As more and more marketers use the concepts put in place, it results in fewer and fewer results.

This is a perfect example of market movement and active management in currency trading.

You can’t hold certain trades forever and expect exponential performance.

Just because something is generating an insane ROI now, doesn’t mean you can ride it off into the sunset.

Markets are constantly shifting, just like marketing tactics.

What was hot one day (banner ads) isn’t now.

If you don’t adjust your strategy based on analytic research and forecasts, you risk declining performances associated with passive management.

Passive management is when you sit idly by and attempt to cruise to the finish line on your current strategy.

Active management relies on analytical performance data over time to spot trends and make informed decisions about what needs to change.

If you notice a decline in organic reach on Facebook, you probably shouldn’t be dumping your campaign dollars into it.

Unfortunately, us marketers (including me) fall into this trap more often than we’d like to admit.

You log in to Google AdWords or Analytics and see some great conversion data:

Your plans are working as you’d hoped.

But that doesn’t mean you can sit back and let the good times roll.

Sure, you can do that for a little bit. But over time, as markets, tactics, and consumers shift, you’ve gotta take an active role in managing campaigns.

Adjust based on trends.

A great way to do this is by analyzing specific topics on Google Trends:

Or even keeping up to date with the latest studies on popular marketing tactics by conducting a basic Google search:

Stay up-to-date with market movement and look at the underlying trends or patterns. Because when people are blogging about it, tweeting it, favoriting it, or liking it, it’s already too late.

Be Cautious in a Bull Market

When everything is running smoothly, it’s referred to as a bull market.

Investor confidence and financial optimism are at an all-time high.

On the surface, everything is running like a well-oiled machine.

Unemployment is low. The economy’s GDP is growing steadily. Stocks are rising.

And your marketing tactics are getting more traction.

But with all of this surface-based optimism comes serious potential side effects:

It now becomes difficult to predict potential shifts and trends or when tactics might change.

Facebook’s organic reach was booming just a few years ago. Until, of course, it didn’t.

Image Source

Now? Good luck. We’ve crapped out.

There is actually a pretty easy explanation for it. Simple supply vs. demand.

User growth is slowing while the number of content pieces has exploded exponentially. Too much supply, not enough demand.

Guess what’s going to repeat now on Instagram?

Right now it’s the place to be for your content. Just give it a minute.

And don’t get swept up by the bull market.

Find your own Big Short

Have you ever seen The Big Short?

If not, I highly recommend it. It’s a great movie.

Not just because it’s an incredible, intense account of the 2005 housing crisis.

Mainly because it features Steve Carell:

via GIPHY

Inspirational as always, Prison Mike.

In all seriousness, it’s a great movie that heavily relates to digital marketing.

The main concept of the movie was based on the true story of Michael Burry, a hedge fund manager who shorted the housing crisis of 2005.