#direct personal taxation

Text

from @/wtp.resist on Instagram:

Tax Day is Monday, April 15th... just 4 days away ‼️ 💸

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Follow this outline for an easy-to-understand guide on how to participate in war tax resistance this year. If you are unable to participate in war tax resistance but still wish to legally protest, please see slide #7. We want to encourage people to think big and act with courage, but we also understand not everyone can resist in the same way, so we wanted to provide several measures of resistance and resistance support in our Act I — War Tax Resistance — Tax Blackout 2024 Campaign.

⠀⠀⠀⠀⠀⠀⠀⠀⠀

Our #TaxBlackout goal is 50 million people... with 16% of the U.S. population participating with at least 5% being redirected to vetted emergency relief in Gaza, Washington D.C. will receive a message loud and clear:

⠀⠀⠀⠀⠀⠀⠀⠀⠀

We will not fund Genocide and Imperialism!

transcript of all slides under the cut

slide 1: Act I Tax Resistance

by @ WTP.resist / We the People

The Tax Blackout 2024 Guide

Tax Resistance

slide 2: Is It Illegal?

Taking any type of direct resistance or civil disobedience action for peace often means taking risks. War tax resistance is no exception.

Since World War I, only two war tax resisters (James Otsuka (1949) and J. Tony Serra (2005)) have been brought into Federal court, convicted, or jailed because of war tax resistance. Most resisters have been taken to court for failure to file, "falsifying" 1040 forms, contempt of court (by refusing to produce records), or (in the early 1970s) "fraudulently" claiming too many dependents on their W-4 form.

slide 3: Filing And Refusing - Step-By-Step

How to File as a War Tax Resister (typical process):

1. File your Form 1040 on or before April 15

Fill out the form per IRS filing instructions. To avoid being considered a "frivolous filer" (an IRS category) and being subject to frivolous filing penalties, do not make claims or write your thoughts on the form.

2. You can enclose a letter that explains your refusal to pay part (or all) of your taxes

Many war tax resisters send letters to explain their refusal to pay is an act of conscience, of civil disobedience. War tax resistance is about refusal to pay for war, not promoting tax evasion or challenging the constitutionality of taxation or war taxes.

slide 4: Filing And Refusing - Step-By-Step

3. Refusal Options:

Refuse a symbolic amount, a percentage (at least 5%), or refuse all of the federal income tax (see next slides).

4. Withholding Adjustments:

Salaried employees can increase the # of deductions on their W-4 form at any time to owe federal income taxes on April 15, and then can choose how much you want to refuse. Take the form home fill it out and return only the first page of the form, not the worksheet (page 3), to your employer. If you are self-employed and don't use a W-4 form, you must adjust the amount of estimated taxes you pay quarterly to resist when you file.

slide 5: Methods Of Resistance

1. File and Refuse to Pay

This involves filling out a 1040 form and refusing to pay either a token amount of your taxes (we are asking at least 5%) a percentage representing a "military" portion, or the total amount (since a portion of whatever is paid still goes to the military).

2. Refuse to File a Tax Return

NWTRCC recommends filing your taxes or the IRS will file on your behalf. They cannot garnish wages until the tax debt has been assessed, which can take some time. The statute of limitations begins at the point the tax is assessed.

slide 6: Methods Of Resistance Continued

3. Earn Less Than The Taxable Income

This can involve having such a low income that you are not required to file federal income tax returns (approximately $12,550 for a single person in 2021), or it can mean filing and taking deductions so that no income tax is owed.

4. Tariffs and Excise Taxes

Today, thousands of people continue to "Hang Up On War" by refusing to pay the small amount on their local telephone bill listed as "Federal Excise Tax" or "Federal Tax." This federal excise tax, like many others, pays into the general fund of the U.S. government - the same place your federal income taxes go. The monies in the general fund help to pay for the Pentagon, the militarization of our culture, and war.

slide 7: Ways To Legally Resist

Send a letter of protest with your 1040 tax form.

Enclose it along with (but do not staple it to) your form. Send copies to your elected officials.

Write letters to editors protesting taxes for war, especially when people are thinking about taxes during tax filing season between January and April.

Write a message of protest on the check you send with your tax forms.

Pay the tax with hundreds of small-denomination checks or coins.

Lobby for Peace Tax Fund legislation that would allow conscientious objectors to pay taxes to a fund that would not be used for military spending.

slide 8: Remember!

If at any time you have questions about risks and how to prepare:

War Tax Resistance Counselor: NWTRCC.org/resist/contacts-counselors

War Tax Resistance Hotline:

TEL: +1-800-269-7464

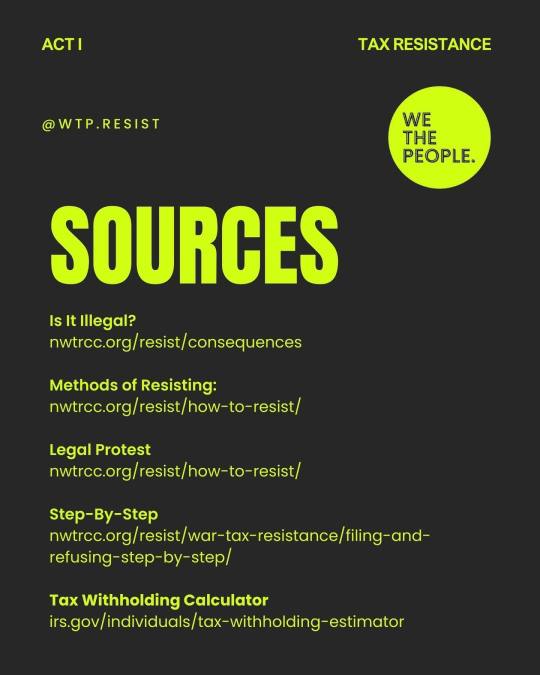

slide 9: Sources

Is It Illegal?

nwtrcc.org/resist/consequences

Methods of Resisting:

nwtrcc.org/resist/how-to-resist/

Legal Protest

nwtrcc.org/resist/how-to-resist/

Step-By-Step

nwtrcc.org/resist/war-tax-resistance/filing-and-refusing-step-by-step/

Tax Withholding Calculator

irs.gov/individuals/tax-withholding-estimator

#tax resistance#war tax resistance#we the people#free palestine#palestine#EndIsraelsGenocide#tax blackout 2024#anti imperialism

30 notes

·

View notes

Text

The IRS will do your taxes for you (if that's what you prefer)

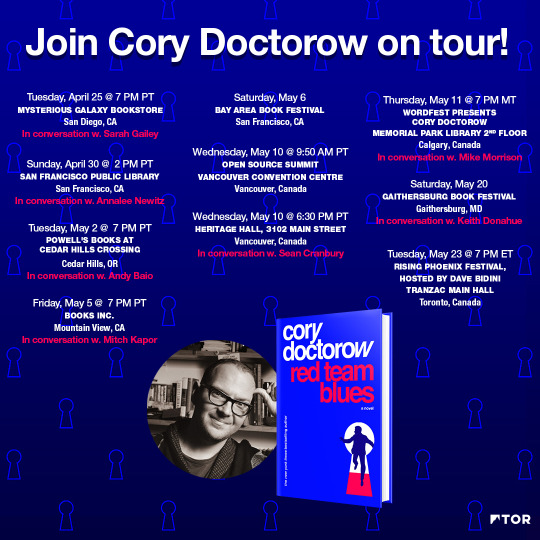

This Saturday (May 20), I’ll be at the GAITHERSBURG Book Festival with my novel Red Team Blues; then on May 22, I’m keynoting Public Knowledge’s Emerging Tech conference in DC.

On May 23, I’ll be in TORONTO for a book launch that’s part of WEPFest, a benefit for the West End Phoenix, onstage with Dave Bidini (The Rheostatics), Ron Diebert (Citizen Lab) and the whistleblower Dr Nancy Olivieri.

America is a world leader in allowing private companies to levy taxes on its citizens, including (stay with me here), a tax on paying your taxes.

In most of the world, the tax authorities prepare a return for each taxpayer, sending them a prepopulated form with all their tax details — collected from employers and other regulated entities, like pension funds and commodities brokers, who must report income to the tax office. If the form is correct, the taxpayer signs it and sends it back (in some countries, taxpayers don’t even have to do that — they just ignore the return unless they want to amend it).

No one has to use this system, of course. If you have complex finances, or cash income that doesn’t show up in mandatory reporting, or if you’d just prefer to prepare your own return or pay an accountant to do so for you, you can. But for the majority of people, those with income from a job or a pension, and predictable deductions, say, from caring for minor children, filing your annual tax return takes between zero and five minutes and costs absolutely nothing.

Not so in America. America is one of the very few rich countries (including Canada, though this is changing), where the government won’t just send you a form containing all the information it already has, ready to file. As is common in complex societies, America has a complex tax code (further complexified by deliberate obfuscation by billionaires and their lickspittle Congressjerks, who deliberately perforate the tax code with loopholes for the ultra-rich):

https://pluralistic.net/2021/08/11/the-canada-variant/#shitty-man-of-history-theory

That complexity means that most of us can’t figure out how to file our own taxes, at least not without committing scarce hours out of the only life we will ever have to poring over the ramified and obscure maze of tax-law.

Why doesn’t the IRS just send you a tax-return? Well, because the tax-prep industry — an oligopoly dominated by a handful of massive, ultra-profitable firms — bribes Congress (that is, “lobbies”) to prohibit this. They are aided in this endeavor by swivel-eyed lunatic anti-tax obsessives, like Grover Nordquist and Americans for Tax Reform, who argue that paying taxes should be as difficult and painful as possible in order to foment opposition to taxation itself.

The tax-prep industry is dominated by a single firm, Intuit, who took over tax-prep through its anticompetitive acquisition of TurboTax, itself a chimera of multiple companies gobbled up in a decades-long merger orgy. Inuit is a freaky company. For decades, its defining CEO Brad Smith ran the company as a cult of personality organized around his trite sayings, like “Do whatever makes your heart beat fastest,” stenciled on t-shirts worn by employees. Other employees donned Brad Smith masks for selfies with their Beloved Leader.

Smith’s cult also spent decades lobbying to keep the IRS from offering a free filing service. Instead, Intuit joined a cartel that offered a “Free File” service to some low- and medium-income Americans:

https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free

But the cartel sabotaged Free File from the start. They blocked search engines from indexing their Free File services, then bought Google ads for “free file” that directed searchers to soundalike programs (“Free Filing,” etc) that hit them for hundreds of dollars in tax-prep fees. They also funneled users to versions of Free File they were ineligible for, a fact that was only revealed after the user spent hours painstaking entering their financial information, whereupon they would be told that they could either start over or pay hundreds of dollars to finish filing with a commercial product.

Intuit also pioneered the use of binding arbitration waivers that stripped its victims of the right to sue the company after it defrauded them. This tactic blew up in Intuit’s face after its victims banded together to mass-file thousands of arbitration claims, sending the company to court to argue that binding arbitration wasn’t enforceable after all:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

But justice eventually caught up with Intuit. After a series of stinging exposes by Propublica journalists Justin Elliot, Paul Kiel and others, NY Attorney General Letitia James led a coalition of AGs from all 50 states and DC that extracted a $141m settlement for 4.4 million Americans who had been tricked into paying for Turbotax services they were entitled to get for free:

https://www.msn.com/en-us/news/us/turbotax-to-begin-payouts-after-it-cheated-customers-new-york-ag-says/ar-AA1aNXfi

Fines are one thing, but the only way to comprehensively end the predatory tax-prep scam is to bring the USA kicking and screaming into the 20th century, when most of the rest of the world brought in free tax-prep for ordinary income earners. That’s just what’s happening: the IRS is trialing a free tax prep service for next year’s tax season:

https://www.washingtonpost.com/business/2023/05/15/irs-free-file/

This, despite Intuit’s all-out blitz attack on Congress and the IRS to keep free tax-prep from ever reaching the American people:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

That charm offensive didn’t stop the IRS from releasing a banger of a report that made it clear that free tax-prep was the most efficient, humane and cost-effective way to manage an advanced tax-system (something the rest of the world has known for decades):

https://www.irs.gov/pub/irs-pdf/p5788.pdf

Of course, Intuit is furious, as in spitting feathers. Rick Heineman, Intuit’s spokesprofiteer, told KQED that “A direct-to-IRS e-file system is wholly redundant and is nothing more than a solution in search of a problem. That solution will unnecessarily cost taxpayers billions of dollars and especially harm the most vulnerable Americans.”

https://www.kqed.org/news/11949746/the-irs-is-building-its-own-online-tax-filing-system-tax-prep-companies-arent-happy

Despite Upton Sinclair’s advice that “it is difficult to get a man to understand something, when his salary depends on his not understanding it,” I will now attempt to try to explain to Heineman why he is unfuckingbelievably, eye-wateringly wrong.

“e-file…is wholly redundant”: Well, no, Rick, it’s not redundant, because there is no existing Free File system except for the one your corrupt employer made and hid “in the bottom of a locked filing cabinet stuck in a disused lavatory with a sign on the door saying ‘Beware of the Leopard.’”

“nothing more than a solution in search of a problem”: The problem this solves is that Americans have to pay Intuit billions to pay their taxes. It’s a tax on paying taxes. That is a problem.

“unnecessarily cost taxpayers billions of dollars”: No, it will save taxpayers the billions of dollars (they pay you).

“harm the most vulnerable Americans”: Here is an area where Heineman can speak with authority, because few companies have more experience harming vulnerable Americans.

Take the Child Tax Credit. This is the most successful social program in living memory, a single initiative that did more to lift American children out of poverty than any other since the days of the Great Society. It turns out that giving poor people money makes them less poor, which is weird, because neoliberal economists have spent decades assuring us that this is not the case:

https://pluralistic.net/2023/05/16/mortgages-are-rent-control/#housing-is-a-human-right-not-an-asset

But the Child Tax Credit has been systematically sabotaged, by Intuit lobbyists, who successfully added layer after layer of red tape — needless complexity that makes it nearly impossible to claim the credit without expert help — from the likes of Intuit:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It worked. As Ryan Cooper writes in The American Prospect: “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies”:

https://prospect.org/economy/2023-05-17-irs-takes-welcome-step-20th-century/

So yes, I will defer to Rick Heineman and his employer Intuit on the subject of “harming the most vulnerable Americans.” After all, they’re the experts. National champions, even.

Now I want to address the peply guys who are vibrating with excitement to tell me about their 1099 income, the cash money they get from their lemonade stand, the weird flow of krugerrands their relatives in South African FedEx to them twice a year, etc, that means that free file won’t work for them because the IRS doesn’t actually understand their finances.

That’s a hard problem, all right. Luckily, there is a very simple answer for this: use a tax-prep service.

Actually, it’s not a hard problem. Just use a tax-prep service. That’s it. No one is going to force you to use the IRS’s free e-file. All you need to do to avoid the socialist nightmare of (checks notes) living with less red-tape is: continue to do exactly what you’re already doing.

Same goes for those of you who have a beloved family accountant you’ve used since the Eisenhower administration. All you need to do to continue to enjoy the advice of that trusted advisor is…nothing. That’s it. Simply don’t change anything.

One final note, addressing the people who are worried that the IRS will cheat innocent taxpayers by not giving them all the benefits they’re entitled to. Allow me here to simply tap the sign that says “between 13 and 22 percent of EITC benefits are gulped down by tax prep companies.” In other words, when you fret about taxpayers being ripped off, you’re thinking of Intuit, not the IRS. Just calm down. Why not try using fluoridated toothpaste? You’ll feel better, and I promise I won’t tell your friends at the Gadsen Flag appreciation society.

Your secret is safe with me.

Catch me on tour with Red Team Blues in Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

If you’d like an essay-formatted version of this thread to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

[Image ID: A vintage drawing of Uncle Sam toasting with a glass of Champagne, superimposed over an IRS 1040 form that has been fuzzed into a distorted halftone pattern.]

#pluralistic#earned income tax credit#eitc#irs#grover nordquist#guillotine watch#turbotax#taxes#death and taxes#freefile#monopoly#intuit

176 notes

·

View notes

Text

Ko-Fi prompt from @kayasurin:

Economy topic - Trickle Down Economics, why they work/don't work

HI it's been two months since I got this prompt, so. Sorry about that. been a lot going on in my personal life, so let's hope this makes up for the wait.

(To anyone who was considering doing a ko-fi prompt... I promise to get to them, but I cannot promise a reasonable time frame, sorry.)

So, Trickle-down economics, and if they work.

Short answer: They absolutely don't.

Longer answer that you actually paid for:

Trickle-down is basically a propaganda-driven hustle that rich people run against the working class. It's an economic theory that is known to not function, but since it serves the people up top to keep pushing it, we still have to deal with people pretending it's a real thing.

The basic concept of it is that if the capitalists at the top are allowed to retain more money (less taxes), then that money will naturally find its way lower down the pyramid through natural market forces. If a wealthy individual is allowed to keep an extra 50% of their marginal income, then the bulk of that 50% will go into their businesses, reinvested to generate more wealth by purchasing new equipment, running R&D, and paying more money to more workers. By not paying the taxes, they wealthiest classes can direct their money as they see fit, so really they don't end up with any more money than they would have if they paid their taxes!

As you can guess, this is not what actually happens in almost every possible application of the theory.

First, let's address the concept of marginal tax rates. They get a lot of hate, but I find this infographic explains the reality best:

(source: This post, but originally from Kasia Babis on The Nib/@thenib)

To summarize for those using a screen reader:

Let's say you earn 50k every year, and we're not going to bother with currency, because this is a simplified explanation. In this scenario, there is a national/federal income tax of approximately 20%. With that, you give 10k to the government, and retain 40k for your own purposes.

You have a neighbor who makes 500k every year. In this hypothetical, a marginal tax rate applies to earnings over 100k. The marginal tax rate is 70%. What does that mean for your neighbor?

They pay 20% on the 100k, which is 20k. Then they pay 70% on the remaining 400k, which is 280k. Combining the base tax and marginal, they are taxed 300k.

At the end of the day, they are left with 200k. The total tax on their income is 60%. If you're following along, you can tell that regardless of the final percentage, anyone that the marginal tax applies to is always going to get to keep at least 80k, the amount left of the pay that is taxed at the base rate.

The more you earn, the more you are taxed. Again, this is super simplified, but this is the most basic way marginal taxation works. (Tax brackets are related but not entirely the same thing.)

With a marginal tax, exorbitant wealth is curtailed by forcing that wealth back into the system. The understanding is that nobody can actually perform hundreds of times more labor than their lowest-paid worker, and so all that surplus income was in some way not distributed properly. They get to keep enough to live on, quite comfortably, but not all of it.

There may be some companies that are willing to cap their highest wages in relation to their lowest, but those are far and few between. There's a reason the average ratio of CEO to entry level worker in the US is nearly 400:1... up from 1965's 20:1. (source)

Trickle-down theorizes that, if allowed to keep that exorbitant wealth, the Capitalists will distribute that wealth back to their workers or reinvest it into productive enterprise, and do so in response to market forces or out of fear of a return of the marginal tax.

This is not what happens, basically ever. People do not earn that much money if they are already paying a living wage and distributing wealth properly. You cannot get exorbitantly wealthy through anything other than wage theft, system abuse, or capital-based market manipulation (see: hedge funds, housing market).

I suppose you could inherit the money, or win the lottery, but the latter is actually taxed higher than the former, believe it or not. The United States federal government doesn't have an inheritance tax, and most states also don't. There might be various legal fees and such, but not any actual taxes.

Where we end up is that those taxes the rich don't have to pay go instead towards 'passive income' schemes and market manipulation like the housing market.

(That is an entire separate rant, but yeah, most of the housing market at that income bracket is, to some degree, deliberately manipulated by those involved in it. We are all 100% watching for that bubble burst that is inevitably heading our way.)

The wealth does not trickle down to the workers. It is guided by those who have it, and they are significantly more likely to put it in foreign bank accounts, liquid assets, and real estate that they hope will gain value for a capital gain at sale.

Trickle-down economics relies on the goodwill of the wealthy, but almost nobody gets that wealthy by having goodwill to spare.

(Prompt me on ko-fi!)

259 notes

·

View notes

Note

I’m learning so much from you today but it’s so weird because in school (I’m British by the way) we learned very little about recent British history but one of the few things we were told is that the Queen has no real power and she was pretty much just a ceremonial figure head they bring out for special occasions. I think that’s very odd. Also, I’m finding out today why we weren’t taught much about our own history.

You're welcome. As a person who did their PhD in a UK university and taught in the history department at said university: my freshmen students would come into class having studied the Tudors, the Industrial Revolution/Victorians, and World War II (where Churchill saved the world!) during their time in secondary school, and that was it. That was the only thing they knew about British history, their own past, or anything else in the premodern era. I have written about the British penchant for "imperial nostalgia" before, where the country still largely thinks that the British Empire was actually a good thing, and how this rampant, embedded, and systematically unexamined xenophobia and sense of British exceptionalism gave way to Brexit.

Likewise, of course it's useful for them to teach you that the Queen is "apolitical" and "doesn't have a role in government" and "just has to follow the advice of her ministers." On that topic particularly, I advise you to read the entire investigative series on "Queen's consent" that The Guardian did, which explored how her political power was used in direct, secretive, and extensive ways to benefit herself and her family, including personal exemptions from pretty much any law, taxation, or civil rights requirement that she damn well pleased.

465 notes

·

View notes

Text

Changes to the Tax Collection System in Revolutionary and Napoleonic France

My (loose) translation from Le prix de la gloire: Napoléon et l’argent by Pierre Branda, about money and finance. This part is specifically about the reforms made to the tax collection system. Problems with taxation had been the source of many woes, so it went through major changes.

“The [tax] work of the Consulate mainly concerned the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the ‘tax slips’, to be established by municipal administrations. Their work was complex, because each year it was necessary to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of the contribution to pay. Poorly motivated (or even corrupt), the municipalities had put little care in the execution of their mission since a large part of the taxpayers had not yet received anything for their taxes of year VIII, or even of year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left outstanding). If the sending of tax matrices left something to be desired, the collection of direct contributions was hardly better. The tax collector was also not an agent of the administration: this function was assigned to any person who agreed to collect taxes with the lowest possible commission (otherwise called ‘collecte à la moins-dite’). With such a system, there were numerous inadequacies, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the profits of the collectors were most of the time too low to provide such a service; also, to compensate for their losses, they were ‘forced’ to multiply small and big cheats. In any case, in such a troubled period, letting simple individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.”

“One month after Gaudin’s appointment, on December 13, 1799, the Directorate of Direct Contributions was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely ‘in the hands of the Minister of Finance’ and in this way the taxpayer found himself in direct contact with the administration. The tax system no longer having any obstacles, the beneficial effects of such a measure did not take long to be felt. With ardor, the agents of this new administration carried out considerable work: three series of rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the ministry had not skimped on their pay (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was undoubtedly not unrelated to such success.”

“Tax reform was slower. It was not until 1804 that all tax collectors were civil servants. The consular system gradually replaced the collectors of the departments, then of the main cities and finally of all the municipalities whose tax rolls exceeded 15,000 francs. At the end of the Consulate, the entire tax administration was thus entirely dependent on the central government. Subsequently, the one in charge of indirect contributions (taxes on tobacco, alcohol or salt) created on February 25, 1804 and called the Régie des droits réunis was built on the same pyramidal and centralized model. It was the same later for customs.”

“According to Michel Bruguière, historian of public finances, ‘Napoleon and Gaudin can be considered the builders of the French tax administration. [...] They had also developed and codified the essential principles of our tax law, so profoundly derogatory from the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers’. Basically, after having clearly understood the true cause of the ‘financial wound’, Bonaparte wanted an effective, almost ‘despotic’ instrument to avoid experiencing the unfortunate fate of his predecessors. As a good soldier, he created a fiscal ‘army’ responsible for providing the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in everything that concerned public revenue. The time of the farmer generals of the Ancien Régime or the ‘second-hand’ collectors of the Directory was well and truly over. Napoleon Bonaparte, with his fierce desire to centralize power in this area as in many others, undoubtedly gave his regime the means to last.”

#Le prix de la gloire: Napoléon et l’argent#Le prix de la gloire#Napoléon et l’argent#napoleon#napoleonic era#napoleonic#napoleon bonaparte#19th century#first french empire#1800s#french empire#france#history#reforms#finance#economics#french revolution#frev#la révolution française#révolution française#Gaudin#tax#tax collection#tax collection system#taxation#law#napoleonic code#source#book source#french history

36 notes

·

View notes

Text

The End of an Era (Ikemen Prince)

Records of Assassin!Emma

Warnings: mentions of blood, Gilbert, and violence

Word count: 2.5k

Featured characters: Emma, Gilbert, Roderich, Chevalier, and Clavis

Plot: Emma undertakes a mission from Chevalier to bring back information on weapon development in Obsidian

3rd person, contains Gilbert pov

A/N Thank you kind patron Atelier for the generous donation of daggers and poison vials for Assassin!Emma

Killers for hire...

They do not choose their missions, they only follow orders.

She alone knew the final destination of those who openly defied the black-clad minister when his stay at the palace was still young, those who disappeared without a trace or final word. She was the specter that roamed these castle walls. The shadow of the devil.

It was already nighttime when Emma approached the castle of Obsidian from the moonless side. The shot of her crossbow was timed with the loud clang coming from the execution site in front of the castle. A fellow agent just went down. Emma hastily climbed to the top of the wall, the rope disappearing behind her as that of the most daring of magic shows about the same time another patrol was turning around the corner.

Normally in Information retrieval missions, a spy would be planted as a staff member, waiting months even before making any move, but the castle of Obsidian had such thorough background checks and investigations, The only way was a direct approach. Emma knew her biggest obstacle yet to overcome was not the bleak walls of the castle but the first prince of Obsidian himself, if she ever had the misfortune of running into him. From hearsay, Emma suspected it was this avid collector of information and enthusiast of spies that led Obsidian's counterintelligence operations. Once you touch a web, it doesn't take long before the spider comes forth.

Gilbert lounged in a chair behind a black desk, resting his head in the palm of his hand leisurely, one blood-red eye trained on the papers in front of him while a hooded figure gave detailed reports by his side.

¨...Just a small number of refugees fled across the border to Jade. It appears they were escaping exceedingly high taxation from the corrupt noble in their territory. Needless to say, he was taken care of¨

¨Some might come, others will go, It's the natural order of things, don't you think?¨

Gilbert picked up one of the papers giving it a once-over

¨...there have been no reports of anyone coming back, oder?¨

¨You said something about a commotion that happened around that time at the border, several days ago¨ Gilbert's voice was cheery albeit his eye shined devoid of any mirth. ¨A good opportunity to escape, as it goes, some would risk life and limb to get out, conversely some would use the opportunity risking as much trying to get in. Do you know who that might be?¨

The question was purely rhetorical, followed by a knowing silence. There were a few reasons someone might want to breach obsidian's defenses and it was never for sightseeing. Gilbert finally averted his gaze from the paperwork and border reports, this time looking somewhere far through the window where stormy clouds were beginning to form.

¨hmm The birds that sing at dusk were unusually silent this evening.¨ He hummed.

To anyone else, those words might have appeared cryptic but oftentimes one had to have an eye for the little things, those little anomalies others brushed aside. Gilbert always had an eye for details, that's what set him apart from the rest. Ironically, with one eye he saw more than most, little missteps, like for example, when someone carelessly scared off the wildlife.

Gilbert smiled.

¨Im saying we have a visitor¨

A shadow crept through the spacious hallways. The silence that reigned in this foreign place was eerie, somewhat unnatural. Emma sidestepped security, men dressed in the distinct military uniform of Obsidian, numerous times, reaching the armory easily. Almost too easily. Not that an assassin would seek conflict or the thrill of a fight like some ordinary street hooligan but the reception or lack thereof was off-putting. It felt like a twisted welcome like Emma was already expected. The door that held those coveted secrets stood ahead, beckoning.

The space was littered with heavy rectangular crates and other goods that to her trained eye were of no interest. She crouched to bust a gap in one of the boxes using a metallic tool as a lever, picking by their size and placement. Fortunately, Emma wouldn't need to search for long, luck was on her side as she extracted the paragon of military innovation that was carefully stacked there. She passed her hand over its cool surface, it weighed much lighter than Emma imagined. Noted, they improved on that aspect as well it seems. Emma didn't find any ammunition nearby, assuming it was placed in a different location altogether.

Out of a side pocket, she fished out her own bullet for comparison. The one in her hands was salvaged from its testing grounds a long time ago, it didn't fit the new rifle which needed much smaller, sharper, and slender ammunition. The new bullets must have shrunk and taken shape compared to the lump of metal in her palm. Could this mean this version was more accurate? it was unlikely to be just to cheapen production; Obsidian usually went all out in weapons production, its cost coming only second to its quality. Emma burned its measurements to memory. Checking the thing inside and out briskly, a little bit too enthralled, she paused spotting the Obsidian's coat of arms stamped at the beginning of the barrel, the sign of pride of a nation. A grim feeling settled in her stomach, sensing the bigger picture. This was much more than a new toy, a new era was looming over the continent, one where knights were not welcome.

¨You seem to be enjoying yourself¨

Emma stiffened. This was unusual, she didn't sense anyone's approach.

A tap, its sound rumbled through the walls around her. Emma looked over her shoulder to see a man clad in black, standing in the doorway, both hands reclined on a cane. The pale light from the hallway outlined his raven hair, multiple medals and awards hung adorning his chest but his most prominent feature was his blood-red eye that seemed to bore into her very being. Only one man Emma knew of passed the description. She felt an uncharacteristic sense of foreboding wash over her.

¨Did i startle you?¨ Gilbert tilted his head with a sickeningly sympathetic tone. Or rather, the impression of one.

¨ You understood me just now, as I thought, you're from Rhodolite. This is unusually brash even for Chevalier, I wonder if the brutal beast is getting impatient ¨ he mused, the last part almost like an afterthought.

Emma was left bemused by the precise conclusion, she could've sworn her expression was schooled up until now, professional that she was. She didn't recall giving any answer nor sign of understanding, and then immediately regretted the slight surprise that might have shown on her features from his assessment, after the realization that the prince wasn't judging the events prior but her response to what he said just now, confirming his point.

¨I'm a big believer in giving credit where it's due. However...¨

Emma slowly stood up, grip instinctively tightening around the rifle. Gilbert only smiled as he continued monologuing.

¨I dislike trespassers. All spies are actors and by extension liars, and there's nothing I hate more than lies¨ Gilbert took something out of his pocket throwing it in the air. Emma caught the small object with her free hand.

¨This is...¨ the object in question was a black bullet.

Gilbert nodded.

¨Go ahead. You seemed a bit too eager to use it just now.¨

¨why?¨ was all Emma could muster in response, trying not to read too much into the man's contradictory words lest she get more confused, more interested in determining her next course of action.

Gilbert moved the weight of his cane into one hand, shifting from his reclined position to stand up at full height.

¨To make the game more interesting, of course.¨ That was all it was to him. A mere game.

¨Is that a threat?¨ She slowly pointed the yet-to-be-loaded barrel in his direction.

¨more of a heads-up, really¨

Confrontation with Gilbert was a gamble. Emma might have the tempting advantage here, but one thing she knew: there are few things more dangerous than a skilled enemy on his own carefully chosen ground, and Emma's mission wasn't to kill Gilbert, it was to return alive. A few moments of silence passed between the two until it was broken when, without warning, Emma hurled the rifle at his face. Gilbert caught it with one hand, by then, the assassin slid past him in one fluid motion. No further crossing the threshold, she felt a strong grip tugging at her collar. Not paying it any mind, Emma rid of her coat losing a few buttons in the process.

And suddenly, she was running, Gilbert's smile fading from view, receding into the darkness of the hallway. The light of the windows flickered by, the only sound being that of frantic steps. Seconds before Emma took a left turn her instincts went into overdrive sensing the impending ambush. She grabbed an ornate candelabra parrying mid-flight the blade that came the moment of the turn. The assailant's sword flew into the air and with a swift turn of the impromptu weapon, his hand was now securely forked into a nearby wall. The man groaned giving Emma a margin of a moment to assess the situation. Sure enough, a few dozen guards stood in her way, awaiting to block her escape route. Some of them were fully armored, a few wore military uniforms. Her ears strained hearing the approach of clattering steps from behind. It appeared that turning back was not an option either. But now, more than ever in her life, Emma knew exactly what to do. Slowly, she raised her hands in the air. The men exchanged a glance but as soon as two of them approached to apprehend her, two sharp pins found their way into their throats. As they stumbled in shock, the intruder was already dashing past them, head-on into the crowd.

Emma was an unfeeling killer in truth and a half; trained to kill and trained to do so without leaving a trace, trained in the art of assassination and the arts of infiltration and espionage, however, she was not entirely unfeeling. She felt a lot. She felt the taste of blood as one of the guards retaliated with a jab, Emma felt the humming of the air as she sidestepped the incoming cut that followed again and again, maneuvering through blades like in a frenzied dance. And at the end of the hallway, before the pale light of the moon that came through the large crystal window, her silhouette sparred a deadly duet with a relentless adversary, it was then that she felt her alarm bells go off, a sense of unease, and rightfully, at the familiar tap of a cane.

Gilbert stood at the far end of the following corridor, opposite where Emma had come from, tilting his head with a placid smile. How he appeared ahead, almost waiting, was truly a mystery that, alas, time would not allow her to resolve. In an instant, Gilbert's cane was pointing at her.

A cloud passed over the moon, yet again, hiding its alluring beauty and ethereal light. Adrenaline kicked in. Emma reacted before she could fully process what was happening, pulling the guard before her in a shielding manner, almost tearing his sleeve. She heard The slight rasp of material ripping, then a deafening discharge as shards of glass sprang everywhere like a cascade. Pain shot through her system like a shockwave, Emma stumbled back gripping the window behind her, her ears were ringing.

The guard's mass collapsed on her form tilting her world in a second that felt like an eternity and just like that Emma was falling into the abyss. Her injury burned as the rain came down, piercing the sky in thousands of icy needles. Her vision blurred the edges of the dark obsidian castle as its peaks buried themselves into the tempest clouds. Perhaps deep down Emma had already given up, only moving her limbs on instinct, her heart getting up by habit. She hit the edge of a tower, tumbling down. The tiles screeched, pierced by the dagger in her hand, dulling its polished surface. The assassin managed the relent her descent short of reaching the edge. The thick curtains of rain may serve as a cover for escape but right now all they were doing was depriving Emma of much-needed breath. It was increasingly difficult to assess distances in the darkness of the downpour and the dizzying altitude. They shifted, stretched, and narrowed all the while Emma's weight was slowly giving in to the slippery surface under her.

She pressed a hand against the smudged spot on her shoulder that darkened by the second, wincing slightly. New streams of blood replaced those washed away by the water and her cold, wet clothes stuck asfixiatingly close to her body. She turned to the sky, eyes closed, silencing a whimper of pain. Emma composed herself promptly and gripping the watery eaves, jumped, swiftly sliding into the window below. She did not remain for long. Eluding the crowded hallways, Emma swiftly exited another window, one less steep and more accessible for an escape downwards if escape was even possible for a castle that looked more like a military fortress.

Emma stood before Chevalier, After crossing the border and returning to the court she went directly to the secluded room in the library. Before she gave her report the mission was far from over. His cold eyes met with hers after Emma's ragged form appeared from the shadows, bowing politely. Chevalier scoffed at her appearance. Although she already had the wound on her shoulder wrapped up in a spare piece of bandage, her boots left a fine trail of mud which the second prince probably didn't appreciate that much in his pristine sanctuary of books, not to mention her uniform was rightfully tattered from her presumably ungraceful fall in bushes amid her descent.

¨...It's worse than I initially imagined. It's a good thing the prototype is too complex for mass production... for now¨

¨That only buys us time. Go on.¨ Chevalier closed the book in his lap giving Emma his undivided attention.

¨Unfortunately they already have enough in stock to supply an entire company¨

¨ But with its destructive power it could make for one hell of a surgical strike¨ Clavis' head popped from behind the shelves. He stacked a book from the pile he was carrying in its place with a shady smile that looked more forced than usual.

¨If he's withholding could it be that he's waiting for the right moment, what do you think Chev?¨

¨He's not one to go for a direct approach¨ Chevalier stood up from his seat. ¨enough of this¨

Clavis frowned. Chevalier turned at last, his pale blue eyes zeroing in on the spy. ¨What else did you bring?¨

¨No, that was all for now... oh¨ Emma's hand brushed past something in her pocket. Strange, She could've sworn she lost it somewhere along her escape... then when did...?

She carefully extracted the object and handed it to her employer.

Clavis stole curious glances while Chevalier turned it in his palm, frowning immediately. It was the black bullet, on closer inspection It was by no means ordinary, Emma even had doubts now if it even belonged to the type of rifle she was inspecting back then.

¨That's very like him to do¨

Chevalier tossed the bullet back to Emma, his silence translated to "Good work". Before Emma could ask what was wrong he turned towards the library exit.

Clavis followed suit striding gallantly, passing Emma with a pat on the shoulder.

Emma turned the bullet, It was under the reddish hues of the setting sun that she caught a glimpse of something she had missed the first time she held it

A familiar name was etched into the bullet's shell, each letter's silvery outline gradually shining on the black surface. This was how Gilbert von Obsidian sent his regards to the second prince.

Did he know of her arrival? was her escape less of a coincidence and more of a calculated gambit?

Emma thought, regardless of the truth of what happened,

"What a bold declaration of war"

#assassin!emma#ikemen prince#ikemen ouji#ikepri#ikepri gilbert#gilbert von obsidian#ikepri chevalier#ikepri clavis#ikepri emma#chevalier michel#clavis lelouch#Ikepri assassin emma#Ikepri spy emma#Ikepri assassin au#assassin emma

71 notes

·

View notes

Note

Just saying man. If Covid was a plot to instill a facist regime across the world, why go with an accelerationist plan? The movement was going very well from 2016 to 2018; slow and steady. The pandemic brought on social unrest and a resistance movement. Sounds more like they were sabotaging themselves (whoever "they" are) by attempting to bring societal collapse.

No, I didn't say it was planned or a plot by the elite to subjugate the people, the release of the virus from the Wuhan Institute of Virology was completely accidental, the CCP's mismanagement of containing the spread most likely wasn't deliberate either.

Governments will use any crisis to gain power, and once they have this power they will never relinquish said power, we have seen this time and time again, from the 1980's when Pierre Trudeau created a crisis to enact emergency powers and install his previously rejected Charter of Rights and Freedoms, (which overwrote the Canadian constitution by adding a line which basically reads as "you have all the rights and freedoms guaranteed by the Constitution, unless the government says so") to 9/11.

Hell, both Canada and the US have had to suffer under 100 years of paying a "temporary" wartime tax, known as income tax, and before anyone cites leftist articles supporting the taxation let us go over history, in Canada at least, the original tax act of 1917 was to finance the war effort, all eleven pages of it. Finance Minister White said it would be a temporary tax and so insisted it be called a "war tax" so that once the war ended, it would be. Instead, in 1921 the government added a sales tax, and even more over the years since.

Governments do not relinquish power, unless they are made to.

We have no evidence that the Governments of the world had ever planned for the Coof outbreak, well, other than

Event 201 is a damning thing for those who remember it, it was held in 2019, it simulated an outbreak of a novel zoonotic coronavirus transmitted from bats to pigs to people that eventually became efficiently transmissible from person to person, leading to a pandemic. The pathogen and the disease it caused were modeled largely on SARS, but it is more transmissible in the community setting by people with mild symptoms.

The scenario ends at the 18-month point, with 65 million deaths. The pandemic begins to slow due to the decreasing number of susceptible people. The pandemic continues at some rate until there is an effective vaccine or until 80-90% of the global population had been exposed.

The Governments of the world reacted the way they did because they trained themselves to do so, this isn't even the first event of its kind, they run scenarios like this every year at Davos, from Nuclear engagements to viral epidemics.

But the truly terrifying thing aren't the world leaders, but those who have openly admitted to infiltrating governments around the world.

Lead by a man who decried the Great Reset as a conspiracy despite his own website having this and he himself having authored a book called COVID-19: The Great Reset.

A man, and an organization that wants you to own nothing and be happy by 2030, fucking German economists.

They're still moving forward with the WEF's plans for digital IDs, which work the same as China's social credit system.

Listen, my point is, they do want you under their thumb, they aren't the most competent or smartest people, but they are persistent, they will whittle away at your rights until you're not when sure you had them in the first place, hell, most Canadians don't even know that prior to Pierre we had a right to self defense with a weapon at that, now you can't even use pepper spray.

50 notes

·

View notes

Text

Why do i get to be on the dole? Well, im part of a standing army called the british commonwealth and we all surround the king from everyone else, but of course, we all surround him, period...american leaders have no loyalty to their people so your wellfare programs are weak and everyone growls about bootstraps to eachother

Its a quid pro quo scheme, like the healthcare. Unemployment is a real thing, in my world. "Its rather fashionable actually" said marwood to uncle monty, iirc

Universal basic income, for them that asks

Really im on disability but thats only 400 more a month and they might bump me down to regular assistance if my case were audited particularly harshly; admittedly im less disabled now than i was when i got on it but the reasons i got on it are ongoing irrevocable issues including those of neuroanatomy, and frankly, the shit they perscribe for that costs the government a lot more than i have being off it, so, i consider myself a kind of pilot project or case study vis a vis my own policy recommendations

If its true that we have the budget for UBI if we abolish inheritance, and install a personal wealth cap, beef up corporate earnings taxation and corporate crime fines (for pollution, sabotage, hostile monopolization etc), restructure the military spending....well, WOULD that help even highly "dysfunctional" and aggrieved people regulate better and live more pro-socially? And the answer is YES

Poverty as punishment for "sloth" or "wrath" or "irresponsibility" or "undue impulsivity" or whatever imagined personal flaw is projected onto any given skid among the economically disenfranchised, is war on the poor, because poverty kills

And if the poor are on one side and the other side is full of morality police and the bourgeoisie, well, shit gets messy, its open season in either direction, its "by any means necessary" from either sphere's most militant combatants' povs

3 notes

·

View notes

Note

How did Lincoln's economic policy set the GOP on their path towards corporate domination?

To be fair, I do approve of much of Lincoln's economic policy - the first income tax, the use of greenbacks, land grant colleges, etc. - so it's more that there are a couple areas of economic policy where I think Lincoln's administration had that effect, and the extent to which I think it's fair to hold Lincoln accountable for the long-term implications varies:

Procurement: to be fair, Lincoln inherited a Federal government that really didn't have a modernized procurement system. However, between that and the pretty thorough corruption of Secretary of War Simon Cameron and others within the Federal government, a lot of businessmen got rich selling substandard goods to the Union army and navy at a markup in exchange for kickbacks - so much so that the term "shoddy" became generalized and popularized as a result. (Previously, "shoddy" had specifically referred to reprocessed wool.)

Bonds: in order to finance the Union war effort, the Lincoln administration sold an enormous amount of bonds - and Treasury Secretary Salmon P. Chase basically turned the Union's bond drive over to Jay Cooke, a politically-connected Philadelphia banker. To give him credit, Cooke was very good at selling bonds both to ordinary bankers and the man on the street, but Cooke's personal commission meant that he (and the men he hired as his sub-agents) became staggeringly wealthy and thus a major donor to the Chase presidential campaign in 1868. Cooke ultimately was bankrupted when his Northern Pacific Railway went bust in the Panic of 1873.

Banking: while the National Banking Act of 1863 had many good elements - nationalizing the currency, and establishing Federal charters that allowed the Federal government to regulate banks on capital and reserve requirements - it also had the effect of further concentrating currency and credit in Northeastern banks (which could more easily meet those requirements due to being better-capitalied to begin with), which was a bit of a problem when you realize that the U.S didn't have a central bank to ensure that all regions of the country had decent access to currency and credit.

Railroads: the Pacific Railroad Acts of 1862 and 1864 provided for the Federal subsidization of transcontinental railroads through the granting of Federal land. While this got the railroads built, it didn't come without a healthy side-order of corruption: understanding that they stood to make a fortune if the railroad acts went through, railroad companies gave out a lot of free stock to U.S Congressmen, who in turn made sure the Acts passed and the Federal government was generous with land grants, loans, etc. This wouldn't blow up until the Credit Mobilier scandal of 1872, but the roots go back in the 1860s.

As you might expect, a lot of the bankers and railroad executives who had gotten rich off the Civil War became major donors and activists and party leaders and elected officials of the Republican Party. This had a significant impact on the party's political and policy direction: by 1868, the Republican Party's national platform mixed calls for civil rights and equal suffrage with demands that Civil War debt be redeemed in gold rather than paper money (which contributed to post-war deflation and represented a repudiation of the Greenback Acts), and that progressive taxation be done away with.

18 notes

·

View notes

Text

Six Main Advantages to Grow your Business in Turkey

Introduction

Six advantages to grow your business in Turkey will be analyzed in this paper. Of course, Turkey has a growing economy, with a rapidly increasing young population and a growing number of large companies. Above all, the below-mentioned advantages are of great importance in attracting sustainable foreign direct investments (FDI).

Is It Safe to Invest in Turkey for and beyond 2023

At this stage, we should bear in mind main benefits of investing in Istanbul and other cities of Turkey.

Is Turkey a Good Investment Because of Fast Growing Economy?

It is critical to note that Turkey is recognized as being in the top 20 economies in the world. Therefore, the Turkish country attracts numerous foreign investors from every single region. Besides, Turkish authorities attach a high priority to the encouragement of foreign investment. The Country provides a broad range of initiatives for FDI.

Is Turkey a Good Investment through High Youth Population Rates

Compared to 10.6 percent of the European Union, despite a slight decrease, Turkey’s youth population constitutes 15.3% of total population. This makes Turkey a good place for large-scale investments.

Expand Your Business through High Workforce Rates

According to main indicators, the labor force participation rate for young people was %41.7 percent. These numbers clearly mean that foreign investors have a great chance to benefit from flexible employment opportunities.

Increasing Value of Foreign Currencies

Before making the decision to invest and establish business operations, investors keep in mind the value of domestic currency and foreign currencies. Particularly, increasing value of foreign currencies and decreasing value of Turkish lira play a vital role in reducing the cost of the institution of necessary infrastructure for investments including any kind of production.

Investing in İstanbul because of Excellent Geographic Location

Turkey offers a business-friendly environment, a deep talent pool and global market access at the nexus of Asia and Europe. Hence, the Turkish environment is very close to the properly functioning markets from the east and west. Investing in İstanbul is seen as a gateway between different continents by business lawyers and entrepreneurs.

Is Turkey a Good Investment In Terms of Income Tax Commitments?

The question of how foreign investments are taxed in Turkey is open to discussion. In that respect, it is significant to note that the Turkish taxation system is based on residency.

In accordance with the Law on Income Tax, natural persons who are not resident in Turkey are only taxed on their earnings generated in Turkey.

Taxation rules dramatically change if the relevant natural or legal person has a permanent residence in Turkey.

Also, there are regulations and international agreements preventing double taxation and promoting trade in Turkey.

In accordance with the Law on Corporate Tax, that is also the case for legal entities. In this sense, foreign companies are only taxed on their earnings generated through their operation in Turkey.

Why Do You Need an Investment Advice While Investing in İstanbul?

Turkey has been located in very special territory connecting three continents, economic regions and numerous people. Turkey offers a cost-effective environment to entrepreneurs. Thus, several Turkish companies are interested in growing their business and extending their investments inside or outside the country. Turkish markets offer a business-oriented environment together with low employment and facility costs. An embracing investment advice can be very useful to maximize all aforementioned advantages. Turkish investment lawyers can be very useful to improve a proper investment plan in Istanbul.

What Is the Significance of Help by Turkish Business Lawyers in Turkey?

Legal framework and implementation requires a great deal of knowledge in every single country. Every single investment project needs an embracing analysis of applicable Turkish norms. Commercial activities such as company formations, opening a branch, mergers and acquisitions, franchising system must be managed through an efficient legal guidance by foreign investors. Turkish business lawyers provide in-depth services to large, middle or small scale of corporations and|or individuals for their upcoming investment activities.

Conclusion

In the light of the aforementioned considerations, this article has highlighted six advantages to grow your business in Turkey. To sum up, the growing economy, high youth and workforce rates, increasing value of foreign currencies, amazing geographical point, tax exemptions on foreigners makes Turkey a very attractive place for investors. Consequently, it is really worth investing in İstanbul. Nevertheless, there is no doubt that every investment carries certain risks. Accordingly, companies and individuals investing in Turkey need a comprehensive legal guide and strategic advice from business lawyers. Such assistance may be very instrumental in taking the right steps. Particularly avoiding high-level risk factors through a full-fledged consultation is very important in investing in Turkey.

3 notes

·

View notes

Text

“The traditional, premodern state form is that of a (absolute) monarchy. The democratic movement was directed against kings and the classes of hereditary nobles. Monarchy was criticized as being incompatible with the basic principle of "equality before the law." It rested on privilege and was unfair and exploitative. Democracy was supposed to be the way out. In opening participation and entry into state-government to everyone on equal terms, so the advocates of democracy claimed, equality before the law would become reality and true freedom would reign. But this is all a big error.

True, under democracy everyone can become king, so to speak, not only a privileged circle of people. Thus, in a democracy no personal privileges exist. However, functional privileges and privileged functions exist. Public officials, if they act in an official capacity, are governed and protected by "public law" and thereby occupy a privileged position vis-à-vis persons acting under the mere authority of "private law." In particular, public officials are permitted to finance or subsidize their own activities through taxes. That is, they are permitted to engage in, and live off, what in private dealings between private law subjects is prohibited and considered "theft" and "stolen loot." Thus, privilege and legal discrimination — and the distinction between rulers and subjects — will not disappear under democracy.

Even worse: Under monarchy, the distinction between rulers and ruled is clear. I know, for instance, that I will never become king, and because of that I will tend to resist the king's attempts to raise taxes. Under democracy, the distinction between rulers and ruled becomes blurred. The illusion can arise "that we all rule ourselves," and the resistance against increased taxation is accordingly diminished. I might end up on the receiving end: as a tax recipient rather than a tax payer, and thus view taxation more favorably.

And moreover, as a hereditary monopolist, a king regards the territory and the people under his rule as his personal property and engages in the monopolistic exploitation of this "property." Under democracy, monopoly and monopolistic exploitation do not disappear. Rather, what happens is this: instead of a king and a nobility who regard the country as their private property, a temporary and interchangeable caretaker is put in monopolistic charge of the country. The caretaker does not own the country, but as long as he is in office he is permitted to use it to his and his protégés' advantage. He owns its current use — usufruct — but not its capital stock. This does not eliminate exploitation. To the contrary, it makes exploitation less calculating and carried out with little or no regard to the capital stock. Exploitation becomes shortsighted and capital consumption will be systematically promoted.

(…)

The state operates in a legal vacuum. There exists no contract between the state and its citizens. It is not contractually fixed what is actually owned by whom, and what, accordingly, is to be protected. It is not fixed what service the state is to provide, what is to happen if the state fails in its duty, nor what the price is that the "customer" of such "service" must pay. Rather, the state unilaterally fixes the rules of the game and can change them, per legislation, during the game.

(…)

The state does not defend us; rather, the state aggresses against us and it uses our confiscated property to defend itself. The standard definition of the state is this: The state is an agency characterized by two unique, logically connected features. First, the state is an agency that exercises a territorial monopoly of ultimate decision making. That is, the state is the ultimate arbiter and judge in every case of conflict, including conflicts involving itself and its agents. There is no appeal above and beyond the state. Second, the state is an agency that exercises a territorial monopoly of taxation. That is, it is an agency that can unilaterally fix the price that its subjects must pay for the state's service as ultimate judge.

Based on this institutional setup you can safely predict the consequences: First, instead of preventing and resolving conflict, a monopolist of ultimate decision making will cause and provoke conflict in order to settle it to its own advantage. That is, the state does not recognize and protect existing law, but it perverts law through legislation. Contradiction number one: the state is a lawbreaking law protector. Second, instead of defending and protecting anyone or anything, a monopolist of taxation will invariably strive to maximize his expenditures on protection and at the same time minimize the actual production of protection. The more money the state can spend and the less it must work for this money, the better off it is. Contradiction number two: the state is an expropriating property protector.

(…)

A society is free if every person is recognized as the exclusive owner of his own (scarce) physical body, if everyone is free to appropriate or "homestead" previously unowned things as private property, if everyone is free to use his body and his homesteaded goods to produce whatever he wants to produce (without thereby damaging the physical integrity of other peoples' property), and if everyone is free to contract with others regarding their respective properties in any way deemed mutually beneficial. Any interference with this constitutes an act of aggression, and a society is unfree to the extent of such aggressions.

(…)

All states must begin small. That makes it easy for people to run away. Yet states are by nature aggressive, as I have already explained. They can externalize the cost of aggression onto others, i.e., hapless taxpayers. They don't like to see productive people run away, and so they try to capture them by expanding their territory. The more productive people the state controls, the better off it will be.

In this expansionist desire, they run into opposition by other states. There can be only one monopolist of ultimate jurisdiction and taxation in any given territory. That is, the competition between different states is eliminative. Either A wins and controls a territory, or B. Who wins? At least in the long run, that state will win — and take over another's territory or establish hegemony over it and force it to pay tribute — that can parasitically draw on the comparatively more productive economy. That is, other things being the same, internally more "liberal" states (in the classic European sense of "liberal") will tend to win over less "liberal," i.e., illiberal or oppressive states.

Looking only at modern history, we can so explain first the rise of liberal Great Britain to the rank of the foremost world empire and then, subsequently, that of the liberal United States. And we can understand a seeming paradox: why it is, that internally liberal imperial powers like the United States tend to be more aggressive and belligerent in their foreign policy than internally oppressive powers, such as the former Soviet Union. The liberal US empire was sure to win with its foreign wars and military adventures, while the oppressive Soviet Union was afraid that it might lose.

But empire building also bears the seeds of its own destruction. The closer a state comes to the ultimate goal of world domination and one-world government, the less reason there is to maintain its internal liberalism and do instead what all states are inclined to do anyway, i.e., to crack down and increase their exploitation of whatever productive people are still left.

Consequently, with no additional tributaries available and domestic productivity stagnating or falling, the empire's internal policies of bread and circuses can no longer be maintained. Economic crisis hits, and an impending economic meltdown will stimulate decentralizing tendencies, separatist and secessionist movements, and lead to the breakup of empire. We have seen this happen with Great Britain, and we are seeing it now with the United States and its empire apparently on its last leg.

There is also an important monetary side to this process. The dominant empire typically provides the leading international-reserve currency, first Britain with the pound sterling and then the United States with the dollar. With the dollar used as reserve currency by foreign central banks, the United States can run a permanent "deficit without tears."

That is, the United States need not pay for its steady excesses of imports over exports as is normal between "equal" partners, in having to ship increasingly more exports abroad (exports paying for imports). Rather, instead of using their export earnings to buy American goods for domestic consumption, foreign governments and their central banks, as a sign of their vassal status vis-à-vis a dominant United States, use their paper-dollar reserves to buy up United States government bonds to help Americans to continue consuming beyond their means.” - Hans-Hermann Hoppe, ‘The Daily Bell’ (27 March 2011)

#hoppe#hans hermann hoppe#monarchy#monarchism#democracy#libertarian#libertarianism#anarchocapitalism#capitalism#mises#ludwig von mises#economics#austrian economics#praxeology

12 notes

·

View notes

Text

a particular perspective

Carl Jones

In a nutshell, the reason the country is in the shape it is in today goes back to, in my opinion, three cataclysmic events in American History-

Lincoln, in the 1860s, by winning his war of conquest changed the nature of the union by dissolving by force the ability of the States to rein in and control the general government. This was a reversal of the design promoted by proponents of the constitution, and demanded by the ratifying States in 1787 and 88. The die was cast that "if you resist federal power, you'll be invaded."

Secondly, Woodrow Wilson, acting on the groundwork laid by Lincoln, and furthering the power of the executive office established by "precedent" in previous administrations, cemented the progressive agenda, brought about central banking and fiat currency, enacted direct taxation and control over personal wages and income, further stripped the States of authority with the 17th Amendment, and embarked on a globalist notion of America as "world policeman" while lying us into what would become a state of perpetual war.

Third, Franklin D. Roosevelt, taking the cue from Lincoln and Wilson, further centralized executive powers, and with his "New Deal" changed the very fabric of American culture and its views of government's role. His perpetual "nanny state" agenda is now concreted in both liberal and "conservative" thought to the extent that neither "side" (sic) even desires a true restriction of government. Rather than being the protector of individual liberties, government under Roosevelt became the grantor of rights, the origin of liberty, the creator of jobs and prosperity and the system that must micro-manage all of these things. Nothing of substance stands in the way, and few recognize that, rather than benefiting America, this agenda continues to kill us by chipping away at our original foundation. It is systematic.

This is a very basic summary of events, but it gives a cursory view of the undoing of American thought, tradition and originalism. The idea that Bush, Obama, or Trump "killed the country" is short-sighted in the extreme. The mess we're in was initiated well before any of them were even born.

6 notes

·

View notes

Text

Napoleon & the creation of the tax collection system

Not wanting to impose new taxes on the people, the tax work under Napoleon was focused on reforming tax collection by creating a system which was more efficient, complete and equitable. He also worked to destroy the link which existed between private interests and state service concerning public revenue.

From Le prix de la gloire: Napoléon et l'argent by Pierre Branda. Translated by me, so any mistakes are my own 🙂

The [financial] work of the Consulate mainly concerns the reorganization of tax collection. Until now, this essential element was not administered directly by the Ministry of Finance. The Constituent Assembly had wanted the tax rolls for direct contributions, that is to say the “tax sheets”, to be established by municipal administrations. Their work was complex, since each year they had to draw up a list of taxpayers, determine each person’s share of tax and send them the amount of contribution to be paid. Unmotivated (or even corrupt), the municipalities had taken little care in the execution of their mission, since a large proportion of taxpayers had not yet received their tax assessments for Year VIII, or even from Year VII or year VI. Also, with two or three years of delay in preparing the rolls, it was not surprising that tax revenues were low (nearly 400 million francs were thus left in abeyance). If the mailing of tax matrices left much to be desired, the collection of direct contributions was not much better. The tax collector was not an agent of the administration either: this function was assigned to any person who was willing to collect taxes with the lowest possible commission (otherwise called “least collected”). With such a system, failures were numerous, often due to incompetence, but also due to the prevailing spirit of fraud. However, in their defense, the collectors’ profits were most of the time too low to provide such a service; so to compensate for their losses, they were “forced” to increase the number of small and big cheats. In any case, in such a troubled period, letting private individuals carry out such a delicate mission could only be dangerous for the regularity of public accounts. In short, the mode of operation of taxation that Bonaparte and Gaudin inherited was failing on all sides and threatened to sink the State.

One month after Gaudin’s appointment, on 13 December 1799, the Direction des contributions directes was created with the mission of establishing and sending tax matrices. This administration, dependent on the Ministry of Finance, was made up of a general director, 99 departmental directors and 840 inspectors and controllers. The organization of direct contributions became both centralized and pyramidal, the opposite of the previous system, decentralized and with a confused hierarchy. The work of preparing the rolls, for so long entrusted to local authorities, passed entirely “in the hands of the Minister of Finance” putting the taxpayer in direct contact with the administration. With the tax system now free of obstacles, the beneficial effects of such a measure were soon felt. With ardor, the agents of this new administration carried out considerable work: three series of tax rolls, that is to say more than one hundred thousand tax slips, were established in a single year. It must be said that the Ministry had not skimped on their salaries (6,000 francs per year for a director, 4,000 for an inspector and 1,800 for a controller), which was no doubt a factor in their success.

Reform of tax collection was slower. It wasn’t until 1804 that all tax collectors became civil servants. Under the Consulate, tax collectors were gradually replaced in the departments, then in the main towns, and finally in all communes whose tax rolls exceeded 15,000 francs. By the end of the Consulate, the entire tax administration was entirely dependent on the central government. Subsequently, the administration in charge of indirect taxation (taxes on tobacco, alcohol or salt), created on 25 February 1804 and known as the Régie des droits réunis, was built on the same pyramidal, centralized model. It was the same, later, for customs.

According to Michel Bruguière, historian of public finances, “Napoleon and Gaudin can be considered the builders of French tax administration. They had also developed and codified the essential principles of our tax law, so profoundly at variance with the rules of French law, since the taxpayer has nothing to do with it, while the administration has all the powers.” Having understood the true cause of the “financial plague”, Bonaparte wanted an effective, almost “despotic” instrument to avoid the unfortunate fate of his predecessors. As a good military man, he created a fiscal “army” to provide the regime with the sinews of war. It was also necessary to definitively break the link between private interests and state service in all matters concerning public revenue. The days of the fermiers généraux of the Ancien Régime and the “second-hand” tax collectors of the Directory were well and truly over. Napoleon Bonaparte’s fierce determination to centralize power in this area, as in many others, undoubtedly gave his regime the means to last.

———

French:

Pg. 208

Pg. 209

Pg. 210

#Le prix de la gloire: Napoléon et l'argent#Pierre Branda#Branda#Le prix de la gloire#Napoleon’s reforms#history#napoleon#napoleonic era#napoleonic#napoleon bonaparte#first french empire#money#french empire#economics#financial#finance#Economic history#financial history#france#19th century#tax collection#tax collection system#french history#Michel Bruguière#Constituent Assembly#gaudin#Martin-Michel-Charles Gaudin#french revolution#directory#the directory

6 notes

·

View notes

Text

How To Be a Tax Consultant in India?

Tax Consultant may be an interesting process function for every person who envisions a a hit profession in finance. As a tax consultant, you could paintings for the authorities or begin your personal tax consultancy, except running for reputed firms.

As the call suggests, a Tax Consultant or consultant is person who allows individuals, in addition to organizations, record their tax returns in a monetary year. This consists of reading and extracting essential records from a hard and fast of monetary files to the likes of employment, wage, investments, mortgages, and extra.