#dailyfx calendar

Text

How Does Scraping The DailyFX Calendar Data Enhance Trading Strategies?

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More :

https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More :

https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Forex Trading News: Tips for Successful Traders

Staying updated with forex trading news is essential for traders aiming for success in the dynamic currency markets. With news impacting market volatility and currency values, having a solid strategy for utilizing forex trading news can make a significant difference in your trading outcomes. Here are some valuable tips for traders looking to leverage forex trading news effectively:

Stay Informed with Reliable Sources

Financial News Websites: Regularly check reputable financial news websites such as Bloomberg, Reuters, and Financial Times for the latest updates.

Forex News Platforms: Utilize specialized forex news platforms like Forex Factory, DailyFX, and Investing.com for specific market insights.

Economic Calendars: Use economic calendars from trusted sources like Forex Factory and Investing.com to track key economic events.

Understand Market Reactions

Immediate Reaction: Be prepared for immediate market reactions to news releases, especially during high-impact events like central bank announcements.

Volatility Management: Have risk management strategies in place, such as stop-loss orders, to navigate volatile market conditions.

Analyze Market Sentiment

Sentiment Indicators: Use sentiment indicators like the COT Report (Commitment of Traders) to gauge market sentiment and positioning.

Social Media Analysis: Monitor social media platforms for trader sentiment and discussions on market-moving news.

Plan Ahead for Major Events

Calendar Awareness: Mark major economic events and central bank meetings on your trading calendar to plan your strategies accordingly.

Preparation is Key: Anticipate potential market scenarios based on different outcomes of economic releases or geopolitical events.

Trade the News Wisely

Wait for Confirmation: Avoid trading immediately at news release times; wait for the initial market reaction to settle before entering a trade.

Consider Scalping or Swing Trading: Adjust your trading style based on the time frame of the news and your risk tolerance.

JRFX - Empowering Your Trading Journey

Advanced Tools: Explore JRFX's advanced trading tools and platforms for enhanced analysis and execution.

Educational Resources: Access JRFX's educational materials and webinars to deepen your understanding of forex trading news.

Customer Support: Benefit from JRFX's dedicated customer support team for assistance with trading queries.

In conclusion, forex trading news can be a powerful tool in a trader's arsenal when used wisely. By staying informed, understanding market reactions, and planning ahead, traders can navigate the markets with confidence. With JRFX as your trusted partner, you have access to the tools and support needed to thrive in the forex trading arena.

Elevate Your Trading with JRFX:

Advanced Trading Tools: Experience JRFX's cutting-edge trading platforms for precise execution.

Educational Resources: Enhance your trading knowledge with JRFX's educational resources and webinars.

Personalized Support: Get personalized support from JRFX's dedicated customer service team.

Empower your trading journey with JRFX ( https://www.jrfx.com/?804 ) and make the most of forex trading news. Start trading with confidence today!

0 notes

Link

EUR/USD Price, Chart, and AnalysisA fresh multi-month high but further EUR/USD gains may be limited.Watch for moves in both the US and Eurozone bond markets. Recommended by Nic...

0 notes

Text

Business Conditions Improve, Inflation Cools

Business Conditions Improve, Inflation Cools

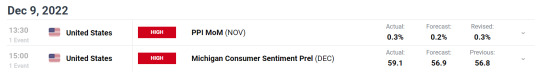

University of Michigan Consumer Sentiment Report: All Readings Rise

Index of Consumer Sentiment 58.1 vs 56.8 (Nov)

Index of Economic Conditions 60.2 vs 58.8 (Nov)

Index of Consumer Expectations 58.4 vs 55.6 (Nov)

Customize and filter live economic data via our DailyFX economic calendar

Consumer sentiment made a stark improvement on last month, improving in all three categories. Most notable…

View On WordPress

0 notes

Text

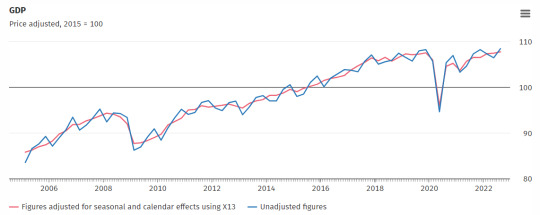

Euro Breaking News: Inflation in Focus After German GDP Surprises Higher

Euro Breaking News: Inflation in Focus After German GDP Surprises Higher

EUR/USD ANALYSIS TALKING POINTS

German GDP dampens recessionary fears backing euro bulls.

German CPI and U.S. core PCE dominate the calendar later today.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

EURO FUNDAMENTAL BACKDROP

Italy and France kicked off the morning with Italian inflation beating…

View On WordPress

0 notes

Photo

Indonesia To Legislate Blockchain Bill For Acceptance Of Bitcoin As Legal Tender/ Cryptocurrency exchange,bitflyer,CoinMarketCap,poloniex,bitfinex

The government of Indonesia has disclosed that it will soon sign into law legislation to legally recognize Bitcoin (BTC) as a trading commodity.

Indonesia’s Commodity Futures Trading Regulatory Agency, also known as Bappebti, had in June 2018 signed a decree to make cryptocurrency a commodity legally acceptable on stock exchanges.

The regulatory agency disclosed that the Indonesian government would soon make the necessary corresponding legislation to regulate currency exchange companies, taxation, and other related matters.

Bappebti approved a regulation to recognize Bitcoin and other cryptocurrencies as a legal trading commodity. The legislation also gives legal backing to cryptocurrency exchange firms already operating in the country.

The new policy outlines a set of regulations with regard to cryptocurrency circulation in the country. It particularly requires cryptocurrency exchange firms to comply with risk assessment, anti-money laundering (AML) and combating the financing of terrorism (CFT) laws. In addition, the policy also states that cryptocurrency traders must keep records of the transaction for at least five years and have a server located within the country.

The Head of the agency, Indrasari Wisnu Wardhana revealed that with the introduction of the new legislation, the agency hopes to “give cryptocurrency investors protection against fraudulent sellers”

However, the head of the Payment System Policy Department in the Bank of Indonesia (BI) Onny Widjanarko disclosed that “Bank of Indonesia still prohibits Bitcoin or crypto as a means of payment. A commodity is not an area of the bank, but we are concerned about the above.”

Although Indonesian Bitcoin brokers have expressed their dissatisfaction with regulators following the new capital requirements that were introduced in October 2018, the new policy requires brokers to have at least 70 million dollars to launch futures trades.

The Bank of Indonesia, with its headquarters situated in Jakarta, Indonesia, is the central bank of the country and sole the issuer of Indonesia’s legal tender currency – the Indonesian Rupiah.

It is noteworthy that the bank is independent of the government and operates a typical central bank like organization, making it contemporaries to many other central banks in the world.

In addition to its primary responsibility of maintaining the general stability of money and prices the Bank is also entrusted with the function of, maintaining financial stability and sustainability, increasing and reassessing the effectiveness of the country’s monetary management, maintaining an efficient banking system for its citizens, issuing legal tender currency as well as to overseeing payment systems.

Recently, the bank unveiled plans to retain its monetary policy rate for the third successive month after a two-day meeting of its governing board last week. The apex financial institution also vowed to continue in its efforts to make sure sufficient liquidity in the banking sector is achieved in other to encourage loan growth this year.

During the meeting, the bank also decided to maintain its seven-day reverse repo rate at 6 percent while the lending facility and deposit facility rates were also remained 6.75 and 5.25 percent, respectively - bitseven.com.

Bitcoin leveraged trade at 100x leverage maximum, 100% profit at 1% price raise

Make a profit whether the bitcoin price rises or falls

BITSEVEN BITCOIN LEVERAGE TRADING YOU CAN TRUST

https://www.bitseven.com/en

coinbene,Bithumb,Upbit,HitBTC,BitForex,FxPro,exchange rate,poloniex,bitcoin price today,btc price,FX Margin Trading,FX Margin,bitcoin Margin,kraken,currency exchange

#bitcoin mining#Mining Pool#dailyfx#bitcoin cash news#gbp usd#ico calendar#Bithumb#southxchange#Indodax#Mercatox

0 notes

Text

Can You Trade Forex This past weekend?

Numerous traders wonder in case you could trade foreign exchange this past weekend. While buying and selling in the weekend is possible, the marketplace is still closed on Friday. If you would like to participate in the particular action, factors to consider you understand the guidelines and strategies. This particular way, you can make the particular most of your time. If you fail to create it during standard market hours, you can attempt trading on the weekends. However, this option would be not typically the best choice for all those traders.

Professional traders need the weekend to remainder and recover from their long times on the marketplace. They typically get started trading at six: 30AM GMT plus work until 7PM GMT, which is definitely when the market closes. They review the previous day's trading performance to determine which trading should be placed over the weekend break. Beginners is going to take a new break on the weekend. During the week, they ought to determine their performance and even refine their strategies.

When some brokers provide weekends trading, this is not possible on typically the major currencies. Due to the fact of the moment differences, you will need to be able to access the market throughout the weekend. mt4 forex demo account , such as the Nasdaq, will be closed on the weekend. While many people like to get their weekends off of, some brokers happen to be more flexible. You could trade on the weekends at several brokerage firms. Many of them have got weekend trading websites.

You should remember that not really all forex brokers offer weekend trading. Since the international exchange market is usually open 24 several hours a day, numerous brokers don't include the ability to service their clients. If a person are looking intended for a broker that offers weekend trading, to understand options. They often offer lower profits and are more adaptable with their several hours. If you aren't make it for the weekend, you may want to consider a different broker.

In addition to these advantages, trading this past weekend gives you the chance to research forthcoming events and cryptocurrencies. If you can spare some moment to do this, you need to take benefit of the prospect. DailyFX Economic Diary is a great resource to be able to use to recognize important economic dates. You can also appear for a distance that appears involving two different prices. The market is usually always open intended for trading. You can utilize typically the dailyFX Economic Calendar to see when you will find any styles that you need to keep the eye on.

You need to also remember of which it is vital that you be consistent together with your trading period. Despite the fact that the foreign exchange market is open up 24 hours a new day, some traders are still unsure whether or not they can create a profit over the weekend. For this purpose, it is highly recommended to consider the time frame of the chosen broker prior to you start investing. You should always ask them how much time they would get willing to invest with you.

1 note

·

View note

Text

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More :

https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Scraping DailyFX Calendar data provides real-time economic event insights crucial for informed trading decisions and market analysis.

Know More :

https://www.iwebdatascraping.com/scraping-the-dailyfx-calendar-data-enhance-trading-strategies.php

#ScrapingTheDailyFXCalendarData#TheDailyFXEconomicCalendar#webscrapingtheDailyFXCalendar#Scrapingfinancialdata#Financedatascraper#ScrapetheDailyFXCalendarwebsite#Financedatascrapingservices

0 notes

Text

Gold Price Latest — Support Continues to Build Ahead of a Pivotal Week

Gold Price (XAU/USD) Analysis, Price, and Chart

Gold remains supported despite higher US Treasury yields.

US inflation and the FOMC policy decision are next week’s main drivers.

For all market-moving data releases and events, see the DailyFX Economic Calendar

Data via Treasury Direct

The economic calendar is full of high-importance US data releases and events next week with Tuesday’s inflation report and Wednesday’s FOMC interest rate decision the two standouts. The post-FOMC decision press conference will need to be followed closely as well as the quarterly FOMC economic projections (dot plot). While the Fed is expected to leave rates unchanged, the press conference and projections will give the market a much clearer picture of the Fed’s current thinking.

For all market-moving data releases and events, see the DailyFX Economic Calendar

The $1,932-$1,940/oz. zone is proving to be a strong level of short-term support for gold with the precious metal testing and failing to break through on a number of occasions over the last two weeks. Spot gold is also back above $1,960/oz, just, and is currently trying to break above the 20-day simple moving average, a short-dated indicator that has weighed on the precious metal for the last month. Next week’s calendar will define gold’s short-term future.

Gold Daily Price Chart — June 9, 2023

Retail Traders Boost Net-Short Positions

Retail trader data show 64.49% of traders are net-long with the ratio of traders long to short at 1.82 to 1.The number of traders net-long is 15.96% lower than yesterday and 0.28% higher than last week, while the number of traders net-short is 32.33% higher than yesterday and 0.76% lower than last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Gold prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed Gold trading bias.

What is your view on Gold — bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

0 notes

Link

The Taper That Will Really Bite Into U.S. Growth Isn't the Fed's Bloomberg

Fed expected to stay cautious as economy sends mixed signals Bangkok Post

Precious Metals & Energy - Weekly Review and Calendar Ahead By Investing.com Investing.com

Weekly Fundamental US Dollar Forecast: Taper Talk to Intensify at September Fed Meeting DailyFX

US Dollar Propels High On Strong Retail Data FX Empire

View Full Coverage on Google News

0 notes

Text

Crude Oil Forecast: CFTC Data Points to Supportive Environment for Brent

Crude Oil Forecast: CFTC Data Points to Supportive Environment for Brent

BRENT CRUDE OIL (LCOc1) TALKING POINTS

Long bets increase on Brent crude oil.

Supply cuts by OPEC+ still at the forefront of market participants.

Light economic calendar with Fed speakers under the spotlight.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

BRENT CRUDE OIL FUNDAMENTAL…

View On WordPress

0 notes